Thesis

A common hurdle faced by many companies and industries is unstructured data, much of which requires manual processing. In fact, the sheer volume of data that exists globally, both on the cloud and in data centers, is daunting. Global data volume is projected to reach 175 zettabytes by 2025, up from 33 zettabytes in 2018. 80% of that is expected to be unstructured, a potential source of errors during manual processing.

Companies often spend significant resources on manually processing data, leading to inefficiencies and increased operational costs. Research shows an 18-40% probability of errors during manual data entry. Furthermore, a 2021 survey indicated that 83% of workers spent one to three hours a day correcting such errors, further exacerbating time and productivity losses. Automating such processes should help businesses to save time and reduce errors.

The intelligent process automation (IPA) market is witnessing substantial growth as businesses are increasingly adopting IPA solutions. In June 2022, businesses adopting intelligent process automation reported an average of 32% in cost savings. The global IPA market, valued at $16.2 billion in 2024, is expected to reach $42.1 billion by 2032 and is growing at a CAGR of 12.6%.

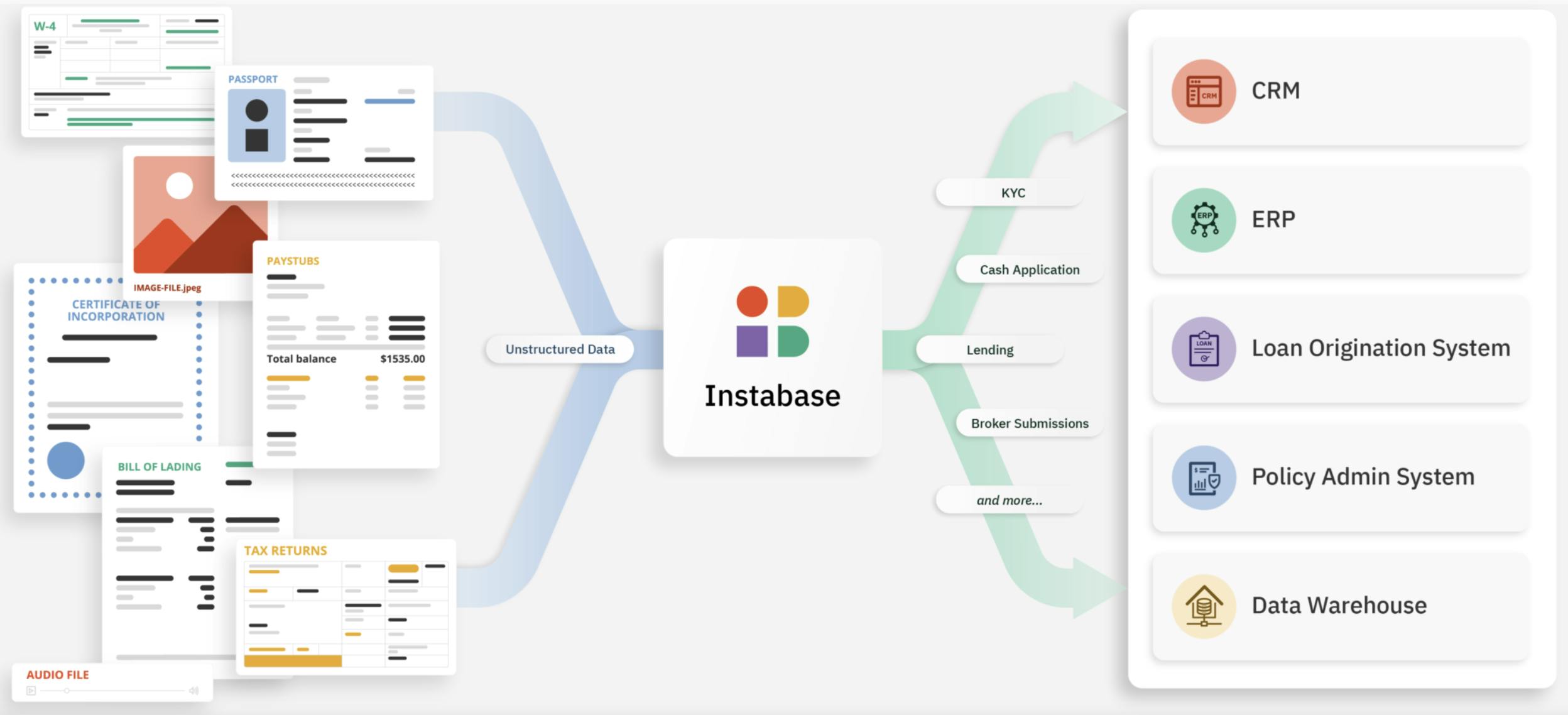

Instabase provides AI-powered document processing and workflow automation solutions. The company offers customizable applications that assist businesses in industries such as finance, insurance, and legal services, in extracting and processing unstructured data, such as handwritten forms and documents. These solutions leverage AI to automate workflows, enabling users to create end-to-end processes without coding.

