Thesis

Since the beginnings of transportation technology, inventors have aspired to automate those inventions to operate without human control. In some cases, a transition from human-operated to partially or fully automatic transportation has been so successful as to make manual control a distant memory, like the removal of elevator operators or the introduction of autopilot on commercial flights. As consumers increasingly prefer transactions that don’t involve interacting with another human, with 70% of younger consumers preferring to interact with robots or self-service tools, it is unsurprising that automated transportation technology has never been in higher demand.

This bears true in the automated transportation space, both for ride-sharing customers and private vehicle owners. Ride-sharing customers in cities with driverless taxis were willing to pay over $10 more for driverless vehicle rides than for a Lyft or Uber during peak demand periods as of June 2025. In January 2024, 65% of vehicle owners said they’d want their car to be autonomous within the next 10 years if proven safe, and 78% would pay $5K or more for an autonomous car than a traditional vehicle.

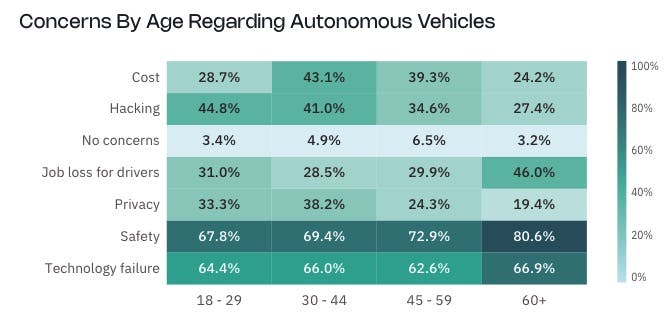

As trials of self-driving vehicles become more common and technology improves, the share of US consumers who fear safety issues in those vehicles is falling, with a 7% increase in the number of respondents to one survey stating they would feel either “safe” or “very safe” as a driver in a city with driverless cars from 2023 to 2024. Concurrent with a growing demand for automated vehicles has come progress in sensor technology and transformer-based AI models that can be applied to autonomous vehicles, unlocking advancements in self-driving software.

Nowhere has the progress in autonomous vehicles been more readily visible to the general public than in ride-sharing. By December 2024, robotaxis in San Francisco had grown to equal Lyft in terms of market share. In the years leading up to the advent of autonomous vehicles, passengers have increasingly turned to passenger vehicle ride-sharing for transportation, with the global ride-share market size estimated to have grown from $45 billion in 2019 to $107 billion in 2023. The market is expected to grow even further to reach $480 billion by 2032.

Ride-sharing has not just meaningfully displaced taxi and private car services but expanded to replace personal vehicle transportation for some populations. At its peak, taxis in New York City provided 170 million rides in 2014. By 2024, ride-sharing apps were providing over 160 million rides per year in New York City and over 10 billion rides per year globally. At this scale, ride-sharing creates an ideal testing ground for autonomous vehicles.

However, only a small portion of rides have been facilitated by autonomous vehicles as of June 2025, due in part to transportation authorities, automakers, and users of ride-sharing platforms pushing for increased numbers of driverless vehicles on US roads. In 2017, senators introduced the AV START Act, a bipartisan bill “calling for standards to be set for safety and cybersecurity requirements and for guidelines on determining accident liability if no one is driving”. The goal of this bill was to set standards for autonomous vehicles that would operate better than human drivers, with the goal of decreasing the share of human drivers on roads, given that humans are the main factor in over 90% of car crashes.

Automakers have committed R&D and production resources to Advanced Driver Assistance System (ADAS) features considered precursors to full-self driving (FSD) capabilities, with several features reaching 90% of the new car market in 2023 across automakers including forward collision warning, automatic emergency braking (AEB), lane departure warning, and pedestrian detection. Alignment of government, corporate, and consumer interests in support of emergent technology is rare, especially as compared to the disputes over players like Uber in the ride-sharing space.

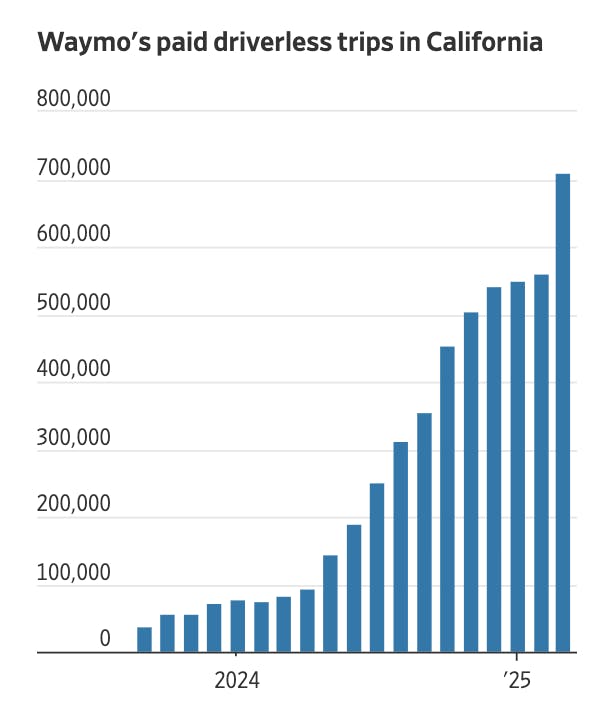

As of June 2025, Waymo is one of three major providers of autonomous vehicle rides that have launched in the US, the other two being GM’s Cruise service, which has since been suspended, and Tesla’s Robotaxi service. Waymo delivers over 250K robotaxi rides per week in the US and is growing rapidly, delivering 4 million trips in 2024 compared to less than 1 million trips in 2023. In addition, Waymo plans to more than double the size of its fleet in 2026. Waymo is positioning itself to deliver autonomous vehicles for ride-sharing both via its own ride-hailing app and partnership with Uber, and to deliver its driving technology to personal vehicles via partnerships with traditional OEMs.

Founding Story

DARPA Grand Challenges

Self-driving car development in the US began in the 1980s, but gained real traction in the early 2000s with the US Defense Advanced Research Projects Agency (DARPA) Grand Challenges, a series of competitions in 2004 and 2005 that tasked participating teams with designing and assembling self-driving ground vehicles. These challenges were proposed in February 2003 by Tony Tether, then director of DARPA, promising a $1 million prize for any team to finish a set course the fastest. The challenges inspired the founding teams of a number of self-driving startups, including Waymo, Nuro, Cruise, Zoox, Aurora, and May Mobility. Competition organizers interviewed over a decade later contextualized the challenge this way:

“In 2001, eager to keep soldiers away from harm in combat zones, the US Congress demanded that a third of the military’s ground combat vehicles be uncrewed by 2015. But defense industry stalwarts weren’t innovating quickly enough on the sensor and computing technologies that would enable autonomous driving.”

The DARPA Grand Challenges were open to teams from universities, companies, and other organizations around the world: 106 applied to compete in 2004 and 195 in 2005. The goal of the 2004 competition was to create a vehicle that could drive 150 miles through the Mojave Desert from California to Nevada autonomously. None of the vehicles completed the challenge that year. The furthest distance any of the vehicles drove was the entry from the Carnegie Mellon Red Team, which only made it 7.4 miles. The next year, five vehicles successfully completed a new 132-mile course, with the winning vehicle, Stanley, coming from Stanford’s racing team. Stanley navigated the course using a wide-angle camera in addition to radar and laser range-finding systems, and is now part of the Smithsonian National Museum of American History’s collection.

Source: MarcoPolo

Participants Sebastian Thrun and Anthony Levandowski met at the 2005 Grand Challenge, competing on behalf of Stanford and UC Berkeley, respectively. The two would go on to be founding members of the Google Project that would become Waymo. Other participants from the DARPA Grand Challenges included Dave Ferguson, the future co-founder of Nuro; Chris Urmson, the future co-founder of Aurora; and Edwin Olson, the future co-founder of May Mobility.

Later, Thrun hired Levandowski to work for him at the Stanford Artificial Intelligence Laboratory (SAIL) on VueTool, a project that used camera-mounted vehicles to create street-level maps. In 2007, Google acqui-hired the VueTool team to troubleshoot Google’s similar project, Street View. To equip the initial fleet of Street View vehicles, the team mounted a fleet of 100 Toyota Prius sedans with data-streaming cameras from startup 510 Systems. Unbeknownst to Google at the time, 510 Systems was owned by Levandowski and other members of his DARPA challenge team. Google would go on to acquire the startup, whose camera systems became the backbone of both Street View and Google’s self-driving car projects.

Project Chauffeur

Street View was a success for Google, covering over 5 million miles of road by 2012 and 10 million miles by 2025 out of an estimated 50 million miles of road worldwide. Street View became the “ground-truth” for fact-checking Google Maps. Luc Vincent, one of the leaders of the Street View project, led the team through the introduction of additions to Google Maps, including Street View perspectives through time and laser assemblies that allowed Street View to project its images onto a 3D mesh of the physical shape of the world.

Thrun’s team continued to have success, first with Street View and then on a subsequent project called Ground Truth, which was an assemblage of car and plane-generated maps that reduced Google’s reliance on third-party maps. From there, Google gave the team permission to pursue self-driving vehicles in a program named Project Chauffeur under the company’s “moonshot factory”, GoogleX. Like their university teams in the Grand Challenge, Project Chauffeur team members did not build vehicles from scratch but focused on building systems to enable existing vehicles to drive autonomously.

Levandowski and 510 Systems went on to assemble the lidar systems for Project Chauffeur. Another of Levandowski’s side projects, Anthony’s Robots, was focused on generating publicity from filming a self-driving car delivering pizza. That company would go on to provide hardware systems for the project. All of these adjacent businesses were being built while Levandowski was still working for Google. 510 Systems was eventually acquired by Google in a deal that seemed strategically arranged by Levandowski to ensure that no payout was made to 510 Systems’ employees with equity. That was one of what would become multiple controversial actions by Levandowski, who was later found guilty in 2020 of stealing autonomous vehicle IP from Google.

Project Chauffeur set the stage for autonomous vehicle testing and driving on public motorways despite initial incidents with testing safety, including accidents involving Google employees and executives test riding in the cars. By 2010, the project team had completed 10 routes selected by Google co-founders Larry Page and Sergey Brin, each 100 miles in length, driving fully autonomously. In 2012, the first license for a self-driving car was issued to Google by the state of Nevada after government officials rode along in an early Project Chauffeur vehicle. Those trips involved a modified Toyota Prius, the same model Google used for Street View, on the Las Vegas strip and around neighborhoods in Carson City. That same year, Thrun left Google to begin work on education startup Udacity.

Source: Motor Authority

Three years later, in 2015, Levandowski left Project Chauffeur to work with Thrun on his next project after Udacity: a flying electric taxi project called “Tiramisu”. Google then hired former Hyundai executive John Krafcik, who would go on to lead Waymo for six years, as the CEO of its driverless car project.

The same year, Project Chauffeur completed the first entirely autonomous ride on a public road. The ride was given to a legally blind passenger, Steve Mahan, and it took place with no safety driver, no safety vehicles, and no police escort. In 2016, engineer Dmitri Dolgov, also of Stanford’s Grand Challenge team, replaced Chris Urmson as head of software for the project. Dolgov had been working on the driverless car project at Google since it began in 2009. In December 2016, the project was spun out into a separate subsidiary company of Alphabet called Waymo to enable external funding and expanded independence.

Waymo

As of June 2025, Waymo was led by co-CEOs Tekedra Mawakana and Dmitri Dolgov, former COO and CTO of the company, respectively, who replaced Krafcik. As COO, Mawakana helped shape Waymo’s policy, testing, and regulation standards. Dolgov had been promoted to CTO in 2019, when he was responsible for both hardware and software for the company. In 2020, Waymo became the first autonomous vehicle company to release driverless taxi services to the public without a safety driver, beginning service in Chandler, Arizona.

Since 2020, Waymo has expanded driverless taxi services from Arizona to San Francisco, Los Angeles, and Austin, and opened technology and assembly centers in Novi and Detroit, Michigan in addition to Mesa, Arizona, where Waymo’s suite of sensors and motion control system are installed on existing vehicles, beginning with the Jaguar I-Pace in Detroit and expanding to the Zeekr RT in Mesa. In May 2025, Waymo claimed that completed vehicles from the Mesa factory could begin picking up passengers 30 minutes after driving out of the factory autonomously.

Product

Waymo Driver

The Waymo Driver, dubbed by Waymo “the World’s Most Experienced Driver”, has driven over 33 million miles on public roads and billions of miles in simulation. Testing and training the Waymo Driver model in simulation allows the company to test changes to the model, examine model behavior in edge cases, and reproduce rare or dangerous scenarios.

Waymo’s Simulation City uses data from millions of Waymo-driven miles, Alphabet’s internal data and infrastructure, along with data from third parties like the National Highway Traffic Safety Administration. In 2019, Waymo acquired Latent Logic, a startup using imitation learning to create more realistic simulations of human driving behavior, which Waymo has since integrated into its driver model research and development.

