Thesis

For centuries, so-called “bakkals”, neighborhood grocers that deliver goods within their communities and serve as social hubs, have dotted nearly every street corner in Turkey. These local institutions allow customers to shop, socialize, and even purchase items on credit via an informal ledger, simultaneously serving as convenience stores, community centers, and quasi-banks. With their unique combination of convenience and familiarity, bakkals have long been a fixture of local commerce in Turkey.

As Turkey has modernized, however, consumers increasingly turned to the low prices and wide selection of big retailers. The country rapidly digitized and went online; internet adoption in Turkey nearly doubled from 40% in 2010 to 78% in 2020. As this happened consumer preferences underwent another shift toward online and app-based services. The COVID-19 pandemic further accelerated these trends around the world, ushering commerce into a new, more digital era and, with millions stuck in their homes, catalyzing demand for online and ultrafast grocery delivery.

As a result, in Turkey, online grocery sales grew by 434% in the first half of 2020 alone. The US was no different: a 2021 survey found that nearly 60% of consumers were buying groceries online, up from 37% in 2019. Despite the relative infancy of ultrafast delivery, by 2022, nearly 42% of men and 28% of women in the US said that they had used a same-day grocery delivery service.

Bridging the gap between traditional bakkals and this new digital economy, Getir is a company that originated in Turkey and operates in several countries. It offers ultrafast food and grocery delivery and other on-demand services. Leveraging a vertically integrated network of distribution centers and couriers around the world, Getir can deliver groceries, toiletries, and other items to urban users in as little as 15 minutes. The company has expanded its offering into restaurant delivery and car-sharing and is building a global brand that stretches from the US to Europe.

Founding Story

Getir is an Istanbul-based company that was founded in 2015 by Nazim Salur (CEO), Serkan Borançılı, and Tuncay Tütek.

Previous to founding Getir, Salur had founded a ride-hailing app called BiTaksi in 2013. While there, he realized that the same cabs the company was using to ferry passengers across Istanbul could be repurposed to swiftly deliver groceries and other products across the city. Salur soon left BiTaksi to pursue this idea in earnest, and after successfully pitching two Russian oligarchs, which was the subject of some controversy, he was given $9 million in funding and began building Getir.

From the beginning, the startup faced an uphill battle. Competition, both from tech-enabled players and traditional bakkals, was fierce. Creating detailed, up-to-date mapping of Istanbul was a large and complicated task, and matching the supply of drivers with demand from customers was a difficult balancing act.

Amidst these challenges (and a wider economic crisis within Turkey), Getir struggled to grow. The company was forced to make a number of strategic tweaks and pivots, including franchising most of its distribution centers in mid-2017 and abandoning van deliveries in favor of mopeds and bicycles. These changes paid off. In 2017, it reportedly saw a 400% increase in revenue growth and has since seen sustained traction.

Product

Getir offers a fast online delivery service for consumers and relies on a web of vendors and intermediaries to facilitate deliveries. A dense network of mostly franchised distribution centers and couriers manages deliveries, while Getir itself handles product selection, pricing, mapping, the shipment of items to the distribution centers, and the in-app experience for users.

Ultrafast Delivery

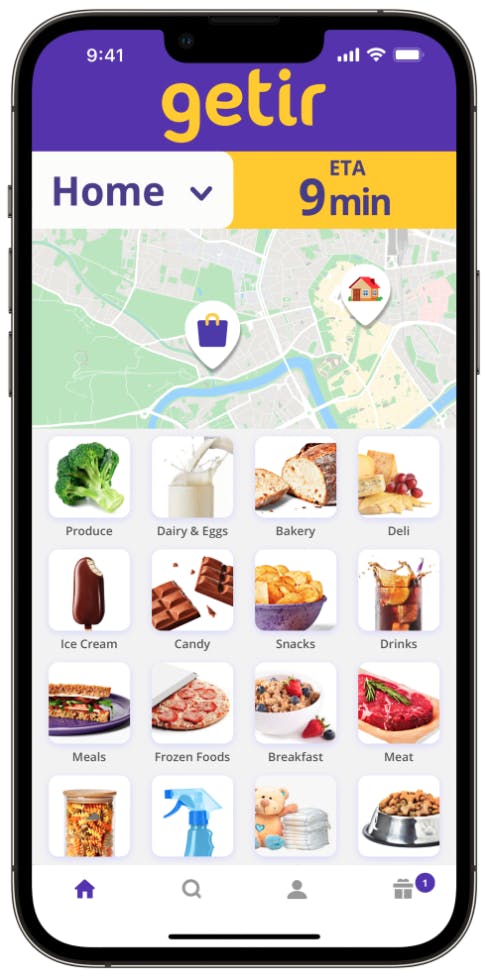

Through Getir’s mobile app, buyers can browse a wide selection of groceries, toiletries, and other products, select the items they want, pay for their order, and track it through a live map. Nearly 2K items from leading brands were available at each distribution center as of September 2022, and the inventory displayed on the app is updated in real-time.

