Thesis

Blockchain and crypto-focused companies continue to see interest, both from investors and the broader financial services sector. In Q2 2024, investors deployed $3.2 billion into the category, up from [$2.5 billion in Q1 2024 and $2 billion in Q4 2023. This marks 28% and 29% increases quarter-over-quarter, respectively. One 2023 survey revealed that 85% of leaders in financial services organizations view blockchain technology positively and are considering investing in it as a high priority for their business. The projected value of the blockchain technology market, encompassing blockchain infrastructure, middleware, and protocols, is estimated to reach $2.3 trillion by 2032, with a CAGR of 85.7% over the forecast period from 2023 to 2032.

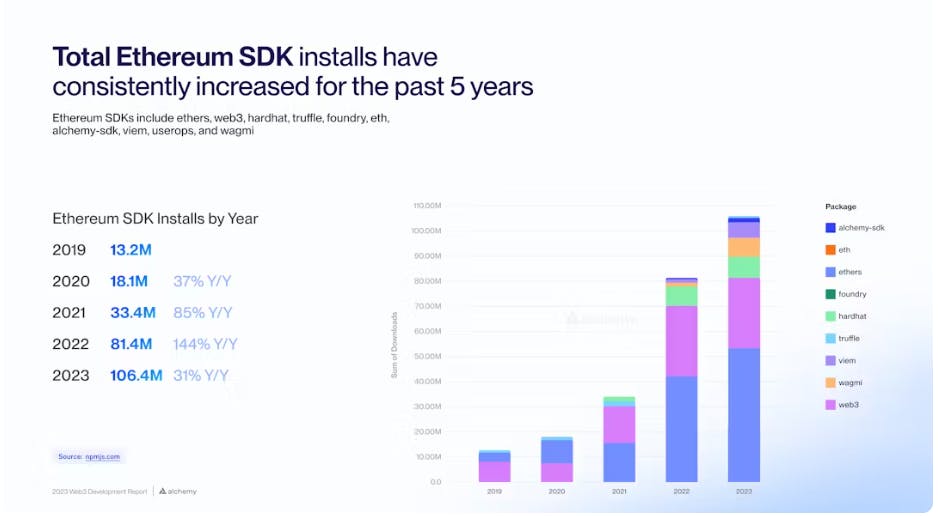

Blockchain developer activity is also steadily on the rise. This is evidenced by the increasing number of Ethereum Software Development Kit (SDK) installs, which provide developers with the essential tools to build applications on the Ethereum blockchain. In 2023, Ethereum SDK installs reached an all-time high of 106.4 million, up 31% YoY from 2022. Furthermore, the number of Ethereum Virtual Machine (EVM) smart contracts created on major chains was also up 303% YoY from 2022.

Source: Alchemy

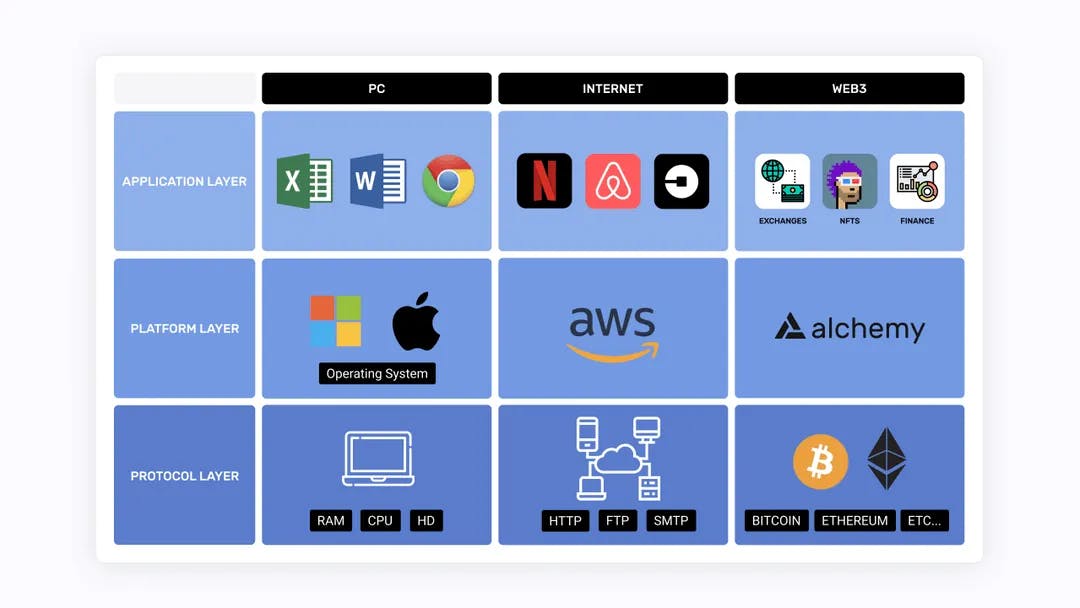

However, high levels of complexity and lack of developer-friendly tooling make developing on the blockchain a difficult experience. Modern blockchains serve as a new kind of computer, capable of being programmed in the same fashion as a PC, smartphone, or cloud computer. Developers are able to write code to ensure the blockchain will operate in a predetermined manner. Each new kind of computer needs its own operating system, platform, and tools that make it easy for developers to build new things. Bridging this gap is critical for enabling developers and enterprises to build on blockchain technologies. In fact, in 2023, 52% of enterprises reported that their developers faced a steep learning curve when implementing blockchain technologies and cited limited developer knowledge as the largest obstacle holding them back from adoption.

