Thesis

The beauty industry — spanning skincare, fragrance, cosmetics, and haircare — was valued at $430 billion in 2023 and was projected to reach $580 billion by 2027. While consumers cut back in other areas, 75% of Americans in August 2023 continued to spend money on beauty products and cosmetics, spending an average of $1.8K annually on them. There is even a paradoxical trend of increased spending on cosmetics in times of economic hardship known as the lipstick index. Meanwhile, ecommerce is becoming an increasingly big part of beauty sales. Between 2015 and 2022, ecommerce beauty sales nearly quadrupled. In 2023, ecommerce represented the fastest-growing channel for beauty products with more than 20% market share.

This shift reflects changing consumer dynamics, with social media and influencer marketing playing an increasing role in beauty product discovery and purchasing decisions. 82% of beauty shoppers were daily Instagram users and 67% relied on influencer recommendations to discover new products as of December 2023. In light of these trends, many beauty industry companies, direct-to-consumer players, and omni-channel retailers have enhanced their online shopping capabilities and social selling strategies.

IPSY is a beauty subscription service that offers personalized monthly makeup and beauty samples. Its core membership product sends members five curated makeup and skincare samples each month based on user preferences. Users take a “beauty quiz” to get started and then receive boxes with products valued at up to $70 for the price of $14/month. It uses customer data and predictive algorithms to tailor its boxes to users’ individual needs and preferences. Through the company's ecommerce shop, members can also access discounted full-sized products.

Founding Story

IPSY was founded in 2011 by Michelle Phan, Marcelo Camberos (former CEO), and Jennifer Goldfarb (former President). Michelle Phan built her career as a beauty influencer through viral makeup tutorials on YouTube. Her first video in 2007, "Natural Looking Makeup," drew 40K viewers and hundreds of comments within a week. Phan's audience quickly expanded: her 10th video hit 100K views and by fall 2008 she averaged 600K views per month. In February 2009, her channel amassed 4.5 million total views.

Having accumulated millions of followers for her beauty content, Phan was sought after by top beauty companies, starting with a partnership with Lancôme in 2010 to create branded content. Through these partnerships, Phan recognized an opportunity to disrupt the industry by delivering a personalized solution to beauty discovery. Drawing from her influencer insights and partnership feedback, she envisioned a monthly subscription service that would curate makeup products for members to discover new looks and brands from home. Phan aimed to leverage data from her follower base to create an interactive, tailored experience for customers.

Phan's vision for IPSY began gaining momentum when she partnered with Camberos and Goldfarb. Camberos, who received his MBA from Stanford Graduate School of Business in 2007, was a founding executive at Funny or Die, a comedy media company founded by Will Ferrell and Adam McKay. He then founded Real Influence, a company that matched YouTube influencers with brands. This experience led him to connect with Phan. Soon after launching IPSY, Camberos met Goldfarb, another Stanford MBA graduate. Goldfarb previously worked as an investment banker at Goldman Sachs and as VP of Corporate Strategy at Bare Escentuals (rebranded as bareMinerals in 2012), a makeup company where she ran infomercials.

In late 2011, the trio unveiled subscription-based Glam Bags on their beta site, myglam.com. After Phan’s announcement of the new venture on her popular YouTube channel, the company quickly amassed over 500K subscribers and routinely sold out each month. The following year, IPSY officially launched with a program similar to Glam Bag. For a monthly fee, subscribers received a personalized makeup bag with four to five deluxe or full-size beauty products tailored to their unique preferences. To drive IPSY's initial sales, Phan leveraged her YouTube platform, which had over 2 million subscribers at the time (which had grown to 8.7 million subscribers by February 2024), as well as partnerships with other major beauty influencers.

In January 2023, Camberos stepped down as CEO into a role as Chairman. Meanwhile, Goldfarb had previously stepped down as President in July 2018 into the Chairman role until Camberos took her place in 2023. As of February 2024, Goldfarb's only involvement with the company is as a board member.

