Thesis

As of 2022, around 73% of greenhouse gas emissions resulted from energy production. There is an escalating demand for alternative, renewable forms of energy. Policy changes are contributing to increased urgency in this space. For instance, in 2015, 175 countries signed the Paris Agreement, aiming to limit global warming to below 2 degrees Celsius relative to pre-industrial temperatures. Since then, many countries have implemented policies encouraging sustainable energy innovation, such as the IRA in the US or the European Green Deal.

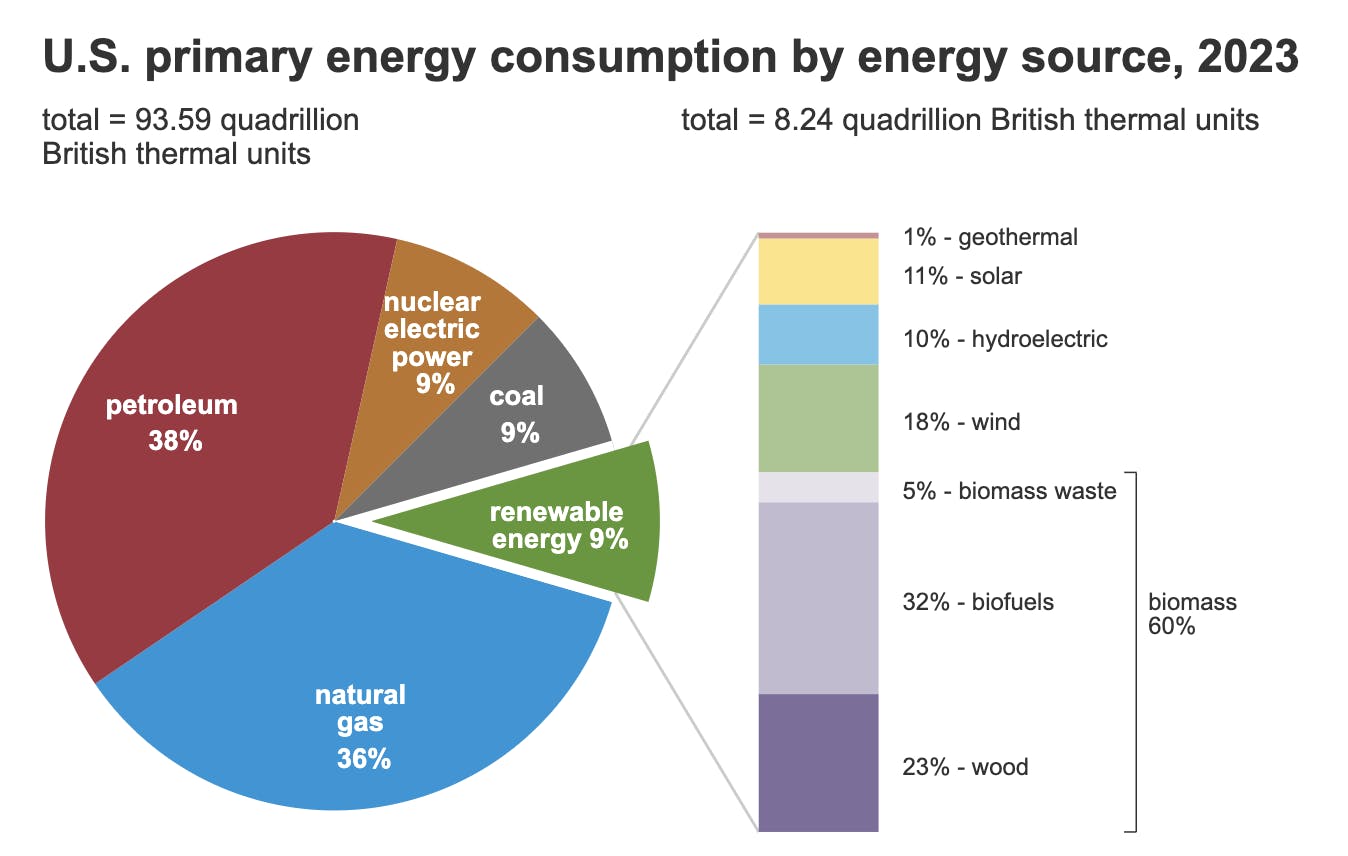

As of 2023, the main sources of renewable energy are hydropower, nuclear fission, wind, solar, and biofuels. Each of these has various drawbacks and trade-offs, such as low availability, variability in output, low energy yield, waste production, safety, or high costs of production. The promise of nuclear fusion, if successfully harnessed, is the production of cheap, abundant, renewable energy without any of these drawbacks.

Though fusion is not yet viable at a commercial scale, there have been significant breakthroughs in recent years. In 2023, the Lawrence Livermore National Laboratory announced it had demonstrated the first fusion ignition, meaning it was able to extract more energy from fusion than was required to drive the reaction.

Achieving commercial viability is the next challenge for fusion technology. Helion, a Washington-based fusion research company that aims to be the “first to fusion,” is among the companies leading the charge. In 2021, Helion CEO Dr. David Kirtley proclaimed that Helion’s mission would be “to build and deploy low-cost energy for the whole world. The rest of the universe is powered on fusion, and I believe we can do it too.”

Having created seven prototypes in less than 10 years, Helion is one of the fastest-moving companies in the space. The company utilizes a different fusion technique and reaction than its competitors, which it believes reduces the risk of radiation and increases efficiency. By choosing to use the rare isotope Helium-3, combined with the use of a magnetic energy capture technique for a more efficient energy capture, they hope to create a net energy positive reactor without needing to reach the point of ignition, using engineering techniques to circumvent critical principles of physics.

Founding Story

Helion was founded in 2013 by Dr. David Kirtley (CEO), Chris Pihl (CTO), Dr. George Votroubek (Head of Research), and John Slough (former Chief Science Officer).

Before embarking on a quest to build commercially viable fusion reactors, the co-founders met while working at MSNW in Redmond, Washington. The mandate of MSNW, an organization with ties to the University of Washington, is to research the use of plasma physics in rocket propulsion. Prior to founding Helion, the four co-founders had accumulated 30 combined years of fusion experience, and various master’s and PhDs in aeronautical, astronautical engineering, and astrophysics.

For Kirtley, however, the fascination with fusion started long before his work at MSNW. Living under the flight path of the space shuttles launching out of Florida, Kirtley got hooked on applied physics and engineering early on. While still in high school, he realized that the world would need more sustainable energy and became inspired by the promise of nuclear fusion. Kirtley began studying plasma physics and enrolled at the University of Texas, Dallas, studying electrical engineering. After two years there, he joined the nuclear engineering department at the University of Michigan and, still as an undergraduate, published his first paper on antimatter-based fusion.

At that point, Kirtley thought commercial fusion was unlikely to happen within his lifetime and focused his career on aerospace engineering. He worked on building Hall-effect and plasma thrusters for spacecraft at the Air Force Research Labs and the MSNW.

After completing his PhD, Kirtley decided that plasma physics and fusion research had developed to a point where commercializing nuclear fusion at scale would be possible on a reasonable timeline and started to build the foundations for Helion.

Source: Power Technology

Once Kirtley teamed up with his MSNW colleagues, they started work on the problem of magnetic compression, funded by $7 million from the Department of Energy, the Department of Defense, and NASA. Taking advantage of research conducted in the 1950s and 1960s, the team built a small system that heated plasma up to thermonuclear conditions and recovered energy from a magnetic field. When the team measured the results of their work, they realized that their project outperformed all previous fusion efforts. That’s where they settled on Helion’s general approach to fusion development.

Quickly, Helion gained the scientific community's attention, becoming a finalist in the 2013 National CleanTech Open Energy Generation competition. The company would later be awarded the 2015 ARPA-E ALPHA contract, "Staged Magnetic Compression of FRC Targets to Fusion Conditions,” receiving just under $4 million. In 2014, as former YC president Sam Altman stated his intent to use YC funding to invest more heavily in hard tech and energy companies (particularly nuclear), Helion was accepted into Y Combinator’s 2014 cohort.

Helion’s goal after YC was to create net energy gain from nuclear fusion within three years, something most engineers at the time thought was decades away. Unlike most fusion power station experiments, such as ITER in France, which cost upwards of $50 billion, Helion’s reactors are much smaller and were expected to only cost somewhere in the low tens of millions. According to CEO David Kirtley, these relatively small reactors should produce 50 megawatts of electricity, enough to power ~40K US homes.

