Thesis

Partnerships between the Department of Defense (DoD), universities, and technology manufacturers in and around World War II led to the founding of companies like Lockheed Martin and Raytheon. For example, when national security threats emerged, private industry and government facilities came together to produce nearly 300K aircraft and 80K tanks for World War II. However, over the last several decades, willingness to work in defense and national security has cooled as VCs discouraged startups from depending heavily on government contracts. From 2013 to 2017, US VCs invested under $15 billion annually into defense tech startups. By 2024, this had increased to $37.9 billion.

In 2024, geopolitics returned to the forefront of public discourse. Russia’s invasion of Ukraine, Israel’s war with Hamas and other Iranian proxies, and rising tensions with China caused global military spending to surge to an all-time high of $2.4 trillion in 2023, an increase of 6.8% from the prior year adjusted for inflation, and the biggest year-over-year increase since 2009. Since 2020, global defense spending has increased at an annualized rate of 4.2%, marking a 4x rise from pre-pandemic levels. To avoid being left behind, the US accelerated defense spending as well. The 2024 NDAA, which authorized defense spending for FY 2025, allocated $895.2 billion in total defense spending, of which $849.9 billion was for the DoD.

Rising global conflict and increased focus on the modernization of defense systems have changed investor appetite and general sentiment around defense tech. This can be seen in defense tech funding trends. Between Q4 2022 and Q1 2023, the number of global VC investments in defense tech jumped from 60 to 89. Moreover, between 2021 and 2023, US-based defense tech startups secured nearly $100 billion in VC funding, marking a 40% increase compared to the total investments from the previous seven years combined. As of October 2025, global VC funding into defense tech startups reached $7.7 billion, more than double the 2024 levels and the highest annual total on record, driven by larger late-stage rounds.

With more individuals choosing to pursue careers in defense tech and increased funding from the US government for advanced defense technologies, companies like Anduril* are making use of these opportunities by digitizing defense tech operations. One potential opportunity in the space is making sense of the 22 terabytes of data the DoD collects every day.

Vannevar Labs was founded to solve the problem of inefficient traditional methods of collecting intelligence and data. Vannevar Labs seeks to improve intelligence-gathering efforts by developing AI and ML solutions and enhancing data analysis. Vannevar Labs' flagship product, Decrypt, is a foreign text workflow platform that helps intelligence officers find patterns and insights in vast amounts of battlefield information, translate foreign languages, and search for key documents. The company was named after Vannevar Bush, an American engineer and science administrator who played a key role in the development of the Manhattan Project and the creation of the National Science Foundation.

Founding Story

Source: DFJ Growth

Vannevar Labs was founded in 2019 by Nini Hamrick (President) and Brett Granberg (CEO), who founded the company while getting their MBAs at Stanford Graduate School of Business from 2018 to 2020.

Hamrick grew up in the Washington DC area and was drawn to public service because her family and friends’ parents served in the government. For example, her grandfather served in both the military and public office, and her father was a US attorney focused on criminal prosecutions. In middle school, Hamrick began developing an interest in national security after 9/11, when her dad lost a colleague from the FBI in the Twin Towers, and her friends worried about their parents who worked in the Pentagon.

Hamrick graduated from Harvard University in 2011 with a degree in history and worked for the Defense Intelligence Agency (DIA) and the Office of the Director of National Intelligence from 2012 to 2018. She explained that “the path ahead [for her] in government was to start managing teams and eventually divisions or larger parts of organizations,” but before doing that, she was curious about how people outside of the government built companies in the defense space. As a result, she attended Stanford Business School in 2018.

Meanwhile, Granberg’s interest in defense was shaped by a distinct set of experiences. His grandfather lost an older brother in World War II, and his grandmother grew up in Scotland at a time when children were taught to run to their elementary school in zigzags to avoid bombings from German planes. As a result, Granberg felt a deep responsibility to help people who had experienced trauma similar to that of his grandparents.

Granberg, who initially intended to pursue a Math PhD when he went to grad school, shifted to consulting at McKinsey after his advisor doubted his chances of being accepted to a prestigious math program. His work at McKinsey in defense technology strategy sparked a commitment to national security, eventually leading him to In-Q-Tel, an early-stage VC fund, where he focused on investing in AI-driven projects like computer vision and NLP for counterterrorism efforts.

