Thesis

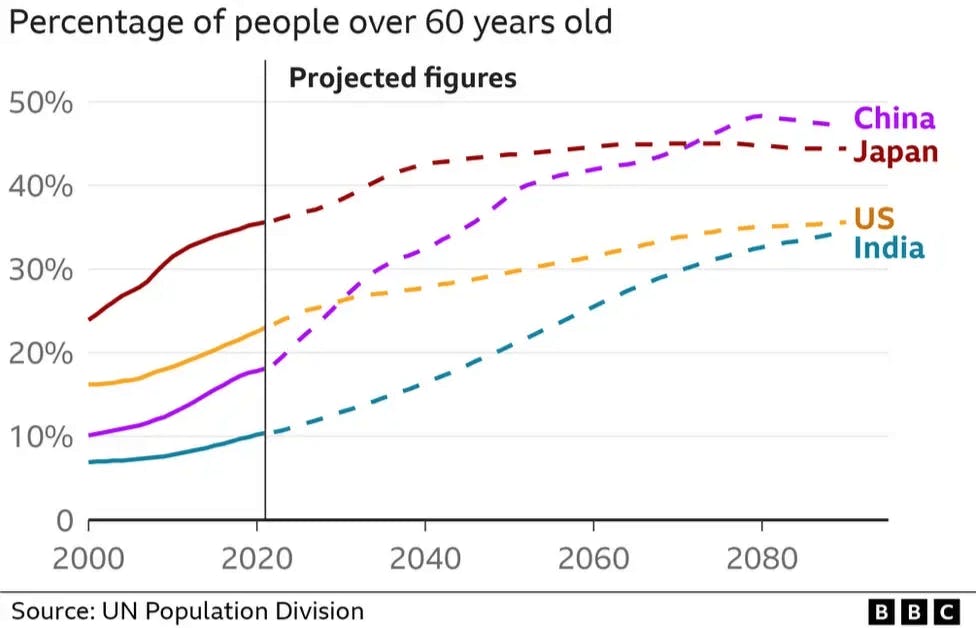

Barring the COVID-19 pandemic, life expectancy has steadily increased over the last two decades. Between 2000 and 2019, global life expectancy increased from 66.8 years to 73.1 years. At the same time, in over half the countries in the world, the fertility rate has dropped below the replacement rate of 2.1 children per woman. As a result, several countries have been experiencing shifting age structures.

The US serves as a testament to this trend as the share of the population aged 65 and older increased from 8% to 17.7% in the 70-year span between 1950 and 2023. At the same time, in the 50 years leading up to 2024, the birth rate fell from 15.3 to 10.6 births per 1K members of the US population. In countries such as Japan and China, this trajectory has reached the point of demographic crisis. The share of Japan’s population aged 65+ was 29.3% as of September 2024, and the country’s labor force was experiencing a shortage across several sectors as of April 2025. Similarly, in China, 300 million people between the ages of 50-60 are expected to leave the labor force in the 10 years following 2024, which accounts for the country’s largest age group.

Source: BBC

These demographic trends have significant economic ramifications. A paper published in 2014 estimates that a 10% increase in the fraction of the population ages 60+ decreases GDP per capita by 5.7%. This is driven in part by the fact that working-age populations are expected to shrink and increased burden of care will be placed on younger generations. With increased age comes increased healthcare expenditure. Per capita personal healthcare spending for the 65+ age demographic in the US was $22K in 2020, almost 2.5x the spend of the average working-age person.

However, high demand for care has already been placing a strain on sectors tied to healthcare services. Amongst rentals and retirement communities, such as independent and assisted living centers, 88% of properties in the US were occupied in May 2025. Many of these facilities were understaffed as well. A March 2024 sector survey of nursing homes found that 94% of facilities struggled to recruit staff and 72% remained below pre-pandemic staffing levels.

Collectively, these demographic and economic pressures highlight a need to extend healthspan (the number of years lived in good health) while reducing dependency on intensive, late-stage care. This is where advances in aging biology, or biogerontology, could play a meaningful role.

However, biogerontology as a discipline was scientifically constrained until the early 21st century. Prior to the completion of the Human Genome Project in 2003, researchers focused largely on simple model organisms such as C. elegans (roundworm) and Drosophila (fruit fly), identifying genes that appeared to regulate lifespan by being up- or downregulated with age. The biological basis of aging in humans remained largely speculative, and findings from simpler organisms could not be directly mapped onto human systems. This uncertainty fueled a debate between “complificationists,” who viewed aging as a highly complex, multigenic process, and “simplificationists,” who believed that a few key pathways governed the phenomenon in humans.

The completion of the Human Genome Project began to resolve some of this uncertainty, providing the first nearly comprehensive reference sequence for the human genome and enabling the identification of human orthologs of longevity-associated genes discovered in model organisms.

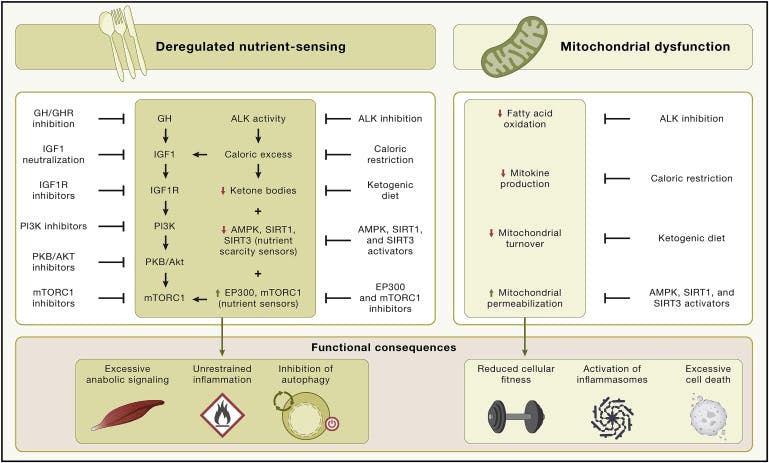

Source: Cell

Since then, a more mechanistic understanding of pathways that regulate lifespan and cellular fitness has emerged. In 2013, a seminal review, titled the Hallmarks of Aging was published. In it, the authors discuss nutrient-sensing proteins such as mTOR, AMPK, and sirtuins as being implicated in aging, among other mechanisms such as telomere (protective caps at the ends of chromosomes) attrition, stem cell exhaustion, and oxidative damage of DNA. A total of nine hallmarks were identified. A decade later, the second edition of the paper was published with three additional hallmarks, highlighting pathways such as deregulated autophagy (cellular recycling) and their associated genes (ATG5, ATG7, and BECN) while further solidifying the view that aging is driven by discrete, targetable biological processes.

