Thesis

By 2035, autonomous driving could create more than $300 billion in revenue in the passenger car market. From 2010 to 2021, established automobile manufacturers like GM, Honda, and Volkswagen invested $106 billion into ensuring their cars had the best self-driving capabilities before others beat them to market. Waymo raised $5.6 billion in October 2024, bringing total external funding to over $11 billion. Tesla launched its Robotaxi service in Austin in June 2025, expanding autonomous driving modalities available to consumers. Beyond commercial mobility, autonomous systems are also gaining traction in defense applications. The US Department of Defense’s FY 2026 budget includes $13.4 billion explicitly for autonomy and autonomous systems, with $9.4 billion specifically allocated to unmanned aerial vehicles.

By mid-2025, Waymo was delivering over 250K robotaxi rides per week (totalling over 4 million rides in 2024, compared to less than 1 million in 2023), having logged over 100 million autonomous miles as of July 2025. As companies race to achieve level 4 and 5 self-driving autonomy, the challenge is no longer just building autonomy stacks. Instead, it’s proving them safe enough for large-scale, driverless deployment in diverse conditions. This requires significantly more testing, both to innovate and to pass rigorous public safety and regulatory standards required for autonomous vehicles and Advanced Driver Assistance Systems (ADAS) to be deployed on the road. The same imperative exists in defense, where unmanned aerial, ground, and maritime systems must meet mission-critical reliability benchmarks before they can be trusted in operational theaters.

Real-world testing, however, is expensive, time-consuming, and inherently limited in scope. Even Waymo’s 100 million autonomous miles, built over more than a decade, cover only a fraction of the rare, high-risk scenarios needed for statistical safety confidence. That’s why simulation has become instrumental for both commercial AV developers and defense programs. Waymo, for example, has amassed over 20 billion simulated miles as of August 2025, enabling it to train and validate systems against edge cases that may be impractical or dangerous to replicate on public roads or in live military exercises. High-fidelity simulation can reduce the need for physical testing miles by up to 99.99%, dramatically lowering costs, accelerating iteration cycles, and giving companies and defense agencies the confidence to move faster toward safe, scalable autonomy.

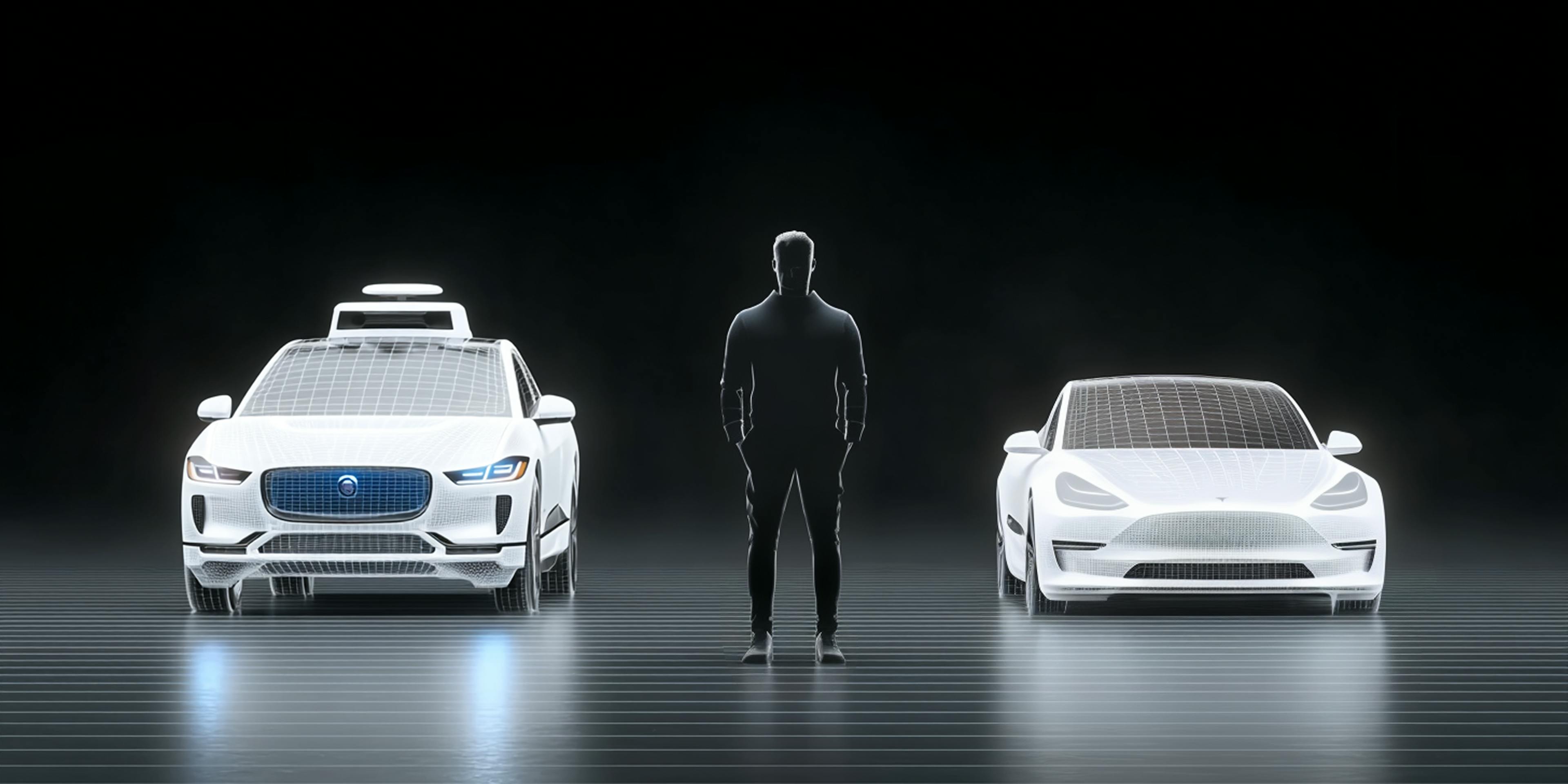

Applied Intuition offers a platform that enables clients to design, test, and validate their autonomous systems in a virtual environment before testing on the road. Applied Intuition’s suite of products, focused on simulation and analytics, provides software infrastructure for self-driving testing. As it continues to expand its simulation and data suite, the company is extending to provide simulation testing for autonomous robotics, trucking, and defense vehicles.

