Thesis

The Rise & Fall of Nuclear’s First Act

In the 1950s, nuclear power was hailed as the energy of the future. Scientists and policymakers promised a new era of abundant, clean electricity that would be "too cheap to meter." It was expected to revolutionize how we generate power, offering a clear path beyond fossil fuels toward an energy-abundant world.

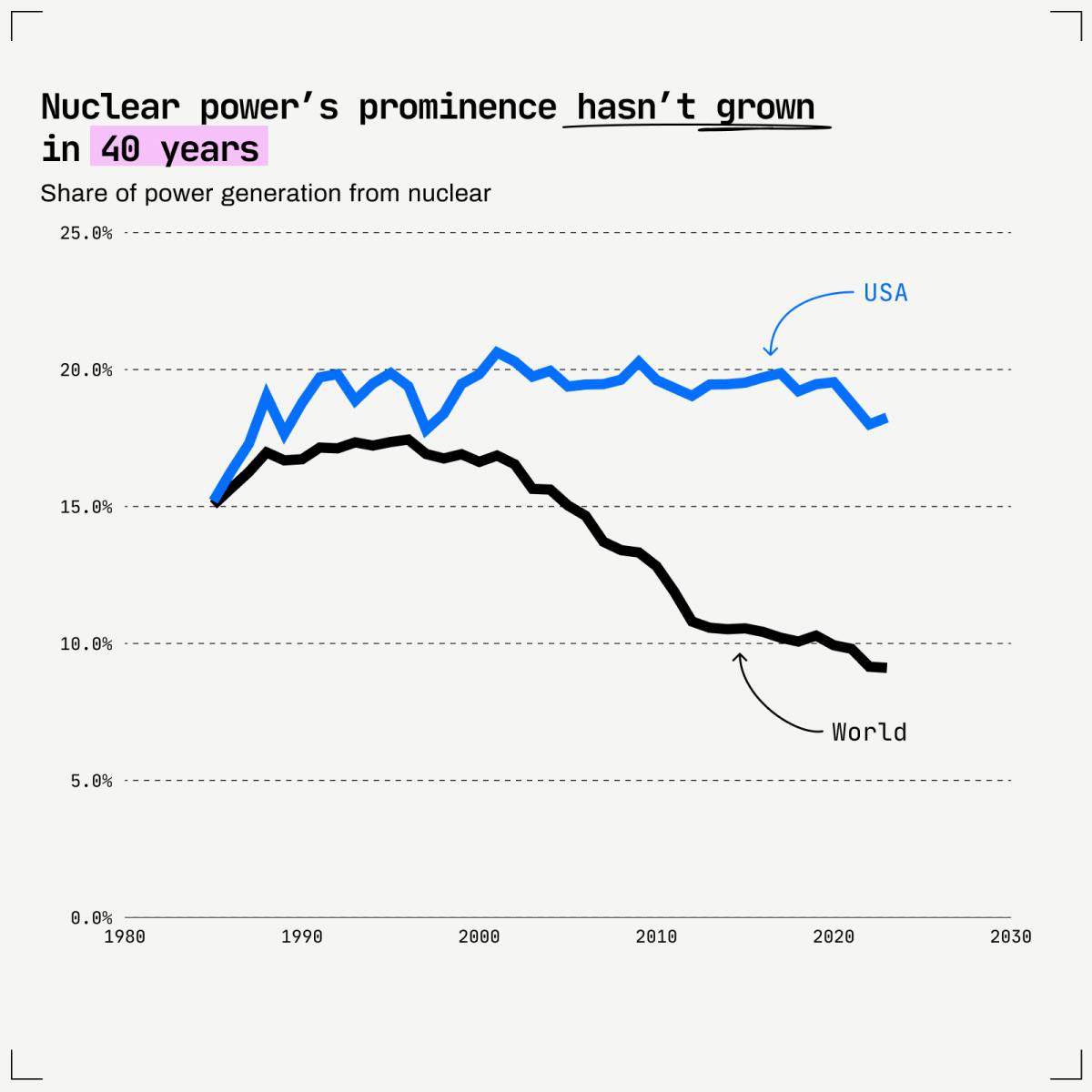

A single kilogram of uranium contains enough energy to power an entire city for a year. Uranium was poised to become the new gold, and nuclear power plants were expected to rise like pyramids across the globe. Yet today, nuclear energy accounts for only about 10% of global electricity, down from its peak of 18% in the mid-1990s. Reactor designs have remained largely unchanged for decades. The industry is now stagnant, costly, and entangled in complex regulations.

At its core, the decline of nuclear is not technological, but institutional. The basic physics of fission remain unmatched in energy density, producing 20K times more energy per kg of fuel (uranium) than coal, or safety when properly managed. What stalled was not the science, but the systems around it: regulation, financing, and public trust.

The story of nuclear power is one of early promises followed by unexpected declines. After the first commercial nuclear power plants were built in the 1950s, the industry grew rapidly through the 1960s and early 1970s. Many countries invested heavily in nuclear infrastructure, viewing it as a reliable path to energy independence. Between 1960 and 1975, over 400 reactors were ordered in the United States alone, with utilities expecting steady cost declines through standardization.

However, by the late 1970s, this expansion slowed dramatically. In the United States alone, 63 nuclear units were canceled between 1975 and 1980. More than two-thirds of all nuclear plants ordered after January 1970 were eventually scrapped. Globally, nuclear's share of electricity generation held steady at around 16-17% through the mid-1980s before declining to less than 10% as of 2025.

Source: Freethink

Regulatory Landscape & Public Perception

What began as a reasonable focus on safety evolved into a complex, unpredictable regulatory system that made nuclear plants increasingly expensive to build and operate. Regulations weren't just strict; they were constantly changing, even during construction.

This regulatory uncertainty created massive cost overruns. Plants that started construction with one set of requirements often had to redesign and rebuild components as regulations changed mid-project. The Sequoyah plant in Tennessee exemplifies this problem: construction began in 1968 with a scheduled completion date of 1973 at a cost of $300 million. After numerous regulatory changes and redesigns, it finally went into operation in 1981 at a cost of $1.7 billion. Nearly six times the original budget. This phenomenon, known as “regulatory ratcheting,” led to construction costs for US reactors rising by an average of 200–300% between initial approval and completion.

Source: Journal of Economic Perspectives

Isaiah Taylor, CEO of Valar Atomics*, argues that the regulatory environment in the West has made it nearly impossible to bring new commercial reactors online at a pace compatible with innovation. As Taylor told Contrary Research in a November 2025 interview:

"In the existing nuclear regulatory framework, the minimum [time to set up a commercial reactor] is five to six years. And no one's actually hit that minimum yet… everything takes even longer than that. That's just a dead industry, right? You can ignore everything else. It's impossible to develop a technology if it takes five to six years. That just doesn't work."

