On October 30th, 2025, Presidents Trump and Xi met for the first time since 2019, and agreed to a tentative one-year truce in the ongoing trade conflict between the two nations. Their deal eased US tariffs and delayed China's export restrictions on rare earth minerals. Yet one key issue remained untouched: US export controls on AI chips.

Three days later, Trump publicly clarified his administration’s position. China could purchase older Nvidia chips, but not the company's state-of-the-art GPUs. Four days after that, Trump reportedly backtracked and is set to ban “sales of Nvidia’s scaled-down AI chips to China”. This extreme volatility reflects a historical tension in US AI export control policy: How far should Washington go in restricting China's access to the hardware that powers artificial intelligence?

Beneath that complex question lies a controversial debate over the timeline to AGI. Just weeks ago, Andrej Karpathy made headlines by declaring the next decade, "the decade of agents," contrasting with Greg Brockman’s assertion that 2025 is the “year of agents.”

If transformative AI takes at least another decade, as Karpathy believes, then export controls risk accelerating China's domestic semiconductor capabilities while eroding American chipmakers' long-term competitiveness. But if transformative AI emerges within five years, as Brockman believes, American labs could leverage their compute advantage over their authoritarian counterparts to secure economic and military dominance.

This existential gamble, between short-term leverage and long-term blowback, sits at the center of one of the most consequential technology-related policy decisions of this century.

The Compute Advantage

AI progress has been driven by three inputs: data, algorithms, and compute. Unlike data or algorithms, state-of-the-art compute is virtually monopolized by the West. It exists as a stack of hardware, software, and infrastructure concentrated in a handful of chokepoints controlled by the US and its allies. This control is crucial for America, as compute has reliably accelerated AI performance and is increasingly vital for deployment.

Compute Drives Performance

In 2019, reinforcement learning co-founder Rich Sutton articulated what he called the bitter lesson of AI research. He argued that AI systems that learn independently through massive amounts of compute consistently outperform alternative methods.

