Disclosure: Contrary was an early investor in Zepto through one or more affiliates. Materials included in this report include a mix of private conversations and public sources and do not constitute investment advice.

Thesis

The Indian economy, which is among the largest and fastest-growing on earth, is expected to grow 6.3% in 2025. For comparison, this was three times as fast as the US, which is forecasted to grow 1.7% in 2025. India’s economic growth is likely to bring many Indians to online commerce for the first time in the coming decade. Hundreds of millions of Indians are expected to enter the ecommerce market by 2027, which is growing rapidly at a rate of between 25% and 30%.

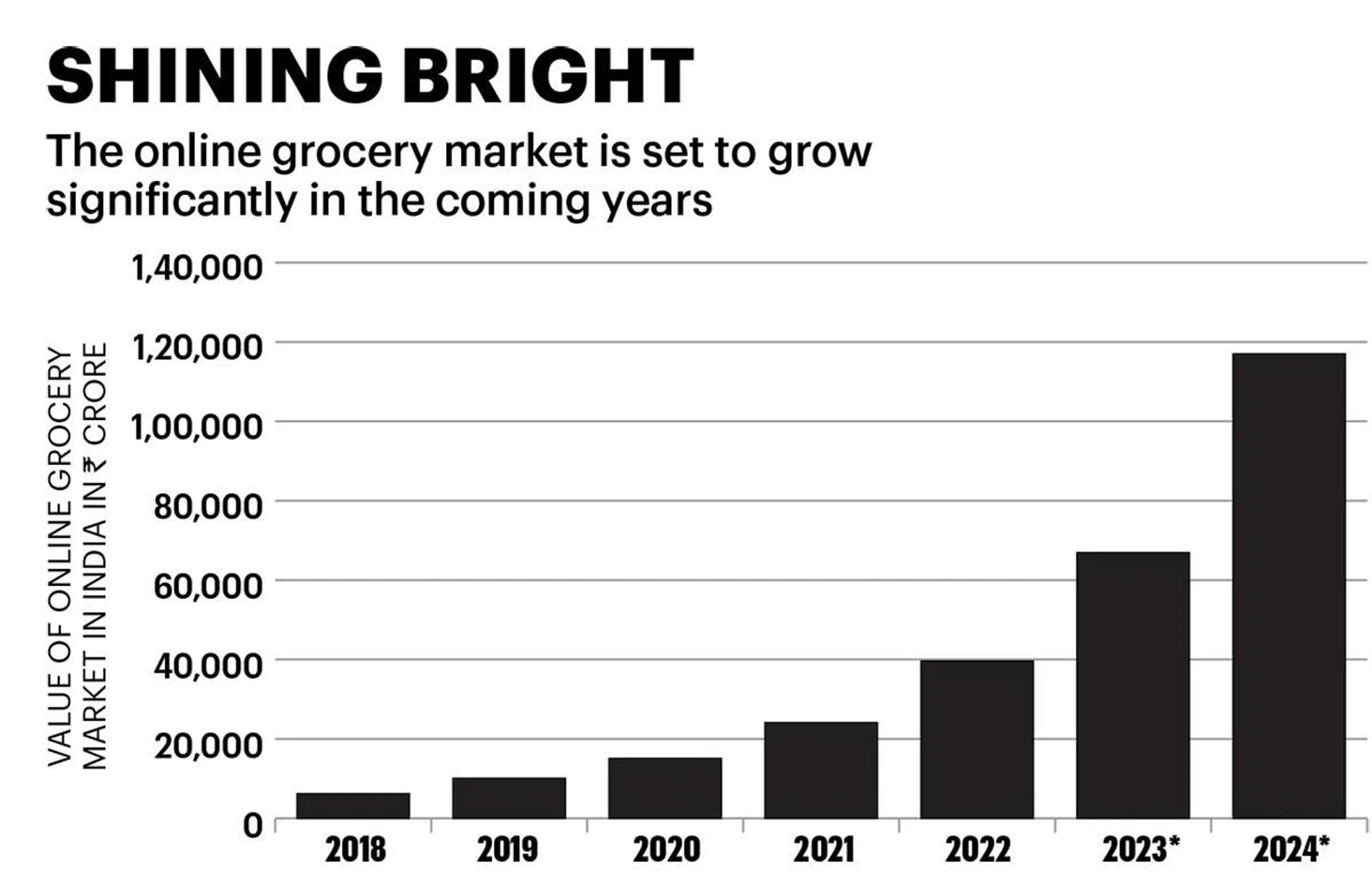

In particular, Indian grocery delivery is growing even faster than ecommerce more broadly. Valued at $8.8 billion in 2024, it is expected to grow by a further 45% from 2025 to 2030, driven by Indian economic growth and growing internet penetration. Quick commerce is a subcategory within grocery delivery where the delivery takes place within an hour or less of a customer’s order. This is a rapidly growing market category, both globally and in India alone, where the quick commerce sector is projected to grow from $6 billion in sales as of 2025 to $100 billion in sales by 2035.

