Thesis

Historically, the nature of warfare has been dictated by scale, whether it was having the largest army, ships, or weapons. In some instances, the scale of armies could outperform raw technical ability. In WWII, the pace of American production and fleet tactics outcompeted the more powerful German Panzers by weight of sheer numbers. As military historian Steven Zaloga put it, "quantity has a quality all its own”. However, modern battlefields make it more difficult to depend on sheer volume. Electronic jamming systems, for example, are disrupting traditional communication through RF systems, making it harder to operate large fleets at scale.

In response to the changing landscape, the Pentagon is seeking to utilize AI-driven autonomy to address ground defense, which the Defense Innovation Unit (DIU) describes as “fast, complex, and lethal.” The DoD’s openness to autonomy began with the 2001 Defense Authorization Act, which authorized experiments with unmanned systems. Many of the early breakthroughs in autonomy came from the DARPA Grand Challenge, which kickstarted self-driving research in 2005 and led to the birth of companies like Waymo. Later, in 2023, the DIU formed the Ground Expeditionary Autonomous Retrofit System project as an effort to advance off-road field autonomy. Despite these efforts, there is no dominant provider of ground autonomy: the ability of vehicles and robots operating on the ground to navigate and perform tasks without direct human control.

While aerial and maritime autonomy have seen a number of fielded solutions from companies like Shield AI, Anduril*, and Saronic, ground warfare remains largely reliant on manual human operation. The problem is twofold: (1) the US cannot produce ground military assets fast enough due to operational inefficiencies, and (2) labor shortages limit the ability to scale vehicle deployments, while remote-controlled systems are vulnerable to jamming, exposing operators to enemy exploitation. Ground autonomy mitigates these vulnerabilities while safeguarding the operator by removing them from the field.

Overland AI's mission is "to equip armed forces with the most advanced, dependable autonomy solutions to increase ground power and save lives". Its autonomy stack, asset orchestration platform, and hardware products are intended to enable a single operator to manage a fleet of vehicles remotely without ever entering the vehicle. In GPS-denied environments like the Russia-Ukraine war, remote-operated tanks are vulnerable to jamming, which exposes the team to enemy exploitation. Where human operators cannot have a line of visibility, autonomous systems can continue to execute missions independently. Overland AI’s stated mission is to replace the most dangerous jobs for tank operators by deploying modular autonomous systems that interpret and respond to the unpredictable battlefield terrain in ways human drivers can’t.

Founding Story

Source: Geek Wire

Overland AI was founded in 2022 by Byron Boots (CEO), Greg Okopal (COO), and Stephanie Bonk (President). It was spun out of an autonomous robotics lab at the University of Washington (UW), which was experimenting with off-road autonomous technology under the DoD’s autonomous vehicle project.

After earning dual degrees in Computer Science and Philosophy at Bowdoin College, Boots earned both a Master's and PhD in Machine Learning at Carnegie Mellon University, a leading robotics institution. After this, he advanced down the path of academia and became an assistant professor at Georgia Tech in 2014, and later, he became a professor of machine learning at UW. At the same time, he was appointed as the Principal Research Scientist at NVIDIA’s Robotics Lab in Seattle. As of July 2025, he was still an active professor at UW.

Boots was inspired to work in ground autonomy after years of collaboration with the US Army Research Laboratory through his time at UW’s Robot Learning Lab. Overland AI spun out of this research to advance warfighters' capability in autonomous combat. The Robot Learning Lab was selected to participate in the Defense Advanced Research Projects Agency (DARPA) Robotic Autonomy in Complex Environments with Resiliency (RACER) program. This allowed Boots to work directly with military personnel for the ten years he was involved in the program. Teams are selected to compete in two phases, one of which was the E4 experiment at a military training site in late 2023. The DARPA Challenge allowed Boots to contribute to self-driving technology at its inception.

Overland AI’s goal is to eliminate risk to human lives by conducting “rigorous field testing” made possible by the 200-acre proving ground in Washington state. Overland AI performs twice-weekly tests of its vehicles. In regard to the market opportunity here, Boots saw a gap:

"I know there are a lot of folks who are working on drones and on unmanned aerial vehicles and surface vessels, but there are comparatively fewer in the ground autonomy space"

He joined two researchers he had worked closely with at the UW Robotics Learning Lab as his co-founders.

Okopal earned his Master's and PhD in Electrical Engineering at the University of Pittsburgh. During this time, he did research in field robotics, signal processing, and underwater object detection for over a decade at various research institutions before co-founding Overland AI in 2023 as the COO.

Bonk studied Industrial Engineering at Purdue before receiving her MBA at the Wharton School of UPenn. She worked with consumer and B2B products at Apple before transitioning to the RACER Lab at UW, where she worked as the Director of Strategic Affairs with Boots.