Product

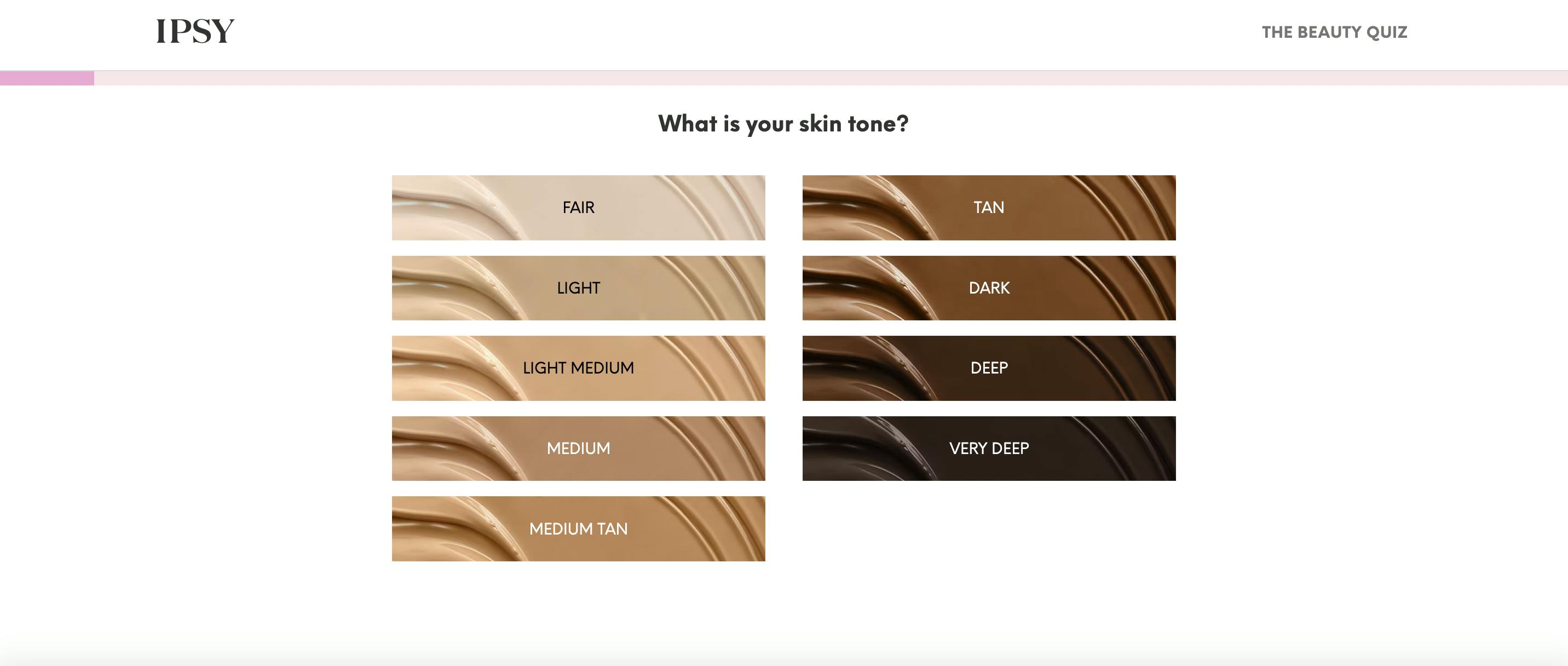

The Beauty Quiz

Source: IPSY

IPSY's Beauty Quiz is the cornerstone of its personalized subscription service. First-time visitors take a brief quiz covering skin tone, eye and hair color, favorite styles, and brands. Once registered and finished with the quiz, their IPSY homepage displays customized looks and product recommendations.

By gathering over 150 data points, IPSY's algorithm gains an intricate understanding of each member's unique preferences. This ensures subscribers receive beauty items that are well-tailored to their individual tastes.

Monthly Subscription Bag

Source: IPSY

After taking the Beauty Quiz, new members choose their monthly subscription plan. IPSY offers three tiers for its subscription plan as of February 2024: Glam Bag, BoxyCharm, and Icon Box. Members can also add a Refreshments subscription for personal care products. Using quiz data, IPSY curates each box to match members' beauty needs and preferences. The customized products — including makeup, skincare, haircare, and more — arrive in a collectible makeup bag.