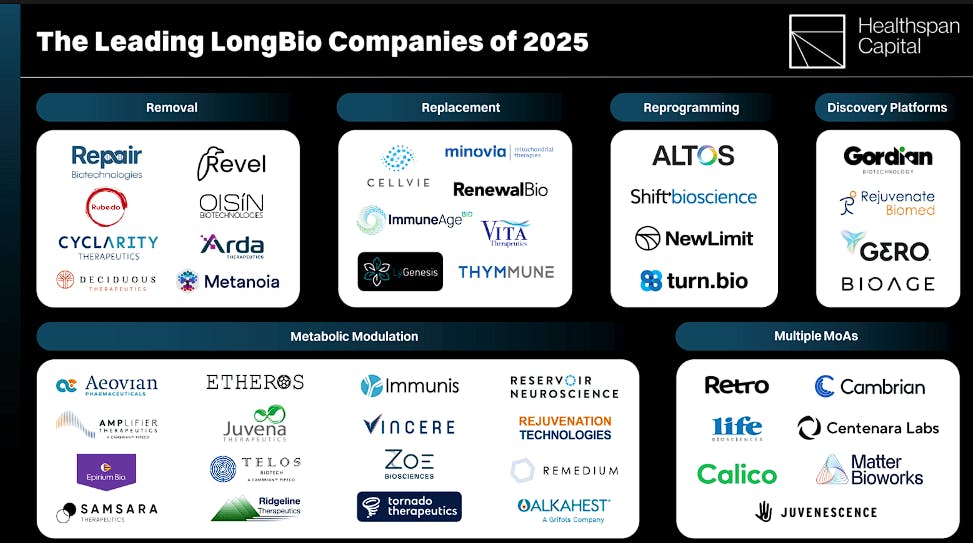

This shift opened the door for a new category of therapeutics and ultimately catalyzed the emergence of longevity biotech as a distinct subsector. Since its inception in the mid-2010s, the field, which aims to “combat age-related diseases and enhance human healthspan”, has grown to more than 550 companies globally by the end of 2024. Cambrian Biopharma is among the players building directly on this mechanistic foundation while adopting a differentiated approach to the traditional biotech business model.

Cambrian Biopharma operates as a distributed company (DisCo) with several subsidiaries that develop drugs targeting various healthspan improving pathways. CEO, Peyer describes the company as both an “early stage VC firm and a pharma company”. Broadly, Cambrian’s goal is to target the mechanistic drivers of aging through a multiple shots-on-goal approach.

Founding Story

Source: Cambrian Biopharma

Cambrian Biopharma was founded in 2019 by James Peyer (CEO), Christian Angermayer (Chairman), and Sebastian Brunemeier (former CIO).

While growing up, Peyer observed his grandfather battle with cancer, as treatment after treatment failed. This early exposure to the limitations of medicine stuck with him, motivating him to pursue a career in biotech.

Prior to Cambrian, Peyer began his entrepreneurial journey early, founding his first company, Genotyp, focused on biotech education, at 21. With a background in biotechnology, he went on to complete a PhD at UT Southwestern in stem cell biology before joining McKinsey & Company, where he worked in the firm’s biopharma practice.

During his time at McKinsey and through his PhD work, Peyer became interested in the emerging field of aging biology and developed a strategic vision for how to translate aging research into viable biotech ventures. He recognized that traditional clinical trials focused on aging prevention would be infeasible, and instead concluded that targeting specific molecular mechanisms and disease indications would offer a more practical path forward.

Peyer did not yet have a specific company concept, though he had a clear strategy. At McKinsey, he voiced these ideas to many colleagues, and after a year, through a network of “friends of friends,” he was connected with investors interested in aging biology who shared his vision for advancing longevity-focused therapeutics. This collaboration ultimately led to an invitation to establish a new investment fund based in Germany.

In 2016, Peyer co-founded Apollo Health Ventures, a fund dedicated to creating and investing in biotech companies developing therapies that target the mechanisms of aging. It was through Apollo that Peyer met Brunemeier.

Brunemeier had begun a joint Ph.D. program at Scripps and Oxford studying the biochemistry of aging before leaving academia to launch new companies full-time. As an early member of Apollo, Brunemeier co-founded Samsara Therapeutics in 2018 with Peyer to develop small-molecule compounds that enhance autophagy (cellular recycling).

The final founder, Angermayer, came into the picture when he and Peyer crossed paths in Germany. At the time, Angermayer had an established track record as a serial entrepreneur and investor with a long-standing focus in the life sciences. While still in college, he co-founded Ribopharma, a company pioneering RNA interference–based therapeutics, together with his professors. He then sold his stake in the company in 2003 when it merged with Alynlam Pharmaceuticals.

Building on his experience in early-stage biotech, Angermayer later founded atai life sciences in 2018, developing psychedelic therapeutics for various mental health disorders such as treatment-resistant depression. With a personal interest in slowing aging, Angermayer and his fund, Apeiron Investment Group, would go on to provide the financial foundation for Cambrian’s launch, anchoring the company’s $60 million raise as it emerged from stealth in 2021.

