Thesis

Environmental concern and the decreasing cost of solar power has driven a boom in solar installations. Some countries have set goals to derive 50%+ of their power from solar, and ~$9 billion was spent in 2020 for new and retrofitted solar power installations. While the demand for solar has risen dramatically the complexity of solar installations remains.

Aurora Solar has emerged as a market leader in solar design software. Aurora Solar helps automate the design and proposal process for solar projects in order to reduce costs and increase sales. Inefficient processes in the average solar project increase costs by ~$7K. Aurora Solar not only decreases that costly complexity by streamlining the project, but also increases revenue opportunities by decreasing the average sales time for a solar project by days.

Solar software represents a $3 billion TAM in the US and is expected to grow to $19 billion by 2025. As of September 2022, 10 million residential and commercial projects used Aurora Solar and this number climbs by 100K every week. The increasing demand for solar power and the slim margins for these projects creates an opportunity for Aurora Solar to continue to increase efficiency in the market.

Founding Story

The founders of Aurora Solar, Christopher Hopper (CEO) and Samuel Adeyemi (CRO), met at Stanford. Both went to Stanford with an interest in solar power. Samuel grew up in Kenya, where he saw people living without electricity. While in Kenya, he developed ideas for using solar power to improve rural communities. Christopher led a team of engineering students building solar projects in rural Rwanda. His electrical engineering background, and Samuel’s work in finance, gave them complementary skill sets.

While studying at Stanford, the pair began working on a solar installation project for a school in Nairobi, Kenya. After witnessing firsthand the challenges of going from design to installation, they decided not to continue working on these smaller projects and instead tackle a larger problem. Frustration with their own project stemmed from discrepancies between the design and the final solar installation. After some brainstorming, they came up with the idea for Aurora Solar.

Product

Aurora Solar streamlines designing, proposing, and selling solar installations for solar project developers. The company focuses on serving the rooftop solar market, but it also serves commercial customers.

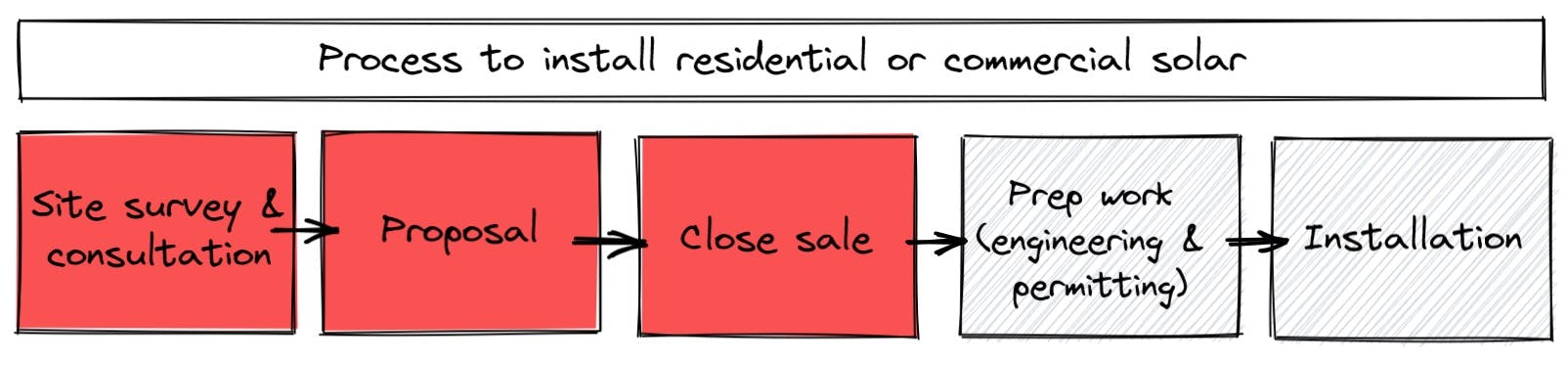

Source: Contrary Research

Without Aurora Solar, residential solar design and sales are manual processes. Contractors measure rooftops on-site, send off the measurements to draft solar installation designs based on rooftop measurements, and then create a final proposal for solar installation.

Often, the manual design process produces differences between the design and installation. An inefficient design and installation can often cost up to half of the total cost of a project. Sometimes, a week's delay increases cancellations by 5-10%. By using Aurora Solar, solar developers can avoid cancellations and reduce costs.