Product

Source: Overland AI

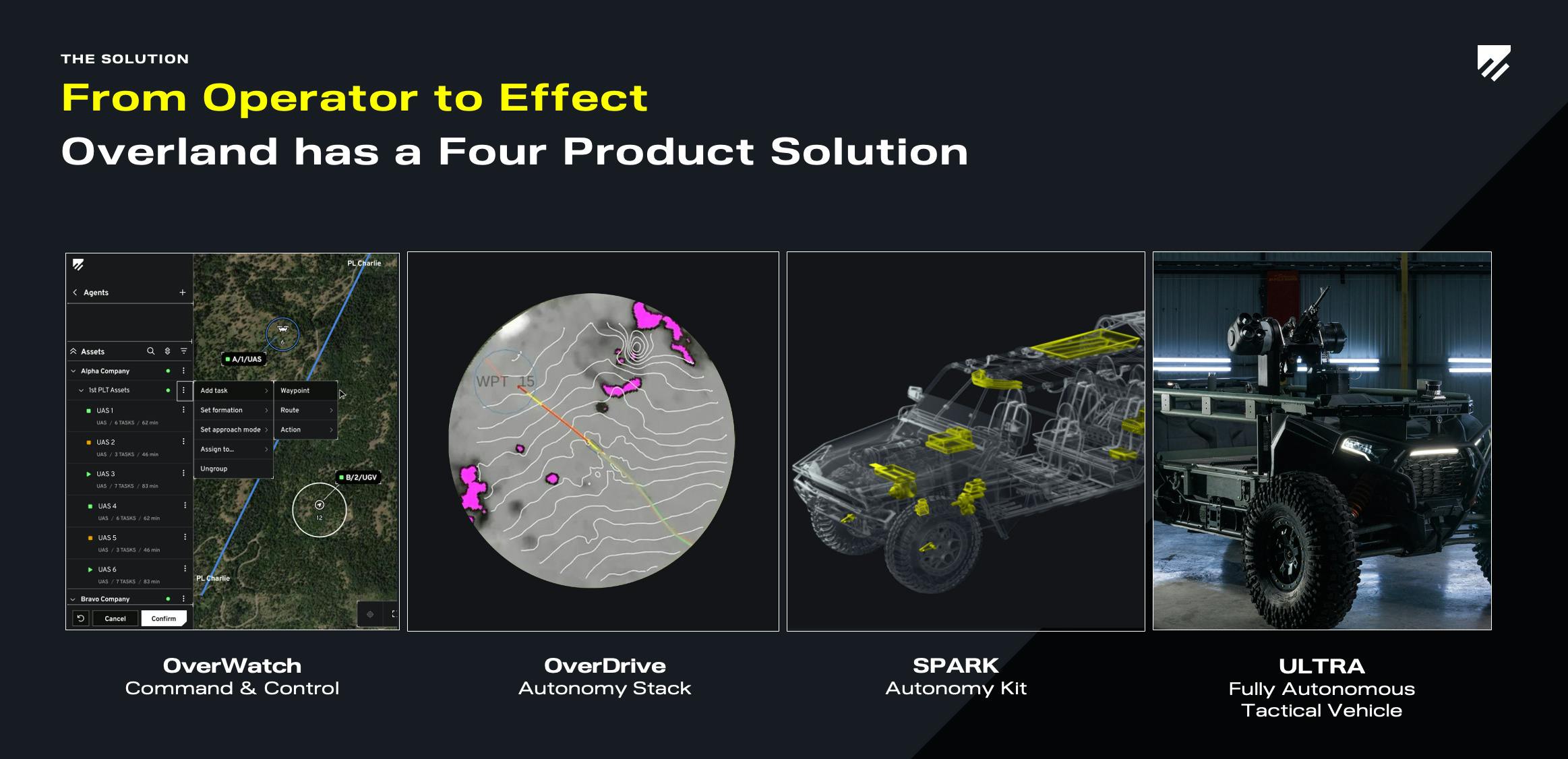

Overland AI provides an autonomy stack for ground vehicles and a Command and Control (C2) Software system to integrate with vehicles provided by the customer. In addition, Overland AI has launched several of its own ground vehicles as well.

