Thesis

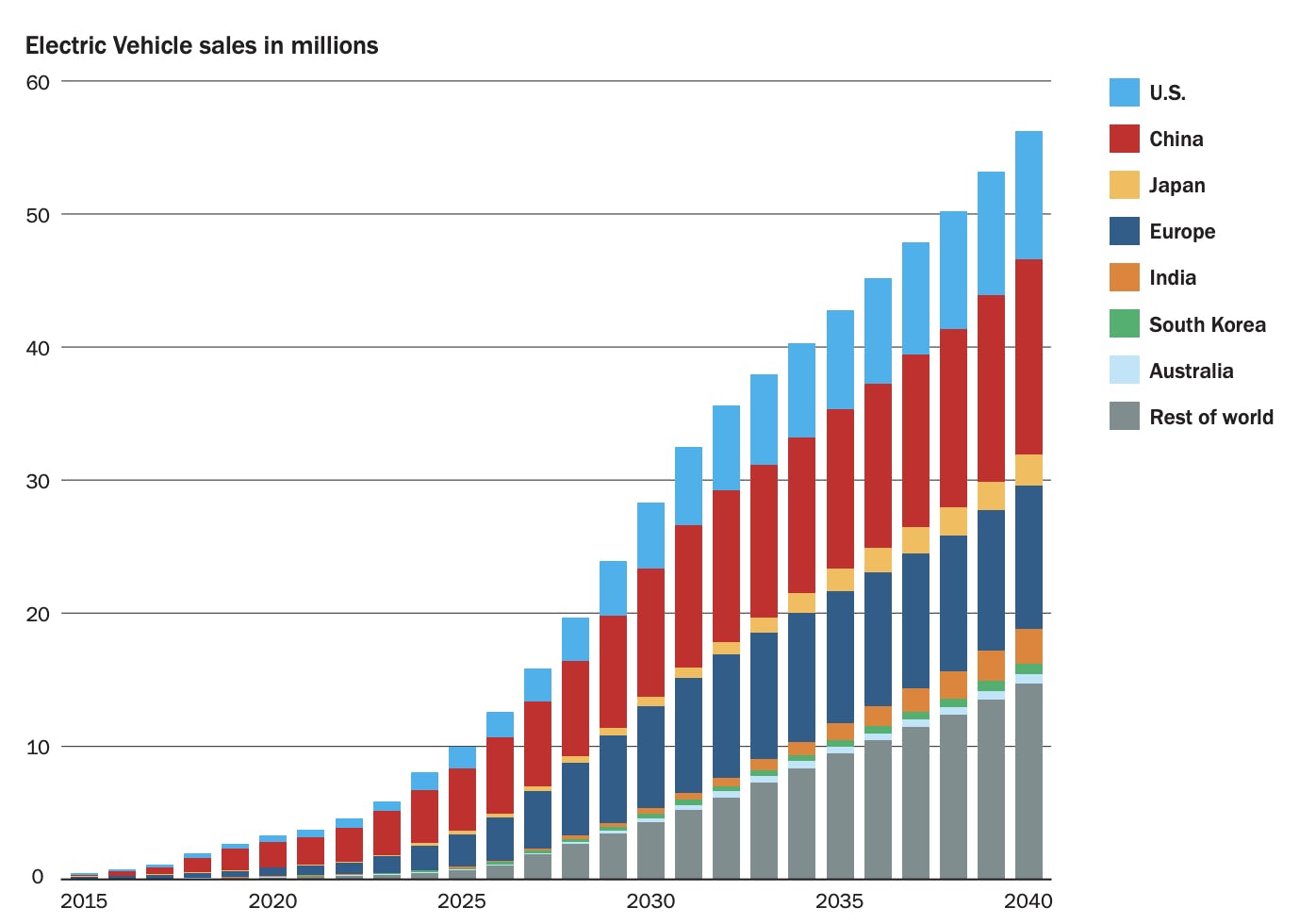

The demand for electric batteries is soaring as the world increasingly shifts towards electric vehicles. Increasing demand for batteries means greater demand for metals like lithium, nickel, and cobalt, which are critical for battery manufacturing.

While the $374 billion Inflation Reduction Act passed by the US Congress in late 2022 aims to accelerate this transition, a crucial missing piece is mineral supply. To meet the rising demand, the mining industry must invest $1.7 trillion over the next 15 years to secure enough of these critical minerals, a challenge that becomes all the more pressing as transportation — responsible for 27% of CO2 emissions — undergoes a shift towards electrification.

