Thesis

The proliferation of AI-powered systems and drones has transformed modern warfare. In September 2023, the United States government sent 31 M1A1 Abrams tanks to aid the Ukrainian war effort. The Abrams tank, which costs $10 million and is widely considered the “Best Tank in the World,” was expected to impact the battlefield. However, quickly, the Russian military deployed first-person view (FPV) drones, which can cost as little as $500, and destroyed five tanks. Within one year, the Ukrainian government pulled its American Abrams tanks from the frontlines.

This interaction between traditional and nascent warfare underpins an inflection point in military technology. In June 2023, General Milley, the 20th Chairman of the Joint Chiefs of Staff, declared “rapidly advancing technology […] is causing the most significant fundamental change in the character of war ever recorded in history”

The proliferation of advanced software enables militaries to ingest, analyze, and react to dynamic military environments. For example, militaries can use algorithms for the target coordination cycle (find, track, target, and prosecute) within minutes, a process that can take conventional technology hours. Armed with artificial intelligence, these algorithms are improved after each encounter on the battlefield. The modern war is a “clash of algorithms,” a war fought as much in the digital realm as the physical one. As a result, electronic warfare, the use of electromagnetic energy to prevent enemies from accessing the electromagnetic spectrum (such as radio waves, microwaves, and infrared), has become crucial in subverting enemy offensives.

Furthermore, these advances in precise targeting and robotics have created an environment ripe for disruptive military hardware. In this new landscape, small drones have gained widespread adoption. In 2024, Ukraine supplied 1.2 million drones to its army because of their low cost, range, ease of deployment, and reconnaissance capabilities. Small military and commercial drones are used in ‘kamikaze’ strikes that can immobilize tanks and be used against enemy personnel. Although kamikaze drones can only hold a limited amount of munitions, unarmed drones expedite the targeting process for precise artillery responses. As a result, the Ukrainian War has seen historically high usage levels of drones from both sides. The rapid proliferation of combat drones has spurred massive global spending on manufacturing, highlighted by Ukraine’s strategic commitment to manufacture 4 million drones annually.

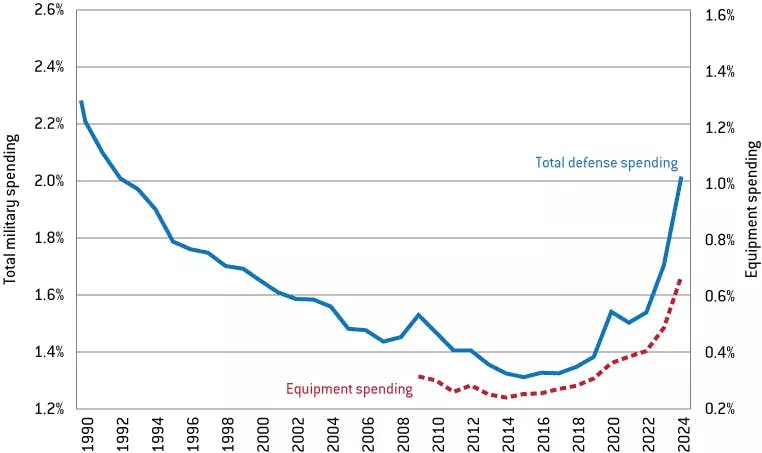

These two compounding factors, a rapidly changing battlefield and global stage, have caused a drastic increase in military spending across Europe. In 2024, the continent spent $279 billion on the military, a 10% increase from the previous year. Furthermore, 32% of this spending is going towards R&D and procurement, more than double a decade ago. The current environment in Europe has an appetite for disruptive military technology.

Helsing is a Munich-based defense technology company specializing in AI solutions to enhance military capabilities for democratic governments. Helsing's flagship offerings include the Altra Recce-Strike software platform, the HX-2 kamikaze drone, and AI systems for electronic warfare and air combat. The company emphasizes ethical considerations in its operations, selling exclusively to democracies and securing significant government contracts across Europe.

Founding Story

Helsing was started in 2021 by a trio of co-founders, Dr. Gundbert Scherf (Co-CEO), Torsten Reil (Co-CEO), and Niklas Köhler (President).

