Thesis

Energy systems are at a turning point: as electrification, digitization, and decarbonization accelerate, the demand for carbon-free, reliable, always-on power has never been higher. Intermittent renewables are essential but by themselves struggle to meet the needs of mission-critical infrastructure, remote off-grid sites, and large industrial loads that cannot tolerate supply disruption.

Meanwhile, the digital economy — particularly AI data centers, large compute clusters, and edge sites — is placing unprecedented pressure on the grid, demanding not just more clean energy in aggregate, but a more consistent energy supply that can service changing consumption patterns throughout the day. At the same time, decades of under-investment in nuclear power and its legacy of cost-overruns are being hit by waves of policy, regulatory, and market change. Governments are reforming regulations, tech companies are investing in advanced reactors, and small modular reactors (SMRs) and microreactors are emerging as scalable alternatives to legacy large reactors.

In the past, the solution for places where a stable supply of electricity was essential or in places that could not rely on grid backup (remote communities, military bases, research centers, or post-disaster scenarios) was diesel electricity generators. In some areas, such as sub-Saharan Africa, diesel generators produced up to 40% of the total power supply as of 2023. An average generator, however, emits 2.2X more CO2 per unit of energy than the US grid and emits fumes that can cause major adverse health effects, including lung cancer.

But in light of increasing demand for stable energy throughout the grid, diesel generators are no longer sufficient. As a result, alternatives like nuclear power plants are experiencing a renaissance, and their public support is growing. Nuclear power plants can be a stable and reliable source of energy supply. US nuclear reactors operate at full power a minimum of just over 86% of the time and a maximum of over 92%. In 2025, 60% of Americans said they support nuclear power, compared to just 43% in 2020. As of October 2025, corporate-backed investment in fusion startups totaled $3.7 billion between 2024 and 2025, compared with $1.7 billion for nuclear fission startups over the same period.

Traditional nuclear fission has many problems that prevent it from scaling efficiently. The industry is plagued by long development cycles, delays, and cost overruns, making some projects unviable economically. For example, the construction of the Vogtle 3 and Vogtle 4 nuclear plants saw delays of over seven years and cost overruns of over $15 billion, doubling the original budget. Similar to how SpaceX changed the aerospace industry by lowering launch costs with innovation, nuclear startups have an opportunity to change this by creating more efficient methods of providing nuclear energy supply.

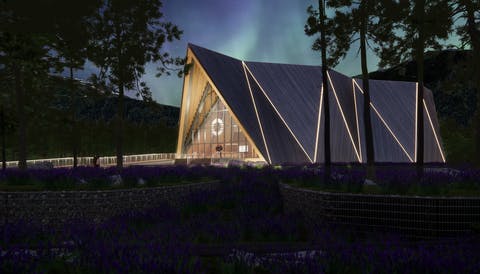

Radiant builds portable nuclear microreactors that are intended to replace diesel generators in “remote villages” and to provide “resilient backup power for hospitals, data centers, and military installations. The Kaleidos, Radiant’s first product, is designed to produce 1.9 MW of thermal power “for facility heating or water desalination”, and generates 1M of electric power. It is also designed to fit in a shipping container for ease of transport.

Radiant’s mission is to create clean alternatives to off-grid power solutions and replace all diesel power generators. Applications include military sites, disaster relief, and other off-grid use cases. With a unique engineering approach, building on the team’s experience at SpaceX, in October 2025, Radiant finalized relocating its manufacturing base to Oak Ridge, Tennessee, where it will build the world’s first mass-production nuclear microreactor factory and construct its first Kaleidos reactor on the Manhattan Project site.

Founding Story

Radiant was founded in 2020 by Doug Bernauer (CEO) and Bob Urberger (CTO).

Bernauer studied Electrical Engineering at Case Western Reserve University and later joined SpaceX as an R&D engineer in 2007. He describes SpaceX as an experience that shaped his approach to engineering and company-building as follows:

“Whenever someone asks me where I went to school, I jokingly answer, ‘SpaceX.’ It is, after all, the place I learned hands-on about the importance of execution and about meticulously testing each component, its sensors, and the software system.”

During his 12 years at SpaceX, Bernauer worked on a variety of R&D projects, including leading avionics development for the Grasshopper, the first SpaceX rocket. Bernauer then worked on a variety of ”Elon's side-projects”, including the Hyperloop and The Boring Company. One of these projects was finding the best way to generate energy for a potential SpaceX Mars colony:

“At one point, I focused on solving how we could power a colony on Mars as well as refuel ships allowing passengers to travel back and forth to Earth. I wasn't necessarily the best engineer for the job, I was simply the only engineer who recognized a design vacuum on the team and applied myself to fill it.”

At first, Bernauer focused on investigating ways to use solar power, as it is theoretically the most cost-efficient way of generating power. But he quickly realized that generating the necessary amount of power would take about “three football fields worth of solar panels”, which was an inefficient use of space. This led him to investigate other options. A colleague suggested he should simulate powering a colony with nuclear fission. In this process, Bernauer found that small modular nuclear reactors (SMRs) were a solution that didn’t suffer from many of the drawbacks of solar.

Along with several other SpaceX engineers, Bernauer built “a power model based on nuclear, [using] code to run a trade study.” Bernauer became obsessed with learning about nuclear technology and the dynamics of the nuclear market. He quickly realized that if efficient nuclear reactors could power Mars colonies, they could also provide abundant, reliable, and cheap power on Earth. He started to form the vision for Radiant as a result:

“In a world where nuclear technology is not risky, where it has a known cost and schedule to develop, every design would be optimized for its specific application. You could have reliable power for underwater research facilities, remote areas on earth, the tallest peaks of Mt. Everest, in Earth-orbiting satellites, or even power our lives on other worlds.”