At In-Q-Tel, Granberg learned that the prevailing view was that defense companies needed commercial applications, or provide "dual-use technologies”, to be considered viable investment opportunities. However, Granberg noticed that certain defense-specific problems could only be solved by companies fully dedicated to defense applications because dual-use technology companies require their engineers to juggle their time between two distinct missions, with 90% of the time being focused on commercial uses.

Realizing this, Granberg sought to form a defense-first company that would address some of the problems dual-use companies weren’t able to address. However, to hedge his bets and buy some time, he decided to simultaneously attend business school at Stanford. Since they attended Stanford at the same time, Granberg and Hamrick connected immediately over their shared focus on assisting the defense and intelligence communities. As they began to brainstorm, the first problem they attempted to solve was specific to counterterrorism intelligence — Arabic language data that was stored in different formats.

As of November 2024, Vannevar Labs employed over 150 professionals with diverse backgrounds, including military and intelligence agency veterans, alumni of tech giants like Amazon and Apple, and former employees of established defense tech companies, including Anduril and Palantir.

Product

Vannevar Labs builds computer vision and NLP products for the defense industry. Its software provides battlefield information to allies, identifies threats, and is intended to help the US deter conflict. Vannevar Labs' core competency is processing vast amounts of open-source intelligence (OSINT), and it specializes in aggregating hard-to-access and complex data, applying real-time analysis to translate this information and uncover critical insights.

