Thesis

Many businesses spend significant time and money finding and selling to new customers. However, sales professionals often struggle to use and manage their tooling effectively. One 2024 survey found that 45% feel overwhelmed by the number of sales tools they use, with research from December 2022 finding that companies average around 10 tools to close sales deals.

In addition, while prospect data defines a sales organization’s ability to convert leads and close deals, sales teams struggle to efficiently collect, manage, and utilize this data. The types of useful data for sales have expanded beyond contact and company information to include intent data, technographics, and market research. Sales teams rely on multiple data providers, but cannot guarantee their data is exhaustive, with only 35% of sales professionals confident in their data accuracy, according to a 2024 survey.

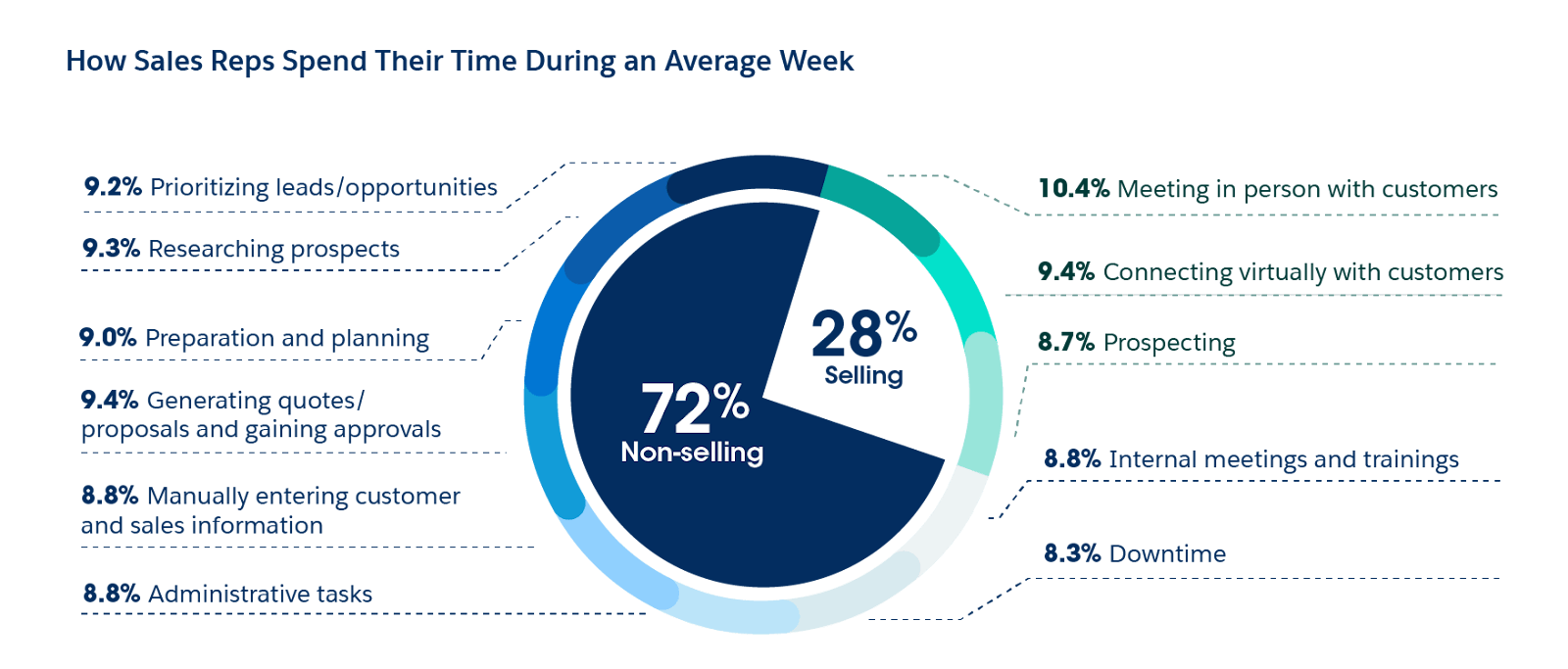

Traditional data providers can’t sell the hyper-specific data that businesses need for effective targeting. As a result, many teams fill this gap with time-intensive manual research. This causes sales representatives to have to spend less than 30% of their time actually selling, according to research from December 2022.