Bernauer recruited several colleagues from SpaceX, including Urberger, with whom he collaborated on the Grasshopper project, to learn more about the potential applications of SMRs. The duo began collaborating with top scientists at the Argonne and Idaho National Labs, and they found SMRs as a cost-effective, climate-friendly alternative to diesel generators.

Then, in 2019, the DoD issued a call for the design of a small, portable nuclear reactor for military use that could fit in a shipping container. The pair saw this as an opportunity to commercialize their efficient SMR idea, with a stable revenue and regulatory pathway from the military. Bernauer and Urberger left SpaceX and founded Radiant the same year.

Since then, Radiant has recruited several key colleagues from SpaceX, as well as nuclear industry experts. In June 2025, Radiant announced the appointment of Dr. Rita Baranwal as its first Chief Nuclear Officer - having served as Assistant Secretary for Nuclear Energy at the United States Department of Energy (DOE) from 2019-2021 and most recently as Chief Technology Officer and Senior Vice President for the AP300 small modular reactor program at Westinghouse Electric Company.

The team they formed is experienced in both aerospace and nuclear engineering, leaning on their combined time at SpaceX, McMaster-Carr, and various leading US national laboratories and research facilities. The key hires included Roger Chin (Radiant’s Software Architect and a former SpaceX colleague), Ben Betzler (Director of Nuclear Engineering, previously a researcher at Oak Ridge National Laboratory), as well as Steve Burns (board member, former NRC Commissioner).

Product

Radiant’s flagship product is the “Kaleidos”, a portable nuclear fission microreactor capable of generating 1.9 MW of heat energy, or 1MW electric power.

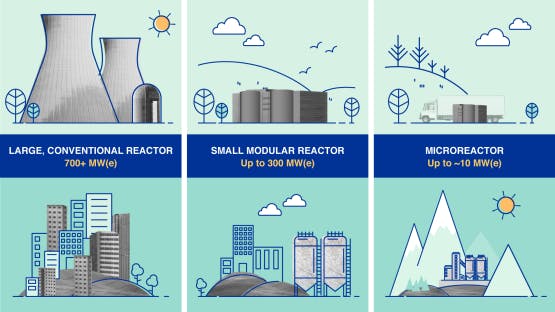

Small Modular Reactors (SMRs)

A conventional nuclear reactor in the US generates about 1K MW of power. SMRs are smaller reactors generating up to 300MW of power, using advanced technology to optimize operation. They can be thought of as safer, easier to install, and more affordable than conventional reactors. As of April 2025, China and Russia had the only operating SMRs.

Microreactors are an even smaller type of reactor, designed for mobility and speed of deployment, in addition to efficiency.

The Kaleidos

While conventional reactors are deployed at fixed locations, the Kaleidos is being built to be fully portable. As described by Bernauer, it’s designed to fit in a shipping container ”8 x 20 [feet], 9-and-a-half-feet high” that can be transported by air, ship, and road.

Bernauer has claimed that the on-site setup of the reactor will be able to be conducted overnight without relying on heavy infrastructure. Portability will therefore be the defining feature of the Kaleidos. Bernauer noted that while Radiant can build modular systems of reactors, the key to their reactors’ deployment is unprecedented mobility.

Source: Forbes

The Kaleidos will have an operating life of 20 years and will require refueling every five years. After those five years, the core of the reactors will be refueled at the Radiant factory, ensuring streamlined and secure nuclear waste management.