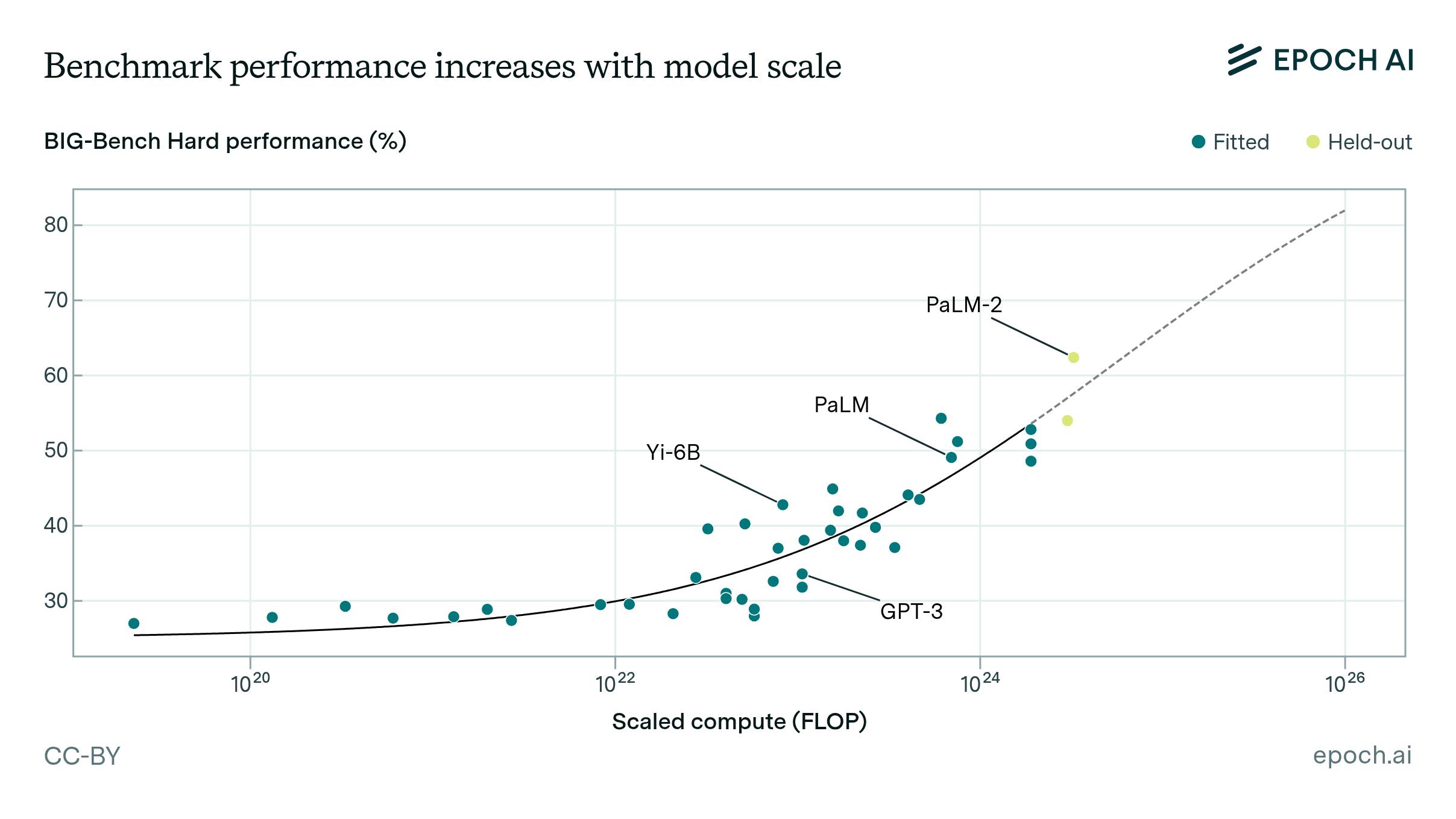

A 2024 Epoch AI study confirmed Sutton's prescient observation, finding 60-95% of recent AI performance gains had come from scaling compute and data rather than algorithmic breakthroughs. Accordingly, since 2015, training compute requirements have doubled approximately every six months, establishing a clear formula: more compute enables researchers to train larger models with more parameters, which in turn delivers better performance across all benchmarks and real-world tasks.

Source: Epoch AI

The evolution from GPT-3 to GPT-5 demonstrates this relationship perfectly. Five years and a rumored 5 trillion parameters later, a model that barely wrote coherent sentences can now demonstrate PhD-level intelligence.

