Thesis

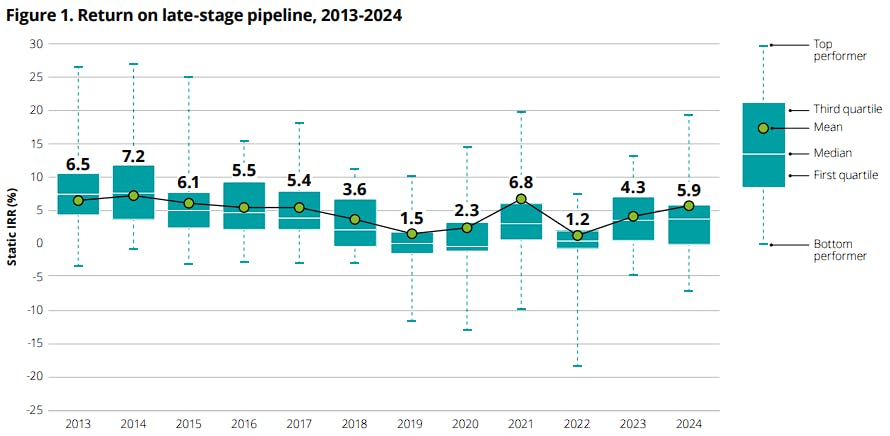

Credited with saving an estimated 149 million life-years in the 32 years between 1981 and 2013, the pharmaceuticals industry faces a growing innovation plateau. Each breakthrough raises the bar for the next, leaving fewer “low-hanging fruit” molecular targets and modalities to pursue. Outside of isolated surges in R&D returns, such as cases like COVID-19 vaccines and GLP-1 drugs for obesity, overall R&D productivity in pharma has remained stagnant.

Source: Deloitte

At the same time, domestic pressures in 2025 have reshaped the pharmaceutical landscape. In the US, policy changes such as the Inflation Reduction Act (IRA), which enables Medicare to negotiate down prices for several blockbuster drugs, and most-favored-nation pricing proposals that tie the US prices to international benchmarks, threaten companies’ top lines. Meanwhile, tariffs on active pharmaceutical ingredients (APIs) and proposed limits on Chinese in-licensing could drive up costs and restrict external innovation pipelines.

Together, these forces create a financial squeeze, making pharmaceutical innovation more challenging and more expensive. Amid these obstacles, artificial intelligence has emerged as a promising way to streamline R&D. Models such as AlphaFold, which contributed to Nobel-recognized advances in structural biology, have already demonstrated how prediction and simulation can accelerate early-stage discovery.

Building on this momentum, the broader life sciences industry has joined forces with AI leaders. OpenAI partnered with Eli Lilly, Moderna, and Sanofi to explore AI-assisted drug design throughout 2023 and 2024. In its collaboration with Eli Lilly, the company is applying generative AI to develop therapeutics targeting drug-resistant bacteria, a direction that in 2024 had only recently been demonstrated in academic research.

Meanwhile, Google DeepMind’s Isomorphic Labs is integrating prediction into discovery pipelines. In 2024, it released AlphaFold 3, a structural prediction model that expanded beyond proteins to include DNA, RNA, and ligands. Finally, Anthropic launched its AI for Science program in 2025, offering scientists free API credits to accelerate research in the life sciences.

This convergence between AI and the sciences reflects a broader shift across “hard tech” sectors such as chemicals and materials science as well. Rising demand for sustainable materials increases complexity, but also creates an opportunity for AI enablement. In the US, accelerating materials discovery through AI has become a policy priority as new projects like the Materials Genome Initiative seek to deploy “advanced materials twice as fast and at a fraction of the cost”.

Yet across these domains, AI systems still depend on human-generated datasets, and the gap between computational prediction and experimental validation remains a constraint on progress. In January 2024, even AlphaFold’s high-confidence predictions showed nearly twice the error rate of experimental crystal structures.

Given this bottleneck, Lila Sciences aims to bridge the divide between prediction and validation across the life sciences, materials science, and chemicals. Its Autonomous Science platform pairs AI models trained on the scientific method with automated experimentation in AI Science Factories to produce novel therapeutics, technologies, and compounds. These assets can then be transferred to enterprise partners through licensing or collaboration, for further development.

As of October 2025, Lila has begun offering access to its platform to commercial partners who have not yet been disclosed. Nevertheless, as more experiments are automated on its platform, Lila can strengthen its predictive systems towards its mission of “building scientific superintelligence”. It helps partners reduce R&D costs and shorten timelines, easing pressures on increasingly strained innovation pipelines while bringing AI and “hard tech” closer together.

