The Business of People-Moving

Getting from point A to point B is a huge part of the human experience. People travel almost 3.3 trillion miles each year just in the US, and 120 million Americans take 7.1 billion trips on some kind of transportation that isn’t their own car every year — including rideshare, buses, or other public transit. Such trips account for over 250 billion trips globally each year.

From the first horse and buggy taxi service in 1605, the business of people-moving transitioned to yellow cab taxis in 1908 and thrived for almost 100 years. Take New York City, the ride-hailing capital of the US, for example. By the beginning of the 21st century, taxis were providing ~170 million rides each year in New York alone. Then, in 2009, Uber entered the scene. Over the next decade, Uber would complete 10 billion trips. In New York alone, as of December 2024, Uber provided ~180 million rides per year. Globally, Uber was completing over 10 billion rides per year by the end of 2024.

The first two decades of Uber’s existence have heavily revolved around questions like the protectionism of the taxi industry, the viability of the gig economy, and the ouster of Uber co-founder and CEO, Travis Kalanick. However, the real underlying story of Uber’s position in the world revolves around autonomy.

The Promise of Self-Driving Cars

If there is one thing that has been consistently true about self-driving cars, it's the inability of anyone to accurately predict a timeline for their arrival. In 2016, Elon Musk predicted Tesla would have full autonomy, able to drive “from Los Angeles to New York without human intervention” within a year. Similarly, Musk said in 2019 that Tesla would have one million robotaxis on the road by 2020. In 2015, a senior VP at Baidu said the company would offer self-driving cars to Chinese consumers by 2020. Around the same time, Lyft President, John Zimmer, predicted that by 2021 the majority of rids on their platform would be autonomous.