However, the path to mineral discovery is fraught with obstacles. More than 99% of exploration projects fail to become mines, and the industry now spends three times more to make 60% fewer discoveries compared to 30 years ago. There’s a supply crisis looming. Mineral exploration today is a largely manual process where geologists use heuristics to identify patterns in maps and data. That makes searches slow, inefficient, and prone to unpredictable discoveries.

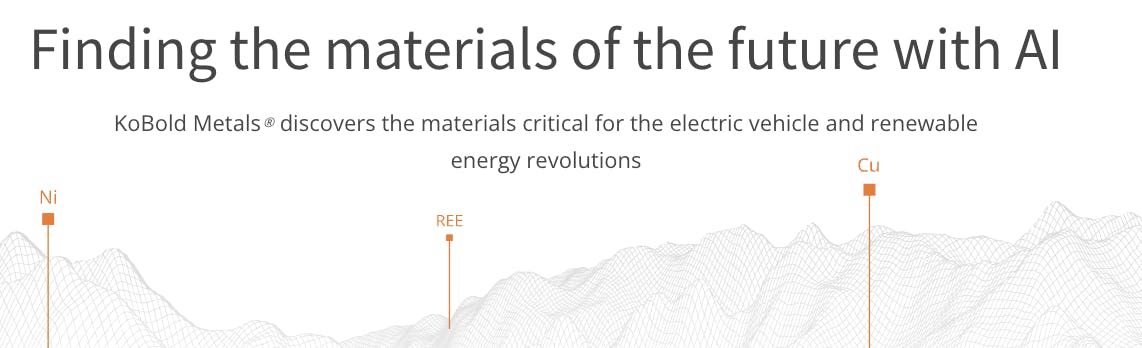

KoBold Metals is building a full-stack digital prospecting engine using computer vision, machine learning, and data analysis to find materials critical for electric vehicles and the renewable energy revolution. It is trying to make the discovery process cheaper and more efficient by using ore-deposit science and machine learning algorithms. Using a wide variety of data sources — geologic reports, soil samples, satellite imagery, and academic research papers — the team uses geological science to find potential deposits beneath the earth's surface. The team’s past experiences in academia, investing, and the hard sciences position them well to tackle this complex problem. Rather than selling the software as a product, KoBold Metals seeks to generate revenue by holding ownership stakes in the mineral resources discovered.

Founding Story

Before KoBold Metals, co-founders Kurt House, Josh Goldman, and Jeff Jurinak each had different experiences across corporate, academic, and scientific worlds. With backgrounds in strategy, carbon sequestration, and reservoir engineering, the trio has long been interested in the intersection of energy and technology. They first came together in 2014 while working at a company called Phase Change Resources where they developed an oil and gas acquisition platform using data science.

By the summer of 2017, the three had left Phase Change Resources. They recognized that transitioning from coal to natural gas was important for the climate but saw a greater opportunity in accelerating electrification. The current reality of the explosion in electric vehicle production, supplemented by new policy support for renewable technologies globally, led them to take a particular interest in battery production as it became clear that energy storage would be key to the widespread adoption of electric vehicles and renewable energy. They believed finding new sources of materials needed for batteries would be a very high-leverage endeavor and founded KoBold Metals in 2018.

Product

KoBold Metals’ core product premise is to add a software overlay over the physical world, modernize mining, and make it cheaper, better, and faster.

Source: KoBold Metals

KoBold Metals’ product has three offerings that work in unison: TerraShedSM, Machine Prospector, and a Human Prospector Team.

TerraShedSM

Terra comprehensive data system aggregates geological data into a structured, searchable pipeline — like Google Maps for the earth’s crust. As it stands, geological data is messy and lacks standard vocabulary. Valuable insights are distributed among government repositories, spectral data from satellites, and century-old, hand-written reports. TerraShedSM is built to ingest, index, and structure data using statistical normalization tools and optical character reading software. Soil samples, radiometric, and academic research papers are also used in this process.

