Thesis

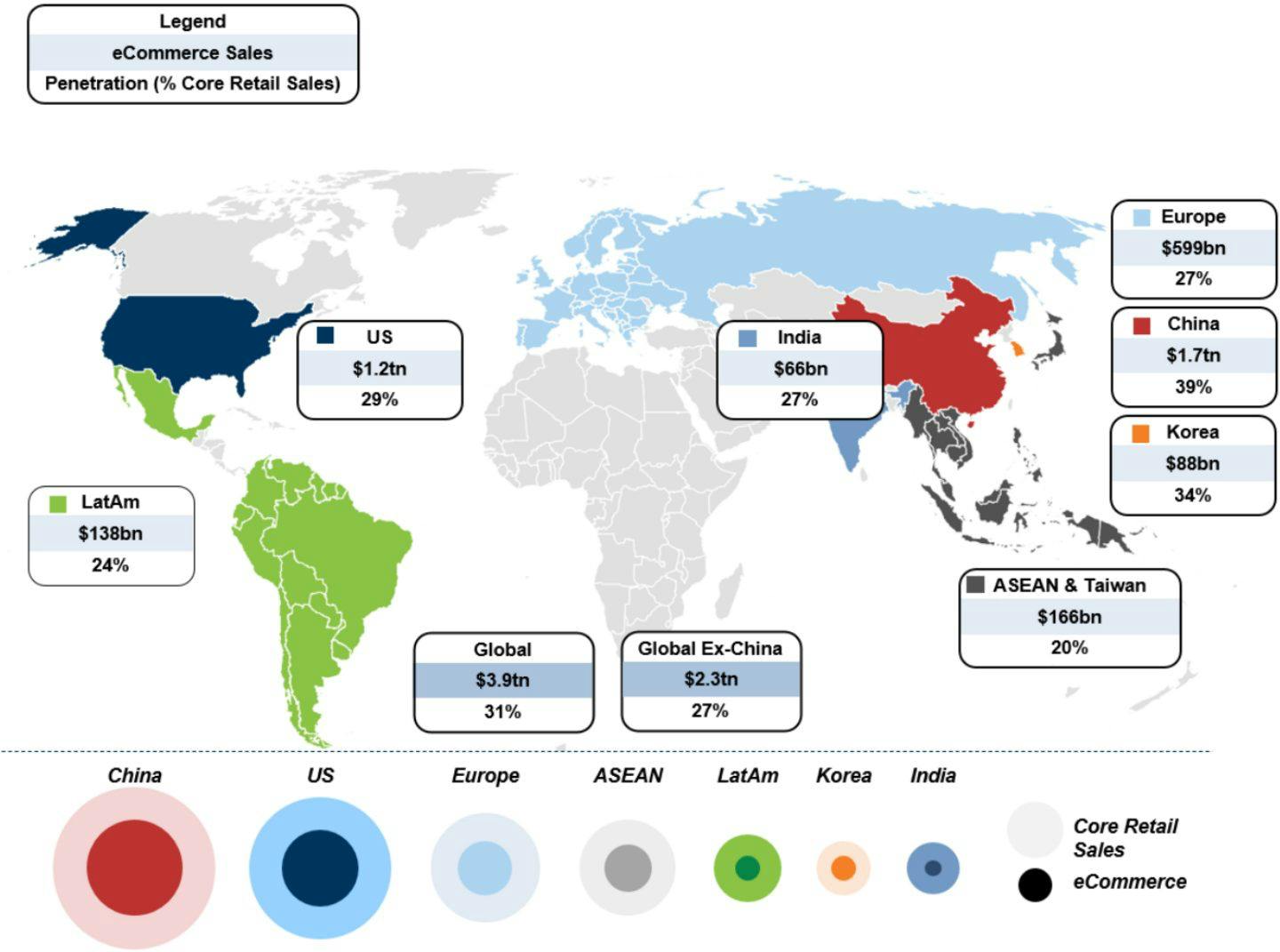

Ecommerce commands a large and growing share of the retail market. In 2023, global ecommerce sales were $3.6 trillion, and were expected to reach $5 trillion by 2026. The COVID-19 pandemic was a major accelerant for this trend: in 2020, the first year of lockdowns, the share of global retail sales that took place online increased from 13.6% to 18%, equating to roughly the last four years of online ecommerce growth combined.

