Thesis

By 2023, 30.9% of Americans surveyed reported that they used consumer goods subscriptions for most of or all their regularly used products in the prior six months. Subscription services saw a 20-40% boost across categories during the 2020 COVID-19 pandemic as households looked for alternatives to in-person shopping. In particular, as of August 2024, one study found that 53% of pet supply consumers had reduced in-store pet-related shopping, demonstrating the rise of subscription services for pet supplies. For example, Chewy, the largest online retailer of pet food and supplies, had net sales of $11.9 billion in 2024. Among subscribers of Chewy’s Goody Box, an assortment of toys and treats for dogs, 53% shopped for pet supplies in physical stores less often, and 11% no longer shopped for pet supplies in person at all. Chewy was acquired by PetSmart in May 2017 for $3.35 billion, which was the largest ecommerce acquisition to date as of July 2025.

The increased utilization of subscription services for pet food comes in tandem with higher quality pet care and supplies becoming a major household expense category for pet owners. In 2024, US households spent approximately $150 billion on products and care for their pets. Pet food and treats make up nearly half of this total spend, reaching $65.8 billion in 2024. The increased spend on pets is often attributed to the increasing proportion of pet owners who consider their pets part of the family, referred to as humanization in the pet industry. In a 2024 survey, 72% of dog owners reported that their pets were considered part of the family. For example, Chewy refers to pet owners exclusively as “parents”. In 2023, 85% of dog owners prioritize high-quality nutrition over other pet-related purchases.

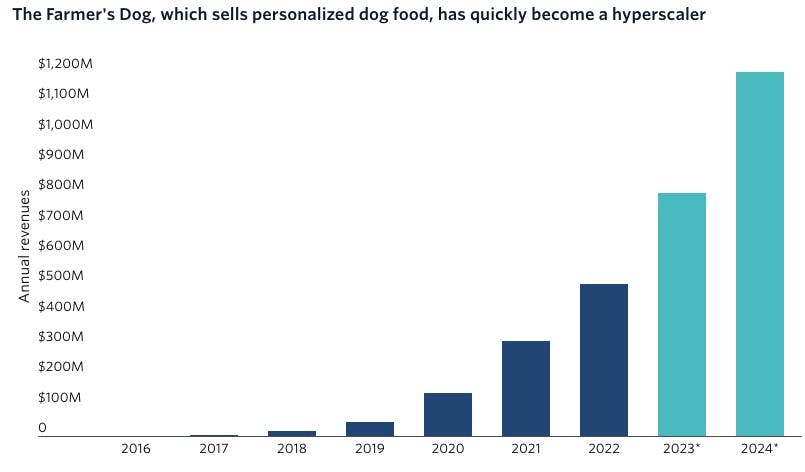

The Farmer’s Dog is an ecommerce company that sells fresh pet food subscriptions to dog owners in the US with a specific focus on premium products. As of 2023, North America made up 35% of the pet subscription market, and dog food made up over 54% of pet subscription box revenue. As of July 2025, The Farmer’s Dog had grown to deliver millions of meals every month. Amid growing direct-to-consumer competition, The Farmer’s Dog has become one of the most recommended fresh dog food brands as of April 2025, with an annualized net revenue of $1.2 billion as of February 2025.

Founding Story

The Farmer’s Dog was founded in 2015 by Brett Podolsky and Jonathan Regev (CEO), who met in 2014 on a birthright trip to Israel.

Podolsky studied at Lynn University in Boca Raton, Florida, and in 2014 was living in New York City, working in finance and as a stand-up comedian. Regev, who attended UC Berkeley, stayed with Podolsky in New York City in 2014 while looking for an apartment of his own. At the time, Podolsky’s dog Jada was sick with digestive problems. Jada’s veterinarian had recommended Podolsky try home-cooked meals, as opposed to the big-bag kibble she had eaten previously. After seeing improvements in her health, he tried switching her back to kibble, but found that her problems returned each time. The pair went on to explore the differences in recipes, regulatory practices, and canine health outcomes between home-cooked dog food and traditional pet foods. The experience inspired Podolsky and Regev to start The Farmer’s Dog.

The company launched in 2015 in a production kitchen for rent in New York City, where each bag was labeled by hand with the customer’s dog’s name and delivered by Regev and Podolsky. By the end of the first year, there was so much demand from customers that a waitlist had to be formed, and the company started speaking to investors to explore expanding further.

The company wanted to scale operations specifically by beginning production in a factory that also manufactured food for humans. Its goal was to operate in a facility that was regulated at the same level as human food. However, most factories did not want to be associated with making dog food, regardless of how it was made. Podolsky and Regev spoke with over 200 factories before finding one that would manufacture for The Farmer’s Dog, becoming the first pet food company to manufacture in a human food facility.

The founders have said the company was profitable even before raising external funding, and that the first hires they made were software engineers, designing the company’s website and customer fulfillment system. As of July 2025, the company had grown to over 500 employees and has offices in Greenwich Village in NYC, Boca Raton, and Nashville, Tennessee.

Product

The Farmer’s Dog offers a fresh, human-grade dog food subscription service. The company mails customers frozen bags of one or more dog meals selected from a choice of five recipes based on recommendations for nutrient profile and portions specific to a customer’s pet, as of July 2025. The company’s core product includes recipes designed with production regulations and canine health outcomes in mind, personalized meal plans, and a subscription delivery service.

Recipes

Regev and Podolsky found that ingredient labels claiming pet foods were made with “whole foods” or organic ingredients still differed significantly from the foods made in Podolsky’s kitchen. The pet food industry is not regulated like the human food industry, meaning, for example, that way pet food is manufactured differs significantly, end products could include meats that are not USDA inspected or approved, and may be from diseased animals, or not contain animal muscle and fat but instead use bones or skin.

There are significant differences between the regulatory standards for facilities that manufacture human food versus and that manufacture pet foods. Products for human consumption must be manufactured in “current good manufacturing practices” (cGMPs) as defined by the Food and Drug Administration (FDA). These standards regulate sanitation practices, construction requirements, and employee rules, among other contamination mitigation measures. There are far more recalls of human food than pet food each year because of these higher standards, making it hard to compare the contamination risk for human food facilities versus pet food facilities.

The Farmer’s Dog has found that ingredient labels for traditional pet food have differences from human food nutritional labels that can make interpreting them more difficult for consumers. Many labels employ deceiving tactics like listing ingredient constituents in a way that makes more attractive ingredients like meat and vegetables appear first in ingredient lists. As an example, The Farmer’s Dog points to a product label that could list ingredients either as “Rice (30%), peas (30%), Beef (20%), potatoes (20%)” or, more accurately, as “Beef (10%), beef heart (10%), long grain rice (10%), brown rice (10%), white rice (10%), split peas (10%), pea protein (10%), english peas (10%), potato (10%), potato starch (10%).”