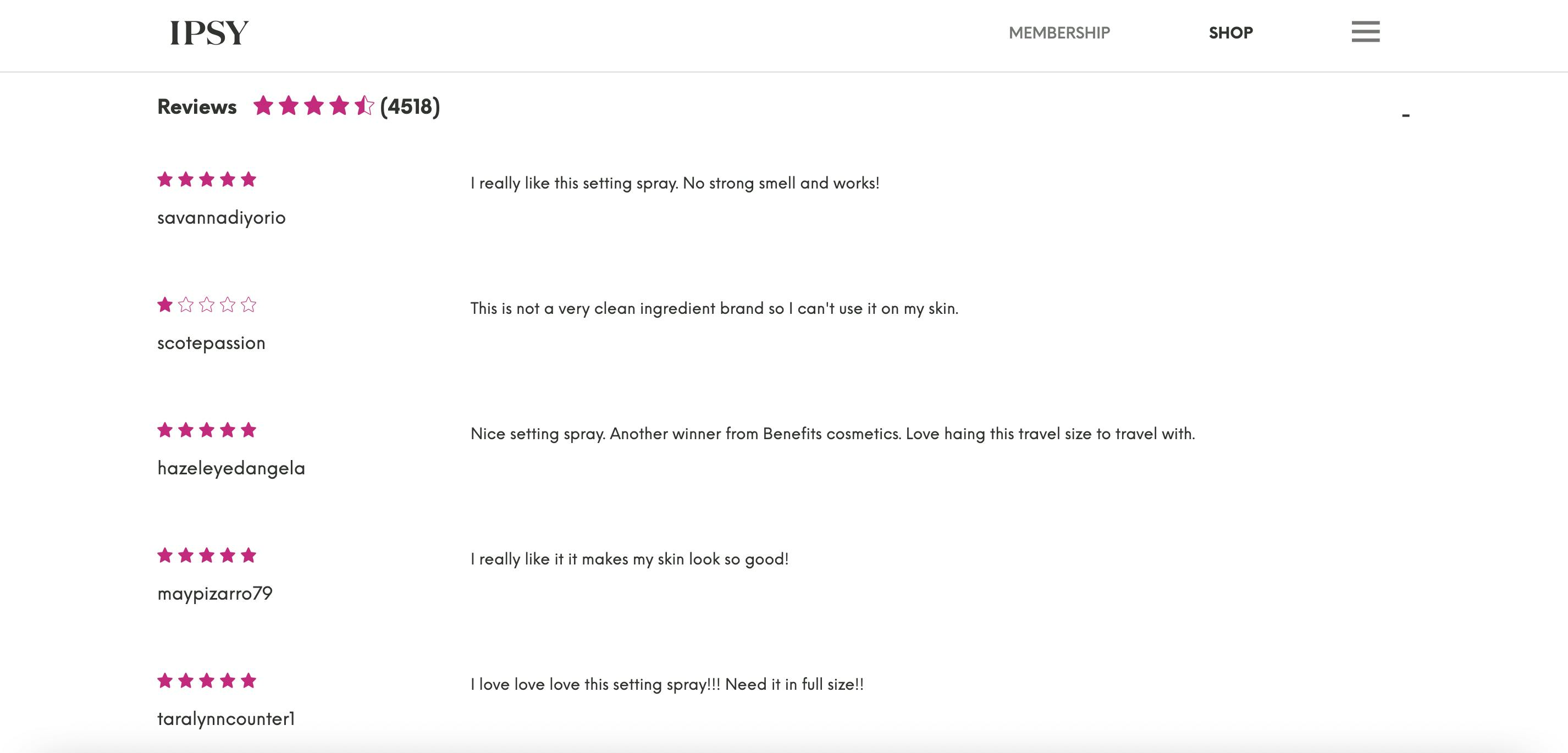

Product Reviews

Source: IPSY

Every month, subscribers can rate and review the products they receive. These reviews serve dual purposes: they provide insights for the IPSY community more broadly and also serve to improve the personalization of future shipments for the individual member. IPSY leverages member reviews to gain a deeper understanding of members' product preferences. The more feedback given, the more tailored future packages become. Additionally, members earn points for each review that can be redeemed monthly for complimentary bonus products.