Supply chain and logistics are important aspects of what has enabled this growth. In warehousing, for example, 1.3 million square feet of distribution space must be built to match every $1 billion increase in ecommerce sales. Ecommerce supply chains require greater complexity than traditional brick-and-mortar due to distributed customer bases and short delivery times.

This complexity is expected to increase. At an operational level, ecommerce supply chains for smaller players must keep pace with Amazon’s rapid compression of delivery times, going from more than eight days in the early 2000s to two days in 2015, which has created a broad change in consumer expectations. In 2022, a survey showed that 90% of US online shoppers expected shipping within two to three days, and 25% of customers were willing to pay a premium for same-day delivery.

Beyond the challenge of compressed delivery times, the ecommerce market itself is becoming increasingly global. On the supply side, social media has spawned a long tail of merchants. In China, social media-led sales, known as social commerce, drove 16.3% of total ecommerce sales in 2023, a number which was expected to reach 25% by 2025. Emerging markets are also seeing growth, with ecommerce in Latin America and the Philippines growing at 22% and 24% in 2023, respectively.

Satisfying the demands of their global customer base, coming from a variety of demand channels, poses a difficult task for ecommerce merchants. To lessen the burden, merchants can outsource their supply chain function to third-party logistics providers (3PL). 3PLs best positioned to serve these merchants are tech-native: they likely run a warehouse management system to manage labor and inventory and have tight integrations with ecommerce platforms.

ShipBob is a logistics company that provides a suite of products designed to streamline ecommerce supply chains. Its global network of fulfillment centers and software platform enables merchants to store and ship inventory sold on popular ecommerce channels and major retail marketplaces, eliminating the need for manual fulfillment processes. ShipBob’s solutions aim to shorten delivery times, reduce shipping expenses, and give businesses the ability to scale more efficiently. As of June 2025, ShipBob operated over 60 fulfillment centers worldwide and had fulfilled over 200 million orders, according to the company.

Founding Story

ShipBob was founded in 2014 by Dhruv Saxena (CEO) and Divey Gulati (COO).

Saxena and Gulati met while growing up in New Delhi, India. In 2007, they both emigrated to the US to pursue undergrad studies. Saxena studied electrical engineering at Purdue, and Gulati studied computer engineering at UIUC, graduating two years early and earning his MBA over the remaining two. After leaving school in 2012, the pair moved to Chicago, with Saxena working as a developer for a small startup and Gulati working as a consultant for Deloitte.

On nights and weekends, Saxena and Gulati worked on many side projects, one of which was an ecommerce business selling retro-style mobile photos. As engineers, they tried to automate each piece of the company but got stumped when it came to logistics. They found themselves spending too much time at the post office waiting to ship out each order. To outsource their logistics, Saxena talked to 3PLs, but providers were reluctant to take on their business due to the small order volume of about 500 orders a month. This fell far below most 3PLs’ minimum threshold of 10K orders a month.

To further understand the problem, Saxena and Gulati stood outside Chicago post offices and talked to anyone carrying lots of packages. They found many ecommerce merchants had similar issues and were desperate for a logistics solution. With the problem identified, the pair etched a go-to-market strategy and pitched their idea to Y Combinator. They were accepted into the Spring 2014 cohort, propelling them to quit their jobs and pursue ShipBob full-time.

Source: ShipBob

While in YC, ShipBob’s KPI was the number of shipments done on the platform. To achieve this, Gulati and Saxena would manually pick up inventory from merchants daily and bring it to the most cost-effective carrier to ship. This all sat on a basic web app, which they would show to more people at the post office for their input. The business model was simple: $5 per package shipped. At some point, the merchants suggested it was easier for ShipBob to store the inventory itself.

ShipBob saw meaningful traction against its KPI. In its first nine months, the company grew over 35% month-over-month and hit $1 million in revenue. Once storing customer inventory in their Chicago apartment got to be too crowded, they purchased warehouses. Saxena and Gulati worked in the warehouses every day, learning the intricacies of day-to-day operations.