Scherf is a former McKinsey Partner who spent two years as a Special Advisor in the German Federal Ministry of Defense and organized the creation of the military’s first information domain service. In 2001, Reil dropped out of Oxford Biology PhD to found UK startup Natural Motion, which created software systems for capturing and synthesizing motion for video game and film studio developers. 13 years later, Reil sold Natural Motion to Zynga for $527 million. Köhler initially worked on healthcare AI applications at Helmholtz Zentrum München, but quickly realized “applications like detecting drones are, in terms of methods, not so dissimilar from how you would find cancer in large CT scans.”

The founding of Helsing is tied to growing geopolitical threats in Europe. Reil recounts that the inciting incident was the 2014 annexation of Crimea and the “lack of reaction by European and Western governments in general” and an “increasing concern that we [NATO-affiliated Europe] are falling behind the key technologies in our open societies.” In 2018, Google employees protested a contract with the Pentagon — a decision Reil did not understand:

“If we want to live in open and free societies, be who we want to be and say what we want to say, we need to be able to protect them. We can't take them for granted…. I felt like if they're not doing it, if the best Google engineers are not prepared to work on this, who is?”

In 2021, the trio founded Helsing with the tagline “Artificial intelligence to protect democracies.” A German company based in Munich, Reil, described the goal of Helsing this way:

“It's very simple. We want to make Europe safer. We want to be able to point at the difference that we've made in terms of the geopolitical security of this continent. That is the goal of the company.”

At first, the company utilized the Economist’s Democracy Index, which failed to account for the ‘gray zone’ of whether a country is a democracy and the moral standards a country holds itself to during conflict. Although the co-founders make the final decision of which countries are eligible to purchase Helsing’s services, the team holds company-wide ethics workshops to get “everyone to contribute to the decision process.”

Product

Helsing is branded as a software-first AI defense company. More specifically, Helsing builds AI software to process information from defense systems, boost weapons capabilities in drones and jet fighters, and improve battlefield decisions. Reil describes the company’s focus on compute this way:

“We use our own compute obviously. We’re on ‘Edge’ devices, and there’s always local compute required as well. We also announced a few weeks ago Project Centaur, which is based on reinforcement learning to create an AI for air combat. That requires a lot of compute. So we spend a lot of money right now on training and training agents. Eventually, we’ll have extremely high capabilities in air combat. And there we use scaled-up compute.”

Altra Recce-Strike Software Platform

Source: Helsing

The Altra Platform is an operating system for warfare across different domains, which "accelerates target identification, localization, assignment, and engagement by combining on-edge AI with a degradation-resilient networking stack and powerful ground station software.” The service is composed of four different parts: Altra Ground Station, Altra ISR, Altra Strike, and Altra Indirect Fires. Each is for a different unit: land combat, ISR (Intelligence, Surveillance, and Reconnaissance) drones, Altra Strike (HX-2 and other strike drones), and artillery.

Altra combines different data inputs from multiple drones to provide information to operations, which Scherf asserts gives operators “more time to make decisions, but then also be more precise [and] lethal.” Furthermore, the use of spotters and “other sources” that are integrated into a common operation picture (COP) for Altra Ground Station and handheld defenses. As a result, the Ground Station can utilize information to direct and coordinate various attacks. Moreover, AI-aided assignments can reduce the load for human operators and automate fire adjustment for artillery.

In total, Altra offers a suite of features such as AI-based decision chain, autonomous mission management, onboard autonomy for unmanned strike and ISR in EW-contested environments, GNSS-independent localization, navigation, and targeting. Lastly, the platform can be integrated with different defense tools such as European artillery systems, mortar launchers, RC weapon stations, ISR drones, and strike drones.

Because Altra is explicitly designed for operation in contested and degraded environments, it features a degradation-resilient networking stack, which ensures that units can operate even when communications are jammed or GPS signals are denied. This capability allows Altra to continue enabling real-time coordination, even under heavy electronic warfare (EW) conditions—an increasingly common challenge in modern conflict zones.

Another distinguishing feature is Altra’s multi-domain applicability. While much of the focus is on drones and artillery, Helsing emphasizes that the platform spans “land, air, sea, and cyber.” This suggests that Altra is not just a point solution but a comprehensive operating system that can be deployed across services and geographies, stitching together data and autonomy layers across a wide range of military assets and units.

