Thesis

The last two decades have witnessed a proliferation of subscription-based businesses. The global subscription economy was valued at $276 billion in 2022 and is expected to grow to $599 billion by 2026. 95% of B2B companies surveyed in 2020 offer at least one subscription-based product, while 75% of B2C companies are estimated to offer subscription services in 2023. This suggests that offering subscription products is becoming table stakes.

However, many companies operate with complex and difficult-to-scale billing infrastructure, leading to lost revenue. Roughly 50% of subscription attrition is due to involuntary churn, yet only 53% of subscription businesses track involuntary churn. Companies lack analytics giving them a centralized dashboard, preventing them from analyzing metrics to identify revenue opportunities and diagnose churn. The increasing complexity in recurring revenue model is driving demand for more efficient and accurate revenue management solutions among the growing number of subscription-based businesses.

This is where Chargebee comes in. Chargebee offers a suite of products designed to support the spectrum of recurring revenue management, enabling subscription businesses to capture, retain and maximize revenue opportunities. Its platform includes subscription management, billing automation, recurring payments, reporting, and analytics. Chargebee aims to provide a growth engine for early-stage startups to large enterprises to power, capture, and understand revenue.

Founding Story

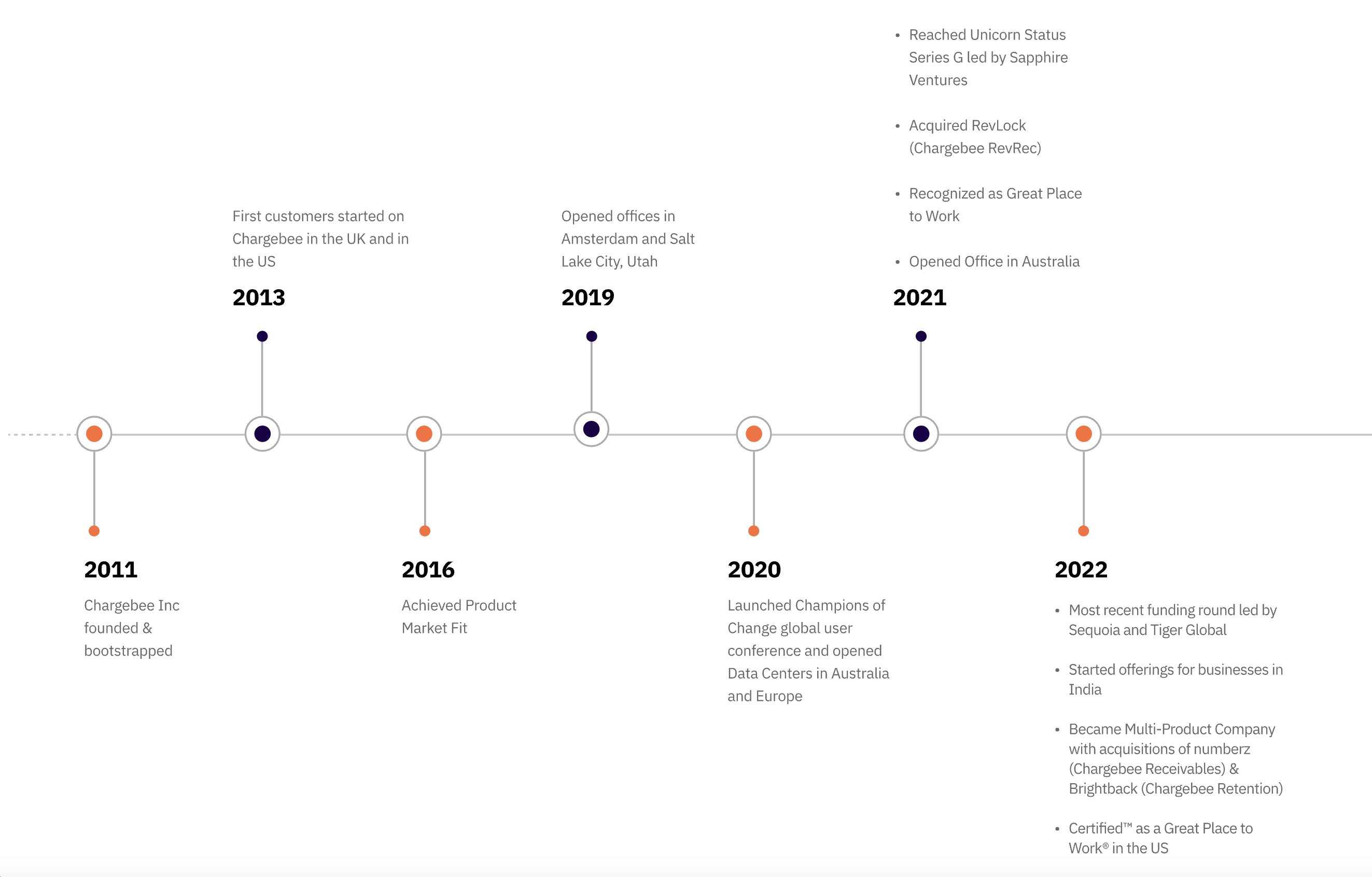

Chargebee was founded in 2011 in the southern Indian city of Chennai by four friends: Krish Subramanian (CEO), Rajaraman Santhanam (COO), Saravanan KP (CTO), and Thiyagarajan Thiyagu (Architect).

Growing up, Subramanian closely watched how his uncles ran their restaurant business, observing how they managed customers, operations, and cash flows. He saw firsthand the difficulties of maintaining the fragile relationships existing between customers and businesses.

