Thesis

Founder-led sales works because founders maintain complete context on every customer conversation, every pain point discussed, and every commitment made. This lossless memory enables the deep relationships that close early deals. But as companies scale from 5 to 50 people, this context evaporates. Sales reps inherit fragmented communications threads, conflicting sources of truth, and tribal knowledge in disparate Slack channels.

Traditional CRMs were built to solve this problem through structured data entry – requiring sales teams to manually log every interaction, update every field, and maintain every record. The cost: high-performing sales representatives (those who exceed quota by at least 150%) spend 10% less time actively selling than their peers, dedicating that time instead to CRM maintenance and data consolidation.

A 2022 report from Salesforce found the average modern sales team juggles ten different tools to close a single deal. A 2025 Shopify report found 76% of top salespeople report that they diligence companies before outreach even begins, yet they must do so across fragmented systems that require manual context maintenance. Enterprises have begun responding with AI adoption, and companies implementing AI in sales functions see revenue uplifts of 3-15% and ROI improvements of 10-20% as of 2023.

Lightfield is an AI-native CRM designed to abstract away secretarial work from sales workflows so founders and salespeople can focus on closing deals. It automatically ingests unstructured data across the customer lifecycle – email, calendar, Slack, meetings, support tickets – and combines it with structured customer data in flexible, backfilled schemas. This source of truth is then optimized for LLM automation across sales operations, enabling everything from email generation to pipeline analysis with natural language queries.

By building the integration layer itself rather than another point solution, Lightfield provides access to customer intelligence while automating workflows that traditionally consume sales representatives' time. Lightfield positions itself as the foundational system of record for go-to-market operations and the central nervous system for AI-powered sales.

Founding Story

Founding Tome

Lightfield, originally known as Magical Tome and then later just Tome, was founded in 2020 by Keith Peiris (CEO) and Henri Liriani (CPO) to transform the way ideas are shared in the workplace. The two founders brought product experience from their tenures at Meta, where they worked on products used by billions of consumers.

Peiris's interest in entrepreneurship began relatively early. When he was just nine years old, his father – who worked at an IT company selling computers – gave him a book on Photoshop and a bootlegged copy of the software to experiment with. In the early 2000s, while other kids his age were playing video games, Peiris was teaching himself Macromedia Flash and building websites.

What started as casually sharing his sites on forums soon turned into a legitimate business venture. Users started messaging Peiris, commissioning him to build websites for them at a rate of $250/site. By age fifteen, Peiris had become his family's breadwinner through his web design company, Cyberteks Design. With his father eventually joining full-time, the company grew to serve around 100 clients, charging $5K/site. Peiris noted,

“We weren't valued like a tech company, of course. At the age of 15, though, I had become the accidental breadwinner of our household. That gave me the confidence that I could make it as an entrepreneur in the long run.”

After studying nanotechnology engineering at the University of Waterloo, Peiris began his career at Meta, then known as Facebook, where he managed products across Facebook, Instagram, and Oculus, growing Instagram Direct more than 10x to 500 million monthly active users. In 2018, Peiris briefly joined Glossier as Head of Product before taking on the same role at Citizen in 2019.

Liriani complemented Peiris's background with his own expertise in zero-to-one product development. He spent six years building products at Meta and served as Head of Product of Facebook Messenger’s Human Interfaces group from 2019-2020. In this role, Liriani built the core messaging experience for Project Lightspeed, a then-new version of Messenger that involved reducing core Messenger code by 84% and re-engineering 90+ of Messenger’s core features with enhanced speed and efficiency. From this, Liriani developed an intimate understanding of how people communicate and share ideas in the digital age. His experience in building communication experiences for billions of users shaped his perspective on user behavior and needs.

While searching for a co-founder, Peiris found Liriani through a mutual friend. While both founders had experience building storytelling and information-sharing experiences with mobile and camera technology, they came together over a shared frustration with a lack of a comparable experience in the workplace. So, they sought to develop an intuitive storytelling platform that mirrored the simplicity of social media, tailored for professional contexts. This would become Tome, later known as Lightfield.

In 2020, Peiris left Citizen to join Greylock as an Entrepreneur in Residence. During the early months of the pandemic lockdown, Peiris engaged in brainstorming sessions with Liriani, as well as Greylock's Seth Rosenberg (another ex-Meta PM). These discussions, combined with their shared observations about the limitations of existing presentation tools in the new remote work environment, led to the development of what was initially called Magical Tome. After fellow product managers said they’d pay for a fuller version of a mockup prototype that Peiris produced, the company was incubated later that year at Greylock, with Greylock Partner Reid Hoffman leading the firm's $6.3 million seed investment and joining its board.

Growth of Tome

Tome launched in public beta on TechCrunch and Product Hunt in March 2022. The platform experienced rapid initial adoption, becoming the fastest productivity tool to reach 1 million users within its first four months. By early 2024, this user count had grown to 20 million. In the months before the pivot, Tome surpassed 25 million.

According to The Information, Tome reached $2 million in annual recurring revenue by mid-2023, primarily driven by enterprise customers adopting the platform for sales materials. ZoomInfo estimated Tome’s pre-pivot revenue at $7.4 million. After the company's pivot to enterprise sales, Tome reported that their most engaged users are now enterprise sales teams, with some creating up to eight Tomes per day.

Pivot to Lightfield

In an August 2025 interview with Contrary Research, Peiris shared that Tome continued to grow for years, with 30 million users joining in the eighteen months before the pivot. However, with these new users came new personas, new needs, and new use cases.

According to Peiris, the team felt it would be impossible to deliver a horizontal product that would be perfect for every ICP, as every persona needed its own data sources and context construction. So, they stepped back to reorient towards verticalizing.

By running pilots with marketing and sales teams, the team found their primary pain point wasn’t just content generation – it was ingesting, organizing, and making sense of fragmented sales data. This insight manifested as Lightfield: an automatic CRM that consolidates unstructured data (from meetings, web research, and email) with structured sources (tickets, product analytics, and company metrics), creating a foundation for LLM-driven sales workflows. Rather than stitching together point GTM platforms, Lightfield is intended to serve as the foundational system of record for additional go-to-market tools.

The original founders continue to lead the company as of November 2025, with Peiris serving as CEO and Liriani as President.