Once an order is received, a warehouse employee collects and packs the purchased items, typically in less than two minutes. A courier, clad in a distinctive purple and yellow Getir uniform and using a company-subsidized vehicle, then picks up the order and delivers it to the customer, all with full transparency through the live tracking tool. Using this vertically integrated model, Getir can fulfill orders in as little as 10-15 minutes.

To ensure couriers can meet these quick timelines, deliveries are limited to certain urban areas, and addresses are validated automatically when entered into the app. In 2021, Getir operated in 81 cities in Turkey as well as the UK, the Netherlands, France, Spain, Germany, Portugal, and the US, and it eventually expanded to Italy. However, in July 2023, the company announced it was going to withdraw from Italy, Spain, and Portugal. It said it would continue to operate in the UK, the US, Germany, the Netherlands, and Turkey.

Source: Getir

Promotions & Rewards

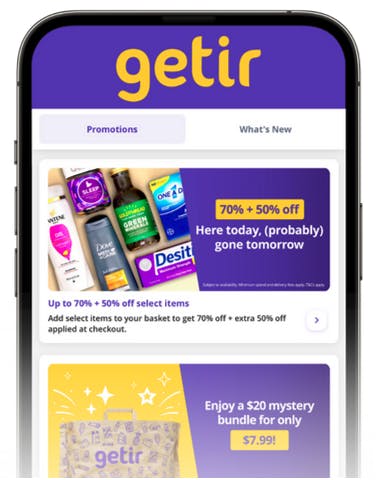

Getir provides a range of promotions and rewards to promote purchases and engage and retain customers. These offerings include discounts on orders, free delivery, and unique product bundles, all of which are presented on a single tab within the mobile app. Unlike its rivals such as Uber Eats or Gopuff, Getir does not place advertisements of brands on its app, instead using promoting rewards and incentives.

Source: Getir

GetirBiTaksi

After signing a strategic partnership with BiTaksi in 2021, Getir launched GetirBitTaksi, a ride-hailing service. Users in Turkey can call and pay for a cab from BitTaksi’s established network of drivers directly within the Getir app. The ties between Getir and BiTaksi go beyond this strategic cooperation, of course: Getir’s founder and CEO Nazim Salur founded BiTaksi back in 2013, and Getir has previously invested in BiTaksi as well.

GetirFood

GetirFood is a restaurant delivery service. The tool is built into the main Getir app, allowing users to browse food categories and restaurants, order, and pay in one flow. This is intended to create a seamless, efficient delivery experience. The service is available across Turkey, and customers can choose between two different delivery methods: “Restaurant Delivery”, where unaffiliated couriers fulfill the order, and “Getir Delivery”, where users pay an added fee to have the order delivered more quickly by a Getir courier.

GetirDrive

GetirDrive is a short-term car-sharing app. Introduced on the back of Getir’s acquisition of Moov, a Turkish car rental startup, GetirDrive allows customers to browse nearby vehicles, select and unlock the one they want, and pay for as many miles as they use, all through a standalone mobile app. As of December 2023, the service is available in Istanbul and Izmir, deepening Getir’s ecosystem of products in the country.

GetirJobs

Another standalone app borne out of an acquisition, GetirJobs is a location-based matchmaking platform for employers and jobseekers. Launched in 2022, the app allows users to build their profiles, browse nearby jobs, and securely communicate with employers. The service is available only in Turkey, connecting job seekers all over the country with tens of thousands of job listings.