OverDrive: The Autonomy Stack

Source: The University of Washington

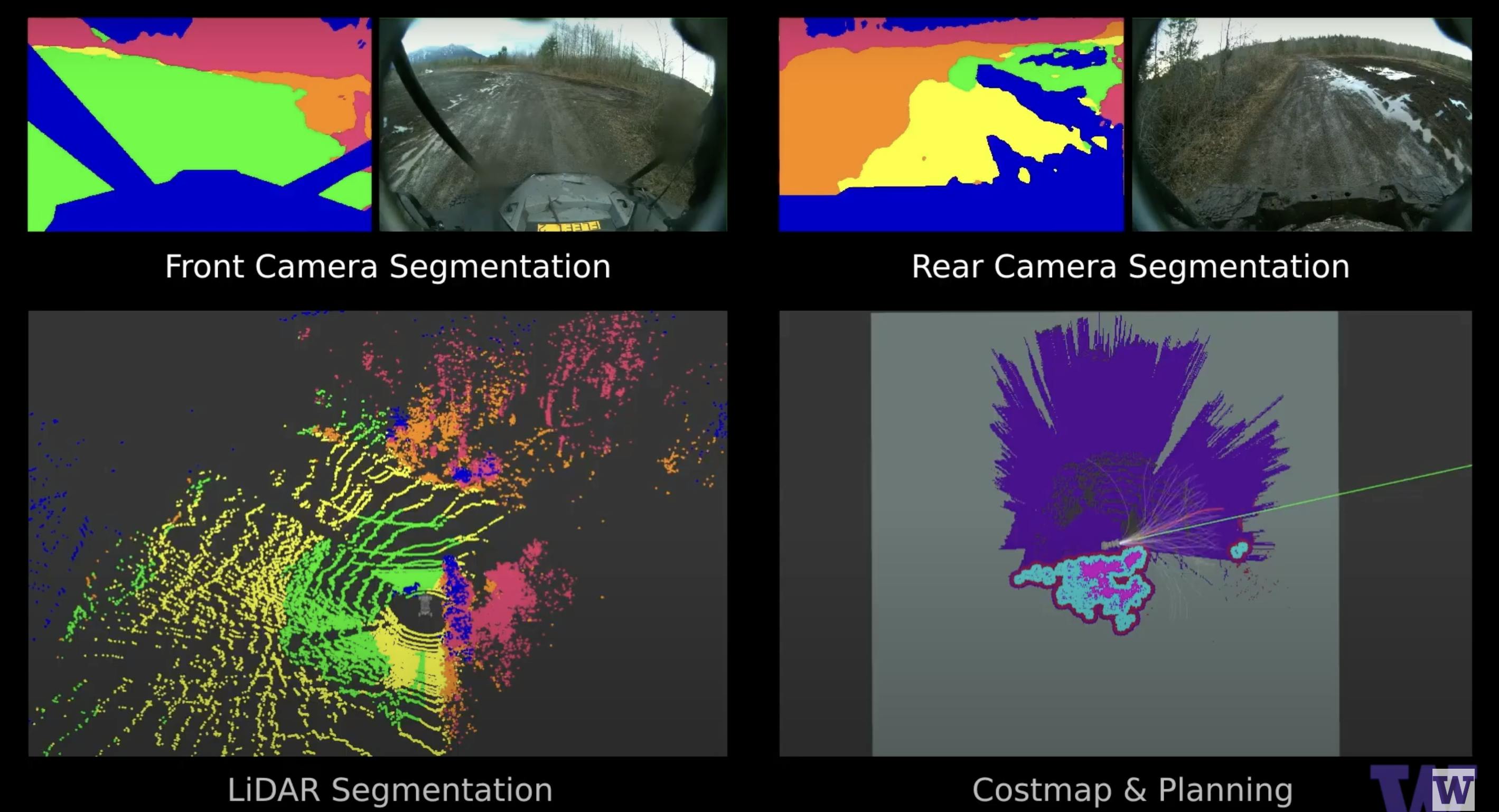

Overland AI’s OverDrive system is the autonomy stack that powers off-road perception and navigation in unpredictable conditions. It addresses the challenges of limited high-resolution terrain imagery, GPS-denied communication ecosystems, and unstructured environments without pre-mapped roads. The stack includes three parts:

(1) Perception: Onboard sensors like LiDAR and camera feeds create a digital twin of the outside world in real time by monitoring the orientation of modules and the vehicle’s positioning. It can support increased payload capacity for hosting additional thermal and optical sensing units for more detailed mapping.

This supports the system to remain operational in interfering weather conditions like rain and fog by deeply understanding the ecosystem through incremental exposure. Layer-based perception divides the geometry of the environment into different groups. Fused together, this can adapt to different vehicle dynamics:

The ground layer is the minimum elevation supporting surface for the vehicle, which includes hills and ditches.

The object layer is the maximum elevation that detects objects like trees, rocks, and bushes, which are understood in semantic context. This communicates whether an object can be safely traversed or if the vehicle should swerve around it.

The ceiling layer characterizes elevated objects that the vehicle needs to go underneath, like tree branches.

(2) Prediction: Simulations are run to test all possible trajectories and select vehicle dynamics with the safest traversal. Most functions are applied based on the safety of objects to design the optimal object traversal path. In-house machine learning techniques minimize error incrementally based on new information. This is different from other algorithms because it does not assume the world is static and can constantly update its rules based on new information. Objects are segmented, and visual semantics are applied to them to label them as dangerous or safe to traverse.

(3) Navigation: The vehicle navigates based on the digital map created by the environment. It can operate consistently even when communication links are severed.