Public perception compounded these regulatory challenges. Nuclear power's association with weapons of mass destruction during World War II cast a long shadow over civilian applications. In addition, three major nuclear accidents further damaged public confidence, from Three Mile Island (1979) to Chernobyl (1986) and Fukushima (2011). The word "nuclear" became synonymous with danger in the public mind. Even though the total global fatalities from nuclear power, at less than 5K including all major accidents, remain lower than those from coal every single week, perception has outweighed reality.

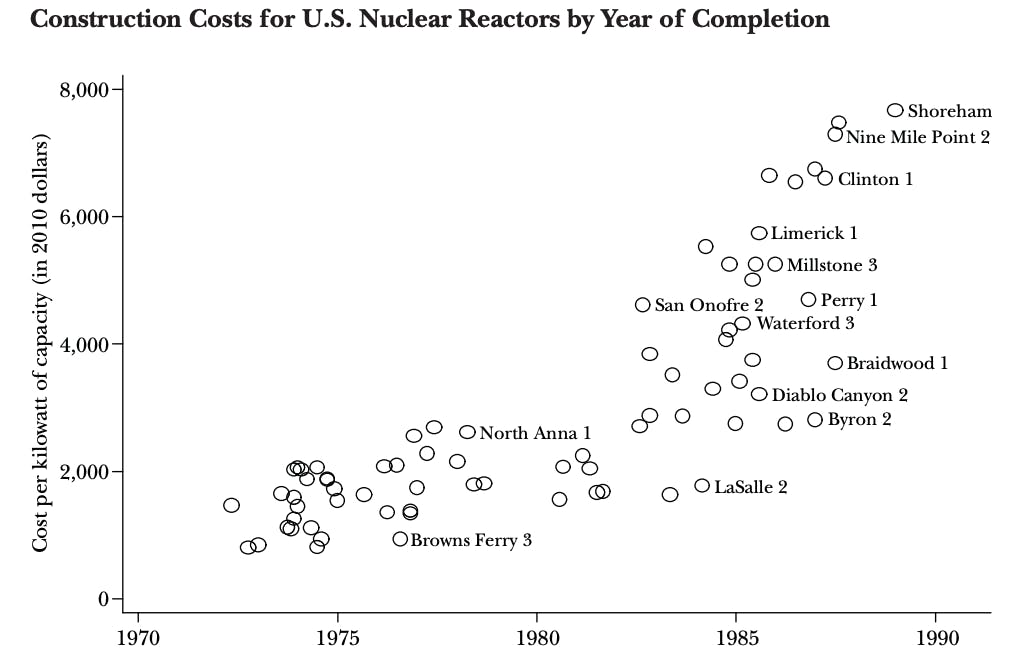

Perhaps most puzzling is what happened to nuclear economics. Through the 1950s and 1960s, nuclear costs declined rapidly, following the typical learning curve seen in other industries. But around 1970, this trend reversed, and costs began rising; an inversion of the learning curve that is almost unprecedented in industrial history. Unlike other industries that benefit from standardization and repeated construction, each nuclear plant became a custom project, preventing the cost reductions that come with scale and experience.

This combination of regulatory burden, public fear, and economic challenges created a vicious cycle. High costs and regulatory barriers limited deployment, which prevented the learning and scale economies that could reduce costs, which in turn further limited deployment. The traditional approach to nuclear power of large, custom-built plants connected to the electrical grid had run into seemingly insurmountable barriers.

The Stagnation

The stagnation of nuclear power creates what Jason Crawford summarizes as a conflict between two of the most pressing problems of our time: poverty and climate change:

“To avoid global warming, the world needs to massively reduce CO₂ emissions. But to end poverty, the world needs massive amounts of energy. In developing economies, every kWh of energy consumed is worth roughly $5 of GDP. ”

Energy consumption and economic prosperity are fundamentally connected, particularly for developing nations seeking to industrialize and improve living standards. The positive relationship between energy and economic growth is clear: income and energy consumption are tightly correlated on every continent and across every time period for which data exists. As one piece puts it: ”Nowhere in the world is there a wealthy country that consumes only a little energy, nor a poor country that consumes a lot.”

The causal relationship works both ways. While wealthier societies demand more energy-intensive services, energy consumption itself drives economic output since energy is an input for almost all economic activity. Billions of people need more energy to escape poverty, while the planet needs fewer emissions to avoid a climate disaster. Nuclear power offers abundant, reliable, carbon-free energy that could address both challenges simultaneously. Yet its deployment has stagnated precisely when it's needed most.

In an April 2024 interview, the founder of Bismarck Analysis, Samo Burja, highlighted several points describing the nuclear challenge and reasons for stagnation. First, global energy demand doesn’t necessarily justify the scale required to build the thousands of safe, cheap traditional reactors necessary to make the nuclear industry work economically. In addition, nuclear power would likely fit better in a society that was consuming 10x more energy. Nuclear succeeds when energy abundance is a civilizational goal, not a climate change solution.

This analysis presents a challenging outlook for nuclear energy. If thousands of reactors are needed to achieve economies of scale, but current energy demand doesn't justify building them, how can nuclear ever break out of its high-cost trap? It's a classic catch-22 that has kept nuclear power stagnant for decades.

A New Nuclear Era

Valar Atomics, a nuclear energy startup founded by Isaiah Taylor, is tackling many of these obstacles head-on by taking a novel approach to nuclear power. Rather than fighting the limitations of the electrical grid, Valar has identified a fundamental mismatch between nuclear capabilities and electricity as a product. "Electricity is a terrible product," Taylor argues, because it can't be easily transported through space or time. It must be used immediately and requires fixed infrastructure to deliver.

Taylor's insight cuts to the heart of nuclear's problems. The issue isn't just regulation or public perception; it's that nuclear power has been trying to sell the wrong product. Electricity's limitations as a commodity have prevented nuclear from achieving the scale needed to drive down costs. By focusing exclusively on electricity generation, the nuclear industry has trapped itself in a business model that can't support the thousands of reactors needed to make the technology economically competitive.

Taylor realized that "the world already runs on hydrogen, but it's bonded with carbon for convenience." This realization led to Valar's core innovation: using nuclear reactors not to generate electricity, but to produce synthetic hydrocarbon fuels that plug directly into our existing energy infrastructure.

"You can create diesel, jet fuel, gasoline using hydrogen and CO2, and you get that hydrogen from splitting water using a nuclear reactor," Taylor explained. "So what this would allow you to do is actually make jet fuel, diesel, gasoline, essentially from industrial water and air." This approach allows Valar to "plug nuclear energy essentially into the existing distribution system of oil and gas."

