In September 2025, we published The Vertical AI Playbook, a deep dive into the ways AI is being distributed. In that piece, we started with a quote from William Gibson: “The future is already here – it’s just not very evenly distributed.“

Three months later, the quote remains highly relevant to AI. The future, in the form of AI, is here. Companies are writing 50% of their code with AI, law firms are reducing parts of their headcounts by 10% because of AI, and AI companies are generating hundreds of millions of dollars in revenue in a matter of months. But it is not evenly distributed.

Among companies attempting to use AI, 42% of AI initiatives were discontinued in 2024. In a world where AI is having such transformative effects among some players and categories, why isn’t that happening in others? We previously laid out the evidence for why, in many instances, AI requires an operational transformation around how different businesses function and think about their data and workflows. In many cases, those operators aren’t up to the task. As a result, a new model has emerged to distribute AI: AI operator roll-ups. Instead of selling AI to the end operator, companies are buying the end operator and leveraging AI themselves.

There are countless examples of this playbook in the wild. Whether it’s Long Lake and Metropolis in real estate or Crete or Multiplier, or others in accounting. Typically, these examples are either (1) acquiring operators and plugging in AI, or (2) building an AI-native operator from scratch. These approaches are less about go-to-market strategy and more akin to a delivery mechanism for a drug: how do you effectively get the new thing into the existing system? Our piece primarily focused on those examples and playbooks. But there is another equally viable path: incumbent platforms, in some cases decades-old players, who are leveraging AI within their existing operations.

As we seek to illustrate the ways AI is being more evenly distributed, we felt it was advantageous to drill into these particular examples as well. As a result, we’ve written this piece as a case study of vertical AI as executed by QXO, a serial acquirer founded in 2023. Below, we lay out the core thesis of the company and how the business has evolved to more effectively implement AI into its business.

The QXO Thesis

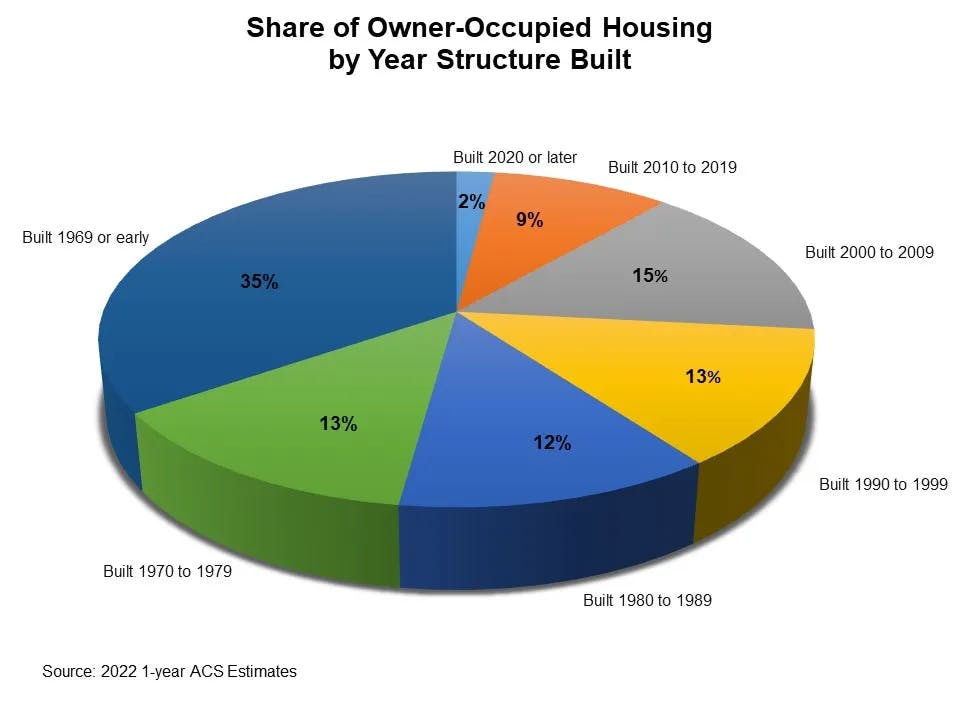

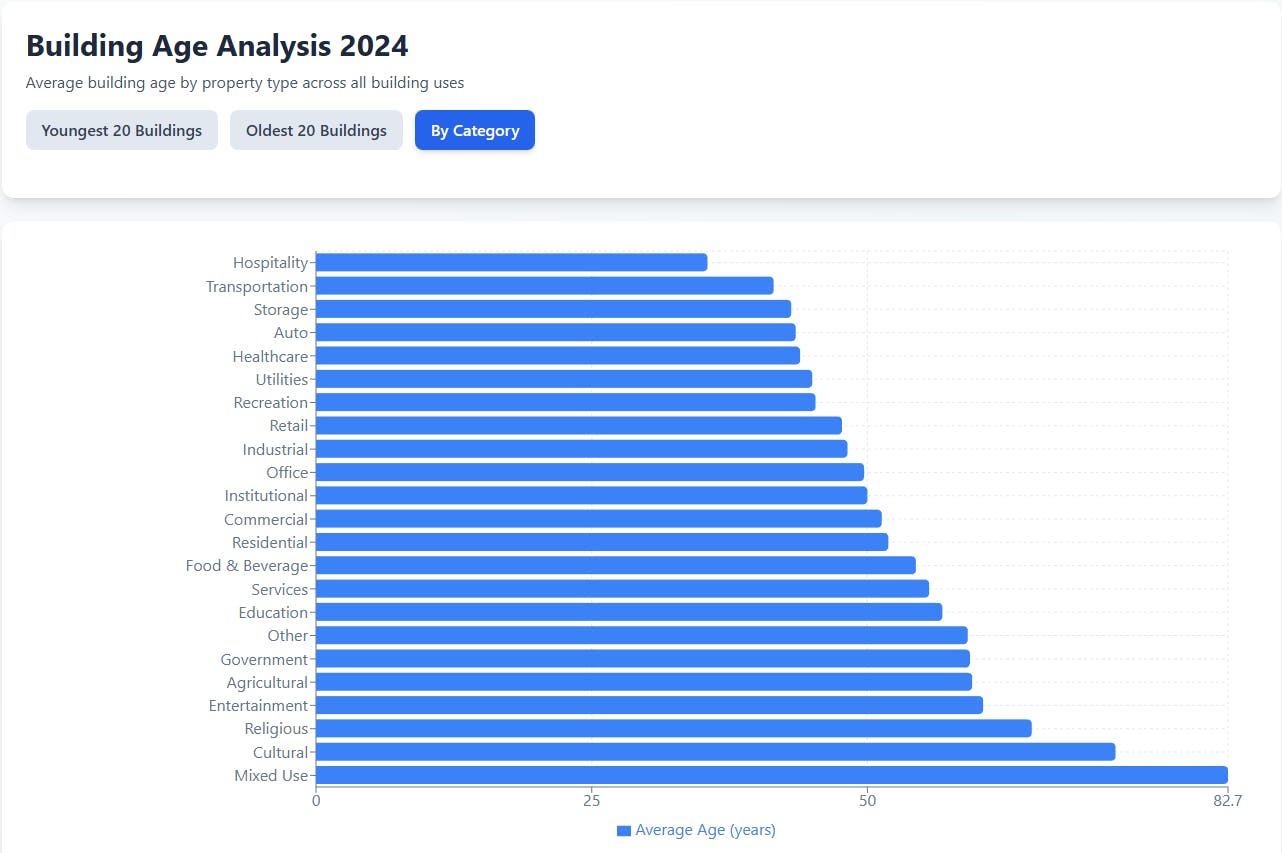

Today, the Western world is experiencing a chronic housing crisis. In 2024, the US alone faced a shortage of over 4 million homes. A construction slowdown in the 2010s, followed by a pandemic-era homebuying surge, has left housing supply depleted. As of 2024, the average US home is over 40 years old, and the average commercial building is even older at 55. Meanwhile, new housing starts have continued to fall, with new-build sales declining 9% YoY in August 2023 despite clear undersupply. The resultant housing shortage may be at the root of many second-order issues: inequality, obesity, declining fertility, climate strain, and financial instability.

Source: NAHB

Given local government bureaucracy and constraints on building new housing, a more effective solution to the housing shortage might be revitalizing our existing built environment as an alternative to new construction. This implies that renovation and repair will be the defining construction trend of the coming decade. And at the center of this ecosystem is one of the least digitized, most fragmented sectors in the industrial economy: the distribution of construction products. The global market for building materials was worth $1.5 trillion in 2024. In the US, it is dominated by regional operators, plagued by outdated systems, and still reliant on fax machines, phone orders, and human memory. Fewer than 20% of transactions occur online, and ecommerce transactions account for only 5% of total revenue.

Source: CommBuildings & Claude

QXO was established to address this exact opportunity. Founded by Brad Jacobs, who previously built United Waste, United Rentals, and XPO Logistics into multi-billion-dollar consolidators, QXO is executing a familiar but powerful playbook. The company is acquiring regional distributors, integrating their operations under a unified platform, and introducing modern software and AI to streamline logistics, optimize pricing and inventory, and automate warehouse operations.