Founding Story

Applied Intuition was founded in 2017 by Qasar Younis (CEO) and Peter Ludwig (CTO).

Younis was born on a farm in Pakistan and moved to the United States after his uncle, an engineer at GM, sponsored his family to live near GM’s headquarters in Michigan. Growing up in Detroit, he attended the General Motors Institute of Technology (now Kettering University) to study mechanical engineering, spending the first seven years of his career as an automotive engineer. After attending Harvard Business School, Younis started TalkBin, which was acquired by Google, where Younis met Ludwig for the first time. Before founding Applied Intuition, he served as the COO of Y Combinator.

Ludwig grew up in a household where most of his family were automotive engineers, starting with his grandfather, who had worked at GM for more than 30 years. His first job in high school was as a software engineer at an automotive tooling company. He went to the University of Michigan for his undergraduate and master’s degrees. After college, he began his career as an Associate Product Manager at Google. As part of the program, one year in, Ludwig met Younis. The pair soon clicked and began working together on Android Automotive at Google.

The two first explored starting a self-driving company in 2013, but concluded that pursuing Level 4 autonomy directly would require the vast capital and scale of established OEMs or well-funded tech giants. When GM acquired Cruise in 2016, they reconnected and saw an opportunity: instead of building an autonomous vehicle themselves, they would create the simulation and infrastructure tools that every AV developer would need.

This insight became the foundation for Applied Intuition, which began by serving automotive OEMs and quickly expanded into trucking, robotics, and defense. In 2025, the company appointed Brian Dong as CFO to guide financial strategy as it scaled globally.

Product

Applied Intuition sells software that enables autonomous vehicle companies to simulate and test the software and hardware of their vehicles in as many circumstances as possible, helping to accelerate their pace of innovation by speeding up feedback loops, testing at scale, and reducing development costs.

Simulation

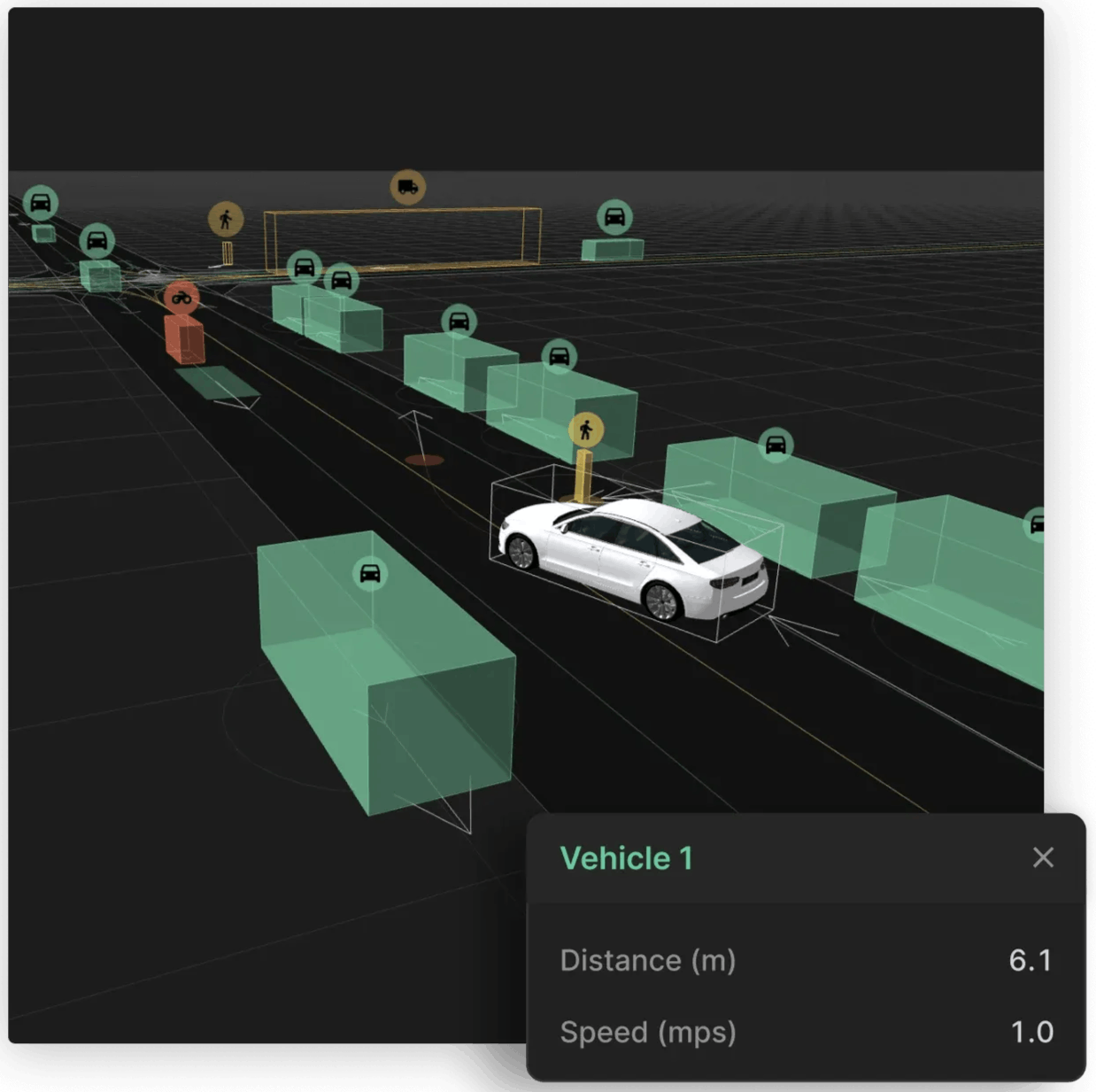

Object Sim: Object Sim is Applied Intuition’s primary simulation tool, which generates scenarios used by developers to test their software in many different situations quickly. It’s valuable to clients because Object Sim can create thousands of scenarios, enabling more comprehensive coverage to identify capability gaps and suboptimal performance of their vehicles. This not only accelerates the development process but also enhances the safety and reliability of the autonomous systems before they are deployed on public roads.