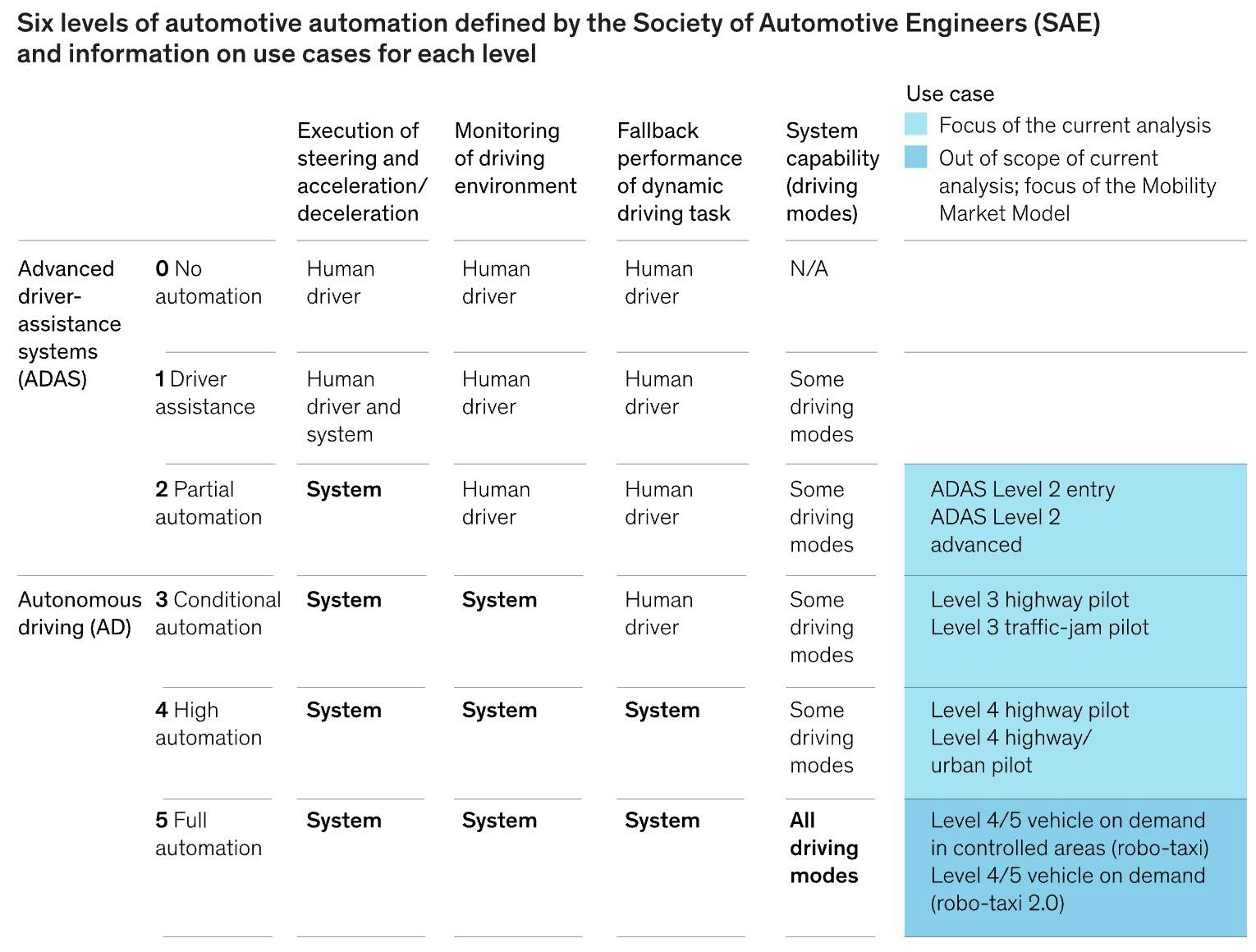

The Waymo Driver is considered a “Level 4” autonomous vehicle system, according to the Society of Automotive Engineers International J3016 Levels of Driving Automation standards. A Level 4 autonomous vehicle is capable of steering, accelerating/decelerating, environment monitoring, and environment response, with the option of intervention from a human driver. Waymo ride-share vehicles are Level 4, whereas Tesla Full Self Driving available in privately owned vehicles is Level 2.

Source: SAE International

Fundamental components of autonomous vehicles in the fleets built by Waymo include: (1) vehicles, (2) autonomous driving sensors and hardware, (3) autonomous driving software, and (4) the compute required for real-time driving decisions and reactions.

Vehicles

While Waymo has primarily focused on software and hardware outfitting for existing vehicles to enable automation, the earliest “generations” of software and hardware of the Waymo Driver were installed in a Project Chauffeur custom vehicle called “Firefly”. By 2017, when Waymo began rolling out rides to the public in Arizona, the company had moved to using the Hybrid Chrysler Pacifica with the fourth generation of the Waymo Driver.

Waymo has said it is committed to an all-electric vehicle fleet, both for environmental sustainability and to enable vehicles to charge while parking, which eliminates the need to make separate trips to gas stations for refueling. As of June 2025, the fifth-generation fleet in operation is comprised of electric Jaguar I-Pace SUVs. In 2021, Waymo partnered with Chinese automaker Zeekr for its upcoming sixth-generation fleet, which will be built on a Waymo-customized Zeekr RT. Waymo also has existing partnerships with Nissan, Volvo, and Hyundai for ride-sharing vehicle development, though no products have launched from these partnerships as of June 2025. In April 2025, Waymo announced a partnership with Toyota that will focus more on the development of a “generalizable driver” for personal vehicles.

In 2020, Waymo partnered with trucking logistics company C.H. Robinson and Class 8 truck OEM Daimler to explore autonomous trucking applications of the Waymo Driver in the Waymo Via program. However, since then, Waymo has directed resources towards ride-sharing and away from Waymo Via, given the relative momentum of the program. If, after June 2025, Waymo Via partnerships continue, the team will likely focus more on freeway driving capabilities and less on trucking and delivery specifics.