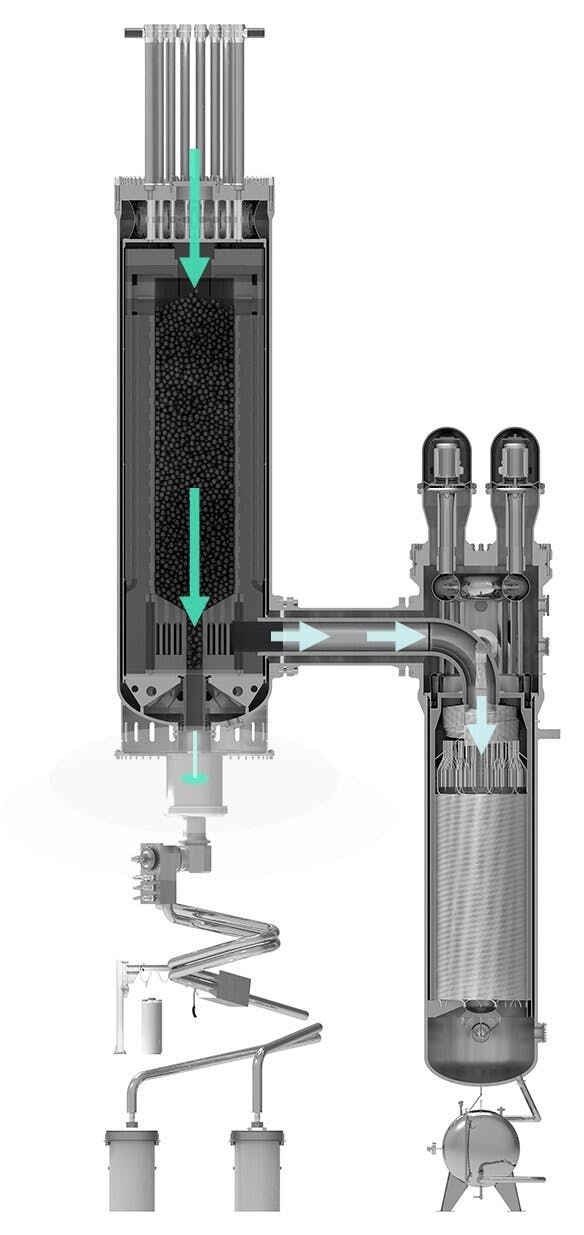

The Kaleidos is a high-temperature gas-cooled reactor (HTGR). It will use TRi-structural ISOtropic (TRISO) fuel and a helium coolant. The reactor will produce heat through a controlled fission chain reaction in a graphite-moderated core. Conventional reactor designs use a steam Rankine cycle for power conversion, using water to transfer that heat into power. Radiant opted for a CO2 closed-loop Brayton Cycle power conversion system, which will enable the use of a smaller turbine with a comparable power rating. Using helium and the Brayton cycle also eliminates the need for a constant water supply, allowing Radiant to deploy the reactor anywhere without the need for continuous maintenance.

Source: USV

Moreover, using a helium coolant reduces the risks of corrosion, building, and contamination. The helium coolant ensures heat dissipation, which will prevent a meltdown even if the reactor is suddenly shut down, improving safety. To ensure safety, the cooling system will be fully fault-tolerant, meaning “you can go and rip the chords out of it while it's running and it will try to keep running and it can handle a lot of damage before it stops itself”. This is ensured by redundancy built into the system, using techniques borrowed from the team’s experience in rocket and spacecraft design.

Autonomous Operation

A key feature of the Kaleidos is its autonomous and maintenance-free operations. This will enable Kaleidos reactors to be deployed at remote sites without continuous oversight. The reactors will be operated autonomously as a fleet by Radiant’s software platform. Operating the reactors as a fleet will allow Radiant to optimize operations through big data analytics, as Bernauer put it in a January 2023 blog post:

“Stream data from hundreds of reactors deployed all over the world, use machine learning to identify potential issues, and perform preventative maintenance when necessary.”

This approach is intended to enable operational efficiencies and streamline safety and regulatory monitoring. As of April 2024, the US had 54 operating commercial nuclear reactors at 94 nuclear power plants across the US. These lack standardization, preventing them from sharing data. Radiant hopes to drive new safety reporting standards for the whole industry, thanks to its software platform:

“So the NRC [Nuclear Regulatory Commission] already has an amazing safety record, but you could beat that by using live fleet monitoring that tells your team of nuclear engineers exactly where they need to look. And that information could also be passed on to regulators.”

TRISO Fuel

The Kaleidos will use a TRi-structural ISOtropic (TRISO) particle fuel. Each of the small TRISO particles (the size of a poppy seed) is comprised of uranium, oxygen, and carbon covered by ceramic and carbon materials.

Radiant’s fuel particles are coated in multiple layers of graphite and silicon carbide, a non-porous material that keeps all fission gases inside each pellet and prevents potential breaches. In the Kaleidos, the TRISO particles are formed into large cylinders, rather than conventional rods, further decreasing the risk of a breach. TRISO fuel is a well-tested material. As explained by Bernauer in 2020:

“We will be using a very well-established, extensively tested fuel, that’s already had hundreds of million of dollars of DOE testing. We are taking what exists now and making it purely able to compete on cost.”

Engineering Approach

Source: Radiant

Radiant is focused on developing one reactor design as quickly as possible. Drawing from SpaceX’s development process, a key factor in Radiant’s engineering process is proprietary digital twin technology. This is developed in-house and customized to its processes. The digital twin software, which the company calls SimEngine, fuses reactor digital twins with aerospace-derived hardware and simulators across a range of operating conditions.

This SimEngine can couple software with physical components, allowing Radiant to test how a different physical design of a component (a physical prototype) will interact with the whole reactor, as well as foresee any potential failures. The company claims this to be the “first-of-its-kind” approach in the nuclear industry.

Market

Customer

The Kaleidos is designed to be a sustainable alternative for any customer using diesel generators. One fuel load of the Kaleidos (lasting about five years) will allow customers to eliminate the need for about four tons of diesel fuel. Consequently, each Kaleidos will offset about 22K tons of diesel fuel and associated CO2 emissions. In October 2023, Bernauer, the CEO of Radiant, explained:

“Essentially anywhere diesel is used today, we can do this by factory constructing and transporting to site, also bringing back the nuclear waste to handle at a centralized refueling facility.”

One key customer of Radiant may be the US military. Remote military bases are dependent on a stable, reliable supply of power. They currently rely on diesel generators, which create major logistical challenges. Generators require constant land shipments of fuel, which adds significant operating costs and security risks.

A 2018 US Army report estimated that over nine years during the Iraqi Freedom and Enduring Freedom operations, about half of the 36K casualties occurred from hostile attacks during land-transport missions, including refueling missions. Each Kaleidos could save the army over 22K tons of diesel fuel that won’t need to be transported.

After awarding Radiant a grant in 2023, the Department of Defence’s (DoD) Operational Energy Capability Improvement Fund (OECIF) also sees the potential in battlefield applications:

“This [is] an opportunity for developing advanced energy conversion methods that can be applicable to warfighters of the modern era and the rapidly evolving energy landscape of the battlefield.”

