Thesis

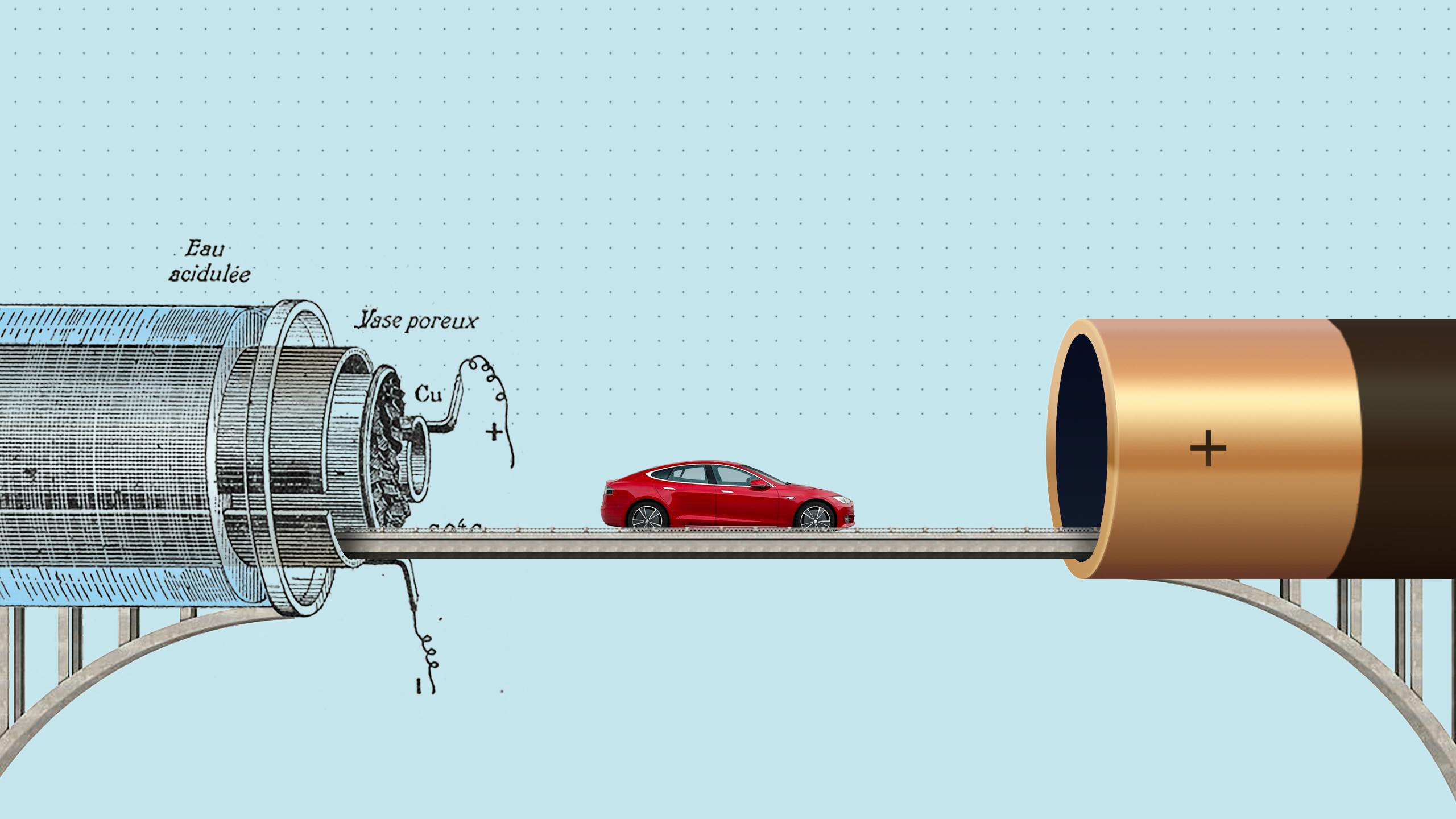

A rapid increase in consumer demand for electric vehicles (EVs) since 2011, along with regulatory pressure to reduce emissions and a decrease in cost for lithium-ion batteries, has led most of the world’s automakers to produce electric vehicles in their current and future lineups. This increase in production requires significant resources. While EV production volume was historically constrained by the complex processes required to build them, the primary bottleneck since 2020 has been the raw materials needed to make their batteries, including lithium, cobalt, and other rare earth minerals.

As a result, the raw materials required for producing an EV can cost a total of $6.7K on average, as opposed to just $2.4K for internal combustion vehicles. The battery alone constituted 30-40% of the cost of producing an EV as of 2023. These costs present a major challenge for the mass production of EVs. As an example, in 2021, Mercedes committed $47 billion to its mission of becoming an EV-only brand by 2030. To hit its target, the company will require more than 200 gigawatt hours (GWh) of battery capacity, almost 4x the entire production capacity of the US in 2021. In 2024, Mercedes announced a delay in its electrification goal and pushed it back 5 years, citing slowing demand for EVs.

