Thesis

The rapid progress of artificial intelligence has made it a focus of the American military and intelligence services. Historically, innovation in the defense industry has been led by hardware. However, the next generation of warfare will likely be driven by software, particularly artificial intelligence, working in concert with hardware. AI systems can provide operators with real-time intelligence and situational awareness by enabling rapid processing and analysis of vast amounts of data, enabling operators and troops to make more informed decisions that could give them tactical advantages over adversaries. Furthermore, autonomous software integrated into military systems such as aircraft, drones, and ground vehicles could improve reconnaissance, logistics, and combat missions without risking human lives. Driven by these dynamics, the artificial intelligence defense market is growing quickly. It was valued at $6.4 billion in 2021 and is expected to reach $13.2 billion by 2028.

AI integration with the military may also dramatically reduce human casualties and enhance the safety of military personnel. As AI applications continue to improve and become increasingly complex, the need for soldiers on the front lines may be reduced. Conflicts like the Russo-Ukrainian war and the Gaza war have underscored the importance of AI technology on the battlefield, demonstrating a shift in the technological stack for warfare. Despite Russia's significantly larger defense budget, technologies such as drones, AI-based targeting, and imagery intelligence have enabled Ukraine to withstand Russian forces. In March 2023, the Biden-Harris Administration submitted a budget request to Congress of $842 billion for the Department of Defense, an increase of $26 billion over FY 2023 levels and $100 billion more than FY 2022. From the 1990s to the 2010s, the US defense industry has largely consolidated into five large companies: Lockheed Martin, Boeing, Raytheon, Northrop Grumman, and General Dynamics. This consolidation has not only likely inflated prices but has possibly stifled innovation. However, growing pressure may prompt the government to commit to investing more in AI and could foster a greater willingness to work with and invest in defense tech startups such as Shield AI.

Shield AI is a defense technology company that builds AI systems, starting with fully autonomous quadcopters that collect data in dangerous environments and protect military personnel and civilians. Shield AI’s Hivemind software is an AI pilot for military and commercial aircraft that enables aircraft to perform missions ranging from room clearance to penetrating air defense systems and dogfighting F-16s. Hivemind employs algorithms for planning, mapping, and state estimation to enable aircraft to execute dynamic flight maneuvers and uses reinforcement learning for the discovery, learning, and execution of winning strategies. The company has contracts with the Department of Defense and the Department of Homeland Security.

Founding Story

Shield AI was founded in 2015 by brothers Brandon Tseng (President, CGO) and Ryan Tseng (CEO), as well as Andrew Reiter (ex-CTO, Technical Fellow) to be the next-generation aerospace and defense technology company. Growing up across Houston, Seattle, and Orlando, Brandon and Ryan were taught early on by their father, a Taiwanese immigrant, the many opportunities that the US afforded them. As a young boy, Brandon dreamed of becoming a Navy SEAL and after graduating from high school, went on to study at the US Naval Academy, later serving overseas. Meanwhile, his brother Ryan went to the University of Florida to study engineering and became an entrepreneur.

As a Navy SEAL, Brandon Tseng experienced firsthand problems where intelligent autonomy could have made life-saving differences. He served two tours in Afghanistan and other deployments in Asia and the Pacific. He saw firsthand that soldiers were risking — and sometimes losing — life and limb when entering compounds and buildings with little information about what lay around the next corner or behind the next door.

Source: Shield AI

After serving seven years in the Navy, Brandon Tseng left the service, went home, and began transitioning to civilian life. While overseas, Brandon Tseng spent time working with sensors and inexpensive computers. He identified a problem that he felt was solvable: the challenging task of physically searching buildings that had been a persistent problem for soldiers during the urban warfare of the post-9/11 era. In 2015, after receiving an MBA at Harvard Business School, Brandon co-founded Shield AI. The other co-founders were his brother Ryan Tseng, who had previously founded a wireless charging company acquired by Qualcomm, and Andrew Reiter, an engineer who had worked on computer vision applications for Draper Labs, a non-profit advanced engineering company. Together, the co-founders embarked on building a prototype for Nova — the company's flagship drone that could go into buildings and search for threats.

In 2015, Shield AI faced rejections from investors who admired the team and technology but refused to back anything related to defense. At one point, they were offered a $5 million investment, contingent on abandoning their mission. In 2016, Ryan Tseng took an overnight bus from San Diego to Oakland to meet David Frankel of Founders Collective. That meeting became a turning point and Frankel became an investor in the company, signing its first term sheet for $800K. The seed round was led by investors Shivon Zilis, David Frankel, and Satya Patel.

In 2018, the company’s Nova quadcopter became the first fully AI-piloted drone to be deployed in combat, operating successfully in GPS-and-communications-denied environments in the Middle East. A year later, Shield AI followed with another milestone — the operational deployment of V-BAT, the first tail-sitting VTOL drone.