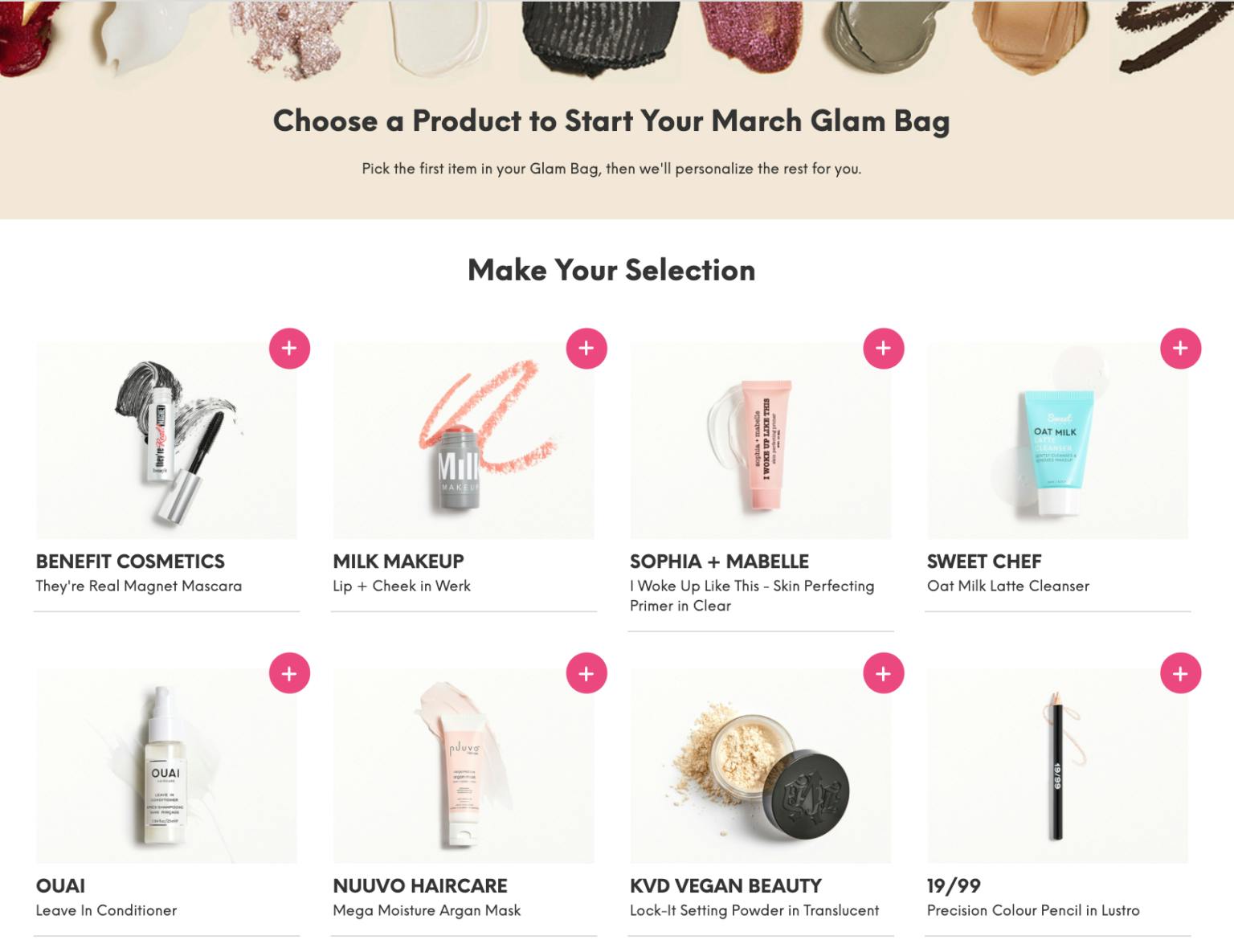

IPSY Choice

Source: IPSY

Every month, Glam Bag members can handpick one deluxe sample-sized product for their next shipment through IPSY Choice. They are presented with 10 personalized options curated based on their Beauty Quiz and reviews. The chosen product is then shipped with the next Glam Bag. The date for each IPSY Choice varies, usually occurring between the 20th and 26th of each month.