Machine Prospector

Machine Prospector is a library of predictive models that uses data from TerraShedSM to identify new mineral deposits buried below the earth’s surface. The prospector deploys two primary methods: definite, physics-driven models and black-box statistical algorithms. Both look for anomalies in the earth’s crust to produce maps where target metals are likely to be found. KoBold Metals has used its technology to purchase land in North America. It also highlights what type of data would affect the per unit dollar of exploration expenditure, recommending what data should be collected next. The precise location, depth, and angle of the hole that would intersect the largest number of all the possible deposits is calculated to determine where to mine.

Human Prospector team

Beyond data scientists and software engineers, KoBold Metals also employs mineral prospectors that have worked in every major nickel region. The human teams use helicopter and drone-supported geophysical surveys to collect samples based on predictions. Samples are analyzed to determine if the land contains sufficient concentrations of the target metal. If successful, sites are developed. If not, feedback is returned to the data science team to calibrate future models. Geological experts provide context to data, guiding where KoBold’s ground and helicopter teams survey, sample, drill, and discover.

Business Model

KoBold Metals is not a traditional mining company; it is instead a software provider for mining companies. However, instead of selling its software as a service, it operates more similarly to a junior miner in traditional resource extraction — i.e. a company that doesn’t have extraction facilities but is focused on finding new sites and giving larger partner mining companies access to those sites.

KoBold Metals makes money by leveraging information asymmetry to make strategic investments, making land claims around areas of interest. It then pursues joint ventures with mine operators to explore existing mine licenses further. Owning the initial land claim means that KoBold Metals could own all or a portion of the mineral resources discovered.

The company has joint exploration ventures with large mining companies like Rio Tinto, BHP, and Bluejay Mining. For example, in the case of the Disko-Nuussuaq (Disko) project with Bluejay Mining in Greenland, Kobold Metals has acquired a 51% stake in the license agreement on an earn-in commitment of $3.4 million and $11.6 million across two phases, as well as earn-in agreements with exploration companies. A similar structure is seen again in the company’s $150 million investment in a copper mine in Zambia.

Market

Customer

KoBold Metals has a primary and secondary customer base. The company is primarily selling licenses to mine operators and secondarily selling the extracted minerals.

The company’s primary customers are large mining firms that currently rely on traditional methods like geological surveys and drilling to identify mineral deposits. The top 5 mining companies make up a little over 50% of mining market share, with BHP and Rio Tinto in the lead with 16 and 12 percent respectively. KoBold has entered into partnerships with both. It is also worth noting that BHP Ventures was one of KoBold’s initial investors.

The secondary customers are battery producers, the common denominator between purchasers of nickel, lithium, cobalt, and copper.

Market Size

Each mineral that KoBold Metals is prospecting for has a market cap that, combined, hints at the total addressable market size for the company. In 2021, lithium was valued at $7.1 billion, cobalt at $8.7 billion, nickel at $31.5 billion, and copper at $283.4 billion. These minerals make up a basket of battery materials, expected to grow at a CAGR of 18.9% from 2021 to 2030. Applications for lithium-ion batters include usage to power electric vehicles, portal devices, industrial uses, and others.

The majority of materials listed above are currently sourced from mines in ore mines in Australia or salt deserts in Chile or Argentina. 74% of the lithium produced currently goes toward battery production by companies like CATL, LG Energy Solution, and Panasonic. Despite being a concentrated market with large, established players, the growing demand for electric vehicles means that manufacturers will may welcome new mineral sources.

Competition

Software Exploration Tools

Several other companies are also focused on using software to accelerate the exploration process, namely Datarock and EarthAI. They target different layers of the software stack. Datarock’s products focus on augmenting site selection using computer vision. EarthAI has taken the opposite approach - managing the operationally intensive but cost-saving in-house practices of drill deployment, core transport, logging, cutting, and sampling. KoBold Metals is less focused on automating resource-intensive tasks for existing exploration groups.

In-House Software

KoBold Metals’ most fruitful allies could also be their greatest competitors. Large mining companies like BHP Group, Rio Tinto, and Glencore International have staffs in the thousands, some of whom are data scientists and engineers on mineral exploration teams. Mineral exploration companies are also developing software analyzing electromagnetic and radiometric data to accelerate processes. For example, using similar methods, lab results from Eclipse Metals’ 2021 program confirm the discovery of silver, tin, and lithium in Greenland. What differentiates KoBold is its speed of operation. Partners have cited its quick, iterative processes as an advantage, supplemented by the team’s previous experiences in startups.