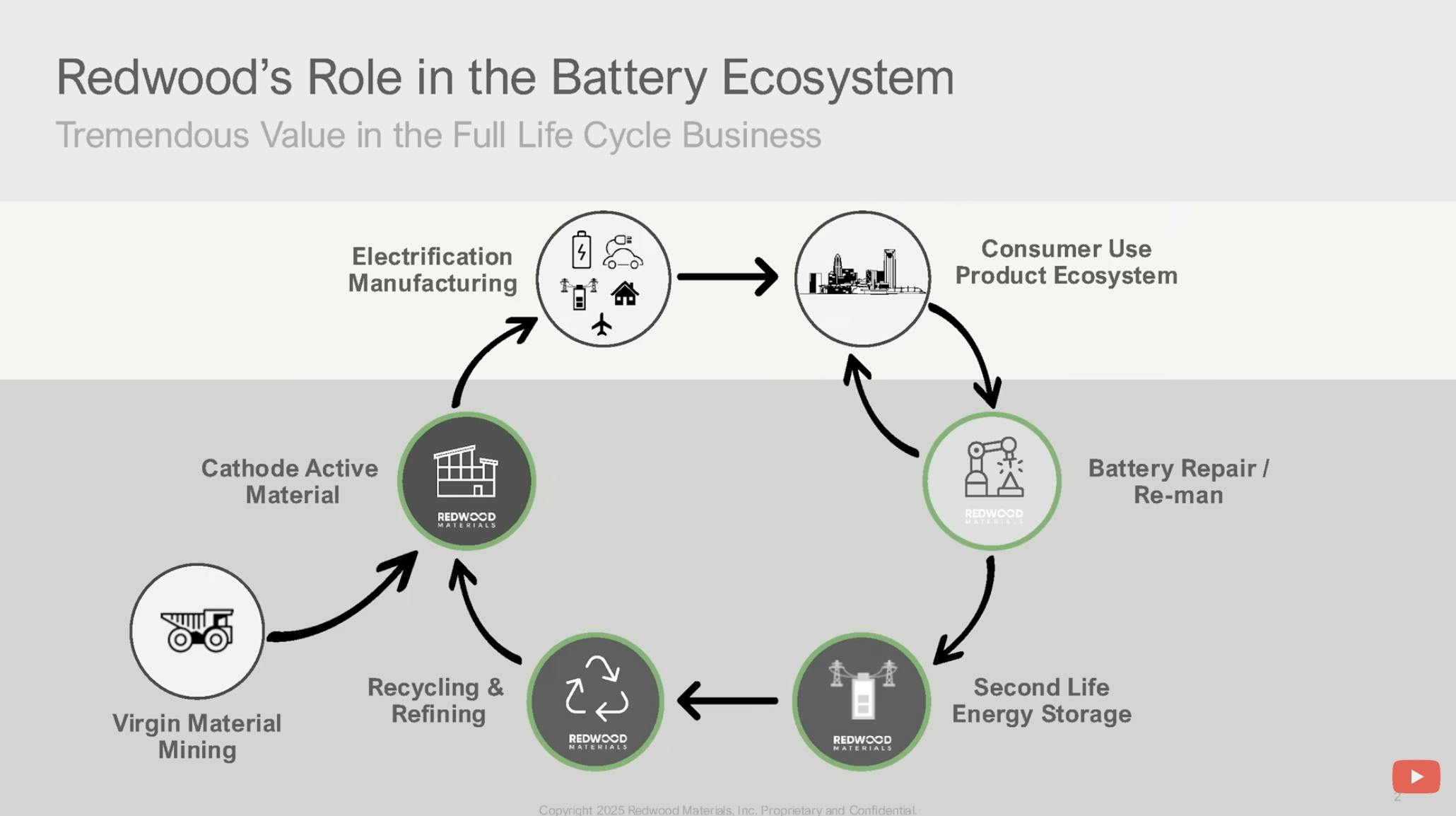

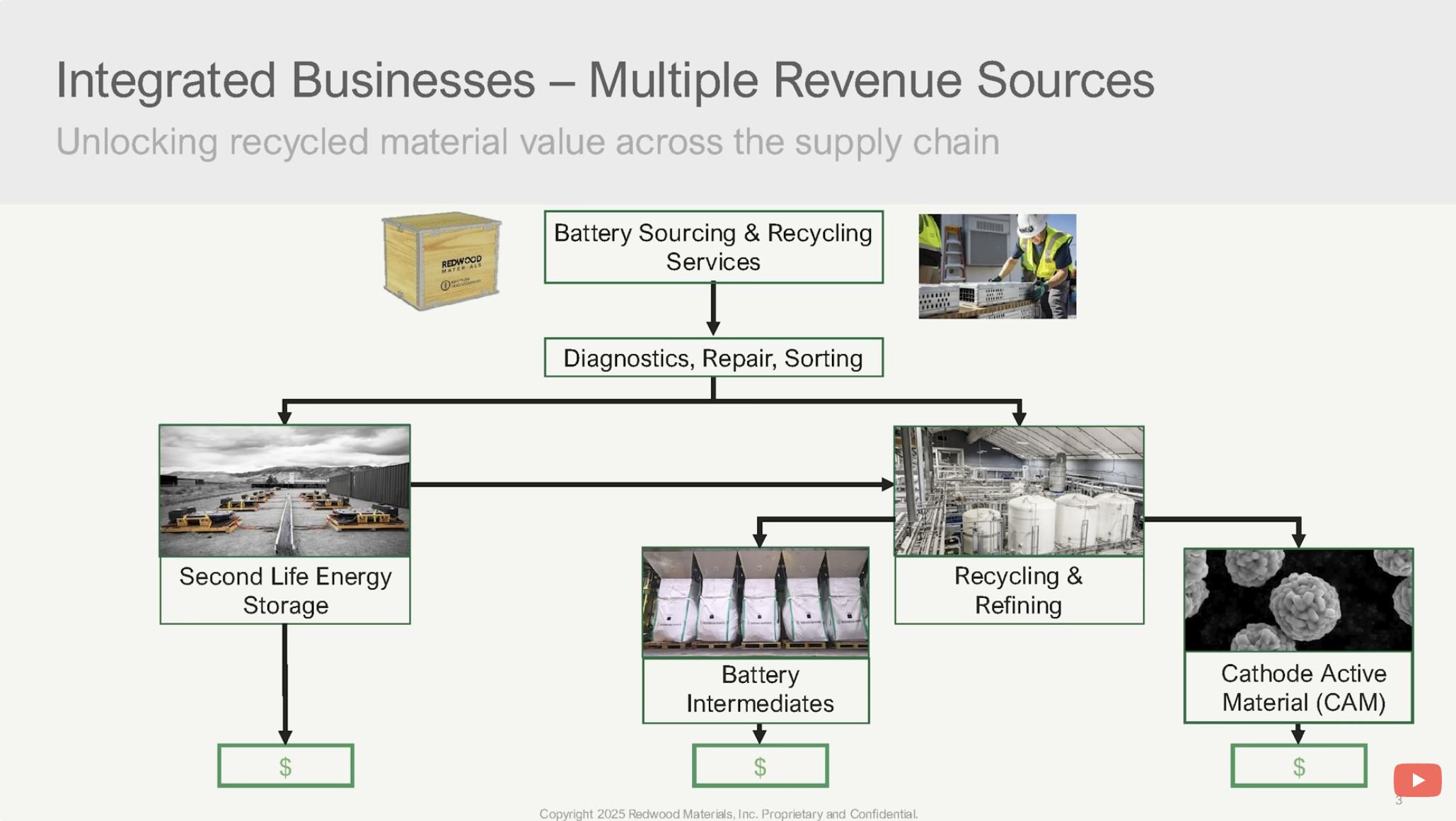

Redwood Materials operates across multiple stages of the lithium-ion battery value chain, by (1) repurposing used batteries for grid-scale energy storage, (2) recycling and refining recovered metals into battery-grade materials, and (3) manufacturing cathode active material (CAM) for new battery production. This integrated model allows Redwood to capture more economic value per battery than traditional recyclers, while helping automakers meet domestic sourcing requirements and reduce exposure to volatile global supply chains.

Founding Story

Redwood Materials was founded in 2017 by JB Straubel (CEO) and Andrew Stevenson (former CFO). Straubel received his bachelor’s degree in energy systems engineering at Stanford University, where he became known for converting an old Porsche into an electric vehicle for the purpose of drag racing. He involved himself in solar car racing during the same period. Straubel later received his master's degree in engineering, also from Stanford.

In 2003, Straubel met Elon Musk, who had recently left PayPal, and pitched him on his idea for an electric car: a vehicle with 10K cells he believed would be capable of crossing the US on one charge. He and Musk, who was already looking to fund an EV project, identified a small startup named Tesla Motors that soon became a household name with Musk’s investment and marketing.

Straubel became an early employee of the company and helped develop the lithium-ion battery powertrain that has become a blueprint for manufacturers around the world. Musk credits Straubel as a Tesla co-founder for his contributions. Fixated on the problem of wringing as much power from batteries as possible, Straubel was frustrated by the lack of planning for battery reuse and the economic barriers to making EVs cheap and accessible to all.

In 2017, Straubel and Andrew Stevenson, then the head of special projects at Tesla, filed documents with the SEC announcing their intention to launch Redwood Materials. The SEC note disclosed a $2 million investment in the stealth startup. Stevenson would go on to serve as the Redwood Materials CFO. Straubel left Tesla in 2019.

In 2019, Redwood Materials set up shop in Carson City, Nevada, located just miles from the Tesla Gigafactory, the country’s largest lithium-ion battery factory. It raised $40 million from Amazon, Breakthrough Energy Ventures, and the Capricorn Investment Group to start scaling operations. The purpose of Redwood Materials and its place within Straubel’s wider vision was to recycle batteries, capturing as much long-term value as possible from the complex array of raw materials required to make them. Stevenson left the company in December 2020.

By 2024, Redwood Materials became the largest lithium-ion battery recycler in North America and began expanding into higher-value segments of the battery supply chain, producing cathode and anode materials, which are two of the most complex and valuable components in a lithium-ion battery. As of October 2025, the company sells over 20 individual products, ranging from high-margin battery-grade materials to lower-value outputs like unprocessed aluminum scrap and calcium sulfate.

In June 2025, Redwood launched a dedicated energy division focused on repurposing retired EV batteries for stationary storage, further extending the lifecycle of its supply chain and reinforcing its end-to-end strategy.