In April 2025, the company completed its first major acquisition: Beacon Roofing Supply, a Fortune 500 distributor with over $9 billion in 2024 revenue. This transaction instantly established QXO as one of the largest players in roofing and exterior products in North America, while providing a public platform to scale further across the US and Western Europe. Over the next decade, management is targeting $50 billion in revenue through a disciplined acquisition and integration strategy.

Source: QXO

QXO is not a software company. Rather, it is a digitally native industrial operator, using technology and capital efficiency to transform an analog sector. Its model represents a compelling application of the Vertical AI Playbook: leveraging AI and automation to modernize operational workflows in large, outdated industries.

Founding Story

QXO was founded by Brad Jacobs in Greenwich, Connecticut, in December 2023, as his next long-term industrial platform. The company was conceived as a vehicle to apply Jacobs’ proven consolidation and transformation playbook to a new, under‑digitized sector of the economy.

Brad Jacobs

Brad Jacobs started his career in commodities, founding Amerex Oil Associates in 1979 and later Hamilton Resources, where he learned the fundamentals of trading and arbitrage under the mentorship of Ludwig Jesselson, the CEO of Philipp Brothers. In 1989, Jacobs shifted into industrial operations by founding United Waste Systems. His strategy focused on consolidating small waste collection companies with overlapping routes, primarily in rural areas. He took the company public in 1992 at $6 per share, and scaled it rapidly before selling it to Waste Management in 1997 at $45.42 per share, for a total price of $2.5 billion.

Source: Forbes

In 1997, Jacobs founded United Rentals, which pursued a similar consolidation strategy in the highly fragmented equipment rental industry. The company focused on heavy equipment such as excavators, scissor lifts, and telehandlers, serving construction and industrial customers across North America. United Rentals went public three months after its founding, and grew through a rollup of regional rental dealers across North America. United Rentals would go on to become the world’s largest equipment rental provider, and one of the best-performing US stocks of the 2010s, returning over 1,400% from December 2009 to December 2019.

Source: United Rentals

In 2011, Jacobs turned his attention to logistics. He invested $150 million into third-party logistics provider Express-1 Expedited Solutions, renamed it XPO Logistics, and assumed control as chairman and CEO. Under his leadership, XPO became one of the world’s largest logistics companies. Notable transactions included the $3.5 billion acquisition of Norbert Dentressangle, a French freight leader, and the $3 billion acquisition of Con-way, a top less-than-truckload (LTL) carrier in the US. Both businesses doubled their profitability within three years of acquisition, and XPO’s LTL segment alone generated over $4 billion in cumulative net cash from 2016 to 2022.

Every new company that Jacobs launched was more tech-forward than the prior one. XPO was no exception, having adopted advanced technology and having been one of the first logistics companies in the world to trial “cobots” (or collaborative robots) at its facilities. Additionally, XPO successfully captured the soaring ecommerce fulfillment demand caused by the COVID-19 pandemic, expanding driver training and operational capacity on time.

Source: XPO

XPO spun off its global contract logistics business into GXO in 2021 and its tech-enabled truck brokerage into RXO in 2022, retaining its North American less-than-truckload (LTL) focus to unlock shareholder value by creating distinct, pure-play companies. This separation allowed each entity to have its own focus, investor base, and valuation.

Across these ventures, Jacobs has raised approximately $50 billion in institutional capital. All three of his prior companies delivered significant outperformance relative to the S&P 500. His reputation for repeatable value creation, disciplined capital deployment, and operational integration has made him one of the most closely followed industrial entrepreneurs in the public markets.

Source: Koyfin

Founding QXO

After stepping back from day-to-day responsibilities at XPO Logistics in August 2022, Brad Jacobs began a top-down search for his next long-term platform. He screened 55 industries for a combination of scale, fragmentation, and operational inefficiency, looking specifically for a sector where his proven “buy, integrate, tech-enable” playbook could drive attractive returns on invested capital. His criteria were consistent with his past ventures: low digital penetration, recurring demand, and significant whitespace for consolidation.

In December 2023, a Jacobs-led investor consortium acquired SilverSun Technologies Inc., a small publicly traded ERP software company based in New Jersey. The group committed $1 billion in new capital, using the public listing as a ready-made vehicle for future acquisitions. In June 2024, SilverSun was renamed QXO and publicly announced its intent to become the tech-enabled consolidator of choice in the building products distribution industry.

From mid-2024 through early 2025, QXO raised an additional $5 billion in private placements from a mix of long-only institutional investors and strategic partners, many of whom had backed Jacobs’ prior ventures. The capital structure was designed with conservative leverage, targeting 1-2x net debt to EBITDA, providing the company with significant dry powder for acquisitions while maintaining balance sheet flexibility.

Source: QXO

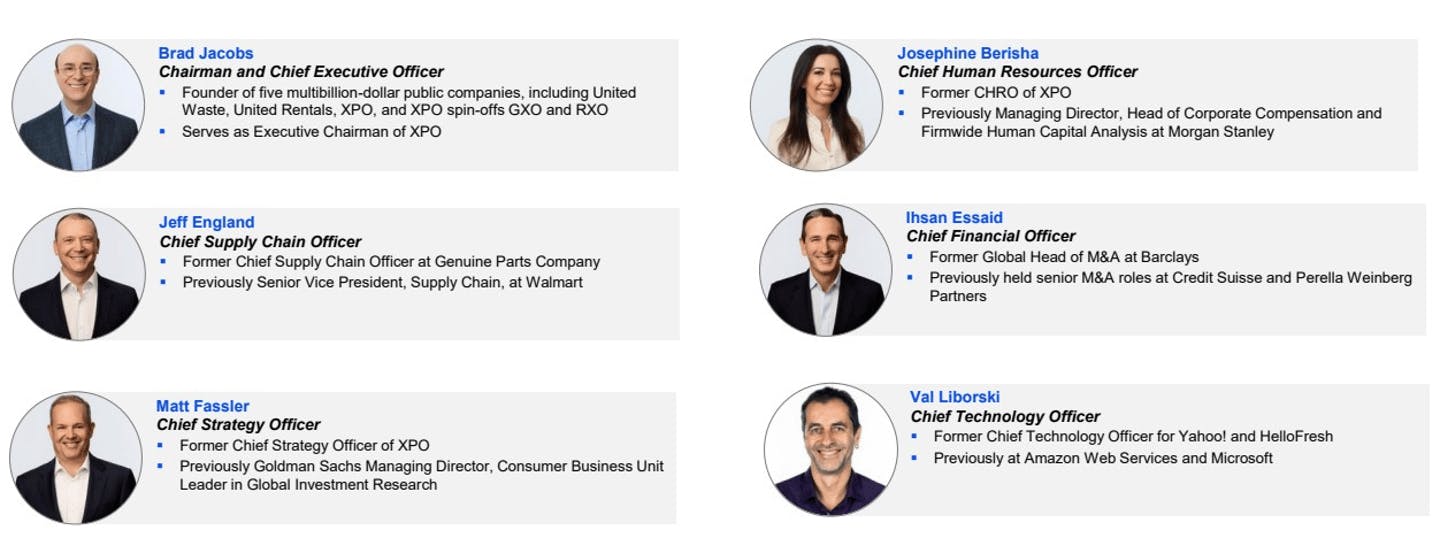

QXO assembled a 15-person senior leadership team with specific transactional and operational experience. Key hires included Ihsan Essaid, former Head of M&A at Barclays, and multiple executives who had previously helped scale XPO, GXO, and RXO. In April 2025, Val Liborski joined as Chief Technology Officer, bringing prior experience as CTO at Yahoo and HelloFresh.

QXO’s first major acquisition attempt came in September 2024, when the company submitted a $9.4 billion offer for Rexel SA, a leading French distributor of electrical parts. Rexel’s board rejected the offer, stating that it significantly undervalued the company and its long-term value creation potential. While unsuccessful, the bid signaled QXO’s ambitions to expand into Europe and consolidate a broad range of building-related distribution verticals.

Beacon Roofing Supply

Beacon Roofing Supply has long been a foundational player in the North American building products landscape. Founded in 1928 in Charlestown, Massachusetts, the company began as a small regional supplier with just 32 employees. Over the next nine decades, Beacon steadily expanded its footprint through both organic growth and acquisitions, emerging as one of the most trusted distributors of roofing and complementary building materials for residential and commercial contractors.

Source: QXO

Over the second half of the 20th century, Beacon expanded across New England, eventually diversifying from commercial roofing into residential products and opening multiple branches across the region. By 1997, it had grown to seven branches and generated approximately $72 million in annual revenue.

That same year, private equity firm Code, Hennessy & Simmons acquired a majority stake in the company. This marked the beginning of an aggressive consolidation strategy. Beacon began acquiring regional distributors across North America, starting with Quality Roofing Supply in Pennsylvania, and continued to roll up operators in the US and Canada. Some of the companies Beacon bought included Best Distributing in North Carolina, The Roof Center in Maryland and Virginia, and Groupe Bedard in Quebec.