The pair codified their learnings into their warehouse management software, allowing them to scale similar operations globally. Jivko Bojinov, an early employee, noted that ShipBob reached escape velocity once the company began partnering with other third-party warehouses. This allowed ShipBob to increase its geographical footprint much more easily than buying each warehouse outright.

Source: ShipBob

In May 2025, ShipBob hired Adam Patnaude as its new CFO. Prior to joining ShipBob, Patnaude was the CFO of GrubHub, where he had spent nine years. Speaking about the hire, ShipBob COO Divey Gulati commented that:

“As we look ahead, Adam's financial acumen, specifically in understanding complex tech-enabled operating models like ours, will be instrumental to sustainably accelerate our growth and continuing to help our merchants realize the benefits of ShipBob's scale."

Product

ShipBob offers a fulfillment platform designed for ecommerce merchants. Through its global fulfillment network and software interface, merchants can power and manage their entire supply chain.

Outsourced Logistics (3PL)

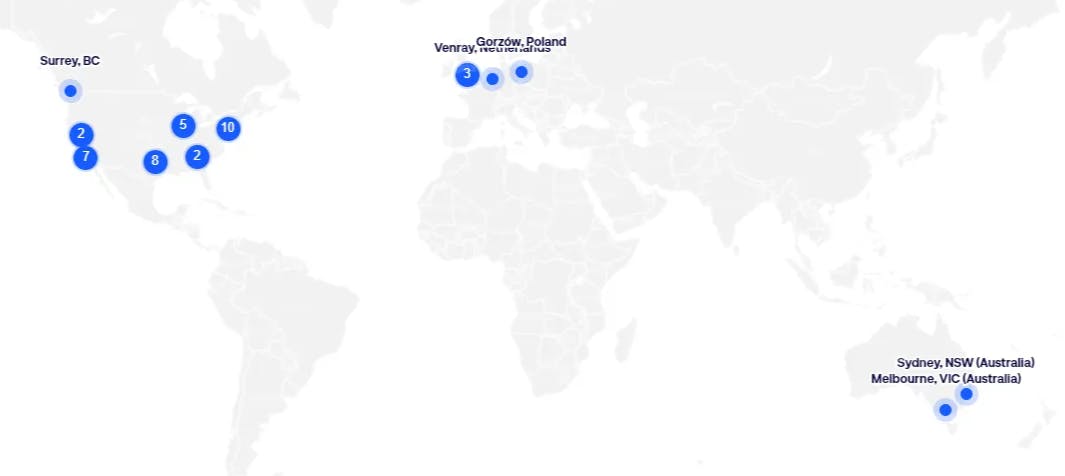

ShipBob's core product offering is outsourced fulfillment, also known as third-party logistics. With a network of over 50 fulfillment centers as of December 2024, merchants can start by sending their products to a ShipBob fulfillment center. Their inventory will then be stored across various fulfillment centers. Once a merchant’s customer places an order, ShipBob handles the picking, packing, and shipping processes.

Source: ShipBob

ShipBob’s network of fulfillment centers spans across the US, Canada, the EU, the UK, and Australia, allowing merchants to ship to over 250 destinations as of June 2025. This network features a mix of warehouses, some owned and operated entirely by ShipBob, and others operated through a partnership model called the ShipBank Fulfillment Network (SFN). While SFN warehouses are not owned by ShipBob, they operate using the company’s warehouse management system and are functionally identical. ShipBob’s large geographic footprint allows the company to provide merchants with guaranteed two-day shipping coverage across 100% of the continental US.

ShipBob enables merchants to sell across an array of channels, including ecommerce platforms like Shopify, 100+ retailers, online marketplaces, and Amazon as of June 2025. When merchants sign up for ShipBob, they also get a free analytics tool that assists in order management, year-end reporting, and inventory management.