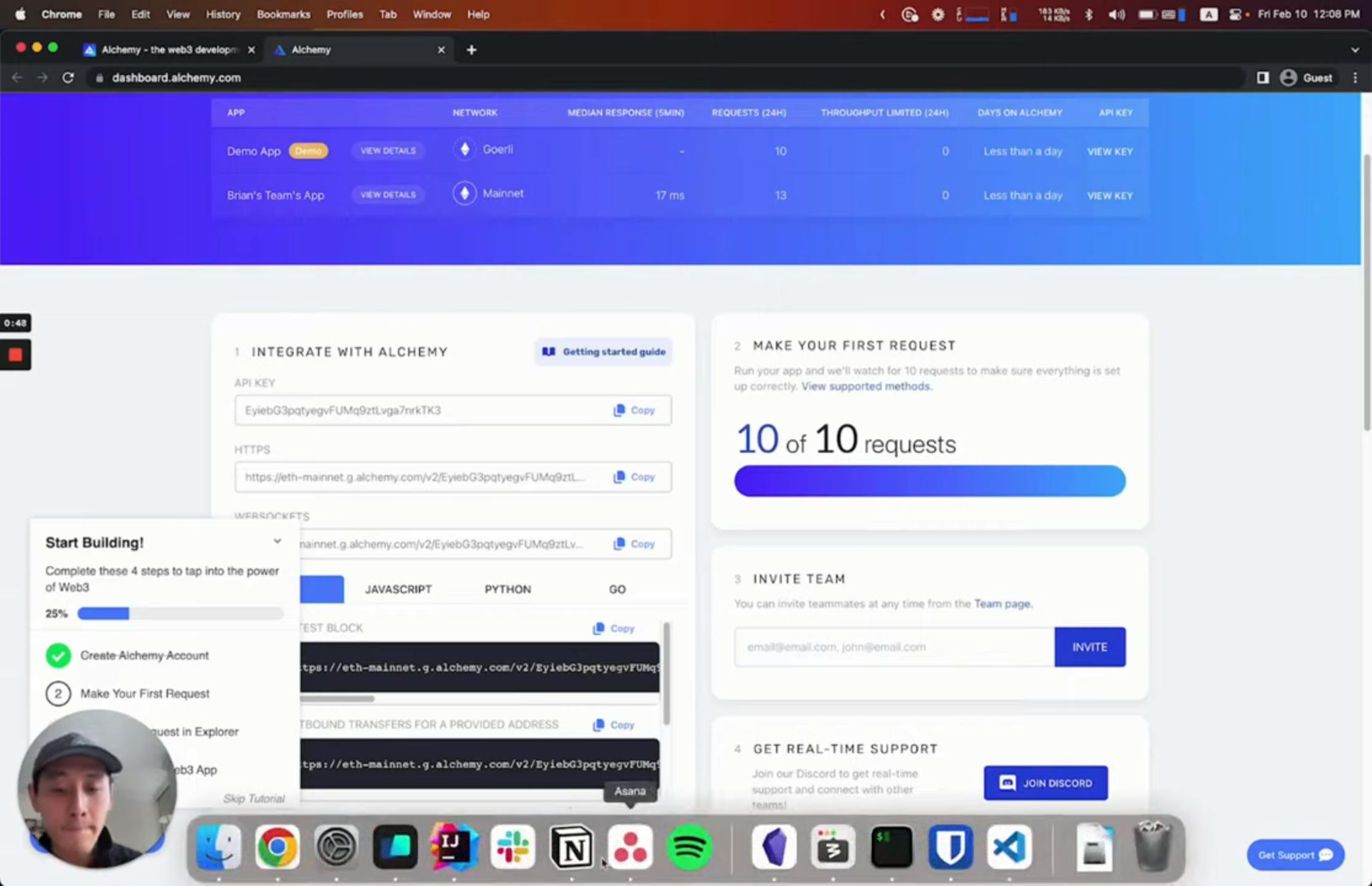

Alchemy is a blockchain developer platform that offers the tools and infrastructure needed to build, scale, and rapidly iterate on blockchain applications. Alchemy's suite of APIs, tools, and node infrastructure services simplifies the building process on the blockchain, reducing complexity and enabling developers to focus on creating crypto applications. In the same way that cloud computing and infrastructure are now essential elements of the modern internet, Alchemy is positioning itself as a blockchain infrastructure provider, offering developers and businesses a wide range of services and tools.

Source: Alchemy

Founding Story

Source: TechCrunch

Alchemy was founded in 2017 by Nikil Viswanathan (CEO) and Joe Lau (CTO), who were both Stanford alumni and long-time friends. Having met as fellow teaching assistants at Stanford, Nikil, and Joe were teaching a databases class at Stanford the first quarter that Stanford opened the class up online to the public. Instead of the 100 in-person students the class would normally get, Viswanathan and Lau faced the challenge of teaching 100K students. Their first experience working together ended up in the pair writing code to automatically generate PDFs with certificates of completion for all 100K students in the class the night before the end of the class.

After graduating, Viswanathan and Lau continued working together, launching 8-9 products before launching a social app called Down To Lunch, which went viral among high school and college students. Although the app briefly hit the top of the App Store, Down to Lunch ultimately failed to achieve sustained success. As Down to Lunch wound down in the summer of 2017, the pair noticed their friends getting involved in crypto. Lau then convinced Viswanathan to try developing a crypto product to capitalize on the interest and activity at the time.

Their first product was an analytics platform for hedge funds and traders which saw early traction, convincing them of the potential in crypto. But while building out this blockchain analytics platform, Viswanathan and Lau realized that developing a blockchain application was 10-100 times harder than creating any non-blockchain application. Both founders realized that the tools and infrastructure needed to make development much easier were nonexistent in crypto. Lau described the state of blockchain tooling and infrastructure as analogous to “trying to build skyscrapers with picks and shovels.”

In 2017, Viswanathan and Lau decided to pivot and launch the infrastructure they had created rather than the analytics platform they had built the infrastructure for. Although Alchemy saw some initial traction and the founders had conviction in the product, the team wasn’t sure how large the blockchain market would eventually be. After launch, Viswanathan and Lau continued quietly refining their product, raising a Series A in 2019 in the depths of a crypto winter that saw Bitcoin prices fall under $8K. Less than a year later, the crypto market came back dramatically, kicking off the start of another bull cycle that would serve to accelerate Alchemy’s growth.

Product

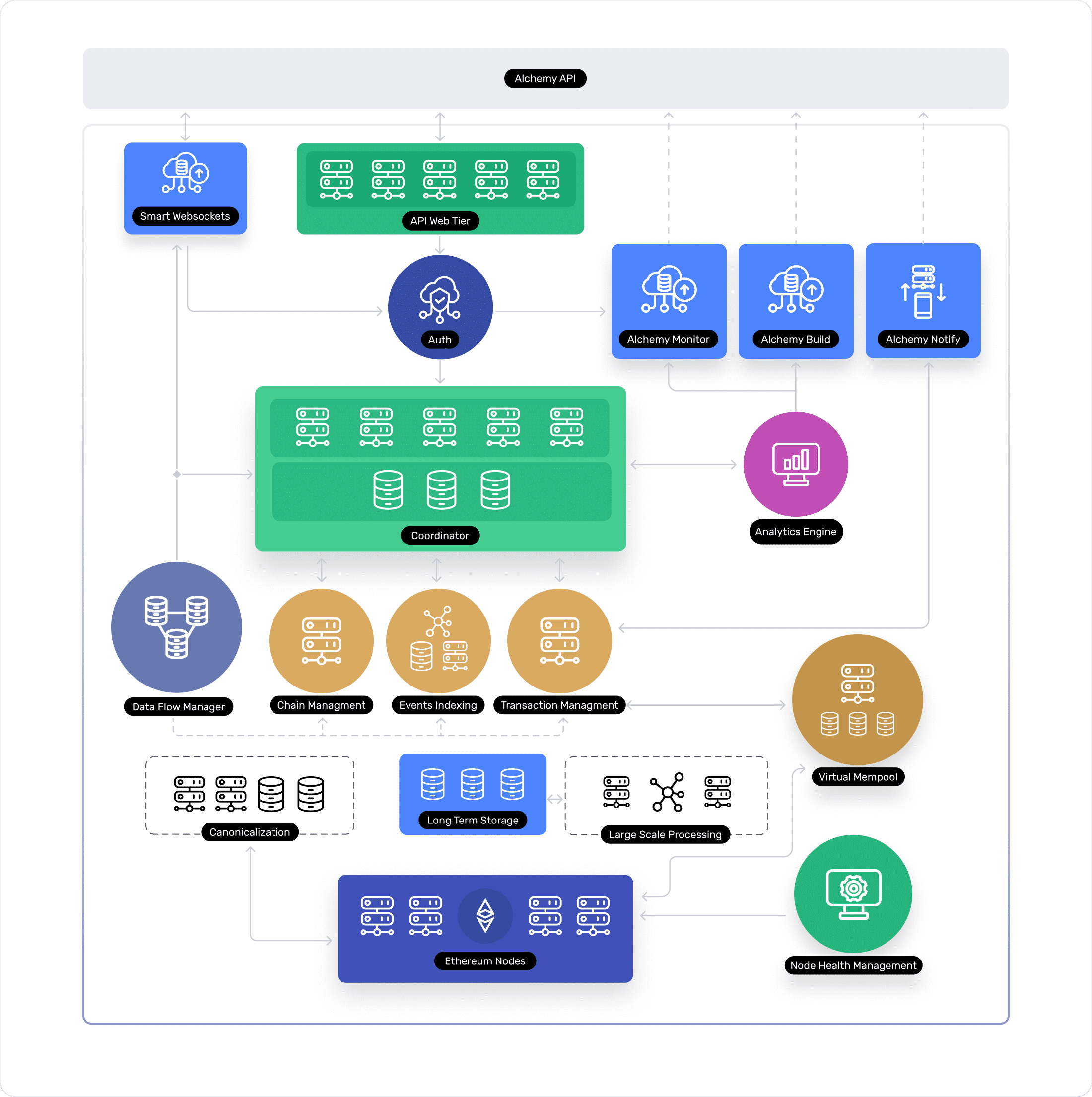

Alchemy provides a suite of developer tools and infrastructure for individual operators and enterprises to create blockchain applications. The product suite aims to streamline the process of building, deploying, and scaling blockchain applications. Alchemy’s product portfolio consists of four primary verticals: APIs, chains, SDKs, and tools, as well as a few standalone offerings, such as rollups, pipelines, embedded accounts, and account contracts.