Source: Salesforce

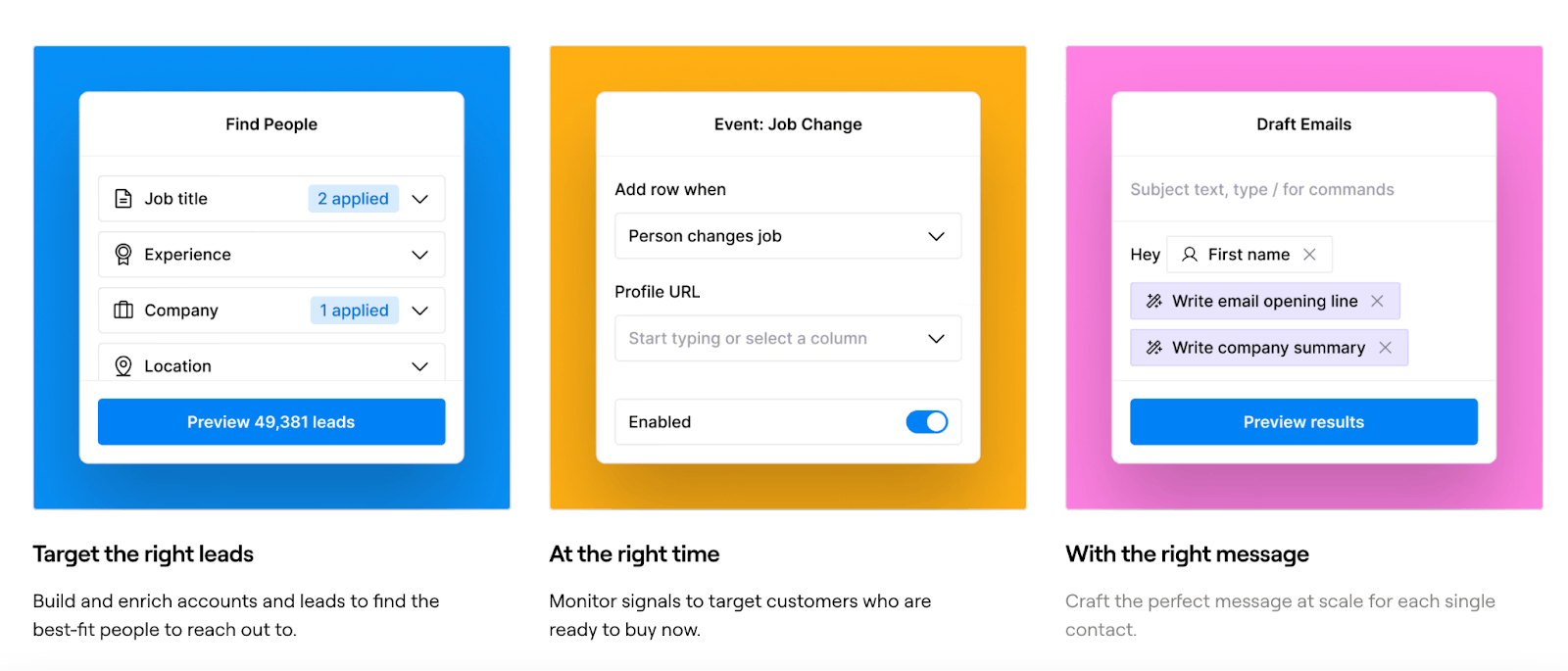

Clay addresses these problems with a go-to-market (GTM) software platform that provides data enrichment, workflow automation, and AI agents to allow companies to find, contact, and close customers more effectively. It helps combine first-party data, intent data, and third-party data from over 130 data sources in one place, as of July 2025, for GTM teams to do deeper customer research and automate outreach without the need to write code. Clay aims to significantly improve the efficiency of GTM teams and allow sales teams to spend more time on nurturing customer relationships and closing deals, not on manual tasks or data collection.

Founding Story

Source: Forbes

Clay was founded in June 2017 by Kareem Amin (CEO) and Nicolae Rusan. Varun Anand joined as a co-founder in 2021.

Originally from Egypt, Amin grew up in a community of expat hospital employees in Saudi Arabia, where his father was a doctor. Amin completed an undergraduate degree in Electrical Engineering with coursework in physics at McGill University. At McGill, Amin met Rusan, and they became close friends before starting their careers at Microsoft. Rusan graduated from McGill in 2009, a year after Amin, with degrees in computer science, political science, and economics.

In 2010, the pair left Microsoft to build a startup. Their first idea was Shared Web, a social network based on shared interests. However, after recognizing the rise of the iPad for ecommerce, they pivoted to Frame in March 2011. Frame was a startup aimed at helping ecommerce companies offer tablet-friendly experiences. Recognizing Shopify as a major ecommerce service at the time, they developed Frame as a Shopify app to ensure company storefronts were easily accessible on an iPad. The app quickly gained traction due to positive reviews and became widely used among Shopify stores, with the team even receiving a call from Shopify about the platform.

While building Frame, Amin and Rusan relocated from Seattle to New York City, where they worked in the office of Sailthru, a startup that automated marketing for ecommerce. Frame was eventually acquired by Sailthru in May 2012, just five months after its launch. Amin and Rusan transitioned to roles at Sailthru to help scale the company’s product. Reflecting on the acquisition, Amin expressed that he would have preferred to continue building Frame after obtaining product market fit, but he lacked the guidance to persist. The pair eventually left Sailthru in August 2013, and both joined Dow Jones. Amin took a position as VP of Product at the Wall Street Journal, which is owned by Dow Jones, and Rusan joined Dow Jones as a VP of Product.

By the end of 2015, both Amin and Rusan had left their roles at Dow Jones to brainstorm ideas for a new company focused on how programming could transform work processes. They aimed to go beyond creating a tool that drove solely work collaboration, with Amin stating, “We wanted to see how these APIs and SaaS tools on the internet could help people work better.” In 2017, they started by enhancing the spreadsheet to become more connected with external data. The idea led to the development of a spreadsheet that could pull data from the internet based on specific values entered. Clay’s product evolved to building APIs that connect spreadsheets with external databases, enabling users to create spreadsheets with identifying information, such as profiles, ratings, and descriptions.

Meanwhile, Anand started his career in politics as a communications intern for Hillary Clinton’s personal office. As a freshman at the University of Pennsylvania, he sent 10 emails to one of Hillary Clinton’s senior advisors before securing a meeting in a D.C. coffee shop. Originally planning to leave shortly, the advisor ended up having an hour-long conversation with Anand and subsequently offered him a role in the office. After working for Hillary Clinton’s presidential campaign, Anand worked in a communications role at Jigsaw, a Google incubator focused on developing safe technology, and in GTM roles at Candid and Newfront. At Newfront, Anand became interested in no-code tools and discovered Clay. After reaching out to and speaking with Rusan, he began sending Clay companies that became its first paying customers. Anand initially joined as an advisor to the company before becoming a co-founder and Head of Operations in September 2021.