Founding Story

Instabase was founded in 2015 by Anant Bhardwaj (CEO). Originally from India, Bhardwaj first came to the US for his Master’s in computer science at Stanford in 2010. Following that, he went to MIT in 2012 to pursue a PhD. In 2015, while at MIT, he was working on four different projects as part of his PhD research. One of the four projects, Datahub, aimed to redefine the traditional database concept by establishing a centralized hub capable of connecting various data sources and enabling the building of applications.

While Bhardwaj did not have any grand plans for Datahub originally, it quickly gained popularity within MIT as various organizations and clubs within the university began using it for their own projects. Around that time, a venture capitalist was visiting MIT and encouraged Bhardwaj to drop out and pursue the project full-time.

Bhardwaj took this advice and, in August 2015, dropped out of his PhD program and moved to the Bay Area. At the same time, he reached out to Matei Zaharia, the CTO of Databricks who was also a faculty member at MIT at the time, to introduce Bhardwaj to investors. These introductions allowed Bhardwaj to successfully raise a seed round for his new company, Instabase, which was based on the Datahub project he had been pursuing at MIT.

After raising seed capital, Instabase needed to find use cases for its technology. The first few apps developed ended up being unprofitable. During this experimentation phase, several potential deals fell through as the company was talking to early potential customers like Zenefits to find product-market fit.

Eventually, Martin Casado, an investor at Andreessen Horowitz, came across an Instabase demo and proceeded to lead its Series A funding round, a $23 million round in 2017. He also introduced Instabase to what became its first major client, Standard Chartered Bank, which signed a $1.5 million annual contract in 2018. Instabase essentially found product-market fit as a result of this deal, as it began to focus on financial institutions and the banking industry, eventually signing eight out of the top 10 banks globally as clients.

Originally, the company had an anti-ML stance as the technology was not yet advanced enough to work well for the problem it was tackling, i.e. unstructured data. However, after reading the 2017 Google paper "Attention Is All You Need", Bhardwaj pivoted completely on the issue in 2018, even going so far as to send a note to the board which he described as “wildly contested at the time” that stated:

“At Instabase, we have determined that deep learning is the future of language understanding. We are going to invest fully in that. The question is not about whether this approach will work or not. We have determined that we will invest everything to make this approach work.”

The company initially built its own language model, InstaLM, which could run on CPUs but required GPUs to fine-tune. Many customers did not have GPUs, so the company devised a solution to train the models on the cloud before running it on-premise for them. This solution worked well until 2022 when large language models (LLMs) became more popular, especially after the release of OpenAI’s ChatGPT that year.

While testing its applications using LLMs, Instabase realized it would be able to produce better results without the need for fine-tuning, thereby eliminating the GPU issue faced by its customers. Bhardwaj then connected with his friend and OpenAI co-founder Ilya Sutskever. After experimenting with OpenAI’s models himself, hedecided to partner with the company and use its GPT model for its next flagship product, AI Hub, which was launched in 2023.

In terms of notable hires, Sumeet Gajri joined Instabase as Chief Strategy Officer in March 2020, having been an advisor to the company previously. Gajri had previously been Chief Strategy Officer at Carta.