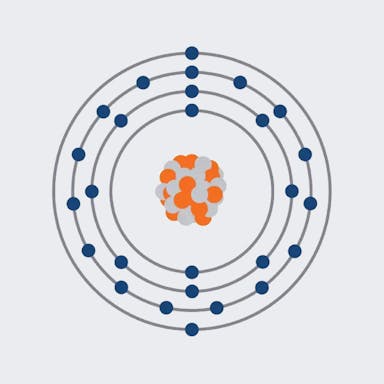

Product

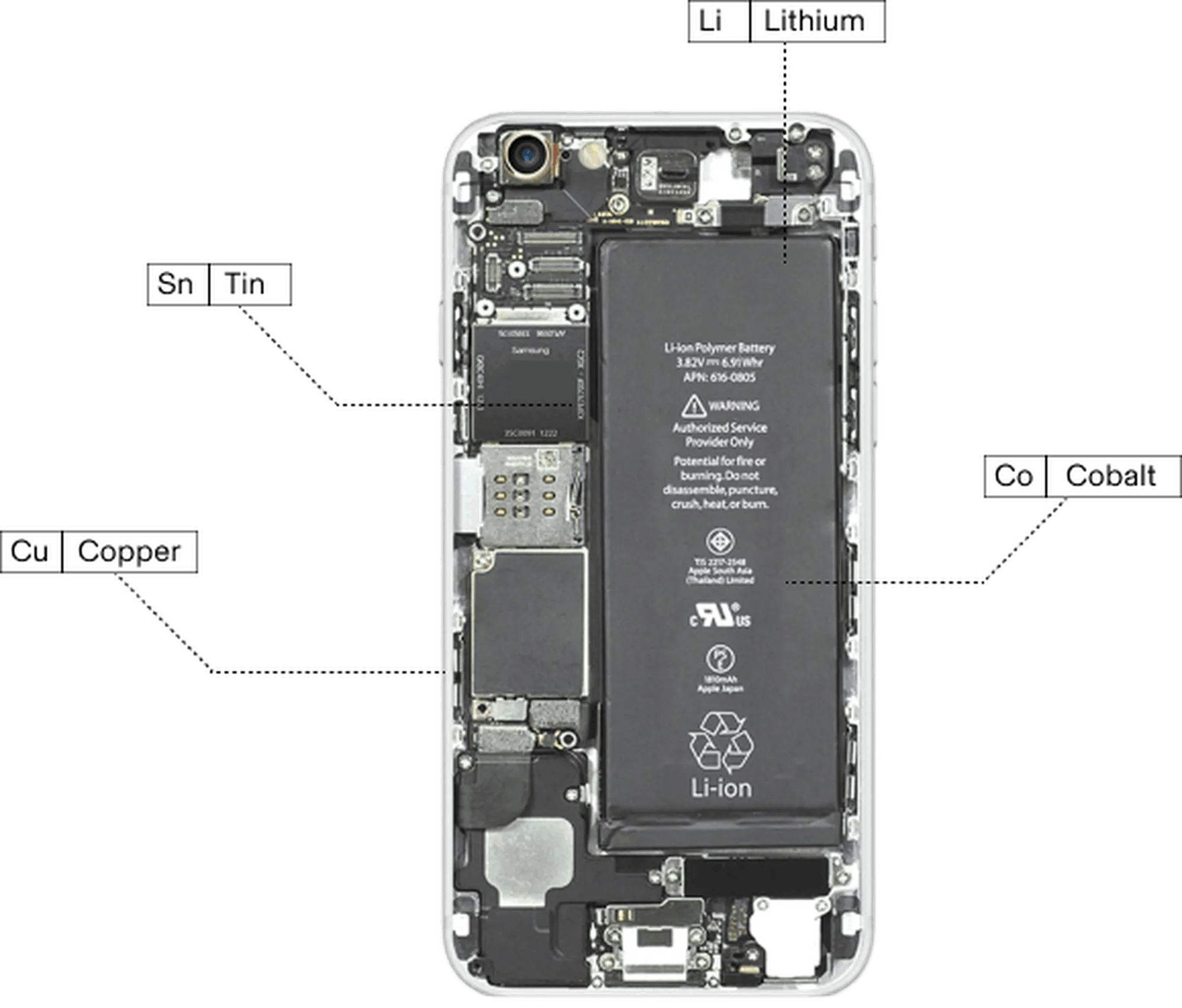

Lithium-ion batteries are comprised of four key parts: the anode (negative electrode), cathode (positive electrode), separator, and electrolyte. The cathode, made of lithium, nickel, and cobalt, represents a substantial part of a battery's cost. Meanwhile, the anode, composed of copper and graphite, greatly influences the battery's charging performance. The electrolyte is usually a lithium salt in an organic solvent. The separator is designed as a barrier to keep the anode and cathode apart and is comprised of synthetic resin.