Zepto* is a grocery and consumer product rapid delivery company founded on the idea that faster delivery speeds could lead to better (instead of worse) unit economics. In other markets globally, rapid delivery from dark stores has been associated with high valuations and high burn rates. GoPuff in the US, Rappi in LatAm, Gorillas in Europe, Getir in the Middle East, and Airlift in Pakistan (which shut down) were all at some point valued at more than $5 billion, but have struggled to become profitable in the long run.

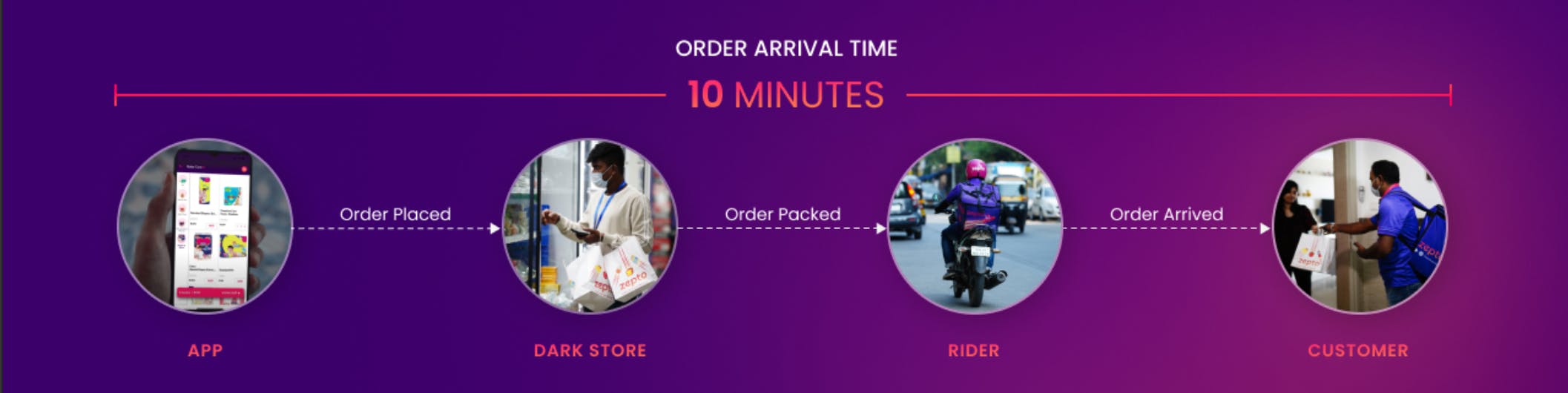

Zepto’s bet is that faster fulfillment can improve both customer retention and unit economics by increasing order density per store and labor efficiency per rider. To support this, the company has built a network of more than 1K dark stores across India’s largest cities, using routing software and demand forecasting to keep average delivery times near 10 minutes. Since 2022, Zepto has moved beyond groceries into pharmacy, prepared food through Zepto Café, and household goods, with each category designed to increase order frequency and store utilization. In 2025, the company also launched Zepto Atom, a subscription analytics tool for brands, and expanded its retail media offering, creating higher-margin revenue streams alongside commerce. The model remains unproven at national scale, but Zepto’s expansion shows how rapid delivery can evolve from a single-product service into a broader platform for daily essentials.

Founding Story

Aadit Palicha (CEO) and Kaivalya Vohra (CTO) founded Zepto in 2021. Childhood friends who grew up together in Dubai, the two were introduced to technology early on through their engineer fathers. Both were fascinated by building products from a young age, often collaborating on small projects throughout their school years. By 17, they launched GoPool, a ride-hailing app for schoolchildren.

As they prepared to graduate, Palicha and Vohra wanted to turn their shared hobby of building into a full-time career. Inspired by stories from Silicon Valley and the Y Combinator community, they applied to Stanford University as a pathway into the startup ecosystem and were both admitted, planning to enroll in 2020. When the COVID-19 pandemic forced classes online, they reconsidered the value of attending virtually and decided to take a gap year to build something instead.

While living in Mumbai during lockdown, they noticed the severe inefficiency of grocery delivery. Online platforms often took up to a week to deliver, and local kirana stores (the Hindi word for grocery) were unable to meet growing demand. To help their community, they began informally delivering groceries to neighbors through a WhatsApp group, which quickly grew beyond its capacity. Recognizing the demand, they built a simple app to coordinate orders and partnered with nearby kirana stores to fulfill them.

This project evolved into KiranaKart, launched in 2020 as a grocery pickup-and-drop platform. With early backing from Contrary, which provided ₹4 million (~$50K) in seed funding, the pair began manually onboarding local store owners across Mumbai. They handled every part of the business themselves, from customer support and order packing to delivery and sales. While running these experiments, the two began to worry that scaling such a model would be a serious challenge and might not ever lead to profitable margins, even at scale.

Source: Business Today

After receiving additional funding from Y Combinator and others, Palicha and Vohra started to notice a trend in their customer retention rates. On average, KiranaKart was able to deliver groceries within 45-60 minutes. However, in some instances, it was able to deliver groceries in 10-15 minutes due to proximity. Palicha and Vohra realized that the engagement and retention metrics of individuals who were able to get their groceries in the 10-15 minute time frame were significantly higher than for customers with longer wait times. In 2021, Vohra noted the effect this had on their business:

“Simply put, customers love a rapid delivery experience. The data speaks for itself – once we started delivering in 10 minutes, our NPS shot up and has constantly remained at around 85 with a 50%+ week-on-week user retention rate, which shows the incredibly strong customer love for our product”.

