Thesis

SMEs (small and medium-sized enterprises) form the foundation of the European economy, accounting for 99% of all European businesses and employing over 88 million people as of 2024. Traditional financial institutions have consistently failed to meet their evolving needs. Similarly, a 2024 survey of 2.8K European business leaders revealed that 63% view traditional banks as too slow to meet their financial needs, with 79% experiencing high fees, delayed transactions, and poor mobile functionality.

At the same time, business operations are becoming increasingly digital. In 2024, 73% of EU small businesses reached at least basic digital intensity, defined as using at least four of 12 modern technologies, such as cloud computing or customer relationship management tools. This number is up from just 58% in 2023, with the EU’s Digital Decade agenda aiming to raise this figure to 90% by 2030. Adoption of tools like e-Invoicing is also accelerating. Only 22.6% of SMEs issued eInvoices in 2018, but that number rose to 37% by 2023, with further growth expected as national mandates continue to push adoption.

Qonto is aiming to become the leading financial operating system for Europe’s small businesses, freelancers, and entrepreneurs. The company offers a digital-first finance platform tailored to the needs of SMEs, featuring business accounts, invoicing, expense management, and additional tool integrations. As of September 2025, Qonto serves over 600K customers across eight countries in Europe, with a 4.8/5 Trustpilot rating based on 35K reviews.

Founding Story

Frustrated by their own experiences with business banking, Alexandre Prot (CEO) and Steve Anavi (President) founded Qonto in April 2016 to build a modern alternative for European SMEs and freelancers.

After beginning his career as a consultant at McKinsey, Prot joined European startup incubator Rocket Internet, where he spent around 18 months working on Wimbdu, a short-term rental platform. He described the experience as pivotal to his career trajectory and left the incubator to fully commit to entrepreneurship.

Anavi, an engineer by training, started his career at Deloitte before joining Groupon in 2012. He worked in the goods and e-commerce division through 2013 and has said he was drawn to the company’s high-energy culture, strong leadership, and sense of ownership.

Prot and Anavi, who were classmates in high school, reconnected at a birthday party after a decade apart and began meeting regularly to exchange ideas about entrepreneurship. Within weeks, they decided to team up. In August 2013, the pair co-founded Smokio, a smart e-cigarette company that allowed users to track their smoking habits via a connected app. Smokio was acquired in 2015 by a Fortune 500 company. While running Smokio, Prot and Anavi experienced firsthand the frustration of managing company finances through traditional bank providers. They encountered problems like slow onboarding processes, poor customer support, and hidden fees.

The pair recalled receiving dozens of pages of quarterly statements with thousands of euros in transfer fees, often discovered only after the fact. Prot and Anavi also noticed that many founders, themselves included, spent business hours on their core growth drivers and would deal with administrative tasks on nights and weekends. Anavi, who was active in a Facebook group for French startups in 2016, frequently saw posts from entrepreneurs voicing their dissatisfaction with existing banking solutions. In 2016, the Net Promoter Score, a proxy for customer satisfaction, was negative for SME financial services in Europe. These frustrations inspired them to build Qonto: a modern, digital-first banking solution designed for SMEs and freelancers.

From day one, Prot and Anavi envisioned Qonto as a pan-European platform. Though the product first launched in France, all internal documentation, support materials, and platform interfaces were offered in both French and English to lay the groundwork for cross-border expansion. As of September 2025, the company employs over 1.6K people across eight European countries, with approximately 40% of its team focused on product and engineering.

Product

In a 2023 interview, Anavi characterized Qonto as the “Google Workspace for Finance,” reflecting its goal to unify banking, payments, expense management, and financial workflows into a single modern platform. Prot shared that their original vision of Qonto remains largely intact as of 2023. Built from the frustrations they faced while building Smokio, Qonto’s product suite addresses several of the problems traditional banks have, such as slow onboarding processes, inadequate customer support, and hidden fees.

Qonto vs. Traditional Banks

As of September 2025, Qonto operates as a payment institution, supervised and regulated by France’s ACPR. This classification prohibits Qonto from directly issuing credit, but allows Qonto to perform most other core banking functions, such as managing deposits, enabling transfers and direct debits, and issuing payment cards. Qonto filed for a banking license in July 2025.

Payment institutions, such as Qonto, continue to offer customer protections for their deposits through a two-level security framework. At the first level, if a payment institution goes bankrupt, customers could still access their funds directly from the holding account. At the second level, if the credit institution managing the holding account were to fail, customer deposits are insured up to €100K in France by the Fonds de Garantie des Dépôts et de Résolution (FGDR).