As Cambrian expanded, James invited Juliette Han to join Cambrian as COO and CFO in 2020. Han was a former mentor to James at McKinsey and before Cambrian, she was Chief of Staff at Two Sigma Investments, COO of people at Citadel and Chief of Staff for McKinsey New Ventures. She comes from a scientific background, receiving a Ph.D in neuroscience from Harvard University.

Cambrian Biopharma operates as a distributed company (DisCo) with several subsidiaries that develop drugs targeting various healthspan-improving pathways. CEO, Peyer describes the company as both an “early stage VC firm and a pharma company”. Broadly, Cambrian’s goal is to target the mechanistic drivers of aging through a multiple shots-on-goal approach.

Product

Cambrian has seven pipeline companies under its umbrella, and a total of four assets in clinical trials as of November 2025. The goal of these companies is to improve the healthspan of patients, described by Peyer as trying to “take people who are still mostly healthy and intervene to increase the amount of time they spend in good health.”

Amplifier Therapeutics

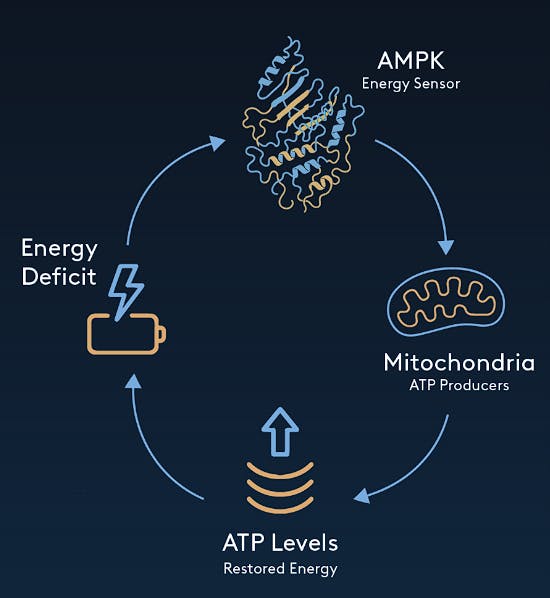

Source: Amplifier Therapeutics

Amplifier Therapeutics’ lead asset is ATX-304, which is a small molecule AMPK activator and enhancer of mitochondrial respiration in phase 1b/2a trials. AMPK (AMP-activated protein kinase) is an enzyme that, when activated, induces a signal cascade in cells, redirecting metabolism towards catabolism, which is the breakdown of complex molecules into simpler molecules for energy generation. AMPK also promotes autophagy or recycling of degraded cellular components. In humans, AMPK activity declines with age, and in a 2021 paper, it was demonstrated that AMPK activators could improve cardiac function and exercise capacity in aged mice.

As of November 2025, Amplifier’s drug is being investigated for cardiometabolic diseases in phase II and for obesity in phase I clinical trials. It is hypothesized that AMPK activation in tandem with GLP-1 drugs may offer complementary mechanisms of action by increasing muscle metabolism and decreasing appetite in such a way that enhances fat loss and reduces muscle loss.

Isterian

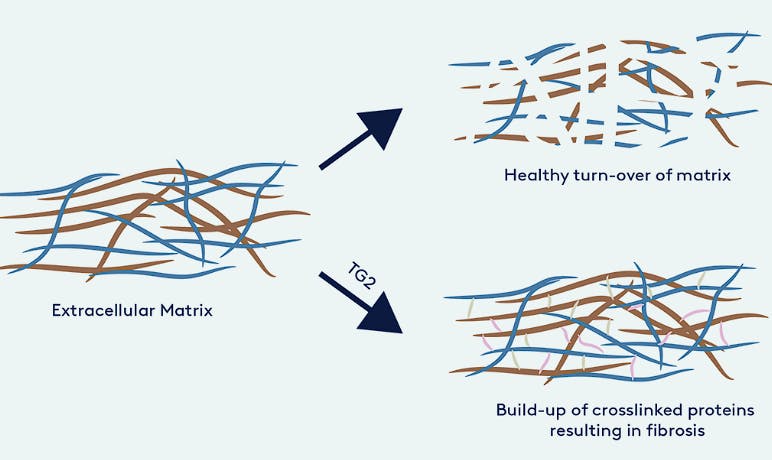

Isterian’s lead asset is IST-01, a selective TG2 inhibitor for idiopathic pulmonary fibrosis, a condition in which lung tissue becomes increasingly stiff, making it more challenging to breathe.

Transglutaminase 2 (TG2) is a multifunctional enzyme that catalyzes the formation of isopeptide bonds between glutamine and lysine amino acids in proteins of the extracellular matrix. This cross-linking enhances protein stability, reduces susceptibility to protein degradation, and contributes to the development of fibrosis. TG2 expression and activity are upregulated by transforming growth factor-β (TGF-β), which in turn can be further activated by TG2-mediated cross-linking, establishing a positive feedback loop that drives fibrotic progression. By inhibiting TG2, the goal is to disrupt the cross-linking of extracellular matrix proteins and reduce profibrotic signaling.

Isterian was founded through a partnership with Professor Martin Griffin’s laboratory at Aston University. Griffin’s research group has demonstrated selective inhibition of TG2 to reduce fibrosis in several animal models.

Source: Isterian

Tornado Therapeutics

Tornado Therapeutics is developing rapamycin analogs to improve the healthspan of patients. In February 2022, Cambrian announced a licensing agreement with Novartis to develop selective mTOR inhibitors. Its four compounds in development, TOR-101, TOR-103, TOR-104, and TOR-105, are being developed to treat patients across four therapeutic areas: Viral Respiratory Tract Infections, Oncology, Autoimmune Disease, and Dermatology.