Founding Story

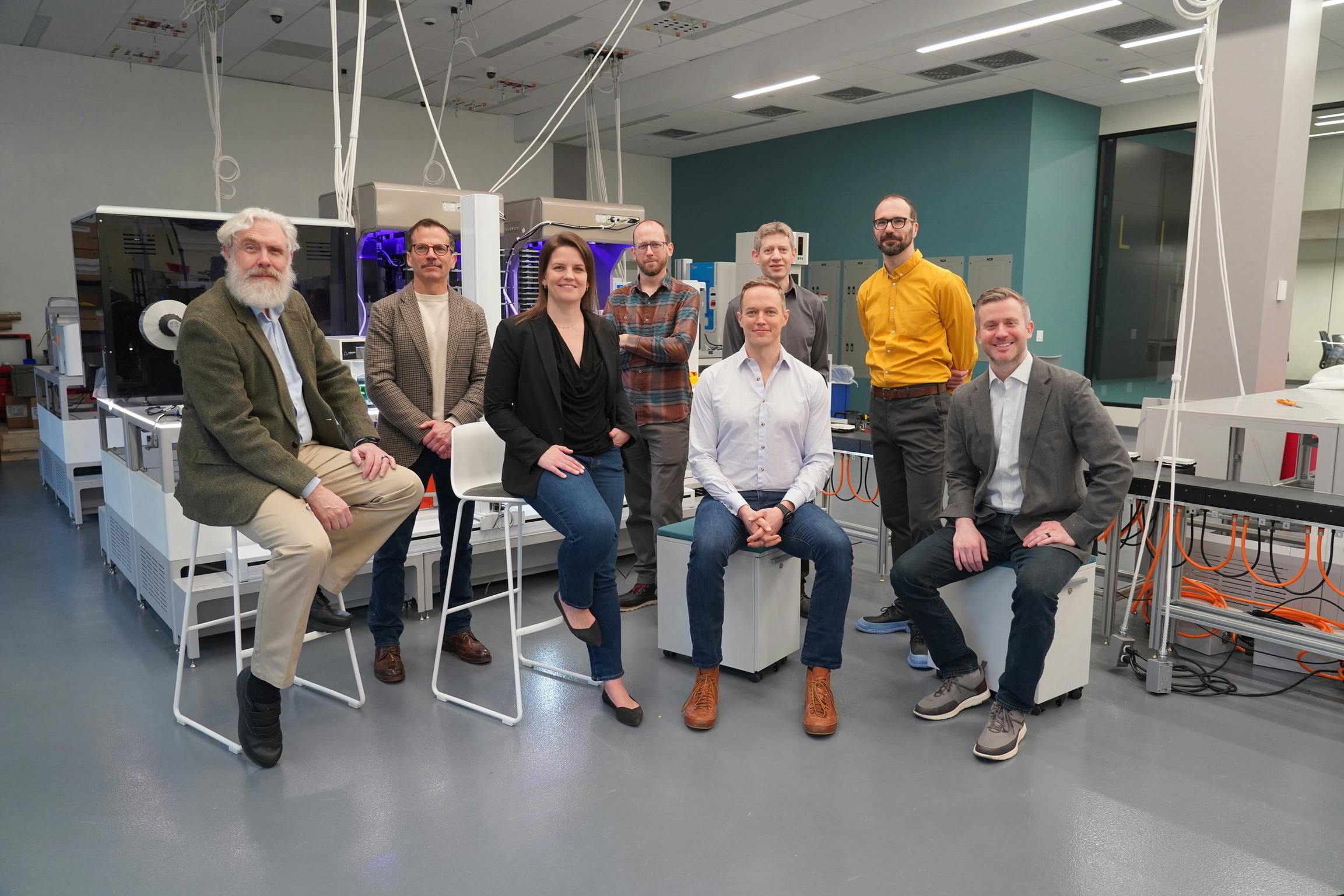

Source: Lila Sciences

Lila Sciences was founded in 2023 by Geoffrey von Maltzahn (CEO), Noubar Afeyan (Chairman), Molly Gibson (former President of Future Science), Alexandra Sneider (Head of Corporate Development), Scott Robertson (Chief Commercial Officer), Ben Kompa (Head of AI Lab Innovation), and Jake Feala (SVP Autonomous Platform). The company was formed out of Flagship Pioneering, a biotech startup incubator and venture capital firm.