Source: Redwood Materials

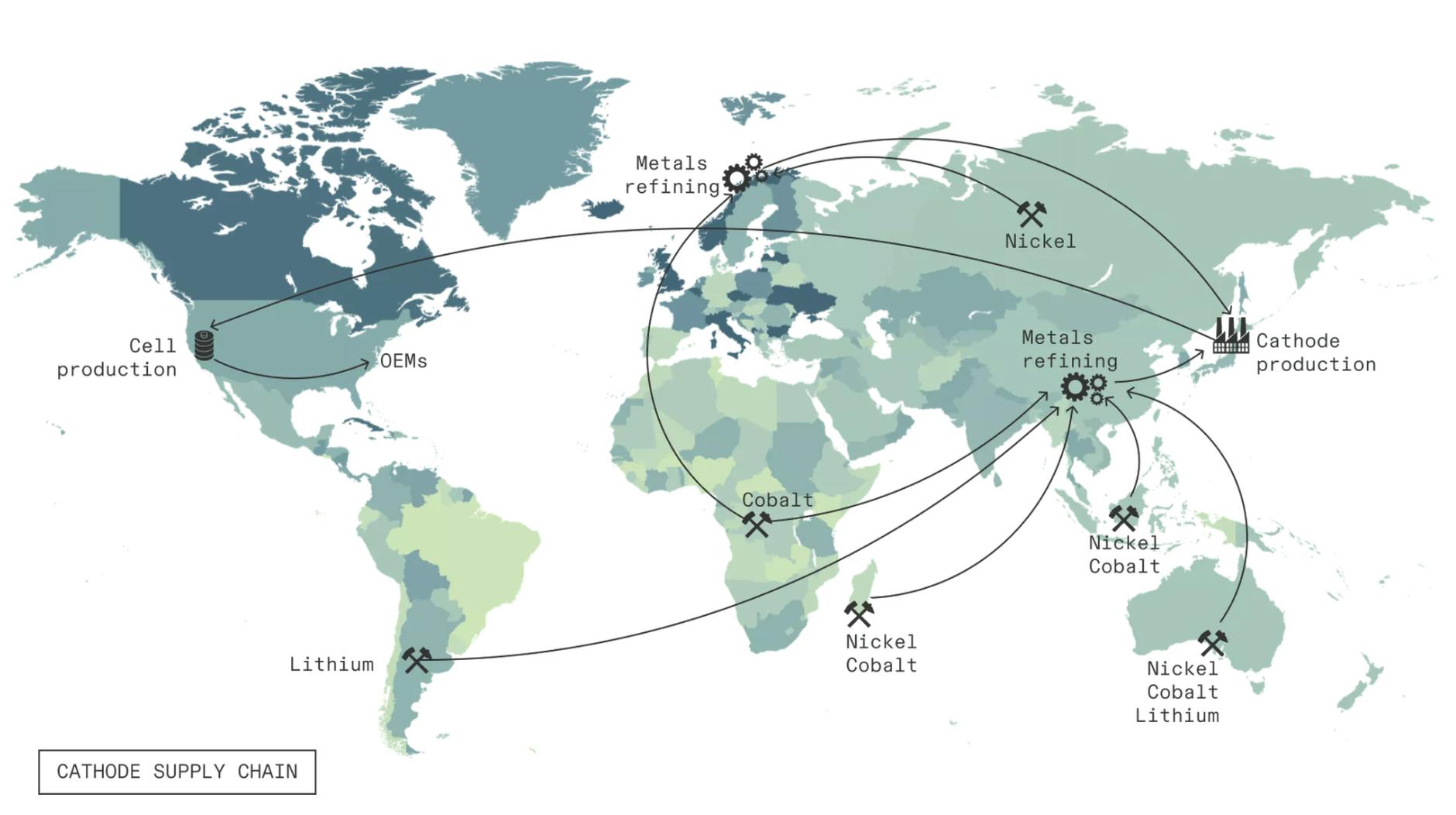

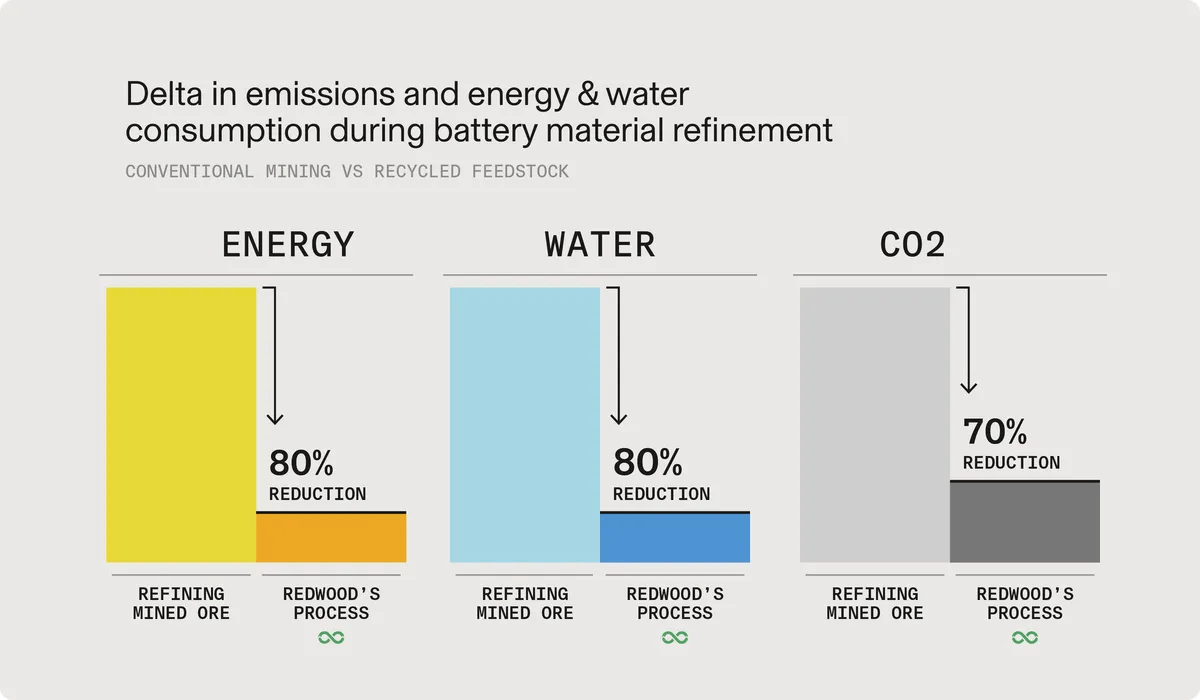

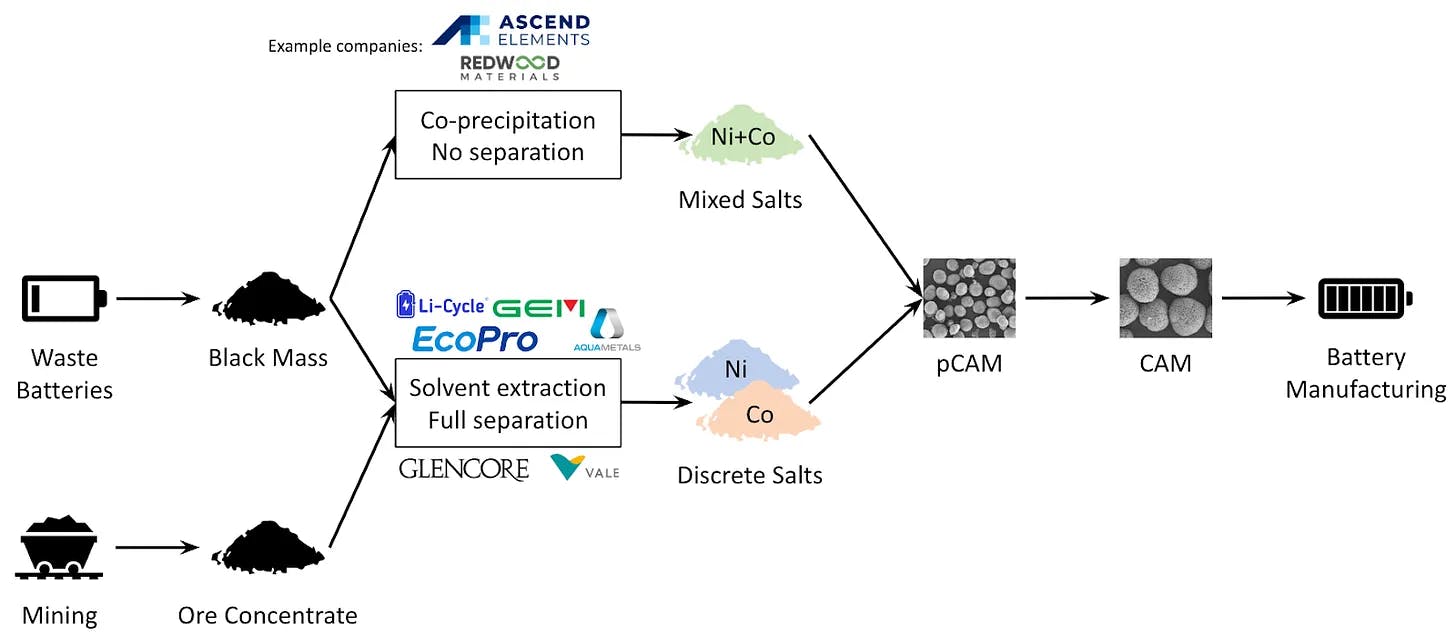

The traditional means of obtaining the metals and other minerals required for battery production is through mining. Though mining is less expensive than recycling, there are many weaknesses in the supply chain and negative externalities. Lower prices are often due to cheap mining labor, which is frequently likened to slavery. In 2023, many of the locations where mines are prevalent were affected by air pollution, water contamination, and land degradation. From mine to manufacturer, battery materials travel 50K nautical miles as of 2022, producing carbon emissions along the way. Reliance on mining also puts the EV industry at the whim of volatile global commodities markets.

Source: Redwood Materials

Redwood Materials operates across multiple stages of the battery value chain, by (1) repurposing used batteries for grid-scale energy storage, (2) recycling and refining recovered metals into over 20 distinct battery-grade materials, and (3) manufacturing cathode active material (CAM) for new battery production. This integrated model allows Redwood to capture more economic value per battery than traditional recyclers, while helping automakers meet domestic sourcing requirements and reduce exposure to volatile global supply chains.

Source: Munro Live

Collection & Diagnostics

There are three primary ways that recyclable materials enter Redwood Materials factories:

Consumer electronics (including old phones, e-bikes, power tools, and laptops) are received from third-party e-waste suppliers and direct mail.

End-of-life EV batteries, which are recovered for reasons ranging from depleted capacity to automobile accidents.

Scrap from battery cell production. These factories scrap up to 10% of battery materials, which could amount to 80 GWh of squandered capacity by 2025. A former Tesla engineer claimed the company was wasting over $200 million worth of scrap metals.

Once collected, materials are shipped to Redwood’s Nevada facilities. There, teams disassemble electronics and battery packs and conduct diagnostic tests. Batteries with significant remaining capacity are routed to energy storage projects. Packs with diminished capacity are processed for materials recovery.

Source: Redwood Materials

Energy Storage

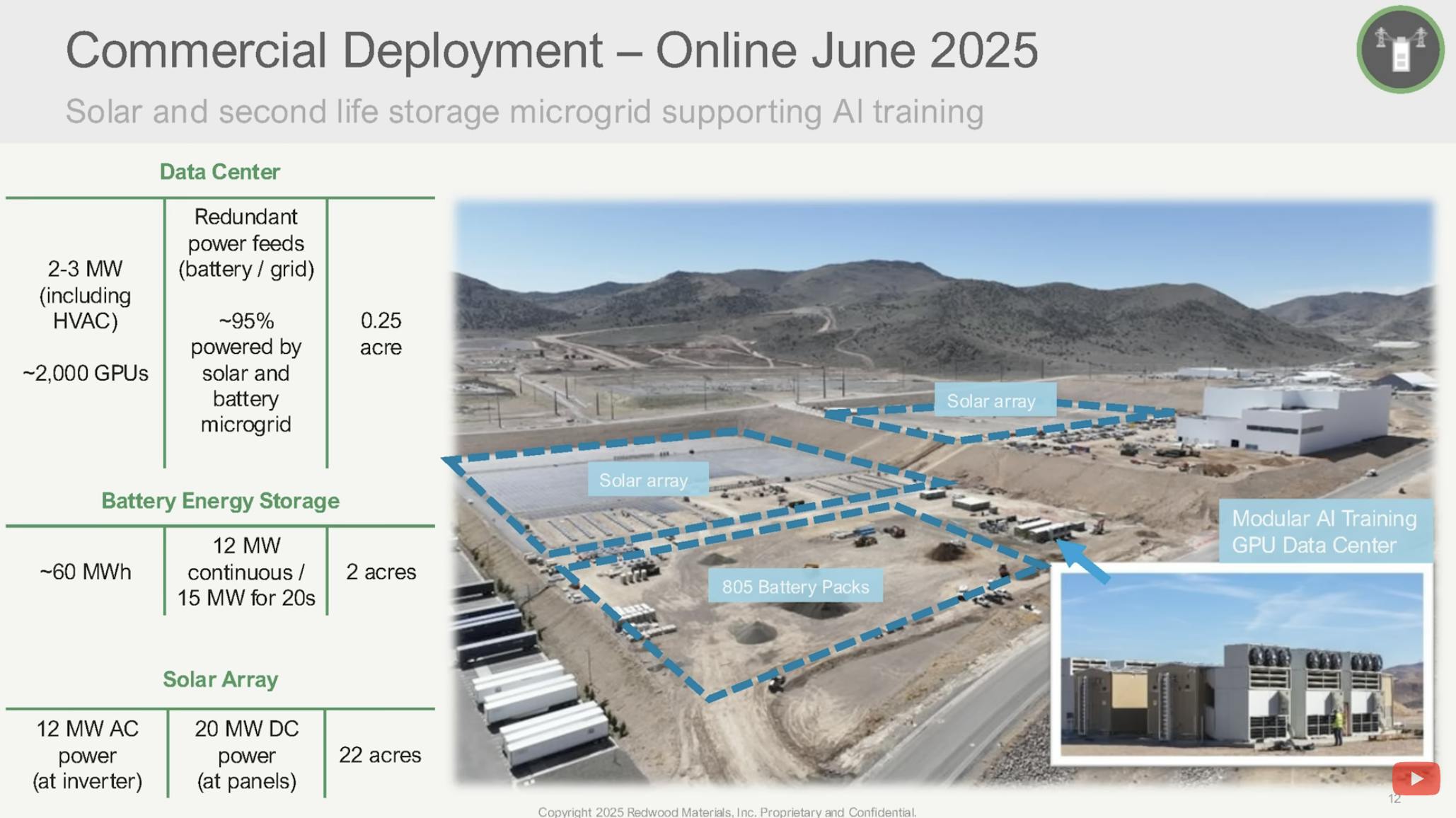

In June 2025, Redwood launched a new division, Redwood Energy, to repurpose used EV batteries into grid-scale energy storage systems. CEO JB Straubel mentioned that some batteries received by Redwood have 50–80% of remaining usable capacity. These batteries, which still retain a significant portion of their original capacity, are deployed in modular microgrids capable of storing and distributing renewable energy.