Traction

By December 2022, KoBold Metals had positions in over 30 projects across three continents according to its website. Kobold Metals started by prospecting for cobalt in northern Quebec, south of Glencore's Raglan nickel mine. The next area for exploration was a joint venture with BHP exploring an area exceeding 500K square kilometers in Western Australia. KoBold Metals has broken ground at Disko Island in Greenland, looking for cobalt and nickel with Bluejay Mining. In December 2022, KoBold Metals also announced its joint venture partners EMR Capital and Zambia’s state-backed mining company ZCCM-IH. The $150 million Mingomba Deposit investment was announced during the Biden Administration’s 2022 African Leader’s Summit.

Valuation

KoBold Metals has raised a total of $212.5 million to date, most recently with a Series B raise of $192 million in February 2022. Investors included Andreessen Horowitz, Bill Gates’ Breakthrough Energy Ventures, Bond Capital, BHP Ventures, Sam Altman’s Apollo Projects, and the Canada Pension Plan Investment Board, among others. KoBold Metals’ valuation is estimated to be between $770 million to $1.2 billion as of February 2022. KoBold Metals is one of few industrial companies receiving private venture capital despite its longer product development timelines.

Key Opportunities

Regionalization of Supply Chains

There is a renewed US interest in creating a domestic lithium-battery manufacturing chain for supply resilience, cost savings, and clean-energy manufacturing jobs. As North American consumers increasingly turn toward EVs, the cost savings from localizing production is becoming noteworthy.

Here’s Drew Baglino, Senior Vice President of Engineering at Tesla, speaking on this subject:

“We’re gonna go and start building our own cathode facility in North America and leveraging all of the North American resources that exist for nickel and lithium, and just doing that, just localizing our cathode supply chain and production, we can reduce miles traveled by all the materials that end up in the cathode by 80%.”

The climate crisis, critical mineral shortage, and ambient geopolitical instability loom. Because 70% of cobalt currently comes from The Democratic Republic of the Congo, there is an incentive to diversify existing supply chains to support coming growth.

Software Is Eating Mining

By becoming early software partners with the largest mining companies around the world, the opportunity to become the software arm of the mining industry could prove an important wedge for KoBold Metals. This could also give the company an opportunity to go after other layers in the software stack to help with the end-to-end mining of critical minerals.

Responsible Mining

Mining is historically an industry stained with reports of human rights abuses in Congo, which currently produces more than 70% of the world’s cobalt. Having alternative mineral sources means global buyers have more negotiating power to help maintain baseline working conditions.

Mining can be invasive, emitting, and toxin-producing if not done correctly. The lack of precision in site discovery means we spend more funds and emissions on unnecessarily invasive drilling. Mining contributes to erosion, sinkholes, deforestation, loss of biodiversity, significant use of water resources, dammed rivers, wastewater disposal issues, acid mine drainage, and soil contamination, all of which can lead to health issues in local populations. KoBold Metals’s technology and growth can help reduce the adverse impacts of how mining is currently done.

Key Risks

Technological Effectiveness

Even with help from AI, placing bets on potential mineral deposits is far from a foolproof process. Metals often turn up in places with wildly different conditions and geologic histories. “When you’re training an algorithm to recognize a face, you can assume there’s a mouth, and it’s below the nose and eyes,” Sam Cantor, head of product at Minerva Intelligence, another AI-driven mining exploration startup, has noted. “But if you apply that training to insect faces, you might find more than two eyes and no nose. Training an algorithm on data from Alaska and applying it to Nevada means it might have a lot of wrong assumptions.”

