Thesis

Global demand for operational software is being reshaped by structural failures in legacy ERP systems and the rising cost of inefficiency. Over 70% of ERP initiatives are expected to fall short of business objectives by 2027, often due to poor planning and misalignment. Failures are becoming more visible and costly. In 2024, Spar Group’s unsuccessful SAP rollout led to over $80 million in lost revenue and ~$38 million in lost profit. As of 2025, ERP deployments require six to twelve months for mid-sized companies, with basic implementations priced between $10K and $150K. Despite these barriers, most ERP vendors continue to push monolithic architectures that lock users into rigid, high-maintenance systems.

Operational demands now outpace what traditional ERP platforms can handle. Ecommerce, distributed fulfillment, and complex supply chains introduce frequent errors such as stock keeping unit (SKU) mismatches, overselling, delayed shipping, and manual reconciliation. As of 2025, these errors are costing firms up to $800K annually in inefficiencies. These issues persist in systems reliant on custom code and siloed architecture.

In response, enterprise buyers are shifting toward modular stacks. By 2027, 55% of global organizations plan to decouple from monolithic systems in favor of incremental, modular deployment models. Automation is accelerating this shift. By 2029, 80% of ERP workflows are expected to be automated. Buyer expectations have also changed. Usability is now critical; 80% of B2B users ranked it as a top priority in 2023. Software flexibility is increasing with tools like no-code and low-code software, which is a market that is expected to reach $125.6 billion by 2031. In parallel, industry-agnostic ERP infrastructure is becoming essential to enabling firms across sectors to streamline operations without vertical-specific constraints.

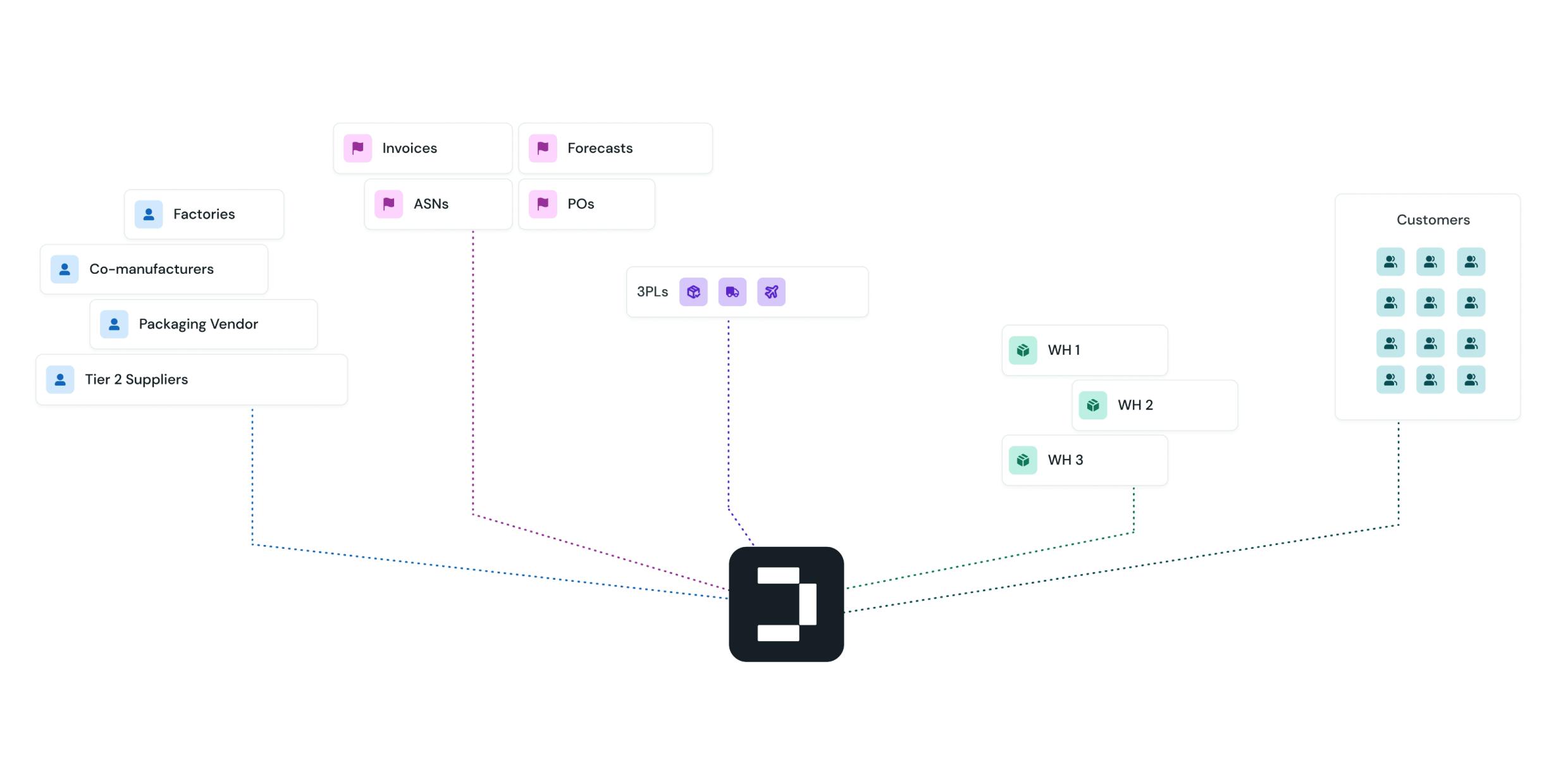

DOSS* is targeting this shift with a modular ERP platform that provides low-code infrastructure, readable by both humans and AI, combining inventory, order, and fulfillment management in one system. With 75% of ERP strategies not aligned with business strategies as of 2024, DOSS takes a customer-first approach. Deployment takes weeks, and pricing is usage-based. With over 30 integrations across ecommerce, logistics, and finance as of April 2025, DOSS allows teams to configure workflows directly, avoiding reliance on engineers or consultants while sidestepping version lock-in.

Founding Story

Source: Contrary

DOSS was founded in 2022 by Wiley Jones (CEO) and Arnav Mishra (CTO), alumni of the University of Illinois. Though they had known each other since school, they reconnected through a mutual investor and quickly aligned on a shared conviction: ERP software needed to be rearchitected from first principles. They committed to building what Jones described as an attempt to “speed-run 50 years of ERP software.”

Jones grew up in a Midwestern manufacturing family, where he learned firsthand how legacy systems broke critical operations. JD Edwards, an ERP platform used by his father’s company, frequently failed to deliver basic reliability and downstream functionality. During later work with contract manufacturers in China and Taiwan, Jones saw similar breakdowns: systems that restricted reporting to specific calendar days, fractured data visibility, and over-reliance on manual workarounds. As Jones described it, “you had to change what your business did in order to meet the application… [and] I was pretty resigned to the fact that that’s just how it worked.” The polished image of “digital transformation” stood in stark contrast to the reality of spreadsheets, PDFs, and tribal knowledge which drive global supply chains.

Mishra approached the problem from a systems engineering perspective. After completing computer science degrees at UIUC, he built infrastructure at Rubrik and Siteline. At both companies, he faced brittle integrations with Oracle and other legacy platforms. Many pathways required unofficial workarounds that exposed system vulnerabilities and confirmed a core belief: these platforms were not built to evolve. Mishra concluded that rebuilding the ERP layer from scratch was the only viable path.

When the pair reconnected, they shared an intuition-led approach rooted in pattern recognition and operator empathy. They listed every reason not to build an AI-native ERP. None held. The company was first incorporated as Odonata Inc., Latin for dragonfly, a creature that spends majority of its lifecycle in development. It was a metaphor for the depth and time required to build foundational software. It was later renamed DOSS, a name Jones coined after repeatedly walking past “Ross” en route to his office.

From the beginning, they committed to understanding how real operators worked. At one business, a team was managing an $80 million top-line using Airtable to track a product catalog with over 500 unique fields. The pair found that these teams were trying their best to avoid implementing legacy ERP systems because existing options were too rigid, expensive, or disconnected. They didn’t see this as an edge case but the norm.

Jones often references the Anna Karenina principle—“All happy families are alike; each unhappy family is unhappy in its own way.” In his experience, most businesses fail in unique ways but share a small number of root causes: fragmented order systems, disjointed inputs and outputs, and lack of integration across internal and external platforms. Their goal with DOSS was to focus on solving those shared issues while offering the flexibility to support company-specific expression.

Their early insight was that most workflows boil down to three flows: goods, dollars, and data. Traditional software isolated each into separate systems. Jones and Mishra saw potential to unify them through generative AI. After Jones saw GPT-3 generate SQL from plain English, he recognized that natural language could be translated into execution logic. Business users operate in concepts like “track landed cost by SKU,” while software has traditionally required them to think in schemas. DOSS built infrastructure to translate intent into safe, structured primitives.

Over 18 months, the team constructed a modular ERP platform with a schema-aware engine. Components include databases, workflows, and cloud services, each dynamically configurable. The goal was to create operator-grade software without shortcuts or brittle automation.

Jones argues that if humans are 70% water, enterprise operations are 70% spreadsheets and static documents. That observation continues to shape the team’s focus: unlock global value chain efficiency by rebuilding it from first principles, one primitive and one workflow at a time.

Product

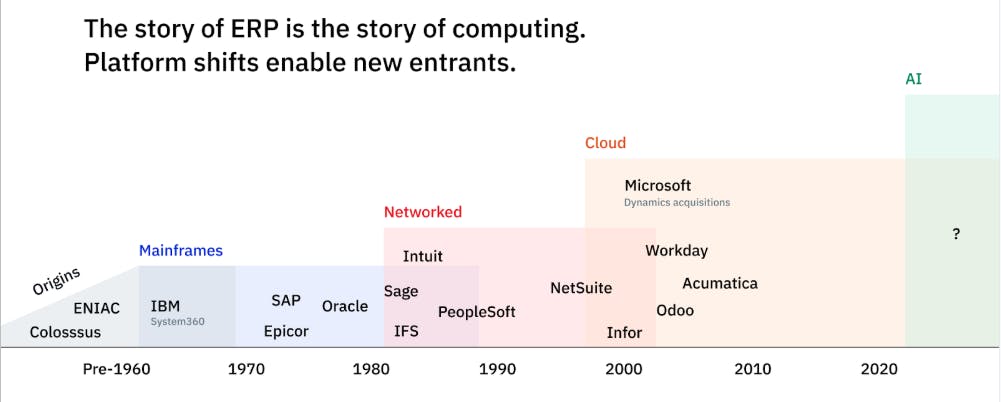

The History of ERP

Source: DOSS

In the mid-20th century, long before “ERP” entered common usage, businesses managed supply chains with manual ledgers and basic reorder-point systems. The introduction of machines like ENIAC and UNIVAC in the 1940s and 1950s enabled early automation through Material Requirements Planning (MRP), initiating enterprise computing in logistics and resource control.