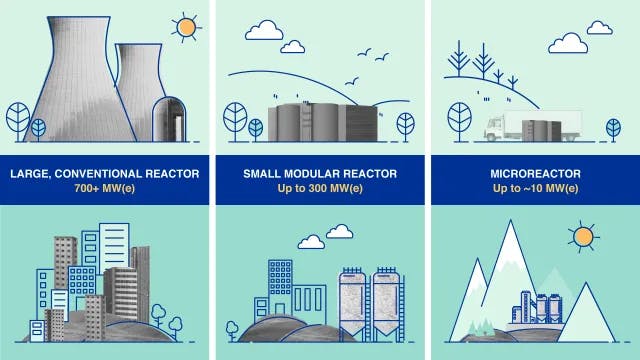

The company's model centers around "gigasites", which are massive industrial complexes hosting hundreds or even thousands of small modular reactors operating together. These high-temperature gas reactors use helium as coolant and operate at significantly higher temperatures than conventional nuclear reactors. The heat enables efficient hydrogen production through thermochemical processes, which is then combined with captured carbon dioxide to create carbon-neutral synthetic fuels. This bypasses the most common issue for renewables: intermittency. Valar’s synthetic fuels can be stored relatively easily for usage during peak hours.

By November 2025, Valar had secured over $150 million in total funding and completed assembly of "Ward Zero," its first reactor prototype using silicon carbide instead of uranium in the core. This non-nuclear test reactor allows the company to validate its design and safety features before building "Ward One," its first uranium-containing reactor.

By concentrating many reactors at a single site, Valar minimizes regulatory burden by "amortizing the site-specific licensing costs over 10x-100x more reactors than compared to other reactor companies". This concentration also enables the development of a skilled workforce at each site, avoiding the excessive costs of labor procurement and training that plague traditional nuclear projects.

Perhaps most importantly, Valar's approach solves the scale problem that has trapped nuclear power in a vicious cycle. As of 2024, the world consumed about 20.5 terawatts of continuous power, which would require approximately 60K gigawatt-scale nuclear reactors. That’s "more than enough units to get on an industrial cost curve," as Taylor notes. By producing fuels that can be sold into global markets rather than electricity constrained by local grids, Valar creates the demand needed to manufacture thousands of identical reactors, driving down costs through learning and economies of scale. As one Valar investor explains:

“Valar could produce ~$1 billion of revenue annually per 100 reactors deployed on a gigasite from synthetic fuels sales. Given nuclear reactors' small footprint, a single gigasite could host 1,000+ reactors, driving $10 billion+ in revenue per year.”

The company believes it can produce carbon-neutral synthetic fuels at prices competitive with or lower than traditional fossil fuels, even without carbon subsidies. If successful, this approach could transform not just the nuclear industry but the global energy landscape, providing a path to abundant clean energy that works with, rather than against, our existing energy infrastructure. As Taylor put it:

"The last time mankind switched to a source of power that was an order of magnitude cheaper, it sparked the industrial revolution. Right now, we're at the footsteps of perhaps a steeper mountain: becoming multiplanetary, harnessing artificial intelligence, and living longer lives."

Founding Story

Valar Atomics was founded by Isaiah Taylor (CEO) in July 2023 to transform the global energy landscape through nuclear power. Valar Atomics emerged out of stealth in early 2025.

Taylor’s great-grandfather was a nuclear physicist who worked on the Manhattan Project, planting the seeds of a fascination that would eventually bloom into Valar Atomics. As Taylor explained in a January 2025 interview:

"Atomic energy has been in my blood and something I've always thought about… I founded Valar Atomics due to frustration with the existing nuclear industry."

Taylor dropped out of high school at 16, teaching himself coding and working on multiple software systems. Before turning 20, he had already founded two software companies, including HoodHub, a platform that helped auto shops provide better customer care, which raised $264.9K in funding in 2020. He was making $200K a year as a 17-year-old but seeing none of it, wiring his entire paycheck to the company to keep the business alive.

Despite his experience in software, Taylor remained drawn to the field of nuclear physics. He watched with growing frustration as the nuclear industry stagnated, with reactor designs largely unchanged for decades and manufacturers fixated on electricity production despite its limitations as an energy carrier. This frustration eventually crystallized into a vision for a fundamentally different approach to nuclear energy that focused on producing synthetic fuels rather than electricity.

He spent six years researching and thinking about the nuclear problem before starting the company. As Taylor told Contrary Research in a November 2025 interview:

“Before I even started this company, my brother-in-law and I sat down and looked at all 80 regulatory environments on earth and read all of the laws, and it was like, how could you actually get through this thing? And a lot of people jumped into it 10 years ago, optimistically when the nuclear renaissance was happening, and I think [they] jumped into some suboptimal paths.”

Taylor assembled a team with expertise in nuclear engineering and regulations. The company's technical efforts are led by Chief Nuclear Officer Mark Mitchell, whose credentials bring credibility to Valar's ambitious plans. Mitchell previously served as president of modular reactor firm Ultra Safe Nuclear Corporation (USNC) and led the world's first small modular reactor project at South Africa's Pebble Bed Modular Reactor. His 25 years of experience in the energy industry span both technological innovation and the complex world of nuclear regulatory compliance.

The company's name itself reflects this ambitious vision. "Valar" comes from J.R.R. Tolkien's mythology, referring to powerful beings who shaped the world. Like its namesake, Valar Atomics aims to reshape the global energy landscape, bringing about an era of clean, abundant energy that supports human flourishing while addressing climate change.

Product

What Is Uranium & How Does It Work?

Uranium is the fundamental fuel that powers nuclear reactors. The nucleus of the uranium-235 atom contains 92 protons and 143 neutrons. When a U-235 nucleus captures a neutron, it becomes unstable and splits (fissions) into two smaller atoms, releasing energy in the form of heat along with two or three additional neutrons. These neutrons can then cause other U-235 atoms to split, creating a self-sustaining chain reaction that produces enormous amounts of heat from relatively small amounts of uranium.

This fission process is what occurs in a nuclear reactor. The heat generated is used to produce steam, which drives turbines to generate electricity.

Inside the reactor, uranium fuel is assembled in a way that enables a controlled fission chain reaction. The fuel elements are surrounded by a moderator (typically water, graphite, or heavy water) that slows down neutrons to sustain the chain reaction. Control rods that absorb neutrons can be inserted or withdrawn to regulate the reactor's power level. Not only that, the type of low-enriched Uranium (<20% U235) used is optimized for steady operations and inherently unsuitable for weapons.

Importantly, nuclear reactors cannot explode like nuclear bombs due to their fuel composition and design. While fuel may overheat and melt in a severe malfunction, the concentration of fissile material is insufficient for an explosive chain reaction. Truthfully, the use of the word ‘nuclear’ in both fields is a marketing problem, not a scientific one.

Fission vs. Fusion

Nuclear energy can be produced through two fundamentally different processes: fission and fusion.

Fission occurs when a large atom splits into two smaller ones, releasing energy in the process. This is the reaction that powers all commercial nuclear plants today. Uranium and plutonium are most commonly used for fission reactions because they are relatively easy to initiate and control. The energy released is converted into steam, which spins turbines to produce carbon-free electricity.