Sensors & Driving Hardware

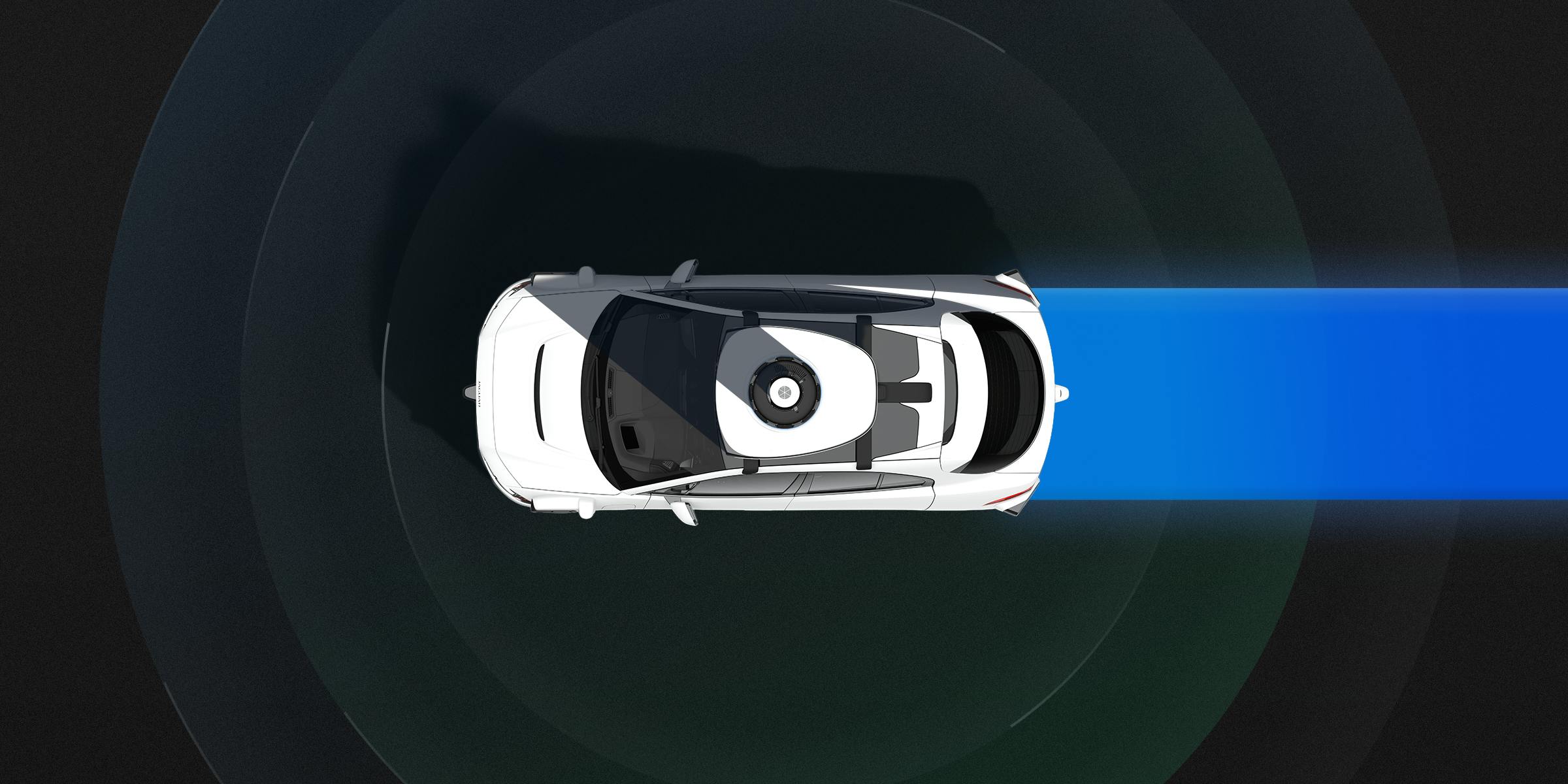

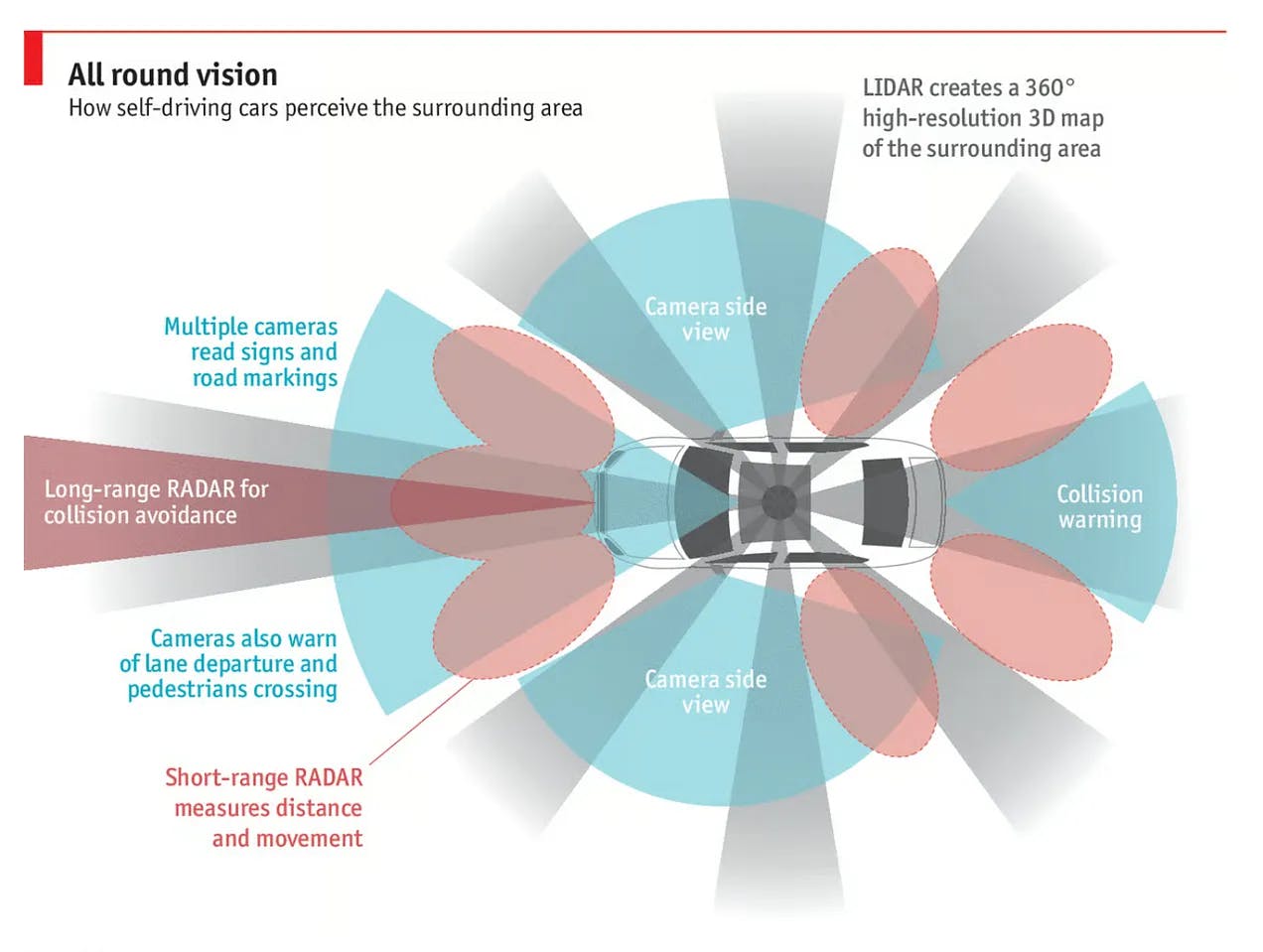

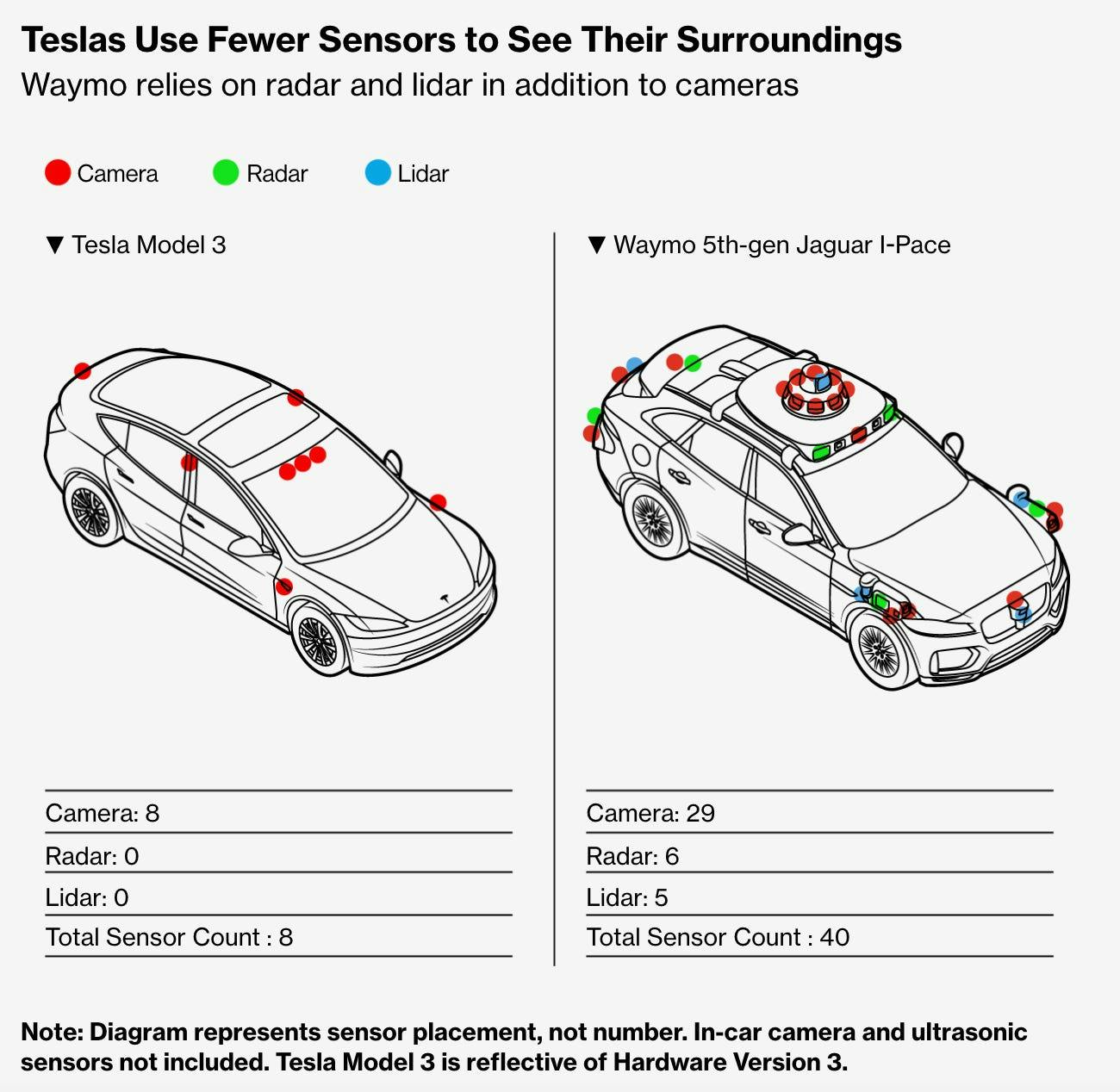

Waymo vehicles are equipped with a suite of both “passive” and “active” sensors to allow vehicles to assess their surroundings. Passive sensors like cameras record the Waymo environment without interacting with it, while active sensors like lidar map the environment using emissions like laser pulses. Waymo describes each element of this suite this way:

Cameras: Capture and identify objects that are recognized in context (construction zones, traffic lights, and signs). These cameras are equipped with thermal stability technology to adjust for lighting in different environments.

Radar & Ultrasonic Sensors: Send radio frequency pulses to identify nearby object distances and velocities. Ultrasonic sensors detect nearby object positions (like a hand opening a door). Radar sensors and ultrasonic sensors are not affected by weather like rain or fog.

Waymo External Audio Receivers (EARs): Microphones placed around the vehicle to detect and triangulate important sounds, including emergency vehicle sirens.

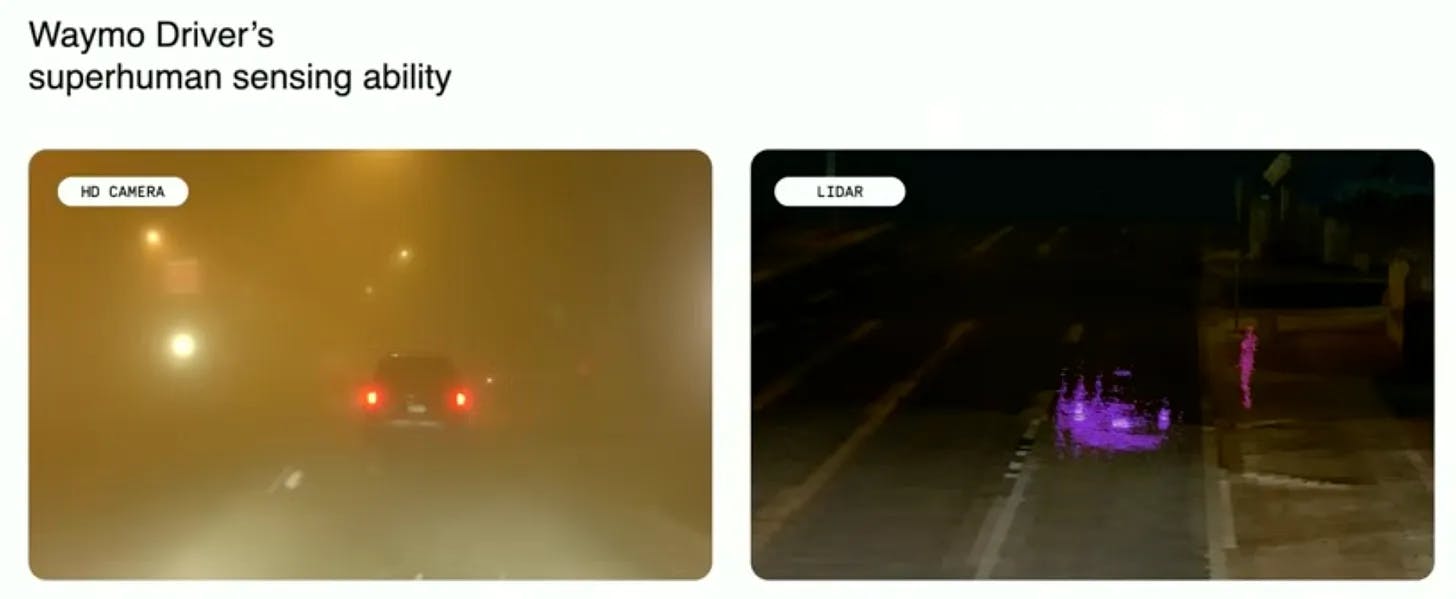

Lidar: Send laser pulses in all directions to create a constantly updating 3D map of surroundings based on the delay between emitted pulses and their registered reflections. Allows Waymo vehicles to “see” regardless of visibility.

Source: The Economist

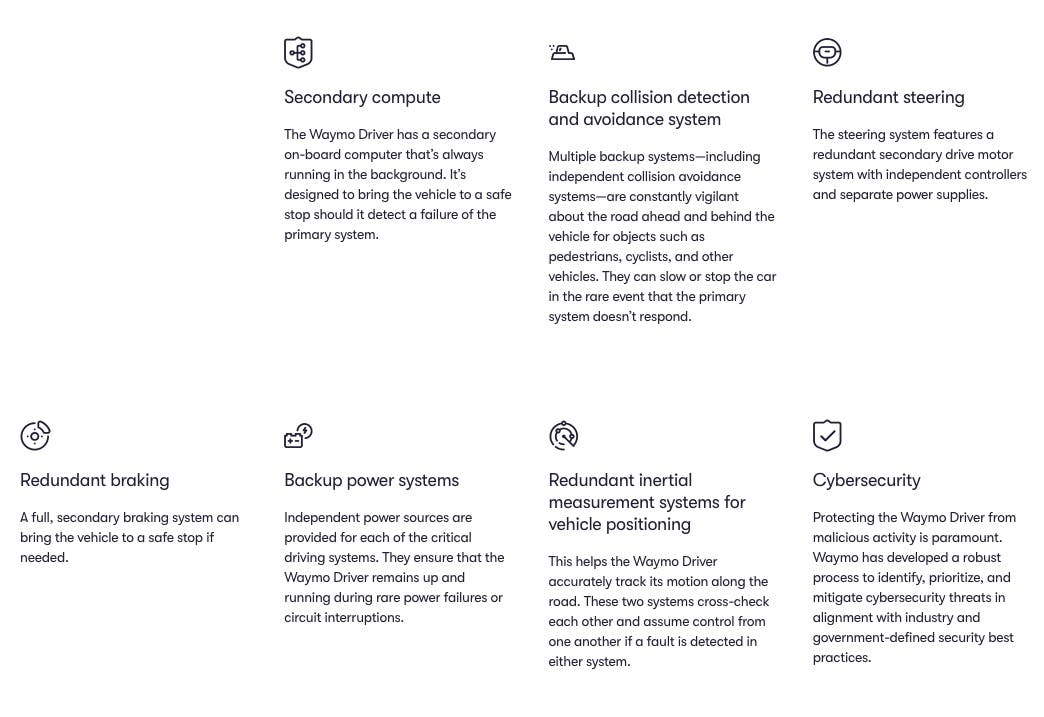

Waymo’s driving hardware is also equipped with redundancies to ensure safety if key mechanical components of the driver or vehicle fail.

Source: Waymo

Software

The software that enables the Waymo Driver to process the inputs from the sensor suite and make both vehicle environment predictions and vehicle action decisions is enabled by a number of systems. As of June 2025, Waymo vehicles only operate within the bounds of cities that have been mapped. Locations like airports outside city boundaries or freeways connecting cities must be mapped separately. Waymo vehicles can operate in locations that haven’t been mapped, and often test in such locations, but don’t operate commercially in non-mapped locations.

The mapped Operational Design Domain (ODD) is the area cars can cover in each city, and critically enables cars to identify their location even if GPS services are interrupted. While Waymo uses these pre-existing maps of ODDs as one important input, the Waymo Driver still adapts to changes from the 3D mapped city data, accommodating differences due to construction and moving elements like pedestrians and bicyclists.

Waymo’s map generation process requires driving vehicles outfitted with sensors down each street in a city to create a 3D environment. Waymo has developed a research model, HDMapGen, which generates maps with the same data granularity as real-world sample maps for traffic scenarios involving multiple lanes, signage, and road topologies. This allows Waymo to better train and test its driving models’ motion forecasting and route planning capabilities. In addition to the training data generated by HDMapGen, Waymo has created Symphony, a tool for generating realistic human driving behavior, and Waymax, a library for simulating autonomous driving research that is available on GitHub.

Source: Waymo Blog

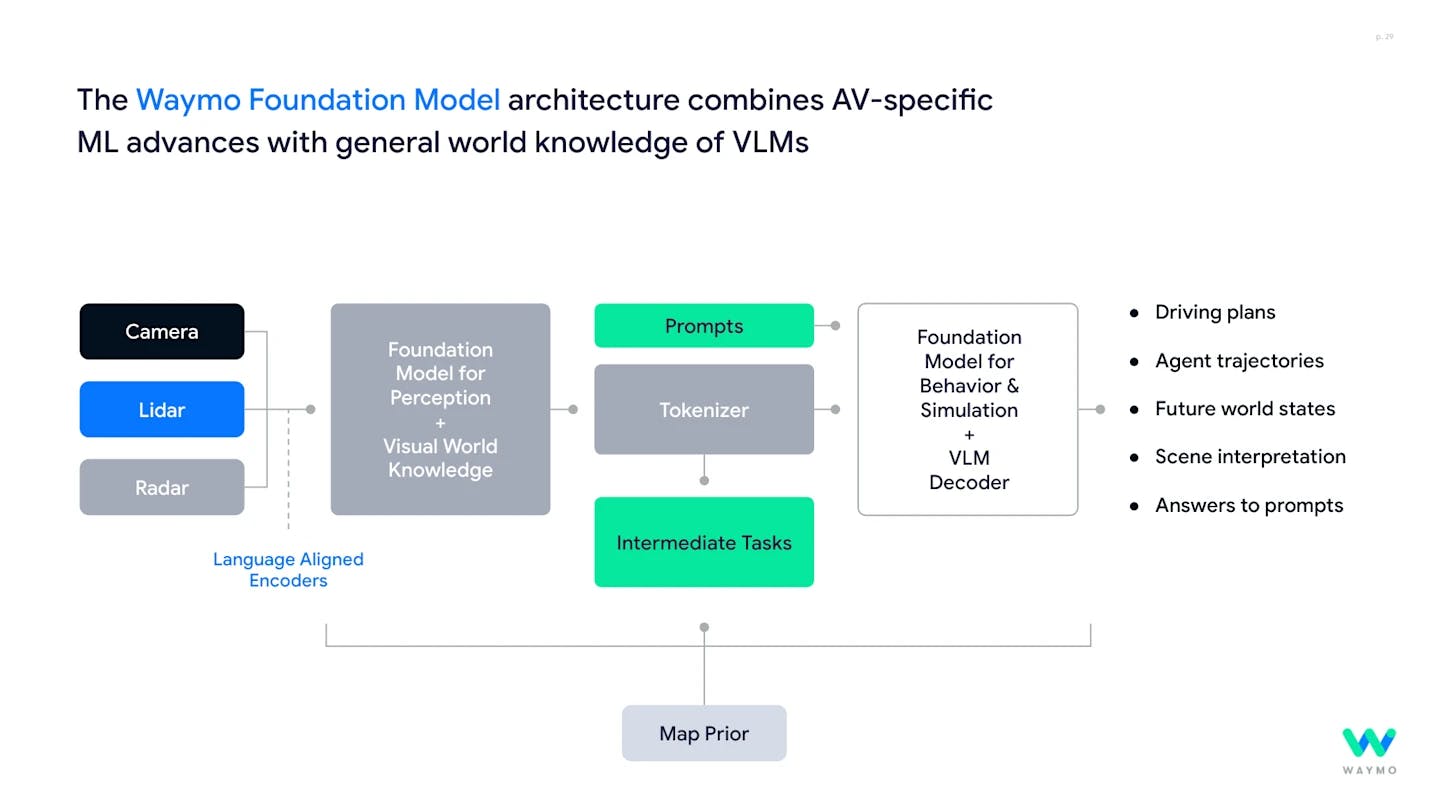

As of June 2025, the AI model powering the Waymo Driver is the Waymo Foundation Model, which is based on a combination of LLMs and VLMs (vision-language models). Waymo’s Foundation Model continually updates to make its outputs, i.e., driving behaviors, more predictable in primarily human-driven car environments.

