Thesis

CFOs are often tasked with responsibilities like financial planning, dictating capital allocation, and managing financial risk. However, much of their time is also spent with administrative tasks associated with compliance issues, taxes, financial reporting, and accounts payable. Of these tasks, accounts payable (AP) is often cited as one of the most time-consuming and tedious.

AP is an accounting liability that is created when a company has received a good or service from a supplier and records an expense but hasn’t yet paid out its supplier in cash. To decrease a company’s AP balance, finance teams upload and track invoices, approve each invoice, and pay out suppliers via their preferred payment methods. However, this process can naturally become complicated for companies when manually dealing with contracts for hundreds of global suppliers and thousands of stock-keeping units.

As a result, one survey found that, in 2022, 73% of CFOs viewed finance digitalization and automation as a high priority and 44% expected their digitalization budgets to grow in the future. Despite this, only 18.5% of companies in 2022 had fully automated AP. Some metrics CFOs use to assess the efficiency of their workflows are cost per invoice and AP cycle time. Invoice processing without automation typically costs around $12 with manual entry, which drops to $5 with automation. AP cycle time, meanwhile, differs greatly across industries and depending on the size of a company, but automating workflows can help save businesses up to 70-80% of their time.

Tipalti is a financial automation platform that streamlines accounts payable and payment processes for businesses, which it says can reduce manual workloads by up to 80%. It supports global payments, tax compliance, invoice processing, and supplier management and integrates with various enterprise resource planning (ERP) systems. Tipalti’s mission, according to a 2020 interview with its CEO, is “to liberate finance teams by automating supplier payment operations so they can focus on making a strategic impact and scale their business rather than the minutiae of accounts payables.”

Founding Story

Chen Amit (CEO) and Oren Zeev (Chairman) founded Tipalti in 2010. Amit came from a computer engineering background and began his career as a software engineer at ECI telecom in 1998. At ECI Telecom, Amit founded its ADSL business unit and led it from inception to $100 million in annual sales before striking out on his own in 2000 to found Verix, a business intelligence software platform for life sciences that launched in 2003. Next, Amit took on a new role as CEO of Atrica, a carrier ethernet company, in 2007. Atrica was acquired by Nokia-Siemens in 2007 for an undisclosed amount.

After his exit from Atrica, Amit had conversations with former classmates from his MBA program at INSEAD business school, which he had graduated from back in 1994. Among them was the eventual co-founder of Tipalti Oren Zeev. Zeev, who was the chairman of an ad-tech company at the time, had received a complaint from its founders about the high cost in time and effort of sending payments to ad publishers.

As a result, he reached out to Amit, and they discussed the paint point and the lack of solutions available. As Amit put it:

“Since it appeared to be such an obvious need, I had trouble believing that there was not already a solution on the market… Having done my own thorough search, it turned out that there indeed was no solution.”

He experimented with possible solutions as a side project, ultimately founding Tipalti with Zeev in 2010. Tipalti means “we handled it” in Hebrew, a nod to the company’s mission of handling the traditional AP pain points of onboarding suppliers, capturing tax forms, payment validation, and more manual workflows.

Amit has cited his software engineering background and the fact that he was a founder coming from outside the payments space as being critical to overcoming the inertia in tackling finance automation. As he put it in a July 2023 podcast interview:

“In a way, had I come from the industry, knowing today everything that I know about how hard it is, I may not have ever started Tiplati.”

Zeev, an INSEAD graduate in the same class as Amit, had already established his career as a technology investor. He started at Apax Partners in 1995 and was a founding team member of Apax Israel. He eventually became a general partner at the firm. Zeev left Apax in 2007 and founded Zeev Ventures, an early-stage venture firm as the fund’s solo GP. At Zeev Ventures, he led Tipalti’s seed round, a $30 million Series C in 2018, and a $76 million Series D in 2019. Zeev also took on a role as co-founder of the company and serves as Chairman of the board of directors as of June 2024.

Product

Accounts Payable Automation

Tipalti’s flagship product is its AP automation software which enables companies to manage their supplier invoices and streamline approval and payment processes. For companies without finance automation software solutions, invoice entry is largely manual. Entire teams are dedicated to manually onboarding new suppliers, inputting hundreds of invoices monthly, approving each invoice, and finally paying out suppliers.

The difficulty in AP automation occurs when businesses are working with many different vendors or if there are various charges and invoices of different natures from an individual vendor. As such, Tipalti’s product begins by automating vendor onboarding by reaching out to vendors on clients’ behalf to aggregate data points such as W-9 tax information, preferred payment methods, and contracts. By integrating with users’ ERP systems, Tipalti can lay out an enterprise’s supplier map.