Fusion, by contrast, occurs when two light atoms combine to form a heavier atom, such as when two hydrogen atoms fuse to form helium. This is the same process that powers the sun and releases several times more energy than fission. Fusion also doesn’t produce highly radioactive fission products. However, fusion reactions require extreme temperatures and pressures, similar to those in the Sun, to overcome the repulsive forces between positively charged nuclei, making them difficult to sustain for long periods. Despite decades of research, commercial fusion power has remained elusive, always just 5 years away!

The Early Days of Nuclear Power

Nuclear energy's origins are deeply intertwined with government-led research and development during World War II. The Manhattan Project, initiated in 1942, brought together top scientists to develop the first atomic bombs, demonstrating the immense power contained within nuclear fission. Following the war, governments around the world began exploring the peaceful applications of nuclear technology, primarily for electricity generation. Early reactors were large-scale, custom-built projects, heavily subsidized and regulated by national governments.

In the 1950s and 1960s, the first commercial nuclear power plants were developed, with the world's first nuclear-powered electricity generator beginning operation in 1954 at Obninsk, USSR. The United States followed shortly after with the Shippingport Atomic Power Station in 1957. These early nuclear programs focused on Pressurized Water Reactors (PWRs) and Boiling Water Reactors (BWRs), which became the dominant reactor designs globally due to their relative simplicity and scalability.

The Era of Large-Scale Nuclear Plants

The 1960s and 1970s saw a rapid expansion of nuclear power, driven by concerns about energy security and the rising cost of fossil fuels. Large-scale nuclear plants, often exceeding 1K megawatts in capacity, were constructed in countries like the United States, France, Germany, and Japan.

The regulatory landscape was complex and evolving, and governments played a crucial role in financing these projects. France emerged as a leader in nuclear energy, with a standardized fleet of PWRs that provided a significant portion of the country's electricity. The French model emphasized centralized control and government support. The country’s Messmer Plan is the prototype: single utility with a limited set of reactor variants built repeatedly.

Construction of these large-scale plants came with many significant challenges, like cost overruns, construction delays, and public antagonism.

Product Overview

While most small modular reactor (SMR) developers are focused on electricity generation, Valar Atomics is taking a fundamentally different approach, recognizing the unique challenges and opportunities in the energy market. As Isaiah Taylor explains: "The contrarian position that led me to found Valar is that we should find a product of nuclear that is not necessarily sold to the grid, but sold into a global open market."

By pivoting away from traditional electricity production and focusing on high-demand industrial applications and synthetic fuels, Valar Atomics is creating a new market for nuclear energy that isn’t constrained by current global electricity demand limitations.

Valar's approach centers on mass manufacturing nuclear reactors to achieve economies of scale, producing grid-independent products like hydrogen, data center power, heavy industrial power, and clean hydrocarbon fuels. The company is developing "gigasites" with hundreds of small modular reactors to generate large amounts of energy efficiently, aiming to create carbon-neutral synthetic fuels that can compete with traditional fossil fuels on price, without relying on subsidies.

Traditional Hydrocarbon Production vs Valar Atomic’s Approach

When it comes to synthetic fuel production, two primary pathways exist for generating the hydrogen needed: electrolysis and thermochemical water splitting. Both methods can produce carbon-neutral synthetic fuels, but they differ in their efficiency and energy requirements.

Electrolysis splits water into hydrogen and oxygen using electricity. The hydrogen is then combined with captured CO₂ to create synthetic hydrocarbons, yielding “e-fuels” or “electrofuels”. Conventional electrolysis typically achieves lower efficiencies due to the two-step conversion process (heat → electricity → hydrogen):

H₂O → H₂ + ½O₂

The thermochemical approach, which Valar employs, uses nuclear heat directly to split water into hydrogen and oxygen. This process eliminates the electricity conversion step, creating a more direct energy pathway (heat → hydrogen). The hydrogen is then combined with captured CO₂ to produce carbon-neutral synthetic fuels.

Valar’s thermochemical water splitting process uses the sulfur-iodine cycle, which operates at temperatures between 800-1000°C; precisely the range that Valar's high-temperature gas reactors can provide. This cycle uses sulfuric acid and hydrogen iodide in a closed-loop process where the chemicals are recycled, with only water consumed and hydrogen and oxygen produced.

The sulfur-iodine cycle consists of three main chemical reactions:

I₂ + SO₂ + 2H₂O → 2HI + H₂SO₄ (120°C)

2HI → I₂ + H₂ (300-450°C)

H₂SO₄ → SO₂ + H₂O + ½O₂ (800-1000°C)

The net reaction is simply: H₂O → H₂ + ½O₂

By eliminating the conversion to electricity, Valar's approach reduces energy losses and improves the economics of hydrogen production.

Once hydrogen is produced, it's combined with captured CO₂ using a modified Fischer-Tropsch process to create synthetic hydrocarbons identical to those derived from fossil fuels. These carbon-neutral fuels can be used in existing infrastructure without modification, providing a seamless transition path away from fossil fuels.

High-Temperature Gas Reactors (HTGRs)

At the core of Valar’s technology is the High-Temperature Gas Reactor (HTGR), a design that offers significant advantages over conventional light-water reactors for industrial heat applications.

Technology

Valar’s HTGRs use helium as a coolant and operate at temperatures in excess of 950ºC-triple that of conventional nuclear reactors. Helium is chemically inert, reducing corrosion risks and eliminating the possibility of chemical reactions with reactor components. This high-temperature capability is crucial for efficient thermochemical hydrogen production.

The reactors use graphite as a neutron moderator, which slows neutrons to thermal energies where they’re more likely to cause fission in uranium-235. Graphite has excellent neutron moderation properties and maintains structural stability even at high temperatures, contributing to the reactor’s inherent safety.

Valar’s reactors are designed for mass production and rapid deployment, with standardized components that can be manufactured in a factory setting.

Fuel

Valar utilizes TRIstructural-ISOtropic (TRISO) fuel, which consists of uranium oxycarbide kernels coated with multiple layers of carbon and silicon carbide. Each fuel particle is about the size of a poppy seed and can be formed into cylindrical pellets or spherical “pebbles,” depending on the reactor design. TRISO fuel can withstand temperatures as high as 1600°C without melting, providing excellent fission product retention, even at high temperatures and burn-up rates. This provides a large safety margin and eliminates the possibility of a meltdown like those that occurred at Three Mile Island, Chernobyl, or Fukushima.

TRISO fuel also offers excellent fission product retention, even at high temperatures and burnup rates. The US Department of Energy has called TRISO particles "the most robust fuel on earth," capable of containing over 99.99% of fission products even in accident conditions.

Source: Valar Atomics

The Gigasite Concept

Valar's business model is centered around the concept of "gigasites," which are large industrial hubs hosting hundreds or even thousands of small nuclear reactors operating together to achieve economies of scale.