Pet foods claiming to be made “with chicken” or “with beef” may be comprised of less than 3% of that ingredient by weight. In fact, the requirements for using terms like “organic”, “natural”, and “feed-grade” in pet food marketing are quite broad. The way traditional dog food is regulated is fairly lax in general. For example, one DNA study found that nearly 40% of pet foods contained meat from animals that were not listed on the label.

The legally allowable ingredients in pet food, as regulated by the Association of American Feed Control Officials (AAFCO), include “4D” or dead, dying, diseased, or disabled animal meat and meat byproducts that have been sufficiently processed. This processing requires heating the ingredients to temperatures high enough to induce the synthesis of cancer-causing compounds like Acrylamide. The US Centers for Disease Control (CDC) notes that pet owners should wash their hands thoroughly after handling pet foods, and shouldn’t let pets lick human faces or mouths shortly after eating.

The status quo of pet food regulation isn’t just unhealthy; it leads to negative health outcomes for animals. Dogs, in particular, have frequent health issues. According to The Farmer’s Dog, over 80% of dogs will develop a form of dental disease in their lifetime, and over 60% are overweight. Other studies show that canine incidences of infectious respiratory diseases and allergies have also risen, which can be attributed to diet-related issues. Since the early days of the company, the Farmer’s Dog has worked with veterinarians to develop fresh pet food recipes that would provide higher-quality health outcomes.

The Farmer’s Dog recipes are made exclusively with human-grade ingredients, and the founders have tasted the food themselves, emphasizing the fact that their products “test on humans”. In addition, The Farmer’s Dog has continued to manufacture its dog food in human food-grade facilities. As of September 2024, the company said it had no plans to vertically integrate by opening its own factory, specifically to continue operating in a facility with human food-level oversight. As of July 2025, the company manufactured all products in the United States.

Personalized Meal Plans

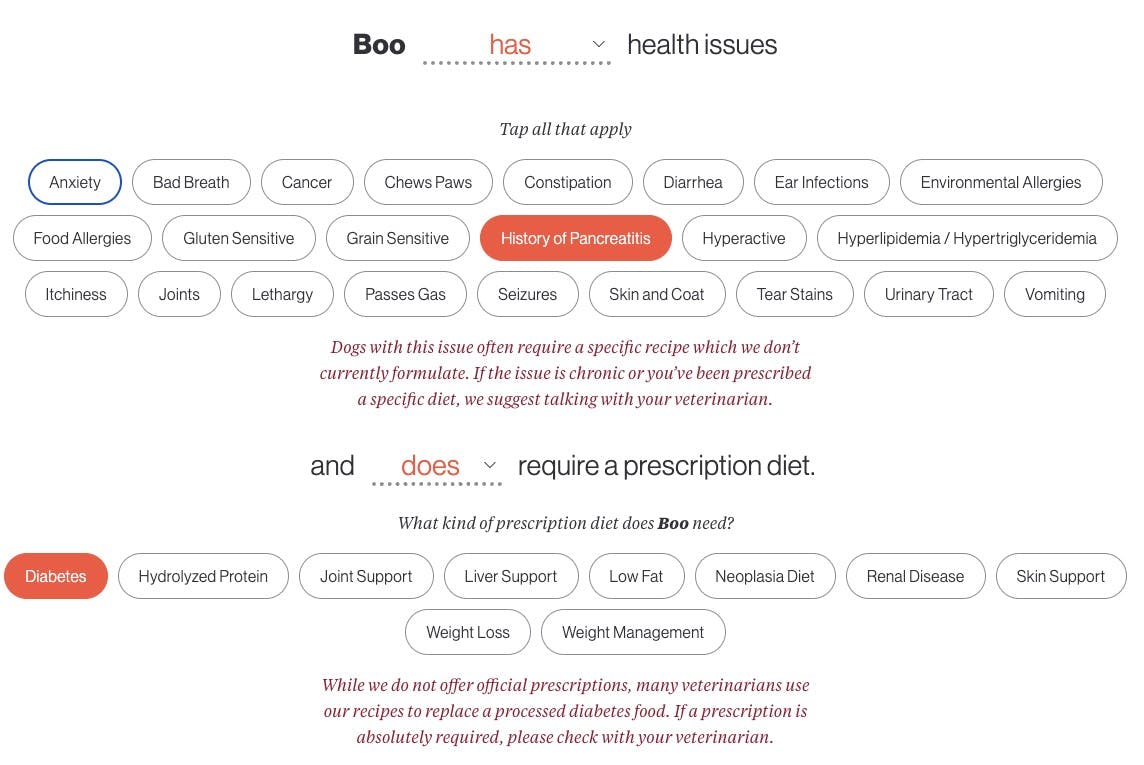

Prospective customers of The Farmer’s Dog complete a dog profile questionnaire, which helps the company understand the nutrient and calorie needs of the animal based on the breed, age, activity level, and size. In addition, the form enables The Farmer’s Dog to collect health information about the pet and any applicable prescription diet considerations.