When it comes time to actually process such payments, Tipalti offers multi-currency operations and optical character recognition (OCR) capabilities that enable it to more accurately process data. Negotiating bank fees and licensing requirements for cross-border money transmission is a particular pain point for global companies, and Tipalti enables self-execution of transfers directly within Tipalti’s platform to simplify global payments.

OCR models enable Tipalti’s platform to scan and read uploaded invoices for relevant information and subsequently extract data without the need for human intervention and manual data entry. With this data, businesses get insights into their payment funnel and can architect approval workflows to automate the payment process.

Once invoice data has been recorded and analyzed, Tipalti allows for 2 and 3-way purchase order matching, a process that involves reconciling invoices with purchase orders and delivery receipts to ensure that goods or services have been received and that confirms a payable amount. Finally, as of June 2024, Tipalti has over 26K payment validation rules that give customers the flexibility to automatically pay approved invoices entirely hands-off.

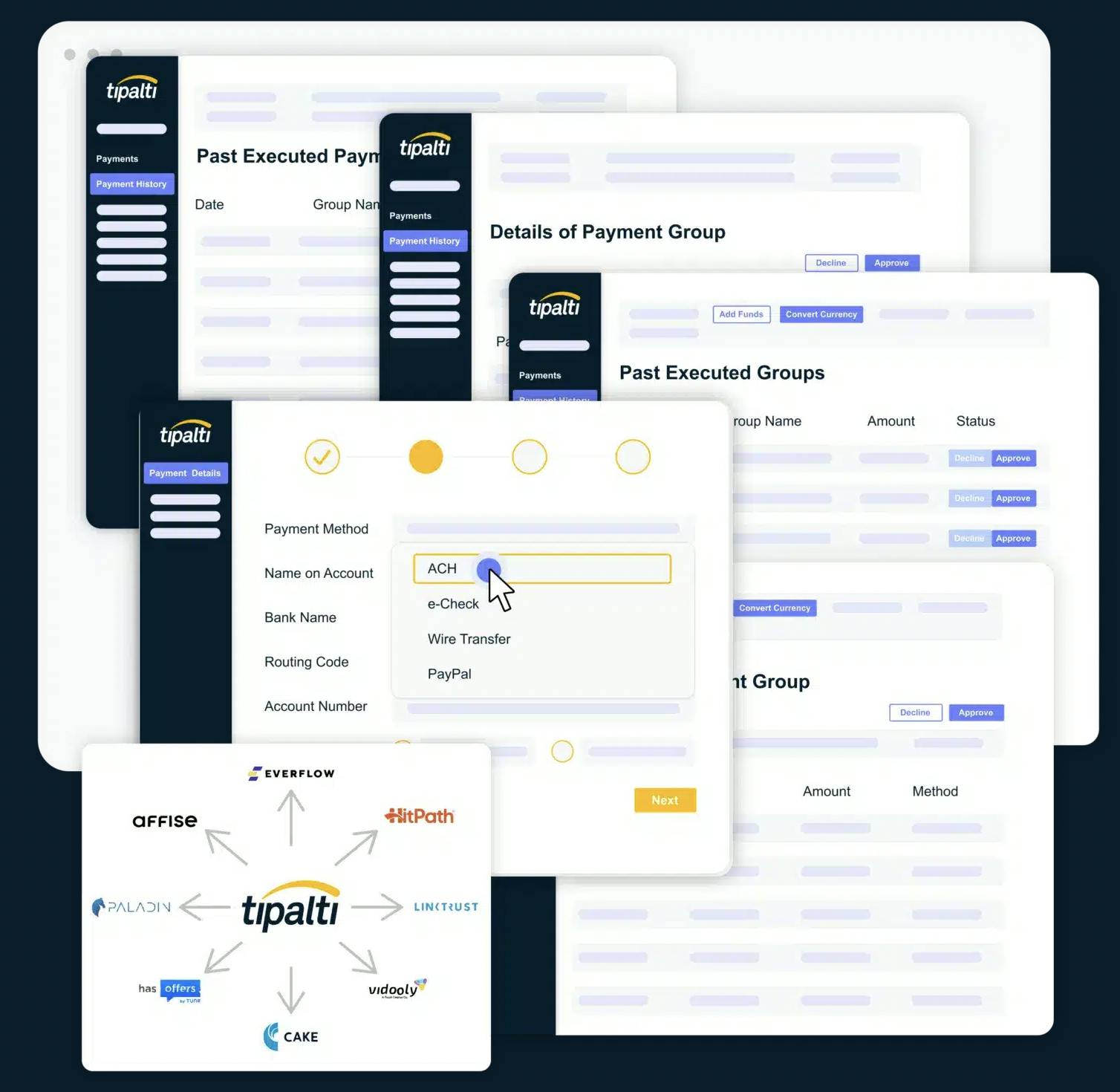

Mass Payments

Source: Tipalti

Tipalti’s mass payments offering allows customers to manage large-scale payouts to freelancers, affiliates, publishers, and other contract workers. This product caters to media publications and content creation or marketing teams that regularly work with third-party partners. It enables cross-border payments to 196 countries in 120 currencies through more than 50 payment methods as of June 2024

Tipalti handles tax compliance workflows as well, collecting and validating tax IDs from vendors for e-filing. This is meant to address a large compliance pain point that arises for customers who may be working with hundreds of different publishers located in various tax jurisdictions. Furthermore, Tipalti’s APIs enable companies to easily integrate their payment infrastructure into existing ERPs and marketing analytics workflows.