Product

AI Hub

Source: Instabase

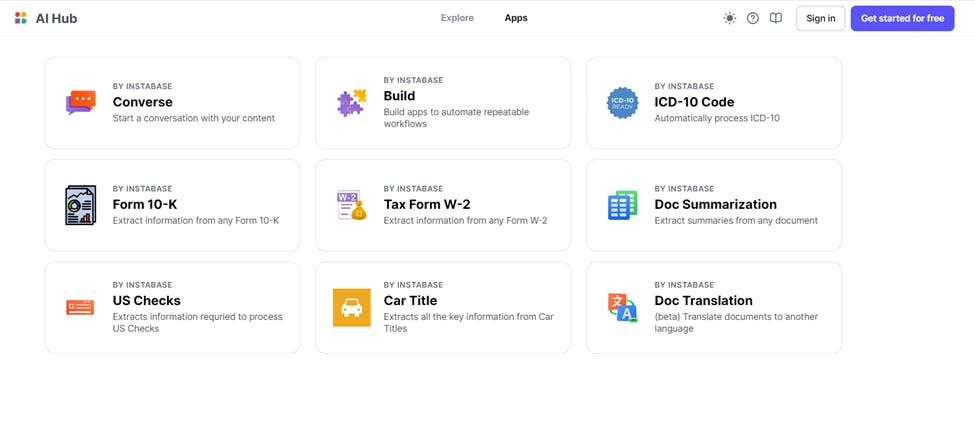

Instabase’s core offering is its AI Hub product. Launched in June 2023, AI Hub is a community platform of applications that leverage OpenAI’s GPT-4 to perform various natural language processing tasks. It enables users to process unstructured data, such as handwritten notes and forms, develop applications to automate recurring end-to-end workflows, and utilize prebuilt applications from both Instabase and the community. The platform contains two main applications, AI Hub Converse and AI Hub Build, as well as an app store for prebuilt applications.

