Thesis

The fitness industry was negatively impacted during the COVID-19 pandemic, experiencing a global decline of around 44% in revenue, which dropped from $96.7 billion in 2019 to $54.2 billion in 2021. 22% of gyms were forced to shut down and 1.5 million fitness professionals lost their jobs from March 2020 to June 2021. This led to an uptick in home workout solutions, with a 70%.) increase in indoor fitness equipment sales, and a 47% increase in fitness app downloads in 2020.

In 2024, gym check-ins increased by 60% from 2023. However, the demand for at-home fitness solutions has remained strong after the COVID-19 pandemic. The home fitness market reached $4.8 billion in 2022 and is expected to reach nearly $10 billion by 2030. A survey indicated barriers people faced when desiring to exercise at the gym in 2024: 39.5% skipped due to lack of time, 16.6% skipped due to a lack of confidence, and 14.3% stated that gyms were too busy. People desired solutions to these barriers given that 58% of people who exercise at least once per week preferred to work out from home as of 2024.

Tonal is a smart home gym system that uses digital weights and AI technology to offer personalized strength training workouts. It features a wall-mounted design with adjustable arms and a built-in touchscreen for interactive coaching. With over 200 exercises across every single muscle group and community features like partner workouts, virtual group workouts, and a live leaderboard, Tonal has created an at-home fitness experience.

Founding Story

Aly Orady (CTO) founded Tonal in 2015 in San Francisco, California.

Growing up as “the chubby kid with glasses who could code,” Orady fast-tracked his education, graduating from high school at 15 and earning a degree in computer engineering from McMaster University by 19. He then worked for a series of technology companies including Hewlett-Packard, Sun Microsystems, and Samsung where he gained experience in hardware and software engineering. He also served as an advisor to Mayfield Fund. Since “physical fitness was never a priority” for him, Orady became overweight, developed type 2 diabetes, and was struggling with sleep apnea by the time he was 35.

Recognizing the need to take charge of his health, Orady changed his lifestyle in 2014. He quit his job as a Samsung consultant and spent nine months losing 70 pounds by working out for four hours a day, six days a week, and incorporating intermittent fasting twice a week. Many mornings began at 6:00 a.m. with cardio sessions at a Gold’s Gym or outdoor biking in San Francisco. Over time, he discovered the benefits of strength training and became “very passionate about it” as it became a staple part of his routine.

Orady realized that if he returned to work, he couldn’t continue going to the gym at 6:00 a.m. He wished for a way to continue strength training at home instead. In March 2015, he was staring at a cable crossover machine at the gym. Drawing on his engineering degree and experiences, he realized if he replaced the weights on the machine with an electromagnetic field, he could shrink the size of the machine while still giving it a real weight machine feeling.

When Orady returned home that day, he ordered parts and began working on RiptLabs, which would eventually become Tonal, on his kitchen counter. The first prototype was a “rudimentary device strapped to a wooden workbench in his home that had a cable you pulled back and forth.” However, there was “too much friction when pulling the cables and not enough magnets” to mimic the experience of gym equipment. It took Orady three more iterations to create an electromagnetic resistance technology comparable to the feel of weight machines.

Confident in the product, Orady began pitching his vision of a “compact at-home strength-training product” to investors. VCs were hesitant due to the crowded fitness market and the costs associated with hardware companies. In October 2015, he was introduced to Bolt through Tim Chang, a partner at Mayfield Fund where Orady was an advisor. Bolt invested $250K in Tonal’s seed round.

Tonal added Darren MacDonald (CEO), previously the Chief Customer Officer for Petco, in September 2024. Prior to that, Tonal promoted Krystal Zell from President to CEO in January 2023, but she left the company in September 2024 as she found herself “wanting a break to spend more time with family and to recharge [her] batteries after an intense few years.” Orady was the CEO from when the company was founded until Zell stepped in. His decision to depart from the CEO spot was inspired by his wanting a “more technology-centered role,” hence why he shifted to CTO.

Ron Will (CFO) joined in July 2023. He held prior CFO positions at five companies including Hinge Health and Ripple. Jonathan Shottan (Chief Product & Content Officer) was hired in November 2023 and previously worked in product and growth at companies like Facebook and Pinterest.

Product

Smart Home Gym

Tonal’s primary product offering is a smart home gym. The Tonal gym is made of steel and consists of features like adjustable arms, an adaptable design, a touchscreen display to see personalized stats and workouts, and additional smart accessories that can be purchased for extra money.

Source: Wired

Tonal’s home gym is designed to fit and be utilized in small areas including apartments, condos, or small homes. It requires a minimal area of 49 square feet, a reliable WiFi connection, a power outlet, and two wall studs. The home gym product supports over 240 strength training moves and contains a movement library featuring over 200 workouts like boxing, dance, yoga, and bicep curls. Customers with an iOS-powered device can preview how Tonal would look in their home using the AR feature on the Tonal app.

Tonal relies on an AI digital weight system that utilizes electromagnetic technology, the same principle that propels electric vehicles, to deliver 200 pounds of resistance. The resistance engine was created using computer chips, coils that create an electromagnetic field controlled by chips, and magnets that allow users to feel resistance as they pull on the machine’s cables.