Overwatch: Command & Control Software

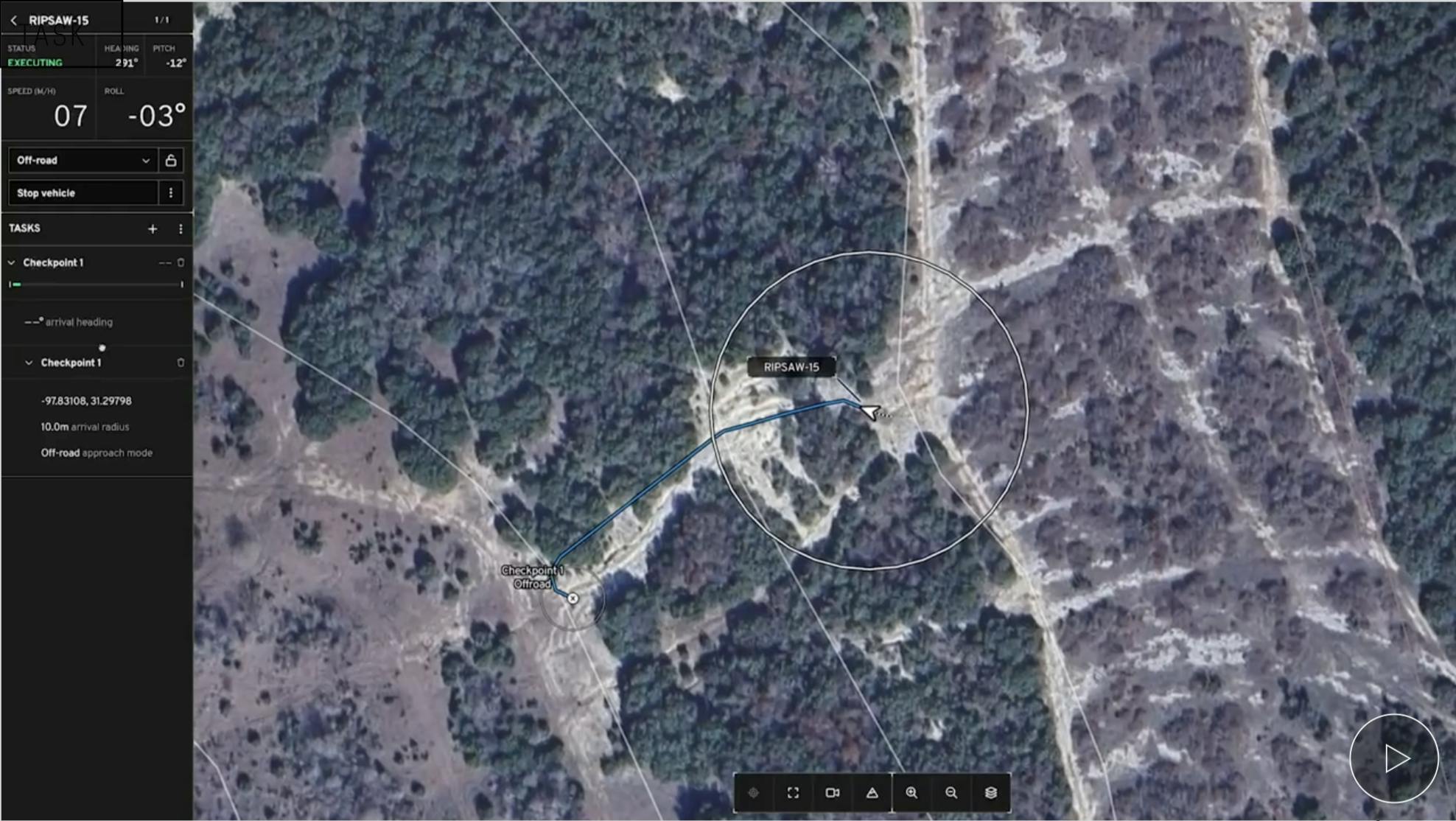

In January 2025, Overland introduced the Overwatch command and control (C2) system, which enables tank operators to monitor and coordinate fleets of tanks remotely. This supports visibility over larger fleets of tanks by visualizing all assets in one interface.

Passive sensor technology and LiDAR are used to avoid detection without pre-mapped routes, allowing it to map surrounding terrain in real time without GPS. Vehicles can be remotely summoned from miles away without defining a path beforehand. A waypoint navigation system allows operators to drop target points that the vehicle can automatically navigate to.

Source: Overland AI

Land Systems

In addition to Overland AI’s core products, OverDrive and OverWatch, the company has also enabled a number of land-based systems that leverage the company’s existing solutions. These land systems include:

ULTRA

Source: Overland AI

Announced in April 2025, ULTRA is a fully autonomous tactical ground vehicle purpose-built for the battlefield. It combines Overland’s core products to enable the product as a mission system to autonomously traverse harsh environments, carry up to 1K pounds of payloads like drones or logistics kits, communicate through mesh, 5G, or satellite links, and conduct reconnaissance, counter‑UAS, logistics, and more.