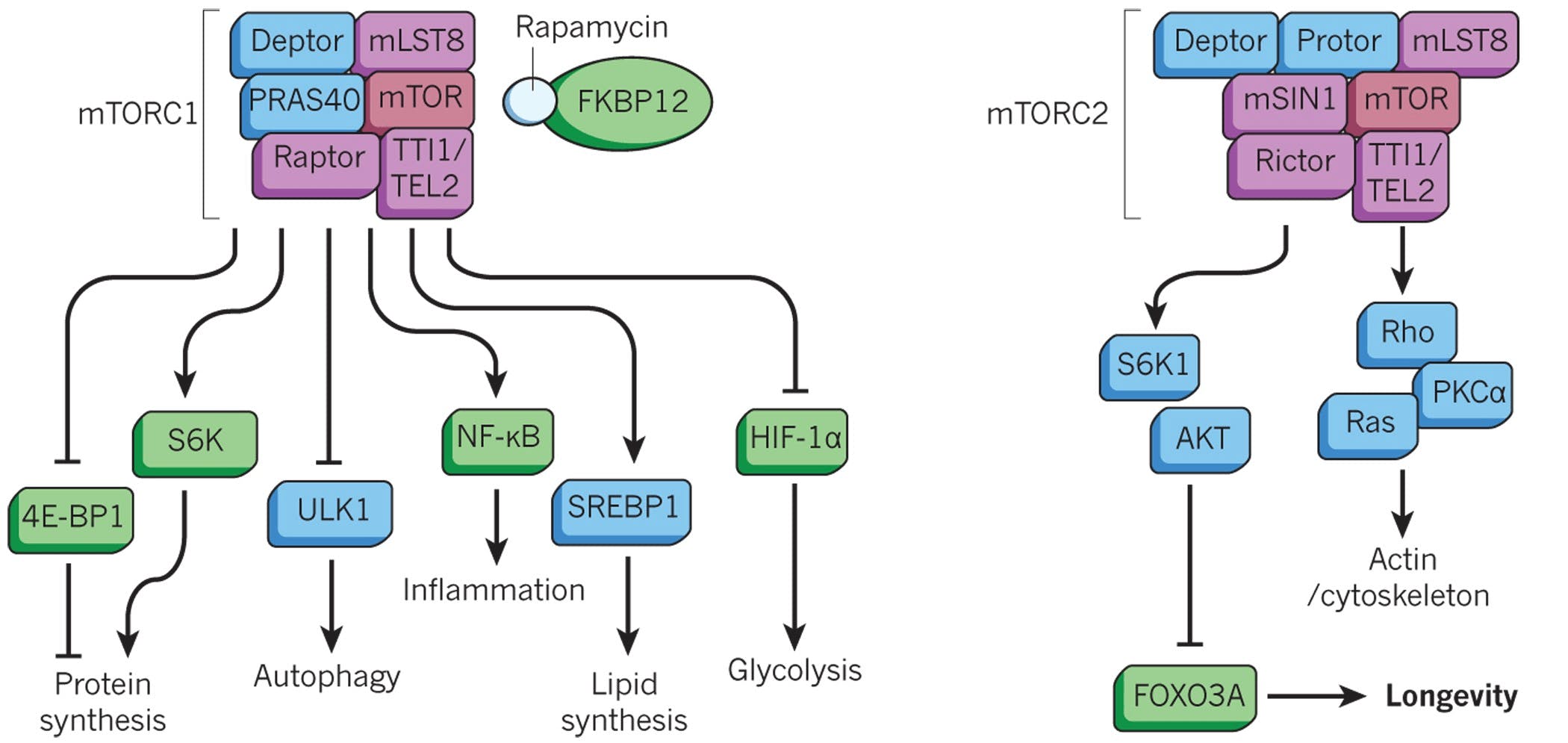

Source: Nature

Rapamycin is an antibiotic discovered on Easter Island in the 1960s and has been shown to extend lifespan in mice. It targets the mTOR (mechanistic target of rapamycin) pathway, which regulates key cellular processes such as cell growth, protein synthesis, and metabolism. mTOR functions as part of two protein complexes, mTORC1 and mTORC2. Inhibition of mTORc1 by rapamycin induces a cellular state resembling that seen during caloric restriction, in which cells shift toward maintenance and repair pathways, including enhanced autophagy. However, extended exposure to the antibiotic can indirectly inhibit of mTORc2, resulting in insulin resistance and other side effects such as impaired tissue repair. As such, Tornado Therapeutics seeks to develop rapalogs that selectively target mTORC1 to improve both efficacy and safety.

Vita Therapeutics

Vita Therapeutics is a cell engineering company leveraging induced pluripotent stem cell (iPSC) technology to develop cell therapies. The company has six assets in its pipeline targeting rare neuromuscular conditions and oncology indications via allogeneic (delivering engineered cells from another individual) cell therapy. Previously, Vita Therapeutics had been developing an autologous cell therapy for limb-girdle muscular dystrophy that was ready for an Investigational New Drug filing. However, due to investors failing to meet their funding commitments, the program was paused in April 2024.