Product

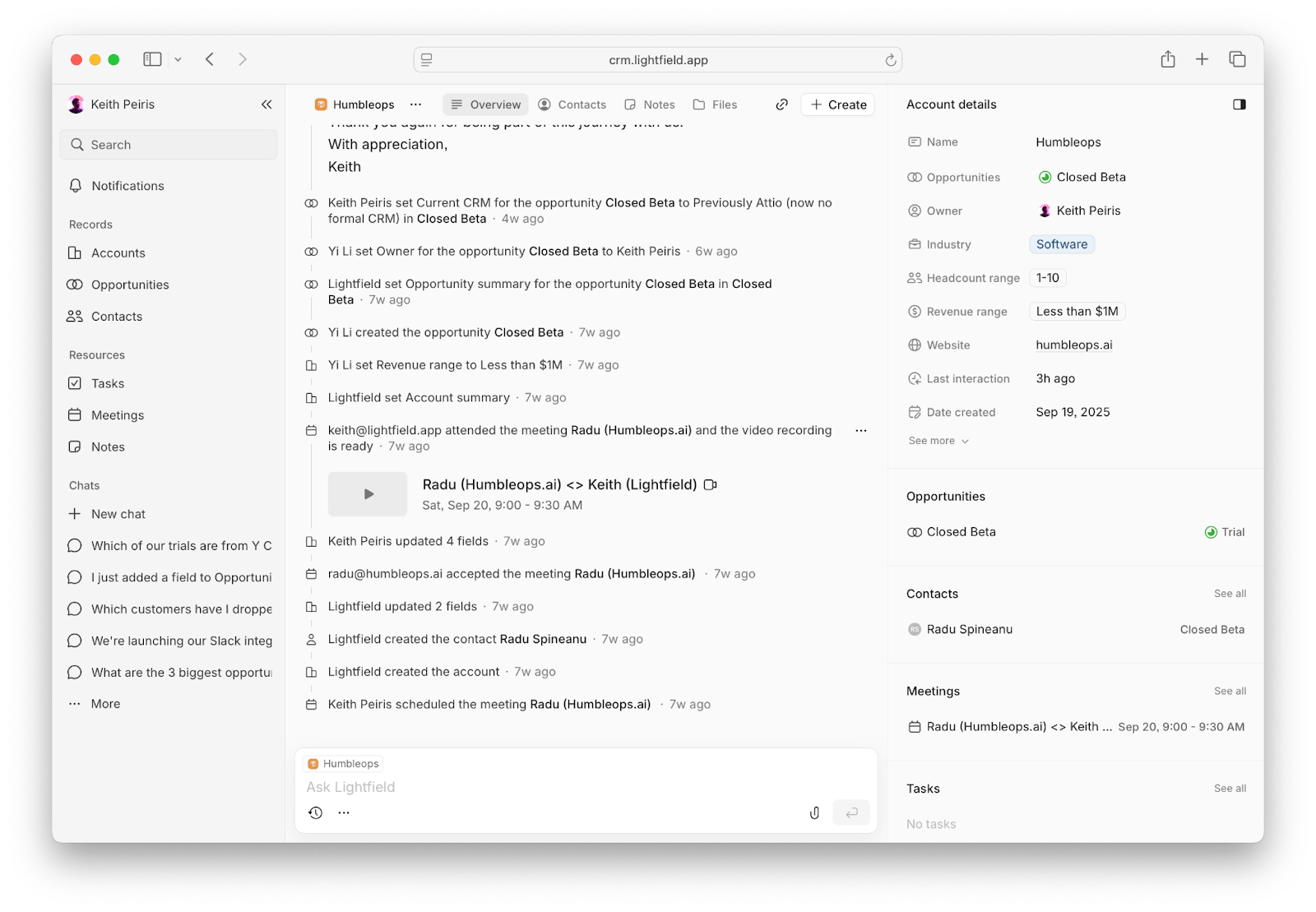

Lightfield has built its customer relationship management product around a core technical insight: rather than requiring manual data entry, the platform automatically constructs a complete CRM from unstructured data across your entire sales workflow.

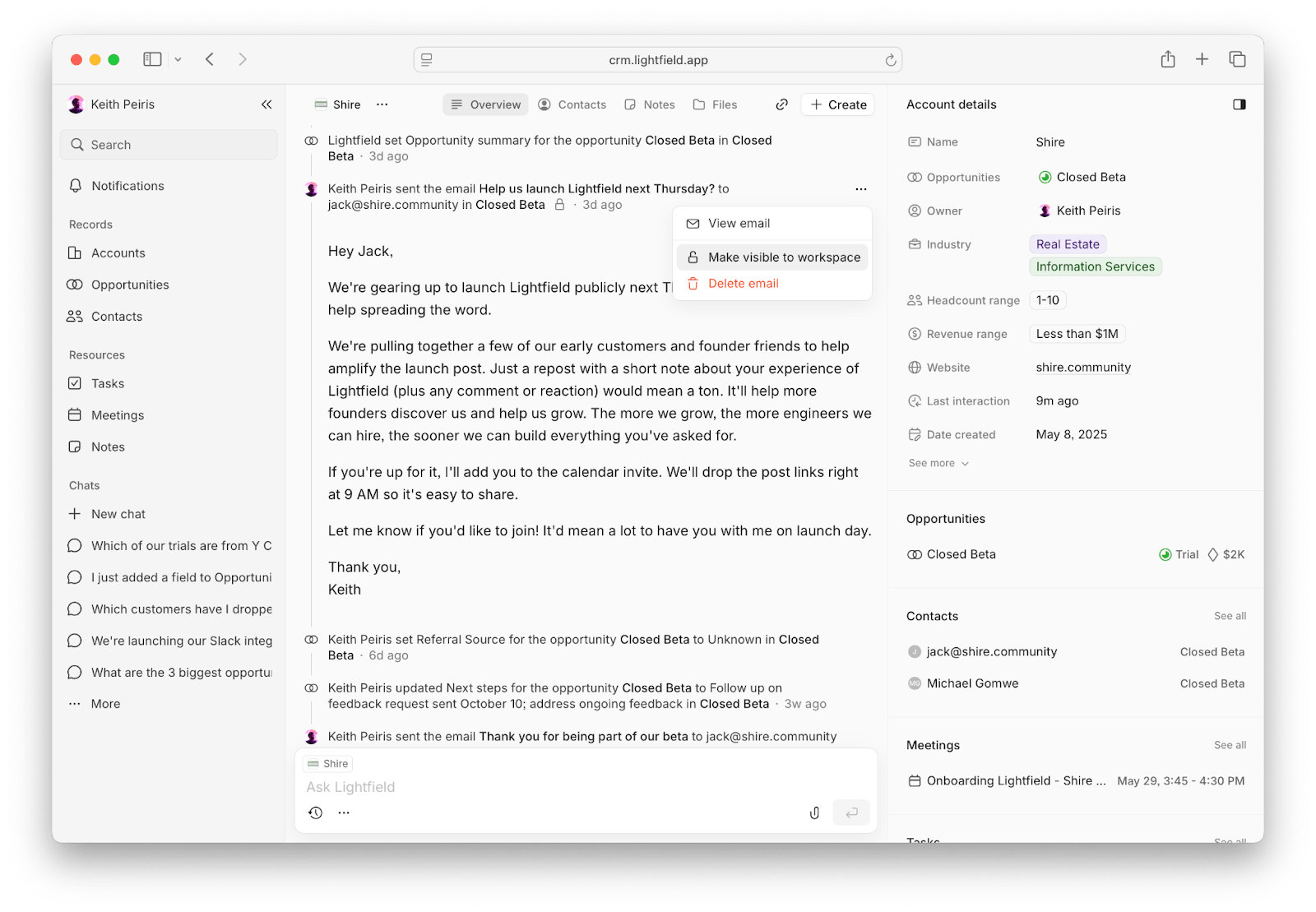

Unlike traditional CRMs that depend on salespeople to log interactions and update fields, Lightfield connects to email, Calendar, Slack, meeting transcriptions, support tickets, and product analytics to autonomously create accounts, contacts, and relationship histories. Peiris shared in a November 2025 interview with Contrary Research that the platform can backfill up to two years of historical data and maintains flexible schemas that re-analyze all past interactions when business requirements change.

This automatic construction enables AI capabilities that traditional systems cannot match. Because Lightfield maintains complete customer context rather than selective manual entries, its LLM-powered features – from email generation to pipeline analysis – operate with the full picture that founders naturally maintain but sales teams struggle to preserve.

In a November 2025 interview with Contrary Research, Peiris described Lightfield’s core value proposition as follows:

"We're not selling you CRM bookkeeping. You need lossless customer memory so that you're prepared for every meeting, you don't drop the balls after meetings, and afterwards, you can reflect on every customer you've met with to understand how to shape your go-to-market."

Ingesting Unstructured Data

Lightfield is intended to operate behind the scenes as an automatic CRM that constantly ingests unstructured data from a company's digital ecosystem. The platform connects to email, Calendar, Slack, support tickets, product analytics, meeting transcriptions, and more to paint a complete picture of customer interactions. Unlike traditional CRMs that require manual data entry, Lightfield autonomously creates accounts and contacts from these touchpoints and can backfill historical data up to two years.