Compute Scales Deployment

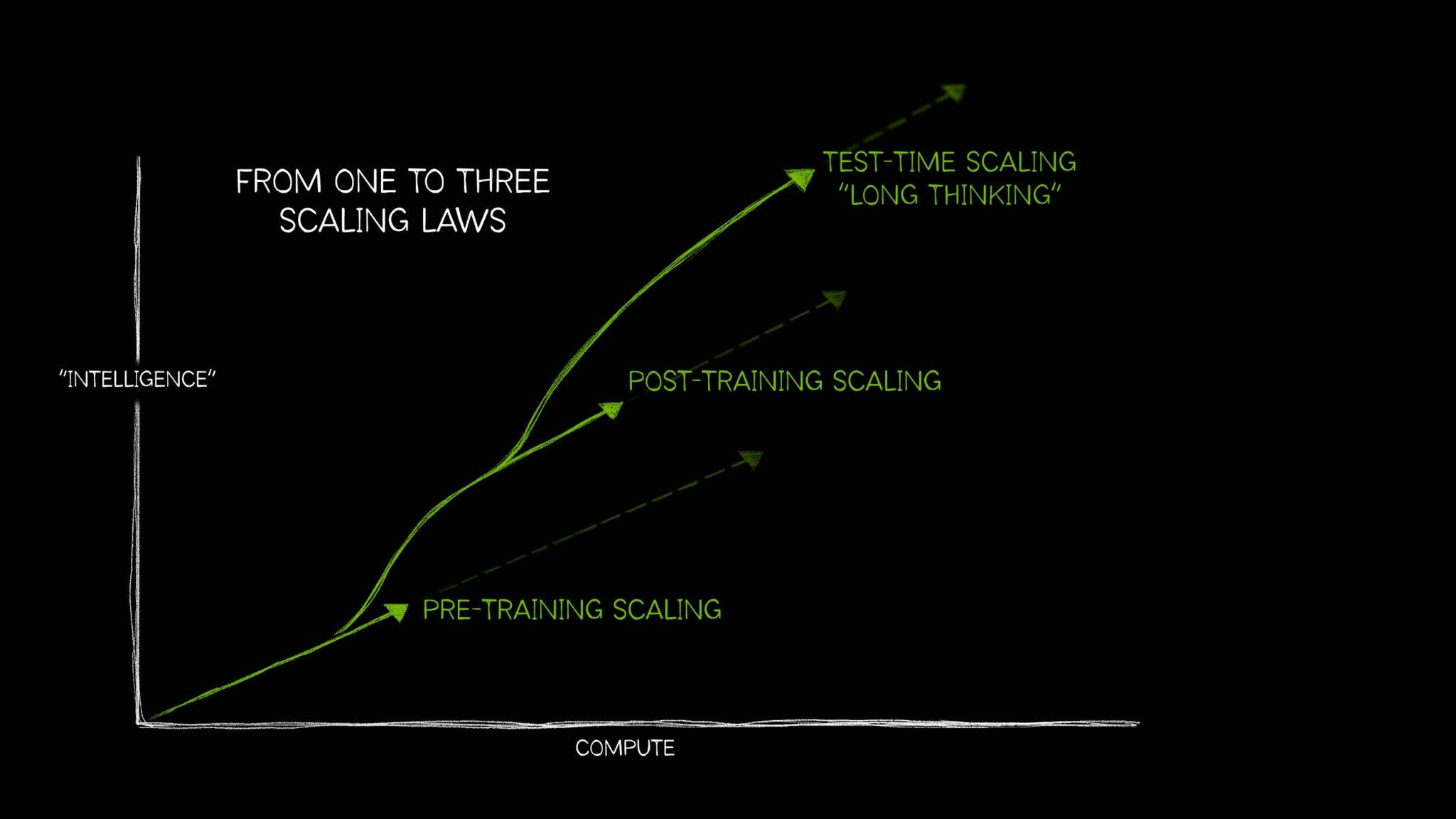

Along with training, compute is becoming increasingly critical for model deployment. For instance, every query posed to ChatGPT requires compute to generate a response, a process formally known as inference. While a single inference cost is trivial, the aggregate cost adds up: platforms like ChatGPT process over a billion queries daily, making inference more expensive than training itself.

Furthermore, recent advances in AI reasoning have dramatically increased total inference costs and, consequently, compute requirements. New techniques like test-time scaling (or "long thinking") enable models such as GPT-5 to evaluate multiple potential responses before selecting the optimal one. For complex tasks like generating customized code, this reasoning process can consume over 100x more compute than traditional inference approaches.

Source: Nvidia

As these reasoning-intensive models become the standard, the gap between nations with compute and those without will widen. This imbalance is exactly what US export controls aim to exacerbate. By restricting China's access to cutting-edge compute, the US seeks to prevent Chinese labs from training frontier AI models and cripple their ability to deploy models at scale.

Evolution of US AI Export Control Policy

Over the past seven years, US export controls on AI chips and semiconductor equipment have evolved to manage global compute diffusion, each iteration reflecting shifting views on AGI timelines and China's push for semiconductor independence.

In 2014, the People's Republic of China released its National Integrated Circuit Plan, seeding a state-sponsored investment fund with $26.1 billion, with the goal of making China the global leader across all segments of the semiconductor supply chain by 2030. This declaration, combined with the CCP's mandate that civilian tech advancements must serve military ends, raised concerns over national security threats from China and set the stage for US export controls.

Tightening of Export Controls

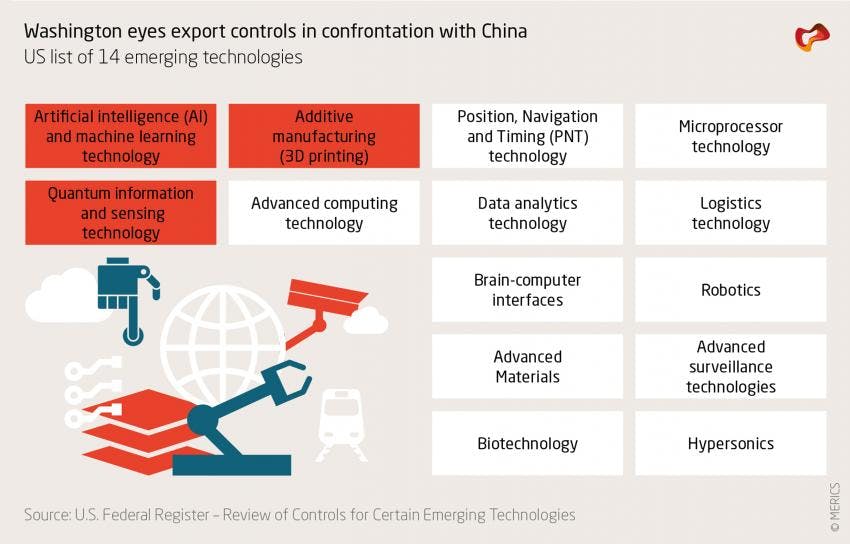

In direct responses to these policies, the first Trump administration introduced the Export Control Reform Act in 2018, empowering the Bureau of Industry and Security (BIS) to regulate "emerging and foundational technologies." The BIS quickly flagged 14 categories, including AI and microprocessor technology.

Among these early export controls, the most impactful was a restriction on extreme ultraviolet lithography machines from ASML. These machines etch circuits below 13.5nm onto silicon wafers, producing faster, more powerful microprocessors. As of November 2025, this export control continues to constrain the Chinese semiconductor ecosystem, as SMEE (China’s ASML) struggles with scaling 5nm production, which has been critical for AI training and inference.