Source: Vita Therapeutics

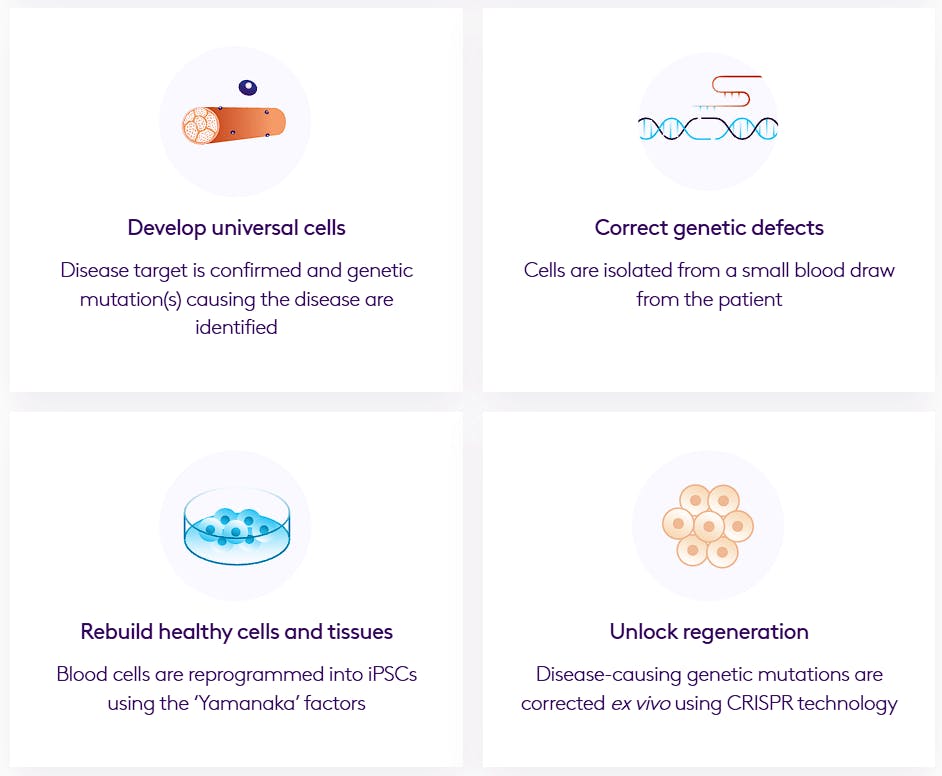

As of November 2025, Vita Therapeutics’ latest-stage programs were in development to treat Facioscapulohumeral Muscular Dystrophy (FSHD) and Duchenne’s Muscular Dystrophy (DMD), both of which lead to progressive muscle weakness and degeneration. The company’s strategy involves correcting genetic mutations in patient-derived cells using viral vector–delivered CRISPR-based gene-editing tools and then reprogramming the edited cells into iPSCs (induced pluripotent stem cells) capable of differentiating into any cell type. These engineered cells are subsequently reinfused into the patient to help restore healthy muscle function.

Telos Biotech

Telos Biotech is a cell-therapy engineering company. The company’s product, Telovance, is a protein complex that is delivered during the ex vivo expansion stage of cell manufacturing. The complex lengthens the shortest telomeres in engineered cells to expand their persistence upon delivery. This is particularly crucial in CAR T-cell therapy, where T cells are isolated from patients, engineered to target cancer cells, and reinfused. Yet approximately 50% of patients fail to achieve long-term remission. A contributing factor is the extensive replication required to produce sufficient CAR T cells for treatment, which leads to progressive telomere shortening and thereby T cells with lower transduction and cytotoxic efficiencies.

Oviva Therapeutics

Oviva Therapeutics, now part of Granata Bio, is developing treatments to improve ovarian function. Its lead candidate, OVI-586, is a recombinant anti-Müllerian hormone (AMH) therapy being explored for applications in IVF and menopause. The company was acquired by Granata Bio in April 2025, which seeks to advance OVI-586 beyond its preclinical stage.

Market

Customer

As of November 2025, all of Cambrian’s therapeutic programs were undergoing preclinical or clinical studies, and therefore, the company had no direct end users. As with most biotech companies, the ultimate beneficiaries of its drugs will be patients, but its primary customers will include physicians, hospitals, health systems, and insurers responsible for coverage decisions.

Customers may also include larger pharmaceutical or biotech companies that could serve as strategic partners or acquirers of Cambrian’s pipeline programs. This model has precedent as a pipeline company, Oviva Therapeutics, was acquired by Granata Bio, a biopharma company focused on women's health and infertility in April 2025.

Cambrian has one commercially available product as of November 2025, Telovance. Customers of Telovance are ex vivo manufacturers of CAR-T cell therapy, as Telovance is an ancillary reagent that can be slotted into cell engineering workflows.

Market Size

Cambrian operates within the broader longevity biotech ecosystem, a subsector that has attracted substantial investment and commercial activity. Between 2021 and 2024, funding of the longevity biotechs was approximately $9.7 billion, representing 2.9% of total biotech investment during the period. Additionally, 550+ companies were identified in the space, receiving a total of $33 billion in private investment as of 2024.

At the same time, the market opportunities for Cambrian’s portfolio companies (PortCos) can also be analyzed independently based on the individual therapeutic areas they play in.

Cambrian’s lead PortCo, Amplifier Therapeutics, operates within the obesity space. Between 2021 and 2023, obesity prevalence was approximately 135 million people in the US, or nearly 40% of the population. Despite this disease burden, only about 8 million Americans were eligible for anti-obesity medications as of May 2025. Globally, this unmet need has contributed to a dramatic expansion of the anti-obesity market as spending grew to roughly $30 billion in 2024, a tenfold increase since 2020. This figure is projected to reach $130 billion by the mid-2030s, growing at a CAGR of 13–15%.

Isterian represents Cambrian’s entry into idiopathic pulmonary fibrosis (IPF), which affects approximately three million people worldwide. As of May 2023, approximately 80K people in the US were affected by the condition, with 25K new diagnoses made each year. Notably, as of November 2025, there were three FDA-approved anti-fibrotic agents: Nintedanib (brand name Ofev), Perfenidone (brand name Esbriet), and Nerandomilast. In 2024, Ofev, developed by Boehringer Ingelheim, had global sales of $4.2 billion, and Esbriet had peak sales of $1.1 billion in 2021. Nerandomilast was a new treatment for IPF developed by Boehringer Ingelheim and received FDA approval in October 2025.

Vita Therapeutics expands Cambrian’s reach into rare genetic muscle diseases. Its programs target two indications: Duchenne’s Muscular Dystrophy (DMD) and Facioscapulohumeral muscular dystrophy (FSHD). DMD affects approximately 300K people worldwide and FSHD affects approximately four in 100K people.

Competition

Source: Healthspan Capital

Retro Bio: Founded in 2021, Retro Bio is a cellular reprogramming company developing treatments for several age-related diseases, ranging from Alzheimer’s disease to blood disorders. As of November 2025, the company has raised a total of $180 million, all originating from its March 2023 Seed round, funded entirely by Sam Altman.