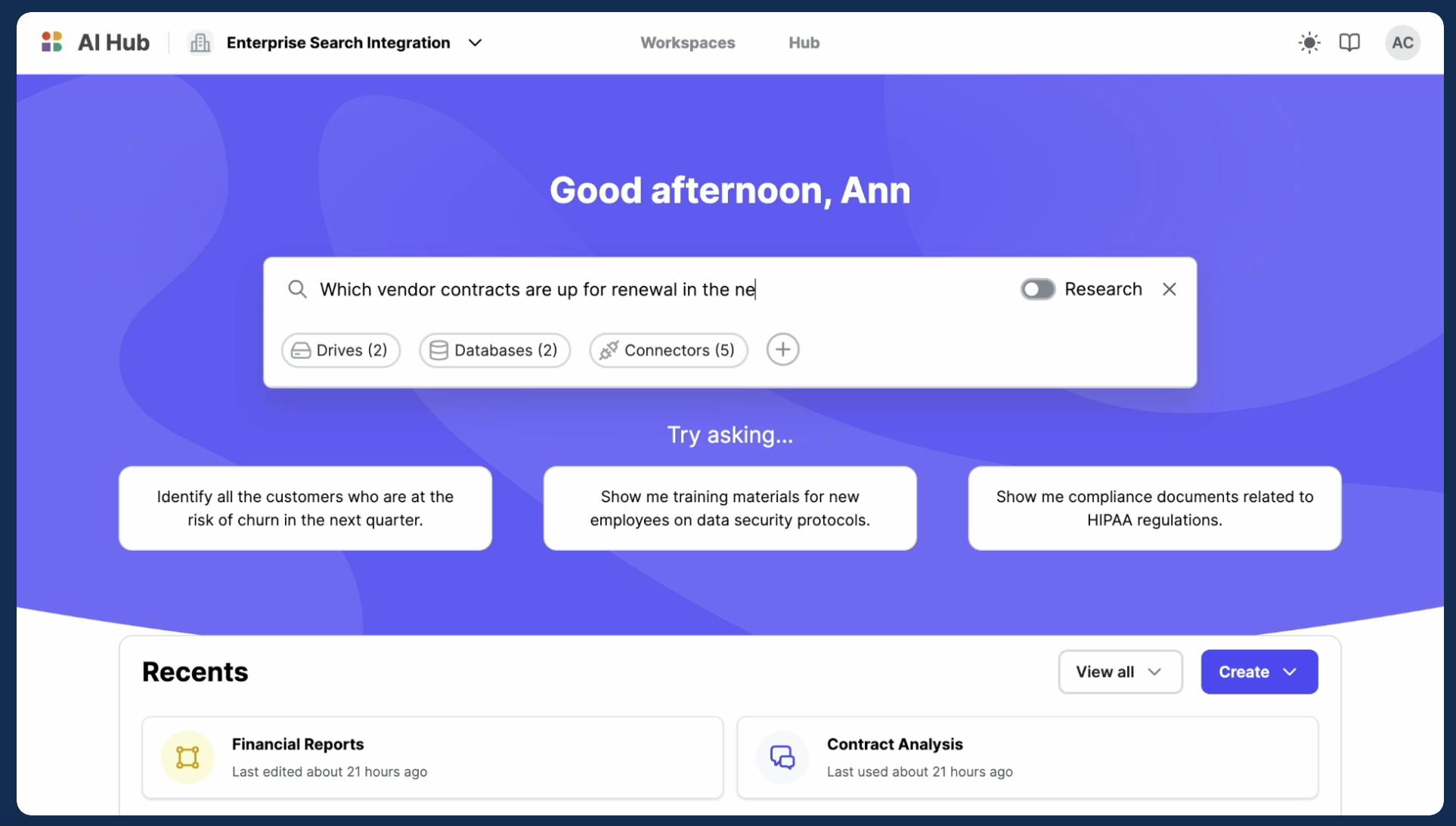

AI Hub Search

Source: Instabase

Instabase’s AI Hub Search helps users gain insights and take action across all their data and systems. It digitizes and interprets unstructured data from various formats, delivering researched and referenced answers. The tool integrates with over 100 apps and data stores as of July 2024, using secure, federated AI agents, maintaining data access controls without centralizing data. This offering is intended to allow users to bridge information silos and make informed decisions efficiently.

AI Hub Build

Source: Instabase

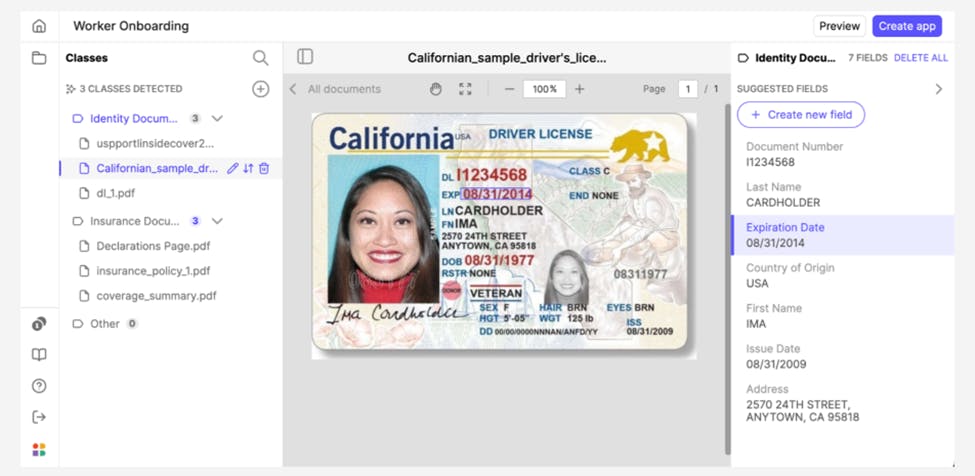

Many businesses deal with a large volume of documents that require processing, verification, validation, and other actions. Instabase’s AI Hub Build offering is a no-code tool that allows users to build apps and workflows to process documents and extract insights, summarize, translate, reason, or generate new content from those documents. It provides customers with a customizable and configurable way to extract and process data from documents or files containing unstructured or handwritten data.

The outputs from user-built apps can then be downloaded in structured formats like CSV files. Furthermore, apps can also push outputs to connected storage solutions like Google Drive or Amazon S3 buckets. There are also APIs available to export results to downstream applications, enabling automation of manual processes at enterprise level.

An example use-case for AI Hub Build would be for enterprises onboarding new employees. Using this product offering, an enterprise can build an application that detects ID documents such as drivers licenses, and extract the relevant information into a structured file format that can be processed within their system.

The apps built via this tool can understand and process documents varying in format, complexity, and imperfections. Also, as part of the no-code experience, users can customize and define the fields they require and provide brief descriptions when building their applications, leaving the AI to handle the rest. There are also AI guardrails in place to verify results against various data quality checks and business rules, intended to maximize the accuracy of extracted data while minimizing errors.

Instabase Apps

Source: Instabase

Instabase’s AI Hub also has an app store containing various apps pre-built by Instabase using AI Hub Build. These applications were inspired by Instabase’s existing and early users and targeted the common workflows and documents they faced. These include apps to extract info from tax forms (i.e. W-2), US checks, car titles, etc. While these pre-built applications are the only applications available on the app store as of July 2024, Instabase is also working on the functionality for users to share their custom-built apps onto their public app store.

