Thesis

In 2022, ecommerce businesses lost $41 billion to online payment fraud, with projections reaching $48 billion in 2023. The COVID-19 pandemic accelerated the shift to digital work environments, introducing new security risks. A 2022 Verizon report found that 79% of chief information security officers (CISOs) believed recent changes in work practices adversely affected their organization's security, while 66% of CISOs felt remote work increased vulnerability to cyberattacks. In response to these challenges, security spending has increased. The same 2022 report found that 77% of respondents increased their cybersecurity budgets in 2022, up from 65% in 2021. Regulatory bodies are also taking note, with the SEC expanding cybersecurity disclosure requirements in 2023 and showing a willingness to penalize companies for lax practices.

Mobile security is another growing area. There were 7.2 billion mobile device users as of 2024, and this number is expected to reach 7.5 billion by 2025. As a result, the mobile attack surface has grown significantly. The global mobile app market was valued at $252.9 billion in 2023 and accounted for up to 61% of e-commerce purchases in 2024. In enterprises, 60% of endpoints accessing corporate assets are mobile devices and multi-factor authentication often relies on mobile as an additional factor. As of 2023, 70% of digital fraud occurs on mobile devices. Additionally, mobile security breaches are a threat with 45% of companies reporting mobile-related compromises in 2022, rising to 61% for companies that operate globally.

Along with the growing risks associated with mobile devices, organizations are also navigating the complexities of cloud security in an evolving digital landscape. Public cloud revenue was $32 billion in 2018 and is expected to reach $675 billion in 2024. However, security remains a bottleneck in cloud adoption. The diversity of cloud workloads has expanded the attack surface, making cloud security a top priority for CISOs. The shared responsibility model of major cloud providers places the onus on customers to correctly implement security tools, often leading to misconfigurations that cause breaches. This complexity has forced growth for cloud security solutions, with spending on cloud infrastructure security estimated at $172.5 billion in 2022, and expected to reach $267.3 billion by 2026.

Lookout is a cybersecurity company specializing in mobile endpoint security and cloud security solutions for enterprises. Its product offerings include Mobile Endpoint Security, Threat Intelligence, and a Security Service Edge (SSE) platform. Leveraging one of the world's largest mobile security datasets, Lookout provides advanced threat detection and protection for over 2K enterprise customers as of December 2024, including major telecommunications companies and large tech companies.

Founding Story

Source: Lookout

Lookout was founded by John Hering (Executive Chairman, former CEO), Kevin Mahaffey, and James Burgess (former COO and CIO) in 2007.

The co-founders met as classmates at the University of Southern California in 2004. All three had a background in security, and when playing around with a Nokia 3610 in 2004, they discovered a few security vulnerabilities relating to its Bluetooth functionality. They tried working with Nokia to solve this issue, but the company ultimately ignored them, believing that solving it would be too minor of an issue since the range of vulnerability for the issue question was only 10-100 meters.

To challenge Nokia on this assumption, the founders built BlueSniper, a device they used to extract data via Bluetooth. That same year, they set the world record for Bluetooth range, connecting to the Nokia 1.1 miles away and stealing the phone’s entire contact list and sending SMS messages to it. In 2005, they brought the BlueSniper to the Academy Awards and detected vulnerabilities on hundreds of celebrities’ phones. During this time, they continued their research, built the core technology for Lookout’s mobile app, and spoke at security conferences.

Source: Lookout

In 2007, the founders officially launched Lookout under the name Flexilis. In 2008, the company launched its first product, a consumer-facing security app for the Windows Mobile platform. In an interview, Mahaffey recalled the difficulty with user acquisition early on; because Windows Mobile had no App Store, they had to promote the product through blogging platforms.

In 2010, Lookout launched its app on Android. Mahaffey recalled this launch going “phenomenal”, and ultimately led the company to acquire 1 million users faster than FourSquare and Twitter did. In 2011, the company launched its app on iOS and surpassed 10 million users across all its platforms.

Hering led Lookout as its CEO from 2007 until 2014, after which Jim Dolce, who remains CEO as of December 2024, took the helm. Dolce was a four-time founder and held executive roles at Akamai Technologies and Juniper Networks before joining Lookout.