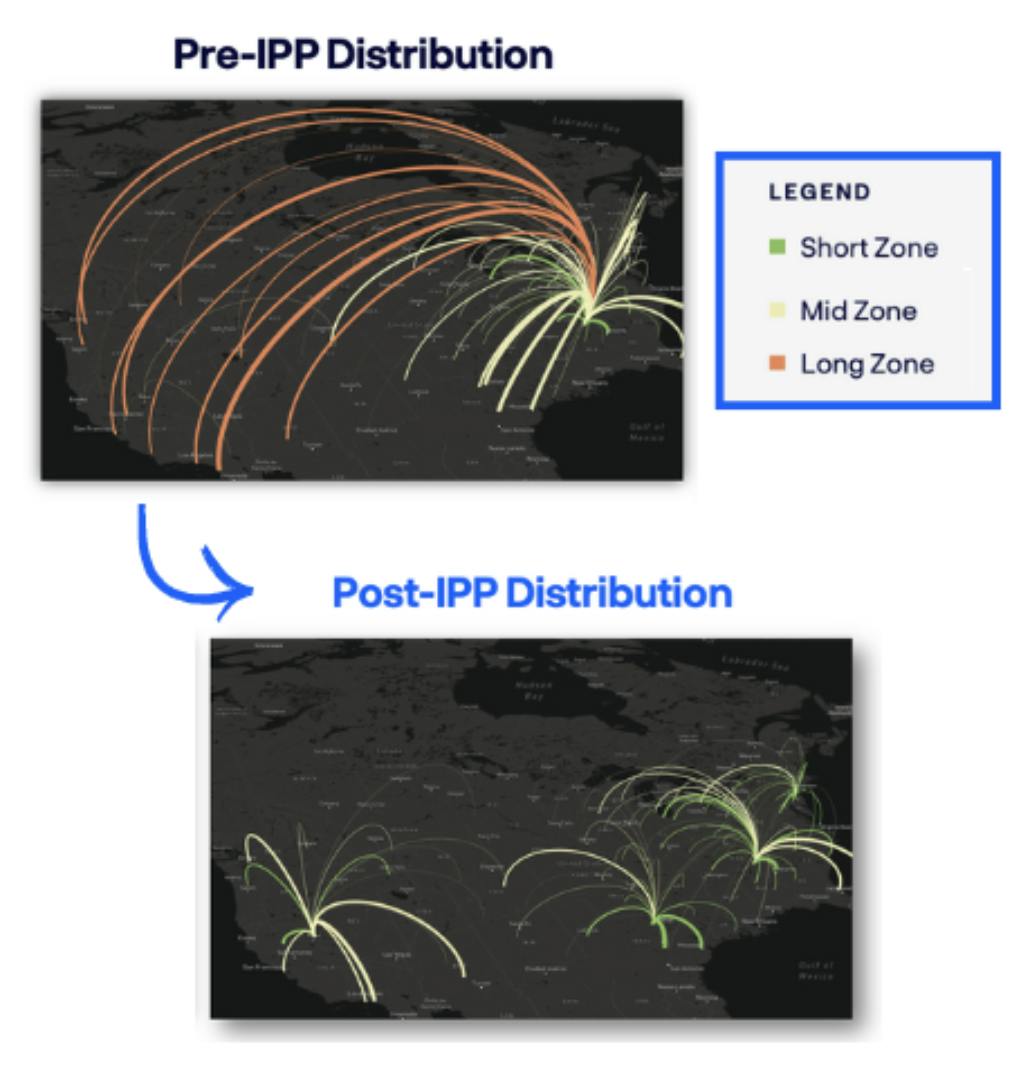

Distributed Inventory: If a merchant opts to use the Inventory Placement Program (IPP), merchants can further simplify their logistics by shipping their inventory to one fulfillment “hub location”, reducing inbound freight costs. Using its AI Decision Engine, ShipBob will then strategically distribute the inventory across its network, placing inventory closer to end customers, in turn providing faster and cheaper shipping.

Source: ShipBob

Customer Experience: ShipBob enables merchants to own the unboxing experience and increase their customer retention through the Customization Suite. The suite includes customized kitting capabilities (combining multiple products into single SKUs), a process that can be optimized both in terms of box dimensions and SKU combinations. To further enhance customer experience, merchants can design boxes and include marketing inserts and personalized gift notes.