Before Lila, von Maltzahn, a general partner at Flagship, had co-founded 10 companies that collectively have realized $10 billion in public and private market capitalization. In collaboration with others at Flagship, including Afeyan, he has helped found companies such as Sana Biotechnology, a cell engineering biotech, Seres Therapeutics, known for developing the first FDA-approved live biotherapeutic, and Generate: Biomedicines, where he was formerly CEO.

Likewise, Afeyan had a background in entrepreneurship prior to joining the Lila team. As co-founder and CEO of Flagship Pioneering, Afeyan had already helped build over 100 startups across life sciences and tech and raised $3.6 billion in 2024 for the firm’s eighth fund. Throughout his career, he has served as an advisor to several companies that have been acquired, as well as Moderna, known for developing an mRNA vaccine during the COVID-19 pandemic.

Lila Sciences also draws from the expertise of Gibson and Feala, who joined from a peer Flagship startup, Generate:Biomedicines. Founded in 2018, Generate:Biomedicines applies machine learning and automated experimentation to design and optimize protein therapeutics with improved predictability. At Generate, Gibson served as co-founder, CSO, and CIO, while Feala led computational biology efforts. Gibson earned her Ph.D. in computational and systems biology from Washington University in Saint Louis in 2015. Feala earned his Ph.D. in bioengineering from UCSD in 2003.

Kompa, who completed his Ph.D. in machine learning and biotechnology at Harvard in 2022 and later joined Flagship Pioneering as an Associate, contributes to Lila’s artificial intelligence and computational innovation initiatives. Together, Gibson, Feala, and Kompa support the scientific and technological foundation of Lila’s efforts to integrate computation with experimental biology.

The other two founders support Lila’s commercial efforts. Sneider, a Principal at Flagship and a chemical engineer by training, supports partnership formation. Lastly, Robertson brings business experience as a former investment banker and as CCO of Solugen, a company applying enzyme engineering to sustainable chemical manufacturing.

The concept behind Lila was shaped by a growing recognition within Flagship of the potential for generative AI in scientific discovery. In a 2022 interview with McKinsey and Co., Gibson shared this vision:

“A lot of times, people think about layering AI on top of how we already do things. What gets me more excited is the idea that AI gets to transform what we do. It’s not just about doing the things that we already do faster, cheaper, and better. It’s about being able to do things that we weren’t able to do before.”

Similarly, in early 2024, before Lila exited stealth mode, von Matlzahn spoke at MIT about enabling AI to “access the real world” and close the loop between computational and experimental science. This idea became central to Lila’s founding mission to develop a superintelligent AI capable of learning beyond the limits of human-generated data.

Lila Sciences was originally established as a merger of two separate AI-related Flagship Pioneering projects in 2023. One project centered on materials science and the other on biology. Since their goals were aligned and both sought to recruit similar talent, Flagship leadership consolidated them into a unified effort to automate scientific discovery.

The company was then publicly unveiled in March 2025, announcing its seed round fundraising. At the same time, it shared the appointment of George Church as CSO as well as Andrew Beam as CTO. Church, a renowned professor of genetics at Harvard Medical School, has authored over 700 scientific papers and holds more than 150 patents.

Notably, Church had a hand in the development of next-generation sequencing technologies, gene-editing systems, and Multiplex Automated Genome Engineering (MAGE) — a platform for high-throughput genome engineering experiments that closely aligns with Lila’s mission to merge automation and biological discovery. Beam, on the other hand, was an Assistant Professor of Biomedical Informatics at Harvard Medical School prior to joining Lila as well as a co-founder and head of machine learning at Generate:Biomedicines.

Product

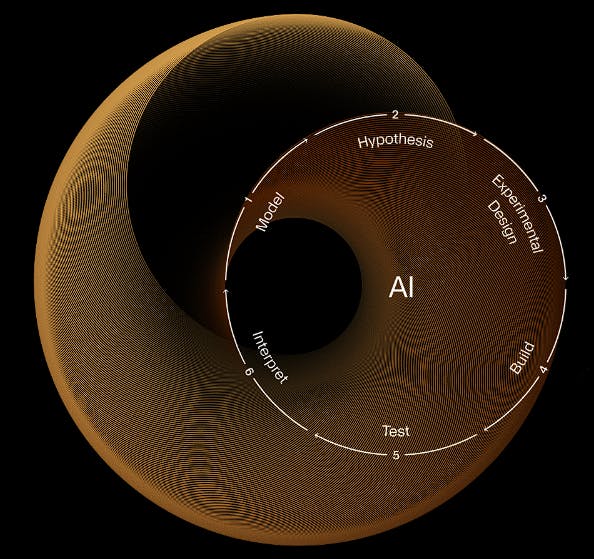

Lila’s primary offering is access to its Autonomous Science platform, which includes the use of its AI models and automated lab spaces. Trained on existing scientific literature and the results of each successive experiment it performs, Lila’s AI enables users to make discoveries by serving as a scientific assistant that conducts experiments and continuously learns to refine future hypotheses.