Aurora Solar uses satellites, LiDAR, and data analytics to survey installation sites. The company’s software designs proposals for rooftop solar installations in ~15 minutes. By using Aurora Solar, solar developers reduce the required resources for project completion.

Aurora Solar offers rooftop measurements, rooftop eligibility assessments, and solar design automation. The company remotely measures rooftops using data from satellite images and LiDAR. It also estimates the power generation and cost-saving potential installations. Homeowners use Aurora Solar’s software to see how installed solar panels would look and to estimate electricity production and cost savings.

Aurora Solar’s products offer three primary benefits for the solar industry: (1) Tools for quicker, more accurate design of solar installations, (2) Virtually showing customers solar installations on their house, estimating power production, and cost-savings, and (3) Simulations for reducing change orders and assuring final installations are as expected.

3D Modeling Software

Aurora Solar’s first product was 3D modeling simulation software for solar designers. The product served residential solar designers creating model rooftop projects designed with Aurora Solar. The company's success with solar modeling software allowed it to train a simulation engine while earning revenue. Its simulation engine is trained to generate accurate, realistic solar designs automatically. The company then developed storage and energy efficiency systems to complement its software.

AI Sales Model

After success with modeling and simulation software, Aurora Solar made Sales Mode, a product built on top of their simulation engine for closing rooftop solar deals. The company's customer base grew by introducing Sales Mode to serve solar sales teams.

Aurora Solar claims its software reduces the number of change orders by ~30%. Reducing the number of changes cut installation lead times and costs for installers. That frees solar installers to unlock the pent-up demand for residential solar.

Sales Mode launched right as the COVID-19 pandemic began. Lockdowns and work-from-home policies forced solar installers to start virtual sales. Aurora Solar experienced unexpected growth due to pandemic-induced market opportunities using Sales Mode. Many installers began using Aurora Solar for their virtual sales teams during the pandemic.