Source: Lightfield

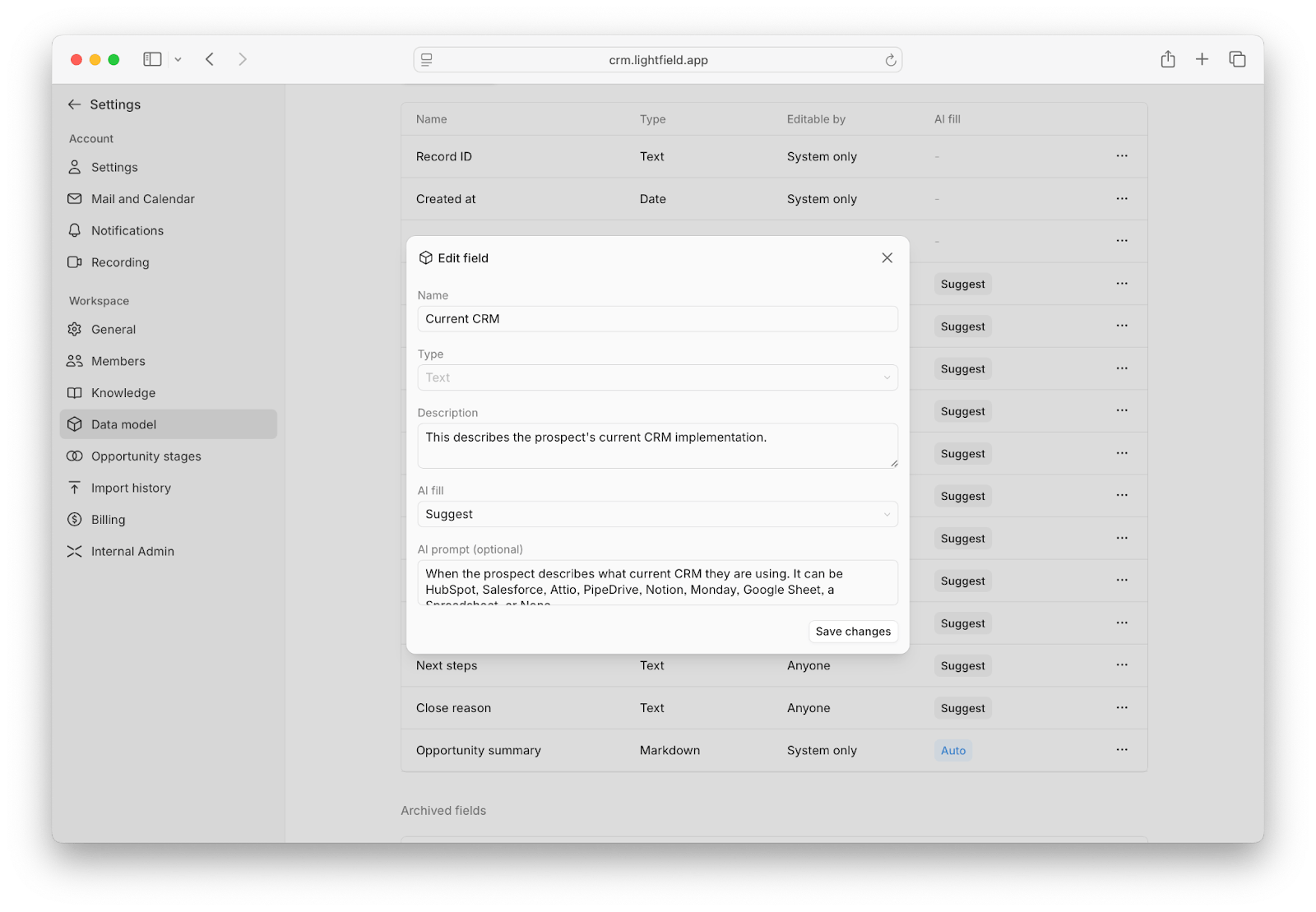

Schema Management and Customization

Once this data is ingested, Lightfield uses it to populate preconfigured schemas. While these schemas are preconfigured to optimize for a typical sales process, many verticalized businesses have niche requirements and pipeline nuances. Customers can define custom opportunity stages, account attributes, and relationship types that they’d like to have tracked.

As the schema changes, new data is backfilled accordingly – when users modify or add new fields, the system re-analyzes all historical unstructured data to backfill the new schema.

Source: Lightfield

Lightfield maintains data provenance, ensuring that changes to the schema don't create orphaned or inconsistent data.

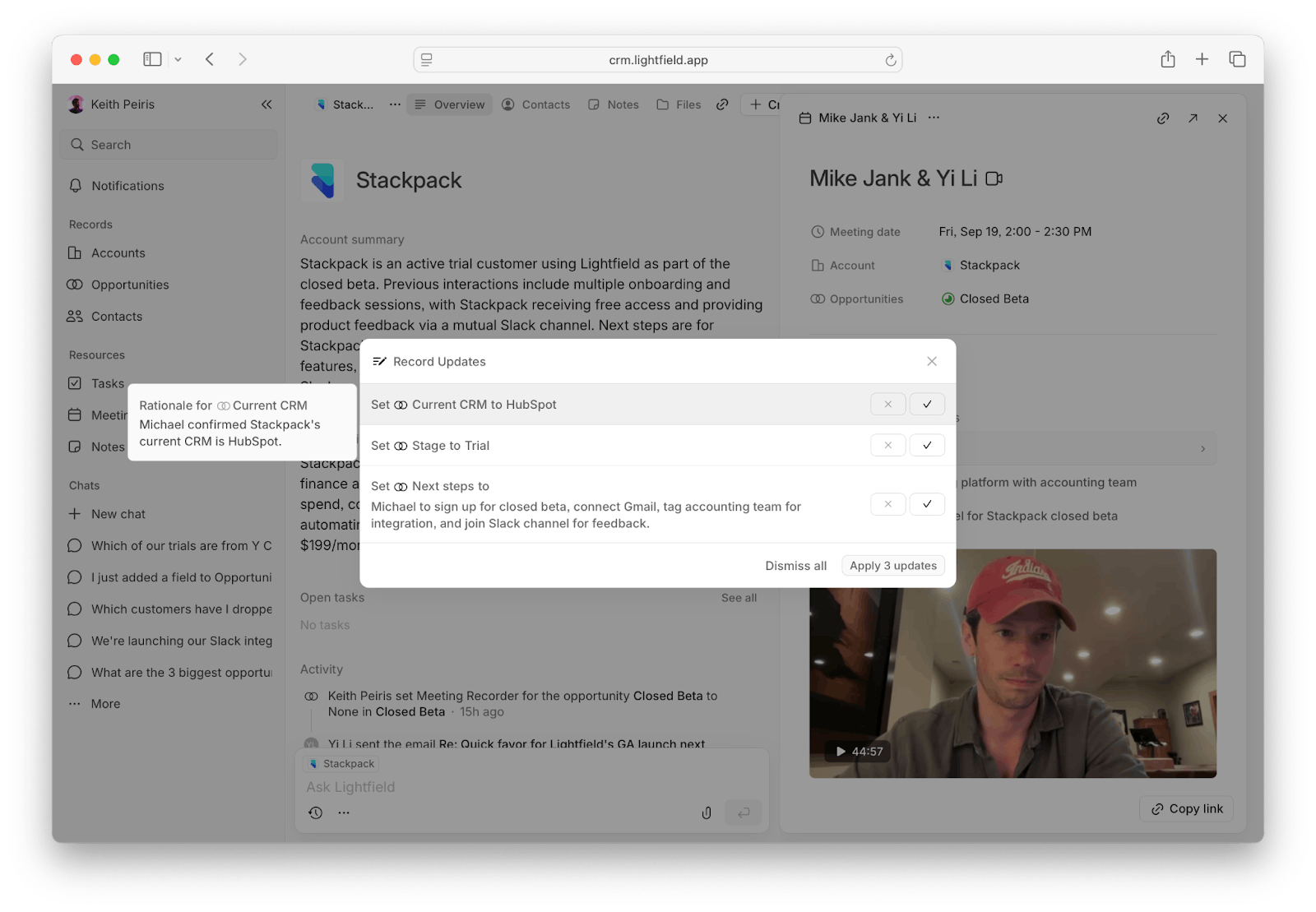

Automated Pipeline Movement

After every customer message or meeting, the platform analyzes conversation transcripts and suggests CRM record updates for human approval. These suggestions include next steps, key insights, timeline updates, and relationship changes.

Source: Lightfield

The human-in-the-loop approach ensures data quality while maintaining automation benefits. As Peiris explained in a November 2025 interview with Contrary Research: "We want the human attached to the record update so that you can trust it. If everything's AI, then you can't trust your CRM the way that you might trust Salesforce."