Source: Helion Energy

As of January 2025, Helion’s team had reached over 450 employees, most of whom are engineers. An additional 100 jobs are expected to be added in its plans to manufacture its own capacitors. Three of the four original founders - Kirtley, Pihl, and Votroubek - are still with the company. While John Slough joined the Helion team as a co-founder and Chief Scientific Officer, he had previously been the President and Head of Research at MSNW, and in May 2018, he left Helion to once again focus on his role at MSNW.

Source: Helion

Product

Background on Nuclear Fusion

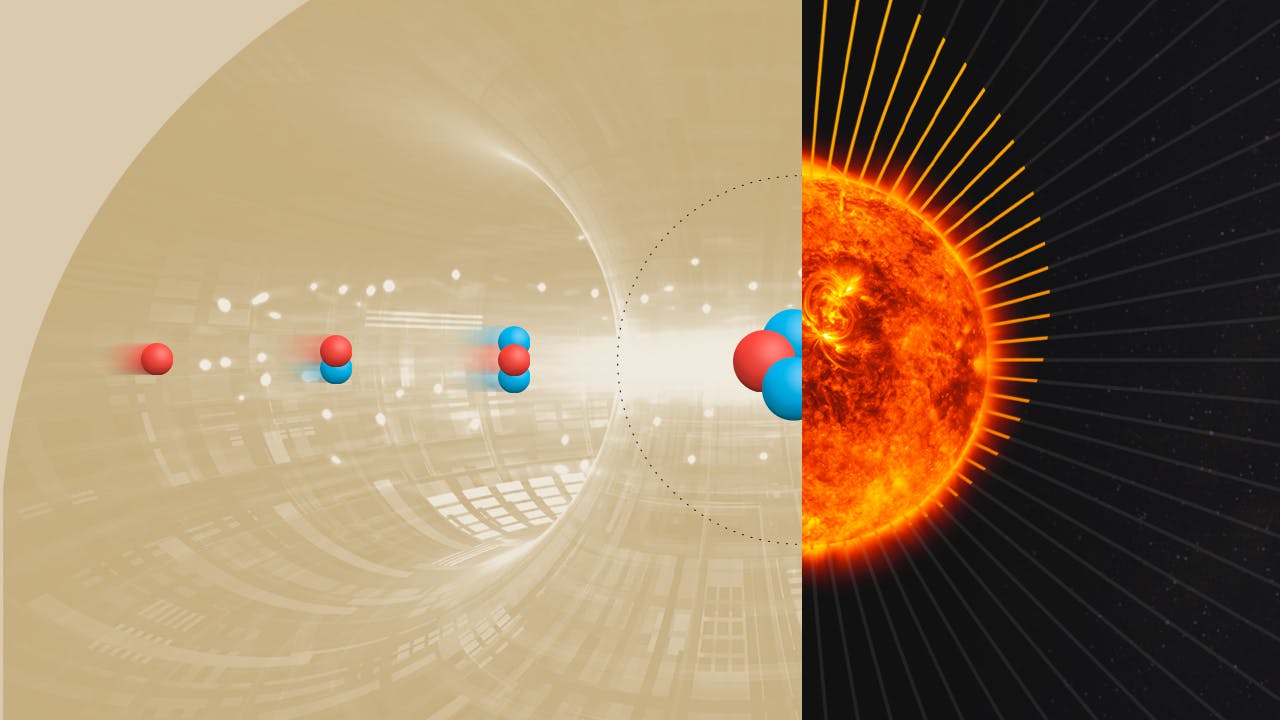

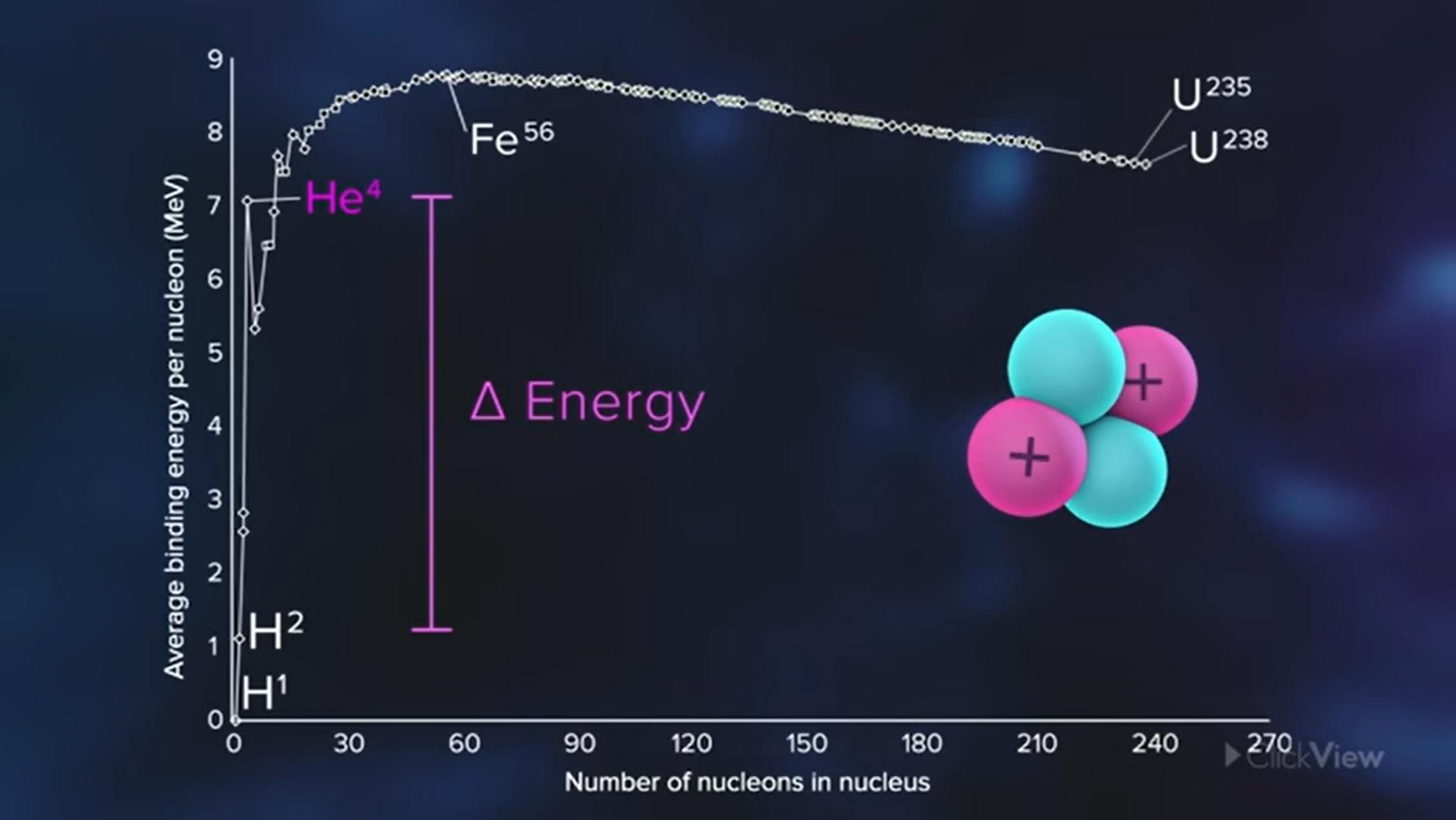

Nuclear fusion is a process that naturally occurs inside the Sun’s core, creating the light and heat that all life on Earth depends on. Fusion happens when two light nuclei merge to form a single nucleus with a lower mass than the two nuclei. This decrease in weight creates energy, based on Einstein’s equation, showing that energy is equivalent to the square of mass times the speed of light. The amount of energy released when two nuclei merge is known as binding energy.

Fission, the opposite of fusion, occurs when a single nucleus is broken into two separate nuclei, creating energy in the form of heat. This heat is then used to boil water and create steam to power a turbine, resulting in commercial electricity. There are two primary advantages to fusion when compared to fission: (1) combining light atoms produces much more energy than separating large atoms, and (2) fusion is inherently much safer than fission, which produces highly radioactive waste.

Source: Nuclear Fusion Explained

Fusion is more difficult to engineer on Earth than fission. For fusion to occur, an extreme amount of force must be placed on the two nuclei. The center of the Sun is 15 million degrees Celsius, with a gravitational force more than 28x stronger than the Earth’s surface. Strong gravity plus intense heat, which causes atoms to speed up and collide, produces uncontrolled fusion in the Sun. On Earth, temperatures need to reach at least 100 million degrees for fusion because the Sun’s gravitational force can’t be replicated.