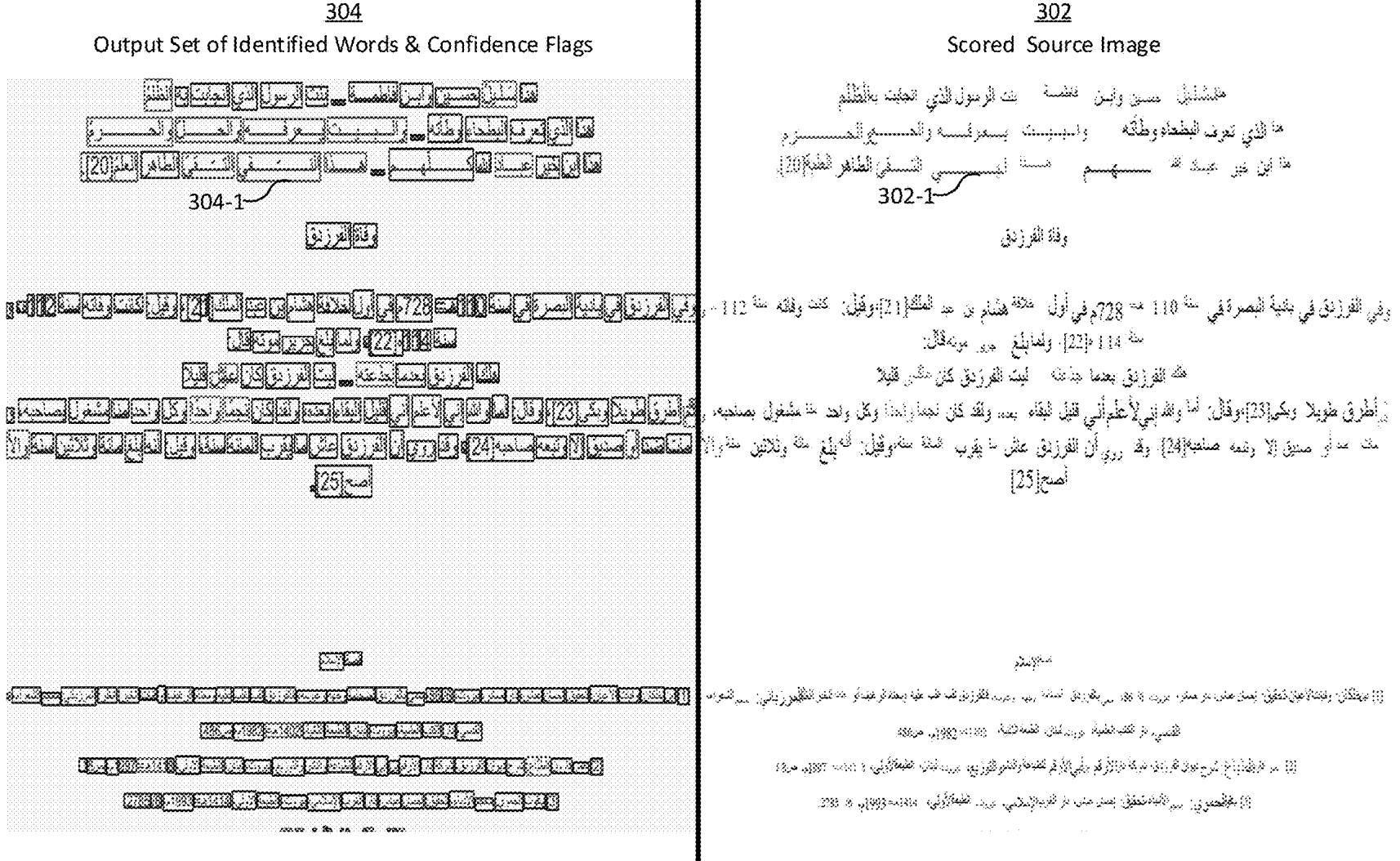

Originally, Vannevar Labs was focused on solving the Arabic optical character recognition (OCR) problem. However, Granberg and Hamrick faced challenges while building as the military's strategic focus shifted from counterterrorism operations in the Middle East to addressing threats from state powers such as Russia and China. Nevertheless, the lessons learned laid the groundwork for what would become Vannevar Labs’ flagship product, Decrypt. Following feedback from product demos, Granberg and Hamrick modified the core architecture of their original product to focus on languages like Mandarin and Russian. Designed to navigate the complexities of modern intelligence gathering, Decrypt offers capabilities in accessing hard-to-find data and transforming it into actionable insights.

Source: The US Patent Office

Vannevar Labs has expanded its product suite beyond Decrypt, introducing new offerings. However, as of November 2024, public details on these products are limited to brief descriptions on Vannevar Labs’ website.

Serra is a product designed to collect and analyze non-traditional intelligence, similar to Decrypt.

Revere and Foreshadow focus on enhancing maritime domain awareness.

Overwatch and Local are aimed at detecting, monitoring, and responding to foreign disinformation campaigns.

Telescope provides tools for emerging missions within the strategic competition spaces.

Additionally, Vannevar has two unreleased products that remain in beta as of November 2024: one is TIE, related to narrative analysis, and the other is Curator, which appears to function as a translation tool. Further information about tools beyond Decrypt is not yet publicly available.

Decrypt

Decrypt is a database scaling entity designed to absorb and analyze vast amounts of data. Its core function is to serve as a "search and discovery" platform atop the extensive data it collects, providing users with efficient access to information that is typically challenging to obtain. As articulated by Hamrick, “Decrypt collects overseas information that would otherwise be hard for military teams to access directly in areas around the world that are increasingly contested.”

Early on, Vannevar Labs recognized that Decrypt’s use case was a top-three priority for the DoD and that the DoD was urgently looking to procure services to address this issue. Initially, Vannevar Labs launched a beta that allowed users to search for a singular data source. Despite the limited functionality, high demand for the product enabled Vannevar Labs to deploy it quickly, gain traction, iterate, and expand adoption. Decrypt launched in January 2021. The description of the product and its use cases mentioned were taken down from Vannevar Labs’ website in June 2024.

Data Collection and Layering: At the heart of Decrypt's functionality is its ability to persistently listen to OSINT and gather hard-to-find data. It draws from various sources, including foreign publications, news sites, social media, and blogs, to gain a comprehensive view of adversaries' perspectives. Decrypt also takes extensive measures to conceal how information is being collected, ensuring that adversaries are not alerted to their efforts. This is significant, as overt interest in specific data can lead adversaries to remove the information of interest or flood sources of interest with false information.

Decrypt also layers multiple intelligence disciplines, including human intelligence (HUMINT) and signals intelligence (SIGINT) to create a comprehensive data repository. This multi-layered approach ensures a holistic view of the intelligence landscape.

Data Harmonization and NLP: The primary value proposition of Decrypt is its data harmonization and NLP capabilities, which allow Vannevar Labs to clean up the data it collects and generate actionable insights. Key use cases include enhanced threat assessment, facilitation of war gaming, and pressure testing analyses. Decrypt has been used by various agencies and military branches, including the US Air Force, which used it to analyze technical documents on Russian anti-aircraft systems.