Permitting Uncertainty

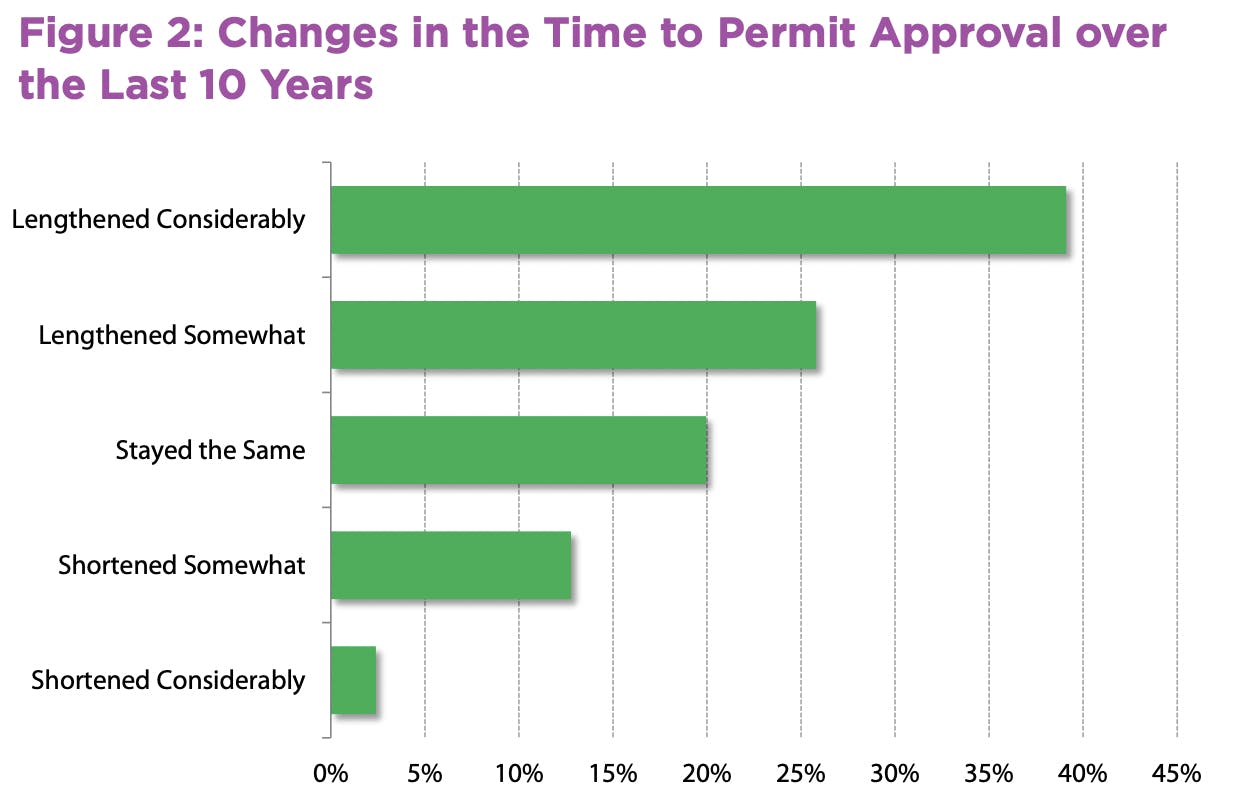

When sites are discovered, KoBold Metals must apply for permits before prospecting. The time it takes to get approval has grown longer and more onerous over time. This has been attributed to the administration, environmental regulations, regulatory duplication, or inconsistencies. In Canada and Australia, 87% of respondents answered that they received the necessary permits in six months or less. In the US, the timelines are similarly fraught. The U.S. mining industry is calling for permit reform and a reevaluation of the National Environmental Policy Act (NEPA) to streamline the exploration process. The current permitting process can take years to complete.

Source: Fraser Institute

Mineral Substitution

In recent years, concerns about human rights violations in the sourcing of cobalt and lithium have prompted researchers to explore alternative cathode designs for grid storage applications. While several less developed options, such as zinc-air, sodium-sulfur, and sodium nickel, have been prototyped, none have yet been able to fully replace lithium in meeting the demands of the mobility sector. One potential alternative, sodium ion, is still in development and is expected only to be capable of tackling low-performing applications. Widespread adoption and viability of alternative minerals could become a headwind for KoBold Metals.

Summary

If there is anything to learn from the last clean tech investment surge, it’s that momentum does not equate to adoption. Due to mismatched timelines, large-scale electrification was slowed by a lack of readily usable technology and investment retraction. Since costs have come down per kWh, the challenges the industry now faces are mostly around material sourcing.

Mineral prospecting is a high-risk, high-reward business. As a software company privy to large public-private partnerships, KoBold Metals sits at a unique middle ground between technology and policy. The KoBold Metals team brings diverse experiences, an understanding of commodities markets, and scientific backgrounds. The company’s investment-based business model achieves a level of incentive alignment that other SaaS companies can miss. The company has also secured hundreds of millions of dollars of licensing and partnership deals in Zambia, Greenland, Canada, and Australia. Moving forward, it could be a pivotal player in supplying the most critical minerals in the 21st century.