Thesis

Fast fashion, a term coined in the 1990s, represented a significant shift in fashion production and retail, emphasizing the rapid manufacture of highly affordable, trend-driven clothing. Pioneered by brands like Zara, fast fashion retailers abandoned traditional fashion seasons in favor of regular releases of low-cost clothing, getting consumers hooked on an endless “cycle of novelty”. By 2019, the average lead times for clothing production had decreased to just 60 days, and US shoppers were buying five times more clothing than they did in the 1980s. The global fast fashion market was valued at $123 billion in 2023, with the average woman in the US spending $545 on clothing each year as of July 2022.

At the same time, the growth of ecommerce has radically changed shopping habits, with the rise of giants like Amazon changing the way people buy and sell goods. In 2023, an estimated 2.6 billion consumers will have completed at least one purchase online. US ecommerce sales surged from $571.2 billion in 2019 to $815.4 billion in 2020 and will total $1.1 trillion in 2023. Customer discovery has shifted to social platforms like TikTok and Instagram, with 67% of consumers in 2023 having bought products through social media.

SHEIN is a global online retail company specializing in fast fashion. Operating primarily through its digital platform, it offers an extensive range of clothing and fashion accessories and leverages its proprietary technology and network of manufacturers to quickly respond to the latest trends and fulfill consumer demand. Beyond apparel, SHEIN has launched a two-sided marketplace, expanding its product range to include other categories like home decor and electronics, catering to a global customer base. SHEIN’s platform and effective use of digital marketing channels position it as a key player in fast fashion and ecommerce.

Founding Story

There are conflicting reports on SHEIN’s origins. Although it was formally founded in 2012, the company’s history goes back to a small ecommerce shop named Nanjing Dianwei Information Technology (NDIT) launched in 2008 by entrepreneur Chris Xu (CEO), his ex-colleague Wang Xiaohu, and a business partner and part-time consultant named Li Peng. Little is known about the founding team, but reports describe Xu as a hardworking “SEO whiz” who focused on technical matters and left business development, finance, and other more corporate functions to Xiaohu and Peng. Though some sources describe Xu as a Chinese-American who studied at George Washington University, SHEIN disputes this, arguing he was born and raised in China.

Working out of a cramped office in Nanjing, China, the trio experimented with selling different products, tested distribution strategies, and began perfecting the high-volume, low-margin model that would eventually become SHEIN’s trademark. Xiaohu said that NDIT explored clothing and fashion, reasoning that a Chinese company could take advantage of local manufacturing in much the same way as Western brands did.

In 2012, things took a turn. According to Xiaohu and Peng, Xu abruptly shuttered NDIT and forced his two co-founders out, pivoting to a wedding dress retailer Xu named SheInside.com. The website initially operated like many Chinese ecommerce retailers. It sourced product from wholesale garment markets in the city of Guangzhou, and played no role in design or manufacturing.

In 2014, the company began transforming itself into a vertically integrated retailer which did more than just ship product from wholesalers to end customers. That year, it purchased rival online Chinese retailer Romwe. It also expanded its presence to European markets like Spain and Germany.

By 2015, Xu had rebranded the company officially to SHEIN, raised more than $50 million in financing, and built a network of thousands of manufacturers across China. By 2016, SHEIN had a team of 800+ designers and prototypers, and claimed to no longer work with suppliers which produced “mediocre-quality” products and images. SHEIN made a push into the US market in 2017, advertising on daytime television and partnering with fashion influencers.

Despite his company’s success, CEO Chris Xu has remained largely out of the spotlight, maintaining anonymity despite his status as one of China’s richest men.

Product

Source: SHEIN

SHEIN is a global online retailer best known for its extensive range of fashionable, affordable clothing and accessories. It operates as a two-sided marketplace linking 6K+ manufacturers of clothing and other physical goods with consumer demand around the world. Low-priced fashion under private labels like Romwe has long been SHEIN’s focus, but the company has expanded horizontally into electronics, decor, appliances, and other categories as well. Through its website and mobile app, SHEIN’s users can browse and purchase a frequently updated selection of nearly 600K items at low prices.

Backed by marketing campaigns and internal management software that analyzes consumer behavior in real-time, SHEIN “algorithmically” feeds products to users, adding up to 10K individual items and styles to its platform every day. By closely collaborating with its network of small and medium-sized manufacturing partners, largely located in China, SHEIN can iterate through production cycles in a matter of days, rapidly reacting to shifting trends and shipping items directly from its network of suppliers.