Source: Merics

Upon learning that frontier AI's compute demands were set to surge tenfold in the coming year, the Biden administration prepared to announce a broad set of export controls on cutting-edge compute, focused on China. In October 2022, ahead of the launch of ChatGPT, the BIS imposed export controls on advanced computing items (including Nvidia's cutting-edge GPUs) and restricted US persons from supporting the development or production of integrated circuits at Chinese facilities without a license.

This groundwork set the stage for further escalation when ChatGPT launched, and fears over an AI arms race intensified calls for stronger export controls. AI leaders argued that if transformative AI arrived within two to five years, denying adversaries access to advanced compute was essential to prevent authoritarian regimes from weaponizing AI.

In July 2023, during a Senate testimony, Dario Amodei testified that powerful AI capable of helping design biological weapons could emerge by 2025-2026, framing the AI race as an existential risk requiring democratic nations to shape AGI's development. Sam Altman claimed in November 2024 that OpenAI had a clear roadmap to AGI by 2025, arguing in a 2024 op-ed that tighter controls would prevent adversaries from gaining an irreversible geopolitical advantage. Similarly, Leopold Aschenbrenner warned in Situational Awareness that:

"Authoritarians could use superintelligence for world conquest, and to enforce total control internally. Rogue states could use it to threaten annihilation. And though many count them out, once the CCP wakes up to AGI it has a clear path to being competitive."

Proponents of stricter export controls also argued that with weaker controls, China could exploit its manufacturing and energy production capabilities to win the AGI race by scaling compute infrastructure much faster than the US. With unrestricted access to cutting-edge chips, China could potentially deploy data centers five times larger than current US facilities. Further, China’s energy dominance (having added more net electricity capacity in 2024 alone than the US has in a decade) could enable prolonged, high-intensity training runs on subsidized power, while US labs face rising energy costs, grid constraints, and regulatory delays. This edge would allow Chinese labs to train larger models and scale inference massively, ultimately tipping economic and military power toward authoritarian dominance.

Facing mounting pressure from AI leaders over the existential risk of an authoritarian AGI, the Biden administration introduced the AI Diffusion Rule in January 2025. This rule expanded the scope of export controls globally in three ways.

Source: RAND

First, it imposed license requirements on shipments of state-of-the-art AI chips, high-bandwidth memory, and semiconductor manufacturing equipment to over 100 countries.

Second, it extended controls to cloud computing services that could remotely provide access to restricted hardware.

Third, it tiered nations into groups — 18 close allies like the UK were exempt, while every other country, like the UAE, faced caps on volumes and performance thresholds.

Loosening of Export Controls

By mid-2025, however, the hype around imminent AGI had begun to fade as real-world limitations persisted, tempering aggressive short-term forecasts. Despite expanded context windows, long-context performance remained poor, with accuracy dropping to 24.2% on tasks requiring recall from contexts exceeding 100K tokens. Hallucinations persisted in LLMs, appearing in 9.2% of general knowledge questions across all models.

Meanwhile, promises of agentic AI fell short. By the end of 2027, 40% of agentic AI projects are projected to be canceled due to escalating costs and unclear business value. These shortcomings, along with unresolved issues such as the looming data wall and energy bottlenecks, have led even Sam Altman to revise his timeline, suggesting that full AGI might not arrive until 2030.

This shift has strengthened the "long-term blowback" argument: if AGI is at least a decade away, strict export controls may harm US interests without meaningfully slowing China's progress. Jensen Huang labeled the controls a "failure" in November 2025, warning that “China is nanoseconds behind the US on AI” and “China is going to win the AI race,” since American chipmakers are losing global market share due to unnecessary regulations.

Similarly, Rene Haas, CEO of Arm, cautioned that overzealous licensing requirements delay chip approvals for months or years, forcing countries like China to innovate around restrictions. This creates "parallel universes" in which non-US entities emerge as viable alternatives, thereby reducing American competitiveness. China's efforts to bypass EUV lithography bans illustrate this dynamic. SMIC achieved viable 5nm yields through multi-patterning, bringing it closer to competing with TSMC’s 3nm chips.

Influenced by this blowback logic, the second Trump administration rescinded the Diffusion Rule in May 2025 and introduced the America's AI Action Plan in July 2025.

Source: Vinay Mummigatti

The plan aims to maintain US technological leadership by exporting the complete "American AI stack" to allies and partners. This strategy generates revenues to fund domestic R&D, establishes UD standards globally, and creates strategic dependencies that strengthen diplomatic alliances. Regarding export controls, the plan maintains targeted restrictions on adversaries like China, approving sales of older chips, such as Nvidia H20s, while reducing regulatory burdens for other nations. Despite this framework, policy uncertainty persisted in November 2025, when Trump reportedly considered blocking the sale of Nvidia H20s to China.