In addition, BoxyCharm and Icon Box members can handpick three of the full-size products to be included in their next shipment. These members make their Ipsy Choice while building their box from the first through the third of each month. The build period starts at noon PT on the first of the month and typically ends at 3 PM PT on the third, or when supplies run out.

IPSY Match

IPSY Match is IPSY's proprietary machine learning (ML) technology that personalizes monthly shipments. It evaluates 500 data points monthly to match each member with suitable products. By regularly updating preferences, reviewing products, making a monthly IPSY Choice and staying with IPSY long-term, members help IPSY Match optimize for their evolving style.

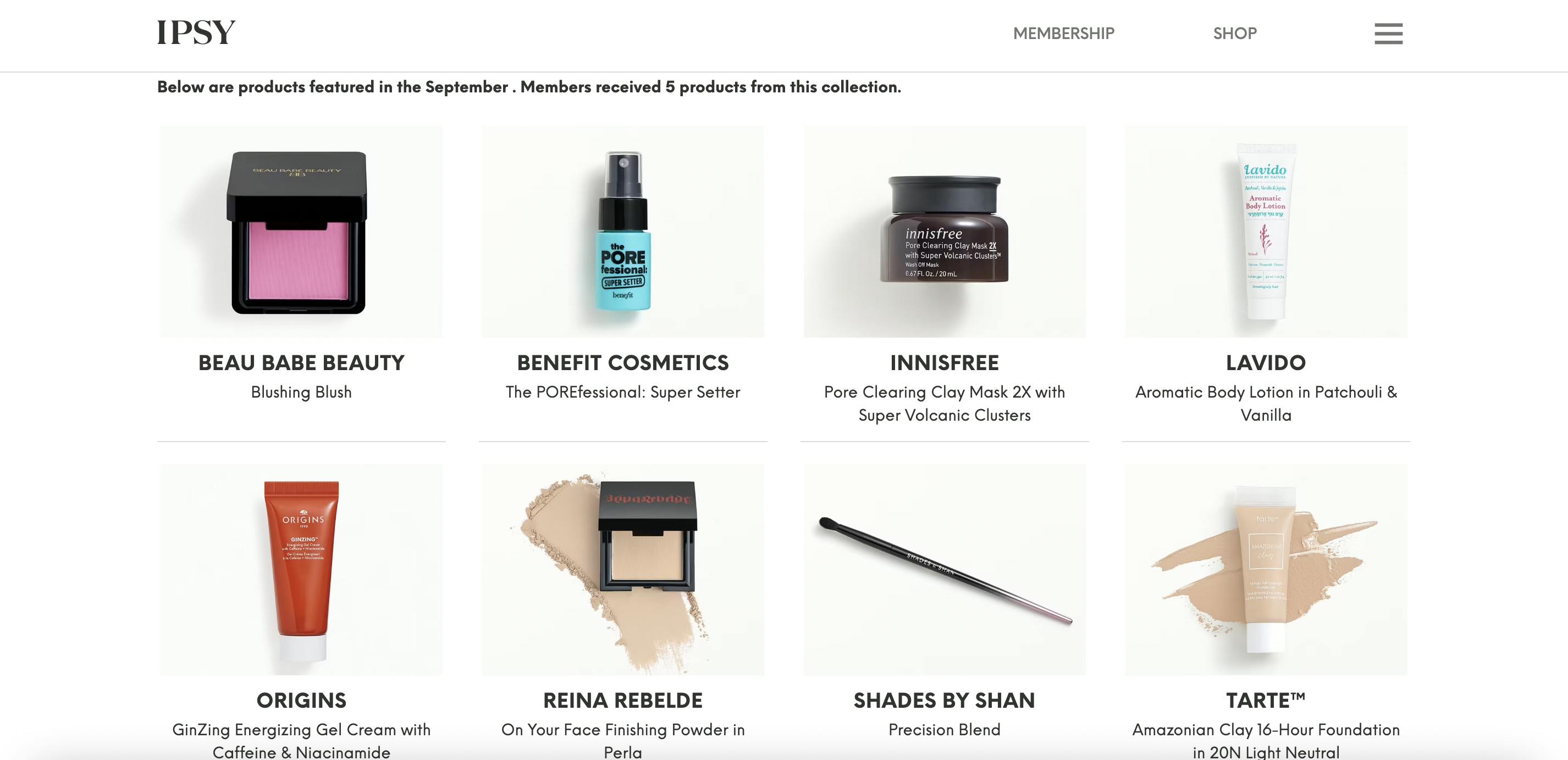

IPSY Shop

Source: IPSY

The IPSY Shop is an exclusive marketplace for current and former IPSY members. According to IPSY, it offers discounts of 30%-80% off retail prices on a variety of beauty products. Members can browse product bundles, sales, special offers, and VIP perks. IPSY introduces new arrivals weekly to this marketplace.

IPSY's quarterly Mega Drop Shop is the largest member-exclusive event, with discounts of up to 80%. Featuring makeup, skincare, haircare, and lifestyle products, it occurs every January, April, July, and October. The Mega Drop Shop offers members savings on a variety of beauty and lifestyle items in the IPSY Shop.

IPSY Flash is a five-day member-exclusive event offering time-sensitive deals on popular products. Glam Bag members gain access right after making their monthly Choice, typically around the 20th-25th. BoxyCharm and Icon Box members get automatic access when Flash opens.

Add-Ons

Beginning at noon PT on the first of each month, members have the option to choose up to 10 product add-ons that will be shipped with their subscription. These additional products are offered at various price points, including $3.50, $12, $18, $25 and $50. However, these choices are only available until 3 PM PT on the third of the month, so members must make their selections promptly.

Market

Customer

Based on data from Similarweb, IPSY's customer base is predominantly composed of Millennial and Gen Z female consumers, with women between the ages of 18 and 44 making up about 52.8% of its audience. Overall, IPSY’s audience is around 16.8% male and 83.2% female as of February 2024.