Traditional nuclear plants are built as individual units at separate sites, each requiring its own licensing, infrastructure, and workforce. This not only maximizes regulatory burden, but also prevents the industry from achieving the cost reductions that come with standardized, repeated construction.

The gigasite concept turns this model on its head. By concentrating many reactors at a single site, Valar minimizes the regulatory burden by amortizing site-specific licensing costs over 10-100 times more reactors than other companies. This allows local regulators and politicians to build familiarity with the systems as deployment scales, rather than having to continuously educate stakeholders in new locations.

Valar has already demonstrated its ability to move quickly, designing and building its thermal test unit, Ward Zero, in just 10 months. This non-nuclear prototype uses silicon carbide instead of uranium in the core, allowing the company to test the reactor's thermal and mechanical systems without the regulatory complexity of nuclear fuel. With Ward Zero, Valar Atomics has essentially validated mechanical assembly, helium leak-rate targets, thermal performance, and control systems, all necessary for the Ward One path.

The company's first uranium-containing reactor, Ward One, will be deployed in partnership with the Philippines Nuclear Research Institute, taking advantage of the 123 Agreement between the United States and the Philippines that establishes a framework for nuclear cooperation. Valar's naming convention for its products (e.g., Ward Zero, Ward One) is in honor of CEO Isaiah Taylor's great-grandfather, Ward Schaap, who worked on the Manhattan Project.

In September 2025, Valar Atomics broke ground on a new project in Utah. Ward 250 is a small, helium-cooled, TRISO-fueled high-temperature gas test reactor at the state-owned San Rafael Energy Research Center (also called the Utah San Rafael Energy Lab) in Orangeville, Emery County. The project is part of the US Department of Energy’s Nuclear Reactor Pilot Program, which aims to construct, operate, and achieve criticality of at least three test reactors by July 4, 2026.

Market

Customer

Valar Atomics' approach to nuclear energy opens up markets far beyond traditional electricity generation. By producing synthetic fuels and providing high-temperature process heat, Valar targets industries with significant energy demands and decarbonization challenges.

The aviation industry represents a prime potential customer segment for Valar's synthetic jet fuel. Airlines face mounting pressure to reduce their carbon footprint through both regulatory requirements and corporate sustainability commitments. Unlike other proposed aviation decarbonization solutions like hydrogen or battery-electric propulsion, synthetic jet fuel is chemically identical to conventional jet fuel, requiring no modifications to existing aircraft or fueling infrastructure like other green solutions (e.g. hydrogen fuels) do. This drop-in compatibility eliminates the need for costly fleet replacements or airport infrastructure overhauls while providing the same energy density and performance characteristics pilots and engineers trust.

Maritime shipping presents another substantial potential market opportunity. The International Maritime Organization has mandated a 40% reduction in greenhouse gas emissions from international shipping by 2030 compared to 2008 levels. Valar's synthetic diesel and fuel oils offer a path to compliance without sacrificing range or power. Like aviation, maritime vessels represent a difficult-to-electrify sector where energy-dense liquid fuels will otherwise likely remain essential for decades to come.

Hyperscale data centers constitute a rapidly growing energy market driven by cloud computing, artificial intelligence, and other data-intensive applications. These facilities require enormous amounts of reliable electricity, often hundreds of megawatts per campus, and increasingly face pressure to source low-carbon power. Valar's gigasites can provide dedicated, grid-independent power generation with minimal environmental impact, offering data center operators both sustainability benefits and energy security.

Heavy industry, including steel, cement, and aluminum production, relies on high-temperature process heat typically generated by burning fossil fuels. These hard-to-abate sectors account for approximately 22% of global CO₂ emissions. Valar's high-temperature gas reactors can supply both the heat and hydrogen needed for these industrial processes, enabling decarbonization of sectors that have few other viable pathways to reduce emissions.

National defense and government agencies represent other strategic customers, given the evolving security requirements around energy. Military operations depend heavily on liquid fuels for aircraft, vessels, and ground vehicles. Synthetic fuels produced domestically from nuclear energy offer independence from foreign oil supplies and price volatility while supporting climate goals.

Looking further into the future, in situ rocket fuel production represents a specialized but potentially meaningful application of Valar’s technology. The ability to produce methane and oxygen propellants on Mars using local resources would dramatically reduce the mass requirements for Mars return missions, potentially making human exploration and eventual settlement more feasible.

These diverse customer segments share several common characteristics that make them ideal targets for Valar's technology. They all operate energy-intensive businesses requiring large, reliable supplies of power and fuel. They face increasing pressure to reduce carbon emissions from both regulatory and market forces. And they value long-term energy solutions that offer cost stability and reduced dependence on volatile fossil fuel markets.

These customers rely primarily on traditional petroleum products and grid electricity, often supplemented with carbon offset purchases to mitigate emissions on paper. However, as carbon pricing mechanisms expand globally and corporate sustainability commitments grow more ambitious, the market for truly carbon-neutral energy solutions is expanding rapidly. Not to mention the fact that synthetic fuels overcome offsets’ greatest criticism: the inability to target scope 3 emissions.

Market Size

The nuclear power market is experiencing significant growth, with global nuclear capacity projected to reach 398 gigawatts by 2025, growing at a CAGR of 2%.

In financial terms, the nuclear electricity market is substantial, valued at $270 billion in 2024 and expected to reach $281.6 billion in 2025, growing at a CAGR of 4.3%. Looking further ahead, the market is projected to reach $328.1 billion by 2029 at a CAGR of 3.9%.

As for carbon capture, utilization, and storage (CCUS), this market is growing rapidly as well. The global CCUS market was valued at approximately $1.9 billion in 2020 and is projected to reach $7 billion by 2032, growing at a CAGR of 13.8%.

While these existing market segments represent the direct market services that Valar Atomics is addressing, the real opportunity is one of substitution. Globally, the aviation and maritime industries spent $200 billion and $140 billion, respectively, in 2024 alone on fuel. The energy demand across data centers consumed 4.4% of all energy demand in the US in 2024 and could rise to 21% globally by 2030 (even more for AI data centers) as companies invest nearly $7 trillion in data center infrastructure. Beyond that, there’s steel, cement, and aluminum production, national defense energy demands, and space exploration. Trillions of dollars could be addressed if Valar Atomics’ technology is able to reach sufficient scale.

Competition

Competitive Landscape

The nuclear energy market can be broadly categorized into three segments: traditional nuclear energy, small modular reactors (SMRs) focused on electricity generation, and companies pursuing alternative approaches like fusion and advanced fuels.

Traditional nuclear energy is dominated by established players like Westinghouse, GE Hitachi Nuclear Energy, and Électricité de France (EDF). These companies have decades of experience in reactor design, construction, and operation, but often struggle with high costs, regulatory complexity, and lengthy project timelines. The 2024 completion of Georgia Power's Vogtle Units 3 and 4 in the United States, the first new nuclear units built in the country in more than three decades, took over 15 years and cost more than $35 billion, more than double the original estimate.