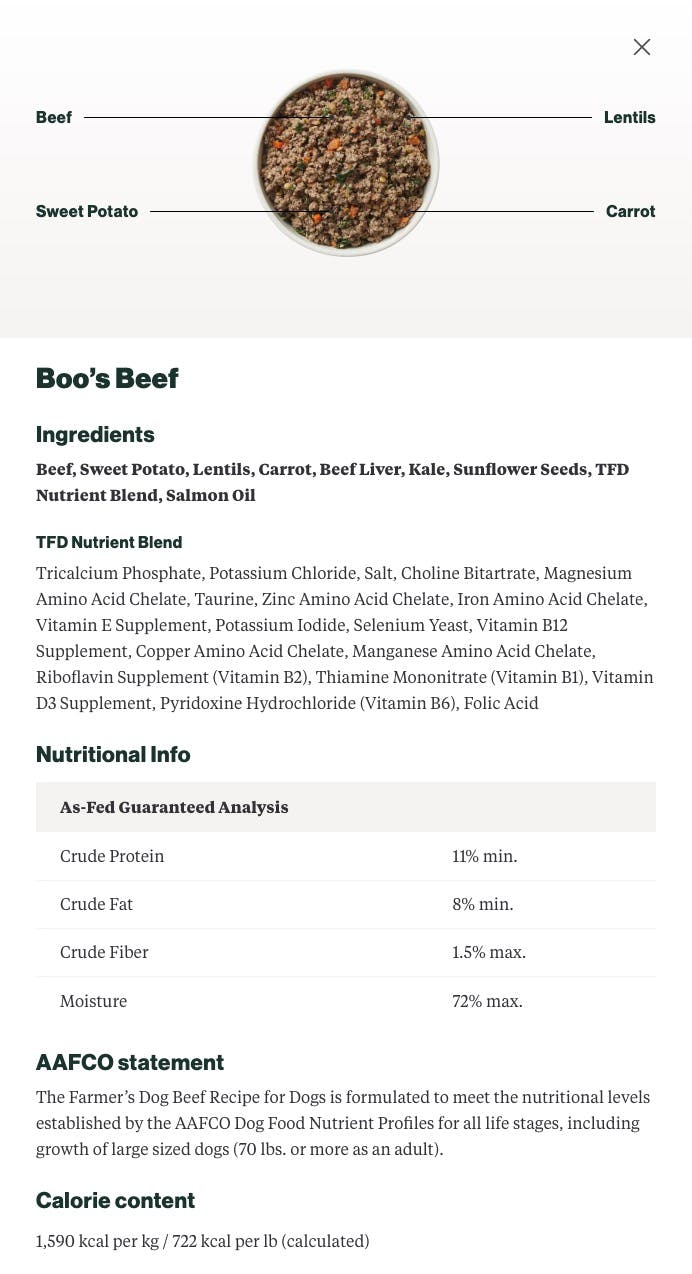

Source: The Farmer’s Dog

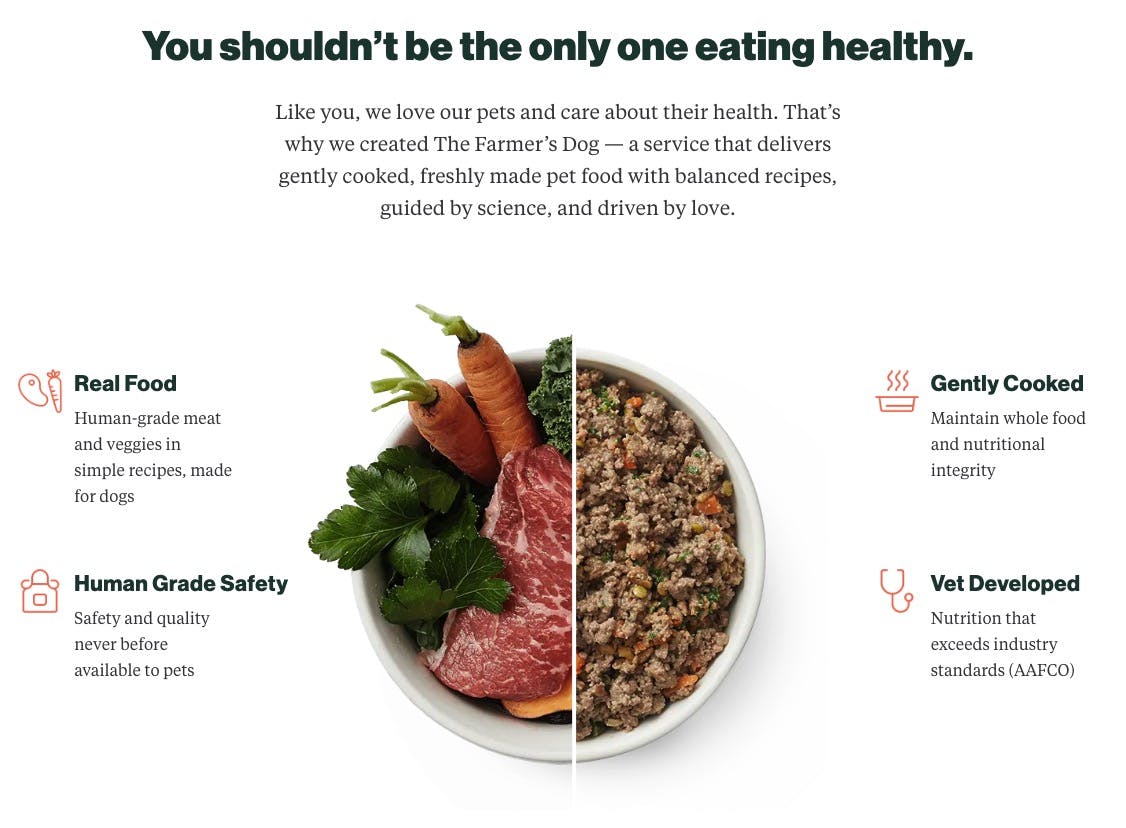

After completing the form, the website recommends a meal plan consisting of one or more recipes. The meals are described as “fresh” as opposed to wet, dry, or raw, and “gently cooked just enough to get rid of dangerous pathogens while maintaining whole food integrity”. Because the food is both cooked and frozen, this contradicts the AAFCO definition of “fresh”. The meals are also described as “human grade”, a label that is regulated by AAFCO standards based on the ingredients, cooking methods, and manufacturing process. None of The Farmer’s Dog products contain preservatives.

Source: The Farmer’s Dog

The Farmer’s Dog consistently claims that the meal service is “personalized” to individual pets, though, in reality, only the dog’s name and the package portions are personalized, not the recipes themselves. Some customers believe that “every batch of food is personalized for [their dog]’s idiosyncrasies,” but The Farmer’s Dog does not offer prescription diets for dogs with health conditions or truly customized recipes. Podolsky told a reporter in 2017 that as the company continued to scale, “each pack of food will continue to be precisely portioned for each pet and will always feature his/her name on the label.” Despite the lack of full recipe personalization, the company has continued to lean into the idea of personalization, with Podolsky saying in a 2020 interview:

“At first, we thought we couldn’t afford to continue to be personalized since we felt our ultimate differentiator was the quality of our food, more than the personalization. But over time, we realized that personalization was fundamental to who we are as a brand.”

All the bags processed by The Farmer’s Dog are the same size, but include guidelines on how many servings are appropriate for each pet (e.g., 4 servings per bag versus 8 servings per bag). The founders said in 2021 that they were exploring pre-portioned bags but did not want to compromise on their goal of minimizing plastic use in packaging.

Fresh “Human-Grade” Dog Food

The recommendation system selects one or more of five preset recipes for the pet based on the responses entered in the form. There is no difference in the composition of each of the recipes depending on the characteristics of the pet: the only difference is the recommended portion size. Four recipes are shown below; the fifth is Chicken and Grain, which is slightly less expensive.

