Thesis

Europe's financial services landscape is undergoing a digital transformation, driven by the ubiquity of services offered through mobile technology and changing regulations. As of 2025, half a billion Europeans are connected to mobile internet, and, as of 2023, 63.9% of Europeans aged 16-74 had utilized online banking. The revised Payment Services Directive (PSD2), passed in 2015, enabled third-party providers to access bank data. These conditions have fueled the rise of digital-only banks, making Europe the largest market in global neobanking.

Traditional banks, by contrast, have long burdened European customers with cumbersome branch-centric services, high fees, and poor user experiences. Opening an account or receiving services often meant completing paperwork and visiting a branch, while legacy banks charged hefty fees for everything from basic accounts to foreign transactions. These pain points left consumers frustrated by the complexity and lack of innovation in traditional banking. In response, neobanks emerged in the 2010s, utilizing a mobile-first approach to offer more convenient and cost-effective banking services. Operating without expensive branch networks enables neobanks to run lean and pass savings to customers through lower fees and better rates.

Founded in 2013 in Berlin, N26 is a notable player in Europe's digital banking scene. The company offers a fully licensed mobile banking platform centered on a checking account that customers can open and manage entirely on their mobile device. Beyond checking accounts, it also offers debit cards and international money transfers, alongside newer features such as savings tools, investment options, and cryptocurrency trading. It is the first 100% mobile bank to have been granted a full German banking license from BaFin, and its goal is to become the leading financial platform in Europe for everyday money management, combining banking, investing, and insurance in a single app.

Founding Story

Source: N26

N26 was founded in 2013 in Berlin by longtime friends and Co-CEOs Valentin Stalf and Maximilian Tayenthal, who set out to improve a banking industry they saw as antiquated and user-unfriendly. Frustrated by traditional banks' lack of transparency and digital innovation, the founders envisioned a mobile-first bank that lives entirely on the smartphone.

Before N26, Stalf worked as an Entrepreneur-in-Residence at Rocket Internet, where he helped develop fintech startups in mobile payments such as Payleven and Paymill. Tayenthal was previously an Associate at a law firm and the assistant to the CFO at an insurance group. Tayenthal originally joined as CFO before assuming the roles of Co-CEO in 2021 and COO in 2022.

The idea for N26 began in early 2013 as an app for parents to connect with prepaid cards for their teenagers. By 2014, the team had decided it needed to pivot to a product that makes banking more accessible for millions of people worldwide.

Early on, Stalf and Tayenthal faced skepticism from investors. Stalf has recounted pitching the idea of a branchless, app-based bank to 300 different investors, 298 of whom rejected the concept as too radical at the time. The persistence paid off when a small group of investors finally backed the venture, enabling the launch of "Number26" (the company's original name) in 2015 as a free app-based account in Germany and Austria.

In its first year, Number26 did not yet have its own banking license and instead partnered with third-party bank Wirecard to hold customer funds. By July 2016, N26 had secured a full German banking license from the German regulator BaFin and rebranded from Number26 to N26 Bank, allowing it to operate independently and expand across Europe. Armed with its license, N26 rapidly rolled out services to 17 Eurozone countries by the end of 2016.

Over time, N26 further expanded its leadership team. Gino Cordt joined as Head of Data in June 2015 and was later promoted to Chief Technology Officer in 2019. Jan Kemper joined as CFO in January 2021, after CFO stints at Zalando and ProSiebenSat.1 Media SE, and later departed at the end of January 2023. He was succeeded in February 2023 by Arnd Schwierholz, previously CFO of Flix SE and Air Berlin. Mayur Kamat became Chief Product Officer in February 2024, following product leadership roles at Binance and Agoda.

Product

N26 is a digital bank that offers a fully licensed mobile banking platform. It provides users with core banking services like checking accounts, debit cards, and international money transfers, alongside adjacent features such as savings tools, investment options, and cryptocurrency trading. Its goal is to become the leading financial platform in Europe for everyday money management, combining banking, investing, and insurance in a single app.

Core Product: Checking Accounts & App Experience

N26's core offering is a digital current account that customers can open in minutes from their smartphone. Onboarding is often under 10 minutes, leveraging video identification and automated know-your-customer (KYC) checks, in contrast to the days-long process at traditional banks. Upon sign-up, users receive a German International Bank Account Number (IBAN) or local account details in select countries, along with a Mastercard debit card, all without needing to visit a branch.

The N26 mobile app is the main component of its user experience. Transactions appear instantly with push notifications, and customers can manage everything from daily transfers to card settings in-app. N26 was an early pioneer of in-app card controls, such as locking the card and enabling overseas usage, as well as Mint-like spending analytics. This user-centric design has yielded a highly engaged customer base, with N26 reporting that users logged into the N26 app an average of three times per week in 2021, reportedly the highest engagement rate among European banks.

