Thesis

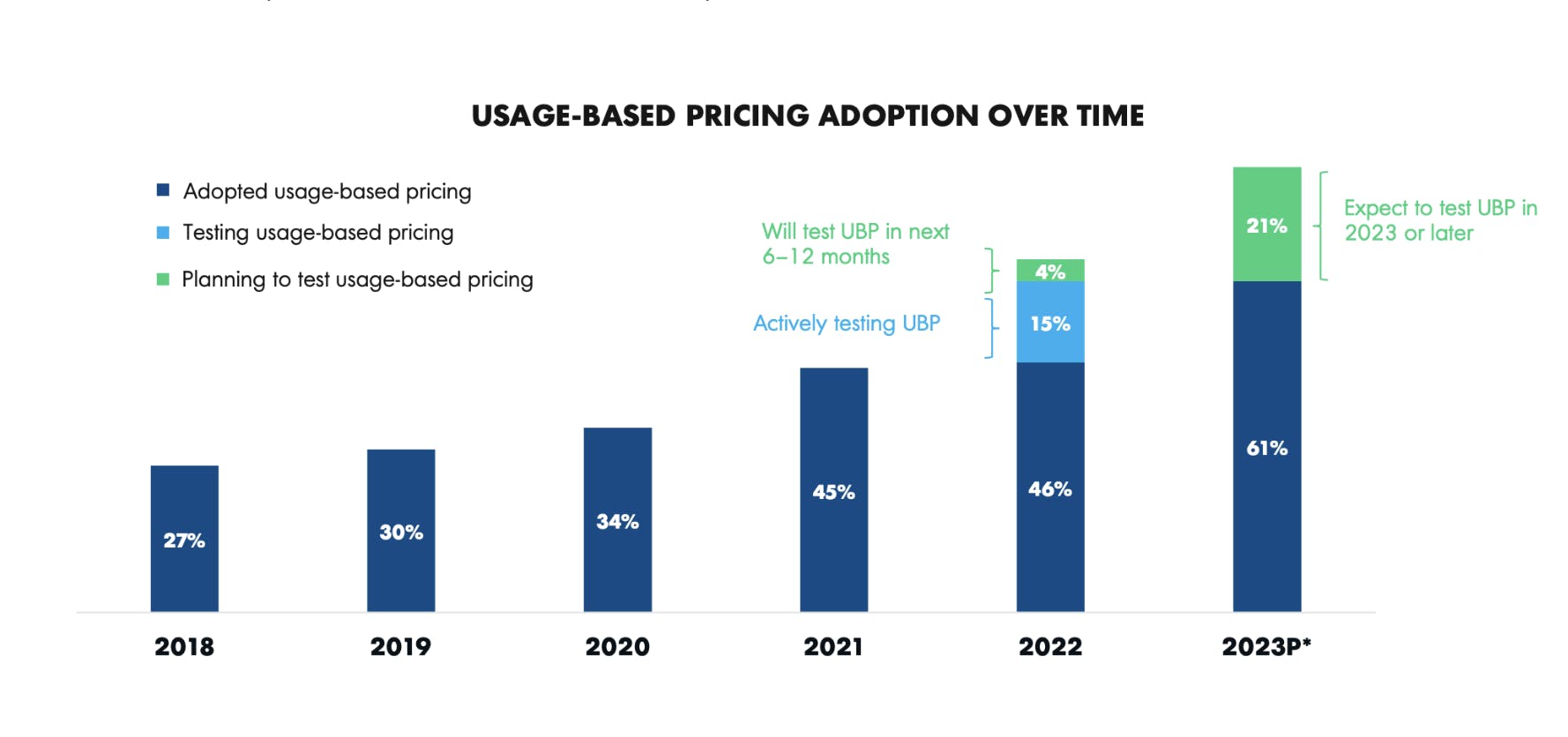

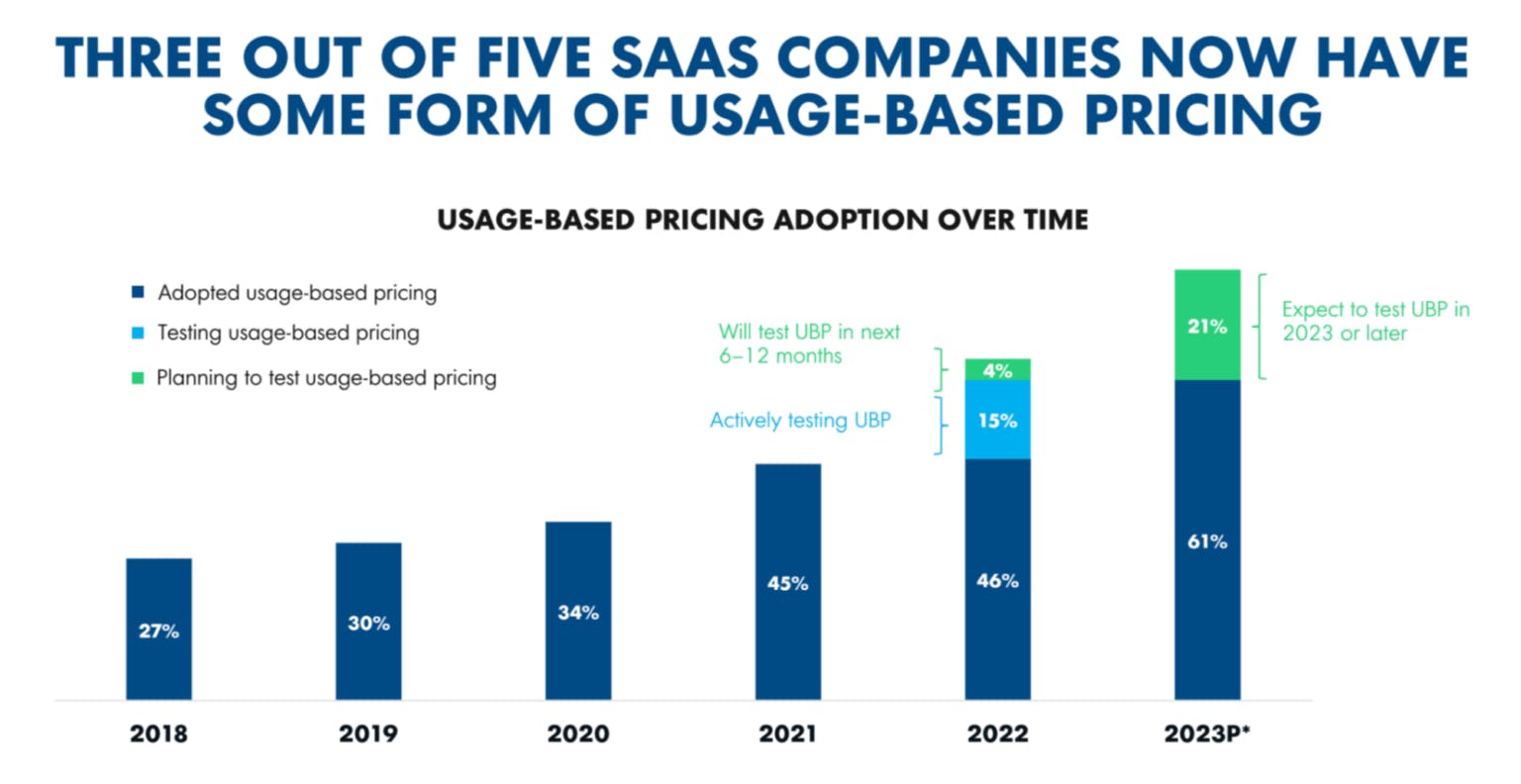

Software companies are increasingly adopting usage-based pricing models, which charge customers in direct relation to how much they use a company’s product. In 2018, 27% of SaaS companies had adopted a usage-based model. In 2022, this number had more than doubled to 61%. Usage-based pricing is anticipated to become the most popular monetization model in software for a few reasons.

First, it makes customer acquisition easier for software companies by reducing barriers for new users to try their products. Additionally, companies using this model have more enhanced net dollar retention (125%) compared to the broader SaaS index (114%) as of January 2023—more effective customer acquisition and revenue retention results in usage-based businesses achieving accelerated year-over-year revenue growth.

Specifically, the highly variable cost structure of AI and AI infrastructure businesses has caused them to pivot to a usage-based model. As of June 2024, it was found that cloud compute costs were increasing by 2.6x annually, while model training and inference costs were diminishing. When costs increase, under a fixed SaaS subscription model, companies building AI and infrastructure products suffer from reduced margins. Thus, the usage-based pricing model protects margins as revenue potential is unbounded — revenue is able to scale with customer usage.

That’s where Metronome comes in. Metronome provides a usage-based billing platform for companies that seek to deploy a pricing model, precisely measure how much end customers use their products, and apply pricing changes. Such changes can be applied “in minutes”, according to the company. Metronome’s core product consists of a high throughput metering platform that precisely measures customers’ product usage and a pricing engine that allows customers to apply any combination of pricing model(s) on top of the collected usage data. This results in end customers being billed the amount that precisely aligns with their product usage.

Metronome's pricing and billing automation is intended to reduce time spent by software engineering resources on billing instead of working on core business initiatives like building new products. It is also intended to reduce the burden on revenue operations teams that are often understaffed or under-resourced. According to an October 2024 interview with Metronome’s CEO, Metronome’s product was designed with the goal of functioning as “a universal solution, scalable from a two-person startup to a multibillion dollar public company.” This is reflected in its customer base, which as of February 2025 primarily consisted of AI, infrastructure, and data services companies, including OpenAI, Databricks, NVIDIA, and Cockroach Labs.

Founding Story

Metronome was founded in November 2019 by Scott Woody (CEO) and Kevin Liu (Chairman, former CEO). The two have similar stories as exited founders, which eventually caused them to cross paths at Dropbox.

Woody’s Background

While pursuing his PhD in Biophysics at Stanford, Woody co-founded a company called Foundry Hiring in April 2011. This was an applicant tracking system that imported job applicants from emails, scheduled events, coordinated interviews, automatically monitored where applicants were in the hiring process, and maintained oversight of interviewee feedback.

In 2013, Dropbox acquired Foundry Hiring for an undisclosed amount. After the acquisition, Woody joined Dropbox and led the growth and monetization engineering team, whose responsibility was to release products and “get them priced and packaged appropriately.” While there, Woody found that the process of changing pricing models for Dropbox’s products was highly frustrating because even a small change needed to be hard-coded manually by engineers before any strategic decision could be made.

He also worked closely with the billing team, comprised of 50+ engineers. This team’s responsibility was to release products and “get them priced and packaged appropriately.” The billing team faced numerous complexities, such as getting a central source of truth for how customers used Dropbox products and integrating that data with downstream 3rd party services such as Salesforce, revenue recognition software, and payment vendors like Stripe. This caused the team to become quite large.

Liu’s Background

Liu and Woody followed similar paths as entrepreneurs, leading them both to Dropbox. While an undergraduate student at Penn, Liu co-founded Predictive Edge in 2010 alongside two Stanford students, Steven Wu and Marty Hu. Ultimately, the company focused on providing A/B testing, personalization, and targeting tools for marketers in the e-commerce space. In July 2014, Dropbox acquired Predictive Edge. Like Woody, Liu joined Dropbox and worked on early marketing efforts for the company’s Enterprise offering.

How Woody & Liu Met

Immediately after Liu arrived at Dropbox in 2014, he and Woody became close friends after a mutual friend had introduced them due to their shared status as exited founders who’d sold their respective companies to Dropbox. Although Liu left Dropbox in 2016 to serve as an advisor to other startups, he and Woody remained close. The two would often sneak into the Dropbox office and think through startup ideas that they could work on together.

As second-time founders, Woody and Liu wanted to deeply diligence each other to gauge whether they would be compatible as co-founders. As Liu said in a 2024 interview, “just because you were friends with someone, that doesn’t necessarily mean that you’ll be able to work well together”.

Source: TechCrunch

When Liu and Woody were doing industry research on a separate business idea related to small businesses, Liu said he knew that he and Woody would work well together. To learn more about small businesses, the pair bought a box of Krispy Kreme donuts and went door-to-door, pretending to be Stanford grad students working on a small business. They offered people a donut in exchange for doing a user research interview with them. They set a goal of continuing to knock on doors until they got rejected 50 times. They crossed this number, which made Liu realize that because he and Woody could go through an uncomfortable experience together, like knocking on doors, and still enjoyed doing it, they would work well together as co-founders.

Origin of the Idea for Metronome

In co-founding Metronome, Woody brought experience from his time standing up the growth and monetization engineering team at Dropbox. According to Liu, this team was a “really important piece of Dropbox’s growth from about $200 million to about $1.6 billion in ARR”. However, during his tenure, Woody frequently encountered significant challenges stemming from the limitations of Dropbox’s billing system. These challenges often inhibited critical strategic decisions such as launching new products, pursuing acquisitions, adjusting pricing and packaging, or expanding into international markets.