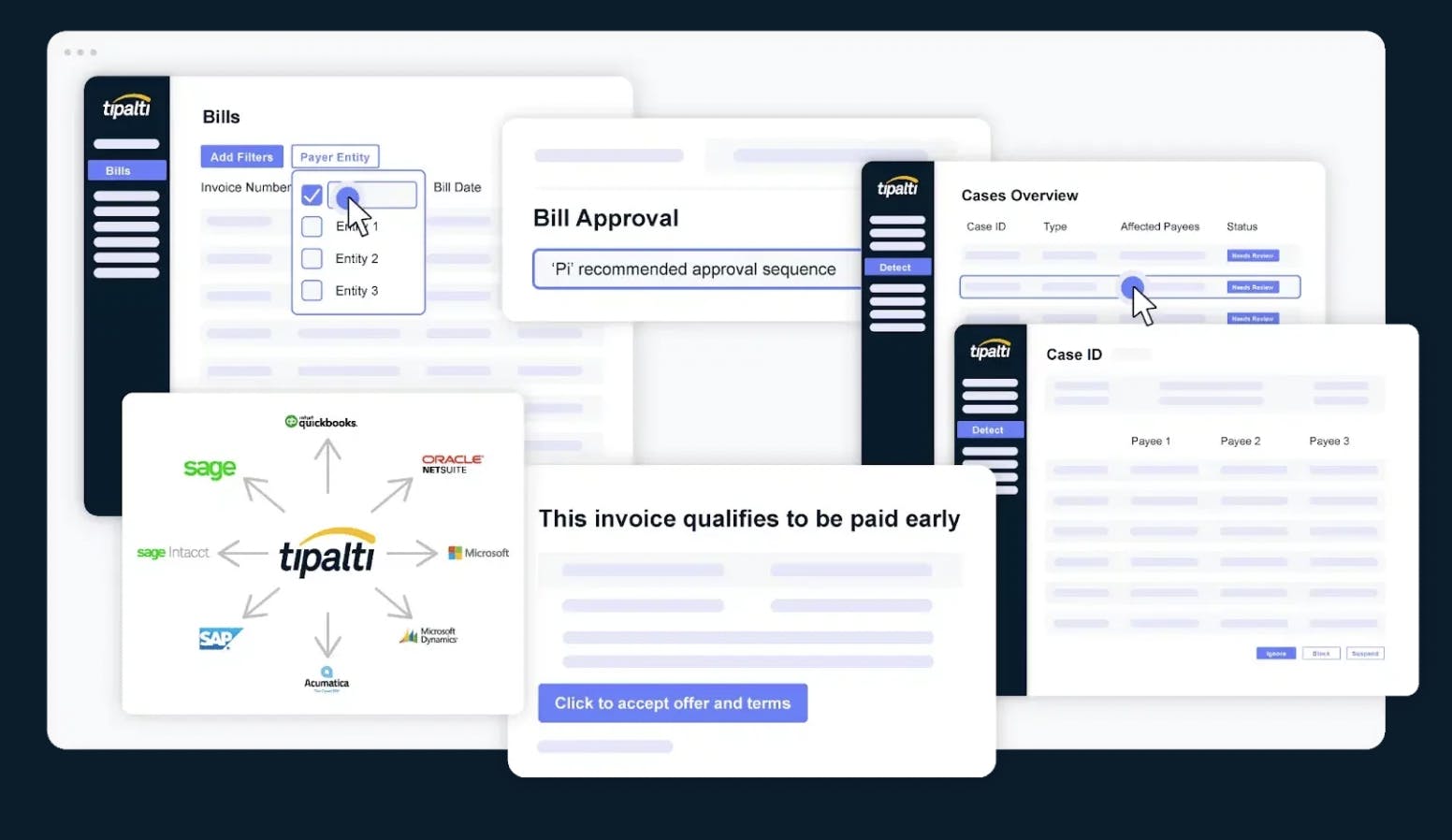

Procurement

Source: Tipalti

Tipalti’s procurement suite is complementary to its core products and provides custom intake forms for the easy submission of purchase requests. The suite also automates purchase order approval & management with rule-based decision tree routing. Furthermore, Tipalti Procurement integrates with ERPs and other products to enhance visibility with a spend analytics dashboard.