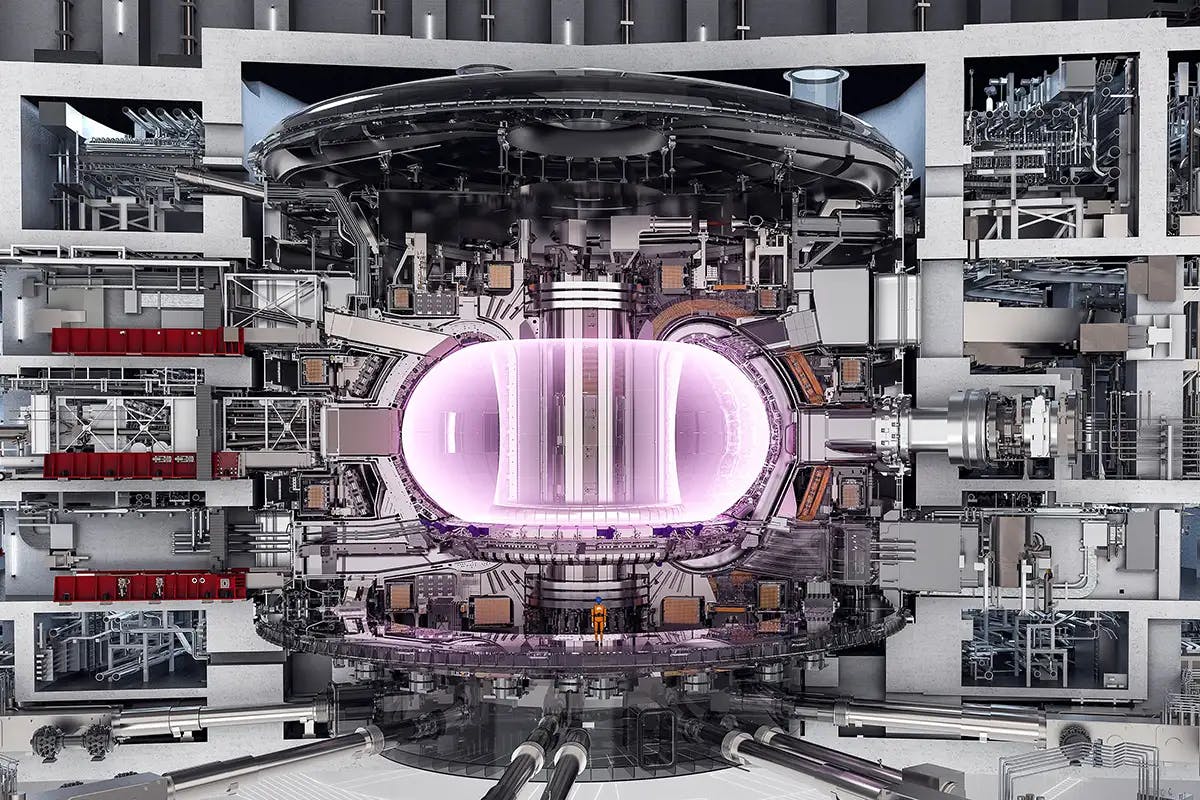

Traditionally, two common types of fusion reactor designs were used.

Laser fusion, which fires intense lasers simultaneously at a small capsule to heat it.

Tokamaks, the more common system, produce a single plasma in a donut-shaped reactor, which is heated and pressurized.

Source: NewScientst

Usually, fusion reactors produce electricity similar to a traditional coal or oil power plant. Most fusion labs combine deuterium (hydrogen-2) and Tritium (hydrogen-3), which releases energy in the form of neutrons (accounting for 80% of energy production). The resulting heat is then used to steam water and power a turbine. However, steam turbines lose 10-20% of the reaction's energy and require additional space. Additionally, Tritium is both radioactive and rare, mostly produced by nuclear reactors.

Helion’s Approach to Fusion

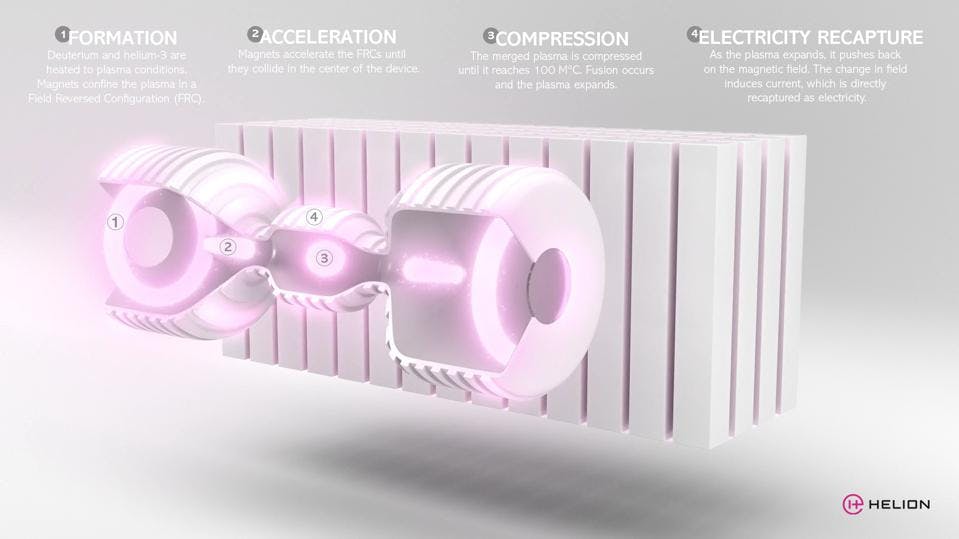

Source: Helion Energy

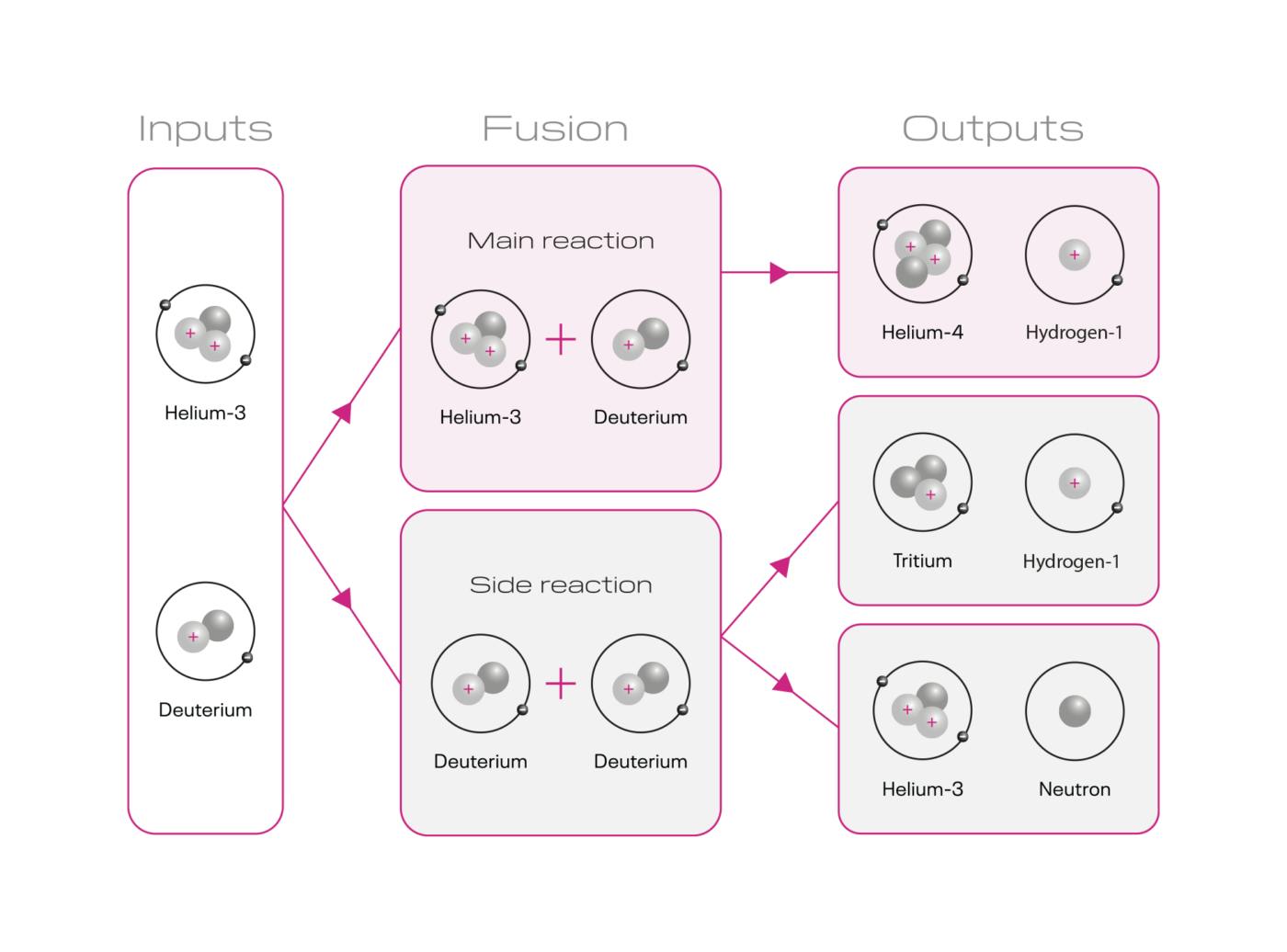

Helion Energy has achieved aneutronic (reaction with limited energy carried by the neutrons) fusion by fusing deuterium (hydrogen-2) and helium (helium-3) to produce helium-4 (the common isotope of He) and a single proton: 2H + 3He → 4He + 1p. However, a mixture of these two isotopes will also incur a co-reaction (D-D fusion), with the 2 deuterium nuclei reacting with each other to either release a helium-3 and a neutron, or a Tritium and a Proton.