Finally, Altra’s architecture supports dynamic tasking and re-tasking of assets. This means strike drones or ISR units can be redirected mid-mission based on real-time inputs, either from other units or ground command. Combined with AI-generated prioritization and target recommendations, this enables faster kill chains and adaptive responses without requiring full operator control at every stage.

HX-2 “Karma” Strike Drone

Source: Helsing

Although Helsing is primarily focused on selling software, the company has also entered the hardware space. In December 2024, Helsing announced HX-2, an electrically powered, software-defined, and mass-producible strike drone. It features a cruciform (X-wing) design that enhances stability, maneuverability, and aerodynamic efficiency during flight. Weighing approximately 12 kilograms (26.4 pounds), HX-2 is capable of engaging artillery, armored, and other military targets and operates beyond-line-of-sight-range (62 miles), and has a top speed of 136 mph. The kamikaze drone has a multi-purpose payload that includes anti-tank and anti-structure munitions.

Advanced onboard artificial intelligence ensures the HX-2 is immune to hostile electronic warfare measures, allowing it to search for, re-identify, and engage targets even without a signal or continuous data connection. A human operator remains in or on the loop for all critical decisions. Köhler describes how the HX-2 is integrated with the Altra-Recce-Strike Platform this way:

“Individual HX-2s can reliably engage armored targets in highly contested environments. When deployed along borders at scale, HX-2 can serve as a powerful counter invasion shield against enemy land forces.”

In addition to precision targeting, the onboard AI ensures that the HX-2 can survive heavily contested EW environments. When EW cuts the signal or data connection between the drone and operator, the HX-2 can still search for, re-identify, and engage targets — the HX-2 is armed with an onboard computer that stores mapping data and AI that evaluates landmarks and images. Nevertheless, Helsing still stipulates that there is “full human control and oversight.”

These drones have the potential to make a notable impact on the battlefield. Russia and Ukraine’s inability to assert air superiority has positioned drones as a cost-effective solution. While a long-range kamikaze drone will cost in the thousands, the surface-to-air missile that knocks it down will probably cost more and take longer to replace. These versatile drones can be sent in waves and target a wide range of targets and geographic areas. Helsing claims that it can produce tens of thousands of drones at a lower price by using advanced manufacturing techniques such as 3D printing. In December 2024, Ukraine began production of HX-2 drones and experimented with the drone in combat.

SG-1 & Lura

Source: Helsing

In May 2025, Helsing unveiled Lura, an advanced AI platform designed for persistent underwater surveillance. Developed from first principles, Lura aims to address the complexities of the modern underwater battlespace by providing scalable and autonomous detection of subsurface threats. The system employs a large acoustic model (LAM), akin to large language models, enabling it to classify and localize acoustic signatures such as those emitted by ships and submarines with heightened sensitivity and accuracy. According to Helsing, Lura can detect acoustic signatures ten times quieter than other AI models and operates up to 40 times faster than human operators.

Lura is integrated into the SG-1 Fathom, a mass-producible autonomous underwater glider capable of patrolling for up to three months. Each SG-1 Fathom glider is approximately 1.95 meters in length, 28 centimeters in diameter, and weighs 60 kilograms. These gliders can operate individually or as part of large-scale constellations, providing real-time detection and classification of underwater threats. The system is designed to be managed by a single operator from a maritime headquarters, offering surveillance capabilities at a fraction of the cost of traditional crewed anti-submarine warfare patrols.

The development of Lura and SG-1 Fathom was driven by interest from several navies seeking adaptable and scalable underwater surveillance solutions. The capabilities of the system were demonstrated at HM Naval Base Portsmouth in May 2025 to a select audience of users and industry partners. Helsing is collaborating with partners including Blue Ocean Marine Tech Systems, Ocean Infinity, and Qinetiq to scale and deliver Lura and SG-1 Fathom to customers, with plans to deploy the system within the year.

The introduction of Lura and SG-1 Fathom also reflects a broader shift in defense strategies, emphasizing the importance of autonomous and AI-driven technologies in modern warfare. By providing a cost-effective and scalable solution for underwater surveillance, Helsing aims to enhance the capabilities of democratic nations in protecting their critical infrastructure and national waters.