Product

Mobile Endpoint Security (MES)

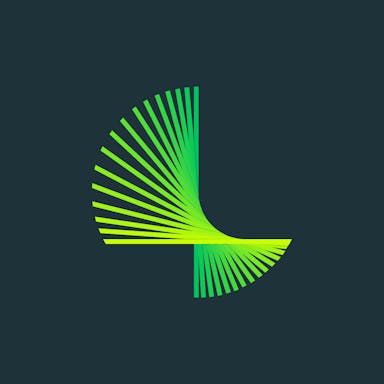

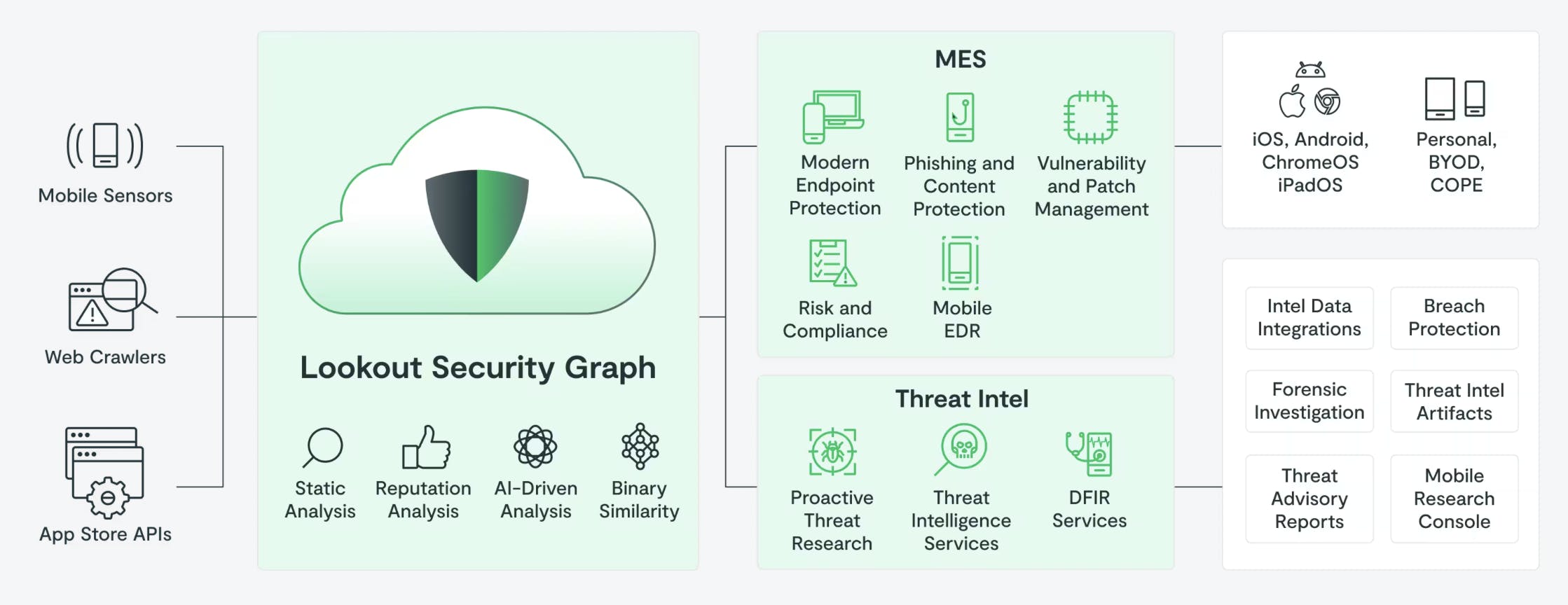

Lookout offers a mobile security product suite that includes Mobile Endpoint Security (Mobile EDR) and Threat Intelligence. The Mobile EDR solution provides real-time detection and response to mobile threats using AI and advanced threat intelligence. Meanwhile, Lookout's Threat Intelligence leverages the world's largest mobile telemetry dataset to track APT activity, discover new mobile malware, and provide actionable intelligence to organizations.

Mobile Security Overview (Source: Lookout)

Mobile EDR: Lookout secures mobile devices for enterprises with its mobile endpoint detection and response (EDR) solution. EDR, a term coined by Gartner in 2013, provides cloud-native security for an organization’s endpoints. While Lookout’s EDR solution is focused exclusively on mobile devices running on iOS, Android, ChromeOS, and iPadOS, endpoints broadly include any physical device, from a mobile phone to a server, that is connected to the organization’s network.

Starting in the early 2010s, EDR solutions saw traction in the enterprise and began to gain an edge over signature-based antivirus software that sat on-prem. EDR’s cloud-native nature allows the solution to be more lightweight, dynamic, and wide-reaching. In the case of Lookout’s mobile EDR solution, the product protects against a broad set of cyber-attacks including mobile phishing, malicious apps, dangerous networks, and device compromise, all dynamically in response to a device’s determined risk level. This dynamic responsiveness is made possible through a process known as Zero-Trust-Conditional-Access (ZTCA).

