Thesis

In 2021, Americans drove 325 billion more miles than they did in 2020, and 1% less than the 3.3 trillion miles they drove in 2019. Traffic deaths rose 12% in the first 9 months of 2021 to 31.7K, representing the highest number of traffic deaths in a year since 2006. In 2021, 52% of all trips in the US across transportation modes were shorter than 3 miles. 28% were less than 1 mile. Many of these short trips were for engaging in local commerce. For example, 88% of households use cars to buy groceries by driving 4 miles, on average, to stores. In 2018, 87% of consumer spending in the US occurred offline.

At the same time, there’s an ongoing shift in consumer preferences toward convenience, speed, and reliability, driving demand for last-mile and same-day delivery services. Consumers increasingly want and expect fast delivery, with 68% of consumers saying that fast shipping would make them more likely to place an online order and 34% of US customers now placing orders for same-day pickup or delivery. The global last-mile delivery market is projected to grow from $131.5 billion in 2021 to $288.9 billion by 2027. However, profitability and costs remain significant challenges for many companies in this sector. This poses a difficulty for retailers who must reconcile rising consumer demand for ever-faster delivery with the high costs of providing such delivery services.

This is where Nuro comes in. Nuro is a company that creates autonomous delivery vehicles for local goods transportation and aims to transform the last-mile delivery landscape. Its goal is to help merchants deliver goods to customers quickly, affordably, and safely. By leveraging advanced sensing and artificial intelligence, Nuro aims to provide an offering that reduces labor costs, improves operational efficiency, and enhances safety in the same-day and last-mile delivery spaces. Nuro has strategic partnerships with major retailers like Chipotle, Kroger, and Walmart, and has positioned itself to capitalize on the continuing growth of e-commerce.

Founding Story

Source: Nuro

Nuro was founded in 2016 by Jiajun Zhu and Dave Ferguson, both of whom were formerly engineers at Google’s self-driving car project.

Zhu holds a master's degree in computer science from the University of Virginia and was one of Google’s first self-driving project engineers, where he spent eight years after graduation. At Google, Zhu led a team of researchers and engineers working on the self-driving car's perception technologies and simulation system. Ferguson, meanwhile, received a Ph.D. in computer science. During his time at CMU, Ferguson and the CMU team won the DARPA Urban Challenge, a 60-mile obstacle course on city streets for autonomous vehicles, in 2007. He later spent over five years at Google as the self-driving program's machine learning and computer vision lead.

In 2016, Zhu and Ferguson were working together on self-driving cars at Google. Zhu stated:

“We both were leading pretty large teams and were responsible for a pretty large portion of the Google’s car software system.”

At the time, Google was getting ready to spin out its self-driving car project into what would eventually become Waymo. Early team members like Zhu and Ferguson were given the option to either stay on and receive payouts over eight subsequent years, or take a lump sum and leave the company. Zhu and Ferguson chose the latter, and each of them got a cash payout of around $40 million. Ferguson stated that this payment was important in giving the pair the confidence to go start a company of their own, and said that:

“What we were fortunate enough to receive as part of the self-driving car project enabled us to take riskier opportunities, to go and try to build something that had a significant chance of not working out at all.”

Just weeks after they left Google, the pair had founded Nuro with the idea of taking a different path towards autonomous vehicles focused on delivering goods instead of passengers.

Product

Nuro is a robotics company that provides autonomous delivery services to retailers. Nuro has three types of autonomous vehicles that make up its fleet: Nuro, R2, and P2.

Source: Nuro

Nuro

In January 2022, Nuro launched its third-generation autonomous delivery vehicle, the eponymous “Nuro”. Nuro’s compartments hold up to 500 lbs of groceries and it has an advanced HVAC system designed to maintain optimal temperatures for various items, with temperature-controlled compartments maintaining a range of 22ºF to 116ºF. Modular inserts allow for customization and adaptability, providing potential for applications like mobile marketplaces and hot coffee dispensing. The Nuro has a custom external pedestrian airbag and a new top speed of 45 mph, an increase over its predecessor. It is powered by battery-electric and is emission-free. The third-generation Nuro will be built out of a new manufacturing and test facility in Nevada.