Subramanian kept this memory in mind when he reconnected with Santhanam, a former classmate, and Thiyagu and KP, two engineers from Zoho, one of India’s most successful cloud software companies. Inspired by Fog Creek Software’s journey (now Atlassian), the team wanted to bring people together and enable them to make decisions rather than start by finding a unique product to build. As Subramanian puts it:

“[Atlassian] didn’t start with an interesting problem. They took a boring problem and solved it in interesting ways.”

From their experiences across SaaS companies, the team saw the importance of having seamless systems integrate across complex processes. During the discovery phase, the team realized that managing recurring billing and payment subscriptions was most complex yet poorly integrated system. Many business owners did not spend time thinking about billing operations. However, billing issues in subscription businesses can quickly snowball, as customers pay at regular intervals rather than making one-time purchases. Roughly 50% of subscription attrition is due to involuntary churn, yet only 53% of subscription businesses track involuntary churn.

Chargebee’s founders believed that companies should not have to build their own billing infrastructure, inspiring them to start the company. In the early days, Chargebee had a slow start. More businesses were moving to recurring revenue models, yet many founders still had questions around implementing subscription payments including how to handle payments and billing logic. The team initially found traction with ecommerce companies which typically lacked the developer resources to build their own systems, but it took them five years to achieve product-market fit. When asked about Chargebee’s journey, Subramanian said:

“I would actually split our journey into two parts. The first five years of finding product market fit journey and then continuing to grow a 100% year on year in the next five years and going through the scaling journey of the company.”

In the last two years, Chargebee made two notable acquisitions: (1) RevLock, an automated revenue recognition platform that helps companies meet compliance and reporting requirements, and (2) Brightback, a customer retention automation platform. With these acquisitions, Chargebee intends to support the entire revenue lifecycle from first interaction to closing the books, enabling teams to make better business decisions.

Source: Chargebee

Product

Chargebee offers a suite of products designed to support the spectrum of recurring revenue management.

The platform enables subscription businesses to capture, retain and maximize revenue opportunities through (1) subscription management, (2) billing automation, (3) recurring payments, and (4) reporting and analytics.