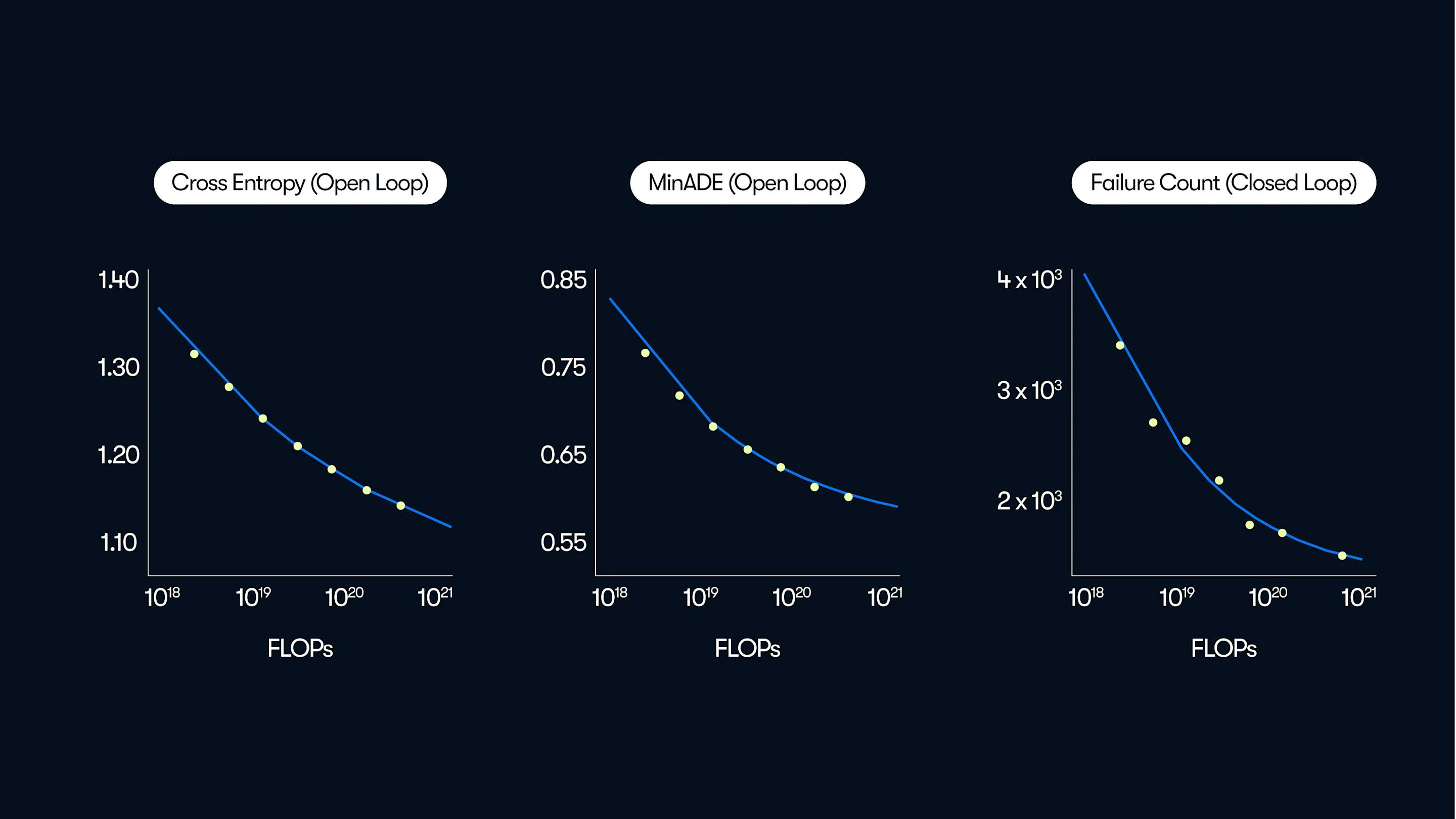

As part of Waymo’s continued research into autonomous driving models, it has developed a model called MotionLM based on similarities between 3D spatial models and language models, including similarities in scaling benefits. In an October 2024 conversation with Dolgov, tech reporter Timothy Lee interrogated some of the claims that Tesla CEO Elon Musk had made about the differences between Tesla and Waymo, including that many of the Waymo Driver’s decisions are based on hard-coded rules, despite them being based on the flexible transformer-based foundation model. As Dolgov explained:

“We had this insight that this problem of reasoning in the space of trajectories and decision making for autonomous vehicles is not unlike how language works… [The transformer had] some of the nicer properties that we were struggling to achieve with convolutional networks… [Transformers] provided a big boost across the stack, including perception, generative models for planning and behavior prediction.”

Source: Waymo

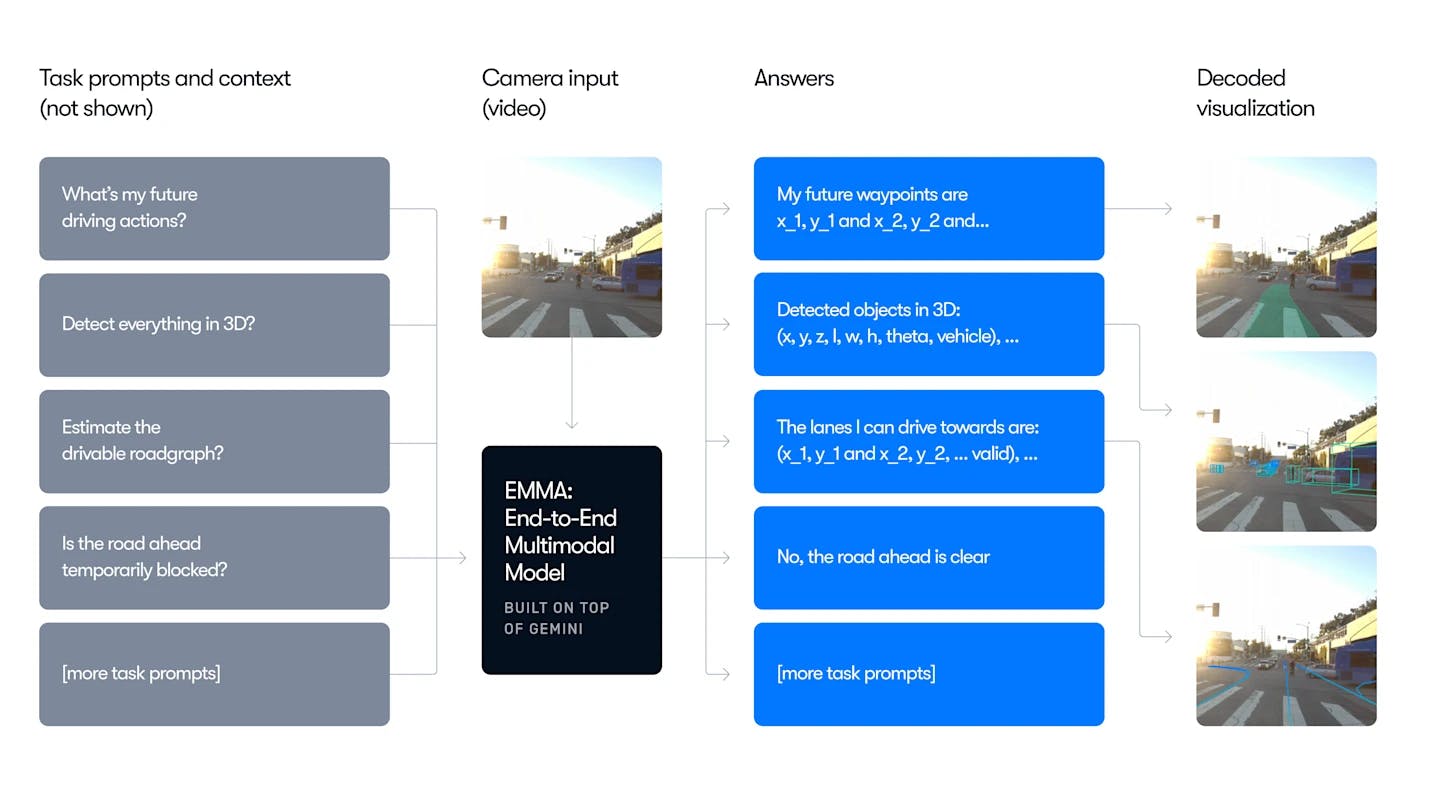

As of June 2025, Waymo’s research team was also exploring an end-to-end multimodal model for autonomous driving, or EMMA. An EMMA uses a multi-modal large language model foundation to map directly from raw camera input to driving-specific outputs, including planner trajectories, perception objects, and road graph elements, which is a departure from the multi-model architecture of the Waymo Foundation Model. In the research paper introducing EMMA, the authors claimed:

“EMMA maximizes the utility of world knowledge from the pre-trained large language models, by representing all non-sensor inputs (e.g. navigation instructions and ego vehicle status) and outputs (e.g. trajectories and 3D locations) as natural language text. This approach allows EMMA to jointly process various driving tasks in a unified language space, and generate the outputs for each task using task-specific prompts.”

As of June 2025, Waymo had not said if or when EMMA will be used in the Waymo Driver, and had clarified that the model does not yet take lidar input in addition to visual input.

Source: Waymo

Compute

Waymo vehicles are equipped with an onboard computer for real-time driving decisions, model updates, and access to training and simulation data in the cloud. While Waymo does not share details of this system publicly, it describes the onboard compute as “combining server-grade CPUs and GPUs.” Followers of the space have speculated that the company may have been using NVIDIA’s Tegra-based platform. Zeekr announced in January 2025 that it would be using NVIDIA’s Drive AGX Thor system-on-a-chip for the new fleet of Zeekr RTs.