The two founders, therefore, decided to stop working with kiranas, verticalize the entire operation to enable scalable, rapid delivery, and re-launch as Zepto in April 2021. The company has since raised $2.8 billion in funding and established a network of more than 1K micro-distribution centers across 10 cities in India, with tens of thousands of delivery drivers at work.

Product

Zepto’s business rests on four core products: the customer app, the dark store network, Zepto Cafe, and Zepto Atom. The app is where customers browse, select items, and place orders. Dark stores are micro-warehouses that handle inventory and pack orders for delivery within short timeframes. Zepto Cafe extends this model into prepared food, operating dedicated kitchens inside select dark stores to deliver coffee, snacks, and meals within minutes. Zepto Atom serves brand partners, offering analytics on sales and demand patterns across the platform. Together, these products connect customer experience, fulfillment operations, food delivery, and brand insights that define Zepto’s approach to quick commerce.

Zepto Platform

Source: Google Play

Zepto operates as a digital platform accessible via both its mobile app and website. Customers can browse across categories such as fruits, vegetables, dairy, household essentials, and personal care, and then place orders through either interface. Zepto launched Zepto Pharmacy in August 2025, delivering medicine with the same 10-minute promise.

Zepto has expanded its catalog to more than 45K products, covering groceries, beverages, personal care, and small electronics. To help users navigate this scale, Zepto applies personalized search ranking powered by deep learning models. These systems re-rank search results based on customer cohorts and past behavior, surfacing frequently repurchased items and improving product discovery.

Orders are fulfilled entirely within the digital platform, with customers able to track delivery progress in real time once checkout is complete. Zepto promotes a 10-minute delivery promise across major metros, with, as of 2024, a median delivery time of 11 minutes and an average distance of 1.5 kilometers from warehouse to front door. The app also incorporates membership features such as Zepto Pass, which offer delivery benefits and loyalty incentives, further tying customers into the platform.

In November 2025, Zepto also began piloting two new verticals to expand beyond grocery. Super Mall introduces higher-value categories, such as home décor, electronics, and fashion, into the app, utilizing early discounts to gauge whether users will shift discretionary purchases to Zepto.

As of November 2025, the company is also trialing Zepto Diagnostics, an at-home testing service within its Pharmacy category. Through a partnership with Orange Health Labs, users can book blood tests with 60-minute sample collection and a six-hour turnaround.

Dark Stores

Source: Zepto

Dark stores are approximately 2.5-3K square foot micro-warehouses tightly packed with goods. Instead of serving customers themselves, the site is full of employees quickly packing goods for drivers to pick up for delivery. This model allows Zepto workers to assemble orders quickly and reduces front-of-house costs. As of April 2023, the cost to run dark stores was less than 10% of company revenue, and the average dark store could ship 2.5K orders per day.

Because less space is needed to set up a dark store than a normal storefront, Zepto can establish a dense network of sites across a city, keeping delivery radii short. As of October 2025, Zepto operated in ten of India’s major urban centers, including Mumbai, Pune, Delhi, Noida, Gurgaon, Ghaziabad, Kolkata, Hyderabad, Chennai, and Bangalore, which includes seven of the country’s ten largest cities. To support this, Zepto has built over 1K dark stores, which are replenished as needed by larger mother-warehouses.

As consumer preferences vary from location to location, each dark store carries items specifically catered to the customers it serves. This hyper-local assortment improves turnover and reduces waste. The model also benefits drivers: since stores serve compact zones, couriers rarely finish their routes far from home, helping Zepto avoid excessive overtime and overpayment.

Operational technology has been central to making this model efficient. Zepto deploys warehouse-management software that maps optimal picker paths, forecasts demand at the PIN-code level, and re-optimizes store layouts around fast-moving SKUs. High order density and rapid turnover are what keep dark stores viable. While dark stores have occasionally been scrutinized for zoning or food-safety issues, Zepto has leaned on its technology to maintain speed and consistency.

According to co-founder Aadit Palicha, it is these in-house innovations that have been decisive in driving early traction:

“We don’t want our competition to know what is happening inside our dark store… We have optimized to a point that within 76 seconds of an order being placed, the order is packed and made ready for pickup. So, the tech we use is a trade secret, and we wouldn’t want anybody to get wind of it. The SOP is to not let anybody in. There are tighter aisles, and SKUs of frequently ordered products are accessible.”

Source: TechCrunch

Zepto Cafe

In addition to its grocery-delivery service, Zepto launched Zepto Cafe in April 2022, a private-label food delivery service that delivers cafe-style food like coffee, snacks, and meals within 10 minutes. The cafe offers more than 140 items, including breakfast dishes, snacks, freshly-brewed coffee, and pastries. Zepto Cafe was initially embedded within the broader Zepto app, but launched its own app in December 2024.