By the 1960s and 1970s, computing power had consolidated into centralized mainframes. IBM launched a computerized inventory forecasting system in 1967, and MRP matured into MRP II, covering broader operational planning. This period marked the rise of ERP’s earliest vendors: SAP in 1972, followed soon after by Oracle. Both delivered monolithic, on-premise systems with deep integration. Adoption remained limited to large enterprises due to cost and rigidity.

During the 1980s and 1990s, client-server computing replaced mainframes with distributed networks. No longer tethered to mainframes, systems could run on distributed networks, and vendors like PeopleSoft, Sage, IFS, and Intuit emerged with targeted solutions for finance, HR, and operations. By the 1990s, ERP had evolved into suites of interlinked modules running on local servers, structured around shared data models. Adoption expanded beyond large enterprises.

In 1998, NetLedger (later NetSuite) introduced the cloud ERP. Delivered through a browser and priced via subscription, it eliminated on-premise infrastructure and introduced real-time visibility into core financials. This shift catalyzed SaaS ERP across the 2000s and 2010s, with platforms like Workday, Acumatica, and Microsoft Dynamics following suit. Cloud ERP offered faster deployment, simpler updates, and global reach.

ERP faces a structural shift in 2025. Large language models, real-time data infrastructure, and no-code interfaces are transforming ERP from passive record-keeping into systems capable of initiating and executing actions. Rather than layering AI onto outdated frameworks, newer systems begin with schema-aware logic and dependency graphs built for AI-native operation.

Despite market momentum, incumbents lag. Cloud-first platforms carry legacy expectations such as lengthy contracts, rigid deployments, and priorities shaped by enterprise buyers. As with past shifts, disruption begins in overlooked segments. ERP’s evolution echoes the core idea in The Innovator’s Dilemma: breakthroughs rarely start with superior performance but redefine value over time. In this cycle, LLMs are no longer tools; they operate as agents within the system.