SPARK

Source: Overland AI

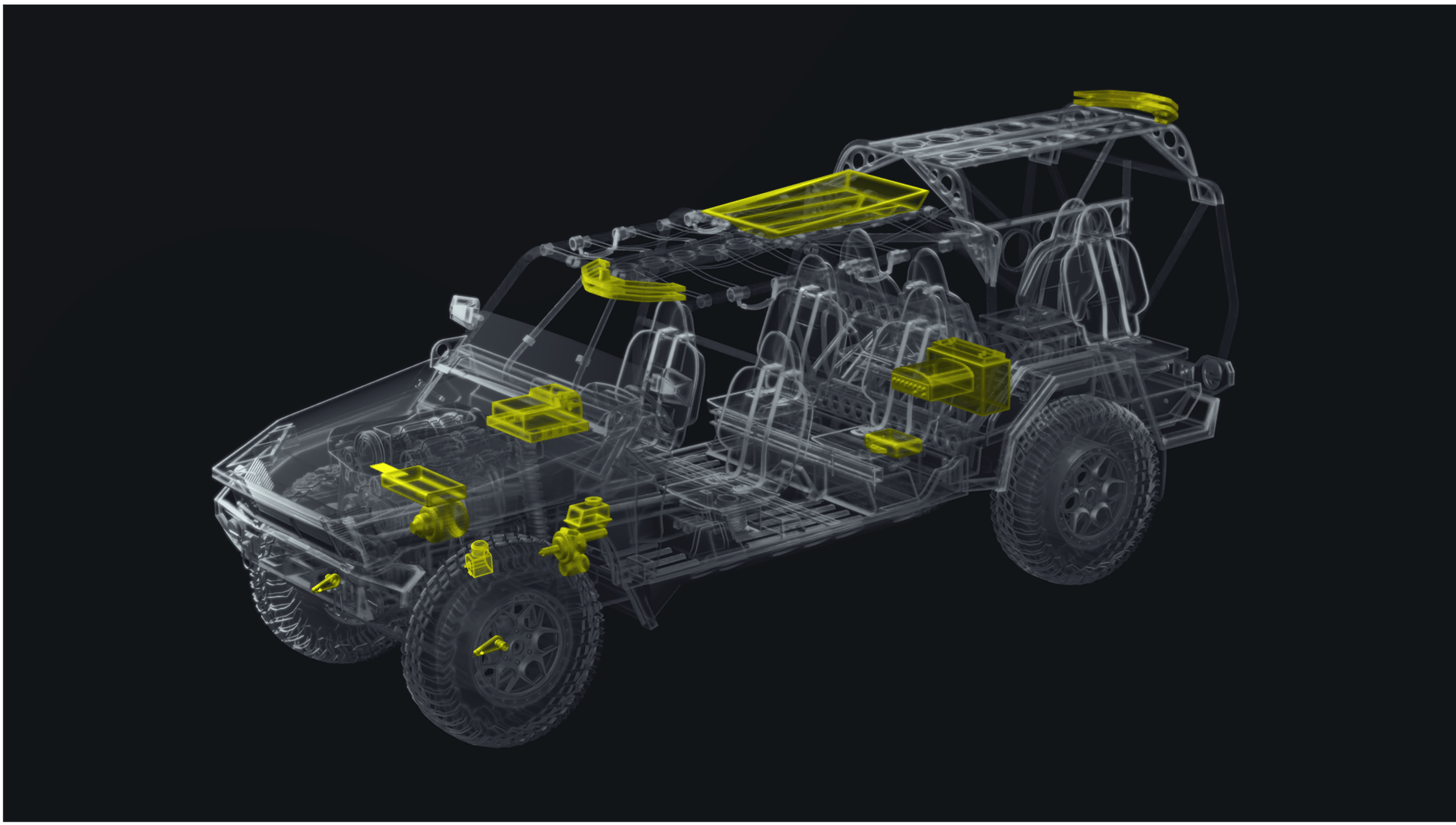

Announced in March 2025, Overland AI’s SPARK is an autonomy “up‑fit” kit designed to convert existing ground vehicles, ranging from light trucks to armored platforms, into fully autonomous systems. SPARK integrates OverDrive, the company’s advanced off‑road autonomy software, into a rugged, compact compute module that attaches via drive‑by‑wire interfaces and includes LiDAR, stereo cameras, GPS, IMU, and speed encoders to maintain perception and navigation even in darkness, dust, storms, and GPS‑denied environments. It also incorporates resilient communications, such as Starlink, tactical mesh, LTE, and Wi‑Fi, to ensure mission continuity in contested environments.