Cirra

Source: Helsing

Cirra is focused on addressing the challenges posed by shapeshifting software-defined anti-aircraft radars and electronic warfare that can change their signal characteristics dynamically, making them difficult to detect and classify using traditional methods. Leveraging deep learning and artificial intelligence, Cirra enables the classification and understanding of unknown anti-aircraft emitters, significantly enhancing the combat readiness and survivability of fighter jets in dynamic conflict scenarios.

The system operates through two primary components: Cirra Onboard and Cirra Ground Station.

Cirra Onboard runs real-time algorithms on a dedicated compute stack integrated within various electronic warfare (EW) systems. This allows for live assessment of unknown emitters, supporting pilots with immediate threat evaluation and intent recognition during missions based on analysis of incoming electromagnetic signals.

Cirra Ground Station processes collected EW data offline, automating the end-to-end tactical loop. By utilizing historical data, it continuously learns and improves EW responses, scaling to support virtually unlimited assets and missions. Its AI-powered analytics suite further refines radar capabilities by comparing them against extensive mission data, ensuring perpetual improvement and adaptability in evolving combat environments.

Cirra was officially unveiled by Helsing in December 2024 as part of the company's broader initiative to enhance defense capabilities through AI. The platform has been developed with the intent to integrate into existing and future EW systems, offering modularity and scalability to meet various operational requirements. While specific details about customer adoption and partnerships have not been publicly disclosed, Helsing's focus on AI-driven defense solutions has garnered attention from several European defense entities.