Crucial to SHEIN’s operation is its large-scale automated test and reorder (LATR) system. The system identifies a trendy design, commissions a small order from one of its partnered factories — typically 50-100 units per day — and then ramps up quantity if that style proves to be popular. As a result, SHEIN’s inventory turnover sits at just 47 days. To help streamline delivery, SHEIN invests in distribution centers globally and partners with last-mile services like UniUni. The prices of clothing sold on SHEIN, according to one 2022 estimate, are 39-60% cheaper than clothing from competitor H&M.

Third-Party Marketplace

To complement its core vertically-integrated retail offering, SHEIN launched an integrated marketplace in June 2023 which sells items from third-party brands like New Balance alongside the company’s existing private labels. For consumers, the new marketplace means a wider selection of products, including name brands that they may already be familiar with. For third-party sellers, besides access to SHEIN’s user base, the new offering provides real-time data analytics, product fulfillment tools, marketing exposure, and training and incentives programs.

For SHEIN, the marketplace creates the opportunity to expand inventory and create revenue without requiring as much investment as its first-party sales. As of November 2023, SHEIN offers an extensive range of product verticals on its website, both from its inventory and its seller marketplace. The products it lists can be divided into three broad categories: fashion, home and living, and electronics.

Fashion

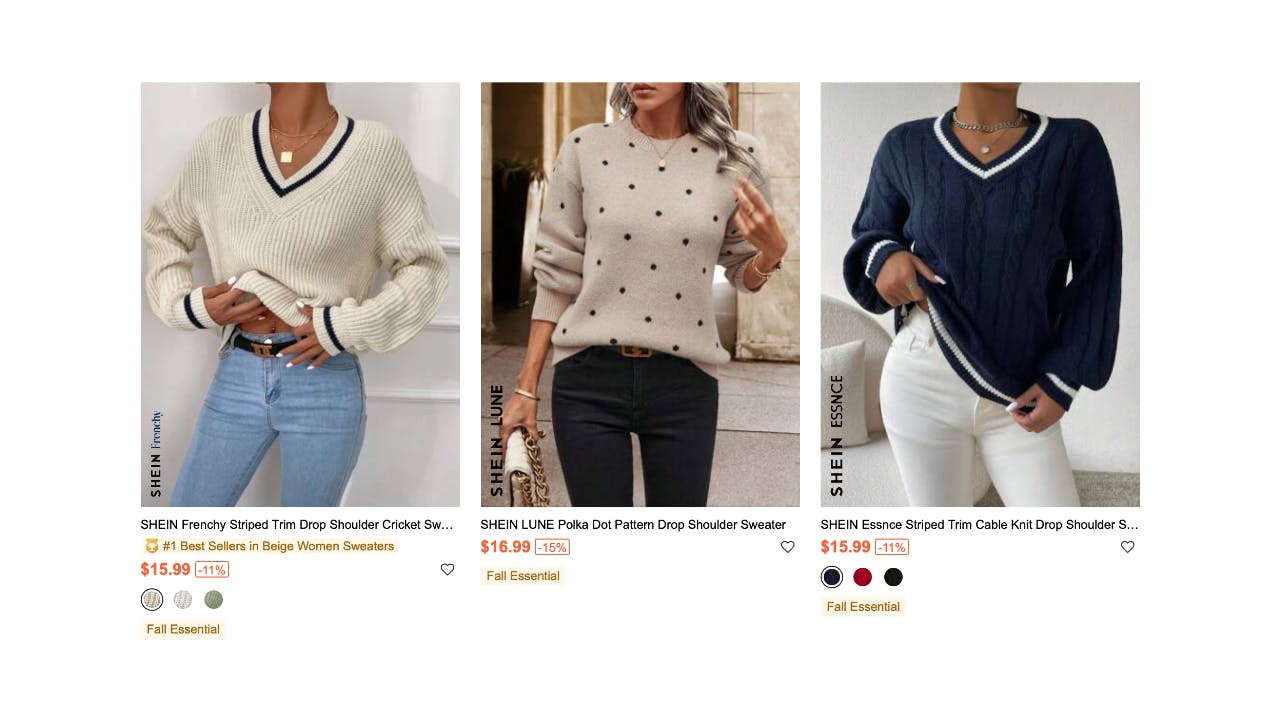

Source: SHEIN

Since SHEIN’s inception, clothing and fashion have been central to its offering. As of November 2023, SHEIN’s official vision is to “bring fashion into the modern era”, and to that end, the company uses its vertically-integrated supply chain and growing network of third-party brands to sell a wide range of inexpensive shirts, dresses, shoes, jewelry, accessories, and other fashion items. Low-priced women’s clothing dominated SHEIN’s sales as of November 2023, but the company has ventured into men’s and kid’s apparel and also began moving upmarket in 2021, investing heavily in its premium private label MOTF, signing deals with designer brands, and encouraging local designers and artists to sell on its platform.