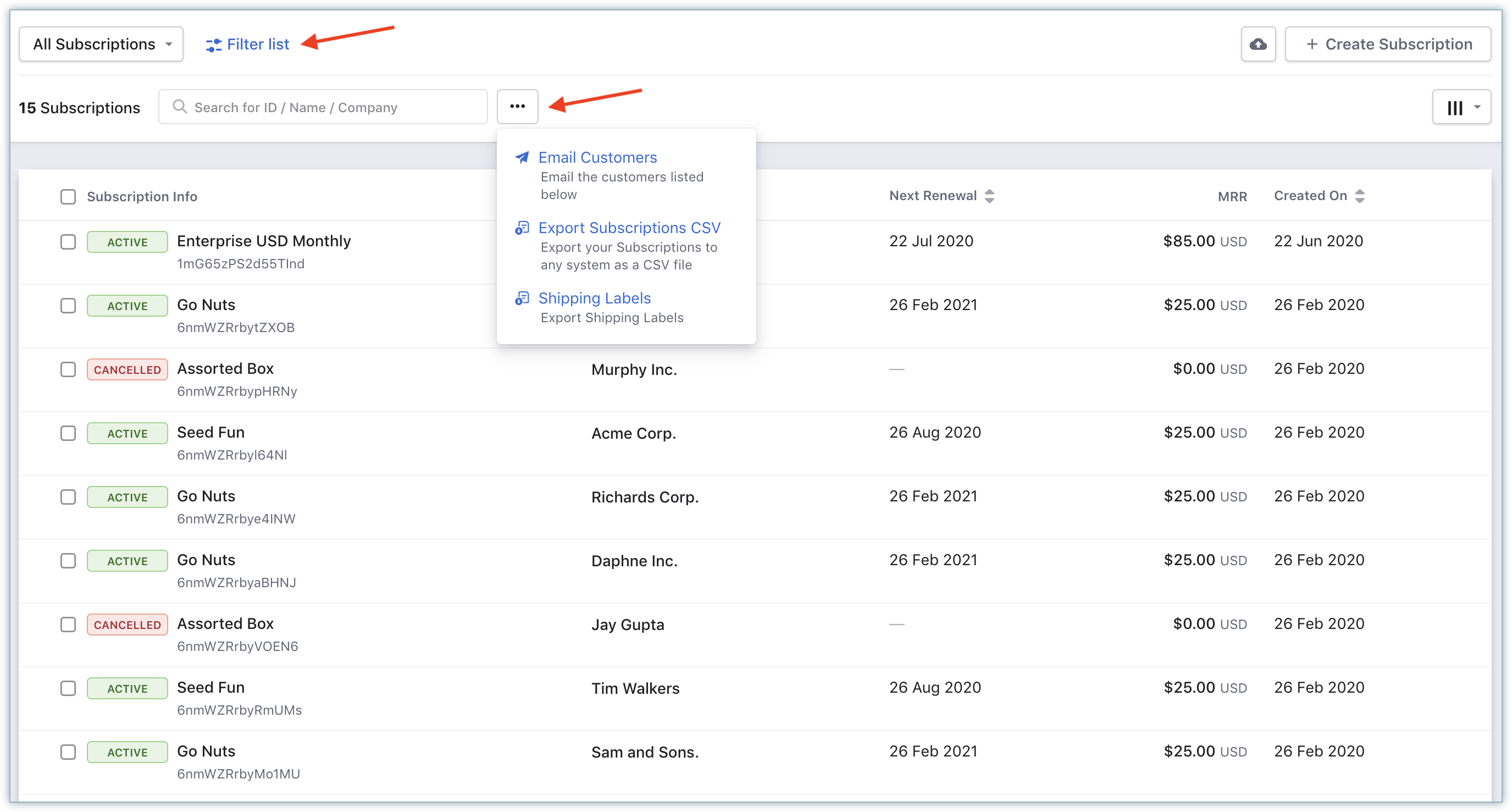

Subscription Management

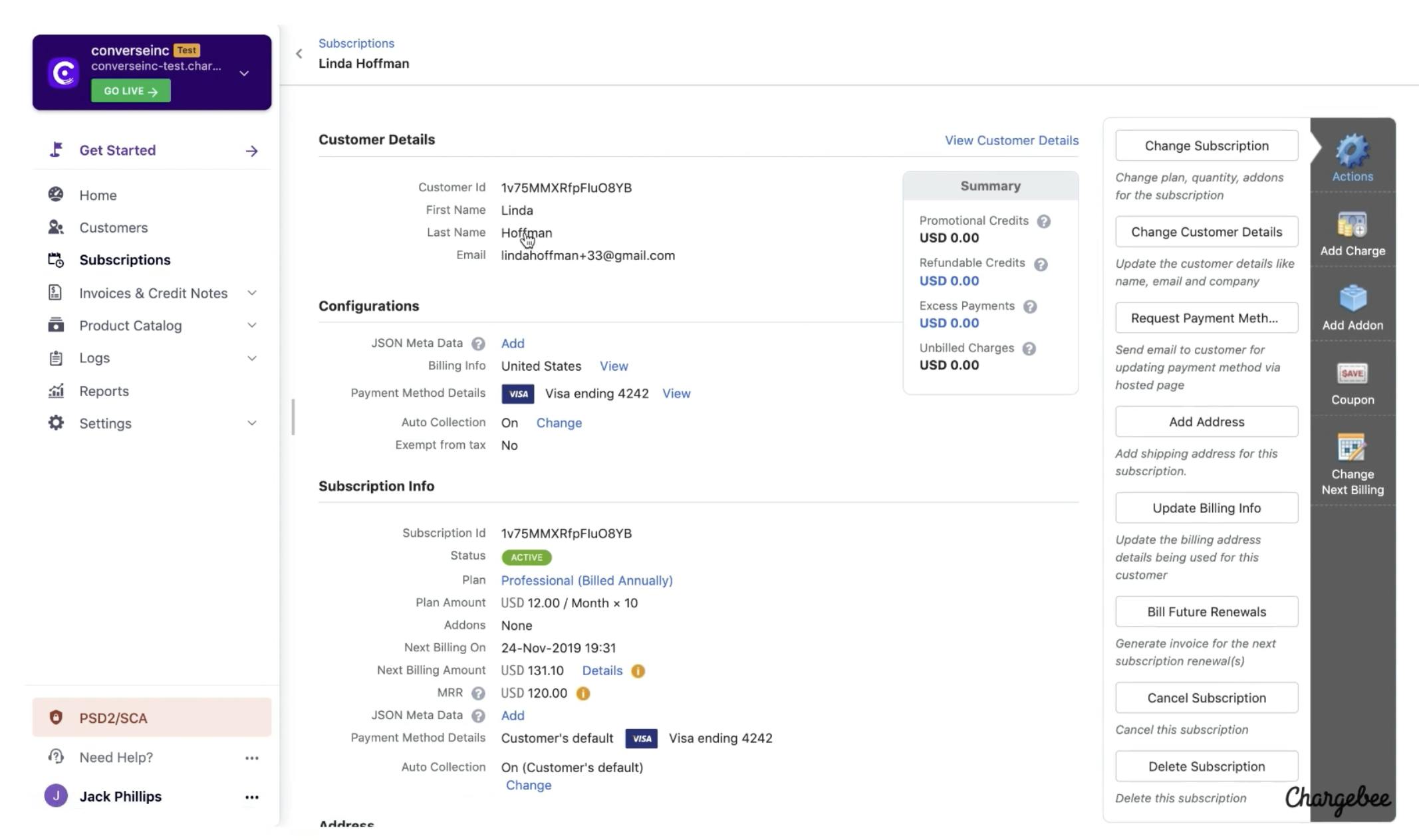

Chargebee’s subscription management module handles a customer's subscription lifecycle from trial to signups, plan management, upgrades, downgrades, and cancellations. The module also offers features such as proration and trials, enabling businesses to manage the complexities of their recurring revenue models.

Source: Chargebee

Key features of the module include:

Subscription Lifecycle Management: Create, manage, pause, cancel, reactivate and extend subscriptions. Handle upgrades and downgrades at any point in the billing cycle. Keep customers engaged with automated emails throughout the journey.

Flexible Pricing Models: Customers may experiment with flat fee, per unit, tiered, volume and stairstep pricing models.

Reengagement Tooling: Sales and marketing teams can use Chargebee to run campaigns to engage with existing customers better.

Automated Customer Engagement: An automation tool allows customers to send automatic recurring reminders (via email and SMS), while also providing visibility on their customer's engagement with product and services.