Source: Helion Energy

Aneutronic fusion is preferable because it releases the same amount of energy without creating radioactive byproducts. As opposed to Tritium, 3He is neither radioactive nor the proton released after fusion. The proton's momentum energy interacts with the reactor's containing magnetic field, resulting in direct electricity capture at 85-95% efficiency with no steam turbine. Scientists have been proposing an efficient reactor with no turbine since the early fusion research in the 1950s, but the technology has historically not been advanced enough.

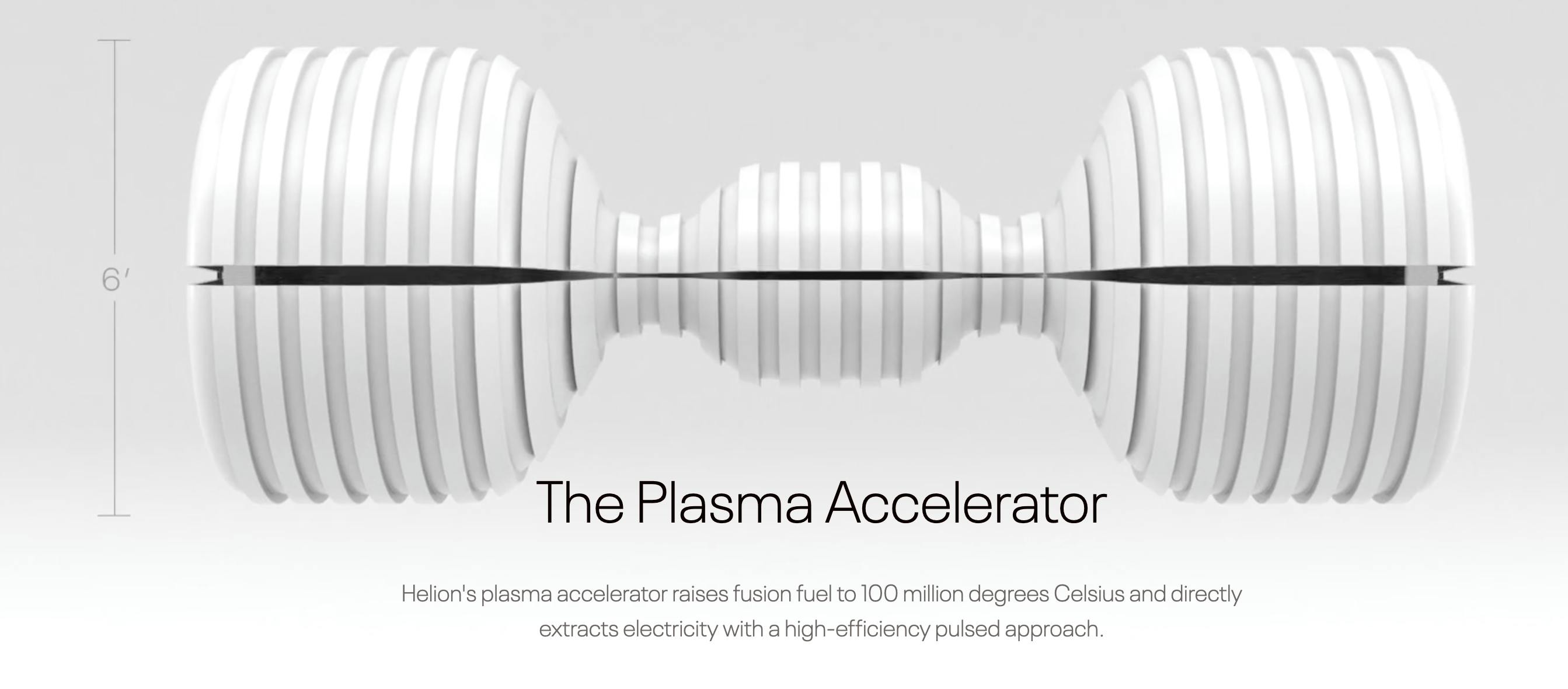

Helion describes how its reactor works this way: two heated, donut-shaped plasmas made of 2H and 3He are launched at one another at 1 million mph by way of magnets on the outside of the reactor, similar to that of a particle accelerator. Upon collision, they combine into plasma, compressed by the same magnets. The pressure causes the plasma to reach 100 million degrees Celsius, fusing atoms within the plasma and generating energy. All of this occurs in 1 millisecond. Kirtley explains how the reactor generates electricity this way: “When you use a pulsed electromagnet rather than big cryogenic superconductors — just a regular aluminum magnet — and pulse it with a large electric current, that generates a magnetic field. Like two magnets that you push on, they repel each other, which induces a magnetic force that compresses a fusion fuel up to these 100-million-degree temperatures. That fuses, and as that pressure pushes back on the magnetic field, you can extract electricity directly just with Faraday’s law, with the same fundamental technology as regenerative braking in an EV or an alternator in a conventional car.” The disadvantage to this pulsating method is that the fast-moving particles need to be charged, so helium-3 must be used in the process. Helium-3 possesses a high energy threshold of 750 million Kelvin, about 4 times higher than the deuterium and tritium-based approaches. As of August 2025, Helion’s operation has still been stagnant on the 100 million Kelvin achieved by its Trenta prototype in 2021, with no energy threshold being reported for its newer models.

To circumvent the issue of the high energy threshold, Helion proposes a non-ignition method of electricity harvesting. Harvesting energy from fusion can be thought of as reaching key thresholds that allow for fusion reactions to occur. The key to exciting reactions is found in the triple product: the product of fuel density, temperature, and time. The point of ignition was the typical target of fusion reactors, which required the high temperature of 750 million Kelvin for helium-3 to reach the necessary triple product value. At this point, plasma produces enough heat to overcome the total loss of energy, causing the reaction to be self-sustaining, eliminating the need for external heating. In other words, fusion ignition is the point at which the increasing self-heating of the nuclear fusion produces more heat energy than its input energy, allowing for energy to be harvested.

Helion claims that total net energy gain will be possible if 95% of the input energy after each pulse is recovered, allowing for net electricity production without relying on ignition. Helion Energy claims that its field-reversed configuration (FRC) plasmas, combined with a high ratio of plasma pressure to magnetic pressure (known as beta) of up to 1 or 100% may allow for non-ignition fusion energy harvest to be met.

Most fusion systems operate at a beta of 10% or less, and the claimed 10x increase in beta allows Helion Energy to achieve exceptional efficiency and confine high-pressure plasma using relatively modest magnetic fields. The proposed solution would rely on fusion products depositing their energy in a confined system, which remains a novel idea. Additionally, a plasma expanding into a changing magnetic field is Rayleigh-Taylor unstable, requiring a stabilization technique to be invented by Helion Energy for proper deployment.

Additionally, Helion Energy claims that the use of short, millisecond pulses allows the fusion process to behave more like a heat engine, where plasma is compressed, reacts, expands, and pushes back on the magnetic fields to generate electricity. This addresses some of the issues in continuous systems, such as confinement and stability. However, the pulsating nature also produces a substantial amount of radioactivity due to the rapid release of a neutron instead of a gamma ray, causing safety to be a possible concern. A solid barrier of one meter around the reactor is likely needed to meet sufficient safety regulations.

Source: Helion

Commercial Viability

Helion Energy's ultimate goal is to generate abundant power at costs as low as $0.01/kWh. As CEO, David Kirtley puts it: “Fusion is hard, and we have a lot of work left to do. To get to where we are to powering your home … some of those key challenges of how we build this system and take it from a pulse once every 10 minutes to running once a second and then 10 times a second.” In terms of inputs, most fusion reactors use deuterium or “heavy water” because it is naturally abundant on Earth and easily extracted from oceans. There is enough deuterium on the Earth to power the planet for 8.33 billion years. One gallon of seawater contains enough deuterium to produce the equivalent energy of 300 gallons of gasoline. Thus, 0.5 liters of deuterium can power a home for 800 years.