Initially, Clay developed features for a variety of customer use cases, including those for engineers, recruiters, and sales professionals. However, customers began requesting irrelevant features, and platform usage became inconsistent. While searching for customers, Rusan began using Clay’s product for outbound outreach and realized the complexity associated with outbound tools and data retrieval. The team recognized Clay’s potential as a growth tool, enabling growth teams to execute on ideas quickly and creatively. By January 2022, they decided to focus the product on outbound data enrichment specifically for growth and sales teams. Clay identified growth marketing teams as its primary target customers, with revenue operations as a secondary focus. In February 2022, Clay launched its newly focused platform on Product Hunt.

Clay has also built a company culture that reflects a deliberate emphasis on curiosity, creativity, and non-traditional backgrounds. For example, they created a GTM Engineering team, a reimagining of traditional sales roles that collapses sales development representatives, account executives, and sales engineers into a single function that builds revenue engines using AI and automation. Many individuals on this team don’t have a traditional sales background and instead come from growth investing, engineering, and marketing. Internally, the company promotes a collaborative environment with informal traditions like weekly DJ sessions.

Product

Data Enrichment & Hygiene

Source: Clay

Data enrichment is the process of enhancing raw, first-party data by combining it with information from other internal or third-party sources. The types of data can include demographics, technographics, and firmographics. Data hygiene then cleanses those records, removing errors, redundancies, and outdated fields, so teams can act on reliable information.

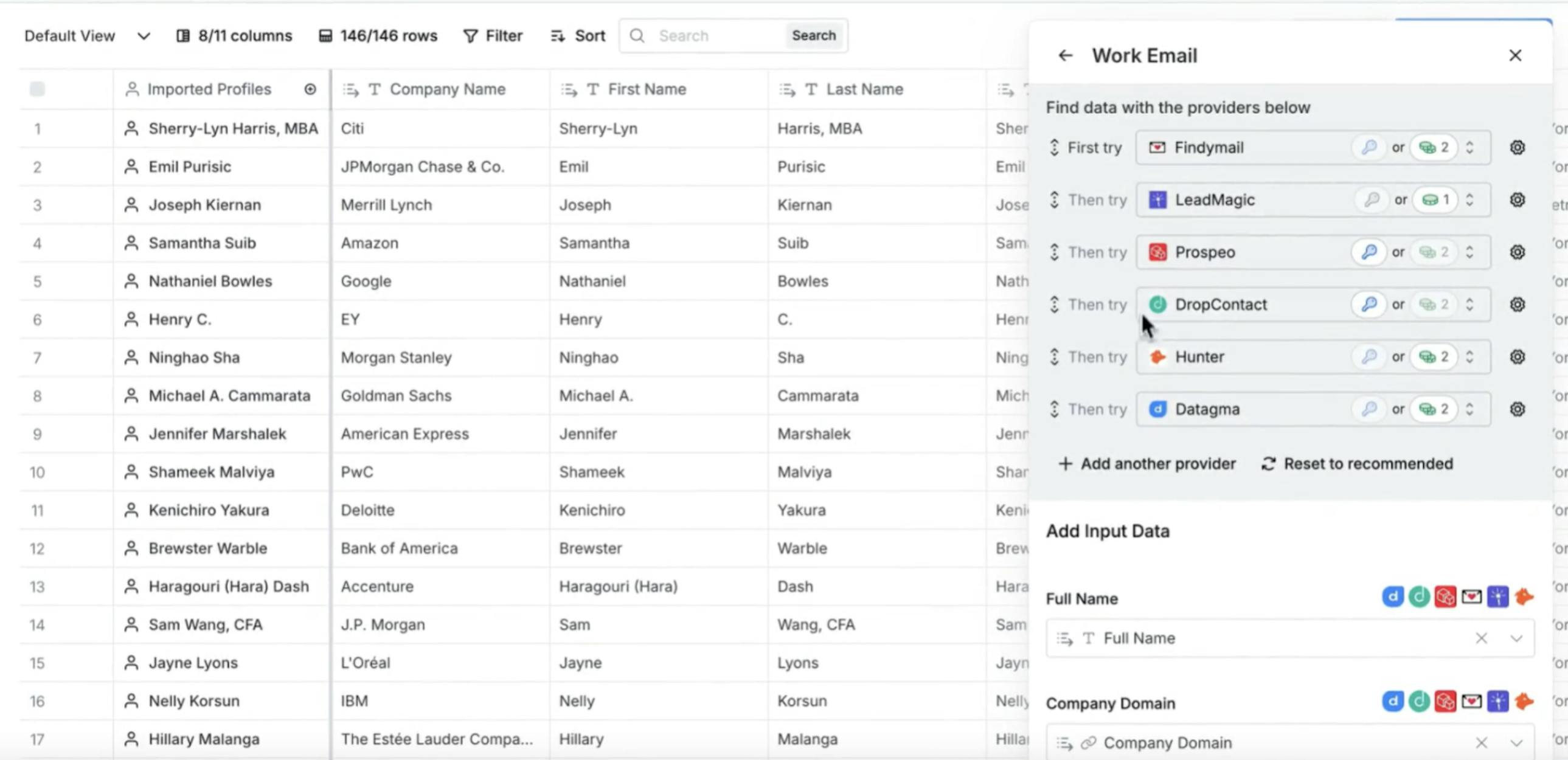

Clay’s data enrichment tool enables customers to enhance first-party data with over 130 data providers as of July 2025. Customers can connect their CRM or data platform to integrate with these providers through Clay’s built-in waterfall enrichment feature. This feature allows customers to choose and sequentially search a list of databases, such as Apollo.io, Hunter.io, and ZoomInfo, ensuring that existing matches are found. For example, if a user needs prospect phone numbers, Clay can sequentially query several databases until it finds a number; an approach that helped Anthropic to triple its contact enrichment rates versus relying on a single provider.