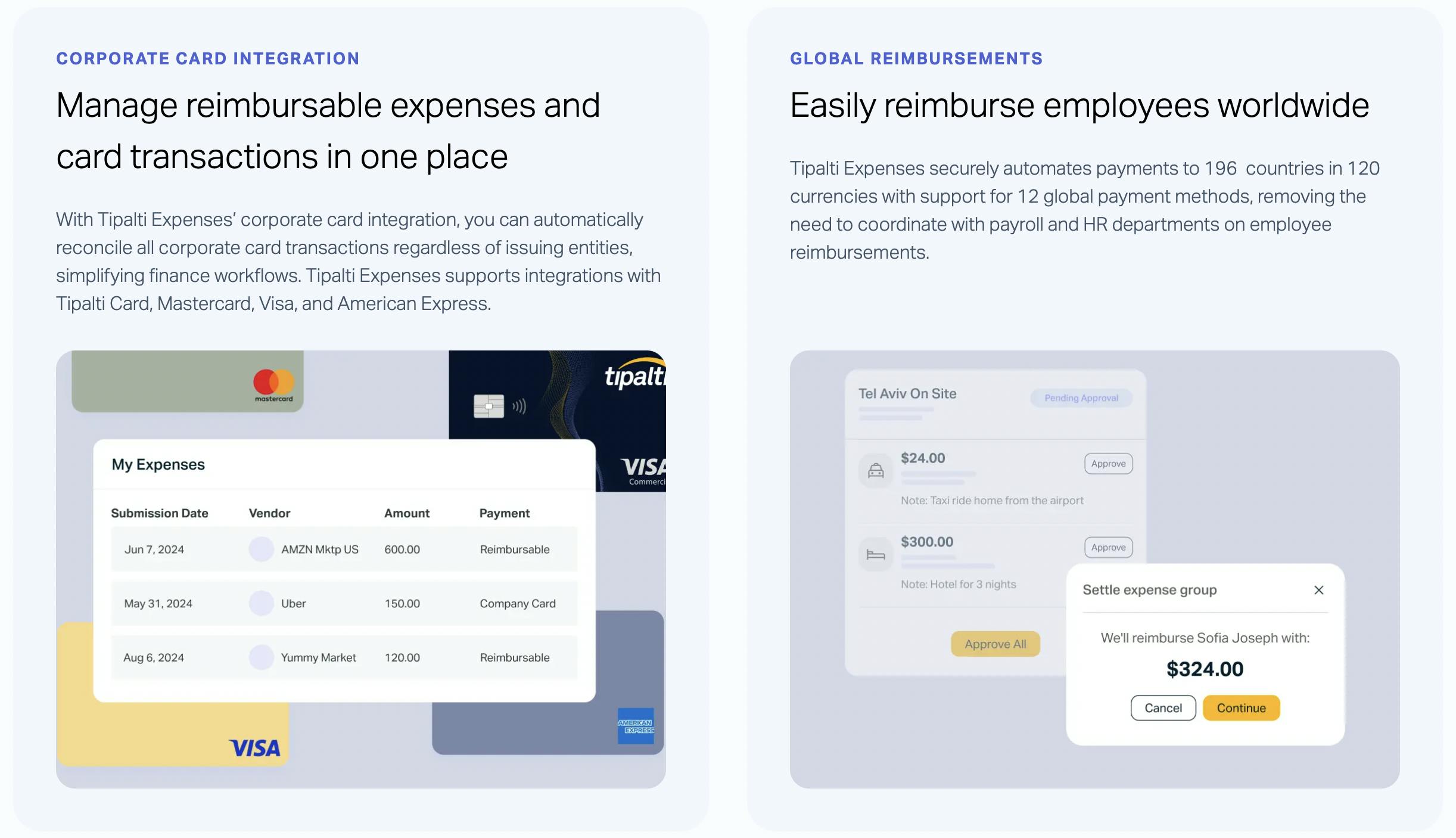

Expense Management

Source: Tipalti

Tipalti offers a corporate card called the Tipalti Card, but also integrates with other payment service providers such as Mastercard, Visa, and American Express to manage corporate spend and reimburse employees. The Tipalti Card comes with the ability to implement spend limits and carefully manage budgets while integrating with ERPs and accounting systems such as Sage, SAP, Oracle, and Quickbooks.

Market

Customer

Tipalti’s target customers are mid-market companies (50-1K employees) using ERPs. In 2023, reportedly 29% of mid-market companies experienced AP complications, a higher share than the 24% for large firms and 22% for small companies. End users include finance, procurement, and accounting teams. According to a July 2023 podcast interview with Amit, Tiplati’s sales team was staying disciplined about sticking to this customer profile and did not prospect beyond it.

As of June 2024, Tipalti had over 4K customers globally. Notable customers included Roblox, Typeform, Therabody, Noom, National Geographic, and Spotify.

Market Size

The global financial management software market was valued at $17.9 billion in 2023 and is expected to grow at a 10.8% CAGR to reach $49.9 billion in 2033. Financial software can be broken down into three categories: core financials, financial planning and analysis, and financial close. Tipalti’s products offer functionality across all of these, but its core AP automation offering falls under core financials. Within this, AP and invoice automation alone was worth roughly $1.4 billion in 2023 with projected growth of 18% through 2025. Broader market tailwinds such as the growth of cross-border payment volume, which is projected to reach $250 trillion by 2027 (up from $150 trillion in 2017), and an increase of overall IT spend budgets which are projected to grow 6.8% YoY in 2024, may also contribute to growth in Tipalti’s addressable market.

Competition

Tipalti operates in a crowded space, with both pure-play competitors in the form of AP automation point solutions as well as enterprise resource planning (ERP) platforms it integrates with that also offer basic workflow automation functionality.