The adaptive weight system conducts thousands of calculations per second and monitors users’ forms to adjust the resistance they experience in real time. The electromagnetic motor also prevents users from relying on momentum to help with each rep and supplies resistance on the eccentric, the part of the movement in which the muscle is lengthened, and the concentric, the part of the movement when the muscle contracts, phase of the exercise. As a result, Tonal weights feel slightly heavier than traditional metal weights.

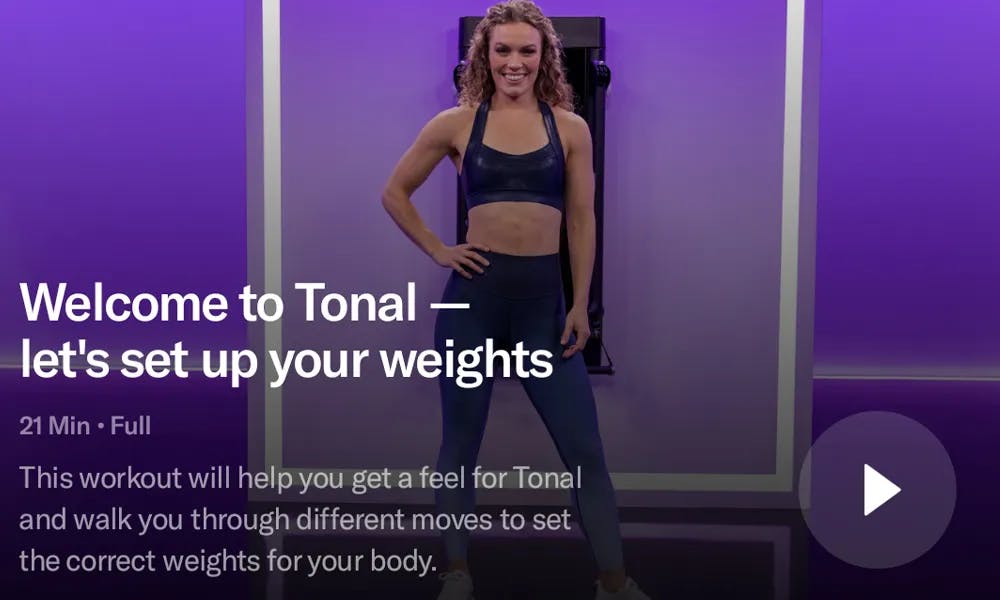

Tonal also offers personalized weight recommendations to its users. These recommendations are determined by a strength-training assessment upon first using Tonal. The assessment consists of four movements: seated lat pull-down, bench press, seated overhead press, and neutral grip deadlift. As the user goes through the movements, Tonal measures strength, force, power, speed, acceleration, and range of motion. From this information, it fine-tunes its weight suggestions.

Source: Tonal

Features

Tonal’s features include feedback on form, various weight modes, strength score, and smart accessories.

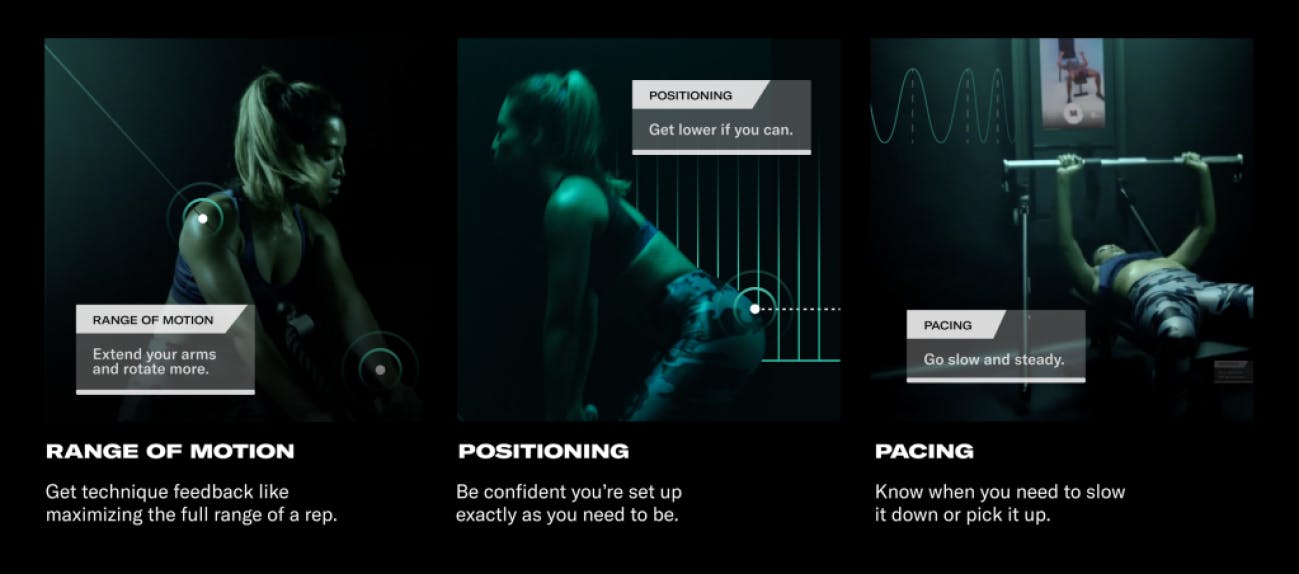

Form Feedback

Source: Tonal

To provide accurate form feedback, Tonal uses sensor technology and cable length data that is tracked 60 times per second in addition to a database of almost one billion repetitions with over 100 million sets. Tonal analyzes movement patterns and finds opportunities to correct aspects of form like pace, range of motion, positioning, balance, and symmetry using AI. It then delivers the feedback immediately when it detects imperfections through specific cues like “drive your hips back to get lower if possible” or “lower yourself slower and with control.” The feedback technology sparks has allowed Tonal users to improve their form, on average, by 10% after 10 sets and up to 34% after 200 sets.