IPSY's success with Millennials and Gen Z stems from its personalized, interactive, and budget-friendly offerings. These qualities resonate with the digital lifestyles of younger consumers who want to stay current on beauty trends affordably. Aligning with its original marketing ethos, IPSY still reaches its core demographic through social media and influencer marketing.

Market Size

Though IPSY primarily operates within a subscription box business model, the company has been steadily expanding its IPSY Shop platform, recognizing direct-to-consumer (DTC) ecommerce as an opportunity to further engage its members.

The global beauty subscription box market size is estimated to be worth nearly $724 million in 2023 and is expected to grow to over $10 billion over the next 10 years at a CAGR of 26.7%. The US market is anticipated to reach $1.2 billion by 2033. Meanwhile, US DTC beauty sales totaled $6.7 billion in 2021. Pure-play DTC beauty brands increased total sales from $3.3 billion in 2020 to $3.5 billion in 2021.

Based on data from the Census Bureau, there were about 65 million women in the US between the ages of 15 and 44 in 2022. A 2019 survey of US women over the age of 18 found that 23% never wear makeup. Assuming 77% of women wear makeup in some capacity, it's implied that IPSY’s target customer base includes about 50 million women in the US.

Competition

Subscription Box Businesses

BirchBox

BirchBox, founded in 2010, was an early player in the beauty subscription box space. After amassing over 800K subscribers, BirchBox was valued at $485 million at its peak in 2014. Later, facing heightened competition and financial struggles, BirchBox was acquired by FemTec Health in 2021 for just $45 million. Following the acquisition, subscription shipments were briefly paused but have since resumed with new offerings. These include a monthly membership at $20 per month, a three-month prepaid membership at $19 per box, and a 12-month prepaid membership at $17 per box. Each BirchBox contains four to six member-chosen beauty and wellness products, plus a surprise addition.

FabFitFun

FabFitFun, founded in 2010, is a lifestyle membership service known for its signature FabFitFun Box. This seasonal box features full-size products across beauty, fashion, fitness, wellness, home, and tech, from both premium and emerging brands. Membership options include an annual subscription at $219.99 per year or a seasonal subscription at $59.99 per box. FabFitFun has received $262.1 million in total funding as of February 2024, including $100 million in debt financing in 2020 and an $80 million growth round in 2019 led by Kleiner Perkins.