Helium, like tritium, is not abundant on Earth. The moon has 1.1 million metric tons of Helium-3, all within several meters of the lunar surface. The US only needs 25 metric tons to create enough electricity through fusion for an entire year. The gas giants of our solar system have enough helium-3 to power the world effectively.

The synthesis of Helium-3 through tritium decay (a process where lithium-6 is bombarded with neutrons to produce tritium, which then decays into He-3) is a possible solution, with Helion Energy currently utilizing two complementary processes. D-He3 fusion (which generates more power and consumes helium-3) and D–D fusion (which produces helium-3 and yields less power). They plan to use the two reactions to create a self-sustaining fuel cycle. D-D fusion is said to yield 50% of direct helium-3, and the remaining 50% produces tritium that will transform into helium-3 at a rate of 5.5% per year based on its 12.3-year half-life. To support its effort for fuel recycling, they constructed a new fuel processing laboratory to establish new procedures and study the reaction cycle.

Market

Customer

Supplying energy directly to the grid requires the build-up of infrastructure, among other difficulties. Helion has initially targeted private customers requiring large amounts of stable, cheap, sustainable electricity. This includes big industrial firms and large data centers. These large buildings consume massive amounts of energy and require a secure supply of electricity. As of October 2022, many of Helion’s potential customers were using diesel generators as a way of guaranteeing a stable supply of power.

Helion believes that its first commercial agreements show that many other industrial firms are urgently looking for clean power products. However, the lack of availability and limitations of today’s renewables and battery technology make them challenging to implement. Fusion reactors would solve the challenges of providing cheap, stable, and sustainable power at scale. Helion will enable customers to decarbonize their electricity supply without sacrificing stability. Kirtley believes that the company will be able to provide energy to data centers at less than $0.01 per kilowatt-hour (kWh), becoming their primary power source.

In the long term, Helion aims to sell electricity directly to the grid. Once its reactors can consistently produce energy, it plans to partner with utilities in the US that manage grid activity to replace fossil fuel consumption and start powering homes, factories, businesses, and more as a large-scale provider of baseload power. The average home pays $0.15 per kWh in the US for electricity. Solar power is only $0.06 per kWh in the cheapest areas and $0.11 per kWh in others. Assuming that Helion could consistently supply electricity at $0.01 per kWh, the energy produced by fusion reactors would represent a 93.3% energy cost reduction when it reaches scale.

In January 2024, Kirtley noted that in the long term, he hopes there will be many fusion companies with millions of gigawatts of fossil fuel electricity capacity replaced by fusion. He sees many customer segments with different electricity needs, for example, large factories, data centers, or military bases, which will require different reactor designs and implementations.

Market Size

Global Energy Market

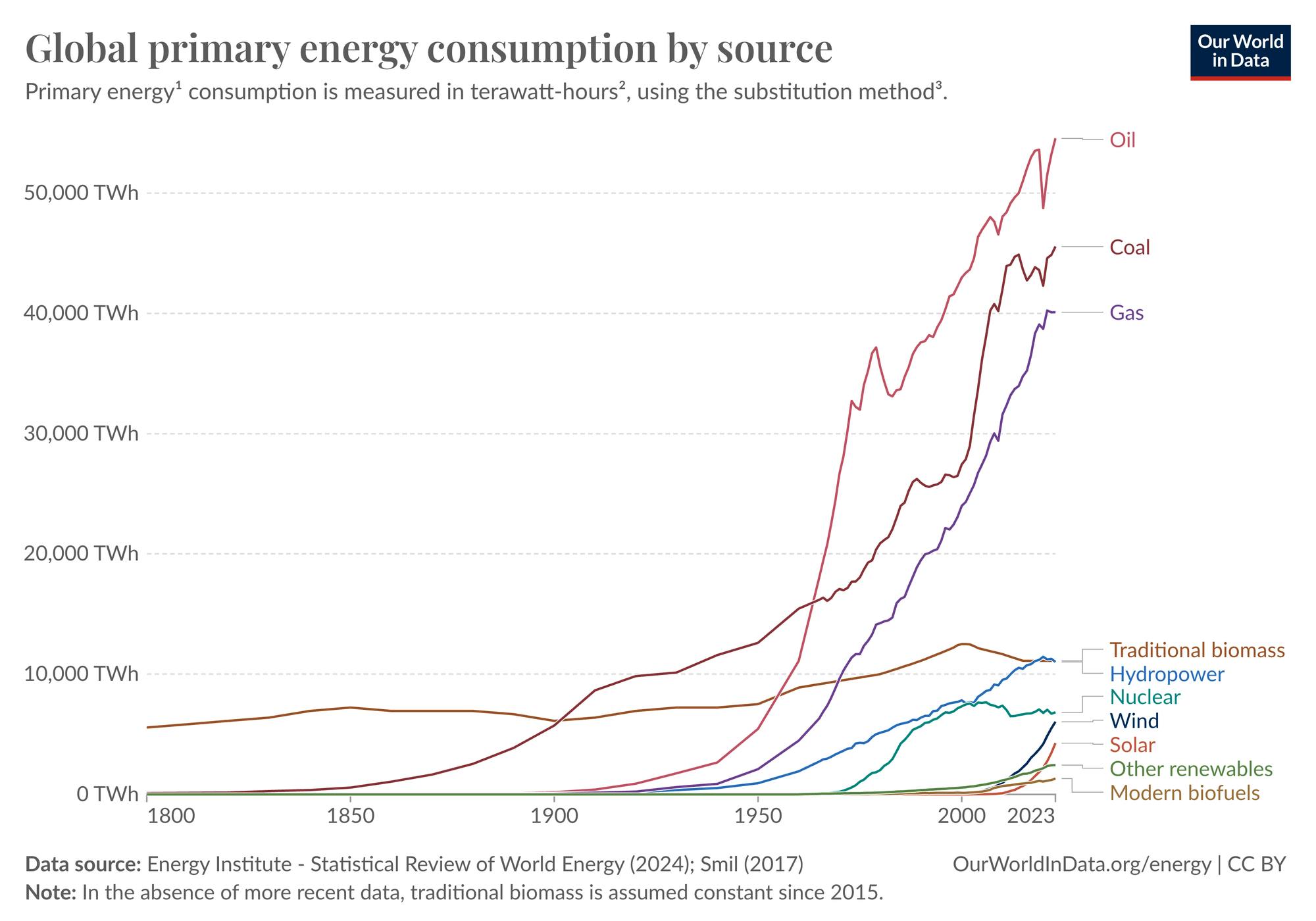

The global population grows ~0.84% annually, down from over 2% in the 1960s. Growth in population, coupled with an ever-increasing demand for more electricity, has caused energy consumption to increase by 2% on average every year since 2000. As humanity becomes more dependent on technology, energy consumption will continue to rise.

Global electricity demand is expected to increase by 60% between 2024 and 2040, from around 30K TWh in 2024 to around 48K TWh in 2040. Assuming the average electricity price of $0.178 per kWh in the US, the global electricity market in 2040 will be worth over $8.4 trillion.

In August 2014, Helion estimated that it could eventually penetrate 50% of the new electricity capability added to the grid per year. With its royalty model, assuming conservative electricity prices of $0.04 to $0.06 per kWh, it could represent an addressable market for Helion of $52 billion per year.

Renewable Energy Market

The 2015 Paris Agreement was a policy catalyst intended to effect changes in global energy production, carbon removal efforts, and wildlife preservation. Such policy catalysts, consumer demand for lower emissions, and investor interest in climate tech companies have created significant tailwinds for the renewable energy market.

Global renewable energy production is set to reach over 8 billion kWh in 2024 and grow to more than 10.3 billion kWh in 2029. However, this is largely dependent on nations living up to their commitments to reduce the consumption of non-renewable fuels. Additionally, it’s still a minor part of the global electricity demand. Current renewable energy sources need to reach global scalability. Otherwise, without coal and oil, the global grid will crash. While renewables have grown over the past 40 years, non-renewable fuels have grown much more quickly and need to be replaced at scale.

Source: Our World In Data

While the renewable energy market continues to grow, the viability of other forms of alternative energy also represents a risk to Helion. If solar and wind become more viable energy options at scale, consumer preferences for nuclear reactors could go down. Overall, the market for fusion is difficult to predict, given that it has not yet achieved commercial production. Some estimate the nuclear fusion market will grow to $472 billion by 2030, but there are no reliable predictions about when fusion will become commercially viable.