Liu recalled a particularly memorable example when Dropbox sought to expand into the Japanese market — its largest base of free users outside North America. This expansion was postponed because the billing system’s product pricing was hard-coded, requiring engineers to revise the code manually. This was a “hugely impactful thing to delay” because of an internal system that lacks the flexibility to accommodate it.

This lack of flexibility meant that every time Dropbox wanted to change a small element of its pricing model, engineers had to pause on other impactful projects to spend multiple sprints to make billing code revisions instead. This often took “3, 6, 12 months to [get the pricing change] live”.

Having this perspective, Liu and Woody looked more holistically at large enterprise SaaS companies built for the revenue tech stack. They found that because the revenue stack was so closely tied to how companies survive, it naturally gets a lot of attention: “You have Salesforce that [manages all of the sales opportunities], Stripe as a payment infrastructure layer, at the endpoint you have SAP with its ERP and ledger.”

However, the key insight was that for the middle of the revenue stack, the billing system, “there wasn’t a gigantic, obvious, world-beating company in the middle” which is the “most central and most important part of the revenue stack.” This felt like a profound opportunity that he and Woody could pursue.

Arriving at Usage-Based Billing

Liu and Woody wanted to educate themselves on the billing problem within SaaS, so they conducted 60+ interviews across six weeks with SaaS businesses during their initial market research process. Serendipitously, they fell into the usage or consumption-based business model despite it not being widely adopted in 2019.

Only 10 to 15% of the companies they spoke with used usage-based billing, but 85 to 90% were working on a new product or add-on that would cause their pricing model to become more complex. This would drastically change how their billing system functioned and caused this portion of companies in their interview set to want to adopt a consumption-based model in the near future.

The two realized that while only a small fraction of their sample size was experiencing challenges with their billing system, they knew their entire sample size would have “some version of this problem at some point.”

The Right Timing

In hindsight, the usage-based pricing model's popularity growth extrapolates beyond Woody and Liu’s initial interview set to the broader SaaS market. Their founding Metronome in 2019 directly aligned with the period when usage-based pricing adoption was accelerating rapidly.

About 27% of SaaS businesses in 2018 used a usage-based model, which eventually scaled to 61% using some form of usage-based pricing as of 2022. 45% used largely usage-based models, and 15% were testing the model.

Source: OpenView

Product

Setting the Stage: Eras of Software & Pricing Models

The Mainframe Era

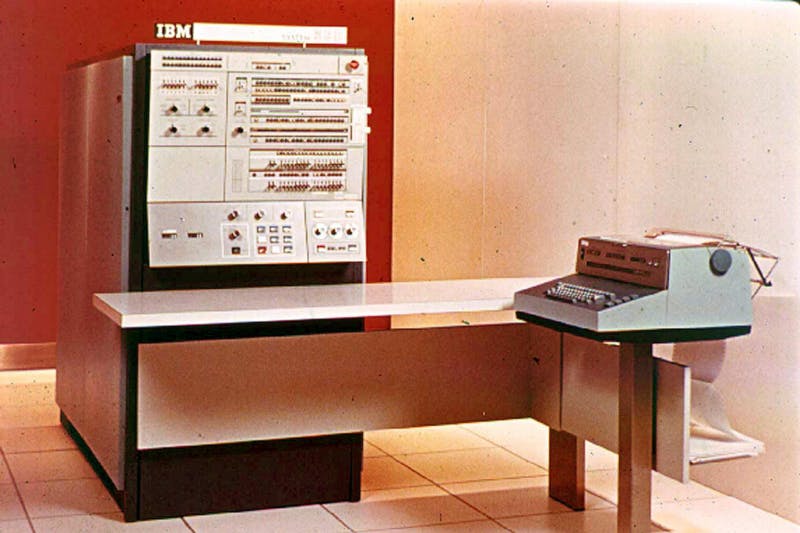

In the early 1960s, IBM had dozens of independent, incompatible product lines, from hardware components to operating systems. These products were challenging to update. As a result, anyone buying a new computer had to start from scratch and completely rewrite custom software for each machine.

To mitigate this issue, IBM wanted to build a highly upgradeable computer that allowed customers to easily swap out new modules and use a library of software applications. In April 1964, IBM released System/360, a mainframe computer named as such because of the idea that a ”single computer could serve a full spectrum of customers.”

For the first time, “software written for one machine could run on any other machine in the line,” as System/360 could run many software applications. The release of System/360 helped IBM scale its revenue from $3.6 billion in 1965 to $8.3 billion in 1971.

Source: Sourcegraph

During this period, “software was rarely seen as a standalone product.” To incentivize customers to lease System/360 hardware, IBM offered free software as an add-on. Over time, IBM garnered a sizable free software library from a vast community of users willing to share their programs.

Because of this, in 1969, the United States federal government filed an antitrust lawsuit against IBM, alleging that the company had monopolized the electronic digital computer system market. As a result, in January 1970, IBM unbundled software from its hardware. As software became a standalone product, the “software industry was officially born.” The birth of the software industry meant that people could start building and selling their own software.

The Personal Computer Era

With the rise of the software industry, Bill Gates founded Microsoft in 1975. Initially, the fledgling company rose to notoriety as the “largest producer of computer programming languages” for the early PC market. However, In 1980, Gates signed an agreement with IBM to become the sole operating system provider for IBM’s PCs. Gates cleverly included a clause in the contract that allowed Microsoft to license its operating system, MS-DOS, to other companies, which enabled its rapid scale.

Source: History of Computers

As the earlier version of Microsoft Windows, MS-DOS “provided the foundation for millions of computer users to interact with their machines and access a vast array of software” and had a profound role in shaping the software industry:

“As more users adopted personal computers running MS-DOS, the demand for software grew exponentially. This created a thriving software ecosystem, with developers making various applications, from productivity tools to games.”

In the PC era, software was sold as a pre-paid, locally installed product. Customers received physical cardboard boxes and floppy disks to install their copies of the software on their computers. It was purchased upfront in full on a perpetual licensing model, and customers could use it as long as they desired.

If a software company created an updated version of its software, customers had to pay in full again to receive the updated physical copy. This was beneficial for software companies as they got paid upfront but “had to earn the right to get more money from existing customers with every new version.”

The SaaS Era

In 1993, the Internet became widely available to the public. This technology changed the way that software companies “market, sell, and deliver their products, and the ways by which they interact with customers”. The internet became the infrastructure that enabled customers to access software through a company’s owned web page — a fundamental shift from having to manually install a physical copy on one’s computer.

In 1999, Salesforce was the first to utilize the internet to deliver its product and pioneered the Software-as-a-Service (SaaS) market by creating the first multi-tenant cloud platform. Every element of its customer relationship management system “was hosted on the internet [via the cloud] and made as a subscription service.”

With the shift to the cloud-based model, all of the costs required to run software were transferred from the customer to the vendor. In exchange for removing the hassle of owning physical software and managing the costs required to run it, the software industry widely pivoted from perpetual licensing to the subscription-based SaaS pricing model.

The rise of the subscription model meant that, for the first time, customers could rent software instead of having to buy it. This shift also altered the dynamic between vendors and customers. Instead of customers paying upfront for software, the SaaS subscription model requires them to pay smaller amounts on a recurring basis. This means that customers can stop paying for software between payments if they stop gaining value from the product. This increased the importance of customer support as it drives SaaS customer retention and growth.

The Artificial Intelligence Era

The increasing adoption of artificial intelligence marks the “fourth major wave” of software. This is primarily due to AI companies having a much more unpredictable cost structure than typical software companies. This is due to large cloud providers such as AWS and Google Cloud charging varying rates for usage that often involves model training, inference, and deployment — services with constantly fluctuating costs.

Andreessen Horowitz commented on this disparity between typical software companies and those producing AI products: “We have noticed in many cases that AI companies and AI infrastructure companies simply don’t have the same economic construction as software businesses.”

These variable cost structures, along with companies’ increased desire to flexibly meet the needs of different customer segments, have caused many AI and AI infrastructure companies to employ usage-based business models. This reduces barriers to entry for customers to try out new AI products while also protecting companies’ margins by uncapping revenue potential.

When Metronome first publicly announced its product in February 2022, Woody and Liu interviewed hundreds of companies who wanted to adjust their pricing quickly after witnessing companies like Snowflake, Twilio, and AWS achieve success through the usage-based model. Many of these companies “couldn’t afford the immense resources required to build and maintain flexible and reliable billing infrastructure at scale.”

Metronome’s mission is to “revolutionize billing by providing all software businesses a flexible, transparent, and customer-centric billing experience” that allows them to support the varying pricing preferences of end customers while also enabling them to protect their margins.

Product Overview

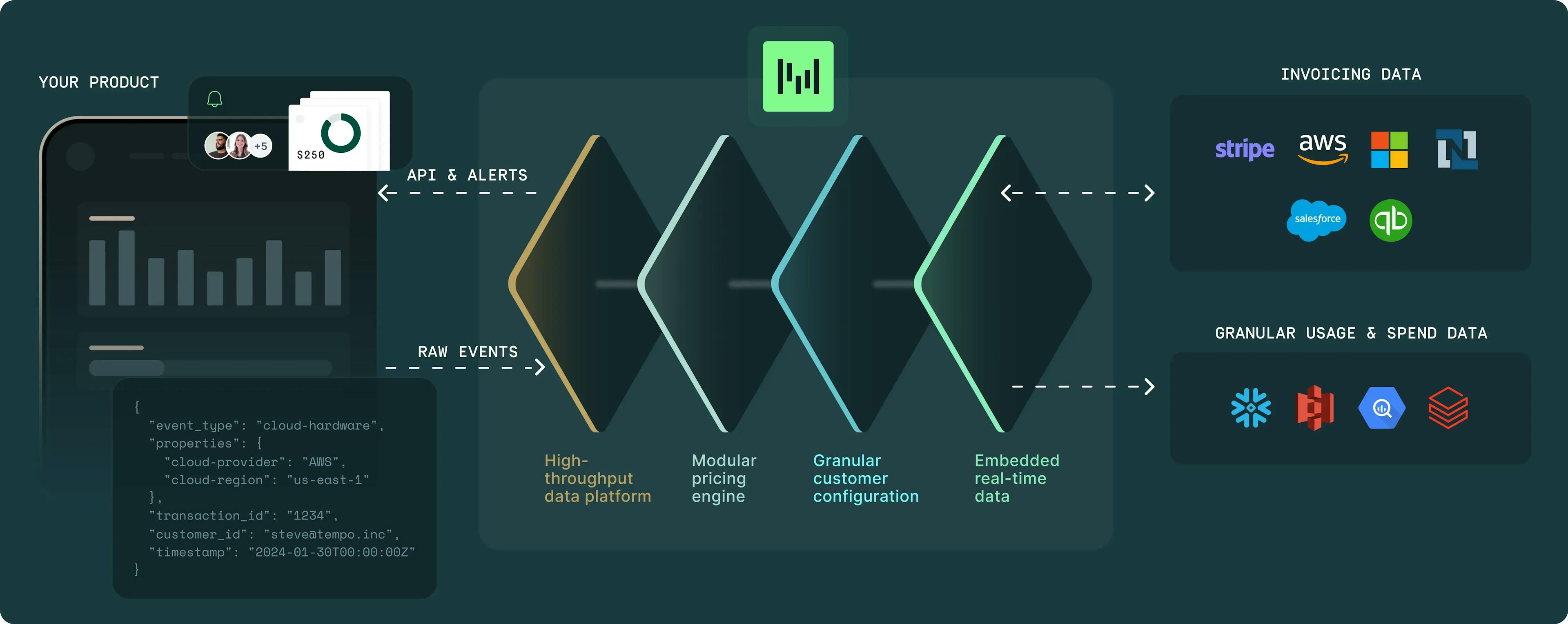

Source: Metronome

Metronome’s product enables companies to “adopt any pricing model on earth”, make pricing adjustments in minutes, and equip companies with integrations that connect the rest of their revenue stack to Metronome’s usage data. There are three core components of its product:

High-throughput data platform that captures every individual unit of end-user product

Pricing engine that assigns prices to the actions taken by customers on products and automates the invoicing process.

Analytics dashboards to glean revenue, pricing, and product usage insights. They can also embed customer-facing dashboards in their own product, so end customers can review their usage and spending metrics.

Data integrations that seamlessly deliver usage, revenue, and pricing data to various downstream platforms in the revenue tech stack, such as Salesforce, Quickbooks, and Anrok, as well as data platforms like Databricks, Snowflake, and MySQL.

High Throughput Data Platform

Metronome's high-throughput data platform is powered by two key elements: usage events and billable metrics. Usage events capture individual actions, like playing a song or making an API call, providing a raw record of product activity. Billable metrics take these events and apply filters and calculations to aggregate them into meaningful totals, such as the total number of songs played in a month or total API calls made. By combining granular usage data with customizable billing metrics, the platform enables businesses to align product usage with more accurate, real-time billing.