Zepto Cafe operates out of the same hyperlocal dark stores that power its grocery service, but with dedicated kitchen setups inside select locations. These kitchens are equipped with speed ovens and coffee machines, allowing staff to prepare hot and cold beverages, snacks, and light meals on demand. Once ready, the cafe items are dispatched alongside grocery orders.

Zepto Atom

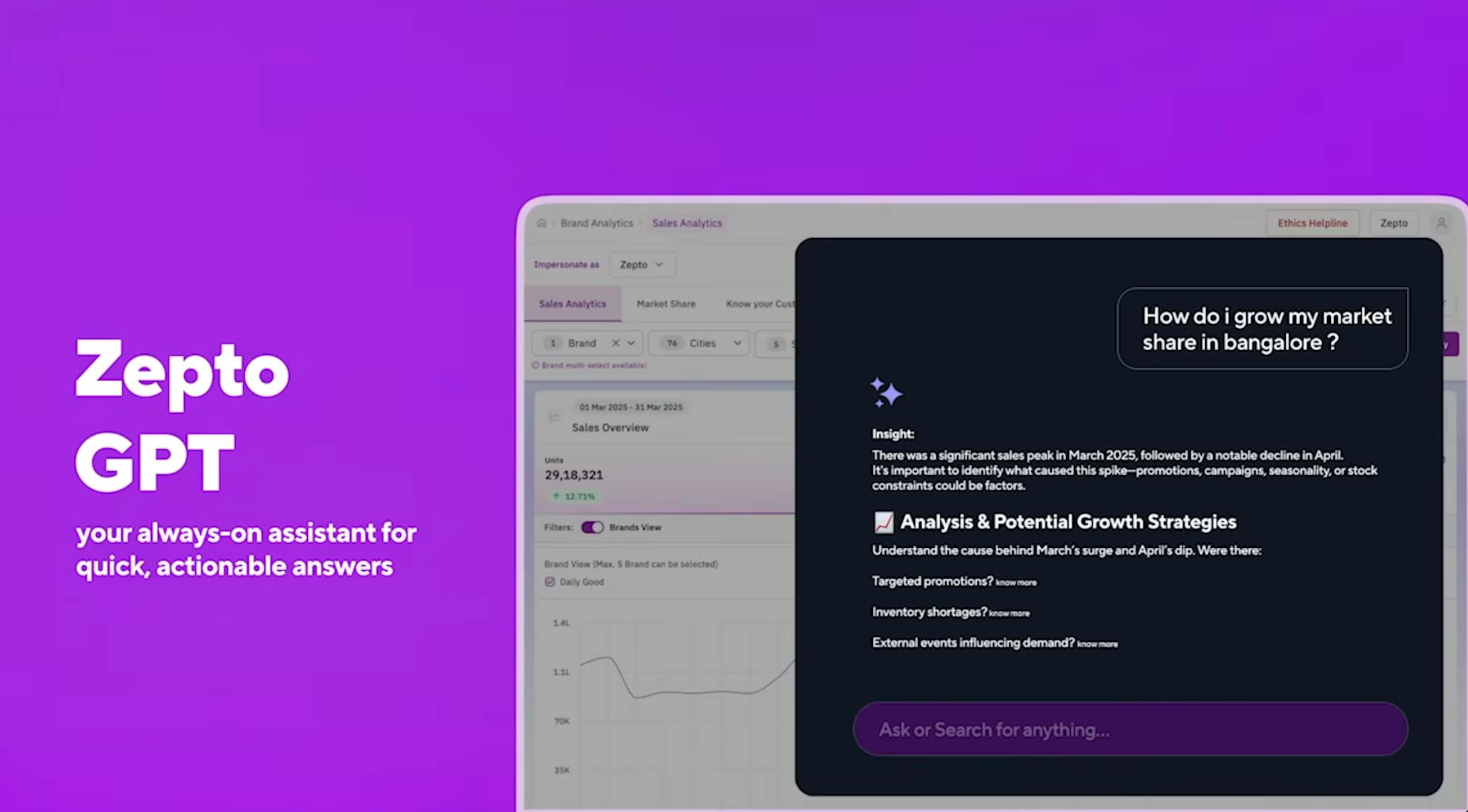

Zepto launched Zepto Atom in May 2025 as a subscription-based analytics platform for consumer brands using its quick-commerce network. Atom gives brands detailed visibility into sales and customer behavior at the PIN-code level, rather than broad city or regional averages. The platform provides real-time dashboards, which update every minute, on metrics such as units sold, impressions, and conversion rates.

Source: Zepto

Atom includes an AI-driven assistant, referred to as Zepto GPT, that allows brand managers to query the system in natural language. Zepto GPT uses Atom’s datasets to generate actionable recommendations and even data reports. Brands can apply these insights to evaluate promotional campaigns, identify underperforming SKUs by geography, and much more. For smaller or mid-sized brands without large analytics teams, this lowers the barrier to using granular performance data.

Market

Customer

As of August 2025, Zepto served approximately 16 million monthly transacting users and, as of June 2025, fulfilled roughly 1.5 million daily orders. Market share estimates put the company at roughly 29%. Its customer base is concentrated in Tier 1 and Tier 2 cities, such as Mumbai, Bengaluru, Delhi-NCR, and Hyderabad.