Competition

Competing Nuclear Fusion Labs

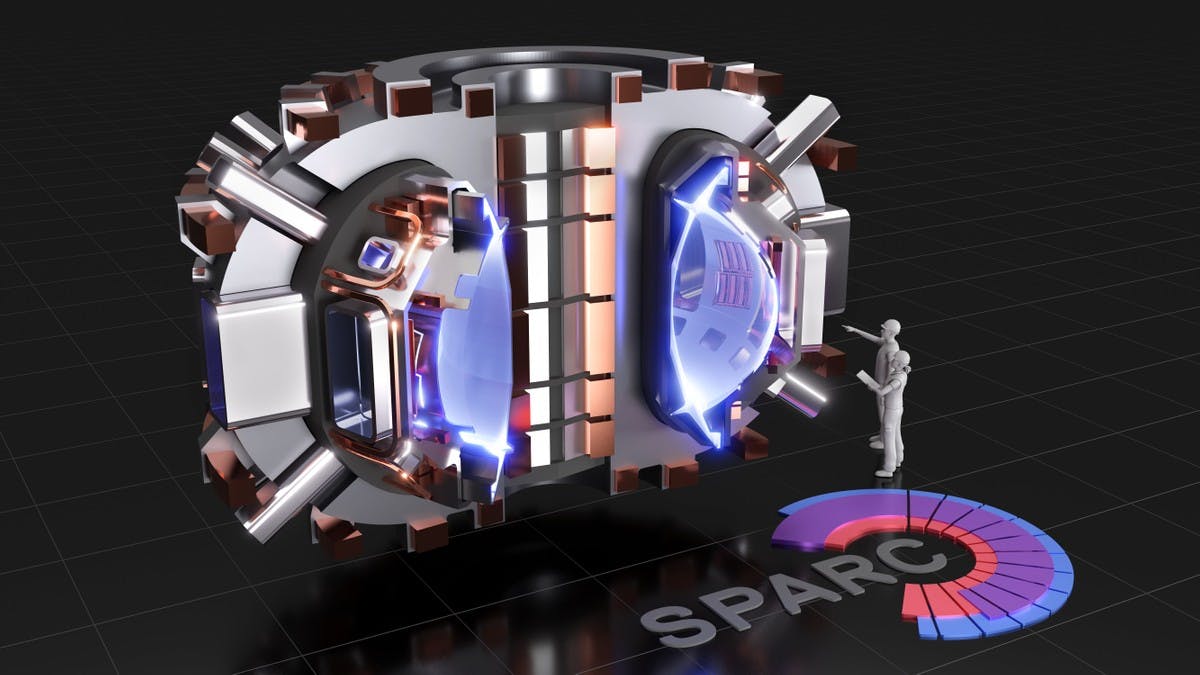

Commonwealth Fusion Systems (CFS): Founded in 2018 in Cambridge, Massachusetts, CFS was spun off from MIT’s Plasma Science and Fusion Center. CFS’s SPARC Tokamak reactor uses high-powered magnetic fields to control a single, donut-shaped plasma and is scheduled to be completed in 2025. Once SPARC demonstrates net energy production, the company will move on to building ARC, its commercially viable fusion power plant.

Though it is still years away from injecting SPARC with plasma to produce energy, it is one of the fastest-moving companies in the space and aims to generate electricity commercially in the 2030s. In March 2024, the company announced successful tests of its magnets, confirming its technology meets the requirements for a compact fusion plant. Since 2018, it has raised $2.9 billion in funding as of November 2025. With its technology progressing at a similar pace to Helion, CFS is positioned to become its closest rival.

Source: Commonwealth Fusion Systems

China National Nuclear Corporation: The CNNC is a state-owned enterprise in China founded in 1955 that covers all aspects of the nuclear industry, including both fission and fusion. In the realm of fusion, CNNC operates the HL-2M Tokamak in Chengdu, which was able to reach a temperature of 117 million degrees Celsius, and is designed to follow the exact same fusion process as that found in the sun. The CNNC is also reported to pursue a hybrid fusion-fission power plant, with the goal of generating 100 MW by the end of the decade. The fusion division of the CNNC is estimated to have the backing of $2.1 billion from the Chinese government.

Helion Energy’s FRC approach is also pursued by other companies and university research labs, but it has secured the most funding and industry recognition as of August 2025.

TAE Technologies: Founded in 1998 near Irvine, California, TAE Technologies also pursues an aneutronic, FRC design. Its method is designed to work with an advanced fuel cycle (hydrogen-boron or p-B11), which would produce very little neutron radiation, allowing for direct energy conversion. TAE has built a series of successful research machines, with its current fifth-generation device, "Norm," demonstrating stable plasma performance at over 75 million degrees Celsius.

The company is now constructing its sixth-generation machine, "Copernicus," which is expected to demonstrate the viability of net energy generation from fusion. Besides fusion, the company also pursues a number of power solutions, such as energy storage, charging technology, and EV powertrain components. TAE’s latest round, in June 2025, raised $150 million, with participation from Chevron Technology Ventures, Google, and NEA. This brought its total funding to $1.5 billion.

Zap Energy: Founded in 2017 as a spinout from the University of Washington and located near Seattle, Washington, Zap Energy is developing a cost-effective and scalable approach to fusion using a Sheared-Flow-Stabilized (SFS) Z-pinch. In a Z-pinch, a large electrical current is driven through the plasma, which generates a powerful magnetic field that "pinches" the plasma to fusion conditions. Historically, Z-pinches have been notoriously unstable. However, Zap claims that its SFS technology uses flowing plasma to smooth out these instabilities, allowing for confinement times long enough for fusion to occur.

This method notably avoids the need for the large, complex, and expensive superconducting magnets required by tokamaks and stellarators, dramatically reducing the potential cost and complexity of a fusion power plant. The company is currently operating its fourth-generation device, FuZE-Q, and in late 2024 announced that it had successfully produced its first fusion plasmas. As of early 2025, Zap Energy has raised a total of $337.8 million in funding as of November 2025 and is focused on scaling its technology toward a prototype capable of reaching "breakeven," where the energy produced by the fusion reactions equals the energy put in to create them.

General Fusion: Founded in 2002 in Vancouver, British Columbia, General Fusion utilizes magnetized target fusion. In this fusion process, plasma is injected into spinning liquid metal, where fusion occurs. The heat from the fusion is used to create steam and power a turbine. The company’s fusion reactor is expected to be operational by 2027, and General Fusion hopes to reach the 100 million degrees Celsius threshold, which Helion did in 2021. General Fusion has raised $392 million in total funding as of November 2025, with the latest round being a $22 million injection in August 2025. The company will be collaborating on its reactors with both the United Kingdom Atomic Energy Authority (UKAEA) and Canada’s particle accelerator center (TRIUMF).

Competing Nuclear Fission Labs

Kairos Power: Founded in 2016 and based in Alameda, California, Kairos Power is developing a fluoride salt-cooled high-temperature reactor (KP-FHR). The KP-FHR uses TRISO fuel pebbles, which are extremely robust, and a molten fluoride salt (Flibe) coolant that operates at low pressure for safety measures. The company is currently building its Hermes demonstration reactor in Oak Ridge, Tennessee, with nuclear construction having started in May 2025.

Hermes is a test reactor designed to provide data for its commercial units, with operations planned to begin by mid-2026. Tritium, which is produced from the lithium in the salt coolant, is managed by a dedicated Tritium Management System. The heat generated is not directly captured for energy but will be used in a conventional steam cycle to produce electricity in its commercial plants, which are targeted for deployment in the early 2030s. Kairos has been tapped by Google to build and operate a 500 MW fleet of advanced nuclear power plants by 2035, with the first set to come online by 2030.

Aalo Atomics: Founded in 2023 and headquartered in Austin, Texas, Aalo Atomics is a fission company developing small, factory-built Extra-Modular Reactors (XMRs) specifically to meet the massive energy demands of AI and data centers. Its Aalo-1 reactor is a 10 MWe sodium-cooled design. The company's main product is the "Aalo Pod," a 50 MWe power plant that houses five Aalo-1 reactors and a single turbine for high reliability. In April 2025, Aalo unveiled a full-scale non-nuclear prototype of its reactor and its 40K-square-foot manufacturing facility. The company aims to break ground on its first nuclear test reactor at Idaho National Laboratory in 2026. By using a sodium coolant, the reactor operates at atmospheric pressure, and the heat is used to generate electricity via a traditional turbine.

The company raised its $100 million Series B round in August 2025, with backing from Valor Equity and NRG Energy. This brought its total funding to $136 million.