Source: Alchemy

APIs

Source: YouTube

The list of enhanced APIs provided by Alchemy includes the following:

Supernode: Alchemy Supernode is an Ethereum API providing reliability, data correctness, and scalability. It incorporates the functions of a standard Ethereum node with enhanced features. Alchemy Supernode simplifies blockchain interaction, providing an accessible and efficient API for Ethereum.

NFT API: Alchemy's NFT API enables developers to fetch and display NFTs easily. This API is used for facilitating the creation and integration of NFTs in various projects. It simplifies developing applications that interact with NFTs on different blockchains.

Transfers API: Alchemy's Transfers API can fetch historical transactions for any address without scanning the entire chain, including internal transfers. This service simplifies the process of transaction history retrieval. It eliminates the need for indexing every user when looking up transaction data.

Token API: The Alchemy Token API allows developers to request specific token information, including metadata or balances. This API provides a direct way to understand different tokens on a specified blockchain. The service supports developers seeking insights into token specifics.

Transact: Transact is a set of APIs that programmatically make blockchain transactions faster, cheaper, and more reliable. The system handles high gas variance and stuck nonces to manage blockchain transactions effectively. Transact's optimized approach reduces developer complications from high gas prices and transaction processing.

Transaction Simulation: This feature lets developers preview on-chain transactions, ensuring that assets are kept safe. It presents a secure environment for transaction operations. Developers using this product can test and evaluate application transactions in a sandbox without the risk of incurring high fees or irreversible transactions.

Subgraphs: Subgraphs provide developers with a streamlined method for accessing on-chain data in real time, allowing for the creation of interactive applications. By aggregating application-specific blockchain data, subgraphs offer quick access to frontend developers through GraphQL APIs, enabling real-time queries of transaction data on their contracts. This is especially beneficial for developers of complex, custom smart contracts that require robust frontend interfaces. For instance, Uniswap developers can query all transactions within a single Uniswap v3 liquidity pool over the last 24 hours by defining their schema, indexing event data to create the subgraph, and utilizing the generated GraphQL API for efficient data retrieval. Alchemy's subgraphs facilitate faster shipping of applications with a custom API for on-chain data, reducing data lag by up to 50% and backfilling data up to 5x faster.

Webhooks: Alchemy’s webhooks allows developers to subscribe to push-based event notifications related to their application. It keeps developers informed in real-time about relevant blockchain events such as mined transactions, address activity, NFT activity, and metadata updates. Its utility extends to monitoring and responding to app activities. By removing the need for API calls, Alchemy estimates it has saved developers more than $3 million annually through these push-based, real-time notifications

Custom Webhooks: The Custom Webhooks APIs offer developers more specificity than the standard webhooks, allowing them to understand contract-based events beyond transfers. These events include token activities, marketplace trends, and data ingestion processes. Custom Webhooks are relevant for developers who require a comprehensive understanding of events on-chain.

Websockets: Alchemy's Websockets API provides subscriptions to pending transactions, log events, new blocks, and more across Ethereum, Polygon, Arbitrum, and Optimism. It enables real-time monitoring of various blockchain events.

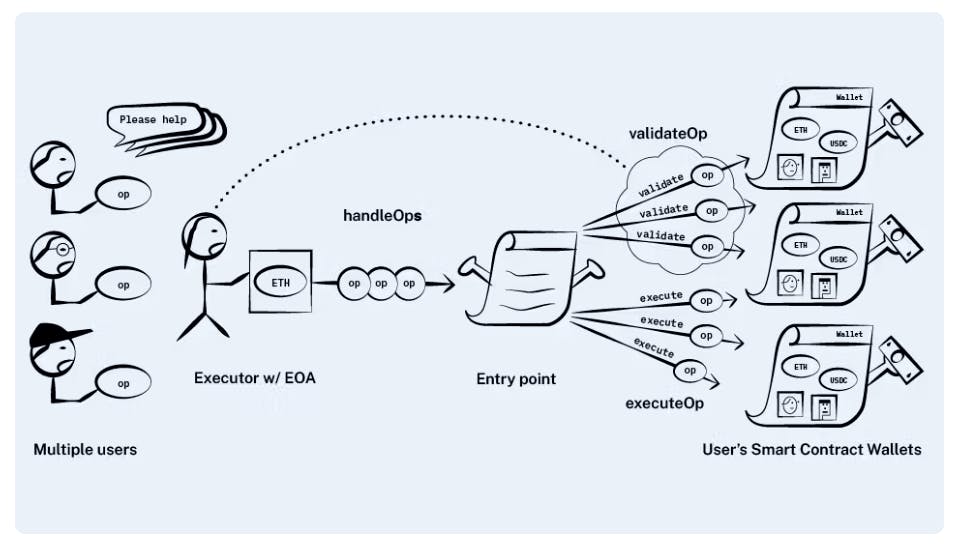

Bundler API: Bundling refers to the process of aggregating multiple transactions into a single batch, which is then processed as a single transaction on the blockchain. This technique is used to improve efficiency, reduce costs incurred by gas fees, and enhance the scalability of blockchain applications. Developers can call Alchemy’s bundler API to perform various actions such as sending user operations to a bundler, estimating gas for user operations, or retrieving user operation receipts.

Source: Alchemy

Gas Manager API: Gas fees often pose a barrier to entry for new application developers, as they are required to pay fees for each action they perform. The gas manager API addresses this as it enables users to utilize a smart contract that permits one entity to sponsor gas fees for another. This functionality empowers developers to sponsor gas fees for their applications' users, effectively eliminating the entry barrier associated with gas fees.