SHEIN’s grip on the fashion market is made possible through a sales, marketing, and data analytics pipeline that enables the company to keep pace with shifting trends. Crucial to this effort is SHEIN’s social media presence. It has millions of followers across major platforms like TikTok and Instagram and deals with influencers and celebrities like Katy Perry.

Home & Living

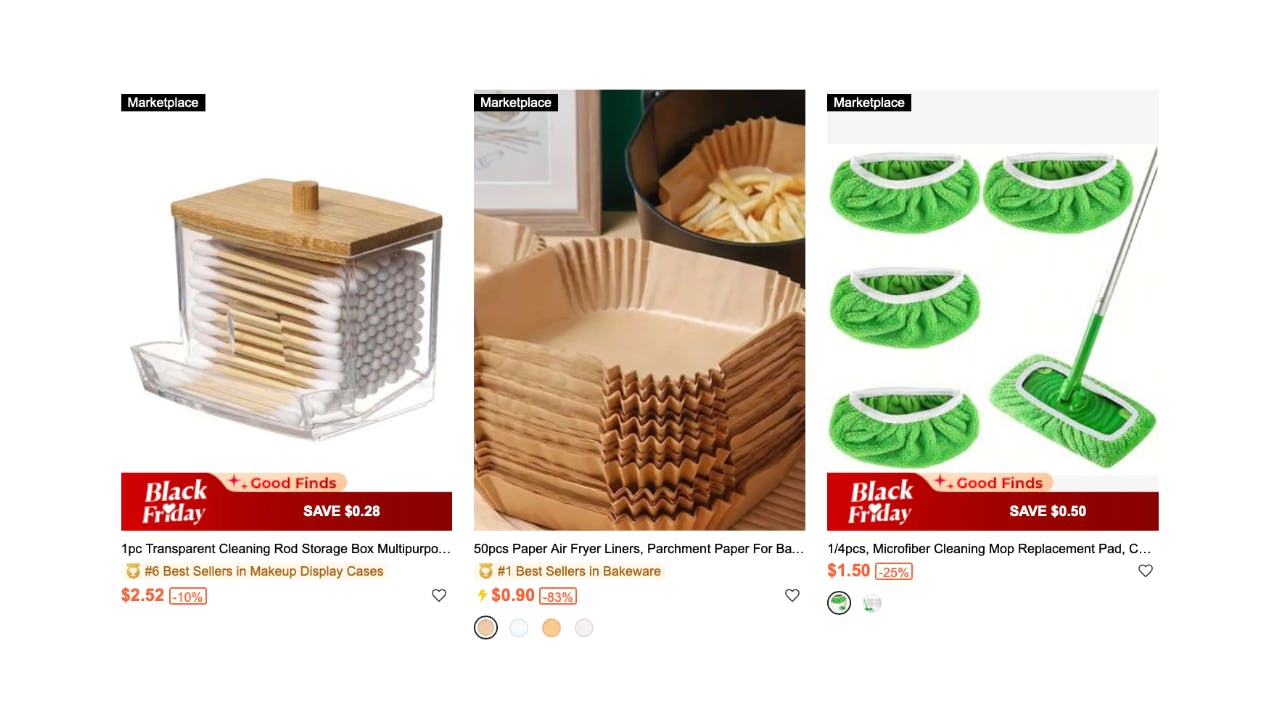

Source: SHEIN

To meet growing customer demand for products “that go beyond fashion and apparel”, home goods has become a near-term priority for SHEIN with the 2023 launch of its marketplace. The company has quickly established a foothold in the space, selling a wide range of decor, furniture, lighting, tools, utensils, and other household items and even leaping appliances and smart home devices in 2023. Unlike its core fashion offering, SHEIN relies on an array of third-party brands to fulfill many of these orders.