Dynamic Weight Modes

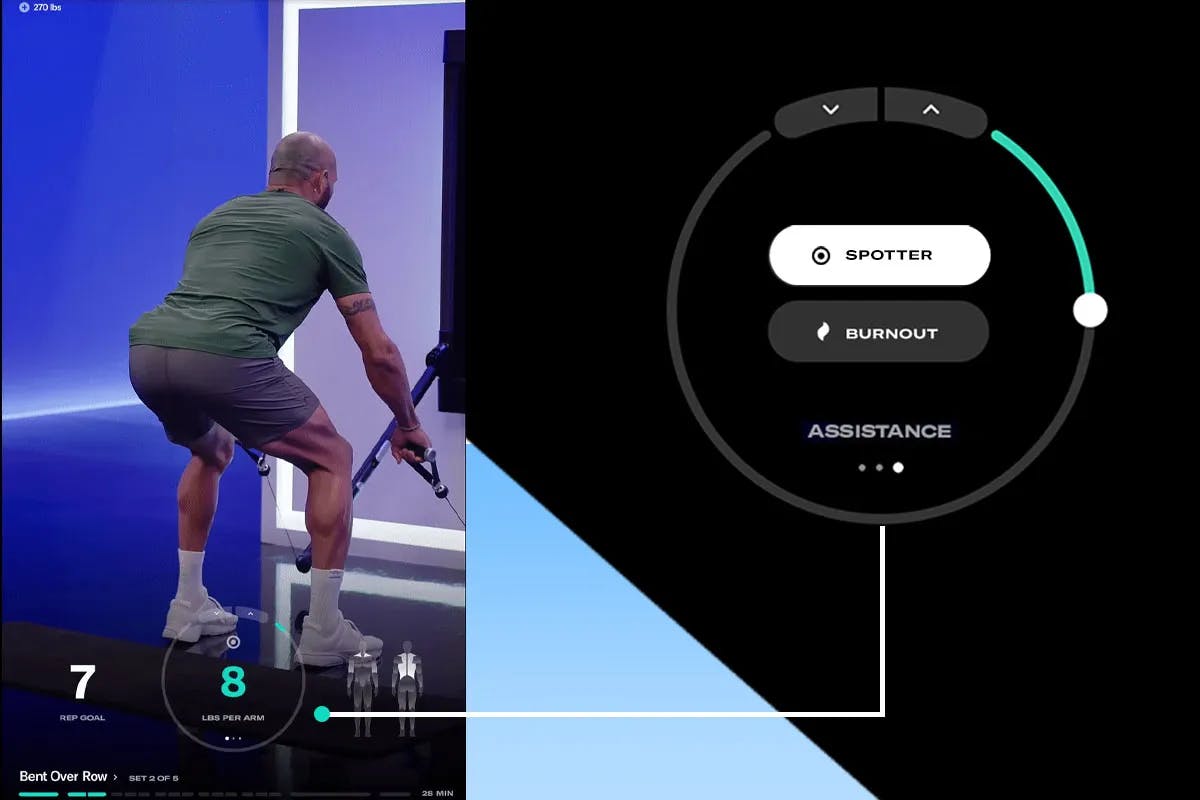

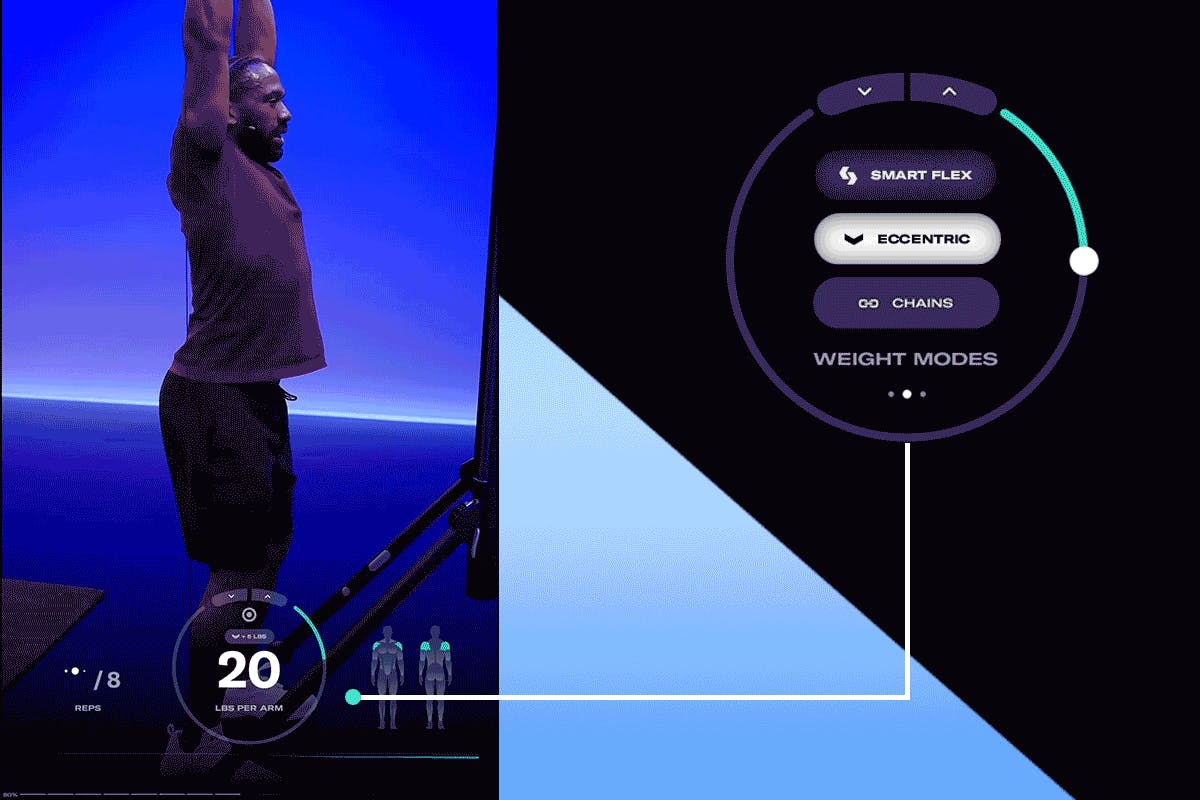

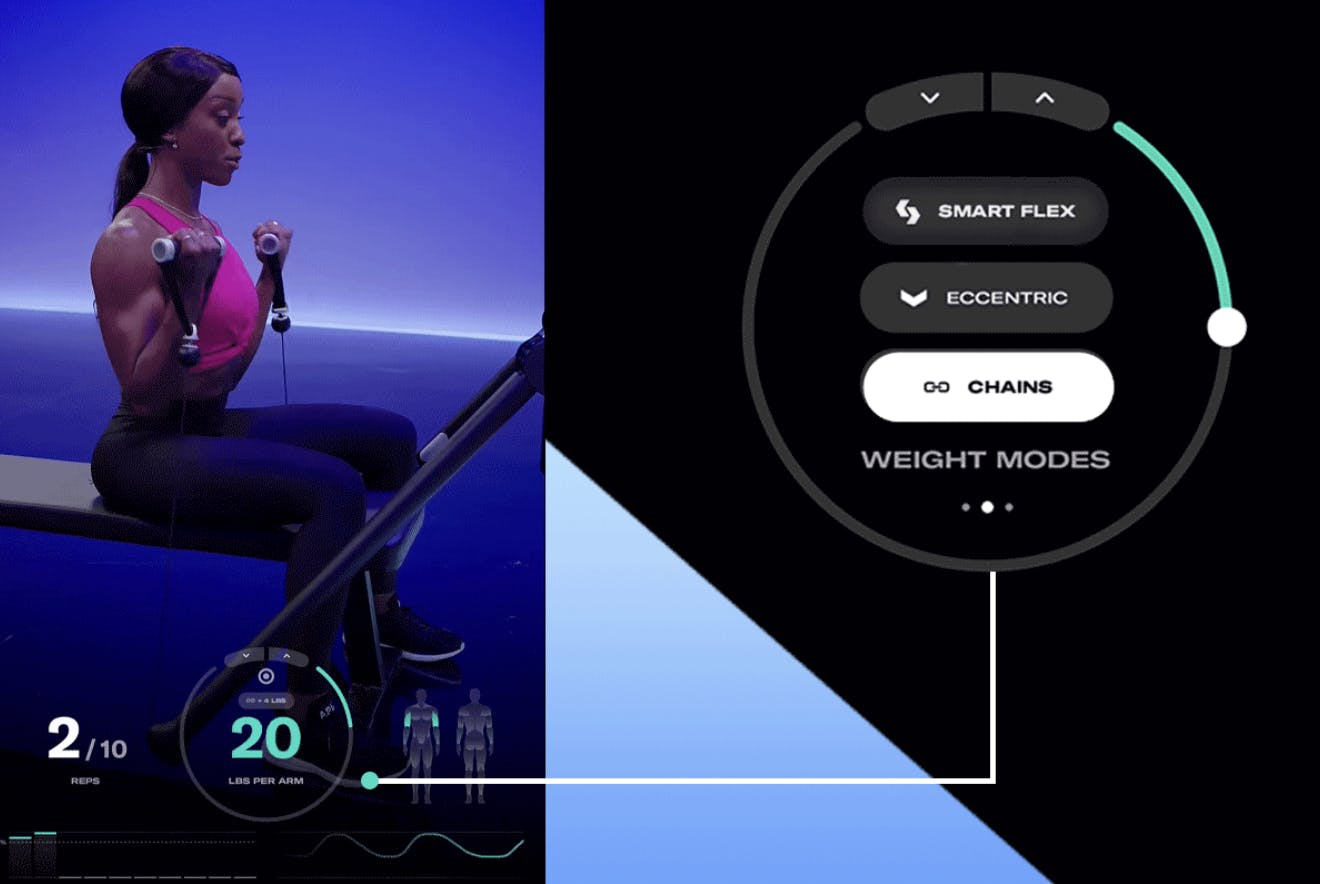

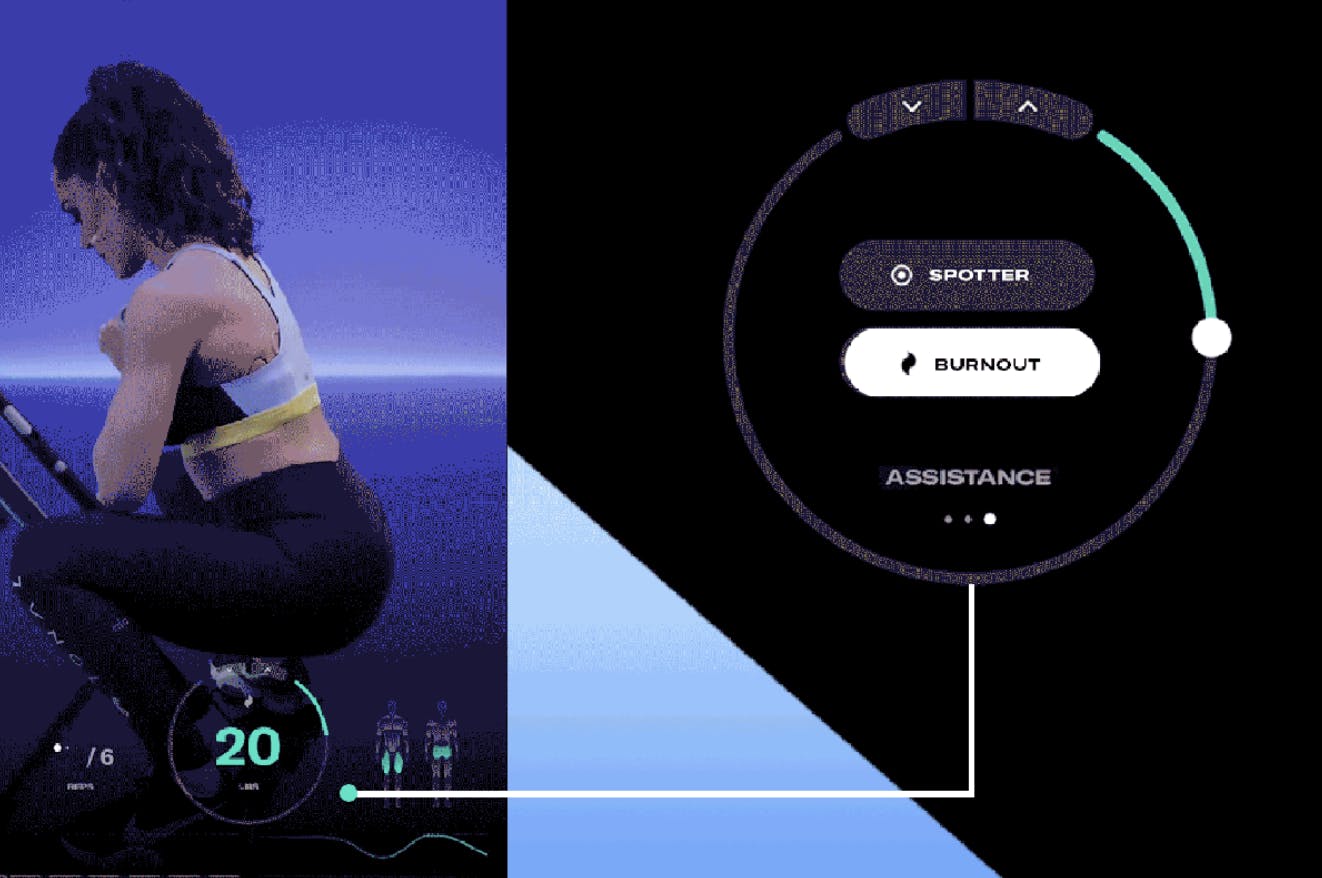

Tonal also has five dynamic weight modes to offer different resistance training experiences: Spotter, Smart Flex, Eccentric, Chains, and Burnout.

Spotter mode is on by default for more than 200 movements. Similar to a human spotter in a gym, Spotter mode automatically detects when a user is struggling to complete a rep, and automatically reduces the weight to help them complete the set. It will also restore the original resistance when it detects the weight is no longer causing the user to struggle.

Source: Tonal

Smart Flex automatically increases the load in the strongest phase of an exercise and removes it during the weakest part of the rep. Once activated, it will activate on the second or third rep of a set. Tonal first understands the user’s range of motion and strength curve, how strong the user is at different points of the rep, before Smart Flex can add the appropriate amount of extra resistance.

Source: Tonal

Eccentric mode automatically increases the load of the eccentric portion of a movement and removes it on the concentric. Loading weight on the eccentric weight of a movement is proven to increase muscle size and power. However, it is difficult to add weight to the eccentric part of a rep and then remove it on the concentric. Tonal’s Eccentric mode is designed to make the eccentric portion 25% heavier than the concentric load without reaching the user’s max weight.

Source: Tonal

Chains mode replicates the technique of adding chains lifted off the floor to increase resistance to the movement's concentric portion. Chains mode acts as the opposite of Eccentric mode. This technique primes the nervous system for heavier lifting and has been shown to improve users’ one-rep max.

Source: Tonal

Burnout mode replicates the concept of drop sets, reducing the weight as lifters fatigue through the set. This mode automatically reduces the digital weight as users get stuck which helps complete the set.