Source: Forbes

R2

The Nuro R2 is the company’s second-generation autonomous delivery vehicle. With the release of the R2, Nuro was one of the first autonomous vehicle companies to receive a temporary exemption from the National Highway Traffic Safety Administration which allowed Nuro to start deploying and operating its fleet of low-speed autonomous vehicles in February 2020.

Source: TechCrunch

While the R2 has been superseded by Nuro’s third-generation vehicle (the Nuro), the R2 continues to be the primary vehicle used for Nuro’s operational markets today while the company prepares to scale the newer model for production readiness. The R2 is an update of the previous R1 robot prototype, which Nuro retired in 2020.

P2

The Nuro P2 is a Toyota Prius with the same sensor and compute capabilities as Nuro’s third-generation and R2 vehicles. Because the P2 can accommodate human safety drivers, unlike the third-generation and R2 vehicles, which lack room for drivers or passengers, Nuro uses its P2 fleet to evaluate new versions of its autonomous software.

Source: Nuro

When entering a new market, Nuro first deploys a fleet of P2s with human safety drivers to map out areas. Using the mapping data, Nuro tests and evaluates the readiness of its autonomous fleet against the area the company wants its robots to operate. The P2 is also used for testing initial deliveries as part of the validation process.

Market

Customer

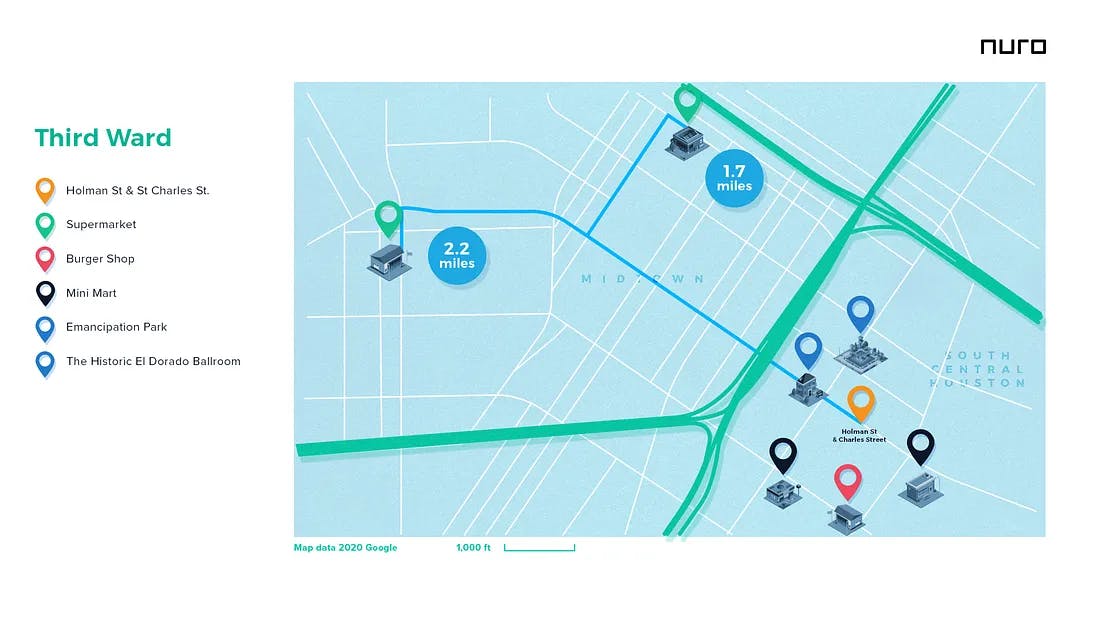

Nuro’s ideal customer profile comprises individuals and businesses seeking convenient, affordable, and safe local delivery services. The company’s autonomous vehicles cater to customers who may not have the time or means to travel to stores or run errands themselves. Nuro’s primary target market includes busy urban dwellers, elderly or disabled people, and businesses that require frequent deliveries. Low-income households and residents of neighborhoods with limited access to fresh and healthy food options are other beneficiaries of Nuro’s autonomous delivery vehicles. With its aim to reduce the cost of a delivery order to $0, Nuro could make it possible for people living on fixed or low incomes to enjoy the same convenient and affordable access to groceries, prescription drugs, and other local products as those in food-rich areas.