Vehicle Systems

Source: Overland AI

Beyond Overland AI’s own autonomous vehicles and integration kits, it also enables the utilization of a number of other systems. Leveraging the company’s vehicle‑agnostic OverDrive autonomy stack, Overland AI can transform a variety of platforms ranging from heavy robotic Ripsaw M5 skid‑steer tanks and medium payload S‑MET carriers to agile Polaris RZR Turbo S4 utility vehicles into fully autonomous systems capable of navigating complex, off‑road terrain without GPS or direct human control. Each platform maintains its original steering configuration (e.g., skid‑steer or Ackermann steering) and payload capabilities, allowing integration of sensors, modular mission kits, and tactical equipment. Overland complements this autonomy with OverWatch, a command‑and‑control interface that allows operators to monitor and coordinate multiple unmanned vehicles simultaneously in contested environments. Together, these technologies enable scalable, multi-role off‑road autonomy across defense vehicle types.

Market

Significant progress in autonomous ground vehicles has occurred in the commercial sector with companies like Waymo, Pony.ai, and Tesla. However, that market has had some setbacks. For example, GM-owned Cruise halted operations and laid off employees after a December 2023 incident where a pedestrian was struck and landed under a Cruise vehicle, before being dragged and seriously injured by the vehicle. Similar efforts by Argo AI shut down in 2022, while Apple abandoned its own autonomous vehicle efforts two years later. Despite challenges, autonomous vehicle operations are seeing material breakthroughs, such as the potential for scaling laws to apply to autonomous vehicles, driving dramatic improvements with more data and compute. In particular, the value of autonomy is even clearer in use cases that require dangerous operations, from construction to defense.

Customer

For Overland AI, the Defense Department is the primary customer investing in autonomous ground systems to support telecommunications, surveillance, and battlefield logistics. In 2022, the DIU formed the Ground Vehicle Autonomous Pathways (GVAP) project as an initiative to introduce software systems that could support autonomous, uncrewed vehicles for telecommunications and surveillance purposes. Out of 110 applicants, Overland AI was one of the few vendors selected, alongside Anduril, Palantir, and Shield AI, to deliver autonomous technology to the DoD.

Overland achieved “Awardable” status through the Chief Digital and Artificial Intelligence Office’s (CDAO) Tradewinds Solutions Marketplace, granting it permission to sell AI solutions within the broader DoD marketplace. Beyond procurement, Overland partners with DARPA programs that run research labs at universities, including the University of Washington.

Market Size

The market for unmanned ground vehicles (UGV) was valued at $3.9 billion in 2025 and is expected to grow to $8.8 billion by 2034. As of 2024, North America holds a 41% market share in the global UGV industry, with nearly 75% of the revenue share dedicated to defense use cases, rather than commercial. Market growth is, in part, driven by versatility. UGVs’ dual-purpose use cases for surveying untouched land and autonomously transporting parcels across extreme terrain make them attractive for both commercial and defense applications.

Competition

Competitive Landscape

Developing vehicles and solutions capable of managing off-road autonomy is complex. Companies must develop vehicles that overcome a lack of operator training, uncontrolled environments, and loss of road-based infrastructure to complete their mission. This complexity requires a robust cloud-based infrastructure that can efficiently orchestrate fleets and operate in remote conditions. Additional security issues and infrastructure make it more difficult for new players to enter the industry. Companies entering the market have taken different approaches, whether through commercial autonomy or simulation data generation.

Companies

Anduril Industries: Founded in 2017, Anduril is a US defense-tech firm specializing in autonomous systems, including unmanned aerial systems, counter-UAS, fixed and maritime platforms (Altius drones, Ghost Shark submarines), as well as a core command-and-control software, Lattice. Anduril’s products often enable autonomy through leveraging the company’s C2 capabilities, which compete with Overland AI’s ground autonomy systems. As of July 2025, the company had raised $6.2 billion in total funding, including a $2.5 billion Series G in June 2025, bringing its valuation to $30.5 billion.

Shield AI: Founded in 2015, Shield AI is a developer of autonomous drones and AI-powered autonomy software extending across products like Hivemind Enterprise, Nova indoor drone, V‑BAT VTOL, etc., that competes with Overland’s ground autonomy platforms, focusing on military intelligence, surveillance, and reconnaissance. As of July 2025, the company had raised total funding of $1.3 billion, including an $240 million Series F in March 2025 at a valuation of $5.3 billion.

Palantir Technologies: Founded in 2003, Palantir is a public software company offering defense and intelligence analytics platforms (Gotham, Foundry, AIP) that enable mission planning, fleet communication, and autonomy decision modules with functionality that overlaps with Overland AI’s command systems. In July 2025, Palantir had a market cap of $352 billion.

Applied Intuition: Founded in 2017, Applied Intuition provides AI-powered autonomous vehicle simulations to validate autonomy stacks across automotive, construction, and other industries. Headquartered in San Francisco, the company had raised $1.5 billion in total funding as of July 2025, including a $600 million Series F at a $15 billion valuation in June 2025. Applied Intuition’s core business is in data simulation to help other autonomy platforms, like Waymo, train their models, making it more of an adjacent competitor to Overland AI.