Waymo One

Source: Contrary Research

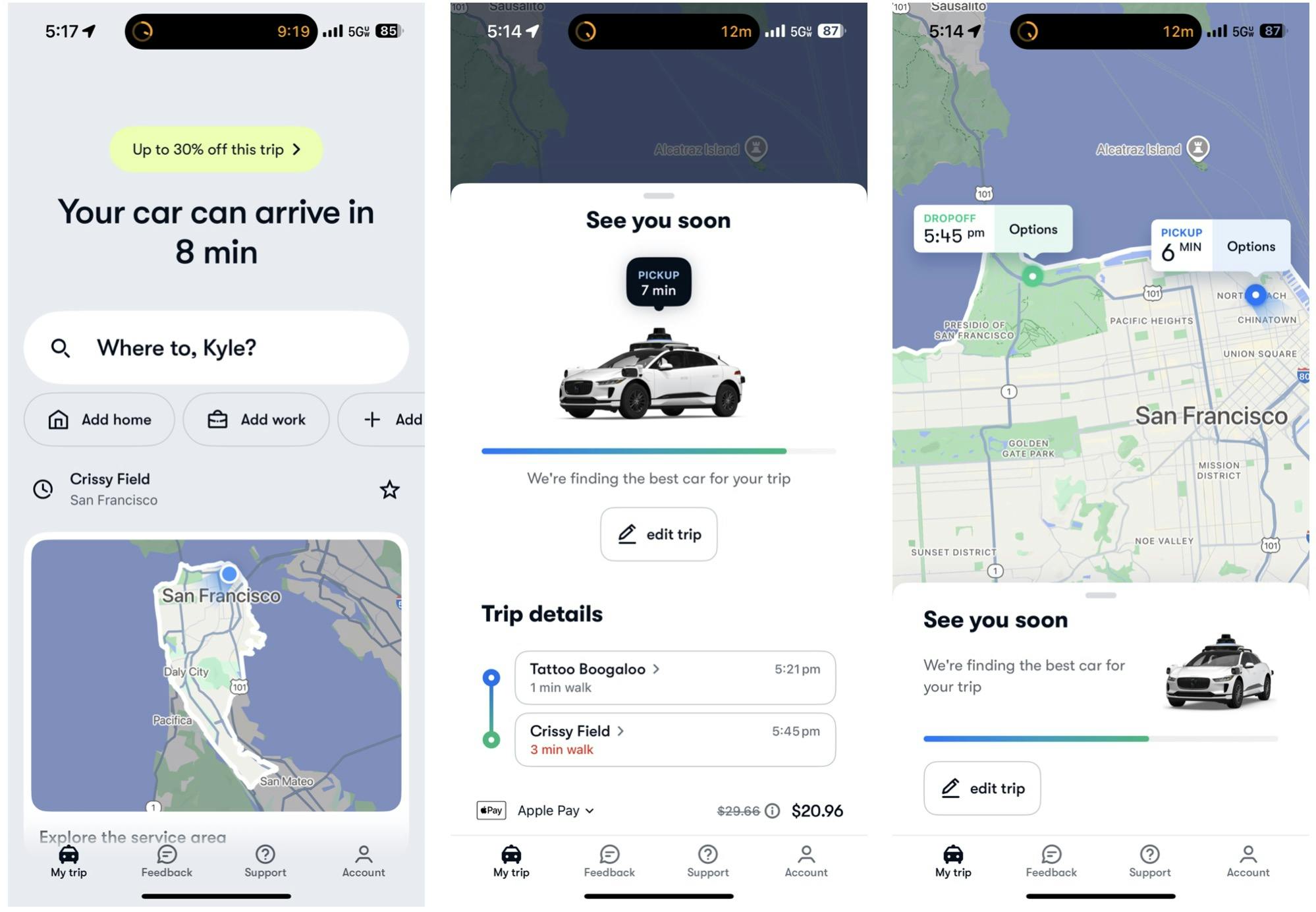

Waymo One is the company’s app for ride-hailing in San Francisco, Phoenix, and Los Angeles as of June 2025. The company has also stated that it would begin offering rides in Miami in 2026 and applied to begin testing in New York City in June 2025.

Waymo One is a direct competitor to existing ride-hailing apps like Uber and Lyft. Waymo One allows users to:

Select two unique letters to appear on the Waymo vehicle beacon to easily identify it

Add stops or change destinations mid-ride

Adjust the temperature and music to personal preferences

In addition to Waymo One, Waymo has also partnered with Uber to provide rides in Austin, with plans to expand to Atlanta as of June 2025. Uber has also partnered with numerous other autonomous vehicle companies to provide rides in other cities. In Austin, riders requesting an UberX may be matched with a Waymo instead of a human driver, but users cannot specifically request a Waymo, and can opt out if they would prefer a human driver only.

Waymo Via

Waymo launched the Waymo Via program in 2017 with the goal of enabling L4 autonomy for Class 8 trucks. Waymo partnered with trucking logistics companies C.H. Robinson and J.B. Hunt, as well as Uber Freight and truck builder Daimler. The program did test trucks outfitted with the Waymo Driver, but always with safety drivers in the vehicle. Waymo Via was put on pause in 2023 to dedicate more resources to passenger ride-share expansion. As of June 2025, the project remained on pause.

Market

Customer

Waymo’s primary customer base is passenger ride-share users. There is general enthusiasm for robotaxis among users of the service, with riders in San Francisco willing to pay more than $10 extra for driverless vehicle rides compared to Uber or Lyft during peak demand periods. Both tourists and locals in San Francisco have expressed support for robotaxis, and more frequently return to the service in comparison with Uber and Lyft. This is a marked shift in sentiment given that, as recently as 2023, San Franciscans wanted robotaxis banned from the city.

In 2025, Waymo published research that found “every single Waymo ride generates economic benefit for the San Francisco Bay Area, culminating in nearly $40 million in economic output associated with visitor demand”. Despite increasing support for robotaxis in cities where Waymo is active, there is still widespread concern about self-driving vehicles, due in part to coverage of accidents involving autonomous ride-share competitors and issues with Tesla’s Full Self-Driving (FSD) product, which, unlike Waymo, requires human driver oversight during operation.

Ridesharing apps that partner with Waymo fleets, like Uber and GO, may also be considered customers in that they pay Waymo a portion of the fees from each ride they provide to passengers using the Waymo fleet. These players may also be considered competitors to Waymo One in markets where both are active.

Market Size

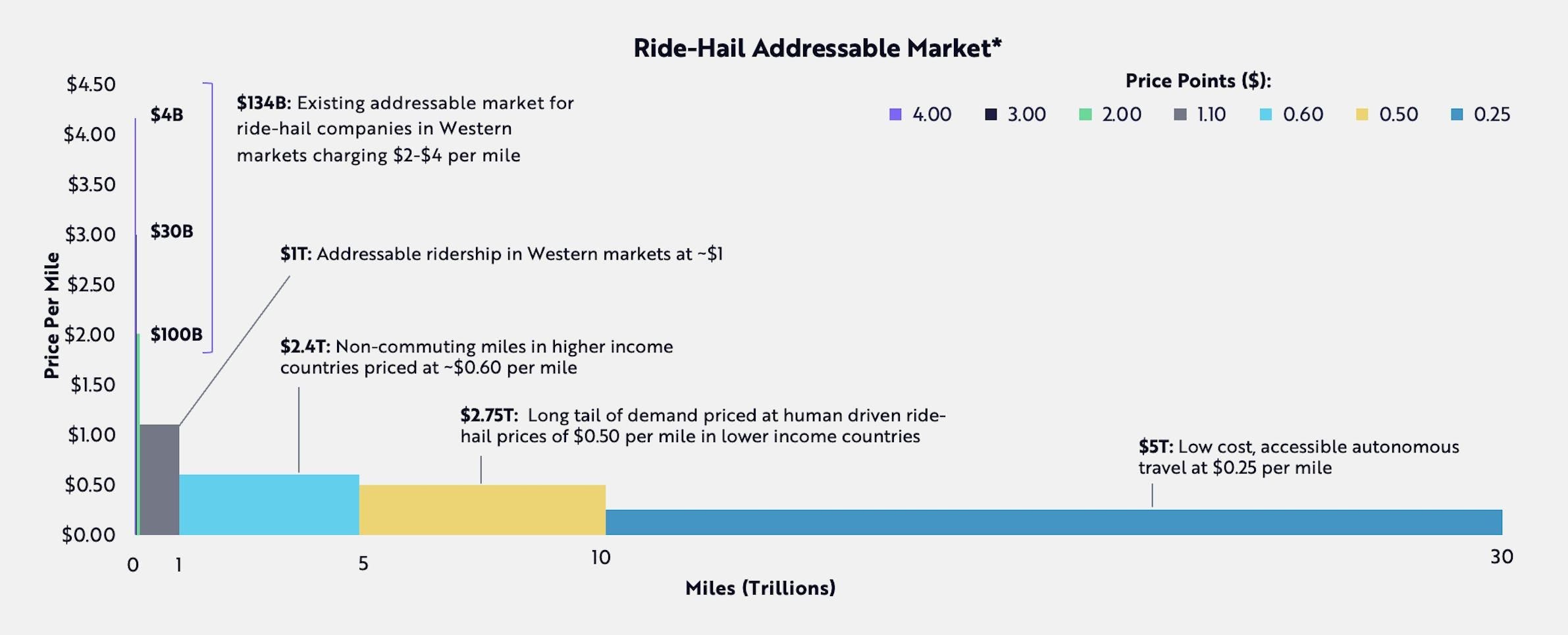

Riders in the US and around the world have increasingly turned to passenger vehicle ride-sharing for transportation, with the global ride-share market size estimated to have grown from $45 billion in 2019 to $107 billion in 2023, and projected to increase to $480 billion by 2032. Proponents of the market opportunity for autonomous ride-sharing point to the falling costs of sensors and EV batteries as drivers. The cost-per-mile of robotaxis could fall to $0.25 by 2035; by comparison, driving a personal vehicle costs an estimated $1.10 per mile as of 2025, and ride-sharing rides cost $2.00 per mile.

Source: ARK Invest

As of June 2025, Waymo operates in the Phoenix metropolitan area, the San Francisco Bay Area, and Los Angeles. It is also operational in Atlanta and Austin through Uber. Waymo has also stated that it will expand to Miami and Washington, D.C. next, and as of May 2025, Waymo was mapping Boston, Nashville, New Orleans, Dallas, Las Vegas, and San Diego and testing in Orlando, Houston, San Antonio, and New York City.

As Waymo looks to consider expanding, the decision of which cities to map next is a function of both the ride-sharing population, the sentiment around autonomous vehicles, and the driving environment in the city, including variables like traffic, common ride-share routes, and hardware considerations like visibility and weather.

Other significant potential future markets for Waymo’s technology include:

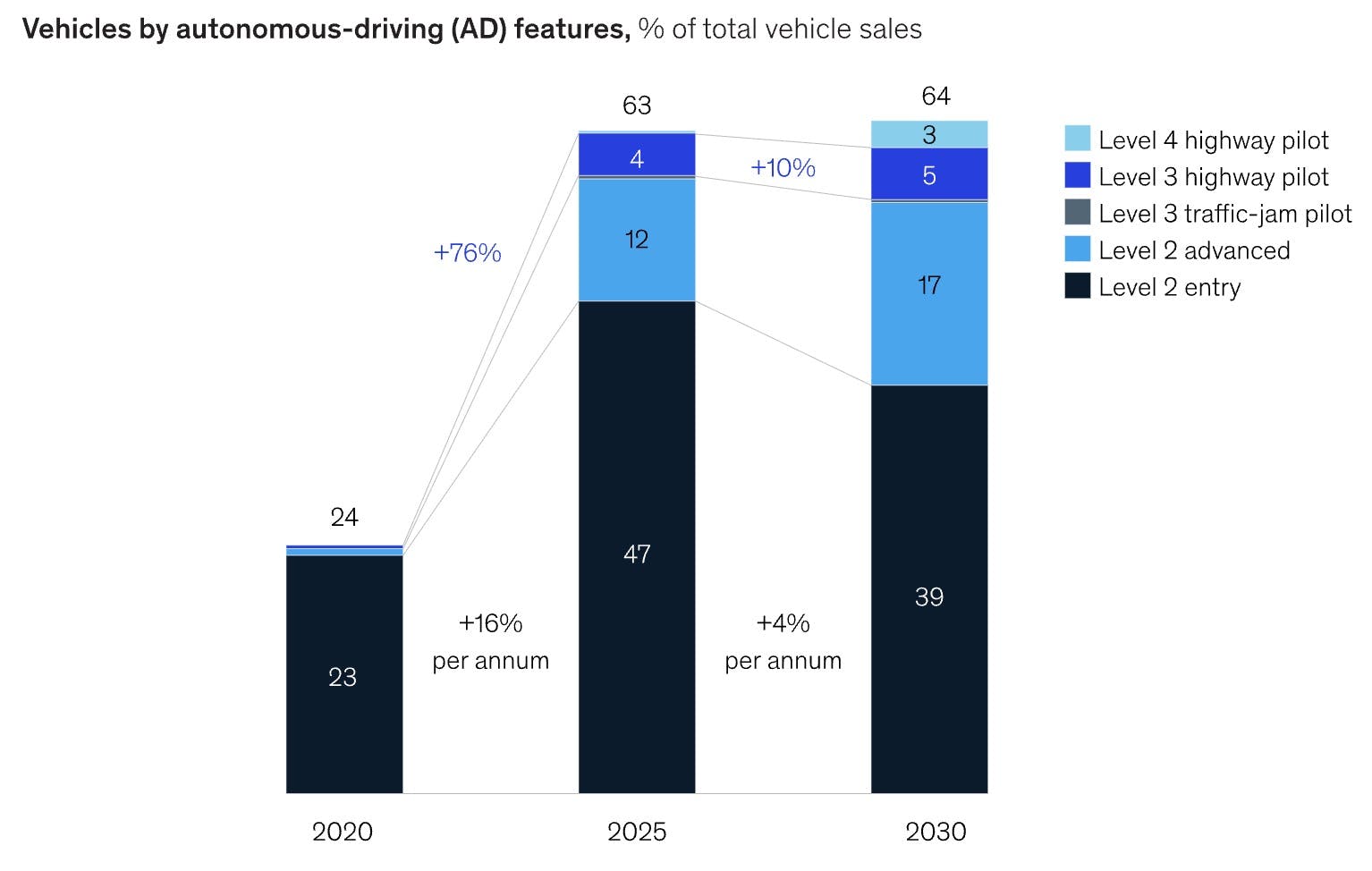

US household car market: As of April 2025, Waymo was exploring research on generalizable drivers with Toyota for personally owned vehicles (POVs). There are currently no Level 4 autonomous driving systems available for privately owned personal vehicles, though automakers are increasingly integrating L2 and L3 Advanced Driver Assistance System (ADAS) features.

While Waymo is not currently exploring expansion into the commercial trucking market since the pause of the Waymo Via program, this remains a space where other companies like Aurora and Kodiak Robotics are making continued progress.