Search and Delivery Functionality: Decrypt's search indexing capabilities empower users to find specific information efficiently. In addition to streamlining retrieval through its search functions, Vannevar Labs is building a suggestion feature that proactively highlights information relevant to the user's interests. The browser-based platform supports multiple concurrent workstreams and facilitates cross-domain solutions by pulling information as needed, ensuring that users have access to the most relevant and up-to-date data.

Market

Customer

Vannevar Labs' end user profile primarily consists of various units within the US DoD, with its products having been deployed in at least 15 US military bases worldwide. However, selling to these customers presents challenges due to the complex procurement process and the DoD's preference for working with established system integrators (such as Booz Allen Hamilton) or defense primes (such as Raytheon). According to a Government Accountability Report published in July 2025, 80% of the US government’s IT budget is spent on maintaining legacy systems, perpetuating a system where a small number of players dominate.

Furthermore, selling to the government is a relationship-intensive effort and notoriously difficult for startups with limited resources and a scant track record. The decentralized nature of the DoD, with thousands of program managers overseeing different initiatives, complicates market entry. Even if a company successfully engages with an individual program manager, scaling revenue across the DoD remains a challenge. The process of understanding the pain points of service members and intelligence officers is complex and time-consuming, with approval to test a product often taking months. Lastly, the organizations responsible for managing the procurement process are divorced from the end-user. As articulated by Granberg, companies are sometimes forced to play a “multidimensional game of chess”, where they simultaneously balance the needs of the end user versus the demands of those allocating funds.

To address these hurdles, Vannevar Labs leverages flexible contracting mechanisms such as Other Transaction Authority (OTA) agreements and partnerships with the Defense Innovation Unit. These alternative pathways streamline the engagement process with military units and get Vannevar Labs' technology into the military’s hands more efficiently.

As of January 2026, Vannevar Labs’ customer base was US-focused, with no international sales. Specific customers include commands such as the US Indo-Pacific Command (INDOPACOM), Air Force Special Operations Command (AFSOC), US Special Operations Command (SOCOM), and the National Air and Space Intelligence Center (NASIC).

Market Size

The defense tech market is driven by government spending. From 2020 to 2024, contractors received 54% of the Pentagon’s $4.4 trillion in discretionary spending. The National Defense Authorization Act, which specifies the budget, expenditures, and policies of the DoD, authorized $895.2 billion of defense spending for FY 2025, with $849.9 billion allotted to the DoD. As of December 2025, Congress advanced a $901 billion bill setting policy for the Pentagon, which was then signed into law by President Trump.

In recent years, global military spending continued its upward trajectory, with total world military expenditure reaching a record approximately $2.7 trillion in 2024, marking the tenth consecutive year of annual increases amid ongoing geopolitical tensions. The defense tech market in particular is expected to reach $184.7 billion by 2027 and is growing at a CAGR of 15.9%. Within defense tech, the market for AI capabilities in the military is set to expand from $9.2 billion in 2023 to $38.8 billion by 2028, with a CAGR of 33.3% during the forecast period.

Within the expanding defense budget, the market for emerging technologies like OSINT tools is a niche but rapidly growing segment, expected to reach $36.2 billion by 2030. Even when only considering users without access to classified networks, OSINT products remain useful and provide an easy platform for addressing core intelligence questions. Moreover, the reliance on publicly available information enables collaboration with allies and partner nations, allowing them to allocate budgets to these tools and enhance joint intelligence efforts without the complexities of sharing classified data.

However, the TAM for OSINT tools within the defense sector is relatively small compared to other defense sectors like weapons systems or large-scale platforms. Of the $290 billion allocated for R&D and procurement of weapons and systems as of September 2025, a fraction is dedicated to smaller, flexible projects, including emerging technology acquisitions like OSINT tooling. As a result, the market for OSINT tools is limited in scale within the broader defense budget.

As Vannevar Labs introduces new dual-use products, its market size could expand significantly. These products have the potential to tap into larger segments of the defense budget focused on emerging technologies like cybersecurity, data analytics, and AI. By moving beyond traditional intelligence gathering, Vannevar Labs could also choose to mitigate the constraints of a niche market and potentially enter select commercial sectors similar to Palantir, which began with the DoD and later expanded into the commercial sector by helping banks aggregate data for mortgage evaluations.