Events

An event is a “packet of information”, or a specific action taken by a user on a customer’s product, which reflects exactly how a product is being used**.** It can be thought of as a raw unit of measurement or a record of an individual action taken by a customer on a company’s product. Examples of usage events may include individual API calls, units of data transferred, individual units of compute power consumed or individual input or output tokens used.

For example, if you are using a music streaming service, an event might be defined as playing a song. Alternatively, an event could be one minute of song playtime. This is specified by the company when creating a usage event. Individual usage events are continuously tracked as data is ingested into the Metronome pipeline.

Just like when a phone company measures your data usage to bill you appropriately in a usage-based contract, Metronome tracks individual usage events to calculate an end user’s consumption of a company’s product.

Source: Metronome

Billable Metrics

Billable metrics aggregate individual usage events to provide a unified measure of product usage over time. Each usage event represents a single action, such as playing a song or making an API call. A billable metric combines these events by applying filters and calculations to determine aggregated usage within a specified period. For example, if a usage event is defined as playing a song, the billable metric might sum up the total number of songs played by a user in a month.

These customizable queries operate on the stream of usage events continuously ingested into the Metronome platform. Businesses can tailor billable metrics to align with their pricing models, such as summing compute hours, counting API calls, or tracking data transferred.

In essence, billable metrics translate individual usage events into standardized units of consumption. Additionally, multiple billable metrics can be calculated on top of a single usage event based on different aggregations or by referencing different properties of the same usage event.

In the below example, the usage event is “compute_heartbeat” on AWS. The first billable metric is the total amount of compute hours used, denoted as SUM(compute_hours). The second billable metric is the maximum storage gigabytes consumed, denoted as MAX(storage_gb).

In this example, the same individual event type is being used, but is being aggregated in two separate ways.

Source: Metronome

Modular Pricing Engine

Once usage events have been ingested and billable metrics are defined, customers then apply billable metrics and pricing models to their products and determine how customers will be billed.

Products

Products in Metronome represent a company’s individual products or service offerings, “analogous to SKUs or items in an ERP system”. Types of products that customers can specify are usage-based, subscription-based, and composite (a mix between usage-based and subscription-based).

Billable metrics are assigned to products. For example, OpenAI could designate its GPT-4o model as a product and assign a billable metric that measures the sum of input tokens incurred by a customer. Additionally, Metronome customers can edit the pricing of products in real-time, even when they are in active use by end customers. They can schedule the changes to take effect at a specified time, as well. Lauren Workman, Senior Revenue Operations Manager at OpenAI, emphasized the value that this newfound flexibility has had on the company:

“I can make pricing changes in Metronome in under an hour with no engineering resources. This would have been a painfully manual process without Metronome.”

This directly resolves the pain point that Woody consistently experienced while at Dropbox. Every time the Growth and Monetization team wanted to slightly tweak the pricing model of a product, it would take many months and sprints to make this change as engineers had to manually change the billing code.

Companies can now seamlessly adjust pricing for their products within minutes, not months. This eliminates the need for engineering resources to spend valuable time changing billing code and instead enables them to work on alternative projects. This is reflected in that as of June 2024, OpenAI had less than 10 engineers working on billing at the same level of scale that Dropbox had 70 to 80 engineers working on billing. This efficiency is due to Metronome providing the infrastructure needed to adjust pricing instantly.

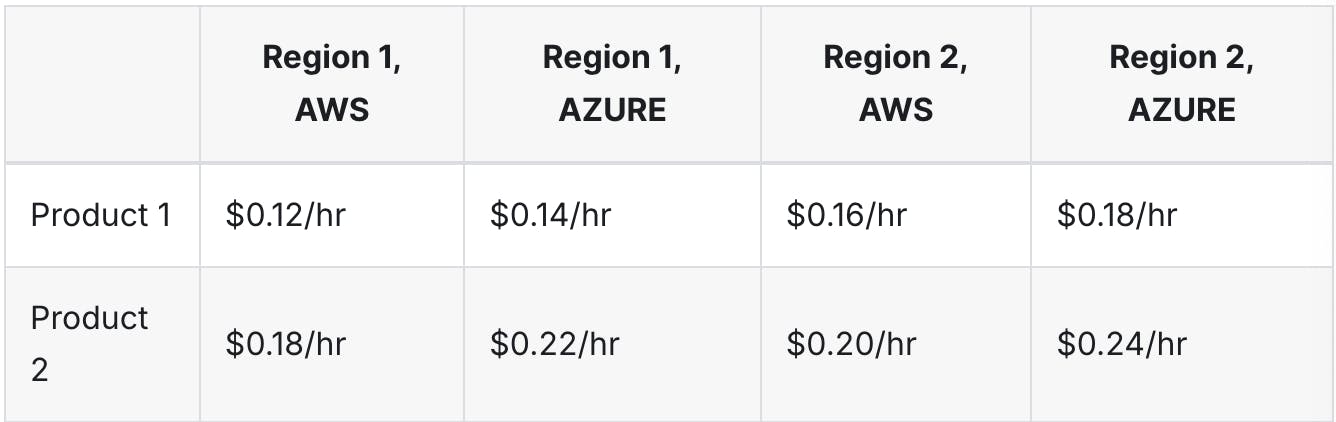

Rate Cards

Rate cards provide a central location for product pricing. For usage-based products, rates associated with their billable metrics are displayed. For products that have subscription-based, fixed, or composite pricing, pricing structures are determined on rate cards.

For usage-based products, customers can establish dimensional pricing on rate cards, which allows them to charge for the same billable metrics differently based on one or multiple end-customer attributes. For example, OpenAI may bill customers for the same billable metric and product differently based on the region they are located in or the cloud provider they use.

Source: Metronome

Invoicing

Contracts

Once the customer sets up usage events, billable metrics, products, and rate cards, they must set up a contract for each customer. Just as rate cards reference products, contracts reference prices on rate cards.

On contracts, Metronome customers can specify miscellaneous contract terms such as pre-paid credits or balances or discounts off of the full billable metric price. As companies scale, the complexity of customer contracts does also. This is driven by the “need to accommodate large and more diverse customer bases” and provide “ competitive pricing and service agreements”.

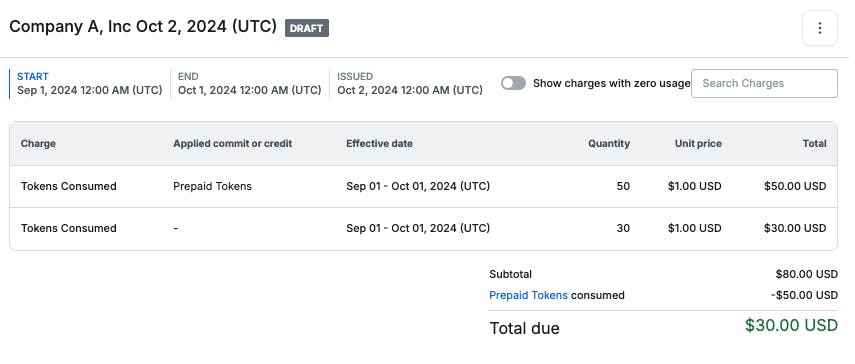

Once the contract has been created, the Metronome platform generates invoices that reflect contract terms, including total usage across all products and any pre-paid balances and/or discounts.

Invoices

For each product, the total quantity of billable metrics incurred by the customer is updated continuously as usage events are pulled into the data pipeline. This is reflected as “Quantity” below. The unit price for a given billable metric is then pulled in from the customer’s rate card, which is displayed as “Unit price”.

In the example below, the customer had $50 in pre-paid balance specified in the contract, which was deducted from the total due. Because usage event data is constantly ingested in real-time, invoices provide customers with a precise view of how much they have used a product.

Source: Metronome

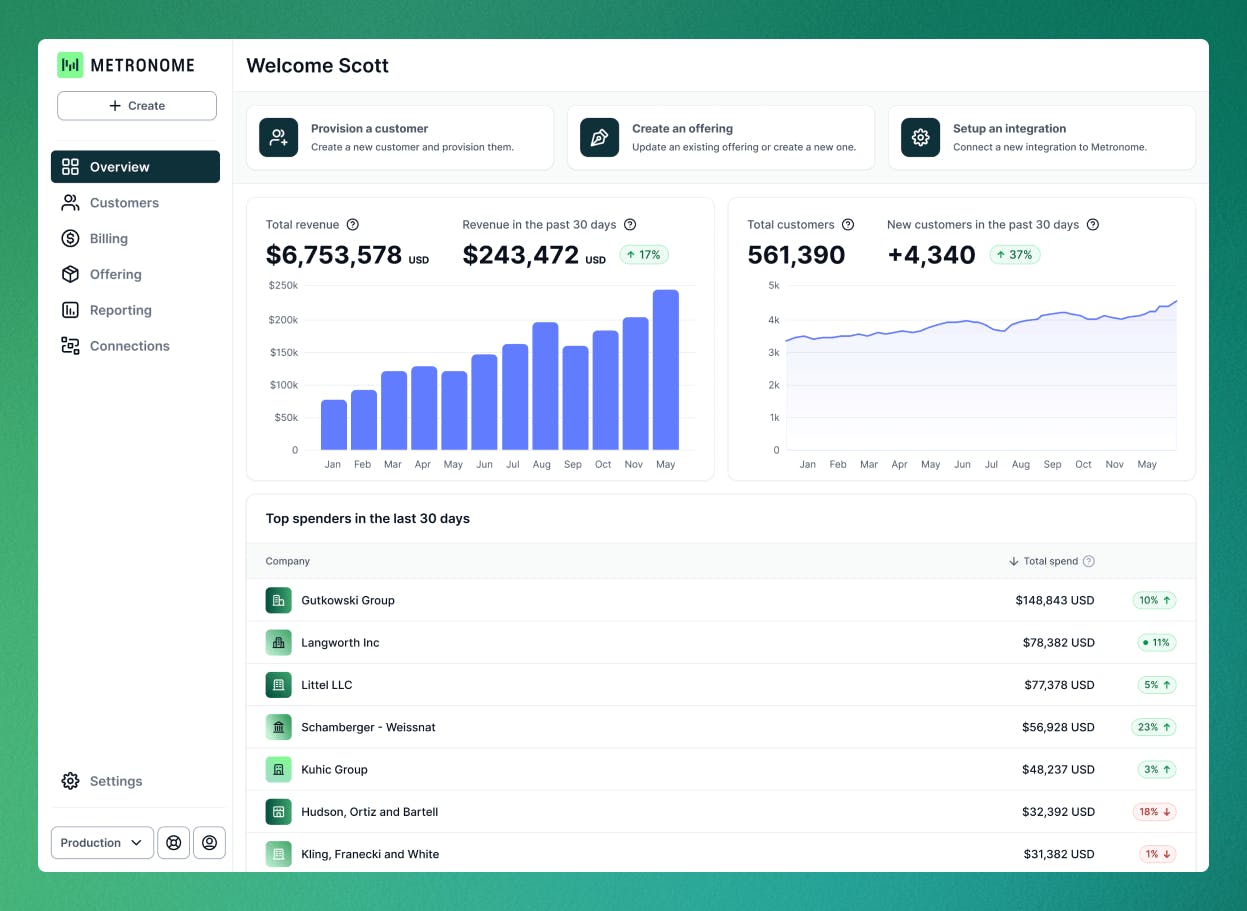

Analytics Dashboards

As usage events are ingested and pricing logics are placed on top of this data, Metronome delivers granular data to two parties. First, its own customers. They receive revenue and cost metrics by product category over time. Second, it provides embeddable dashboards that its customers can put into their products so that end customers can view their product usage and spending data.

Internal Employee Dashboards

Invoice breakdown export was released in October 2024 and is intended to provide Metronome’s users (internal customers) with daily insights on total revenue generated and each end customer’s consumption patterns by product and region. The report breaks down each invoice line item daily and displays the “quantity, unit price, total charges, and any credits or commitments applied to each item for a given day.”

Source: Metronome

Conor Beverland, Senior Director of Product at Astronomer, emphasized the importance of daily revenue reports to his company:

“Metronome allows us to monitor credit usage, track customer health in real time, and drive upsells at the right time—ensuring our customers get the most value from our products while avoiding overages.”

On a broader scale, a sample of public B2B SaaS companies in August 2021 indicated that visibility into data and metrics was crucial and that it helped them to execute against growth and productivity targets.

End Customer-Facing Insights

In October 2024, Woody reflected on the disconnection he experienced at Dropbox between the billing system and the product experience. This caused Dropbox customers to have “no idea what they were paying for” and that this data was “buried in spreadsheets and general ledgers, making it nearly impossible to analyze.”

As part of its Metronome 2.0 release in October 2024, Metronome customers can use the usage API to embed customer-facing product usage analytics dashboards directly within their products. With the API, usage data is sent to the Metronome customer’s product. This allows end customers to view real-time, granular insights on their product usage and spending metrics.