AvidXchange: AvidXchange is a Charlotte-based AP automation software founded in 2000 that offers verticalized payments software. AvidXchange’s products provide specific workflows for industries such as medical networks which have tight regulations surrounding payment documentation and data privacy. AvidXchange went public in October 2021 and in May 2024, the company was trading at a market cap of roughly $2.3 billion.

Bill.com: Bill.com is a San Jose-based finance automation provider founded in 2006 that offers AP and accounts receivable automation along with business spend management products. As a direct competitor to Tipalti, Bill.com targets the SMB space by offering a lower-end product with a starting price of less than half that of Tipalti and added integrations with accounts receivable automation. Bill.com went public in December 2019. In May 2024, the company was trading at a market cap of around $5.6 billion.

MineralTree: MineralTree is a Cambridge-based AP automation software founded in 2010 that offers AP automation and payment optimization for mid-market and enterprise businesses. MineralTree’s niche within the AP space places an emphasis on payment optimization. MineralTree has raised $119.7 million in total funding as of June 2024, including a $50 million Series D at an undisclosed valuation in September 2020 led by Great Hill Partners, Eight Road Ventures, and .406 Ventures.

QuickBooks: QuickBooks by Intuit is an accounting platform for small businesses founded in 1983. Its products streamline the bookkeeping, invoicing, payroll, financial reporting, and tax preparation functions. Tipalti integrates with QuickBooks for small businesses to reconcile payables and manage suppliers in real time.

Concur: Concur by SAP is a travel, expense, and invoice management software founded in 1993. As a leader in the space, Concur automates the processes for corporations to manage their business expenses. Its invoice management suite primarily provides analytics and visibility into an organization’s AP with 3-way matching and vendor payment. Concur was acquired by SAP for $8.3 billion in September 2014.

Sage: Sage is a Newcastle-based business management software founded in 1981. Sage’s flagship product is its Intactt ERP platform for mid-market businesses, providing cloud-native accounting, payroll, and HR. The Sage 50 accounting platform offers businesses visibility into cash flow, expenses, and payments by automating the invoice reconciliation workstream. Sage went public on the London Stock Exchange in 1989. In May 2024, Sage was trading at a market cap of around $10.7 billion British Pounds.