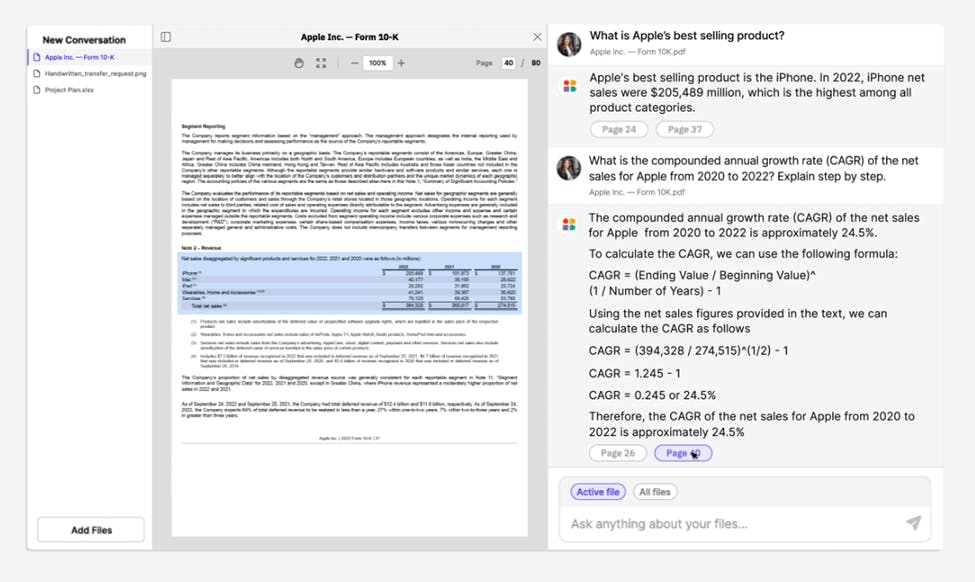

AI Hub Converse

Source: Instabase

Powered by GPT-4, AI Hub Converse enables users to interact with files they upload. Through conversational prompts, users can extract and process data, as well as generate answers, summaries, and analyses from their uploaded content. AI Hub Converse can understand, index, and route correspondence, such as emails, attachments, chats, and letters. Beyond that, it can also classify files, discern intent, and even split multi-document packets into individual files.

AI Hub Converse can handle a variety of file formats regardless of complexity or length. It is designed so the results of data extraction, processing and analysis remain consistent irrespective of whether customers engage with single-page handwritten notes or with 400-page financial filings. Customers can even fact-check the sources of information obtained.

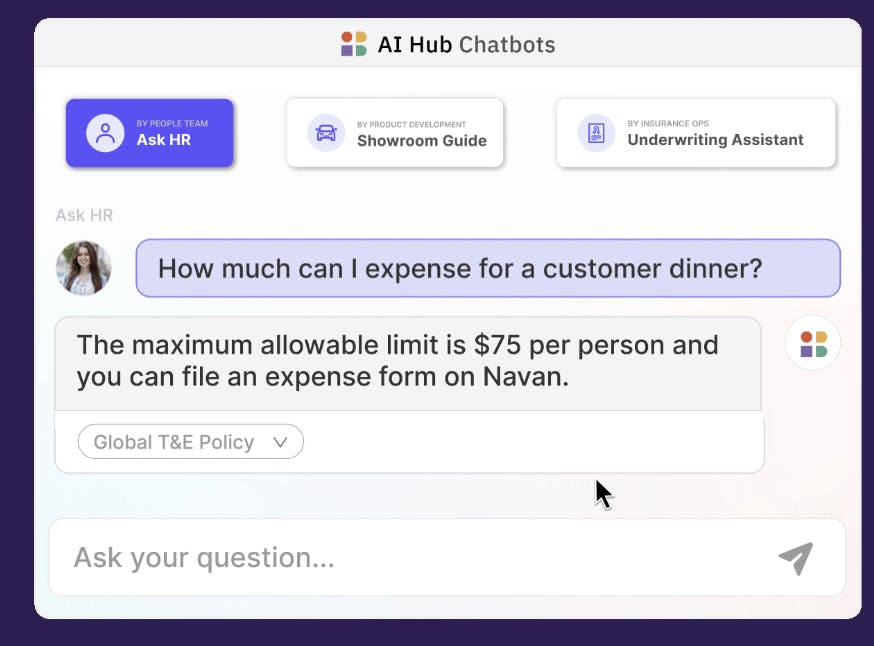

AI Hub Chatbots

Source: Instabase

Instabase AI Hub Chatbots is a product offering that is intended to turn company knowledge into expert chatbots, allowing employees and customers to quickly access answers from unstructured data. This is intended to enhance productivity, accelerate onboarding, and improve customer support for customers.

The tool supports various applications, including employee onboarding, customer support, underwriting assistance, product documentation, investment analysis, and compliance. Instabase claims that it is able to provide accurate, referenced answers from diverse data sources like PDFs, scans, and spreadsheets, ensuring reliable and verified responses.