Source: ShipBob

Zone Skipping: In June 2025, ShipBob rolled out a nationwide zone-skipping service that loads parcels bound for the same region onto dedicated trucks, line-hauls them to a regional hub, and only then hands them to last-mile carriers, cutting transit times on eligible lanes by one full day and lowering damage risk. The launch also introduced TrackBob, a time-stamped tracking interface that reduces “where-is-my-order” inquiries by giving shoppers Amazon-style visibility from pick to doorstep.¹

A May 2025 ShipBob guide explains that zone skipping consolidates thousands of packages into a single shipment, bypassing multiple sort centers to save on carrier fees and trim delivery windows from four to five days to roughly two or three. The strategy pays off for merchants with high regional order density and dovetails with ShipBob’s Inventory Placement Program, distributed-inventory model, and two-day US coverage. The goal is to boost margins while keeping carbon footprints and last-mile costs in check.

Other Products & Services

Warehouse Management Software: In July 2022, ShipBob began offering its warehouse management software (WMS)—the software platform the company uses to run its fulfillment centers—as a stand-alone product for other 3PLs, warehouses, and larger ecommerce operations. ShipBob’s WMS is designed to streamline operations for a warehouse, from staff onboarding to packing inventory. Inventory and order data are tracked by image, location, and status. Once it's time for the product to be shipped, the WMS helps optimize the picking and packing process with flexible options and intuitive onboarding.

ShipBob Plus: Launched in April 2025, ShipBob Plus is an enterprise-grade tier that layers a high-touch service model onto ShipBob’s global infrastructure. The program bundles four modules: Supply Chain Plus, Technology Plus, Support Plus, and Access Plus. These modules are intended to give mid-market and enterprise brands priority receiving, tailored shipping rates, demand forecasting, direct API/solutions-architecture support, and executive-level account sponsorship. ShipBob positions the offering as an “operational command center” that lets fast-growing brands convert logistics from a cost center into a growth lever as they scale from $100 million to multi-billion-dollar revenue runs.

Market

Customer

ShipBob primarily serves SMB and middle-market ecommerce merchants. As of 2023, ShipBob’s SMB merchants typically conducted between 1K and 10K shipments per month. While its middle-market merchants are anything above the 10K threshold, the typical merchant in this category has 40-50K shipments a month. In its early years, ShipBob worked exclusively with SMBs, as Saxena and Gulati understood the problem first-hand, but as its merchants grew in size, the company’s client base evolved.ShipBob’s merchant customers include Dossier, PetLab Co., and Pit Viper.

In addition to serving ecommerce merchants, ShipBob also serves other 3PLs through its WMS product and SFN partnership program. As of June 2025, ShipBob limits access to its WMS to warehouses that ship between 3.5K and 120K orders a month. With the SFN partnership program, ShipBob rents out space from the partner, providing order flow and usage for the warehouse. As of June 2025, some of ShipBob’s customers in these areas include GPA Logistics, Brilliant Fulfillment, and Geneva10 Fulfillment.

ShipBob Plus, launched in April 2025, targets merchants that have outgrown traditional SMB 3PLs and now ship tens of thousands of units across multiple channels and regions. Early adopters include Tonies, whose team credits the program with moving over one million Tonieboxes in the US while sustaining 50 percent year-over-year growth. Other notable customers of ShipBob, as of June 2025, included Bloom, Spikeball, PetLabCo, 100 Thieves, Clearstem, and Chamberlain Coffee.

Market Size

In 2023, US 3PLs earned $129 billion in net revenue. This net revenue figure was 12.8% lower than in 2022. Global 3PL revenue in 2023 was $1.2 trillion, a 18.5% decrease from 2022. Reasons for these declines in revenue include decreased transportation rates, declines in air and ocean freight demand, and an increased focus on cutting logistics costs. The global 3PL market is expected to grow to $1.8 trillion by 2027.

Zooming out to the ecommerce market broadly, US retail ecommerce sales were $1.2 trillion as of September 2024. Globally, ecommerce sales were $3.6 trillion in 2023 (30% of global retail sales) and are expected to grow at a CAGR between 7% and 14% until 2028. As of September 2024, US retail ecommerce sales were $1.2 trillion. Key drivers for this growth in this market include increased adoption in non-US and non-China markets and omnichannel shopping.