Source: Applied Intuition

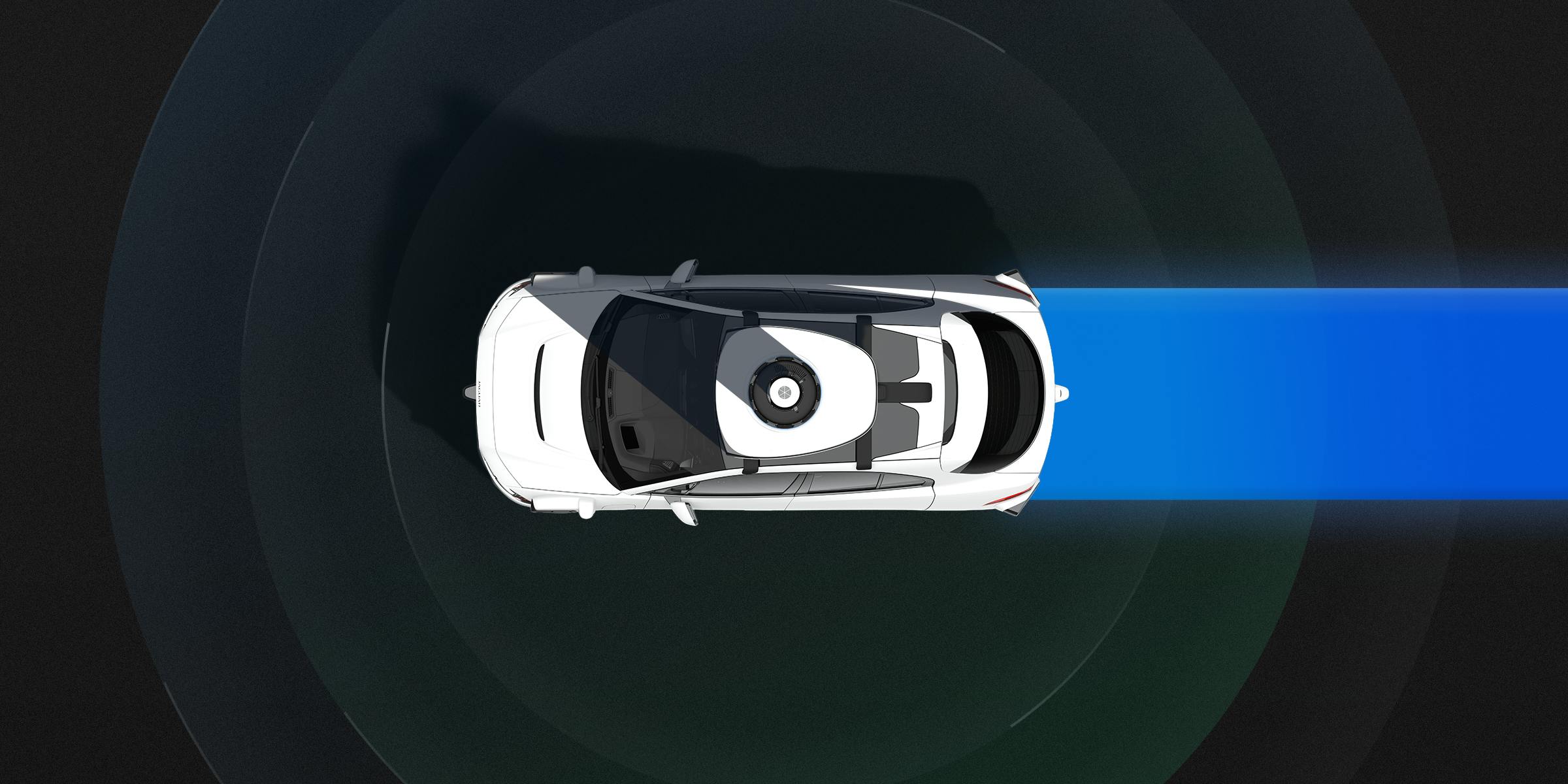

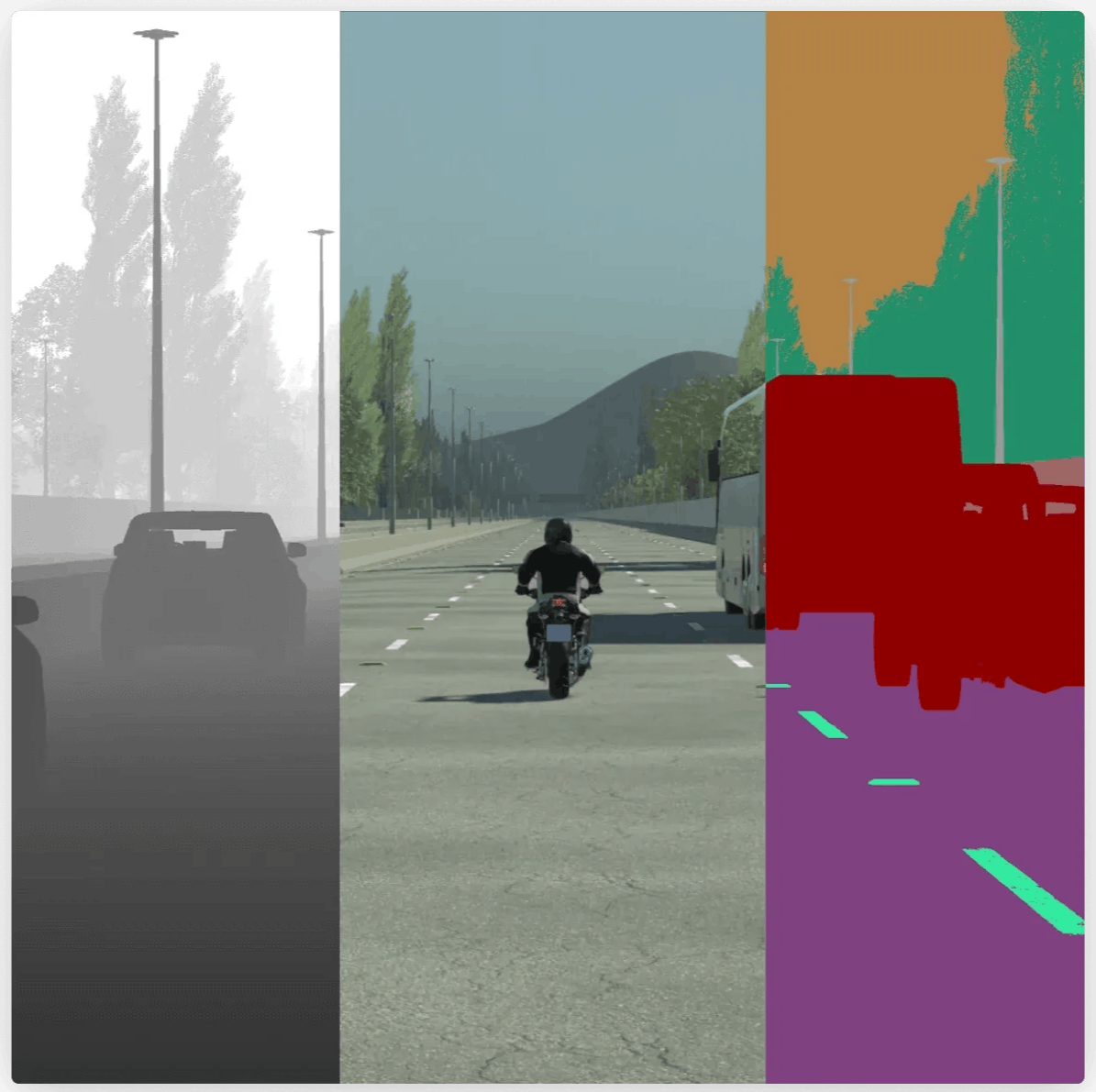

Sensor Sim: The company’s sensor simulator ensures the software is working as it should in reaction to how a car’s sensors work. If a sensor detects an object moving closer in front of the car, Sensor Sim ensures that the car slows down or stops in reaction to that sensor. Sensor Sim uses a library of sensors for different scenarios, like cold weather or rain, to see if the sensors work as expected. It can also determine the best configuration of sensors with its prototyping feature. One of Sensor Sim’s value propositions, according to Applied Intuition, is that it allows users to “comprehensively test robustness to long-tail cases” so that they can be sure about edge cases that are “difficult or dangerous to test in the real world.”

Source: Applied Intuition

NeuralSim: An AI-powered simulation engine that generates photorealistic, physics-consistent sensor data to train and validate perception systems. NeuralSim uses generative models to produce rare or geographically specific scenarios, such as unusual weather, unique road markings, or uncommon object types, without the need for costly real-world data collection. This allows teams to quickly expand test coverage and improve perception robustness before deploying vehicles or autonomous systems in the field.

Source: Applied Intuition

Cloud Engine: This offering provides continuous integration. A problem developers encounter when writing code for self-driving vehicles is that bugs in the code are costly and hard to find. Cloud Engine aims to solve this problem by ensuring that every time any new production code is run against predefined scenarios to see how performance changes before allowing it to get merged. Cloud Engine can run its own simulators, including Object Sim, or third-party simulators.

Source: Applied Intuition