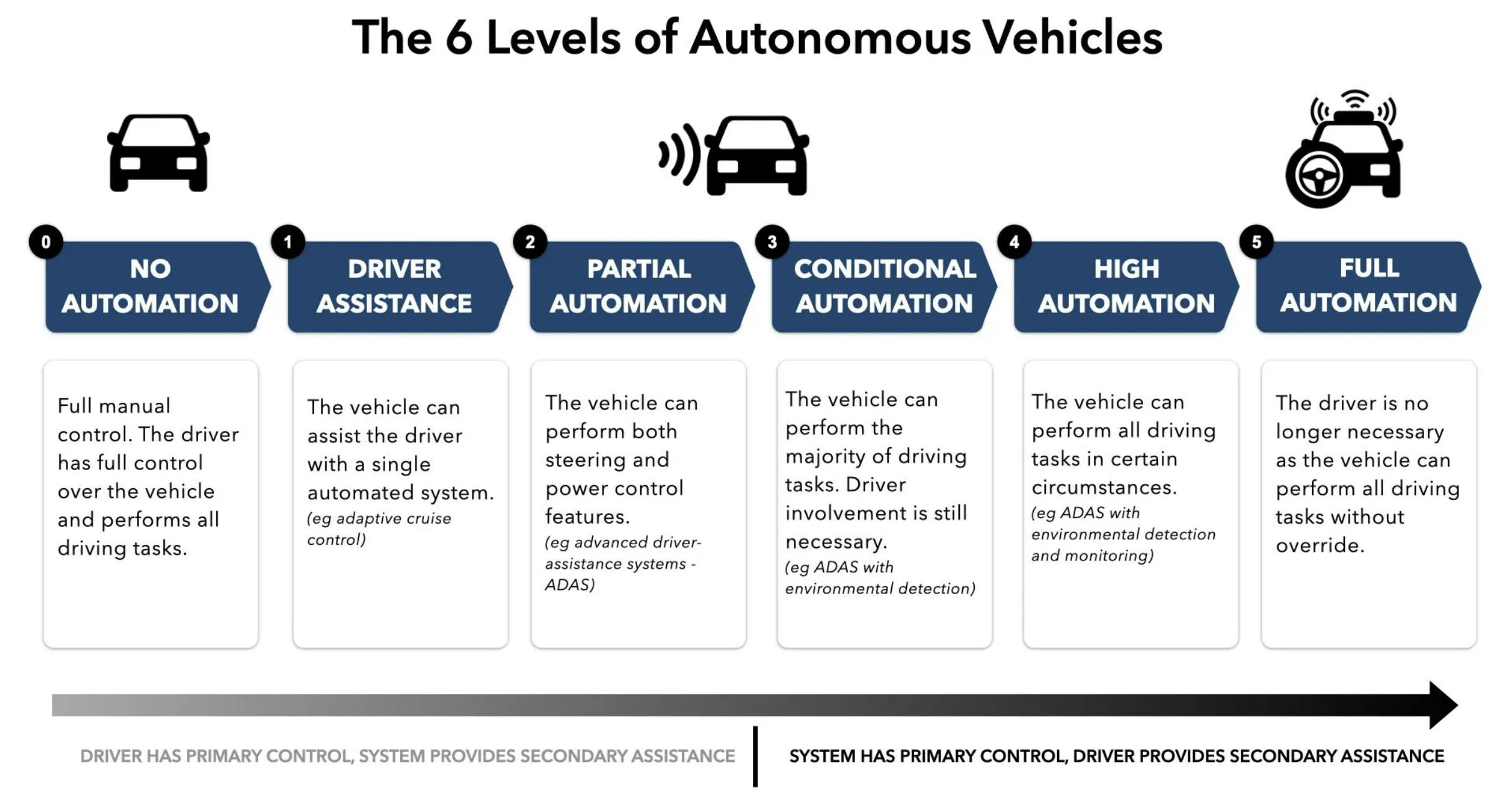

But even as autonomous robotaxis started to roll out, unanticipated issues arose. In February 2022, Cruise became the first company to operate Level 4 robotaxis in a major city, operating from 11 PM to 5 AM in specific parts of San Francisco at no more than 30 mph. This meant that, for the first time, a vehicle was commercially available to riders that could “perform all driving tasks in certain circumstances.”

Source: Ptolemus Consulting Group

Less than two years after Cruise began autonomously moving people from point A to point B, the company was banned from SF. After an incident in October 2023 where a pedestrian was dragged for 20 feet beneath a Cruise vehicle, regulators decided the product posed an “unreasonable risk to public safety.” As a result of the ban, Cruise’s parent company, GM, decided to shut down the self-driving unit in December 2024.

Between autonomous startups including Cruise, Pony.ai, Zoox, Nuro, Aurora, Mobileye, Argo AI, and beyond, companies have spent probably $100 billion chasing the vision of driverless cars with little to show for it. The one exception? Waymo.

Waymo was started as the flagship initiative of Google X, the "moonshot factory". Founded in 2009, the same year as Uber, Waymo would go on to spend billions in pursuit of autonomous driving. In 2016, the project was spun out from Google to become one of many companies under the Alphabet umbrella. Then, in October 2024, Waymo raised $5.6 billion from investors like Alphabet, Fidelity, a16z, and others, at a $45 billion valuation.