The non-trucking delivery and service vehicle market is another that Waymo has the potential to expand into, potentially serving partners like DoorDash and Uber Eats. In Phoenix, Waymo has already begun exploring these services, which may be more palatable to a set of customers that is still nervous about personally riding in a Waymo.

Competition

Direct Competitors

Tesla

Founded in 2003, Tesla is primarily an electric vehicle design and manufacturing company, and has been the leader in US sales of electric vehicles since 2017. As of June 2025, Tesla sells vehicles equipped with Full Self-Driving or “FSD” for personal ownership. These vehicles are considered L2 autonomous, meaning they require driver supervision and do not satisfy the principle in self-driving vehicles known as Roy’s Razor: “Can you sleep in the car while it is driving?”

In its April 2024 earnings call, Tesla announced its intentions to go “balls to the wall for autonomy”, shortly after dropping the prices of its FSD ADAS package and the monthly subscription to use the package, which analysts believe may be a bid to activate FSD in more cars to collect more data. Also in April 2024, Elon Musk announced that Tesla intended to reveal its L4 fully autonomous vehicle, the Cybercab, in August 2024. However, the product was not ultimately unveiled until October 2024, when Tesla held an event at Warner Bros Studios in Los Angeles, at which it also announced its intention to enable a fully autonomous robotaxi fleet in 2025. As of October 2024, Tesla was targeting a bill of materials (BOM) cost for CyberTaxis below $30K.

Tesla’s launch of its robotaxi service was originally scheduled for June 12, 2025, but Elon Musk announced that Tesla would delay the launch to June 22nd because Tesla was “being super paranoid about safety.” The launch was originally limited to ten vehicles in certain neighborhoods in Austin, and all vehicles had a safety driver in the passenger seat, with only select citizens having access to the app. The vehicles used in the launch were Model Ys, not the Cybercabs previewed by the company in October.

Reviews of the service were initially mixed, with videos of vehicles braking unexpectedly and driving on the wrong side of the road gaining traction online. Following the launch, the US National Highway Traffic Safety Administration (NHTSA) reported it was aware of the incidents, but did not immediately announce any changes to Tesla’s permitted operations. However, the NHTSA did request that Tesla submit responses to a number of questions surrounding FSD incident data. Tesla asked that the NHTSA not make its responses public.

Tesla’s FSD system, both as currently available and as deployed in robotaxis, differs from Waymo’s most notably in its sensor suite and reliance on maps. Tesla AVs do not use radar and lidar systems and instead rely solely on cameras. In 2021, Musk said that he didn’t believe self-driving vehicles required lidar and other active sensors; as Musk put it: “Humans drive with eyes & biological neural nets, so makes sense that cameras and silicon neural nets are only way to achieve generalized solution to self-driving.”

Tesla claims not to be reliant on mapping, and instead plans to achieve L4 autonomy via scaling of models based on visual input data. Supporters of Tesla’s path point to the 3.6 billion miles of driving data it had accumulated across its fleet as of March 2025, compared to Waymo’s 22 million as of June 2024. Waymo itself has found that the performance of autonomous driving models consistently improves with data scaling. Autonomous vehicle analysts, however, point to Tesla testing behaviors suggesting that the company is engaged in mapping, both related to the October 2024 launch in Los Angeles and the June 2025 launch in Austin. Tesla also pursued mapping data collection for FSD in 2020.

Source: Bloomberg

Wayve

Wayve is a UK-based autonomous driving startup founded in 2017 by Alex Kendall and Amar Shah, University of Cambridge PhD students in machine learning. Wayve approached autonomous driving through what it calls Embodied AI, Wayve’s hardware-agnostic AI driver. Embodied AI enables passenger vehicles to operate at levels 2, 3, and 4 on the autonomous driving scale. Wayve uses a sensor suite of cameras, radar, and lidar similar to Waymo, with the biggest difference in technology being Wayve’s end-to-end AI model, which takes video as inputs and produces driver actions as outputs, eliminating intermediate engineering and transition between models, similar to Waymo’s End-to-End Multimodal Model for Autonomous Driving (EMMA), which hadn’t been deployed by Waymo as of June 2025.

As of June 2025, Wayve operates a testing and development center in Germany and announced in April 2025 that it would be opening a similar research and development facility in Japan. The company has also partnered with Nissan to provide software for Nissan’s self-driving ProPILOT technology. Licensing software to OEMs is Wayve’s primary revenue generation channel, as opposed to running its own Robotaxi service. However, in June 2025, Uber announced a partnership with Wayve to bring trial Robotaxis rides to app users in London in early 2026, in a model similar to its partnership with Waymo in the US. This would be the first such pilot program in the UK for Wayve, and the vehicle maker for the robotaxis has not been announced. As of June 2025, Wayve had raised over $1.3 billion, including a May 2024 Series C where it raised $1.05 billion, led by Softbank with contributions from NVIDIA, Microsoft, and Uber.

Zoox

Zoox is an automated driving company founded in 2014 by Tim Kentley-Klay and Jesse Levinson. The company was founded to develop autonomous vehicles optimized for autonomy, rather than retrofitting vehicles designed for human drivers. In 2018, Zoox was the first company approved by the state of California to provide self-driving transport services to the general public. In 2020, Amazon acquired Zoox as a wholly owned subsidiary for over $1.2 billion, though the company had been valued at over $3 billion at the time of its 2018 funding round, when it had raised $800 million in total. In June 2025, Zoox opened an autonomous vehicle manufacturing plant and aims to have driverless taxis on the roads in Las Vegas and San Francisco (the two cities in which testing has begun) as soon as fall 2025. Unlike Waymo or Wayve, Zoox is manufacturing vehicles from scratch, not partnering with existing OEMs.

Cruise

While not a competitor to Waymo as of June 2025, General Motors’ self-driving car subsidiary, Cruise, warrants discussion as an important former competitor to Waymo that is no longer operational.

Cruise was a self-driving car startup founded in 2013 by Kyle Vogt and Daniel Kan. It was acquired by GM as a majority-owned subsidiary company in 2016. Cruise launched ride-sharing services in San Francisco, available to the public in June 2022, operating 100 vehicles in San Francisco and expanding to Phoenix and Austin in 2023.

In early 2023, both Waymo and Cruise reached 1 million driverless miles within a month of one another, but posted differing safety records. Cruise vehicles encountered traffic jams blocking roads, hit pedestrians in crosswalks at low speeds, and in October 2023, a cruise vehicle hit a pedestrian who was dragged 20 feet by the vehicle as it attempted to pull over. In August 2023, following the traffic jam incident, California’s DMV requested that Cruise “immediately reduce its active fleet of operating vehicles by 50%” and, in October 2023, suspended all Cruise driverless permits, prompting Cruise to recall the entire fleet and pause operations in all cities.

While Cruise did end up continuing some operations of ride-hailing services with vehicles in “manual” mode, which involved drivers behind the wheel, GM announced in December 2024 that it would be shuttering public operations entirely and fully acquiring Cruise. It increased its ownership from 90% to over 97% in order to consolidate the Cruise technical teams with GM’s own autonomous and assisted driving teams, which are responsible for Super Cruise, GM’s ADAS capability for some vehicles.

May Mobility

May Mobility is a self-driving car startup founded in 2017 by Edwin Olson, Alisyn Malek, and Steve Vozar and based out of Ann Arbor, Michigan. As of June 2025, May Mobility provides shuttle and ride-sharing services in Texas, Michigan, Minnesota, Florida, California, and Georgia, though only those operations in Georgia are fully driverless. May Mobility partners primarily with Toyota to outfit passenger vehicles for both city streets and campuses like factories, universities, and retirement communities.

May Mobility's business model differs from Waymo and other ride-hailing services in that the majority of provided rides are free, with May Mobility being paid by the city or university it serves. This model may be evolving, given a May 2025 announcement that May Mobility would be partnering with Uber to provide rides in Texas in the latter part of 2025. As of June 2025, May Mobility had raised a total of $383 million, including a $105 million Series D in November 2023 led by NTT, in a deal that gave NTT the exclusive rights to distribute May Mobility technology in Japan. May Mobility has shared that it has sites that are profitable as of 2021, presenting a distinction from other players in the space that continues to grow as of 2025.

Baidu

Baidu is a Chinese technology and internet company founded in 2000. In 2013, Baidu launched the Baidu Apollo Network, an open-source autonomous driving project that partners with Chinese busmaker KingLong to make low-speed autonomous mini-buses. Baidu has trialed these buses in multiple regions of China. Baidu’s Apollo differs notably from Waymo and most other autonomous driving companies in that it makes its self-driving software open source, with the company president, Ya-Qin Zhang, saying in 2017:

"Tesla, Apple, Waymo, essentially everyone is building their own platform, their own technology. So at the beginning of the year we contemplated our own strategy. We looked at the history of PCs and mobile, and we believe an open system is more powerful, more vibrant, in the longer term. So we decided to open Apollo, both the IP, the technology and the source code.”

Open source may make more sense in China than in other countries developing self-driving technology. With over 200 automobile brands in China, the market is more fragmented, and greater software penetration might be achieved by allowing companies to develop self-driving cars on their own to later partner with Baidu. Like Waymo, Baidu has also developed a corpus of HD maps of highways in China, with over 1.5 million kilometers mapped. Though the technology is competitive, as of June 2025, Baidu is unable to compete in the US market, given American regulatory blocks stopping Chinese AV companies from operating domestically.

Pony AI

Pony AI is an autonomous vehicle company that was founded in 2016 by James Peng and Tiancheng Lou, both of whom were software engineers at Baidu. The company is based in Beijing with offices in California. Similar to Waymo, Pony AI outfits existing vehicles with software and hardware it develops for autonomous passenger vehicle driving. Pony AI went public in November 2024 in the US at a valuation of $5.3 billion, after previously entering into a joint venture with Middle East investment fund NEOM to “develop, manufacture and deliver autonomous driving services, advanced vehicles, and smart vehicle infrastructure in NEOM and key markets in MENA”. Prior to this investment, Pony AI also received $112 million in funding from traditional investors like Morningside Capital and Sequoia China. As of June 2025, Pony AI currently had a market cap of $4.7 billion.

Pony AI launched trials of its self-driving car systems in Guangzhou, China, and Irvine, California, which began in 2019, and trials of autonomous trucks in China, which began in 2025. In May 2025, Pony AI and Uber announced a partnership to launch Pony AI robotaxis on the platform initially with safety drivers onboard, beginning with cities in the Middle East later in 2025. The next month, Pony AI announced a partnership with Shenzhen Xihu Corporation, a conglomerate corporation that operates shuttle and bus fleets, among other transportation services, to roll out 1K robotaxis in Shenzhen. The launch date for this had not been announced as of June 2025.

WeRide

WeRide is an autonomous driving startup founded in 2017 by Tony Han. In addition to hardware and software for autonomous passenger vehicles like the Robobus and Robotaxi, which the company manufactures, WeRide also produces delivery vehicles like the Robovan and sanitation vehicles like the Robosweeper. In September 2024, WeRide partnered with Uber to bring driverless taxi services to the UAE, marking Uber’s first autotaxi service outside the United States, and has since operated autonomously for special events and pilot programs in France, Germany, and Spain. WeRide was listed publicly in October 2024 at a valuation of over $4 billion after raising more than $1.1 billion. In May 2025, Uber and WeRide announced an expanded partnership that plans to bring driverless taxis available through Uber’s app to 15 additional cities in the next five years. Like Waymo, WeRide does not manufacture vehicles and outfits vehicles from OEM partners like Renault, Bosch, and Yutong Group.

Autonomous Driving Software

Mobileye

Mobileye is an Israeli autonomous driving company headquartered in the United States that was founded in 1999. Mobileye produces both software systems for autonomous driving and sensors like cameras and lidar, though Mobileye shuttered internal lidar development in September 2024 in light of reductions in third-party lidar pricing. Mobileye went public in 2014 before being acquired by Intel in 2017 for $15.3 billion. It was relisted in 2021 at a valuation of $17 billion and as of June 2025 had a market cap of $12 billion. Mobileye has partnered with various OEMs, including Ford, Nissan, BMW, Toyota, and Porsche, and in 2024 announced a partnership with Lyft to enable fleets of autonomous vehicles for passenger transportation in North America.

Applied Intuition

Founded in 2017, Applied Intuition is a software company that builds AI systems for self-driving vehicles for construction, mining, defense, agriculture, trucking, and passenger transportation. The company’s primary product is a simulation system called Simian, which allows autonomous vehicle companies to test their driving models across situations and environments like limited visibility. Applied Intuition’s main customers are OEMs, like GM and Toyota, who use Applied Intuition to improve automation for driving, and have 17 of the top 20 OEMs as customers. In June 2025, Applied Intuition raised a $600 million Series F round of funding at a $15 billion valuation, up from $6 billion in March 2024.

Nuro

Nuro is an American robotics company developing autonomous vehicles for delivery that was founded by Jiajun Zhu and Dave Ferguson in 2016. Both of Nuro’s founders had previously been founding engineers at Waymo. As of April 2025, Nuro had pivoted its business from providing autonomous delivery services in California, Arizona, and Texas through partnerships with companies like Domino’s, FedEx, and CVS to deliver to customers. Originally, Nuro manufactured its own autonomous vehicles in addition to outfitting existing vehicles and licensing its software to partner companies. Since April 2025, the company has instead focused on licensing its self-driving technology to automotive OEMs, commercial delivery fleets, and ride-hail companies. As of June 2025, Nuro had raised $2.2 billion, including a $106 million Series E in April 2025 led by T. Rowe Price and Tiger Global Management at a valuation of $5.9 billion.