Payments & Cards: Debit Card, Transfers & Cash Access

Source: N26

Payments are central to N26's value proposition, and the company has continually improved the flexibility of moving money through its platform. Every N26 account comes with a Mastercard debit card that is usable worldwide. The card is integrated with mobile wallets, and N26 was among the first European banks to support Apple Pay and Google Pay. In-app, N26 provides granular card controls and instant transaction notifications. Customers can freeze/unfreeze their card with one tap, set spending limits, and even disable features like ATM withdrawals or online payments when not needed.

For day-to-day transfers, N26 supports all standard payment methods in its markets. Eurozone customers enjoy free Single Euro Payments Area (SEPA) transfers, and N26 was a launch adopter of SEPA for instant EUR payments, allowing near-real-time transfers to other banks that support it. Uniquely, N26 developed an in-network P2P payment feature called MoneyBeam, which lets users instantly send money to friends via their phone contacts or email. If both parties have N26, the transfer is immediate. If not, the recipient gets a link to input their bank details to receive the funds. This facilitates social payments akin to Venmo or Revolut's peer-to-peer transfers.

Cross-border payments are addressed through partnership: starting in 2016, N26 integrated TransferWise (now Wise) for international transfers in various currencies. Customers can send money abroad from the N26 app, with Wise executing the currency exchange at “low cost.” While N26 historically focused on EUR accounts, in November 2020, its premium tiers introduced zero FX fee perks for card spending abroad, ensuring travelers could use N26 without a surcharge.

N26 has also bridged the gap between digital banking and cash usage through a feature called CASH26. In the absence of branches, N26 partnered with retail chains, like supermarkets and drugstores, to enable cash deposits and withdrawals at the register. Through the app, users generate a barcode for the desired deposit/withdrawal amount, which the cashier scans to accept or dispense cash. The amount is then instantly credited or debited from the account. As of July 2025, N26 had over 13K partner stores in Germany and 2.9K in Austria offering CASH26 services. As of July 2025, Cash26 withdrawals are free with some minor exceptions, and the withdrawal limit is €200 per transaction and €900 per 24-hour period.

This solution catered to markets like Germany and Italy, where cash remains common, giving N26 customers the convenience of branch banking while preserving N26's branchless cost structure. As of July 2025, N26 offers a limited number of free ATM withdrawals per month, which vary by country and plan, typically ranging from three to five, using third-party ATMs with Mastercard's network.