Source: Tonal

Strength Score

Tonal also has an exclusive strength score that measures users’ total body strength for over 100 moves. Each body region, including upper body, lower body, and core, has its own associated strength score, which is then used to calculate the entire body’s strength score. Tonal members can see where their strength score falls relative to others.

Source: Tonal

Smart Accessories

Members looking for more beyond Tonal’s base version of the home gym can purchase the Smart Accessories bundle. The bundle includes a smart bar, rope, bench, mat, roller, and smart handles designed to elevate a user’s workout experience.

Source: Tonal

Customer

According to the CDC, 28.3% of men and 20.4% of women met the physical activity guidelines for both muscle-strengthening and aerobic activities as of August 2022. However, strength training has become more accessible, a trend also evident among Tonal members. By the end of 2023, 40.7% of Tonal members were female, with users ranging from under 20 to over 80 years old.

The majority of Tonal’s customers fall between ages 30 and 55 and live in or adjacent to the 10 major US metro markets including New York City, Los Angeles, and Chicago. Tonal also markets its product to those who are likely to have stationary jobs, an attraction towards software products, and people with smaller homes.

Market Size

The global smart gym equipment market was valued at $24.9 billion in 2023 and is projected to reach $59.5 billion by 2031, growing at a CAGR of 15.7% from 2024 to 2031. As of 2023, 28% of Americans exercise the proper amount of 150 minutes per week. Since Tonal is available in the US, this percentage can be used to calculate an estimate for Tonal’s market.

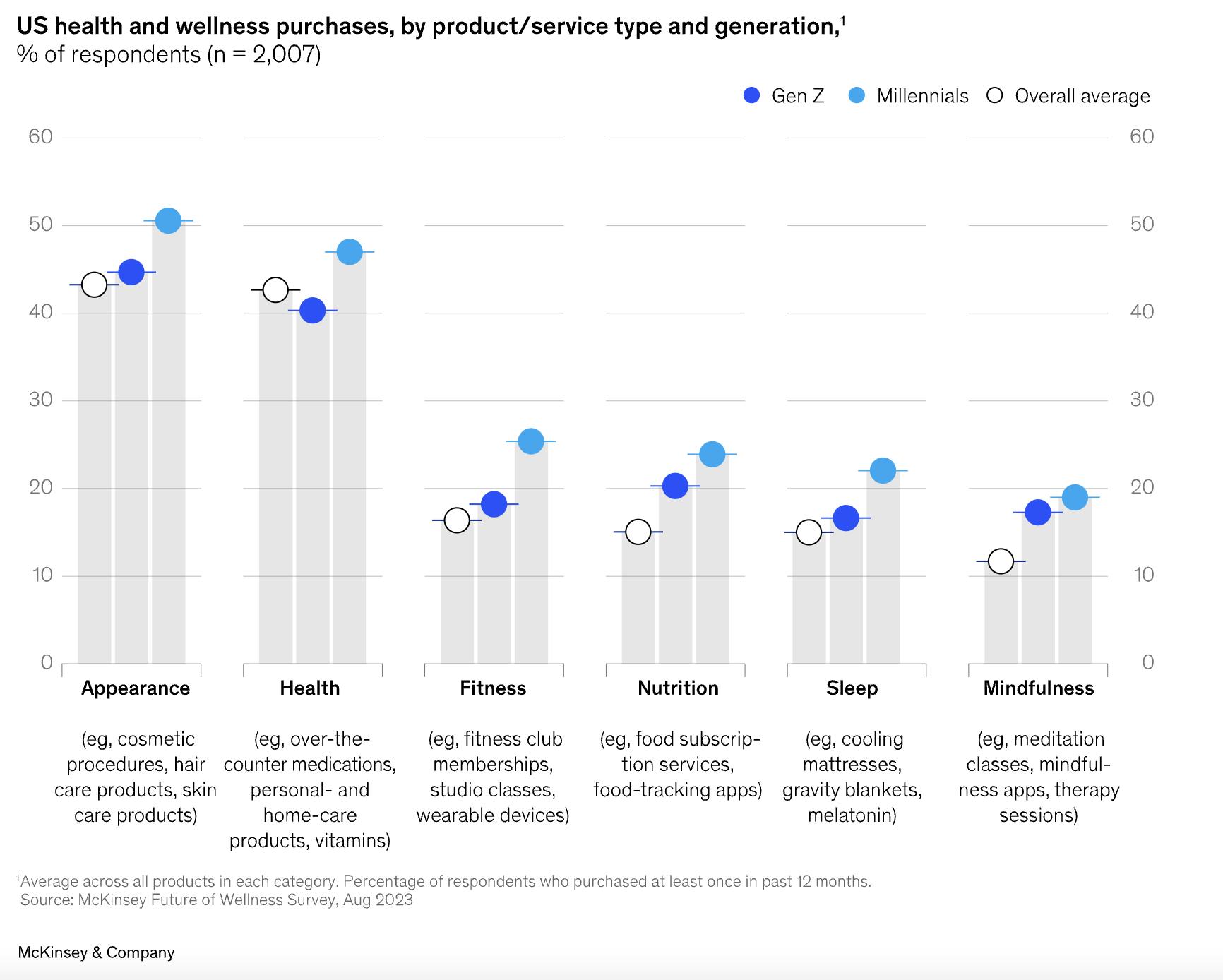

As of August 2021, the US adult population stood at around 258.3 million, meaning that about 72.3 million adults regularly exercise. This number includes individuals who participate in all kinds of physical activity, not just strength training. As of January 2024, Millennial and Gen Z consumers spent more on health and wellness than older age demographics. Considering Tonal’s customers are between 30 and 55 years old, it targets Millennials and Gen X consumers.