Use Cases

Financial Services

Intabase’s financial services suite contains apps that handle data from common forms across five specific subsectors within the financial industry: retail banking, commercial banking, investment banking, asset management, and wealth management.

Retail banking customers can use this suite of applications to process documents across KYC, account opening, lending, and others to enable their employees to spend more time in value-added customer engagement. Commercial banking customers can leverage it across use cases like onboarding, payments, compliance, and client service, creating competitive differentiation, better risk management, and enhanced customer experience. Investment banking customers can utilize this suite for documents in areas like onboarding, trading, operations, and investment processes.

Insurance

Instabase’s insurance offering contains apps that handle forms and documents used in or by Property and casualty insurance, life insurance, brokers, and reinsurance. Property and casualty insurance customers can use this offering to process documents faced during broker submissions, commercial claims, and bodily injury auto claims. Life insurance carriers can use it to help automate underwriting, process claims, and automate administrative changes such as adding a dependent.

Brokers and agents receive information from their customers such as exposure documents, quotation documents, loss runs, and schedules of value. These are usually emailed in and have high variability. Brokers can therefore use this offering to help process such information and make it structured, to reduce cycle time and increase capacity.

Important reinsurance processes across property and casualty, life and benefits, and specialties such as underwriting and claims adjustment are underpinned by unstructured data. Such data normally requires manual handling and review. Instabase provides apps that can automate the processing of this data to help achieve higher accuracy, faster settlement times, and greater processing capacity.

Healthcare

Instabase’s healthcare suite contains apps that handle common forms and documents for patient onboarding, service delivery, claims adjudication, and payments and operations. It helps to streamline end-to-end patient onboarding with automated document understanding. It’s also intended to eliminate manual review and reduce onboarding times while remaining compliant with regulations.

Instabase’s healthcare offering is also intended to improve service delivery by decreasing handling times and identifying claims that qualify for reimbursement correctly. When it comes to claims adjudication, incoming claims need to be adjudicated through a review of accompanying medical documents. Appeals and denials to claim decisions are common. This suite also offers solutions for risk management, appeals and denials, and utilization management to prevent fraud.

Healthcare payments and operations is a complex area often involving many stakeholders. Cross-billing and reconciliation is a constant activity and is made more complex by the high variability of incoming invoices. This offering also helps with invoice processing with the goal of simplifying and reducing the time and effort involved.

Public Sector

Instabase's Public Sector suite automates document-heavy processes for public sector agencies like the Department of Defense to enhance mission outcomes, reduce backlogs, and improve the citizen experience. It processes large volumes of unstructured data such as documents and logs. Key applications include contract management, fraud detection, immigration processing, and tax automation.

Market

Customer

Source: Instabase

Instabase began with customers in the financial services and insurance industries originally before diversifying into other sectors, eventually building a customer base across a variety of industries such as financial services, insurance, travel, transport, logistics, and the public sector. Notable customers as of July 2024 include Natwest, Standard Chartered, Gusto, Uber, Rocket Mortgage, and AXA.

Businesses in the industries that Instabase serves often manage their processes through a combination of legacy systems and manual effort. Instabase’s AI-powered document processing solution is intended to streamline these workflows. For instance, one Instabase client estimated that it would only need five or six employees for its financial compliance project using Instabase compared to the original 100 it was planning to allocate. Instabase says its solutions are able to reduce customer processing times by up to 83%, significantly improving efficiency as well as freeing up time for employees to address other tasks.

Market Size

As of May 2024, the global intelligent process automation (IPA) market was estimated to be valued at $14.4 billion in 2023 and was projected to reach $42.1 billion by 2032, growing at a compound annual growth rate (CAGR) of 12.6%. This market includes various components such as point solutions, end-to-end workflows, and technologies like machine learning, natural language processing, and robotic process automation. SMEs are projected to be a fast-growing segment within the IPA market from 2022 to 2030.

Enterprises across various sectors, such as financial services, healthcare, and manufacturing, have all begun investing in automation solutions to streamline their processes. This is evidenced by a poll conducted in 2022 which showed that 70% of companies were piloting some form of automation feature, up from 57% in 2018.

Competition

Hypatos: Founded in 2018, Hypatos specializes in automating document-based back-office processes with AI-powered software. The company raised an undisclosed amount in a Series A funding round led by DN Capital in January 2022. The Berlin-based startup has raised €13.2M in total funding from investors like BlackFin Capital Partners and Grazia Equity.