Competition

Defense-Focused AI and ML Startups

Primer: Founded in 2015, Primer is a company specializing in AI-powered data analysis and integrating AI search and discovery into workflows. Its products can parse, analyze, and search large volumes of data and documents across several languages, allowing Primer to improve time to identify threats via social and news media and to accelerate mission planning and asset tracking. In June 2023, Primer announced a Series D round where it raised $69 million at an undisclosed valuation. As of January 2026, Primer has raised a total of $237 million from investors such as Lux Capital, DCVC, and Avalon Ventures. Vannevar Labs and Primer are similar in that both develop specialized ML solutions designed to enhance data analysis, language processing, and situational awareness. However, Vannevar Labs is hyper-focused on serving the government, and specifically the DoD.

Rebellion Defense: Founded in 2019, Rebellion Defense builds mission-focused AI and ML software tools to solve defense challenges for the government. Rebellion Defense’s product suite includes two products: Iris and Nova. The product suite's functionality encompasses synthesizing various types of collected intelligence data using AI to identify threats, serving as mission planning software to expedite military operations, and detecting security vulnerabilities in missions and systems. Between 2024 and 2025, the company expanded its footprint within the Navy and was designated an awardable vendor under the DoD’s CDAO Tradewinds procurement framework, strengthening its access to scaled AI software programs.

Vannevar Labs and Rebellion Defense are competitors in developing AI solutions tailored for defense and intelligence agencies, focusing on applications that enhance decision-making, situational awareness, and mission-critical operations for national security. In September 2021, Rebellion Defense raised $150 million in a Series B round led by Insight Partners and Venrock, valuing the company at $1 billion.

Accrete AI: Founded in 2017, Accrete AI specializes in NLP and ML technologies for both commercial and defense applications. Its core product, Argus, is an AI software agent designed for threat detection and information operations. In November 2022, Accrete secured a multi-year DoD contract for Argus, and in 2024, received a multi-million-dollar US Army award to further deploy Argus Social for influence and information operations use cases. Accrete AI and Vannevar Labs both provide AI-driven analytics and intelligence tools for government and defense sectors, focusing on solutions that support national security, decision-making, and mission-critical operations. As of January 2026, Accrete AI has raised a total of $79.1 million over ten funding rounds.

Incumbent Defense Primes and System Integrators

Raytheon: Raytheon was founded in 1922 and serves customers in the commercial aerospace and defense industries in a variety of ways, namely through the operation of its subsidiaries. In 2023, Raytheon was the second-largest defense contractor in the US and had developed an extensive range of products that transform unstructured content into actionable analysis. Like Vannevar Labs, Raytheon plans to develop AI-driven capabilities to enhance military decision-making. As of January 2026, Raytheon had a market cap of $267.6 billion.

Northrop Grumman: Originally founded in 1939 and restructured in 1994, Northrop Grumman develops and sells advanced weapons, including aircraft, next-generation space systems, and cybersecurity solutions. In 2024, it was the fourth-largest defense contractor in the US. According to its website, it has AI and ML applications specifically for intelligence use cases, with specific threat detection products that have already secured sizable government contracts. While Northrop Grumman provides a broad range of defense systems and services, Vannevar Labs focuses specifically on advanced AI software to support mission-critical analysis and decision-making for national security. Northrop Grumman has a market cap of $93.9 billion as of January 2026.

Booz Allen Hamilton: Established in 1914, Booz Allen Hamilton is a management and technology consulting firm that provides a wide range of services to both government and commercial clients, with a market cap of $12 billion as of January 2026. With a strong emphasis on defense and intelligence sectors, the company offers expertise in areas like cybersecurity, data analytics, and artificial intelligence. It has secured numerous contracts with the DoD, delivering large-scale solutions and advisory services. Unlike Vannevar Labs, which focuses on specialized AI solutions leveraging harder-to-access data sources, Booz Allen Hamilton offers broader consulting services that often integrate commercial off-the-shelf technologies.

Palantir: Founded in 2003, Palantir is a data analytics company specializing in big data integration and analysis for both defense and commercial sectors, with a market cap of $423.7 billion as of January 2026. Its core products, Palantir Gotham and Palantir Foundry, enable organizations to manage and analyze vast amounts of data from disparate sources. While not considered a Defense Prime by some, Palantir has secured significant contracts with the U.S. government and DoD. On the commercial side, Palantir Foundry is utilized by industries such as finance, healthcare, and energy to derive actionable insights from complex data sets. Unlike Vannevar Labs, which focuses on specialized AI solutions leveraging harder-to-access data sources, Palantir offers comprehensive platforms designed for large-scale data integration and analysis across multiple domains.