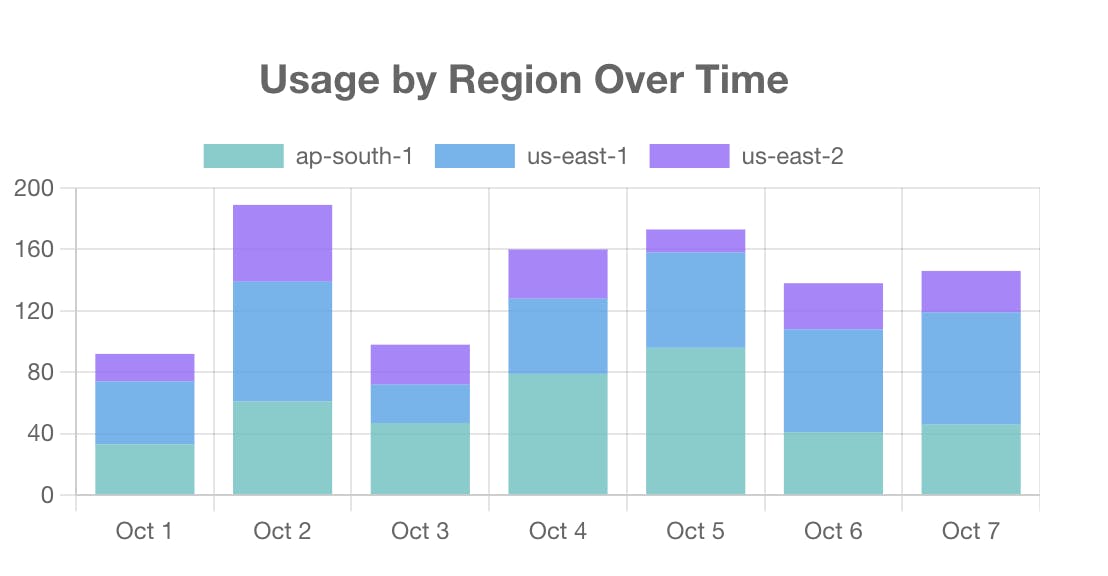

End customers can filter their usage data based on any of their usage event properties. For example, a bar graph that measures the usage by region by the day can be done. Among other possibilities, usage by product over time can also be visualized.

Source: Metronome

Woody mentioned that the objective of this new offering is to “make it simpler for organizations that have embraced usage-based billing to surface more granular data to their end customers”. This comes at a critical time in which end customers of usage-based products are demanding more visibility into their consumption and spending. Snowflake, one of the pioneers of the usage-based billing model, emphasized:

“Customers want to understand their usage of the solution and how credits of dollars are spent relative to their contract. Predictability, visibility and cost transparency are core tenets of the consumption model; customers must be able to clearly understand and track usage and spend.”

Offering in-product dashboards that map out customers’ usage patterns and spending metrics for a given period has been recommended as a way to fulfill this requirement of end customers.

Downstream App Integrations

Metronome offers a broad suite of integrations spanning the revenue stack which allows customers to simplify their billing operations processes. These integrations span payment infrastructure, accounting and tax platforms, CRMs, and data analytics platforms.

For example, with the Stripe integration, Metronome customers can easily invoice and collect payments from end customers. With the Quickbooks integration released in June 2023, invoices can be synced with customers’ accounting systems.

In August 2022, Metronome released its Salesforce integration. As of January 2025, 90% of the Fortune 500 uses Salesforce, and 49% of Salesforce’s customer base are small businesses. This aligns with Metronome’s customer base as it serves startups, SMBs, and large enterprises.

Metronome providing integrations with the rest of the revenue stack is critical as companies with usage-based models have an increased incentive to provide a strong customer experience as the ability to grow revenue over time is “directly tied with the value a customer receives”. Allison Pickens, former Chief Operating Officer at Gainsight, emphasized the importance of customer success in this pricing model:

“If you think of Customer Success as being responsible for adoption and revenue through adoption, then Customer Success becomes even more important, because they’re driving the adoption that generates the revenue.”

The Salesforce integration provides the real-time insights that sales and customer success teams need to provide an optimized customer experience. It can be used to gain a complete customer view so potential customer obstacles and upsell opportunities can be identified early.

Beyond core revenue stack integrations like Stripe, Quickbooks, and Salesforce, Metronome released Data Export in November 2023. This feature allows internal employees to easily export their usage, pricing, and revenue data to downstream data warehousing platforms like Databricks, Snowflake, and BigQuery, databases like MySQL and Postgres, and object storage platforms such as Google Cloud Storage and Amazon S3. Data is automatically updated each day on these platforms.

Market

Customer

Emerging Market Focus

As of June 2024, Metronome had the most success with companies in technical infrastructure markets such as AI, databases, and data services. Woody and Liu’s objective from the start was to work with large enterprise customers like Databricks and NVIDIA. Woody acknowledged that this “went against conventional wisdom” to start with the most complex customers, but his and Kevin’s mission was to prove that they could “operate at the highest possible scale”.

Because AI, infrastructure, and database companies incur high variability in their cost of goods sold, they commonly employ usage-based business models to maintain their margins. According to the company, “the entire AI stack has usage-based COGS, from APIs down to the GPU infrastructure layer”.

Metronome provides the infrastructure that allows these companies to use a variety of pricing models, including consumption-based pricing, relieving their engineers of having to build and maintain internal billing systems. These engineers can instead direct their company’s product usage data to the platform and “skip having to own and maintain their own infrastructure.” This was a problem that Woody had personal experience with, as 70 to 80 Dropbox engineers would need to spend months manually changing the billing code and maintaining these internal systems.

As new startups have entered the AI market, the company has experienced more pronounced traction with earlier-stage companies. Woody indicated that “there are companies, often just two people in a garage starting an AI business, who look at Databricks, OpenAI, or Anthropic and think, ‘I want that business and pricing model.’” The scalability of the Metronome product is what makes it usable out-of-the-box by fledgling startups to the world’s largest companies and companies falling anywhere in between.

This is reflected in its customer base as of February 2025 which spans emerging, early-stage startups like LangChain and Luminai to global enterprise companies like Databricks and NVIDIA.

Source: Metronome

Customer Stories

OpenAI

OpenAI is an AI research and deployment company with a “mission to ensure that artificial general intelligence benefits all of humanity.” In November 2022, the company released ChatGPT, a generative language model that interacts with users in a conversational way via a chatbot interface. OpenAI partnered with Metronome in 2022 due to the rigidity of its in-house billing systems and rapid customer scale in a short time period.

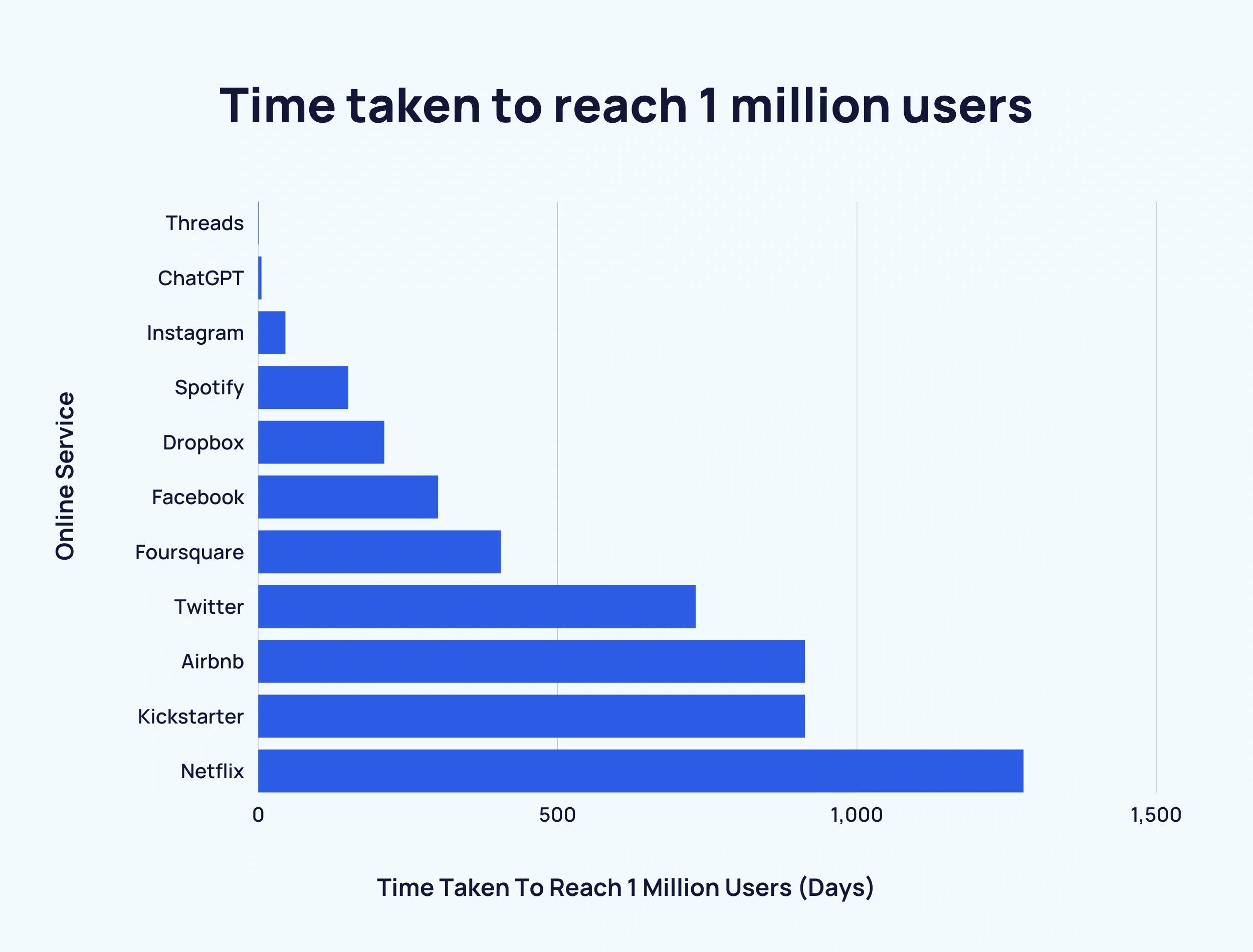

Just five days after ChatGPT’s release, it surpassed 1 million users. This number grew at an unprecedented rate to 100 million by January 2023. As of February 2023, ChatGPT was the “fastest-growing consumer application in history”, with prominent apps like Facebook and Twitter taking 4.5 and 5 years to reach 1 million users, respectively. As of October 2024, ChatGPT had surpassed 250 million weekly active users.

Source: Exploding Topics

OpenAI has also rapidly expanded its product portfolio, which includes access to the text-to-image model DALL-E 3 and flagship models like GPT-4o. The company’s customer base is comprised of both consumers and enterprise users with varying pricing model preferences.

The flexibility and scalability of Metronome’s product allow OpenAI to support usage-based pricing and meet the needs of its diverse customer base while also remaining competitive in the rapidly changing AI market.

Before partnering with Metronome, OpenAI initially had an in-house billing system that required manual labor for tracking usage and invoicing customers. Evan Morikawa, Lead of OpenAI’s Applied Engineering team, emphasized: “We didn’t have the flexibility and customization to support usage-based pricing or enterprise contract complexity.”

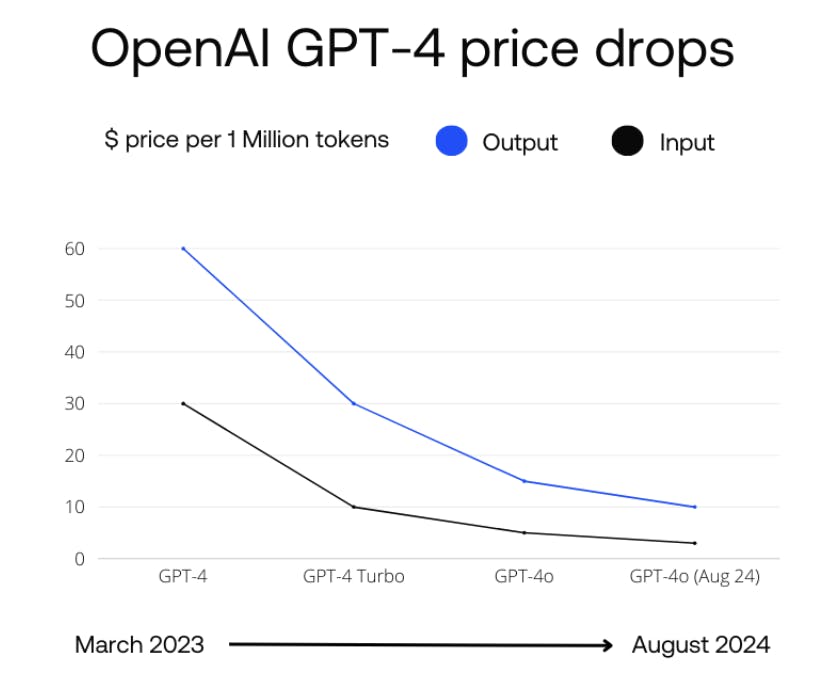

Due to increased competition, OpenAI has used Metronome to quickly reduce its prices per 1 million tokens to remain “at the forefront of the [LLM] market”.