Source: The Farmer’s Dog

Each recipe contains information about the proportion of protein, carbohydrates, and fat in the product, which are the most common metrics used to distinguish dog foods. The Farmer’s Dog recipes are all comprised of at least 50% meat. The macronutrient percentages differ from those typically seen in traditional extruded kibbles, which, after cooking, are dehydrated and air-puffed. These differences are largely due to the percentage of water in products from The Farmer’s Dog. The company’s product is not dehydrated and is typically around 75% water, compared to traditional pet foods, which typically contain about 10% water. The high water content can help support kidney health.

Source: The Farmer’s Dog

Subscription Service

Customers purchase dog food from The Farmer’s Dog by subscribing to a meal delivery service, as opposed to purchasing food a la carte. As of July 2025, the company only sells directly to consumers and ships to the contiguous 48 US states. The Farmer’s Dog claims it can provide cheaper prices compared to retail by delivery direct-to-consumer and avoiding markups from large retail stores. Subscriptions are sent every seven to 60 days, depending on the size of the dog. Food is mailed frozen and insulated, and the company instructs users not to serve the food if the temperature exceeds 40°F. Customers are expected to store food in the freezer, which can take up significant space, and allow packages to thaw for about 12 hours in the refrigerator prior to serving.

Source: Animal Bliss Blog

Brand as a Product

The Farmer’s Dog does not have a dedicated marketing team, but instead has a community team focused on keeping the company close to its current and potential customers. The company’s emphasis on community is underscored in the fact that, as of September 2021, co-founder Podolsky’s official position within the company was Head of Community, while Regev was CEO.

The Farmer’s Dog community includes staff veterinarians and a dog care blog called Digest, as well as an affiliate program that includes influencers, podcasts, newsletters, pet service professionals, nonprofits, other pet brands, and event companies. The company’s community-building effort has also included partnerships with the New York Mets, social media accounts, and events like dog socials and adoption drives.

Market

Customer

The primary customer of The Farmer’s Dog is households that own dogs. As of 2024, 51% of US households have dogs, up from 44% in 2023. The cohort with the largest increase in dog ownership was Gen Z, with ownership rising 43.5% between 2023 and 2024. Higher-income households in the US make up a disproportionate share of total spending on pets, and spending on pets has historically been resistant to economic changes. During the COVID-19 pandemic, pet adoption increased, though by less than some reports indicated. From January through November 2020, pet food industry stocks outperformed the S&P 500 by 30% As of 2024, 77% of surveyed pet owners said that pet ownership had not been affected by the economy.

The subset of dog owners that comprise The Farmer’s Dog’s customer base is characterized by those with higher incomes, higher proclivity for online or subscription purchases, and/or pets with particular dietary needs or preferences. In particular, dog owners who have a stronger-than-usual affinity for their dogs are more likely to purchase the types of products sold by The Farmer’s Dog. According to a 2024 survey, 72% of dog owners reported that their pets were considered part of the family, though this included only 46% of Gen Z dog owners compared to 76% of Baby Boomer dog owners. So there can be an even greater tilt towards older dog owners who are like customers of The Farmer’s Dog. As of July 2025, The Farmer’s Dog has specifically targeted customers with similar characteristics to their existing customer base.

Market Size

The global pet food market was estimated to be between $127 billion and $152 billion in 2024. Of that market, the US pet food market is estimated at between $44 billion and $62 billion, roughly 30-40% of the global market. Within the US pet food market, the portion contributed by dog food is 30-35%, adding up to between a $16 billion and $19 billion US dog food market. The portion of the dog food market served by ecommerce solutions is typically 40% compared to in-person retail. The estimated market size for fresh dog food provided via subscription services in 2024 is $3.4 billion, roughly 17-21% of the overall US dog food market.

Competition

The American Feed Industry Association (AFIA) reported at the 2024 Pet Food Conference that one-third of new pet food products in the prior five years had come from new entrants to the market, a much higher share than in the human food market. Many of these new entrants point to quality ingredients and recipes as their primary selling point. However, given the lax regulatory environment around dog food, it can be difficult to differentiate the claims across a broad and noisy competitive landscape. Despite the noise, as of August 2024, 70% of the dog pet supply subscription market share was held by the seven largest players, including The Farmer’s Dog, BARK, and Nom Nom.

BARK

BARK, formerly BarkBox, is a dog subscription box service founded in 2011 by Carly Strife, Matt Meeker, and Henrik Werdelin. The company’s primary product is monthly delivery of boxes containing a selection of toys, treats, and chews personalized to individual dog preferences. Since its inception, the company has expanded to offer dog dental products, essentials like beds, harnesses, and car covers, as well as apps including Bark Buddy, an adoption app, and Bark Cam, an “Instagram for dogs”. In 2024, the company launched BARK Air, a private jet service for dogs and their owners. Similar to The Farmer’s Dog, BARK offered a dog food delivery service in 2020, though the company delivered food from other brands, including Purina and Nature’s Variety. BARK reportedly hasa 30% market share in subscription boxes for pets. BARK was publicly listed in June 2021 and has a market cap of $162 million as of July 2025.

Ollie

Founded in 2016, Ollie produces fresh human-grade pet food and competes directly with The Farmer’s Dog. Ollie has raised $50.7 million, including a $21.4 million Series B in March 2024. Like the Farmer's Dog, Ollie asks customers to complete a survey for recommendations for their pet, though it does not ask about pet health conditions. Ollie’s product is similar to The Farmer's Dog’s, but the company’s subscription service is marketed as a membership facilitated by a mobile app. The app helps customers measure portions for their dog and provides free digestion, dental, and weight health screenings for dogs. The membership also includes a storage container for unfinished food and a measuring scoop. Ollie dog food is made from human-grade ingredients in the company’s Minnesota manufacturing facility. Unlike The Farmer's Dog, Ollie sells both fresh and baked (dry) dog food and, as of July 2025, offers seven flavors.

Nom Nom

Founded in 2014 by Nate Phillips and Alexandria Jarrell, Nom Nom is a pet meal subscription service for both dogs and cats. Nom Nom was acquired in January 2022 by Mars Inc. for $1 billion. Mars Inc. also owns Royal Canin, a major traditional pet food brand, and said in January 2022 that Nom Nom would operate as an “autonomous brand” under the Mars Petcare umbrella. Prior to its acquisition, Nom Nom raised a Series B in April 2021 of $21 million. Nom Nom produces fresh, hydrated meals similar to The Farmer’s Dog.

JustFoodForDogs

JustFoodForDogs is a fresh pet food company founded in 2010 by Shawn Buckley. The company’s dog food offerings include frozen, nonperishable, prescription-formulated, and DIY meals. Unlike most other pet food brands, the company offers personalized meals that are actually formulated for a specific pet. JustFoodForDogs offers fresh dog food direct to consumers, both a la carte and via subscription, and sells in retail locations like Petco and branded locations. These locations offer JustFoodForDogs products off the shelf and have small kitchens where shoppers can watch the food be prepared. As of July 2025, the company had raised $105.1 million.