Berber Hunter Tool Kit: Bundled by ECS Federal, a major federal software vendor, the Berber Hunter Tool Kit (BHTK) is a collection of surveillance tools from various firms —most notably Dataminr's First Alert news product and solutions from Two Six Systems. Unlike Vannevar Labs' Decrypt, which integrates broad and customizable data analysis into a single product, BHTK requires users to navigate multiple tools depending on their needs.

Dataminr's First Alert offers broad, real-time data aggregation based on global queries, alerting users to worldwide events, but struggles with highly specific, localized information such as unique communication channels in regions like Northeast Syria. In contrast, Two Six Systems provides customizable platforms capable of handling these specific queries and can perform outgoing actions to influence narratives as part of information campaigns — a capability not included in Decrypt. ECS Federal and three other federal contractors jointly own SEWP, which resells Berber Hunter.

Business Model

Vannevar Labs primarily generates revenue by selling specialized software solutions to the DoD and related organizations. Its business model centers around providing SaaS products that offer advanced data analysis and intelligence capabilities. Vannevar Labs’ sales cycle involves conducting pilots, demonstrating the product, and ultimately securing contracts — a process that can span from 6 to 12 months. For new contractors, it often takes at least 18 months of planning before winning their first government contract.

Vannevar Labs often leverages flexible contracting mechanisms like Other Transaction Authority (OTA) contracts to expedite this process. OTA contracts allow the DoD and other federal agencies to enter into agreements for research, development, and prototyping without adhering to the traditional Federal Acquisition Regulation (FAR) process. This flexibility enables Vannevar Labs to engage with military groups that have immediate needs.

Its standard go-to-market strategy involves identifying a group with a specific need and initiating an OTA contract to provide a prototype or pilot. Once users experience the benefits of the product, Vannevar Labs works to expand into larger contracts and, ultimately, seeks inclusion in a program of record for sustained funding and deployment. For example, its first sale of Decrypt was ~$25K, a three-month pilot with four users. By rapidly improving Decrypt to meet more of the users' workflow needs, it converted this pilot into a $1.3 million contract in approximately four months. This information was taken down from the Vannevar Labs website as of November 2024.

In many cases, existing relationships within the DoD have been instrumental for Vannevar Labs. When a customer has already identified its product as the desired solution, the customer may tailor the RFP to align closely with Vannevar Labs' offerings. This practice is facilitated by the company's connections within the government, which creates a relationship moat that could pose a barrier to potential competitors.

Non-traditional defense companies like Vannevar Labs often use OTA agreements and Commercial Solutions Openings (CSOs) through the Defense Innovation Unit to enter the defense market. These mechanisms are particularly valuable because traditional RFPs tend to favor incumbent contractors due to existing relationships and risk aversion among program managers. Through CSOs, companies are paid to develop prototypes, but this does not guarantee a production contract. The process involves submitting a proposal, delivering an oral presentation, and, after competition, receiving contract issuance. If successful, a "success memo" can be issued, allowing the government to award a production contract directly without further competition.

Vannevar Labs typically operates under firm-fixed-price contracts, focusing on delivering specific outcomes and milestones rather than billing for personnel hours. This approach requires it to manage costs while reinvesting in R&D to enhance its product offerings. These improvements not only address evolving customer needs but also generate additional revenue, creating a "flywheel effect" where satisfied customers drive further adoption. Notably, for every dollar invested by the DoD, Vannevar Labs has attracted more than $3 of private funding for further product development.

Pricing for Vannevar Labs' products varies significantly based on project scope and complexity. It offers both per-user (seat pricing) and enterprise pricing models, though seat pricing is the primary approach. Smaller projects may cost around $75K to $80K, while more complex contracts can reach $650K to $750K. Factors influencing pricing include data harmonization requirements, analytics complexity, deliverables, geographic considerations, and specific subject matter needs. These prices are substantially higher than traditional enterprise software solutions like Salesforce or Quip, reflecting the specialized nature of Vannevar Labs' products.