The SMR market is more dynamic and fragmented, with numerous startups developing novel reactor designs and business models. According to the World Nuclear Association, there are over 70 SMR designs under development worldwide. These companies offer the potential for greater flexibility and scalability compared to traditional nuclear plants, but many face challenges in securing regulatory approvals, raising capital, and demonstrating commercial viability.

Valar Atomics has positioned itself uniquely within this landscape by focusing on three key differentiators: mass manufacturing of reactors, grid-independent synthetic fuel production, and the gigasite concept. Rather than competing directly in the crowded electricity generation market, Valar targets the $2 trillion global liquid fuels market, where nuclear-powered synthetic fuel production could offer a carbon-neutral alternative to fossil fuels without requiring changes to existing infrastructure.

Competitors

Small Modular Reactors (SMRs)

NuScale Power

Founded in 2007, NuScale Power develops and commercializes small modular reactors for electricity generation, district heating, and other applications. As of November 2025, the company had secured over $450 million from investors, including Fluor Corporation, Doosan Enerbility, and Samsung C&T, which invested $60 million in May 2023. NuScale went public in 2022 and trades on the NYSE under the ticker "SMR" with a market cap of around $4.6 billion as of November 2025.

NuScale's technology centers around a 77 MWe pressurized water reactor module that can be deployed in configurations of up to 12 modules for a total plant output of 924 MWe. The company received design approval from the US Nuclear Regulatory Commission in 2020, making it the first SMR design to complete the NRC's review process.

While NuScale and Valar both focus on SMR technology, their business models differ significantly. NuScale targets traditional electricity generation for the grid, whereas Valar focuses on synthetic fuel production. NuScale's approach requires navigating complex grid integration and electricity market regulations, while Valar's fuel-focused strategy allows it to bypass many of these challenges.

TerraPower

Founded in 2006 by Bill Gates, TerraPower designs and develops advanced nuclear reactors, including the Natrium sodium-cooled fast reactor and a molten chloride fast reactor. The company raised $830 million in 2022, with significant backing from Gates himself.

TerraPower broke ground on its first demonstration plant in Kemmerer, Wyoming, in 2024, making it the first advanced reactor company in the US to move from design to construction. The Natrium reactor, developed in partnership with GE Hitachi Nuclear Energy, is designed to provide 345 MWe of baseload electricity, with the ability to boost output to 500 MWe for over five hours when needed.

While TerraPower has explored synthetic fuel production in the past, its primary focus remains electricity generation. The company's approach to reactor design is innovative, but its business model still centers on traditional grid integration rather than Valar's fuel-focused strategy.

X-energy

Founded in 2009, X-energy is developing a high-temperature gas-cooled reactor called the Xe-100, which shares some technical similarities with Valar's HTGR design. As of November 2025, the company had secured over $700 million in funding and is working on a demonstration project in Washington state in partnership with Energy Northwest and the Department of Energy.

X-energy's Xe-100 is an 80 MWe reactor that can be deployed in four-pack configurations to create a 320 MWe power plant. Like Valar's reactor, it uses TRISO fuel and helium coolant, allowing for high operating temperatures. However, X-energy remains focused on electricity generation rather than synthetic fuel production.

Ultra Safe Nuclear Corporation (USNC)

Founded in 2011, USNC is developing the Micro Modular Reactor (MMR), a 5-10 MWe high-temperature gas-cooled reactor. The company has raised significant funding and is working on demonstration projects in Canada and the US.

Interestingly, Valar Atomics' Chief Nuclear Officer, Mark Mitchell, previously served as president of USNC. This connection suggests that Valar may be building on USNC's technical expertise while pursuing a fundamentally different business model.

Alternative Approaches

Helion Energy

Founded in 2013, Helion Energy is developing fusion power technology with the goal of producing clean, safe, and affordable electricity. In November 2021, Helion raised $500 million in a Series E funding round led by Sam Altman, with the potential for an additional $1.7 billion tied to achieving technical milestones.

Helion's approach uses a pulsed non-ignition fusion system that directly recovers electricity from the fusion reaction, potentially eliminating the need for steam turbines and other traditional power plant components. The company had aimed to demonstrate net electricity production by 2024 and build a commercial fusion power plant by 2028, though as of November 2025 continues to be behind schedule.

While both Helion and Valar are pursuing innovative approaches to clean energy, they represent fundamentally different technologies. Helion is focused on fusion-combining light atoms to release energy, while Valar uses fission-splitting heavy atoms. Fusion promises virtually limitless fuel and minimal radioactive waste, but the technology remains unproven at commercial scale. Valar's approach, based on existing HTGR designs, offers a more immediate path to deployment.

Terraform Industries

Founded in 2021 by Casey Handmer, Terraform Industries is developing technology to produce synthetic gasoline from air and renewable electricity. As of November 2025, the company had raised $41 million in total funding, including a $26 million round in 2025 to complete development of its Mark One terraformer.

Terraform's process uses renewable electricity to extract carbon dioxide from the atmosphere and combine it with hydrogen (produced through electrolysis) to create synthetic hydrocarbons. This approach aims to create carbon-neutral fuels that can be used in existing vehicles and infrastructure.

While Terraform and Valar both target the synthetic fuels market, their approaches differ significantly. Terraform relies on renewable electricity as its primary energy input, making it dependent on the availability and cost of wind, solar, or other renewable sources. Valar's nuclear-powered approach provides a consistent, weather-independent energy source but requires navigating the regulatory complexities of nuclear deployment. Additionally, Terraform's process requires carbon capture technology to extract CO₂ from ambient air, energy and capital intensive, while Valar can use more concentrated, inexpensive sources like industrial emissions.

Commonwealth Fusion Systems (CFS)

Founded in 2018 as a spinoff from MIT's Plasma Science and Fusion Center, CFS is developing compact fusion power plants based on high-temperature superconducting magnets. The company has raised over $2 billion from investors, including Bill Gates and Google.

CFS plans to build SPARC, a demonstration fusion device, by 2027, followed by ARC, a commercial fusion power plant, in the early 2030s. Like Helion, CFS represents a long-term alternative to traditional nuclear power, but with significant technical and commercial uncertainties.

Oklo

Founded in 2013, Oklo is developing a 1.5 MWe fast reactor called Aurora that uses High-Assay Low-Enriched Uranium (HALEU) fuel. The company has raised over $500 million and is working with the Department of Energy to secure sites for its first commercial deployments. After going public via SPAC in May 2024, Oklo grew to a market cap of $16.2 billion as of November 2025. But, just like other companies using HALEU fuels, Oklo’s largest risk is fuel availability, something Valar’s LEU-TRISO dodges.