Product Overview

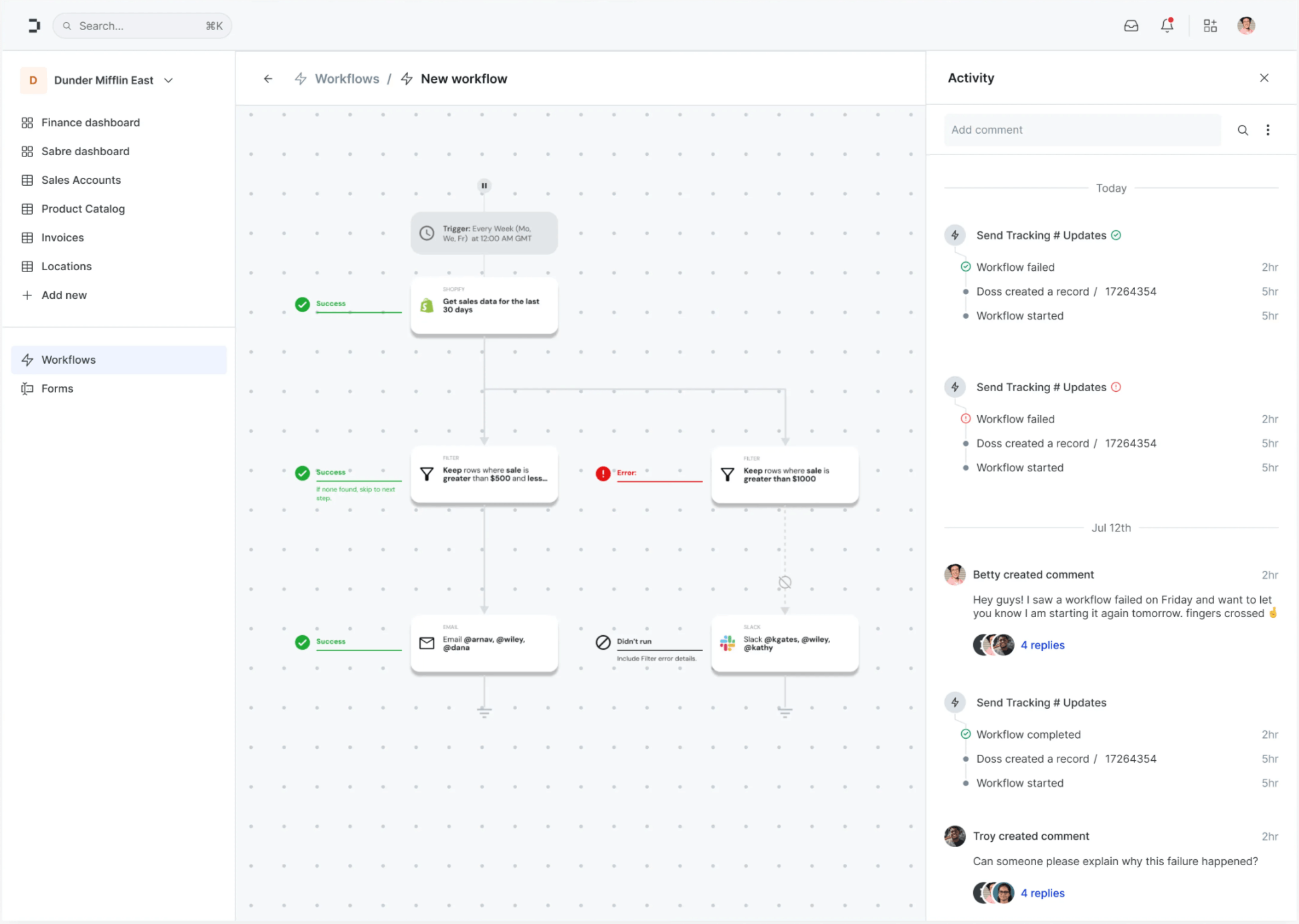

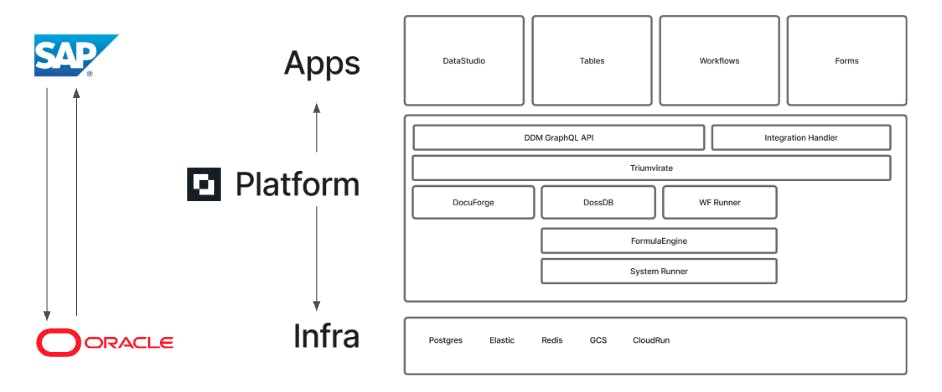

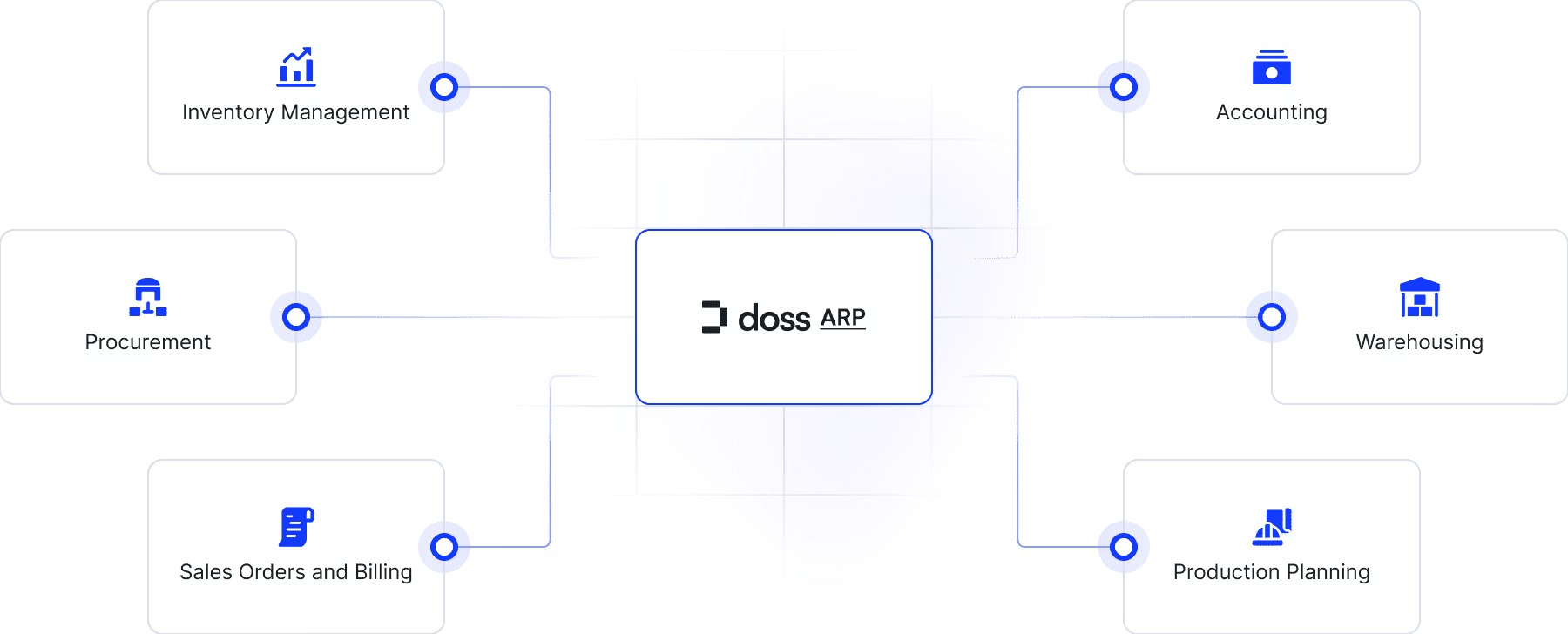

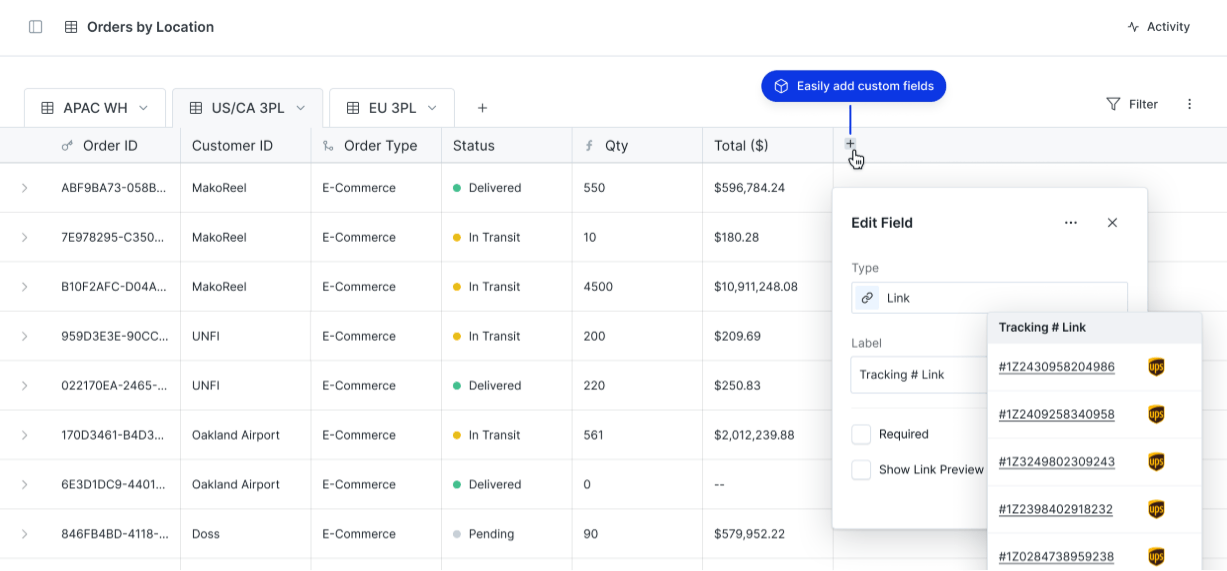

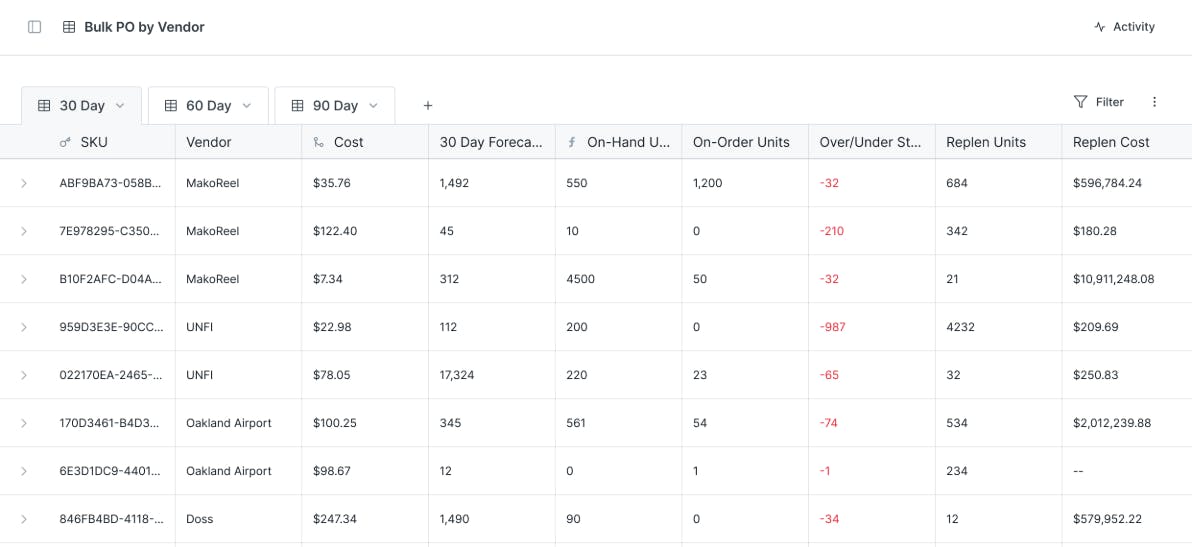

DOSS ARP is an application suite spanning modules from project management to inventory control. It runs on two core platforms: DOSS IDP, which integrates external systems into a unified data layer, and DOSS DataStudio, which provides embedded analytics and real-time visualization.

Source: DOSS

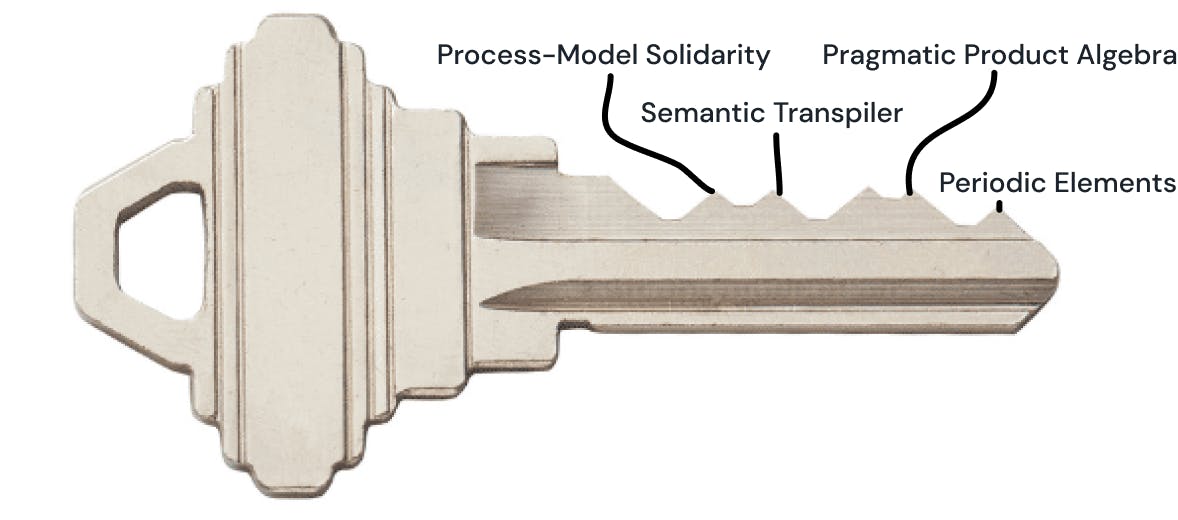

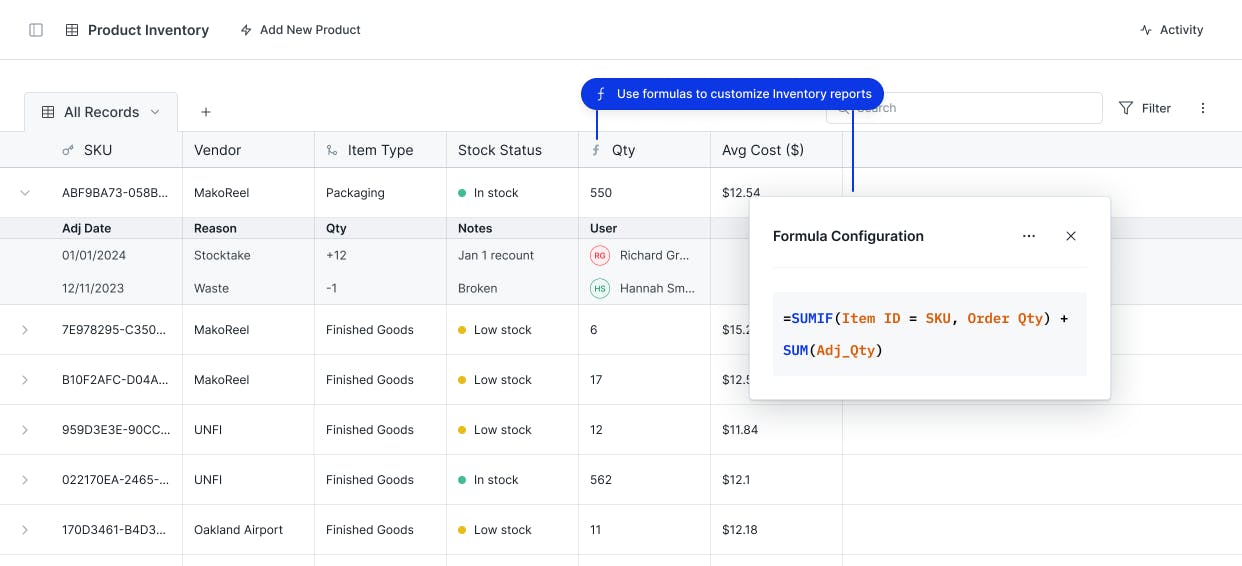

DOSS’s product architecture emphasizes flexibility. Instead of replicating legacy features, it breaks systems like QuickBooks, Anvyl, Cin7, and Bill.com into atomic, reusable elements called periodic elements. These primitives include data types, records, and subtables, which can be composed into workflows and applications. This approach reduces time to deploy and lowers operational complexity.

The architecture is governed by what DOSS terms pragmatic product algebra. It structures data as Tables → Records → Subtables → Subtable Records, a model that mirrors how business data is typically structured. As each primitive is reusable and composable, DOSS can support new use cases by configuring from existing logic, not writing new code.

Another pillar of the product philosophy is process-model solidarity, embedding operational logic directly into the interface. Instead of relying on documentation or disconnected diagrams, users interact with a live model that reflects real operations. Similar to observing a physical assembly line, users can see and modify processes within the environment.