Maev

Maev* is a human-grade dog food company founded in 2018 by Katie Spies and Christine Busaba. As of July 2025, the company sells freeze-dried raw dog food, supplements, treats, and bone broth for dogs and is a direct competitor to The Farmer’s Dog in the direct-to-consumer dog food market. Maev offers both subscription and à la carte orders, and allows customers to select products off the shelf with the option to specify pet characteristics to receive portion recommendations. Maev’s primary distinction from other companies in the market is the fact that its food product is never cooked, which the company website claims is cheaper and healthier for dogs than traditional pet food or other fresh food alternatives. Maev has raised a total of $19 million as of July 2025, with a Series A funding round in 2022 led by VMG Partners at an undisclosed valuation.

Open Farm

Founded in 2014 by Isaac Langleben, Derek Beigleman, and Jacqueline Prehogan, Open Farm is an Ontario-based pet food startup that competes directly with The Farmer’s Dog. Open Farm raised $65 million via private equity funding from General Atlantic in 2021. Open Farm makes dry, “fresh”, freeze-dried raw, bone broth, and wet food for dogs and cats. They do not ask prospective customers to complete a survey for a personalized recommendation, and instead show all their products and prices up front. Unlike The Farmer's Dog, Open Farm sells products a la carte and does not offer subscription services.

Raised Right

Raised Right was founded in 2016 by Braeden, Mary Ann, and Larry Ruud, who started cooking for their pets at home after mass pet food recalls in 2007. The company produces human-grade dog and cat food that meets AAFCO standards for balanced and complete pet foods without using synthetic vitamins and minerals, unlike The Farmer’s Dog and most other pet food companies. These meals are fresh, as opposed to dried, and are shipped frozen to customers. Raised Right is sold in retail locations nationwide. As of July 2025, it had not raised funding.

Dog Child

Dog Child is a dog food startup that sells premade dog meal supplement mixes. Founded in 2021 by Nicole Marchand, Dog Child aims to address the nutritional deficiencies encountered by owners trying to make pet food from scratch at home. It sells blends of canine multivitamins and other ingredients included for their nutritional profile, like fruit and oats. Customers can prepare meals for their dogs by cooking the mix with the meat of their choice. As of July 2025, Dog Child had raised $210K in funding.

Freshpet

Freshpet is a pet food company founded in 2006 by former executives in the pet food industry, Scott Morris, Cathal Walsh, and John Phelps. Freshpet makes perishable, refrigerated pet food for cats and dogs packaged in tubes, and differs from other fresh pet food companies in that it does not recommend its product as personalized to individual pets. It was reportedly the first company to produce and distribute refrigerated pet food in North America, growing in 2007 after a mass dog food recall prompted many pet food buyers to turn to alternatives without preservatives. Freshpet owns its manufacturing facilities, allowing it to control production processes and quality. Freshpet was publicly listed in November 2014 at a $477 million valuation and, as of July 2025, had a market cap of $3.5 billion.

The Pets Table by HelloFresh

Unlike many other competitors of The Farmer’s Dog, The Pets Table by HelloFresh is a subsidiary of a human food subscription company, HelloFresh. The brand was originated by three HelloFresh employees who owned dogs. Similar to The Farmer’s Dog, The Pets Table asks prospective customers to complete a survey about their dog to receive recommendations. The Pets Table makes both fresh, or wet, and air-dried food as well as dog treats. Its products are available directly from the website and through partners like Walmart and Chewy. Some air-dried options are also available in select Walmart stores.

HelloFresh is primarily a meal kit company for human food, delivering meal ingredients and cooking instructions to customers. This contrasts with The Pets Table, which is already cooked and ready to eat. HelloFresh was founded in 2011 in Berlin by Dominik Richter, Thomas Griesel, and Jessica Nilsson. As of July 2025, the company was listed on the Frankfurt Stock Exchange and had a market cap of $1.7 billion.

Business Model

The Farmer’s Dog customers can purchase dog food by subscribing to a meal delivery service, as opposed to purchasing food a la carte. This business model has been compared to other direct-to-consumer companies like Blue Apron and Dollar Shave Club.