Source: Nebuly

Metronome also helped OpenAI free up valuable engineering resources that would have otherwise been manually adjusting billing codes, to work on OpenAI’s core products. Woody stated that when the two companies first partnered, OpenAI had “half an engineer working on billing”. After their unprecedented growth, they still have a “single digit” number of engineers working on billing as of June 2024 due to Metronome supporting their usage tracking and billing operations in the background.

OpenAI also recognized that when using a usage-based pricing model, customer experience is crucial, and billing is an “integral part of how users experience a product.” Metronome allows the company’s end users to view product usage and incurred costs, as well as OpenAI internal teams to view revenue and product usage trends by day and month.

Morikawa commented on this: “Having a consolidated source of record with Metronome is critical to powering our understanding of our customers, our operational workflows, and providing customer transparency.”

Source: Metronome

Salad

Salad offers a two-sided marketplace called SaladCloud. It connects users who want to share their computer’s unused compute power with companies and individuals who need extra computing resources.

The company seeks to be a cost-effective alternative to expensive cloud hyperscalers like Google Cloud and AWS, which often leave AI companies with a huge bill for computing resources needed to train and deploy their products. As of September 2024, Salad claimed the status of offering the lowest-priced GPUs on the market due to its large supply network of over 450K compute providers.

Founded in 2018, Salad’s first few years were spent establishing both sides of the marketplace and a “strong network of compute resources”. Prior to Metronome, the company had managed billing and invoicing manually in spreadsheets. Once they had established a strong enough network of compute suppliers and those seeking to purchase resources, Salad desired a self-serve, product-led growth model.

In addition to its desire to employ a product-led growth strategy, Salad brought AI compute resources onto its marketplace in 2023. They needed a platform that automated billing, accommodated a high-growth, self-serve customer acquisition strategy, and had built-in pricing flexibility for quick adjustments.

Metronome’s free trial credit capability paired naturally with Salad’s self-serve model and “empowered Salad’s sales team to offer free trial credits easily” which reduced entry barriers for new users. When users want to transition from free trials to paying for resources, they can see exactly how much they’ll pay per hour of resource usage. This is made possible by Metronome’s platform. Like OpenAI, Salad provides its end customers with real-time transparency and better spend management with Metronome’s embedded dashboard feature. Daniel Sarfati, former Chief Product Officer at Salad, emphasized:

“By offering end-of-month visibility, transparent dashboards, and proactive spend management alerts, Salad has made significant strides in enhancing customer satisfaction with more insight and control on their usage.”

Also similarly to OpenAI, Salad has automated billing and invoicing with minimal engineering resources and doesn’t “need anyone dedicated full-time to billing.”

End User Personas

In a December 2023 interview, Woody articulated that for enterprise customers, the Metronome platform was designed with two distinct user profiles.

The first user persona touches the first half of the product: the data infrastructure component that pulls in usage data, prices it effectively, and delivers invoices to customers. The end users of this product segment are those with technical, engineering backgrounds. They value developer experience, low latency, and high uptime. This user is focused on streaming usage data into Metronome so it can automatically be priced and packaged appropriately.

The second user persona touches the second half of the product: the interface layer for pricing and packaging logic that is used once data has been pulled into the platform. End users of this segment are non-technical and are commonly in finance operations, sales operations, or product management. This end user would otherwise have to submit tickets to the engineering team to adjust the pricing model. With Metronome, they can adjust pricing on the platform in minutes.

Market Size

The global billing and invoicing software market was valued at $4.3 billion in 2024 and is forecasted to reach $13.1 billion by 2031, reflecting a 15.2% CAGR across this period. This type of software helps in “automatically generating bills and invoices for services rendered or goods sold.”

While this market is growing, Metronome’s specific market opportunity is within the metered billing software space. Metered billing requires the “continuous monitoring of user consumption, whether it’s in the form of data usage, minutes on a call, or the number of API requests” that a user consumes. It has been used in a variety of industries, such as utilities, tool rental services, telecommunications, and cloud services.

Metronome’s target audience, emerging AI and infrastructure companies, has become a new vertical that metered billing companies are selling to. There are a few primary drivers for this.

AI Variable Cost of Goods Sold

The cost structure for AI businesses is very different from that of a regular software company. For a typical software company, “costs are generally relatively low compared to overall revenues.” However, AI companies have multiple variable cost drivers, such as increasing cloud computing costs and decreasing training and inference costs.

It was noted that in the age of on-premise software, companies sold their product to customers, who were then responsible for paying all costs to run the software. However, the rise of SaaS has caused tech companies to own training, inference, and deployment costs, resulting in large bills for cloud compute power.

Because renting is often far cheaper than purchasing hardware needed to train and deploy AI projects, “many businesses opt for cloud platforms like AWS, Google Cloud, or Azure”. Yet, cloud providers offer compute power at highly variable costs.

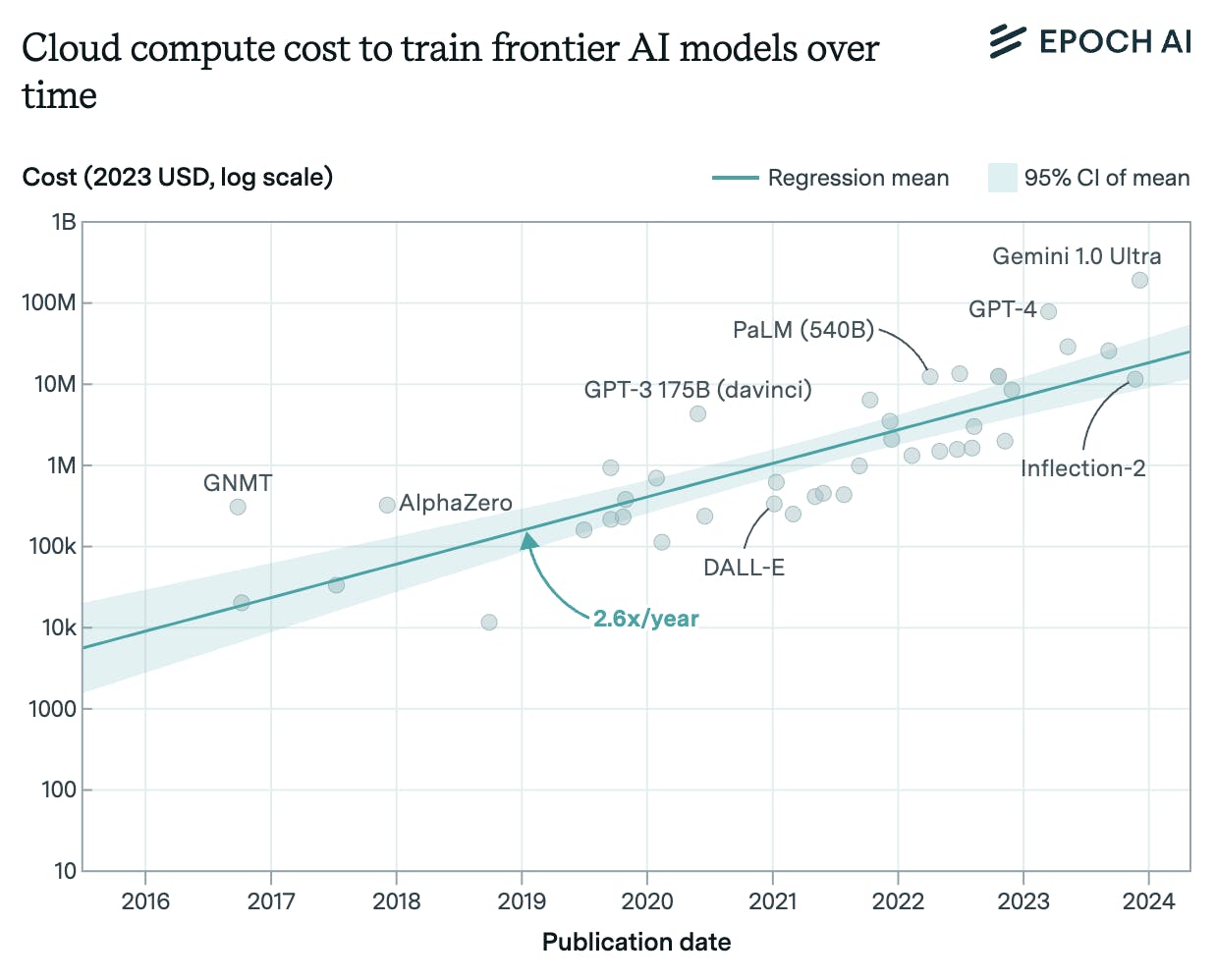

In June 2024, researchers at Epoch AI and Stanford University calculated the cost of training frontier AI models in the cloud using rented hardware. They found a growth rate in cloud computing costs of 2.6x per year.

Source: Epoch AI

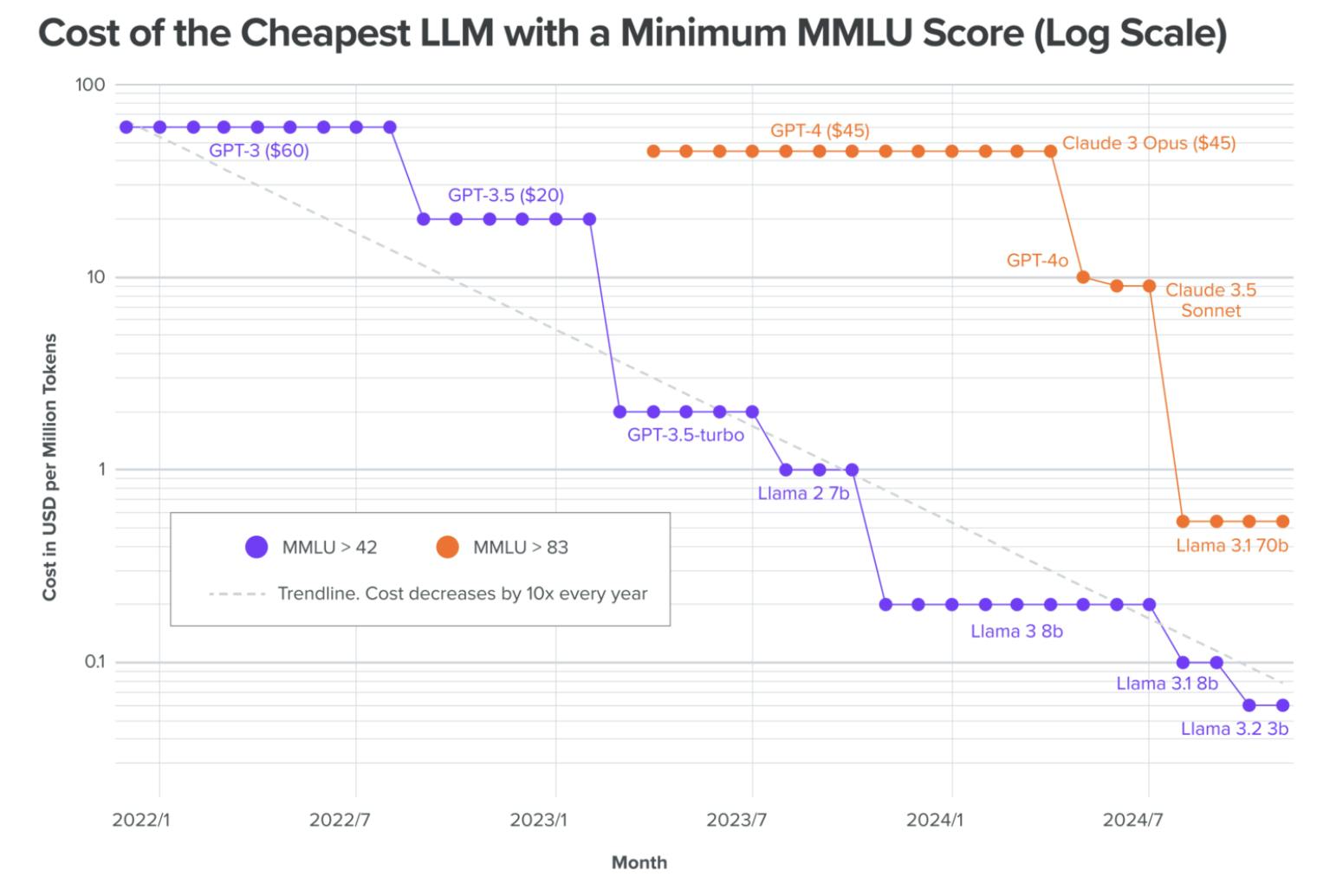

While cloud compute costs have exploded, AI inference costs have decreased drastically between January 2022 and July 2024. In a November 2024 analysis, the price per 1 million tokens was calculated for different models between two performance scores (shown below as purple and orange lines). The dashed trend line below indicates that inference costs are decreasing by 10x annually.