Developments that reinforce Radiant’s customer credibility include its selection by the US DOE in April 2025 to receive high-assay low-enriched uranium (HALEU) fuel for its first Kaleidos test, signalling both governmental confidence and nearer-term deployment timelines. In August 2025, Radiant entered into a deal to deliver Kaleidos microreactors to the US Air Force under the Advanced Nuclear Power for Installations (ANPI) program, with a goal of delivery within 36 months and “plug-in, power on in 48 hours” capability.

Other use cases for potential future customers of Radiant include communities, municipalities, research centers, or data centers looking for remote power, disaster relief, or micro-grids.

Remote Power Generation: Remote areas and communities separated from the electricity grid, such as research centers, face challenges similar to military bases. They also need a stable, reliable supply of power (particularly in harsh environments like Antarctica) and face the same logistical challenges as army bases, with receiving constant fuel shipments in adverse circumstances.

Disaster Relief: Many disasters cut large areas off from the electric grid. In case of sudden disasters like hurricanes or earthquakes, the Kaleidos’s fast set-up speed could make it a suitable replacement for diesel generators in supplying areas that have lost power. In slow-moving crises, like droughts, the Kaleidos can provide over 1.9MW of thermal power for heating or desalination in addition to generating electricity.

Micro-Grids: Long-term applications of Radiant’s technology might include modular reactor systems to power small electricity grids. The electricity grid faces significant long-distance transmission pressures from renewable energy generation. The future of the grid may be a decentralized network of small, local grids. A modular system of Kaleidos reactors could be well-suited for powering such microgrids or providing backup power to complement renewables. The Kaleidos could also be well-suited for decarbonizing energy-intensive industrial and manufacturing processes, with cost-effective power.

Transport Applications: Radiant’s reactors could also see applications such as powering charging stations along highways, as well as powering propulsion systems such as spacecraft.

Market Size

As of 2025, it was estimated that there were around 100 million diesel generators in use around the world. The market for diesel generators remains sizable but has been rising faster than older estimates suggested. Market research places the global diesel-generator market at about $25.3 billion in 2025, up from an estimated $15.8 billion in 2024, with forecasts showing growth to roughly $34.6 billion by 2030, representing a 6.5% CAGR. Despite the global shift toward renewable energy, diesel generators remain essential in industries and regions where reliable grid power is lacking — particularly across the Asia-Pacific region, which accounts for nearly half the global demand. Replacing those diesel generators is the immediate addressable market for the Kaleidos.

In the long term, Radiant’s market potential might include other power generation applications. Energy consultants Wood Mackenzie have noted that:

“Off-grid deployments will take an increasingly larger bite out of present and future power demand on the grid, particularly where systems and incomes are large enough to support modular system upgrades over time.”

For the first time, renewable energy has overtaken coal as the primary source of electricity. However, global electricity demand is expected to increase by 60% between 2024 and 2040, from around 30K TWh in 2024 to around 48K TWh in 2040. The International Energy Agency estimates that over 70% of this new energy capacity, or over 12 TWh, will need to be delivered by off-grid solutions. Assuming the average price of energy in renewable energy PPEs of $50 per MWh, this would give Radiant a potential TAM of over $600 billion.

Competition

Small Modular Reactor (SMR) Developers

X-Energy: X-Energy is an SMR development company founded in 2009. X-Energy is developing a gas-cooled microreactor using TRISO fuel, using a proprietary nuclear fuel technology called TRISO-X. It is targeting industrial use cases and secured a joint development agreement with Dow to demonstrate “the first grid-scale advanced nuclear reactor for an industrial site in North America”.

Source: X-Energy

The company has raised a total of $1 billion in funding as of October 2025. In March 2025, it raised $22.8 million in a private equity round and, in October 2024, raised a $700 million Series C anchored by Amazon.com, Inc.’s (“Amazon”) Climate Pledge Fund. In late 2023, the company called off a SPAC with Ares Management Corporation, which would have valued it at $1.8 billion.

Oklo: Oklo is a nuclear technology startup founded in 2013 that went public via a merger with Sam Altman's AltC Acquisition Corp in May 2024. Oklo is pursuing a "fast fission" design for its Aurora Powerhouse, a modular nuclear reactor with upwards of 75 megawatts of power generation. In September 2025, the company held a groundbreaking ceremony for its first Aurora Powerhouse SMR. In June 2025, Oklo completed a $400 million public stock offering at $60 per share. As of October 2025, Oklo has a market cap of $14.4 billion but generates zero revenue and is still awaiting NRC approval before it can begin construction.

Source: Oklo

Saltfoss Energy: Saltfoss Energy is an offshore SMR developer founded in 2014. Seaborg is developing low-enriched-uranium microreactors to float on offshore barges to reduce nuclear safety risks. It’s planning a modular system connected to the electricity grid, with each barge having one SMR producing up to 800MW of electricity with a lifetime of 24 years. The company is planning to produce commercial prototypes of its reactor by 2024, with serial production in 2026, and has secured a letter of intent from Norwegian national utilities to investigate using its reactors.

Source: Seaborg Technologies

Saltfoss Energy has raised total funding of $52 million. In February 2025, it raised $28 million in Convertible Debt, and in 2020, raised a Series A, estimated at around $20 million from an undisclosed group of investors at an undisclosed valuation.