Lending and Financing Tools

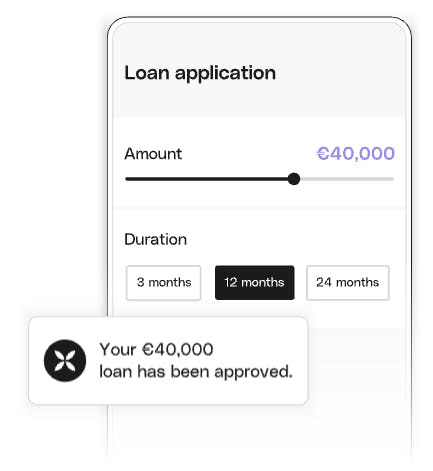

In 2023, 21% of SMEs in Europe reported “problems with financing” as their primary business challenge. In response, Qonto released its Financing Hub in 2023 across France, Germany, Italy, and Spain through strategic partnerships with four financing partners. The platform enables businesses to apply for and receive loans through partner lenders Defacto, Karmen, RiverBank, and Silvr. These funds are designed to finance mid-to-long-term projects, offering loans of up to €1 million. This allows customers to automate their applications and receive funds directly through their Qonto accounts. Moreover, Qonto facilitates near-instant loan approval, compared to the 40 days it typically takes through a traditional bank. In 2023 alone, almost 8K loans were financed for a total amount of nearly €60 million.

In March 2024, Qonto released Pay Later to its financing suite. At launch, the solution provided eligible customers with instant access to €10K directly in their Qonto account to pay invoices, with interest at 1.17% per month and a repayment spread across three installments over 90 days. Since their 2024 launch, Qonto has worked towards more flexible terms. As of September 2025, eligible customers have instant access to up to €50K in their account with repayment options available over 3, 9, or 12 monthly installments, and interest rates starting from 0.62% per month. In 2024, Pay Later financed over €10 million across more than 4K invoices.

Source: Qonto

Invoicing and Payment Collection

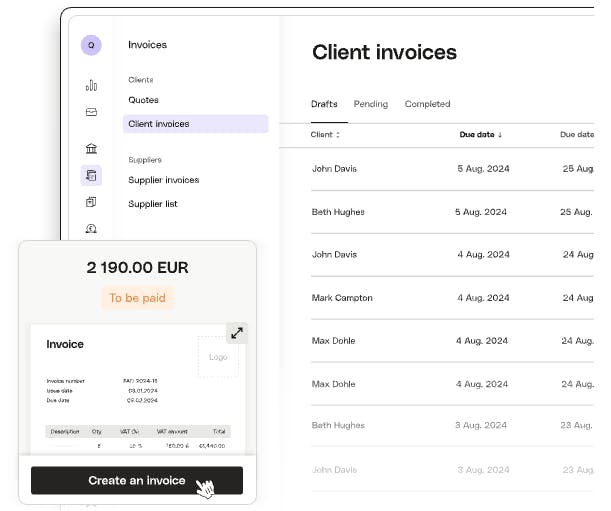

Qonto offers a built-in invoicing suite that allows users to create and send quotes or invoices in seconds. Customers can embed payment links directly in the invoice, supporting multiple payment methods, including SEPA transfers, credit cards, PayPal, and Apple Pay. These links are PSD2-compliant, use bank-grade encryption, and can be sent through email, WhatsApp, or alternative social media channels. Partner research indicates that invoices with payment links are paid up to 5x faster.

Real-time notifications track when an invoice is opened, paid, or overdue, and users can automate follow-ups. Payment data is automatically reconciled with accounting records, reducing manual work for finance teams.

Source: Qonto

Expense Management and Multi-Accounts

Qonto offers an expense management system that enables users to create sub-accounts with dedicated International Bank Account Numbers (IBANs, allowing them to allocate budgets by department, project, or region. Each account can be issued its own virtual or physical card, with customizable limits and permissions, and offers easy transfer of funds between sub-accounts.

Accounting and Integrations

Qonto’s accounting suite is designed to reduce administrative burden through automation. It supports automatic value-added tax (VAT) detection, receipt scanning with legal certification, and auto-tagging of expenses to chart-of-accounts categories. Supplier invoices can be imported from over 11K connected sources and matched automatically to bank transactions.

As of September 2025, Qonto integrates with 80 third-party accounting tools, enabling companies to centralize their financial operations. Real-time dashboards offer visibility into cash flow, upcoming invoices, and spending forecasts.