Built into the system is the semantic autotranspiler, a generative layer that converts user intent into structured configurations. LLMs interpret high-level operational input and transform it into executable logic. Teams automate and customize workflows without writing code or relying on technical staff.

Source: DOSS

DOSS addresses a key product challenge: the tradeoff between opinionated systems (like SAP) and agnostic tools (like Notion). The former enforces structure but limits flexibility; the latter allows freedom but lacks automation and governance. This tension forces teams to split workflows, exploring via flexible tools and executing in rigid ones. DOSS eliminates that fragmentation by merging structured automation with schema-aware flexibility in a unified environment. Users can analyze data, configure logic, and trigger workflows without switching between Airtable + QuickBooks or Slack + SAP.

Source: DOSS

This duality leads to what DOSS calls its barbell strategy. One end serves non-technical users through intuitive modules. The other supports developers with an SDK, app store, and Bring Your Own Cloud deployment. Architecture connects infrastructure with application logic and developer tooling. According to Jones:

“We don't do stuff in the middle mostly and the rationale for that is it's a forcing function on building a really great user experience or building perfect abstractions.”

Jones describes the platform as a blend of Retool, Zapier, Airtable, and Google Forms. Internally, the problem space is modeled as a triangle of interface, data store, and workflow execution. Each layer operates independently but is unified by a validation engine.

Source: DOSS

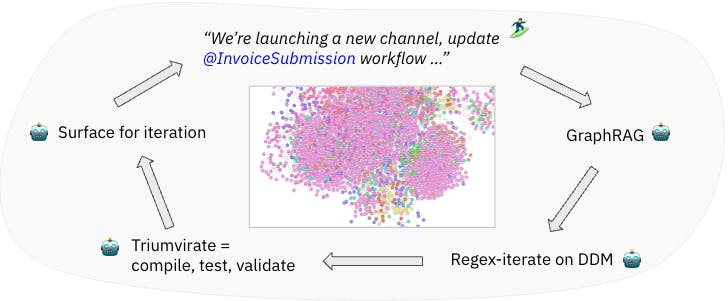

At the heart of DOSS’s architecture is the Triumvirate model: build a graph, store it, traverse it. This system governs how AI-generated and user-generated updates reach production. Each change flows through validation, beginning with GraphRAG, a retrieval layer built on OrgGraph, which maps dependencies across tables, workflows, and forms. Updates are parsed, tested with regex-style rules, and compiled. If validated, they surface for review or execution.

OrgGraph supports traceability and schema-aware access control. DOSS enforces permissions at the row, field, and document level using Role-Resource-Based Access Control (R²BAC), a policy engine influenced by Figma’s DSL-based model.

DOSS ARP

Source: DOSS

DOSS ARP is a modular suite for managing daily business operations, built from schema-aware primitives: tables, workflows, forms, generated files, and embedded analytics. Tables resemble Airtable-style spreadsheet-database hybrids, with underlying schema enforcement. Jones describes the modularity of the product as critical:

“The real magic is what we have underneath our platform, almost its own programming language that can compile down our whole application for a customer, and build itself back up.”

Key operational modules include:

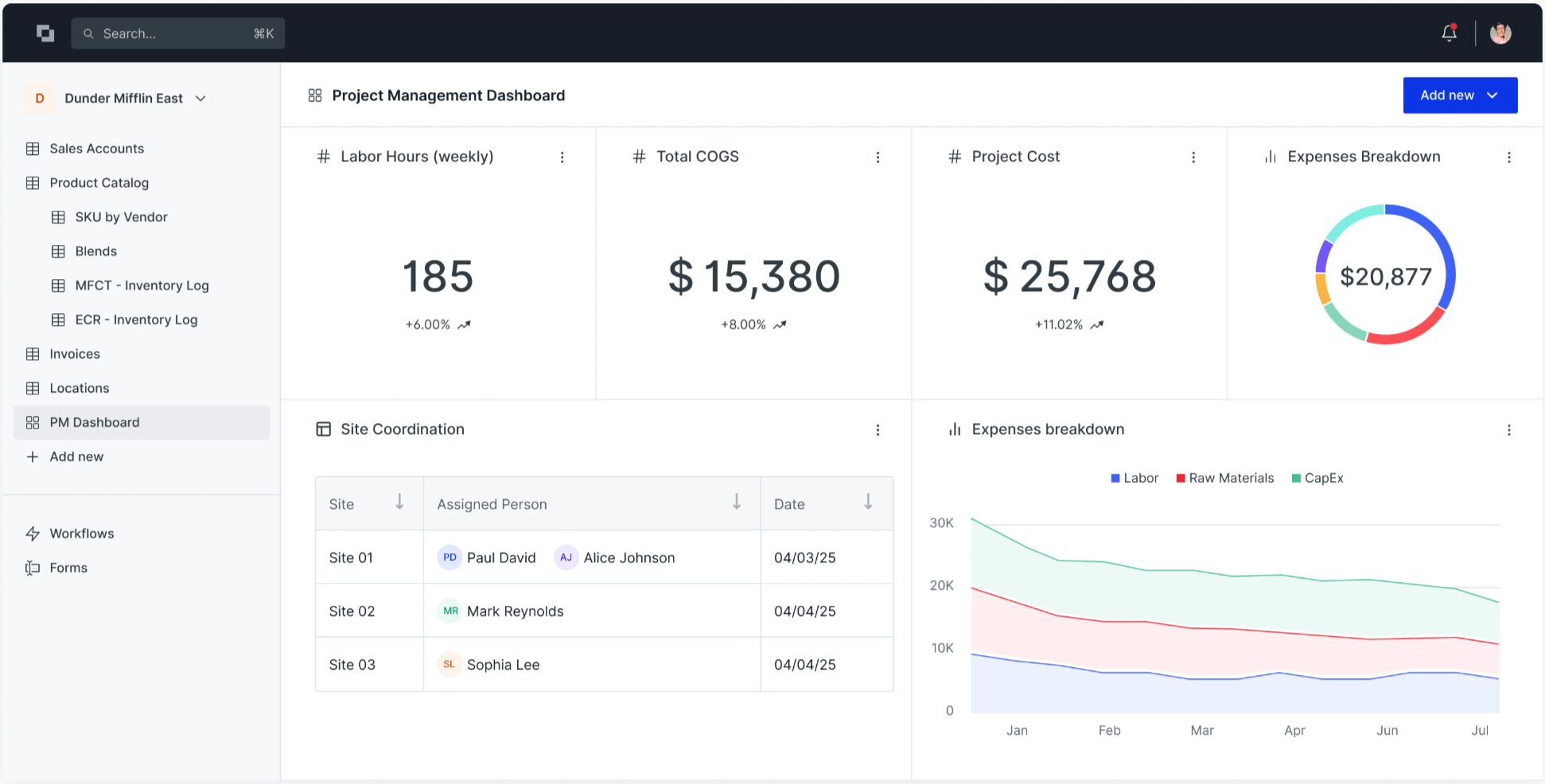

Project Management

Source: DOSS

Supports complex initiatives through trackable components with dynamic resource allocation and automated milestone tracking. It supports unlimited projects and deliverables, tightly integrated with budgeting, HR, and operations. A configurable engine automates assignments and status updates while maintaining manual control. Methodology-agnostic workflows accommodate Agile, Waterfall, or hybrid models, with real-time insight into resource use, delivery timelines, and risk.

Production Planning

Source: DOSS

Centralizes production through a Master Production Schedule linking procurement, inventory, and shop floor execution. Built-in Configure, Price, Quote (CPQ) tools support make-to-order and assemble-to-order workflows without expanding item masters. The module handles custom builds, assemblies, and Bill of Materials (BOMs) while tracking lead times, constraints, and capacity utilization in real-time.

Warehouse Management

Source: DOSS

Consolidates in-house and third-party logistics into a single platform, acting as the system of record for inventory, shipping, and fulfillment. This product also automatically generates documentation (BOMs, bills of lading, and packing slips) and applies historical data to optimize packaging and handling. Finally, it can track full container lifecycle, centralize freight providers, and provide real-time performance data to identify inefficiencies and shape logistics decisions.