Last Energy: Last Energy is an SMR developer founded in 2020. Last Energy is developing a 20MW pressurized water microreactor and is focused on efficiently “packaging” conventional nuclear technologies to offer attractive unit economics. It uses mostly off-the-shelf parts with modular construction, intended to keep engineering costs low. Commercial traction has accelerated: Last Energy now reports agreements for 80 microreactor units across Europe, up from 51 as of October 2023, with 39 units contracted to power data centers and the remainder focused on heavy industrial customers in Poland, Romania, and the Netherlands. The company had raised a total of $64 million as of November 2025, with Gigafund leading its Series B funding round of $40 million in August 2024.

Source: Last Energy

NuScale Power: NuScale is an SMR company founded in 2007. NuScale developed the first SMR certified by the NRC. The company is planning to begin operating a reactor in Idaho by 2030. It announced a deal to supply Standard Power with 1.8MW of power using 24 SMRs to power two data centers. However, the viability of the deal has been called into question. It is a public company with a market cap of $5.9 billion as of November 2025.

Source: Business Wire

Incumbents

Westinghouse Electric Company: Westinghouse Electric Company is owned by Brookfield Business Partners. The Canadian company is a leader in the nuclear development industry and has developed the Vogtle plant Units 3 and 4, a conventional nuclear reactor project in the US. As of April 2024, the company is developing the Westinghouse AP300 SMR and is planning to begin commercial operation in the early 2030s. Westinghouse secured an agreement with Community Nuclear Power to deploy the Westinghouse AP300 in the UK. In March 2025, Westinghouse signed an MOU with Data4, a European data center operator, to explore deploying AP300 reactors to power future data centers in Europe.

Rolls-Royce: Rolls-Royce has an SMR division, which is part of the Rolls-Royce conglomerate. In June 2025, Rolls-Royce SMR was selected as the preferred bidder by Great British Energy - Nuclear (formerly Great British Nuclear) to build the UK's first small modular reactors following a two-year competition. The UK government pledged over £2.5 billion for the overall SMR program, with contracts expected to be signed later in 2025 and projects connecting to the grid in the mid-2030s.

Business Model

The company is most likely to use the price-purchase agreement (PPE) model used by most other SMR developers, as well as most renewable energy projects. PPEs are contractual commitments from customers, such as military bases, data-center operators, and disaster-response contractors, to purchase a certain amount of electricity at a certain price.

Last Energy, a Radiant competitor that uses a PPE model, is estimated to charge its customers between $130 $200 per megawatt-hour of generated energy for its most lucrative agreements. This is more than most renewable energy sources, with solar PPE rates often as low as $50 per megawatt-hour. Nuclear costs, however, are expected to come down rapidly as the technology matures.