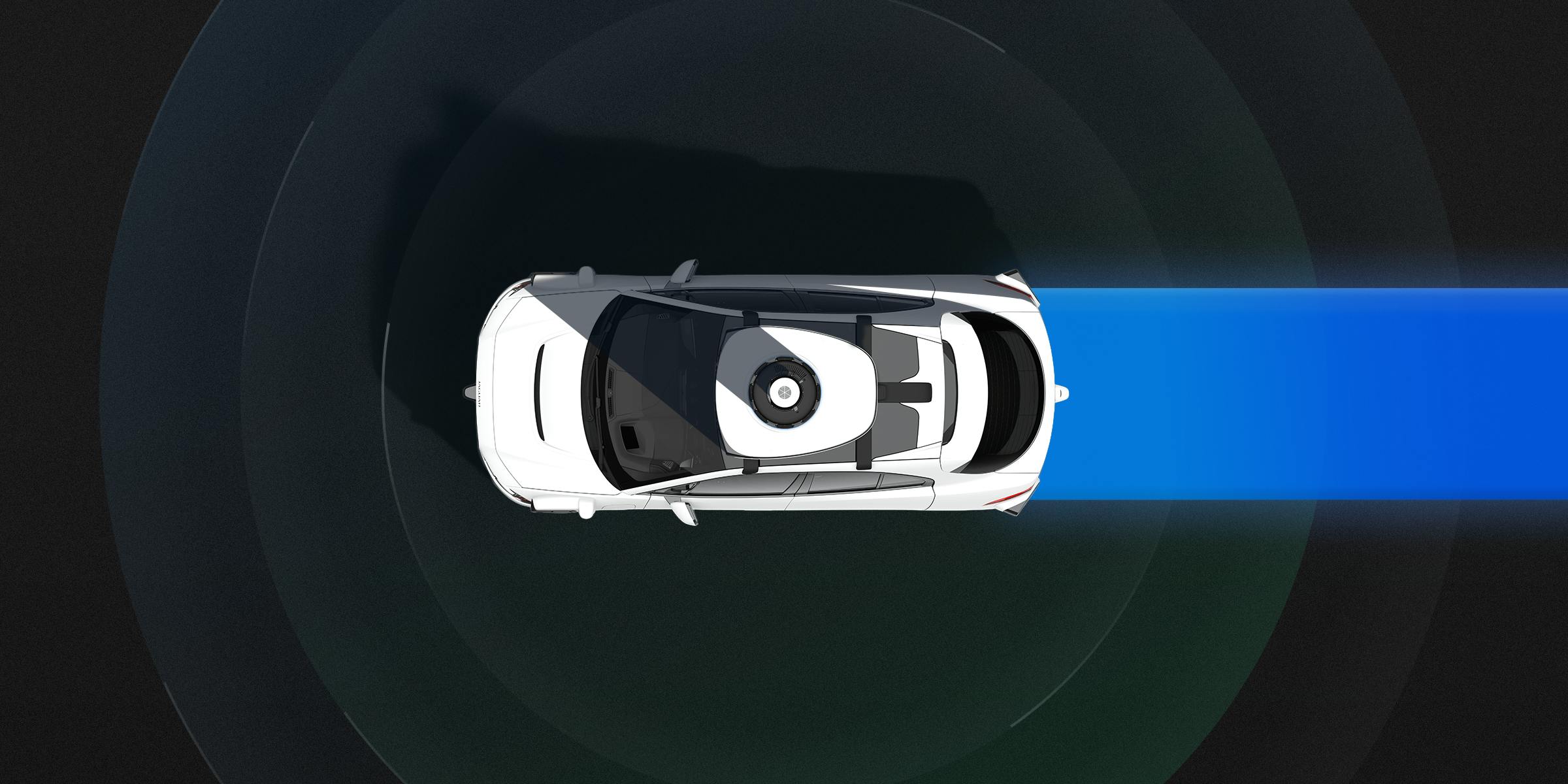

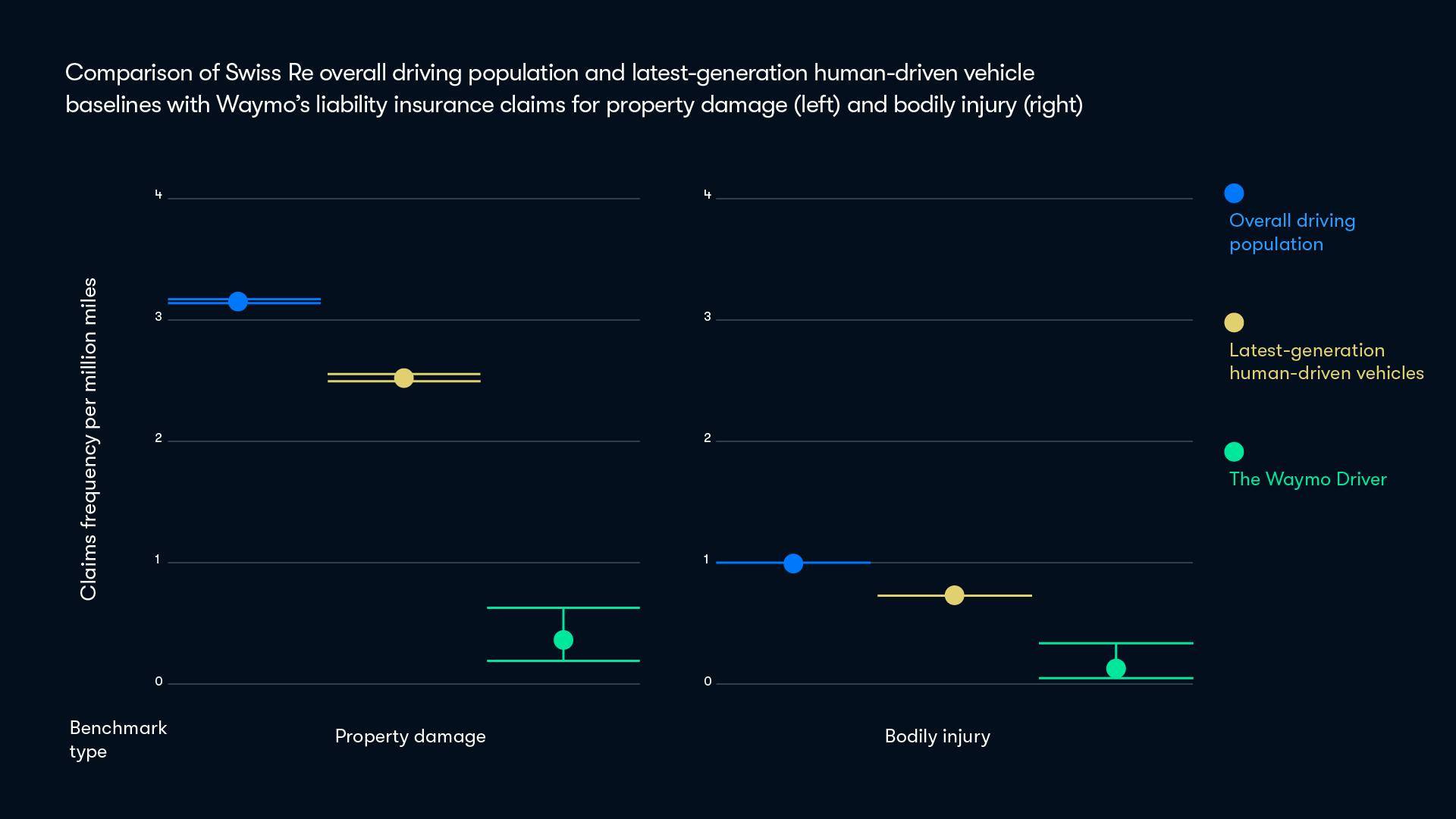

Since then, Waymo has proven itself not just in the press, but on the streets. By December 2024, Waymo had driven over 25 million miles autonomously across Phoenix, San Francisco, and Los Angeles. One report by insurer, Swiss Re, found that across a dataset of 200 billion miles, Waymo outperformed human drivers, even in the latest generation of human-assisting vehicles, across avoidance of property damage and bodily injury.

Source: Waymo

From August 2023 to August 2024, Waymo grew from 12K rides per month to 312K rides per month just in California. That’s a far cry from Uber’s 40 million rides each month in the US, but it isn’t just about comparing Waymo vs. Uber rides apples-to-apples. It's what Waymo’s accomplishment means for an unfulfilled dream of Uber’s potential.

Uber’s Premonition

In February 2015, when Uber was about six years old, the company announced a partnership with Carnegie Mellon to create the Advanced Technologies Group (ATG). By May 2016, Uber was demonstrating a prototype self-driving car; a modified Ford Fusion Hybrid. Just four months later, Uber acquired Otto, a self-driving car company founded by Anthony Levandowski, who previously worked for Google’s driverless car effort. That’s where Uber’s driverless ambitions went off the rails.

Waymo sued Uber, asserting that Levandowski had stolen trade secrets in order to build Otto, which Uber now had. While Uber and Waymo eventually settled in 2018, the legal battle dragged on until Levandowski was eventually sentenced in 2020. By this point, Uber co-founder and CEO, Travis Kalanick, had already been forced out of Uber. That happened in June 2017, just nine months after the acquisition of Otto.

Over the course of five years, Uber would go on to invest $2.5 billion in its self-driving division. But by September 2020, three years after Kalanick’s exit, Uber’s ATG had only produced “a car that can’t drive more than half a mile without encountering a problem.” From the Levandowski lawsuit to a pedestrian death in 2018, the effort had been riddled with issues. Finally, in December 2020, Uber sold ATG to Aurora for $4 billion.

A failed experiment ahead of its time, right? Well, not according to Travis Kalanick. In March 2025, Kalanick reportedly expressed his skepticism of the move to jettison the self-driving car effort:

“Look, [new management] killed the autonomous car project we had going on. At the time, we were really only behind Waymo but probably catching up, and we were going to pass them in short order … I wasn’t running the company when that happened, but you know, you could say, ‘Wish we had an autonomous ride-sharing product right now. That would be great.’”