Qonto Cards

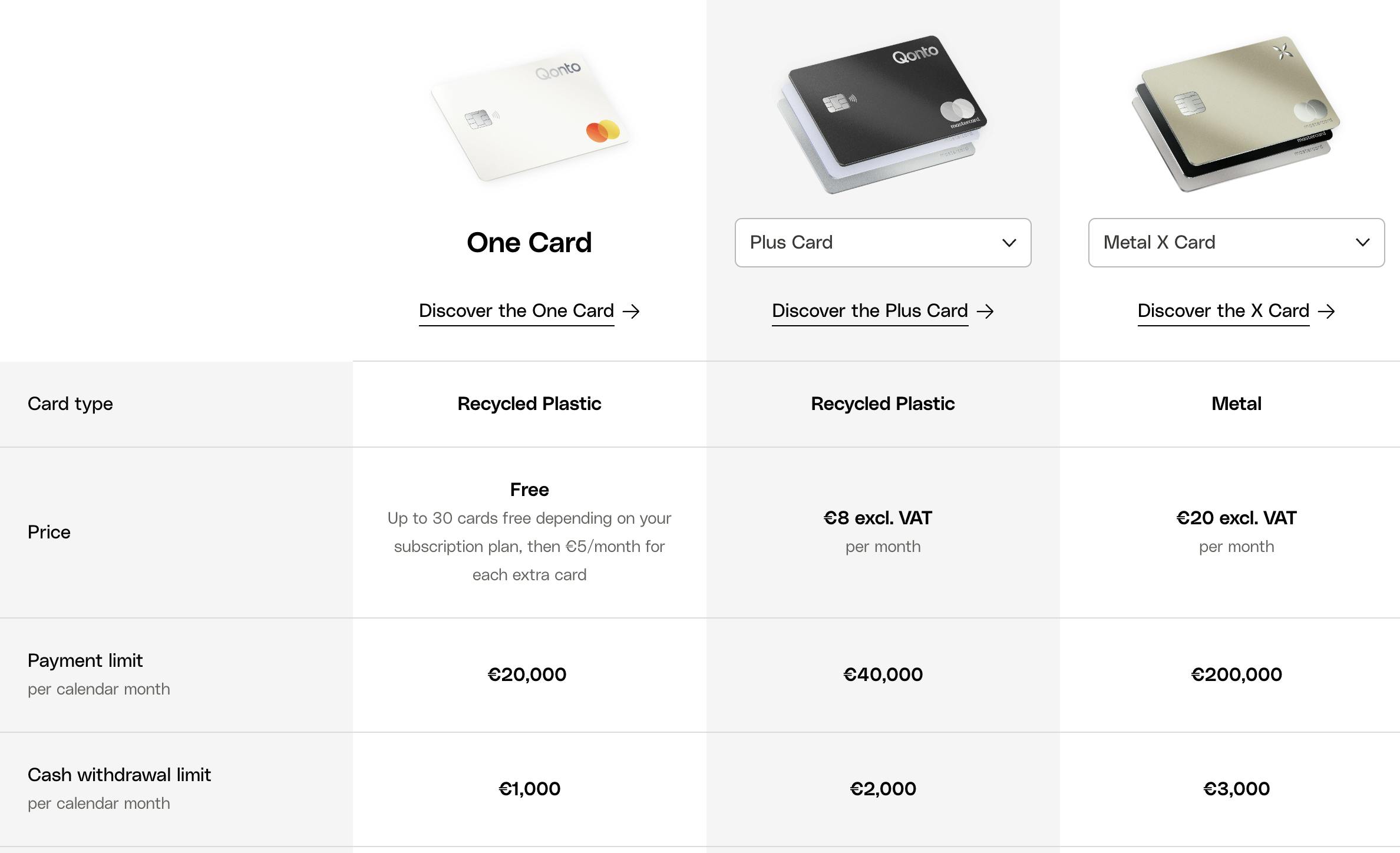

As of September 2025, Qonto offers three tiers of payment cards designed for modern business needs. All cards are issued as corporate Mastercards and are available in both physical and virtual formats, featuring instant freezing/unfreezing, customizable spending limits, and real-time transaction tracking.

The One Card, included for free (up to 30 per account, depending on the plan), is the base tier designed for general expense management. It carries a monthly payment cap of €20K and a €1K cash withdrawal limit with no free ATM withdrawals, and a 2% foreign exchange fee.

The Plus Card, priced at €8 per month (excl. VAT), increases monthly payment and cash withdrawal caps to €40K and €2K, respectively, and includes five free ATM withdrawals per month. It additionally includes enhanced insurance coverage, including protection for fraudulent payments and stolen cards.

The highest tier X Card (€20 per month excl. VAT) offers premium functionality, including a €200K monthly card limit, unlimited ATM withdrawals, and 0% foreign exchange fees. It also includes access to a 7-day-a-week concierge service and over 1.1K airport lounges, along with premium insurance to cover travel, purchase, and fraud protection, as well as legal assistance benefits.