Beauty Incumbents

Sephora

Sephora, founded in 1969, is a French multinational beauty retailer carrying nearly 340 brands along with its Sephora Collection label. Offerings span cosmetics, skincare, fragrance, nail polish, tools, lotions, haircare and more. The company offers an auto-replenish subscription, where customers receive 5% off retail prices and receive desired products on a cadence of their choosing. Sephora was present in 35 countries with over 2.6K stores as of April 2020 and was on track for $15 billion in revenue in 2023. The company was acquired by LVMH for $262 million in 1997.

Ulta

Ulta, founded in 1990, is the largest US beauty retailer, providing cosmetics, fragrance, skincare, haircare and salon services to beauty enthusiasts. The company offers over 25K products from more than 600 established and emerging brands, including its private label Ulta Beauty Collection. In addition to beauty products, Ulta operates full-service salons in every store. Ulta is present across all 50 states, with over 1.3K retail locations as of January 2023. In 2022, Ulta had $10.2 billion in revenue. The company’s market cap was $24.7 billion as of February 2024.

Dermstore

Dermstore, founded in 1999, is a US pure-play online retailer of cosmetics, fragrances, skincare, haircare, and more. The company also offers a subscription service, BeautyFIX, which features best-selling beauty products curated by Dermstore experts. The BeautyFIX boxes contain five or more full and deluxe-sized products totaling over $100 retail value and are available monthly, bi-yearly, or on 12-month prepaid plans for $24.95 per month, $22.95 per month, and $21.95 per month respectively. In January 2021, THG acquired Dermstore from Target for $350 million.

Business Model

IPSY mainly generates revenue through subscriptions and ecommerce sales. The company offers three subscription tiers with differing product sizes, customization, and add-ons. The IPSY Shop also sells discounted beauty products, including branded and IPSY's own items.

Glam Bag

Source: IPSY

IPSY's Glam Bag subscription offers members a monthly selection of five deluxe beauty samples, including one personal selection, for $13 per month. These samples hold a total value of up to $70. Members are guaranteed at least one Power Pick (a standout product or brand) in each month's curated selection.

BoxyCharm

Source: IPSY

IPSY’s BoxyCharm subscription provides members with five full-size beauty products for $28 per month. These products hold a combined value of up to $200. Members can choose three items in their monthly shipment. They are also guaranteed two “Power Picks” in their five-product assortment.

Icon Box

Source: IPSY

IPSY's quarterly Icon Box is a members-only upgrade for Glam Bag and BoxyCharm subscribers. It offers eight full-size products, curated by beauty industry figures, valued at up to $350. Icon Box replaces the usual monthly bag in upgrade months (February, May, August, and November) for $58 per quarter. Subscribers select three of the eight full-size products themselves. The curator chooses the remaining five based on beauty preferences.

Refreshments

Source: IPSY

Refreshments, IPSY's personal care membership, delivers personal care essentials like razors, body wash, face wipes, and more. The membership allows subscribers to schedule shipments of clean, vegan, cruelty-free products for the body, face, hair, and more. Delivery cadence is customizable, with savings of up to 50% for auto-delivery. Members can modify orders until month-end, with shipments arriving around the 15th. Costs vary based on product choices.

IPSY Shop

IPSY's online store offers members 30-80% off retail prices on a diverse range of beauty products. The platform allows members to explore bundles, sales, special offers, and VIP perks. The shop includes full-sized products from subscription boxes, with new arrivals added weekly for an up-to-date selection. IPSY's ecommerce model also includes events such as the Mega Drop Shop, IPSY Flash sales, and subscription Add-Ons where members can purchase additional products directly through the platform.

Traction

In 2015, four years after its launch, IPSY had garnered over 1.5 million subscribers, $150 million in annual revenue, and was shipping more than 15 million boxes per year. IPSY reached $500 million in annualized revenue by 2019, more than tripling in size since 2015. By 2020, IPSY had accumulated 3 million active subscribers, growing subscriptions by 60% month-over-month from mid-March to the end of July of that year.