Threat Intelligence: Lookout's Threat Intelligence platform leverages the world's largest mobile security dataset to provide comprehensive protection against mobile cyber-attacks. The platform collects and analyzes proprietary data points from over 220 million devices, 315 million mobile apps, and 450 million malicious sites, allowing Lookout researchers to discover, track, and protect against advanced cybercrime groups and APTs targeting mobile platforms.

The Threat Intelligence platform offers several key services tailored for security operations centers (SOCs) and threat research teams. These include access to the same threat data used by Lookout's researchers, in-depth analysis of advanced malware and mobile APT campaigns, and customized research hours to address specific intelligence gaps. Organizations can use this intelligence to correlate indicators of compromise (IOCs) from traditional EDR platforms with mobile threats, track global threat actors using advanced mobile surveillanceware, and build proactive protection policies based on emerging threat trends.

Unlike Lookout’s Mobile EDR solution, which focuses on real-time detection and response on individual devices, the Threat Intelligence platform provides a broader, more strategic view of the mobile threat landscape. It enables organizations to conduct threat hunting, reconstruct attack kill chains, and improve overall security strategies. Additionally, the platform offers digital forensics and incident response (DFIR) services, allowing organizations to gain previously unseen insights into mobile device compromises during security incidents.

MES Dashboard: Security teams can gain comprehensive visibility and control through Lookout's Mobile Endpoint Security Dashboard. The dashboard provides real-time analytics on protected devices, analyzes apps, and detects potentially malicious sites across the organization's mobile fleet, allowing teams to quickly assess deployment status and risk levels to enforce security policies effectively.