This aligns with OpenAI, one of Metronome’s customers, which has reduced the cost of 1 million tokens from $60 in 2022 to $0.06 in July 2024. This refers to a trend coined ‘LLMflation’ — the rapidly decreasing cost of LLM inference.

Source: Andreessen Horowitz

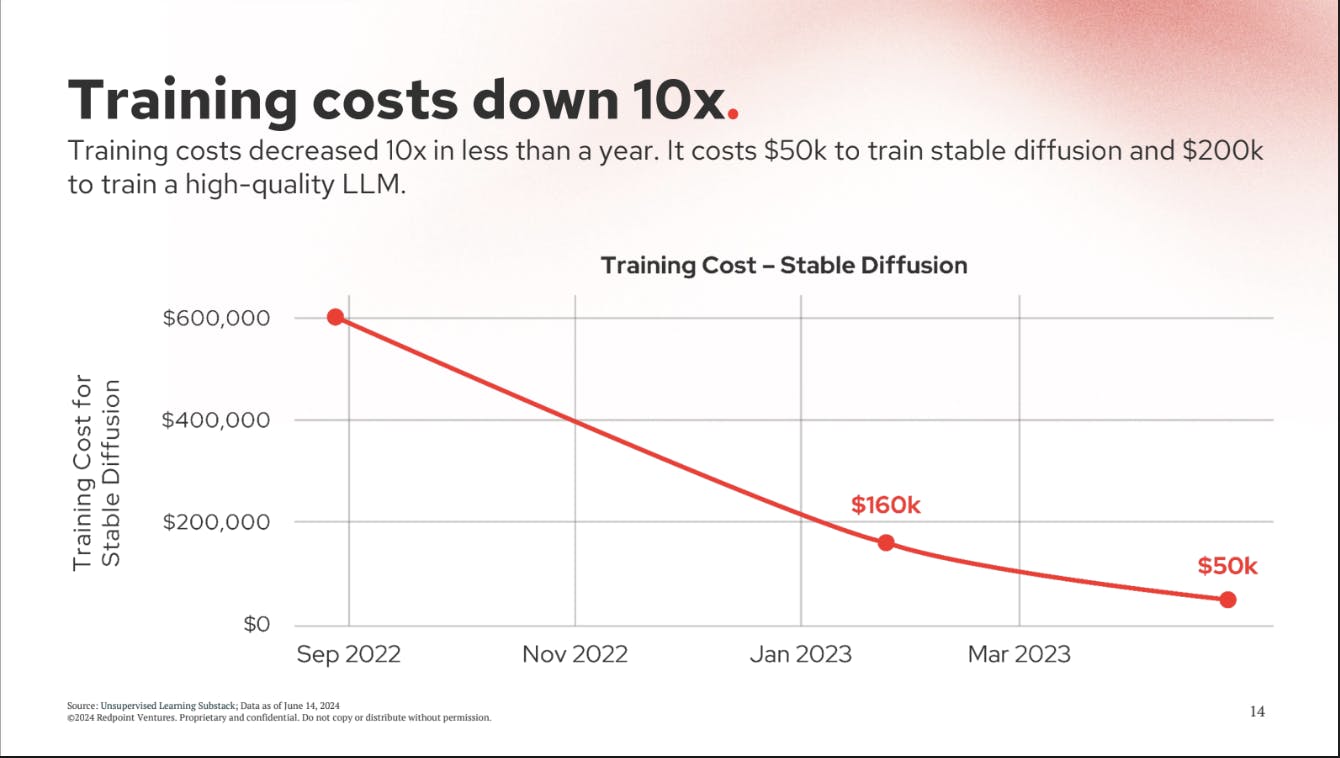

It has also been found that LLM training costs decreased by 10x between September 2022 and April 2023. In September 2022, it cost about $600K to train a high-quality stable diffusion model. In April 2023, this cost had decreased to $50K.

Source: Redpoint Ventures

Because AI and infrastructure companies incur costs each individual time their product is used, their margins are compromised under a subscription-based model that delivers fixed revenue in a given period regardless of usage. This segues into the second driver of the metered billing software market — the expanded adoption of usage-based billing.

Expansion of Usage-Based Pricing

Companies that have variable cost structures, including AI and infrastructure companies — Metronome’s target audience — have been increasingly adopting usage-based pricing models for multiple reasons. Between 2018 and 2022, adoption increased from 27% to 46%. As of 2023, it was expected that 61% of SaaS companies would have adopted this model.

The first reason — as previously mentioned — is that companies incur incremental revenue each time their product is used. In a subscription model, companies receive a fixed payment without regard to usage volume. With usage-based pricing, revenue potential is unbounded which protects margin as costs increase with more usage.

Source: Openview

Additionally, this model has removed barriers to entry for new customers:

“Instead of paying upfront in a subscription or per-seat model, customers can start using a product at a “comparatively low cost. This lower barrier to entry attracts more customers to get started and allows for a subset of customers to grow their usage rapidly.”

Companies that have a usage-based model not only acquire customers more easily but retain and upsell more effectively. Net dollar retention (NDR) measures how well a company retains revenue from and upsells existing customers.

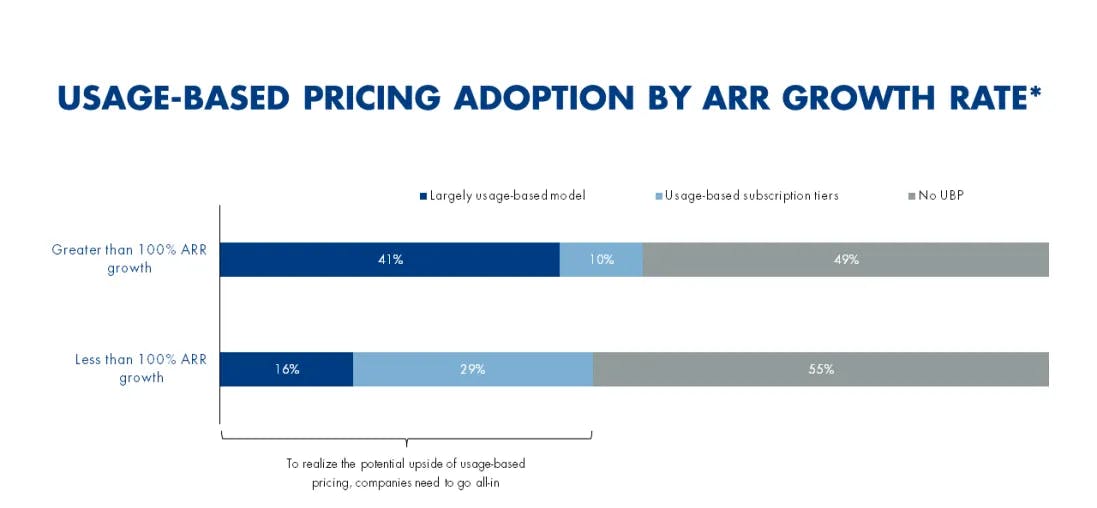

As of 2021, the top-quartile NDR for companies primarily using a consumption-based model was 122%, compared with usage-based subscription tiers (110%) or no usage-based pricing (109%). The combination of more effective customer acquisition, along with the improved ability to retain and scale existing customer revenue, results in software companies that grow at over 100% per year to be disproportionately likely to employ a usage-based model.

Overall, the highly variable cost structure inherent in AI and infrastructure companies, along with improved customer acquisition and accelerated revenue growth potential of companies using consumption-based pricing, are inferred to be significant growth vehicles of the metered billing software market.

Competition

Stripe

Stripe was founded in 2010 and is one of the largest providers of financial infrastructure in the world. Its infrastructure is “developer-centric and API interface-driven” and helps companies send and receive payments as well as optimize revenue. It possesses about 31.9% of the payment management software market, only trailing PayPal.

As of February 2025, the company was valued at $70 billion and had raised a total of $8.7 billion after it sold an $861 million stake to limited partners of early investor Sequoia Capital in September 2024. In an annual letter published in 2024, Stripe announced that it had surpassed $1 trillion in total payment volume in 2023, up 25% from 2022.

Related to Metronome, Stripe has a Revenue and Finance Automation product suite that “helps users manage the entire revenue cycle, including invoices, billing, taxes, revenue recognition, and reporting.” As of August 2024, this suite was on track to exceed $500 million in revenue run rate within the few subsequent months.

Within Revenue and Finance Automation sits Stripe Billing. The company announced in April 2024 that Stripe Billing supports usage-based billing with its new Meters API, which is “natively integrated with Stripe Payments and with all products in [the] Revenue and Finance Automation suite’.

Stripe Billing is very similar to Metronome’s product as it ingests and analyzes up to 100K usage events per second, bills users with a wide variety of pricing models, and processes payments in one platform. A few of Stripe’s usage-based billing customers include Intercom, Deel, Retool, Atlassian, and Cloudflare.

Although Stripe’s usage-based billing product is integrated with its broader product portfolio and includes many of the same features as Metronome’s product, it reportedly has a less intuitive product experience for non-technical users. As indicated by an employee at Replit, “Stripe just provides you with a bunch of [APIs] for you to build from,” while Metronome has more features out of the box, including a pre-built event ingestion engine which Stripe lacks.

Zuora

Founded in 2006, Zuora provides a comprehensive suite of products that serve as an “intelligent subscription management hub” that helps companies manage and collect subscription or recurring-based revenue. Its product portfolio includes Zuora Billing, Zuora Revenue, and Zuora Payments.

Zuora’s software has customers including Box, Caterpillar, General Motors, and Zoom. It is most specialized in subscription and recurring revenue billing and payments while Metronome’s predominant position is in usage-based metering and billing. However, Zuora and Metronome both offer fairly flexible business model combinations that customers can use alongside recurring and usage-based such as volume-based tiers, discount-fixed, and discount-percentage.

Zuora went public in 2018 and traded on the New York Stock Exchange until October 2024, when it was acquired in a public-to-private LBO for $1.7 billion by private equity firms Silver Lake and GIC. While it was still public in May 2024, it acquired usage-based billing platform Togai for $26 million. This acquisition enhanced Zuora’s ability to cater to the increasing proportion of companies that employ hybrid (both usage and fixed recurring) business models.

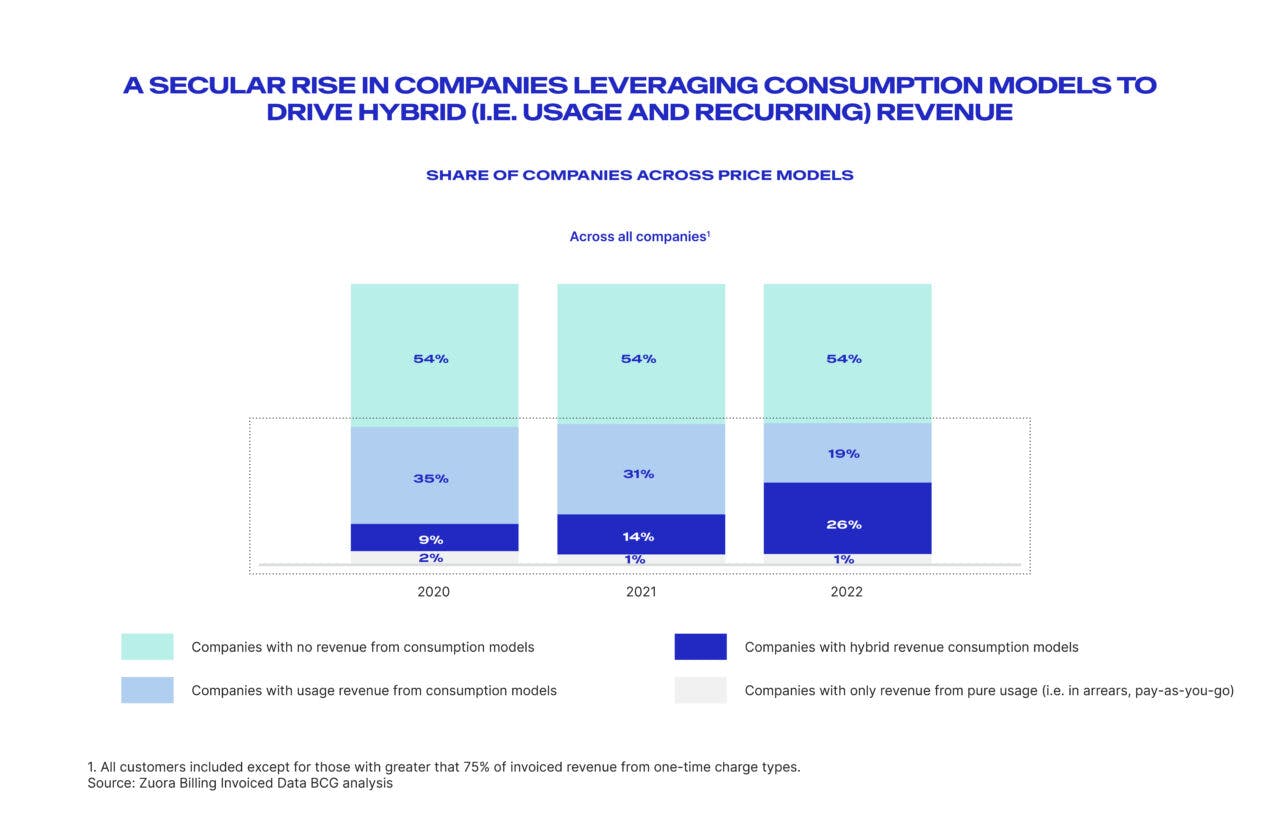

Between 2020 and 2022, the share of companies using hybrid pricing models rose from 9% to 26%. However, over 50% of Zuora’s customers employ a hybrid pricing model.