Log Sim: To learn from the real-world situations that vehicles weren’t prepared for, Log Sim will re-run those scenarios on existing code to help developers determine what went wrong and fix it. Once they do, Log Sim will also add that scenario to the test suite so that all future code written will be checked against that scenario. Log Sim helps a fleet improve over time as a function of its total experience.

Source: Applied Intuition

Vehicle Dynamics

In 2022, after acquiring Mechanical Simulation, Applied Intuition started helping vehicle manufacturers simulate and test the mechanical parts of their vehicles in different environments. The software simulates the dynamic behavior of passenger vehicles, multi-axle trucks, and motorbikes. It uses a 3D multi-body dynamics model to reproduce the physics of the vehicle in response to controls from the driver, like steering, braking, and gear shifting in environments such as snow and ice.

VehicleSim: A physics-based vehicle dynamics suite used to simulate passenger cars, trucks, motorcycles, and specialized vehicles in real time. VehicleSim products like CarSim, TruckSim, BikeSim, and SuspensionSim provide deterministic, validated models that capture steering, braking, suspension, and multi-axle behavior under diverse road and weather conditions. These simulations underpin software-, hardware-, and driver-in-the-loop testing (SIL, HIL, and DIL), giving engineers confidence in system safety before deployment.

HIL Sim: A hardware-in-the-loop simulation framework that connects real hardware components to Applied Intuition’s virtual testing environments. HIL Sim allows developers to detect safety-critical failures early, validate sensors and controllers against simulated scenarios, and shorten development cycles. By bridging SIL tools with hardware validation, it reduces costly late-stage errors and ensures reliable performance when autonomous systems are integrated into vehicles or defense platforms.