Cloud Security

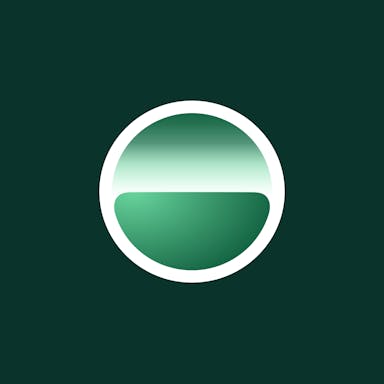

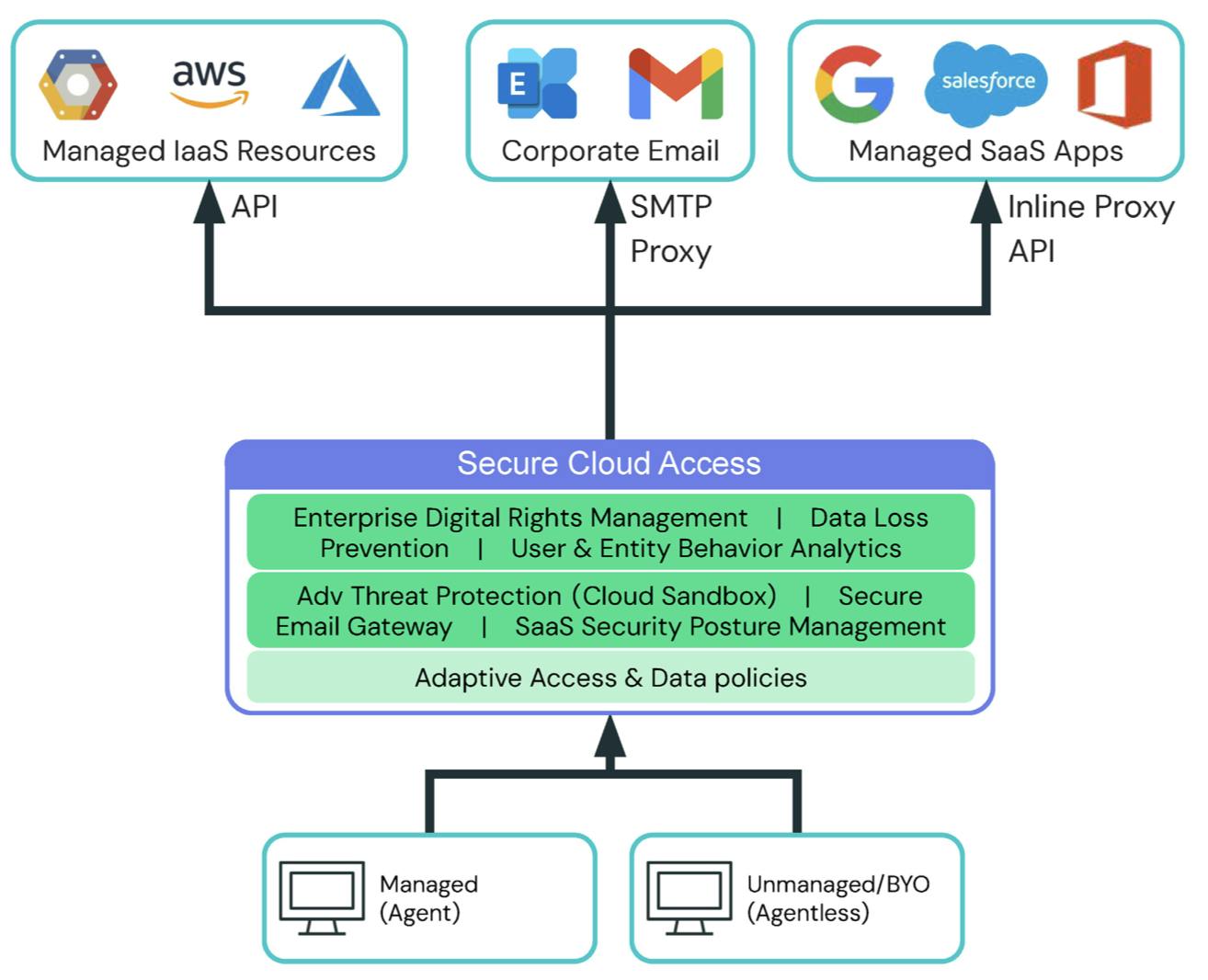

In 2021, after acquiring CipherCloud, Lookout began offering a cloud security solution for enterprises. Lookout's cloud security solution is a security service edge (SSE) offering, designed to address the needs of enterprises in securing their cloud-based assets and remote workforce. SSE is a cloud-based security framework that emerged as a critical component of the broader secure access service edge (SASE) architecture. Introduced by Gartner in 2021, SSE consolidates multiple security functions, including cloud access security broker (CASB), secure web gateway (SWG), and zero trust network access (ZTNA), into a unified cloud-delivered platform. This approach was developed in response to the increasing adoption of cloud services and remote work, which rendered traditional perimeter-based security models obsolete.

Secure Cloud Access (CASB): Lookout Secure Cloud Access is a CASB solution that provides visibility and control over cloud and SaaS applications. It discovers, classifies, and protects data across multi-cloud deployments. The product integrates with productivity suites and offers data loss prevention, encryption, and rights management. It also detects insider threats using behavior analytics.

Source: Lookout

Key features include context-aware access control, cloud security posture management, and protection against cyber threats. The CASB scans for malware, uses sandboxing to detect zero-day threats, and assesses user behavior for anomalies. It supports compliance efforts by enforcing data protection policies and providing audit reporting. The solution can be deployed without agents and integrates with various enterprise security tools.

Lookout's CASB addresses shadow IT risks by integrating with existing network infrastructure. It assesses cloud service usage and provides visibility into unauthorized cloud services. The solution offers real-time alerts and detailed dashboards for monitoring. It employs a combination of forward and reverse proxies to control access across all endpoints and app instances, regardless of device management status.