Source: Nuro

Market Size

The market size for Nuro centers around the autonomous last-mile delivery sector, which combines autonomous vehicle technology with the rapidly expanding last-mile delivery market. The autonomous last-mile delivery market was valued at $1.1 billion in 2022, with one estimate projecting its value to reach $5.9 billion by 2030 (representing a 23.5% CAGR).

Competition

Cruise: Founded in 2013 and acquired by General Motors in 2016, Cruise builds self-driving vehicles. In March 2022, General Motors acquired Softbank’s equity ownership in Cruise for $2.1 billion and invested an additional $1.35 billion. While Cruise primarily focuses on the autonomous ride-hailing business, it has delivery partnerships with Walmart in Arizona. Its custom-built Origin vehicle contains locked storage units and customer authentication, showing Cruise’s plans to move into the last-mile delivery market.

Serve Robotics: Spun out of Postmates in 2021 following the acquisition of Postmates by Uber, Serve Robotics is a robotics company developing autonomous last-mile delivery robots. While Serve focuses on the food delivery market like Nuro, its robots operate only on sidewalks and are not intended for driving on the road. In 2021, Serve partnered with Uber Eats to provide autonomous food delivery in select areas in the Los Angeles area. It has raised $24 million in funding.

Starship Technologies: Starship Technologies develops self-driving delivery robots and compete with Nuro in the autonomous last-mile delivery space. Founded in 2014, Starship claims the largest fleet of autonomous delivery robots, with 1.7K robots in operation and 10K deliveries daily as of March 2022. The Starship Robot is a small delivery robot that operates only on sidewalks, capable of carrying up to 3 bags of groceries. As of August 2021, it operated primarily on college campuses, with a footprint of 20 colleges in 15 states. It has raised $197 million in funding.

Business Model

Nuro operates a B2B model, focusing on partnerships with retailers, restaurants, and other businesses to provide autonomous delivery solutions for a fee. The company generates revenue through these partnerships by providing a delivery service that aims to be lower-cost and safer than existing human drivers. By reducing costs associated with human delivery drivers, co-founder Dave Ferguson stated that Nuro could fund delivery operations exclusively through fees charged to partners, allowing free delivery for consumers.

Traction

Nuro has experienced significant growth since its founding in 2016, driven by its focus on developing autonomous delivery vehicles and securing strategic partnerships with major retailers. In 2018, Nuro launched its first autonomous delivery pilot with Kroger, one of the largest grocery chains in the United States. Its partnerships expanded in 2020 to include other retail giants like Walmart and Domino’s Pizza. By the end of 2021, Nuro had deployed its autonomous delivery vehicles in Houston and Silicon Valley.

In March 2021, Nuro announced a partnership with Chipotle, which also invested in the company’s Series C funding round. FedEx announced a pilot program to test Nuro’s delivery vehicles in Houston in 2021. In September 2022, Uber Eats and Nuro announced a 10-year deal for autonomous food delivery service in California and Texas. Nuro became the first company in California to receive an Autonomous Vehicle Deployment Permit in December 2020, allowing it to roll out commercial autonomous vehicle services. The company also made preparations to scale up in August 2021, announcing plans to build a $40 million factory in Nevada to test and assemble its autonomous vehicles.

In November 2022, Zhu and Ferguson announced that Nuro would lay off 20% of its team in an effort to extend its runway into 2025.

Valuation

In November 2021, Nuro raised $600 million in a Series D led by Tiger Global Management which valued the robotics company at $8.6 billion. Key investors also included T. Rowe Price, Softbank, Google, Kroger, Fidelity Management and Research Company, Baillie Gifford, Woven Capital, and Gaorong Capital. Nuro has raised $2.1 billion in total funding as of May 2023.

Key Opportunities

Robotaxi Expansion

Going forward, Nuro could diversify its offerings and tap into the robotaxi industry, which is expected to be worth upwards of $100 billion by 2029. Autonomous vehicle companies' most significant challenge is developing mature, safe, self-driving technology. If Nuro can provide autonomous delivery services at scale, the company could leverage its technological and operational expertise to grow into the adjacent robotaxi business. Entering the robotaxi market would allow Nuro to capitalize on its existing expertise in autonomous vehicles, expand its addressable market, and diversify its revenue streams.