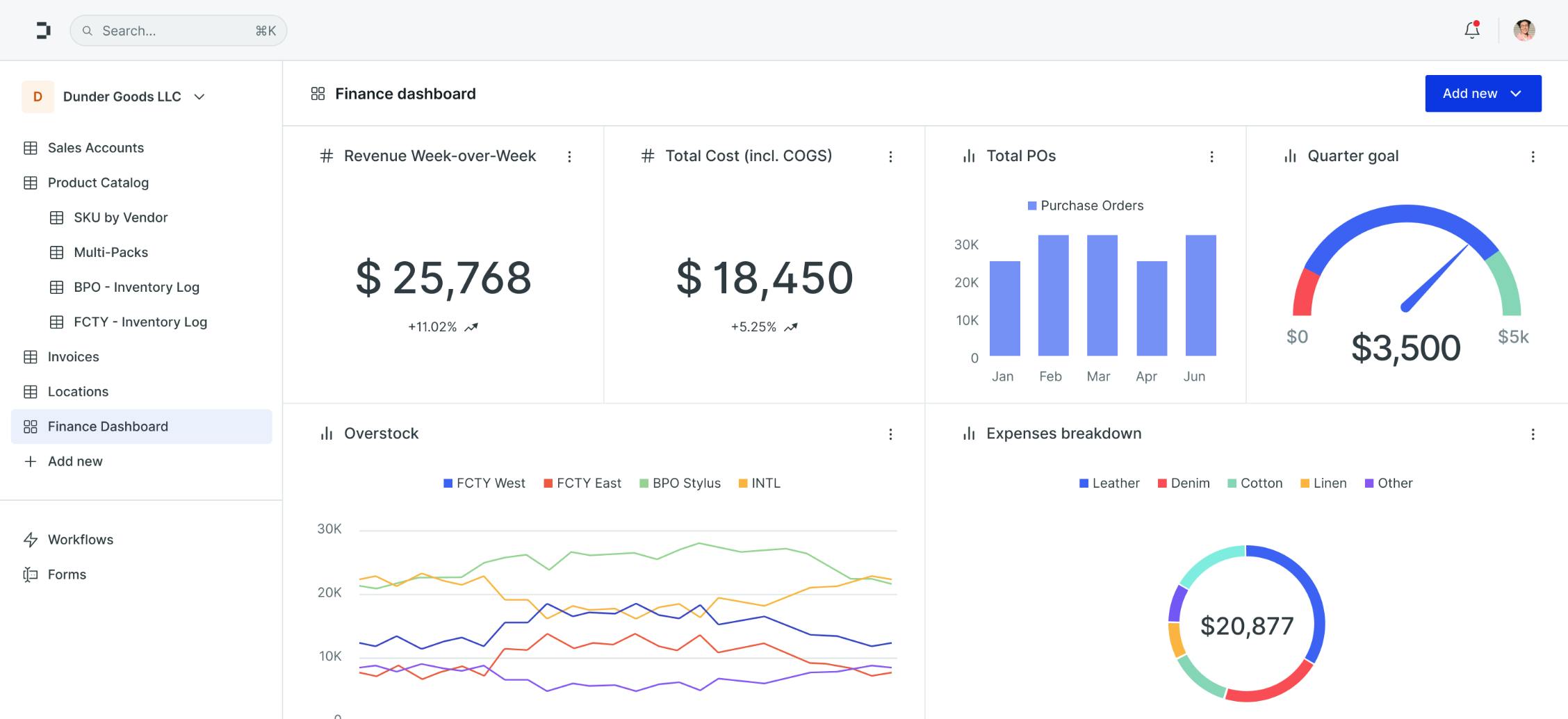

Finance & Accounting

Source: DOSS

This module combines ledger, payables, receivables, treasury, and multi-currency support. In addition, it enables native payment processing and automated reconciliation, with integrations to tools like QuickBooks and Xero. Finally, the product supports multi-order invoicing and links financial records to procurement and sales activity which offers real-time views into cash flow, cost, and profit metrics.

Sales Orders & Billing

Source: DOSS

This module can automate end-to-end order orchestration across channels like Shopify, Amazon FBA, WooCommerce, and EDI. In addition, it connects sales, inventory, and procurement data flows, covering backorders, returns, CPQ, and customer pricing. The system employs a no-code configuration of order-routing logic and also handles invoicing, stock alignment, payment processing, and tax calculation natively.

Kahawa 1893, a DOSS customer since late 2023, turned to the platform to keep pace with surging wholesale demand. Rapid growth introduced operational complexity: more SKUs, more manufacturing partners, and larger, time-sensitive orders. The team had built functional workflows in spreadsheets, but manual processing became a bottleneck. DOSS automated core systems across order routing, stock transfers, and variant pricing. Order processing time dropped from 10 minutes to 20 seconds. The team eliminated manual steps while gaining visibility across procurement, fulfillment, and revenue. PDF generation, vendor coordination, and pricing controls were able to run without intervention, giving Kahawa a single source of truth across their operations.

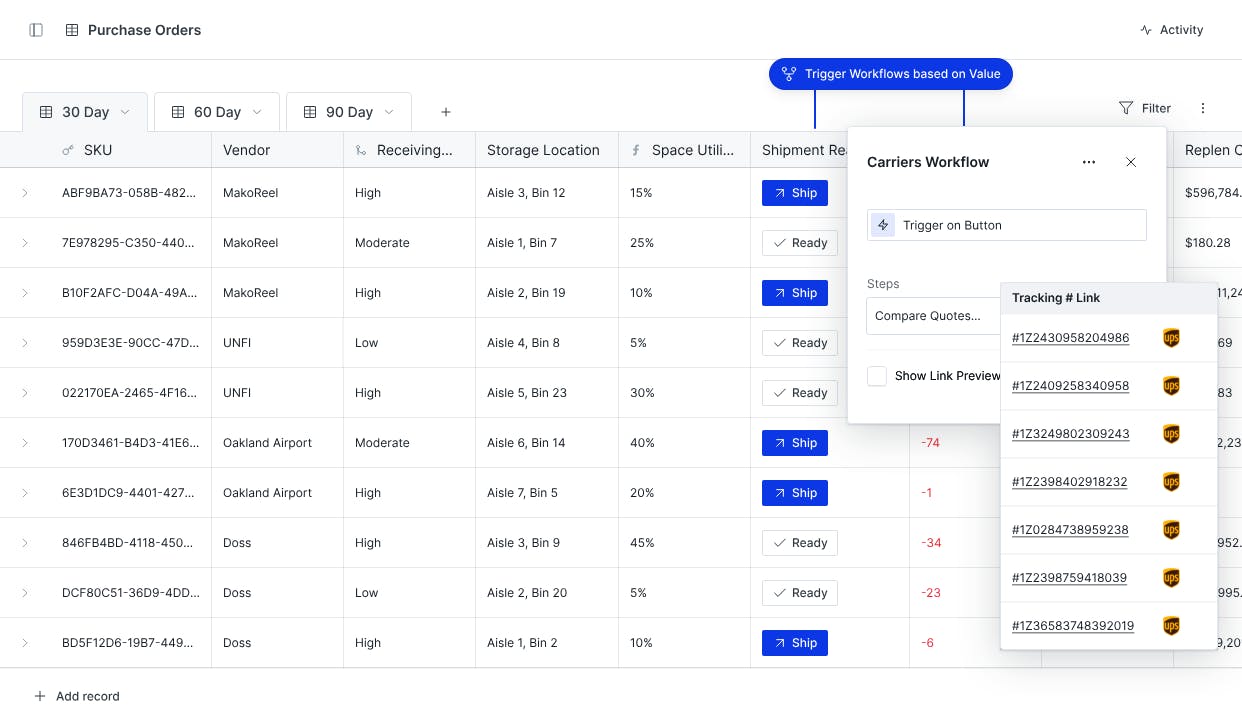

Procurement

Source: DOSS

This module streamlines procure-to-pay and offers tools including vendor tracking, purchase order (PO) generation, invoice processing, and embedded payments. POs are triggered by real-time demand signals, thresholds, and reorder logic. In addition, the product supports three-way matching, contract visibility, and compliance monitoring across in-house and 3PL-based supply chains.

Inventory Management

Source: DOSS

Delivers real-time, location-aware stock visibility with features that include barcode scanning, cycle counts, automated replenishment, and return routing. It supports first-in, first-out (FIFO), last-in, first-out (LIFO), and custom inventory logic. Spreadsheet-style interfaces allows rapid edits and are designed to scale across thousands of stock-keeping units and complex product catalogs.

One customer use case example is Noodles, a Berlin-based furniture manufacturer specializing in handcrafted industrial design pieces who needed a fast migration. The company’s ERP was nearing end-of-life, and a delayed rollout would mean operational risk. Noodles required an integration with WooCommerce, German-language support, and a go-live date with no room for slippage. DOSS was able to deploy in two weeks with purpose-built workflows for real-time 3PL sync, order management, and custom CPQ logic. What is typically a nine-month process was completed in under fifteen days. As a result, Noodles claims to save more than 100 hours each month as of April 2025 by automating manual tasks and removing data-entry errors across key workflows.

DOSS IDP

Source: DOSS

DOSS Integrated Data Platform supports the broader DOSS ARP system by connecting with over 30 external applications in finance, e-commerce, logistics, and messaging as of 2025. Integrations include QuickBooks, Shopify, Amazon, SPS Commerce, and Gmail. Low-code and no-code connectors enable bi-directional sync, allowing DOSS to act as an operational layer that both aggregates data and initiates updates, including invoice reconciliation and shipment tracking.

External data flows into a unified model, eliminating silos and avoiding traditional ETL pipelines used to move data from disparate sources into a central warehouse. While DOSS does not explicitly disclose whether the platform runs on its hybrid transactional analytical processing engine, a system that supports both real-time analytics and transactional workloads on a single data store, components of DOSSDB may be in use. DOSSDB, the platform’s underlying database, combines PostgreSQL for transactional operations, Elasticsearch for analytical queries, and change data capture to support precise, real-time updates.