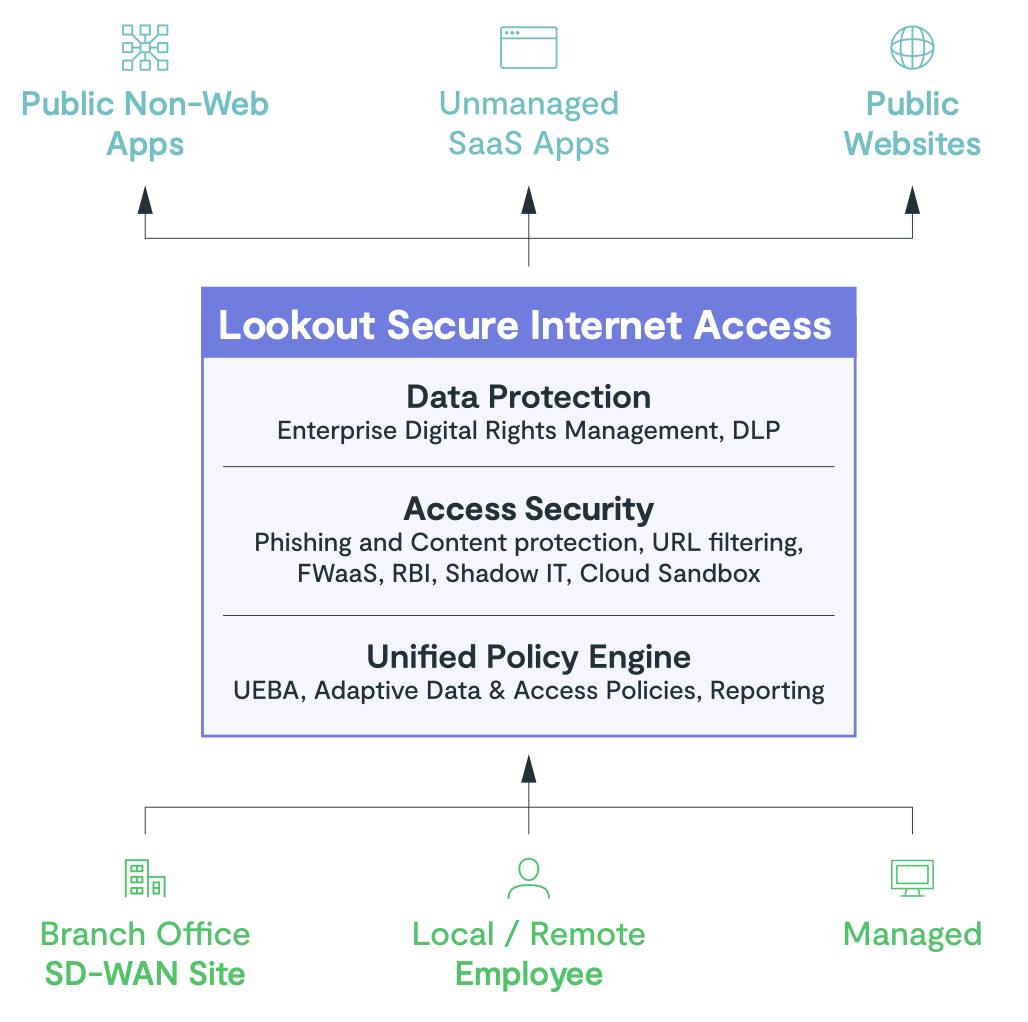

Secure Internet Access (SWG): Lookout’s Secure Internet Access is a cloud-delivered SWG. It protects users, networks, and data from internet-based threats while preventing data leakage. Built on zero trust principles, it offers a single-proxy architecture with inline and API security controls. It inspects all web traffic for malicious content and sensitive data, simplifying IT operations.

Source: Lookout

Lookout Secure Internet Access also performs TLS/SSL inspection on all inbound and outbound traffic. It applies URL filtering based on threat intelligence from millions of websites, domains, and apps. Additionally, it implements data loss prevention, offers Remote Browser Isolation, and monitors sensitive data across various apps and websites.