Source: QXO

By 2004, Beacon had surpassed $500 million in revenue and completed its initial public offering. The public capital base enabled further M&A. Over the next decade, Beacon continued to grow both organically and through acquisitions, entering new markets in the Midwest, Southeast, and Western Canada, and surpassing $2 billion in annual revenue by 2012.

Source: Beacon

By 2024, Beacon had grown to over 8K employees and operated more than 600 locations across the US and Canada. With annual revenues exceeding $9 billion, it was the only specialty roofing distributor publicly listed in the US and the only one to achieve Fortune 500 status. Beacon’s scale, operational footprint, and deep contractor relationships made it a critical link in the building products supply chain. However, despite its scale, Beacon remained operationally analog in some areas. Ordering systems were largely offline, branch operations varied by region, and digital tools like Beacon PRO+ had yet to reach widespread adoption. This made Beacon a compelling target for QXO’s platform strategy.

Source: Claude & Companiesmarketcap

In November 2024, QXO initiated its acquisition effort for Beacon Roofing Supply, submitting direct proposals to Beacon’s board and management for an all-cash buyout at $124.25 per share, or $11 billion as a total offer price. This represented a substantial premium above Beacon’s historical trading levels, although at a discount to industry comparables. The deal valued Beacon at 12x forward EV/EBITDA, well below the 16-18x multiple paid by Home Depot in 2024 for SRS Distribution, a peer of similar scale. Analysts from Chain Bridge Research and others estimated fair value in the $140-$204 per share range.

Despite multiple engagement attempts and reiterations of the premium offer throughout November and December 2024, Beacon’s board responded with defensive maneuvers. In January 2025, Beacon adopted a poison pill to block QXO’s tender offer and repeatedly delayed negotiations by claiming they were exploring alternative buyers. No other credible bidders emerged during this period.

In January 2025, QXO publicly announced an $11 billion tender offer for Beacon Roofing Supply, complete with fully secured financing and no due diligence contingency. Beacon’s board rejected the offer on February 6th, characterizing it as undervaluing the company, despite insiders having sold shares below QXO’s bid. QXO responded by contesting Beacon’s anti-shareholder tactics, emphasizing its accretive proposal and Beacon's historical underperformance versus industry peers. The acquisition campaign evolved into an activist confrontation, with QXO urging shareholders to decide the company’s future and announcing plans to nominate independent directors at Beacon’s 2025 annual meeting should the board continue to block the transaction.

Beacon and QXO reached a definitive agreement on March 20th to proceed with the acquisition at $124.35 per share, valuing Beacon at approximately $11 billion. Beacon’s board unanimously endorsed the transaction and withdrew its defensive measures. QXO completed the acquisition in April 2025, merging Beacon into QXO, paying remaining shareholders in cash.

This marked the first major transaction in QXO’s rollout, and provided the company with immediate revenue scale, nationwide distribution infrastructure, as well as a credible platform from which to build, all of which can now be served more efficiently through technology-forward workflows. Unlike most companies in the Vertical AI Playbook, which prove value before acquiring, QXO bought first, yet shares the same goal of reshaping operations by applying modern technology to a digitally underdeveloped industry.

QXO Today

In June 2025, QXO made a bid to acquire GMS Inc., a leading US distributor of gypsum wallboard and related building products, at $95.20 per share or a total price of approximately $5 billion. The acquisition would have expanded QXO’s portfolio into interior construction materials, adding both product and customer diversification. However, QXO was ultimately outbid by SRS Distribution, a subsidiary of Home Depot, which offered $110 per share, or a total price of $5.5 billion. Rather than engage in a bidding war, QXO chose to walk away, reinforcing its commitment to price discipline and return thresholds.

As of Q3 2025, QXO maintained a formidable balance sheet with $2.3 billion in cash and a net leverage ratio within its 2x target. The company’s capital structure gives it substantial flexibility to pursue both large platform acquisitions and smaller tuck-ins. The company is actively evaluating a pipeline of targets across roofing, siding, drywall, and specialty building products. With a strong operating team in place, proprietary sourcing channels, and a centralized technology stack built to scale, QXO is positioned to become the digital operating system for the $800 billion building products distribution industry.

Company Overview

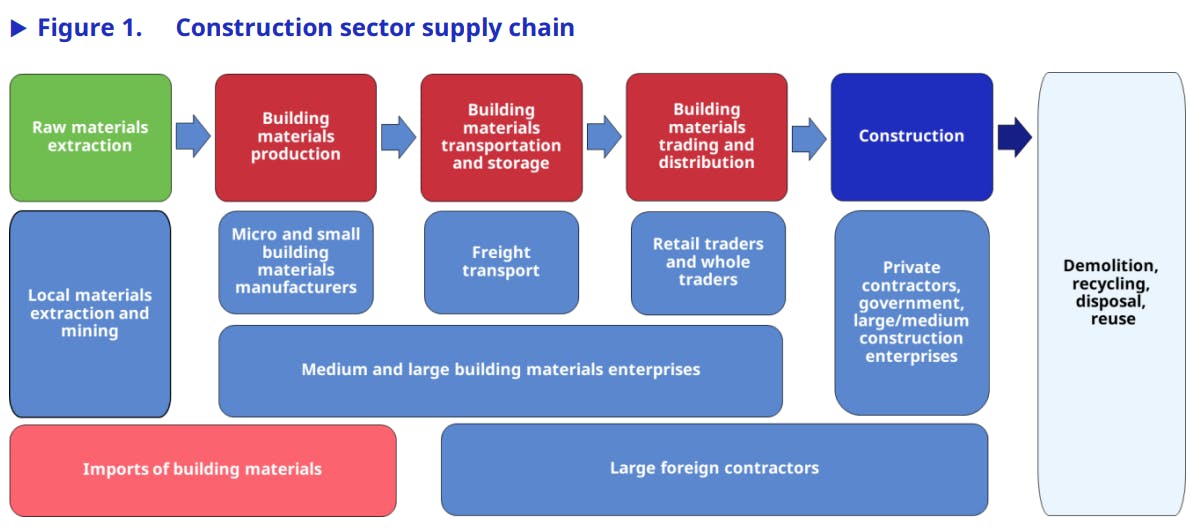

The building materials supply chain sits at the center of the broader construction ecosystem, connecting upstream manufacturers and downstream contractors. The value chain begins with raw materials extraction and manufacturing, moves through distribution intermediaries, and ultimately reaches construction firms and end projects. Within this chain, building materials distributors function as critical logistics hubs, aggregating thousands of products from manufacturers and ensuring last-mile delivery to job sites under time-sensitive and weather-dependent conditions.

Source: ILO

QXO operates in the trading and distribution node of this value chain, handling freight, warehousing, and local jobsite fulfillment across both residential and commercial construction markets. It acts as a procurement and logistics partner to over 100K contractors across North America, supporting the full lifecycle of construction activity, from new builds to long-tail renovation and repair. Beacon’s 2024 network alone completed 1.4 million deliveries using a fleet of more than 2.4K CDL trucks, most equipped with cranes and hydraulic booms for rooftop material placement.

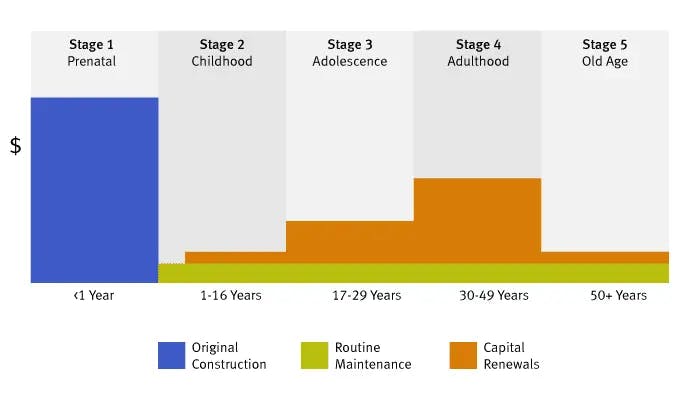

The typical building goes through five life stages, from initial construction to decades of upgrades, capital renewals, and eventual demolition. Data from RDH shows that the vast majority of spending occurs after the original build, driven by maintenance, retrofits, and capital improvements. Buildings aged 30+ years, a category that now represents the majority of US housing stock, enter a prolonged phase of roof replacements, HVAC upgrades, siding overhauls, and envelope repairs; all core revenue drivers for QXO.

Source: RDH

Approximately 80% of roofing demand is re‑roofing activity, which is tied to required maintenance rather than discretionary construction. This long tail of lifecycle demand creates consistent, recurring business for building materials distributors. It also insulates QXO from cyclical housing starts and positions it to benefit from aging infrastructure across both residential and commercial markets.