Superintelligence and AI Science Factories

Source: Lila Sciences

Lila Sciences’ mission is to develop a superintelligent AI capable of learning beyond the limits of human-generated data. With this goal, Lila seeks to create AI models on its Autonomous Science platform that are capable of generating their own knowledge through experimentation. Trained not only on scientific literature and documented results, the Autonomous Science platform is instructed to leverage the scientific method such that it can develop its own hypotheses, design and perform experiments, and ultimately learn from these findings.

Source: Bloomberg

Lila Sciences seeks to leverage a combination of robotics and artificial intelligence to develop AI Science Factories (AISFs) that can autonomously run experiments across three scientific disciplines: materials science, life science, and chemistry. These factories, powered by Lila’s Autonomous Science platform, serve as the AI’s “lab bench”, equipping it with state-of-the-art instrumentation and robotic tools to direct reagents and products to different workstations. Importantly, as of December 2025, the Autonomous Science platform does not operate completely independently, as scientists are still needed to supervise the machinery. The intention behind these factories is to scale scientific experimentation beyond human capacity.

As of December 2025, the startup has a single AI Science Factory in development in Cambridge, MA. However, the team aims to expand operations to two major biotech hubs: San Francisco and London.

Scientific Partnership

Notably, Lila’s platform is not intended to replace scientists but instead serves as a partner for scientists to rapidly make new discoveries. Under the existing model in 2025, scientists with as little as no specialty in a field can provide the AI with a directive, such as the development of a sustainable catalyst, and the AI can support experimental design, candidate molecule testing, and result generation, allowing scientists to focus on interpretation.

Discoveries

Lila has demonstrated the feasibility of its platform across four key applications. However, as of December 2025, it has not publicly released data regarding these findings:

“Generation of optimal genetic medicine constructs that outperform commercially available therapeutics;

Discovery and validation of hundreds of novel antibodies, peptides, and binders for a broad range of therapeutic targets;

Generation of unique non-platinum group metals as catalysts in the production of green hydrogen at a fraction of the cost of current commercial catalysts; and

Design of new material for industrial-scale carbon capture with better capacity, thermal stability and kinetic binding than leading products.”

CEO Von Maltzahn elaborated on these critical advances made by the technology’s early platform. In an interview from April 2025, he shared more details on two of these projects:

Improved genetic medicine constructs: Using autonomous science, three non-experts in mRNA biology discovered mRNA sequences that were more than 3x efficient than those used in the BioNTech or Moderna COVID vaccines in four months. Efficiency was measured based on protein expression levels of mRNA.

Improved non-platinum catalysts: Generation of green hydrogen (a renewable fuel) by electrolysis occurs by splitting water into hydrogen and oxygen gas. Currently, this approach is cost-prohibitive. One reason for this is that electrodes that perform electrolysis are designed with platinum and iridium, which are scarce and expensive. Two scientists at Flagship used autonomous science to discover electrode compositions from Earth-abundant metals that could perform comparably to platinum and were 1000x cheaper.

Market

Customer

Lila’s primary customers will be enterprises and institutions that operate across life sciences, materials science, and chemistry. Access to Lila’s platform will initially be limited to a few select companies; however, the company’s longer-term vision is to open more doors to users worldwide. Von Maltzahn explains the rationale behind this strategy:

“We are going to have some meaningful relationships with initially a small number of entities that can access the platform in a privileged way so that we can, with less distraction, aggressively pursue the one wheel of science that achieves and leads scientific superintelligence…”

Market Size

Lila Sciences operates across three markets: life sciences, chemical sciences, and materials science.

In the life sciences market, drug discovery remains one of the most immediate applications of Lila’s platform. As of 2024, the global AI market for drug discovery was an estimated $2 billion. This figure was expected to grow to $35 billion by 2034 at a CAGR of 29.6%. However, drug discovery is just one application of Lila’s AI in the life sciences.