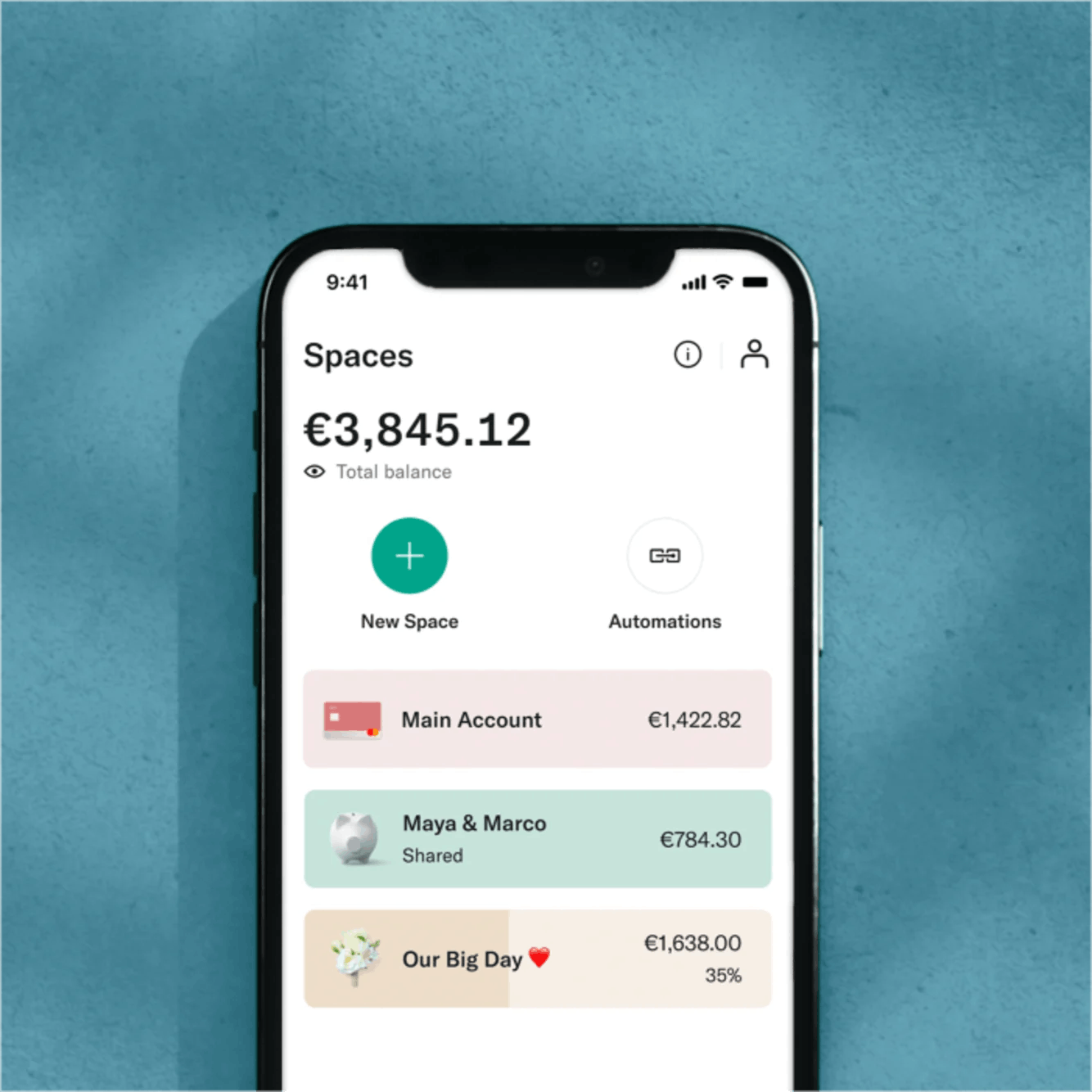

Savings & Budgeting: Spaces, Analytics & Interest Features

Source: N26

N26 also helps customers save and manage their finances, primarily through Spaces. N26 Spaces are sub-accounts that sit alongside a user's main account, allowing segregation of funds for specific goals or budgets. As of October 2024, customers can create multiple named Spaces. Free users can create up to two, while premium subscribers can create as many as 10. Each Space functions like a mini-account: users can move money in or out instantly, set savings targets, and even assign a unique IBAN to certain Spaces to receive direct deposits. For example, one might have a "Rent" Space with its own IBAN for salary or roommate transfers, a "Vacation" Space to save for a trip, and so on. The interface lets users visualize progress towards goals, making abstract financial goals more tangible.

Source: N26

Building on Spaces, N26 introduced automated saving features in 2021 to further encourage good financial habits. The Round-Ups feature automatically rounds up each card purchase to the nearest euro and sweeps the spare change into a chosen Space. For instance, a €2.30 coffee would trigger a €0.70 transfer into savings. Similarly, an Income Sorter tool was launched to allow users to automatically distribute incoming funds, such as paychecks, across Spaces by percentage or amount, similar to "envelope budgeting".

In addition to helping users allocate money, N26 has expanded into true savings products, especially as the interest rate environment shifted. It partnered with Raisin in 2017 to offer fixed-term deposit accounts from third-party banks, giving users access to higher interest rates via the N26 app. In late 2022 and 2023, as the European Central Bank raised rates, N26 began passing on interest to its own customers more directly. It launched N26 Instant Savings accounts in 2023, an instant-access savings feature linked to the ECB deposit rate. By March 2024, N26 had rolled out Instant Savings to 13 markets.

Investing & Trading: Crypto, Stocks & ETFs

Source: Bitpanda

N26 has extended its product suite into the investing realm, adding cryptocurrency trading and stock/ETF trading. N26 took a partnership-driven approach to enter these markets. In October 2022, N26 launched N26 Crypto, a feature that allows users to buy and sell digital currencies directly within the N26 app. Rather than building a trading engine from scratch, N26 partnered with Austrian crypto platform Bitpanda, which handles the trade execution and custody behind the scenes. At launch, N26 Crypto was introduced to a pilot group in Austria, providing access to 100 different cryptocurrencies, including Bitcoin, Ethereum, and popular altcoins.

By February 2024, N26 had expanded crypto trading to multiple countries, including Germany, Belgium, Ireland, and Spain. The crypto interface is integrated into the app's "Finances" tab, alongside Spaces, so users can view their cryptocurrency alongside other assets. The fee structure at launch was 1.5% per trade for Bitcoin and 2.5% for other coins, and remains the same as of July 2025.

Step two of N26's investment product expansion was the introduction of traditional equities. After hinting at its ambitions in 2022, N26 launched a Stocks and ETFs trading service in stages throughout 2023 and 2024. The feature, developed in partnership with Berlin-based fintech Upvest, allows N26 users to trade fractional shares of thousands of stocks and exchange-traded funds within the app.

As of July 2025, customers could invest in over 4K stocks and ETFs. Initially, N26 charged a flat fee of €0.90 per trade for stocks/ETFs. However, in a move to drive adoption, N26 announced in January 2025 that it was eliminating all trading fees for stocks and ETFs.