Source: Qonto

Fuel Cards and Travel Spend

For businesses with recurring travel needs, Qonto also offers dedicated fuel cards. These cards are linked to company accounts and enable employees to pay for specific spending categories, such as gas. Fuel cards come with real-time expense tracking, customizable daily or monthly payment limits, and the ability to block or deactivate fuel cards.

Source: Qonto

Customer Support

One of the core motivations for Prot and Anavi to found Qonto was the frustrating customer experiences of long onboarding times and poor customer support they endured while running Smokio. To address these pain points, Qonto’s onboarding process is fully digital, enabling customers to open a business account with a French IBAN in under 10 minutes. This simplicity has driven product-led growth, and as of April 2023, 80–90% of customers opened accounts without speaking to anyone at Qonto.

Qonto additionally offers 24/7 customer support, responding to the insight that most founders work on admin tasks during off-hours. As of September 2025, Qonto maintains a 4.8/5 Trustpilot rating based on 38K reviews.

In 2024, the company partnered with Mistral AI to develop and launch an AI-powered chatbot called “Moshi.” In 2024, Moshi handled over 50% of chat conversations autonomously, which helped reduce chat ticket resolution time by 44%.

Market

Customer

As of September 2025, Qonto served 600K+ SMEs, freelancers, and entrepreneurs across eight countries in Europe.

At launch in 2016, Qonto originally focused on micro-businesses and solo entrepreneurs who needed simple, digital-first banking solutions. As these customers grew in headcount and complexity, Qonto evolved its product to support them. Newer features as of September 2025 include multi-user permission settings and integrations with accounting software typically used by larger companies.

As of January 2022, around 33% of Qonto customers created their business and opened their first account with Qonto, as opposed to switching from other providers. Among customers who joined after founding their companies, 50% closed their other bank accounts entirely, while the other 50% continued to use Qonto alongside other banking providers.

Although the company initially launched in France, it quickly expanded to Italy and Spain in 2019, followed by Germany in 2020. As a licensed payment institution, Qonto can passport its license across the EU, enabling efficient entry into new European markets.

From December 2020 to December 2023, Qonto Germany, Spain, and Italy saw a customer CAGR of 86% and a revenue CAGR of 138% for Germany, Spain, and Italy. In September 2024, Qonto expanded into four new countries: Austria, Belgium, the Netherlands, and Portugal. As of June 2025, Qonto remains focused on deepening its presence in these markets, with a reduced emphasis on France given its already strong position there.

Market Size

Qonto operates in the banking sector, specifically serving European SMEs and freelancers. As of December 2024, Qonto’s TAM is €52 billion, with 17.4 million SMEs able to adopt Qonto across its markets in France, Italy, Spain, Germany, Austria, Belgium, the Netherlands, and Portugal. Of these, 13 million SMEs are concentrated in the European Union’s four largest economies (France, Italy, Spain, and Germany). According to the European Commission, SMEs make up 99% of all businesses in the EU, and 93.7% of them are classified as micro-enterprises, employing fewer than ten people. Based on research published in 2024, the global neobanking market size was valued at $195.1 billion, growing at a projected CAGR of 45% from 2025 to 2033 to reach $5.5 trillion.

Competition

Wise: Founded in 2011, Wise (LSE: WISE) began with the vision of making international money transfers faster, cheaper, and more transparent. Originally launched as TransferWise, the company disrupted the remittance market by offering currency exchange at the mid-market rate with low upfront fees. Over time, Wise has evolved into a global cross-border payments platform offering multi-currency accounts, debit cards, and business tools to individuals and enterprises alike. As of September 2025, Wise has over 10 million active personal and business customers, with a market capitalization of $11.3 billion.

Sofi Technologies: Founded in 2011, SoFi Technologies (NASDAQ: SOFI) began as a student loan refinancing platform and has since transformed into a full-spectrum digital financial services company. Today, SoFi offers personal loans, home loans, credit cards, investment accounts, insurance, and a checking and savings product through its national bank charter. As of September 2025, Sofi has 10.9 million members, with a market capitalization of $29.5 billion.

Nubank: Founded in 2013, Nubank (NYSE: NU) is one of the world’s largest digital financial services platforms. As of December 2024, Nubank is the world’s largest digital bank, serving over 118 million customers in Brazil, Mexico, and Colombia. Initially launched as a no-fee credit card managed entirely through a mobile app, Nubank has since expanded into a full-suite digital financial platform offering personal loans, savings accounts, investment products, insurance, and business accounts. As of September 2025, Nubank has a market capitalization of $71.6 billion.

