Thesis

The proliferation of drones is rapidly transforming modern warfare. Global military drone spending is expected to reach $56.7 billion in 2033, up from $21.2 billion in 2024. Nations worldwide are accelerating the development of their drone capabilities, leading to the deployment of drone swarms. For example, in October 2020, a state-owned Chinese company showcased a "barrage swarm" system capable of launching 48 attack drones simultaneously to overwhelm targets. Meanwhile, the Israel Defense Forces made history by employing a swarm of multi-copter drones to locate, identify, and strike militants during the "Guardian of the Walls" campaign in July 2021. Non-state actors also utilize drone technology. US Navy ships intercepted multiple drones launched from areas in Yemen controlled by Houthi rebels, who received support from Iran in December 2023. In the 2024 conflict between Russia and Ukraine, both countries deployed vast fleets of drones, with projections suggesting that Ukraine aims to produce one million drones in 2024, while Russia may produce up to 1.4 million. This surge underscores the need for effective countermeasures against drone swarms.

Counter-unmanned aerial systems (UAS) solutions are economically unsustainable due to a cost disparity. The US often relies on expensive missiles to neutralize relatively cheap drones, leading to inefficient resource allocation. For instance, the Navy's long-range air-defense missile, the SM-6 Standard missile, costs over $3 million per unit and is designed to intercept high-value targets like jet fighters or cruise missiles. Using such missiles against drones that cost a few thousand dollars is impractical. Even a medium-range option like the evolved sea sparrow missile comes with a price tag of $1.8 million per shot. Ground-based systems face similar issues. For example, the stinger shoulder-launched anti-aircraft missile, an American man-portable air-defense system, costs around $480K per use. Even anti-aircraft cannon fire can become cost-prohibitive when multiple rounds are required to down a single drone. This asymmetrical cost dynamic highlights the need for more economical and scalable counter-UAS solutions.

Existing countermeasures, including jamming technologies, are becoming less effective against modern drones. Traditional radio frequency jammers disrupt the communication link between a drone and its operator, causing the drone to lose functionality. However, advancements in AI and imaging navigation have enabled drones to operate autonomously without relying on external signals. Preprogrammed missions allow drones to navigate using onboard cameras and AI, rendering jamming techniques obsolete.

Technological advancements have made directed energy systems, particularly high-power microwave (HPM) systems, a practical and effective solution. Innovations in compound semiconductors, specifically gallium nitride, have increased the power and efficiency of these systems. Following a trend akin to Moore's Law, the power output of semiconductors has doubled approximately every 12 months, making it feasible to develop portable, solid-state, long-pulse HPM weapons.

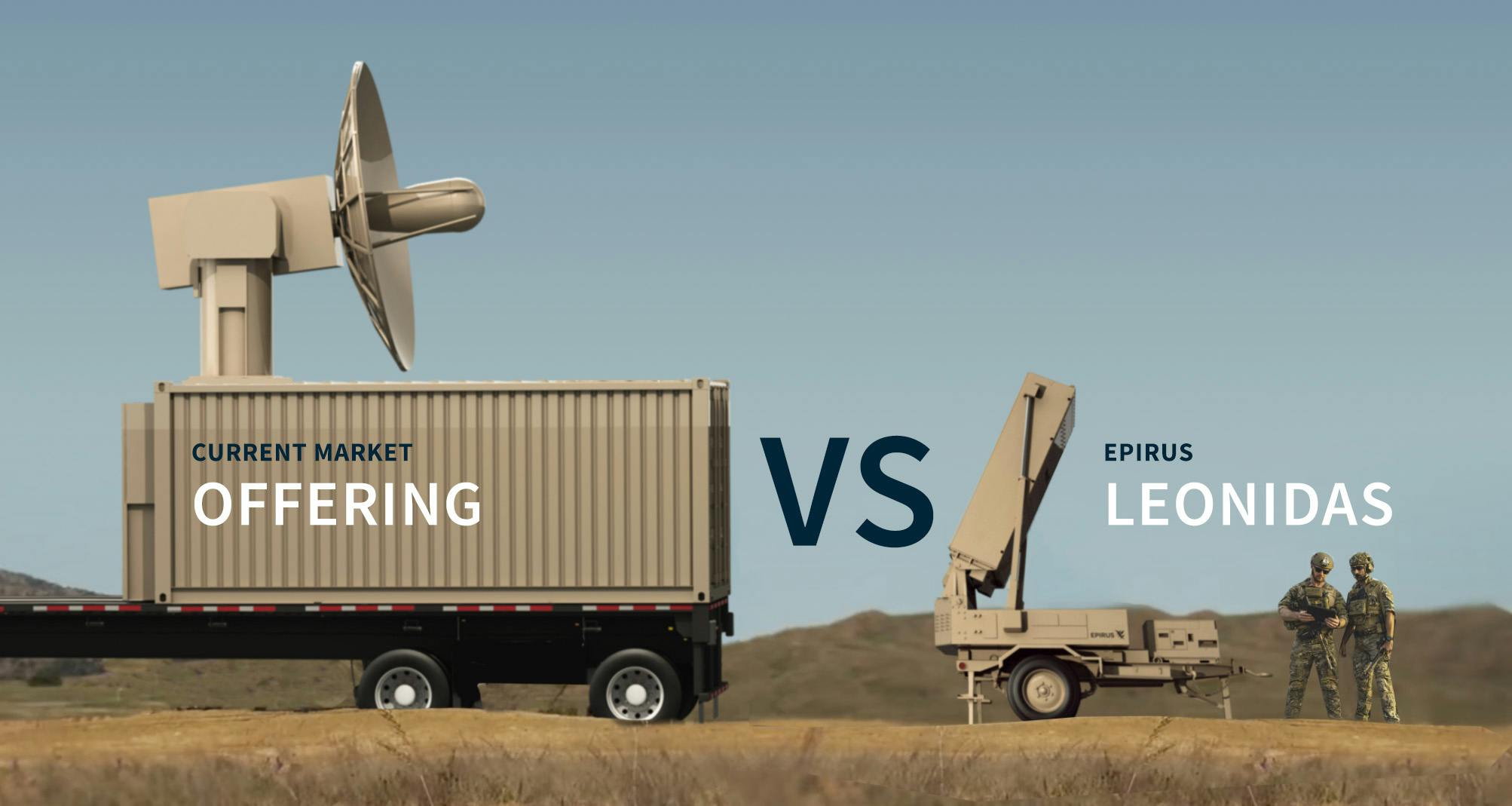

Epirus was founded to leverage these technological breakthroughs, providing innovative and cost-effective counter-UAS solutions. By harnessing advancements in semiconductor technology and HPM systems, Epirus aims to address the escalating threat of drone warfare and the corresponding need for cost-effective defenses. Unlike traditional HPM technology, which was bulky and required extensive human operation, modern systems like Epirus's Leonidas are more versatile and can neutralize multiple drones simultaneously without causing collateral damage. These advancements address the limitations of previous technologies and offer a scalable means to counter the growing threat of drone swarms. The name "Epirus" was inspired by the mythical Bow of Epirus, a weapon with an infinite supply of arrows.

Founding Story

In July 2018, Nathan Mintz, Dr. Bo Marr, Max Mednik, Joe Lonsdale, Grant Verstandig, and John Tenet co-founded Epirus to create counter-drone technology with HPM systems. The founders brought expertise from backgrounds in defense, engineering, and software to tackle the escalating threat of UAS head-on.