Nathan Michael, a Research Associate Professor at Carnegie Mellon University, replaced Reiter as CTO of the company in July 2018. Reiter remained with Shield AI in other roles until his departure to ThorconUS in 2023.

Source: Shield AI

Product

Shield AI builds autonomous systems for defense aviation. Its products are organized around two categories: Hivemind, the company’s AI pilot software, and a suite of aircraft platforms, including V-BAT, ViDAR, and Nova 2. Hivemind is the software layer that enables aircraft to operate autonomously, with no human input required. It can be integrated into Shield AI’s own vehicles or third-party systems. Together, these products support a wide range of missions, from maritime surveillance to close-quarters reconnaissance.

Hivemind

Hivemind, Shield AI’s flagship product, is an autonomous software stack that is a self-driving platform for military and commercial aircraft. Hivemind is an AI pilot that reads and reacts to the field, similar to a human pilot. With Hivemind, aircraft use sensors to create a map and then follow the instructions given by the "autopilot,” eliminating the need for GPS, waypoints, or communication systems. Shield AI calls this a “top gun for every aircraft.”

Hivemind is sold in two ways: Enterprise, a pre-built autonomy stack delivered to customer engineering teams; and Turnkey Solutions, where Shield AI’s team integrates and adapts Hivemind for specific missions across a growing number of aircraft.