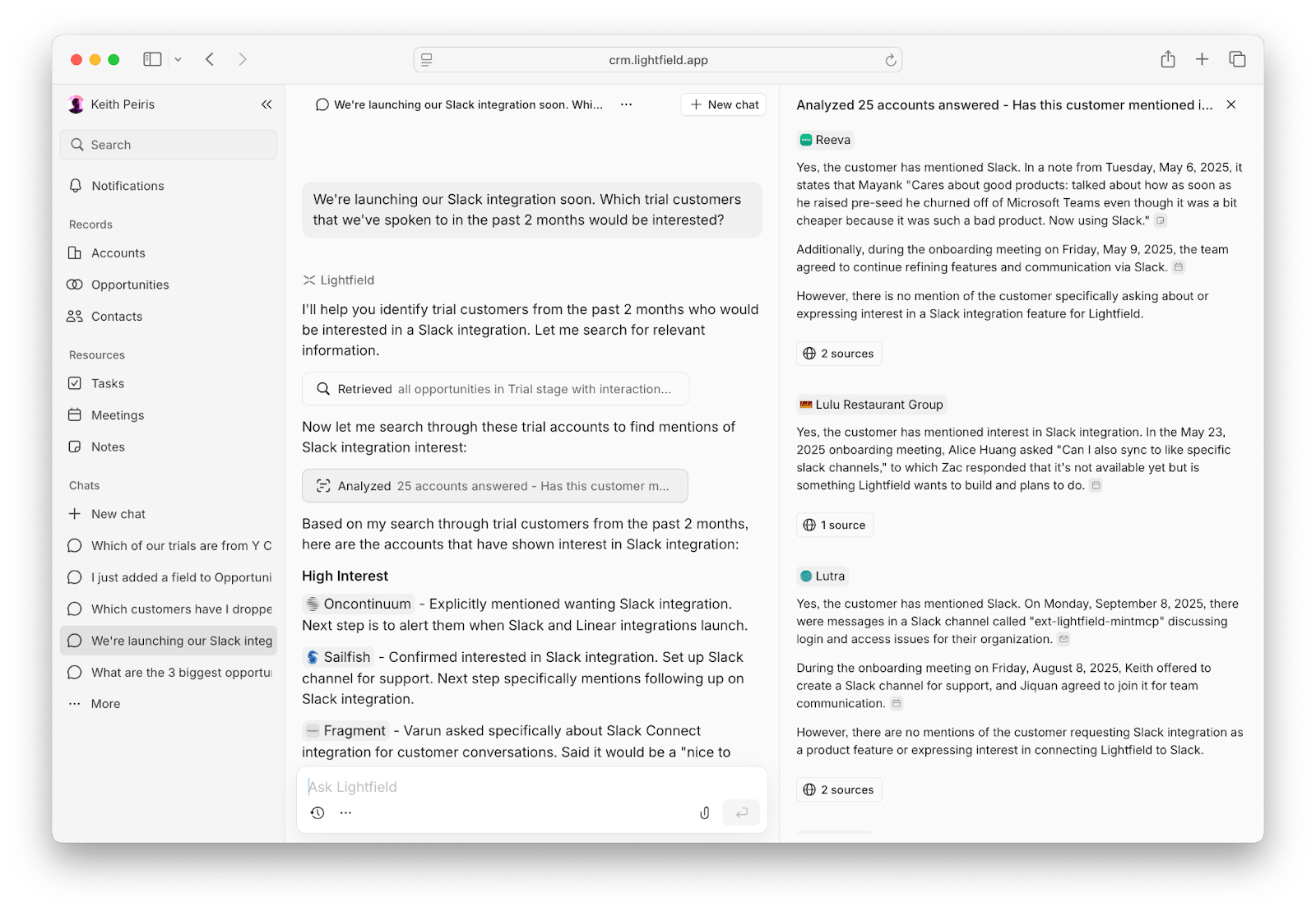

Natural Language Intelligence Layer

The platform enables users to query their entire customer database using natural language, leveraging the structured data foundation to provide analytics. Users can ask questions like "Which of my active opportunities would have moved faster if we had our Slack integration?" and receive detailed, cited responses that reference specific accounts and interactions.

Source: Lightfield

Lightfield can identify patterns across customer interactions, suggest prospect prioritization based on historical successful deals, and provide recommendations for go-to-market strategy adjustments based on accumulated customer feedback.

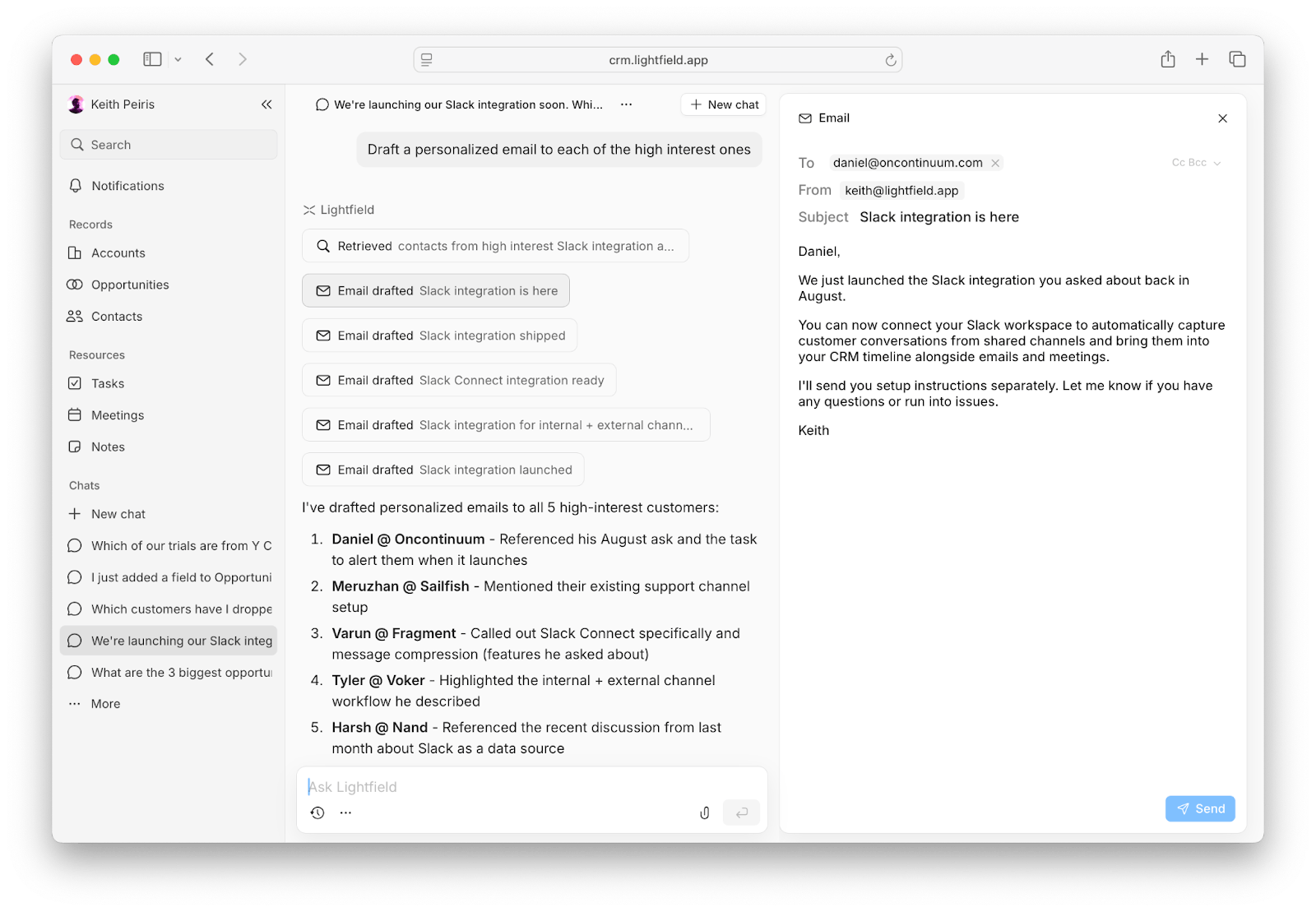

Automated Workflow Execution

Lightfield can automatically generate follow-up emails that reference specific meeting details, deadlines, and next steps, maintaining context that would typically require manual note-taking and synthesis. Email generation leverages the platform's customer data to create personalized outreach that demonstrates understanding of the prospect's situation.

Source: Lightfield

The platform creates tickets in project management systems like Linear and will soon be able to execute actions automatically. The roadmap includes features like automatic trial account creation, demo scheduling, and proposal generation based on meeting outcomes.