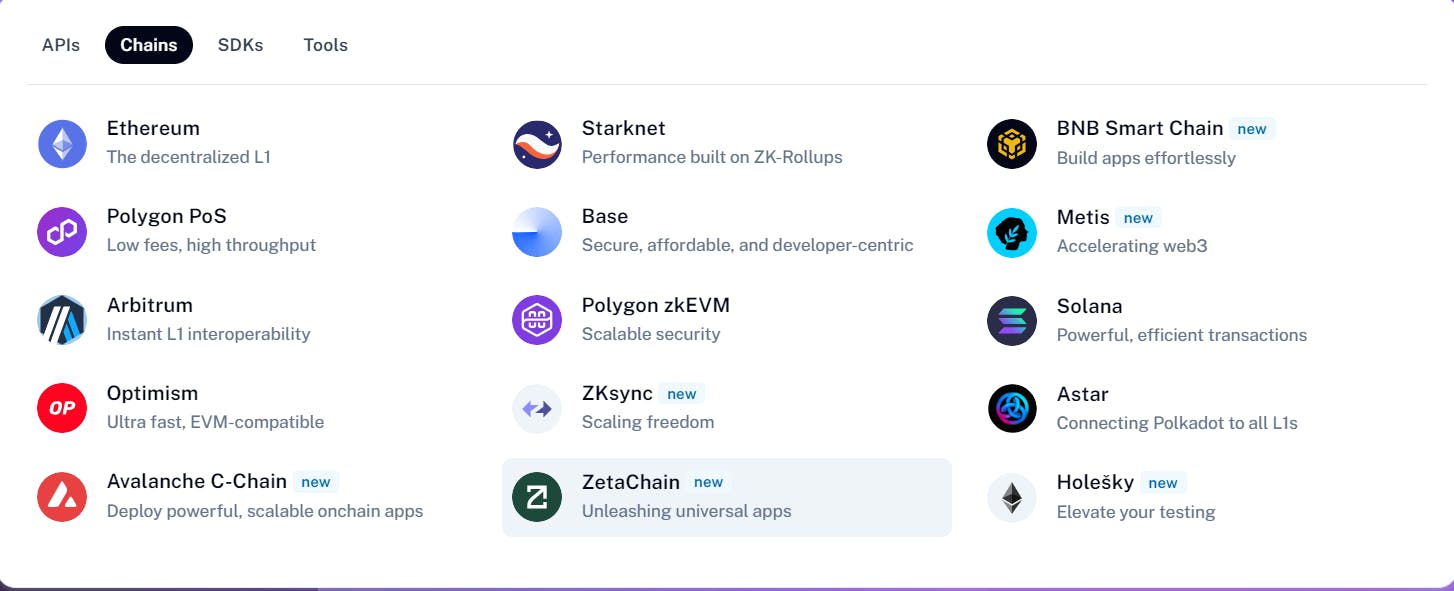

Chains

Source: Alchemy

Alchemy supports a wide array of blockchains to ensure developers can interact with their preferred chain. Customers can also request that Alchemy offer support for additional blockchains. Blockchains supported by Alchemy include Ethereum, Polygon PoS, Arbitum, Optimism, Avalanche C-Chain, Starknet, Base, Polygon zkEVM, zkSync, ZetaChain, BnB Smart Chain, Metis, Solana, Astar and Holešky.

Tools

Create Web3 Dapp: This open-source offering allows developers to build a full-stack decentralized application directly from their command line. It includes pre-built components and templates for users to help speed up development. It also enables direct connection between users’ wallets and NFTs.

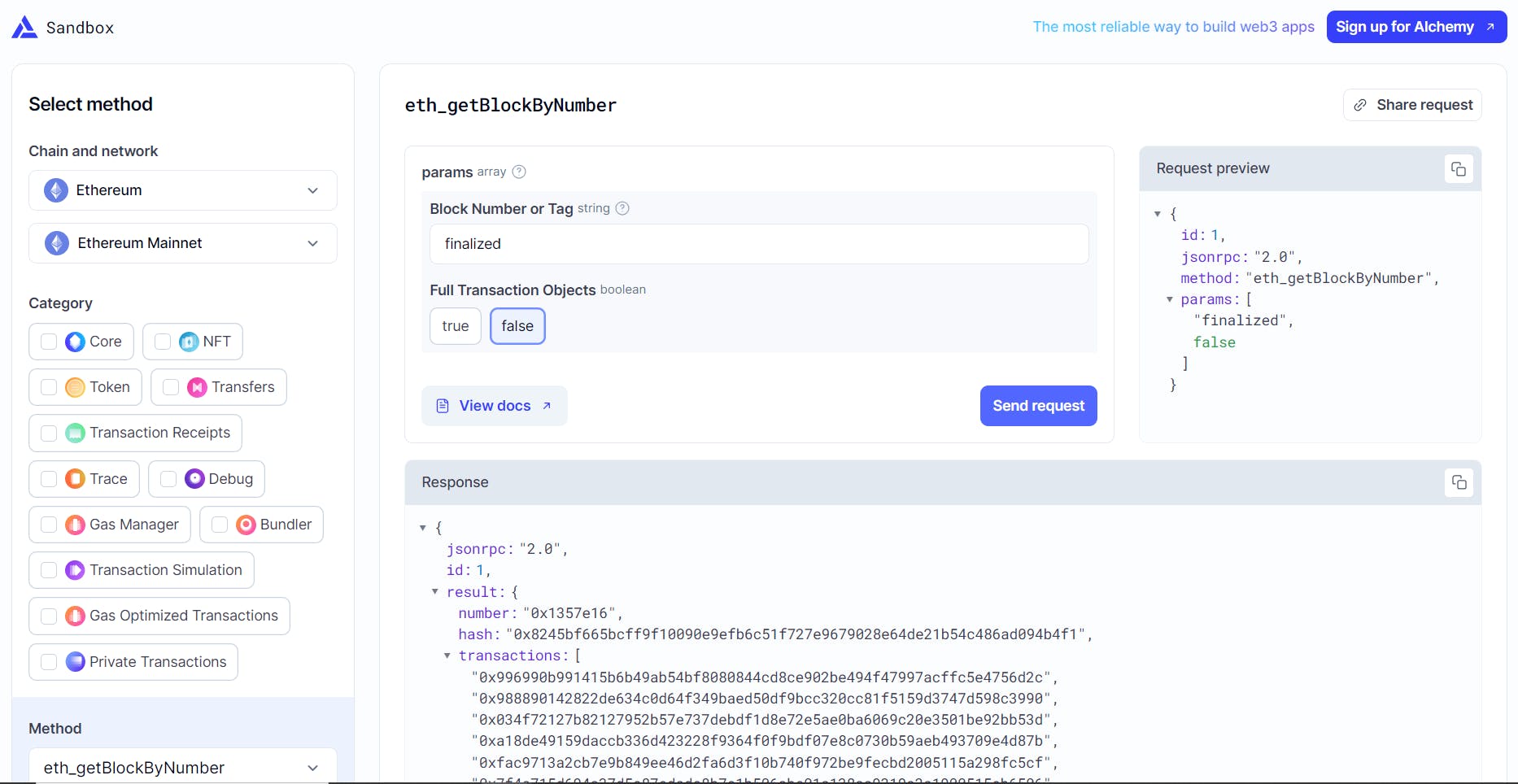

Sandbox: Alchemy offers an in-browser request sandbox tool that aids developers in building and testing API requests. This tool does not require any setup and facilitates rapid prototyping within the browser, thereby removing the infrastructure challenges faced by developers. Sandbox is used by developers in testing, debugging, and refining their API requests.