Retro Bio’s latest stage drug, RTR242, is a small molecule designed to boost autophagic flux for Alzheimer’s disease. The rationale behind the approach is that promoting cellular recycling should reduce aggregation of misfolded proteins in cells in the brain, which is a key hallmark of Alzheimer’s. By the end of 2025, the company expects to dose its first patient with RTR242.

At the same time, Retro Bio is also exploring partial and full cellular programming therapeutics using hematopoietic stem cells and microglia. Together, through a partnership with OpenAI, the company shared in August 2025 that it developed a miniature version of GPT-4o to re-engineer reprogramming factors and increase their efficiency. The collaboration yielded a “50-fold higher expression of stem cell reprogramming markers than wild-type controls” in vitro.

Altos Labs: Altos Labs was founded in 2022, focusing on cellular rejuvenation programming which is an approach grounded in the work of Nobel laureate Shinya Yamanaka and Juan Carlos Izpisua Belmonte, a pioneer in regenerative medicine. The technique leverages the idea that activation of pluripotency factors (specific genes that promote an undifferentiated cell state) can reset cellular epigenetic markers associated with aging. Given their central role in developing this science, Belmonte is the founding scientist at Altos and Yamanaka serves as a scientific advisor.

Altos Labs launched with an unprecedented Series A fundraise of $3 billion in January 2022 and has yet to raise additional capital as of November 2025. Notable investors include Jeff Bezos and Yuri Milner. The company is structured as a research-first organization with several integrated institutes designed to bridge basic science, computational modeling, and therapeutic development. As stated by the company:

“The Altos Institutes of Science will pursue deep scientific questions and integrate their findings into one collaborative research effort. The Altos Institute of Medicine will capture knowledge generated about cell health and programming to develop transformative medicines.” Finally, the Institute of Computation will “build computational models that decode the language of biological resilience at the cell, organ, and organism levels to achieve the Altos mission.”

In May 2025, the company announced its acquisition of Dorian Therapeutics, which had been developing treatments for Alzheimer’s, osteoporosis, osteoarthritis, diabetes, and autoimmune diseases. Although Altos has yet to announce any drugs being tested in clinical trials as of August 2025, its acquisitions and growing research programs suggest it is laying the groundwork for future therapeutic development.

Calico Life Sciences: Calico Life Sciences was founded in 2013 as a subsidiary of Alphabet. As of January 2025, the company had raised at least $3.5 billion in funding, and by November, Calico’s pipeline was made up of more than 20 early and late-stage preclinical compounds in cancer, neurological diseases, and tissue homeostasis and repair.

Calico had an 11-year agreement with AbbVie that was terminated in November 2025. Abbvie had invested $1.75 billion in its partner between 2013 and 2022 and prematurely cut ties with the startup which it had an agreement with until 2027. The announcement came shortly after Calico reported that its investigational ALS therapy, fosigotifator, did not meet the primary endpoint of slowing disease progression in a Phase II/III clinical trial released in January 2025.

Calico’s most advanced program is ABBV-CLS-628, an antibody therapy for Autosomal Dominant Polycystic Kidney Disease. The company received Orphan Drug Designation for the asset in November 2025 and Fast Track status in October 2025. As of December 2025, the treatment is being evaluated in a phase II trial for safety and efficacy.

In oncology, Calico continues to advance two earlier-stage candidates. Lead compounds, ABBV-CLS-579 and ABBV-CLS-484, are PTPN2/1 inhibitors being investigated in phase I trials for patients with locally advanced or metastatic tumors. The therapeutic rationale behind this approach is that inhibiting PTPN2/1 can promote T-cell expansion and enhance responses to immunotherapy, as these proteins natively act to dampen inflammatory signaling.