Defense & Multi-Domain Autonomy

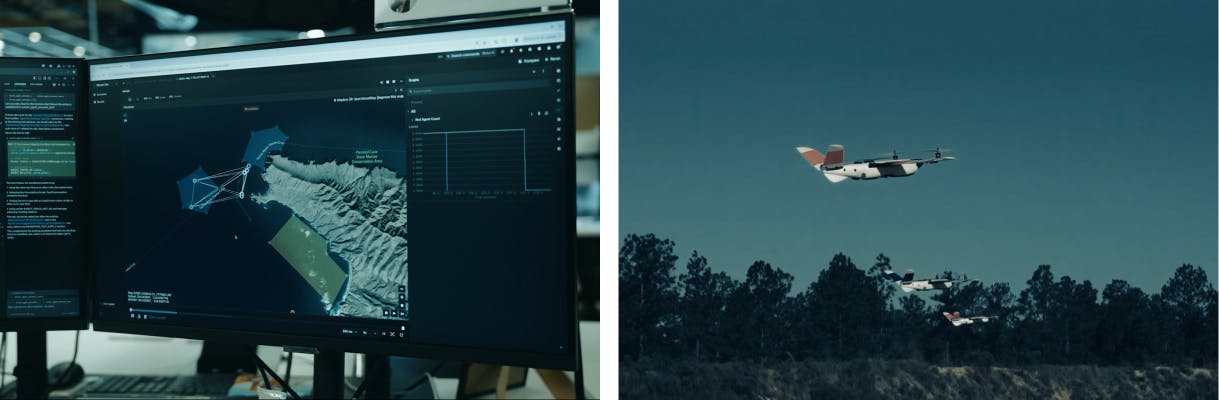

Axion: A cloud-based development and mission-planning environment designed to rapidly develop, test, and deploy autonomous capabilities across air, land, sea, and space domains. Axion integrates simulation, mission rehearsal, and analytics into a single platform, enabling operators to plan and adapt autonomy in dynamic environments.

Acuity: A platform-agnostic onboard autonomy stack that can be integrated into a wide range of vehicles, from unmanned ground vehicles to aerial drones. Acuity enables real-time perception, planning, and control, and can operate in both connected and disconnected environments. Combined, Axion and Acuity connect virtual development with field deployment, making Applied Intuition’s simulation expertise directly actionable in defense and industrial contexts.