After earning a degree in computer science from Stanford University, Joe Lonsdale began his career as an early executive at Clarium Capital, a global macro hedge fund. In 2004, he co-founded Palantir, a data analytics firm specializing in defense and intelligence applications. Following this, Lonsdale founded a new company in 2009 called Addepar. Addepar is a wealth management platform designed to provide transparency and analytics for complex investment portfolios. Next, in 2012, he co-founded OpenGov, which offers cloud-based software solutions for government budgeting and financial management. Finally, in 2015, Lonsdale founded 8VC to invest in tech companies.

In 2017, Lonsdale recruited John Tenet to help build a defense and national security vertical at 8VC. This initiative also sparked a call from Lonsdale to Mintz, who knew each other from their college days at Stanford, for advice. Prior to this, Mintz had served as an advisor to OpenGov. After receiving bachelor's and master's degrees in materials science engineering from Stanford, Mintz spent nearly nine years at Raytheon, where he secured six patents and focused on space and airborne systems. Mintz then joined Boeing, where he initially led various space and airborne projects before moving into a business capture role.

As recounted by Mintz, Lonsdale asked during the call, "What have you got for me? You're the one that I know that's deepest in this space." Mintz got to work brainstorming potential opportunities. A few days later, reports of a drone sighting near Gatwick Airport in England caused hundreds of flights to be delayed due to fears of a terrorist attack. This piqued Mintz's interest and he began researching counter-UAS solutions that were on the market.

While researching, he stumbled upon a report from the Center For the Study of the Drone at Bard College, which stated that there were 235 anti-UAS counter-UAS systems on the market, most of which were basic jammers that could be built in a garage. The one solution already on the market that caught Mintz's attention was a family of EMP systems being built by the Department of Defense (DoD) that used HPM to incapacitate drones. However, these systems were $25 million each and large in size, making them impractical in many situations.

Having found an interesting problem to tackle, Mintz reached out to a friend and fellow expert on electronic warfare, Dr. Bo Marr. After completing his undergraduate studies at Duke, Marr received a PhD from Georgia Institute of Technology in electrical and computer engineering, with an emphasis in circuits and neuromorphic computing. During this time, he also contributed to the DARPA Synapse program by modeling silicon chips after neural architectures to achieve greater efficiency than traditional GPUs. After his PhD, Marr went to IBM to co-engineer the chips behind the Watson initiative, developing processors for the IBM Watson supercomputer. He then spent nearly a decade at Raytheon as Director of RF Systems, where he worked on the Navy’s Next Generation Jammer.

While brainstorming with Mintz, Marr floated the idea of using gallium nitride chips, which were rising in power density, to design a system to incapacitate drones that used a solid-state phased array. To try the idea, they went to Walmart and bought a few drones, a voltmeter, and a voltage source. They began by placing voltages across various parts of the drone and noted when it turned off. Based on that, they determined the amount of voltage swing needed at a particular distance and how much effective radiative power that translated to.

Recognizing the need for sophisticated software to make their idea work, Mintz recruited Max Mednik to join as co-founder and COO. Mednik had previously co-founded Ridacto, a legal tech startup, and worked at Google, developing ML applications and Chrome OS tools. He brought the expertise necessary to blend advanced software with the microwave technology that Mintz and Marr were developing.

After spending several weeks developing the idea through the 8VC Build Program, the team pitched the idea to Lonsdale, who responded that the idea sounded “like classic disruption." With backing from 8VC and mentorship from industry leaders like Northrop Grumman CEO Kathy Warden, the company was off to the races after that.

As Epirus has evolved, so has its leadership. In 2020, Mintz stepped down as CEO, making way for Leigh Madden, a General Manager of National Security at Microsoft and former Navy SEAL. Madden departed in 2023 to return to Microsoft as VP of National Security. Madden was succeeded in his role as CEO by then-CFO of Northrop Grumman, Kenneth Bedingfield. Bedingfield, in turn, departed Epirus in December 2023 to take a senior VP and CFO position at L3Harris Technologies.

Andy Lowery, Epirus’ CEO since December 2023, had over 30 years of experience in military service, corporate leadership, and entrepreneurship. A retired lieutenant commander in the US Navy, he holds a bachelor's degree in electrical and computer engineering from the University of Illinois at Urbana-Champaign. Lowery formerly co-founded RealWear, Inc., specializing in industrial head-mounted display systems, and DAQRI, which focused on mixed reality wearables for enterprise use. From 2008 to 2014, he held key roles at Raytheon, including business area chief engineer for electronic warfare systems, and from 2004 to 2008, he led high-power amplifier products at MACOM.