Rivian

Rivian is an electric passenger car and truck manufacturer founded in 2009 by RJ Scaringe. Rivian has sold electric passenger vehicles, including pickup trucks and SUVs, since 2021, becoming the first automaker to bring a fully electric pickup truck to the US. Rivian raised $10.5 billion before going public in November 2021 at a valuation of $66.5 billion. While the company’s market cap rose to over $100 billion, it has since fallen to $15.8 billion as of June 2025.

While Rivian has integrated driver assistance features including hands free driving to models within its R1 series as of March 2025, the company clarifies that this is not Level 3 self-driving enablement, though it does feature a sensor system of 11 cameras and five radar units including what the company says is the “highest resolution [camera] of any vehicle in North America”. When Rivian announced this advancement to its Enhanced Highway Assist system, it also announced that it hoped to progress to eyes-off self-driving capabilities by 2026.

Self-Driving Trucks

Aurora

Aurora was founded in 2017 by Chris Urmson, who previously served as CTO of Project Chauffeur and was a member of Carnegie Mellon’s DAPRA Grand Challenge, Sterling Anderson, the former head of Tesla Autopilot, who left Aurora in June 2025 to become GM’s Chief Product Officer, and Drew Bagnell, the former lead of autonomy and perception at Uber. Aurora produces the Aurora Driver, a system similar to the Waymo Driver for the operation of autonomous trucks. In 2019, Aurora acquired Blackmore, a US developer of Frequency Modulated Continuous Wave (FMCW) lidar, and has continued to develop its own lidar systems. Then in 2020, Aurora acquired Uber’s autonomous driving division, Advanced Technology Group (ATG). In addition, Uber invested $400 million in the company for a 26% ownership stake, and Uber CEO Dara Khosrowshahi joined Aurora’s board. He later resigned from the board in January 2025.

Like Waymo, Aurora has explored both self-driving trucks and passenger vehicles, partnering in 2021 with Toyota to create self-driving taxis under a project called Aurora Connect, which aimed to bring robotaxis to the Dallas-Fort Worth area by late 2024 but hadn’t launched as of June 2025. Aurora’s self-driving trucks, however, have been on the roads from Fort Worth to El Paso since 2023 with safety drivers onboard. Aurora targeted the release of “driver-out” trucks by late 2024, but later pushed this back to April 2025. After only three weeks of driverless operations with an observer in the backseat of the vehicle, Aurora reversed its decision to operate without a safety driver at the request of partner OEM Paccar. Aurora went public via SPAC in 2021 at a valuation of $13 billion, and had a market cap of $9.4 billion as of June 2025.

Kodiak Robotics

Founded in 2018, Kodiak Robotics is an autonomous vehicle builder producing hardware and software platforms for heavy ground vehicles like Class 8 delivery trucks, tanks, and work vehicles. As of June 2025, Kodiak had raised $319.9 million in total funding, and as of April 2025 was planning to go public at a valuation of $2.5 billion via SPAC merger with Ares Acquisition Corp II. Kodiak Robotics was founded by Don Burnette, who worked previously at Google as a software engineer on the Project Chauffeur team. Kodiak trucks are active in goods delivery for US consumers in the Permian Basin, with a fleet of 100 trucks under delivery as of June 2025. Kodiak Robotics is not a direct competitor to Waymo as of 2025 because it doesn’t have passenger vehicle systems, and Waymo’s trucking project, Waymo Via, has been largely put on pause.

Business Model

Revenue

Waymo makes money from operating autonomous taxis, either via its own app or through Uber’s platform. Waymo’s revenue is not publicly available, but as of 2024 was estimated to fall around $100 million annually, given estimated ride numbers and average ride prices, though estimates vary. Another estimate placed Waymo’s 2024 revenue between $50-75 million. In addition, Morgan Stanley estimates Waymo’s annual revenue could reach over $2.5 billion by 2030. Waymo’s primary other possible revenue streams are related to licensing a generalizable version of its driver for use in other vehicles, either personally owned vehicles or other service vehicle fleets, especially as American OEMs have largely failed to generate any successful in-house AV capabilities and are increasingly partnering with external firms.

While details of the partnership with Uber haven’t been made public, analysts believe Uber collects between 10-20% of the cost of each ride, compared with the company’s claim that it collects around 15% for human-driven rides. Though some drivers have reported Uber could retain up to 50% of the cost of rides. In October 2023, Waymo announced a Phoenix metro area partnership with Uber, but by March 2025, Waymo had added the ODD to Waymo One without removing the partnership with Uber. As of June 2025, neither company had spoken publicly about why both options are available in Phoenix, though this may point to Uber getting more out of the partnership with Waymo than vice versa, as Waymo would likely not launch a new Waymo One market if demand for the cars was being met through Uber.

Costs

Analysts have estimated that Waymo’s sensor suite costs $12.7K per vehicle. The price of the underlying vehicle and the implementation of the Waymo Driver hardware put estimates of the price per Waymo vehicle as of June 2025 above $100K. While exact estimates vary, then-CEO Krafcik said in 2021, “If we equip a Chrysler Pacifica Van or a Jaguar I-Pace with our sensors and computers, it costs no more than a moderately equipped Mercedes S-Class.”

Within Waymo’s sensor suite, lidar systems are typically the most expensive and arguably most critical to the driving system’s safety, allowing the car to “see” elements of the environment that may be difficult for cameras to pick up due to their location or visibility factors. For example, Waymo has demonstrated its ability to sense individuals during a sandstorm that wouldn’t have been identifiable via cameras.

Source: Google I/O May 2025

Lidar systems like those used by Waymo have fallen in price precipitously, from around $75K per unit in 2014 to around $500 per unit as of 2024, though most of the cheapest systems are available only via imports from China. Autonomous technology companies, like Mobileye, have stopped making their own lidar sensors, given increasingly cost-effective third-party solutions like those from Chinese lidar maker Hesai and US sensor company Luminar Technologies.

Waymo may see cost savings in the future from eliminating elements that can be removed from an L4 autonomous vehicle when there is no onboard override capability required. These include elements like the steering wheel, pedals, steering motor, dashboard elements, power-adjustment seats, large curved windshields, fast-acceleration engines, and long-range batteries. The cost of equipping vehicles with the required sensor and motion control hardware is also falling with scale and is subsidized in some states for the skilled jobs it creates.

While such changes haven’t been implemented in Waymo vehicles to as of June 2025, new fleets in production will be customized to Waymo’s use case and may feature more bespoke outfitting. Waymo has purchased 20K Jaguar I-Pace SUVs and an unreported number of Zeekr RT vehicles for delivery in 2025 and 2026.

Unit Economics

Waymo rides are reportedly more expensive than human-operated ride-shares as of June 2025, though some investors project that by 2035, autonomous ride shares could be an order of magnitude cheaper. The costs of human ride-hailing services and robotaxi operations are largely different, with more robotaxi costs eligible to benefit from economies of scale. Whereas human ride-hailing services have primarily fixed unit costs like fuel and driver time, there is significant room for the primary costs of autonomous vehicles to fall on a per-ride basis as the vehicles take more trips and the number of vehicles grows. Neel Mehta, who was previously at Zoox, explained the unit economics of robotaxis this way:

“It starts to become a very big deal if they can crack 30 trips/vehicle/day. The economics become potentially compelling even at a relatively high vehicle BoM cost (inclusive of sensors and compute). Without knowing the actual unit economics, my rough internal math suggests that @ 30 trips per day and $125-150,000 all-in vehicle cost, it's plausible they could recoup the upfront investment on the vehicle in 1 year. This is after deducting various operating costs to run the service (tele-operations, customer support, maintenance/repair, charging/electricity, etc).”

Source: ARK Invest

Traction

Expansion

As of June 2025, Waymo had rolled out over 1.5K vehicles in four US cities (Phoenix, San Francisco, Los Angeles, Austin) with two near-term additions (Atlanta and Miami), and the company was exploring expansions to Washington, DC, New York City, and Tokyo. In established ODDs, Waymo is adding important transit conduits and destinations like freeways and airports.

Reactions of riders to Waymo have been somewhat polarized, with some riders enjoying driverless rides as a “must-see” experience in and of itself, while other passengers are refusing to ride in a driverless vehicle. Waymo’s first few years in ride-sharing operation have helped both consumers and regulators understand the safety of Waymo vehicles, while the company has still encountered and addressed issues with Waymo Driver.

In May 2025, Waymo voluntarily recalled over 1.2K vehicles “to update software and address risks of collisions with chains, gates, and other roadway”, though a corrective software update had already been deployed. Waymo vehicles have made news with one-off incidents such as blocking traffic, getting stuck driving in loops, or honking at one another in dedicated parking spaces.

Waymo’s physical ODD boundaries are an important current limitation to its services, as limited operational areas mean customers cannot travel into or out of the area, including to high-demand locations like airports in some cities. Waymo reported in its July 2024 rider survey that 89% of surveyed riders were very interested in using Waymo to get too in from SFO, that there were 13.3K searches for SFO in the Waymo app in December 2024, and that 718 people had installed the Waymo app while they were at the SFO airport in person.

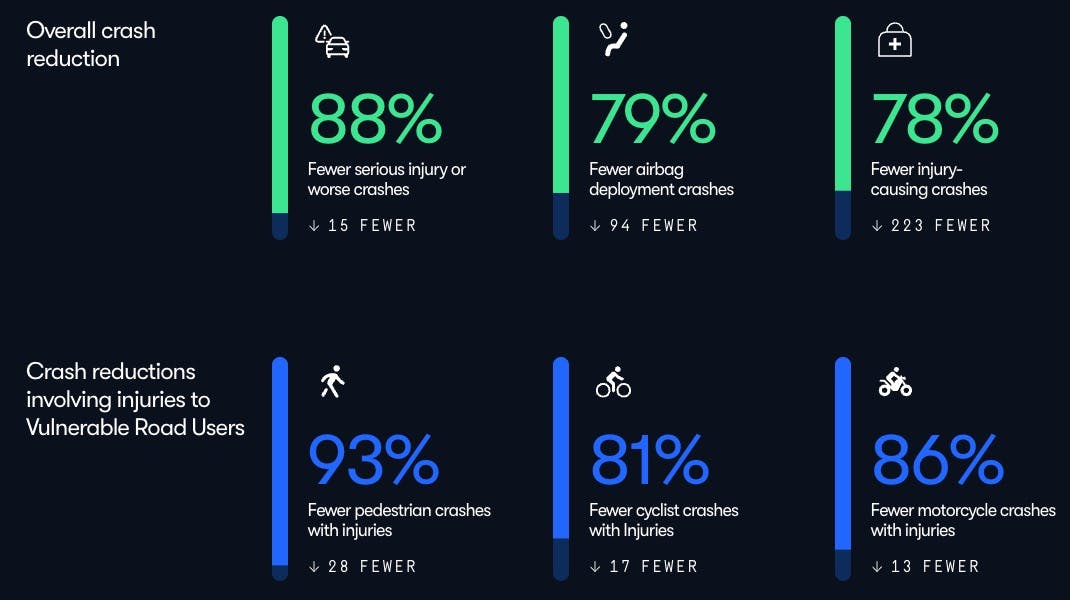

Safety

Waymo has published rider-only (RO) vehicle safety statistics relative to human drivers in the same cities where it operates. This data was compiled in a study by Swiss Re, a global reinsurer. Waymo reportedly has a safety record that is better than average human drivers across all metrics incorporated in the study. Waymo has set up a safety hub that includes data for each city in which it operates, and has published the results of its studies on AV safety, including work on collision avoidance and response time.

Source: Waymo Safety

In February 2023, Waymo released a report detailing its first million miles of fully driverless operation, including 20 crashes that occurred during the period. Some of these included:

“A passenger car backed out of a parking space and made contact with the Waymo AV.”

“An SUV backed out of a driveway and made contact with the Waymo AV.”

“The vehicle that had been previously stopped behind the Waymo proceeded forward, making contact with the rear bumper of the Waymo AV.”

“A passenger car that had been stopped behind the Waymo AV passed the Waymo AV on the left. The passenger car’s rear passenger side door made contact with the driver side rear of the Waymo AV.”

The report did not include any reported injuries and noted that 55% of all incidents were human drivers colliding with stationary Waymo vehicles. The report also included two incidents in which the Waymo vehicle hit another vehicle: one in which a motorcyclist in an adjacent lane lost control of their bike and fell off, and another in which a vehicle cut in front of a Waymo and was rear-ended despite the Waymo braking.

There is less data available on the differences in safety metrics between autonomous driving systems (Waymo vs Cruise or Tesla FSD). As of 2023, Waymo and Cruise had reported 103 and 68 collisions in San Francisco since the beginning of 2022 (respectively). 14 of those crashes involved injuries for Cruise, while the same was true for only two of Waymo’s reported crashes. Cruise vehicles encountered traffic jams blocking roads, hit pedestrians in crosswalks at low speeds, and in October 2023, a cruise vehicle hit a pedestrian who was dragged 20 feet by the vehicle as it attempted to pull over. In August 2023, following the traffic jam incident, California’s DMV requested that Cruise “immediately reduce its active fleet of operating vehicles by 50%” and, in October, suspended all Cruise driverless permits, prompting Cruise to recall the entire fleet and pause operations in all cities.