Source: Applied Intuition

Data

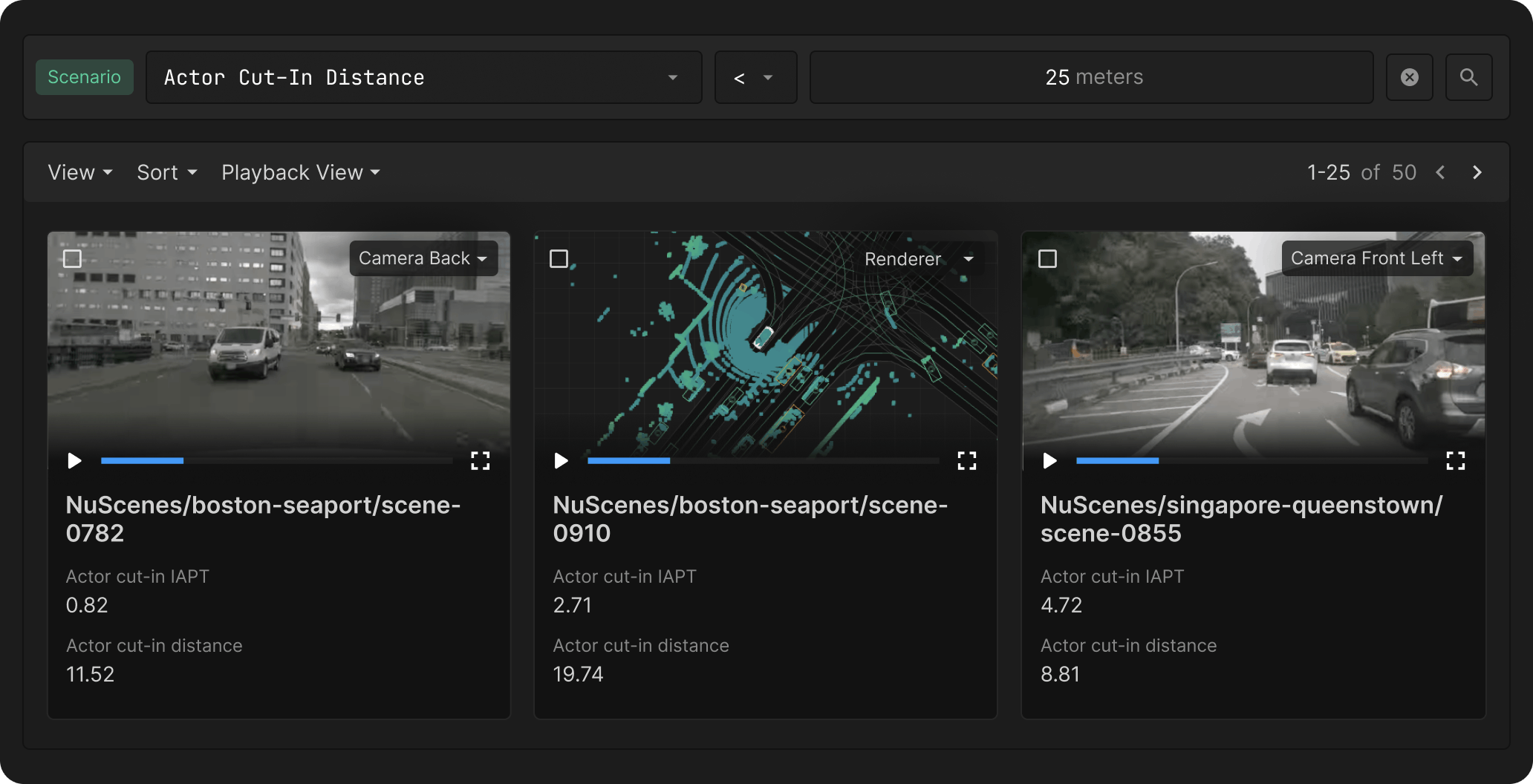

Data Explorer: Software providing log data exploration. AV and ADAS companies get thousands of hours of data about their vehicles that are often impossible for individuals to sift through. Data Explorer automatically detects anomalies in the data from the vehicles and provides a video replay of when things went wrong so developers can easily find errors and fix them. The replays come with multiple cameras and satellite views. Data Explorer ingests all drive logs and automatically attaches higher-level metadata to events and objects, making them easy to search for in a SQL database.

Source: Applied Intuition

Map Toolset: This software provides map editing and analysis for companies that would like to test their own software on real-world maps. With Map Toolset, companies can create their own 3D maps based on real-world locations, validate that everything about their existing maps is correct, or create their own synthetic maps to test for specifically difficult scenarios.

Synthetic Datasets: Provides labeled data for training machine learning algorithms. Oftentimes, the data a vehicle’s perception system can collect is too sparse to use for simulations and become useful. To expand to a new region with different roads or signage, AV companies would need to deploy their fleets in the physical world to learn how to appropriately respond, which is time-intensive and expensive. Synthetic data solves the sparse data issue by filling the gaps in the data so that each recorded scenario can become another useful test case. It helps companies train on synthetic data before they start semi-supervised learning on real data, saving them money and training time.

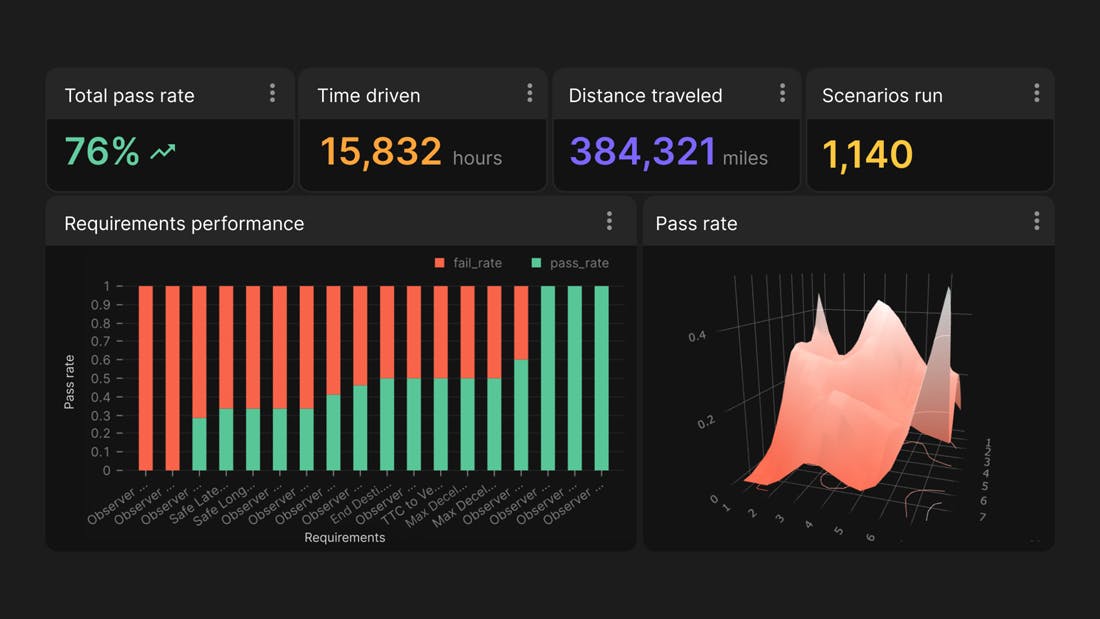

Validation Toolset: This software enables verification and validation management. After testing their vehicles in millions of scenarios and hundreds of thousands of miles on the road, AV and ADAS companies generally need to update their external stakeholders, like regulators, auditors, and compliance teams. Validation Toolset automatically takes the performance statistics from all tests and real-world drives and aggregates that information into a single dashboard to share with anyone from a non-technical background. It allows teams to customize which KPIs they want to track, centralize requirements, and test management across different testing methods (Object Sim, Sensor Sim, etc.).

Source: Applied Intuition

Test Suites: Test Suites are pre-defined simulation test cases for vehicle software testing and safety validation. Creating scenarios or simulations, even with Applied Intuition’s Object Sim, can be very time-consuming but necessary to meet specific performance goals in line with regulatory benchmarks, which pre-defined test cases can help validate.

Copilot: An AI-powered assistant that layers on top of Applied Intuition’s platform to accelerate workflows with natural language. Copilot enables engineers to generate scenarios, analyze logs, tag drive data, and query results up to 40x faster using text prompts. By combining LLMs, retrieval-augmented generation, and perception models, Copilot helps teams uncover edge cases, reduce manual effort, and onboard faster across simulation, mapping, and validation tasks.

Market

Customer

Applied Intuition’s core revenue comes from OEMs, like GM and Toyota, which use Applied Intuition to improve automation for driving and processes already in production in 2023, such as auto-parking and automated braking systems. The company has had success with automotive OEMs, counting 18 of the top 20 as customers. It also collaborates with other autonomous driving tech companies like Kodiak Robotics, Voyage, and May Mobility.

Applied Intuition is also exploring offerings adjacent to simulation testing. For example, in the robotics sector, customers like Scania leverage Applied Intuition's technology for simulating and testing robots in warehouses and mines. Moreover, both the US Army and Defense Innovation Unit (DIU) have selected Applied Intuition to provide a comprehensive software development and testing platform for the Army's Robotic Combat Vehicle (RCV) program. In the trucking simulation domain, Applied Intuition has made a significant move by acquiring Embark for $71 million.