Electronics

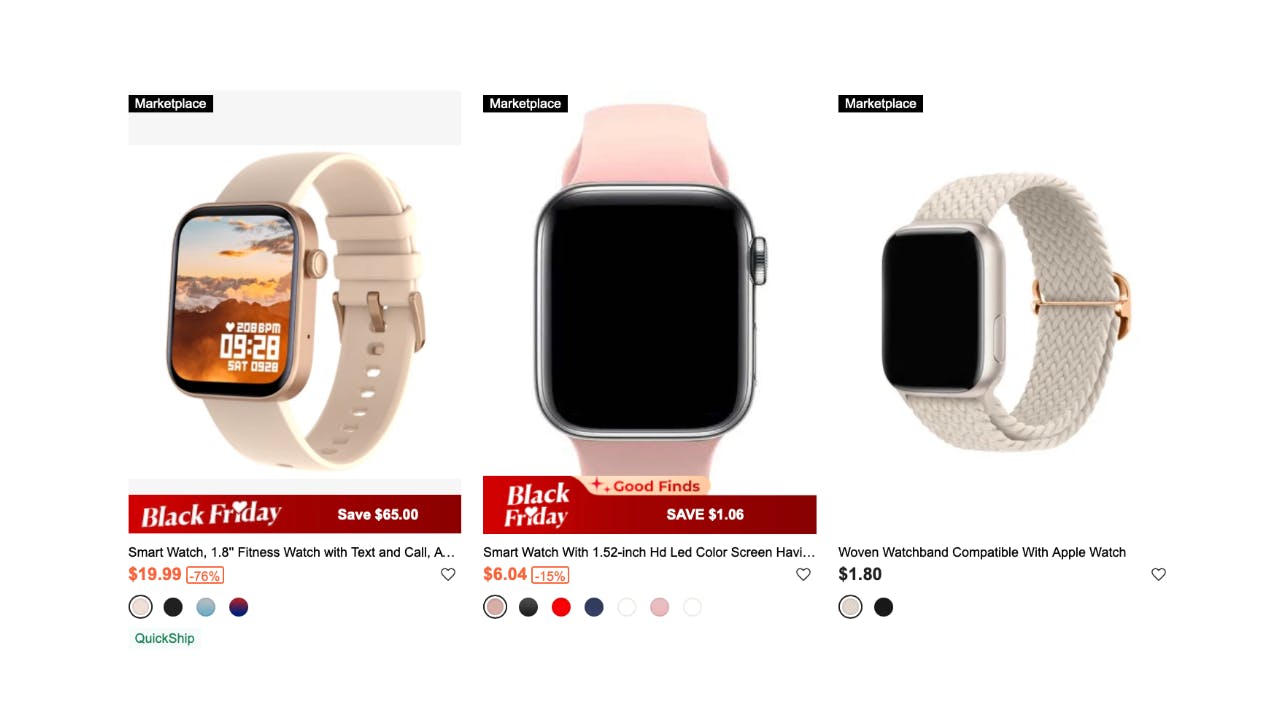

Source: SHEIN

As SHEIN continued to expand horizontally, electronics became another area of emphasis for the company. Under this category, SHEIN sells cameras, phones, computers, speakers, and many other hardware products and accessories. These products are sourced from third-party brands like Oscal and TCL and are sold at very low prices. Major Chinese sellers like electric toothbrush maker Fairywill and consumer electronics brand Aukey, both of which were banned from Amazon in 2021 for review manipulation, also sell via SHEIN’s platform.

Market

Customer

Despite being originally founded in China and relying largely on Chinese suppliers and manufacturers, SHEIN has a minimal consumer presence in the country. Instead, the company’s primary target market is Gen Z and millennial consumers in regions including the US, Europe, the Middle East, Latin America, and Australia who regularly shop online.

With its roots in women’s fashion, SHEIN’s typical customers are women in their twenties, but the company is increasingly catering to men, children, and older women as it expands its selection of products. Generally, SHEIN’s users prioritize access to a wide selection of highly fashionable goods more than the average shopper. A June 2023 report found that the average SHEIN customer is female, earns $65K in annual income, and reported spending $100 per month on women's clothing.

As part of its push to become a more fully-featured marketplace, SHEIN also sells products from third-party brands and designers, appealing to customers with an interest in major labels. In that capacity, the company is targeting a wide range of merchants — from smaller sellers like Cape Robbin to global giants like Skechers and Lenovo and high-end fashion labels like Paul Smith and Stuart Weitzman. Gen Z customers will continue to drive much of the company’s momentum, but SHEIN is diversifying its core customer base via its expanded range of merchandise.