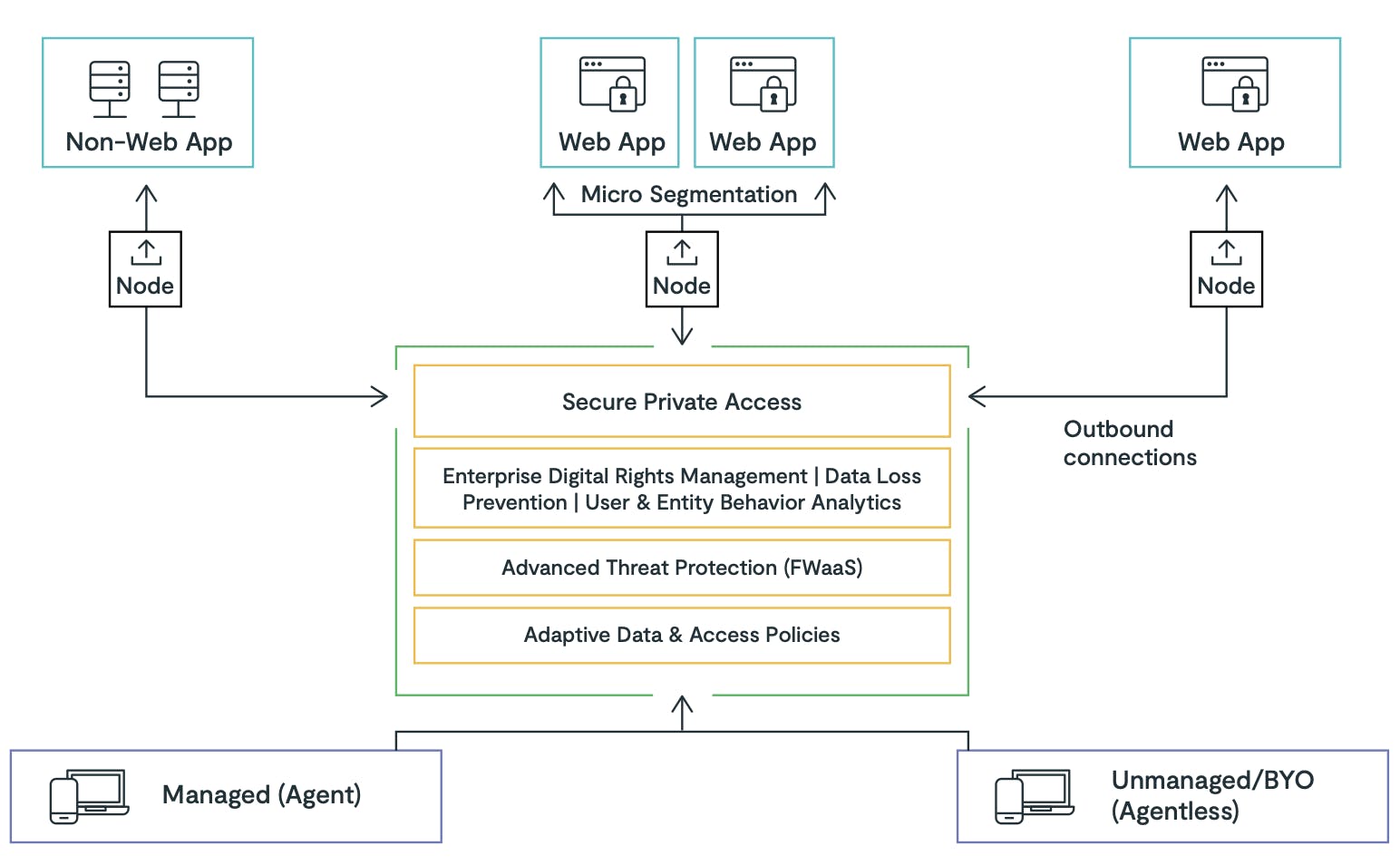

Secure Private Access (ZTNA): Lookout Secure Private Access is a cloud-delivered zero trust network access (ZTNA) solution for enterprise private applications and data. Similar to a virtual private network (VPN), ZTNA provides users access to private apps, regardless of user or app location. Unlike VPNs, however, Lookout’s ZTNA solution takes a data-first approach and performs continuous monitoring of user activity and device posture for adaptive access control.

Source: Lookout

The product provides visibility into all applications deployed on private networks, both on-premises and in the cloud. It implements adaptive DLP policies and offers DRM for private applications. Lookout Secure Private Access inspects files downloaded from enterprise private apps for malware, blocking infected files. It enables network-level segmentation to prevent lateral movement within the organization's infrastructure.

Lookout Secure Private Access integrates with existing multi-factor authentication and identity solutions. It extends inspection of incoming and outgoing traffic beyond HTTP/HTTPS to include all ports and protocols. The solution provides unified policies for all Secure Service Edge (SSE) use cases, including secure access to the internet, cloud apps, and private apps.

Market

Customer

Although Lookout was founded as a consumer-oriented business, upon selling off its consumer cybersecurity business in 2023, it has shifted focus entirely to serving enterprises. While the company has mainly worked with large enterprises and governments, it has expanded into small and medium-sized enterprises as of 2024.

Lookout markets itself as a channel-first company, meaning it generates revenue through its partnership network. The company divides its partnerships into four categories: carrier partners, channel partners, managed service provider (MSP) partners, and technology partners.

Carrier Partners: Carrier partnerships allow Lookout to reach a vast consumer audience. For example, AT&T, Verizon, and Telcel bundle Lookout's mobile security solutions with their service plans, providing built-in protection for millions of smartphone users. This model generates revenue for Lookout through licensing fees or revenue-sharing agreements with the carriers.

Channel Partners: Channel partnerships are typically value-added resellers that integrate Lookout's products into comprehensive security packages, leveraging their existing business relationships to promote and sell these solutions. Lookout benefits from this arrangement through bulk license sales to VARs, who then mark up the prices when reselling to end customers.

Lookout’s channel partnerships can be one of two levels: elite and select. Elite partners, who may provide differentiated value for Lookout, enjoy additional benefits including large deal discounts, marketing development funds (MDF), additional revenue streams, and a more personalized client-service experience.