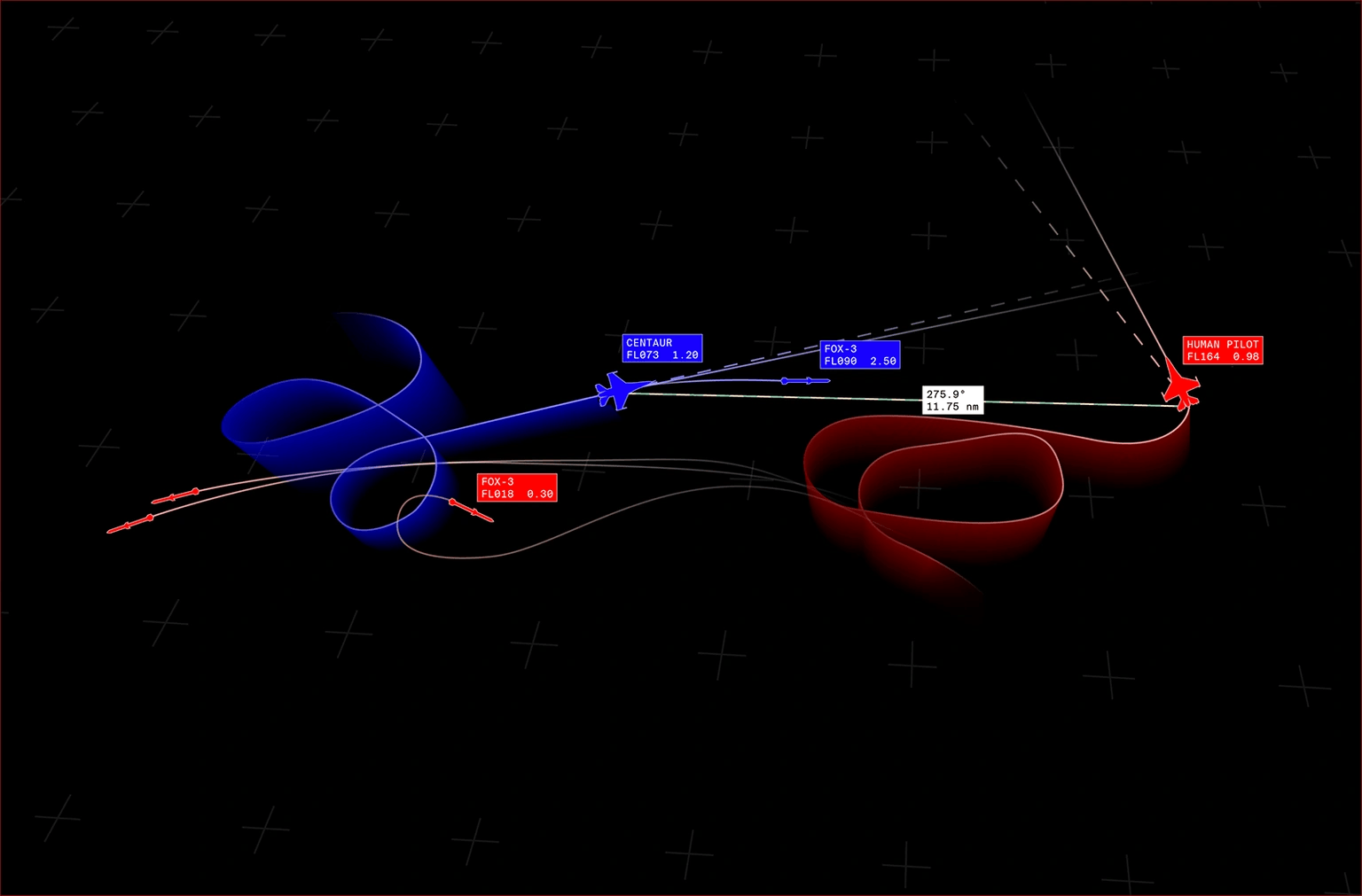

Centaur

Source: Helsing

Centaur is a project dedicated to developing autonomous AI fighter pilots capable of achieving human-level performance in beyond-visual-range (BVR) air combat. Utilizing a scaled reinforcement learning program, Centaur is designed to integrate with both existing and future air combat systems, including advanced platforms such as Loyal Wingman, FCAS, and GCAP.

Centaur AI agents undergo extensive training, equivalent to over 500K hours, to master the complexities of advanced air combat techniques. These include engagement tactics, defensive maneuvers, and innovative approaches that push the boundaries of traditional strategies. By leveraging high-performance simulation environments, Centaur ensures that AI pilots are equipped with the skill and intuition necessary to operate effectively in highly dynamic and challenging combat scenarios.

Early responses from Helsing’s network have been positive. In particular, human pilots involved in Centaur trials reportedly responded enthusiastically, with Helsing noting encouraging reactions during AI-versus-human exercises. Additionally, Helsing’s participation in the Airbus demonstration at the 2024 Berlin Air Show marked a key industry moment: Airbus publicly confirmed its partnership to integrate Helsing’s AI stack within its unmanned “Wingman” concept, aiming to fuse sensor data and advanced algorithms for collaborative air operations.

As of May 2025, Helsing indicates Centaur is in “advanced development,” with plans to demonstrate its AI pilots to select military audiences. While most activities remain internal, the company is working toward field demonstrations and integration collaborations with defense primes and nations across Europe.

Resilience Factories

Source: Helsing

In response to increasing demand, Helsing has scaled up production of the HX-2. The company has completed its first Resilience Factory in southern Germany. In February 2025, Helsing announced the production of 6K HX-2 drones for delivery to Ukraine, following a previous order of 4K HF-1 strike drones.

Helsing's Resilience Factories are a new type of high-efficiency production facility, designed to ensure local and sovereign manufacturing capabilities for nation states. The first Resilience Factory (RF-1) was completed in December 2024 in Southern Germany and is now operational. RF-1 has an initial monthly production capacity of more than 1K HX-2 drones. Helsing plans to build additional Resilience Factories across Europe, with each capable of scaling production rates to tens of thousands of units as needed, thereby unlocking distributed production capacities for critical defense assets, with each location gaining the ability to source from local supply chains and workforces. The Resilience Factories are designed to ensure uninterrupted production in times of conflict.

Market

Customer

Helsing explicitly only intends to sell to countries that are democracies, with a focus on European NATO countries. The current list of customers includes Germany, Ukraine, and Estonia. In July 2024, Helsing announced plans to invest €70 million in Baltic defense projects over the next three years.

Often, larger contracts are carried out with competitors that sell to similar countries, such as Saab. Helsing’s strategic partnership with Saab resulted in Saab acquiring a 5% stake in the company. This alliance focuses on integrating Helsing's AI software into Saab's Gripen E fighter aircraft, enhancing its electronic warfare and surveillance systems.

Notably, the German Air Force has integrated Helsing's AI software into the Eurofighter Typhoon, enhancing its electronic warfare capabilities. Additionally, Helsing has been selected to develop AI infrastructure for the Future Combat Air System (FCAS), a collaborative project involving France, Germany, and Spain.