Market Size

In the US alone, fast fashion – the high-volume, low-priced retail model pioneered in the 1990s – is a $100 billion industry and is expected to grow to $167.5 billion by 2030, representing a CAGR of 7.7%. Social commerce reached an estimated $992 billion in global sales in 2022 and is projected to grow to more than $2 trillion by 2025. While ecommerce as a whole has slipped slightly since the end of the COVID-19 pandemic, online retail sales still grew nearly 10% YoY to $5.7 trillion globally in 2022. Even as growth slows from its peak, retail ecommerce sales are projected to grow to $8.1 trillion by 2026.

Adding to this is the fact that consumer expectations globally are shifting towards convenient, one-stop-shop purchasing experiences like SHEIN. As of 2022, 66% of consumers preferred online marketplaces over traditional retailer sites, and B2C marketplaces are projected to facilitate $2.1 trillion in sales by 2024.

Competition

Online Retailers

Temu: Temu, launched in September 2022, is SHEIN’s strongest challenger in low-priced ecommerce. While still new, Temu has rapidly gained traction in Western markets and has consistently been one of the most downloaded apps in the US since its launch. By September 2023, a year after its launch, Temu had 61 million monthly active users in the US. Fully owned by Chinese ecommerce giant PDD Holdings, the company’s growth has come at a cost: it is reportedly burning at least $600 million per year in growth through promotions and advertising as of 2023.

Unlike SHEIN’s vertically integrated supply chain, Temu is solely an asset-light marketplace for third-party brands that handle their own distribution. Nevertheless, SHEIN and Temu have increasingly come into conflict, a rivalry that boiled over into an exchange of lawsuits in 2023, with Temu alleging that SHEIN engaged in anticompetitive behavior. PDD Holdings traded at a market cap of $146.5 billion in November 2023. Specific revenues for Temu are unknown, but it was estimated in August 2023 that it represented less than 1% of PDD’s total sales in the second quarter of that year.

Fashion Nova: Fashion Nova is a US-based online fashion platform. Founded in 2006 as a brick-and-mortar retailer, the company pivoted into online sales in 2013 when its founder, Richard Saghian, noticed growing opportunities in ecommerce. Leaning on a modern marketing strategy centered around celebrities and influencers like Cardi B, Fashion Nova built its brand in women’s fashion but has since expanded into men’s clothing, children’s clothing, and beauty products, selling a wide array of private label goods. The company reportedly generated over $1 billion in annual sales as of March 2022.

Omnichannel Retailers

H&M: H&M, founded in 1947 in Sweden, is a clothing and apparel retailer. One of the early pioneers of fast fashion, H&M leverages an omnichannel approach, generating the bulk of its revenue from its network of brick-and-mortar stores while also online sales through its app and website. The company operates in the US, Europe, and a handful of other markets around the world, selling mostly private-label goods to budget-conscious consumers.

Despite its global scale, H&M lags behind SHEIN in fast fashion sales. H&M controlled 16% of the fast fashion market in the US in November 2022, behind SHEIN’s 50%, and its $24.9 billion market cap as of November 2023 is approximately a third of SHEIN’s 2023 private valuation of $66 billion. The company has sought to become more competitive in the space, launching a marketplace for third-party brands in 2023 and investing in partnerships with designers and more premium brands. H&M sued SHEIN for copyright infringement in July 2023.

Zara: Zara, founded in 1975, is a global fashion brand. Operating through its online platform and its network of 3K+ stores around the world, the Spanish company — owned and operated by fast fashion conglomerate Inditex — helped spark the movement in the 1990s. Unlike its peers, Zara has remained upmarket, selling more premium, higher-cost products and largely avoiding any deep with third-party brands. While its top-line growth is not as great, Inditex has historically outpaced SHEIN in terms of total revenue, generating close to $8 billion in the second quarter of 2023 alone. Inditex’s net profit margins are higher, at 13% to SHEIN’s 3.5%. Inditex, which also owns brands like Bershka, Massimo Dutti, and Stradivarius, traded at a market cap of $108.7 billion in November 2023.

Global Marketplaces

Amazon: Amazon, founded in 1994, is an online retailer and technology company. SHEIN’s push into becoming a broader ecommerce marketplace has brought it into direct competition with Amazon, which was estimated to account for nearly 33% of the online apparel and accessories market in the US and close to $70 billion in annual sales. Like SHEIN, Amazon sells private label products, largely through its Amazon Basics brand, but the company’s third-party marketplace is its primary growth engine. Amazon’s main differentiator is its convenience and speedy delivery. Whereas a shipment from SHEIN can take up to several weeks, Amazon can fulfill orders in as little as one or two days. Amazon traded at a market cap of $1.5 trillion in November 2023.