Market

Market Size and Tailwinds

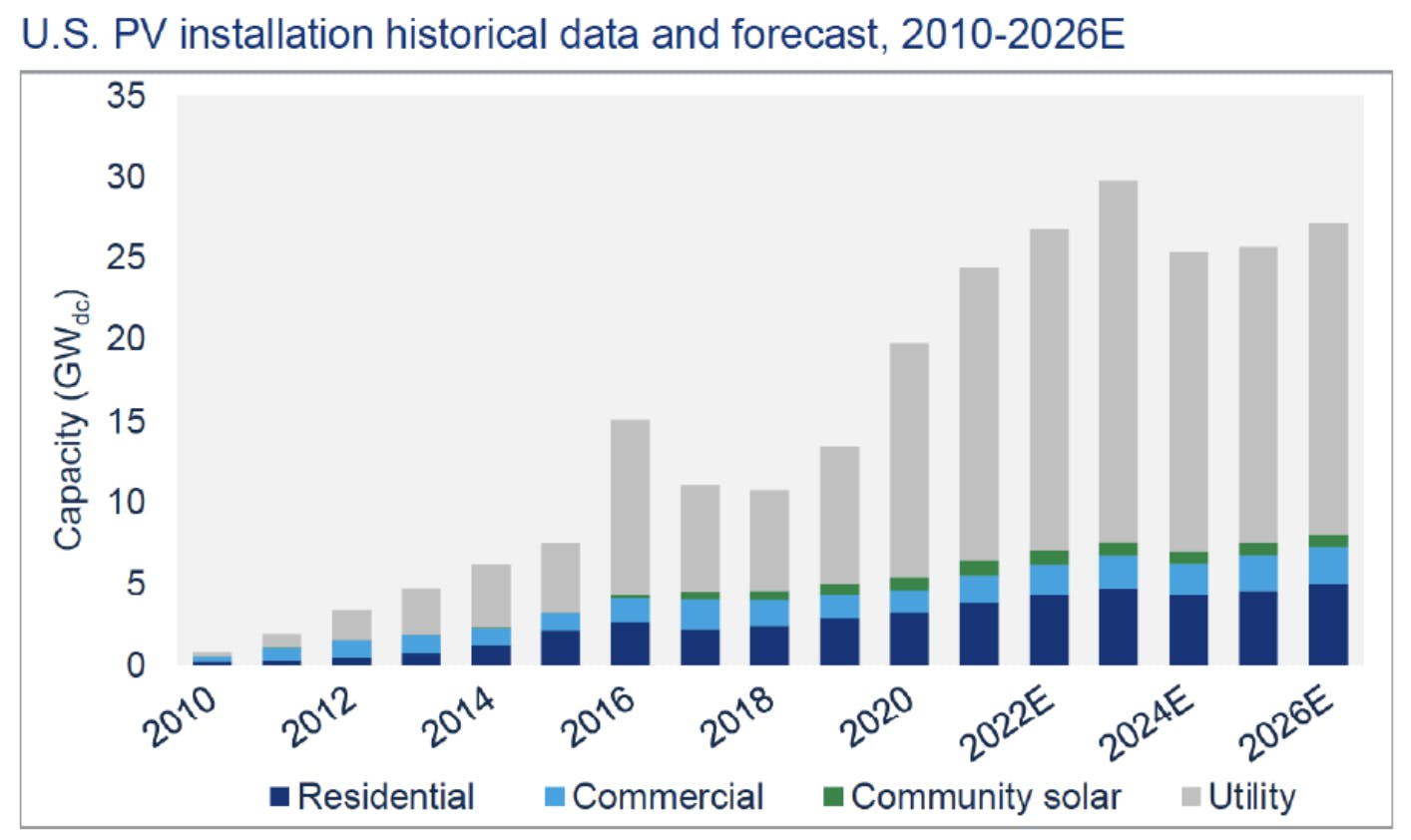

Since 2013, Aurora Solar has ridden the tailwinds of declining costs for solar photovoltaic (PV) systems. Lower costs boosted residential, commercial, and utility-scale solar installations. Costs decreased for residential (64%), commercial (69%), and utility-scale (82%) solar installations from 2010 to 2020, while residential and commercial capacity grew by over ~600%.

Until 2023, Aurora Solar focused solely on the U.S. market which, over the last decade, has experienced growth in PV installations due to declining solar PV costs. In February 2023, Aurora Solar announced incorporation and expansion to Ontario Canada.

Source: SEIA

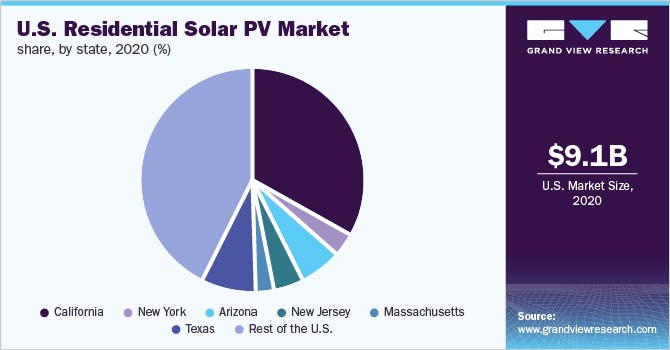

More than 3 GW of residential solar was installed in 2020, representing ~10% growth since 2019. That 3 GW of solar installations translates to a market size of roughly $9.1 billion for residential solar in the U.S. Due to policies promoting solar power, like net metering, most solar installations are in California and New York. California’s political tailwinds underscore why Aurora Solar benefitted from starting in California.

Customer

Aurora Solar built its initial product focused on rooftop solar installers. The company’s early customers were SMB installers working with residential solar, largely focused in California. Favorable regulation drove a rooftop solar boom in the 2010s.

SMB solar installers are a fragmented customer base but sales cycles are shorter, and barriers to entry are lower than selling to enterprise customers. SMBs have fewer resources to measure and design installations, meaning they likely experience longer timelines from initial measuring to final installation. Given Aurora Solar's value proposition to reduce soft costs and streamline the painstaking process of designing installations, SMBs can more fully benefit from the company's platform.