Source: Goldman Sachs

Competition

Competitive Landscape

Within ShipBob’s core market of outsourced logistics, at the SMB level, it is overshadowed by Amazon, which had $28.6 billion in 2023 logistics revenue, followed by a long tail of smaller, regionally-focused providers. ShipBob, as well as the competitors listed below, sit between these two extremes — each one is ultimately trying to present a compelling alternative to Amazon FBA for the ecommerce merchant. The four key differentiators in this space include price, technology, value-added services (e.g., two-day shipping), and reach (both in terms of geography and platform integrations).

Competitors

ShipMonk: Founded in 2014 by Jan Bedar, ShipMonk is a logistics platform for ecommerce merchants. The company operates 12 fulfillment centers across the US, Canada, Mexico, and the EU as of June 2025. At a product level, both companies are functionally the same: a previous ShipMonk employee said the two companies are in a race to beat each other on price, marketing, and a marginally better customer experience.

In a December 2022 interview, Bednar said that ShipMonk differentiates itself with vertical integration, as the company owns and operates all of its fulfillment centers. Bednar also mentioned the company being profitable since its founding, another potential differentiator. ShipMonk has raised a total of $365 million in funding as of June 2025 from investors including Periphas Capital and Summit Partners.

Flexport: Founded in 2013 by Ryan Petersen, Flexport is a supply chain logistics platform and freight forwarder. In May 2023, Flexport acquired Shopify’s Logistics arm for an undisclosed amount. The acquisition included Deliverr, which Shopify had purchased for $2.1 billion the previous year. Prior to the acquisition, Deliverr primarily served SMB merchants and was viewed as a close competitor to ShipBob and had raised $490.9 million from investors including Tiger Global and Coatue.

By integrating within Flexport’s broader freight forwarding platform, customers can benefit from having their entire supply chain work end-to-end on the platform. Nonetheless, it has struggled financially. At the time of its acquisition by Flexport, Deliverr was reportedly losing $4-5 per order, which was driven in part by its 5 million square feet of warehouse space. To mitigate this, in October 2024, Flexport announced plans to shift the business to an asset-light model by 2027.

Stord: Founded in 2015, Stord is a logistics platform designed for companies to compete and grow using logistics. Similar to ShipBob, the company operates a large fulfillment network. In addition to 11 anchor facilities owned by Stord, the company also gives merchants access to its “Premier Partner Network” of over 1K warehouse facilities. This large network was contributed in part from its acquisition of FulfillmentWorks, a smaller B2C fulfillment provider, in September 2021 for an undisclosed amount. The company has raised a total of $525 million in funding as of June 2025 from investors including Founders Fund, Lux Capital, and Kleiner Perkins. In May 2022, the company announced it had crossed $200 million in ARR.

Business Model

ShipBob’s main revenue generation comes from its 3PL business, which is monetized through charging customers on a per-shipment basis. In other words, for every product ShipBob sends, it charges the merchant a single fee comprising the picking, packing, shipping, packaging materials, and labor involved. These fees vary per shipment. Product weight, shipping zone, and market rate are the main drivers of this fee. For a merchant selling small products like cosmetics, the fee would be around $4-6.

The basic unit economics on ShipBob’s shipment fee are that for every dollar ShipBob gets in shipment fees, 15 to 25 cents go to labor and technology costs, and 45 to 55 cents go directly to the carrier shipping the end package (e.g., FedEx, UPS, or USPS), leaving a 20-40% gross margin. The rates that ShipBob pays to carriers are often cheaper than what a merchant would pay, due to their high order volume and negotiating power.

In addition to its per-shipment fee, ShipBob also earns revenue by charging service fees for inventory receiving ($35 and up) and storage ($5 and up), and product add-ons like kitting and returns. ShipBob’s WMS product earns revenue via a one-time implementation fee and a monthly software fee. These service fees are often higher-margin than its core 3PL revenue, boosting the company’s profit margins to roughly 25%.

While ShipBob’s product relies on a vast physical warehouse network, since the company doesn’t own most of these warehouses, its balance sheet can remain relatively asset-light. This reduces ShipBob’s overall margin, as it must now share some of its revenue with the warehouse provider, but it in turn allows the company to scale faster and mitigate balance sheet risk.