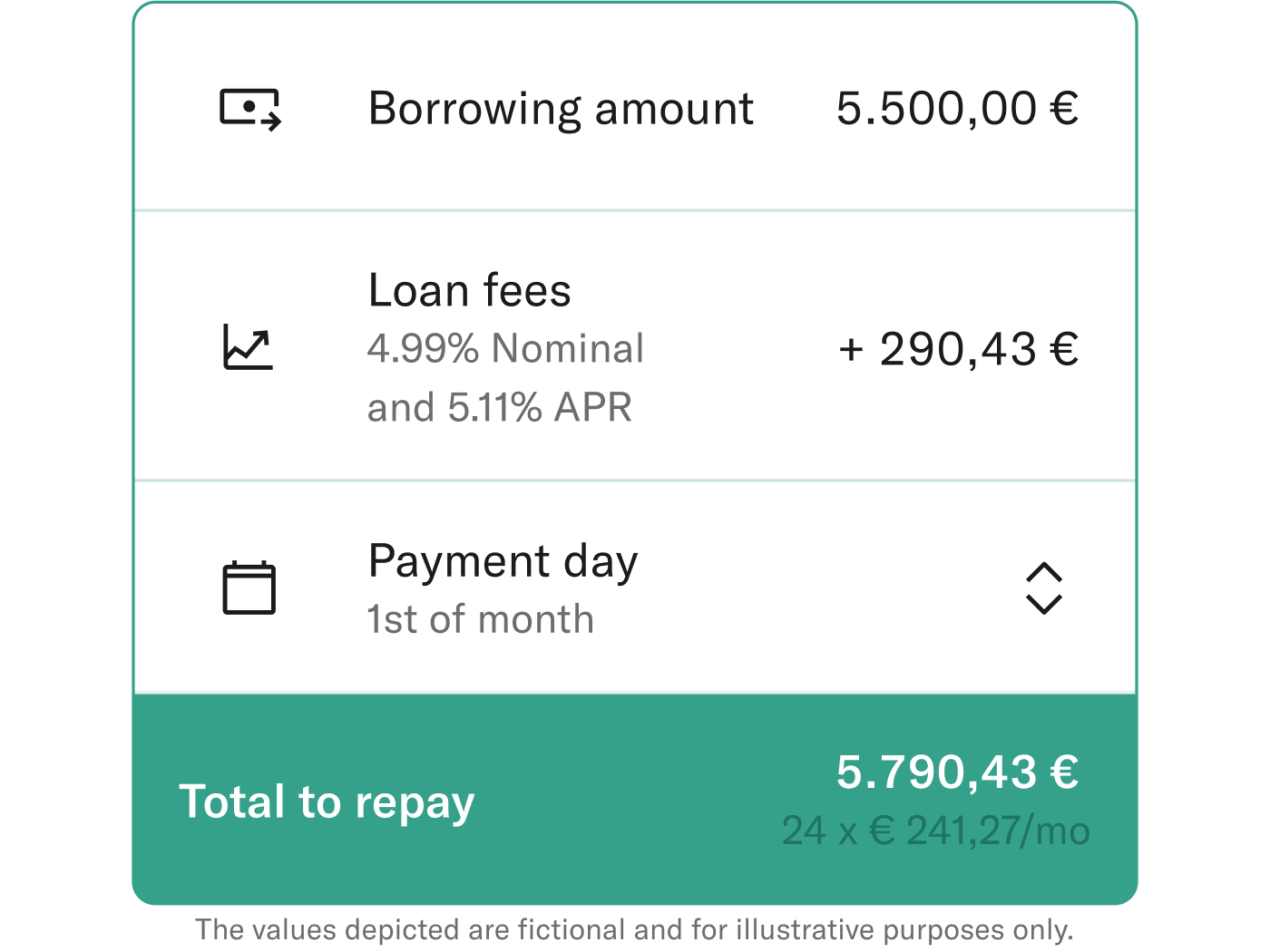

Credit Products: Loans, Overdrafts & Mortgages

Source: N26

Despite its roots in deposit accounts, N26 has gradually built out a range of credit products to serve customers' borrowing needs. Early on, N26 introduced a flexible overdraft feature, which remained a core offering tied to the checking account through July 2025. Eligible customers, based on creditworthiness, can activate an overdraft line within minutes via the app, typically up to a few thousand euros. Interest on the overdraft is calculated daily and charged quarterly. In July 2024, N26 set a fixed overdraft interest rate of 13.4% APR. Users get an overdraft approval instantly, without paperwork, and can adjust their limit in-app.

Beyond short-term overdrafts, N26 offers personal loans through its N26 Credit product. It partners with Auxmoney in Germany and with Younited Credit in France, effectively brokering loans from those platforms via the N26 app. This allows N26 to offer loan amounts up to €25K–50K without taking all the risk onto its own balance sheet. If accepted, loan funds are disbursed into the N26 account.

N26 has also entered the mortgage market. In 2023, N26 launched a fully digital mortgage offering in the Netherlands under a dedicated brand, N26 Hypotheken. By November 2024, N26 had already originated over €600 million in home loans in the Netherlands since its launch.