Source: Chargebee

Billing Automation

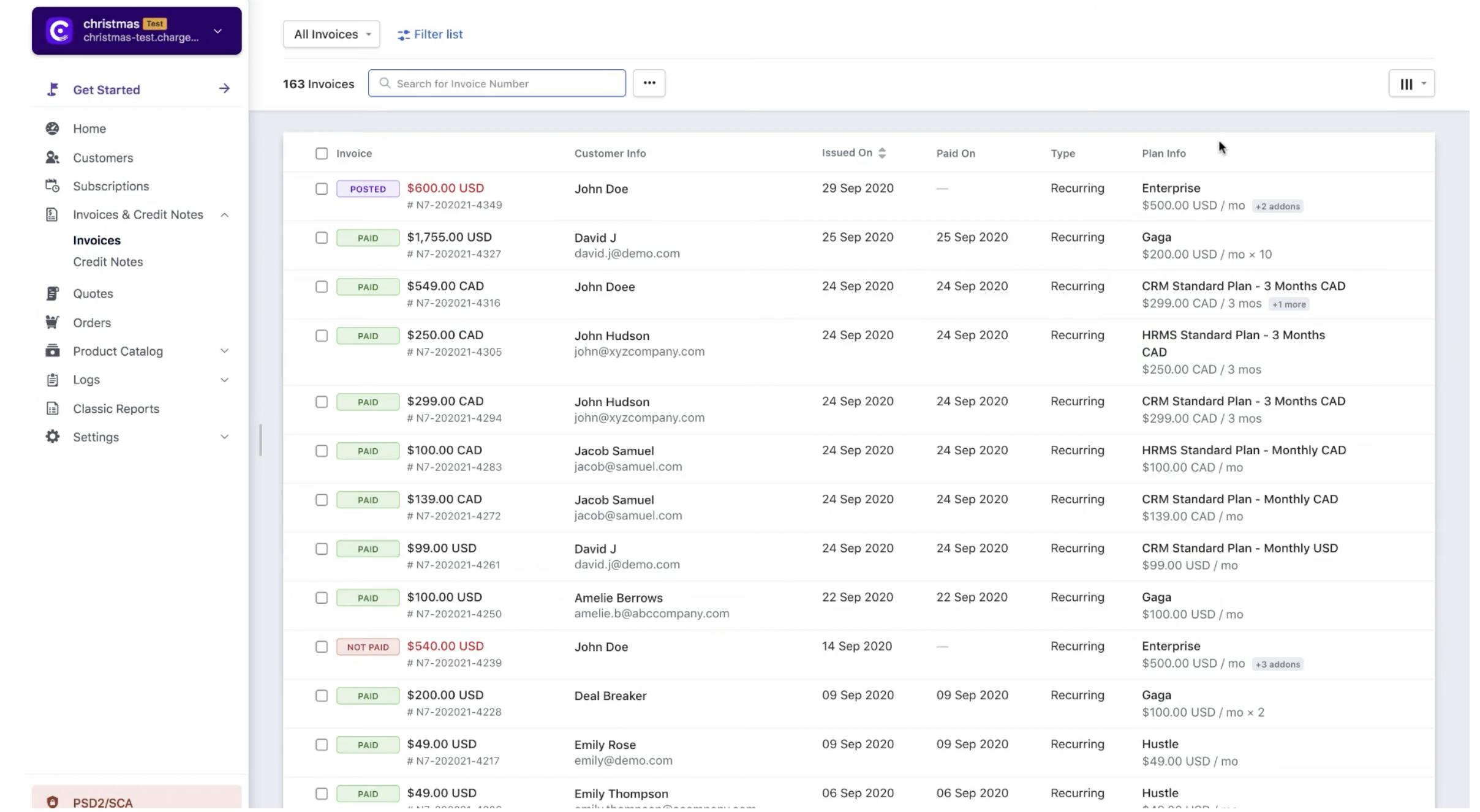

Chargebee’s billing automation module handles new customer signups or purchases by automating their billing and invoicing process. Businesses can set up recurring billing cycles, manage billing exceptions, and handle proration and discounts all within the platform. The module supports multiple payment gateways and currencies, making it easy for businesses to manage global transactions.

Key features include:

Customizable Billing Cycles: Customize billing frequency, choosing to charge customers on a yearly, monthly, weekly, daily, or based on usage.

Chargeback Management: Pull up dispute information and use the Chargeback workflows to make changes to subscriptions, and the status of invoices and issue credit notes with low manual effort.

Account Hierarchy: Structure customer accounts by allowing customers to model customer organizational charts into logical parent-child relationships and set billing preferences.

Metered Billing: Charge customers based on their usage of your app or add overages to a base fee. Chargebee takes care of the calculation and the workflow automation.