Oklo's compact design targets remote and off-grid applications, positioning it differently from both traditional nuclear plants and Valar's gigasite concept. While innovative, Oklo's approach remains focused on electricity generation rather than synthetic fuel production.

Kairos Power

Founded in 2016, Kairos Power is developing a fluoride salt-cooled high-temperature reactor (FHR) that combines elements of molten salt and high-temperature gas reactors. The company has raised significant funding and is working on a demonstration reactor called Hermes in Tennessee.

Kairos's technology offers high operating temperatures similar to Valar's HTGR design, potentially enabling efficient hydrogen production. However, the company has primarily focused on electricity generation applications rather than synthetic fuels.

Chevron, ExxonMobil, and Traditional Oil & Gas

Major oil and gas companies represent significant competitors in the synthetic fuels market. Companies like Chevron and ExxonMobil are investing in biofuels, renewable diesel, and other alternative fuel technologies as part of their energy transition strategies.

These companies have extensive experience in fuel production, distribution, and marketing, along with massive existing infrastructure. However, their approaches to synthetic fuels typically rely on biomass feedstocks or carbon capture from their existing operations rather than nuclear-powered synthesis. Valar's nuclear approach could potentially produce synthetic fuels at lower costs and with fewer land use impacts compared to biomass-based methods.

Business Model

Valar Atomics' business model centers on producing and selling carbon-neutral synthetic fuels directly into the existing $2 trillion global liquid fuels market. Rather than competing in the increasingly crowded electricity generation sector, Valar has identified synthetic fuels as a higher-value product that leverages nuclear energy's unique capabilities while bypassing the constraints of the electrical grid.

The company plans to generate revenue primarily through the sale of synthetic jet fuel, diesel, gasoline, and other hydrocarbon products that are chemically identical to their fossil-derived counterparts but produced without extracting additional carbon from the ground. These fuels will be sold into existing distribution channels, allowing Valar to tap into established markets without building new infrastructure.

While reactor deployment itself is not Valar's core focus, Valar CEO, Isaiah Taylor, told Contrary Research in a November 2025 interview that the company may generate additional revenue through specialized deployments for specific industrial applications requiring high-temperature process heat. This could include direct partnerships with steel manufacturers, chemical producers, or other heavy industries seeking to decarbonize their operations.

By focusing on fuels rather than electricity, Valar creates a pathway to scale that isn't limited by local grid capacity or demand. The global market for liquid fuels is enormous, representing approximately 100 million barrels per day, which provides ample room for Valar to scale production as costs decrease, creating a potentially virtuous cycle of increasing deployment and falling costs.

Traction

In February 2025, Valar completed assembly of Ward Zero, its first reactor prototype using silicon carbide instead of uranium in the core. This non-nuclear test reactor will allow the company to validate its design before building Ward One, its first uranium-containing reactor. Simultaneously, Valar announced a partnership with the Philippines Nuclear Research Institute (PNRI) to build and deploy the first uranium reactor in the Philippines, whose 7.6K islands currently rely heavily on diesel power. Why the Philippines? The US–Philippines 123 Agreement, signed in 2023, provides the bilateral framework for nuclear cooperation and fuel services.

In June 2025, Valar Atomics signed a memorandum of understanding with the State of Utah to explore not only the deployment of a test nuclear reactor in Emery County but also the fabrication of TRISO nuclear fuel at the same site. The agreement outlined collaborative research on nuclear safety and technology performance, with all activities subject to Nuclear Regulatory Commission oversight. Vertical integration through production of TRISO would eliminate or at least reduce one of the company’s largest risks.

Valuation

Valar Atomics raised a $130 million Series A in November 2025 led by Doug Philippone at Snowpoint Ventures, who was previously the Global Defense Lead at Palantir. Other investors included Palmer Luckey, the founder of Anduril Industries*, Shyam Sankar, the CTO of Palantir, Dream Ventures, Day One Ventures, and Contrary. The company previously raised a $19 million seed round in February 2025, led by Riot Ventures, with participation from AlleyCorp, Day One Ventures, Initialized Capital, and Steel Atlas.

In total, SMR developers have collectively raised more than $1.5 billion in the year preceding February 2025. Notable competitors have secured substantial funding, including X-Energy's $700 million round in February 2025 (backed by Amazon's Climate Pledge Fund, Segra Capital, Jane Street, and Ares Management), and significant investments in Oklo, NuScale, and Nano Nuclear.

While Valar remains private, publicly traded companies in the SMR and nuclear technology space provide useful valuation benchmarks:

NuScale Power, which focuses on grid-connected SMRs rather than Valar's synthetic fuel approach, had a market capitalization of approximately $4.8 billion as of November 2025.

Centrus Energy, which specializes in uranium enrichment rather than reactor manufacturing, reported revenue of $442 million in 2024 and a market cap of ~$5.2 billion as of November 2025.

BWX Technologies, which focuses on defense contracts and traditional reactor services, reported revenue of $2.7 billion in 2024 and a market cap of $17.7 billion as of November 2025..

These public comparables suggest that nuclear technology companies with proven revenue streams command valuations in the billions. Given Valar's approach to nuclear energy, focusing on synthetic fuel production rather than grid electricity, the company could potentially command a premium valuation if it successfully demonstrates its technology and business model.

Key Opportunities

Energy Security & Geopolitical Independence

Global energy security has become an increasingly urgent priority for nations worldwide, driven by geopolitical instability and the desire to reduce dependence on foreign energy sources. The Russia-Ukraine conflict highlighted the vulnerabilities of relying on imported fossil fuels, particularly for European countries dependent on Russian natural gas. Germany, for example, saw its energy costs spike dramatically after cutting ties with Russian gas, forcing the country to scramble for alternative suppliers at much higher prices.

Valar's technology offers a pathway to energy independence by enabling the domestic production of carbon-neutral synthetic fuels. Countries could leverage Valar's gigasites to reduce reliance on imported oil and gas, enhancing national security and economic stability. Unlike renewable energy sources that depend on weather conditions and require vast land areas, nuclear-powered synthetic fuel production can operate continuously regardless of external conditions, providing reliable energy security for nations seeking to reduce their dependence on volatile global energy markets.

AI Data Center Power Demand

Artificial intelligence is creating unprecedented demand for energy, with AI data centers potentially consuming over 21% of global electricity by 2030. A single GPT-4 training run now consumes over 50 GWh, and this demand is accelerating rapidly as AI models become larger and more sophisticated.

Traditional grid infrastructure struggles to meet this concentrated, high-density power demand. Valar's gigasites can provide dedicated, grid-independent power generation specifically designed for AI data centers. This approach offers several advantages: consistent baseload power without weather-dependent variability, minimal land use compared to renewable alternatives, and the ability to locate data centers near nuclear facilities rather than being constrained by existing grid capacity. Additionally, Valar can use AI to optimize the design, operation, and maintenance of its HTGRs, creating a symbiotic relationship between nuclear power generation and AI optimization.