Joint Accounts: Shared & Social Finance

In 2024, N26 launched formal Joint Accounts in many of its markets. Joint Accounts allow two individuals, typically partners or spouses, to fully share an account with a joint IBAN and equal ownership. N26 had long said Shared Spaces were a modern replacement for joint accounts, but over time, they saw demand for a true dedicated joint product. The new Joint Accounts, rolled out to 21 countries in April 2024, come at no extra cost and can be opened by any two N26 customers regardless of their plan. Each joint account comes with its own account number and allows two cardholders.

Business Banking: Freelancers & Emerging SME Accounts

While N26's focus has been predominantly on retail consumers, it has also explored the business banking segment, starting with accounts for self-employed individuals and eventually targeting small and medium-sized enterprises (SMEs). N26 Business accounts were introduced a few years after launch in April 2017, targeting freelancers and sole proprietors who wanted to use N26 for their business finances.

These accounts are very similar to personal accounts, but in the business owner's name, and they come with one notable perk: cash back on card spending. N26 Business Standard, Smart, and Go plans offer 0.1% cashback on all purchases, while Business Metal offers a higher 0.5% cashback. Recognizing opportunity in SME banking, N26 announced plans in November 2024 to expand into business accounts for companies. It then opened pre-registration for a new SME-oriented account in Germany and stated that it aimed to launch fully in 2025.

Market

Customer

N26 primarily targets tech-savvy individuals who prioritize mobile-first banking solutions. Its core demographic includes millennials and Gen Z consumers, typically aged between 18 and 35, who value convenience, transparency, and digital innovation in financial services. N26's app offers features such as real-time notifications, budgeting tools, and spending analytics, appealing to those seeking efficient financial management. The bank's freemium model, which includes a free Standard account alongside tiered paid plans, caters to a wide range of financial needs and income levels. Additionally, N26 has expanded into digital banking services for businesses, aiming to tap into the SME market across Europe.

N26's customer base has grown to over 4 million active users as of 2025, with its footprint almost entirely in Europe. The bank operates in 23 European countries (including all Eurozone countries) and has a particularly notable presence in its home market of Germany, as well as France, Spain, Italy, and Austria. The company’s user base as of July 2025 is almost entirely in continental Europe. The company withdrew from the UK in 2020, citing Brexit regulatory issues, and shut down its US operations in 2021 to refocus on Europe.

Market Size

N26’s market is essentially the retail banking market in Europe, which comprises hundreds of millions of potential customers and trillions of euros in deposits. In terms of revenue, the European digital banking market was valued at approximately $8.7 billion in 2024 and is projected to reach over $35 billion by 2033. This figure encompasses the combined revenues of neobanks and digital offerings from incumbents. If we consider the broader retail banking market, including traditional banks, the opportunity is even larger. The top banks in Europe collectively generate hundreds of billions of euros in annual revenue, much of it from basic banking services that fintechs like N26 are starting to disintermediate.

Competition

N26 operates in an increasingly competitive neobanking landscape, contending with both other fintech upstarts and entrenched traditional banks adapting to the digital era.