BAE Systems: Founded in 1999, BAE Systems is a traditional defense prime that develops a full set of simulation technology, combat vehicles, and a sensor stack to enable autonomous navigation. For example, BAE Systems has developed and demonstrated multiple uncrewed/autonomous ground vehicles, such as Australia’s ATLAS CCV, an 8×8 wheeled platform equipped with a 25 mm cannon, designed for off‑road autonomy, obstacle avoidance, and configurable for roles like direct fire, logistics, and counter-UAS missions. Though, reportedly, the ATLAS platform has operated with “human-in-the-loop” oversight.

In addition, BAE Systems has also explored integrating Forterra's land autonomy systems (AutoDrive) onto existing BAE chassis to enable autonomous navigation and mission execution. Finally, BAE Systems has previously produced prototypes like the Black Knight unmanned combat vehicle, demonstrating autonomous route planning, obstacle avoidance, and remote weapon control. As of July 2025, BAE Systems had a market cap of $75 billion.

Potential: Founded in 2018, Potential provides technology for off-road autonomy for commercial use cases and hobbyist drivers. As of July 2025, the company had raised $5.9 million in funding from investors like Brightspark and Brunswick. Potential’s autonomy system relies more heavily on physics, like torque and suspension settings, to create the optimal set point for the vehicle at each point in the operation.

Business Model

Overland AI doesn’t sell its vehicles, but rather its autonomy stack (OverDrive) and C2 System (OverWatch) to defense customers. The stack itself is designed on a modular architecture that can be integrated into any vehicle and coupled with different payload assets. Instead, the company often sells software licenses to defense customers, which gives access to the OverDrive Autonomy Stack and OverWatch Fleet Management Software. The OverWatch system can also manage large fleets of AGVs for research groups that want remote visibility over the battlefield environment. The product also offers integrations with vehicles like Polaris RZR, S-MET, and Textron Ripsaw M5, expanding partnerships with established primes like General Dynamics and L3Harris.

Traction

In April 2023, Overland AI was awarded $18.6 million by the US Army and the DIU to accelerate the development of the autonomy stack prototype for the Army’s Robotic Combat Vehicle. Overland AI is paired with Palantir and Anduril to adapt its OverDrive solution to support navigation across contested areas without GPS support. After securing endorsement from the DoD, Overland AI went on to partner with the XVII Airborne Corps to integrate ground autonomy into breaching initiatives. This is a significant experiment run on a dangerous offensive operation previously executed by combat engineers. Also in 2023, Overland AI was selected as one of three finalists for DARPA’s RACER Phase 2 program, offering some validation of its off-road autonomy performance in live field tests under complex terrain and GPS-denied conditions.

In October 2024, Overland AI partnered with L3Harris to integrate advanced autonomy systems into the DiamondBack, its AGV used for reconnaissance to logistical support. Diamondback’s hardware systems are designed for modularity and configurability, while Overland AI provides its software autonomy stack. Combined, this enables DiamondBack to handle extreme terrains and high-risk environments.

Source: tlimagazine

Following these partnerships in 2025, Overland AI began a hiring spree. The team grew to 50 people in January 2025 after raising its Series A. One new hire included Jay Wishman, a previous US Army Officer as the Chief Strategy Officer.

Valuation

In May 2024, Overland AI raised $10 million in seed funding led by Point72 Ventures with participation from Shasta Ventures, Ascend VC, Pioneer Square Labs, Voyager Capital, and Cubit Capital. Then, in January 2025, Overland AI raised a $32 million Series A Round led by 8VC, a deep-tech focused venture firm with a portfolio including Anduril, Epirus, and Saronic. Joe Lonsdale, the managing partner at 8VC, said Overland is postured to become "the next great defense prime.” Point72 Ventures, Overmatch Ventures, Shasta Ventures, Ascend, Osage University Partners, and Caprock participated in the round.

Key Opportunities

Adaptive Capability

Most autonomous driving solutions rely on a plethora of detailed satellite imagery and visual mapping frameworks around how roads are designed. Off-road solutions operate on a different paradigm of adaptability, which makes them versatile for different weather conditions and terrain. One transportation analyst explains that “building software that doesn’t rely on some of the main crutches of testing and deployment” can define a new segment of autonomy.

This capability provides a much more robust fallback option in GPS-denied environments where onboard sensor fusion can increase the perception capability of the environment without relying on detailed satellite maps. The system can operate in real time. It does not rely on traditional GPS or remote human operators. The software understands the ground geometry and semantic meaning. This means that operators can transition to monitoring tasks rather than constant control.