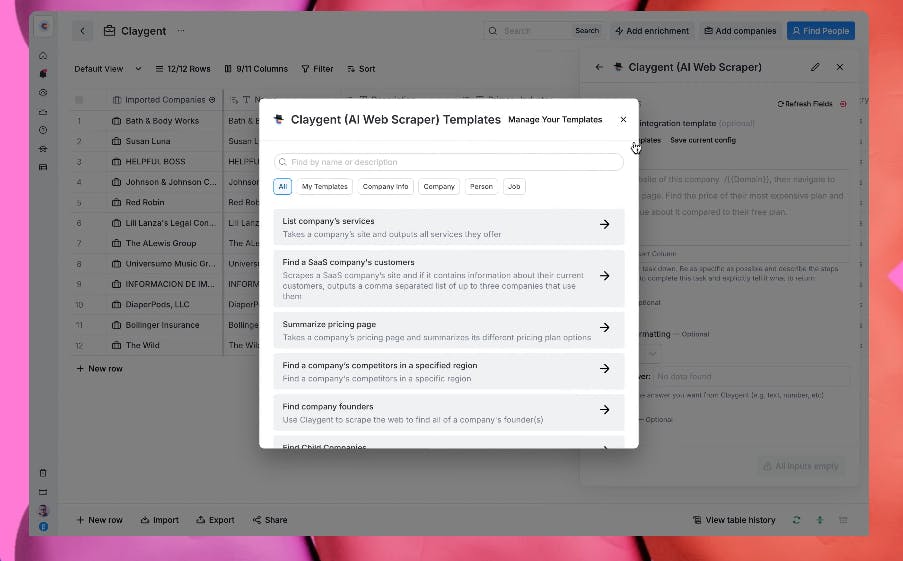

Claygent, Clay’s AI research agent, also helps find new types of data by browsing public sources and unstructured data to answer custom queries. Examples Clay highlights include determining if a target account is SOC-2 compliant, allows for remote work, or is hiring for certain roles. This allows companies to act on unconventional lead signals. For example, Intercom used Claygent to discover that companies that mention ‘fertility’ on their sites tend to need better customer support, which it says it would have never spotted before Clay.

Source: Clay

As of mid-2024, 30% of Clay’s customers were using Claygent, generating 500K research and outreach tasks per day. In June 2025, Claygent surpassed one billion cumulative runs.

Inbound & Outbound Automation

Source: Clay

Sales leads arrive through two paths: inbound, when prospects reach out, and outbound, when the business reaches out.

For inbound, Clay ties into webpages, newsletters, and webinar sign-ups, enriching each new lead with contact or qualifying data. Claygent also fills in missing pieces, corrects misspellings, converts personal to work emails, and links firmographics or social profiles. Those enriched leads flow back into the CRM, where intent data and timestamps help teams determine the optimal follow-up moment.

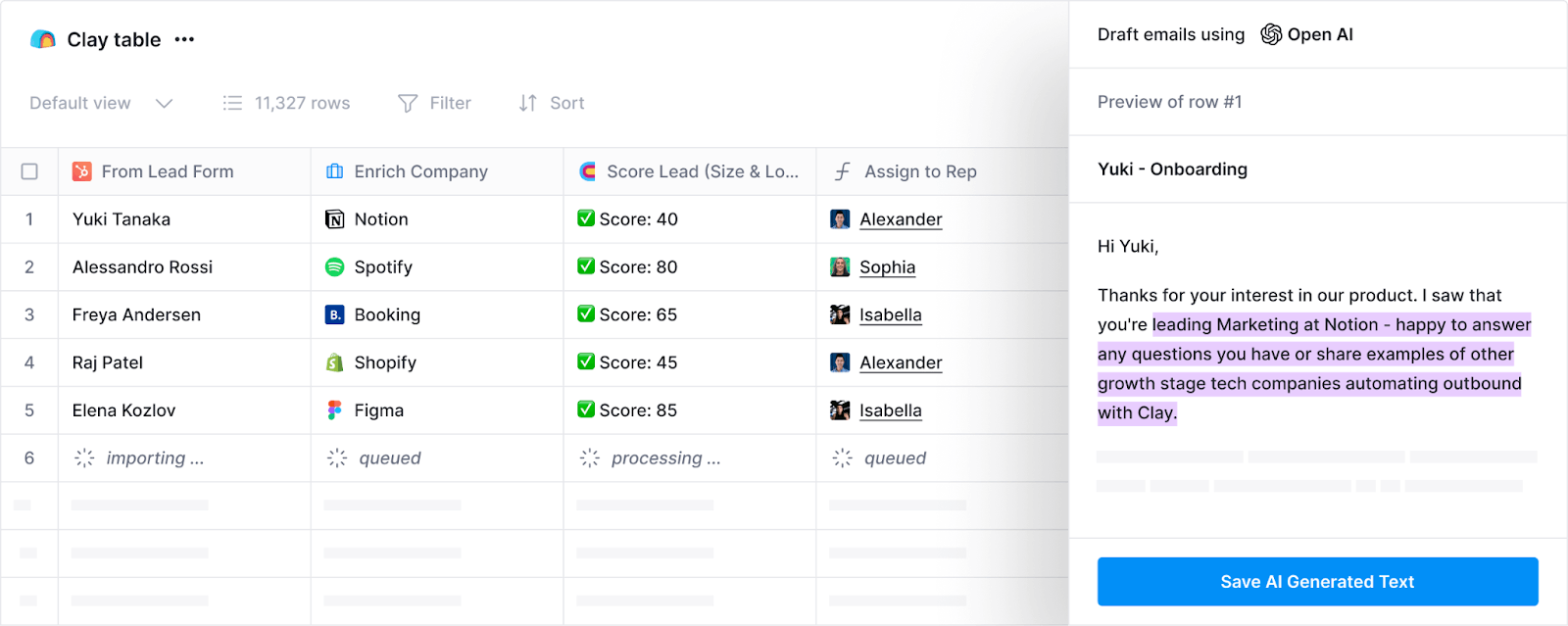

For outbound, Clay connects to sequencing tools to automatically create email and messaging campaigns based on its data. Clay customers can use AI to create detailed, individualized emails to prospective customers based on its data. For example, customers can tailor the message based on a prospective customer’s location, increasing the likelihood of that email being opened.