Source: Chargebee

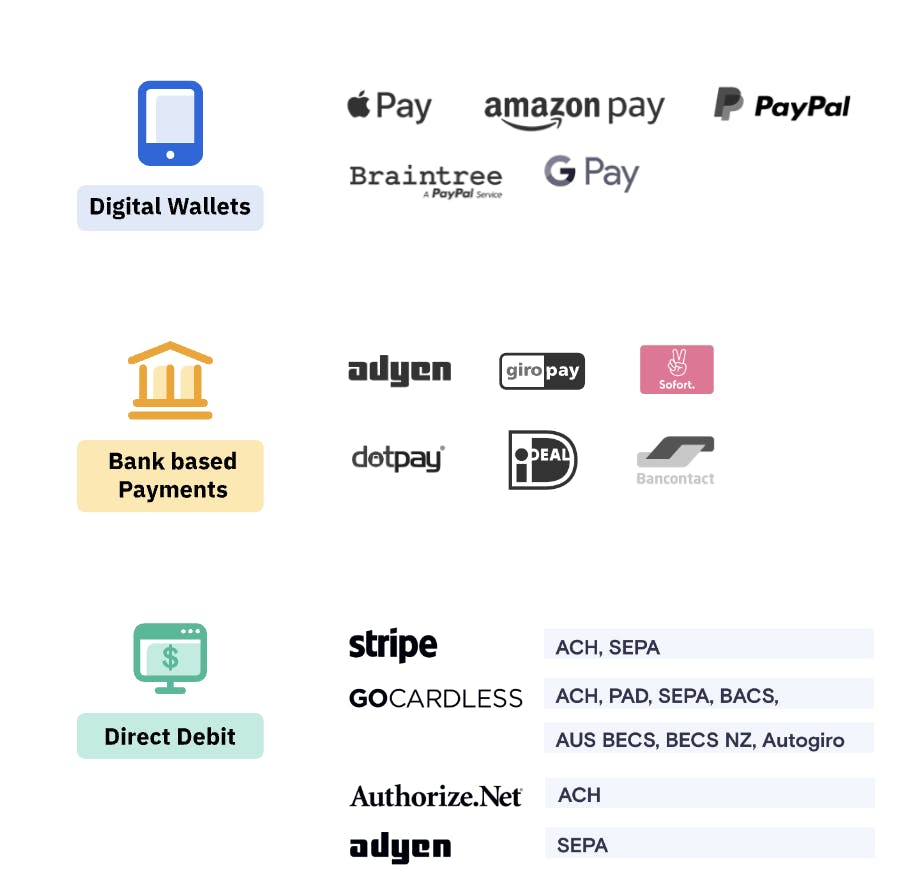

Recurring Payments

Chargebee's Recurring Payments module offers businesses a flexible and secure solution for managing recurring payments across 150+ countries. Features include payment retries, dunning management, payment scheduling, and automatic payment processing.

Source: Chargebee

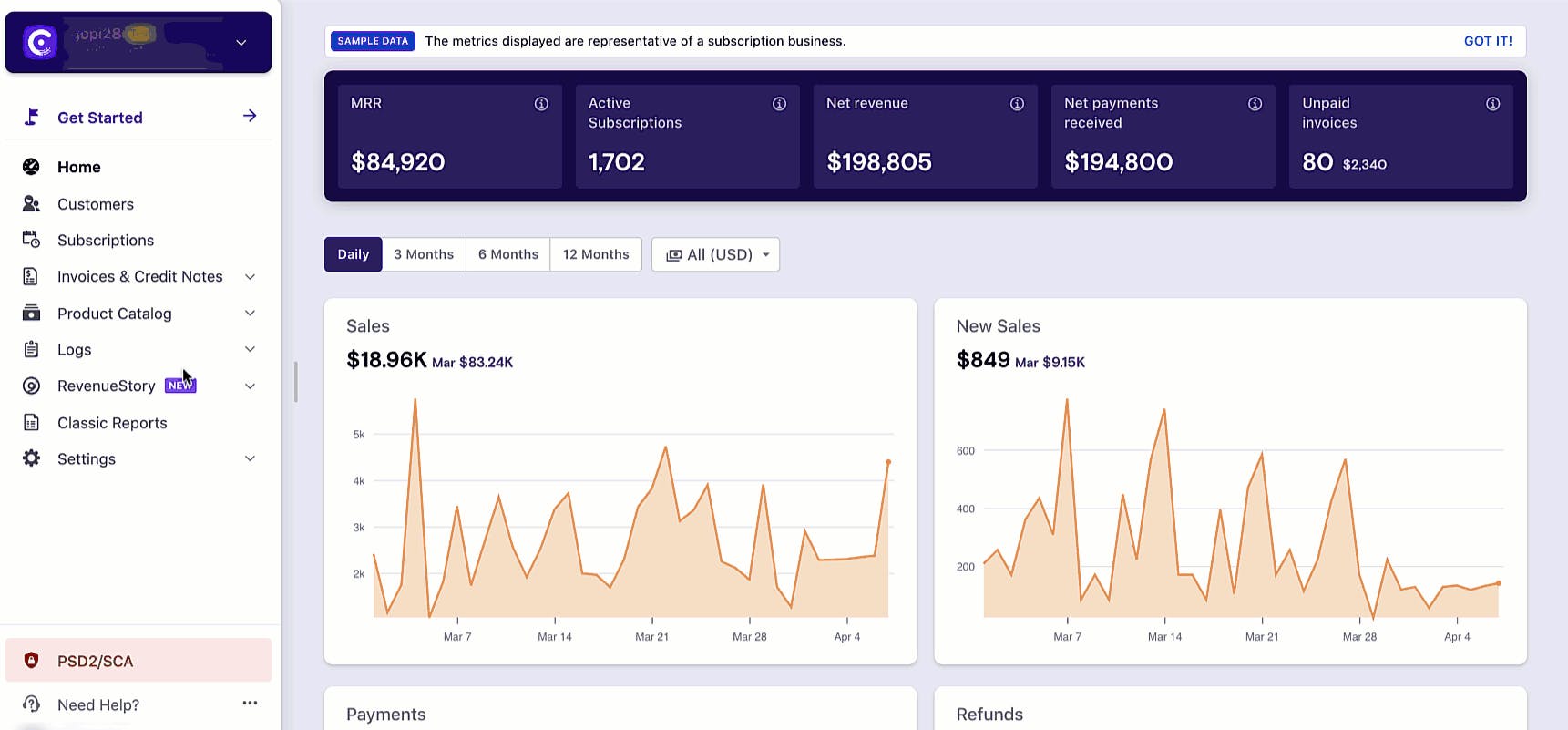

Reporting and Analytics

Chargebee's Reporting and Analytics module provide businesses with real-time insights into their recurring revenue models. With this data, a customer can make better-informed decisions on acquisition and retention. Users can monitor MRR, customer lifetime value, retention, engagement, and churn. The module also enables businesses to create custom reports and dashboards and export data to other platforms, such as spreadsheets and data visualization tools.