Parker Conrad, the current CEO of Rippling, who was similarly removed from his first company, Zenefits, defended Kalanick’s position saying:

“It seems like a pretty reasonable argument that Uber is screwed without [an autonomous vehicle] program. Travis’ argument is that it would have worked, or he could have made it work. That they shut it down doesn’t prove that it was doomed. What if they kept going? What if he had?”

Post-Uber, Kalanick went on to found a business taking advantage of another under-utilized Uber dream: Uber Eats. Kalanick’s CloudKitchens is reportedly generating over $1 billion building ghost kitchen infrastructure for food delivery. Take that same lens and aim it at the potential future for Uber’s autonomous build-out.

If Kalanick is right that Uber was keeping pace with Waymo, and he had been able to stay in control of the company, there’s an argument to be made that the company could now control not only the leading distribution mechanism for ride-hailing (the Uber app) but the infrastructure to deliver those rides autonomously.

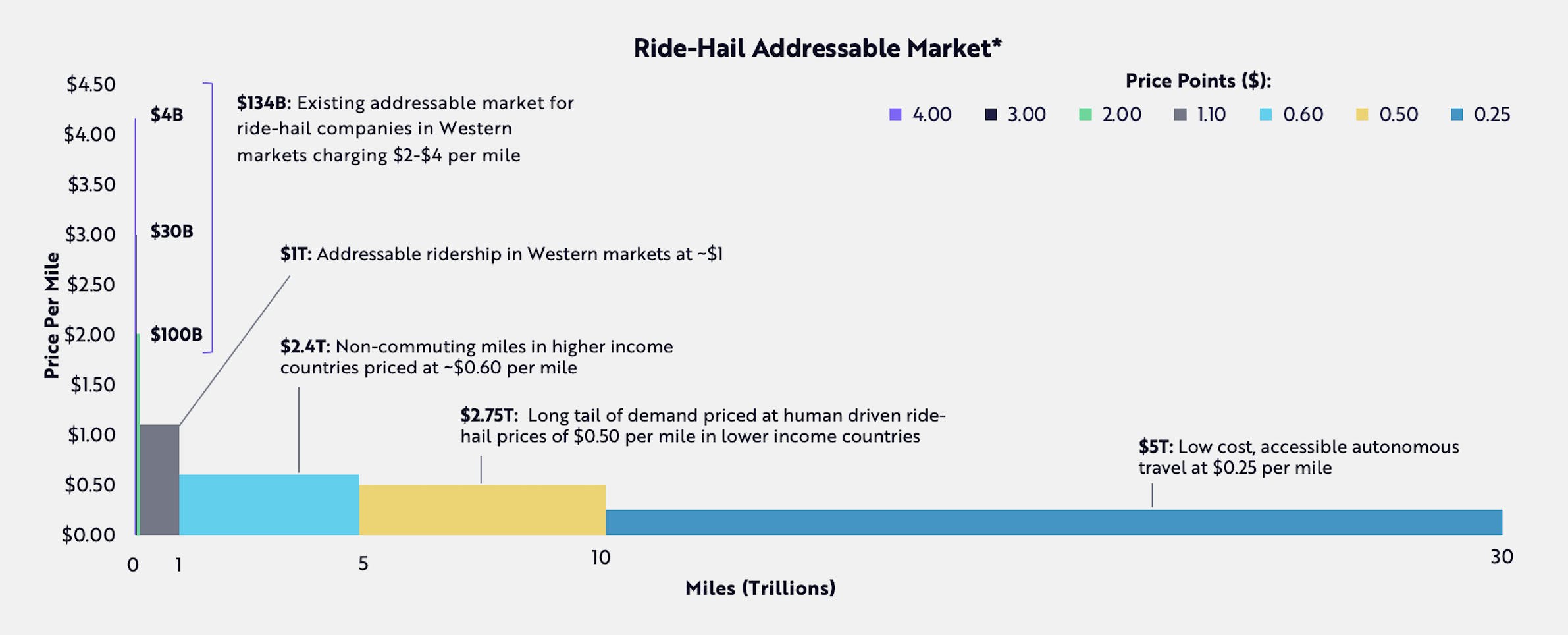

Instead, today the vision as Uber articulates it is to be the platform for autonomous ridesharing, but not the product. Uber’s current CFO of mobility describes the vision around autonomous vehicles as a $1 trillion addressable market for Uber. But rather than owning the infrastructure around autonomous vehicles, Uber will provide the platform for fleet owners to access Uber’s user base of riders. That’s where Waymo re-enters the conversation