Source: Shield AI

Enterprise

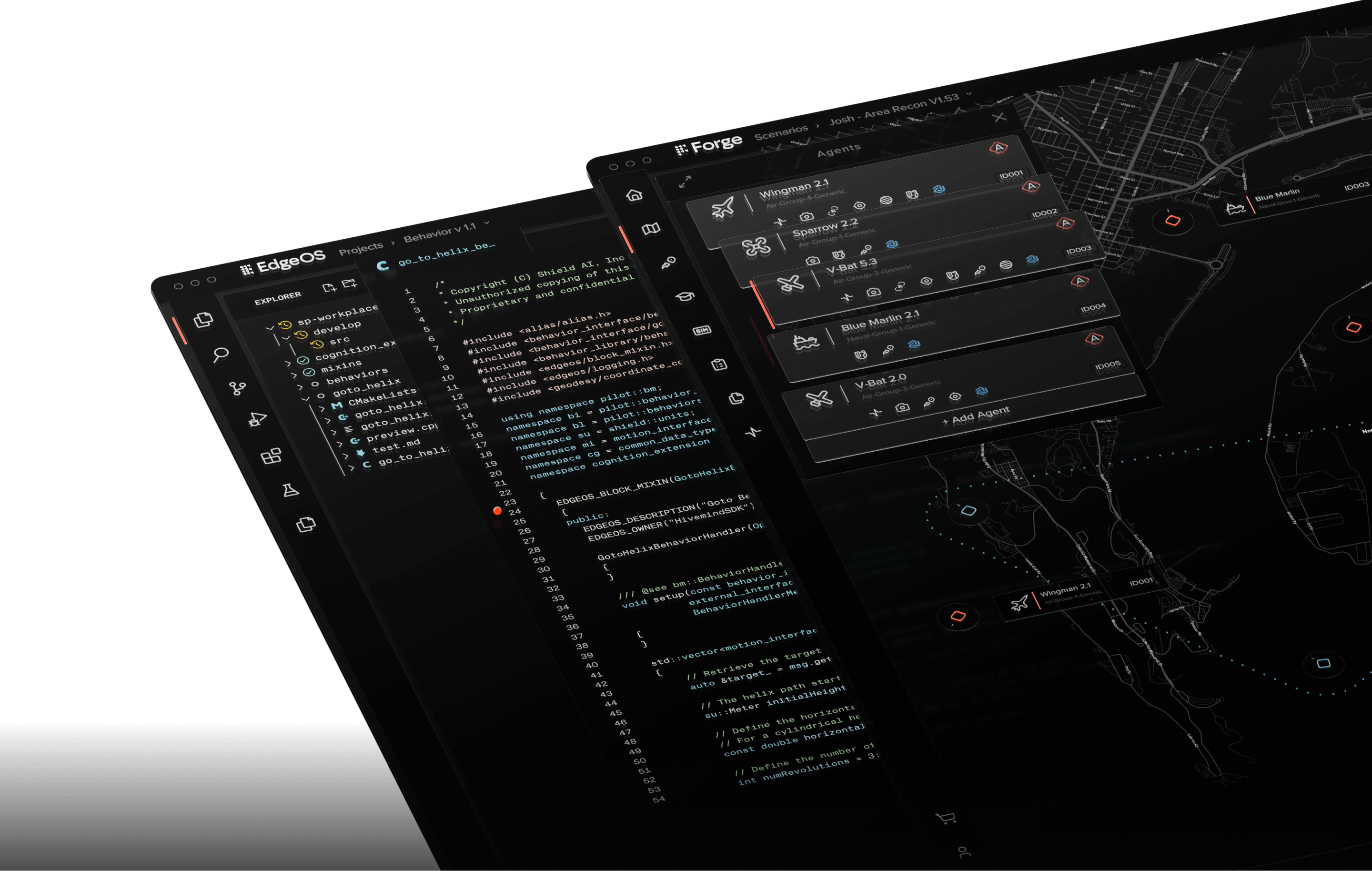

Shield AI offers Hivemind Enterprise as a packaged autonomy stack that can be integrated by customers into their own aircraft platforms. It enables full autonomy across a range of flight operations — from takeoff to mission execution — without requiring GPS, comms, or remote piloting. It is designed to be integrated and operated by a customer’s internal teams and supports both onboard autonomy and offboard simulation environments. The platform is built around four modular components:

EdgeOS – Lightweight edge-deployed software that delivers autonomy onboard uncrewed systems. Designed for real-time operation in GPS-and-communications-denied environments.

Pilot – Hivemind’s decision-making engine, enabling dynamic flight, object detection and classification, real-time re-planning, and multi-agent coordination.

Commander – Mission planning and C2 tools that allow operators to direct autonomous systems while incorporating human oversight.

Forge – A simulation and development environment used for training, testing, and refining autonomy models, including reinforcement learning for tactical maneuvers.

According to Shield AI, Hivemind is the first and only autonomous AI pilot deployed since 2018. It is used to power aircraft and UAV (unmanned aerial vehicle) missions ranging from dogfighting to penetrating air defense systems. Shield AI’s long-term strategy is to integrate Hivemind with various platforms and missions across the military landscape, such as fixed-winged drones, combat jets, ships, satellites, and submarines.

Customers receive Hivemind Enterprise as a software product with supporting documentation, developer tools, and training resources, enabling their internal teams to run autonomous flight missions and adapt the system to evolving needs. Shield AI has partnered with Palantir to make Hivemind available through Gaia, enabling users to simulate, train, and deploy autonomy at scale. Other customers include Korea Aerospace Industries and Singapore’s Air Force, both of which are exploring Hivemind integration for next-generation uncrewed aerial systems. Booz Allen Hamilton also collaborates with Shield AI to integrate Hivemind across federal programs, using the stack as a baseline for new autonomy projects.

Turnkey Solutions

For customers without the capacity to integrate autonomy themselves, Shield AI delivers turnkey implementations. In this model, Shield AI’s engineering team takes responsibility for the full integration of Hivemind onto new aircraft, adapting the autonomy stack to the specific flight dynamics, sensors, and missions of each platform.

Turnkey integrations allow customers to field new capabilities without building autonomy teams from scratch. Shield AI has deployed Hivemind on a growing number of tactical and combat aircraft, including the Kratos Firejet, General Atomics’ MQ-20 Avenger, and the F-16 fighter jet. The company has also partnered with L3Harris to bring autonomous operations to Group 3 UAS platforms. These efforts demonstrate Shield AI’s focus on accelerating time to deployment across a wide range of defense use cases — from adversary air training to autonomous ISR and strike.

Source: Shield AI

Platforms

Shield AI’s aircraft platforms are designed to operate in contested and denied environments, powered by Hivemind for fully autonomous execution. The company manufactures its own vehicles at its Batcave facility in Dallas, Texas — including V-BAT, ViDAR, and Nova 2 — and also partners with third-party manufacturers to expand its footprint across global defense missions. These platforms serve a range of use cases, from maritime surveillance to indoor reconnaissance, and can be deployed as standalone systems or integrated into larger autonomous fleets.

V-BAT

V-BAT is Shield AI’s vertical take-off and landing (VTOL) unmanned aircraft system (UAS), equipped with its Hivemind software. The V-BAT drone was first developed and manufactured by Martin UAV, a US-based aviation technology company. In July 2021, Shield AI acquired Martin UAV, and continued the development and production of the V-BAT.

The V-BAT drone has a flight ceiling of 18K feet and can be deployed for various missions, including force protection, aerial patrol, target search and detection, surveillance, and more. One key feature that sets the V-BAT apart from other Vertical Takeoff and Landing (VTOL) drones is its ducted fan design, which Shield AI says boosts the drone's thrust by more than 80% and allows for greater control authority in harsh conditions such as rocky terrain, crowded flight decks, high winds, and small landing zones.

V-BAT can launch and recover from a hover, fly over 13 hours in horizontal flight, and make mid-flight transitions to "hover and stare" anytime during a mission. Additionally, the V-BAT has long-endurance capabilities. Standing roughly 10 feet tall with a 10-ft wingspan, V-BAT can be fully deployed by a team of 2 and fits in a minivan, the back of a pick truck, or a helicopter such as the UH-60 Blackhawk.