Export Controls Affect on Chinese LLMs

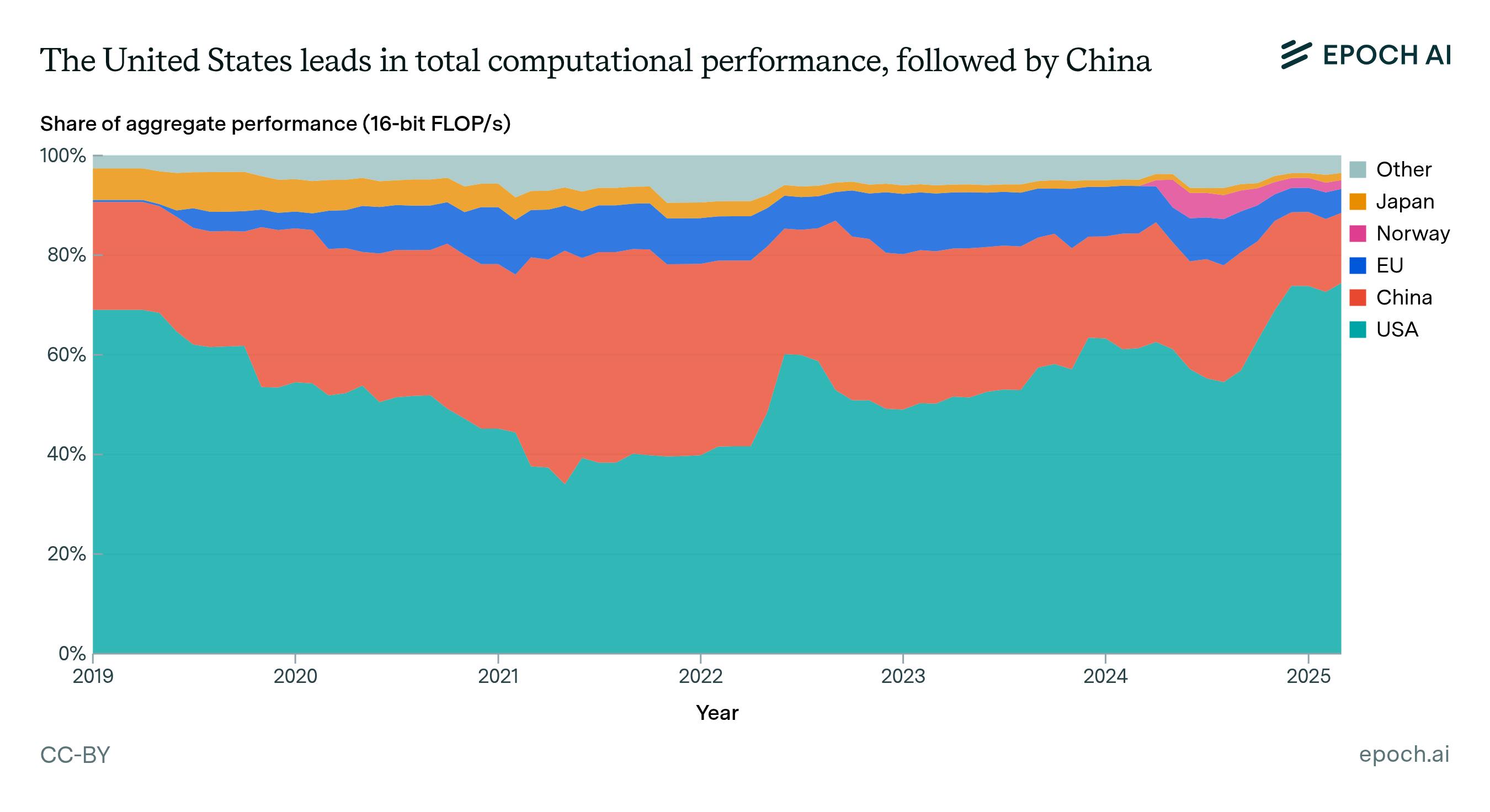

Despite the extreme volatility in export control policy across administrations, as of March 2025, the United States controls 75% of worldwide AI compute capacity, while China's share has plummeted from 37.3% in March 2022 to just 14.1% in three years.