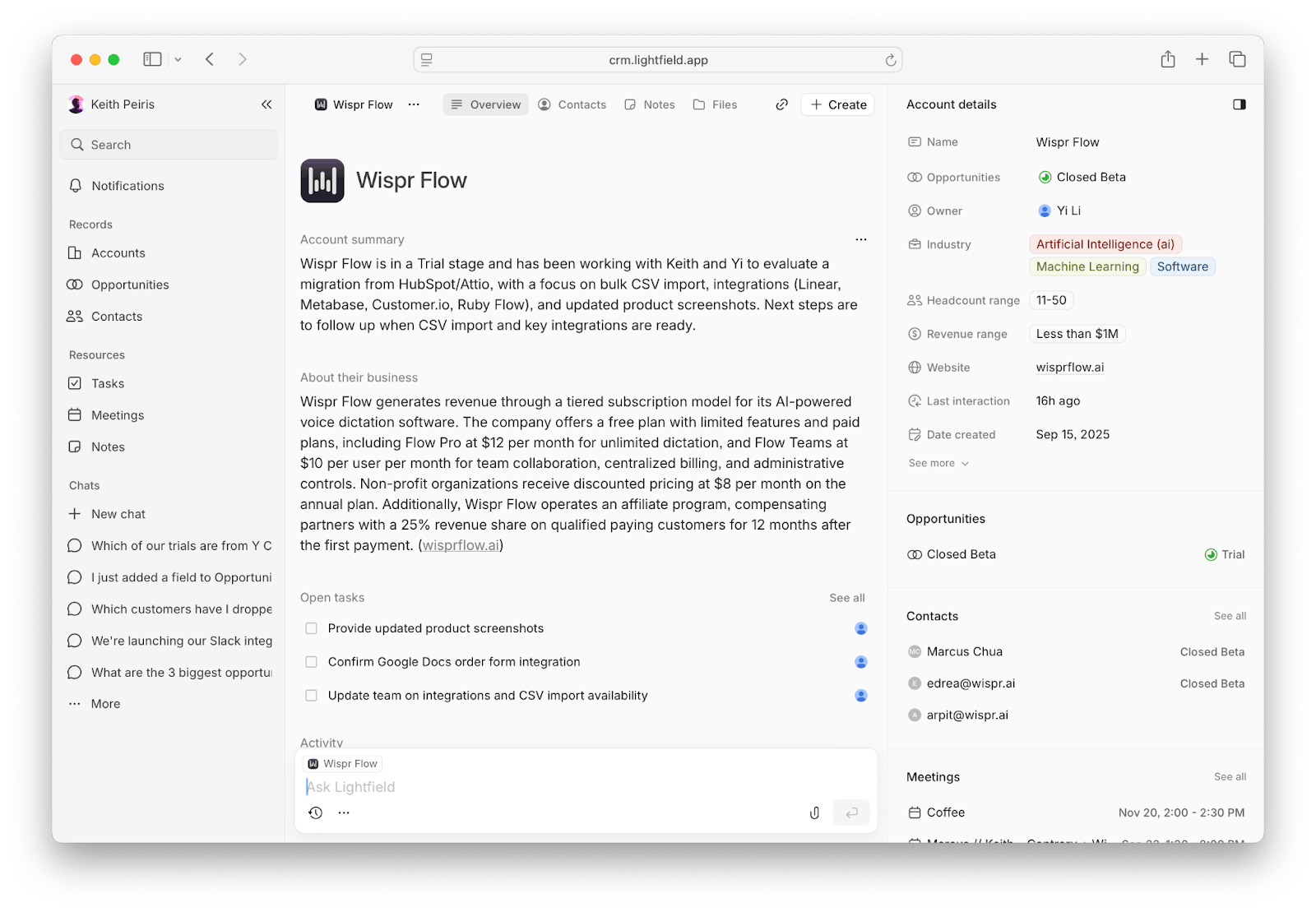

Generated Account Summaries

Lightfield automatically generates and updates account profiles that serve as dynamic intelligence hubs for each prospect and customer. These profiles aggregate information from all connected data sources to create a unified view of each account's business context, key stakeholders, and interaction history.

Source: Lightfield

Lightfield continuously updates these profiles as new information becomes available. When a prospect mentions budget changes in a meeting or announces strategic initiatives, Lightfield automatically incorporates this intelligence into the account profile without manual data entry.

Account profiles include automatically generated summaries of the company's business model, recent developments, and identified pain points that align with the seller's value proposition. This comprehensive account intelligence becomes the foundation for Lightfield's automated pipeline management capabilities.

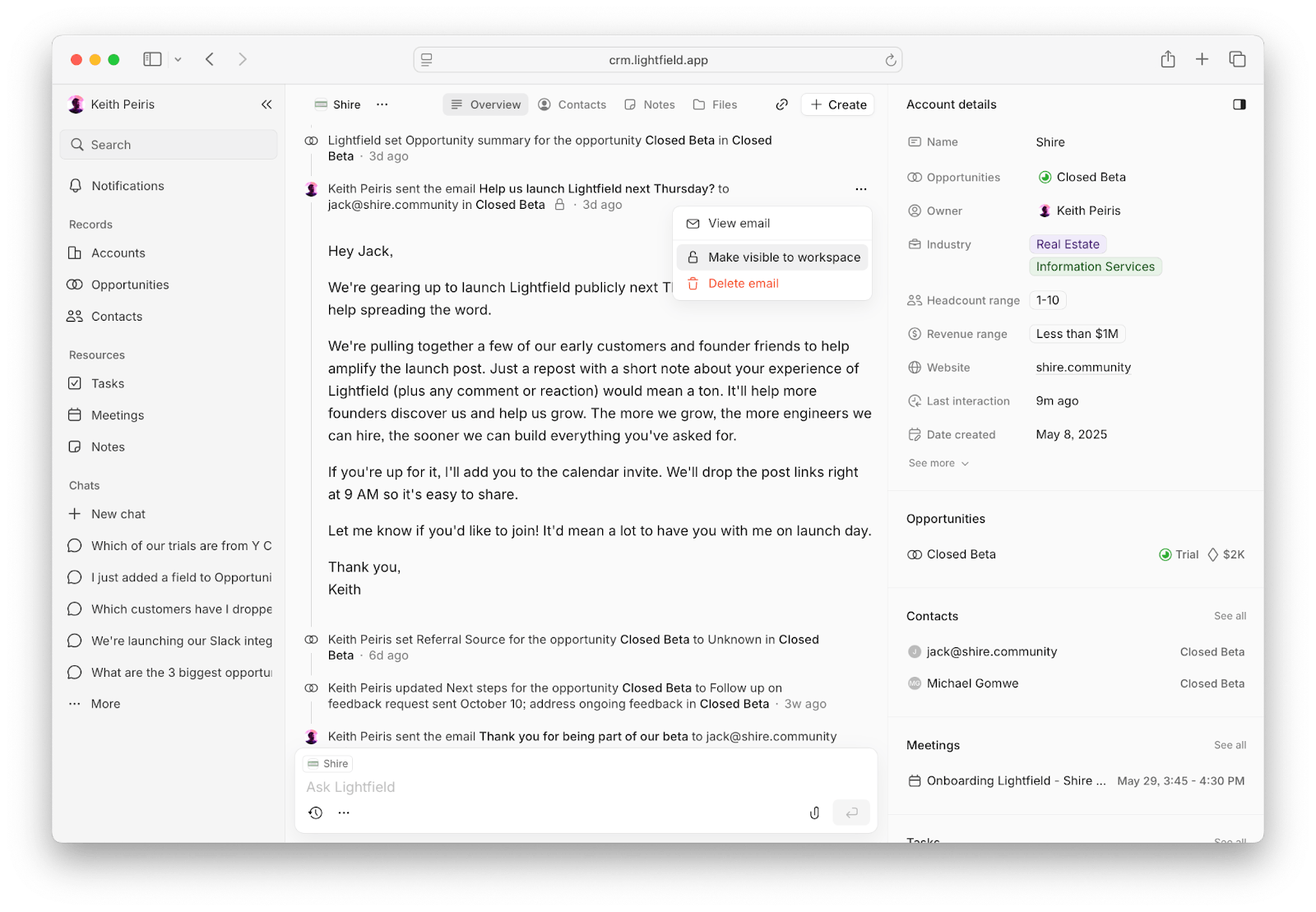

Team Collaboration & Access Control

Lightfield implements Peiris’s vision of "wall-to-wall access" by providing different permission levels that ensure everyone at the company can access customer data while maintaining appropriate controls. The platform allows read access for all team members while restricting creation and editing capabilities based on role requirements.

Lightfield was built with a per-object privacy model from the beginning. Any email, account, or object can take on a unique privacy/visibility setting. The LLM can only see what each user can see within the CRM. This means that Lightfield can have a CEO using the product who is only sharing certain emails with the CRM - when the CEO uses Lightfield, the agent has access to all of their emails. In contrast, when a regular user is on Lightfield, the agent is unaware of the emails the CEO has privately shared with the CRM.

This mitigates information silos common in traditional CRMs, where customer context is locked behind seat licenses, ensuring that product, engineering, and other teams can access the customer intelligence they need for their roles.

Source: Lightfield

Integration and Portability

For teams with preexisting GTM workflows, Lightfield will soon support data portability and integration. The platform offers two-way synchronization with major enterprise tools and provides standard export formats. In a November 2025 interview with Contrary Research, Peiris emphasized: "As a CRM, you need to integrate with everything. You should own your data, since it’s your customer data."