Social Media Platforms

TikTok Shop: TikTok, launched in 2018 by Chinese technology company ByteDance, is a social media platform known for its short-form video content. The platform has been expanding into ecommerce, launching TikTok Shop in September 2023 in the US. TikTok Shop provides an integrated shopping experience for the platform’s over 150 million active users. Through the company’s mobile app, users can browse thousands of products, sort through recommendations, and even buy items directly in videos and livestreams. For merchants, brands, and creators, TikTok offers advertising, marketing, checkout, and logistics solutions, among other tools.

While products from third-party brands dominate the platform, TikTok has also experimented with selling private label goods from a subsidiary of its parent company ByteDance, a more vertically integrated model that brings the platform into closer competition with SHEIN. Much like SHEIN, TikTok has faced significant pressure over its ties with China, with some lawmakers seeking to ban the app outright in the US. ByteDance is a private company and was valued at $231 billion via secondary market sales as of November 2023.

Business Model

SHEIN's business model revolves around an ultra-fast fashion approach, leveraging a highly responsive supply chain to quickly produce and distribute trendy, affordable clothing. In parallel, its ecommerce marketplace offers a less operationally intensive platform where third-party sellers

SHEIN’s core fashion offering emphasizes rapid production cycles and a massive inventory, offering a wide variety of products and styles that are frequently updated to keep pace with the latest trends in fashion and consumer products. The company sells low-margin products at an average price of close to $8, per 2021 estimates, all largely sourced and shipped through a vertically integrated network of factories and distribution centers.

SHEIN’s net margin on fashion products it sells via its network of partnered manufacturers was reportedly 3.5% in 2022. For its newer marketplace offering, it was reported in July 2023 that SHEIN was pitching a 5-10% take rate to prospective sellers. This was an effort to court sellers away from Amazon, which took a cut of 15-17% on goods sold via its platform as of July 2023. It is not known how long this aggressive fee structure might remain in place.

SHEIN’s model also relies on strong import tax minimization. Whereas competitors like H&M pay millions in import and export duties every year, SHEIN’s products are shipped and delivered tariff-free. Taxes on the company’s exports are waived per a rule adopted by the Chinese government for D2C brands like SHEIN in 2018. With imports, the company has taken advantage of a decades-old loophole in the US that exempts packages valued up to $800 from taxes as long as they're addressed and shipped to individuals. Traditional retailers typically import their merchandise in bulk and then package and deliver to customers, but SHEIN’s products are individually packaged from the factory.

Traction

Since its founding, SHEIN has developed a significant presence in fashion retailing and ecommerce. By 2019, the company had surpassed an estimated $4 billion in annual sales. The COVID-19 pandemic and its associated consumer shopping trends were a major accelerant for the company, which saw its sales jump nearly 250% YoY to $10 billion in 2020.

The company has maintained momentum in the years since, recording a reported $16 billion and $22.7 billion in revenue in 2021 and 2022, respectively. SHEIN has also achieved profitability, earning a reported $800 million in net income in 2022. However, the profit margin of 3.5% it achieved was narrow — significantly lower than the 11% margin of Inditex, which owns competitor Zara. The company’s leadership said in a 2023 investor presentation that it expects revenue will reach $58.5 billion in 2025.

SHEIN has also become an impactful cultural phenomenon. It was the most downloaded shopping app in 2022 and is the most followed fashion retailer on TikTok. It was also the most searched fashion brand worldwide in 2022. The company employs the help of a large number of celebrities, influencers, and users who share their SHEIN purchases on social media, using hashtags like #SHEINHaul, which boasted 13.7 billion video views on TikTok alone as of November 2023.

Source: Business Insider

Valuation

SHEIN raised $2 billion at a $66 billion valuation in May 2023, bringing its total funding to $4.1 billion. The company’s cap table includes investors like Sequoia Capital China, General Atlantic, and Tiger Global. While still one of the world’s most valuable private companies, SHEIN has seen its valuation reduced by a third since its previous raise in April 2022, when it was valued at $100 billion. SHEIN’s sliding valuation comes amid fading investor interest and significant macroeconomic headwinds. Compared to $12.6 billion in capital poured into the ecommerce space in 2021, 2022 saw just $8.8 billion.