The V-BAT has been in operation since 2018, supporting the US Southern Command (SOUTHCOM), the US Coast Guard, the US Marine Corps, and several international customers. Shield AI’s long-term vision with V-BAT is to develop a swarm of drones and place them on every US and allied naval vessel in the world. A swarm of V-BAT drones could create an intelligence, surveillance, and reconnaissance network over battlefield areas that could transform situational awareness and data-sharing levels.

Source: Shield AI

Nova 2

The Nova 2 is a small quadcopter drone that can be deployed by a digital scout. Powered by Hivemind, the Nova 2 can operate autonomously without needing a GPS or a human operator. Nova 2 can clear a building, detect threats, and auto-populate them on a map while vibration notifications alert the user, providing real-time information for those entering dangerous environments. It can also build 3D multi-story maps, providing a common operating picture of the battlefield.

By using the Nova 2 to scope out a building before they go in, soldiers can better understand the layout of the building and identify potential threats, such as traps or enemy combatants. This can help them plan a more effective and safer approach, potentially reducing the risk of casualties and increasing the chances of a successful mission.

Nova 2 is not armed, but Tseng says that the company does not object to equipping it with weapons in the future. Shield AI’s Nova 2 drones have been used by the U.S. Special Operations Command since 2018. Its previous generation drone, Nova 1, was the first AI-powered drone deployed for defense in US military history. US and Israeli forces have also named it the most “mission-capable indoor drone” worldwide.

Source: Shield AI

ViDAR

ViDAR, standing for “Visual Detection and Ranging”, is an AI-enabled optical payload designed for wide-area surveillance and precision targeting in contested environments. Unlike traditional EO/IR turrets that rely on narrow fields of view, ViDAR provides persistent, uniform coverage over land and sea — ensuring no object is missed, even at high speeds or in high sea states.

ViDAR has been developed and manufactured by Australia-based Sentient Vision Systems. In April 2024, following Shield AI’s steep growth in the Australian market, Shield AI acquired Sentient Vision Systems and assumed ownership over ViDAR manufacturing.

The system combines ultra-HD multi-spectral sensors with onboard AI to passively detect, classify, and track both stationary and moving objects in real time. It can spot small drones or individual people from altitudes up to 30,000 feet and operates effectively day or night, including in Sea State 6 maritime conditions.

In 2025, Shield AI delivered its first ViDAR payloads to the U.S. Marine Corps via NAVAIR’s PMA-263 program office. The deployment marked Shield AI’s first turn-key ISR payload delivery and demonstrated ViDAR’s ability to enhance situational awareness across forward operations while remaining stealthy, jam-resistant, and lightweight enough for rapid integration across platforms.

Source: Shield AI

Market

Customer

Shield AI was founded to serve the US military and its allies by providing AI technology to enhance the safety and effectiveness of troops in the field. Shield AI has worked with several departments of the US military, specifically the US Air Force, the US Army, the US Special Operations Command (SOCOM), and the Defense Innovation Unit (DIU). Over time, Shield AI’s customer base has grown to include platform manufacturers, defense contractors, and integrators. In December 2024, Shield AI’s CTO Nathan Michael explained that the company categorizes its customers into four main segments:

Immediate-need customers who require field-ready intelligence and autonomy.

Equipment manufacturers looking to integrate AI pilots into their aircraft platforms.

Sovereign autonomy buyers — typically national governments — seeking to build internal AI aviation capabilities.

Engineering services and integrators who deploy, test, and scale autonomy within complex defense systems.

Source: Shield AI via X

Immediate-Need Customers

Shield AI supports customers operating in high-stakes, time-sensitive environments. In Ukraine, the company has been deploying V-BAT aircraft since August 2024, as well as training personnel to enable autonomous ISR operations on the frontlines, where GPS jamming and comms denial are common. In Israel, Shield AI’s Nova quadcopters have been deployed for close-quarter indoor combat and hostage rescue operations during the Gaza war.

OEMs

Leading aerospace and defense primes work with Shield AI to integrate Hivemind into their aircraft. Kratos partnered with Shield AI in 2024 to demonstrate fully autonomous flights of the MQM-178 Firejet, demonstrating Hivemind’s ability to coordinate multi-agent operations in contested airspace. As of February 2025, L3Harris is incorporating Hivemind into its DiSCO system for adaptive electronic warfare. In March 2023, Boeing signed a memorandum of understanding to explore autonomy integration into future platforms, while India’s JSW has been working with Shield AI to locally manufacture and scale V-BAT for national use since November 2024.

Sovereign Autonomy Buyers

Governments working with Shield AI seek to build domestic AI aviation programs. In March 2025, Korea Aerospace Industries announced its use of Hivemind Enterprise to develop modular autonomy for its aircraft. In Singapore, Shield AI is collaborating with the Air Force and defense tech agency DSTA to co-develop AI flight ops. Brazil’s VSK Tactical has procured V-BATs for border and rainforest surveillance. Romania and Japan are both introducing V-BAT into their naval ISR fleets, with the Japanese Maritime Self-Defense Force deploying it as the country’s first autonomous maritime ISR platform.