Product

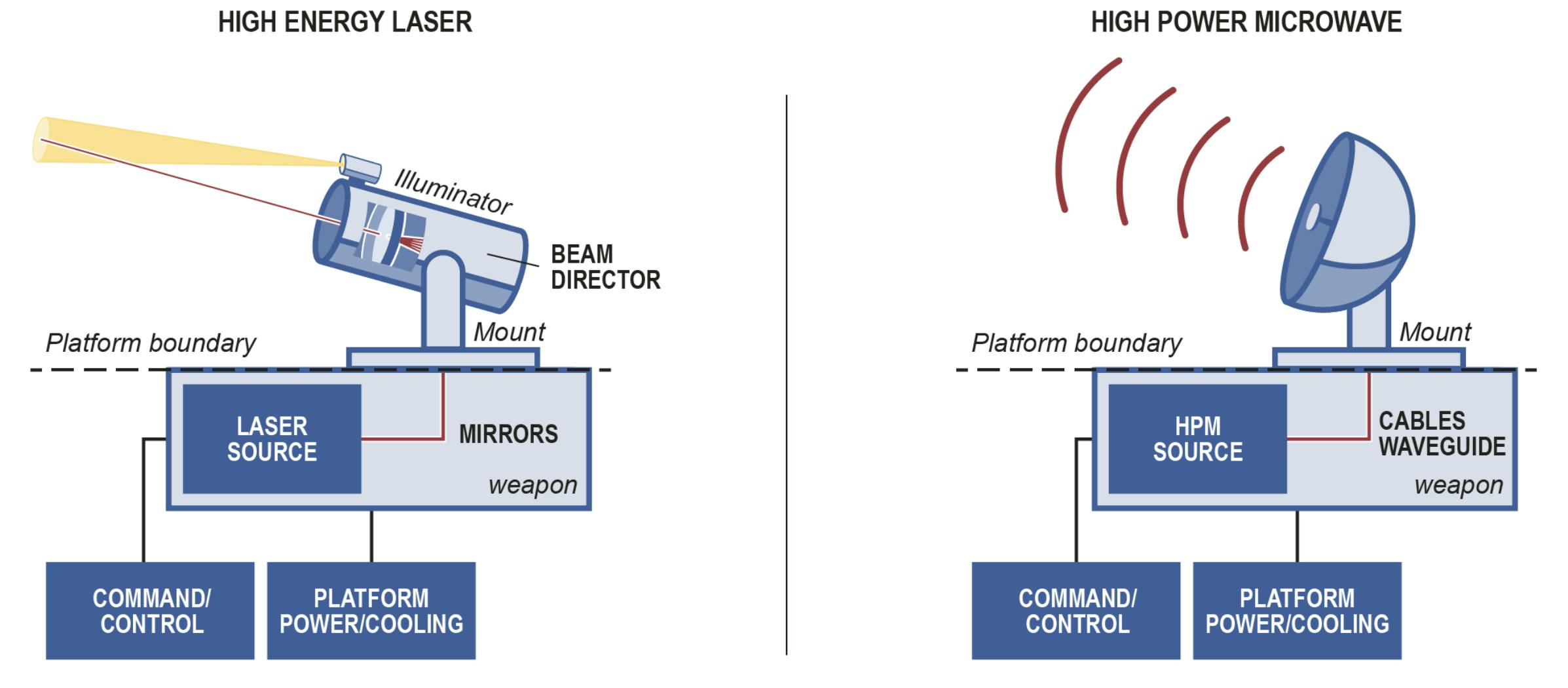

The History of High-Power Microwave Technology

HPM technology originated in the early 1960s, with both the US and the Soviet Union pursuing capabilities to gain electromagnetic spectrum superiority. Initially envisioned as a transformative weapon that could instantly disable enemy electronics, HPM promised a potentially decisive battlefield advantage to whoever could perfect it. However, despite significant investment, particularly by the US Air Force from 1960 to 1990, the necessary advancements in HPM needed to make the technology battlefield operational failed to materialize. Early systems were plagued by technical hurdles, primarily excessive size and heat generation. Engineers also struggled to produce the necessary high-power output to neutralize electronic threats without causing the systems to overheat.

These thermal management issues persisted for decades, leading to widespread skepticism about the viability of HPM weapons. Critics highlighted repeated failures in government projects aimed at developing practical HPM solutions. One notable example was the active denial system (ADS), developed for crowd control and area denial. ADS was a non-lethal, directed-energy weapon that emitted focused millimeter waves to induce an intense burning sensation on the skin. Intended for deployment in Iraq in 2003, the system was ultimately rejected due to its large pulse generator requiring a separate vehicle, making it an easy target. Another obstacle was its need for 16 hours of cooling before operation, which severely limited its tactical usefulness. Similarly, the Air Force Research Laboratory's MAXPOWER system was designed to remotely detonate roadside bombs by using HPM technology to induce electrical currents in IEDs. However, it proved too large and unwieldy for effective deployment in agile combat environments like Afghanistan. By 2011, funding for MAXPOWER had ceased due to its impracticality.

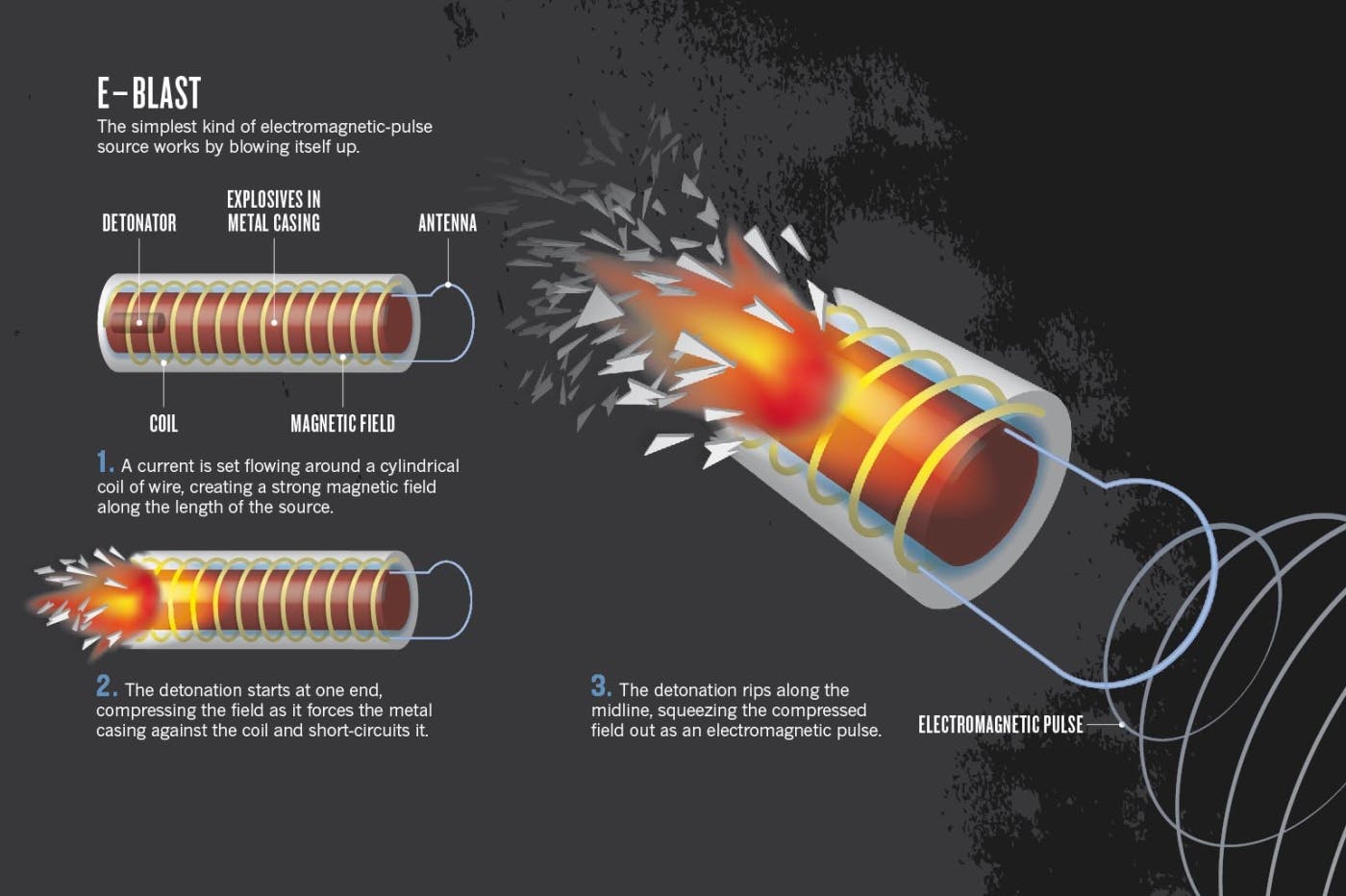

By the early 2010s, a consensus had emerged that producing an HPM pulse powerful enough to disable electronics required more than conventional power sources like batteries. At the time, the solution was thought to be to detonate an explosive inside the HPM system itself, which would create a strong electromagnetic pulse by compressing a magnetic field generated along a cylindrical wire. As the explosive detonated, it would compress the magnetic field and the collapsing metal casing would short-circuit the coil, launching the compressed field as an EMP. However, deploying such explosive-based systems on aircraft and other mobile platforms was too risky, limiting the Air Force to pursuing HPM weapons designed primarily for single-use missiles.

Source: Nature

These persistent challenges led people to view HPM technology as a dead end. This skepticism was encapsulated in Sharon Weinberger's famous 2012 paper, ”Microwave weapons: Wasted energy”, in which she argued that HPM weapons were unlikely to become viable due to insurmountable issues related to system size, cooling requirements, and thermal management. However, advancements in semiconductor technology, particularly in gallium nitride (GaN) semiconductors, revitalized the field. GaN's electrical properties allow for higher power output and efficiency in a smaller form factor, effectively addressing the historical limitations of HPM systems. By harnessing GaN technology, Epirus has been able to overcome the challenges that once hindered HPM development.