Applied Intuition has also entered into various strategic alliances. In March 2025, Applied Intuition entered into a multi-brand software-defined vehicle (SDV) partnership with the TRATON Group, covering brands such as Scania, MAN, International, and Volkswagen Truck & Bus, to deploy its AI-enabled Vehicle OS and developer tooling across the group’s global operations. In August 2024, a five-year collaboration with Isuzu Motors was announced, aimed at co-developing Level 4 autonomous commercial trucks and targeting launch in Japan and North America by FY 2028.

In early 2024, the company partnered with Valeo to integrate digital twin technology into ADAS sensor simulation, boosting the fidelity of Spectral’s sensor modeling and enabling more rapid, safe deployment of perception systems. Applied Intuition was also selected as one of six inaugural partners in Northrop Grumman’s Beacon program in July 2025, designed to accelerate aerospace autonomy using the Scaled Composites Model 437 Vanguard aircraft as a testbed.

Market Size

The simulation software market was valued at $13.6 billion in 2025 and is expected to reach $26.3 billion by 2030. The market is expected to grow at a CAGR of 14.1% from 2025 to 2030. The simulation software market is comprised of several core revenue buckets, including the driving simulator market, the drone simulator market, and the military simulation and testing market.

The driving simulator market was valued at $2.2 billion in 2024 and is expected to reach around $2.9 billion by 2030. The drone simulator market size is expected to grow at a CAGR of 14.2% from 2025 to 2033 to reach $3.9 billion by 2033. As for the military, the US Department of Defense FY 2026 proposal includes $13.4 billion for autonomy, spanning drones, maritime systems, ground vehicles, and software, with $9.4 billion for aerial systems alone. Applied Intuition also sells into smaller markets, including agriculture, AMR, and construction and mining.

Competition

Aurora: Founded in 2017 and now public (via SPAC in 2021), Aurora builds the full-stack Aurora Driver, integrating software, hardware, and services for autonomous cars and trucks. In January 2025, Aurora announced a strategic partnership with NVIDIA and Continental, integrating NVIDIA’s DRIVE Thor platform with plans for mass production by 2027. Unlike Applied Intuition, which sells simulation and validation infrastructure, Aurora develops and operates its own AV fleets, which makes it more of a downstream operator than a direct infrastructure competitor.

Waabi: Founded in 2021, Waabi is the producer of the Waabi World simulator and driver for L4 autonomous trucking. The company has partnered with Volvo Autonomous Solutions, planning to integrate its AI system into Volvo VNL trucks at scale. Waabi resembles Applied Intuition in its heavy reliance on simulation, but rather than providing infrastructure to third parties, Waabi builds vertically integrated autonomy using its own simulator as a differentiator. Waabi raised a $200 million in Series B funding in June 2024, bringing its total funding to $280 million as of November 2025.

Foretellix: Founded in 2017 in Tel Aviv, Foretellix specializes in safety-focused scenario-based verification and validation (V&V) for ADAS and AVs. The company closed an $85 million Series C round in December 2023, bringing its total to $135 million as of November 2025, with backing from 83North, Temasek, and NVIDIA. Foretellix partners with OEMs like Volvo Autonomous Solutions to ensure systems meet regulatory and safety requirements. Compared with Applied Intuition, which spans simulation, perception, and data management, Foretellix is more narrowly focused on compliance and V&V, but directly overlaps in validation workflows.

Cognata: Founded in 2016 in Rehovot, Israel, Cognata provides simulation across AVs, ADAS, defense, agriculture, mining, and warehouses. It has raised approximately $23.5 million in total as of November 2025. Cognata competes head-to-head with Applied Intuition in simulation and perception validation, though at a smaller scale and with heavier emphasis on defense and industrial applications.

Parallel Domain: Founded in 2017 in San Francisco, Parallel Domain is a synthetic data generation platform that provides photorealistic perception datasets for AVs and robotics. It has raised $44 million total as of November 2025, including a $30 million Series B round in 2022. Unlike Applied Intuition, which provides a full suite of simulation, validation, and data tools, Parallel Domain is tightly focused on synthetic data for computer vision training, which overlaps with Applied’s Spectral and Synthetic Datasets products.

NVIDIA: NVIDIA, founded in 1993, has built a dominant end-to-end hardware and software ecosystem for autonomy, centered on the DRIVE Sim Omniverse and its new DRIVE Thor compute platform. In 2025, it deepened its AV footprint through a partnership with Aurora and Continental, targeting DRIVE Thor deployment in mass-produced trucks by 2027. Compared with Applied Intuition, which provides neutral simulation and validation tools, NVIDIA competes as both a hardware and simulation provider, making it a partner for some customers but also a direct competitor in software simulation.

Business Model

Applied Intuition offers software and services to help clients design, develop, and validate their autonomous systems. It licenses its software tools on a subscription basis to companies developing AV and ADAS. It works with customers to tailor its simulation and testing tools to their needs. This allows the company to charge a premium for customized solutions that address clients' unique challenges. Applied Intuition also provides consulting and support services to help clients implement and integrate its software tools into the customer’s development processes.

Traction

Applied Intuition counts 18 of the top 20 global automotive OEMs as customers. It has become a core partner in how companies like GM, Nissan, Hyundai, and Toyota develop and validate autonomous systems, and it has expanded into adjacent verticals, including defense, agriculture, mining, construction, aerial systems, and robotics.