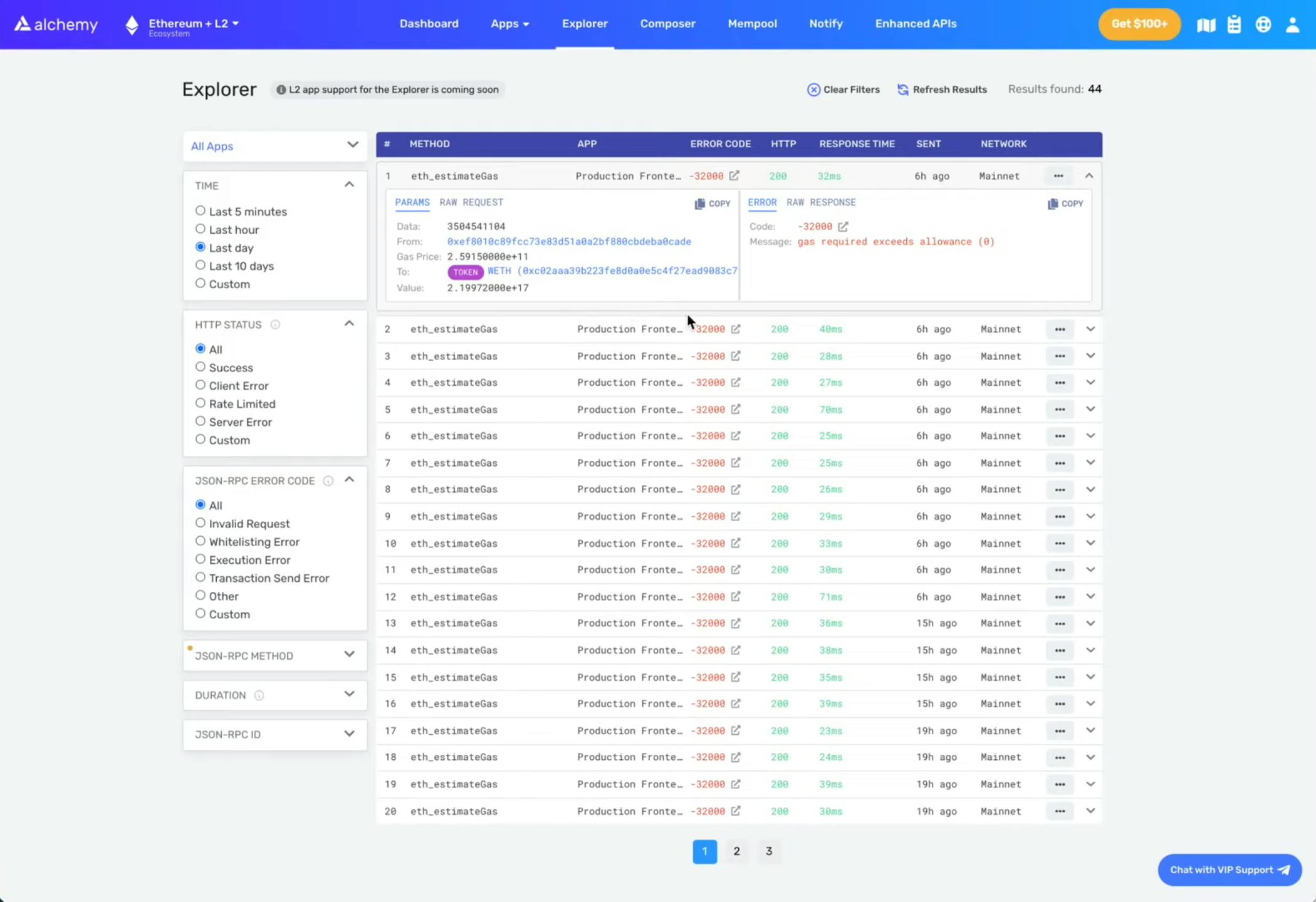

Source: Alchemy

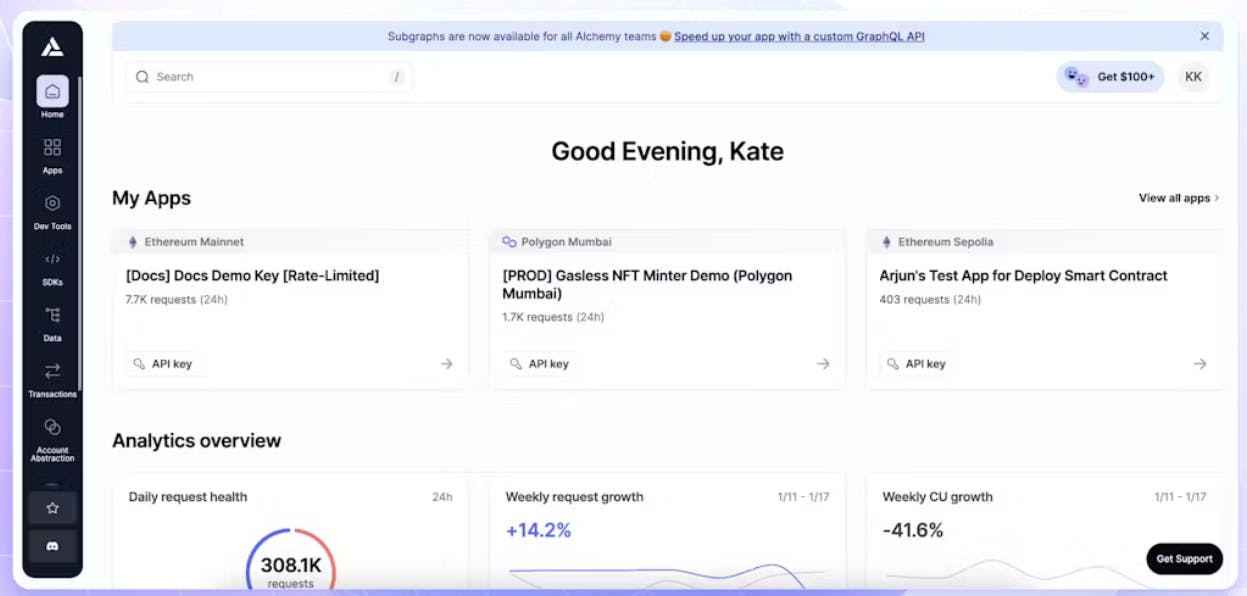

Alchemy Dashboard: This offering is a suite of tools, charts, alerts, and analytics for app health, performance, and user behavior. The Alchemy dashboard allows developers to visit app-specific pages, learn about the latest product updates, and view the overall health of their apps including error rates, weekly growth, and compute consumption. They are also able to review usage analytics and set up custom alerts for monitoring error rates across their apps.

Source: Alchemy

Alchemy AI: This offering is designed to aid developers using AI. It contains 2 smaller features: ChatWeb3 and an Alchemy ChatGPT plugin. ChatWeb3 is a GPT-powered chatbot that has been trained on thousands of pages of Alchemy documentation and was designed to help Web3 developers build software more quickly and seamlessly. The Alchemy GPT plugin, on the other hand, is a standalone plugin for ChatGPT that can be accessed via OpenAI’s Plugin Marketplace. It is a tool to get real-time blockchain data through natural language using Alchemy API endpoints.

SDKs

Alchemy SDK: The Alchemy SDK is a Javascript SDK that facilitates developer interaction with blockchains. The SDK works in a similar fashion to the widely used Ethers.js tool, allowing for an easy transition for developers who are already familiar with it. This is similar to how a universal remote can work with a variety of devices. Alchemy’s SDK also includes features like easy access to Alchemy's specialized APIs, which are like unique channels for interacting with digital assets and blockchain data. It also offers communication capabilities and improvements like automatic retries, akin to redialing a phone number when a call doesn't go through. The SDK leverages Alchemy's existing node infrastructure for reliability, scalability, and data correctness.

Source: YouTube

Account Abstraction SDK: In blockchain technology, account abstraction refers to the ability to separate the control of a user’s funds from the execution of smart contracts. In short, users can use smart contracts to manage funds without transferring control of their funds to the smart contract. Account abstraction is an important concept in blockchain technology and the larger web3 development space. It can substantially improve user experience and security, especially for those with no prior blockchain exposure or who are unaware of the various nuances and intricacies of the technology, without relinquishing full access to their wallets.

Alchemy’s account abstraction SDK is a developer kit for those who are building applications and wallets on Ethereum and other EVM-compatible layer 2 blockchains like Arbitrum, Optimism, Polygon, and Base. Developers can use this SDK as a single point of access to interact with account contracts, manage gas costs using the Gas Manager API, and bundle transactions efficiently using the Bundler API.

Embedded Accounts

With traditional Ethereum wallets, users usually need to download an extension, back up a seed phrase, and fund a wallet with ETH, which adds friction to the onboarding process. Alchemy simplifies this by enabling the creation of embedded accounts directly within developers’ applications. This removes the cumbersome onboarding steps by allowing new accounts to be created without additional downloads. These accounts also enable users to recover them without seed phrases and perform gasless transactions through third-party gas sponsorship using the gas manager API. Alchemy’s embedded accounts are available as both traditional externally owned accounts (EOAs) and smart contract accounts.