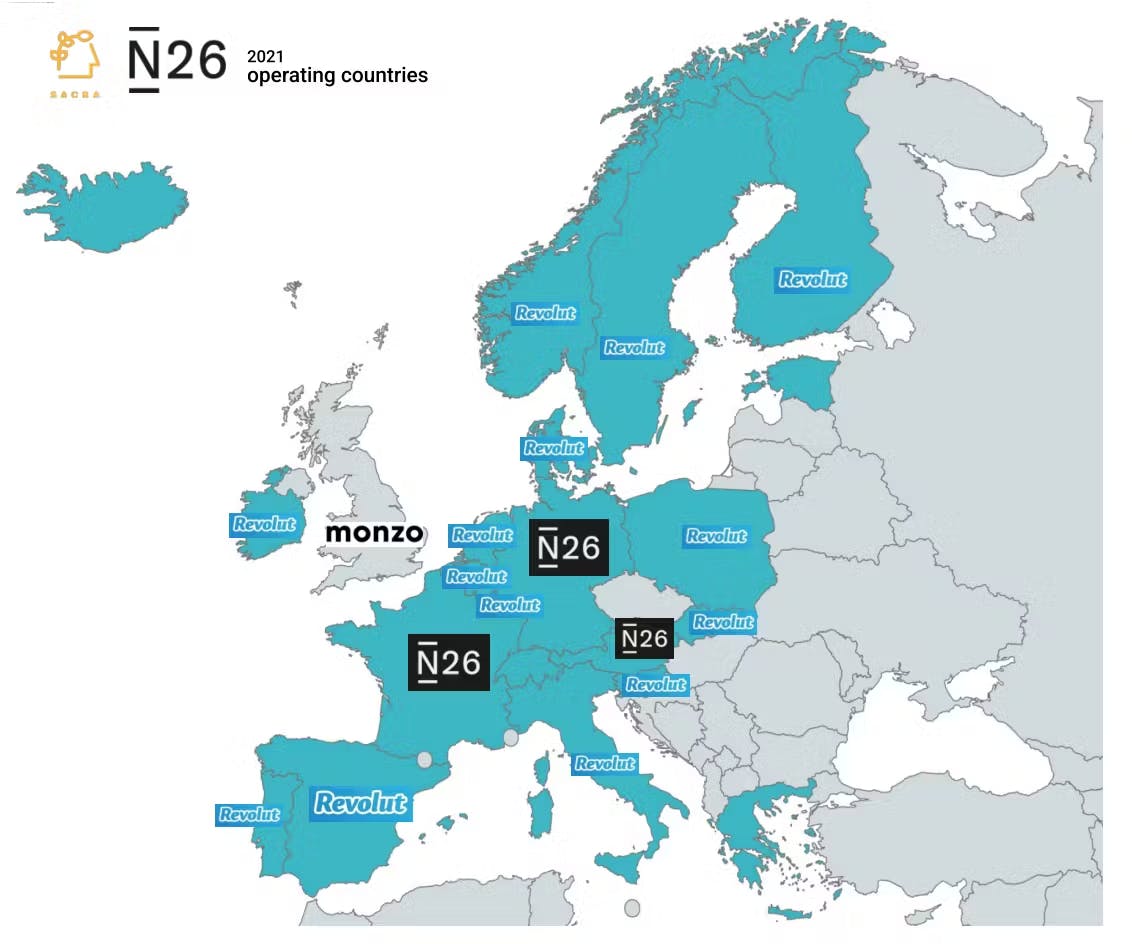

Global Neobank Rivals

Source: Sacra

The most direct competitors are other leading digital-only banks in Europe and abroad. Revolut, based in London, is the largest European neobank with over 30 million customers globally as of 2025. Revolut offers a broad platform spanning banking, trading, crypto, and more, and has achieved scale by expanding beyond Europe into the US and Asia. Importantly, Revolut is also profitable, with a net profit of $428 million in 2023, setting a benchmark for the sector. N26 and Revolut often vie for similar customers in Europe, though their approaches differ: Revolut started with multi-currency and wealth features, whereas N26 focused on straightforward banking and a full bank license.

Another peer, Monzo, is a UK-based neobank with ~10 million users as of 2025, mostly in the UK. Monzo turned profitable on an annual basis in 2023 and emphasizes personal finance tools and vibrant community engagement. Starling Bank (UK) is another notable competitor. It focuses on both retail and SME accounts and has 2.9 million “active core” accounts as of June 2024, and has been profitable since 2021.

Continental European Neobanks

Within the EU, N26 faces competition from a range of regional fintech banks. For example, Vivid Money in Germany offers a similar app-based account with investing features. In France, Nickel and Orange Bank have gained users with low-cost accounts distributed through alternative channels. Bunq in the Netherlands is another pan-European neobank known for its budgeting features and green initiatives. While none of these have the scale of N26, they target specific niches or home markets. N26's ability to operate across many countries with one license is a competitive strength, but it also means it must localize and compete with whichever local fintech is strongest in each market.

Traditional Banks & Incumbents

Indirectly, every incumbent bank with a decent mobile app is a competitor to N26. Large banks in Europe have responded to the fintech challenge by improving their digital offerings. For instance, Spain's BBVA launched Cuenta Online with no fees, and Germany's Deutsche Bank offers Fyrst for freelancers and has modernized its subsidiary Postbank's app. Moreover, European consumers often already have accounts with legacy banks that offer familiarity and a broad range of products (mortgages, credit cards, etc.), which N26 is still building toward. A specific subset of incumbents, direct banks and online divisions, is particularly relevant: ING's direct banking arm, ING DiBa in Germany, has millions of users and similarly has no branches. These players have the advantage of scale and trust while offering many of the zero-fee, online conveniences that attract users to N26.

Emerging Tech & Fintech Giants

Fintech trading platforms have also begun obtaining banking licenses, potentially transforming into neobank competitors. Trade Republic, for instance, secured a full EU banking license in late 2023, enabling it to take deposits and offer savings accounts. This blurs the line between a broker and a bank, meaning customers might use Trade Republic for saving/investing instead of opening an N26 account.

Business Model

As a fully licensed bank, N26 can generate revenue in a manner similar to conventional banks, earning interest on deposits and lending, as well as fees for services and interchange on card payments.