Coupa: Coupa is a San Mateo-based business spend management software platform founded in 2006. Coupa’s core products are its sourcing and procurement solutions for supply chain management. However, it competes with Tipalti on the AP automation front as well by streamlining the sourcing, procurement, and payment workflows all on the same platform. Coupa went public in October 2016 before being taken private by private equity firm Thoma Bravo for $8 billion in December 2022.

Business Model

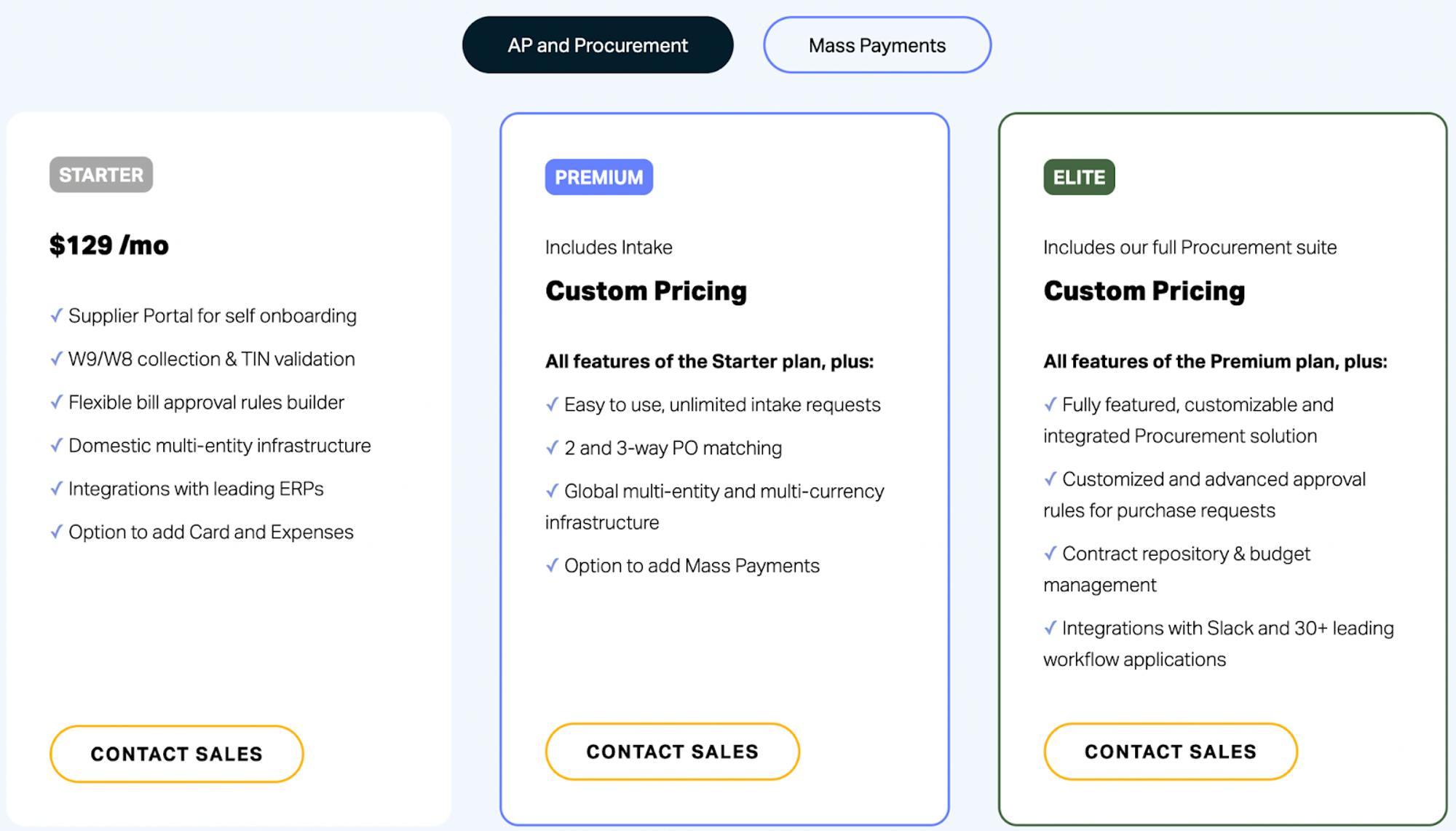

AP and Procurement

Source: Tipalti

Tipalti employs a software-as-a-service subscription pricing model for its core AP & procurement product offerings, starting at $129 per month for its starter product with basic functionality that excludes invoice reconciliation, mass payments, and automated supplier onboarding. Its Premium and Elite plans are for larger organizations with bespoke pricing likely dependent on company size.