In the aerospace sector, Helsing has partnered with Airbus Defense and Space to develop AI technologies for the "Wingman" project, an unmanned fighter-type aircraft designed to operate alongside manned combat jets. This collaboration aims to augment the capabilities of manned aircraft with AI-driven unmanned platforms.

In the maritime domain, Helsing collaborates with Blue Ocean Marine Tech Systems, Ocean Infinity, and QinetiQ to deploy AI and autonomy in underwater operations. This partnership aims to support allied navies in digitalizing ocean surveillance and protecting critical undersea infrastructure.

Furthermore, Helsing has teamed up with Loft Orbital to deploy Europe's first AI-powered multi-sensor satellite constellation. This initiative is designed to deliver real-time intelligence and situational awareness for governmental defense and security applications.

Market Size

In recent years, Europe has significantly increased its defense spending in response to heightened security concerns, particularly following the 2022 Russian invasion of Ukraine. In 2021, only four EU member states met NATO's 2% GDP defense spending benchmark; by 2024, that number had risen to 16. At the end of 2024, European military funding reached €326 billion, with a growing emphasis on collaborative procurement and defense capability development.

A substantial portion of this funding is being directed toward joint procurement initiatives, with 40% of defense equipment expected to be procured collaboratively by 2030. This figure is projected to rise to 50% by 2030 and 60% by 2035, fostering greater intra-EU trade, which is anticipated to represent at least 35% of the market by the end of the decade. Additionally, the European Commission estimates that around €500 billion in new defense investments will be required over the next ten years to meet strategic goals. These efforts are supported by initiatives like the European Defense Industrial Strategy (EDIS), which aims to enhance industrial readiness, promote joint research and development, and reduce reliance on non-EU suppliers.

Source: Bruegel

Competition

Although Helsing is a European defense company, it competes with American companies for similar customers.

Anduril*: Anduril is a defense technology company founded in 2017. It builds technology for military agencies and border surveillance and has raised $3.7 billion in funding as of May 2025. It works with the US and its allies to develop autonomous defense solutions such as surveillance drones and the software needed to operate them. The company offers an operating system for warfare named Lattice that connects sensors and platforms to create a real-time situational awareness system. Furthermore, Anduril offers Bolt, a VTOL kamikaze drone that has 40 minutes of endurance and 20km of range. In contrast to Helsing, Lattice has dual-use cases, and Bolt is a smaller drone with less range and explosive power.

Palantir: Founded in 2003, Palantir is a data analytics company specializing in big data integration and analysis for both defense and commercial sectors, with a market cap of $296 billion as of May 2025. Its core products, Palantir Gotham and Palantir Foundry, enable organizations to manage and analyze vast amounts of data from disparate sources. In contrast to the wide-ranging applications of Gotham, Helsing’s Altra is tailored for real-time land combat and emphasizes autonomous mission management and direct combat support, including features like GNSS-independent targeting and automated fire corrections.

Shield AI: Founded in 2015, Shield AI is an artificial intelligence company that develops both AI-enabled software and hardware for aerial missions, with a focus on autonomous systems. Its flagship product, Hivemind, is an AI pilot enabling drones and aircraft to operate independently in GPS- and communications-denied environments. Shield AI also produces advanced drones such as the V-BAT, a vertical takeoff and landing kamikaze drone with proven combat use in Ukraine, and the Nova 2, optimized for indoor reconnaissance. Comparable to Helsing’s Project Centaur, Hivemind’s relative maturity has positioned it as a category leader in AI fighter pilots. As of May 2025, Shield AI had raised $1.3 billion in funding with a valuation of $5.3 billion.

Business Model

Helsing’s business model is heavily reliant on securing government contracts, which take various forms depending on the client and project. For instance, Helsing provides a hardware solution through the HX-2 kamikaze drone, thousands of which are being produced for Ukraine to enhance its combat capabilities. In other cases, Helsing is selected for advanced software development projects, such as the Eurofighter upgrade in partnership with Saab, a program commissioned by the German Ministry of Defense to integrate AI-enabled electronic warfare capabilities. Additionally, some agreements are broader and long-term, such as Helsing’s partnership with Estonia, where the company has committed to advancing AI-driven military capabilities through investments and collaboration with local industry. These diverse contracts underline Helsing’s strategic focus on tailoring its offerings to meet the specific defense needs of allied democratic nations.