To navigate the complexities of defense contracting and access established channels, Vannevar Labs often collaborates with larger defense contractors and systems integrators like Booz Allen Hamilton. In some instances, Vannevar Labs acts as a subcontractor under Booz Allen Hamilton’s contracts. While this arrangement provides entry into broader contracts and leverages Booz Allen Hamilton’s established relationships, it may also impact profitability due to the margins added by the prime contractor.

While initial contracts often come from individual military units with discretionary funds for prototyping, these funds are limited and insufficient for widespread deployment. Vannevar Labs recognizes that to achieve significant scale and secure larger, long-term contracts, they need to become part of a program of record within the DoD. Inclusion in a Program of Record locks in multi-year funding and enables its products to be widely adopted across the military, providing a stable and recurring revenue stream.

Securing a place in a program of record involves working with Program Executive Offices (PEOs), which allocate funding in multi-year tranches known as the Program Objective Memorandum (POM). This process requires formal justification of the product's necessity through Capability Development Documents (CDDs), which identify gaps in current capabilities. Once a requirement is established, the acquisition process typically follows a competitive approach involving Requests for Information (RFIs) and Requests for Proposals (RFPs). While this process is complex, it’s what’s necessary for Vannevar Labs to scale its solutions across the DoD.

Traction

Vannevar Labs has continued to scale its presence within the DoD well beyond its early growth trajectory. After growing its annual contract value from $3.5 million in 2021 to $49 million in 2023, the company secured a major production contract from the Defense Innovation Unit valued at approximately $99 million in late 2024, with an initial $16 million obligated to expand deployments across DoD mission sets. Revenue grew from $3.5 million in 2021 to $80 million in 2024, with Vannevar achieving profitability within three years — a feat that took industry peers like Palantir more than a decade.

Vannevar Labs was featured on Forbes' list of the top 50 AI companies in April 2025 for the second year in a row and has scaled its team to over 200 employees as of December 2025. It also announced a partnership with Databricks in October 2024 to enhance its AI-driven defense tools, improving the accuracy of essential capabilities like sentiment analysis and strengthening contributions to defense missions. On the deployment front, Vannevar’s technology has been fielded in major joint military exercises, including Balikatan 2025 and Talisman Sabre 2025, and its AI tools have been cited by US Marine units as force multipliers in Pacific operations.

Valuation

Vannevar Labs raised $75 million in a Series B round in January 2023, which valued it at $575 million. This brought the company’s total funding to $87 million, where it remained as of January 2026. Notable investors include Felicis, General Catalyst, Point72 Ventures, and Costanoa Ventures.

Vannevar Labs ended 2024 with $80 million in revenue. Based on its Series B valuation, that would result in a ~7.2x revenue multiple as of December 2025. As a sector, defense tech startups raised $218 billion from 2019 to Q2 2025 across 5.2K deals. Anduril raised $2.5 billion in June 2025, making it the largest fundraising in the history of the defense tech industry. From January 2025 to November 2025, Palantir’s stock was up nearly 123%, compared to an increase of 16% in the S&P 500 over the same timeframe.

Key Opportunities

Geopolitical Tensions Driving Demand

Escalating geopolitical tensions have led to increased demand for advanced defense technologies, with global military expenditure rising by 3.7% to $2.2 trillion in 2022. Similar expansion of DoD spending creates an opportunity for Vannevar Labs to extend and grow existing contracts while also expanding its product line to service new and changing government demand.

Expansion Into Financial Market Intelligence

Vannevar Labs could leverage its expertise in data analytics and NLP to assist in diligence or forecasting upcoming events that impact financial markets. Similar to how Palantir expanded from defense contracts to aiding large banks in assessing mortgage applicants by aggregating data from various sources, Vannevar Labs could provide financial institutions with actionable insights. By pulling data from multiple feeds, including OSINT and proprietary data, it could offer services that help clients make informed investment decisions, manage risks, and stay ahead of market-moving events.

Expansion Into Hardware

Vannevar Labs has an opportunity to vertically expand into hardware as it expands its product catalog. By developing an integrated security infrastructure that enables real-time collection of open-source information, Vannevar Labs could transcend the limitations of web scraping for data to inform its NLP capabilities. This would allow it to establish a hybrid data-collection technique, combining OSINT with proprietary data gathered from its own devices. This would mirror the strategy of Anduril, which strategically built both software and hardware products to own more of the outcomes. In just five years, Anduril has developed a wide range of innovative software and hardware assets and has been effective in securing government contracts.