GaN Semiconductors and Epirus's SmartPower Technology

The introduction of GaN semiconductors has shifted the landscape of HPM technology. GaN's wide bandgap, a measure of the energy required to free an electron from its atomic orbit, allows it to withstand stronger electric fields compared to traditional silicon-based materials. This property enables the creation of semiconductors with short depletion regions and high carrier densities, resulting in devices that are both compact and capable of operating at higher voltages.

GaN semiconductors excel in managing larger electric fields within smaller footprints, delivering faster-switching speeds — up to 100 times faster than silicon counterparts. They can tolerate higher power densities and operate efficiently at elevated temperatures, making them ideal for applications where speed, size, and thermal resilience are critical. Epirus harnesses the advantages of GaN through its SmartPower technology platform, which is integral to the Line Replaceable Amplifier Modules (LRAMs) used in its Leonidas system. These LRAMs leverage GaN's properties to achieve greater power management and control, addressing the historical challenges of overheating and size constraints in HPM systems.

SmartPower introduces digital precision to power management, a significant departure from the analog methods traditionally used in high-voltage applications. By utilizing GaN and silicon carbide chips capable of handling higher voltages, SmartPower digitizes power systems that were once exclusively analog due to voltage limitations. This digital control enables the system to modulate power consumption dynamically, ensuring that energy is used only when needed and minimizing waste. As stated by Marr, the digitized system can “slice it up into 10-nanosecond time slices so you find all these opportunities to save power”. SmartPower intelligently regulates power flow, activating components only when required and achieving efficiency improvements of up to 95%. This advanced power management allows Epirus to generate the high-power pulses necessary for effective HPM operation without causing thermal overload. ML algorithms within SmartPower coordinate power usage across the system's components, optimizing performance while maintaining safe operating temperatures.

The digitization of power management not only mitigates previous thermal issues but also enables software-defined capabilities. Epirus's system can be updated or reconfigured through software changes, offering flexibility and adaptability in various operational scenarios. The smaller form factor achieved through GaN technology also means that HPM systems can be integrated into platforms where space and weight are at a premium.

Product Overview

At the core of Epirus's products is a software-defined backend paired with a phased array front-end. This configuration allows for electronic beam steering and shaping, enabling the system to direct energy precisely toward targets and rapidly scan across large portions of the sky. Rather than using one large antenna, Epirus uses thousands of smaller antennas, with each one emitting photons. Using SmartPower to individually adjust the output from each chip in the array, the beam can be widened or narrowed as needed, and even nullified in specific areas to avoid affecting friendly assets — a feature Epirus refers to as the "Dynamic Blue Force Zone."

The systems use dynamic gate control to adjust the input to power transistors in real-time, precisely managing power output. This allows HPM systems to adapt their power levels dynamically, enhancing targeting efficiency and meeting diverse operational demands. To ensure high signal fidelity at elevated power, Epirus applies digital pre-distortion techniques, and preprocessing signals to counteract expected distortions. This keeps transmitted HPM pulses clean and focused, maximizing their impact on target electronics.

Epirus's products are modular and scalable, featuring an open architecture that integrates seamlessly with a range of command and control (C2) systems, including the Forward Area Air Defense Command and Control (FAAD C2) used by the US and NATO. This integration is crucial, allowing operators to leverage existing detection and tracking systems to cue the HPM system for rapid response. Epirus has successfully integrated its systems with platforms from Droneshield, Anduril's* Sentry, and Northrop Grumman's Counter-Rocket, Artillery, and Mortar (C-RAM) and Indirect Fire Protection Capability (IFPC) systems.

Advanced sensors — including electro-optical, infrared, and radio frequency types — are combined with data analytics and machine learning algorithms to provide comprehensive UAS detection and identification over vast areas. The system can simultaneously detect, identify, track, and analyze UAS and drone swarms, predict their movements, and recommend appropriate countermeasures to safeguard assets.

Epirus's HPM systems are equipped with a “digitally beamformed antenna”, allowing it to optimize the amount of power used and engage drones at significant distances — far enough that visual confirmation would require magnification, though specific ranges remain classified. The HPM beam generates a high electric field in the air, inducing an overvoltage scenario that can either cause a soft reset (disabling the drone temporarily) or a hard reset (permanently disabling the electronics). Leonidas is equipped with a sensor that detects the number and distance of incoming drones, allowing it to adjust the beam accordingly.

The products utilize a Line Replaceable Amplifier Module (LRAM) architecture, which serves as the foundational building blocks of all their HPM systems. This design mitigates the risk of a single point of failure, a common issue in vacuum-tube-based systems, by enabling graceful degradation to maintain operational effectiveness. During Capabilities and Limitations Testing in April 2024, Epirus's system neutralized 100% of the drones it was tested against, including militarized drones equipped with electromagnetic pulse protections. While human oversight is currently essential to the decision-making process, the integration of AI indicates a likely progression toward more autonomous operation.

Epirus’ Product Suite

Epirus offers a suite of four HPM systems: Leonidas, Leonidas Mobile, Leonidas Pod, and Leonidas Expeditionary (ExDECS). Each system is designed to address specific operational needs while leveraging the same advanced technology platform.

Leonidas

Source: Epirus

Epirus’s original and foundational system, Leonidas, is a stationary HPM platform intended for fixed installations where mobility is not a primary concern. It provides robust, continuous protection against unmanned aerial systems (UAS), making it ideal for safeguarding critical infrastructure and strategic assets. Leonidas is intended to establish a strong defensive perimeter and effectively neutralizing drone threats over extended periods.

Leonidas Mobile

Source: Epirus

Leonidas Mobile was designed for enhanced flexibility and adaptability and to integrate seamlessly with vehicles or attach via standard hitches. The mobile version of Leonidas also allows for rapid deployment and mobility across various terrains. Its transportability enables defense forces to extend their protective reach, respond swiftly to emerging threats, and reposition as mission objectives evolve. Epirus has integrated its Leonidas system with the General Dynamics Land Systems Stryker but it is not clear if Leonidas is compatible with additional vehicles.