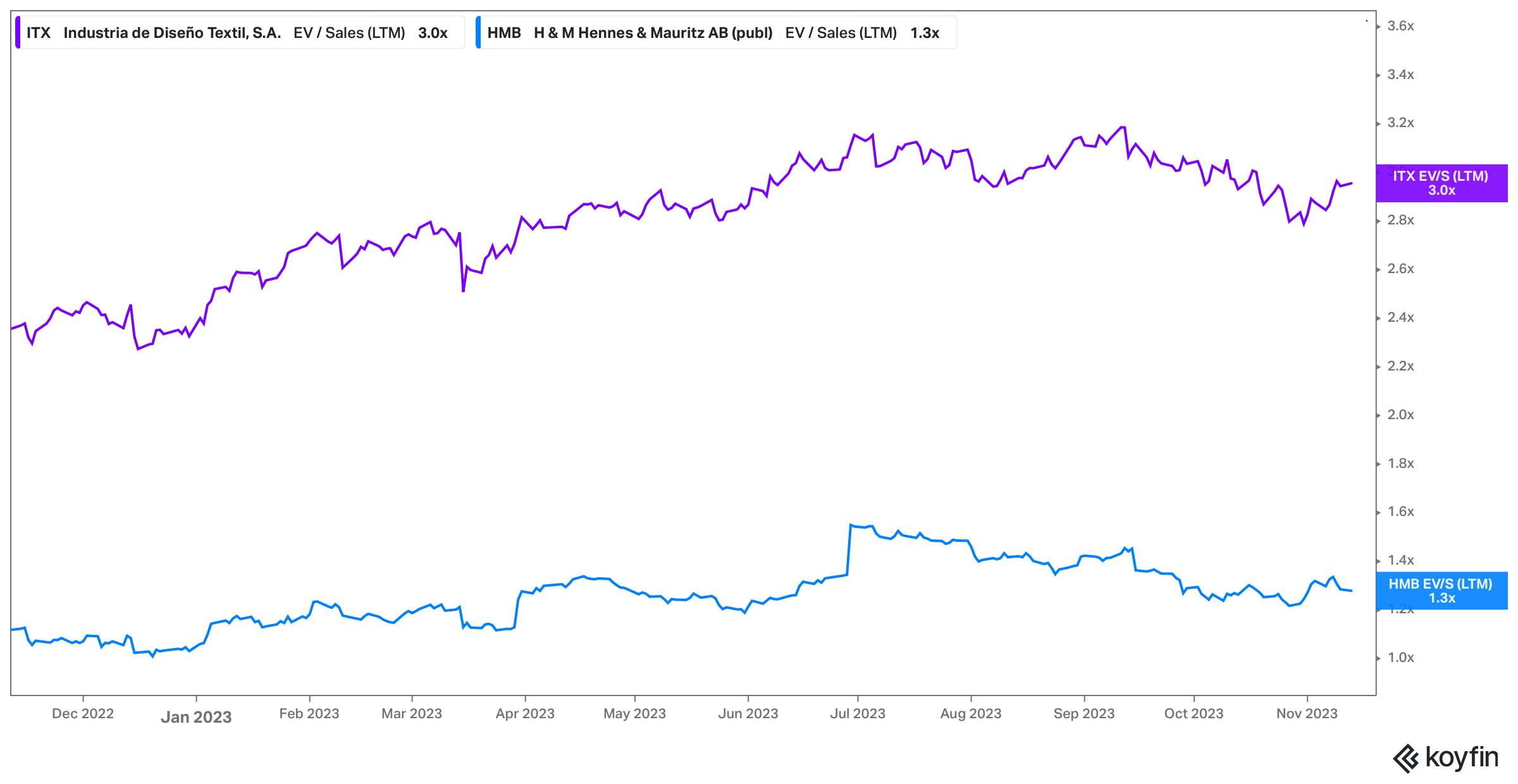

Assuming the May 2023 valuation of $66 billion and SHEIN’s internally projected 2023 revenue of approximately $33 billion, this would put the company at a 2x revenue multiple for that year. For comparison, comparable public stocks Inditex and H&M trade at similar multiples of 1.3-3x.

Source: Koyfin

Key Opportunities

Further Partnerships

Partnerships are a major avenue of growth for SHEIN and other fast fashion brands. To help bolster its omnichannel capabilities, SHEIN has already teamed up with Forever 21 to get access to the latter’s network of retail locations. To streamline fulfillment, SHEIN has partnered with last-mile delivery startup UniUni. Co-branded deals have also been a strong lever for the company. for example, it joined with Warner Brothers to sell chocolate-themed beauty products to promote the studio’s Willy Wonka brand. Using its large user base as currency, SHEIN can effectively fill gaps in distribution, technology, brand, and other functions with strategic partnerships.