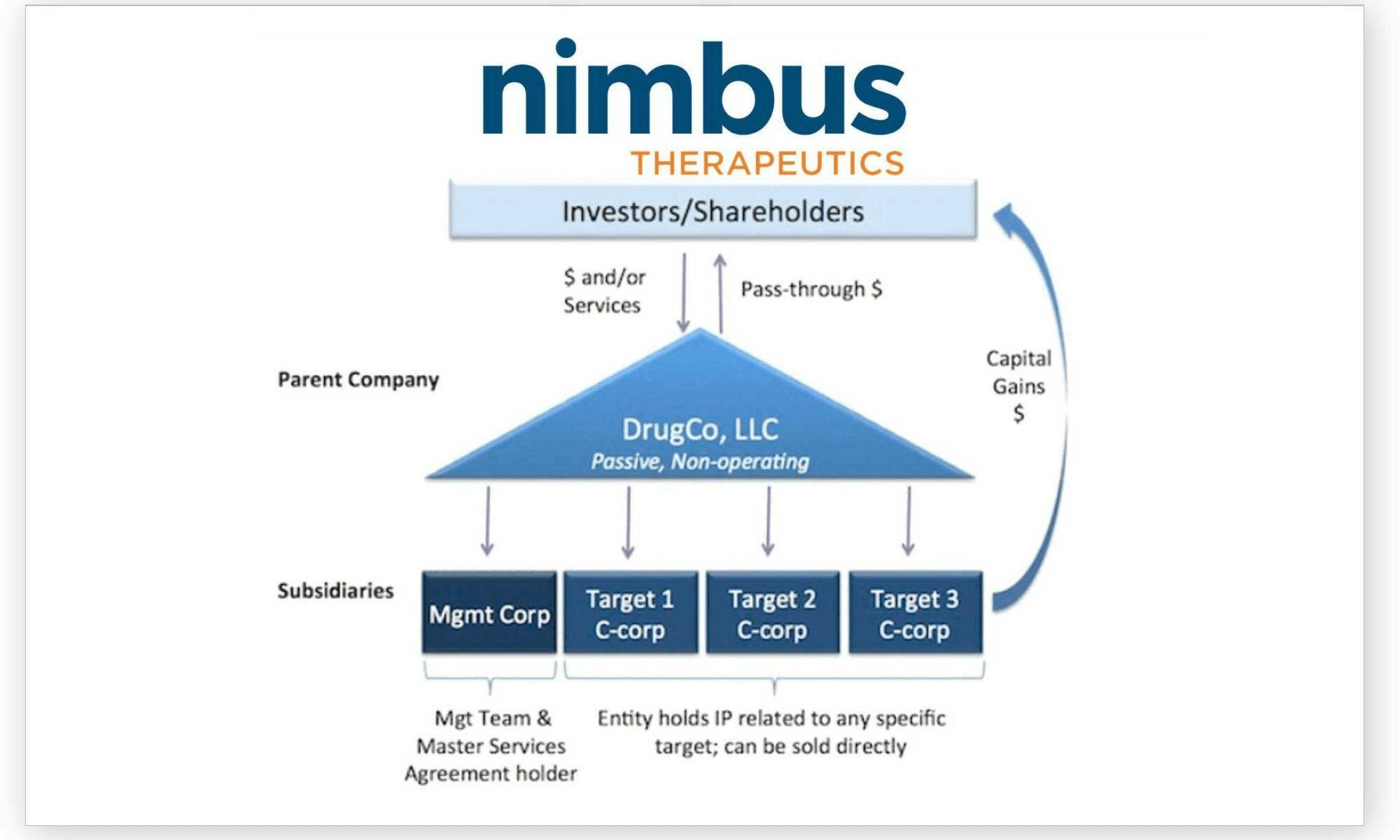

Nimbus Therapeutics

Nimbus Therapeutics was founded in 2009 through a collaboration between Atlas Venture and Schrödinger, built around a pioneering “hub-and-spoke” business model and early adoption of computational chemistry software. The company has raised a total of $673 million as of November 2025, and most recently raised private financing of $210 million in September 2023. Notable investors in the biotech include Bain Capital Life Sciences, RA Capital Management, and Bill Gates.

Source: Nimbus Therapeutics

Nimbus made significant news in the industry after its sale of a TYK2 inhibitor for anti-inflammatory diseases to Takeda for $4 billion, in one of the most lucrative deals of an unapproved drug. In its pipeline, Nimbus Therapeutics has an AMPK activator that competes directly with Cambrian Bio’s asset targeting the same protein. The compound is still being developed preclinically in collaboration with Lilly as of November 2025.

Business Model

Cambrian operates under a distributed company (DisCo) model where it incubates and finances several portfolio companies (PortCo’s) that each adopt different approaches to improving human healthspan. Each PortCo functions as a semi-independent biotech subsidiary, developing its own pipeline of compounds or therapies, and securing funding through independent investment rounds.

Traction

Since its launch in 2019, Cambrian Biopharma has received several accolades from the industry. In November 2022, Peyer was named “Biotech Company CEO of the year” by BioTech Breakthrough. Momentum continued into 2023, as when PipeCo Telos was unveiled, it announced that it had in-licensed its Telovance technology from the University of Texas Southwestern Medical Center. By December of the same year, the company was named one of Fast Company’s “Next Big Things in Tech”. Most recently, in July 2025, Amplifier Therapeutics presented preclinical data on its ATX-304 compound in combination with Eli Lilly’s GLP-1, semaglutide, at the Endocrine Society conference.

Valuation

As of November 2025, Cambrian has raised three rounds of capital, totaling $160 million. Most recently, the company raised its Series C of $100 million in October 2021. The financing was co-led by Anthos Capital and SALT Fund, with existing investors such as Apeiron Investment Group (co-founder, Angermeyer’s fund), Future Ventures, and Moore Capital also investing in the round.

Several of Cambrian’s portfolio companies have raised capital as well. As of November 2025, Amplifier Therapeutics has raised a total of $33.3 million, all of which came from its Series A round led by Future Ventures and RA Capital Management in October 2023. Similarly, Oviva Therapeutics announced its Seed round fundraising of $11.5 million provided by Cambrian in May 2022. Finally, Vita Therapeutics has raised a total of $66 million with the closing of it Series B of $31 million led by Cambrian and Solve FSHD in October 2022.

Alongside its internal incubations, Cambrian has invested in external companies. In October 2020, the company announced that with H&S Ventures, it would co-lead Sensei Biotherapeutics’ (NASDAQ: SNSE) Series A round of $28.5 million. Later, in February of the following year, Sensei Biotherapeutics underwent an IPO, raising over $130 million to bring its market capitalization to $600 million while Cambrian was the largest shareholder. As of November 2025, Sensei Biotherapeutics’ market capitalization has fallen to $12.6 million.

Key Opportunities

Diversified Portfolio

Cambrian’s distributed company model inherently reduces program-specific risk. With 20+ therapeutics assets under management, it operates multiple PipeCos in parallel across distinct hallmarks of aging. A failure in one mechanism, which might traditionally capsize a single-asset biotech, does not significantly jeopardize overall pipeline momentum.

Cambrian’s platform is also diversified across therapeutic modalities, including small molecules, cell therapies, and hormone-based interventions. This helps to hedge against risks that platform biotechs face when their core modality underdelivers. Moderna, for instance, known for its mRNA COVID-19 vaccine success in 2021, has struggled to translate its mRNA approach to other disease areas such as CMV (cytomegalovirus) and RSV (respiratory syncytial virus).

This approach aligns with the hub-and-spoke business model pioneered by companies such as Nimbus Therapeutics, Roivant, and Bridge Bio. The potential benefits of said model were published in a 2012 paper, where economists at MIT proposed that biotech productivity could improve when companies apply principles of portfolio theory. They suggested that isolating scientific bets into independent entities reduces correlated risk and creates the opportunity to raise program-level debt.

This is a feature that has enabled Bridge Bio to achieve three FDA approvals within 10 years of its founding in 2015. Along these lines, Peyer pitched Cambrian as the “Bridge Bio for longevity” to investors, framing the company’s structure as a way to generate superior risk-adjusted returns.