Traction

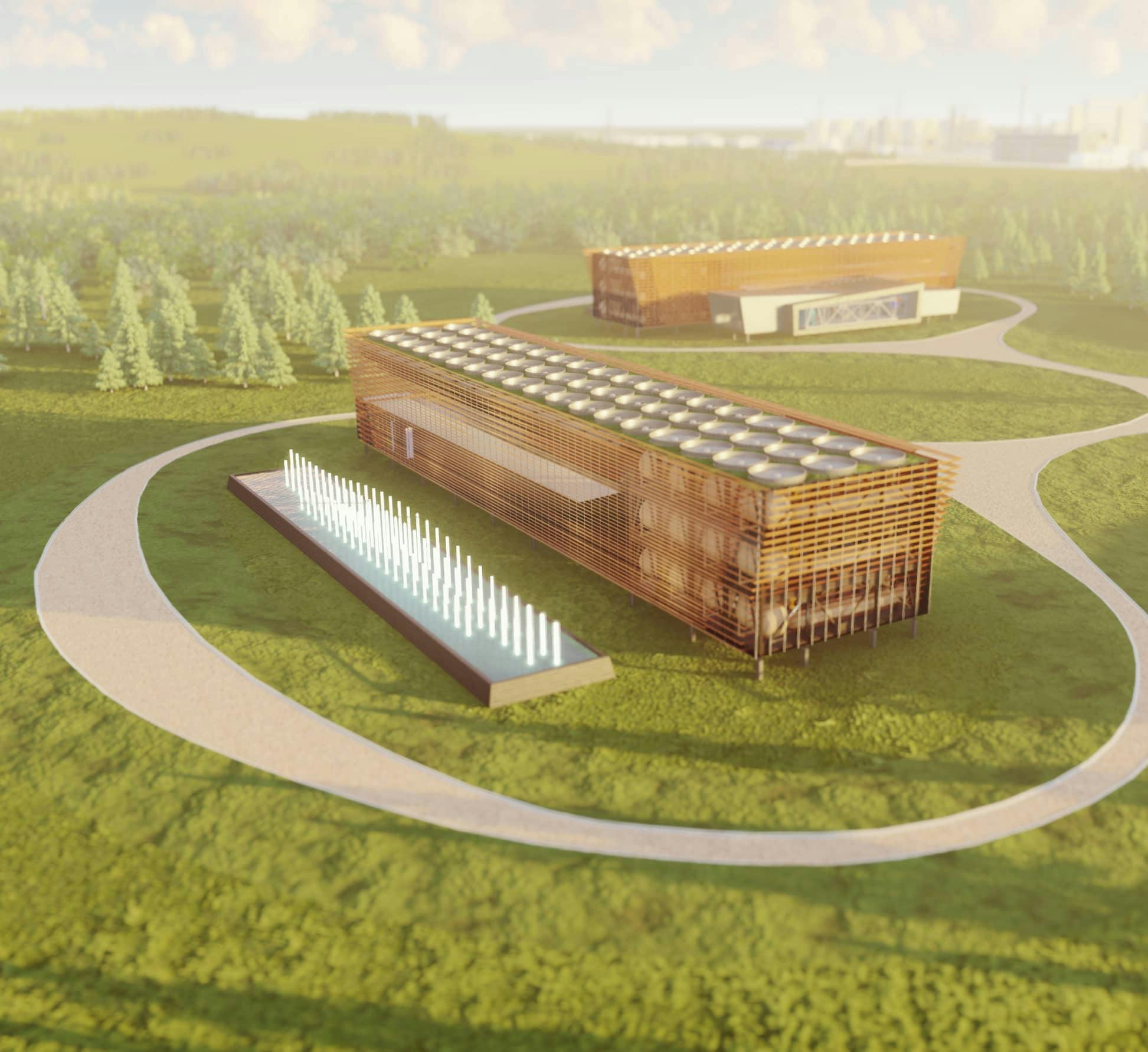

Radiant Nuclear confirmed in September 2025 that the first operational Kaleidos unit will undergo prototype testing in early 2026 under a DOE demonstration agreement at Oak Ridge National Laboratory, marking a key pre-commercial milestone before scaled manufacturing.

As of October 2025, Radiant has transitioned from its R&D phase into active pre-commercial operations, with its manufacturing base now relocated to Oak Ridge, Tennessee, where it is constructing the world’s first mass‑production microreactor factory, the R‑50 facility. The $280 million investment is scheduled to begin in early 2026, positioning Radiant to deliver its first mass-produced Kaleidos units by 2028, scaling to approximately 50 reactors per year. In November 2025, Radiant submitted a DEO Authorization Request for Kaleidos, a milestone on the way to the 2026 build.

Radiant has also begun establishing initial commercial traction. The company signed a DoD agreement in August 2025 to deliver its first military‑grade Kaleidos reactor by 2028, which will provide resilient off‑grid power at a US base. Furthermore, Radiant secured its first commercial preorder with Equinix, a major data‑center operator for 20 Kaleidos units - a signal of early private‑sector adoption.

Radiant continues to follow an “anti-stealth” philosophy, and the team is very transparent with the roadmap and milestones towards commercialization. As explained by Bernauer in October 2023:

“We have proposed to test a full-scale microreactor at 3.5MWt for 150 hours continuously. The test will provide controlled conditions, well-trained staff, proximity to waste storage and test facilities, including a hot cell that overall reduces the risk to test a first-of-a-kind.”

Bernauer elaborated that the test will produce data “with real rather than simulated fuel, and proof of operations of all safety-critical components, allowing for reduced uncertainty in licensing for commercial units.”

The US DOE has awarded a combined $5 million to Radiant and Westinghouse to advance their microreactor designs for testing at Idaho National Laboratory’s new Demonstration of Microreactor Experiments (DOME) test bed. The funding will support the Detailed Engineering and Experiment Planning (DEEP) phase, a key step in the DOE’s multiphase process to help reactor developers prepare for the design, fabrication, construction, and testing of fueled microreactor systems.

Radiant also secured a number of collaborations with research and government agencies. In 2023, the company received a voucher from DOE’s ANL Laboratory. This award will give Radiant access to research capabilities and expertise at ANL, including work on numerical modeling of heat production and removal.

In 2023, the company received a Small Business Innovation Research award from the DoD. As a part of that partnership, Radiant will develop base modeling and simulation capabilities for key energy resilience scenarios at Hill Air Force Base. Radiant and Hill AFB will simulate how Kaleidos reactors would provide critical heat and power alongside the base’s system of existing generators, proving the viability of its reactors for the military.

Valuation

As of November 2025, Radiant has raised a total of $218.8 million in funding. Notable investors include StepStone, Giant Ventures, Hanwha Asset Management Venture Fund, SGA, Crossbeam Venture Partners, and Align Ventures. In November 2024, it raised $165 million in Series C funding at an undisclosed valuation. Previous investors include Andreessen Horowitz (who led their $40 million April 2023 Series B), Founders Fund, and Decisive Point. The company will use the funds for the 2026 first test of Kaleidos.

Radiant has received significant government funding to advance its microreactor technology. In November 2024, the US DOE awarded a combined $5 million to Radiant and Westinghouse to advance their microreactor designs for testing at Idaho National Laboratory's new DOM test bed, supporting the DEEP phase.

In 2023, Radiant also received $3.8 million award from the Office of the Under Secretary of Defense’s Operational Energy Capability Improvement Fund (OECIF). Radiant’s work with the OECIF includes delivering a compact CO2 cycle turbine-alternator-compresor to shrink the footprint of battlefield power solutions.

For comparison, NuScale, a publicly-traded SMR developer, was trading at around 79x revenue multiple as of October 2025.