Revolut: Founded in 2015, Revolut began as a low-cost FX and international transfer platform but has since evolved into one of the most comprehensive consumer and business neobanks in Europe. The company now offers corporate banking, multi-currency accounts, automated investing, travel insurance, and more. As of July 2024, Revolut has secured a UK banking license and is in the process of rolling out expanded services. It counts over 9 million UK users and 45 million globally. Revolut is rated 4.5/5 on Trustpilot based on 234K reviews. Revolut’s most recent large funding round was in 2021, where it raised $800 million in its Series E led by Softbank and Tiger Global. As of August 2024, Revolut announced a secondary share sale for employees at a valuation of $45 billion and has raised a total of $1.7 billion since its founding.

N26: Founded in 2013, N26 is a Berlin-based mobile-only bank. Unlike Qonto, it holds a full European banking license and caters to both personal and business customers. As of September 2025, N26 is available in 24 countries and had 4.8 million active users as of the end of 2024. It has traditionally focused more on individual consumers than SMEs. As of September 2025, N26 is rated 3.3/5 on Trustpilot based on 35K reviews. In October 2021, N26 announced its $900 million Series E led by Third Point Ventures, Coatue Management, and Dragoneer Investment Group, which valued the company at $9 billion. In April 2023, Allianz sought to sell its 5% stake in N26 at a $3 billion valuation. As of September 2025, N26 has raised a total of $1.7 billion since its founding.

Tide: Founded in 2015, Tide was established in the UK as one of the first digital-only finance platforms. It markets itself as an all-in-one platform for managing businesses, offering workflows for accounting, business savings, and payroll. As of September 2025, Tide serves over 10% of all SMEs in the UK and over 1 million sole traders, freelancers, and limited companies worldwide across the UK, Germany, and India. In July 2021, Tide announced a $100 million Series C round led by the Apax Digital Fund, valuing the company at over $650 million. In May 2025, Tide secured a £100 million securitization debt facility through Fasnara Capital. These funds were primarily raised to help Tide enhance its short-term cash flow management solution for its customers. As of September 2025, Tide has raised $328.5 million.

Finom: Founded in 2019, Amsterdam-based Finom is another European challenger bank targeting SMEs. The company operates under an Electronic Money Institution (EMI) license and has only recently begun testing lending products enabled by this license. Finom's product offerings include banking, cards, and AI-enabled accounting. Finom doubled its revenue in 2024 and announced a €115 million Series C round in June 2025 at an undisclosed valuation. The company has raised €307.5 million as of September 2025.

Business Model

Qonto operates a multi-stream revenue model centered on subscription-based pricing, as well as add-on premium features, including advanced expense management and accounting solutions, card fees, and transaction fees.