Source: Chargebee

Chargebee’s integrations with a wide range of third-party apps extends billing platform capabilities and help teams work efficiently by streamlining information across functions and automating workflows. Categories include accounting software, helpdesk providers, collaboration tools, and CRMs.

Source: Chargebee

Market

Customer

Chargebee's customer profile is typically a small to medium-sized business (SMB) operating in B2B SaaS and ecommerce. That said, Chargebee also does serve enterprises and supports other verticals, including e-learning, publications, and more.

Chargebee customers either have a recurring revenue model or are looking to switch to one, thus requiring a comprehensive billing and subscription management solution to manage their operations efficiently. Chargebee is said to be able to help large enterprises move to a subscription model within 10 days.

Chargebee leverages a bimodal go-to-market strategy with both freemium and enterprise motion. By offering a free plan, Chargebee gets a foot in the door with early-stage startups, growing LTV as customers continue to scale and upgrade plans.

Market Size

The global subscription economy was valued at $275.6 billion in 2022 and is expected to grow to $599.1 billion in 2026 (22% CAGR from 2022-2026). Some estimate that the ecommerce subscription market will grow even more aggressively, from $96.6 billion in 2022 to $2.7 trillion in 2028 (71% CAGR from 2023-2028).

As the subscription market grows, so does the opportunity for Chargebee to grow its customer base as offering subscription products is becoming table stakes. 95% of B2B companies surveyed in 2020 offer at least one subscription-based product. Within B2C, 75% of organizations is estimated to offer subscription services by 2023.

From a bottoms-up perspective, the subscription and billing management market was valued at $4.8 billion in 2021 and is expected to grow to $17.9 billion by 2030 (16% CAGR from 2022-2030). Key drivers of growth include (1) rising adoption of subscription-based models across B2B and B2C companies, (2) growing emphasis on reducing subscriber churn and improving retention, and (3) rising demand for modernizing legacy systems through cloud-based solutions.

Competition

The market for subscription management and billing automation solutions is fiercely competitive. Chargebee is a rising player, but it faces competition from other subscription management software companies. Notable competitors include Zuora, Recurly, Stripe Billing, and Zoho Subscriptions.

Zuora: Zuora is best suited for medium to large enterprises. It offers a robust revenue recognition engine, sophisticated invoicing and payment capabilities, and a powerful reporting and analytics engine. However, this complexity can also be seen as a disadvantage for some users who may find it difficult to navigate and use. Chargebee has a smaller global footprint and a less extensive product offering, which could limit its ability to serve larger and more complex businesses. Additionally, Chargebee's platform is less mature and established than Zuora's and may not offer the same level of performance and scalability.

Recurly: Recurly and Chargebee targets similar customer segments and their features are more or less on par. Recurly is said to process over 7x the volume of Chargebee and serves over 2.3K customers (versus Chargebee’s 4.8K), implying a higher average account size. While Chargebee's platform is highly customizable, the learning curve may be steeper. Chargebee offers deeper integrations, particularly with Stripe and PayPal, which makes it a better fit for businesses that depend on both. Recurly recently dropped the pricing on its first tier so that it is free for smaller startups, matching that of Chargebee.

Stripe Billing: Stripe Billing is a more streamlined and simplified platform that focuses on payment processing and subscription management, making it a better fit for businesses that do not need a lot of customization or complex reporting. Chargebee is a better choice for businesses that require more advanced billing and reporting capabilities, while Stripe Billing is a more straightforward solution that may be a better fit for smaller businesses. However, Stripe Billing is not as feature-rich as Chargebee, and businesses looking for a complete recurring revenue management solution may find Chargebee a better fit.

Zoho Subscriptions: Zoho Subscriptions offers a more affordable alternative to Chargebee, making it a better fit for businesses that are just starting out or have limited budgets. In addition, Zoho Subscriptions has a simpler and more straightforward user interface, making it easy for businesses to manage their subscriptions and billing processes, even if they have limited technical expertise.