DOSS DataStudio

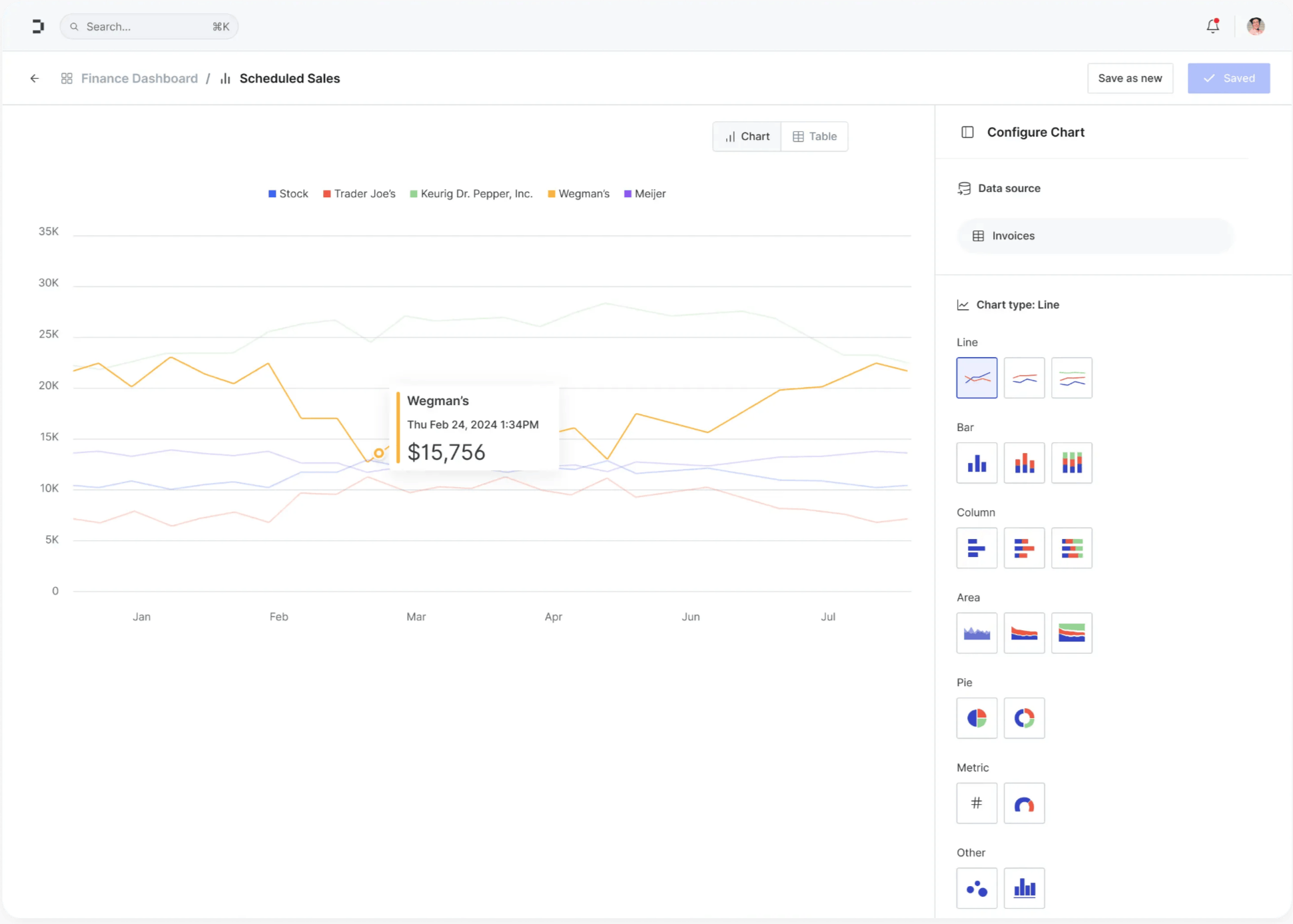

Source: DOSS

DOSS DataStudio provides live access to operational data without requiring external business intelligence platforms or data warehousing. Dashboards can be built using a drag-and-drop interface and customized by any field or metric. Visualizations update dynamically, and users can segment data across any native or custom dimension.

Market

Customer

DOSS serves small and midsize businesses in manufacturing, distribution, and production-driven sectors. Contracts can range from $50K to hundreds of thousands of dollars annually, typically with customers generating between $25 million and $500 million of revenue. The platform is not intended for companies with deeply embedded legacy systems or large-scale ERP deployments. It does not migrate customers from platforms like SAP or Oracle and avoids environments where workflows and user roles are defined by longstanding software. Jones explains:

“We're not in the business of migrating customers from very large scale implementations today … we don't want to be involved in trying to change people's behaviors and change their sense of identity about who they are and what they do.”

Ideal customers often operate without formal ERP systems but manage complex operations that require structure, transparency, and automation. Many rely on spreadsheets, email, and manual coordination, which makes scaling difficult. DOSS addresses three recurring problems: fragmented order management, disconnected processes across supply chains, and limited integration between internal systems and external providers.

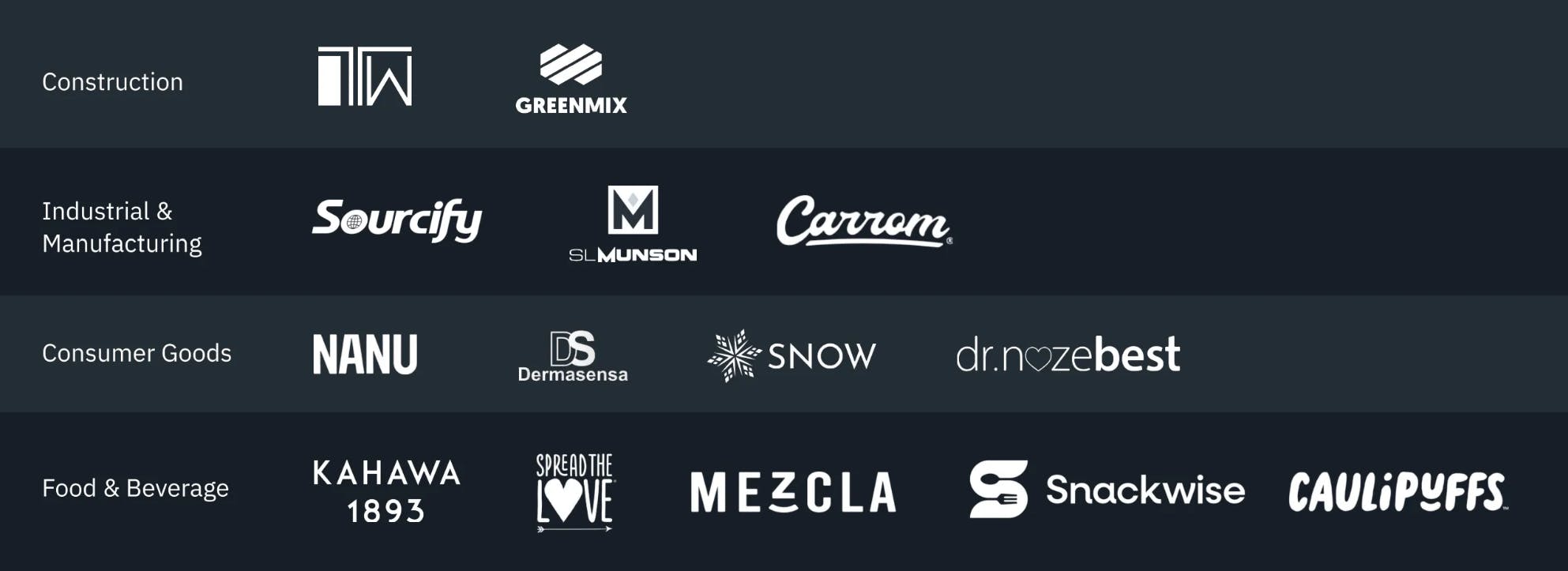

Source: DOSS

As of April 2025, DOSS’s customer verticals encompass: Consumer Goods, Industrials, Food and Beverage, Construction, Distribution, and Cosmetics.

Consumer Goods: DOSS supports rapid product iteration, configuration tracking, and post-sale service workflows. High-SKU categories such as electronics, furniture, and appliances benefit from version-controlled BOMs, customization logic, and service part planning. This enables lifecycle management without sacrificing speed or quality across fulfillment channels.

Industrials: Provides shop floor visibility, dynamic scheduling, and supplier coordination. Supports long-lead-time components, variance analysis, and capacity modeling across work centers. Designed to handle engineer-to-order and make-to-stock hybrid processes.

Food & Beverage: Applies first-in, first-out and first-expired, first-out controls. Tracks batches, enforces regulatory checkpoints, and monitors shelf life. Enables recall readiness and supports promotion-based demand planning for perishable goods.

Construction: Connects bidding, contractor scheduling, material staging, and cost monitoring. Tracks change orders in real-time and manages labor and equipment across distributed job sites.

Distribution: Streamlines high-volume fulfillment. Optimizes cross-docking, automates shipping logic, and ties warehouse performance to real-time demand. Reduces carrying costs and improves order velocity across retail, 3PL, and direct channels.

Cosmetics: Supports formula security, batch-level quality checks, and gated production tied to compliance and brand milestones. Enables coordination with contract manufacturers without exposing intellectual property. DOSS tracks sourcing, packaging, and launch timing aligned with trend forecasts.

Market Size

DOSS operates in the horizontal ERP market, targeting small and medium-sized businesses. It offers a modular platform deployable across industries with shared operational complexity rather than focusing on a single vertical.

The global ERP software market is projected to grow from $71.6 billion in 2025 to over $114 billion by 2030. Growth is driven by mid-market adoption and replacement of legacy systems. Within the broader ERP space, the AI-in-ERP segment is forecast to expand from $4.5 billion in 2023 to $46.5 billion by 2033, representing a CAGR of 26.3%. Adoption reflects rising demand for platforms that support automation, real-time data workflows, and AI-native functionality.

Mid-sized enterprises represent the fastest-growing ERP segment. While on-premises deployments accounted for 72% of the market in 2023, cloud adoption is accelerating, particularly among small and medium-sized firms.