IPSY acquired a rival player in the beauty subscription industry, BoxyCharm, for $500 million in 2020. At the time of the acquisition, the combined businesses had more than 4.3 million subscribers and were on track to earn $1 billion in revenue. IPSY and BoxyCharm worked as separate entities for three years under the Beauty For All Industries (BFA) umbrella before removing its standalone status and relocating Boxycharm.com to Ipsy.com in March 2023. The acquisition paired IPSY's AI-powered member quiz and personalization capabilities with BoxyCharm's curated brand portfolio and merchandising approach, which helped improve IPSY’s position within the beauty subscription market.

Valuation

Beauty for All Industries, the parent company of IPSY and BoxyCharm that formed following the BoxyCharm acquisition in 2020, raised $96 million in a growth round led by TPG Growth in February 2022. Prior to this, IPSY had raised a total of $237.2 million in funding. It raised a $100 million Series B in 2015 at a valuation of over $500 million. The round was led by TPG Growth and Sherpa Capital.

Key Opportunities

Leveraging AI/ML

IPSY's AI/ML capabilities power IPSY Match. Drawing from 200+ million product reviews and millions of other consumer data points, IPSY creates personalization algorithms informing each subscriber's unique monthly box combinations. This data provides IPSY with an understanding of evolving consumer preferences. It also guides decision-making around new product development and brand partnerships.

Furthermore, IPSY's algorithms enable the company to adjust monthly offerings based on shifting consumer preferences and macro conditions; for example, certain categories or price points make more sense in some markets than others. As an early entrant in beauty subscription boxes, IPSY can build upon its robust dataset and AI to maintain market leadership through constant innovation and personalization.

Strategic Partnerships

IPSY allocated 80% of its influencer budget to Meta as of February 2023, down from 90-95% in 2021. The remaining budget was split equally, with 10% to TikTok and 10% to channels like YouTube. The company had 3.7 million followers on TikTok alone as of February 2024. With this reach, IPSY is well-positioned to broaden partnerships with celebrities, influencers, and content creators. These individuals can leverage IPSY's subscription model to differentiate themselves and access customers in the competitive beauty space. For those launching their own brands, IPSY provides engineering, finance, legal, and other support.

Examples of such collaborations include IPSY’s contribution to Addison Rae's ITEM Beauty launch at Sephora or Gwen Stefani’s IPSY Icon Box launched in January 2024. For IPSY, these collaborations can amplify reach, diversify its customer base, and introduce new products. Partnerships with household-name industry icons can enhance IPSY's brand visibility and attract new platform users.

Limited Edition Brand Takeovers & Partnerships

IPSY can extend collaborations beyond individuals to include limited-edition brand takeovers and partnerships with trending sought-after beauty brands. For example, IPSY partnered with Rihanna's FENTY BEAUTY and FENTY SKIN in March 2022, offering members a bundle of seven new products from these brands with a total value of $171 for under $50. Such partnerships can help generate enthusiasm among existing customers while also drawing new audiences, cementing IPSY's reputation as a dynamic, trend-forward player.

Key Risks

High Competition & Digital Noise

The beauty industry is inundated with a multitude of brands and subscriptions employing social media marketing. This creates an overwhelming digital landscape filled with ads and marketing messages. This intense competition leads to consumer distraction with endless options. Despite being a market leader in its category, IPSY faces ongoing challenges distinguishing itself from the noise. The company must consistently introduce unique, compelling offerings to attract and retain customers. This requires rapidly adapting to preferences while proactively staying ahead of trends in the fast-changing beauty space.

Fighting Churn

IPSY battles subscription box churn like others in the industry. With endless consumer choice, retaining loyalty can prove as challenging as initial acquisition. While IPSY leverages AI/ML-driven personalization and an ecommerce model to mitigate churn, outside competition continues to increase. In this landscape, IPSY must vigilantly use customer insights to enhance experiences and consistently demonstrate value.

Summary

IPSY is a beauty subscription and ecommerce platform that delivers monthly curated boxes to its subscribers. Since 2011, IPSY has leveraged proprietary AI/ML, engaging social content, and its community to create traction in the competitive beauty subscription market. Along the way, IPSY has continued to improve its position by acquiring rival BoxyCharm. However, amid stiff competition, addressing subscriber churn is critical. Strategic merchandising, new product development, and evolving engagement strategies can help mitigate churn. By leveraging data-driven insights into customer preferences, IPSY can stay ahead of trends and continue its growth.