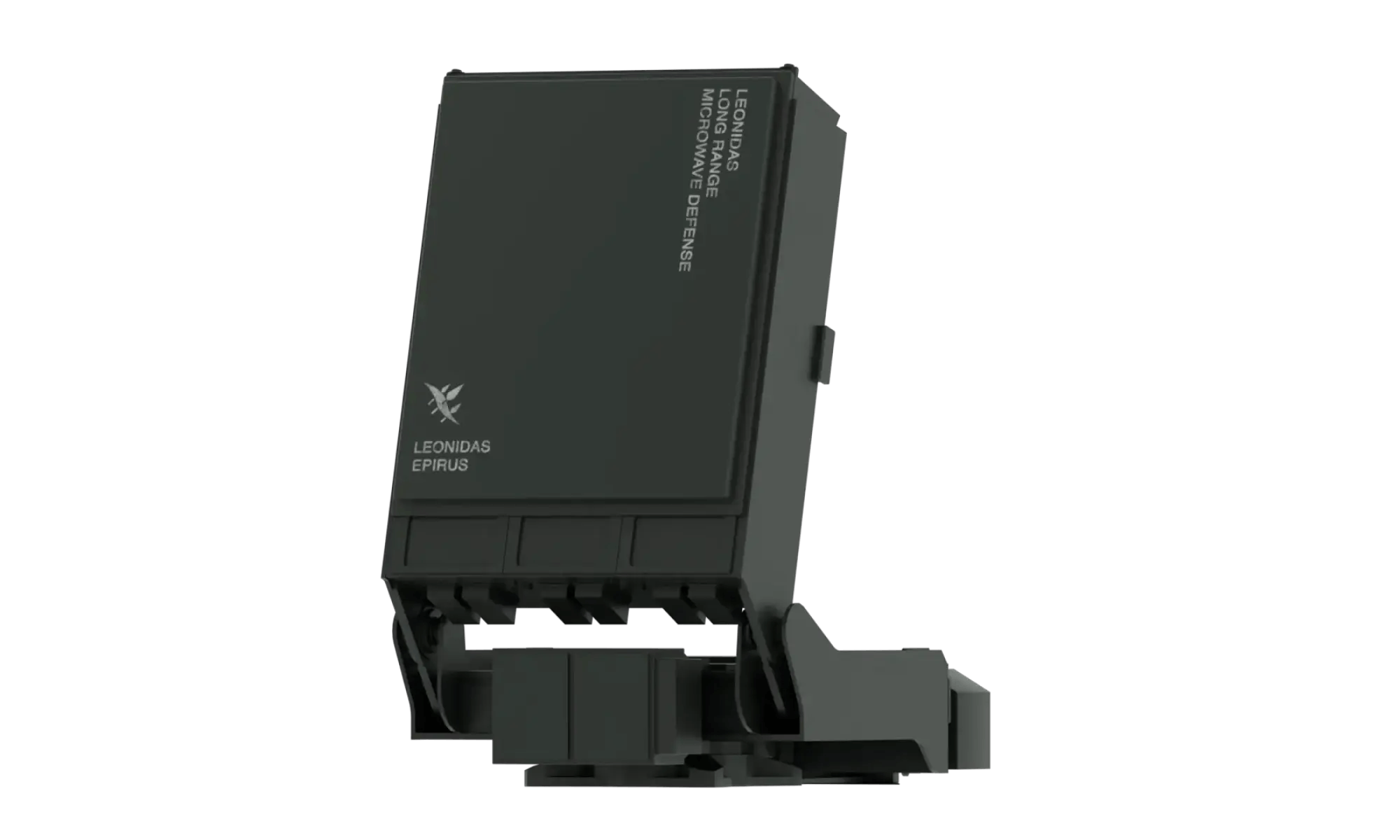

Leonidas Pod

Source: Epirus

The Leonidas Pod is a portable, modular HPM system engineered for maximum versatility. Its compact form factor and lightweight design make it suitable for hand-carrying to required locations, and it offers multiple mounting options, including integration with existing airborne platforms. This adaptability allows units to deploy the system in a variety of operational contexts, from ground-based installations to airborne missions, providing a flexible solution for countering UAS threats in dynamic environments.

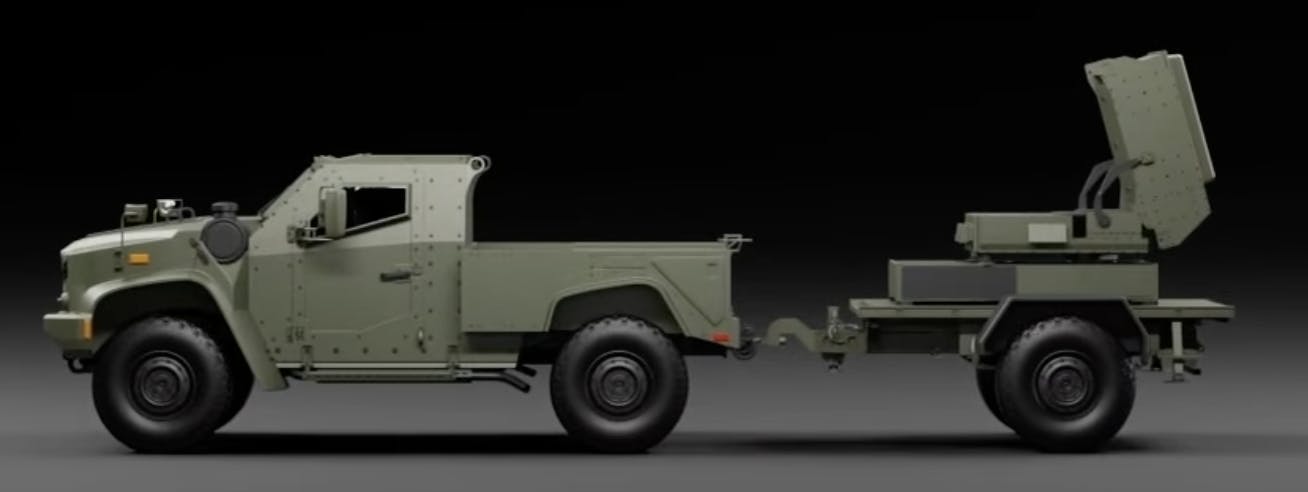

Leonidas Expeditionary (ExDECS)

Source: Epirus

Developed in collaboration with the US Navy's Office of Naval Research, the Joint Counter-small Unmanned Aircraft Systems Office, and the US Marine Corps Warfighting Lab, the Leonidas Expeditionary (ExDECS) is tailored for expeditionary advanced base operations and counter-unmanned systems missions. Compact and easily maneuverable, ExDECS is designed to fit on a Joint Light Tactical Vehicle (JLTV) trailer, enhancing low-altitude air defense capabilities in forward-operating scenarios. According to an Epirus spokesperson, the ExDECS “is a scaled-down version of the IFPC-HPM systems with roughly 1/3 the amount of [Line Replaceable Amplifier Modules] for advanced mobility.” Its integration with mobile platforms allows expeditionary forces to maintain a robust defensive posture while on the move.

Market

Customer

DoD and Military Customers

Epirus primarily serves the US DoD, working with all branches of the military. Instead of relying on traditional cost-plus contracts, Epirus invests its resources to develop technologies it anticipates the DoD will need, a strategy similar to Anduril. By taking on the financial risk, Epirus can deliver innovative solutions quickly and with greater flexibility. This approach not only positions the company for increased upside if its technologies are adopted but also differentiates itself from larger defense contractors, who cannot often invest in risky projects due to their reliance on cost-plus contracts with thin margins.

The Pentagon has identified directed energy technologies, specifically HPM systems, as top priorities due to their potential to counter drone threats and enhance air superiority. Epirus focuses on meeting these requirements, introducing advanced HPM solutions even as the military has been slow to adopt new approaches like solid-state technology.

Commercial Customers

Beyond defense applications, Epirus leverages its SmartPower platform for commercial markets. While specific clients are not publicly disclosed, the company aims to address challenges across industries that require efficient and reliable power management. By applying its expertise in directed energy and power optimization, Epirus seeks to expand into sectors of telecommunications, energy, and emergency services.

Market Size

The National Defense Authorization Act, which specifies the budget, expenditures, and policies for the DoD, authorized $886.3 billion of defense spending for FY 2024, with $824.3 billion allotted to the DoD.

The global counter-unmanned aerial systems (C-UAS) market is set for significant growth. Some forecasts expect the market for defense applications to expand from $1 billion in 2021 to $4.4 billion by 2031. Homeland Security is also expected to see growth in C-UAS spending, increasing from $339.9 million to $1.5 billion over the same period, while the commercial sector is projected to grow from $189.9 million to $565.8 million.