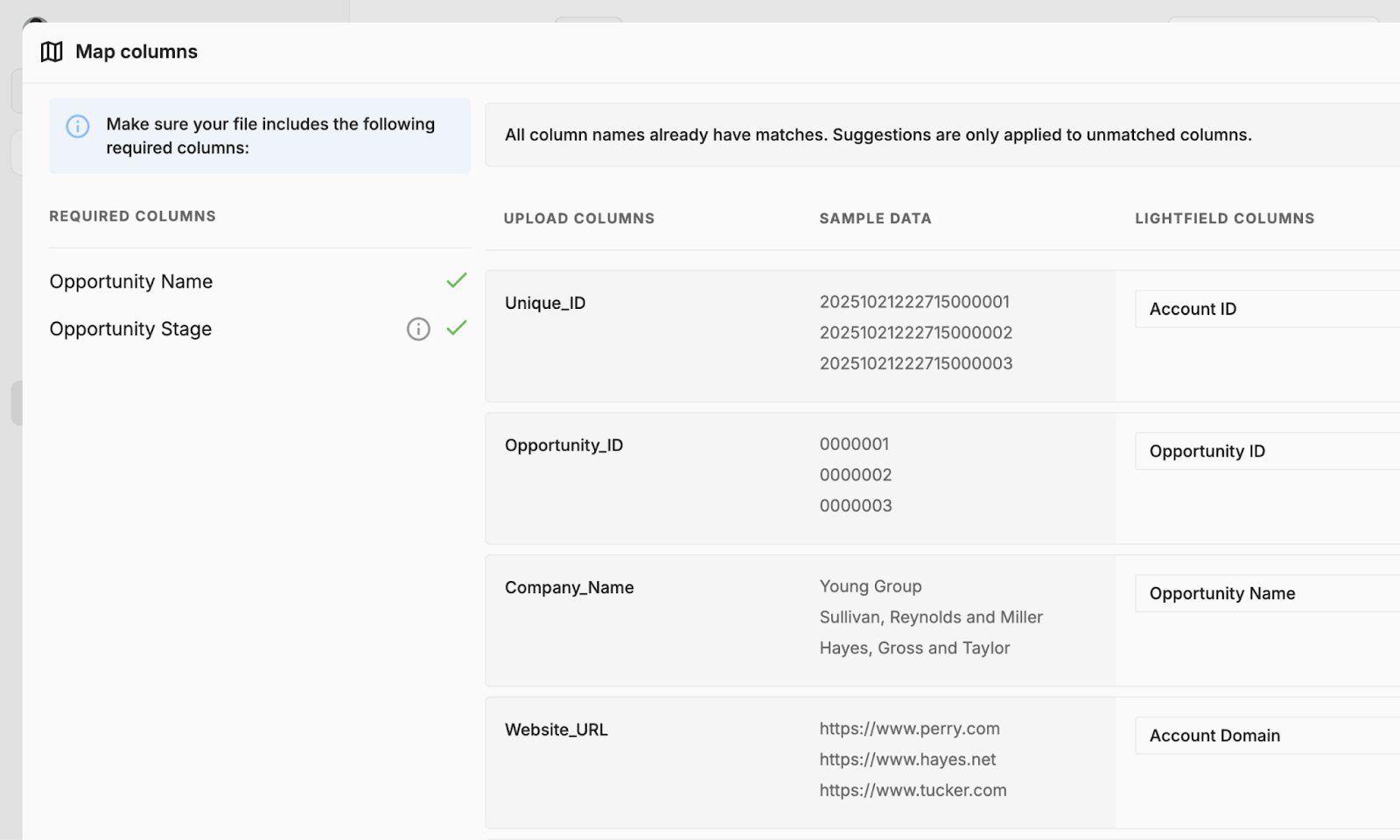

Source: Lightfield

Lightfield enables you to upload CSVs of Accounts, Contacts, and Opportunities that will automatically enrich and preserve relationships in Lightfield.

At the time of writing, Lightfield is building an open-ended API to enable companies to webhook different types of data into the CRM and to push customer context out to various SaaS tools. They’re also building MCP servers to enable context construction for long-tail SaaS tools while maintaining a core position as the primary customer data repository.

Privacy and Security

Lightfield supports per-object privacy with admin and member roles, ensuring that both LLMs and users can only access objects they have explicit permission to view. Per-account privacy controls are targeted for release within the next quarter.

As of November 2025, the company has completed SOC 2 Type 1 certification, with SOC 2 Type II and HIPAA compliance currently underway.

Source: Lightfield

Roadmap Determinism

As Lightfield builds towards helping sales teams through the entire sales pipeline, the company faces what its founders call "roadmap determinism" – the tension between achieving feature parity with decades-old CRM tools and developing entirely new AI-powered capabilities. This concept reflects the reality that certain features must be built to meet basic user expectations, while others represent unexplored territory in enterprise software.

The development team approaches this challenge through parallel "offensive" and "defensive" roadmaps. The defensive elements focus on maintaining essential functionality, ensuring platform stability, and providing expected features that prevent user attrition. Meanwhile, offensive initiatives push toward new capabilities that don't exist elsewhere in the market, driven by first-principles thinking and user validation.

Product Evolution

Lightfield launched in 2022 as Tome, a presentation platform designed to bridge the gap between modern collaborative work tools and static presentation software. Using language models like Claude, Tome automated narrative structure generation and visual layout optimization, while its interactive tile system maintained live connections to data sources like Figma, Google Analytics, and Salesforce. The platform enabled real-time collaboration through dynamic visualizations that updated automatically and provided engagement analytics to help users refine their content based on viewer behavior.

Market

Customer

Lightfield was built for two core customer segments.

The primary target segment is venture-backed tech companies that are early enough to not yet have a CRM but still need to compile data on customer relationships. In a November 2025 interview with Contrary Research, Peiris explained the appeal to this segment: "Those folks don't love bookkeeping. They don't look at HubSpot and Salesforce and be like, thank goodness. Yes. I love all my records." Lightfield positions itself as an automatic solution to aggregate lossless customer memory, with minimal operator input required.

The secondary target segment consists of vertical SaaS companies – businesses building technology for specific industries like farming, solar, or healthcare. These companies often have sophisticated data and automation needs, but want to avoid the complexity of a traditional CRM like Salesforce. To Lightfield, this ICP brings strong revenue retention and a stable customer base for long-term growth.

Across both segments, Lightfield is designed for founder-led sales and early sales teams. The platform aims to extend the existing productivity of small teams rather than requiring dedicated sales operations personnel. As Peiris described in a November 2025 interview with Contrary Research: "The persona we've had in mind is the CEO doing founder sales and just wants to put off hiring their first salesperson a little longer. How can we help you do the work of what three salespeople would do?"

To execute its pivot from presentation generation to sales intelligence, the company laid off 31% of its staff in late 2023, following an earlier 20% reduction. According to Peiris, this brought the company’s headcount from 70 to 7. The team has since scaled as Lightfield, with 23 employees as of 2025.

Market Size

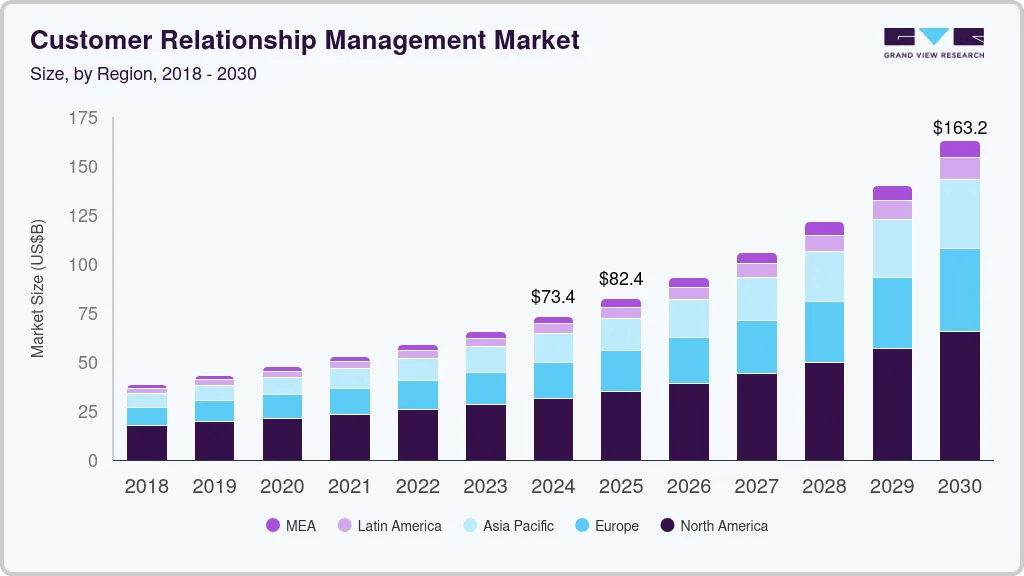

The global customer relationship management market was valued at 73.4 billion in 2024 and was projected to reach 163.2 billion by 2030, growing at a CAGR of 14.6% from 2025 to 2030. North America's customer relationship management market held a share of around 42.8% in 2024, driven by the presence of major industry players like Salesforce, Microsoft, and HubSpot. The market is dominated by established vendors, with Salesforce holding a 23.9% share of the global CRM market, surpassing the combined shares of Microsoft, Oracle, SAP, and Adobe.