Source: Clay

Account & Lead Scoring

Source: Clay

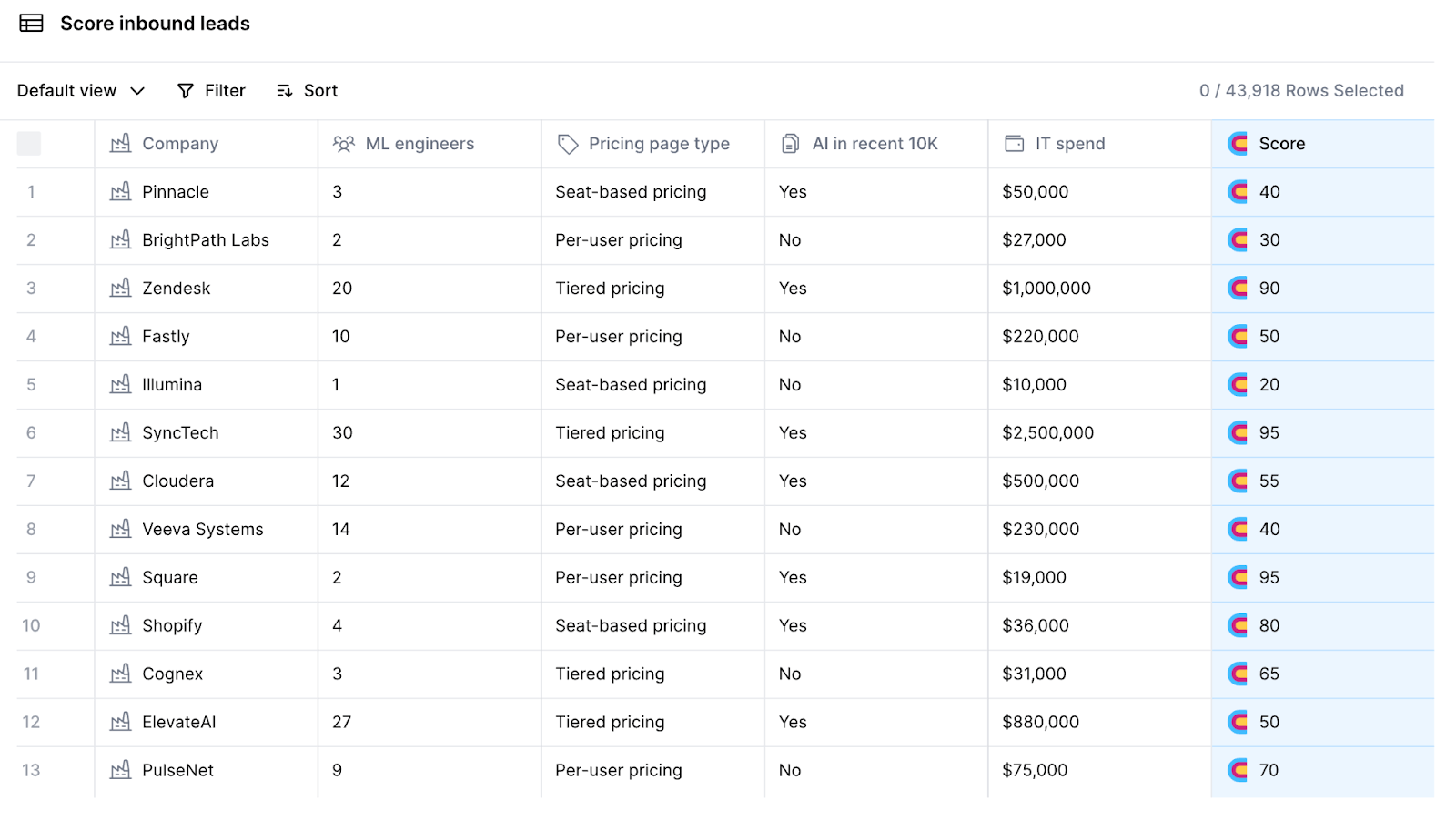

Clay offers an account and lead scoring tool that uses data enrichment and its AI agent. This enables sales teams to effectively score prospective customers to manage time and resources for outreach. The platform enables users to set criteria for determining a prospect’s score and provides relevant data to generate the score. A company can use Clay to set multiple criteria for evaluating a given prospect, such as industry, seniority, or technology stack.

Clay simplifies the information-gathering process by automatically generating lead scores, allowing for comparisons across different industries and companies. These scores save time and effort by enabling companies to re-prioritize prospects based on new criteria without the need to manually re-score.

Custom Signals

Signals are used by GTM teams to indicate changes in prospect or customer behavior that may lead to the consideration or purchase of a product. In May 2025, Clay launched custom signals for GTM teams to track and use unique buyer signals. These custom signals were introduced alongside built-in signals such as Career Movement, Social Listening, and News signals.

Traditional solutions often require teams to manually sift through various websites or use tools that identify generic signals, making it hard for teams to differentiate themselves. Clay’s signals extend beyond job updates or fundraising announcements by monitoring a variety of data points, including social media mentions, event attendance, and support tickets. For example, Density utilizes custom signals to identify a prospect’s office lease expiration and reaches out as that date approaches. In January 2025, Clay acquired Avenue, an automation tool designed to create rules and metrics for operations teams to track customer or vendor alerts.