Source: Epoch AI

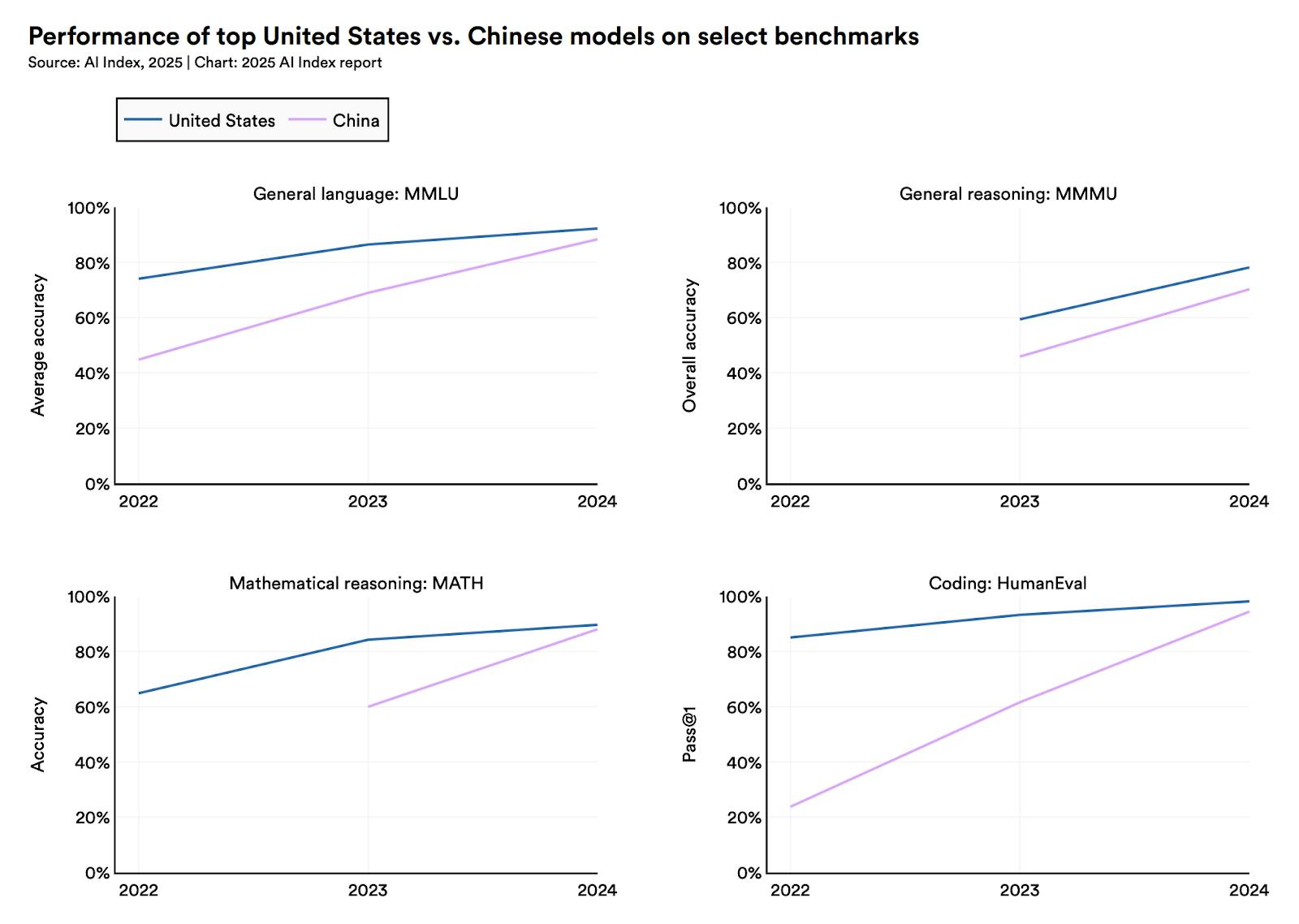

What's remarkable, however, is how this compute imbalance has translated to a surprisingly small gap in model performance. Despite operating with approximately five times less compute, Chinese models have managed to substantially close the performance gap with their US counterparts, narrowing it from "double digits in 2023 to near parity in 2024."