Interchange & Payment Fees

Every time an N26 customer uses their card, N26 earns a small interchange fee from the merchant's bank. In the EU, interchange on consumer debit cards is capped (~0.2%), which limits this revenue per transaction, but high payment volume can make it meaningful. N26 processed over €140 billion in transaction volume in 2024, up from €113.9 billion in 2023. Additionally, N26 can earn fees from ATM usage, as it passes on costs to users after a certain number of free transactions have been made. It also applies foreign exchange markups on card transactions, although premium accounts waive many of these fees. As users increasingly use N26 as their primary account, these revenues grow.

Subscription Revenue

To bolster revenue and customer loyalty, N26 has embraced a freemium model with tiered premium bank accounts. It was one of the pioneers of subscription-based banking in Europe, introducing paid plans as early as 2016 (N26 Black) and expanding the lineup over time. As of July 2025, N26 offers three premium tiers in addition to the free Standard account: N26 Smart, N26 Go, and N26 Metal. Each tier comes with a monthly fee in exchange for enhanced features and benefits. All fees and benefits below are as of July 2025.

N26 Smart costs €4.90 per month and is the entry-level premium plan designed for budget-conscious users who require additional tools. It bundles popular money management features, such as multiple sub-accounts (Spaces), priority customer support, and the new Round-Ups savings tool. Still, it doesn’t have the travel insurance offered in higher tiers.

N26 Metal, at €16.90 per month, is the top tier with the most perks. It has a metallic card, extended insurance such as phone insurance and car rental coverage, dedicated phone support, higher interest rates, and exclusive partner offers.

As of 2023, subscriptions accounted for roughly 30% of N26’s total revenue.

Net Interest Margin

N26 holds a banking license and earns money on the net interest margin on its customer deposits, which totaled over €10 billion as of Q3 2024. From 2022 to 2023, as interest rates rose in Europe, this became a major revenue source. N26 disclosed that interest income accounted for ~40% of its revenue in 2023 and it was on track to reach around 50% of revenue in 2024. This is a shift from the near-zero rate era when interest income was negligible.

Traction

Growth

By January 2016, N26 had 100K users. In September 2021, however, user growth was artificially capped at 50K per month by the German financial regulator BaFin due to compliance concerns. The cap was lifted in June 2024, and as of October 2024, new sign-ups exceeded 200K per month with N26 projecting that it would have 4.8 million “revenue-relevant” customers by the end of the year.

N26 had also seen an increase in transaction volume and deposits. Transaction volume reached €140 billion for 2024, up from €114 billion in 2023. On average, an active customer transacted ~€29K annually with N26 in 2024, up from ~€27K the year prior. This includes card payments, transfers, and other account activity. N26 surpassed €10 billion in customer deposits in Q3 2024 for the first time, up from ~€7.2 billion in 2022.

In October 2024, N26 projected €440 million in revenue for fiscal year 2024, representing a 40% increase from the prior year. It also reported its first-ever quarterly profit for Q3 2024, with €2.8 million of net operating income for that quarter, after years of losses.

Geographic Expansion

N26's growth has been broad-based across Europe. Its largest user bases are in Germany and France, according to media reports, with sizable communities in Spain, Italy, and Austria as well. These core markets drive the bulk of revenue. Secondary markets like Ireland, the Netherlands, and Eastern European countries contribute smaller numbers but still add up under N26's pan-European strategy.

By 2020, N26 had expanded beyond Europe, launching in the US (2019) and planning an entry into Brazil, while also having briefly entered the UK (2018). However, this expansion has not been as successful. Citing the complexities of operating under different regulatory regimes post-Brexit, N26 withdrew from the UK in early 2020 and closed about 200K UK accounts. The US expansion also encountered headwinds: N26 relied on a partnership with Axos Bank in the US (since it lacked a US banking license) and faced tough competition. Leadership turnover in the US team and regulatory hurdles made traction difficult. By late 2021, N26 decided to pull out of the United States to refocus on Europe, resulting in roughly 500k US accounts being closed by January 2022. Plans for Brazil were likewise shelved, with N26 ceasing its Brazilian operations by around EOY 2023 to concentrate resources on its core European markets.

Valuation

In October 2021, N26 raised $900 million in a Series E led by Third Point Ventures and Coatue, with Dragoneer participating, at a $9 billion valuation. In January 2019, N26 raised a $300 million Series D at a valuation of $2.7 billion, led by Insight Partners with participation from GIC. It then raised two extensions to this round. In July 2019, it raised $170 million in a Series D extension at a valuation of $3.5 billion from existing investors. In May 2020, N26 extended its Series D funding by $100 million at the same $3.5 billion valuation from existing investors. In March 2018, N26 raised a $160 million Series C at an undisclosed valuation, co‑led by Allianz X and Tencent.

Earlier rounds, all at undisclosed valuations, include the $40 million Series B in June 2016 led by Horizons Ventures, a €10 million Series A in April 2015 led by Valar Ventures, and a $2 million seed round in June 2014 led by Earlybird.

In 2023, it was reported that Allianz was selling its stake in N26 at a valuation of $3 billion. However, there is no public confirmation that this transaction occurred.