Investment Climbing Again

Private investment in longevity has accelerated rapidly. Between 2023 and 2024, Longevity investment more than doubled to $8.5 billion in 2024, from $3.8 billion in 2023. Financings of healthspan biotechs specifically, also expanded materially from $1 billion between 2013-2017 to $3.9 billion between 2018-2022.

Notably, the investor base remains weighted towards risk-tolerant capital, with VCs and high-net-worth individuals accounting for 60% of funding. In more established therapeutic areas like oncology, pharma, and traditional life science investors account for 90% of investment.

On the public side, funding has grown, supporting foundational basic science research. Between 2014 and 2024, public aging research funding by the NIH grew from $2.6 billion to $6.5 billion. Internationally, this longevity trend has also caught the eye of the Saudi kingdom, which planned to spend $1 billion per year into perpetuity on anti-aging biotech companies in 2022.

Importantly, this influx of capital is translating into clinical activity. Between 2013-2017 and 2018-2022, the total number of clinical trials in healthspan science grew by 27%. Against this backdrop, Cambrian stands to benefit from this market, which is becoming increasingly scientifically validated and well-capitalized.

Public’s Aspirations for Longevity and Willingness to Adopt Medications

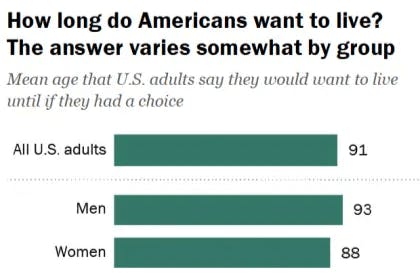

The life expectancy at birth in the US was 78.4 years as of 2023, yet public aspirations extend beyond current averages. A survey in November 2025 showed that 76% of adults in the US wanted to live to at least 80, and 29% would like to live to 100.

Source: Pew Research Center

Interest in longer lifespans has translated to a commercial shift in behaviors. A survey from November 2025 highlighted that 1 in 5 adults is already taking antiaging supplements for aging, reflecting widespread consumer interest even in the absence of FDA-approved aging therapeutics. For Cambrian, this reflects

Key Risks

Limited Regulatory Framework Around Aging

As of January 2025, the FDA has yet to classify aging as a disease. Consequently, clinical trials targeting aging must be designed around age-related diseases rather than aging itself. This has made regulatory pathways more complex and prevented “aging” from appearing as an approved indication on drug labels.

Aging-related clinical trials also require studying patients over longer time scales, which adds significantly to R&D costs. Every 1% increase in patient-months was associated with a 0.9% increase in R&D costs. According to a study analyzing 268 publicly traded biopharma companies in January 2025, the incremental cost per patient-month was an estimated $6,500.

Progress is further limited by the fact that the FDA has not recognized any biomarker as a surrogate endpoint for aging as of July 2025. Without validated biomarkers, drug developers cannot use accelerated approval pathways and must rely on clinical endpoints that take years to observe.

Despite these challenges, there have been active efforts to launch the TAME (Targeting Aging with Metformin) trial, designed to test whether metformin can delay the onset of age-related conditions. Metformin itself is already FDA-approved for managing high blood sugar and has been demonstrated to slow aging in monkeys. Nevertheless, the trial was still raising funds as of November 2025 and is expected to span six years. As such, aging will likely remain unrecognized as a valid disease indication by the FDA for several years.

Stretching Capital Too Thin

Cambrian has raised $160 million to support its portfolio companies however, advancing multiple programs through clinical development will require significantly more capital. In 2024, the estimated cost of developing a drug from discovery to launch was $2.2 billion. Even using more conservative estimates that place total development costs at around $870 million, the median cost of taking a drug through the clinical stages alone was $200 million, according to a 2024 study. While some PipeCos have secured additional funding, the cumulative cost of R&D and clinical trials represents a substantial financial burden. As a result, partnerships or co-development arrangements with larger pharma may be necessary, yet the company has not demonstrated partnership activity as of November 2025 and is less interested in selling its assets.

These capital requirements are further compounded by increasing R&D costs, which have steadily increased year over year. As a percentage of sales, R&D costs were approximately 25.2% in 2024, up from 17.5% in 2015. For the pre-clinical and early-stage biotechs that Cambrian manages, this means that it must deploy capital with exceptional prudence, prioritizing studies that provide early signals into success or failure.

Lack of Alignment with Large Pharma and Strategics

Engaging with longevity biotechs was not a strategic priority for most pharmaceutical companies as of September 2025. When surveyed, pharma executives placed oncology and rare diseases ahead of aging-related areas such as metabolic conditions.

This disconnect is reinforced by historical precedent, as the longevity space faced a setback in 2008 when GSK acquired Sirtris Pharmaceuticals for $720 million. Sirtris had gained significant attention for its development of sirtuin activators as anti-aging drugs. However, soon after the acquisition, Amgen researchers showed in a study that the resveratrol analogs Sirtris was developing were not true SIRT1 activators, but appeared active only because of an experimental artifact.

Since then, other large pharma companies have grown less interested in the longevity space. After an 11-year collaboration, in November 2025, AbbVie prematurely terminated its contract with Calico Sciences. Having invested $1.8 billion into the shared R&D operation, the deal was discontinued after lead compound fosigotifator, a drug treating ALS (amyotrophic lateral sclerosis), failed to slow disease progression in its phase II/III trial in January 2025.

Summary

Cambrian Bio is a biotech company with multiple programs aimed at increasing patients’ healthspan. The company follows a “hub-and-spoke” structure, in which Cambrian functions as the central parent company that finances a network of subsidiary or partner companies developing independent therapeutics. As of December 2025, the company’s lead compound was a small molecule AMPK activator and enhancer of mitochondrial respiration, with the potential to offset side effects of GLP-1 weight loss drugs while promoting cardiac function. Though Cambrian has yet to bring any drugs to the market, its unique company structure helps to decorrelate risk. Should it succeed, Cambrian could establish a scalable blueprint for developing aging-related therapeutics at a time when the field is becoming increasingly scientifically validated, but is still hindered by regulatory uncertainty.