Remote Operation

Traditional autonomous vehicle companies must consider human safety at the forefront. This significantly limits the scope of technical capability compared to vehicles that remove the human from the system. On-road driving may often rely on telecommunications and remote operators to approve actions. For example, Waymo robotaxis end up blocking streets because they may require additional human guidance in particularly complex situations.

Overland AI removes the human from the loop and creates a system that can adapt and anticipate changes in the environment on its own, which increases safety and reduces the gap of operation that happens when constant human approval is required. This also enables field solutions to be much more scalable, rather than limited by the number of humans that can manually operate them.

Continuous Field Testing

Overland AI’s partnership with DARPA and the RACER program provides it with accessible testing terrain instead of relying entirely on synthesized data simulations. This allows the field team to iterate faster and test adaptation in new terrain. The software depends heavily on identifying flaws in the system and iterating on unmapped terrain, which is difficult to simulate due to a lack of representative training data for any given environment.

Boots believes this continuous field testing is the “secret sauce” that supports the resiliency of the autonomy stack. Where other autonomous driving platforms require much more capital and larger facilities to simulate diverse terrain for training purposes, Overland AI has the ability to iterate much more rapidly with the data it has access to.

Key Risks

Operational Reliability

Overland AI’s central value proposition is its ability to deliver trusted autonomy in the most challenging military settings, including areas without GPS, with intermittent communications, and under the threat of adversarial interference. Products like OverDrive and OverWatch are specifically designed for these “edge-case” scenarios, where traditional autonomous systems often fail. But this capability is inherently difficult to deliver consistently. Operating in GPS-denied environments often means relying solely on onboard sensing and machine-learned decision-making, which can degrade under dust, low visibility, or electronic warfare.

Potentially, a single high-profile field failure, such as a vehicle misnavigating into an unsafe zone, losing formation, or misinterpreting its environment, could undercut Overland’s reliability claims and slow its ability to secure or scale contracts. The company has emphasized its alignment with MIL-STD-882E and other safety frameworks, but its systems remain largely unproven at scale across diverse theaters. In a defense context, reliability is binary: either a system works under duress or it’s left behind. Without demonstrable consistent performance, Overland AI risks losing trust with its most important customers.

Escalating Safety Liability & Ethical Use Concerns

As Overland’s autonomy stack is deployed into tactical military vehicles across surveillance and targeting missions or supporting loitering munitions, the line between navigation and decision-making begins to blur. This introduces both legal and ethical concerns. If an Overland-equipped vehicle is involved in an incident, whether from system error or improper deployment, it is not yet clear who bears responsibility: the operator, the software provider, or the command structure. This becomes even more complex in adversarial environments where actions can escalate quickly, and split-second decisions made by AI may lead to collateral damage or misidentification.

Overland AI’s leadership has framed its mission around building "trust" through design and transparency, but frontier autonomy remains a regulatory gray area, especially when integrated into systems capable of lethal or near-lethal actions. These concerns may not only affect customer perception but could also delay broader adoption, especially if public or international scrutiny intensifies around AI-driven military systems. Long-term, Overland AI may face the same liability and insurability questions currently emerging in sectors like commercial autonomous driving and AI-enabled healthcare.

Execution Risk

After early successes like its demonstration at Project Convergence Capstone 5 and an $18.6 million contract award to deploy its autonomy stack on ULTRA vehicles, Overland now faces the complex challenge of scaling from a high-performing R&D startup to a full-scale defense supplier. This means producing and integrating autonomy kits across multiple vehicle classes, supporting real-time operations across distributed theaters, and maintaining system reliability through software updates, diagnostics, and training.

Military hardware deployments introduce a level of logistical complexity and global footprint that few commercial autonomy companies have had to manage. Even minor delays in integration, supply chain disruptions, or gaps in field support could stall broader rollout and invite competition from larger defense primes with established delivery pipelines. The transition from demo success to dependable, global deployment is fraught with operational risk. If Overland AI fails to scale its production and support infrastructure as quickly as it has advanced its technology, it could find itself stuck in pilot purgatory: technically promising, but not reliably fielded.

Summary

Ground autonomy has primarily been dominated by on-road services like Waymo and Tesla and is only reaching mainstream adoption in 2025, despite over a decade of predictions that it was just around the corner. For many of these providers, they’re operating on a very fixed data set and often operating in pre-mapped environments. At the same time, the military is demanding more adaptive ground autonomy that can navigate in unstructured and dynamic terrain, which few companies have touched before.

Overland AI is designing an autonomy stack tailored for off-road navigation built on top of layers of sensors and machine learning pipelines that can quickly identify and draw meaning from its environment. This system equips the military with intelligent technology that can replace human operators on the battlefield and secure their safety, and intelligently navigate new terrain otherwise inaccessible to humans. As Overland AI scales to support remote fleet operations, its technology sets up a new defense domain around ground autonomy beyond human operators. The question going forward will revolve around the ability to consistently field these types of systems.