Market

Customer

Clay customers are GTM teams at startups and enterprises, and the “cold email agencies”, or “Claygencies”, that serve them. Over time, Clay’s target customer has evolved.

When Anand joined the company in 2021, Clay had around 20 customers with contract values ranging from $30 to $200 per month. Since Clay offered a wide variety of use cases, customers came from numerous industries, including recruitment and executive assistance. After joining as co-founder, Anand believed that the company could attract customers more effectively through a product-led growth strategy rather than a proactive sales approach.

To identify Clay’s ideal customer profile, he initially joined Modern Sales Pros, a community and mailing list for sales professionals. By reviewing discussions in the group on topics related to enrichment and outbound automation, Anand found 30 individuals who had knowledgeably discussed these issues, comprising sales development representatives, agency owners, and Vice Presidents of marketing and sales. Conversations with these 30 people helped Anand realize that cold email agencies stood to benefit the most from Clay’s product. As Anand explains:

“These are people who feel the pain point really acutely because they have so many clients that all have the same needs. They’re also technical, they are scrappy because they’re entrepreneurs, and they’re price sensitive so they want to do things in automated ways. And so that’s why we started with them, because we felt immediate pull from them.”

After cultivating a foundational self-serve customer base, in early 2024, Clay moved upmarket and found success with enterprises. As of July 2025, Clay’s customers include notable companies such as OpenAI, Canva, Verkada, Rippling, and Perplexity.

Multiple customer case studies showcase the impact Clay can have on data enrichment. For example, OpenAI doubled its enrichment coverage from 40% to 80% using Clay and scaled from a single-source to a multi-source data model. Enterprise customers also value the ability to experiment and customize workflows. An example is how Clay enabled Rippling’s growth team to create and adjust workflows without needing technical expertise. This flexibility encouraged experimentation and doubled Rippling’s year-over-year performance for cold emails in 2023.

Market Size

Clay’s software operates in several markets, namely sales intelligence and sales automation, and data enrichment. The global sales intelligence market was valued at $2.9 billion in 2022 and is projected to reach $6.7 billion in 2030. The sales automation market was estimated at $8.4 billion in 2023 and is expected to grow to $21 billion by 2032. Data enrichment solutions have a market size of $1.7 billion as of 2021, projected to grow to $3.5 billion in 2030.

One reference point for Clay’s market size is ZoomInfo, a provider of B2B contact data. ZoomInfo generated $1.2 billion in revenue in 2024 and disclosed in its Form S-1 in February 2020 that its total addressable market could be as high as $24 billion, with 800K potential customers.

Competition

Competitive Landscape

The GTM software ecosystem is fragmented, with few dominant players serving all aspects of GTM functions. The market includes a mix of large established companies and emerging startups that are increasingly focused on automating the sales process for customers. Established platforms include ZoomInfo and Apollo.io. While these incumbents hold market share for sales intelligence, they are in the process of evolving from being purely contact databases to providing automation and enrichment tools.

Competitors

ZoomInfo: ZoomInfo was founded in 2000 as a data intelligence platform offering a database of individual and company contact information. The company merged with DiscoverOrg in February 2019 and went public in June 2020. In Q4 2024, the company reported $309 million in revenue and $116 million in adjusted operating income. As of July 2025, ZoomInfo had a market capitalization of $3.4 billion and trades under the ticker symbol “ZI”.

ZoomInfo primarily serves as a directory of contacts and company data for GTM teams with information such as employment history, web activity, org charts, and technographics. ZoomInfo’s tools use internal data with opportunities to integrate CRMs and sales tools. While ZoomInfo offers enrichment and lead sourcing, unlike Clay, the company does not offer integrations for external data sources.

Apollo.io: Founded in 2015, Apollo.io is a sales intelligence platform providing companies with a database of over 210 million contacts and more than 35 million companies. In August 2023, Apollo.io raised $100 million at a $1.6 billion valuation in a Series D round led by Bain Capital Ventures. The company’s revenue grew by 9x in the two years leading up to the Series D round, and it had over 500K customers as of July 2025.

Apollo.io started as a database of contacts for GTM teams. The company has evolved to support GTM processes and offers enrichment and prospecting tools similar to Clay. However, these tools rely on data from Apollo.io’s database, and Apollo.io offers more standardized workflows. In contrast, Clay’s software integrates with multiple data sources and offers more customizable workflows.

Cognism: Cognism is a UK-based sales intelligence platform specializing in B2B sales and marketing data, founded in January 2015. It provides globally compliant contact information for businesses backed by GDPR, CCPA, and SOC-2 standards. Cognism raised an $87.5 million Series C funding round in January 2022 led by Viking Global Investors and Blue Cloud Ventures, with participation from AXA Venture Partners and Volution.

Cognism’s offerings focus on complaint data solutions that include firmographics, sales trigger events, and intent data. Its adherence to compliance standards offers premium data for GTM teams, such as verified phone numbers and business emails. Since the company focuses on premium, compliant data, Cognism offers fewer enrichment and sales tools compared to Clay.

Unify: Founded in 2023, Unify is an AI-powered tool for automating outbound emails. The software enables companies to streamline and enrich outbound emails for sales and marketing functions. The company raised $12 million in a Series A funding round led by Emergence Capital and Thrive Capital, with investors including OpenAI Startup Fund, AltCap, and Abstract. Unify grew revenue by 39x year-over-year before the Series A funding round.

Unify uses intent signals and AI agents to improve prospecting and scale outbound outreach. The company’s platform is more narrowly focused compared to Clay’s offerings, which include automated inbound and outbound workflows. Unify provides customers with an agent-based solution for automated outbound emailing, while Clay’s product caters to teams seeking a broader GTM solution.