The majority of users fall between the ages of 20 and 40, with the 25-34 bracket accounting for 36% and the 18-24 bracket about 29%. These groups include working professionals, students, and young couples who prioritize convenience in day-to-day purchases. Such people typically care most about price and convenience, which is why Zepto goes out of its way to offer promotions and discounts on the app.

Men represent about 64% of the base, while women make up 36%. Customers are generally mid to high-income and mobile-first, reflecting the digital orientation of the service. Usage patterns show high repeat activity, while loyalty programs and in-app personalization have supported retention. The traits of Zepto’s customers have led it to focus on an app that is easy to use for all demographics, has consistent delivery times, and competitive pricing.

Market Size

India’s quick commerce sector, estimated $6 billion in 2025, is expected to scale to roughly $100 billion in sales by 2035. This would make quick commerce close to one-fifth of the country’s total ecommerce market, up from about 5% as of August 2025.

Q-commerce gross merchandise value (GMV) in India rose from $1.5 billion in 2022 to an estimated $6–7 billion in 2024, supported by more than 20 million annual active shoppers and a workforce exceeding 400K as of March 2025. As a result, quick commerce accounted for 70–75% of e-grocery GMV in 2024, up from ~35% in 2022.

Source: Business Today

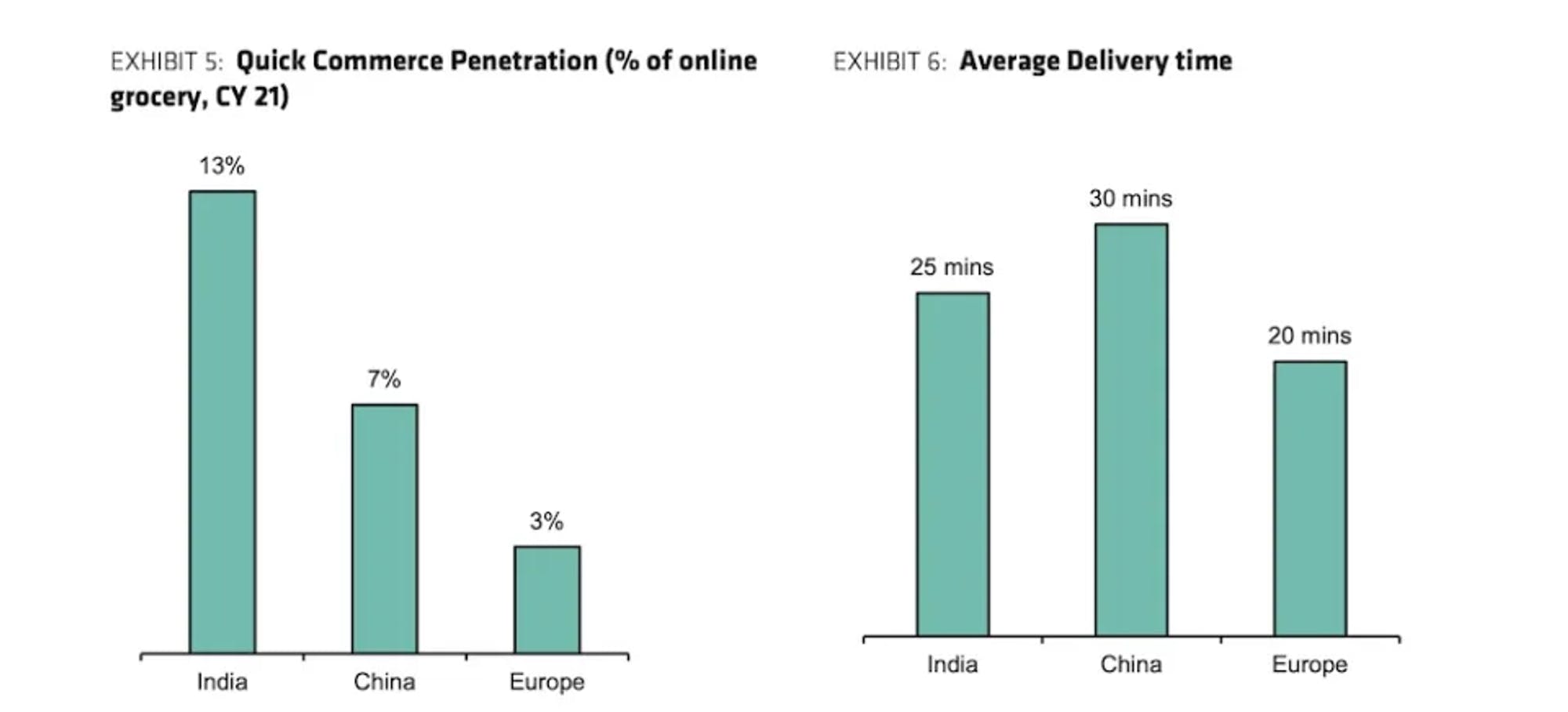

Indian consumers have rapidly embraced the concept of quick delivery compared to other regions. The percentage of grocery delivery in India attributed to quick delivery was nearly 2x that of China and more than 4x that of Europe in May 2022. This outperformance versus China can be explained by India’s structural advantages: a population density in its top eight cities 5x higher than China’s, with manpower costs 80% lower.