Oklo: Founded in 2013 and based in Santa Clara, California, Oklo is developing a compact fast fission reactor called Aurora. The Aurora powerhouse is designed to produce about 75 MWe and can also be used for industrial heat applications. It uses a liquid metal (sodium) coolant and can run on recycled nuclear fuel. Oklo's design emphasizes passive safety systems and a simplified architecture. The company is pursuing a license from the U.S. Nuclear Regulatory Commission (NRC) and aims to deploy its first commercial units in the late 2020s or early 2030s. Oklo is a publicly listed company and has a market cap of $16.9 billion as of November 2025.

Competing Renewable Energy Sources

Nearly 90% of global carbon dioxide emissions are due to fossil fuel consumption, primarily coal, oil, and gasoline. A meaningful shift to clean energy had already started long before nuclear fusion became a viable solution. The percentage of global electricity capacity coming from renewable energy increased from 28.2% in 2014 to 43% in 2023. While energy consumption overall grew ~1.8% on average, renewable energy grew ~14% from 2022 to 2023.

Countries are emphasizing a shift to renewables in part due to increasing demand for energy independence, lower costs, climate awareness, and job creation. Driven by these motivators, as nations continue to invest more in renewable energy sources that are available now, they may not be interested in reconfiguring infrastructure and spending trillions on replacing these sources with fusion reactors down the line.

Enough energy from the sun’s fusion hits the Earth’s surface to cover 10K times what humans need, which is why solar energy is one of the fastest-growing alternative energy sources as of 2023. Other sources of energy receiving large investments include wind energy, hydroelectric and tidal energy, geothermal energy, and biomass.

Business Model

Helion Energy is still in its research and developmental phase, but is planning to bring the first power plant online by 2028. Its future business model will primarily depend on selling energy to the grid for residential, commercial, and industrial use. In the US, more than 80% of energy infrastructure is privately owned, although four organizations control most of the national grid, which generates nearly $500 billion annually. Helion will likely have to sell to entities individually, and the state-owned grids in most other nations.

Helion’s first commercial agreements with Microsoft and Nucor will likely be a blueprint for the company’s early business model. Similar to many renewable projects, Helion will operate on purchase power agreements where energy is sold to a customer at a fixed cost for a predetermined period. This customer often receives a tax credit to subsidize the cost further. As customers (often grid operators) need more energy, they scale demand up or down. The principle is the same with fossil fuel plants, which scale up and down with consumer demand because the grid cannot store massive amounts of electricity in most areas.

If it follows a similar model, Helion will both (1) partner with customers such as data centers and factories to provide direct electricity from an onsite reactor and later (2) set up large nuclear fusion power plants to supply energy to the grid. Helion’s long-term goal is to deliver power at $0.01 / kWh. Helion claims its reactors will dramatically decrease costs compared to current electricity generation methods, as its reactor recovers electricity directly from a fusion reactor without a steam turbine.

Traction

Reactor Development

Helion has released an improved prototype almost every year since 2014. In 2022, Helion’s sixth-generation system, Trenta, became the first private company reactor to reach the 100 million-degree threshold necessary for nuclear fusion for certain reactions. Throughout the 16 months of testing, Trenta produced nearly 10K plasma pulses, not only achieving bulk deuterium-helium-3 fusion but demonstrating direct energy capture to be possible and recovering electricity without the need for a steam turbine. The prototype was retired in early 2023 to focus on the development of the company’s seventh prototype, Polaris.

Polaris is scheduled to begin operations in 2024. It will have a higher magnetic field strength and an increased repetition rate compared to Trenta. The goal of Polaris is to demonstrate the production of small amounts of sustained net electricity. This means Helion aims to be able to recover more electromagnetic energy from the fusion system than it takes to recharge it. Polaris will be Helion’s last scheduled prototype before developing a pilot reactor to fulfill the Microsoft PPA by 2028. The company has also pointed to working on designing its eighth-generation system, a commercial-grade reactor, which it believes will provide enough power to the grid by the end of the decade. However, it is still unclear if either prototype is net energy positive per reaction incurred, a crucial step towards commercialization.

Some of the challenges between Helion and commercial electricity generation include scaling key components. For example, with its seventh-generation prototype, Helion typically demonstrated a fusion pulse every 10 minutes. To generate electricity commercially, this will need to be increased to a pulse every few seconds. Making sure its systems remain stable at scale will be a key focus.

Source: Helion Energy

Helion Energy began construction for a planned nuclear fusion power plant in July 2025, dedicated to supplying electricity to Microsoft data centers. The site, located in Malaga, Washington, will take advantage of the grid infrastructure in place for the nearby Rock Island Dam hydroelectric plant. The project developed from an agreement with Microsoft in 2023 and will have a target power generation of 50 MWe or greater after a one-year ramp-up period in 2028. Constellation Energy will serve as the power marketer and will manage transmission for the project. The plant, called Orion, commenced construction in August 2025 and received a Conditional Use Permit from Chelan County in November 2025.

Private Customers

In May 2023, Helion announced it had entered into a PPA with Microsoft. Under the agreement, Helion will develop its first 50MW fusion power by 2028. Microsoft will purchase the power directly from the plant to supply its campus and data centers in Washington with baseload power. Kirtley notes that the agreement marks “a real commitment to supply electricity, with significant monetary penalties if Helion does not meet its obligation.” Helion and Microsoft have been collaborating since 2015, and the deal is the culmination of Helion’s efforts to understand customer needs in the electricity sector.

In September 2023, Helion announced that it secured a partnership with Nucor, a large industrial conglomerate. The partnership includes the development of a 500MW plant to be developed at one of Nucor’s steel mills by 2030. Helion will own and operate the plant with Nucor purchasing electricity directly from Helion. Helion will also have the ability to sell excess power back to the grid. The Nucor plant would be 10x the capacity of the plant Helion will develop under its deal with Microsoft. Kirtley noted that this project represents a shift in Helion’s work from a research program into an industrial power developer. The partnership with Nucor is not a simple PPA, but rather a larger energy development agreement. Under the agreement, Nucor also made a direct investment of $35 million in Helion. Nucor indicated that it expected its work with Helion to “pave the way for decarbonizing the entire industrial sector.”

In April 2024, the Chelan Douglas Regional Port Authority approved Helion to conduct a feasibility study on a potential power plant site in Malaga. The agreement included options for a long-term lease on the land. The plant would start as a 50MW plant with an eventual ramp-up to 250MW, allowing Helion to fulfill its PPA with Microsoft.

Valuation

Helion made headlines in 2021 after raising one of the year’s largest funding rounds, even in a period that witnessed record-breaking venture funding. After a $40 million Series D in September 2020, with total funding at the time reaching $77 million, Helion raised a $2.2 billion Series E in November 2021 from Sam Altman (lead investor and founder / CEO of OpenAI), Dustin Moskovitz (co-founder of Meta), Mithril Capital (led by Peter Thiel), and Capricorn Investment Group (a leader in sustainable energy investing).

Because the money was raised to fund the construction of the eighth-generation Polaris reactor, $500 million of the $2.2 billion was closed, with the remaining $1.7 billion committed to being unlocked when Helion reaches key milestones. At the time of the investment, Helion was valued at $2.5 billion pre-money. In September 2023, Helion announced a partnership with Nucor. As a part of the agreement, Nucor invested an additional $35 million in the company as a Series E extension.

In January 2025, Helion raised its Series F round totaling $425 million, led by Softbank’s Vision Fund 2, and joined by Lightspeed Venture Partners and an unnamed major university endowment. This most recent round of funding, as of November 2025, put the total amount invested into Helion over $1 billion and valued the company at $5.4 billion.

Key Opportunities

Increased Interest in Nuclear Energy

Source: X

In March 1979, the US experienced its worst nuclear accident in history when the Three Mile Island Nuclear Generating Station in Pennsylvania experienced a nuclear meltdown. Though there were no casualties or long-term health effects, the accident acted as significant leverage for the anti-nuclear movement in the US and significantly impacted efforts to build new reactors. While Three Mile Island attempted to restart in 1985, it was again shut down in 2019 due to its inability to compete commercially.

That sentiment seems to be beginning to change. In September 2024, Constellation Energy Corp., the owner of the Three Mile Island plant, now called the Crane Clean Energy Center, announced it would be investing $1.6 billion to restart the plant by 2028. The driver behind this change in strategy is due to a financial agreement with Microsoft to purchase all of the output to power data centers, marking the “first time Microsoft has secured a dedicated, 100% nuclear facility for its use.” This focus on nuclear energy from AI-centric data center investments is similar to Amazon’s $650 million investment in March 2024 to acquire a data center located next to another nuclear power plant in Pennsylvania.