Engineering Services & Integrators

Booz Allen Hamilton is one of Shield AI’s earliest and most involved integrator partners — working closely to deploy Hivemind across military programs, while also having invested in the company’s Series F round in March 2025. Palantir and Shield AI partnered in November 2024 to integrate operational intelligence with autonomous systems, combining Palantir’s Gaia command-and-control tools with Shield AI’s Hivemind autonomy stack in field demonstrations.

Market Size

In 2024, countries across the world have spent $2.5 trillion on defense. The US was the largest military spender in the world by a large margin, and the US military budget makes up the largest share of the discretionary US federal budget spend. In 2024, the US spent $850 billion on the Department of Defense (DoD). Shield AI operates in two markets: autonomous software and UAS (unmanned aircraft system) platforms.

In 2020, the average total investment for autonomy and AI-related programs within the US Armed Services and DARPA (Defense Advanced Research Projects Agency) was $5.2 billion over three years. The FY2025 US defense budget request allocated $1.8 billion to autonomous technologies. AI research as a whole was allocated between $7.4 - $9.1 billion from FY2018 to FY2024. In addition, the Air Force is receiving new funding for a Collaborative Combat Aircraft (CCA) program for investment into autonomous software and drone research & development.

Competition

Anduril*: Anduril is a defense technology company founded in 2017. It builds technology for military agencies and border surveillance and has raised $3.7 billion in funding. It works with the US and its allies to develop autonomous defense solutions such as surveillance drones and the software needed to operate them. It is one of the most prominent defense-tech startups in the US, with a valuation of $14 billion as of March 2025. Shield AI competes with Anduril in both hardware and software. Like Shield AI, Anduril manufactures UAS, which includes Ghost, ALTIUS, and Anvil drones.

However, the two companies take different approaches in terms of their software. Anduril Industries’ drones are powered by Lattice OS, a complex autonomous AI software that connects sensors and platforms to create a real-time situational awareness system for all of their military hardware. By contrast, Shield AI’s Hivemind software is a full autonomy stack designed specifically for aircraft. While Anduril's Lattice OS provides an all-encompassing operating system for the military, Shield AI's Hivemind offers a tailored solution for UAS autonomy.

Saronic: Saronic is an Austin-based defense technology company founded in 2022 that specializes in autonomous surface vessels (ASVs) for maritime security and domain awareness. As of April 2025, the company has raised $845 million in funding, including a $600 million Series C round in February 2025 that valued it at $4 billion. Saronic’s autonomous systems aim to fill critical gaps in US maritime capability, offering persistent ISR, force protection, and multi-mission platforms across littoral and open-ocean theaters. With its latest raise, the company is building Port Alpha, a next-generation autonomous shipyard designed to manufacture medium and large-class unmanned vessels at a pace and scale not seen since World War II — positioning itself as a key player in the US Navy’s future hybrid fleet.

Skydio: Skydio is a California-based company founded in 2014 that specializes in autonomous drones for government, commercial, and consumer use. As of March 2025, it has raised $740 million in funding. Its drones are designed to be easy to use, safe, and able to fly without requiring a pilot to operate them. Skydio drones are equipped with advanced computer vision and artificial intelligence technology, Skydio Autonomy, that allows them to navigate and avoid obstacles. Drones are also used in construction, agriculture, and public safety industries. The company says its drones are used in every branch of the DoD, by half of all US state departments of transportation, and over 200 public safety agencies.

In November 2024, Skydio raised a $170 million extension round, following its $230 million Series E in February 2023, at a $2 billion valuation. In February 2023, the company said it's seen 30x growth from 2020, and that it is the largest drone manufacturer in the US. Like Shield AI, Skydio manufactures drones used in the military for reconnaissance, powered by its autonomous software system Skydio Autonomous.

AeroVironment: AeroVironment is an American defense contractor that designs, develops, and manufactures a portfolio of intelligent, multi-domain robotic systems. It was founded in 1971. It is one of the leading manufacturers of unmanned aircraft systems, tactical missile systems, and unmanned ground vehicles used for the US military and the top supplier of small drones to the military. Like Shield AI’s drones, AeroVironment’s small drones are used for surveillance, tactic intelligence, and reconnaissance. Unlike Shield AI’s drones, these small drones are not fully autonomous and are hand-launched. The company’s Raven drone is the world's most widely deployed unmanned aircraft system. In 2024, AeroVironment reported full-year revenue of $717 million and an adjusted EBITDA of $127 million. As of March 2025, its market capitalization is $3.4 billion.