Source: Koyfin

Key Opportunities

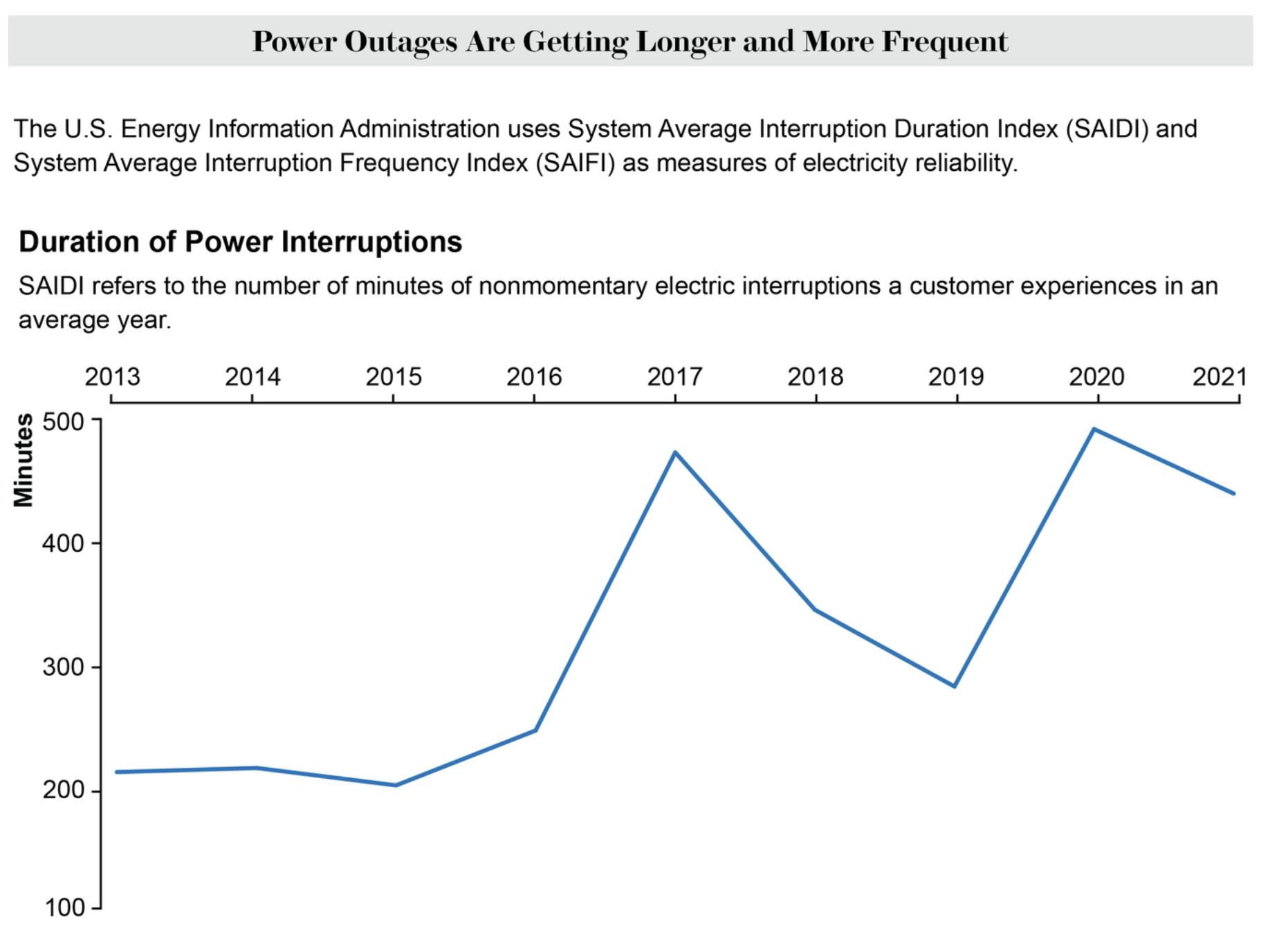

Grid Outages

Grid outages are becoming increasingly frequent, and blackouts are longer lasting. A July 2025 report by the US DOE warned that if current trends in generation retirements and lagging firm-capacity additions continue, some US regions could face more than 800 hours of outage per year by 2030 (more than 100× increase over “single-digit” hours today). Between 2013 and 2021, the number of minutes of grid outage per customer in the US increased from about 210 minutes to over 400 minutes on average.

Source: Scientific American

Radiant’s microreactor design is specifically designed for deployment as a backup, emergency power system during a grid outage or natural disaster. Its rapid deployment, portability, and modularity make it perfectly suited to address such crises, as a reliable replacement for traditional backup generators. The increasing number of extreme weather events will likely increase the demand for a reliable power solution like the Kaleidos. The U.S. power grid is under strain, with 83% of outages attributed to weather events and weather-related causes becoming much more frequent compared to a decade ago. Outages — in terms of duration, frequency, and geographic scope — have worsened by roughly 20% each year since 2019.

Military Modernisation

The US military is increasingly recognizing a need to adapt technology to increase innovation and resilience. Geopolitical tensions and conflicts have highlighted the importance of modern technology in military applications, and companies like Anduril are paving the way for military cooperation with innovative startups. Venture funding for US-based defense tech startups totaled approximately $38 billion through the first half of 2025. More than $100 billion of private capital was invested in US defense-tech startups by 2023, tripling figures from 2016.

Radiant’s microreactor technology is well-suited for military applications, such as remote bases or military vehicles, to increase energy security and resilience. The Kaleidos’s 20-year operating lifespan and maintenance-free operations make it an attractive alternative to diesel generators in sensitive applications. The DoD has specifically expanded trial contracts and SBIR grants to advanced nuclear power solutions for remote installations and mobile operations. Radiant received an SBIR award from the DoD and has active partnerships with the DoD’s Defense Innovation Unit and the Air Force as part of the Advanced Nuclear Power for Installations Program. Representatives from the OECIF have recognized the potential of Radiant’s technology to be applied on the battlefield.