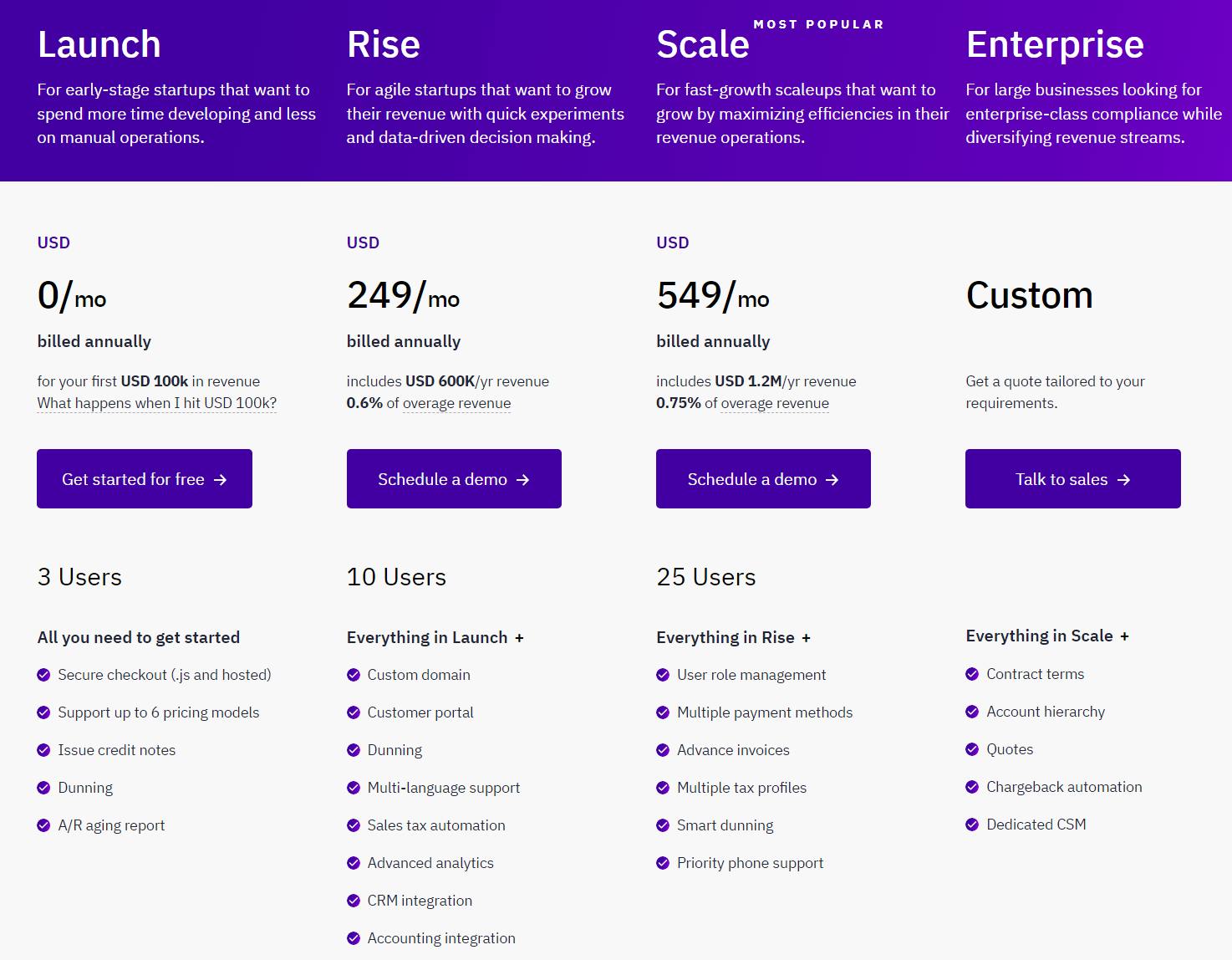

Business Model

Chargebee operates on a SaaS business model and offers four subscription tiers with flat monthly rates based on the customer’s processed revenue needs. If a customer’s processed revenue exceeds the tier’s annual cap, customers will pay an additional overage fee, billed as a percentage of excess revenue.

Launch: Free for early-stage startups generating under $100K in annual revenue. If a customer surpasses this amount and wants to continue with the plan, Chargebee bills them at $99 per month with a 0.5% overage fee.

Rise: $249 per month for mid-stage startups generating under $600K in annual revenue. This is the subscription they recommend most.

Scale: $549 per month for fast-growth startups generating under $1.2 million in annual revenue. Scale is the most popular plan.

Enterprise: Customized pricing and solutions for larger organizations. Benefits include enterprise-class compliance and support.

Source: Chargebee

Traction

As of February 2023, Chargebee serves over 4.8K customers across startups to enterprises and processed over $5 billion in revenue. Most customers are based in the U.S. and Europe.

Source: Chargebee

As of February 2022, B2B customers accounted for roughly 70% of Chargebee's processed revenue. However, management noted that it expects a spurt in ecommerce activity to help Chargebee add more B2C customers. The company does not publicly disclose its financial metrics, but Santhanam revealed in February 2022 that Chargebee grew its annual recurring revenue (ARR) by over 100% in the last 12 months.

Valuation

In February 2022, Chargebee raised $250 million in its Series H at a $3.5 billion valuation, doubling its valuation in 10 months. The round was co-led by Tiger Global and Sequoia Capital India, along with existing investors, including Insight Partners, Sapphire, and Accel. The company has raised roughly $470 million in cumulative funding and serves as India’s 11th unicorn.