Source: Zuora

Orb

Orb was founded in 2021 and is a usage-based billing platform that is “engineered for modern software businesses.” Co-founders Alvaro Morales and Kshitij Grover have a similar story to that of Metronome’s Liu and Woody. The two founded the company after working at Asana and becoming increasingly frustrated with the company’s “inflexible and rigid” billing systems as they were tasked with making changes to product pricing and packaging. Morales commented on the vision for the product:

“We like to think of Orb as marrying an analytics product and a billing product to create a new approach that provides flexibility and enables [pricing] experimentation.”

Like Metronome, Orb ingests raw usage data from customers’ products. Customers can then configure different pricing models and logic on top of this data. The company also provides detailed invoices for its customers and provides embedded reporting dashboards for end customers to view their consumption and manage spend.

As of February 2025, the company had raised a total of $44.1 million after having raised a $25 million Series B round led by Mayfield with participation from Menlo Ventures, Greylock, South Park Commons, and others.

Orb grew ARR by 5x over the previous year as of September 2024, while tripling its customer base. Its customer base includes companies like Perplexity, Pinecone, Vercel, and Replit.

While Orb and Metronome have both found success in AI and infrastructure, Orb has also gained traction in the fintech and developer tools verticals. These verticals present an expansion opportunity for Metronome beyond its current focus on broad AI, infrastructure, and data services.

Although Orb was founded in 2021, it didn’t launch its product until March 2023. By the time Orb launched, Metronome had already partnered with large enterprises like Databricks and NVIDIA and rapidly scaled platform usage with companies like OpenAI. By being one of the earliest to enter the usage-based billing software market, Metronome established a meaningful customer base and demonstrated the scalability of its platform by the time Orb launched its product.

Amberflo

Amberflo was founded in 2020 and provides a metering and usage-based billing platform that tracks real-time product usage by customers. Its core product, Total Monetization Platform, was designed to measure product usage “at a granular level down to every transaction, API call or resource used.” It offers real-time dashboards that display revenue, usage, and cost insights, flexible billing options, and precise customer invoicing.

Founder and CEO Puneet Gupta first gained experience with metering when he built usage-based metering pricing models for AWS between 2011 to 2014. He recalled this experience: “Whenever we built a service, we had to connect to the metering stack. That’s where I became aware, and for me, it was an eye-opener.”

As of February 2025, the company has raised a total of $25 million after having raised a $16 million Series A in January 2023 at a $55 million post-money valuation. The round was led by Norwest Venture Partners. Other investors include Homebrew, Correlation Ventures, Firebolt Ventures, and others.

Source: Amberflo

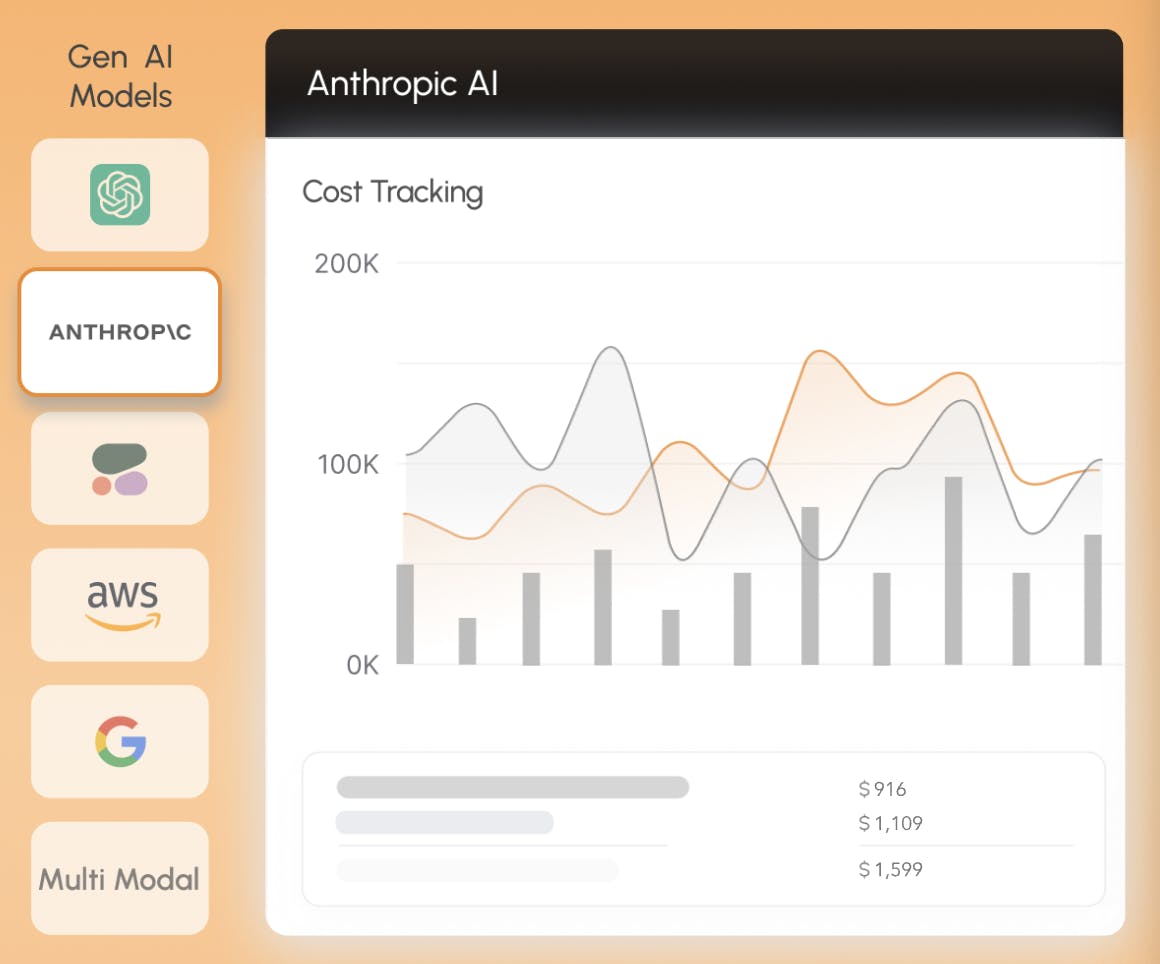

In January 2024, the company released an AI monetization platform that “automatically meters the use of underlying LLMs.” This tool helps Amberflo’s direct customers to precisely track and understand their usage and corresponding costs for using prominent 3rd party LLMs such as OpenAI GPT-4 or AWS Bedrock. This then helps inform the type of pricing model that companies would like to administer for their products in an attempt to maintain margins.

Like Metronome, Amberflo also has defined use cases in the generative AI and infrastructure verticals. However, Amberflo has also documented uses within the developer tools vertical, as Orb has.

M3ter

M3ter was founded in 2020 and is based in London, England. Its core product is a cloud-based usage-based billing platform that is designed to capture granular product usage and cost data in real time, help customers configure complex pricing settings, and calculate accurate invoices quickly. Like Metronome, M3ter offers broad flexibility in pricing types ranging from pay-as-you-go, tiered, prepayments, to usage-based pricing.

As of December 2024, M3ter has raised a total of $33.1 million. It raised $14 million in Series A financing in April 2023. Notion Capital led the round with participation from Insight Partners, Kindred Capital, and Union Square Ventures. A primary use of funding was to fuel its US expansion from Europe.

M3ter’s target customers are B2B software companies. As of 2024, the company reached $6 million in ARR — up from $2.4 million in 2022. In April 2023, it was announced that M3ter partnered with Chargebee to deliver usage event metering and usage-based pricing to Chargebee.

While M3ter customers can send invoices to many of the same downstream applications as Metronome, such as Netsuite, Salesforce, and Quickbooks, its product does not include analytics dashboards for internal employees and end customers as of February 2025.

Chargebee

Chargebee was founded in 2011 and provides a comprehensive suite of revenue growth management services, specializing in recurring revenue and subscription billing. Unlike Metronome, Chargebee appears to predominantly serve businesses that use subscription models. It only began offering metered billing as of April 2023 when it formed a strategic partnership to receive private labeled metering services from M3ter.

It seems that usage-based billing is offered more so as a complement to its subscription-based / recurring revenue support. This differs from Metronome, whose core value add is in precise usage event metering and pricing.

As of February 2025, Chargebee has raised a total of $479.9 million. It raised a $250 million Series H in February 2022, co-led by Tiger Global Management and Sequoia Capital. Additional investors include Insight Partners, Sapphire Ventures, and Accel.

Chargebee also caters to a much broader set of customers than Metronome. As of February 2025, Chargebee has over 6.5K customers across B2C, D2C, and B2B in industries ranging from software such as Calendly and Typeform to consumer goods brands like Vital Proteins and retail chains like Pret a Manger.

Metronome differs in that it is much more focused on serving companies in emerging markets that have highly variable cost structures — such as AI, infrastructure, and data services.

Zenskar

Zenskar was founded in 2022. Its core product is an end-to-end revenue automation software that automates usage-based data metering and pricing, contract management, accounts receivables, and revenue recognition. It also provides analytics for customer use but does not offer embeddable dashboards for end customers to view their usage and spending metrics. Like Metronome, a variety of business models are supported, such as variable subscription, usage-based, and tiered subscription.

As of February 2025, the company has raised a total of $7 million after raising a $3.5 million seed round in November 2022 that was led by Bessemer Venture Partners. Other investors include Shine Capital, Basecamp Fund, Converge, and Rocketship.vc.

Zenskar’s target audience is rapidly growing software companies. Its customer base as of February 2025 is comprised of early, mid, and growth-stage companies spanning a variety of sectors within software.

While both Zenskar and Metronome specialize in usage data metering and pricing, it appears that Zenskar has a wider variety of native integrations available as of February 2025. These include platforms like MongoDB, Postgres, Hubspot, and Shopify.

While Zenskar may have a slightly more built-out integration ecosystem, Metronome’s dashboarding and analytics capabilities appear more user-friendly and granular than Zenskar’s. Metronome also benefits from having been in the market since 2022 and has established a reputable customer base, including some of the most prominent AI, infrastructure, and data services companies.

Business Model

While its exact pricing model is not displayed publicly, Metronome reportedly charges a fixed rate per 1K events ingested. Much like its customers who enjoy revenue increases as their products incur more usage by end customers, Metronome enjoys increased revenue when more events are ingested by its platform. On top of the fixed event ingestion fee, Metronome also charges a platform fee and an additional percentage fee on what customers bill their end customers.