Revenue

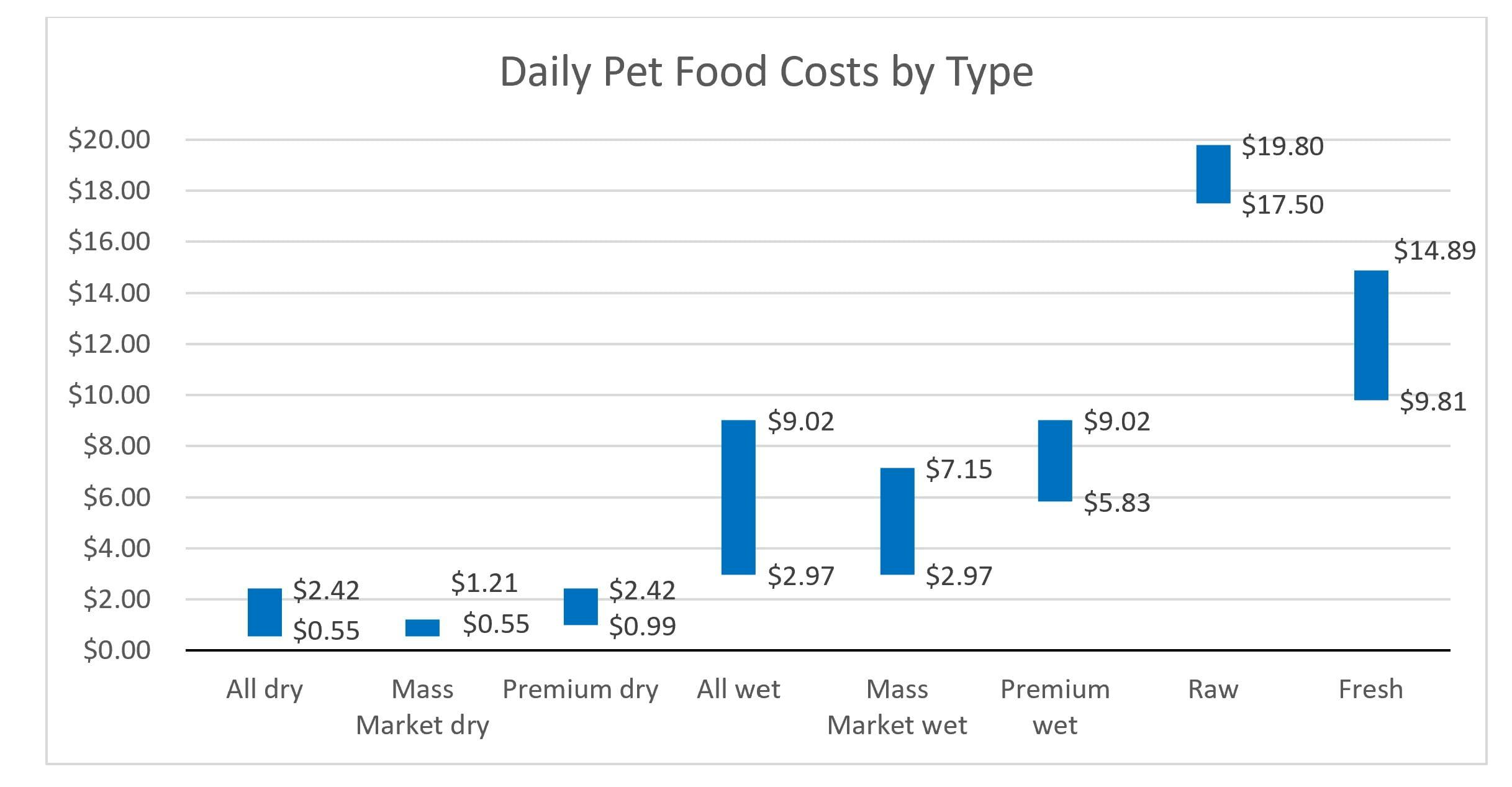

The price of The Farmer’s Dog subscription varies depending on recipe selection and size of dog, ranging from around $2 a day for the smallest dogs on the cheapest recipes to around $20 or even $30 per day for extra large breeds that are very active. One analysis of the company claimed its products “may be the most expensive dog food products ever sold in the United States”.

Subscription pricing can be difficult to determine from the company website alone, with no price information available without completing the questionnaire, except a note on the FAQ page stating that meal plans start around $2 per day. After completing the questionnaire, the website’s displayed prices reflect the 50% discount applied for orders from new customers. At full price, The Farmer’s Dog typically costs 5-6x more than even premium dry kibble.

Source: Tufts University

Research from one pet food brand found that as of February 2024, 25K users search “How much does the Farmer’s Dog cost?” on Google every month; 25x as many users search the same question for the top ten most popular dog food brands combined.

As of August 2024, The Farmer’s Dog prices had reportedly fallen since the company started, though the degree of decline is unclear. The founders have said they deliberately did not want to rely on a scaling model that involved raising prices after acquiring customers. As of July 2025, The Farmer’s Dog targets customers who are more likely to purchase at the higher end of the price spectrum and have dogs with preferences or needs for specialty dog foods.

Costs

Supply Chain & Operations

Production of The Farmer’s Dog is more expensive than the manufacturing of traditional pet food for several reasons. Its product’s ingredients are more expensive, and its human-grade US manufacturing facilities generally have higher operational costs than pet-food facilities. Shipping products is also more expensive relative to traditional pet food brands because the 75% water content of the food makes it heavier. In addition, the perishable nature of the food requires cold shipping and cold storage for surplus inventory.

Other than stating that all manufacturing takes place in the US, The Farmer’s Dog has not shared the location of its manufacturing facilities as of July 2025. In addition, The Farmer’s Dog has not indicated that it has plans to change the model of working with established human-food manufacturing facilities in order to, for example, operate its own production plant. The company has stated it prefers partnering with an established human-food facility instead of pursuing vertical integration in order to maintain human-grade regulatory inspections. The company has distribution centers in New York and Chicago.

The Farmer’s Dog’s corporate operations also differ from traditional pet food companies, as the company has prioritized a significant digital presence and high-quality customer service. This has included building its own AI subscription management instead of using external services.

Marketing

The Farmer’s Dog’s primary channel of customer education is digital advertising. Costs for online and mobile ads have risen since the COVID-19 pandemic, impacting a number of direct-to-consumer brands that do not have a retail presence. The Farmer’s Dog has also reached prospective customers with TV advertisements, most notably making headlines with its 2023 Super Bowl commercial “Forever”. The ad was voted top commercial in the 2023 Super Bowl broadcast by the USA TODAY Ad Meter and was nominated for an Emmy.

Customer acquisition is a critical part of the business, given the number of competitors. In addition, Nikhil Trivedi, who led the Series A funding round for The Farmer’s Dog at Shasta Ventures, has pointed out the difficulty of re-capturing customers who leave the brand, given how loyal customers can become to a product their pets enjoy. This can work both for and against The Farmer’s Dog in acquiring new customers while retaining its existing customers.

The Farmer’s Dog has also utilized email campaigns, physically mailed postcards or pamphlets, phone and text communications, as well as word-of-mouth. The founders said in 2019 that word-of-mouth recommendation, particularly referrals, is the marketing channel they care most about. One media intelligence report noted that The Farmer’s Dog specifically does not target marketing to existing customers of human-grade or fresh pet food, and instead targets customers who are exclusively feeding traditional kibble to their pets, claiming that they see other players in the space as allies and not competition.

They also market to owners of pets with health issues like food allergies or digestive problems. That report claimed that “If a customer has a Poodle with sensitive stomach issues but did not purchase the food, The Farmer’s Dog uses their personalized data to reach out to the customer with a testimonial from a customer who has a poodle with sensitive stomach issues and has found that The Farmer’s Dog has helped their dog overcome their stomach issues”.

The Farmer’s Dog has also partnered with a number of organizations, including the World Small Animal Veterinary Association (WSAVA) and a partnership with the New York Mets for Bark at the Park nights. The company has also partnered with grooming, pet cleanup, and pet-sitting services nationwide.

While the company has not publicly shared details about social media campaigns, one marketing report claimed that The Farmer’s Dog Facebook ads increased sales by 57%, saying the company implemented a cost-cap bidding method for ad placements and allowed Facebook’s internal algorithm to determine audience targeting. The report also claimed that the company re-targeted ads to audiences that had previously visited its website through ads. In addition to Facebook, Gen Z pet owners in particular turn to social media platforms like YouTube, TikTok, and Instagram for information about pet products and services. The Farmer’s Dog partners with pet-owning influencers to extend their reach.

Source: The Farmer’s Dog

Traction

While the company does not share exact customer numbers, it reported that, as of July 2025, the company was delivering millions of meals every month. By March 2025, The Farmer’s Dog claimed to have delivered over 1 billion meals to its customers.