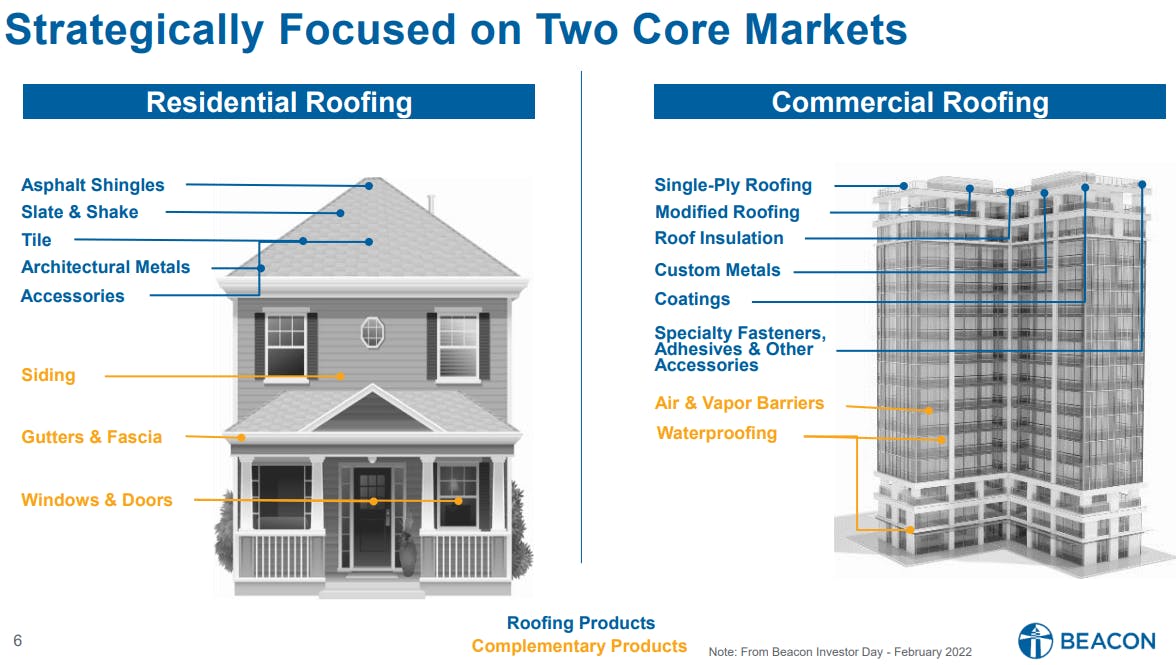

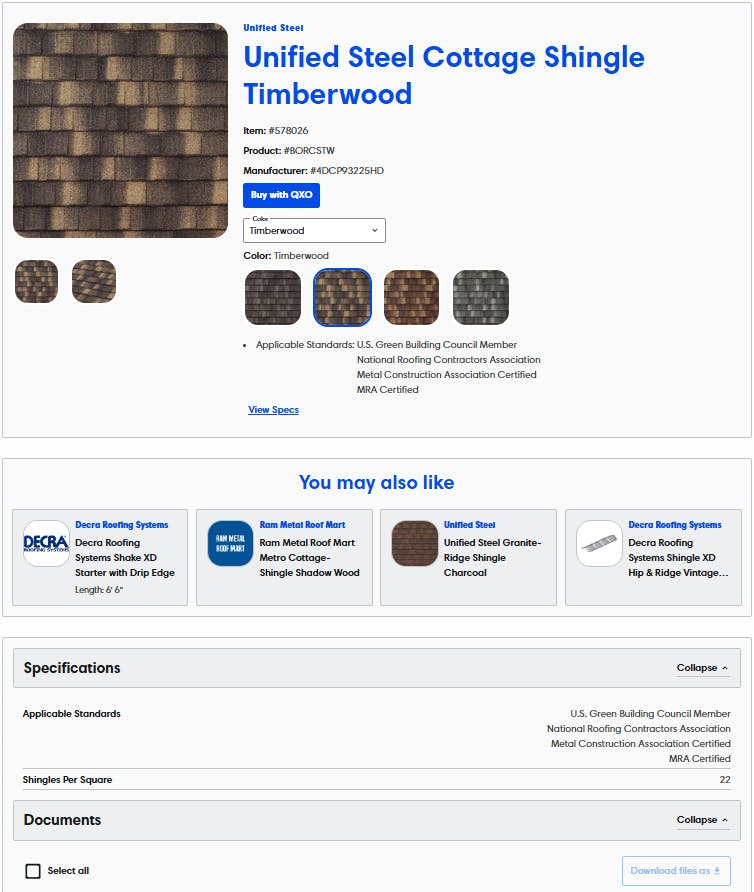

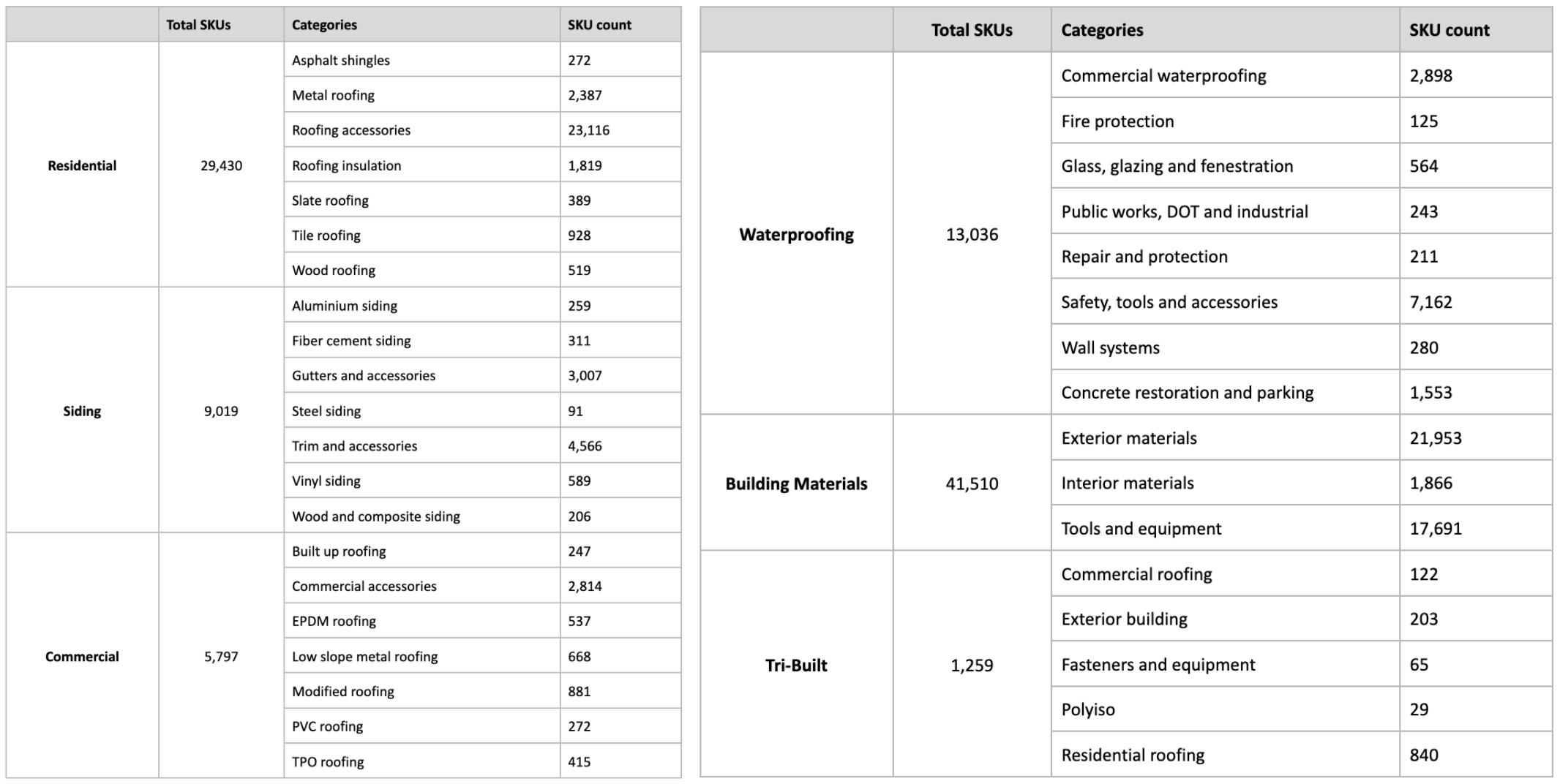

QXO’s current operational scope was established through the April 2025 acquisition of Beacon Roofing Supply, which gave the company a prominent position in roofing and complementary exterior building products. Its core product segments include residential roofing (asphalt shingles, tile, slate), commercial roofing (single-ply, modified bitumen, insulation), and complementary SKUs such as siding, windows, gutters, waterproofing, and fasteners.