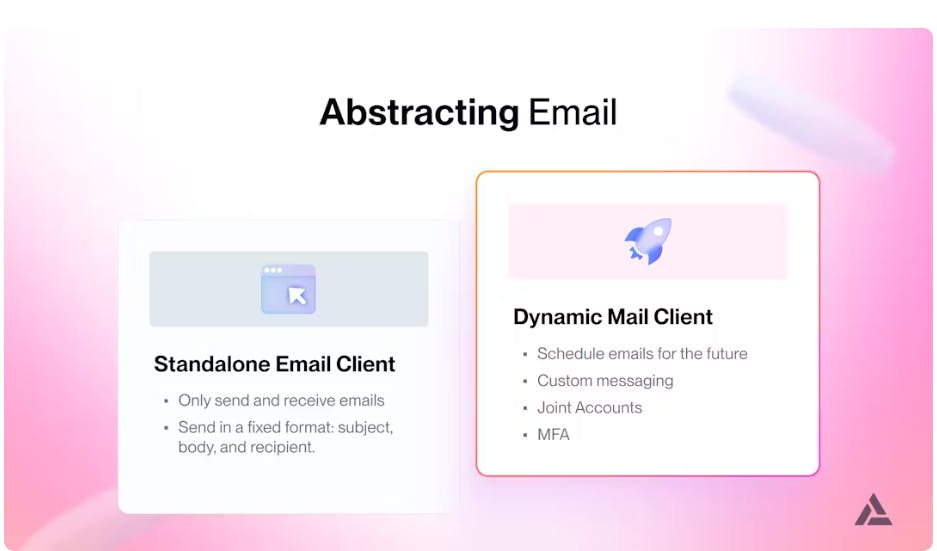

Smart Contract Accounts: Alchemy offers enterprise-grade smart contract accounts, which are more flexible alternatives to traditional externally owned accounts (EOAs). These smart contract accounts leverage the concept of account abstraction to offer more new features and adaptability than their EOA counterparts. There is a parallel to this between standalone versus dynamic email clients. Unlike standalone email clients which can only send and receive emails, dynamic email clients offer more functionality, such as scheduling emails for the future, custom messaging, joint accounts, etc.

Source: Alchemy

Similarly, each smart contract account can define different rules and configurations within its code, thereby making it a much more flexible option. Alchemy offers two types of smart contract accounts: Light Accounts and Modular Accounts. Light Accounts are basic lightweight smart contract accounts that come in single or multi-owner variants. They were based on the Ethereum Simple Account but with improvements such as gas optimization, ERC-1271 signature support, and added support for account ownership transfer. They also contain an upgrade path to modular accounts.

Modular accounts, on the other hand, are smart contract accounts that leverage plugins to support customizable features on top of the standard light account features. These additional features include session keys, which facilitate account permissions such as spending limits and time restrictions, and multisig functionality, which means any action taken by the account requires multiple signatures. Developers can also create their own ERC-6900 plugins, which can then be installed on compliant modular accounts.

Externally Owned Accounts: Alchemy also offers the option for users to create EOAs, which retain the basic transaction functionality. However, unlike the smart contract accounts, EOAs are controlled from off-chain using a private key and also do not have access to the aforementioned smart contract features such as plugins, multi-ownership, batched transactions, and gas sponsorship. Furthermore, if users want to switch from their EOA to smart accounts later, then they will need to transfer their assets from the EOA account to a new smart account as it is not currently possible to upgrade an EOA to a smart contract account. As of Q4 2023, Alchemy reported that 960K smart accounts had been created.

Rollups

Rollups are Layer 2 scaling solutions for Ethereum that bundle multiple off-chain transactions into a single transaction, which is then recorded on the Ethereum mainchain, reducing congestion and lowering transaction costs. They enhance scalability by processing transactions off-chain while maintaining security through proofs submitted to the mainchain.

Source: Alchemy

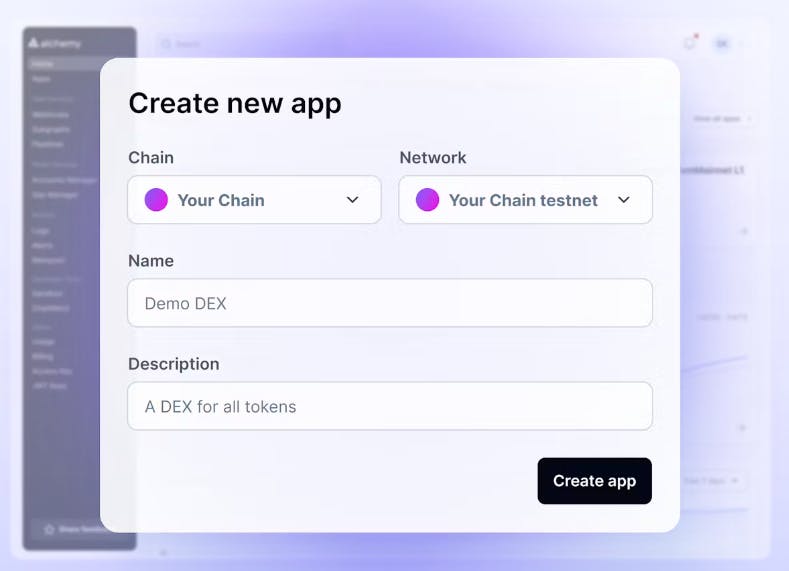

Alchemy Rollups is a developer platform that enables developers to launch their own chain by leveraging Alchemy’s underlying infrastructure and community distribution. Developers can integrate Alchemy’s other product offerings such as Supernodes, smart contract accounts, as well as various APIs such as Transact, Gas Manager, Bundler, or Subgraphs, into their own rollup chain. Rollups also offer developers guaranteed uptime for their chains and come with a dedicated support team with an average response time of under 5 minutes in order to ensure this

Furthermore, developers who launch on Alchemy Rollups will have their chains listed in the Alchemy dashboard. This visibility introduces their projects to the broader community of developers using Alchemy, potentially attracting more developers to build on their chains.

Pipelines

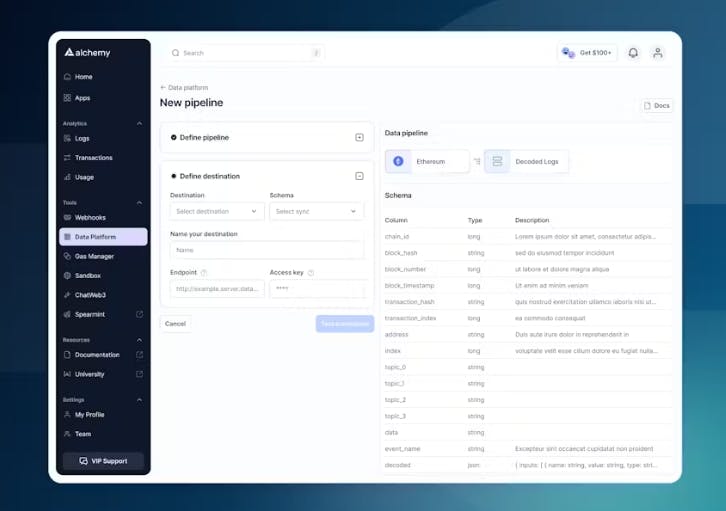

Building and maintaining a blockchain data pipeline in order to stream real-time blockchain data into underlying infrastructure can take weeks of engineering time and expertise. This is time that developers could spend developing product features instead.

Source: Alchemy

Alchemy Pipelines provides a point-and-click interface for creating data pipelines, allowing users to configure a data source (i.e. decoded logs) and a destination (i.e. Postgres) within five minutes. The platform includes features such as an easy-to-use interface, fast historical backfills (writing data to a chosen destination 100x faster than with JSON RPCs), real-time ingestion of incoming data, automatic handling of chain re-orgs, and built-in ABI decoding. Alchemy began beta testing Pipelines in April 2024 and, as of September 2024, access was still limited. The product has been used by beta customers to build pipelines for ingesting transfers of the AAVE token and events from NFT collections.