As of March 2025, the company’s estimated annualized net revenue for 2024 was $1.2 billion, up 50% YoY from $800 million in 2023. As of March 2025, competitor Freshpet was similarly generating $1 billion in annual revenue. Meanwhile, Bark, the company behind BarkBox, expects to generate $500 million in annual revenue by March 2026. Other competitors, like Ollie, are smaller, expected to have generated $61 million.

Source: Pitchbook

Valuation

As of July 2025, The Farmer’s Dog had raised total funding of $103 million, not including $65 million the company raised in 2021 at a $1.5 billion valuation. The company’s $8 million Series A round was led by Shasta Ventures and included Forerunner, an investor in other direct-to-consumer companies like Warby Parker and Dollar Shave Club. It raised $39 million in 2019 in the largest ever Series B for a pet startup at the time.

The landscape of ecommerce dog food brands is broad with everything from publicly traded companies like Freshpet, with a market cap of $3.5 billion as of July 2025, to companies like Nom Nom that were acquired in January 2022 by Mars for $1 billion, and even internally developed products like The Pets Table, created by HelloFresh employees with dogs. In terms of the likely outcomes for The Farmer’s Dog, it seems that there are a variety of options, including IPO, strategic acquisition, or even a majority transaction from a private equity firm.

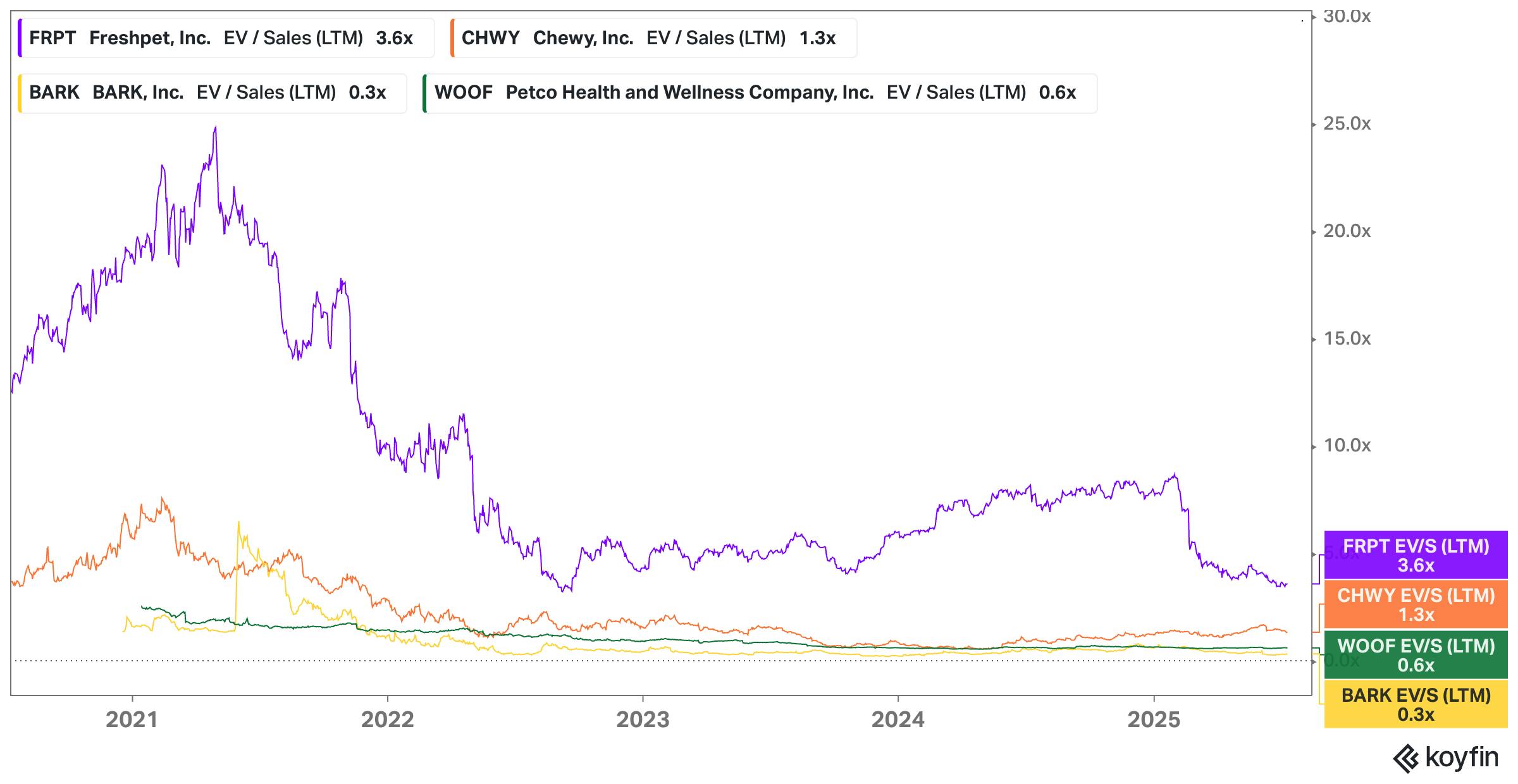

Chewy, for example, was both acquired by PetSmart for $3.35 billion and then later taken public by PetSmart and ultimately spun out as a separate entity, and was trading at a market cap of $16 billion as of July 2025. In terms of how these types of businesses trade, public comps such as Bark, Chewy, Freshpet, and Petco trade at a range of 0.3-3.6x LTM revenue. Compared to The Farmer’s Dog at $1.2 billion in 2024 revenue, that would imply a potential valuation of $360 million to $4.3 billion.

Source: Koyfin

Key Opportunities

International Expansion

As of July 2025, The Farmer’s Dog only operates in the 48 contiguous United States. The company has the potential to expand internationally, specifically because it produces human-grade pet food. Differences in quality and regulatory standards for pet food in the US versus Europe prevent some US pet food brands from expanding internationally. The Farmer’s Dog human-grade ingredients and manufacturing process could give it a leg up in the premium dog-food market. According to a 2024 study, Europe’s human-grade pet food market is expected to grow faster than the global average between 2025 and 2030, making expansion an attractive possibility.

Retail Stores

Unlike some of its competitors, The Farmer’s Dog has not expanded to brick-and-mortar stores as of July 2025. Retail sales can improve distribution logistics and in-person product visibility to potential customers. Pet supply stores typically allow dogs to shop with their owners, a distinctive experience that keeps some owners shopping in person instead of online. Research on in-person shopping has found that social interactions are one of the primary motivators for visiting physical stores versus shopping online. It has been proposed that bringing dogs to places like pet supply stores and hardware stores is a novelty for both humans and pets.