Traction

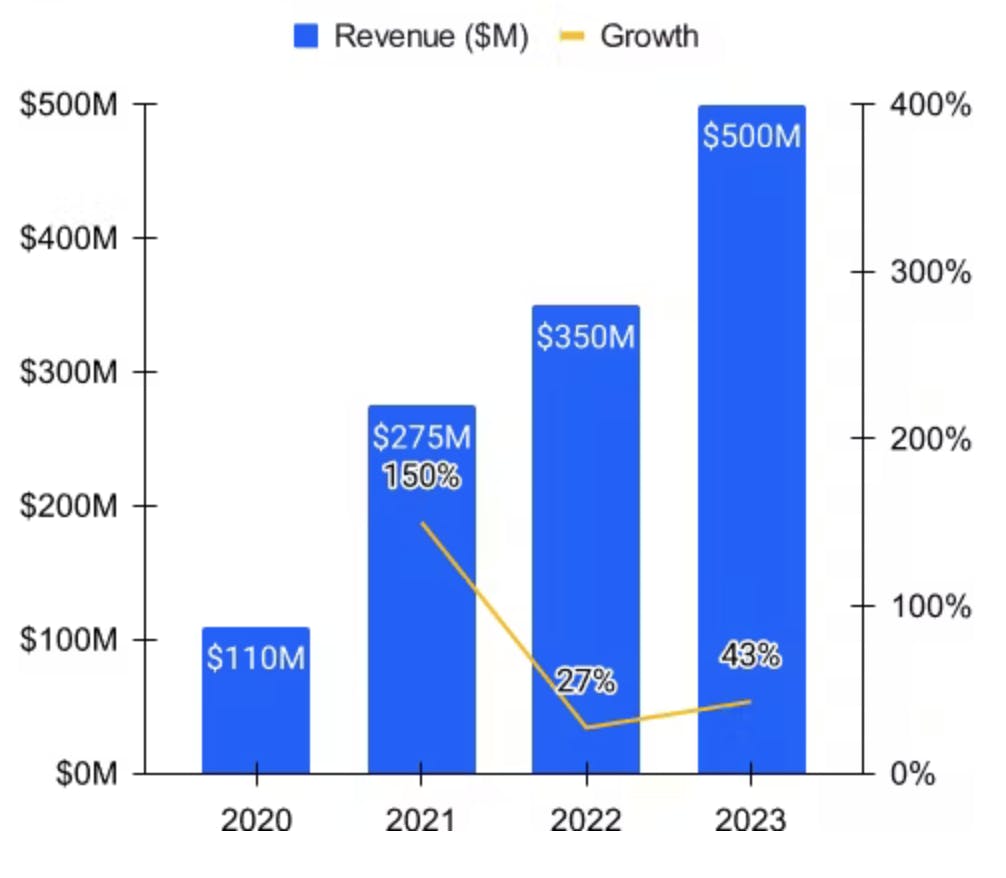

In Q4 2020, ShipBob reported that it was cash flow positive for the first time. In 2023, ShipBob earned $500 million in revenue, a 43% increase from 2022. As of 2023, the company served over 7K customers and processes $4-5 billion in GMV annually. ShipBob’s revenue growth was boosted by the company’s partnership with the TikTok shop, which was announced in September 2023. Through this partnership, ShipBob handles the picking, packing, and shipping for any TikTok sale in the US. ByteDance expected TikTok Shop sales to hit $17.5 billion in 2024. While the platform was launched in September 2023, by the end of 2023, it had already sold to 500K US sellers.

Source: Sacra

Other growth levers for the company have included bulk shipping offerings for retailers (late-2021) and its WMS product offering (mid-2022). While traction for the WMS product had not been reported as of December 2024, its retail-shipping service proved to be more complex than initial expectations, causing some brands to stop using the service.

In April 2025, ShipBob rolled out a plug-and-play connection with Temu that allows US SMB and mid-market merchants to link accounts, sync catalogs and inventory, and ship Temu orders straight from ShipBob’s domestic warehouse network without requiring any middleware. The goal of the partnership is to give ShipBob sellers instant access to Temu’s millions of shoppers while ShipBob keeps fulfillment in-house.