In an overview of the plans to restart the Crane Clean Energy Center, Constellation shared that this would add “835 megawatts of carbon-free electricity to the grid, roughly equivalent to all the renewable energy built in Pennsylvania over the last 30 years.” In addition to corporate support, the project has also attracted support from regulators. Pennsylvania Governor Josh Shapiro, in September 2024, wrote a letter in support of enabling the facility to “skip the regulatory queue, which would mean waiting years, be fast-tracked onto the grid, and be brought immediately online.” Financial institutions are supportive as well. In September 2024, fourteen of the world’s largest banks and financial institutions pledged support for nuclear energy. Organizations like Bank of America, Morgan Stanley, and Goldman Sachs have signed on to the COP28 goals of tripling nuclear capacity by 2050.

This willingness to support existing capabilities around nuclear fission, despite negative aspects like nuclear waste pileups, is promising for companies like Helion attempting to commercialize nuclear fusion. Fusion’s inherent advantage of cleaner nuclear waste product, and self-limiting properties to reduce meltdowns, combined with its inherent higher energy density, make it a compelling investment over fission. An approach to nuclear energy that is more consistent and less waste-producing could see a boom, given the aforementioned public support of nuclear energy.

Government Tailwinds

Governments are providing large grants to clean energy companies that show promise. If Helion can be the first private company to demonstrate net energy gain from nuclear fusion in the near future, it will position itself as the frontrunner for significant funding from the government and philanthropic grants.

The US Department of Energy invests ~$700 million annually in fusion research and has been investing in this technology since the 1950s. In September 2022, an additional $50 million was committed specifically for funding for-profit fusion companies in the private sector. Since the Lawrence Livermore NIF achieved net energy gain in December 2022, fusion has entered the public consciousness in a way it hasn’t for a long time. In January 2024, US climate envoy John Kerry announced an initiative to support the private sector effort in the fusion sector. In 2023, the U.S. Department of Energy (DOE) announced the Milestone-Based Fusion Development Program, a $46 million investment program for fusion companies, supported by the White House. Supporting fusion development has become a major priority in energy policy, which could benefit Helion as a leader in the space.

Additionally, the US Nuclear Regulatory Commission (NRC) will streamline the regulatory approval process for fusion companies. In 2023, the NRC announced the decision to regulate nuclear fusion differently from nuclear fission due to the different risk levels of the technologies. The regulatory risk was seen as one of the main barriers to further investment and development in fusion. Fusion will be regulated under the radioactive byproduct materials framework, a framework applied to particle accelerators, research, and industrial facilities. Under the framework, states or NRC regional authorities will assume regulatory authority over fusion power plants. Helion’s first plant, in Washington, will be regulated by the Washington State Department of Health. Kirtley explains that Helion has actually worked with the NRC for the last few years to persuade the agency to fit fusion into the existing regulatory framework, which has been achieved.

Strategic Partnerships

Using Helium-3 to create fusion, Helion is a unique player in the industry. Helium-3 is rare on Earth but found in abundance on the lunar surface. As companies like SpaceX pursue the establishment of a lunar base, Helion could benefit from a partnership that allows for the transmission of Helium-3 through SpaceX reusable rockets.

Key Risks

Uncertain Timeline of Commercial Viability

Nuclear fusion has a long history of over-promising and under-delivering. The timeline of fusion contains many prototypes, experiments, and breakthroughs, but it took 90 years of research to reach net energy gain. As a result, there are questions around how likely it is for commercial viability to be achieved in the near term. This makes any projection about reaching commercial viability uncertain. For comparison, solar energy also took over 100 years to reach usage at scale.

When Helion raised its $1.5 million seed round in 2014, the team was convinced they would achieve net energy gain within only three years. Just under 10 years later, Helion has yet to cross this threshold. When asked about this in November 2021, CEO David Kirtley said: “We ended up pivoting a little bit in direction, to focus less on scientific milestones of energy and focus more specifically on electricity. We had to prove some of the technologies on the electricity and electricity extraction side of things. We also needed some funding for things that had to happen to get us all the way to those technical milestones.”

Further difficulties associated with scaling energy production might throw Helion off its timeline. In Kirtley’s view, the main potential risk in Helion’s future is supply chain difficulties. He describes acquiring large quantities of capacitors and semiconductors as the main limiting factor for Helion’s progress. The company uses many off-the-shelf components for its reactor, and the development process and commercialization timeline could be under pressure from supply chain delays. To combat this, Helion Energy has moved some of its manufacturing in-house, including quartz tubes and high-voltage capacitors on its latest Polaris prototype.

While the uncertainty remains, Helion has committed to bringing commercial fusion to the market by 2028, with financial penalties associated with not fulfilling its agreement with clients like Microsoft. Most fusion start-ups schedule commercial operations for the 2030s at the earliest, and many question whether Helion will be able to outpace its competitors by so much.

Helion Energy has also been under fire by a number of academics for the lack of disclosure regarding scientific progress. Helion has several patents and published a modeling paper in 2023, but it did not include experimental data to prove their prototype’s supposed efficiency. The fusion community in Academia has also voiced its concern regarding the consequences of a high-profile failure to deliver. “I have a problem with them making promises that might not be kept,” said Saskia Mordijck, a plasma physics professor at William & Mary. “That is damaging to the whole fusion community.”

David Ruzic, a professor of nuclear, plasma, and radiological engineering at the University of Illinois Urbana-Champaign, also critiqued the company by stating,“ They are basically saying, ‘We are going to skip some steps. We’re just going to build the machine. Less than a quarter of their workforce of 300 were trained researchers as of 2021, with roughly half being machinists, strictly building and assembling parts for their prototypes.

Limited Availability of Necessary Inputs

A significant challenge for Helion to scale its technology could be fuel availability. Helion will use deuterium with helium-3, which is a rare and expensive isotope of helium. Helium-3 is very scarce on Earth, with some experts even suggesting mining it on the moon.

Apart from rare naturally occurring instances, there are two main ways to source Helium-3: (1) as a by-product of the maintenance of nuclear weapons (which the US is constantly decommissioning), or (2) from the sun’s solar winds, which land on a planet’s surface. SpaceX and others have seen success in recent years as they have built networks of satellites, but the last attempted moon landing was in 1972. If mining Helium-3 from other planets does not become viable, it is likely to limit Helion’s production ceiling.

Helion is also planning to produce its own helium-3 from deuterium in a patented process. The company claims that it has already produced a small amount of helium-3; however, this will need to be significantly scaled up for commercial fuel cycles.

Alternative Approaches

Not only is Helion betting that fusion is the best source of energy creation, but it is also betting that its formula for fusion will trump other approaches. Multiple types of fusion reactors range widely in their use of magnets, pressure, and more. Helion’s technology may become obsolete if a different type of reactor reaches commercial viability first. As one example, most competitors are using Tritium instead of Helium-3, which means a lot more investment is going into the long-term availability of Tritium. Competitors and researchers are also favoring the pursuit of fusion until full, self-sustaining ignition. The first fusion technology to achieve commercial viability will likely see many imitators and could gain an insurmountable advantage over technologies that take longer to market.

In addition to the alternate approaches to nuclear fusion, there are also continued proponents of other alternative energy sources, like solar and batteries. The argument is that, rather than continuing to invest significant amounts in achieving higher quality nuclear energy, there is a higher ROI in continuing to improve other renewable energy sources. As these other types of energy make strides, it could limit the willingness to make continued investments in approaches to nuclear fusion.

Summary

Climate change is an increasing priority for governments and consumers, and clean energy effectively reduces carbon emissions. Each source of clean energy comes with pros and cons. Helion believes fusion shows the most promise long-term since it requires no variable intake, can easily be scaled up and down, and should be able to produce almost unlimited energy.

Helion has raised billions of dollars in funding as investors are betting on its approach of firing two plasmas at one another in a relatively small reactor and using magnetic force to compress the resulting plasma and create fusion. Because of the unique molecular composition of the plasmas involved, not only is the company’s reactor purported to be less dangerous than other fusion reactors, but it should also be able to efficiently produce electricity directly instead of having to rely on heat to create steam and spin a turbine, which results in lost energy.

However, challenges regarding obtaining the rare isotope of helium-3, along with questions regarding its viability for a net-energy positive, non-ignition reaction, may prove commercialization to be not viable in the near future. The Helion team believes that their shipping contained-sized reactor will be powering homes before the end of the decade, but this could be overly optimistic — many scientists in the 1900s believed fusion would be viable before the end of the 20th century, which did not occur. However, with a track record of rapid iteration and continuous improvement, Helion may soon achieve its mission of creating “an energy source that is clean, reliable, and abundant”. Until net electricity production is showcased, Helion Energy will remain a bet investors are taking towards an energy-abundant future.