Similar to Instabase, Hypatos offers AI-powered intelligent automation solutions. The company also offers no-code functionality for users to train and deploy AI models as part of the automation workflow. However, unlike Instabase, which offers a range of automation solutions across various industries, Hypatos focuses specifically on automating financial document processing.

ABBYY: Founded in 1989, ABBYY specializes in providing intelligent document processing and content capture solutions powered by AI and machine learning. Like Instabase, its AI technology enables organizations to extract insights and automate processes from unstructured data such as documents, images, and emails. However, a notable difference lies in their go-to-market strategies; while Instabase offers a customizable, no-code platform tailored for both SMBs and large enterprises, ABBYY takes a more traditional approach with a strong focus on enterprise-scale solutions and deeper integrations within existing corporate IT infrastructures. ABBYY raised an undisclosed growth equity investment in 2021 by Marlin Equity Partners, adding to an estimated $6 million in total funding prior to this.

IBM Watson Discovery: With IBM Watson Discovery, customers can boost the productivity of knowledge workers by automating the discovery of information and insights with advanced natural language processing. Originally entered the intelligent document processing market in December 2020, Watson Discovery also added additional NLP enhancements in November 2021. It shares similarities with Instabase with a Smart Document Understanding (SDU) feature which is able to analyze enterprise documents to extract user-specified and requested data. Also, Watson Discovery can generate insights and analyses from these documents just like just like Instabase’s AI Hub. Furthermore, it also comes with pre-built applications for similar use cases and target industries like insurance, banking, and healthcare.

UiPath: Founded in Romania in 2005, UiPath is a software company that provides a platform for automating repetitive tasks and business processes. The company enables organizations to deploy software bots that emulate human actions to carry out various tasks, thereby improving efficiency and reducing operational costs. The company went public in April 2021 and had a market cap of $7.1 billion as of July 2024.

While UiPath and Instabase both focus on automating business processes, UiPath primarily focuses on automating structured and repetitive tasks across applications. Instabase, on the other hand, specializes in intelligent document processing, leveraging AI to handle unstructured data and complex document workflows. While UiPath also offers an intelligent document processing solution, its automation extends across a broader range of use cases, from desktop automation to process mining. Instabase’s solution is more niche and is also fully customizable.

Business Model

Source: Instabase

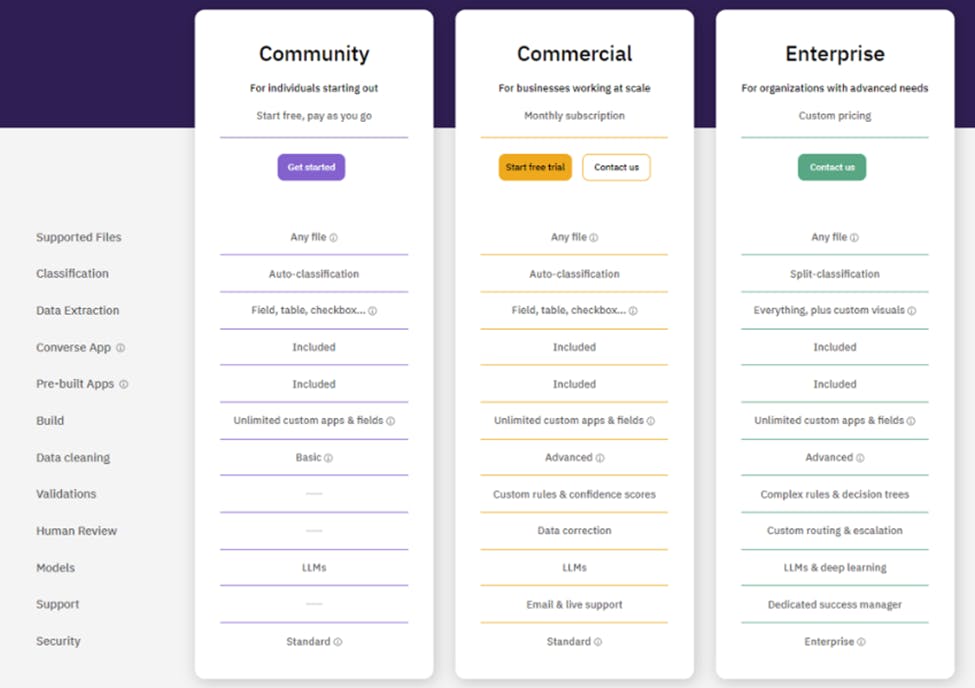

Instabase operates on a SaaS business model with three subscription tiers.