Synthetic biology represents another large market where Lila’s discoveries can create value, supporting crop genetic engineering and microbial strain optimization for biomanufacturing. This market is expected to grow from $16 billion in 2024 to an estimated $81 billion in 2034 at a CAGR of 17.3%.

In the chemical sciences, AI can be leveraged to enable the discovery and formulation of new catalysts and coatings. As of 2023, the global AI in chemicals was projected to grow from $943 million to $5.2 billion by 2032 at a CAGR of 27.8%. Altogether, across the three markets Lila plays in, generative AI could add a total of $260 billion to $450 billion in value, according to one estimate.

Looking forward, Lila also seeks to democratize scientific research by offering its platform directly to individual users. The potential size of this market can be framed by the number of active researchers worldwide. As of 2018, there were an estimated 8.8 million full-time equivalent researchers globally, which grew by 13.7% from 2014. Moreover, in a survey done by Nature in 2023, 28% of researchers stated they used AI products every day or more than once a week. Assuming consistent growth, these rates suggest a total population of 11 million researchers in 2025, and a near-term addressable market of roughly three million AI-active scientists or potential users.

Competition

AI in Life Sciences

Chai Discovery: Founded in 2024, Chai Discovery is developing an AI-based drug discovery platform for molecular structure prediction. As of December 2025, the company had raised a total of $235 million, including a $130 million Series B in December 2025 at a $1.3 billion valuation led by General Catalyst. This came just three months after the company had raised a $70 million Series A round in September 2025. Other notable investors of Chai include Menlo Ventures, OpenAI, and Thrive Capital.

Chai Discovery’s latest model, as of December 2025, is Chai 2. Chai 2 enables antigen (foreign molecule) binding prediction by antibodies with a hit rate of 20% which represented a 100-fold improvement over prior computational approaches. It enables scientists to more efficiently develop antibody therapeutics, like monoclonal antibodies and antibody–drug conjugates, that target disease-causing proteins expressed by pathogens or cancer cells. Unlike Lila, which seeks to apply generative AI more broadly across the life sciences, Chai Discovery operates within the niche of de novo antibody design.

Recursion Pharmaceuticals: Recursion Pharmaceuticals was founded in 2013 with the mission of decoding biology to industrialize drug discovery. The company went public through an IPO in April 2021, and as of December 2025 had a market cap of $2.2 billion.

Recursion’s platform, known as Recursion OS, is composed of wet-lab and dry-lab modules that can be ordered and connected by its proprietary LOWE (Large Language Model-Orchestrated Workflow Engine) to create automated workflows. Its facilities leverage robotics to standardize and automate high-throughput assays, enabling millions of experiments to be performed each week.

These experiments span transcriptomics (the study of RNA transcripts, such as those involved in gene expression), ADME (absorption, distribution, metabolism, and excretion) profiling, and cell imaging, among others. With a library of over 1.7 million compounds, Recursion can screen vast chemical spaces efficiently to identify novel therapeutic candidates. While the company’s platform is accessible to collaborators, Recursion primarily applies its technology toward developing its own internal pipeline of clinical-stage drug candidates.

AI in Materials Science

Periodic Labs: Periodic Labs was founded in 2025 by former OpenAI and DeepMind engineers Liam Fedus (a co-creator of ChatGPT) and Ekin Cubuk (Research Scientist at DeepMind). The company launched with the goal to “automate materials design”, and as of December 2025, the startup has raised a total of $300 million from its seed round, which closed in September 2025. The round was led by Andreesen Horowitz. Other key backers included Accel, Bain Capital Ventures, NVIDIA, and Jeff Bezos.

The startup seeks to build AI models that can learn from scientific literature and physical experiments. One of its key objectives is to develop superconductors that can function at high temperatures. Similar to Lila, it will build laboratories to enable AI to perform experiments automated through robotics; however, its focus remains in the physical sciences.

Generative AI Incumbents

OpenAI: OpenAI, founded in 2015, is a company whose goal is to develop artificial general intelligence. The nonprofit-turned-pseudo-for-profit organization is known for its GPT AI models. As of December 2025, OpenAI had raised a total of $79 billion in funding. In October 2025, OpenAI completed an employee secondary, with current and former staff selling about $6.6 billion of stock to investors, including Thrive Capital, SoftBank, Dragoneer, MGX, and T. Rowe Price, at a $500 billion valuation — up from $300 billion post-money in March 2025 following the $40 billion Series F led by SoftBank.

OpenAI’s GPT models serve both individual and enterprise users, forming one of the largest active AI user bases in the world. As of June 2025, there were over three million paying business users, and in September of the same year, there were over 700 million weekly individual users.