Retail locations would likely lower costs associated with individual pet packaging, such as name-labelled packages and individual order cold shipping, and could simplify distribution logistics. There are a variety of strategies in terms of retail distribution as well. While most competitors of The Farmer’s Dog partner with general pet supply stores, JustFoodForDogs has company stores selling its own products exclusively.

Product & Customer Diversification

Beyond higher quality dog food, humanization of pets has fueled demand for products like dog DNA testing and dog nutritional supplements. Dog DNA testing was an estimated $447.9 million market as of April 2025, but is expected to grow to over $1 billion by 2034, with startup Embark raising $94.3 million for dog DNA testing in April 2025. Dog nutritional and longevity supplements are also estimated to be a $500 million market as of April 2025, with expectations of growth up to 186% by 2033. There is the potential for The Farmer’s Dog to expand into a broader subset of products for dogs in order to increase the value the company can generate from each customer.

In addition to broadening its product set, The Farmer’s Dog could also broaden the types of customers it serves. One potential customer could be dog boarding facilities, which sometimes offer food for boarded dogs if customers prefer not to provide their own. As of 2023, only 6K out of a total of 20K pet boarding facilities were customers of pet supply subscription services, given concerns about storage, especially for perishable food products, and prices. As of July 2025, The Farmer’s Dog has not said whether it is working with any dog boarding facilities, but these or other aggregators of dog owners could be interesting partners.

Key Risks

Increased Advertising Costs

Online advertising, a primary marketing channel for The Farmer’s Dog, has become increasingly expensive as competition for user attention increases. One May 2025 report found that the cost of advertising online had nearly doubled from $41.40 to $70.11 per Google Ads Lead. iOS tracking limitation technology, which allows Apple users to opt out of having their behavior tracked, has made targeting ads to prospective customers even more difficult. Improvements in the algorithms used by sellers of advertisements like Google have made their ad placements more valuable, and the growing variety in ad formats has made higher ROI activations possible. These rising costs have impacted the bottom line of other Direct-to-Consumer businesses like Allbirds and Warby Parker, but as of March 2025, have yet to clearly impact the business model of The Farmer’s Dog.

DIY Dog Food

In line with the increase in dog owners’ concern over their pets’ health, home cooking for pets has increased in popularity. As of 2023, 20% of pet owners claimed that they cooked for their pet at least some of the time. Historically, 95% of homemade dog foods studied were lacking in key nutrients, though that was according to a 2013 UC Davis study. Even if access to quality dog food ingredients has become easier over the last decade, making home cooking can still be challenging for owners who do not supplement their pets’ food with vitamins and minerals.

Home cooking could become a compelling option for customers concerned about price, as one comparison noted:

“On the low end, home-cooked meals for a 50-lb dog come in at about $2.50 per day, or $69.44 per month, and on the high end, they come in at $6.10, or $170.80 per month. The lowest-priced home-prepared meals are only marginally more expensive than the highest-priced dry kibble, which comes in at around $2 per day for a 50-lb dog. However, there is a steep cost difference between homemade food and pre-made fresh food options, which range in price from $3.40 to $22 per day for a 50-lb dog.”

Pancreatitis

A number of The Farmer’s Dog customers have made social media posts on Reddit and TikTok claiming their dogs developed pancreatitis as a result of the product. Complaints have also been made to the Better Business Bureau about dogs developing pancreatitis in the same period they were eating The Farmer’s Dog, with six out of 58 complaints mentioning pancreatitis specifically. Vets have noted that at least some canine digestive issues, including problems as severe as pancreatitis, can be triggered in dogs that are already susceptible to such diseases by the reaction of switching food types drastically and quickly. As of 2021, The Farmer’s Dog claimed that no scientific studies showed a relationship between higher fat diets and canine pancreatitis, though diets both high in fat and low in protein have been associated with the disease.

Consistent Diet Debate

While subscriptions for human food can face challenges associated with a lack of variety, subscriptions for pet food typically don’t have the same problem because dogs have more consistent diets. Additionally, demand for pet food is much more consistent than that of humans using meal services, as dogs typically eat the same amount each day and do not miss meals at home to, for example, eat at a restaurant. Consistent pet diets allow The Farmer’s Dog to maintain a relatively limited number of SKUs compared to human subscription food options.

However, veterinarians, pet owners, and pet food manufacturers have mixed views on whether this is preferable. On the one hand, those in favor of consistency claim that a consistent diet is preferable for dog digestion and nutrition absorption. Others claim that changes in pet diet, or rotational feeding, can allow dogs to benefit from a wider spectrum of nutrients and decrease the risk of food sensitivities.

If pet owner preferences or veterinarian recommendations were to shift towards a more varied diet, it would introduce higher friction within the supply chain of The Farmer’s Dog. The company could have to start carrying a wider selection of food options, which could increase inventory carrying costs and delivery complexity.

Scientific Backing

AAFCO requires pet food to meet at least one of three requirements to be described as “complete and balanced”. First, the food can meet the required nutrient profile of the AAFCO for the dog stage of life which the food is intended. Second, the food can be qualified by the “family rule”, which qualifies foods that are nutritionally similar to others that are considered complete and balanced. The third is an AAFCO feeding trial, in which eight dogs over one year old consume the food for six months and are monitored for changes in weight, nutritional deficiencies, and blood metrics.

The Farmer’s Dog has criticized this testing as failing to capture the long-term impacts of different diets beyond the six-month mark. In March 2014, The Farmer’s Dog partnered with Cornell University College of Veterinary Medicine to study 10 dogs eating The Farmer’s Dog prescribed diets for at least one year and up to six years. The Farmer’s Dog has also made philanthropic contributions to veterinary research, including a $10 million contribution announced in March 2025, and funded the long-term study with Cornell, which concluded that all 10 dogs remained healthy after consuming the product for a year.

There has yet to be any scientific study showing that The Farmer’s Dog increases canine lifespans, despite the company’s slogan being “Long Live Dogs”. The Farmer’s Dog does feature dogs aged 16 or 17 using the company’s products, though critics point out that these dogs were born before the company was even founded.

Summary

The Farmer’s Dog is an ecommerce company selling fresh pet food subscriptions to dog owners in the US. As of April 2025, The Farmer’s Dog is among the most recommended fresh dog food brands, and as of March 2025, the company had generated an estimated annualized net revenue for 2024 of $1.2 billion. Amongst growing direct-to-consumer competition, The Farmer’s Dog has grown to deliver millions of meals every month in correlation with the rising popularity of pet meal subscription services, the continuing humanization of pets, and a marketing campaign that leverages these trends. The company’s success going forward will be largely determined by its ability to further establish its brand and retain its share of premium dog food customers.

*Contrary is an investor in Maev through one or more affiliates.