Subscription Options

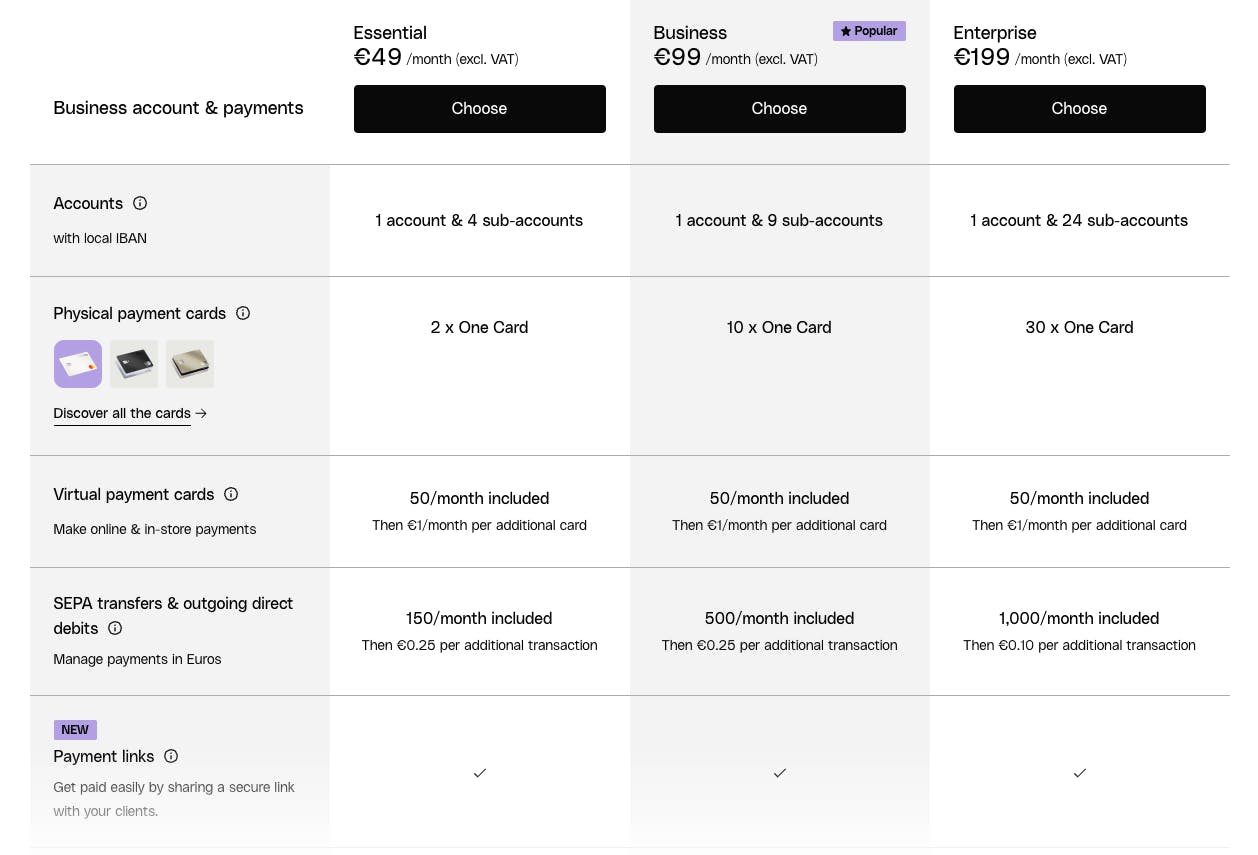

As of September 2025, Qonto offers four different subscription options depending on the size of the business, with each subscription option offering three pricing tiers:

Company Creators: The Company Creators plan is designed for founders seeking to launch their business through Qonto. There are three different tiers available, titled Basic Pack, Smart Pack, and Essential Pack, priced at €169, €289, and €649 for the first year, respectively. The Basic Pack Tier offers a deposit certificate within 12 hours, one One Card, 30 transfers per month, access to financing options, and core invoice management tools. The deposit certificate is important for new business owners, as it is necessary for registering their companies. The Smart Pack also offers accountant access and bookkeeping tools, while the Essential Pack adds unlimited team members and the creation of four sub-accounts, in addition to these features.

Self-employed: The Self-employed plan is targeted towards freelancers and sole proprietors. There are three different tiers available, titled Basic, Smart, and Premium, priced at €108, €208, and €468 per year, respectively. Tier feature offerings are similar to those of Company Creators, but exclude deposit certificates.

Micro-businesses: The Micro-business plan is targeted towards companies with between one and nine employees. There are three different tiers available, titled Essential, Business, and Enterprise, priced at €588, €1188, and €2388 per year, respectively. The Essential plan is designed for essential banking, invoicing, and spend management tools, offering unlimited team members for collaboration. The Business plan also adds more flexibility to team spending and cash flow by providing more One Card Mastercards, monthly transfers, priority customer support, and a dedicated customer success manager. The Enterprise plan is targeted towards micro-businesses that require the highest volume of transfers per month.

SMEs: The SME plan is targeted towards companies with 10-249 employees. There are three different tiers available, titled Business, Enterprise, and Personalized, priced at €1.2K, €2.4K, and a custom price per year, respectively. The Business plan offers 10 One Card Mastercards, 500 transfers per month, and priority customer service, along with a dedicated customer service manager. The Enterprise plan provides the highest limits, including 30 One Card Mastercards and 1K transfers per month. The Personalized plan is tailored for each customer and offers potential features such as premium cards, unlimited transfers, and any necessary additional tooling.

Source: Qonto

Add-on Features

Customers can additionally select add-on features to each plan specific to their business needs. These add-on features include, but are not limited to, custom expense and spend management rules, unlimited instant cards, automated payment initiation through ERP integration for Accounts Payable, automated recurring invoices for Accounts Receivable, and advanced Cash Flow Management features such as cash flow forecasting.

Qonto Cards

Customers can additionally purchase Qonto Cards. Cards are the One Card, Plus Card, and X Card, priced at €5, €8, and €20 per month, respectively. Up to 30 One Cards are included for free for some subscription plans, and additional cards cost five euros per month.

Source: Qonto

Traction

As of September 2025, Qonto supports 600K+ SMEs and freelancers across eight European countries, with 78% of customers using Qonto as their primary account. Since launching in 2017, Qonto has experienced steady growth, expanding its user base from 25K in October 2018 to 65K by January 2020, 220K by January 2022, 450K by September 2024, and surpassing 600K+ as of September 2025. The company has been profitable since 2023 and relies on product-led growth. As of April 2023, 80-90% of clients who opened an account did not speak with anyone before doing so. Qonto has maintained high customer satisfaction, earning a rating of 4.8/5 stars on Trustpilot and an industry-leading Net Promoter Score of 76 as of December 2024. As of December 2024, one in five new businesses in France is created with Qonto’s help.