Among professionals in science and engineering, ChatGPT was most frequently used for "making decisions and solving problems”. In research, chatbots like ChatGPT were found in a 2023 poll to be used by 31% of post-docs for applications ranging from code generation to experimental protocol refinement. To meet growing demand for more capable research tools, OpenAI eventually rolled out deep research in February 2025, enabling users to synthesize information across multiple web sources. While their research applications continue to grow, unlike Lila, OpenAI’s models remain limited to web-sourced and proprietary data and cannot independently perform laboratory experiments.

Anthropic: Founded in 2021 by ex-OpenAI employees, Anthropic is a public-benefit corporation developing generative AI models built with an emphasis on safety and responsible deployment. Through December 2025, the company had raised a total of $33.7 billion with a Series F of $13 billion at a $183 billion valuation in September 2025 led by Fidelity, ICONIQ Capital, and Lightspeed Venture Partners.

Anthropic is best known for its Claude line of models, which are built around the concept of “Constitutional AI”. This approach involves defining a set of human-aligned principles that guide the model to refine its own responses through self-critique and optimize for harmlessness. As of September 2025, 6.8% of Claude usage was devoted to life, physical, and social science tasks. In October 2025, it announced advancements in Claude for life sciences applications by integrating connectors to tools like 10x Genomics and developing agent skills for workflows like single-cell RNA-sequencing. Like OpenAI, Anthropic’s models are trained on a mix of publicly available and proprietary data, but not on AI-generated experimental data.

Business Model

Lila Sciences is building out a unique business model. Whereas most life sciences companies focus on discovering therapeutic compounds and advancing them through clinical trials, Lila’s primary objective is to achieve superintelligence through its Autonomous Science platform. As such, investment will be directed towards continually increasing the scientific intelligence of the platform itself rather than scaling a specific technology or novel asset.

In this model, the user of the platform defines the objective function, such as the discovery of a sustainable catalyst or a novel therapeutic, and the AI autonomously executes the experimental cycle to deliver results. Instrumentation within each AI Science Factory is tailored to its domain, with distinct setups for life sciences, materials science, and chemistry.

Ultimately, commercialization will occur in three modes:

Partnering with large enterprises to run projects on the platform

Enabling external startups to leverage the platform for discovery

Spinning out companies to develop disruptive technologies uncovered by the AI

Access to the platform will initially remain limited to a small number of privileged entities, with a focus on prioritizing near-term commercial opportunities to generate returns that can support reinvestment into the AI platform. Here, discoveries made on the platform will be licensed out to partners for a fee.

Traction

Although Lila Sciences has not announced any strategic partnerships as of October 2025, it has quickly gained attention in the Boston biotech ecosystem. In June 2025, Lila was named an awardee of the Massachusetts Life Science Center Tax Incentive Program, which was a state program promising $29.9 million in tax incentives for 33 life science companies. As a recipient of $1.9 million from the initiative, Lila committed to adding over 100 life sciences roles to the state. Later in September, Endpoints News rated Lila Sciences as one of the eleven “most exciting biotech startups” of 2025.

Lila has also made strides to expand its operations. In Q3 2025, the company signed a lease for a 235.5K-square-foot lab space in Cambridge, MA, making it the largest lab lease in the Greater Boston Area of the quarter.

Valuation

As of December 2025, Lila Sciences has raised two rounds of capital, totaling $550 million. By the time the company was unveiled in March 2025, it had raised $200 million in seed funding from investors such as General Catalyst, March Capital, ARK Venture Fund, Altitude Life Science Ventures, Blue Horizon Advisors, State of Michigan Retirement System, Modi Ventures, and a subsidiary of the Abu Dhabi Investment Authority.

Later in September 2025, Lila raised its Series A of $235 million led by Braidwell and Collective Global at a $1.2 billion valuation. In October 2025, Lila announced an extension of its Series A by an additional $115 million, bringing on investors such as NVentures, IQT, Dauntless Ventures, Catalio Capital Management, among others. This raised its valuation to more than $1.3 billion.

Key Opportunities

Increasing Demand for AI by Pharma, Biotechs, and Academic Labs

The cost of R&D has been rising steadily for drug developers. As of 2024, the R&D cost per pipeline asset was $2.2 billion. Intelligent tech has the capacity to reduce these R&D costs by 35-45%.