Market

Customer

Alchemy's ideal customer profile comprises developers and organizations looking to use blockchain infrastructure to power their applications. Notably, decentralized finance (DeFi) and gaming companies require reliable blockchain infrastructure to ensure their services are consistently available and performant for their customers. Enterprises without blockchain developer expertise or a desire to host and maintain blockchain-related infrastructure are another customer base. Alchemy’s developer tools and infrastructure suite allow companies to build blockchain-powered applications without developing these resources in-house. Alchemy counts prominent blockchain companies and projects like OpenSea, Dapper Labs, and Worldcoin among its customers.

Market Size

As of September 2024, the number of blockchain developers with less than 2 years of experience in the industry was up 11% from 2 years prior and 105% from 3 years prior. Furthermore, the number of established blockchain developers with more than 2 years in the industry was also up 38% from the year prior and 68% from 2 years prior, respectively. This indicates that there are not only more developers joining the industry but staying long-term as well.

Alchemy’s solutions center around blockchain technology, composed of blockchain development tools and infrastructure. These include SDKs, APIs, and a variety of other tools to help developers interact with and build applications on blockchains. With its product suite, the company is poised to address the global blockchain technology market, estimated at $17.5 billion in 2023. This number is projected to grow to $248.9 billion by 2029, at a CAGR of 65.5% over the forecast period.

The growth is expected to be fueled by several factors, including the escalating adoption of blockchain technology by enterprises, a surge in demand for blockchain-as-a-service (BaaS) offerings, and continued public interest in cryptocurrency. Therefore, as Alchemy’s solutions reduce the barrier of entry for developers to build blockchain applications, we are likely to see more companies and developers leverage their offerings to build their applications.

Competition

Infura: Launched in 2016, Infura provides developers with reliable access to Ethereum and IPFS networks around the world. As of September 2024, Infura reported over 400K developers leveraging its platform. As a subsidiary of ConsenSys, Infura benefits from a network of blockchain projects and partnerships. With customers like Uniswap and Brave, Infura directly challenges Alchemy in providing infrastructure for Ethereum-based applications. ConsenSys has raised $726 million in funding as of September 2024. In 2019, it launched Infura+, a subscription service for Infura’s Ethereum API for enhanced infrastructure support for developers building applications of all sizes. The company also launched a decentralized infrastructure network solution in 2023.

QuickNode: Founded in 2017, QuickNode offers scalable blockchain infrastructure for Ethereum, Bitcoin, Solana, Polygon, BNB, and over 20 chains. After graduating from Y Combinator in March 2021, the company reported servicing over 2 billion API requests daily for 20K developers and a 20x increase in revenue and customers. The company has since grown, with over 100K reported developers using their platform as of September 2024. QuickNode offers a competitive alternative to Alchemy's infrastructure services. The company had raised a total of $102 million in funding as of September 2024.

Blockdaemon: Established in 2017, Blockdaemon offers multi-chain node infrastructure to empower blockchain projects. With support for over 60 protocols as of September 2024, Blockdaemon is notable for its broad protocol coverage, which includes popular chains like Bitcoin, Ethereum, Solana, Cardano, Polygon, and Polkadot. It provides a one-stop solution for developers looking to build on multiple chains simultaneously, which makes it a competitive offering to Alchemy’s product suite. Blockdaemon had raised $431 million in funding as of September 2024.

Coinbase Cloud: An offering from Coinbase, Coinbase Cloud was launched in June 2021 to provide developers with easy-to-use blockchain infrastructure. Coinbase Cloud offers a comprehensive suite of developer tools, including SDKs and APIs for wallets, payments, exchanges, and trading. It offers developers the potential for native integration with Coinbase's other products and easy distribution to Coinbase’s customers. This positions it as a potential long-term competitor to Alchemy in blockchain infrastructure.

Business Model

Source: Alchemy

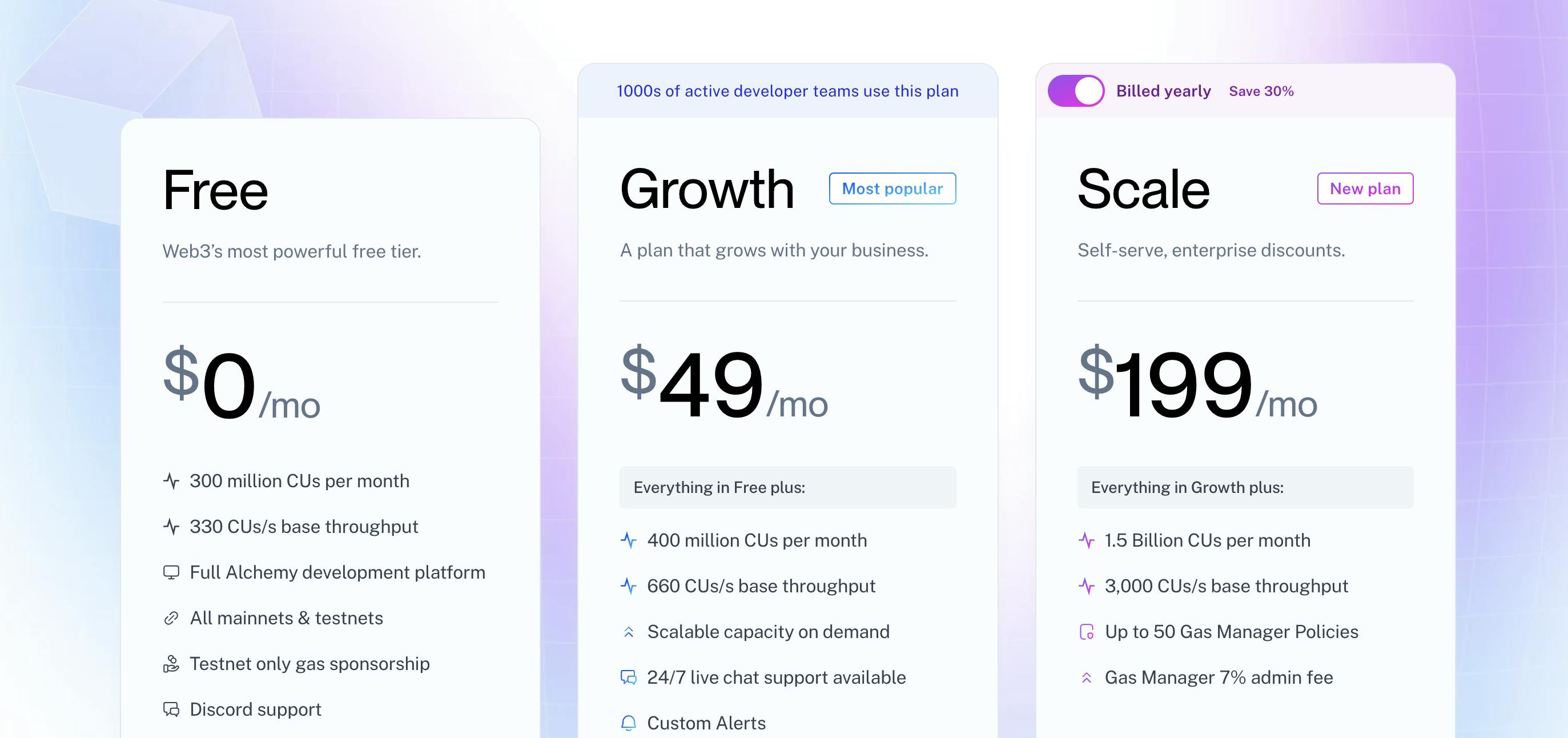

Alchemy operates on a tiered subscription model, targeting developers and enterprises looking to build blockchain technology applications. It has four pricing tiers: free, growth, scale, and enterprise.

The free plan is aimed at individual developers or small teams just starting blockchain development. This plan offers basic access to Alchemy's suite of blockchain developer tools, APIs, and node infrastructure, with restrictions on access to certain APIs, throughput, SLAs, and compute units.