One concern within the quick commerce market in India has been its average order value, which was only $6 as of 2022. However, AOV reportedly increased 40% between 2023 and 2025. In addition, the company expects AOVs will continue to grow as customer stickiness improves.

Source: TechCrunch

Competition

Blinkit

One of Zepto’s largest competitors is Blinkit, originally founded in 2013 under the name “Grofers.” It has successfully expanded to 30 Indian cities and has been able to execute deliveries in under 10 minutes. As of August 2023, the company delivered a plethora of products, including groceries, household essentials, and personal hygiene products, amongst others. As of November 2025, Blinkit had raised $1.3 billion in the private markets from investors like Sequoia Capital, SoftBank, and Tiger Global, in a mixture of equity and debt. Blinkit was acquired by Indian restaurant delivery company Zomato in June 2022 for $568 million.

Blinkit employs a business model broadly similar to Zepto in that it aggregates inventory into central fulfillment points for rapid dispatch. Originally, the company partnered with local neighborhood stores to fulfill orders, but it pivoted toward its own network of dark stores in 2021 due to quality issues. As of August 2025, Blinkit operated more than 1.5K dark stores and had plans to double that to 3K. Blinkit sells over 7K products across 100 serviced cities, including those sold by Zepto as well as mobiles and accessories, electronics (including Apple products), and others. The company even offers private-label goods.

Where Blinkit stands out is its integration with Zomato’s ecosystem. By leveraging Zomato’s food-delivery footprint, payments infrastructure, and brand recognition, Blinkit has become the company’s quick-commerce arm, expanding Zomato into daily essentials, boosting order frequency, and strengthening customer engagement.

Instamart (Swiggy)

Instamart, the quick-commerce arm of delivery giant Swiggy, was launched in 2020 to extend the food-delivery platform’s reach into groceries and daily essentials. Like Zepto, it relies on a network of 1K+ dark stores to achieve sub-20-minute delivery in 127 dense urban markets. The service covers a wide product basket, but benefits from being embedded within Swiggy’s broader delivery ecosystem, which allows it to cross-sell to existing food-delivery users and leverage a logistics network already built at scale.

As of November 2025, Swiggy had raised $4 billion in funding overall, with notable backers such as Prosus, SoftBank, Accel, and Sequoia. Swiggy went public at a target valuation of $11.3 billion, and as of November 2025, that valuation has declined to $10.5 billion.

Compared to Zepto, which has positioned itself as a pure-play quick-commerce startup with an intense focus on dark-store density and category expansion, Instamart represents a platform extension strategy. Instamart’s differentiation comes from being part of Swiggy’s larger ecosystem, enabling it to draw traffic from a broader base of food-delivery users. The contrast highlights how India’s quick-commerce landscape is divided between independent category leaders like Zepto and platform-anchored plays like Blinkit and Instamart.

BigBasket

Founded in 2011, BigBasket is one of India’s largest online grocery-delivery platforms. Rather than pursuing ultra-fast (under-10-minute) fulfillment from the outset, BigBasket has focused on a broad assortment and scheduled delivery model, emphasizing variety and planned shopping. The company has stated that its goal is to complete 80-100% of orders within the same day.

In 2021, Tata Digital acquired a majority stake in BigBasket, integrating the company into the Tata Neu ecosystem. Since its founding, BigBasket has raised about $1.5 billion in funding from investors, including Alibaba, Bessemer Venture Partners, and Trifecta Capital Advisors, alongside Tata Digital, including a $200 million round in 2022 led by Tata, valuing the business at approximately $3.2 billion.

As of 2025, BigBasket continues to operate at scale, serving hundreds of towns across India, but is also pivoting toward quick commerce via its own quick service, BB Now. The company plans to expand its dark-store network from roughly 700 to between 1K and 1.2K by the end of 2025, with the goal of launching a nationwide 10-minute grocery and food-delivery service by 2026.

From a business-model perspective, BigBasket’s core strength still lies in its wide product assortment and private-label brands, supported by a scheduled-delivery system that emphasizes planned shopping. However, the push into rapid fulfillment and dark-store-led operations marks a significant strategic shift, moving the company closer to the ultra-fast models used by competitors like Zepto and Blinkit.

Amazon India

Amazon launched its Indian-marketplace site in June 2013 and started building out localized logistics, including returns capabilities and seller tools for the Indian market. Over time, Amazon India expanded beyond traditional ecommerce into faster delivery models, including trials of Amazon Now, promising 10-15 minute deliveries in select locations like Bengaluru and Delhi starting in December 2024.

In June 2025, Amazon India launched Amazon Diagnostics under the Amazon Medical umbrella, a new at-home lab-testing service in six Indian cities offering over 800 tests, home sample collection in under 60 minutes, and digital reports in as little as six hours, via a partnership with Orange Health Labs. This is comparable to Zepto’s own launch of Zepto Diagnostics in November 2025. This further indicates how each large company, in a bid for India’s delivery market, is increasingly expanding into a broader subset of products and services.