General Atomics: General Atomics, founded in 1955, is an American defense and energy company that specializes in research and technology development. Its affiliate, General Atomics Aeronautical Systems (GA-ASI), is the manufacturer of a series of unmanned aircraft and provides electro-optical, radar, and related mission systems solutions. GA-ASI is the developer of the well-known MQ-9A Reaper drone, an upgrade from their previous Predator drone, and is used for both surveillance and strike missions. The software that powers General Atomic’s drones is based on flight control, ground control, and data processing systems, while Shield AI's Hivemind software leverages AI and machine learning algorithms to enable autonomous navigation and decision-making capabilities.

Business Model

Source: Shield AI

Shield AI operates two intertwined businesses: Hivemind, its autonomy software stack, and a suite of aircraft platforms including the V-BAT, ViDAR, and Nova 2. The company generates revenue by selling aircraft directly to defense customers, providing contractor-operated ISR services, and licensing Hivemind software as a standalone product or bundled with its hardware. Hivemind is designed to integrate into Shield AI’s own systems or third-party platforms, and is sold as enterprise software — customers can deploy it on their own aircraft with Shield AI’s engineering support or license it as part of a broader autonomy solution.

Pricing varies across programs. Public examples suggest a high average selling price — a Romanian government procurement valued a four-drone V-BAT system at $18 million, while a five-year ISR services contract with the US Coast Guard was awarded at $198 million. Shield AI focuses on Programs of Record, long-term contracts that enable predictable budgeting and deployment cycles.

Shield AI’s headquarters and core R&D hub are based in San Diego, CA, while V-BAT development and production take place in Batcave, a 107K square foot facility in Dallas, TX, following the 2021 acquisition of Martin UAV. To fund growth, the company has raised both equity and inventory-backed debt, balancing the demands of autonomy R&D with production scale-up.

In April 2024, the company announced the acquisition of Australia-based Sentient Vision Systems, the creators of ViDAR, and established manufacturing operations in Melbourne to scale its maritime ISR capabilities. Shield AI also maintains offices in Washington, D.C. to support federal engagement, Abu Dhabi, UAE for partnerships in the Middle East, and Kyiv, Ukraine, where it is training Ukraine’s Unmanned Systems Forces and operating a local office to support front-line deployments.

Traction

Source: Shield AI

As of April 2025, Shield AI has grown to a 900-person company with an estimated $267 million in 2024 revenue, and has been recognized across Forbes AI 50 2023, the American Dynamism 50 2024, and Enterprise Tech 30 2025.

Shield AI currently has contracts with the DoD (Department of Defense) and its allies and is actively supporting operations in the field. Its contracts include a $7.2 million Small Business Innovation Research (SBIR) contract to enable the development of AI capabilities for US Army Aviation units and a prime position on a multi-billion dollar Eglin Wide Agile Acquisition Contract (EWACC). While the details of this contract are undisclosed, the contract has a 10-year ordering period with a ceiling value of $46 billion. In July 2024, Shield AI was awarded a $198 million indefinite-delivery/indefinite-quantity fixed-price contract to provide Contractor Owned Contractor Operated (COCO) intelligence, surveillance, and reconnaissance services using their V-BAT UAS.

Shield AI was also rewarded a maximum amount awarded through the Air Force’s Strategic Funding Increases (STRSTFI) program to accelerate the integration of Hivemind into various military and commercial platforms, and an indefinite-delivery/indefinite-quantity contract with a ceiling amount of $950 million from the US Air Force as part of their Joint All Domain Command and Control (JADC2) efforts. They were also recently selected to receive funding from the DoD’s APFIT Pilot Program, which aims to get new technologies into the hands of warfighters quickly. The funding will go into a project involving the initial purchase of Shield AI’s V-Bat. With these contracts, Shield AI can provide advanced AI capabilities to the military and its allies, helping them achieve their missions effectively and efficiently. Furthermore, Boeing and Shield AI have signed a memorandum of understanding to explore strategic collaboration in autonomous capabilities and artificial intelligence on current and future defense programs.

Valuation

In March 2025, Shield AI raised $268 million in a Series F funding round, which brought the company's total funding to $1.3 billion and increased its valuation to $5.3 billion. Washington Harbour Partners, US Innovative Technology Fund, L3Harris Technologies, Hanwha Aerospace, Cacti, and Andreessen Horowitz participated in the round. The proceeds from the round will be used to scale Hivemind Enterprise.