Competition

Competitive Landscape

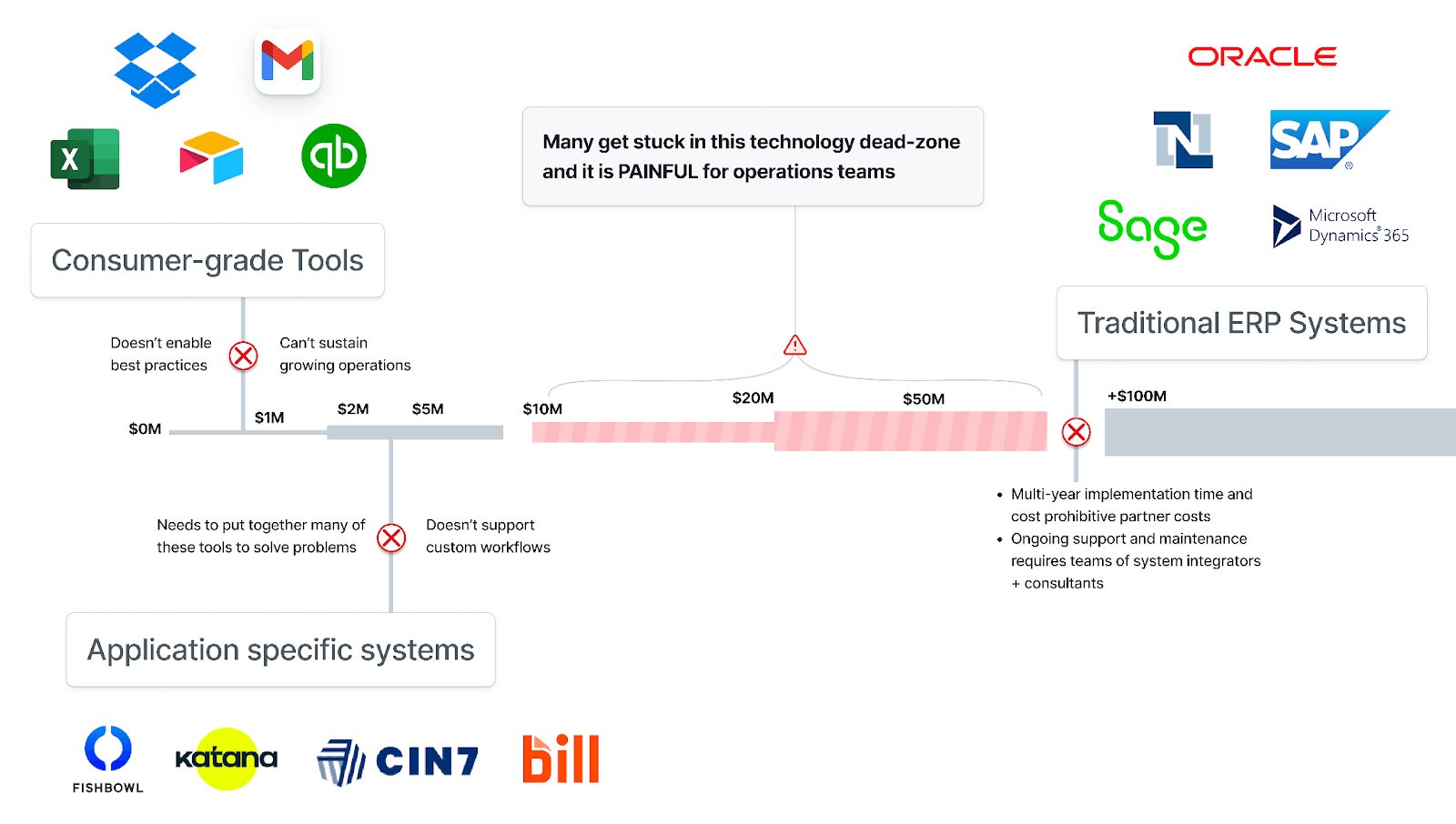

The ERP market remains concentrated. Microsoft Dynamics holds 25.8%, Workday controls 16.5%, and SAP ERP accounts for 9.1% of the global market share as of 2025. These incumbents dominate the enterprise segment through scale and feature depth, however, their platforms remain costly, complex, and slow to implement, leaving mid-sized businesses underserved.

Source: DOSS

DOSS addresses this gap. Companies in the $10 million to $100 million revenue range often outgrow spreadsheets and point tools but lack budget or tolerance for heavyweight systems. Mid-market options like NetSuite and Acumatica are either repurposed enterprise platforms or require vertical-specific add-ons. As a result, many businesses build fragmented workflows around third-party integrations and manual processes, reducing data fidelity and slowing operations.

DOSS presents an alternative to these stacks with a configurable platform that’s AI-native, allowing LLMs to operate it. The Adaptive Resource Platform uses low-code infrastructure to support deployment without consultants.

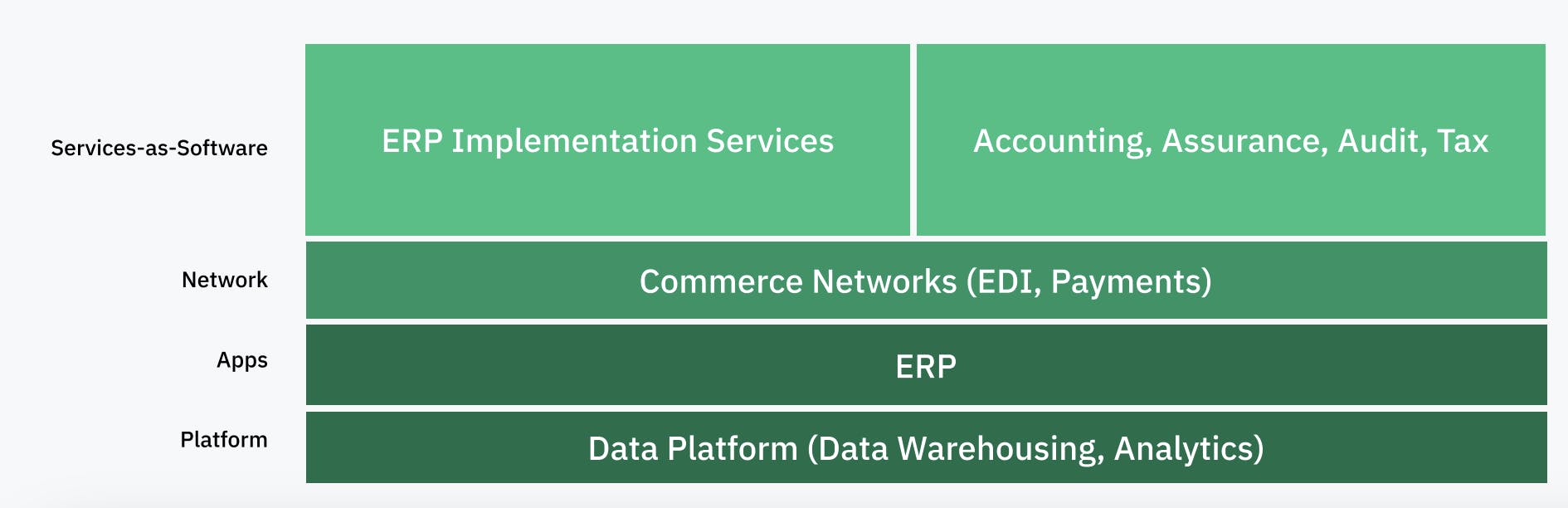

Source: DOSS

DOSS targets companies navigating operational scale without access to enterprise systems. Its strategy focuses on owning the full cost stack: platform, applications, network, and embedded services. The premise is that future ERP providers will function as infrastructure, delivering not just software but the execution layer businesses depend on to operate and grow.

Enterprise-Grade ERPs

While DOSS may be positioned against enterprise-grade ERPs like SAP over time, or consumer-facing tools like Airtable, its most common competitor is not a single product but a patchwork of tools. Many of DOSS’s target customers operate in the “missing middle”—businesses too complex for spreadsheets but too small, cost-sensitive, or time-constrained to deploy heavyweight platforms. These teams often manage critical workflows through a combination of point solutions (e.g., QuickBooks for accounting, Shopify for sales, Airtable for tracking, and email or Slack for coordination), resulting in fragile systems with limited visibility, duplicated effort, and frequent reconciliation errors. However, some of the larger ERP platforms have some product components that may increasingly be seen as direct competitors to DOSS.

SAP

Founded in 1972 by five former IBM engineers, SAP is among the largest global providers of enterprise resource planning software. Its core platform, SAP S/4HANA, integrates finance, manufacturing, supply chain, and other operational functions into a single system adopted by large multinational organizations. As of April 2025, SAP had a market cap of $302.3 billion, placing it among the highest-valued software vendors.

Both SAP and DOSS operate within the ERP category, but they serve fundamentally different customers. For the most part, SAP supports large enterprises with embedded IT infrastructure and complex integration needs. DOSS targets operations-heavy mid-sized businesses that require speed, lower setup cost, and flexibility. SAP’s RISE initiative supports digital transformation for incumbent enterprise clients, while GROW, an initiative launched in 2023, expands cloud ERP access to smaller organizations. DOSS offers a usage-based model with no implementation fees whereas SAP projects typically involve multi-month timelines and significant upfront investment.

SAP S/4HANA Cloud delivers modular ERP functionality but often relies on certified developers for customization. DOSS enables workflow configuration through a low-code interface managed directly by business users. While SAP is transitioning to SaaS through its cloud offering, adoption remains gradual. Recent moves to accelerate this shift include discount programs, migration incentives, and a restructuring plan focused on AI, cloud delivery, and mid-market expansion.

Microsoft Dynamics 365

Launched in 2016, Microsoft Dynamics is a cloud-based suite that combines ERP and CRM modules across finance, supply chain, commerce, and service operations. It targets mid-market and enterprise customers, with a modular structure and native integrations across Microsoft 365, Azure, and Power BI. As of April 2025, Microsoft holds a market cap of $2.9 trillion. Dynamics 365 is a core component of Microsoft’s Intelligent Cloud segment, which reported 19% revenue growth in Q2 FY2025.

Microsoft’s product architecture is embedded across its broader ecosystem. Data flows through Microsoft 365, Power Platform, and Dataverse, enabling continuity for users already on Microsoft infrastructure. DOSS follows a similar pattern. Its Integrated Data Platform (DOSS IDP) consolidates external data sources, and its analytics layer, DOSS DataStudio, surfaces real-time operational metrics without external BI tools. While Microsoft applies AI across its suite through Copilot, DOSS uses schema-aware primitives and adaptive workflows to automate actions and highlight bottlenecks directly within user-defined processes.

Dynamics 365 typically involves deployment timelines between six and twelve months and often requires third-party consultants for implementation and configuration. Training and technical resourcing are prerequisites for most customers. In contrast, DOSS offers a low-code platform built for deployment in weeks, configured directly by internal operators.

Horizontal & Mid-Market ERP

Horizontal ERP vendors address operational complexity in mid-sized firms without the implementation burden of enterprise systems. Customers often lack formal ERP or outgrow point tools and spreadsheets. These platforms emphasize flexibility, faster deployment, and integrated analytics over rigid structure.

Netsuite

Founded in 1998 by Evan Goldberg, NetSuite provides cloud-based software covering ERP, CRM, and ecommerce for small and medium-sized businesses. Oracle acquired NetSuite in 2016 for $9.3 billion, and now operates within Oracle’s cloud applications division. As of April 2025, Oracle holds a market cap of $371.1 billion.

NetSuite targets mid-market customers with a suite covering ERP, CRM, and financial tools. Typical implementations take four to six months and often involve external consultants. DOSS, by comparison, offers a low-code platform deployable in two to three weeks by internal teams.

In terms of cost structure, DOSS employs a usage-based structure with module-based billing. NetSuite pricing often includes bundled functionality, with implementation fees ranging from $25K to over $100K upfront as of 2025. NetSuite financial features also frequently require third-party connectors while DOSS offers a built-in General Ledger, billing, and invoicing system.

NetSuite has been making strides in early 2025 with its AI-powered updates, including NetSuite Text Enhance, CPQ AI Assistant, and SuiteAnswers Expert, which aim to streamline data entry, optimize product configurations, and automate support. NetSuite’s SuiteSuccess XaaS edition offers preconfigured templates for managing recurring revenue, inventory, and project-based operations.

Acumatica

Founded in 2008 by John Howell, Serguei Beloussov, and Mike Shchelkonogov, Acumatica provides cloud ERP software for small and mid-sized businesses. The platform covers financials, distribution, manufacturing, project accounting, and customer management.

Acumatica raised $48.3 million in funding, including a $25 million Series C round in 2018 led by Accel-KKR. Other notable investors include Almaz Capital, Runa Capital, MYOB, and Visma. In May 2024, Acumatica was acquired by Aktion Associates.