Source: Beacon

These products are high-velocity, critical consumables with regular replacement cycles. Many are also heavy, bulky, or weather-sensitive, making distribution efficiency and jobsite timing a key customer value prop. As of December 2025, QXO operates more than 600 branches across the US and Canada, inherited from Beacon’s legacy network. In 2024, approximately 97% of Beacon’s revenues were generated in the US, with Canada accounting for the remaining 3%. This physical footprint enables next-day delivery to most major metro areas and construction hubs across North America.

The roofing and exteriors distribution industry generates roughly $60 billion in annual sales across the US and Canada. Despite significant consolidation, the top three distributors (Beacon, SRS, and ABC) control only about 70% of the market, leaving thousands of regional and local operators. Unlike centralized ecommerce logistics models, building product distribution is hyperlocal by design. Contractors require just-in-time material delivery, region-specific inventory, and credit relationships that are often managed branch by branch. QXO’s network is optimized for this reality and is further differentiated by its fleet ownership, jobsite delivery services, and in-stock levels, all of which are essential to maintaining contractor loyalty.

This mix of hyperlocal operations and industry fragmentation reflects the conditions described in the Vertical AI Playbook, where AI is most effective when applied through ownership and internal change. By acquiring incumbents, QXO gains the control needed to embed automation and standardize workflows, similar to how parking startup Metropolis modernized SP Plus’s branch-based operations after its acquisition.

Source: Beacon

Following the acquisition, QXO has begun centralizing Beacon’s procurement across its top 20 vendors, who represent roughly 70% of total spend, while preserving local customer relationships. This hybrid structure creates a powerful combination of cost leverage and customer intimacy.

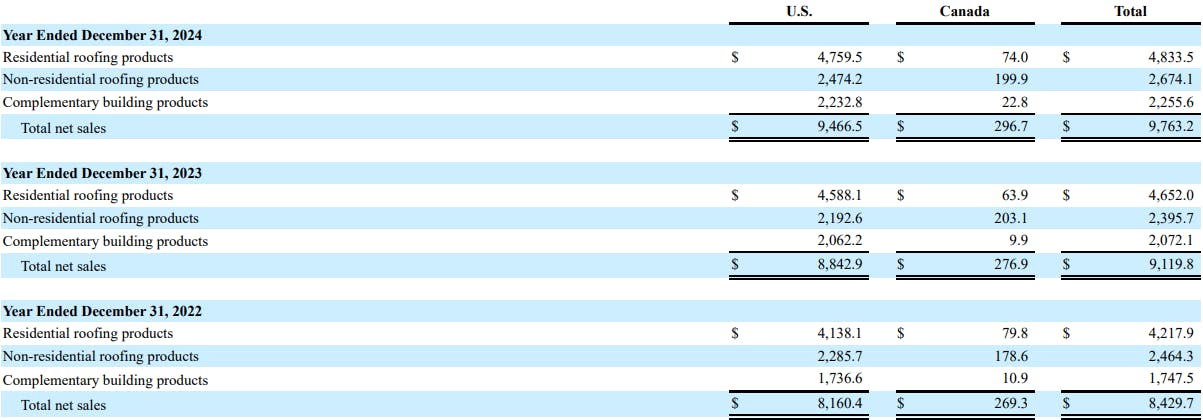

Over the past three years, Beacon’s revenues have grown steadily from $8.4 billion in 2022 to $9.8 billion in 2024, representing a 7.6% CAGR. While residential roofing has consistently accounted for around 50% of revenue, complementary building products have been the fastest-growing category, expanding from 20.7% of sales in 2022 to 23.1% in 2024.

Source: Beacon

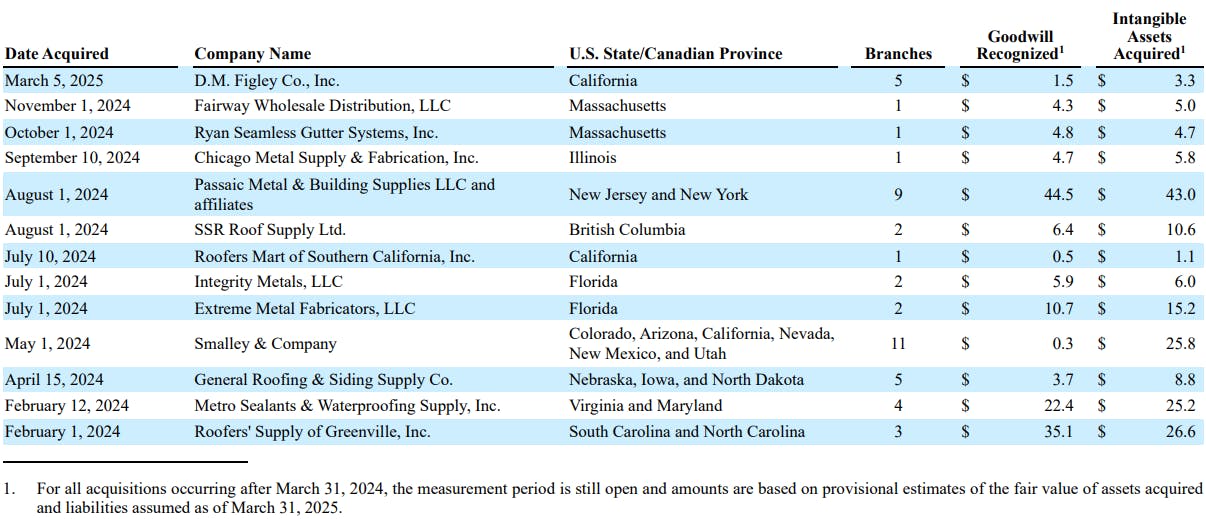

Prior to being acquired by QXO, M&A has been an important part of Beacon's growth strategy. Between January 2022 and December 2024, the company added 85 new branches through 26 acquisitions, contributing over $1.1 billion in acquired sales. In 2024 alone, Beacon generated $414 million in inorganic revenue (roughly 4.25% of total sales) across 12 acquisitions, each averaging $35 million in annual revenue. While overall top-line growth slowed from 8.2% in 2023 to 7.1% in 2024, the vast majority of that deceleration came from a softening in organic growth, which dropped to just 2.6%.

Source: Beacon

As outlined in the Vertical AI Playbook, low-margin sectors with labor-heavy workflows offer ideal terrain for vertical AI rollups. Building products distribution is a structurally low-margin business. Beacon’s cost of goods sold consistently comprised over 74% of revenue from 2019 to 2024, leaving gross margins in the 24-26% range. While modest in absolute terms, even small improvements in gross margin can meaningfully impact profitability at scale.

Operating expenses are significant, particularly SG&A, which represented 16.8% of revenue in 2024. This reflects the labor-intensive nature of the business, including Beacon’s 1,800+ salespeople. As of December 2024, Beacon employed 8,068 staff, a figure that Jacobs noted has remained stable post-acquisition. However, the composition has shifted. QXO leadership removed roughly 250 mid- and senior-level roles to flatten the org and reduce overhead, while simultaneously investing in frontline roles across sales, warehouse ops, and delivery logistics, alongside new hires in procurement and technology.

Beacon has historically delivered consistent EBITDA performance, with margins averaging 8.5-10% in recent years. In 2024, EBITDA reached $867 million, representing an 8.9% margin. Net income came in at $361 million, up from a loss in 2023 due to a $414 million repurchase premium paid to the holders of Beacon’s preferred stock. Management has signaled an intention to expand margins over time by centralizing procurement, reducing SG&A as a percentage of sales, and layering in software and automation across the business.

Product

QXO’s current catalog spans over 135K SKUs, serving the needs of residential and commercial contractors across North America. 100K of these SKUs were available online as of December 2025. Despite the size of the catalog, the business exhibits a classic long-tail profile; roughly 4% of SKUs drive approximately 80% of total sales, reflecting the high velocity of core materials like shingles, insulation, sealants, and siding components.

Source: QXO

The company is strategically focused on roofing and complementary exterior products, with top-selling categories including residential roofing, siding, commercial roofing, waterproofing, complementary building materials, and TRI-BUILT, QXO’s private label brand.