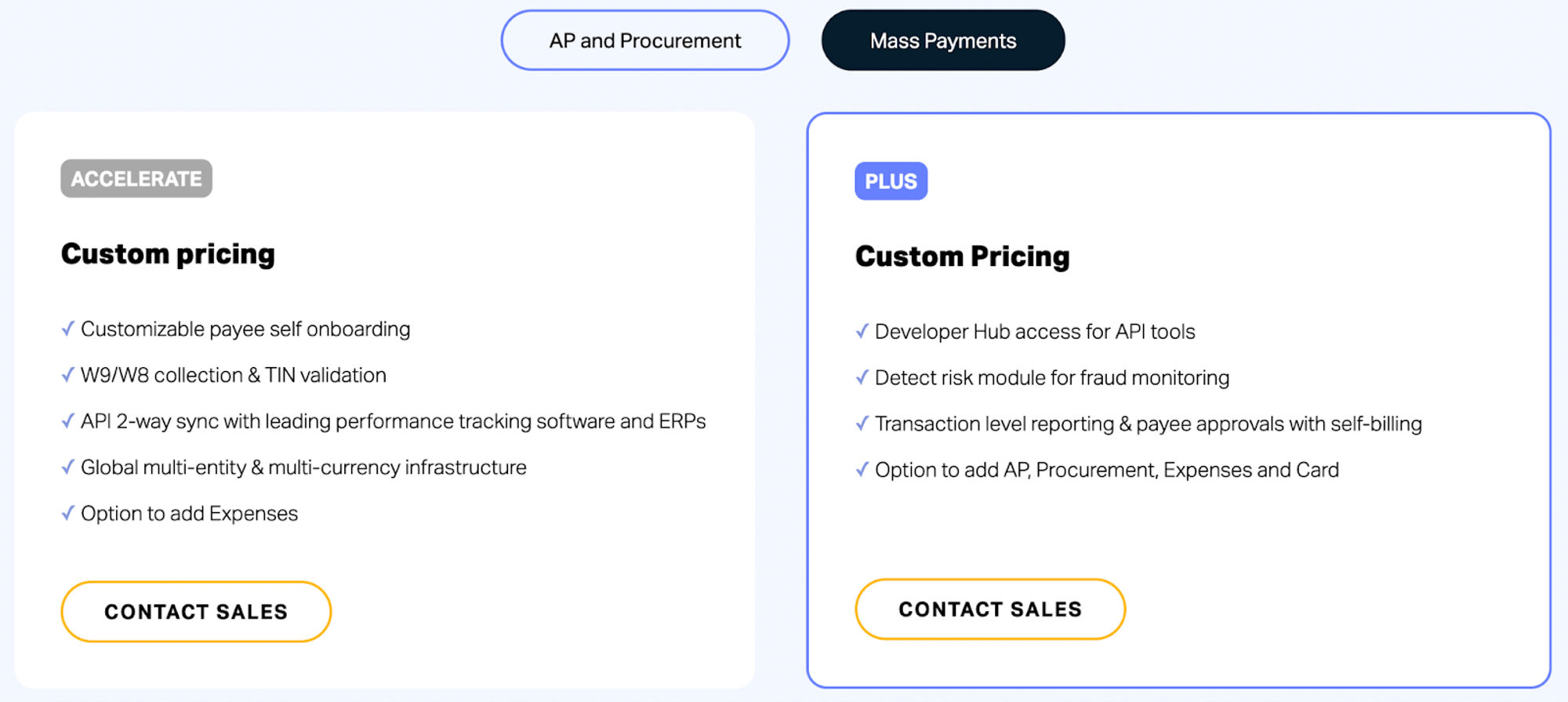

Mass Payments

Source: Tipalti

As of May 2024, Tipalti does not publicly disclose its pricing structure for mass payments product. The pricing for this may be based on either a SaaS pricing model that charges a monthly fee for basic functionality, or volume-based pricing model that charges a take rate as a percentage of payment volume processed through its platform.

Traction

In 2018, Tipaltii saw $5 billion in annual transactions and reached 3 million in supplier payees, while also being named to the Deloitte Fast 500 and Inc 5000 for the first time. In 2019, it had more than $8 billion in annual transactions. The following year, annual transactions jumped to $18 billion in annual transactions, which grew to $36 billion in 2021. In 2021, Tipalti also acquired cloud procurement provider Approve.com for $40 million to round out its product offering in its procurement suite.