This growth is being driven by increasing investments in counter-drone capabilities across military and security agencies. For instance, the US government plans to procure ~1.9K C-SUAS units for $2.8 billion, alongside investments in interim maneuver short-range air defense systems and directed energy solutions totaling over $3.3 billion. Additional funding includes $967.6 million for the US Special Operations Command and $900 million for novel technologies for the US Air Force.

Further support for directed energy and HPM technology was evident in the Fiscal Year 2024 Justification Book, with at least six distinct program elements highlighting directed energy initiatives. These investments reflect a growing emphasis on advanced counter-drone and directed energy systems within the defense sector.

Competition

THOR/Mjölnir by the DoD

Source: Defense Daily

The DoD has been developing HPM technologies to counter the growing threat of unmanned aerial systems (UAS). Notably, the Tactical High Power Microwave Operational Responder (THOR) and its successor, Mjölnir, represent significant advancements in this domain.

Meant for short-range air base defense, THOR is engineered to neutralize drone swarms by emitting powerful electromagnetic pulses. Compactly housed within a 20-foot shipping container, it is transportable via C-130 aircraft and can be operational within three hours. Operating in the S-band frequency, THOR specifically targets drones Group 1 and 2 drones — those weighing less than 55 pounds, flying below 3.5K feet, and moving at speeds under 250 knots. Its 360-degree rotational capability allows for rapid engagement across multiple sectors, and the user-friendly interface requires minimal training.

Building upon THOR's foundation, Mjölnir aims to enhance range, reliability, and manufacturing readiness to facilitate mass production. In February 2022, the Air Force Research Laboratory awarded Leidos Inc. a $26 million contract to develop Mjölnir, focusing on advances in capability and the goal of widespread deployment.

Laser Systems

High-energy laser (HEL) systems offer an alternative approach to countering UAS threats by focusing electromagnetic energy, typically in the infrared or visible light spectrum, into concentrated beams capable of penetrating materials like steel and aluminum. Previous attempts at directed energy weapons, like the US Navy's laser weapon system (LaWS) introduced in 2014, faced challenges with the time required to charge the laser and difficulties in maintaining a clear beam, ultimately leading to its retirement without being used in combat. However, advancements in beam concentration have helped make the technology more viable. HEL technology presents advantages such as a low cost per engagement — estimated between $1 and $10 — and virtually unlimited "magazine depth", as lasers require no physical ammunition and can operate as long as electrical power is available.

However, HEL systems face limitations. Their effectiveness is influenced by environmental conditions. Atmospheric particles and water vapor can absorb or distort laser beams, reducing range and power. Additionally, lasers require sustained focus on a target to deliver sufficient energy for destruction, which can be challenging against fast-moving or multiple targets. The lethality of a laser depends on factors like power output, beam purity, concentration, and target range.

In contrast, HPM systems offer instantaneous effects over broader areas and are less affected by environmental factors. HPM pulses can penetrate non-conductive materials, allowing them to impact targets even behind obstacles. The DoD recognizes the potential of both technologies and has initiatives to develop lasers with power levels up to 1K kW to counter more significant threats such as cruise missiles. Various military branches are integrating HEL systems into their platforms, including the Army's 300 kW HEL for counter-UAS strategies, the Navy's 150 kW ship-based lasers for short-range defense, and the Air Force's prototypes for airborne and ground applications.

Companies

Raytheon: Raytheon, a public company with a market cap of $158.6 billion as of November 2024, offers both HPM and HEL systems, and is Epirus’ primary competitor. Raytheon’s Phaser HPM system, designed to provide short-range capability similar to THOR, has neutralized multiple drones simultaneously during testing exercises. In 2019, Raytheon secured a $16.2 million contract from the US Air Force for further development and evaluation of Phaser.

The DoD has also worked with Raytheon to test the Counter-Electronic High-Power Microwave Extended-Range Air Base Defense (CHIMERA) system, which was “built to fire highly concentrated radio energy at multiple middle-to-long-range targets.” Unlike THOR and Phaser, CHIMERA is intended for longer-range engagement.

Raytheon is also expected to deliver prototypes of the Phaser’s successor via the Directed Energy Front-Line Electromagnetic Neutralization and Defeat (DEFEND) system, in 2026. A program that grew out of THOR and CHIMERA, DEFEND will include a power generator, a transmitter, an antenna that allows for compression of energy into EMPs, and a guidance system. DEFEND is intended to be utilized as a front-line air defense system and will range between 20 to 40 feet.

In the laser domain, Raytheon's High-Energy Laser Weapon System (HELWS) is designed to detect, track, and engage UAS threats. The system utilizes an advanced variant of the company's Multispectral Targeting System, an electro-optical/infrared sensor, for precise targeting. HELWS can integrate with existing radar and command-and-control systems such as FAADC2 and NASAMS and can be set up within a few hours.

First deployed overseas by the US Air Force in 2019, the 15-kW-class laser is capable of neutralizing at least 40 incoming drones. Raytheon claims that HELWS can fire dozens of shots from a 220-volt outlet and infinite shots if connected to a generator. HELWS comes in two configurations. The 15 kW version targets UAS Groups I and II, while the 50 kW version can engage UAS Groups I, II, and III, as well as rockets, artillery, and mortars. The 50 kW system also features a faster battery recharge time of 120 seconds compared to the 180 seconds of the 15 kW version. The Air Force acquired the first HELWS in October 2019 and granted Raytheon a $15.5 million contract for an upgraded version in 2021.

Lockheed Martin: Lockheed Martin’s Mobile Radio Frequency-Integrated UAS Suppressor (MoRFIUS) is a counter-UAS system that competes with Epirus's Leonidas Pod. MoRFIUS is a reusable, tube-launched interceptor weighing less than 30 pounds, equipped with a compact HPM effector and an onboard seeker for non-kinetic capability. Essentially a drone armed with an HPM system, MoRFIUS can be mounted on ground vehicles or aircraft, offering flexible deployment options. It operates in semi-autonomous or autonomous modes based on customer requirements and uses a directional antenna to focus microwaves on targets at optimal distances. Generating “over one million times more power than a microwave oven”, MoRFIUS combines high power with mobility. As of November 2024, Lockheed Martin has a market cap of $127.6 billion.

Leonardo DRS: Leonardo DRS’ Specialized Portable Electromagnetic Attack Radiator (SPEAR) is an HPM system designed to provide counter-UAS capabilities for ground vehicles, field troops, and fixed platforms. The system delivers intentional, high-power electromagnetic pulses at both single-pulse and repetition rates to neutralize drones. It is a solution with a magazine depth of approximately 1 million shots and a minimal cost per shot. The system requires minimal logistical support, is easily transportable, and can be set up and powered up in seconds to minutes. As of November 2024, Leonardo DRS has a market cap of $9.2 billion.

BlueHalo: BlueHalo focuses on defense technologies including space operations, counter-UAS systems, autonomous systems, electronic warfare, cyber operations, and AI. It has developed the LOCUST Laser Weapon System (LWS), a 26-kilowatt high-energy laser designed to detect, track, and neutralize Group 1 to Group 3 UAS threats. Its modular design allows for rapid deployment and integration onto various platforms, including armored vehicles like the Stryker.

The LOCUST LWS features an electro-optical tracking system equipped with a fine tracking system, a powerful telescope, a targeting laser, and more. Multiple camera payload options provide a wide field of view for early target identification and tracking. For added mobility, the setup includes a radar and surveillance module on an extendable mast, all mounted on a 463L-compatible pallet for easy transport. This system can be enhanced with a quad-band electronic jammer, a 360-degree radar, and a long-range direction-finding device. In addition to the LOCUST LWS, BlueHalo also has non-kinetic counter-UAS solutions including its Titan C-UAS and Titan-SV, which help protect users against Group 1 and 2 drones. BlueHalo has raised a total of $723.2 million and has acquired nine companies as of November 2024.