Community: Instabase’s community tier is a free plan meant for individual users just starting out. AI Hub Build, Converse, and existing pre-built apps are available. However, support, validations, and human review functionalities aren’t available.

Commercial: Instabase’s commercial tier is a monthly subscription plan intended for businesses working at scale. It contains additional features beyond the community plan offering, such as email and live support, validation methods like custom rules and confidence scores, and custom data cleaning. The exact pricing for this tier is not publicly listed.

Enterprise: The enterprise tier is intended for organizations with advanced needs. Unlike the commercial plan, a custom pricing model will be assigned to organizations that sign up under this tier. This is the most comprehensive tier with all the commercial tier functionality but also comes with deep learning in addition to just LLMs, a personalized customer support manager, and enterprise-grade security amongst other upgrades. Pricing for enterprise-tier users is custom.

All tiers have a “pay as you use” structure. Additional cost incurred by customers depends on their usage of Instabase’s internal consumption units. Consumption units are available for purchase at 100 consumption units per USD. There are three LLM versions that Instabase offers customers for their products. Users can choose between default, advanced, and multistep models. The usage of consumption units depends on the user’s choice of model. For example, a user using AI Hub Converse to engage with a two-page document is charged one unit per query for the default model, four units per query for the advanced model, and eight units per query for the multistep model.

Traction

In 2021, Instabase placed number 46 on the Deloitte Fast 500 list, which is a ranking of the 500 fastest-growing companies in North America. Its revenue that year was estimated by an unverified source to be $21 million, up 200% from the previous year. Instabase’s estimated revenue from the same source in 2023 was $46 million, a 119% increase from 2021. Notable customers as of July 2024 include AXA, Standard Chartered, Paychex, Sonic Automotive, NatWest, the US trademark and patent office, and Gusto.

Valuation

Instabase raised a $45 million Series C in June 2023 at a $2 billion valuation, with Tribe Capital leading the round. Over five funding rounds, Instabase has raised $192 million in total funding as of July 2024 with notable investors including Andreessen Horowitz, Greylock Ventures, NEA, and Spark Capital. Its $2 billion valuation would have represented a 46.9x revenue multiple if the estimate of $46 million in revenue in 2023 is correct.

Key Opportunities

Customer Experience Applications

One key opportunity for Instabase lies in using AI to enhance customer service and experience. Instabase can utilize its solutions to analyze vast amounts of data from customer interactions and system performance metrics. By identifying bottlenecks and inefficiencies within customer service processes, it can offer targeted improvements that streamline operations and elevate the customer experience. Competitors like UiPath have rolled out solutions for this sector in 2024, indicating that Instabase could benefit from taking advantage of the same opportunity.

AI-Driven Insights

As companies accumulate vast amounts of data across various operations, the ability to derive actionable insights from that data becomes increasingly critical. It is predicted that by 2025, 60% of traditional analytics models will have been replaced by AI-driven ones. Instabase's AI capabilities can analyze complex datasets to uncover patterns, trends, and anomalies, enabling businesses to make informed decisions. It can help companies identify market trends, optimize supply chain operations, and enhance product development strategies.

Key Risks

Custom In-House Solutions

One of the potential risks to Instabase’s business model is the potential for competitors to develop their own in-house solutions. As companies increasingly recognize the value of AI-driven document processing, they may find it more cost-efficient to build custom solutions tailored to their specific needs rather than relying on third-party platforms. For example, Standard Chartered's contract with Instabase reportedly costs $1.5 million annually. Such high costs could drive companies to invest in developing proprietary technologies to reduce long-term expenses.

Privacy and Regulation

Because of the market it operates in, Instabase is exposed to the threats posed by regulatory changes, compliance issues, and privacy breaches. Instabase operates in a landscape of increasing regulatory scrutiny and growing consumer concerns about data privacy and security. Data protection regulations, such as CCPA, could pose regulatory obstacles. Moreover, the handling of documents containing personally identifiable information presents risks of data breaches, which can result in identity theft and financial fraud, leading to reputational damage and loss of customer trust.

Summary

Instabase is positioned in the growing IPA market. Its goal is to change how enterprises handle unstructured data with its AI-driven platform. The company's solutions cater to diverse sectors and are intended to address operational inefficiencies and enhance productivity. With the launch of its flagship product line, AI Hub, in 2023, Instabase has expanded into the broader IPA market by providing its customers with the ability to design and customize full end-to-end workflows using its no-code features. Instabase must navigate significant risks, such as the threat of in-house solutions and the ongoing challenges related to data privacy, compliance, and regulatory concerns.