By 2023, Tipalti reached more than $60 billion in annual payment volume run rate and expanded its customer base by 40% YoY to over 4K global customers. Tipalti says it did this while maintaining 99% customer retention and 1% dollar churn, indicating the stickiness of its product even while the company saw growth.

Tipalti is also targeting European expansion, securing an Electronic Money Institution license in September 2023 to provide payments on behalf of customers in the European market. Tipalti also established offices in London and the Netherlands. It had over 100 customers customers and over 100 employees in Europe as of September 2023, with the goal of bringing “at least 20% of the company’s new business” from Europe by the end of 2024.

Valuation

As of June 2024, Tipalti has raised a total of $715 million in funding. Tipalti raised a $270 million Series F led by G Squared at an $8.3 billion post-money valuation in December 2021. Past investors include Zeev Ventures, JP Morgan Chase, and Hercules Capital. Its estimated valuation in secondary markets was $3.1 billion as of January 2024.

Key Opportunities

Upstream Expansion

Because of the comprehensive nature of Tipalti’s product and its price premium over downstream competitors such as Bill.com, there is a natural market opportunity to move upstream and target enterprises.

That being said, Tipalti has achieved product-market fit with mid-market business target customers, and this may be difficult to replicate when selling to enterprises for several reasons. For one, enterprises tend to be less receptive to high payment take-rates and software vendors lose leverage — an example of this is in the restaurant POS space, where Square targeting SMBs can charge the highest payment take-rates of around 60-90 basis points depending on transaction types, while Toast which is slightly upstream can only charge 40-50 basis points.

International Functionality

Tipalti’s products were created with global customers in mind, supporting payments in 196 countries and 120 currencies. Furthermore, Tipalti is licensed in the EU, UK, and US for security and payments as of 2024. Tipalti’s workflows support various payment types such as international ACH and wire transfers and also provide foreign exchange rate hedging and tax form compliance that eases the friction of paying global suppliers.

These functionalities allow it to differentiate itself from competitor products as there is a growing need for solutions to handle cross-border payments and compliance. Manual processes take up more than 34% of European finance teams’ time and cross-border payment volume is expected to increase by 5% annually until 2027. In September 2023, Tipalti announced that it was expanding into new European markets such as Germany and the Nordics, and hopes that European customers will bring in at least 20% of new business in 2024.

Key Risks

Competition & Commoditization

Tipalti’s largest risk is that of competition both upstream and downstream from legacy ERPs seeking to implement finance automation workflows in-house and from competitors such as AvidXchange and Bill.com that specialize in the payables space. The finance automation space is highly saturated and there is a significant risk of products becoming commoditized as enterprise finance teams seek to cut costs. For instance, Bill.com is a cheaper product with basic functionality (only providing 2-way PO matching versus 3-way for Tipalti) but enterprises looking to cut costs may view it as an adequate product for their needs.

AI Encroachment

One of Tipalti’s current differentiators is the strength of its OCR model which provides high throughput accuracy with invoice recognition. However, OCR technology isn’t perfect, and even the best OCR can only process invoices with 85-90% accuracy. Furthermore, OCR suffers from the basic flaw that it is only effective at working with data sets and fields in newer invoicing types. The rise of LLMs and their ability to efficiently process unstructured data may allow competitors or large in-house enterprises to partner and manage their own payables without outsourcing their finance tech stack.

Data Security

One possible concern for customers working with third-party finance automation providers is the safety of their proprietary data. By integrating with ERPs and having access to sales, supplier, and invoicing data, such software providers are vulnerable targets of cyberattacks. In December 2023, Tipalti became aware that they were undergoing a cyber attack by the ALPHV/BlackCat ransomware group. ALPHV/BlackCat claimed that they had access to Tipalti’s systems since September 2023 and had stolen 265 gigabytes of customer data. Key customers such as Roblox also got involved in investigating the incident. This and any further incidents could harm Tipalti’s reputation and therefore its ability to grow and retain customers.

Summary

Tipalti is a finance automation product founded in 2010 for finance teams of mid-market companies with anywhere from 50 to 1K employees. Its core product is an accounts payable automation solution that automates traditionally manual workflows like supplier onboarding, invoice recognition and approval, and global payments. Tipalti also provides supplementary expense management and procurement suites that give organizations greater control over AP-adjacent business functions. Tipalti operates within a highly competitive market environment, and its key areas of opportunity lie in expanding its customer base while retaining its product differentiation.