Business Model

Zepto’s business model combines quick commerce grocery delivery with additional monetization streams aimed at both consumers and brands. The company operates on a freemium base where standard shopping and delivery are free above a minimum order, while revenue comes from product margins, order fees, subscriptions, advertising, analytics, and commissions.

The company earns retail margin by purchasing inventory in bulk and reselling it, with higher contribution in private-label categories where it controls sourcing and pricing. On the consumer side, Zepto historically charged delivery fees on smaller baskets and during peak-demand windows, alongside platform and handling surcharges. However, in November 2025, Zepto removed handling and surge fees across all orders to simplify pricing and reduce friction in repeat purchasing. The company continues to monetize convenience through subscriptions: Zepto Daily (formerly Zepto Pass) offers free delivery on smaller baskets and exclusive deals, creating recurring revenue and lowering frequency-driven customer acquisition costs over time.

On the brand side, advertising has become a major contributor, with companies paying for digital shelf-space, such as promoted placements in search and featured banners. Additionally, Atom, Zepto’s subscription-based analytics tool for brands, was, as of May 2025, priced at about $340 per month or 0.5% of the subscriber’s GMV, whichever is higher. For Zepto, Atom adds a SaaS-style revenue stream with structurally higher margins than commerce and improves profitability in a sector known for thin margins, while also increasing brand partners’ reliance on the platform for decision-making.

Traction

Zepto has grown rapidly in the Indian quick commerce sector, with revenue reaching $1.3 billion in FY25, a 150% increase from $500 million in FY24 and over five times higher than its $230 million figure in FY23.

The company’s advertising vertical expanded quickly as well, with annual revenue run rate rising from $40 million to $200 million in a single year as of April 2025. Overall business volume has scaled in parallel, with annualized gross order value approaching $4 billion as of July 2025, representing a 300% year-over-year growth.

Customer adoption has followed this trajectory. As of August 2025, more than 16 million people transact on Zepto monthly, with daily order volumes averaging 1.5–1.6 million. As of February 2025, Zepto Cafe hit 100K daily orders, representing an annualized GMV run-rate of $100 million.

The company also expanded its sourcing and distribution network. It works with local vendors and brands, as well as partners such as Criteo, Park+, and Pescafresh. In addition, Zepto sources directly from thousands of farmers through more than 70 collection centers, which by mid-2025 supported daily sales of over 2.2 million units of fresh produce.

Despite strong top-line growth, Zepto initiated a company-wide restructuring and automation effort to improve cost efficiency, leading to the layoff of over 500 employees between April and October 2025, mostly in operations, support, and Zepto Café roles. The company attributed the cuts to its in-house automation drive to streamline functions like replenishment and real estate management, though some on-roll employees were also affected as expansion plans paused in order to stabilize the company's balance sheet. The transition coincided with operational challenges at Zepto Café, which closed 45–50 outlets due to sourcing and staffing issues, causing order volumes in the vertical to fall by roughly half from prior peaks.

Valuation

In October 2025, Zepto announced a $450 million raise at a $7 billion valuation, led by the U.S. pension fund CalPERS, alongside existing backers such as StepStone, Nexus, and Glade Brook. As a result, in October 2025, the company held roughly $900 million in net cash, providing a liquidity cushion as it prepares for a long-anticipated public listing. While Zepto’s co-founder, Aadit Palicha, had originally expressed an ambition to take the company public by 2025, the timeline has shifted slightly, and it is now targeting an IPO in 2026.

Prior to this, Zepto had raised a $100 million Series C in December 2021 at a valuation of $570 million and a $200 million Series D in May 2022 at a $900 million valuation, both led by Y Combinator. Following this 57% increase in Zepto’s valuation, the company has continued to scale rapidly within India’s booming quick-commerce sector.

In August 2023, Zepto raised $231 million at a valuation of $1.4 billion. Less than a year later, in June 2024, the company secured a $665 million Series F at a valuation of $3.6 billion, followed by an additional $340 million round in August 2024 that boosted its valuation to $5 billion. Notable investors include Contrary, Nexus Venture Partners, Glade Brook Capital, Lightspeed, and Avenir.

Key Opportunities

Rapid Growth of Quick Commerce

India’s quick-commerce market has already grown from roughly $300 million in gross order value in 2021 to more than $7 billion in 2025, with projections suggesting it could top $35 billion by 2030. This growth reflects a structural change in consumer behavior, where “instant” is becoming the default expectation for groceries and household items. For Zepto, this trend translates directly into operating leverage. Dark stores, which carry fixed costs in rent and staff, become more profitable as orders per day rise: unit economics improve markedly once stores reach 1K-1.5K orders per day, with store operating costs near $0.25 per order at scale. Zepto’s dense metro footprint means it is already positioned to benefit from this efficiency curve, while the next leg of growth comes from extending this model to Tier 2 and Tier 3 cities, where grocery delivery penetration is still limited. The opportunity lies not just in revenue expansion, but in structurally better margins as utilization increases.