Category Expansion

Nuro’s initial focus has been on groceries and food, with its primary delivery partners including Domino’s, Chipotle, and Kroger. Expanding into the healthcare and pharmaceuticals sector represents an opportunity for Nuro to diversify its autonomous delivery solutions. By collaborating with healthcare companies, pharmacies, and medical supply manufacturers, Nuro can leverage its expertise in autonomous last-mile delivery to provide contactless transportation of healthcare items, medicines, and pharmaceutical products. During the COVID-19 pandemic, Nuro used its delivery robots to transport medical supplies around two stadiums in California that had been converted into treatment facilities, establishing a precedent for serving this market. Drone delivery startups like Zipline have partnered with healthcare providers like Michigan Medicine in the past as well, proving out the market demand for fast, autonomous delivery of prescriptions. With drone use limited in many US urban centers, an opportunity exists for Nuro to deliver essential medical supplies in urban areas that drone companies cannot serve.

Positive Public Sentiment

Nuro’s potential impact on consumer convenience and safety could be substantial. Over 3 trillion miles are driven annually in the US alone. Nuro’s autonomous technology aims to eliminate unwanted miles and time spent on the road for short trips, such as trips for the sake of errands, which would be rendered unnecessary if the company was able to achieve sufficient scale. Furthermore, autonomous vehicles can potentially reduce the 1.3 million global vehicular deaths caused by human errors, such as impairment and distraction. By contributing to their safety and lowering the amount of time customers have to spend on errands, Nuro could then spotlight that contribution both in its marketing materials and in its PR efforts to achieve greater brand awareness and favorability.

Key Risks

Technology Maturity

Nuro relies on developing and deploying autonomous technology for its delivery services. The technology's maturity and level of adoption pose risks to its business model. The progress and timeline for achieving full autonomy are uncertain, with potential delays due to regulatory hurdles, technical challenges, and safety concerns. Without providing autonomous delivery service at scale, Nuro’s current revenue is likely insubstantial compared to its expenditures, although no revenue figures are available. This situation is not unique to Nuro, with other high-profile autonomous technology companies shutting down due to lack of funding or inability to remain solvent, most notably Argo AI and Embark Trucks. There is no guarantee that Nuro will achieve the necessary technological maturity within a reasonable timeframe that allows it to operate a sustainable business, especially in the current macroeconomic downturn. In November 2022, Zhu and Ferguson announced that Nuro would lay off 20% of its team to extend its runway into 2025.

Profitability

The food and grocery delivery sectors experienced rapid growth in the 2010s, but their long-term profitability remains uncertain, with such uncertainties lingering even for incumbents like Instacart, DoorDash*, and Uber Eats. This presents a risk to Nuro, as it provides a similar service with autonomous delivery of food and groceries. Despite increasing demand, food and grocery delivery sectors are characterized by high operational costs, including labor, packaging, and transportation expenses. While Nuro aims to reduce these costs with its autonomous delivery fleet, its technology introduces new cost factors such as research and development, manufacturing, and fleet maintenance. The profitability concerns of established delivery service companies present a significant risk to Nuro, which seeks to provide similar services with unproven technology with unique costs and challenges.

Summary

Autonomous delivery is an emerging market with the potential to disrupt the last-mile, same-day logistics space. Nuro focuses on developing self-driving vehicles specifically designed for local goods transportation, addressing labor costs and environmental and safety concerns associated with conventional delivery vehicles. The company has secured partnerships with major retailers and delivery platforms, showcasing traction in this growing market. However, Nuro faces the challenge of maturing its autonomous technology and scaling to demonstrate a commercially profitable business before exhausting its runway. This challenge has become especially evident in 2023, with major ride-hailing companies like Uber and Lyft divesting their self-driving teams and large players like Argo AI and Embark Trucks winding down. As Nuro continues to refine its technology and expand its operational footprint, it must balance development timelines, cost efficiencies, and strategic partnerships to establish a strong, commercially sustainable presence in the autonomous delivery space.

*Contrary is an investor in DoorDash through one or more affiliates.