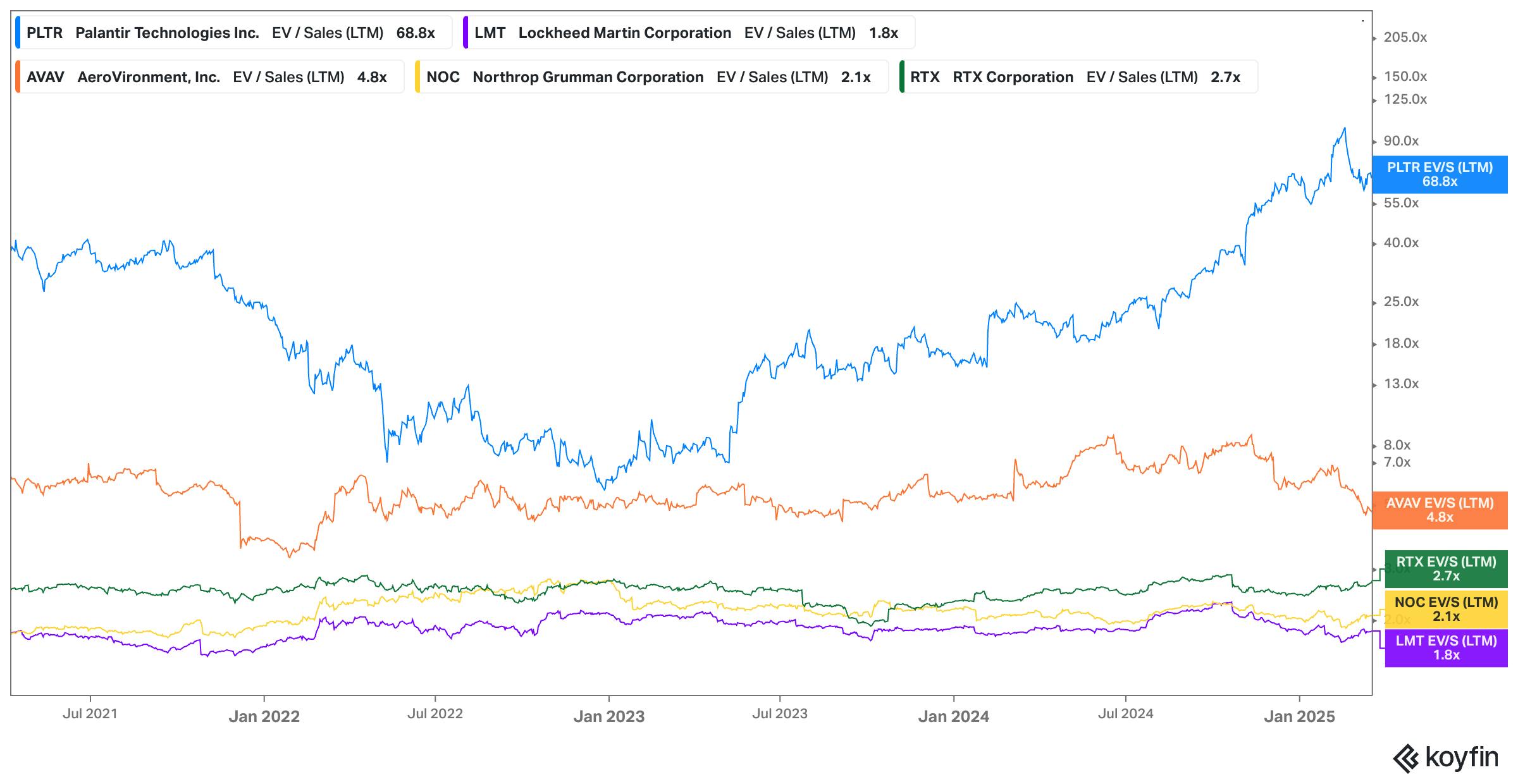

As of April 2025, Shield AI’s Series F makes it the second most valuable defense tech startup in the US after Anduril*, which was valued at $14 billion when it raised its $1.5 billion Series F in August 2024. Shield AI’s revenue in 2024 was estimated at $267 million. At a valuation of $5.3 billion in March 2025, the implied revenue multiple is 20x. As a proxy, Palantir, AeroVironment, Lockheed Martin, Northrop Grumman, and RTX are comparable companies that are publicly traded.

Source: Koyfin

Using these companies as a benchmark gives a range of revenue multiples: Palantir at 68.8x, AeroVironment at 4.8x, Lockheed Martin at 1.8x, Northrop Grumman at 2.1x, and RTX at 2.7x.

As a growth-stage defense technology company with increasing international traction, Shield AI’s 20x revenue multiple reflects investor conviction in its long-term potential to redefine autonomous warfare. The valuation is well above traditional aerospace and defense primes like Lockheed Martin or RTX, and more aligned with high-growth software players like Palantir —signaling that investors view Shield AI not just as a defense contractor, but as a category-defining platform company.

Key Opportunities

Software Backbone of the Military

Shield AI is aiming to become a leading defense contractor for the 21st century, focusing on providing artificial intelligence and autonomous solutions for defense applications. By actively partnering with leading aircraft manufacturers and integrating its AI pilot technology into established aircraft and unmanned systems, Shield AI has the opportunity to become the software backbone for unmanned assets — aircraft, ground vehicles, ships, boats, submarines, etc.— throughout the military. By successfully integrating Hivemind into an established platform like the F-16, Shield AI has demonstrated its ability to bring its AI pilot software stack to existing military systems, transforming its capabilities and enhancing its operational effectiveness.