The Growth plan is designed for scaling businesses and is priced at $49/month. It provides improved features like auto-scaling compute units and detailed information about on-chain activity through parity trace to help companies scale their blockchain applications. Customers also get full access to Alchemy’s product suite.

The Scale plan is aimed at self-serve enterprises and is priced at either $289/month or an annual fee of about $2.4K. It provides upgrades on all the Growth tier’s limits and features such as increased throughput, higher application capacity, and lower gas manager fees. It also comes with faster guaranteed support response times than the previous tiers as well as the option to purchase pre-paid compute units annually at a discounted rate.

The Enterprise plan is tailored for larger businesses with substantial blockchain development needs. Pricing is negotiated on a case-by-case basis, and features include all the benefits of the Scale plan, but with highly scalable infrastructure, bespoke solutions for unique business requirements as well as dedicated support channels and direct access to Alchemy’s engineering and product teams.

Traction

By early 2021, Alchemy experienced a 97x increase in developers on its platform and powered more than $2 billion in NFT sales in 8 months. In 2021, it supported 70% of the world’s top Ethereum applications and over $30 billion in on-chain transactions. By the end of 2023, the company experienced substantial growth in API requests across its major supported chains, with year-over-year increases of 246% on Polygon, 695% on Optimism, and 3995% on Arbitrum.

Alchemy has made several acquisitions in order to continue its expansion. In 2022, the company acquired ChainShot, a web3 development education company, to help onboard and train developers on creating blockchain applications. In 2023, Alchemy acquired Satsuma, a subgraph platform in order to enable developers to build custom GraphQL APIs in a fraction of the time it takes to spin up in-house data pipelines. In August 2024, Alchemy acquired Bware, a blockchain infrastructure provider that enabled Alchemy to expand its exposure to European users.

Alchemy has also expanded its capabilities to support new blockchains, including Arbitum, StarkNet, zkSync, ZetaChain, Base, and Worldcoin as of September 2024. The company has established partnerships with companies like DraftKings and The Smurfs as well as chains such as Polygon and Optimism.

Valuation

In February 2022, Alchemy announced a $200 million Series C1 led by Lightspeed and Silver Lake, which valued the blockchain developer platform at $10.2 billion. This followed its October 2021 Series C, which valued the company at $3.5 billion. Alchemy’s other investors include Andreessen Horowitz, Coatue, Pantera Capital, and Coinbase. As of September 2024, Alchemy has raised $564 million in total funding.

Despite a significant downturn in the crypto market following Alchemy's Series C1 round, when customers like OpenSea experienced dramatic reductions in volume by October 2022, the market had rebounded significantly by 2024. By the end of 2024, the global cryptocurrency trading volume is estimated to exceed $108 trillion, nearly 90% higher than in 2022.

Key Opportunities

Regulatory Compliance Services

As a player in blockchain technology, Alchemy has an opportunity to develop services in regulatory compliance. As more industries adopt blockchain and crypto, they will need robust tools to meet evolving regulatory requirements. Regulatory requirements will constantly evolve with new developments in the blockchain field, with each country taking an individual approach. Alchemy could provide services such as compliance checks and regulatory reporting tools, offering value to customers while deepening its role in its operations.

This would also help Alchemy diversify its revenue streams beyond developer tools and infrastructure. Alchemy’s existing blockchain expertise positions it well to execute this opportunity, as regulatory compliance in this space is complex and technical. Regulatory compliance tools could appeal to many clients from startups to large enterprises, and help accelerate greater blockchain development adoption in the enterprise sector.

Blockchain Education & Training

There is an opportunity for Alchemy to leverage its position by offering education and training services. As crypto continues to evolve, there's a growing need for skilled professionals who understand the technology. Despite significant growth in active crypto developers, exceeding 19K in October 2023, these numbers are quite small compared to the millions of traditional software developers worldwide. Alchemy could develop educational courses or certification programs for individuals looking to enter or advance within the blockchain industry. This could serve as a new revenue stream while fostering a community of educated users around its platform.

Corporate training programs could also benefit businesses seeking to implement or improve their blockchain capabilities. Alchemy's existing suite of developer tools and knowledge of the blockchain ecosystem make it uniquely suited to provide such training. Enhancing the understanding of blockchain technologies among its potential user base could reduce barriers to adopting Alchemy’s products, driving growth. Investing in blockchain education and training could also boost Alchemy's reputation as a thought leader, grow its customer base, and position it as a key enabler of the wider adoption of blockchain technology.

Key Risks

Crypto Winter

As a blockchain developer platform, Alchemy is inherently tied to the health of the cryptocurrency market. In a "crypto winter," cryptocurrencies can experience significant price declines, lowered transaction volumes, and decreased investor interest. When this occurs, Alchemy's business model faces risks. The demand for Alchemy’s products could decrease as crypto projects scale back during downturns and mainstream companies slow or halt their adoption of blockchain technology.

The bearish macroeconomic climate has resulted in a large number of layoffs in the broader crypto industry, a core customer group for Alchemy. Crypto winters also often coincide with decreased investor interest and fundraising difficulties. This was evident during the crypto winter in 2023 when venture capital investments in crypto startups dropped 91% in January 2023 compared to January 2022. Future crypto winters could affect Alchemy’s ability to raise additional capital.

Competitive Pressures

While Alchemy was one of the first movers in the blockchain technology space, it now faces meaningful competition from startups and larger enterprises. Startups like Infura and QuickNode offer similar services and have been gaining traction. On the other hand, major tech companies like Amazon Web Services and Microsoft Azure also offer blockchain services that can leverage their vast resources and customer bases.

Alchemy's strategy focuses on providing superior developer tools and API services for Ethereum and other blockchains, but the company's success depends heavily on its ability to continue innovating at a fast pace to maintain or grow its market share. In June 2022, one former Polygon blockchain analyst stated that they believed Alchemy was experiencing significant user attrition to new platform competitors. The rapidly growing competitive landscape presents a significant risk to Alchemy's growth trajectory and market positioning.

Slow Blockchain Adoption

As an exclusively blockchain tooling and infrastructure provider, Alchemy is exposed to the risk of dependence on the growth and success of other blockchain applications. If the adoption of blockchain technology slows down or web3 fails to live up to its promised potential, Alchemy's customer base could significantly shrink. While Alchemy likens itself to AWS, one difference is that Amazon’s ecommerce business was AWS's first and best customer. Amazon operated a successful e-commerce business that validated the need for a platform like AWS.

Alchemy does not own or operate any blockchain application that would help validate Alchemy’s current product offerings. It is also unclear whether any blockchain application or company has found product-market fit at remotely the same level as Amazon’s e-commerce business, which boasts 300 million customers. While tooling and infrastructure, akin to selling picks and shovels in a gold rush, can be good business, it becomes less so if no actual gold is found. Alchemy’s decision to focus exclusively on providing blockchain tooling and infrastructure makes it largely reliant on other blockchain applications finding product market fit to bring about web3 adoption.

Summary

Alchemy operates in the growing blockchain technology market, offering tools and infrastructure that power decentralized applications. With its product suite, Alchemy strives to be the underlying technology platform that simplifies and accelerates blockchain development, making it accessible for businesses of all sizes. The company provides a suite of services, including developer APIs, node infrastructure, and blockchain data access, that make it easier for developers to build and scale blockchain applications.

However, Alchemy faces stiff competition in a rapidly evolving market, where large incumbents like Coinbase and newer blockchain platforms with built-in scalability solutions challenge its market position. Additionally, as blockchain technology continues to evolve, Alchemy must stay ahead of the curve in integrating new protocols and chains to cater to developers' evolving needs. While its success will largely depend on its ability to continuously innovate its product offering, maintain a robust and reliable infrastructure, and foster relationships within the broader blockchain ecosystem, Alchemy’s potential as a foundational developer platform could be sizable if the promise of blockchain technology is realized and sees widespread adoption.