Traction

In June 2024, Helsing established a partnership with Airbus, committing to work together for the AI systems on the Wingman system, an unmanned fighter aircraft that will operate current combat japs. Lastly, in July 2024, Helsing announced a joint initiative with the Estonian government to supply AI software solutions for the Estonian Defence Forces at the NATO Summit, which includes a $70 million investment from Helsing into the country for factories.

As of May 2025, Helsing had gained notable traction in the form of signed government contracts with NATO-affiliated countries across Europe. As Paul Kwan at General Catalyst explained:

“In June 2023, the German government selected Helsing and its partner SAAB to provide the new electronic warfare capabilities for the upcoming update to the Eurofighter. In August 2023, Helsing and its partners won the contract to provide the AI backbone for the Future Combat Air System (FCAS) program. In addition, on February 24, 2024, the Ukrainian Minister of Strategic Industries, Alexander Kamyshin, and Helsing Co-CEO and Co-Founder Gundbert Scherf signed a Memorandum of Understanding on cooperation in the security and defense sector. As part of the agreement, Helsing will equip Ukrainian drones with modern AI capabilities and become a key player in protecting Ukraine’s freedom amid today’s electronic warfare and drone war. This makes Helsing the fastest new entrant in defense to win a program of record in history.”

Valuation

In 2020, Spotify CEO Daniel Ek pledged €1 billion towards funding deep tech “moonshot projects” across the next decade with a focus on European founders. In one of his first investments, in 2021, Helsing raised €102.5 million in a Series A led by Prima Materia, Ek’s investment fund, at a valuation north of €400 million. In September 2023, Helsing raised a €209 million Series B led by General Catalyst as a core investment of the venture firm’s Global Resilience strategy. In July 2024, Helsing announced a €450 million Series C led by General Catalyst at a €4.95 billion valuation. As of February 2025, the company had raised a total of €762 million from investors such as General Catalyst, Accel, Greenoaks, and Lightspeed Venture Partners.

Key Opportunities

Increased European Military Spending

The changing geopolitical environment and the threat posed by Russia have supercharged investment throughout the European continent. As of 2025, military spending had risen to “Cold War levels,” with the highest year increase in the last 30 years. As leading powers across Western Europe have increased their military budgets, they have been hampered by political infighting. For example, in June 2022, the German Bundestag approved a €100 billion special fund for its military.

Although, as of February 2025, political paralysis and partisanship have slowed the supposed “tectonic shift” in military investment. In July 2023, the French parliament approved a €413 billion military budget for 2024-2030, the largest increase in half a century. In December 2024, the collapse of the Macron-led government triggered a special law to continue the 2024 budget into 2025, which would exclude the defense spending boost. In July 2024, the United Kingdom’s Liberal, Kier Starmer-led government, committed to spending at least 2.5% of its GDP towards defense. In October 2024, the UK announced its 2025 spending budget of €2.9 billion, narrowly missing the 2.5% target.

At the same time, NATO-affiliated countries on the Eastern flank near Russia have especially increased their spending. Poland’s defense spending in 2025 is slated for 4.7% of its GDP, a tremendous increase from 2.5% in 2022. Estonia has pledged 3.3% of its GDP towards defense spending. Predictably, as of February 2025, Ukraine plans to spend record amounts towards defense, 26% of its GDP. Lastly, Trump’s election and posture towards NATO have increased pressure for self-reliant European defense. Reil portrays Helsing as a reaction to the Trump Administration:

“We should want to protect ourselves. We should not need to rely on others. We should be equals in a partnership”

In response, European countries have increased their spending and joined the broader European security umbrella. For example, the NATO alliance has established the NATO Innovation Fund, a multi-sovereign venture capital fund that allocates €1 billion for defense technology. In April 2024, formerly neutral countries such as Sweden and Finland were officially admitted to NATO, aligning their strategic interests and defense spending.