Traction

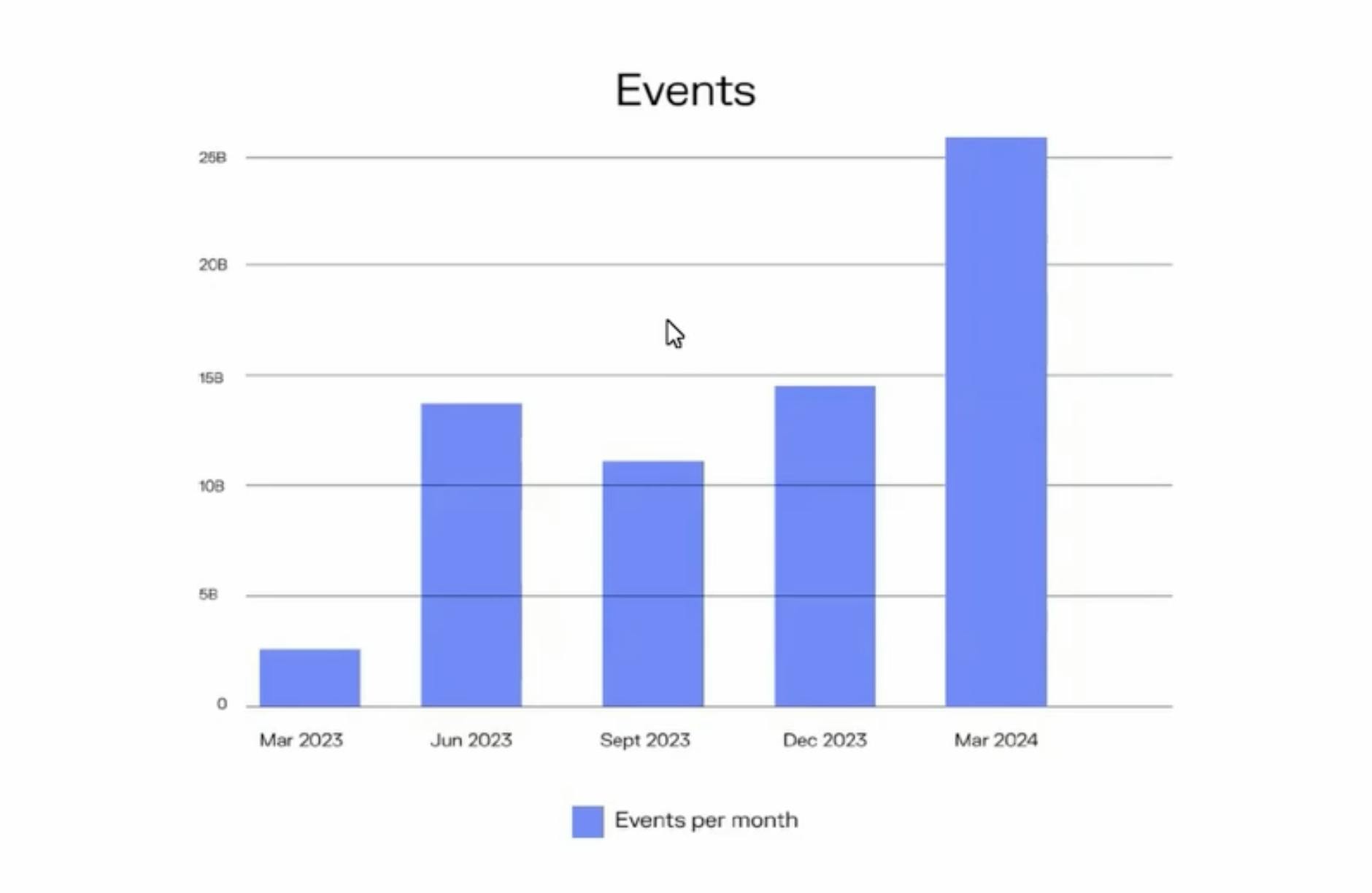

Despite Metronome being founded in 2019, Metronome is one of the “largest billing systems on earth” and bills more dollar and invoice volume than most public companies. As of June 2024, It ingests data on over 30 billion events per month and processes over 100K invoices per minute. Having ingested about 2.5 billion events in the month of March 2023 and 25 billion in March 2024, this reflects a monthly growth factor of 10x.

Source: Metronome

Many companies in Metronome’s customer base have scaled rapidly, such as OpenAI, NVIDIA, Anthropic, and many others. Because Metronome’s revenue scales as its customers’ product usage increases, the company was able to scale ARR by 6x in 2023 as more companies pivoted to usage-based models from subscription models.

Metronome has not only scaled revenue with existing customers, but they’ve garnered interest from emerging AI companies. In January 2024, Woody indicated the company had “a huge amount of inbound interest from companies looking to monetize new AI products.” To support the company’s rapid ARR, customer, and usage event ingestion growth, Metronome has gone from 66 full-time employees in January 2024 to 134 employees as of February 2025.

The company has also received a plethora of 3rd party industry awards. In August 2024, it was one of 25 companies to be named to the Forbes Next Billion Dollar Startups 2024 list. Of the 225 companies that have been previously tabbed on the list, “131, or 58%, became unicorns, including Doordash, Figma, Anduril, Benchling and Rippling”.

In April 2024, Metronome was named to the 2024 Enterprise Tech 30 list alongside other mid-stage companies like Pinecone, Perplexity, and Hex. Lastly, in June 2024, the company was included in the InfraRed 100 list by Redpoint Ventures - a “comprehensive list of the next 100 promising private companies in Cloud Infrastructure.”

Valuation

In January 2024, Metronome raised a $43 million Series B at a $350 million post-money valuation, led by NEA with participation from follow-on investors General Catalyst and Andreessen Horowitz. The round brought the company’s total funding amount to $78 million. The Series B pre-money valuation of $305 million reflects a 2x up round from its Series A, which was priced at a $150 million post-money valuation.

The up round could partially be due to the company having scaled revenue 6X in 2023. Liu also mentioned, that “companies have been cutting spend on ‘nice-to-have’ software, but we’re seen as a core driver of revenue opportunities for our customers.”

NEA Partner Hilary Koplow-McAdams, who previously served as Head of Revenue at New Relic, joined the Metronome Board of Directors and emphasized: “Billing is often under resourced internally and seen as a bottleneck for product launches and pricing changes. In reality, it’s a make-or-break revenue driver for any business.”

Its $43 million Series B followed the company’s $30 million Series A raised in February 2022, led by Andreessen Horowitz. Continuing its trend of partnering with value-add investors, Metronome chose Andreessen Horowitz to lead the round because of the expertise of Martin Casado. He leads the firm’s ~$1.3 billion infrastructure practice, and the Metronome team wanted this advisory at a time in which data volumes being ingested on the platform were rapidly scaling.

The company’s $5 million seed round was led by General Catalyst due to Quentin Clark’s experience as former CTO at SAP and having served as CTO at Dropbox while Liu and Woody were there. Their first check was from Jean-Denis Greze who was formerly the CTO of Plaid and was a former Director of Engineering at Dropbox. Other angels in this round included Plaid co-founders Zach Perret and William Hockey, as well as co-founder and CTO of Hashicorp Armon Dadgar.

Key Opportunities

Expansion of AI Infrastructure & Application Layer

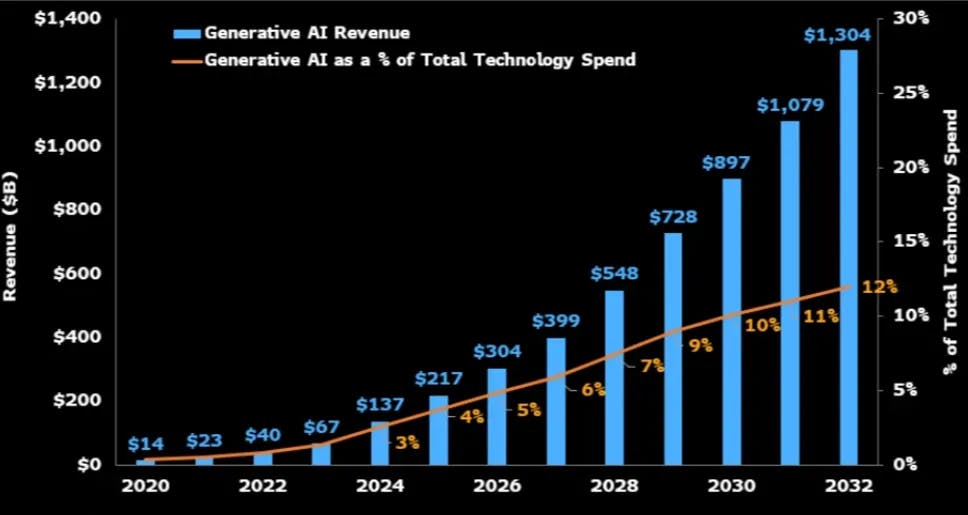

The global Generative AI market is forecasted to be worth $1.3 billion by 2032. Within this market, Generative AI Software revenue is projected to climb from $1.5 billion in 2022 to $280 billion in 2032, reflecting a 69% CAGR. Across the same period, Generative AI Infrastructure as a Service is projected to scale from $2.2 billion to $247 billion. This is a strong indication that the market opportunity for Metronome will expand alongside these tailwinds.

Source: Bloomberg

On the application side, investors are more favorably investing in AI companies building products on top of foundation models rather than the LLM companies themselves due to the mountainous costs required to build foundational models and the oligopolistic nature that the market is taking. On average, large tech companies like Amazon, Microsoft, Google, and Meta are investing “$30 billion to $60 billion in AI per year”.

Sequoia Capital partner Pat Grady indicated that the firm has an “order of magnitude more dollars invested at the application layer,” as it “seems to us that the application layer is where the largest number of billion-dollar-plus companies is going to come.”

Companies at the application layer build products using foundational models that meet the needs of specific verticals. For example, Hebbia is a vertical neural search that was specifically designed to meet the needs of analysts in the financial services industry. As the Generative AI software and AI infrastructure markets are both anticipated to grow rapidly through 2032, the entrance of new companies building verticalized AI apps and/or infrastructure used to train and deploy these apps is an opportunity for Metronome to scale revenue.

Natural Revenue Scalability of Usage-Based Model

The usage-based model enhances customer acquisition as it “allows customers to start at a low cost, minimizing friction to getting started”. Because of this reduced barrier, more users can access a company’s product. The revenue potential also becomes uncapped as what they pay increases alongside their usage.

As previously indicated, this pricing model helps companies retain and scale revenue with existing customers more effectively, as measured by net dollar retention (NDR). The fastest-growing SaaS companies, those growing at over 100% per year, are “disproportionately likely to leverage a usage-based model” as of 2021.

Source: TechCrunch

41% of companies that meet this growth threshold use a predominantly usage-based model vs. 16% who do not meet this threshold. This is due to the combination of more effective customer acquisition along with the enhanced ability to retain and scale revenue with existing customers.

Expansion Into Developer Tools

Orb and Amberflo, both Metronome competitors, already serve the developer tools market. This presents an opportunity for Metronome to expand its customer base. Developers have been known to prefer trying out new products first and gaining value from them before paying, which aligns with the usage-based model.

Additionally, it was indicated that “the best developer-centric platforms have evolved their implementation process to be as smooth and self-serve as possible.” This is reflected in that as of September 2022, of the 70% of public developer-focused companies that had public pricing data, 75% employed usage-based pricing.

Source: WorkOS

For example, Twilio is one of the pioneers of the usage-based model and one of the most prominent developer-focused companies. It was founded in 2008 and provides cloud-based API tools that enable developers to build communication programs, such as sending and receiving phone calls, texts, and videos.

The company’s product is “all about self-service for developers” and its usage-based pricing model aligns with developers’ needs for free product use upfront before making payments. Making it as simple as possible for developers to start using the product “gave the product sales momentum when Twilio eventually went to close enterprise-level deals. From there, they expanded usage and earned bigger and better contracts.”

Given that Orb and Amberflo are serving this market, the natural preference of developers for usage-based pricing, and the developer tools market’s forecasted growth from $5.3 billion in 2022 to $14.3 billion in 2032 at a 17.8% CAGR, this is an appealing market segment for Metronome to pursue.

Key Risks

Stripe’s Market Entrance

Stripe, one of the most established financial infrastructure companies in the world, entered this space in April 2024. Its usage-based billing product is deeply integrated with the rest of its Revenue and Finance Automation product suite, which is anticipated to surpass $500 million in run-rate revenue by the end of 2024.

Its entrance into this space presents a potential threat to Metronome as Stripe could convert its large existing customer base onto its usage-based billing product while attracting new customers with a wide-reaching product portfolio that spans beyond the scope of Metronome’s usage-based billing and invoicing platform.

OpenAI, one of Metronome’s most prominent customers, started using Stripe in March 2023 to power payments for its ChatGPT Plus and DALL-E models. Peter Welinder, Vice President of Product and Partnerships at OpenAI, commented on the partnership:

“We’re excited to work with Stripe to monetize our flagship products. Beyond payments, Stripe is helping us with everything from recurring billing and tax compliance to automating out financial operations.”

Although OpenAI has been working with Metronome to manage usage event metering and billing since 2022, the addition of usage-based billing to Stripe’s robust product portfolio may make it appealing for OpenAI and customers in similar positions to move to Stripe.

Fee Structure

Compared to other competitors, Metronome reportedly charges a fixed rate per 1K events ingested, a platform fee, and an additional percentage fee on what customers bill their end customers. Comparatively, Orb only charges a percentage fee on the total billed to end customers and does not charge for event ingestion or platform usage. These additional fees may cause smaller companies with smaller budgets to hesitate when evaluating Metronome amongst its competitors.

Summary

More than 61% of SaaS companies had either adopted usage-based pricing or had begun testing it, up from 27% in 2018. This shift to the usage-based pricing model from the flat subscription model common in SaaS is primarily driven by the stronger alignment between what customers pay and the value they receive from a product. A separate driver is the highly variable cost structure inherent in AI companies - firms that find value in the uncapped revenue potential that consumption-based pricing provides.

Metronome provides a scalable billing infrastructure platform for companies that seek to employ usage-based pricing models to precisely measure how much end customers are using their products and apply any pricing strategy on top of this data that can be adjusted in minutes.

The company’s customer base primarily spans AI, infrastructure, and data services and serves some of the most well-known companies in the world such as OpenAI, NVIDIA, Databricks, and Anthropic. Due to the rapid growth of its customers, Metronome scaled its ARR 6x in 2023.

Given the rapid growth of the Generative AI software market through 2032 and subsequent forecasted growth of the vertical AI application and AI infrastructure markets, the key question is whether Metronome can sustain its revenue growth amidst a more competitive usage-based software landscape.