Redwood Energy’s first deployment powers an AI data center operated by Crusoe at Redwood’s Nevada facility. The installation uses over 800 second-life battery packs and delivers 12 megawatts of power with 63 megawatt-hours of capacity, backed by an adjacent solar array. This microgrid, the largest of its kind in North America as of October 2025, was constructed in just under four months and has become immediately profitable.

Source: Redwood Materials

Rather than disassembling batteries that still have functional capacity, Redwood keeps the packs intact and integrates them into unified storage arrays. This approach not only extends battery life, but also addresses a bottleneck in clean energy infrastructure, which comes with the need to store intermittent power from solar and wind.

In July 2025, General Motors (GM) expanded its collaboration with Redwood to include both used and unused battery packs for stationary storage projects. This arrangement gives GM a productive outlet for surplus or lightly used inventory, and also deepens its domestic battery circularity efforts. Packs from GM have been incorporated into Redwood’s Nevada microgrid.

As of October 2025, Redwood held over 1 GWh of batteries in inventory and expects to receive another 5 GWh within the following 12 months. The company aims to deploy 20 GWh of storage capacity by 2028, which would make it the largest second-life battery storage provider in North America. If successful, this energy business could outpace Redwood’s core recycling segment in revenue and infrastructure relevance.

Source: Munro Live

Recycling

Redwood Materials also recycles battery materials, which is intended to create a circular supply chain by recovering and refining critical materials like lithium, cobalt, nickel, and other valuable metals from end-of-life electronics and batteries. Unlike many battery recyclers that simply extract raw materials, Redwood’s recycling operations are tightly integrated with downstream refining and manufacturing lines. This enables the company to recover critical metals and process them into battery compounds on-site, minimizing both cost and carbon footprint.

Redwood primarily uses a combination of mechanical separation and hydrometallurgical processing, a water-based chemical method that is less carbon-intensive than pyrometallurgy. As part of this process, battery components are reduced to their recoverable base metals. Materials are placed in an oven at 2.7K degrees Fahrenheit and converted to brightly colored powders, which are used to produce anode and cathode final products.

Source: Redwood Materials

According to Redwood Materials, its processes can reclaim more than 80% of the lithium contained in cells as well as upwards of 95% of the nickel, cobalt, aluminum, and graphite. While batteries do degrade over time, this has a minimal effect on the base metals, which can be recovered. Asked about why recycling is so important, Celin Mikolajczak of Panasonic’s battery technology team stated:

“We look at the materials that are in cells. These are metals that are very durable. And we took a lot of effort to get them out of the ground. It's not like we have excess supply lying around that we can just pull to make cells from. Our excess supply is in the cells that are basically come to end of life and are ready for recycling. So we would be really foolish if we didn't take advantage of the capacity of older cells to create the next generation.”

Once recovered, Redwood refines these metals into over 20 distinct battery-grade materials, including lithium carbonate, cobalt sulfate, and nickel sulfate. These materials are then fed directly into Redwood’s manufacturing lines or sold to cell producers, closing the loop between end-of-life batteries and new production.

Manufacturing

Redwood’s refining operations feed directly into its manufacturing processes, where it produces higher-value battery components like cathode active material (CAM) and copper foil for anodes. These are two of the most expensive and technically demanding inputs in EV battery cells; the CAM is responsible for over 30% of an EV battery’s total cost.

The cathode is built from a precise blend of lithium, nickel, manganese, and cobalt, each of which must meet stick purity and particle size specifications. Redwood manufactures this powder in-house, converting refined metals into CAM that can be directly integrated into battery cell production. Redwood’s CAM business was responsible for most of its revenue in 2024, and by 2028, the company expects to increase the material’s manufacturing capacity to power over 1.3 million EVs annually.

Source: Bloomberg

Additionally, Redwood produces copper foil by reclaiming and processing copper scrap. These foils serve as the conductive base for the negative electrode and must be manufactured to sub-micron tolerances. Redwood’s launch of copper foil production marked the first time this material has ever been manufactured in the US, specifically for use in lithium-ion batteries.

Market

Customer

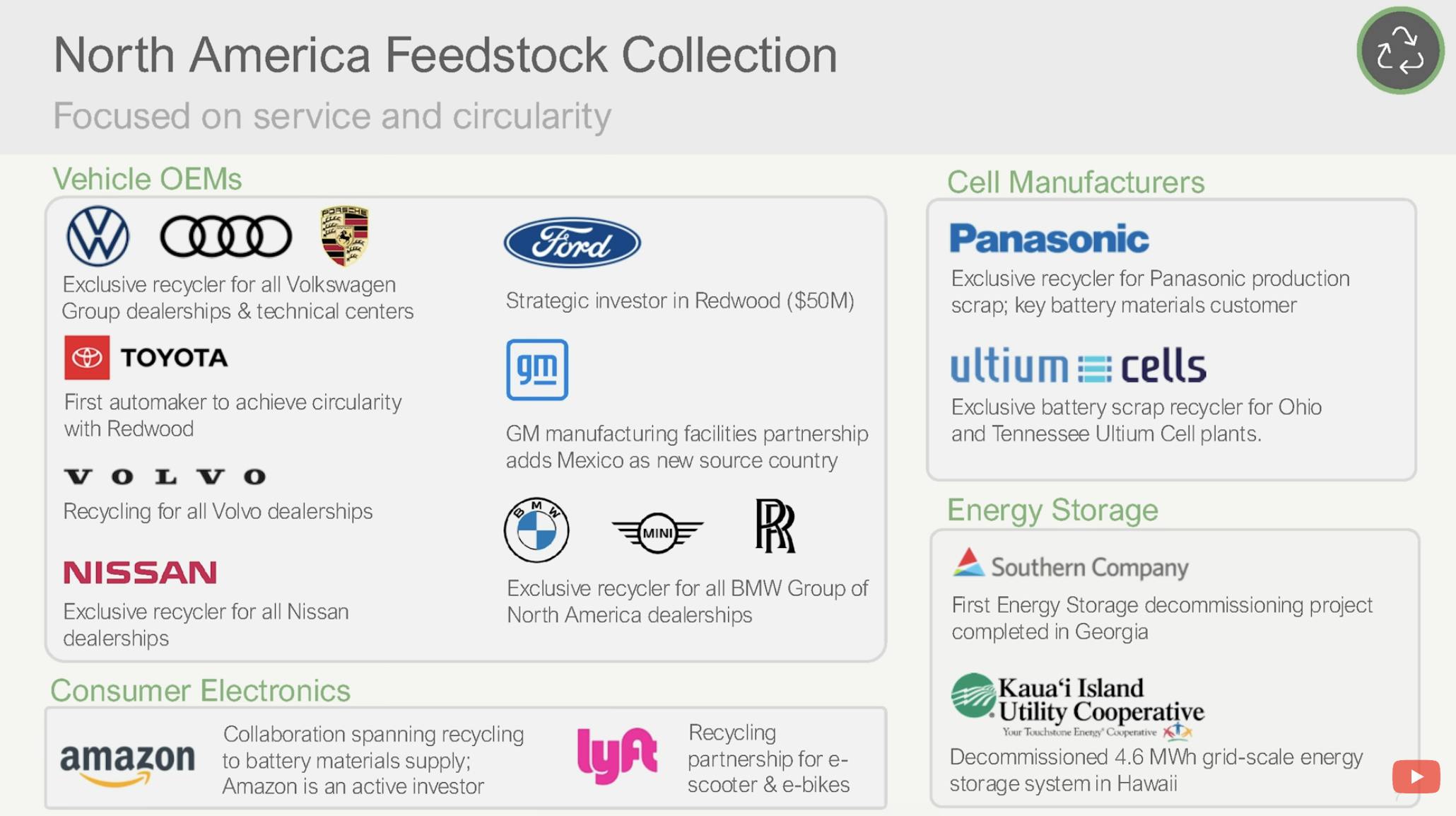

Redwood Materials serves customers on both sides of its operation: those in the market for receiving recyclable materials, and those producing new materials.

Source: Munro Live

The company’s known partners for receiving recyclable materials include Panasonic, Envision AESC, Amazon, Ford, Volvo, the Volkswagen Group (including Audi), Toyota, Lyft, and ERI, which is an e-waste recycler. These companies either collect old consumer electronics from their customers or send retired EV batteries to Redwood Materials’ facilities. The company aims to develop further relationships with EV manufacturers that do not have the capability to recycle materials themselves.