While Waymo and Cruise were largely operational with L4 technology at the same time, Tesla’s FSD systems, as of June 2025, are still L2, but have run into safety issues even with human supervision. A widely circulated Bloomberg Intelligence report states that Tesla ADAS systems have lower accident rates and lower costs than Waymo, but critics point out that this comparison may be flawed for a number of reasons. The data on Tesla vehicles is drawn from Tesla’s Autopilot Safety Report, which combines miles driven under Autopilot and Tesla FSD (both systems that require driver attention at all times).

Tesla Autopilot data is primarily from highway driving, where the system is most often used, and where accidents are less frequent. The Tesla data only includes events in which an airbag or seat-belt pretensioner is deployed, but leaves out fender-benders, curb strikes, and other ADAS incidents. There are numerous reports of serious FSD incidents, like the death of a 71-year-old woman who was not detected by the camera system on a sunny day with significant glare, and over 50 reported fatalities associated with the use of Tesla’s Autopilot system.

Adoption

Increased ridership in San Francisco is showing Waymo’s progression from “novel” to “normal”, with Waymo’s market share by June 2025 second only to Uber and equal to Lyft. Skeptics of Waymo’s rapid ascent in the market point to the limited ODD of San Francisco, only seven by seven square miles, and the relatively low price points associated with shorter trips, where nominal price differences, e.g. a $5 difference versus a $50 difference, may incentivize behavior that is less likely to persist in areas with longer rides. Similarly, Waymo vehicles in Austin are completing more rides than 99% of human drivers, though some of the outperformance is attributable to their ability to run nearly 24 hours per day.

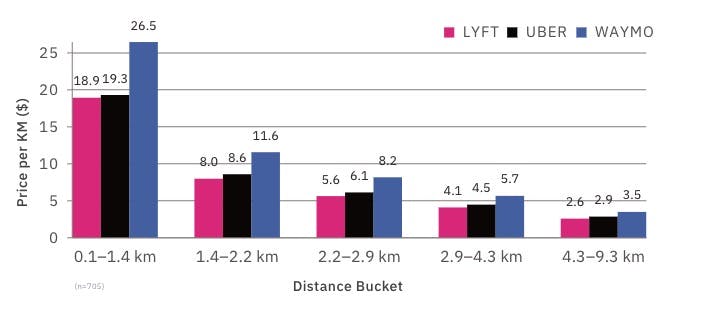

In a June 2025 report, ride-share data aggregator Obi examined differences in prices for trips of the same distance, duration, and location on Lyft, Uber, and Waymo between March and April 2025 in San Francisco. Obi reported that of riders who had taken a Waymo ride, “70% preferred a driverless car to a traditional ride-share or taxi with a driver” and 42% would “pay more for an autonomous Waymo taxi”, while only 31% believe that “Waymo will be safer than human drivers in the next 5 years”.

Source: Obi

This study found that Waymo prices were more expensive across times of day/month where competition due to human driver availability might vary and locations where some routes might be easier for a human versus the Waymo Driver or vice versa, with the gap being largest for the shortest trips. The study found the largest price differences during rush hour, between 5:00 and 6:00 pm, when demand for rides is highest, and the smallest price differences around 5:00 am, though these differences are more consistent on a geometric basis, given higher prices at rush hour.

Source: Obi

Waymo wait times for vehicles were comparable to Uber and Lyft, though with larger variability. Waymo prices displayed consistently strong positive correlations with wait times: at times of higher demand, both prices and time spent waiting for vehicles were higher, while the same correlations were only modest for Uber and Lyft. Despite these cost differences, both anecdotal and data-driven evidence suggest that Waymo is increasingly taking market share from traditional ride-sharing services. Earnest credit card data showed that the average Uber user spent $189 on Uber in the quarter before their first Waymo charge, but only $174 on the platform four quarters after their first Waymo ride. The same report found over 33% of Waymo customers in San Francisco returning to the service 13 months after their purchase, compared to only 23% and 14% for Uber and Lyft, respectively.

Valuation

In October of 2024, Waymo raised $5.6 billion at a $45 billion valuation. Waymo has experienced an order-of-magnitude increase in funding since spinning out from Alphabet by enabling external investment. As of June 2025, Waymo had raised $11 billion compared to a total initial investment in the project from Alphabet of $1.1 billion before being spun out. Investments beyond Alphabet have come from AutoNation, Andreessen Horowitz, and Tiger Global Management, among others. The spin-out also allowed Waymo employees to be compensated in part via equity in Waymo as opposed to in Alphabet at large. Analysts considering the long-term prospects for Waymo have compared it to YouTube, which is another wholly-owned subsidiary that could go public to generate revenue for Alphabet.

Key Opportunities

Brand Advantage

The autonomous taxi service space has a number of parallels to markets like that of traditional ride-sharing (Uber, Lyft, etc.) and home-sharing platforms (Airbnb, Vrbo, etc.). While there may be some differences in platform quality and characteristics between competitors in these markets, the fundamental products each competitor provides ostensibly have few differences. The success of platforms like Uber and Airbnb relative to lesser-known competitors like Sidecar and Wimdu has been attributed largely to the so-called first-mover advantage. First-mover advantage is the term used to describe companies that reach a customer base first, establishing name recognition and potentially brand loyalty before their competitors.

While Waymo first launched driverless taxi services available to the public in Phoenix in 2020, Waymo was second to Cruise in launching their services publicly in San Francisco, with Cruise rides beginning in June 2022 and Waymo launching in November 2022. While Waymo was second to the San Francisco autonomous taxi space after Cruise, it retains many of the benefits of being first to the space, as the first mover is no longer a competitor. Waymo brand recognition has grown largely via word of mouth and social media from customers, with the number of people visiting cities where Waymo is active, wanting to ride in an autonomous taxi, increasing 10% week over week in the period studied by Waymo between August 2023 and July 2024.

Some analysts of these companies believe the benefits of being first to market are oversold, claiming the second-mover pioneer may actually be in a better position; companies entering a market second can learn from the successes and mistakes of the first mover and enter a market efficiently instead of creating that market from scratch. While Waymo scaled more slowly than Cruise after their respective San Francisco launches, it has avoided brand-impacting safety incidents like driving suspensions. Even for riders who have rides without incidents, Waymo’s launches in new cities without a safety driver may provide a better experience for riders than those taking robotaxis, which will continue to have safety monitors until further notice.

Generalizable Driver

Waymo announced in April 2025 its intent to build a generalizable driver that can be applied to different vehicles via a partnership with Toyota. Alphabet CEO Sundar Pichai said there is “future optionality around personal ownership” in reference to the project, though co-CEO of Waymo Tekedra Mawakana also said there was a possibility that Waymo would integrate Toyota vehicles into its ride-hailing fleet.

One McKinsey survey of drivers in Europe, the US, and China found 60% of drivers would switch vehicle brands for better assisted driving features, and predicted Level 3 and 4 autonomous vehicles making up a non-negligible share of overall new car sales by 2030.

Source: McKinsey

Environmental advocates have concerns about personally owned autonomous vehicles based on the notion that an improved driving experience will incentivize driving more and driving further. One 2021 study found that Tesla drivers with FSD drove nearly 5K miles more per year than those without the capability; another found that individuals with access to a private chauffeur, similar to the experience of having a self-driving car, for a week, travelled 83% more. Critics of AVs cite Jevons Paradox, which states that “the economical use of fuel results not in diminished consumption but in an overall increase” in their concern that increasing tolerable commute times in self-driving vehicles will lead to metropolitan sprawl and further environmental consequences.

On the other hand, some players in the space believe that instead of personal vehicles becoming autonomous, personal vehicles will become obsolete all altogether, replaced by per-ride or subscription-based ride-share services with autonomous vehicle fleets.

Key Risks

Regulatory Friction

There are a number of potential regulatory frictions to Waymo’s continued scaling, including import restrictions, legal regulations, and evolving insurance policies. Waymo partnered in 2021 with Chinese automaker Zeekr for its upcoming 6th generation fleet, which will be built on a Waymo-customized Zeekr RT. In the midst of continued deglobalization, this partnership poses a real risk to Waymo, especially as federal limitations on international trade largely center on protecting US technology. Despite Zeekr vehicles being imported from China, Waymo has navigated US regulations against Chinese vehicle imports by arguing that its vehicles should not be subject to import regulations because “all the connected tech on board is American-owned and -fitted”. As one report explained:

“The vehicles Waymo receives from Geely, it says, are ‘base vehicles,’ stripped of telematics systems and any other technology that would allow the vehicle to communicate with, or send data back to, its manufacturer. Only ‘authorized personnel’ install Waymo's self-driving technology into the cars after they’re delivered to the United States.”

Waymo also faces potential operational hurdles in addition to manufacturing frictions. Given the relative newness of the field of autonomous driving, legal precedence is still being established for the determination of who is at fault in accidents when a vehicle is either fully or partially operated by software. While autonomous vehicles, by most metrics, have been found to be safer than typical human drivers, there remain concerns about potential increases in insurance prices given the unique liability profile of the vehicles. As of 2025, Waymo uses a unique insurance model described as consisting of separate policies for differing cases:

“[Waymo] wanted (1) policies for when the car was driverless and not carrying a passenger. In this case it is a liability in case of an accident with another vehicle and its passengers or a pedestrian. In those cases, they wanted specific coverage in order to make for clear and fast settlements. (2) Policies for when the car was driverless and carrying passenger(s). In this case the coverage was similar but extended to the passengers. This would include clear coverage for any medical treatment and follow up related to an incident. (3) Policies for when the car was being operated with a safety driver. This would be similar to (1) but would manage extended liabilities to employees or contractors of Waymo.”

Despite over a decade of testing and driving autonomous vehicles in the US, there is no set of standards to regulate which autonomous vehicles go on the roads in which places. While companies, including Waymo, have generated statistics to compare their own safety performance to human drivers, bills regulating the activity of driverless cars are not standardized at a federal level. This leaves open the possibility that either prospective Waymo expansion locations or the US as a whole may pass legislation limiting Waymo’s operations or significantly impacting its business model.

A threat to all autonomous vehicle fleets is public distrust of autonomous vehicle companies, based both on new technology and the perceived job destruction from not needing drivers for ride-sharing services. Riders of Waymo vehicles have seen vandals attempt to damage the vehicles during their rides, effectively trapping passengers as the vehicles will not move when pedestrians are standing in front of the vehicle. In June 2025, protests in Los Angeles over immigration policies under the Trump Administration resulted in destruction of Waymo vehicles. While the destruction of several vehicles may not have large impacts on Waymo’s overall fleet size, these events have prompted Waymo to suspend service in impacted areas.

Evolving Ride-Share Market

Waymo ride-share partners like Uber have partnerships with other autonomous vehicle companies. There is a possibility that Uber pursues expansions with these partnerships over Waymo. Given the success of Waymo One in cities where Waymo is not partnered with Uber and the fact that Waymo seems to be taking market share in cities where it competes with Uber, this may not be to Waymo’s disadvantage if these ride-share apps and their AV partners end up being more of a competitor than customer for Waymo.

If personal ownership of autonomous vehicles becomes a reality, as competitors like Tesla and Waymo’s own partnership with Toyota seem to indicate, this change could reduce the ride-share market. If, for example, individuals send their self-driving cars to the airport to pick them up from a trip, and don’t need to hail a ride. While this could theoretically cut into Waymo’s ride-share revenue, increased demand for generalized drivers would likely be a net positive for Waymo given its current positioning.

Software & Hardware Dependencies

As of June 2025, Waymo uses detailed 3D maps of ODDs in which it operates to orient its vehicles to surroundings, help make informed decisions in lower-input environments, and help vehicles determine their location in lapses of GPS service. While some Waymo competitors claim to have no reliance on city mapping, this has yet to be clearly demonstrated. If any company, whether Waymo or other AV companies, moves away completely from dependence on pre-mapped inputs, that could enable them to scale more quickly into new markets by eliminating the need for dedicated mapping, especially given the potential improvements of models in line with increased training data.

Source: Waymo

There may be limitations to the full extent to which autonomous vehicles using a Waymo-like sensor suite (principally cameras, radar, and lidar) can scale to locations with more extreme weather capable of meaningfully interfering with environment perception and decision making. While Waymo has begun testing in historically snowy locations like Truckee, CA, and Buffalo, NY, there have yet to be driverless operations in any of these areas.

One difficulty with scaling any electric vehicle fleet, regardless of whether or not those vehicles are autonomous, is finding suitable locations for parking and charging. Industry leaders have voiced concern over the scarcity of sufficiently large and efficiently located lots with access to the required power for charging fleets of electric vehicles.

Summary

Waymo is an autonomous vehicle company spun out in 2016 from GoogleX’s Project Chauffeur team. Waymo’s primary product is Waymo Driver, a software and hardware suite that enables level 4 autonomous driving, meaning no rider supervision or intervention is required. As of June 2025, Waymo provides driverless taxi services in four US cities, with plans to continue expanding, via both its app Waymo One and partnerships with Uber. Waymo announced in April 2025 that it is also exploring providing a generalizable driver that could be installed in privately owned vehicles.

As autonomous vehicles continue to grow in broad user adoption, Waymo has positioned itself as a potential leading choice for driverless ride-share services. That being said, the competition in this category is significant, both from alternative AV ride-share platforms and the prevalence of increasingly automated self-owned vehicles. Waymo’s ability to stand out in a crowded market will have to come from its ability to adapt to the changing landscape.