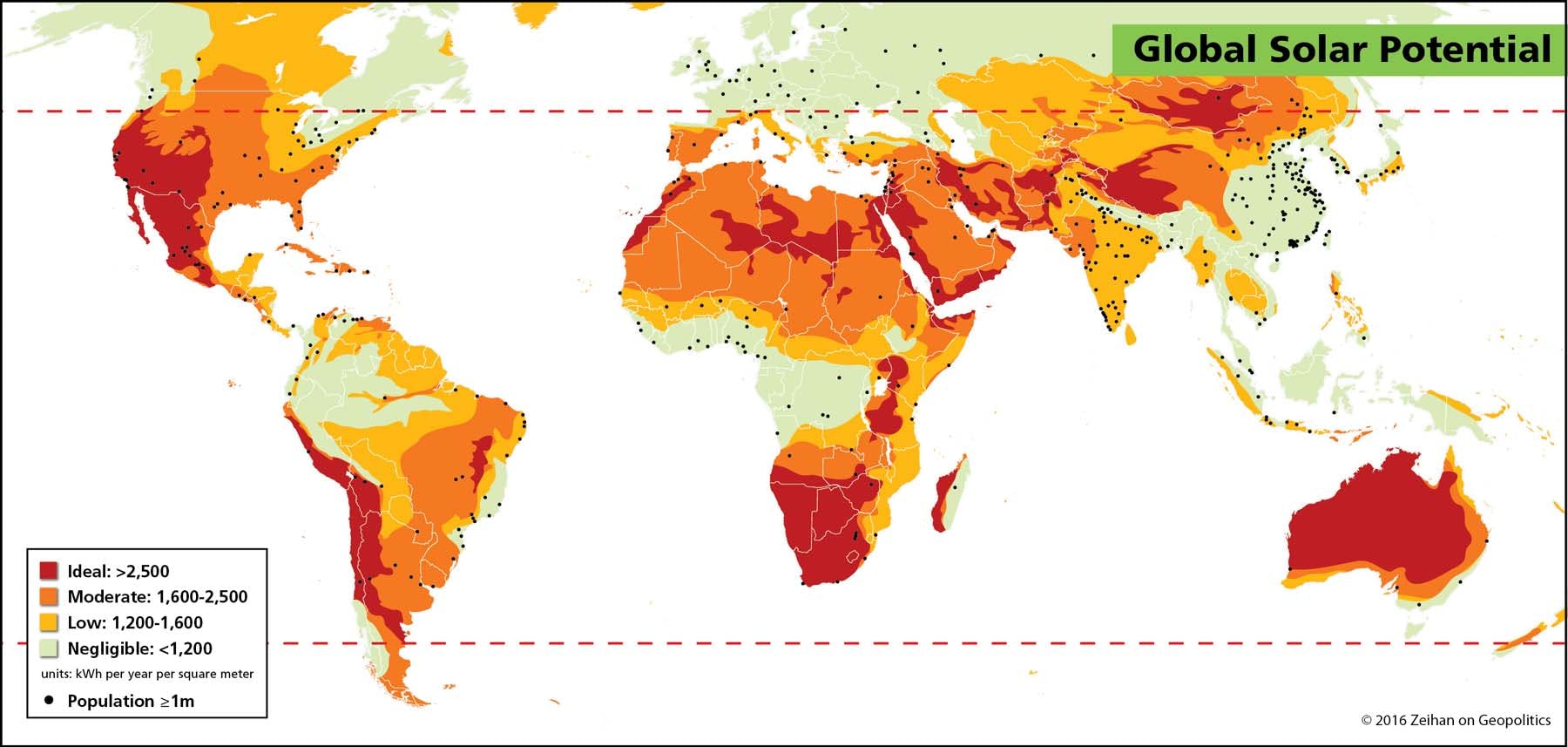

Aurora has begun selling to enterprise solar installers, though still focused on serving US and Canadian residential solar projects. In 2021, the global market size for Solar PV Panels was around $146 billion, with over half of that coming from residential projects. Not only is there a sizable opportunity to expand outside residential projects but globally there are a number of markets that represent significant solar potential.

Source: Zeihan

Competition

Two notable startups are Solargraf and Opensolar. Customers use Solargraf to compare financing options, manage client relationships, and sell solar. Opensolar provides free, end-to-end solar design attractive to Startups and SMBs. However, both are relatively early compared to Aurora Solar. The competitive landscape is still nascent in terms of who will ultimately win out given how much penetration there is still left to win in this market.

Business Model

Aurora Solar generates revenue through a standard SaaS model, charging monthly or annual fees. Aurora Solar’s SaaS model contrasts with solar installers like Sunrun. Sunrun is a company financing and installing rooftop solar with high, asset-heavy, upfront costs. From 2019 to 2022, Aurora Solar’s asset-light business model allowed them to experience venture-scale growth. Declining hardware costs, financial incentives, and green energy demand contributed to Aurora Solar’s growth.