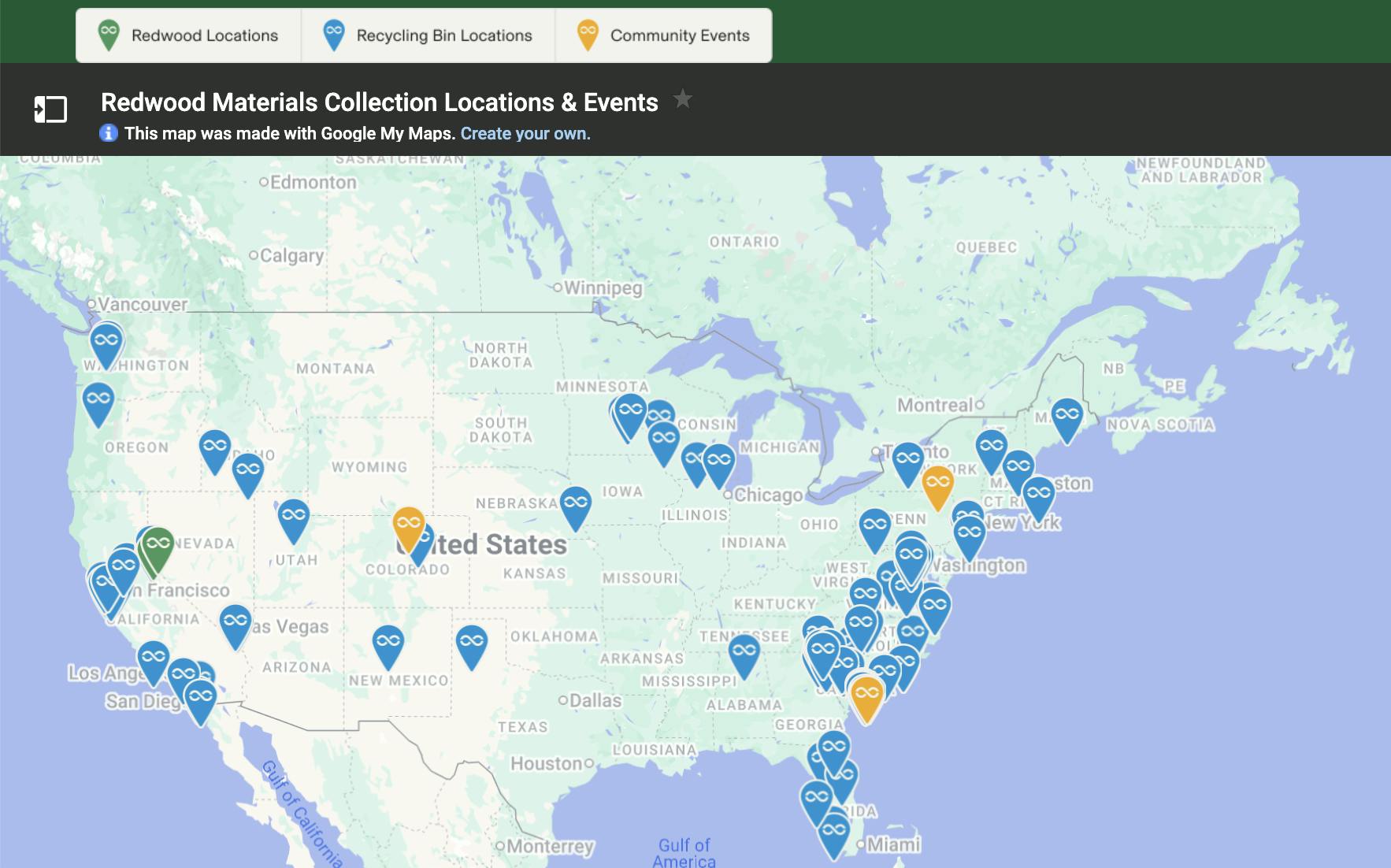

Source: Redwood Materials

While a small percentage of people do send their old electronics to e-waste recyclers, it is not a widespread practice. Straubel argues the world’s largest lithium source could actually be in the drawers of American homes where deprecated electronics are abandoned. As one of the leading buyers, Redwood Materials believes that educating consumers and making it easier for them to hand over electronics (such as offering free shipping) is important.

Redwood Materials also provides chemicals and battery materials to manufacturers like Panasonic, which supplies batteries for Tesla. In 2022, Redwood Materials and Panasonic created a partnership to begin providing cathode materials to Panasonic’s new Kansas factory, which opened its doors in July 2025.

Additionally, through the 2025 launch of Redwood’s Energy division, the company began repurposing EV batteries into stationary grid infrastructure. The division’s first deployment powers an AI data center operated by Crusoe, using over 800 second-life battery packs. In July 2025, GM deepened its relationship with Redwood by contributing used and unused battery packs to support similar storage installations.

In August 2025, Redwood partnered with Caterpillar to recycle batteries from its fully electric R1700 XE underground loaders. Each 213-kWh pack contains high-value metals like lithium and nickel, which Redwood will recover and return to the battery supply chain. The collaboration closes the loop between Caterpillar’s mining equipment and the materials it helps extract, and followed Caterpillar’s investment in Redwood.

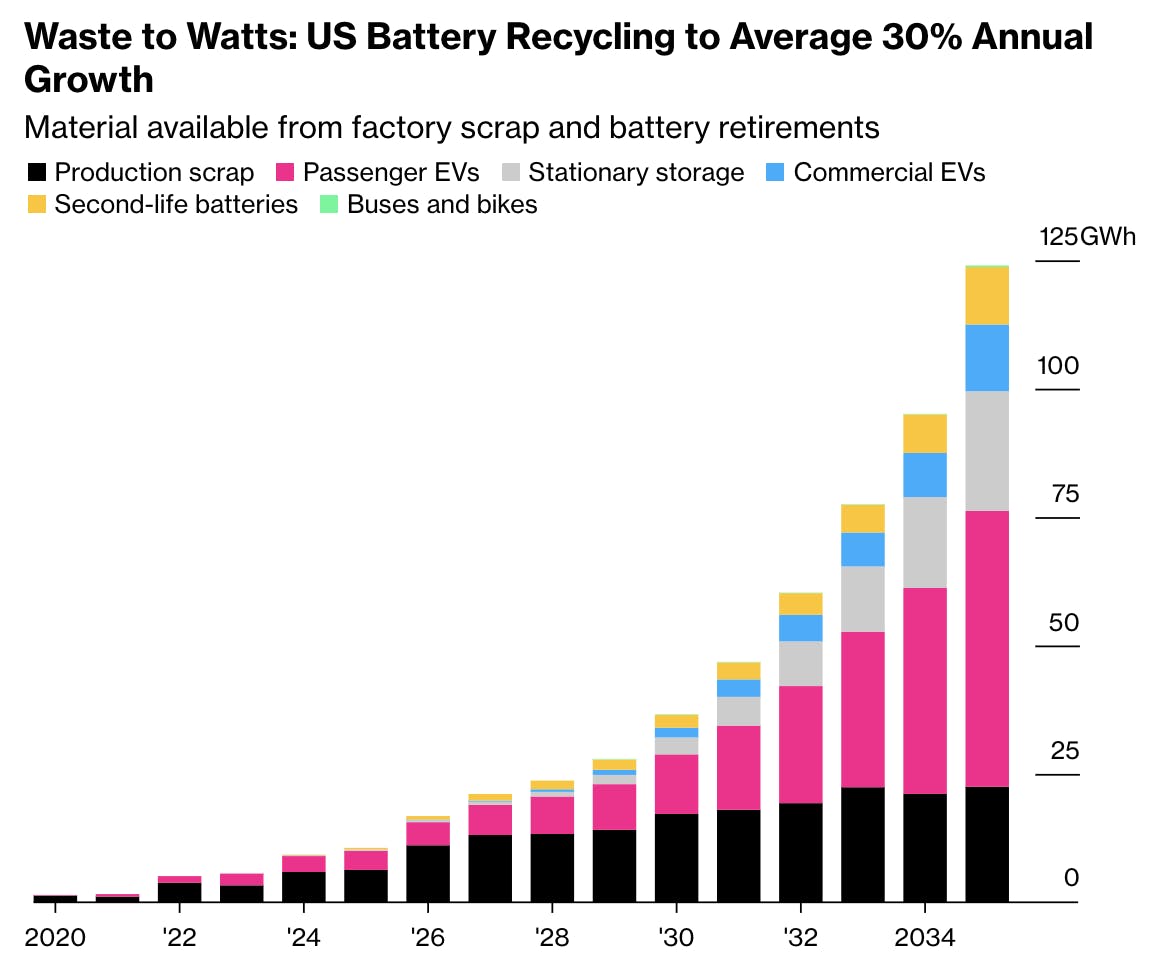

Market Size

Redwood Materials lies at the intersection of several markets: lithium-ion battery production, battery recycling, and stationary energy storage. The lithium-ion battery market was valued at over $28 billion in 2023 and is expected to reach $135 billion by 2031 as the electrification of vehicles and homes continues to expand. EVs accounted for 10% of car sales in 2024, up from 4.6% in 2021, but regulatory changes and increasing demand led analysts to argue they will account for 58% by 2040. As of January 2024, GM’s CEO expected the company’s EV sales to be 10% of GM car sales in 2024.