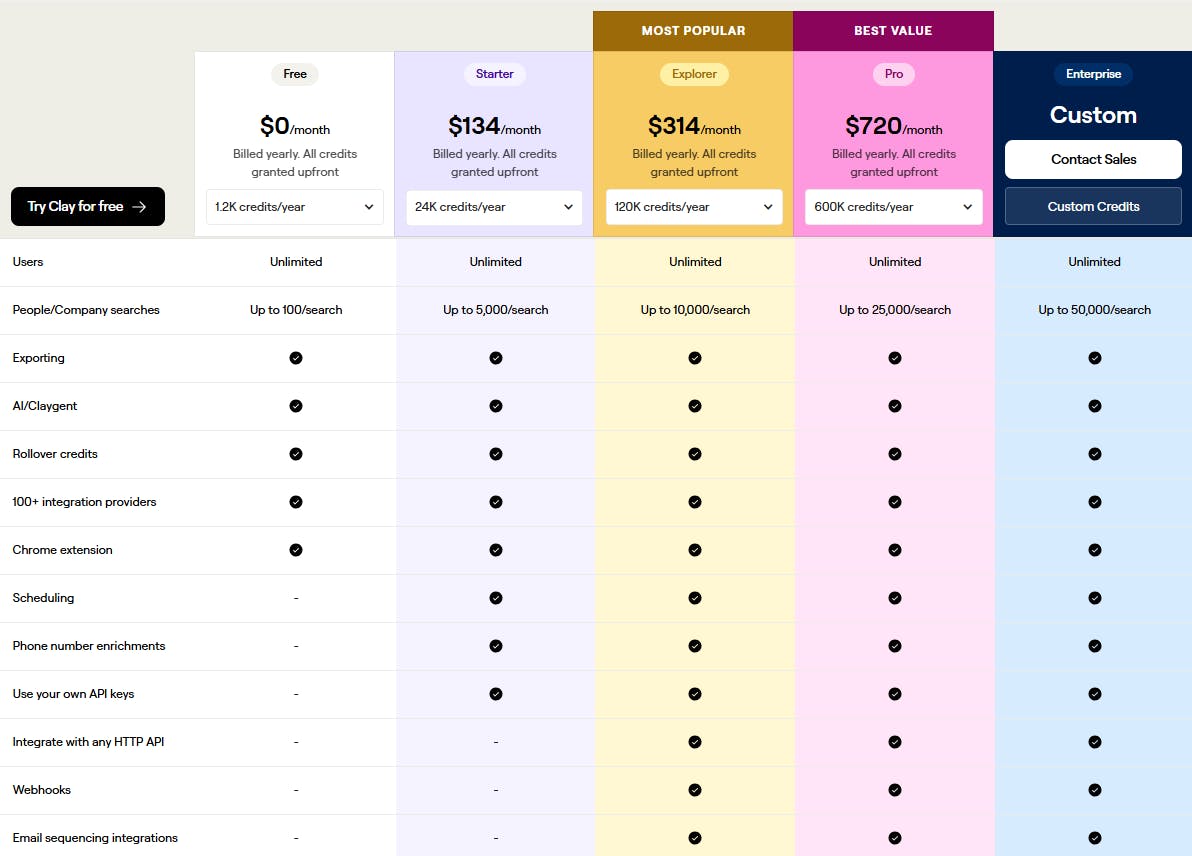

Business Model

Clay uses a subscription-based credit system to monetize its software. Customers purchase a set number of credits per year to use for actions on Clay’s software, such as enrichment, email validation, or search functions. Most actions conducted on the platform are either free or cost one to two credits, depending on the resources and providers required. For instance, the “Find Mobile Number” action costs a default of two credits but can increase up to 25 credits depending on the selected provider.

In May 2024, Clay introduced features that allow customers to top up their credits for the current month or roll over unused credits. These features provide customers with the flexibility to manage their credit usage without needing to change their entire plan. This flexibility is particularly helpful for GTM teams that may experience fluctuating needs for prospecting or enrichment. However, credit top-ups incur a 50% premium, and the number of accumulated, unused credits is capped at twice a customer’s monthly allocation.

As of July 2025, Clay offers four different payment plans that vary based on the number of credits and features included. All plans come with unlimited users, exporting, rollover credits, and Claygent. Additionally, custom plans can be tailored to meet the needs of enterprise customers. Clay also offers a credit calculator to help users estimate their expected credit usage based on the actions and data they require.

Source: Clay

Traction

Clay launched publicly on Product Hunt in February 2022, initially experiencing an influx of users before growth plateaued. In May 2022, the team turned on a waitlist while the company was near zero in revenue, keeping it active for 15 months.

After further focusing on product market fit, Clay saw revenue increase tenfold in 2022 and 2023. Customers also grew from 120 to 1K in 2023. In 2024, Clay’s grew sales by 6x, with the company generating around $30 million in revenue. As of May 2025, the company’s software was being used by over 8K customers, including OpenAI, Intercom, and Rippling.

Source: Ed Sim

Clay has a large community of experts and enthusiasts who have contributed to its growth. The company’s user community started as a Slack group with around 200 members and has grown to over 10K. Clay also has a “Wall of Love” on its website composed of positive customer testimonials about the platform. There are more than 100 “Claygencies” or businesses that offer support services for customers using the platform. Some of these agencies have generated seven figures in revenue by employing their own teams to help companies maximize the use of Clay. Additionally, users have formed Clay Clubs, which host Clay events, with over 40 clubs in over 20 countries as of February 2025. These clubs organize meetups where members come together to watch demos of Clay and collaborate on building workflows.