Financial Counterintelligence and Cybersecurity

Vannevar Labs could focus on filling unmet needs in financial counterintelligence and cybersecurity, particularly in areas like monitoring blockchain transactions and cryptocurrency usage related to terrorism financing. By developing tools and platforms that can analyze and track suspicious financial activities across decentralized networks, the company could offer valuable services to government agencies and financial institutions.

Talent Acquisition

In 2023, Silicon Valley has seen a shift towards greater support for defense tech companies. As a result, it has become easier to acquire high-quality talent. As layoffs from tech companies continued in 2023 and the defense sector expanded its spending and investment, there is a potential opportunity for defense tech startups to pick up talented engineers to expedite product development.

Key Risks

New Product Risk

Go-to-market for defense tech companies requires meaningful funding, familiarity with existing military force structure, testing and certification requirements, and an intimate understanding of the DoD's unique operational requirements. The DoD needs constant vendor support to maintain the product for its entire life cycle. This has historically skewed contracts towards a handful of established defense companies.

Given this dynamic, any new product that Vannevar Labs launches, as it looks to expand its product ecosystem, will be subject to the arduous sales process of the DoD and be forced to beat out legacy defense primes. Effectively, any new product launch comes with risk for Vannevar Labs, as the DoD may or may not adopt it. Even if it wins a pilot contract, the potential for churn exists when working to convert a single-year contract to a multi-year contract. In the world of VC-backed defense tech, funding is typically raised after contracts are secured, so failing to secure a multi-year contract after the first year can negatively impact valuation, forward-looking financial metrics, and future fundraising.

Limited Data to Build Efficient Models

Commercial AI algorithms require a lot of data paired with examples of what to do and what not to do to perform specific tasks. Defense AI applications rarely have access to breadth and depth of data when compared to commercial models. With limited data, poorly defined environments, and unreliable communications, AI for defense is forced to do more with less. For Vannevar Labs, getting access to enough quality data to build effective models could be a technical risk.

Security and Privacy Risk

When dealing with mission-critical and highly sensitive data, especially as a startup, Vannevar Labs is at risk of data breaches and attacks. To address this risk it must put robust security measures in place to protect against cyber threats, data breaches, and unauthorized access. Maintaining data privacy and complying with relevant data protection regulations is of utmost importance when dealing with classified, mission-specific data. Unlike consumer-facing big tech data breaches, of which there are many, should a defense tech company have classified information stolen, it could be a much more significant issue.

Competitive Risks

One of the primary risks to Vannevar Labs is the relatively low technological moat surrounding its products. While Vannevar Labs identified a niche market that was previously unserved, the actual technology may be feasible for larger competitors like Palantir to replicate. The primary challenge has been selling to the DoD and establishing revenue channels, not developing the technology itself.

Although the company has a structural and cultural moat through specialized customer support and military-centric product development, this advantage might not be sufficient against competitors like Anduril or Palantir. These firms already have strong relationships within the defense sector and can integrate similar functions into existing contracts, potentially giving them a leg up. Vannevar Labs risks being outmaneuvered by these established players who can leverage their existing infrastructure and relationships, making the company vulnerable to competition from big players who can quickly develop similar solutions.

Lack of a Commercial Business

Selling exclusively to the government presents challenges, particularly around pricing scrutiny and limited scalability. Without a commercial market to benchmark prices, Vannevar Labs could face pressure from the government to justify costs, often leading to reduced margins. Furthermore, techniques used to gather certain information in the intelligence sector may not be viable in the commercial space due to legal barriers such as the Foreign Intelligence Surveillance Act (FISA), constraining potential growth and revenue diversification.

Summary

Startups building products for the defense sector are growing in number, value, and importance as geopolitical tensions escalate across the world. Vannevar Labs has enabled intelligence officers to comprehend, target, and respond to foreign entities through the use of AI that is designed specifically for the sector. It has managed to attract talent, demonstrate usage across agencies and groups, and had early success in securing government contracts. The next phase of the company’s life cycle will be tested with its ability to produce a product ecosystem and if it can extend single-year contracts to multiple years. As AI and ML solutions are becoming more important for national security and intelligence, Vannevar Labs is well-positioned to serve the DoD but has work to do to gain market share in the evolving space.

*Contrary is an investor in Anduril through one or more affiliates.