Source: AI Frontiers

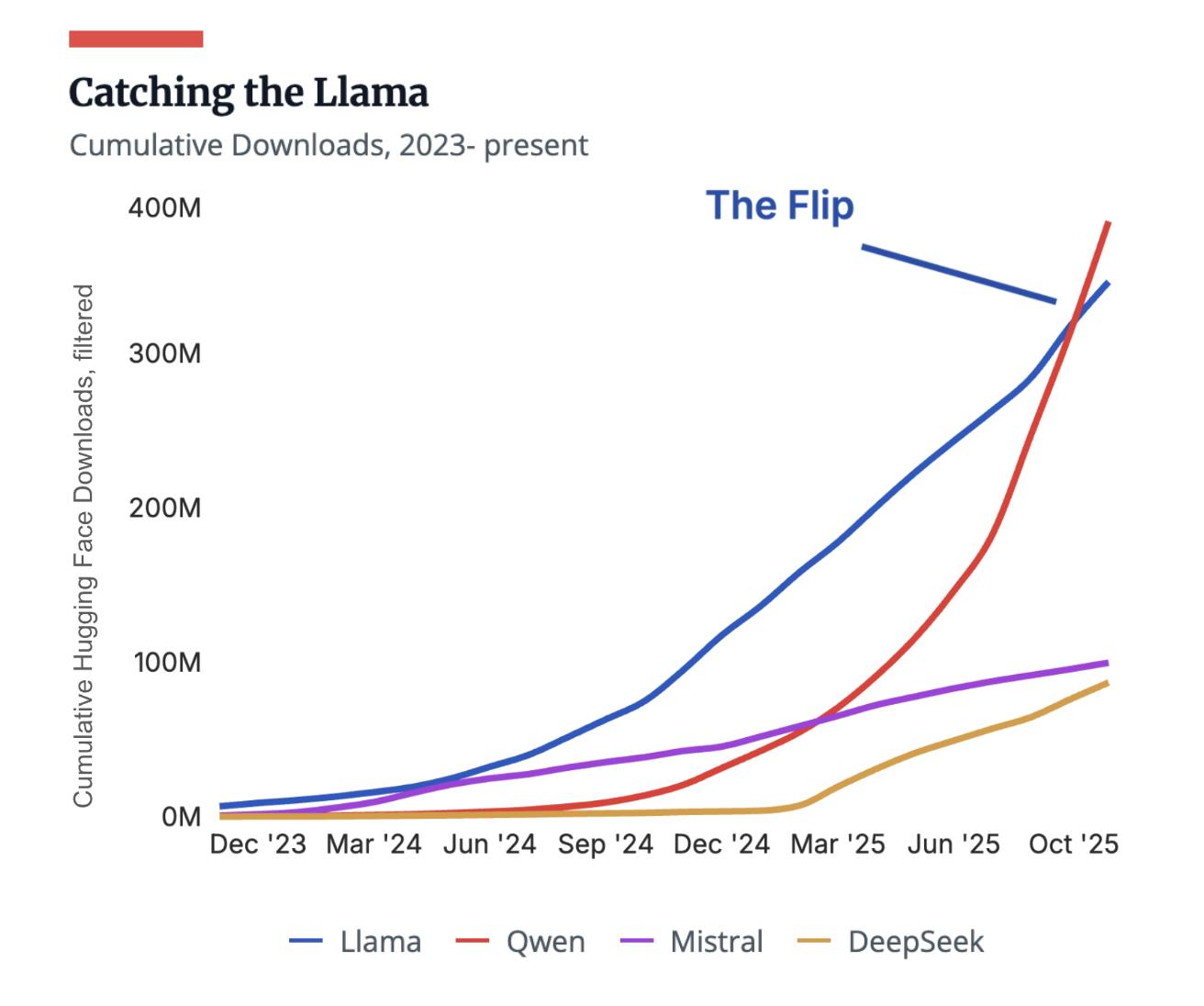

The success of Chinese models can be largely attributed to the ingenuity of Chinese AI researchers, who, constrained by limited compute, were forced to develop innovative algorithms, enabling their strongest LLMs to surpass the best US models in algorithmic efficiency. China's true edge, however, lies in the rapid adoption of its open-source models.

Source: State of AI Report 2025

As of October 2025, China has overtaken the US in monthly open-source AI model downloads, thanks to its more customizable AI tools and licensing strategies, which steer developers away from Western alternatives.

Yet, despite these advances in development and adoption, Chinese model developers still struggle with deploying models at scale due to compute shortages. Industry leaders openly acknowledge this, with DeepSeek founder Liang Wenfeng stating in a 2024 interview: "Money has never been the problem for us; bans on shipments of advanced chips are the problem." This inference bottleneck became evident in early 2025 when DeepSeek restricted API access shortly after releasing its r1 model, likely due to insufficient capacity to handle user demand; Tencent Cloud executive Wang Qi echoed this, warning that chip shortages could severely hinder nationwide AI adoption by either limiting service availability or inflating costs.

Why is China so Resilient?

Despite export controls, Chinese labs have shown remarkable resilience, outcompeting most American AI labs. This perseverance may stem from historical trauma, particularly the "Century of Humiliation" from 1839 to 1949, when Western technological dominance left lasting scars. This national memory shapes China's strategic thinking today. Relying on foreign technology is viewed as an existential threat that could expose the country to coercion.