Growth in Food & Pharmacy

Zepto has begun extending beyond groceries, including its food-delivery arm Zepto Café, launching a standalone app in December 2024. Additionally, Zepto entered the online pharmacy segment with Zepto Pharmacy in August 2025, offering 10-minute medicine delivery in major metros, including Delhi, Mumbai, Bengaluru, and Hyderabad. This category expansion matters because it diversifies Zepto’s delivery occasions and extends its network utilization beyond grocery shopping. For example, peer BigBasket plans to expand its dark-store footprint from 700 to 1K-1.2K stores by the end of 2025 to support a nationwide 10-minute food-delivery service by 2026, highlighting how quick-commerce players are broadening into food and other higher-frequency categories. For Zepto, this expansion deepens customer engagement by capturing more daily routines beyond grocery and unlocks new economic levers: higher baskets via ready-to-eat food/medicines and improved dark-store throughput as more SKUs and order types share the same last-mile network.

New Revenue from Data & Advertising

Zepto is, increasingly, building a high-margin business that is not tied to delivery costs. Its Atom analytics suite turns first-party purchase data into subscription revenue for brands that need hyperlocal, real-time insights on pricing, promotions, and assortment. As app traffic grows, Atom adoption and revenue scale naturally with overall GMV. On the advertising side, Zepto is rolling out an in-app retail media platform referred to internally as “Jarvis”, with features like keyword targeting, bid recommendations, and campaign automation. This follows a model already proven by larger ecommerce players, where retail media has become a major profit driver. For Zepto, ad impressions and spend increase with user engagement rather than delivery volume, creating a separate high-margin revenue stream alongside its core commerce business.

Key Risks

Inability to Reach Profitability Without Fees

India is home to the world’s fastest-growing economy and may become the third-largest economy by 2027. One consequence of this is likely to be that more Indians can afford services like grocery delivery. However, many of Zepto’s customers have grown up in an extremely price-sensitive market, especially when it comes to food. These cultural habits will most likely not disappear quickly.

To attract consumers who are particularly price-sensitive, Zepto is consistently offering promotions to activate users and hopefully build enduring loyalty. Zepto has included a small delivery fee in some markets, which is not uncommon for a service of this kind. That being said, customers may choose to seek alternatives that do not charge any sort of fee, and price competition in this competitive market might exert downward pressure on margins. The question of how much profit margin Zepto can preserve after logistical and delivery costs will remain.

High-Risk Business Model

Zepto’s business model requires a tight timeline from harvest or production of goods to delivery of orders to customers’ doorsteps. There are many steps that must go right in order for a delivery to be completed in less than 10 minutes without any errors or unavailable items, all while allowing Zepto to make a small profit. For example, dark stores cannot be massive warehouses, or else it would take too long to assemble orders, so supplies must be replenished consistently, and any inability to do so would be disastrous. This also means that if any supplier relations are broken, there is little time to find alternatives. The model seems to be working well after a few years of improvements, but as the company scales, it will open itself up to additional risks. The smaller the delivery window is, the less space there is for errors, and the delivery window cannot be much smaller than Zepto’s.

Beyond the current operations of Zepto's model, it’s important to acknowledge the obstacles that other companies in this category have faced globally. For example, Airlift, a similar quick delivery business operating in Pakistan, shut down operations, and both Getir and Gopuff have experienced significant layoffs. Each global market is unique, and Zepto appears to have found unique success by focusing on meticulous operating procedures and geographic focus in the most densely populated areas in India. But the fundamental business model risks remain.

Regulatory Guidelines

As India’s economy is growing, so is the quality of life for citizens around the country. Many of the nation’s cities are built on old infrastructure, making their roads dangerous to navigate. As wealth increases, it is not unlikely that road quality and traffic regulations will also increase. This is positive for Zepto because the company’s drivers will be safer, but it also poses a threat to its delivery times. A driver only has around seven minutes to deliver any given order, meaning he or she must use their bike effectively to pass any traffic between the dark store and the customer. A driver for Zepto’s competitor, Blinkit, even said they fear for their life in certain moments.

Source: BBC

Automotive accidents kill 150K people per year in India, and the addition of rushed delivery riders will not help this number go down. A Blinkit rider said they want the 10-minute delivery trend banned by regulation after seeing a fellow driver injured. Whether guidelines are enacted and enforced remains to be seen, but either way, Zepto can still stay competitive by being faster and more reliable than its competitors.

Summary

Zepto’s story is one of turning a simple lockdown experiment into a new model for retail in India. Its founders realized early that speed itself could transform customer behavior, and built the company around vertical integration and a dense network of dark stores to make sub-20-minute delivery reliable. Over time, the company layered on new categories like food and pharmacy to increase order frequency, and introduced services like Atom and retail media to monetize the traffic and data that flow through the platform. The business combines last-mile logistics with retail media and analytics: a system where each additional use case deepens engagement and drives efficiency across the network. The company’s trajectory shows both the promise and the fragility of quick commerce: operating leverage grows as density increases, but profitability and sustainability hinge on balancing thin consumer margins, operational precision, and an evolving regulatory environment. Zepto’s future depends on whether it can continue to scale this model in a way that keeps both consumers and brands locked in while keeping costs under control.

*Contrary is an investor in Zepto through one or more affiliates.