The market for recycled lithium-ion batteries was worth $6.5 billion in 2022 and could reach $18 billion by 2030. According to Straubel, several GWh worth of energy storage is recycled per year, comprising 1-2% of what is actually being produced annually. That small proportion of total output leads the company to believe expansion opportunities within the market are substantial. The US battery recycling market is expected to reach over 125 GWh of recoverable material by 2035, not including consumer electronics. The majority of this volume will come from EV retirements and factory scrap, directly aligning with Redwood’s current intake streams.

Source: Bloomberg

Finally, Redwood is entering the stationary energy storage market through its new division, Redwood Energy. This market is growing rapidly as data centers, renewable energy providers, and utilities seek ways to store intermittent power. The US grid added 10.4 GW of battery storage in 2024 alone and is forecast to deploy over 130 GWh per year globally by 2030. Redwood aims to deploy 20 GWh of its own second-life capacity by 2028.

Competition

In a broad sense, the biggest competition to Redwood Materials is mining, since there’s a possibility that demand for lithium-ion batteries will be filled by resource extraction and not recycling. Due to the ever-increasing demand for electrification, governments around the world have been committing billions to increase the supply of necessary metals. Within the battery recycling landscape, Redwood Materials faces several direct competitors.

Source: The Gigaton

Startups

Ascend Elements: Founded in 2015 in Massachusetts, Ascend Elements recycles lithium-ion batteries and converts them into various forms of engineered cathode materials. Its patented process, which it calls Hydro-to-Cathode™ direct precursor synthesis, uses a liquid solution in lieu of Redwood Materials’ ovens. While it does not yet have a focus on anode materials, its ability to easily change the concentration of formulas to provide a wide variety of cathode materials is attractive to partners such as Land Rover, Jaguar, and Honda. Ascend Elements has raised almost $1.8 billion in total funding as of October 2025, with $480 million coming from US Department of Energy (DOE) grants and an additional $100 million in debt.

Li-Cycle: Founded in 2016 in Ontario, Li-Cycle uses a patented water-based process to extract valuable chemicals from batteries and separate them into recycled battery components. The most notable chemicals extracted include cobalt sulfate, lithium carbonate, and nickel sulfate. Its process recovers up to 95% of materials lost in otherwise disposed batteries. The company went public via a SPAC in 2021 at a $1.6 billion market cap. In March 2024, Li-Cycle laid off 17% of its staff to save cash and focus on building a facility in New York. In March 2025, Glencore made an offer to acquire Li-Cycle, and Li-Cycle filed for bankruptcy protection in May 2025. In August 2025 Glencore concluded its acquisition of Li-Cycle’s remaining assets, for around $40 million.

Princeton NuEnergy: Chao Yan, a postdoctoral research associate at Princeton University, founded Princeton NuEnergy in 2019, with commercial production beginning in 2021. Its process uses much less water, chemicals, and high temperatures compared to competitors and instead uses high-throughput, low-temperature plasmas. The company claims that this allows it to achieve the same 95% recovery rate of anode and cathode materials while using much less energy. Princeton NuEnergy had raised a total $82 million in funding as of October 2025, including a $26 million Series A in May 2024.

Incumbents

Albemarle Corporation: Founded in 1994 and headquartered in Charlotte, North Carolina, Albemarle is the world’s largest lithium producer and a major supplier of specialty chemicals. The company has long operated at the upstream end of the battery value chain, extracting lithium from brine and hard rock resources globally. In 2022, Albemarle announced plans to build a $1.3 billion lithium refining facility in Richburg, South Carolina, capable of producing enough battery-grade lithium to support around 2.4 million EVs per year. However, amid a sharp decline in lithium prices from their 2022 peak, Albemarle announced in March 2024 that it would pause the project. While not a recycler, Albemarle represents an important alternative to Redwood’s circular model, competing for dominance in the lithium supply chain via traditional extraction and refining. Albemarle generated $5 billion in revenue in 2024 and was trading at a market cap of $10.7 billion as of October 2025.

Glencore: Founded in 1974 and based in Zug, Switzerland, Glencore is one of the world’s largest commodities traders and mining companies, with major operations in metals, minerals, and energy. While traditionally focused on extraction and trading of raw materials like copper, cobalt, and nickel, Glencore has increasingly positioned itself as a key player in the battery materials supply chain. It has invested heavily in lithium-ion battery recycling through partnerships with companies like Li-Cycle and has explored developing its own recycling infrastructure. In March 2025, Glencore offered to acquire Li-Cycle following the latter’s financial difficulties, further signaling its intent to expand downstream. Glencore generated $230 billion in revenue in 2024, and was trading at a market cap of $55 billion as of October 2025.

LG Chem: Founded in 1947 and headquartered in Seoul, South Korea, LG Chem is a global provider of chemicals and battery materials with ties across the electric vehicle supply chain. While traditionally known for its petrochemicals business, LG Chem has expanded into EV battery supply chains through both manufacturing and recycling. In the US, LG Chem is constructing a $3 billion cathode manufacturing facility in Clarksville, Tennessee, set to be the largest of its kind in the country. Once operational in 2026, the plant will produce cathode materials for around 600K EVs annually, using solar and hydroelectric energy to power the site. LG Chem has already signed a $19 billion long-term supply agreement with General Motors through 2035 and another $2.5 billion deal with Toyota for cathode materials. In 2024, LG Chem generated $35 billion in revenue; it had a market cap of approximately $20.5 billion as of October 2025.

Business Model

Redwood Materials receives batteries from a wide array of customers. The transportation of devices containing batteries is actually the largest cost for the company, as well as the dismantling of different devices. While receiving smaller batteries is already a profitable venture, the larger, heavier batteries still present a complicated problem. Depending on the amount of materials a battery may yield and the sales that it provides, Redwood Materials sometimes ends up paying customers back for their devices.

Once collected, batteries are either repaired for reuse, repurposed for second-life energy storage, or processed through Redwood’s recycling and refining lines. The company sells intermediate products and fully refined outputs, such as cathode active material and copper foil, back to battery manufacturers. However, pricing for these materials is closely tied to global commodities markets, meaning Redwood has limited pricing power.

Because recycled battery materials are such a small fraction of the precious metals industry, the company’s pricing power is virtually non-existent. According to Tim Johnson, a co-founder of Li-Cycle, this is actually a longer-term advantage of recycling. As technology improves and the company can recycle batteries at a lower cost while capturing more value, profit margins will naturally improve as the final price will still be determined by the cost to mine.

Source: Munro Live

While Redwood Materials is still burning cash as of October 2025 as it invests heavily in research and development to drive down costs, the long-term hope is to improve the unit economics of collecting, refining, and selling materials. As of 2021, the company has been able to recapture metals at a lower cost than mining. Asked about the profitability of operations in a 2021 interview, JB Straubel said the following:

“Well, we're still we're still growing very quickly. So we're consuming capital as we build the operation and the equipment. The most important thing, though, is the unit operations are profitable. So we're able to take these input materials, refine them, purify them and sell them at a profitable unit margin. And that that's the fundamentally key thing, is it's getting better quite quickly as we improve the technology and scale. That gives me the encouragement that this is economic today relative to mining. Even at this early stage.”

In addition to selling recycled battery materials, Redwood is generating revenue from second-life energy storage products, systems built from retired EV batteries. This initiative broadens the company’s addressable market and helps maximize value extraction from each input, further supporting its push toward vertically integrated circularity.

Traction

In 2020, the first full year of operations, Redwood Materials processed 10K tons of scraps from Panasonic and Envision AESC as well as batteries from Amazon’s shipment vehicles. In April 2021, the company received 60 tons of devices and scraps per day, enough to fill three semi-trucks.

One year after breaking ground on its Nevada factory, Redwood Materials began producing anode copper foil and began producing cathode active material at the end of 2023. To aid in that process, in 2022, the company began construction of a 600-acre, $3.5 billion facility in South Carolina to complement the 400-acre Nevada site. These factories are designed to run on completely renewable electricity and are supported by a $2 billion conditional loan from the US Department of Energy, which will be distributed according to milestones agreed upon by the two parties.

Source: Redwood Materials

As of June 2025, Redwood had a run rate capacity of 20 GWh of battery materials. The company’s goal is to eventually scale its facilities to recycle and produce 100 GWh every year, enough to power 1 million EVs. As its factories scale and improve, Straubel believes that by 2030, the company can bring the price of raw materials down to half the cost required to mine them. The company says doing so would reduce battery cell manufacturing-related emissions by at least 40%.

In 2023, Redwood Materials acquired Redux Recycling GmbH, a German lithium-ion battery recycler, to expand its European presence and work with suppliers, customers, and partners across Europe. At the time of announcement, Redux was the leading European lithium-ion battery recycler and had a facility in Bremerhaven, Germany, equipped with 10K tons of annual processing capacity. The facility is able to recycle batteries from EVs and E-bikes, stationary storage systems, and consumer electronics. A team of 70 technical staff, ranging from chemical engineers, metallurgists, and material scientists, was brought over as part of the acquisition and expanded Redwood Materials’ footprint in Europe.