Market

Customer

Getir is focused on urban millennials and younger people who frequently use smartphones and ecommerce, but it serves a variety of demographics and use cases. As of December 2023, Getir delivers to customers in select cities within the US, UK, Germany, the Netherlands, and Turkey, having wound-down operations in France, Italy, Portugal, and Spain

Generally, online food delivery caters to the young and wealthy, a group whose money and tech savviness make them ideal customers for apps like Getir. Older demographics are entering the market as well, though, with more than 40% of those who order online delivery every month over the age of 40, per a 2021 industry survey. While many of Getir’s customers are looking for convenience, others are seeking deals and discounts, particularly in 2020 and 2021 when many online delivery services were offering rewards and incentives to gain market share.

Market Size

While demand for quick commerce fell significantly in Western European markets after the COVID-19 pandemic ended, the quick commerce market is projected to continue to see growth globally in the post-pandemic period. The global quick commerce market was valued at $133.1 billion in 2022 and was expected to grow to $602.8 billion by 2032, representing a CAGR of 16.4%. Driving this growth is the fact that consumers are growing increasingly more comfortable and familiar with the quick commerce space. Additionally, as Getir explores new products and verticals, its market opportunity may expand. The global ridesharing market, for example, was estimated to be worth more than $69 billion in 2022 and growing at a CAGR of 14%.

Competition

While only a few startups remain in the space, competition in food delivery is intense. Getir competes most directly with vertically integrated players like Gopuff that control their own distribution centers, but it also faces pressure from indirect competitors like Uber Eats and Deliveroo which utilize third-party warehouses.

Billions in capital flowed into ultrafast delivery during and after the COVID-19 pandemic. generating much of this competitive pressure. In Europe, Flink, Gorillas, Weezy, Blok, Dija, Fancy, and Cajoo all launched in 2020 and 2021 alone, each with millions in venture funding. While a wave of consolidation and bankruptcies in 2022 and 2023 left only a few independent players standing, low switching costs for customers for different alternatives, along with encroachment from online grocery stores, diversified ecommerce players, and other platforms all contribute to a highly competitive landscape.

Gopuff: Gopuff is a quick commerce platform that delivers snacks, beverages, and other convenience items to customers in as little as 30 minutes. Founded in 2013, the company initially targeted college students and other young adults in the US, but has since transitioned to a wide array of demographics, facilitating orders via its website and mobile app and its network of fully-owned micro-fulfillment centers.

As of August 2023, it had raised $3.4 billion in total funding and had achieved a valuation of $15 billion. Gopuff has engaged in aggressive marketing and has acquired several smaller rivals, but it has struggled to overcome stagnating consumer demand after the COVID-19 pandemic and challenging economics, forcing the company to conduct three rounds of layoffs in 2022 and 2023, forcing it to turn to Uber, one of its key competitors, to help fulfill orders. It has since downsized its geographic focus significantly to the US and UK.

Flink: Flink is a Berlin-based online grocery platform. The company was founded in 2020 but quickly expanded across Germany, raising a $240 million Series A in June 2021 just six months after its launch. Flink uses the same self-operated distribution model that Gopuff and Getir employ. In December 2021, it raised a further $750 million in a Series B round that valued the company at $2.9 billion.

Like many of its competitors, Flink used M&A to expand its footprint, acquiring French rival Cajoo in May 2022, but the company could not escape the shifting macroeconomic tides and saw a drastic reversal of fortunes. It underwent significant layoffs in May 2023, having declared bankruptcy in Austria in December 2022 and in France in June 2023. Getir sought to acquire the company in 2023, but Flink walked away from talks. Instead, it raised a €150 million round from existing investors in May 2023 at a significant haircut to its previous valuation, bringing its total funding to $1.2 billion and keeping the company afloat.

Yemeksepeti (Delivery Hero): Yemeksepeti is a Turkish grocery and restaurant delivery platform. Originally launched as an online ordering system for restaurants in 2001, the company slowly built its brand and product suite across the region. By 2015, when it was acquired by German quick commerce giant Delivery Hero for $589 million, the startup had amassed more than 3.7 million users and close to 100K daily orders across Turkey and the Middle East. The company has grown post-acquisition, most notably through its launch of Banabi in 2019, an ultrafast delivery platform – a move that has brought it into closer competition with Getir. Yemeksepeti has faced criticism around its treatment of its employees, though, which boiled over into a multi-day worker strike in 2022.

Business Model

Getir has two main revenue streams: markups on purchased items and delivery fees. For its markup, the company purchases its products from wholesalers and then charges 5-8% above the prices in a large grocery chain. Getir then adds flat delivery fees on top (a $1.95 charge in the US as of December 2021) but often waives these fees for customers through promotions and rewards.