MSP Partners: MSP partnerships enable Lookout to penetrate the small and medium-sized business market. For example, in 2023, Pax8 incorporated Lookout's security tools into its managed IT service offerings, providing ongoing management and support. This partnership model generates recurring revenue for Lookout through subscription-based licensing to MSPs.

Technology Partners: Technology partnerships integrate Lookout with complementary security solutions. This enables Lookout to create a more comprehensive and attractive package for enterprise customers. Moreover, these partnerships can lead to joint sales opportunities, technology licensing agreements, and increased market visibility for Lookout's products. Past technology partnerships with Lookout included Amazon, CrowdStrike, and Google.

Market Size

The two markets Lookout operates in include endpoint security and cloud security. Endpoint security, the largest cybersecurity market, was valued between $25 billion and 30 billion in 2022, and it is projected to reach $40 billion by 2024 and $126 billion by 2026. The market grew 29% in 2021, driven by cloud migration and increased remote work. While specific market size data for mobile endpoint security is not available, its importance is underscored by a 2021 study showing that 64% of US adults use personal smartphones for work. Cloud security grew 11% from 2020 to 2021 and is expected to grow at an 18% CAGR, potentially exceeding $100 billion by 2029. Gartner ranks it as the fastest-growing cybersecurity sector.

Competition

Mobile

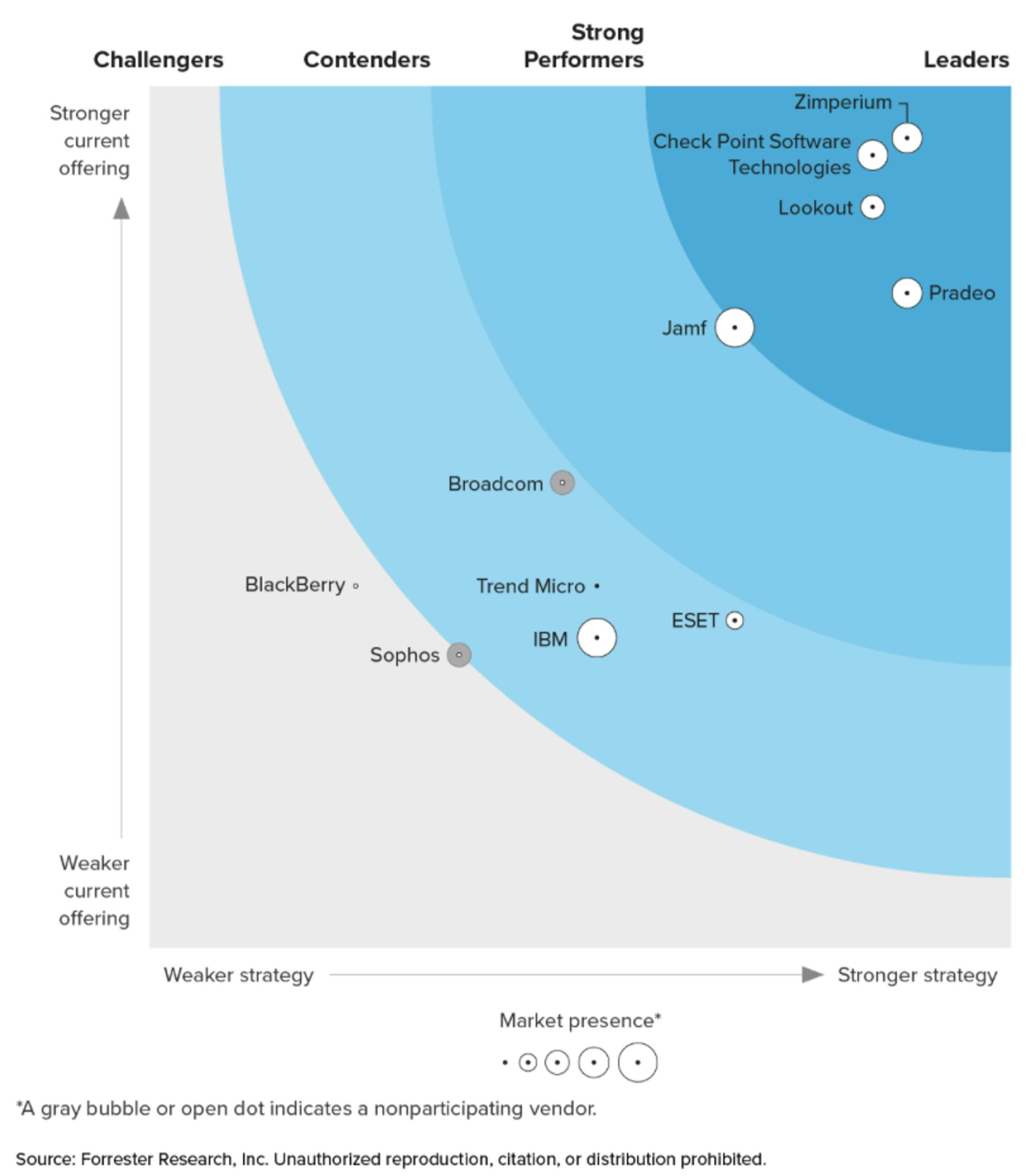

Source: Forrester Wave

Zimperium: Zimperium’s Mobile Threat Defense product focuses on four threat categories: device compromises, network attacks, phishing and content, and malicious apps. Similar to Lookout’s Threat Intelligence product, Zimperium’s z3A feature focused on advanced-app analysis. According to a Forrester report, it outperforms Lookout in its offering and has a stronger market presence as of 2024. Founded in 2010, Zimperium raised $72 million before Liberty Strategic Capital acquired a majority stake for $525 million in March 2022.

Check Point Software: Check Point’s Harmony Mobile offers app, file, network, OS, and device protection through its Behavioral Risk Engine. Forrester reports that Harmony Mobile has a stronger current offering than Lookout, particularly in web security and real-time threat detection. Founded in 1993, Check Point went public in 1996 and has a market cap of $19.9 billion as of December 2024.

Pradeo: Pradeo mobile threat defense identifies threats from applications, networks, and OS, offering real-time remediation and MDM syncing. Pradeo competes with Lookout by offering advanced mobile threat defense solutions focused on app security, device protection, and compliance for enterprises. Founded in 2010, Pradeo acquired Yagaan, a mobile fleet and application security company, in October 2022.