Key Opportunities

Continued Digital Banking Adoption in Europe

N26 stands to gain from the overall tailwinds of consumers shifting to digital-first banking, with European neobank penetration estimated to still only be 13% in 2027. As one of the best-known pan-European neobanks, N26 is positioned to capture a significant share of the millions of new users who will opt for an online-only bank in the coming years. Even within its existing user base, converting secondary account holders into primary account users presents an opportunity to grow deposits and transactions. In markets like Germany, where cash usage has historically been high, the ongoing digitization, accelerated by COVID-19 and changing habits, can drive more users to N26's cashless, app-based model.

Monetization Upside from Product Expansion

N26's broadening product suite provides multiple levers to increase average revenue per user (ARPU). New offerings in trading, crypto, investing, and credit can each contribute incremental revenue. For example, if a significant portion of N26's customers start using its commission-free stock trading feature (launching widely in 2024-2025), N26 could introduce paid value-added services around investing or eventually monetize order flow or margin lending. Similarly, the planned N26 Business accounts represent a new revenue stream, and business users might be willing to pay higher fees or maintain larger balances. Additionally, the company can explore cross-selling more opportunities: e.g., offering a credit card product, more insurance products, or personal finance management tools on a subscription basis. Each product can increase customer stickiness and lifetime value, helping N26 grow revenue faster than user count.

Growing In Core European Markets

By focusing resources on its core European markets, N26 can become a market leader in each. In countries like Germany, France, Spain, and Italy (with ~250 million combined population), N26 still has strong growth potential. In Germany, N26's share of primary accounts is still small compared to giants like Deutsche Bank, which had 19 million retail accounts in Germany as of 2022. If N26 uses its home-field advantage and a preference among young professionals, it could capture a much larger slice of the German market. Each percentage point of market share in those big countries equals hundreds of thousands of new users.

Selective Geographic Expansion

Although N26 pulled back from the US and UK, it left the door open to return when conditions are right. In the long run, re-entering huge markets like the UK (Europe's fintech hub) or the US (largest banking market globally) represents a large opportunity. Next time, N26 can approach these markets with more caution and experience. For instance, partnering with a stronger bank or obtaining its own charter (as others did) could make a second attempt in the U.S. more fruitful. Even beyond those, large emerging markets, like Eastern Europe or beyond, remain untapped. However, given its strategy, N26 will likely prioritize being deeply established in Europe over being broadly established globally for the foreseeable future.

Key Risks

Regulatory & Compliance Risks

A major risk for N26 is regulatory scrutiny, especially given its past issues with anti-money laundering (AML) controls. N26 has already incurred fines, such as a €4.25 million fine by BaFin in 2021 for AML lapses, and suffered a growth cap for nearly three years due to compliance shortcomings. As a bank operating across many jurisdictions, N26 must rigorously enforce know-your-customer (KYC) and AML procedures.

Additionally, the broader regulatory climate for fintechs is becoming stricter, with examples including the EU's AML directives and Digital Operational Resilience Act. N26 will need to invest in compliance, which could lead to continually rising costs. The lifting of the growth cap in 2024 indicates improvement, but regulators will be closely monitoring N26 to ensure it doesn't slip. Any new sanctions or restrictions could significantly derail N26's momentum.

Competitive Pressure

In the face of intense competition, N26 risks losing market share or seeing its growth slow if it cannot maintain a differentiated value proposition. Competitors like Revolut offer broader services and have been quicker to introduce features such as extensive crypto support or more aggressive cashback rewards. Traditional banks are also fighting back with their own digital offerings and often have the advantage of existing customer trust and the ability to bundle products. If N26's app and features become merely "one of many" options, its appeal could wane.

Macro and Interest Rate Risk

While higher interest rates have benefited N26 since 2022, there is an inherent risk that rates fall in the future. N26's interest revenue (about 50% of revenue in 2024) could shrink if the European Central Bank lowers rates or if competition forces N26 to pay higher interest to customers. In low-rate environments, banks struggle to earn margin on deposits, which could push N26 back into losses unless other revenues compensate. Moreover, an economic downturn in Europe could have mixed effects: on one hand, people might seek cheaper banking, favoring N26's low fees. But on the other hand, loan defaults could rise, and consumer spending could drop, reducing interchange income.

Summary

N26 is riding the sustained shift toward digital banking, having evolved from a mobile-first challenger bank into one of Europe's largest fintech banks. The company offers a user-friendly app that primarily appeals to younger, digitally savvy consumers across Europe. N26 has grown to millions of active customers and achieved profitability in 2024, driven by subscription revenues, interchange fees, and net interest margin. N26’s strategic pivot to focus exclusively on its core European markets positions it to capture continued growth in the still-expanding digital banking market, provided it can manage regulatory complexity and intense competition from both incumbents and fintech rivals.