Acquisitions & Partnerships

Shield AI’s goal is to power the next generation of aircraft with Hivemind, intending to expand its AI pilot to larger military platforms through organic growth and acquisitions. In 2021, Shield AI acquired Heron Systems, a Maryland-based defense contractor renowned for its use of reinforcement learning. Heron developed an AI pilot that was able to defeat an experienced Air Force F-16 pilot in five rounds of simulated air combat during the DARPA AlphaDogfight Trials. This strategic acquisition of Heron enables Shield AI to accelerate the deployment of its AI-pilot technology in both legacy and future aircraft.

Moreover, in 2021, Shield AI entered an agreement to acquire Martin UAV, an aerospace company best known for its industry-leading VOTL unmanned aircraft, the V-Bat. In its press release, Shield AI emphasized that the acquisition of Martin UAV is part of its deliberate strategy to integrate Hivemind into unmanned systems by building a portfolio of systems via vertical integration and strategic partnerships. By acquiring companies with complementary products and technologies, Shield AI can strengthen its position in the industry and extend its offerings to cater to a wider range of applications.

Expansion into Commercial

Beyond the military application of Shield’s AI pilot software, there is potential for success in the commercial space. Shield AI is focusing on establishing its product and brand within the US military and its allies. The commercial aviation sector is highly regulated; however, once Shield AI’s concepts are proven in the military, the capabilities can be translated into the commercial aviation sector.

Furthermore, Shield AI's Hivemind software has the potential to integrate not only with military assets but also with eVTOL (electric vertical takeoff and landing) to create a commercial market for short-distance air transport. The economics of flying taxis is challenging, as employing two or even one pilot per aircraft would be economically unfeasible. Flying taxis can only become a reality with highly reliable autonomous systems. Brandon Tseng has stated that Shield AI has been in talks with several companies in the eVTOL space. By venturing into the commercial sector, Shield AI could expand its market. The US commercial drone market was estimated at $29.9 billion in 2022 and has an expected compound annual growth rate of ~39% from 2023-2030. This expansion could position Shield AI as a key player in both military and commercial applications of AI pilot technology.

In April 2024, Shield AI entered an agreement to acquire Sentient Vision Systems, an Australia-based company building AI-enabled real-time situational awareness. In its press release, Shield AI emphasized that the merger will combine both companies' AI expertise and operational understanding to deliver better intelligence surveillance and reconnaissance (ISR) capabilities. The combination of Shield AI's AI pilots and affordable drones will provide the same land and maritime domain awareness that only today's Group 5 drones (costing up to $40 million to $180 million) can at a fraction of the price. Finally, Shield AI will leverage this acquisition to establish Shield AI Australia, thereby expanding its reach into more foreign markets.

Key Risks

Ethical Concerns of AI

Ethical concerns around the development and use of AI in military operations and autonomous drones have been on the rise. As AI technology advances, so do ethical concerns and public debate, particularly regarding the potential for autonomous weapons and the loss of human control over life and death decisions. One such example is the "Stop Killer Robots" campaign, a global coalition of NGOs that seeks to ban fully autonomous weapons, highlighting the dangers of delegating critical decisions to machines without human intervention. Ethical concerns around AI could negatively impact Shield AI’s reputation, funding, and partnerships as public opinion and regulatory pressures could lead to restrictions on the development and deployment of AI-powered military technology.

Competition

The market for AI and autonomy in aviation is becoming increasingly competitive, with numerous startups and established companies entering and operating in the space. Shield AI faces the challenge of staying ahead of competitors in terms of technological innovation, performance, and market share.

Reliance on Government Contracts and Partnerships

Shield AI's growth strategy relies heavily on partnerships with other defense contractors, aircraft manufacturers, and acquisitions of complementary companies. Failure to forge successful partnerships or integrate acquisitions effectively could hinder the company's growth. Additionally, Shield AI has relied on government contracts, which have historically moved very slowly. The military vetting process moves extremely slowly compared to the breakneck speeds that we are seeing in AI development.

Summary

Shield AI is a defense technology company developing AI pilots and autonomous aircraft for military use. Its core software product, Hivemind, enables aircraft to operate and make decisions without GPS, communications, or human input. Hivemind is deployed across Shield AI’s growing suite of aircraft platforms, including the V-BAT (a long-endurance VTOL drone), ViDAR (an AI-enabled optical sensor payload), and Nova 2 (an indoor reconnaissance quadcopter). Shield AI also licenses Hivemind to third-party aircraft manufacturers and defense agencies, positioning itself as both a systems integrator and autonomy infrastructure provider for the next generation of military aviation.

*Contrary is an investor in Anduril Industries through one or more affiliates.