Source: Grand View Research

Lightfield targets a specific gap in the CRM market: early-stage companies that have not yet implemented traditional systems. Between large enterprises and small & medium businesses, the SMB segment represented 40.1% of the market in 2024 and is expected to grow at the fastest CAGR of 16.2% from 2025 to 2030. Peiris described the strategy as reaching companies "before HubSpot even thinks about you," focusing on early-stage venture-backed tech startups and vertical SaaS businesses.

This positioning avoids direct competition with established vendors in mature enterprise accounts, instead capturing companies early in their growth trajectory. By sidestepping costly customer acquisition battles for enterprise accounts locked into multi-year contracts, Lightfield can focus instead on embedding deeply into prospects’ sales workflows before they even consider traditional CRM solutions.

Competition

Lightfield operates in the enterprise sales software market against two distinct competitive sets. Sales intelligence startups like Attio and Reevo are building AI-native platforms that span prospecting, outreach, and pipeline management. Enterprise incumbents like Salesforce and HubSpot are retrofitting AI capabilities onto decades-old architectures while defending historically installed bases. Lightfield differentiates through automatic context construction – rather than requiring users to build their CRM through configuration and manual input, the platform ingests unstructured data to create a complete system of record without human intervention. This positions Lightfield for teams seeking to avoid CRM work entirely, while competitors target teams willing to actively manage their sales infrastructure in exchange for control and customization.

Sales Intelligence Startups

Attio: Attio, founded in 2019, is a CRM that targets the same customer base as Lightfield: founders and early GTM teams who want power without complexity. Attio's core strength is its customizable data model – users can create custom objects like Salesforce but with a consumer-grade interface. The platform automatically enriches contacts from email and calendar sync, eliminating manual data entry during onboarding. While Attio has added AI features for workflow automation and predictive intelligence, these capabilities enhance a traditional CRM workflow rather than replace it.

Attio positions itself as a better system of record – a modern Salesforce replacement where teams actively manage relationships. Lightfield positions itself as a way to avoid CRM work entirely. In a November 2025 interview with Contrary Research, Peiris explained that while Attio builds a system of record that users actively manage, Lightfield's CRM schema exists primarily as an indexing mechanism to make AI more effective at automating sales work.

This architectural difference manifests in product design. Attio users spend time configuring their workspace, building custom views, and maintaining their system. Lightfield users let the platform construct context automatically, intervening only to approve AI-generated updates. Both approaches serve the same market, but optimize for fundamentally different workflows: Attio for control and customization, Lightfield for automation and delegation.

Attio was founded by Nicolas Sharp (CEO), who started the project after struggling to find a flexible CRM as a VC. The company has raised $116.2 million as of November 2025, including a $52 million Series B led by Google Ventures in August 2025.

Clay: Clay, founded in 2017, is a data enrichment and workflow automation platform that directly competes with Lightfield's research engine. The platform aggregates data from 100+ sources as of November 2025 – including company financials, technographics, and social signals - into unified prospect profiles that power automated outreach sequences.

Clay's differentiation lies in its flexible data model and workflow builder. Sales teams can create custom enrichment logic, trigger automated actions based on specific data points, and build complex multi-step campaigns. The platform operates as a GTM engineering environment rather than a point solution, allowing teams to combine data sources and automation in novel ways.

Lightfield and Clay differ with respect to prospect research and enrichment. Clay focuses on sourcing and combining third-party data to identify and qualify prospects. Lightfield focuses on maintaining complete context across the customer lifecycle – not just initial research, but ongoing relationship history from meetings, emails, and support interactions. Clay helps you find prospects; Lightfield helps you maintain lossless memory after they become customers.

Clay's roadmap increasingly pushes into CRM territory with features like contact management and pipeline tracking. Lightfield's automatic data ingestion threatens Clay's enrichment workflows. Both companies are converging on a "complete GTM platform" from opposite directions - Clay from outbound research inward, Lightfield from CRM infrastructure outward.

Clay has raised a total of $204 million at a $3.1 billion valuation as of November 2025. The company serves over 10K customers, including OpenAI, Canva, and Anthropic, as of August 2025.

People.ai: People.ai is an enterprise AI platform founded in 2016 that uses sales data to generate actionable insights for sales, marketing, and revenue operations teams. It automatically captures and analyzes sales-related activities from various sources such as email, calendars, and virtual meetings, enriching CRM systems with accurate data.

People.ai's core product leverages AI algorithms trained on billions of sales activities and closed deals to deliver insights that enhance sales performance, streamline workflows, and improve forecast accuracy. The platform supports sales functions like account planning, deal inspection, and pipeline management while offering generative AI capabilities for real-time coaching and next-step recommendations.

Its integration coverage makes it a back-end sales solution that enhances existing CRM systems like Salesforce and Microsoft Dynamics 365. People.ai’s customers include Zoom, IBM, Red Hat, and Palo Alto Networks, and it has processed over $239 billion in closed deals and 14 billion AI-generated insights as of November 2025. As of its $100 million Series D funding round in August 2021, its latest round as of November 2025, People.ai had raised a total of $200 million at a valuation of $1.1 billion.

Pylon: Pylon, which was founded in 2022, is a B2B customer support platform designed to unify all post-sales functions – support, customer success, account management, and more – into a single system. Unlike traditional support tools built for B2C, Pylon enhances post-sale workflows according to the needs of B2B companies, offering omnichannel integrations (Slack, Teams, Discord), ticketing, knowledge base, AI-powered automation, and customer portals.

Pylon differs from Lightfield in the segment of the customer journey it empowers: while Lightfield is an AI-first CRM and sales intelligence tool designed for go-to-market teams and sales workflows, Pylon is purpose-built for post-sales customer support and success, targeting Zendesk and Salesforce Service Cloud as primary competitors. Founded by Marty Kausas (CEO), Pylon has raised a total of $51.3 million in funding as of November 2025, including a $31 million Series B led by a16z and BCV in August 2025. The company is cash flow positive as of July 2025, serves over 760 B2B customers as of August 2025, and is known for rapid sales cycles and strong retention metrics.

Reevo: Reevo, founded in 2024, is an AI-native sales platform that spans prospecting, outreach, meeting intelligence, and CRM. Founded by David Zhu, former engineering lead at DoorDash, Reevo built an end-to-end sales workflow on a node graph database architecture that enables semantic understanding across the platform.

Reevo is comprised of four modules: Find (prospect database with multi-provider enrichment), Connect (email infrastructure including domain management and deliverability), Sequencing (automated outreach and calling via Twilio), and Sell (CRM with conversational intelligence that interviews users about their business to train AI outputs), and Manage (pipeline management, custom reporting with AI-powered analytics, and no-code workflow automation for lead assignment and post-sale handoffs). The "Ask Reevo" copilot operates across all modules and integrates into Slack for meeting prep, deal updates, and queries.

Reevo competes directly with Lightfield for the "complete AI-powered sales platform" positioning. Both companies target early-stage GTM teams with end-to-end platforms spanning prospecting, outreach, CRM, and intelligence. While Reevo offers tiered pricing plans, the company emphasizes human-led onboarding and sales-assisted implementation, requiring conversations before access. Lightfield optimizes for self-serve adoption with minimal setup friction. The strategic difference lies in scope: Reevo is building a comprehensive platform from prospecting through close, while Lightfield focuses on sales execution and account management.

Reevo raised $80 million in Series A funding from Khosla Ventures and Kleiner Perkins in November 2025 and has raised a total of $91 million in funding as of November 2025.