Source: QXO

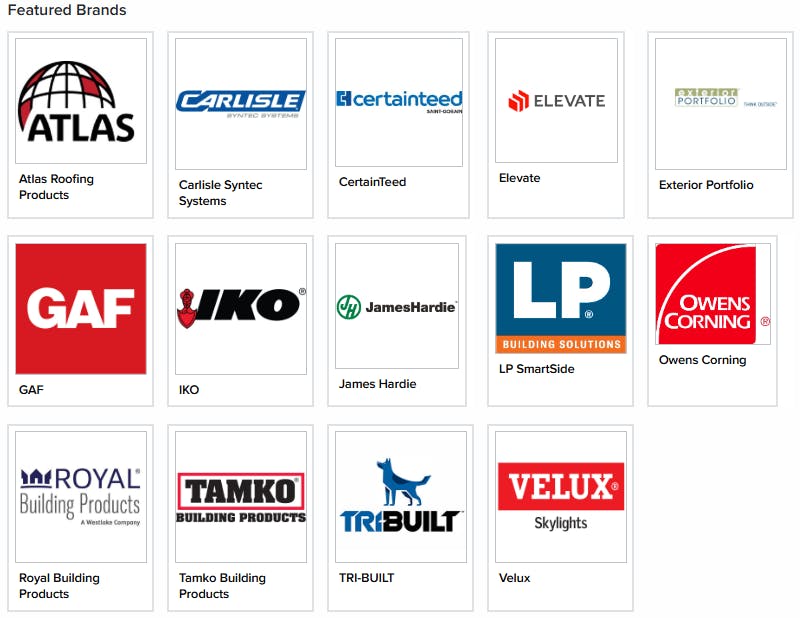

QXO maintains vendor relationships with the leading brands in the category, including GAF, Owens Corning, IKO, CertainTeed, Atlas, TAMKO, Carlisle, James Hardie, LP SmartSide, and Elevate. To supplement third-party brands, QXO also offers a growing portfolio of private-label products under the TRI-BUILT brand. These include roofing accessories, sealants, underlayments, and fasteners, which are high-margin consumables that allow QXO to offer pricing flexibility while improving gross profitability. The TRI-BUILT line is actively expanding and serves as a strategic lever for margin optimization and channel control.

Source: QXO

Technology

QXO is positioning itself as a tech-enabled operating platform for the building trades. Technology is being applied across both the frontend customer-facing experience and backend internal operations.

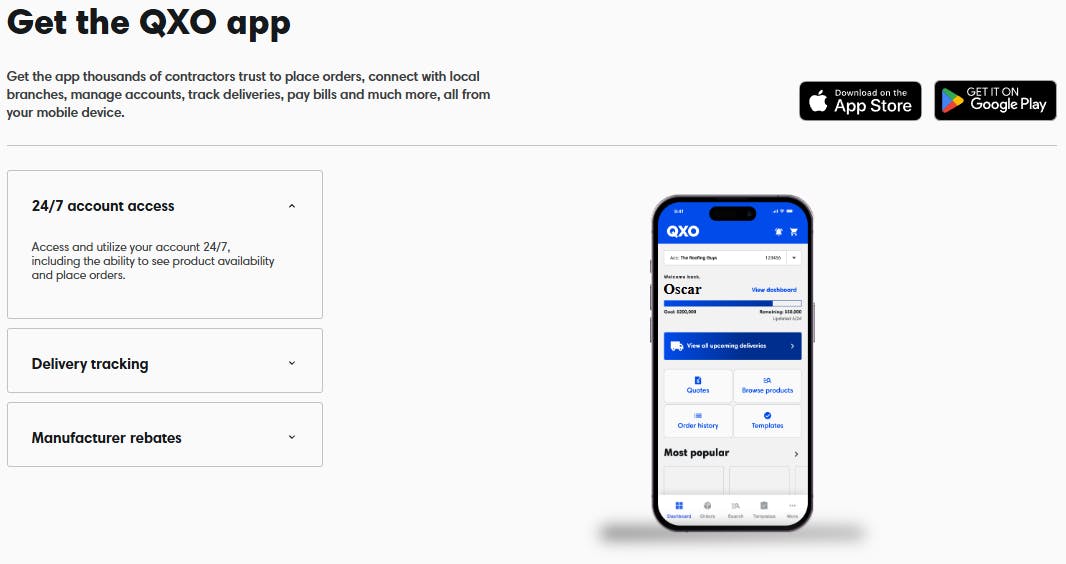

QXO’s customer-facing software suite, QXO Online, is designed to serve as a digital command center for contractors managing roofing and exterior construction businesses. At its core, the platform allows contractors to browse real-time inventory, access dynamic pricing, and place orders for delivery to job sites. But its functionality goes well beyond simple procurement. QXO has layered in a number of high-utility tools that align with how contractors actually manage their businesses:

Delivery tracking provides real-time status updates, proof of delivery, and optional SMS/email alerts, reducing time wasted on-site and increasing scheduling reliability. Users can monitor multiple deliveries in parallel and receive advance notice of upcoming drop-offs.

Order history offers always-on access to past invoices and transaction records, covering both branch and digital orders. Up to five years of order data is stored and easily exportable, giving contractors a digital paper trail for project documentation and financial reporting.

Storm tracking integrates weather maps and street-level impact data into the QXO interface. Contractors can identify storm-affected regions and generate reports for sales teams to mobilize quickly, an especially valuable tool in the insurance restoration segment.

Ordering templates functions like reusable checklists for frequently purchased materials. This reduces human error, accelerates jobsite prep, and helps prevent costly return trips due to incomplete orders.

Online bill pay and accounting tools, powered by integration partners like BillTrust, allow users to schedule payments, view statements, and sync invoice data with accounting systems like QuickBooks and Peachtree.

Manufacturer rebate tracking is built directly into the user dashboard. Contractors can register once and then track rebate eligibility and payment status automatically, with item-level invoice matching. Whether the purchase was made in-store or online, QXO’s system reconciles it.

The experience is optimized for both desktop and mobile, with the QXO app available on iOS and Android. Growth in traffic suggests increasing adoption: the platform saw 240K visits in September 2025, up from 170K in July. QXO is leaning into this traction by expanding its in-house digital team and continuing to roll out new feature modules tailored to contractor workflows.

Source: QXO

These capabilities are available via desktop and a mobile-native app, launched in 2024 and now a growing touchpoint for contractor engagement. QXO’s website saw 240K visits in September 2025, up from 170K in July, reflecting growing usage among its 100K customer base.

Internally, QXO is building a fully integrated tech stack designed to unify its national footprint and optimize operations. Current systems include:

CRM to manage customer relationships and field sales activity

Pricing engine with AI-assisted margin optimization

ERP for finance and inventory visibility

WMS (Warehouse Management System) to optimize picking, packing, and loading

TMS (Transportation Management System) for route optimization and fleet tracking

S&OP tools for demand forecasting, automated replenishment, and inventory planning

BI tools for real-time dashboards and analytics

HRIS to streamline workforce management and talent planning

As of September 2025, QXO is integrating these systems across the Beacon network while layering in AI-powered enhancements, particularly around quote generation, demand planning, quote generation, demand forecasting, dynamic pricing, and logistics. The company is also embedding AI agents to support field sales. This infrastructure forms the backbone of QXO’s strategy to build a digital moat in an industry still largely reliant on phone orders and manual processes. As Brad Jacobs has said:

“If you want to make a lot of money in almost any industry, plan to invest heavily in technology.”

Market

QXO’s customer base of over 100K is highly diversified, spanning professional contractors, home builders, building owners, retailers, and lumberyards across North America. The majority of revenue is driven by small and mid-sized contractors, many of whom operate in a single region and depend on QXO for fast, local access to roofing and exterior materials. At the same time, the company serves larger builders and national construction firms executing complex, multi-site projects. Customers vary widely in size and purchasing frequency, but share a common need for reliable, timely delivery of job-critical materials. QXO supports them throughout the entire project lifecycle, from scoping and estimating to fulfillment, billing, and close-out, reinforcing long-term customer relationships and retention. Notably, no single customer accounts for more than 1% of total revenue.

While QXO’s initial focus remains on roofing and exterior products, where the addressable market exceeded $60 billion in 2024, its long-term ambitions go much further. In Q2 2025, QXO defined its opportunity as the broader $800 billion building products distribution industry, which includes siding, drywall, insulation, windows, fasteners, millwork, and other construction supplies sold through professional channels.