Traction

Aurora’s installed projects grew from 1.5 million projects in 2019 to 7.5 million by the time of its Series D in 2022 and 10 million only 7 months later. Annual revenue has surpassed $100 million and is growing at over 50% yearly.

The company’s list of enterprise customer logos includes leading residential and commercial solar contractors in the U.S. like SunPower, Black & Veatch, and Momentum Solar. In fact, 90% of the top 100 US Residential solar installers were customers of Aurora Solar as of 2023.

Key Opportunities

International Expansion

International expansion is likely a key part of Aurora Solar’s growth long term. Following an already-announced expansion to Canada, developments in Europe make it a natural next step for Aurora Solar’s expansion. The Russia-Ukraine conflict is pushing EU countries to decrease Russian oil consumption. In response, the European Commission hopes to ramp up residential and commercial solar installations. European support will allow Aurora Solar to expand internationally given they already have LiDAR coverage.

There are also opportunities to use customers with global reach to expand internationally. Black & Veatch, for example, is an international, multi-billion dollar engineering services and construction company with a market well beyond just solar installations and could be a wedge for Aurora Solar to expand with those existing customers into other international markets.

Beyond Residential

Those same large enterprise customers like Black & Veatch could help Aurora Solar expand into the commercial and industrial market. Aurora Solar could also enter utility-scale solar as well, increasing its potential market by serving enterprise customers.

Platform Expansion

Aurora Solar’s service may become a platform for automating more aspects of the solar proposal and sales process. They could offer permitting or loan origination. Permitting is a key “soft cost” increasing lead times and reducing sales conversions for developers.

By expanding its platform to include more permit processing as part of the automated design process, Aurora Solar can further reduce costs and become a sticky one-stop shop for customers.

Key Risks

Regulation

Regulation around residential and commercial PV pricing remains the largest threat to Aurora Solar’s growth. As of July 2022, various state and federal tax credits support solar installations and can cover up to 30% of installation costs. In 2022 policymakers are expecting to extend solar tax credits. However, changing administrations and policies could eliminate tax credits, dampening solar demand.

Supply Chain

From 2008-2013, China’s investment and manufacturing decreased solar panel costs by 80%, making China the dominant global supplier. The U.S.-China trade war implemented high tariffs on Chinese goods. Solar panel manufacturing moved to other Southeast Asian countries in response to tariffs. While Southeast Asian countries supply 80% of solar panels in the US as of May 2022, there are concerns that those countries are working in collaboration with China which could again impact the cost of solar panels by as much as 250%.

Delays Leading to Cancellations and Layoffs

The probe into Southeast Asian producers led to canceled projects, project delays, and developer layoffs in Q2 2022. If the number of developers and projects falls, so does the demand for Aurora Solar’s services. Lower demand may not lead to Aurora Solar’s collapse, but it may reduce its market and revenue projections.

Valuation

Aurora Solar raised its Series D in February 2022 at a $4 billion post-money valuation. Some investors compare Aurora Solar’s model favorably with more asset-intense solar players like Sunrun. Sunrun took seven years after its Series A to IPO at a nearly $1 billion valuation in 2015.

Looking at Sunrun as a case study, it is clear the impact that the regulatory environment can have on companies tied to the solar industry. After its IPO, Sunrun traded up to nearly $20 billion in market cap in early 2021 before plummeting to ~$10 billion within 6 months after concerns of rising interest rates affecting its financing business. The stock then dropped again towards the end of 2021 to ~$5 billion in market cap. The latest drop was driven by concerns over “proposed changes to California's Net Energy Metering Program could drastically increase costs for consumers and eliminate ‘tens of thousands of jobs.’” This change could be particularly impactful to Sunrun given ~35% to 40% of its installations are in California.

There are some similarities and differences between Aurora Solar’s business and Sunrun’s. The threat of increased capital costs for financing projects doesn’t impact Aurora Solar’s asset-light business. The regulatory environment, however, is very real. Aurora Solar also has a large portion of its business in California and will be impacted by these same laws.

Summary

As a first mover in solar design software, the company has been able to take a lead in leveraging data and automation to improve the experience in this space. The business can continue to execute as it gathers more data (e.g., expanded satellite, weather, or LiDAR datasets), enhances its capabilities (e.g., AI for design and engineering), and focus on international expansion. The biggest obstacle will be creating stability in its business to weather any regulatory hurdles that make its business model more difficult.