Enterprise Sales Incumbents

Legacy enterprise software providers compete with Lightfield through their established customer relationships and broad platform integrations.

HubSpot: HubSpot, founded in 2006, is a CRM platform designed for small and mid-sized businesses, offering a unified suite for marketing, sales, and customer service. Its platform integrates tools for email marketing, lead management, automation, and analytics, making it a popular choice for companies seeking an all-in-one solution. At the center of its AI strategy is HubSpot AI, a set of features built to streamline workflows and personalize customer engagement across its ecosystem.

Launched in 2023, HubSpot AI automates content creation, optimizes outreach, and provides actionable insights for sales and marketing teams. HubSpot AI also integrates with the platform’s reporting and analytics, surfacing trends and suggesting next steps to drive pipeline growth. Recent updates have expanded these capabilities to include AI chatbots for customer service and predictive analytics for sales forecasting.

Salesforce: Salesforce, which was founded in 1999 and provides enterprise CRM software, leverages its extensive platform integrations and established customer relationships to compete in the AI-driven productivity space. At the core of its AI offerings is Salesforce Einstein, an AI-powered suite embedded across all Salesforce applications.

Introduced in 2016 and continuously enhanced, Einstein combines machine learning, natural language processing, and generative AI to automate workflows, generate insights, and improve customer engagement. Einstein’s capabilities include tools like Einstein Lead Scoring, which prioritizes high-value prospects, and Einstein Copilot, a conversational AI assistant that automates tasks such as generating follow-ups and summarizing meetings. The platform also integrates with Salesforce Data Cloud to ground AI outputs in real-time customer data while maintaining strict data governance. Recent updates, such as Einstein GPT and Einstein 1 Studio, allow businesses to further customize AI workflows and generate tailored content across sales, service, marketing, and commerce operations.

With $34.9 billion in revenue reported for FY24 and a client base spanning industries worldwide, Salesforce continues to solidify its position as a dominant player in enterprise sales and customer relationship management.

Business Model

According to the team, Lightfield employs a usage-based pricing model starting at $40 per Seller per month for basic access, where a Seller is defined as a user needing full email and calendar sync. Additional charges apply for AI inference time used in automations, email generation, and analytics. As Peiris explained in a November 2025 interview with Contrary Research:

"We want everyone at the company to have access to customer data. And then we're just gonna have a consumption model on top where if you are creating automations, asking hard BI questions, you should pay for us doing work for you."

Traction

As of November 2025, Lightfield is in private beta with hundreds of teams using the product every day and tens of thousands of B2B users on the waitlist. The company is selectively onboarding teams during the beta period while gathering feedback and refining the platform.

Valuation

In February 2023, Lightfield (as Tome) raised a $43 million Series B at a $300 million valuation, bringing the company’s total funding amount to $81 million, where it remained as of November 2025. Lightspeed Venture Partners led the Series B with participation from existing investors such as Greylock, Coatue Management, and Audacious Ventures, as well as new investors such as Neo, 8VC, GV, Eric Schmidt (former Google CEO), Emad Mostaque (former Stability AI CEO), David Luan (former Adept AI Labs CEO), Bipul Sinha (Rubrik CEO). This round followed Tome’s $26 million Series A raise in September 2021, which valued the company at $175 million.

Key Opportunities

Early Market Entry

Lightfield targets venture-backed technology companies during their transition from founder-led sales to formal go-to-market operations, before they adopt incumbent CRM systems. This timing avoids migration complexity that affects later-stage implementations and allows Lightfield to become the initial system of record. Lightfield's revenue expansion would correlate with customer growth, as usage-based pricing scales with customer activity and team size. The company captures customers at a 5-20 person scale and can expand alongside companies that reach hundreds or thousands of employees.

Economic Advantage Through Consolidation

Enterprise sales teams deploy 10+ specialized tools with combined costs of $3,000-5,000 per seat monthly across Salesforce ($300-$4K), Gong ($1.3K-$1.6K), and more. Lightfield's consolidated platform addresses the same functional requirements at $20-30 per seat plus usage fees. The total addressable wallet per customer increases as additional workflows move to the platform, while switching costs rise due to centralized data architecture. Customers eliminate multiple vendor relationships, contract negotiations, and integration maintenance. The pricing transparency contrasts with incumbent bundling strategies that often result in unused feature payments.

AI-Native Architecture Advantage

Lightfield's architecture processes unstructured data automatically rather than requiring manual CRM entry, addressing a documented productivity drain where sales representatives spend 65% of their time on non-selling activities. The flexible schema updates historical records when business requirements change, unlike traditional CRMs, where schema modifications only apply to new data. The platform's model-agnostic design allows integration of new AI capabilities as they become available, while incumbents face constraints from legacy system architecture. Context construction across multiple data sources enables LLM performance that exceeds what fragmented tools can achieve individually.

Vertical SaaS Market Opportunity

Vertical SaaS companies operate in specialized domains (agriculture, solar, healthcare software) where they avoid complex enterprise sales tools due to implementation overhead and cost. These companies typically achieve 100-120% net revenue retention and maintain customer relationships for 5+ years due to domain specialization and switching costs. Market data shows vertical SaaS companies growing 40-60% annually in early years with strong unit economics.

Key Risks

Competitive Pressure from Multiple Directions

The company faces intense competition from both ends of the market. These incumbents have significant advantages: massive existing user bases, deep integration with other enterprise tools, and substantially more resources. Competition between Microsoft and Salesforce is accelerating AI innovation in CRM, particularly in autonomous agents and process automation. Microsoft launched Sales Agent and Sales Chat agents while Salesforce countered with Agentforce, with Salesforce reporting it has already closed 1,000 Agentforce deals. Meanwhile, specialized AI startups are developing increasingly sophisticated tools for specific parts of the sales workflow. This competitive pressure could lead to margin compression or market share challenges.

Market Timing Risk

Lightfield's core thesis depends on enterprises preferring consolidated platforms over specialized point solutions, but market evidence suggests mixed preferences. Peiris’s bet that companies "won't need 25 sales tech tools" conflicts with historical enterprise software adoption patterns, where best-of-breed solutions often outperform integrated suites in specific functions. Enterprise systems of record like SAP, Salesforce, and Workday have maintained dominant positions for decades due to deeply entrenched workflows and expensive implementation cycles. The risk increases as AI-native startups are building sophisticated wedge products that can live alongside incumbent systems initially and then slowly replace them, fragmenting the market rather than consolidating it. Additionally, thousands of startups are building narrow-purpose agents, especially for customer-facing tasks, suggesting the market may evolve toward specialized AI tools rather than unified platforms, undermining Lightfield's consolidation strategy.

Feature Completeness Race

Lightfield faces significant pressure to build essential enterprise CRM features before customers outgrow the platform. Enterprise customers require sophisticated capabilities like AI-powered forecasting, territory management, pipeline inspection, and deal slippage analysis that existing competitors already offer. Peiris acknowledged this challenge as "roadmap determinism" - the tension between achieving feature parity with decades-old systems and developing new AI capabilities. The risk intensifies as customers scale beyond the startup phase and demand enterprise-grade functionality that Lightfield hasn't yet built.

Summary

The enterprise go-to-market stack remains highly fragmented, with sales teams using an average of ten different tools to close a single deal. While companies report 28% higher revenue growth when they optimize their sales processes, most teams still spend only 35% of their time actually selling, with the remainder consumed by data entry, research, and administrative tasks across disconnected systems.

Lightfield has reimagined the CRM as an AI-native data platform that automatically ingests unstructured data from across the sales pipeline and schematizes it according to the organization’s needs. By combining email, calendar, Slack, meetings, and support tickets with structured customer data in flexible, backfilled schemas, Lightfield provides the context needed for meaningful AI automation. The platform positions itself as "lossless customer memory" rather than traditional CRM bookkeeping, automating workflows from outbound generation to pipeline analysis.

Rather than building another point solution that integrates with existing systems, Lightfield serves as the foundational system of record for go-to-market operations. This infrastructure-first approach targets venture-backed startups and vertical SaaS companies before they even consider traditional CRM systems, allowing Lightfield to sidestep direct competition with entrenched competitors while reducing customers’ GTM software spend.

The key question is whether Lightfield's bet on AI-native architecture and SMB wedge can establish sufficient competitive advantages before incumbents like Salesforce and Microsoft enhance their own AI capabilities, or specialized startups verticalize into other parts of the sales workflow.