Valuation

As of September 2025, Qonto’s last fundraising round was in January 2022, when it announced a €486 million Series D round led by Tiger and TCV, reaching a €4.4 billion valuation. In January 2020, Qonto raised a €104 million Series C round led by DST Global, Hedosophia, and Tencent. In September 2018, Qonto raised a $23 million Series B round led by Alven Capital and Valar Ventures. In June 2017, Qonto raised €10 million in a round led by Alven Capital and Valar Ventures. In January 2017, Qonto raised a €1.6 million seed round from Alven Capital and Valar Ventures. As of September 2025, Qonto had raised a total of $709.5 million since its founding.

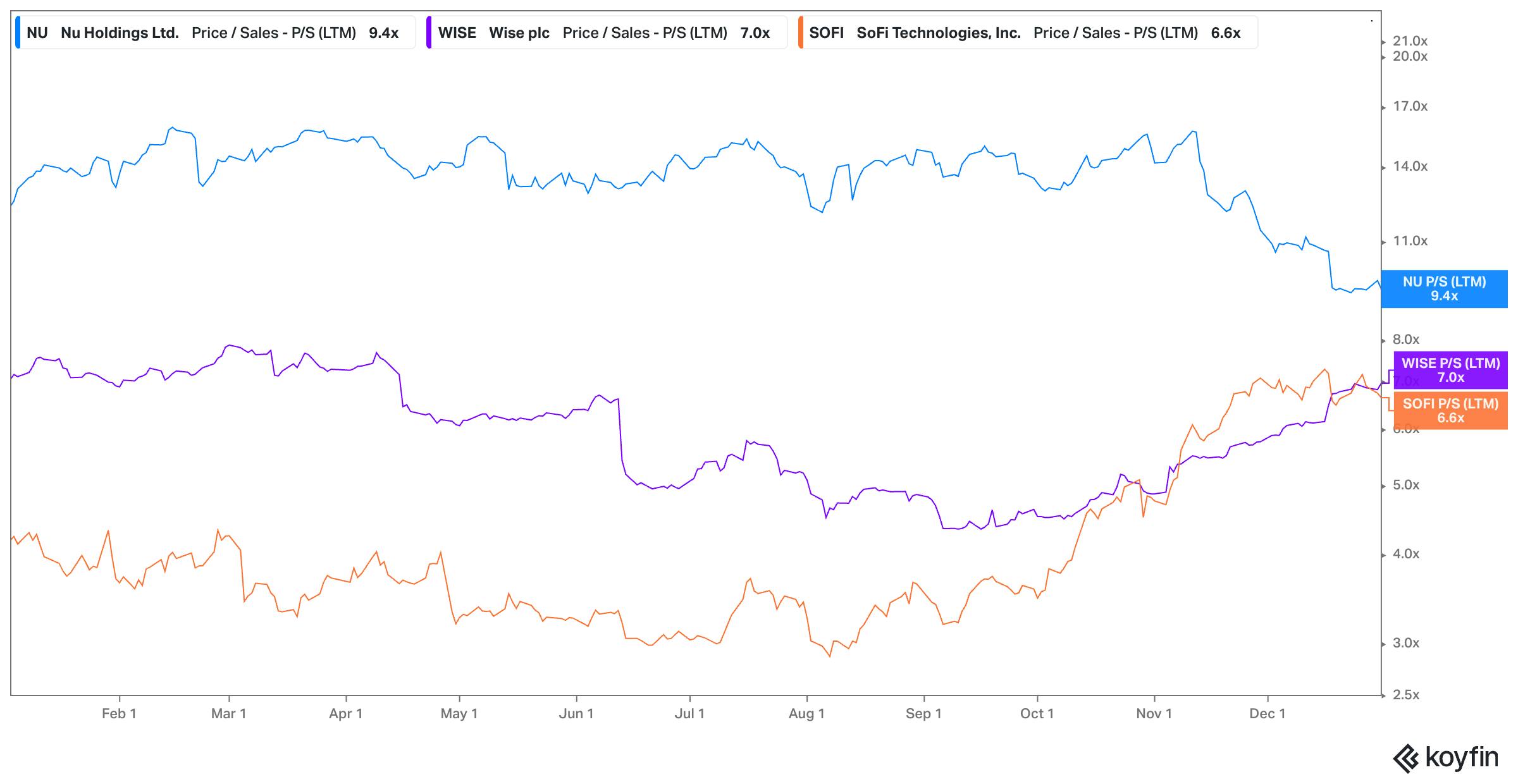

Qonto’s annual revenue was estimated to be €159 million as of 2023. Prot stated that Qonto’s revenue increased by 30% in 2024. As of December 2024, comparable public companies had price-to-earnings multiples ranging from 6.6x to 9.4x.