Source: McKinsey & Company

Competition

Peloton

Peloton was founded in 2012 with the goal of creating an interactive at-home fitness experience. Peloton focuses on cardiovascular health, with products like the Peloton Bike and the Peloton Tread. The company raised a total of $2.2 billion across 12 funding rounds from investors like TCV, NBCUniversal, Tiger Global Management, and Fidelity. Peloton went public through an IPO in September 2019 at an opening share price of $27, valuing the company at $8.1 billion. As of September 2024, Peloton’s market cap has decreased to $1.8 billion.

Peloton’s business model is similar to Tonal’s. It sells its physical exercise products, like its bike, and offers a subscription service that users are required to purchase to access live classes and the Peloton community. Peloton’s hardware products also run in the thousands, with its bike costing $1.4K and the treadmill at $3.5K. Like Tonal’s smart bundle, Peloton sells additional accessories such as the Peloton Guide, a camera to track movements. Both companies generate revenue in nearly identical ways. The primary difference is that Tonal focuses on strength training whereas Peloton has a cardio-intensive focus.

Vitruvian Form

Founded in 2018, Vitruvian Form is a fitness company with a digital home gym that leverages AI to adjust weight in real time and offers personalized workouts. Its main product is the Trainer+, a compact digital home gym platform comparable to Tonal’s home gym. It provides up to 440 pounds of adaptive resistance compared to Tonal’s 200 pounds. Vitruvian has raised a total of $26.1 million from investors including Larsen Ventures, and TEN13. As of December 2023, Vitruvian had a valuation between $56 million to $85 million with a total funding amount of $26.1 million.

Vitruvian’s Trainer+ sells for $2.9K and comes with an all-access membership that offers over 300 classes and programs with workout tracking metrics. The key difference between Trainer+ and Tonal is that Trainer+ is a smaller platform that can be placed on the ground whereas Tonal is mounted to a wall. The technology behind the two machines, however, is very similar, with both relying on electromagnets to create the digital weight experience. Trainer+ also places emphasis on eccentric training and maximizing time under tension.

Tempo

Tempo is a home fitness platform that utilizes 3D sensors and AI in its home gym product, Tempo Studio. Studio comes with a free-standing frame with storage for custom free weights, an interactive screen for a personal training experience, and a built-in camera to track users’ forms.

Founded in 2015, it has raised a total of $298.8 million from investors like General Catalyst and Khosla Ventures. The most recent round was a Series C in April 2021 led by Softbank Vision Fund, where it raised $220 million. As of April 2022, the company had a valuation of $750 million.

Tonal and Tempo Studio both offer a digital display catered towards strength training. Tonal relies on electromagnetic technology to create a digital weight experience, and Tempo Studio offers a traditional, free-weight experience with custom dumbbells and barbells. Additionally, Tempo is versatile in the type of training it offers, especially with cardio workouts, as opposed to Tonal, which is specialized for strength training.

Lululemon

Lululemon acquired Mirror, a fitness mirror that offers a wide variety of exercise classes, for $500 million in 2020. Rebranding it as Lululemon Studio Mirror, it tracks users’ heart rate among other health statistics, has thousands of classes, and additional integrated weights available for purchase.

Lululemon, founded in 1998, is a line of athletic apparel for yoga, running, and other exercise activities. It went public in 2007 at a valuation of $1.2 billion. As of August 2024, Lululemon had a market cap of $29.8 billion.

Studio and Tonal were similar in the integrated workout classes and user metrics that they offer. However, in 2023, Lululemon discontinued the mirror and rebranded it to Studio. It also joined in a five-year partnership with Peloton in November 2023. As a result, Mirror won’t be a competitor of Tonal’s, but Peloton may grow due to Lululemon’s Mirror customers transferring to a Peloton subscription.

Business Model

Tonal generates its revenue through two channels: sales of its physical product, and revenue from its subscription services.

Tonal's home gym retails for $4K as of September 2024. There’s an option to finance the cost into monthly payments of $84 for 48 months with zero interest or APR through Affirm, a fintech company partnered with Tonal. Each purchase includes a 30-day trial period and a three-year limited warranty. Customers can also pay an additional $495 for the “Smart Accessory Bundle” which includes smart handles, a smart bar, a rope, a bench, a roller, and a workout mat. Shipping and installation costs are extra, with prices varying based on the location of the customer. Tonal has professional installers deliver and mount the product to a customer’s wall in their home in less than one hour.

Additionally, Tonal requires customers to purchase a $60 monthly membership fee for the first 12 months upon purchase. The subscription gives a customer’s family unlimited access to its growing library of workouts with personalization and intelligent features. After the 12 months have passed, users have the option to continue or cancel their membership. The ones that cancel lose access to on-demand classes, dynamic weight modes, the ability to create and save custom workouts, and Tonal’s community.

Traction

Tonal achieved over $100 million in annual recurring revenue (ARR) in 2023 with a churn rate of less than 1%. The subscriber base has grown by 300% since 2022 when it experienced an 800% increase in users and reached 50K active users. However, in 2022, the company laid off 35% of its staff to prioritize profitability since costs of its business grew.