Dedrone: Acquired by Axon in October 2024, Dedrone is a company that provides airspace security solutions using drone detection, identification, and mitigation technology to protect against unauthorized or malicious drone activity. Moreover, its products are commercially available, making its solutions accessible to non-military users. However, reliance on sensors like electro-optical and infrared systems can result in range limitations, line-of-sight requirements, and slower detection rates for fast-moving targets. Key offerings include:

DedroneTracker.AI: An AI-driven command-and-control platform that provides real-time airspace monitoring by integrating data from multiple sensors. It uses machine learning to detect and classify over 300 drone types, offering continuous autonomous interrogation and verification.

DedroneSensors: Sensors that employ radio frequency technology to identify and locate drones and their operators, capable of detecting a wide range of commercial and custom-built drones, including the entire DJI lineup.

DedroneDefender: A portable, point-and-shoot device designed to disrupt communication between a drone and its operator. Weighing only 7.5 pounds, it jams control and GPS signals, causing the drone to engage in safety behaviors like hovering, landing, or returning to its launch point. The device has an effective range of up to 2 kilometers.

DedroneOTM: Launched in June 2024, this vehicle-mounted solution provides on-demand, mobile counter-drone capabilities. It integrates DedroneTracker.AI for 360-degree drone detection and includes the DedroneDefender handheld jammer for mitigation, designed for expeditionary forces.

Business Model

Epirus's business model centers on securing contracts from the US DoD. It began by obtaining smaller contracts intended for innovative firms, such as those from the Small Business Innovation Research (SBIR) program and Other Transaction Authority (OTA) agreements, and has now expanded to larger contracts. By investing its resources to develop technologies aligned with the DoD's future needs, Epirus bypasses the traditional cost-plus model.

Securing a program of record is crucial for Epirus's long-term success. This would not only provide initial production contracts but would also lead to ongoing maintenance agreements, offering a stable revenue stream and facilitating long-term planning. Being part of a program of record enhances the company's credibility, making it easier to bid on future projects and expand into adjacent markets. This strategic approach could help Epirus avoid the "valley of death" that causes many defense tech startups to exit the market before achieving recurring revenue.

Traction

Contracts

Epirus has made significant strides in the defense technology sector through substantial contracts with the US military. In January 2023, the company secured a $66 million contract from the US Army's Rapid Capabilities and Critical Technologies Office to develop four prototypes of its Leonidas HPM system. Designed to counter drone swarms, these prototypes are scheduled for testing in fiscal year 2024.

Epirus also announced the development of the Leonidas Expeditionary system in September 2024, funded by a $5.5 million contract from the US Navy's Office of Naval Research. This compact and mobile HPM system, known as the Expeditionary Directed Energy Counter-Swarm (ExDECS), is tailored to support the US Marine Corps Expeditionary Advanced Base Operations. The system aims to enhance ground-based air defense capabilities and is slated for integration with the Marine Corps' Common Aviation Command and Control System, improving effectiveness against unmanned threats in various operational scenarios.

In October 2024, Epirus received a $17 million contract modification to upgrade the sensor suite of the Integrated Fires Protection Capability-High Power Microwave (IFPC-HPM) program. This enhancement involves integrating a closed-loop fire control system and advancing software capabilities to reduce engagement latency and improve accuracy.

Lowery has indicated that Epirus is on the verge of being included in a program of record, contingent on the successful deployment and performance of their systems in operational theaters like CENTCOM. If these deployments meet expectations, the company could achieve this milestone as early as 2025.

Partnerships and Integrations

Epirus has bolstered its technological capabilities and market reach through strategic partnerships. In July 2020, Epirus entered a strategic supplier agreement with Northrop Grumman to enhance counter-unmanned aerial system offerings. This partnership incorporates Epirus's electromagnetic pulse capabilities into Northrop Grumman's C-UAS solutions, providing a non-kinetic option to defeat drone swarms.

In June 2023, Epirus integrated its Leonidas HPM system with DroneShield's DroneSentry platform. Having already invested approximately $2.5 million in DroneShield in November 2022, this collaboration deepens ties between Epirus's directed energy technology and DroneShield's advanced drone detection and jamming systems, offering a comprehensive solution for countering unmanned aerial threats.

The following month, Epirus partnered with Anduril to combine the Leonidas system with Anduril's Lattice Command and Control platform. By enhancing threat detection, tracking, identification, and neutralization within a networked framework, this partnership supports the Marine Corps' modernization efforts under the Force Design 2030 initiative.

In July 2024, Epirus expanded into tactical communications through a partnership with L3Harris Technologies. The collaboration focuses on integrating Epirus's advanced electronics into L3Harris's tactical communication systems. The goal is to develop high-efficiency tactical radios with improved range, extended battery life, and better heat management to meet the demands of modern combat environments.

Valuation

In February 2022, Epirus raised a $200 million Series C round led by T. Rowe Price, valuing it at ~$1.4 billion and bringing its total funding to $287.6 million. This followed a $70 million Series B led by Bedrock in December 2020 and a $17.4 million Series A led by 8VC in November 2019. It also raised a $243K grant from the National Science Foundation in November 2021.

As of November 2024, Epirus's estimated valuation is approximately $1.2 billion according to secondary markets data, reflecting a 13% decrease from its Series C valuation. While Epirus has not disclosed any revenue or profit figures, it has secured government contracts with the DoD.

Key Opportunities

Enhancing Security for Public Venues

The rapid proliferation of unmanned aerial systems (UAS), commonly known as drones, has introduced new security threats to public spaces and critical infrastructure. As drones become more accessible and affordable, they can be misused for surveillance, smuggling, or orchestrating attacks. Public venues like stadiums, airports, and concert halls are particularly vulnerable to disruptions that could endanger large numbers of people. By deploying Leonidas, organizations can protect airports, water systems, communications towers, power plants, pipelines, borders, and other critical infrastructure from UAS incursions.

Expanding Dual-Use Applications for SmartPower Technology

Defense Applications

Epirus's SmartPower technology offers benefits across various defense applications, including efficiency improvements in equipment ranging from ships to ground vehicles. For instance, ships equipped with SmartPower can allocate energy more efficiently, enabling them to host more powerful radars, lasers, and electronic warfare systems. This optimization not only enhances their capabilities but also extends their operational range by reducing fuel consumption. Similarly, military vehicles can benefit from improved power management by adding additional systems like advanced sensors or communication devices without exceeding power budgets. Even for diesel-powered vehicles, efficient power distribution can reallocate energy to propulsion, increasing speed and maneuverability.

Efficient power management is crucial as the military advances toward electrification and adopts more energy-intensive technologies. SmartPower technology allows for the enhancement of existing platforms without the need for significant redesigns or additional power sources.

Commercial Applications

Beyond defense applications, SmartPower technology offers substantial commercial opportunities across various industries — including communications, energy, industrial automation, transportation, and data centers — by optimizing power delivery and enhancing energy efficiency.