Valuation

Clay raised $40 million in a Series B expansion in January 2025 at a $1.25 billion valuation, more than doubling its valuation from the company’s original Series B round. The Series B expansion was led by Meritech Capital and included previous investors such as Sequoia, First Round Capital, and BoxGroup. The Series B expansion is an extension of Clay’s $46 million Series B round, bringing the total capital raised by the company to $102 million.

Following the Series B expansion announcement, Clay introduced a community equity offering in February 2025, allowing customers and individual investors to invest alongside the Series B expansion round. Regarding the Series B expansion, Amin said:

“We didn’t need to raise, but our investors were seeing our traction, how we’ve been growing, and they wanted to double down.”

In May 2025, Sequoia led a tender offer to purchase up to $20 million of employee stock at a $1.5 billion valuation. Current and former Clay employees were eligible, and the offer was meant to give employees a way to liquidate their shares. Alfred Lin, a partner at Sequoia, expressed confidence in Clay, stating, “There is probably going to be less than $20 million in demand, which is sad for Sequoia because we’d like to buy more.”

Key Opportunities

Expanding Integrations

Clay can continue to expand the wide range of integrations supported by the platform. The company offers over 130 integrations as of July 2025, each with specific actions, including integrations with HubSpot, Typeform, and Perplexity. Clay is also seeking to add first-party data integrations related to internal data, such as platform usage, customer billing, and support tickets. Introducing new internal and external integrations increases the variety and volume of data customers can pull into the platform. With access to additional data types, Clay’s use cases will expand, and workflows will become more effective.

Data Centralization

According to Salesforce, sales teams use an average of 10 tools to close deals, including account management, sales forecasting, and prospecting tools. Clay’s software enables GTM teams to consolidate their integrations and providers onto a centralized platform. If a particular tool isn’t integrated into Clay by default, the platform offers customers an HTTP API to build no-code integrations. With 94% of sales organizations seeking to consolidate their tech stacks, Clay’s software serves as an attractive solution for centralizing sales tools and data.

Native Engagement & Sequencing

As Clay expands beyond data enrichment and workflow automation, adding built-in email and multichannel sequencing is another large opportunity. Today, the platform exports enriched leads to tools such as Outreach or Salesloft, but incorporating similar functionality directly in Clay could increase the value of its platform and improve Clay’s existing automated workflow tools. Bringing send-level engagement data back into Clay would also improve lead scoring and signal accuracy over time.

Community-Led Growth

Clay’s community has been an important part of the company’s growth and development. Since the company’s launch on Product Hunt, Clay has prioritized customer experience. When the platform initially launched, Clay started a Slack group for all its customers to provide support and answer questions. The group also acted as a way for customers to provide product feedback and allowed the team to receive instant reactions on shipped features. With the group having over 10K members as of May 2024, Amin credits Clay’s success to the community’s engagement and the company’s focus on GTM teams.

Clay’s community not only includes customers but also vendors. Given the number of integrations available on Clay, the company directs customers to smaller integration providers. Through Clay’s exposure, these providers can expand and offer more Clay-specific actions, fostering mutual growth. For example, Leadmagic, an email and phone number finder, grew from a single integration to six Clay integrations and seven figures in revenue. Clay’s community enables the company to expand through word-of-mouth and adapt to market trends based on customer feedback.

Key Risks

Increased Competition

Companies creating software for GTM and sales teams are transitioning from merely functioning as information databases to offering tools that can extract insights from their data. Sales intelligence platforms like ZoomInfo and Apollo.io offer sales automation and enrichment tools that use their technographic and firmographic contact database. ZoomInfo, in particular, has acknowledged the importance of sales process automation and the utility of interconnected data sources. Although these incumbents often feature less customizable workflows and integrations, their sizable internal data and large customer base could replicate many of Clay’s use cases.

In addition to established companies, early-stage startups have begun emerging for individual components of Clay’s offerings. Startups are developing solutions for workflow automation, AI sales agents, and contact enrichment. One of the main appeals of Clay’s platform for customers is the convenience of accessing various sales, enrichment, and automation tools in a single place. However, as startups introduce more refined versions of Clay's offerings, the market may become fragmented, leading to increased pricing pressure and the risk of customers opting for unbundled solutions instead of Clay's broader platform.

Platform Learning Curve

One common criticism of Clay is that it’s powerful to use but has a steep learning curve. Reviewers often describe the platform as “complicated,” which is part of the reason many businesses hire external “Claygencies” to help them make the most of the product. Clay’s competitors leverage this narrative in their marketing. On its competitor page with Clay, Apollo.io quotes a customer who says Apollo is “much more user-friendly and allows teams to access similar data without the learning curve.”

Long-term, Clay’s growth is at risk if its steeper learning curve pushes users to easier-to-use alternatives or makes it harder for Clay to sell to certain types of customers. Having customers interface through Claygencies also introduces other risks to manage, including inconsistent quality of services and added layers of friction between Clay and some of its end customers.

Summary

GTM teams are consolidating their tech stacks and automating sales processes to enhance productivity, reduce manual work, and scale their operations. This trend reflects a shift in the market towards integrated platforms that offer data and workflow solutions. Clay provides businesses with a singular solution for data enrichment and workflow automation. Its integrations with data providers and AI agents enable companies to automate research and manual tasks. By automating these processes, sales teams can scale prospecting and outreach with fewer team members while maintaining the quality of their leads.

Clay grew revenue from close to zero to $30 million in only four years and has developed a large community of experts and enthusiasts in the GTM space. The company has steadily increased the number of integrations and features available to sales teams, and its AI agent has allowed sales teams to easily pull data that could only be manually researched previously. However, established competitors and emerging startups are developing similar tools and integrations that could threaten the company’s market share. Clay’s continued success depends on its ability to expand its data integrations and automation features while maintaining a focused product for GTM teams.