Regulatory Catalysts

In 2025, six-in-ten Americans said they support nuclear power, compared to just 43% in 2020. This shift in public opinion has been reflected in government policy. The Inflation Reduction Act (IRA) created a number of incentives for nuclear companies. This includes tax credits for nuclear power companies as zero-carbon energy sources.

Through four major executive orders issued in May 2025, the Trump administration set the goal of quadrupling US nuclear generating capacity by 2050 and required the Nuclear Regulatory Commission (NRC) to modernize and streamline its licensing process. Simultaneously, the DOE and DoD received greater authority to conduct fast-tracked reactor testing and to leverage DOE review findings for expedited NRC approval, especially for demonstration projects at federal sites. The Trump Administration’s One Big Beautiful Bill, passed in July 2025, added tax incentives for nuclear, including a new “nuclear energy community” tax credit and future eligibility for master limited partnerships.

In February 2024, Congress also approved bipartisan legislation to speed up environmental reviews of nuclear reactors, limit liability for accidents, and streamline the licensing process. The NRC is also recognizing the need for nuclear innovation and taking steps to significantly simplify the licensing of SMRs. The regulator created dedicated review teams for advanced reactors and “engaged with the nuclear industry to develop a technology-inclusive, risk-informed, and performance-based approach for assessing advanced reactor applications."

These changes could make it significantly easier for advanced nuclear companies, like Radiant, to gain necessary regulatory approvals and find suitable financing schemes for developing commercial projects.

Key Risks

Regulatory Obstacles

Despite sweeping federal reforms in 2025, regulatory processes—especially at the state and local level—remain complex and potentially obstructive for new nuclear deployments. Radiant’s abrupt withdrawal from its Wyoming project in 2025, due to political and community opposition, demonstrates the ongoing risk posed by inconsistent policy, local activism, and evolving standards around nuclear siting and safety. Additionally, broader macro risks—such as changes in energy policy due to elections or global crises, and supply chain instability—could raise barriers, increase costs, or jeopardize deployment schedules. Public acceptance is not guaranteed, as legacy concerns about nuclear safety and waste disposal persist, posing long-term challenges for widespread adoption regardless of technical merits.

However, the safety risks of Radiant’s reactor designs have been estimated to be relatively low for a new, advanced reactor design. Todd Allen, from the University of Michigan, has compared the safety risk of Radiant’s design to the risk of the miniature reactors used by universities across the US for teaching and research purposes.

Radiant’s team also developed a novel reporting mechanism that could help streamline its approval process thanks to additional transparency measures. Using its fleet-management software, the company will be able to collect detailed data and continuously report the performance of its microreactors to the regulators. Such novel safety monitoring capabilities could give the NRC more confidence to approve Radiant’s designs on its tight commercialization timeline.

Technological Risks

As Radiant is developing an advanced reactor design, there are inherent technological risks involved. The company has not yet tested its reactor designs using nuclear fuel. However, the technological risks could be mitigated by relying on proven technology and a transparent development process. As explained by Bernauer, Radiant works in “anti-stealth” as a reaction to the stories of hardware companies like Theranos. Both the HTGR reactor type and the TRISO used by Radiant have been operational in reactors for over 50 years. Its digital-twin engineering approach should also make the company’s design predictable in silico. In November 2024, Radiant moved into the DEEP phase, continuing their ongoing work to complete the final design of the Kaleidos microreactor, submit required environmental and safety documentation, and initiate long lead procurement of key reactor systems. These steps will prepare the reactor for future testing at the DOME facility.

Nevertheless, a risk of Radiant not delivering on its ambitious development timeline remains. There are also risks of the Kaleidos not delivering the desired unit economics, making commercialization unviable. Last Energy, one of Radiant’s competitors developing advanced reactors, estimated the cost of its energy at $130 to $200 per megawatt-hour. This is significantly more than the cost of solar power, the most cost-efficient option, which can be as little as $50 per megawatt-hour. An inability to deliver the planned efficiency savings could compromise the commercialization of Radiant’s technology.

Market Adoption and Cost Competitiveness

The market reception for advanced nuclear microreactors remains uncertain, especially as cost competitiveness pressures intensify. Although demand for reliable, resilient power is rising, Radiant must prove that its total cost of ownership and unit economics can compete with renewable energy and established backup generation technologies. Reports from other advanced reactor projects suggest that achieving parity or advantage over solar, wind, or battery storage remains challenging, with recent peer offerings still priced significantly higher per megawatt-hour than leading renewables. If Radiant’s microreactor cannot demonstrate meaningful price competitiveness once deployed, utilities, industry, and public sector buyers may hesitate to commit, limiting market penetration.

Summary

Growing demand for reliable, always-on power is creating an opening for nuclear innovation, particularly as AI data centers and remote infrastructure push beyond what intermittent renewables can deliver. Radiant Nuclear, founded by former SpaceX engineers, is developing portable microreactors designed to replace diesel generators in military bases, disaster zones, and off-grid sites where power disruptions aren't tolerable. With a manufacturing facility under construction in Tennessee, the company has moved from R&D into pre-commercial deployment—securing a 2028 DoD delivery contract and a 20-unit preorder from Equinix. Radiant's first fueled prototype test is scheduled for early 2026, with mass production targeted to begin in 2028 at a planned capacity of 50 reactors per year. The success of its technology will depend on the company’s ability to gain regulatory approvals, deliver on its development milestones, and maintain cost efficiency.