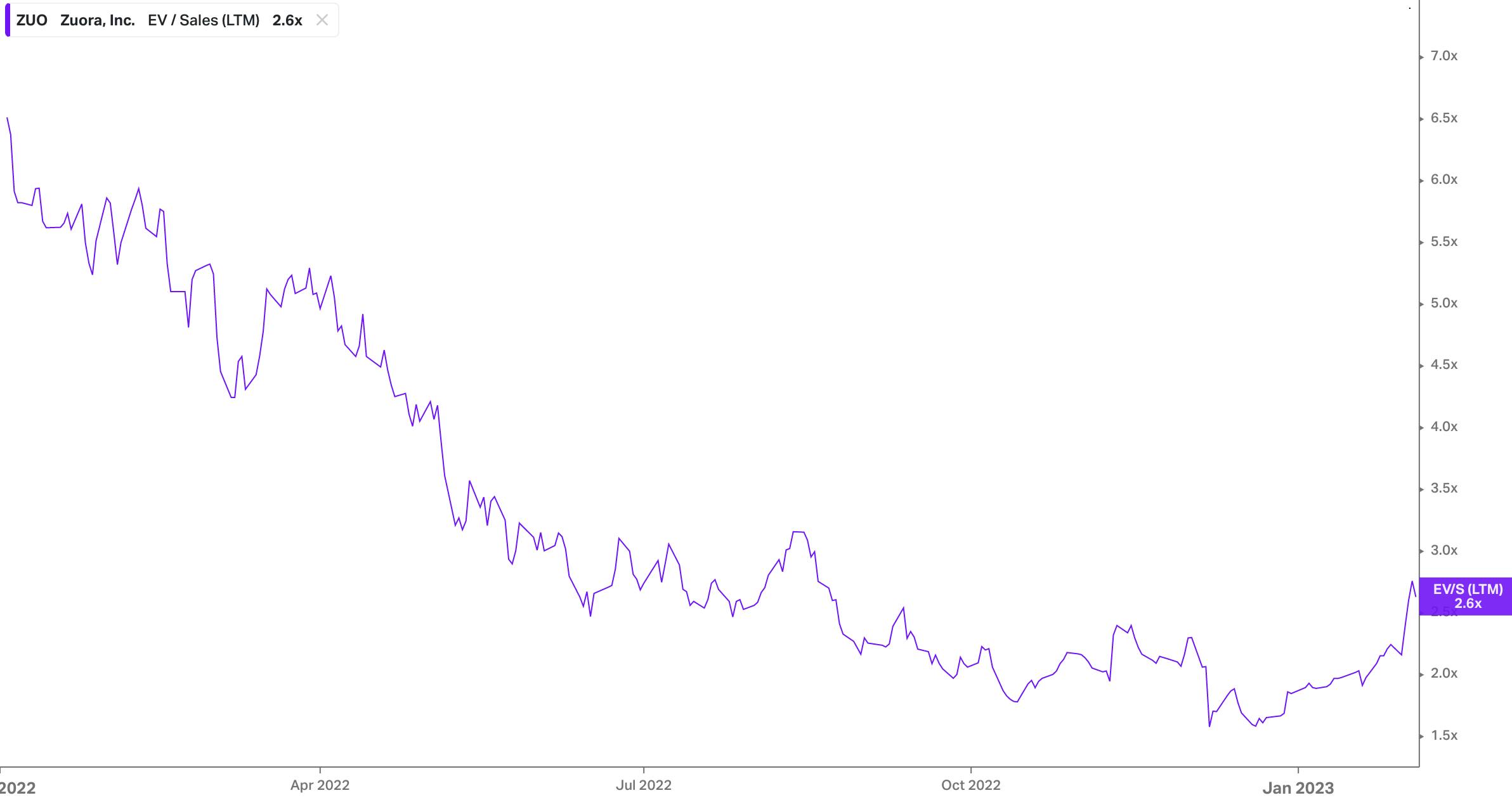

Chargebee’s revenue was reported by one source to be at $115.4 million in 2022. Taking a conservative estimate and assuming Chargebee’s 2021 revenue was in the range of $50-100 million, the latest valuation implies a 35-70x multiple. Chargebee’s competitors are primarily private companies. Zuora ($384 million LTM revenue, 14% YoY growth), Chargebee’s closest publicly traded competitor, has seen its revenue multiples decline from a high of ~7x in 2022 to current levels of ~3x.

Source: Koyfin

Key Opportunities

Increasing Complexity of Recurring Revenue Model

The subscription business model is becoming increasingly complex as businesses look to monetize their offerings in new and innovative ways. Newer models can offer tiered pricing, usage-based pricing, API calls-based pricing, country-level pricing, and other methods. This complexity drives demand for more efficient and accurate revenue management solutions, presenting Chargebee with a growing market for its products. Chargebee has the opportunity to address this need by continuously enhancing its platform to meet the evolving needs of its customers across product innovation, user experience, and customer support.

Product Expansion

Chargebee has the opportunity to expand its product offerings by launching complementary products that address the needs of subscription-based businesses. For example, the company could develop a CRM solution that integrates with its billing and invoicing platform to provide a comprehensive solution for managing customer interactions and sales. Additionally, the company could develop a revenue optimization solution that helps businesses optimize their pricing strategies and maximize customer lifetime value.

Key Risks

Crowded Market

Chargebee operates in a highly competitive market, and intense competition from established players and new entrants could impact its ability to remain relevant and meet the changing needs of its customers. One of the key risks for Chargebee and the subscription management software market is the lack of a geographic competitive moat. The subscription management software market is highly competitive and global, with a large number of players operating across geographies. This creates intense competition and a large threat of new entrants. This could make it difficult for Chargebee to establish a strong regional presence and defend against competitors entering its target market.

Macroeconomics

Chargebee’s revenue model is consumption-based and its growth benefitted from a 10-year bull run in tech. However, given macroeconomic headwinds, Chargebee’s SMB customer base is likely experiencing churn within their own businesses as companies scrutinize vendor spend. This impacts Chargebee’s revenue as customers will either downgrade plans or cancel altogether. Post-pandemic ecommerce growth, a key pillar for Chargebee’s B2C business, also decelerated, proving less persistent than originally expected. In line with broader U.S. tech layoffs, Chargebee also announced a 10% reduction in force in November 2022.

Summary

Managing recurring billing and payment subscriptions is one of the most complex yet poorly integrated systems. With the proliferation of subscription-based businesses across SaaS, ecommerce and beyond, the need for unified management software is growing. Chargebee has seen success serving both early startups to larger enterprises, offering products that cover the subscription lifecycle from in trial to signups, plan management, upgrades, downgrades, and cancellations.

Although Chargebee operates in a rapidly growing market, the company also faces several key risks including (1) intense competition in a crowded subscription management market, which is attracting significant investment and innovation from both established players and new startups, and (2) macroeconomic slowdown as SMB customers may churn or downgrade tiers. To stay competitive, Chargebee will need to continuously innovate and expand upon its product offerings while expanding its global footprint to reach new customers.