Competition

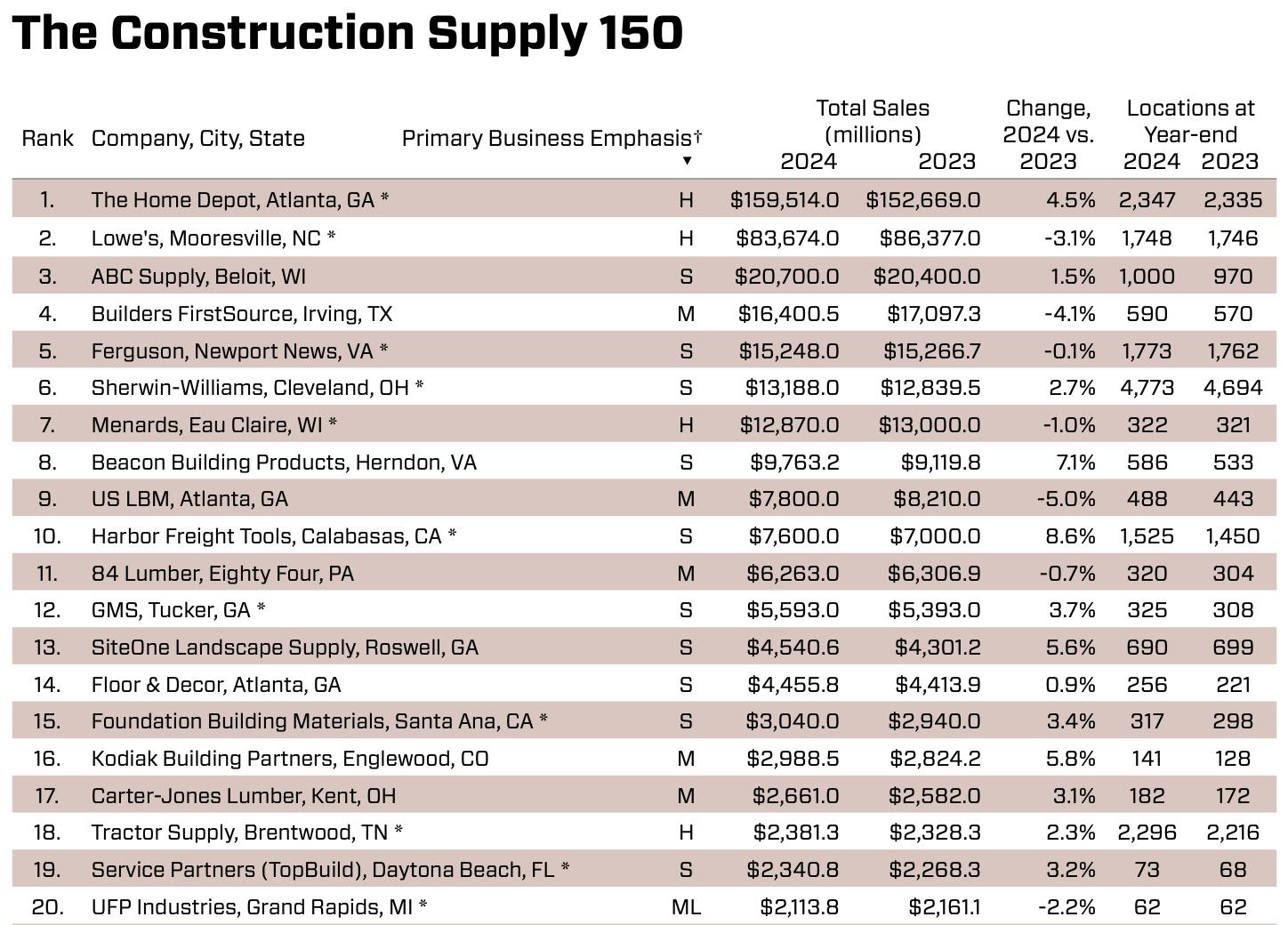

The North American building materials distribution market remains fragmented despite recent consolidation, with no single player holding a dominant share across all verticals. QXO currently ranks fourth among distributors by estimated 2024 revenue, following ABC Supply, Builders FirstSource, and SRS Distribution, now a subsidiary of Home Depot.

Source: Webb Analytics

Home Depot

Home Depot is the largest home improvement retailer in the world, with over $159 billion in 2024 revenue. While best known for its retail presence across over 2.3K locations in the US, Canada, and Mexico, the company has started expanding into the professional contractor and distribution space. In 2024 and 2025, it made two large acquisitions: SRS Distribution and GMS Inc., two of the biggest specialty distributors in roofing, drywall, and related building materials.

SRS Distribution, with estimated revenues of $10-11 billion, operates across over 750 branches and serves roofing, landscaping, and pool contractors through a network of specialized banners (e.g., Roofline, Heritage, B&L). The acquisition marked Home Depot’s most significant move yet into contractor-facing distribution, giving it last-mile capabilities, delivery fleets, and deep product category depth. Shortly after, Home Depot outbid QXO for GMS, acquiring the $5.5 billion drywall and ceilings distributor to further consolidate its footprint.

The integration of SRS and GMS into Home Depot’s ecosystem creates a formidable hybrid model, combining retail reach, digital muscle, and branch-based distribution under one roof. This puts competitive pressure on QXO, which now finds itself going head-to-head with the best capitalized and one of the most digitally enabled operators in the space.

Source: SRS Distribution

ABC Supply

ABC Supply is the largest dedicated building products distributor in North America, with estimated 2024 revenues of $20.4 billion. Privately held and headquartered in Beloit, Wisconsin, ABC has built an extensive branch network spanning more than 800 locations across the US. It focuses primarily on exterior building materials, particularly roofing, siding, and windows, serving residential and commercial contractors through a decentralized, relationship-driven model.

Founded in 1982 and operated for decades under the leadership of Ken and Diane Hendricks, ABC has pursued a methodical acquisition strategy, quietly consolidating regional distributors while maintaining strong contractor loyalty. As of December 2025, ABC is pursuing further acquisitions in the building products distribution industry. Its scale, pricing power, and private ownership structure allow for long-term decision-making and margin discipline, even in cyclical environments.

ABC’s digital stack emphasizes integrations with industry software like EagleView, AccuLynx, JobNimbus, and HOVER. Features like delivery photo confirmation, storm tracking, and jobsite-specific order templates closely mirror QXO’s offering. Beyond software, ABC actively invests in its brand and community presence. Its YouTube channel showcases recruiting efforts, philanthropic partnerships, and short-form storytelling campaigns aimed at celebrating its workforce and contractor community.

Source: X

Lowe’s

Lowe’s is one of the largest home improvement retailers in North America, with over 1.7K locations across the US and Canada and over $83 billion in 2024 revenue. While best known for its consumer-facing retail operations, Lowe’s serves a significant and growing share of professional contractors, particularly smaller builders, remodelers, and maintenance crews through its Lowe’s Pro division. This includes tiered loyalty programs, volume-based pricing, jobsite delivery, tool rental, and credit financing tailored for tradespeople.

Its tech platform supports online ordering, inventory visibility, and project management tools, but remains oriented around smaller trades and DIY customers. Compared to Home Depot, which dominates the Pro segment with deeper logistics and services, and QXO, which exclusively serves trade professionals with a purpose-built distribution model, Lowe’s remains more retail-driven and design-centric.

Source: Business Insider

Builder’s FirstSource

Builders FirstSource is the largest US supplier of structural building products and manufactured components, generating $16.4 billion in 2024 revenue across more than 585 locations. The company serves a broad mix of customers, from national production builders like D.R. Horton and Lennar, to regional developers, custom homebuilders, and remodeling contractors.

BFS stands apart through vertical integration. In addition to distributing lumber and core materials, it manufactures roof trusses, wall panels, millwork, and other prefabricated components used in residential construction. It also offers design collaboration and project scheduling services through its digital tools.

Management & Capital Allocation

QXO is led by a high-conviction operator team with experience across procurement, logistics, and industrial M&A. Beacon’s management held just 1.4% of the company’s common stock prior to its acquisition, which is typical for a mature public distributor but misaligned with long-term value creation. In contrast, QXO’s senior team and the board collectively held 35% of the company as of September 2025. This concentrated ownership creates tight alignment with long-term shareholders. Executive compensation is structured around equity with long lockups and total shareholder return incentives, benchmarked against the S&P 500. The stated goal is to compound value over decades, as opposed to optimizing for quarterly earnings.

CEO Brad Jacobs takes a disciplined, long-term approach to M&A. He emphasizes buying based on intrinsic value instead of projected synergies, and focusing on how much operating profit his team can unlock post-acquisition. At his previous companies, Jacobs doubled the profits of acquired businesses within three years. For QXO, he’s using a more conservative five year target, until the playbook is proven in the building materials sector. He also adjusts acquisition expectations based on QXO’s evolving cost of capital, noting that the company has raised equity at progressively higher share prices ($9 to $22 per share). In his view, this has earned investor trust and given QXO the “currency” to scale its M&A flywheel.

When Jacobs was asked how he views Home Depot and Lowe’s, he described them as exceptionally well-run companies with strong brands, deep customer relationships, and advanced supply chain operations. He’s worked with both as a vendor in previous ventures and speaks highly of their operational execution. However, when it comes to M&A in building products distribution, Jacobs acknowledges that they are likely to outbid QXO on many targets, simply because they operate under different strategic mandates and valuation thresholds.

That said, Jacobs does not view this as a disadvantage. At United Waste, United Rentals, and XPO, Jacobs consistently faced off against much larger competitors, such as Waste Management, UPS, FedEx and Ashtead, and still managed to execute highly accretive consolidation strategies. He believes the same playbook applies at QXO: disciplined underwriting, operational improvement, and a long-term orientation. As Jacobs put it:

“If we aren’t losing bids on deals, we’re bidding too high. We’ll remain disciplined on purchase price because that’s part of how to create massive shareholder value.”

Risks

We’ve laid out QXO’s overall business and the company’s operating principles around balancing price discipline, financial stability, and network effects while also leveraging new-age technology, particularly around use cases like AI for price optimization. As models like that of QXO, the world will see AI become more effectively distributed. But the reality of that vision doesn’t come without critics. As a result, below we’ve laid out some of the critical criticisms as QXO’s model emerged.