In the communications sector, for instance, the rollout of 5G and the development of 6G networks demand equipment that can handle high data throughput while minimizing energy consumption. Telecommunication towers and network equipment often generate significant heat due to high power usage, leading to increased cooling requirements and operational expenses. SmartPower can address these challenges by precisely measuring and supplying the exact amount of energy needed at any given time. This optimization could reduce energy consumption and heat generation, extending equipment lifespan, lowering cooling costs, and enhancing overall network reliability.

Similarly, in industrial automation, manufacturing facilities can leverage SmartPower to enhance the energy efficiency of automated systems and robotics. By delivering precise power levels based on real-time demand, factories can reduce energy waste during low-activity periods, lower operational costs, and prolong equipment lifespan due to reduced wear and tear. This not only improves efficiency but also contributes to sustainability efforts within the manufacturing sector.

The transportation sector also stands to benefit from SmartPower, especially with the rise of electric vehicles (EVs). SmartPower can enhance both charging infrastructure and vehicle efficiency. Charging stations equipped with SmartPower optimize power delivery to EVs, reducing charging times and minimizing energy waste. Within the vehicles themselves, improved energy management extends battery life and increases driving range, addressing critical concerns for both manufacturers and consumers.

Moreover, both data centers and the broader energy sector can leverage SmartPower technology to address significant energy challenges. Data centers, notorious for high energy usage and heat production, can greatly benefit by receiving precise energy amounts to servers and enabling low-power modes during periods of decreased demand. This approach could significantly reduce power consumption and associated cooling requirements, lowering operational costs and reducing carbon footprints. Simultaneously, as power grids integrate renewable energy sources and become more complex, efficient power management becomes essential. SmartPower can enhance grid optimization by reducing energy losses during transmission and distribution. Renewable energy systems like solar panels and wind turbines can improve the performance of inverters and control systems, ensuring maximum utilization of generated energy.

Innovating Across the Electromagnetic Spectrum

Radar technologies

One potential area of product expansion for Epirus is advanced radar systems. In air combat scenarios, the ability to detect enemy aircraft from greater distances provides a significant tactical advantage. If two planes are engaged in combat, the one with the stronger radar can identify the opponent hundreds of miles away, allowing for earlier threat assessment and strategic decision-making. Epirus could consider developing high-power radar technologies that extend detection ranges and improve resolution. By enhancing radar capabilities, the company might offer solutions that improve situational awareness and survivability for military aircraft.

Infrared (IR) technologies

Another possibility is incorporating infrared technologies (IR) to develop sensors and targeting systems effective in low-visibility conditions such as nighttime or adverse weather. IR-based systems can detect heat signatures from personnel, vehicles, or equipment, providing superior surveillance and reconnaissance capabilities. Exploring IR technologies could enable Epirus to offer advanced solutions for missions requiring stealth and precision, where traditional optical systems may be insufficient.

Millimeter Wave (MMW) technologies

Epirus might also explore millimeter wave systems, which operate at extremely high frequencies and enable high-resolution imaging and secure communication links. Developing MMW technologies could lead to advanced radar systems capable of detecting and identifying targets with greater accuracy. These systems can penetrate obstacles like fog, dust, and certain building materials, making them useful for both military applications and civilian uses such as airport security and autonomous vehicle navigation.

Potential for Additional Strategic Integrations

Opportunities exist for Epirus to integrate its technologies with platforms from other defense companies, enhancing capabilities through strategic collaborations. Notably, the CEO of Epirus has discussed the possibility of incorporating the Leonidas system into Anduril's Roadrunner unmanned aerial vehicle.

This integration would involve placing an HPM pulse generator within the Roadrunner's existing compartment, effectively creating a reusable asset capable of disabling multiple drones in a single mission. Because the Roadrunner is designed to be reusable, deploying the Leonidas system in this manner would provide a cost-effective and efficient solution for aerial threats. The drone could ascend, activate the HPM system to neutralize hostile drones, and then return safely for subsequent missions. By exploring such integrations, the company can expand the applications of its technologies and enter new markets.

Increased Autonomy

Epirus's HPM technology effectively neutralizes drone threats but requires human operators, as per the DoD. However, integrating autonomous capabilities could confer several benefits. Autonomous HPM units could react instantly to drone threats without human input, reducing critical response times. Operating autonomously would also allow deployment in hazardous or inaccessible environments, expanding operational reach. As autonomous systems mature and the DoD’s policy around autonomous weapons systems adapts, Epirus is likely to develop HPM solutions that autonomously detect, track, and neutralize drone swarms in real time.

Crowd Control

Epirus could adapt its HPM technology to target enemy personnel as well as drones. Previous attempts, such as the Department of Defense's ADS, aimed to create a burning sensation on the skin using millimeter waves that would force targets to retreat. However, its bulky, vehicle-mounted design limited its portability and mobility.

By harnessing gallium nitride semiconductors, Epirus has proven its ability to develop more compact HPM systems. This technological advancement could enable the creation of a smaller version of the ADS, allowing forces to manage hostile situations, such as urban counter-insurgency, riot control, and border security, without risking civilian casualties or causing infrastructure damage.

Key Risks

Regulatory and Legal Uncertainties

Epirus operates in a regulatory environment fraught with complexities that pose significant challenges to its operations. The management of the electromagnetic spectrum is a critical issue, as the Federal Communications Commission (FCC) allocates frequency bands to various federal agencies and services. Many of the frequencies vital to Epirus's technology are assigned to the Federal Aviation Administration (FAA). Consequently, Epirus must obtain permission from the FAA for domestic use, a process hindered by the agency's staffing limitations and the absence of dedicated teams to assess and integrate new technologies. This bottleneck delays approvals and restricts the timely deployment of Epirus's solutions.

Legal ambiguity further compounds these challenges. Under current laws, actions taken by civilian entities to neutralize drones could be interpreted as hijacking, creating a gray area that hampers Epirus's ability to operate effectively in civilian markets. Even if new federal legislation addresses these ambiguities, the FAA will need to develop and implement specific regulations, a process that could span several years. During this interim period, Epirus could face operational constraints and uncertainty that could impact its market positioning and revenue potential.

Bureaucracy and Slow-Moving Government Agencies

A significant risk for Epirus is the mismatch between its rapid research and development cycles and the protracted procurement processes of government agencies. Epirus demonstrated its capability for swift innovation by developing its prototype in nine months. However, government acquisition cycles are considerably longer, leading to inefficiencies and delayed deployment of new technologies. This time lag can erode competitive advantages, increase operational costs, and hinder the company's ability to respond to emerging threats or market opportunities.

Moreover, domestic agencies such as the FAA exhibit reluctance to engage with new, complex technologies without precedent. Unlike the DoD, which has dedicated teams to evaluate and adopt innovative solutions, the FAA tends to adopt a cautious, wait-and-see approach. These agencies often delay action until observing how the DoD collaborates with companies like Epirus. This hesitancy not only slows progress but may limit Epirus' ability to diversify its client base beyond defense, affecting long-term growth prospects.

Summary

Epirus is a defense tech company pioneering directed energy systems that counter emerging threats, particularly drone swarms. Leveraging AI and advanced microwave technology, its flagship product, Leonidas, rapidly detects, tracks, and disables multiple targets with precision. By incorporating gallium nitride semiconductors and Epirus’ proprietary SmartPower technology, Epirus has achieved a smaller form factor and greater power efficiency than pre-existing products. The company has seen notable traction for its mobile, high-power defense solutions, having secured numerous multi-million dollar contracts and has achieved a valuation of over a billion dollars as of its February 2022 Series C.

*Contrary is an investor in Anduril through one or more affiliates.