On the back end, Getir has a highly capital-intensive operating model. While the majority of distribution centers are franchised, each of its brick-and-mortar warehouses could cost in the neighborhood of $200K if similar in cost to Gopuff’s micro-fulfillment centers (not including inventory). Additionally, the majority of Getir’s workforce, including couriers, are full-time employees with full benefits, adding to costs. Ultimately, every new market requires “local infrastructure, local people, and local operations, “ which are expensive to build out and maintain.

Of course, Getir’s adjacent offerings, like its taxi and restaurant businesses in Turkey, require additional infrastructure and expertise, deepening the complexity of the platform. And Getir’s slew of acquisitions have created redundancies in operations, prompting job cuts and closures of distribution centers.

Traction

Getir saw significant traction early on. By 2018, Getir had surpassed 3 million total orders and amassed a network of nearly 600 delivery vehicles and 60 distribution centers. In 2019, Getir expanded its operations to Ankara and three other Turkish cities, delivering more than 1.5 million orders in December of that year alone. The company soon parlayed this success into its first large institutional round: a $38 million Series A in January 2020.

As demand for contactless and online food and grocery delivery soared in the wake of the COVID-19 pandemic, Getir took advantage, increasing its revenue by close to 400% in 2020. On the back of this growth, Getir closed its Series B, C, and D in quick succession from January to June 2021, raising more than $1 billion in less than six months and growing its valuation to $7.5 billion. Armed with this infusion capital, the company began a campaign of expansion around the world: it followed up its entry into London in January 2021 with Amsterdam, Berlin, and Paris just a few months later. It then made the leap across the Atlantic with a US launch in November 2021.

At its peak, Getir was one of the largest delivery and digital commerce players in the world. The company acquired Gorillas, Blok, and other smaller rivals in an attempt to maintain its market position, but as the macroeconomic environment turned, the same challenges that plagued Getir at the beginning of its existence resurfaced: competition, regulatory uncertainty, tight margins, and unreliable consumer demand, forcing layoffs and broader business tightening.

In 2022, before the ultrafast delivery bubble popped, Getir oversaw a network of 1.1K distribution centers across 81 Turkish cities and 48 other markets around the world, serving an active user base of more than 3 million and delivering almost 1 million orders daily. When the bubble burst, though, Getir was forced to close distribution centers en masse and withdraw from France, Spain, Portugal, and Italy entirely.

Getir previously claimed to be profitable in certain neighborhoods and markets, but sources reported in July 2023 that the company as a whole was burning more than $100 million per month. These cash flow issues have become very public: Getir conducted significant layoffs across the company in 2023 and, in the UK, even auctioned off mopeds and called on staff to go door-to-door promoting the company’s brand. Meanwhile, in the US, Getir acquired New York City-based online grocery company FreshDirect in September 2023.

Valuation

At its height, Getir was valued at close to $12 billion, a valuation it achieved with its $768 million Series E in March 2022. At that point, the company had raised $1.8 billion in total funding since its inception, including participation from investors like Sequoia Capital, Tiger Global, and Alpha Wave Global.

In April 2023, industry sources reported that Getir was nearing a deal to raise an additional $500 million from existing investors that would almost halve its valuation to $6.5 billion. In July 2023, the company confirmed that it was raising capital, detailing that it was finalizing a round from Abu Dhabi state fund Mubadala and other investors. It raised this $500 million round in September 2023 at a valuation of just $2.5 billion, less than a quarter of its valuation from its Series E the year before.

Key Opportunities

Advertising

While markups and delivery fees will likely continue to make up the bulk of Getir’s revenue, advertising for brands within the company’s ecosystem represents an opportunity to increase revenues and improve margins. Unlike some of its competitors, Getir does not widely sell product placements or promotions within its app, decluttering the customer experience but abdicating a potentially significant source of revenue. By contrast, Getir’s rival Gopuff has pursued this channel, with its CEO even arguing that its business model is predicated in some ways on in-app advertising for brands. Amazon and other global players have proven that advertising within digital commerce experiences can be a lucrative strategy at scale.