During 2023, Redwood was reported to have recycled 10 GWh worth of lithium batteries, which is around 44K tons of material and enough to build batteries for 100K EVs. In 2024, Redwood generated $200 million in run-rate revenue, and as of June 2025, maintained a 70% market share in US battery recycling.

Valuation

Since receiving its first check in 2017, Redwood Materials has raised over $4 billion in total funding as of October 2025, with half of that figure coming from a $2 billion Department of Energy loan in February 2025. The company raised a $350 million Series E in October 2025 at a valuation north of $6 billion led by Eclipse, with participation from Nvidia as a new strategic investor. Prior to this round, Redwood was valued at $5.3 billion in August 2023. Other notable investors in the company include T. Rowe Price, Goldman Sachs, Capricorn Investment Group, OMERS, and Microsoft Climate Innovation Fund.

Based on estimated 2024 revenue of $200 million, and the company’s $6 billion valuation, this implies a revenue multiple of ~30x. By comparison, Albemarle Corporation, Glencore, and LG Chem are publicly-traded companies that are competitors of Redwood Materials. These companies were trading at between a 0.4x and a 2.7x revenue multiple as of October 2025 (Albemarle at 3.0x, Glencore at 0.4x, and LG Chem at 1.3x).

Source: Koyfin

These companies operate at vastly larger scale than Redwood and are exposed to broader commodity cycles, which typically compress revenue multiples. Redwood’s premium could be driven by its perceived defensibility, with proprietary processing technology, domestic infrastructure tailwinds, and vertical integration into anode and cathode production.

Key Opportunities

Partnerships with Battery & Auto Manufacturers

As legislators consider setting sunset dates for the same internal combustion vehicles to promote EV sales, as in California, the demand for EVs will likely continue to rise. The existing relationship between Redwood Materials and Panasonic, Tesla’s battery supplier, provides a significant source of growth, but the team will inevitably need to form substantial relationships elsewhere.

Amazon, one of Redwood Materials’ early investors, is also a large investor in the EV truck company Rivian. New US tax credits for EV manufacturers provide benefits to those that source their materials domestically, which is difficult for batteries, whose materials are largely mined overseas. Working with Redwood Materials allows EV companies to take advantage of these credits.

But EVs are not the only 21st-century innovation requiring batteries. Partnerships with factories that build smartphones, smartwatches, laptops, and more present opportunities. Additionally, governments around the world are pushing for grid-scale energy storage, which helps prevent blackouts by balancing utility energy supply and demand and also prevents the loss of renewable energy during periods of surplus.

Grid-Scale Energy Storage

In June 2025, Redwood Materials formally launched a dedicated energy storage business, repurposing retired EV batteries into grid-scale storage systems. As EV adoption grows, so does the supply of used battery packs, many of which still retain 50–80% of their original capacity. By giving these packs a second life in stationary applications, such as storing solar and wind power or providing backup capacity during peak demand, Redwood can extract more value from each battery it touches.

Energy storage capacity in the US is expected to significantly increase in the late 2020s, driven by regulatory mandates and the economics of renewable energy. In June 2025, CEO JB Straubel claimed Redwood is able to deliver electricity from its second-life battery projects at a cost “below the utility”.

Leveraging its recycling infrastructure, battery expertise, and materials supply chain, Redwood is positioned to offer vertically integrated energy storage solutions, both as a low-cost buyer of used batteries and as a supplier of storage systems to utilities, data centers, and commercial users. As battery lifecycles extend across multiple use cases, Redwood’s energy division could serve as a natural extension of its closed-loop ambitions and a meaningful contributor to long-term revenue diversification.

Expansion to Foreign Markets

International expansion is a key opportunity for Redwood Materials, which operates in North America and Europe as of October 2025. It is also essential for the company’s ongoing viability. Relationships between capital-intensive mines, which face huge startup costs, and manufacturing plants that can't afford supply chain disruptions, are typically long-lasting.

These contracts often span many years, ensuring the viability of the business for both parties. A similar long-term commitment will likely be required from battery recyclers, as their battery customers will need the same level of dependability. The more time Redwood Materials takes to expand internationally, the more opportunities manufacturers have to lock in extended contracts with mines or other recycling companies.

In 2021, Straubel said that the company was looking at Europe and Asia as its second and third most important growth areas, respectively. The company expanded into Europe in February 2022, acting on Straubel’s 2021 statement. As the company stated at the time of its European expansion:

“While we’re moving quickly in the US to address our nation’s 2030 electrification goals, there’s another market with similarly aggressive ambitions that also relies heavily on a convoluted, overseas supply chain with high CO2 emissions: Europe. Today, Europe is the fastest growing EV market globally, with an increasing commitment from automakers. 1000 GWh battery cell production is planned in the EU to support EV sales that are expected to account for nearly 30% of total passenger cars by 2025.”

Given the predominance in the manufacture of battery components, Asia remains an opportunity for Redwood to expand its business as of October 2025.

Licensing & Co-Locating Operations

The largest cost for Redwood Materials remains the logistics of collecting and transporting batteries to its Nevada factory. This factory is conveniently located near the Nevada Gigafactory, which reduces the costs of shipping materials to production. As more partnerships emerge, Redwood Materials will have to decide which are large enough to require co-located factories to reduce shipping costs. For example, if a Rivian partnership became successful at a later point, Redwood Materials could place a site near the Rivian plant in Illinois to reduce the costs of shipping materials from Nevada.

Key Risks

Uncertainty Around Federal Support

Redwood Materials has benefited from significant federal support, including a $2 billion loan from the Department of Energy (DOE) to build out its South Carolina battery materials campus. As of October 2025, this financing package constitutes over half of the company’s capital stack. However, this support is not guaranteed to continue.

The “One Big Beautiful Bill,” signed into law in July 2025, represents a policy reversal for the US clean energy sector. It accelerates the phase-out of key tax credits, eliminates transferability, and imposes aggressive construction deadlines, dampening the economics of battery recycling and other electrification investments. For Redwood Materials, which has benefited from prior federal support, the bill introduces material headwinds. While certain provisions like 45X remain in place and could favor domestic suppliers, the broader contraction in federal incentives is likely to slow industry momentum and shrink the addressable market for battery materials.

Development of Alternative Fuels & Batteries

While EVs are the most common way to reduce emissions created by vehicles, they are not the only option. Hydrogen fuel cells, for example, show great promise. Just like lithium-ion batteries, there are many considerations with fuel cell EVs (FCEVs), but many customers appreciate that their only emissions are water vapor and warm air. Companies like Toyota, BMW, Hyundai, and Honda have all released an FCEV. If a hydrogen fuel turns out to be technologically superior or gains market share, it would affect Redwood Materials.

Additionally, lithium-ion batteries are not the only option being investigated for concealed energy storage. Solid-state batteries have gained a lot of attention due to their high energy density. While they still contain many of the same minerals being processed by Redwood Materials, a switch to solid-state batteries may require substantial factory changes.

Inability to Optimize Operations

With so many unusual inputs, from electric toothbrushes to large vehicular batteries, Redwood Materials’ processes are innately challenging to streamline. This is part of the reason mining remains the cheaper option. If operations cannot be streamlined, the price may never come down to a competitive point that allows Redwood Materials and its customers to mutually benefit.

One important thing to note is that if battery breakdown and production become less time- and capital-intensive, customers and the broader market may demand lower prices for recycled batteries, eating away at the company’s margins.

Alternative Recycling Methods

Most of Redwood Materials’ competitors are using water-based methods to recycle battery materials instead of the company’s heat method. As scale increases, one specific recycling method may emerge as most sustainable, or water-based methods in general may prove generally superior. While factories can, in theory, be retrofitted, the furnaces and equipment Redwood Materials has invested in have long payback periods. To minimize this risk, the company will likely continue to work toward making its processes more efficient, while maintaining awareness of developments in the broader sector in case a process change is required.

Summary

Redwood Materials operates across multiple stages of the lithium-ion battery value chain, by (1) repurposing used batteries for grid-scale energy storage, (2) recycling and refining recovered metals into battery-grade materials, and (3) manufacturing cathode active material (CAM) for new battery production. This integrated model allows Redwood to capture more economic value per battery than traditional recyclers, while helping automakers meet domestic sourcing requirements and reduce exposure to volatile global supply chains.

As Redwood Materials looks to expand globally, deep partnerships both on the e-waste supply and battery material demand sides will be extremely important. Government investment, in the interest of making EV supply chains more robust, has produced a number of competitors to Redwood Materials. Along with lowering the cost of operations, Redwood Materials will need to keep a strong watch over competitors to ensure they are using the best technological processes to provide the lowest-priced product.