Focusing on Applied Intuition’s presence in the defense market, the company acquired EpiSci in February 2025. EpiSci was a software company specializing in tactical AI autonomy across land, air, sea, and space, including deployment in the Air Force’s X‑62A VISTA platform. Applied Intuition also acquired Reblika Technologies in July 2025, expanding its capabilities in real-time AI agent simulation for defense and commercial applications. Applied Intuition launched a UK subsidiary in May 2025 with £50 million in planned investment, signalling a deeper committed strategic expansion into sovereign defense autonomy.

In November 2022, Applied Intuition was selected by the US Army and the Defense Innovation Unit (DIU) to provide its software platform for the Army’s Robotic Combat Vehicle (RCV) program, a $49 million contract. The company has also strengthened its presence in the national security ecosystem, adding senior DoD leaders to its National Security and Defense Advisory Board to guide strategy and policy conversations.

Beyond acquisitions, Applied Intuition has entered into landmark partnerships. In July 2025, it announced a collaboration with OpenAI to integrate frontier AI models into Applied’s simulation platform, enabling more realistic human-agent interactions and edge-case testing. In August 2025, the company secured exclusive rights to Ghost Autonomy’s patent portfolio, strengthening its intellectual property position across self-driving and ADAS stacks.

Valuation

In March 2024, Applied Intuition raised a $250 million Series E at a $6 billion valuation from existing investors, such as Lux Capital, a16z, Elad Gil, General Catalyst, as well as “strategic investor Porsche Investments Management S.A., representing the well-known successful sports car manufacturer from Stuttgart-Zuffenhausen.”

In June 2025, the company achieved a major valuation leap, raising $600 million in a Series F and tender offer round co-led by BlackRock and Kleiner Perkins, valuing the company at $15 billion, more than double its valuation just over a year prior. As of November 2025, Applied Intuition has raised $1.5 billion.

With its substantial valuation gain and deep investor base, Applied Intuition is being listed among mobility tech startups most likely to pursue an IPO in the near future. Market observers describe the Series F as “probably the last round before going public,” signaling increased readiness for a public market debut.

Key Opportunities

Increased Regulation

Multiple European countries have created independent efforts to form AV and ADAS regulations. Different regulations have also popped up in China at the municipal level. As regulations from governments across the globe become more difficult to navigate, the more scenarios a self-driving car company would need to pass before it could launch in different countries or even bordering cities in the same country. That’s where pre-defined scenarios targeting different regulations from Applied Intuition become essential for companies looking to expand. It would cost too much to do all the testing for different regulations in the physical world.

Data Advantage

Applied Intuition’s customer base spans 18 of the top 20 OEMs. If the company licenses usage rights over anonymized customer simulation and log data, it may own one of the world’s most comprehensive autonomy datasets. This could form a durable moat: Applied Intuition can offer customers access to a growing network of validated datasets, accelerate perception model training, and even resell benchmarked ADAS/AV software modules to newer entrants, lowering their barrier to entry.

Diverse Customer Base

Applied Intuition’s customer base includes OEMs like GM, Toyota, Nissan, and VW, startups like Voyage, May Mobility, and Kodiak Robotics, as well as the military. By continuing to serve diverse customers across startups, established OEMs, and the military within different regions and regulatory environments, Applied Intuition can significantly reduce any customer concentration risk of the business and increase total addressable market potential.

Expansion into Other Domains

Applied Intuition is no longer just a “land autonomy” company. With the 2025 acquisition of EpiSci, it broadened into air, sea, and space autonomy. In an interview, Younis explained, “We’ve done a lot of on-the-ground, land autonomy, and we thought one area we could augment its portfolio is in other domains — in the air and on the sea … and space as well.” This strategic shift positions Applied to serve not only automakers and trucking firms but also defense primes and allied militaries seeking cross-domain autonomy solutions, creating a significantly larger TAM and enhancing its role as the infrastructure provider for all-domain autonomy.

Key Risks

Generative AI

Generative AI tools like MostlyAI can create synthetic datasets and "what-if" scenarios with minimal input, threatening the need for vertical synthetic data platforms tailored to AV/ADAS. There is a risk that sufficiently advanced general-purpose AI tools could commoditize niche parts of Applied Intuition’s value chain.

Regulatory Risks

Applied Intuition’s customers depend on favorable regulatory environments and consumer readiness for AVs, both of which have changed rapidly in recent years. A 2024 McKinsey consumer survey found that 53% of respondents cited safety concerns as a major obstacle to AV adoption, signifying low consumer comfort with self-driving technology. Multiple high-profile accidents involving Tesla, Cruise, and other AV systems have triggered backlash, including a Florida court verdict in 2025 ordering Tesla to pay $243 million over a fatal Autopilot crash, intensifying public and regulatory scrutiny.

Such safety incidents have spurred calls for tougher oversight and outright bans in some jurisdictions. For example, Cruise had its robotaxi license suspended in California after a pedestrian was dragged below one of its vehicles in October 2023. If governments tighten safety regulations or local regulators (EU, China, US states) layer fragmented compliance requirements, customers may slow or stall AV programs, undercutting demand for Applied’s simulation solutions.

Slow Autonomy Deployment

Despite more than $160 billion invested in autonomy as of November 2022, true Level 4/5 deployment remains limited to small-scale robotaxi pilots in select cities. Timelines continue to slip, and widespread AV adoption may take longer than many projections suggest. For Applied Intuition, whose business scales with the pace of autonomy programs, slower industry rollout translates into delayed revenue capture and elongated enterprise sales cycles. The risk is not existential since Applied Intuition still benefits from ADAS and defense demand, but a slower maturity curve could dampen its growth trajectory relative to the current $15 billion valuation.

Summary

As autonomous systems across every industry become more prevalent, they have become increasingly reliant on virtual testing software that saves them the money and time involved in real-world testing. Applied Intuition’s products for simulation and testing are being increasingly leveraged by OEMs, though the market offers several direct rivals, including companies like Cognata and Apollo. If Applied Intuition can become the de facto provider of synthetic data generated from the advances of generative AI, it may be able to maintain its position in the market.