Reflecting these pressures, large pharmaceutical companies are increasingly prioritizing AI. As of July 2025, 70% of pharma leaders viewed AI as an “immediate priority,” and 30% were interested in pursuing externally sourced AI solutions instead of in-house developments. Within the industry, AI is already being utilized to mine academic literature as well as develop and screen large libraries of drug candidates. In research and early-stage discovery, where Lila seeks to compete, generative AI could generate $15-28 billion in value.

At the same time, academic labs are building out custom LLMs and agents to act as thought partners in the research process. Dr. Le Cong’s group at Stanford developed CRISPR-GPT in 2025 to guide scientists through designing, performing, and troubleshooting gene editing experiments. This creates an advantage for Lila, as its Autonomous Science platform can scale with new users to provide comprehensive experimental support, eliminating the need for custom-built tools.

Cost-Efficient Scalability

The scalability of Lila’s R&D will be defined by the costs of key inputs associated with AI Science Factories, such as robotics and laboratory real estate.

Notably, the average price of an industrial robot has halved from 2011-2022 to about $22K and these costs are projected to continue to decline. Likewise, costs of programming and integration, which account for 50-70% of robot application costs, have the potential to be reduced by half as a result of AI.

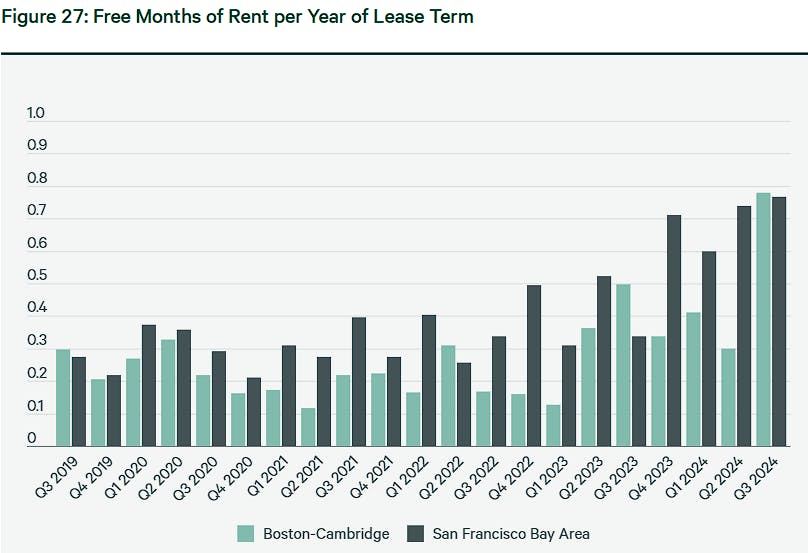

Source: CBRE Research

Life sciences real estate, especially in major hubs such as Boston and San Francisco, experienced an oversupply as of Q1 2025. While the amount of R&D space under construction peaked in Q2 2023, absorption lagged behind due to capital outflows in the biotech sector. As of Q3 2024, 72% of newly constructed lab space, totaling 15 million sq. ft of real estate, was unleased, and lab vacancy rates reached 22.7% in the top 13 life science markets by Q2 2025.

As a result, average rent-free periods offered by proprietors in Boston and San Francisco increased drastically, reducing the cost of expanding R&D operations for emerging life science companies. Lila was already able to capitalize on this trend, signing its lease in Q3 2025, when vacancy rates in Boston reached a record high of 27.7% and can continue to take advantage of favorable leasing conditions as it expands its research footprint.

Disrupting “Academic” Science

Academia’s tradition of publishing findings via the peer-reviewed process dates back to the 17th century. Likewise, high-impact journals such as Nature and Science, which reflect the gold standard of this process, are approximately 150 years old. Despite this longstanding tradition, peer-reviewed research faces challenges with reproducibility. In a study performed by Nature in 2016, 70% of respondents shared they could not reproduce the findings of a peer scientist, and >50% shared they could not reproduce their own findings.

This reproducibility crisis reflects not only the pressure to publish but also deep inefficiencies in how scientific knowledge is captured and shared. Critical information from the rationale behind a hypothesis to detailed experimental parameters and raw data often becomes distilled in the process of writing a paper.

Lila Sciences seeks to alter this long-established approach by enabling a closed-loop system of scientific discovery. Through its Autonomous Science platform, every step of the research process and every measurement, including those from failed experiments, is digitally recorded. This allows Lila’s AI-driven research to build cumulatively on prior work, reducing redundancy and ideally, accelerating discovery.