Source: Koyfin

Key Opportunities

Banking License

As of September 2025, Qonto has filed for a banking license in France. This would enable the company to offer a broader range of financial products, including higher loan amounts, longer-term financing options, savings, and investment services. It would also reduce reliance on partner banks, giving Qonto greater control over its infrastructure and margin structure. As of September 2025, Qonto has operated under a payments institution license obtained in 2018.

M&A

In a September 2024 interview, Prot stated that the company remains interested in acquisition targets that can strengthen its client base, technology stack, or product suite. As of September 2025, Qonto has acquired two companies. In 2022, Qonto bought German competitor Penta to take over the startup’s 50K customers in the country. In 2024, Qonto acquired accounting fintech Regate, enabling the company to expand its suite of products and attract a new class of customers: accountants and accounting firms. In a June 2025 interview, Prot mentioned how the next acquisition targets would be either a geographic or product M&A deal.

AI

In 2024, Qonto launched “Moshi,” an AI chatbot built in partnership with Mistral AI. As of June 2025, 54% of customer support chat interactions are handled by an AI chatbot with satisfaction scores comparable to those of human agents.

In March 2025, Qonto partnered with Twin, a startup developing autonomous agents for finance teams. These agents use OpenAI’s CUA model to automatically extract bank transactions, identify missing invoices, retrieve them from service provider websites, and upload them into Qonto. Internally, Qonto is also utilizing GenAI to enhance its fraud detection algorithms. These efforts position Qonto to expand margins, reduce support costs, and deepen user engagement by embedding AI into core financial workflows.

Long-Term Growth and IPO Readiness

In a June 2025 interview, Prot shared that although Qonto has no immediate plans to go public, the team has been gradually formalizing its books, governance, and internal controls. These efforts are primarily in preparation for its banking license (which it applied for in July 2025), but also reflect preparation for a potential IPO 3-5 years down the line.

Key Risks

Regulatory Complexity Across Markets

While the European Union and Eurozone enable Qonto to passport its French financial license across member states, entering non-EU markets poses significant challenges. The company has avoided expanding into the UK due to complications arising from Brexit, including differences in currency, payment infrastructure, and regulatory frameworks. Similarly, Qonto has held off on entering the U.S. market as of September 2025, citing distinct regulatory requirements and a strategic focus on first winning the European market.

Weak Anti-Money Laundering Controls

In July 2024, Qonto received an order from Banca d’Italia, Italy’s central bank, to strengthen anti-money laundering (AML) controls within its Italian subsidiary. As a result, the company was temporarily banned from onboarding new customers in Italy starting July 25, 2024. The incident indicates potential deficiencies in Qonto’s AML infrastructure and underscores the need for ongoing maintenance of monitoring systems and risk detection tools.

Competition

Qonto operates in a competitive market where multiple neobanks and incumbent banks are converging on the same SME segment. Rivals like Revolut are rapidly expanding their business offerings with integrated invoicing and a banking license. Traditional banks have also begun improving their SME offerings in response to pressure from fintech. For instance, players like Deutsche Bank and Barclays have launched digital-first products such as Vert and SmartBusiness Dashboard.

At the same time, SME banking is structurally low-margin. Monthly plans at Qonto start as low as nine euros per month for solo users, limiting ARPU growth unless customers adopt add-ons or higher tiers. As Qonto scales and takes on fixed costs, such as headcount, office leases, and acquisitions (e.g., Regate), its margin profile will increasingly rely on economies of scale and upselling higher-margin products, including financing and AI-driven automation. Failure to differentiate meaningfully or win long-term customer loyalty could result in rising CAC and downward pricing pressure.

Summary

Qonto is a French payment institution founded in 2016 by Alexandre Prot and Steve Anavi to address the outdated and complex banking experience they faced as entrepreneurs. Positioned as the “Google Workspace for Finance,” it offers a digital platform for SMEs and freelancers across eight European markets, combining business accounts, invoicing, expense management, and financing tools. As of September 2025, Qonto serves 600K+ users with 24/7 support and a 4.8/5 Trustpilot rating. Qonto has been profitable since 2023 and filed for a French banking license in July 2025 to expand its offerings. With a goal of reaching 2 million users by 2030, it continues to scale despite regulatory risks and strong competition from players like Revolut.