Waymo & Uber

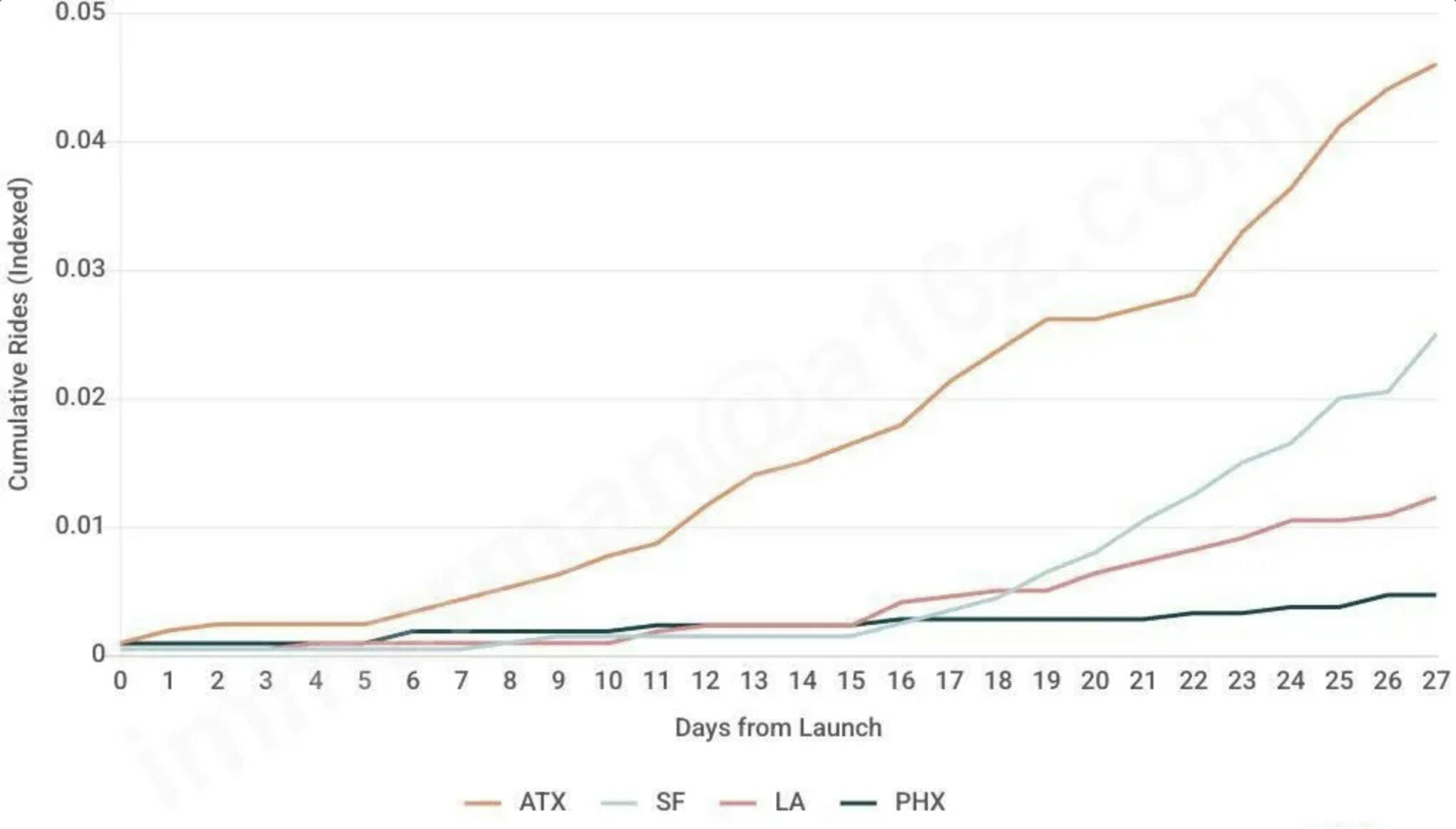

Despite being legal rivals as recently as 2018, Uber and Waymo have recently put the platform + product partnership to the test. Waymo is one of 15 autonomous vehicle partners that Uber has on its platform. In September 2024, Waymo and Uber announced an extended partnership where Uber would enable its users to request autonomous Waymos in Austin and Atlanta. By April 2025, Waymo investor Alex Immerman at a16z shared that Waymo was scaling significantly faster in Austin than it had in previous cities like SF or LA.