Aviation Decarbonization

The aviation industry faces mounting pressure to reduce its carbon emissions, driven by consumer demand, government regulations, and international agreements. Unlike ground transportation, which can be electrified, aircraft will continue to require energy-dense liquid fuels for the foreseeable future due to the weight and energy density limitations of batteries for long-haul flights.

Synthetic jet fuel produced by Valar offers a viable solution for decarbonizing aviation. These fuels are chemically identical to conventional jet fuel, making them compatible with existing aircraft engines and fuel infrastructure as "drop-in" replacements without requiring costly fleet replacements or airport modifications. The global aviation fuel market represents approximately 7.5 million barrels per day, providing a substantial market opportunity for Valar's carbon-neutral synthetic fuels. Airlines are increasingly seeking sustainable aviation fuel (SAF) to meet corporate sustainability commitments and regulatory requirements, creating strong demand for Valar's products.

Key Risks

Regulatory & Licensing Complexity

Nuclear energy faces significant regulatory hurdles and often struggles with negative public perception due to safety concerns and historical accidents. While Valar's HTGR design with TRISO fuel offers inherent safety advantages over traditional reactors, the company will still need to navigate complex regulatory environments in each country where it operates. The licensing process for new nuclear technologies can be time-consuming and expensive, potentially delaying commercial deployment and increasing costs.

The US Nuclear Regulatory Commission's approval process alone can take multiple years and cost hundreds of millions of dollars. For example, NuScale Power's small modular reactor design took over six years to receive NRC approval, despite being based on well-understood pressurized water reactor technology. Valar's HTGR technology, while proven in research settings, has never been commercially deployed at scale, potentially extending regulatory review timelines.

International deployment adds additional complexity, as each country has its own nuclear regulatory framework. The Philippines, for example, has limited nuclear regulatory experience, having never operated commercial nuclear power plants. This could create uncertainty around approval processes and safety standards.

To address the massive regulatory obstacles, in April 2025, Valar Atomics announced it is suing the NRC, arguing that the agency’s current regulatory framework unlawfully restricts small-scale nuclear reactor innovation. The company claims that the NRC has exceeded its authority by requiring full licensing for low-power test reactors like Valar’s Ward One, despite congressional intent in the Atomic Energy Act of 1954 to exempt such devices unless they pose national security or public health risks. Joined by several US states and other reactor startups, the lawsuit seeks to shift regulatory authority for small reactors to states, enabling faster testing and development of advanced nuclear technologies.

Unproven Manufacturing & Scale Economics

Valar's business model relies fundamentally on mass manufacturing of standardized reactors to achieve cost competitiveness, but this approach remains relatively unproven in the nuclear industry. The company will need to establish supply chains for specialized components like TRISO fuel and high-temperature materials, develop manufacturing facilities capable of producing reactors at scale, and implement rigorous quality control processes. No company has successfully mass-produced nuclear reactors at the scale Valar envisions.

Valar's gigasite concept requires deploying hundreds or thousands of reactors at a single location, which has never been attempted. The logistical challenges of coordinating construction, fuel supply, and maintenance for such a large number of reactors simultaneously could prove overwhelming. Any manufacturing defects or design flaws could affect hundreds of reactors, potentially shutting down entire gigasites and destroying the economic model.

Synthetic Fuel Production Economics

The economic viability of Valar's synthetic fuel production process depends on several unproven factors, including the cost of hydrogen production, carbon capture efficiency, and Fischer-Tropsch synthesis at scale. While the company claims it can produce synthetic fuels at prices competitive with fossil fuels, this assertion has not been demonstrated at a commercial scale. The thermochemical water splitting process using the sulfur-iodine cycle, while theoretically efficient, has never been deployed commercially and faces significant technical challenges.

Carbon capture costs remain high and variable, with current technologies ranging from $100-$600 per ton of CO2 captured. Valar's business model assumes access to low-cost CO2, but securing reliable, affordable carbon sources at the scale required for gigasites could prove challenging. Direct air capture, while improving, still costs $400-1K per ton of CO2, which could make synthetic fuels economically unviable.

The global oil and gas industry benefits from decades of optimization, existing infrastructure, and economies of scale that Valar will struggle to match initially. Oil prices are also highly volatile, and a sustained period of low fossil fuel prices could undermine the economic case for synthetic fuels. Additionally, government policies supporting carbon pricing or renewable fuel standards could change, removing potential competitive advantages for Valar's products.

Technology Integration & Operational Risks

Valar's approach requires seamlessly integrating multiple complex technologies including high-temperature gas reactors, thermochemical hydrogen production, carbon capture, and Fischer-Tropsch synthesis that have never been combined at commercial scale. Each component technology carries its own risks, and the interdependencies between systems could create cascading failures. The high-temperature operation required for efficient hydrogen production also increases materials stress and maintenance requirements.

TRISO fuel, while inherently safe, has limited commercial operating experience and faces potential supply chain constraints. The specialized manufacturing required for TRISO fuel particles involves complex coating processes that must maintain strict quality standards. Any fuel quality issues could affect reactor performance and safety, potentially triggering regulatory shutdowns.

The gigasite concept also creates operational risks related to workforce management, security, and emergency response. Managing thousands of reactors simultaneously requires unprecedented coordination and expertise. A single significant incident at a gigasite could affect public perception of nuclear energy globally, potentially derailing not just Valar's business but the entire advanced reactor industry.

Summary

Valar Atomics is pursuing a vision for the future of nuclear energy by focusing on mass manufacturing, grid-independent synthetic fuel production, and the gigasite concept. The company targets the aviation, shipping, data center, and heavy industry sectors, offering a pathway to decarbonization and energy independence.

By producing carbon-neutral versions of the fuels that already power the global economy, Valar aims to enable a smoother transition away from fossil fuels without requiring massive infrastructure changes or technological leaps in end-use applications. The company's high-temperature gas reactors provide the thermal energy needed for efficient hydrogen production, which, combined with captured carbon dioxide, creates synthetic hydrocarbons chemically identical to their fossil-derived counterparts.

Valar faces challenges related to regulatory hurdles, scaling manufacturing, and synthetic fuel economics. The nuclear industry's complex regulatory landscape could slow deployment, while achieving the manufacturing scale needed for cost-competitive fuel production represents a significant operational challenge. The economics of synthetic fuel production must ultimately compete with traditional fossil fuels, which benefit from established infrastructure and decades of optimization.

Despite these challenges, Valar has the potential to disrupt the energy landscape and create significant progress in transitioning to a nuclear economy. The company's success hinges on its ability to navigate the regulatory environment, execute its manufacturing strategy, and demonstrate the economic viability of its synthetic fuel production process. If successful, Valar could help solve the "Gordian knot" of climate change and energy access, providing abundant clean energy while reducing carbon emissions.

*Contrary is an investor in Valar Atomics and Anduril Industries through one or more affiliates.