Product Adjacencies

Getir has already tentatively expanded into new verticals like car-sharing and restaurant delivery, but significant opportunities still exist for adjacent products. The company has expressed its intention to cut back on capital-intensive expansion plans, but financial services are one potential avenue that may still remain: Uber, for example, has invested heavily in its payments and banking offering, further monetizing its massive base of users and couriers. Travel booking is another potential addition, a channel that would deepen Getir’s “super app” proposition”. And since Getir remains essentially a single product in markets outside of Turkey, it could bring its nascent offerings like GetirDrive and GetirFood into the US and other markets it operates.

Partnerships

Partnerships remain a potential growth lever for Getir. Grocery chains, marketplaces, and other brands are increasingly investing in ultrafast delivery and more convenient, efficient shopping experiences, and Getir is well-positioned to capitalize on that momentum. Getir already partnered with Just Eat Takeaway in November 2022 to offer its products on the latter’s marketplace, and Gopuff has similar relationships with Uber. Additionally, 99% of retailers want to implement same-day delivery by 2025, opening up a significant opportunity for Getir to become the go-to logistics and infrastructure provider for such offerings.

Key Risks

Uncertain Market Size

While consumer demand for ultrafast delivery increased dramatically during COVID-19, inflation, the economic downturn, supply chain issues, and a return to pre-pandemic spending patterns have decreased it significantly. One poll from RPI suggests that more than 90% of people who used online delivery services during the pandemic would likely revert back to their original way of shopping. Others argue that consumers care more about fulfillment than speedy delivery, with only 2% of shoppers saying that they would pay an additional fee for ultrafast delivery in an industry survey. It’s unclear whether ultrafast delivery can be anything more than a luxury product and the size of the long-term market is far from certain.

Path to Profitability

As the wave of bankruptcies and consolidation in 2022 and 2023 demonstrated, the ultrafast delivery industry is a “notoriously difficult place” to turn a profit. Getir itself was losing more than $100 million per month as of July 2023, while its now-subsidiary Gorillas had reportedly been losing an average of €1.50 for every €1 it generated in net revenue before being acquired, spending almost all of the $1.3 billion that it had raised.

Profitability issues have been an industry-wide problem: delivery startup Jokr, which has since pulled out of the US and Europe, was losing $13.6 million on just $1.7 million in sales in 2021 according to one report. Endless promotions and incentives, excessive hiring, and bloated operations all contributed to unfavorable unit economics. Significant scale may drive down costs and some companies in the space have even experimented with extending delivery times or moving into luxury items to stem the losses, but questions still linger around whether Getir and other delivery platforms will be able to make money in the long run.

Regulatory Uncertainty

Getir relies on the cooperation and tacit support of local officials in the regions it operates, so any obfuscation from regulators is a serious threat to the company’s business. Regulators in markets around the world are increasingly cracking down on online food delivery and quick commerce brands. Uber has been perhaps the biggest target of this attention, but Getir has come under fire as well — it withdrew from France in June 2023 in part because of harsher regulations from local authorities. Until regulators establish more clarity around how distribution centers are taxed and treated, how couriers are classified, etc., the future of the ultrafast delivery space is uncertain.

Labor Disputes

Like many quick commerce brands, Getir faces scrutiny around the treatment of its couriers and other employees. Unlike Uber and Deliveroo, though, Getir employs a workforce largely made up of full-time employees, all of whom have pensions, holiday pay, and other benefits. Nevertheless, it remains firmly under a microscope, particularly as competitors have left the space and the company has become one of the industry leaders. While some employees agree that Getir has better working conditions than UberEats or Deliveroo, Getir still has its issues: workers have detailed the company’s culture of intense pressure around packing and delivering items quickly, while others have even alleged that Getir is shorting its employees’ pay. This criticism has spilled out into the open, with opposition cropping up on social media and the company facing a lawsuit over labor issues in 2022.

Summary

As the dust begins to settle on the frenzy of consolidation, bankruptcies, and media hyperbole within the online delivery space in 2022 and 2023, Getir has emerged as one of the last independent players. Online and ultrafast delivery has become a regular piece of nearly every major city, and Getir, with its established9 ecosystem of distribution centers, couriers, and users, is poised to continue to drive the momentum forward across the space. New products and channels, whether through partnerships and acquisitions or internal methods, will be key to that growth, but significant challenges still remain: demand is uncertain, Getir’s path to profitability is incredibly challenging, and regulatory and media scrutiny continues to pile on. The opportunity around quick commerce is massive, but as some argue, Getir may need to reinvent itself to survive.