This historical imperative drove China to establish a state-sponsored investment fund in 2014, aiming to build a self-sufficient semiconductor ecosystem. The National Integrated Circuit Industry Investment Fund expanded beyond $143 billion after US controls took effect in 2022. These investments also triggered a return of semiconductor experts, bringing valuable knowledge back to China.

Further, China has invested heavily in AI research talent, producing nearly 70% of global AI patent filings by 2023 and employing 47% of the world's top AI researchers as of May 2025. As a result, China is producing twice as many research papers on chip design and production as the US, with Chinese institutions occupying nine of the top ten spots for semiconductor research publications.

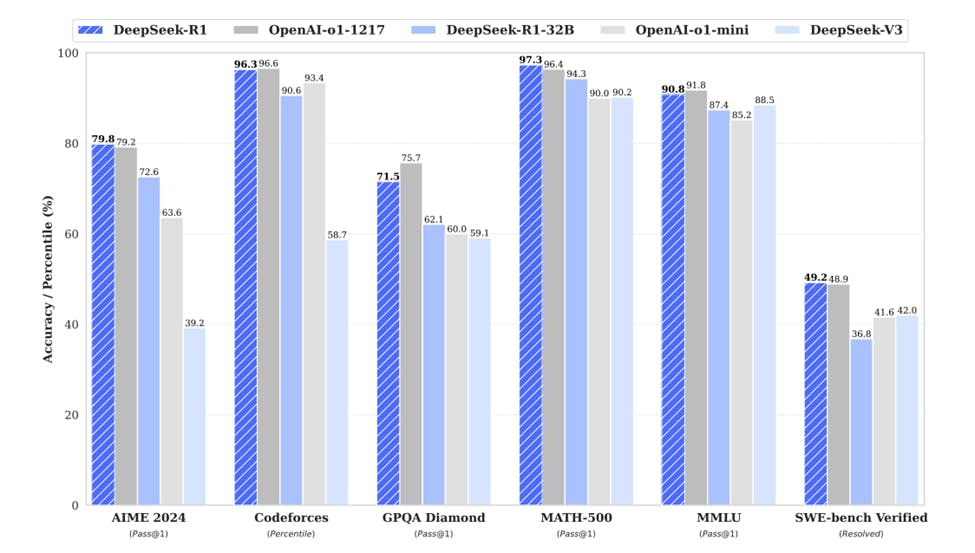

These investments have enabled Chinese AI labs to achieve remarkable results despite compute constraints. DeepSeek exemplified this through an architectural innovation that significantly reduced the compute requirements for training and inference in its R1 model. The company implemented a mixture-of-experts (MoE) architecture that, unlike traditional designs, selectively activates only the most relevant neural network components for specific tasks. This approach enabled its R1 model to be competitive with OpenAI's o1 model while using significantly less compute.

Source: 365DataScience

What’s the Optimal Export Control Policy?

Export controls have widened the compute divide but fallen short of their core objective. Chinese models have achieved near-parity with American counterparts in performance, lead in open-source adoption, and demonstrate superior algorithmic efficiency. This resilience shows that export controls alone cannot maintain American AI dominance.

With AGI unlikely in the near term, America's AI Action Plan offers the right framework: allow American chipmakers to sell older hardware, such as Nvidia's H20s, to China. This generates revenue to fund R&D while slowing China's drive toward semiconductor self-sufficiency. When Chinese labs can access adequate compute, the pressure to develop domestic alternatives diminishes. As of September 2025, the CCP is pushing Chinese companies toward self-sufficiency, even when domestic options underperform. Yet ByteDance and other tech giants prefer NVIDIA chips over domestic alternatives due to superior performance. As Dylan Patel notes, Chinese labs don't care about the domestic supply chain; they want to build the best models and deploy AI as efficiently as possible.

Yet an uncomfortable truth emerges: China's path toward semiconductor sovereignty appears inevitable. Driven by historical imperatives and backed by state investments exceeding $143 billion, China has demonstrated both the resources and resolve to overcome technological barriers. Despite export controls, China has increased its semiconductor self-sufficiency from 15% in 2019 to 25% in 2025. No export control regime, however sophisticated, can permanently constrain a nation with this level of commitment and capability.

Therefore, America should address critical domestic constraints that threaten its competitive edge. The country should support energy sector deregulation to enable rapid buildout of nuclear power and renewable infrastructure, ensuring the grid can support the massive AI deployments that will define this century. Another constraint is the patchwork of state-level AI regulations, which creates uncertainty and inefficiency. A unified federal framework would provide clarity while enabling innovation. By preparing for China's inevitable semiconductor sovereignty, the United States can ensure that when transformative AI arrives, it advances democratic values rather than authoritarian control.