Key Risks

High Costs of Deploying A New Frontier Model

Lila Sciences faces stiff competition from incumbents, which have several years of a head start on it. OpenAI’s Chat GPT has been trained on a “web-scale corpus of data,” and the cost of training such frontier AI models has grown at an estimated rate of 2.4x per year. Training GPT 4.0 in 2023, for instance, was estimated to cost a combined $110 million — $40 million in hardware and energy costs in addition to $70 million in cloud compute costs.

Lila must also contend with the high up-front capital required to develop and power the models driving its AI Science Factories. Yet, the company has raised significantly less funding than many of its peers. This challenge is magnified by rising infrastructure costs: global data center capacity demand for AI workloads is expected to grow by 3.5x between 2025 and 2030, and as of October 2025, the average cost of a data center in the US increased from $426 million to $499 million within 12 months, with a 47% increase in cost per sq. ft.

Challenges with Laboratory Machinery

Use of robotics in a laboratory setting has precedents; however, not at the multi-domain level that Lila suggests. Companies such as Emerald Cloud Labs and Strateos have demonstrated that lab techniques such as screening and profiling assays and cell cultures can be automated with robotics. However, the integration of robotic systems across diverse assay types within a single experimental pipeline remains unproven, let alone across entirely different scientific disciplines. Moreover, as Lila’s models generate novel hypotheses, they may require the design of entirely new experimental assays, necessitating robotic instrumentation that does not yet exist. Lila has already developed instruments in instances where existing tools could not meet these experimental demands.

Beyond automation, connectivity between instruments remains a bottleneck. As of 2024, 37% and 58% of small and large biopharma companies, respectively, shared that at least 60% of their instruments were connected. This fragmentation limits real-time data exchange as well as coordination, and could reduce the efficiency of Lila’s experiments.

Even when instruments are connected and automation is functional, operating lab instrumentation also comes with maintenance costs that can range between 10% and 20% of the original cost of the equipment per year. Together, these technological obstacles could require Lila to invest in innovations that make experimentation more feasible.

Data Security Concerns and AI Guardrails

Lila’s Autonomous Science platform integrates diverse data sources, including public datasets, proprietary partner inputs, and internally generated experimental results. This creates potential IP protection challenges, as insights licensed to one partner could indirectly inform model outputs for others, leading to unintended data intermixing. As such, robust AI guardrails will be essential as Lila will need to protect partner IP while preventing security breaches. Even a single breach can be costly, as the average cost of a data breach in the US was an estimated $10.2 million as of 2025.

Additionally, for Lila, safeguards must extend beyond data security to ensure that AI systems only design and execute safe and ethical experiments. Though the company currently limits this risk with human supervision, as it begins to work with disease-causing agents like bacteria and viruses, it will be essential that the AI is trained to adhere to established biosafety standards, including those defined by Biosafety Levels (BSL).

AI Talent Shortage

In the race to develop the next frontier in AI, major players such as OpenAI, Anthropic, Mistral AI, and others are aggressively competing for scarce machine learning talent. Backed by deep funding, these companies can offer compensation packages worth millions of dollars to top engineers, driving intense competition across the industry. The talent pool is slim, and demand is significantly exceeding supply. According to a January 2025 report by the White House:

“In the AI software sector, the number of job postings for AI software-related positions grew at an average annual rate of 31.7 percent from 2015 to 2022. By contrast, the average annual growth rate of AI software-relevant degrees over the same period was only 8.2 percent for bachelor’s degrees, 8.5 percent for master’s degrees, and 2.9 percent for PhDs.”

This supply and demand imbalance has driven up the average salaries of such engineers. Although Lila has raised a significant amount of capital in a short period, sourcing talent to build out its model will be an obstacle, especially given the significant capital expenditures required for model training and its AI Science Factories.

Summary

Generative AI companies have differentiated themselves through distinct strategic angles, from prioritizing safety to advancing open-source innovation. Lila’s approach to AI is grounded in the sciences and extends beyond software alone. To train a superintelligent model, the company aims to integrate robotics with an AI rooted in the scientific method, enabling it to design and conduct experiments in AI Science Factories and learn from the resulting data.

Demonstrating proof of concept through discoveries across the physical, chemical, and life sciences and securing two funding rounds within seven months, Lila has built strong momentum at a time when demand for sustainable materials and cost-efficient R&D is surging. Meanwhile, competition has been quick to rise, as Periodic Labs announced a similar AI-robotics platform focused on materials science. The company certainly has its work cut out, faced with substantial software and hardware costs. But if Lila succeeds, it could redefine the pace of scientific discovery.