Then, in May 2025, ShipBob added the marketplace SHEIN as a native channel, giving fashion and lifestyle brands one-click order, inventory, and tracking sync plus nationwide two-day delivery via ShipBob’s US fulfillment centers. The partnership lets SHEIN sellers sidestep cross-border delays and tariffs, pairing the platform’s low-fee storefront with ShipBob’s high-speed logistics.

Valuation

ShipBob raised a $200 million Series E at a $1.1 billion valuation in June 2021, led by Bain Capital Ventures. Over seven funding rounds, the company has raised a total of $330.5 million in funding as of June 2025 from investors including Bain Capital Ventures, Menlo Ventures, and SoftBank Investment Advisers. It was reported in February 2024 that ShipBob was planning for an initial public offering in 2025 and hoped to reach a valuation of $4 billion, implying an 8x revenue multiple from 2023 reports. However, as of June 2025, no additional reports have surfaced of ShipBob proceeding with an IPO.

Key Opportunities

Multi-Channel Accessibility

As consumers increasingly expect seamless shopping experiences across platforms, from Shopify stores to social platforms like TikTok, ShipBob is well-positioned to accommodate these demands. Through its network of integrations, ShipBob helps merchants consolidate their back-end operations under one roof, reducing complexity and encouraging retention. As merchants expand into new channels, ShipBob can cross-sell higher-margin value-added services such as kitting and custom packaging, reinforcing its role as an end-to-end logistics partner. This omnichannel strategy, paired with ShipBob’s global fulfillment footprint, could further differentiate ShipBob from competitors in an otherwise commoditized industry.

Strong Economies of Scale

Because ShipBob consolidates shipments across a large merchant base, it can negotiate more favorable carrier rates and capture higher gross margins on each order. Those gains in profitability can be reinvested into additional warehouses, expansion of its value-added services, and improvements to its warehouse management software, reinforcing a virtuous cycle of growth. As this network effect accelerates, ShipBob can pass along some of these cost savings to merchants, thus enhancing customer loyalty and further growing volumes.

Non-Amazon Ecommerce

ShipBob’s strategy aligns well with the rise of D2C and marketplace sellers who seek an Amazon-caliber logistics experience without the need to join Amazon’s ecosystem. Although Amazon remains a dominant player in ecommerce, the surge in GMV from social channels and other third-party platforms presents an opportunity for ShipBob to become a robust, tech-enabled logistics solution for the “rest of ecommerce.” By continuing to expand its fulfillment network and deepen its integrations across Shopify, Target, and TikTok Shop, ShipBob can capture meaningful market share as non-Amazon ecommerce continues to scale globally.

Key Risks

Struggling Customer Base

Many of the D2C and small-to-mid-sized brands ShipBob serves experienced a surge in sales during the COVID-19 pandemic, but are now grappling with softened demand, reduced venture funding, and rising acquisition costs. As these merchants work to stabilize or downsize their operations, they may ship fewer units or shutter altogether, directly impacting ShipBob’s shipment volumes. Should a critical mass of these merchants fail or consolidate, ShipBob could see a slowdown in its own growth trajectory or face higher churn rates.

Industry Consolidation

As the ecommerce fulfillment landscape becomes more competitive, pricing pressure is likely to intensify. Larger logistics companies and 3PLs may resort to aggressive pricing strategies or acquire smaller players to expand their network, further challenging ShipBob’s position. Additionally, if deep-pocketed competitors develop in-house software capabilities on par with ShipBob’s offerings, ShipBob may find it harder to command premium pricing for its tech stack, which could compress margins and slow its path to long-term profitability.

Summary

ShipBob is a global ecommerce fulfillment platform that combines an asset-light warehouse network with proprietary software to help merchants store, manage, and ship products across multiple channels. By offering distributed inventory, robust integrations, and value-added services like kitting, ShipBob aims to deliver a seamless logistics experience typically associated with Amazon. Its comprehensive offering covers everything from inbound freight and inventory optimization to last-mile delivery, making ShipBob an appealing solution for both SMB and mid-market merchants.