Acumatica’s platform targets businesses with industry-specific modules and partner-led customization. Typical implementations require extended setup and consultant involvement. By contrast, DOSS provides a low-code ERP platform with faster deployment and automated updates. Acumatica’s AI strategy embeds machine learning across workflows to enable anomaly detection, automation, and interface optimization. Its product updates emphasize guided insights for mid-sized operators managing data across supply chains and finance.

In late 2024, Acumatica introduced a Professional Services module supporting lifecycle management and customer delivery. As of 2024, Acumatica reported a customer base of more than 10K businesses.

Comparable Startups

Cogna

Cogna is a UK-based enterprise software startup developing AI-powered ERP systems tailored for mid-market companies. Founded in 2023, the company’s platform uses artificial intelligence to automate and streamline core business processes such as finance, inventory, and operations. Its goal is to replace legacy ERP systems with a modern, intelligent alternative that reduces complexity and manual workflows. As of April 2025, Cogna had raised over $20 million in funding from investors such as Notion Capital, Hoxton Ventures, and Chalfen Ventures.

Nominal

Nominal is a financial operations platform designed to integrate and automate workflows across modern finance stacks. The product connects tools such as NetSuite, QuickBooks, Google Sheets, and Salesforce, allowing companies to unify their financial data, automate reporting, and streamline month-end close processes. It targets high-growth companies that outgrow basic accounting software but aren’t ready for full-scale ERP systems. Nominal was founded in 2023 and emerged from stealth in April 2025 with $9.2 million in seed funding led by Hyperwise Ventures and Bling Capital.

Rillet

Rillet is a modern ERP platform founded in 2023 that automates core accounting functions for high-growth companies. The system integrates with tools like CRMs, billing, accounts payable, and payroll to generate invoices, journal entries, revenue schedules, and forecasts with minimal manual input. Built on AI-native infrastructure, Rillet eliminates much of the manual data entry typically required in legacy ERP systems—automating 93% of journal entries to date. The platform is designed to address workforce shortages in accounting and streamline month-end close processes in real time. As of April 2025, Rillet had raised $13.5 million in seed funding from First Round Capital, Creandum, Susa Ventures, and Box Group, with participation from notable individuals, including the former Chief Accounting Officers of Facebook and Stripe.

Keel

Keel is a London-based startup founded in 2022 that offers a customizable platform for building internal operational software, targeting businesses that have outgrown spreadsheets and no-code tools but don’t want the complexity of traditional ERPs. The product enables technically minded operators to develop workflows for areas like inventory, shift scheduling, and payroll without relying on scarce engineering resources. Unlike legacy ERP systems from providers like Oracle or SAP, Keel emphasizes modular adoption, allowing teams to solve specific pain points while retaining existing tools. The platform features an API-first architecture, auto-generated admin interfaces, and is open source to support extensibility. As of April 2025, Keel had raised $6 million in seed funding led by Earlybird and LocalGlobe.

Business Model

When engaging with a prospective client, DOSS employs a simplified approach to document handling. Prospective clients are encouraged to send over all their relevant collateral such as PDFs, Excel files, or other documents, without worrying about organization. DOSS then ingests and restructure client data to tailor workflows to the client’s specific needs, whether it's aggregating orders or embedding the statement of work. This hands-on customization is part of DOSS's belief that some business models are too nuanced to put on rails, allowing DOSS to offer flexibility where other systems often fall short.

DOSS’s core focus during the implementation phase includes order management across ecommerce and wholesale systems, which is then connected to product catalogs and procurement processes. It prioritizes more foundational elements such as accounts payable and receivable systems, as opposed to inventory management and financial reporting which are by-products of upstream workflows. This focus helps businesses start with critical workflows that form the backbone of their operations and helps DOSS complete the majority of setup work internally, with roughly 60% of implementation executed within a single week.

Customers pay based on active modules and usage. Pricing is structured around annual contracts, avoiding bundled licensing and hidden charges typical in traditional ERP deployments.

DOSS’s asset-light business model, leveraging cloud technology, enables lower long-term structural costs, with a primary focus on software development, customer support, and compliance management. However, as DOSS expands its customer base, particularly among larger enterprises requiring compliance, ongoing investments in security, certifications, and customer acquisition will be necessary to sustain growth.

Traction

DOSS began with a concentrated focus on product development, spending the second half of 2022 through the first half of 2024 building and refining its ERP platform before initiating go-to-market efforts. This phase included developing core infrastructure for finance, operations, procurement, and workflow composability.

By the end of 2024, DOSS had reached $1 million ARR across 30 customers spanning six industry verticals, with deployments in the United States, Germany, Israel, and China.

To accelerate onboarding, DOSS introduced features designed to reduce time to deployment. These include a one-shot install available during demos, integrations with third-party platforms such as Shopify and QuickBooks, and AI-driven tools for document processing and configuration.

Valuation

In April 2025, DOSS announced an $18 million Series A led by Theory Ventures, with participation from Contrary, General Catalyst, Bloomberg Beta, and 20Sales. Prior to this DOSS had raised a seed round from Contrary in late 2022.

Key Opportunities

The Collapse of Legacy ERP Satisfaction

SAP, NetSuite, and Microsoft Dynamics have long dominated enterprise ERP through large-scale, on-premise systems and rigid architectures. For mid-market businesses, these platforms often underperform. High implementation costs, fixed workflows, and nearly year-long deployment timelines limit their usability and return on investment. In many cases, legacy software becomes an operational constraint rather than a source of leverage.

The broader issue is structural. Incumbents remain bound to their enterprise base. Product decisions prioritize high-margin, high-complexity customers, leaving mid-market buyers without viable options. Composability, AI support, and fast deployment are rising priorities, yet legacy systems are slow to adapt. DOSS enters this gap with a low-code, automation-first ERP platform built to move quickly and configure around customer workflows. Its design ethos: tools should adapt to the business, not the other way around represents a meaningful departure from ERP orthodoxy.

Worth & Co., a Pennsylvania-based manufacturer, spent multiple years attempting to implement Oracle’s E-Business Suite. Delays, failed customizations, and budget overruns followed. In 2019, the company sued Oracle for $4.5 million over what it described as a non-functioning system. Incidents like this are not isolated. They reflect a broader mismatch between incumbent architecture and the operational needs of growing businesses, a failure that DOSS is built to exploit.

AI-Native Design as Structural Advantage

Unlike incumbents built on legacy infrastructure, DOSS was developed with AI as a foundational layer. While traditional ERP vendors scramble to retrofit existing platforms with AI add-ons, DOSS operates on a unified architecture optimized for low-latency inference, dynamic decisioning, and adaptive learning. This removes the need for bolt-on integrations, brittle pipelines, or performance tradeoffs.

The “secret sauce” is not just that DOSS uses AI, it’s that every workflow, every data model, and every user interaction is structured to expect AI. The platform includes natural language inputs for faster onboarding, a centralized knowledge graph for semantic search and recommendation, and composable APIs that allow modular rollout of AI features as customers scale. This contrasts with SAP’s Joule and NetSuite’s Auto-Insights, where AI operates as an overlay rather than an embedded system.

AI spend across manufacturers and mid-market operators is rising. 82% of manufacturers plan to increase investment in 2025, driven by demand for predictive maintenance, demand forecasting, and supply chain automation. The shift to AI-native SaaS is no longer theoretical. Buyers now expect tools that support modular configuration, context-aware insights, and LLM-compatible interfaces.

The Shift Toward Modular, Composable Enterprise Stacks

The average company runs over 112 SaaS applications as of 2025, more than half of which support daily operations. In response, teams are moving away from monolithic platforms toward API-first tools such as Airtable, Zapier, and Retool that enable fast, modular workflow design. This reflects a growing demand for systems that adjust to changing operational needs without full reconfiguration.

DOSS ARP combines ERP-grade logic with configurable interfaces. It offers the usability of a no-code platform with the structure required to manage finance, operations, and procurement. Its architecture relies on modular components including subtables, validation-aware workflows, and schema-bound data models.

This model aligns with broader adoption patterns. Platforms such as Airtable and APPSeCONNECT are expanding as businesses seek systems that connect CRM, ERP, and eCommerce layers. DOSS supports this shift by offering phased rollout, targeted module activation, and system expansion without vendor lock-in.

Key Risks

Proving Value at Contract Scale

A key risk for DOSS at scale is whether it can consistently command enterprise-level contract values. The widening gap between selling activity and executed contracts in late 2024 raises a potential challenge: converting top-of-funnel interest into committed, high-value deals. Hitting the $5 million contracted ARR target for FY2025 depends not just on volume, but on whether buyers view the product as worth strategic-level investment.

This dynamic is common among ERP entrants. For example, Odoo, an open-source ERP, struggled to reposition itself for larger contracts despite broad functionality and an active open-source user base. A long tail of SMB customers shaped price expectations, making it difficult to justify a shift toward premium positioning. When Odoo raised prices on its Enterprise edition by a factor of five in 2017, it faced pushback from users who no longer saw alignment between value and cost. The case illustrates how buyer perception, not just product scope, can cap contract size.

AI Commoditization

A key risk for DOSS is whether it can maintain product advantage as the AI landscape evolves. Over the past year, incumbents such as Microsoft, SAP, and Sage have integrated AI into their core platforms. ServiceNow’s Now Assist doubled net new ACV in Q2 2024 as enterprise users adopted GenAI to automate workflows across IT, HR, and finance.

This raises expectations for systems like DOSS ARP. As foundation models become more capable, general-purpose agents can build workflows, update records, and execute queries without needing ERP-specific logic. To remain defensible, DOSS must deliver functionality that generic interfaces cannot replicate. That includes domain-aware validation, real-time schema-bound data modeling, and structured process enforcement.

Summary

DOSS is a modular, AI-native ERP platform built for mid-market businesses that have outgrown spreadsheets but remain poorly served by legacy systems such as SAP, Sage, and Microsoft Dynamics. The platform offers a low-code environment for managing order flows, inventory, procurement, and finance, with built-in analytics and over 30 integrations as of April 2025. DOSS targets mid-market companies, emphasizing faster deployment, lower implementation costs, and automation of core workflows. Looking forward, its product architecture faces pressure as general-purpose AI agents advance into workflow generation and orchestration.

*Contrary is an investor in DOSS through one or more affiliates.