Key Risks

Self-Defined Ethical Commitments

Although Helsing is a for-profit corporation that sells defense tools to countries, it has stated that its goal is to “protect democracies” and that it will only work with countries that meet its definition of a democracy. On its website in a section entitled “Navigating the Ethical Landscape”, Helsing states that:

“We put particular emphasis on determining the democracies we work with. To this end, we have established quantitative and qualitative guidelines to help us think about potential customer countries. Often, the decisions are straightforward. Sometimes, they may require further context and information.”

However, this emphasis on ethics and only serving democracies may contradict both the company’s mission to serve NATO and to do what’s best for its business. For example, in a July 2023 interview with Reil, Wired reported that the company did not appear to have clear-cut views on what meets its ethical bar:

“Helsing’s corporate slogan is ‘AI to serve democracies.’ This is meant to illustrate the company’s pledge to never sell to autocratic governments such as Russia and North Korea, says Reil. But what counts as a democracy? When I ask whether the founders would sell to countries like Poland or Hungary—countries within the EU where governments have stripped judges of their independence and cracked down on LGBTQ rights—I do not get an answer.”

Not only that, but the company’s ethical and political point of view may preclude it from doing business with important Western democracies and NATO members like Germany. In a March 2025 interview, for example, Reil stated that it would be a “real problem” for the company to do business with Germany if the political party AfD (Alternative für Deutschland), one of the country’s largest, were ever to come to power.

Such conundrums may put Helsing in the uncomfortable position of deciding which countries qualify as democracies within NATO, and which parties it is acceptable for those countries to elect if Helsing is to do business with them; its position that it will only conduct business with countries that meet its self-defined ethical standard leaves it vulnerable to distrust by those who disagree with its point of view on such questions, and may even cause countries who do currently meet its standards to fear to entrust their defense to a company who may decide it can no longer in good conscience partner with them at some future date.

Speed of Innovation

The ever-changing technological dynamics of the Ukrainian battlefield are a risk for Helsing. In the beginning of the war, Ukraine used Bayraktar TB2s, a larger drone model produced by Turkey, to repel the Russian advance. They were purchased at between $1 million to $5 million a piece. Within months, the Russians responded with surface-to-air missiles, and TB2s quickly became unusable on the battlefield. This ‘cat-and-mouse’ dynamic has continued with the rise of smaller drones. As the use of FPVs rose, Russians responded with jammers, which Ukraine responded to with frequency-hopping modems.

In May 2024, Ukrainian drone manufacturers described that when newly purchased foreign-made drones are delivered, they are already outdated due to the pace of innovation. Helsing’s recent entrance into hardware, through the HX-2 drone, has the potential to be stifled by the rapid pace of innovation, which can render the product negligible by the time it gets onto the battlefield.

Product Criticisms

In April 2025, one report outlined several criticisms from defense experts, former employees, and frontline users. A collapsed strategic partnership with Rheinmetall and criticism from Ukrainian soldiers over the performance and pricing of Helsing-equipped drones had raised concerns about whether the company’s technology can meet expectations. Specific complaints included reports of glitchy targeting software and overpriced drones compared to local alternatives. A Ukrainian military blogger described Helsing’s HF-1 drone as primitive and overpriced, a claim echoed by other sources who noted the company’s steep software markups.

Helsing denied these allegations, stating that its systems had been positively evaluated across more than 100 missions and meet procurement standards in both Germany and Ukraine. Company executives acknowledged past communication challenges but emphasized recent efforts to improve transparency, particularly around its HX-2 drone. The report also indicated that the company has churned through senior personnel and seen partnerships falter over disputes about leadership roles.

In order to continue to build trust in a complex environment like the EU defense industry, Helsing will have to be cautious of how its reputation is formed among key potential customers and partners in order to continue to be successful.

Summary

Startups in defense technology are gaining prominence as global conflicts reshape military strategies. Helsing has emerged as a leader in Europe by developing AI-driven tools that improve battlefield efficiency, such as the Altra platform for real-time decision-making and HX-2 drones for precision strikes. The company’s early success includes securing contracts with NATO countries like Germany and Ukraine while maintaining a strict focus on supporting democracies. As European defense spending rises, Helsing is well-positioned to expand its influence but must adapt to the fast-paced innovation cycles and ethical dilemmas inherent in modern warfare.

*Contrary is an investor in Anduril through one or more affiliates.