Tonal has also pursued partnerships to expand its reach, including a partnership with Nordstrom in 2021 which allowed it to triple the number of physical retail locations the company has. Tonal also announced multiple partnerships with professional athletes like LeBron James and Serena Williams. The athlete partnerships have led to the launches of different campaigns, such as the Strength Made Me campaign, which celebrates the mental, physical, and emotional health of women.

Valuation

As of September 2024, Tonal has raised a total of $580 million. In April 2023, it raised $130 million from six investors at a valuation between $550 million and $600 million. The round was led by Cobalt Capital, Dragoneer Investment Group, Kindred Ventures, L Catterton, and THVC. The valuation is a decline from its $1.9 billion valuation in 2021. Tonal also secured investments from professional athletes including LeBron James, Serena Williams, Stephen Curry, and Mike Tyson.

Taking Tonal’s April 2023 valuation of at least $550 million and its most recent annual revenue of $100 million in 2022, it has an EV/Revenue ratio of 5.5x. Compared to Lululemon’s multiple of 3.0x and Peloton’s multiple of 1.0x, Tonal’s investors are potentially willing to pay more for each dollar in sales.

Source: Koyfin

Key Opportunities

Partnerships

In 2021, Tonal partnered with Nordstrom to expand its retail footprint to 40 stores across 20 states in the US, 12 of which didn’t have a physical Tonal location. The partnership resulted in 50 square foot regions in the women’s active departments of 40 Nordstroms where visitors can experience a full demo of Tonal. The partnership was formed with the expectation of an overall sales growth of 25% in 2021.

People who are accustomed to the traditional gym experience may receive a new perspective if Tonal continues opening small stores across the US. By experiencing the digital weight technology in real life and completing a full workout for free, Tonal has the opportunity to convert interested people into customers as opposed to viewing the technology online. Out of the major fitness brands that Tonal competes with, it is the first to partner with an outside retailer. Tonal could continue to form partnerships with additional retailers to expand its brand presence and market share.

Employee Wellness Programs

Employee wellness programs can benefit both employees and the companies that provide them. For example, Johnson & Johnson’s executives estimate that their wellness programs have saved the company a total of $250 million on healthcare costs from 2002 to 2008. Research has also shown that healthy employees are more likely to deliver quality work performance, live a better life, and boost productivity. As of 2024, almost 90% of large employers in the US have some version of an employee wellness program.

This represents an opportunity for Tonal to expand from selling to consumers to selling to businesses. By partnering with companies and incorporating them into their wellness programs, Tonal can generate a new revenue stream and help employers improve their employees’ health. Companies could include Tonal’s home gym, cover the subscription service for employees who already own Tonal, or purchase additional Tonal products for employee use. Tonal has already started working towards corporate wellness. If successful, it could result in a new line of business for Tonal.

Product Line Expansion

As of 2024, Tonal’s main product is its home gym and the additional accessories that are compatible with it. Another opportunity for Tonal could be expanding its product offerings. While it specializes in strength training, there are ways for Tonal to address other exercises for muscle-building. For example, a person’s diet is essential in gaining muscle and is an even more important part of overall health and fitness than exercise.

Tonal could expand from a home gym product to a personalized wellness brand. To accomplish this, it could launch a multitude of potential nutrition offerings to supplement its home gym product, including protein products or an app feature that connects users to personal nutritionists. It could also partner with fitness trackers like WHOOP or sleep technology companies like Eight Sleep to provide a full wellness bundle to customers.

Key Risks

High Price Point

Tonal's product is expensive: on top of a $4K investment to obtain the home gym itself, users pay extra if they want additional accessories, installation, and a monthly subscription that is necessary to get the full personal and community experience out of Tonal. Not everyone will be able to justify the benefit of purchasing it at the listed price. However, since Tonal is a singular hardware product, it is unlikely that it will be able to lower its prices to accommodate a wider range of users.

The key risk for Tonal is that this high price point may limit the size of its potential user base. Looking at competitors like Peloton, whose market cap has decreased from $8.1 billion to $1.8 billion as of September 2024 due to less demand for the product, Tonal may need to figure out a lower-price product line to make it more accessible to a larger pool of customers and to compete with cheaper alternatives like dumbbells and other low-tech at-home gym equipment or traditional gym memberships.

Workout Preferences

According to a 2021 study, 59% of people preferred going to the gym over working out at home. The attractive qualities of the in-person gym experience include the social aspect, fewer distractions, and access to a wider variety of equipment. Despite the convenience of at-home fitness solutions like Tonal, it can't fully replicate the experience of stepping into a gym. If interest in at-home fitness stalls or declines, Tonal could face a shrinking market leading to potential financial setbacks, especially if most active individuals gravitate toward the engaging gym experience.

Summary

Founded in 2015 by Aly Orady, Tonal is a wall-mounted smart home gym that provides personalized strength training programs with the help of AI, digital weights, and video guidance. It uses electromagnetic resistance, allowing users to perform a variety of strength exercises with up to 200 pounds of resistance. It offers over 200 exercises across all muscle groups, including cardio, yoga, and mobility exercises, with programs that include personalized guidance and adjustments based on user performance.

But in a post-pandemic world, Tonal needs to find new opportunities for growth and continue pushing its product to wider audiences. They may be able to do this through more retail partnerships, exploring different sales channels, and expanding its product line passed its focus on strength training.