Source: Alex Immerman

The growth rate is likely driven by this partnership with Uber. While users in SF or LA had to download the Waymo app, existing Uber users could use the app they already turned to for transportation and request a Waymo as well. As a result, 20% of the rides Uber facilitated in Austin are actually Waymo rides rather than Uber rides.

So it seems like Uber’s “platform” approach may be working. For now.

Today, Uber claims that the typical cost of a human-driven ride is $2 per mile, while Waymo is reportedly $2 to $3.50 per mile. But Waymo is just getting started. What happens when the company launches a cheaper car? Or further reduces its costs?

For that matter, what happens as Waymo’s brand among average users continues to grow? What if they don’t need Uber as a middle-man anymore? There is still the question of whether Uber will be able to maintain relevance in a world of autonomous transportation. It’s possible that Travis Kalanick’s vision for Uber as an autonomous juggernaut was spot on. And it may end up costing Uber more than $2.5 billion. It may end up costing the company trillions.

The Trillion-Dollar Thesis

The one name in the world of autonomous vehicles we haven’t touched on much yet is Tesla. Where is Tesla in all of this? Since 2013, Elon Musk has had his eye on autonomous driving. After a brief conversation with Google that year about their LiDAR technology, Musk opted instead to develop a Tesla-unique approach focused on cameras. From 2015 on, Tesla has had a continuous push towards autonomy, from Autopilot to Full Self-Driving (FSD), with a nationwide campaign by The Dawn Project to get Tesla FSD banned thrown in the middle. As of April 2025, Tesla was offering FSD (Supervised), though it reportedly only went as far as Level 2 autonomy with partial automation in steering and parking.

Despite the seeming lag behind competitors like Waymo, there is one notable Tesla believer who has continued to put their money where their mouth is. Hedge fund ARK Invest made a notably aggressive projection in 2018 when Tesla’s stock was trading at ~$300-350 per share: ARK believed that, by August 2023, Tesla could have a price per share of $800 (after stock splits in 2020 and 2022). The price rise was predicted to be the result of an expected future Mobility-as-a-Service (MaaS) business that would increase Tesla’s gross margins from 19% to 80%.

While Tesla’s stock failed to live up to ARK’s thesis, reaching ~$250 in August 2023, the case for the robotaxi thesis continues to develop. In October 2024, ARK reinforced its robotaxi vision for Tesla, believing the company “could launch a robotaxi service in the next year or two.” While ARK estimated that Waymo was driving 70K miles per day in 2024, they believed Tesla’s vehicles drove 5 million FSD miles per day. Whether or not Tesla can rise to take advantage of the opportunity, its size is something ARK points to independent of who seizes it.

Source: ARK Invest

Remember that Uber currently costs ~$2 per mile, while Waymo is estimated at $2 to $3.50 per mile. As the price comes down the market will grow from the human-driven ridesharing market, which is estimated to be $134 billion in size, to a potentially much bigger $5 trillion autonomous market in the case that autonomous low-cost transportation becomes fully accessible.

ARK’s Tesla share price projections may be hard to believe, but the market opportunity is based on a function of turning non-consumption into consumption. On average, various types of public transit cost ~$1.42. More fixed route transportation, like light bus and rail, can cost $0.31 per mile but are only accessible for a fraction of use cases. If robotaxis could continue to drop to the average cost of $0.25 per mile, you open up a broad universe of use cases.

The trillion-dollar question is which model of autonomy wins. Waymo’s owned fleet, Uber’s connectivity platform, or Tesla’s distributed ownership model, selling cars to consumers who can deploy them as robotaxis. Each path has tradeoffs — capital cost, control, and scalability. As autonomy gets cheaper and more common, the winner won’t necessarily have the best autonomy. In the case of Uber, it may not have any autonomy at all. The winner will come from a combination of distribution, economics, and brand trust. It won’t just be about who drives best — it’ll be about who’s already on your phone, who offers the cheapest ride, and who people are willing to get in a car with. In the end, autonomy is just the engine. The real competition is for the steering wheel of consumer behavior.