Acquisition Integration & Execution Risk

QXO’s long-term strategy depends on the successful integration of acquired businesses into a unified platform. With Beacon alone adding 8K employees and over 600 branches, the operational complexity is significant. Challenges range from cultural alignment to realizing targeted synergies. While Jacobs has a track record of integration success, this is the first time he is applying his model in the building products space, and results may take longer than past ventures to materialize.

This is especially critical given the historical dynamics of Beacon, whose growth over the past several years leading up to the takeover heavily leaned on acquisitions. From 2022 through 2024, acquired branches accounted for the majority of incremental sales, while organic growth, including greenfield expansion, hovered in the low single digits.

Discipline vs Growth Tradeoff

Jacobs emphasizes capital discipline and has declined to overpay in competitive bidding scenarios (e.g., GMS, which was acquired by Home Depot). While this reinforces a commitment to shareholder value, it could slow QXO’s inorganic growth pace, especially as strategic buyers like Home Depot and Lowe’s become more active in distribution. If QXO fails to maintain a robust M&A pipeline or is consistently outbid, its consolidation thesis may stall.

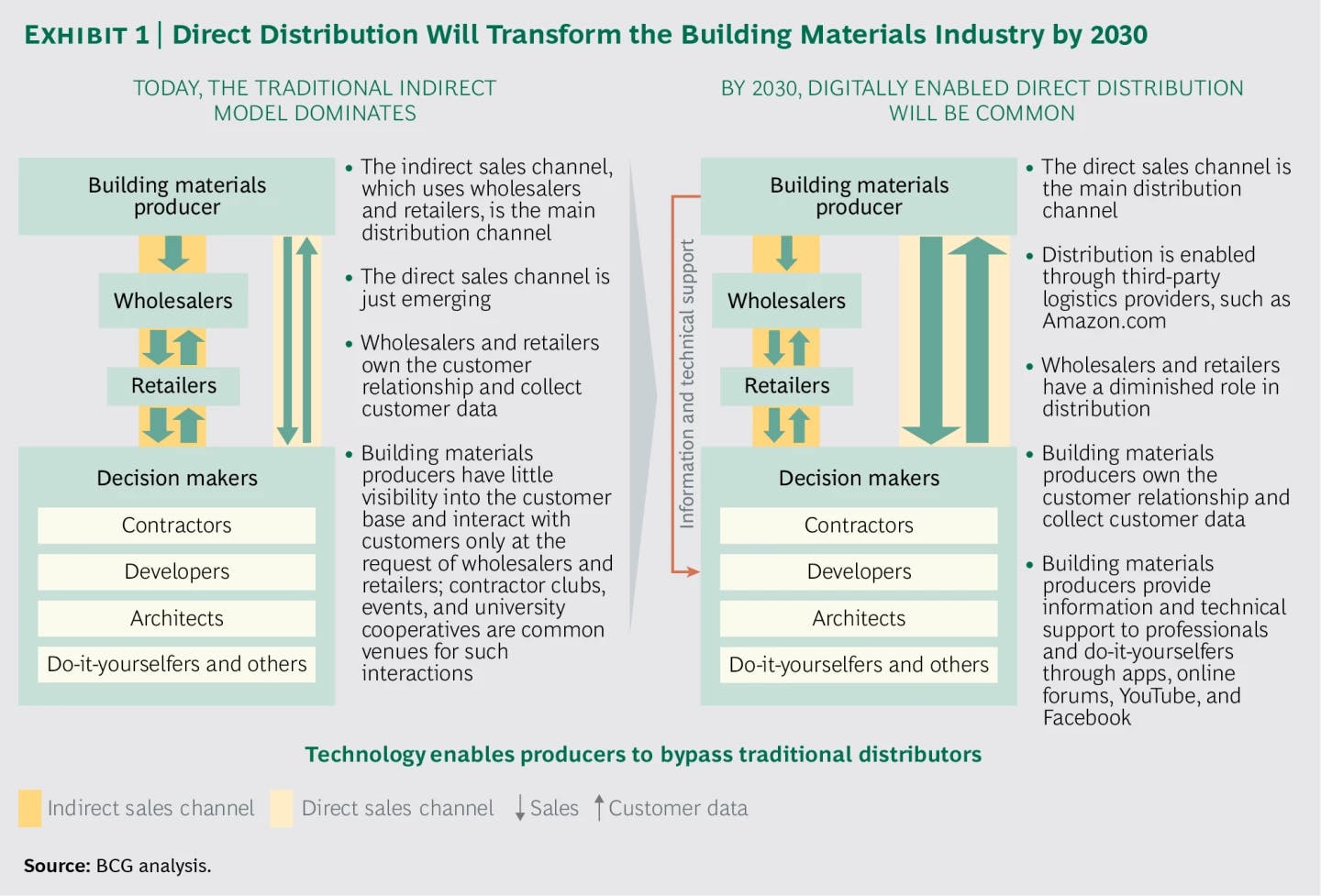

Manufacturer Disintermediation

A major long-term risk is disintermediation: manufacturers increasing their direct-to-contractor sales efforts via ecommerce, owned branches, or digital marketplaces. Although distributors like QXO provide valuable fulfillment and jobsite services, manufacturer bypass could pressure volume, margins, or pricing power over time. BCG has previously predicted that by 2030, the majority of revenue captured by building materials producers will shift from indirect channels (distributors and retailers) to direct channels, in partnership with third-party logistics providers such as Amazon.

Source: BCG

Cyclicality, Labor, & Seasonality

While repair and remodel demand provides recurring volume, construction activity remains cyclical and sensitive to macro conditions, such as interest rates, credit availability, and housing starts. Additionally, tight labor markets for roofers and installers could constrain contractor demand. QXO’s business is also seasonally skewed toward warmer months, making quarterly results more volatile.

Gross Margin Pressure & Supply Chain Sensitivity

Distribution is a low-margin business. QXO’s gross margins (~25%) are sensitive to input costs, vendor rebate programs, and freight expenses. Any disruption in supply relationships or unfavorable renegotiation of rebate terms could materially compress margins.

Talent Scaling & Organizational Depth

QXO’s success hinges on execution from managers, frontline employees, and regional operators, many of whom were inherited through acquisition. While headcount has remained stable post-Beacon, QXO has reduced 250 mid-level roles and is reshaping the org around tech and performance. Failure to attract or retain strong operational leaders could constrain efficiency gains.

Perception & Liquidity Risk

Despite Jacobs’ track record, QXO remains a new and relatively illiquid public vehicle with concentrated ownership. If the market underestimates the value of its rollup strategy or questions its ability to scale profitably, valuation multiples may compress, even if fundamentals remain intact.

Indebtedness & Financial Flexibility

As of December 2025, QXO carries over $5 billion in debt related to the Beacon acquisition. While management targets 2x net leverage through the cycle and maintains asset-based-loan availability, any sharp earnings decline or slowdown in cash flow conversion could strain coverage ratios. The firm’s credit agreements also contain covenants that limit certain types of capital allocation.

QXO’s Vertical AI Scorecard

In the Vertical AI Playbook, we argued that the most successful applications of AI won’t come from selling tools to legacy operators, but from owning the workflows where those tools can be deployed. QXO exemplifies this thesis, not as a pure AI company, but as a technology-forward operator reconfiguring a traditional industry from the inside out.

QXO is executing against each of the five steps we outlined in the Playbook:

1. Map the Ontology: CEO Brad Jacobs screened over 50 sectors before selecting building products distribution, a massive, labor-intensive industry with over $800 billion in annual spend, underdigitized workflows, and frequent demand cycles tied to infrastructure maintenance.

2. Define the Terrain: Building materials distribution has thin margins, high labor costs, and complex, localized operations - the perfect terrain for automation and optimization. Unlike SaaS, where value is captured incrementally, controlling the full-stack service enables margin uplift and data capture end to end.

3. Prove, then Buy: Before deploying capital at scale, in December 2024, QXO acquired a small ERP software firm, SilverSun Technologies, and began offering modernization services to other clients. This gave QXO its initial tech stack and integration infrastructure before making larger bets, allowing them to demonstrate value before committing to major M&A.

4. Test the Distribution Wedge: With Beacon Roofing Supply, QXO acquired $10 billion in revenue, 600 branches, and direct customer relationships with over 100K contractors. Just as Metropolis bought SP Plus to access existing vendor relationships in parking, QXO sidestepped long sales cycles by acquiring incumbents directly, turning their inertia into a moat.

5. Match Capital & Talent to the Path: Backed by over $5 billion in debt and a leadership team drawn from Jacob’s previous companies, QXO combines operational depth with disciplined capital deployment. The company cut 250 mid-level roles at Beacon, added engineers, sales reps, and procurement leads, and built an internal playbook for scaling integration and AI enablement across future targets.

Looking forward, QXO’s ambitions are to grow from just over $10 billion in revenue in 2025 to $50 billion by 2035. If successful, it will become the largest building products platform in the world and one of the most valuable compounders of the next decade. With each new acquisition, QXO will expand its data and its ability to embed systems across an ever-increasing footprint. As AI model performance improves and as more of QXO’s workflows become digitized, the gains will likely accelerate.