Geographic and Vertical Expansion

SHEIN continues to move into new geographies and product verticals. For example, in an attempt to diversify its China-centric operations, the company is investing in warehouses and factories in the US, Canada, Poland, and countless other markets, and in 2023 the company announced a $150 million investment in Latin America, establishing Brazil as its manufacturing and distribution hub for the region. It has similar ambitions for Mexico and other developing countries and plans to roll out its integrated marketplace in countries around the world.

On the product side, SHEIN is expanding beyond fashion and apparel. Appliances and other home goods are the near-term priorities, but electronics, food, and groceries are all potential channels for growth as well. It will face significant competition in these verticals from competitors like Amazon and Temu, but SHEIN’s large user base creates a significant cross-selling opportunity.

Omnichannel Shopping

Long a digital-only brand, SHEIN has yet to fully tap into omnichannel shopping experiences. Consumers began returning to in-store shopping in 2023, and competitors like H&M and Zara have effectively used brick-and-mortar stores to better engage their customers, increase basket sizes, and improve brand awareness. SHEIN began exploring this opportunity in 2023, hosting pop-up stores across the US as part of its marketplace rollout. Additionally, the company’s partnership with Forever 21 will allow it to open physical spaces within Forever 21 stores. As of August 2023, the company insisted it would remain digital-first and had no plans to open permanent physical locations, but hybrid shopping experiences could be an effective extension of the SHEIN brand.

Key Risks

Changing Consumer Preferences

While SHEIN capitalized on consumers prioritizing shopping convenience through the COVID-19 pandemic, these preferences are yet to prove themselves permanent. Discretionary spending slowed in 2022 and 2023, causing many of SHEIN’s penny-pinching customers to pull back on buying items. Additionally, preferences around shopping experiences are changing dramatically. Consumers are prioritizing clothing quality more than ever before and the secondhand market grew 24% in 2022 alone (3x faster than the global apparel market). There is evidence to suggest that online shopping trends established during the COVID-19 pandemic are not entirely durable, with a September 2022 report finding 66% of consumers prefer a hybrid shopping approach including a strong in-store component.

Political Risk

Despite fully moving its headquarters to Singapore in 2021, SHEIN is still subject to the rising tensions between China and much of the rest of the world. In 2020, India banned SHEIN, reportedly in retaliation for an unrelated border dispute between it and China — with the decision being rolled back two years later. In the US, SHEIN has become a favorite target across the political divide, with some lawmakers calling the company a tool of the Chinese Communist Party and others asking the SEC to block any potential SHEIN public offering. SHEIN has since hired a team of lobbyists to help reshape its image on Capitol Hill, but it remains trapped in an unenviable position between China and the West.

Legal Risk

SHEIN’s highly automated business model exposes the company to significant legal risk. Its private labels have drawn the bulk of the attention, with H&M and a growing list of other designers and brands suing SHEIN for copyright infringement, alleging that SHEIN’s processes produced copies of their designs. SHEIN’s supply chain has come under fire, with Temu suing SHEIN for creating exclusive, manipulative contracts with manufacturers. This legal uncertainty is further complicated by SHEIN’s opaque corporate structure that, according to critics, allows the company to “avoid liability” and “avoid disclosing basic information”.

Ethical Concerns

Having received criticism from journalists and advocacy groups for years, SHEIN has developed a significant image problem. The company’s climate footprint has been the target of particularly intense backlash, with its high-volume production model generating an estimated 6.3 million tons of carbon dioxide each year. SHEIN’s treatment of workers has been similarly controversial – multiple investigations have found that the company's factory conditions are unsafe and fail to meet global labor standards. A February 2023 survey found that over 70% of customers were willing to pay more for sustainably produced goods.

SHEIN has sought to improve its brand image through public relations initiatives like EvoluSHEIN and SHEIN X, but critics have been largely unmoved by these efforts. One attempt in particular, a 2023 factory tour for a select group of influencers, faced intense social media backlash. These ongoing public relations issues create uncertainty as to whether the company can maintain its grip on a customer segment that is increasingly conscious of ethical issues in fashion.

Summary

SHEIN has transcended its roots in fast fashion to become one of the largest ecommerce brands in the world. With a vertically integrated supply chain and a deep understanding of consumer trends and preferences, SHEIN has built a growing marketplace of brands and a loyal base of customers, creating an ecosystem that represents one of the first genuine challenges to Amazon and other giant digital commerce incumbents. SHEIN’s potential to transcend its politically sensitive entanglement with China and well-publicized ethical issues remains uncertain, but the company is well-positioned to continue to expand and potentially enter the public market.