IBM: IBM’s MaaS360 mobile threat defense integrates with other solutions and uses AI to help IT Admins discover risks and threats. Forrester reports IBM’s product to have a worse current offering and strategy than Lookout, but a best-in-class market presence. One of the oldest technology still in operation, IBM was founded in 1911 and went public in 1915. As of December 2024, the company has a market cap of $203.6 billion.

Jamf: Jamf's product focuses specifically on Apple devices (iOS, iPadOS). While Forrester reports Jamf to have a worse current offering and strategy than Lookout, it boasts a better market presence in terms of revenue and customer numbers as of 2024. Jamf was founded in 2002 and received $50 million in funding from investors including Summit Partners and Battery Ventures, before getting acquired by Vista Equity Partners in 2017 for an estimated $924 million. In July 2020, the company went public and as of December 2024 has a market cap of $1.9 billion.

SentinelOne: Singularity Mobile is part of SentinelOne's broader Singularity Endpoint solution. In 2024, it was rated as Customers' Choice for Mobile Threat Defense by Gartner. Founded in 2013, SentinelOne raised $697 million from investors including Tiger Global Management, Sequoia Capital, and Accel before going public in 2021 at a market cap of over $10 billion, the highest-valued cybersecurity IPO ever at the time. As of December 2024, the company has a market cap of $7.1 billion.

Cloud

Broadcom: Broadcom’s Symantec endpoint security (SES) covers mobile security, while cloud security is handled by Symantec network protection and Symantec data loss prevention (DLP) cloud. Broadcom's offering is characterized as a "niche player" by Gartner, with poor customer experience for smaller companies. This may be because Broadcom’s core business is selling semiconductor-based products (accounting for nearly 79% of its 2023 revenue). The remaining 21% of its 2023 revenue was from infrastructure software products and services. Founded in 1991, Broadcom was acquired by KKR and Silver Lake Partners in 2005 for $2.7 billion, before going public in 2009. As of September 2024, the company has a market cap of $688.7 billion.

Broadcom’s (SES) competes with Lookout by offering comprehensive endpoint protection for mobile devices, desktops, and servers. SES focuses on threat detection, prevention, and response, similar to Lookout’s mobile endpoint security solutions. Both target enterprises aiming to secure their endpoints from cyber threats, creating competition in endpoint and mobile device protection.

Netskope: Netskope's intelligence security service edge (SSE) is the company’s main product offering and is managed via a single, unified console. According to Gartner, it is the strongest product offering in SSE. Founded in 2012, Netskope has raised $1.4 billion as of September 2024 from investors including Social Capital, Accel, and Sequoia Capital, and was last valued at $7.5 billion in 2021. In June 2024, the company surpassed $500 million in ARR.

Netskope SSE competes with Lookout by offering cloud-delivered security services like data protection, threat prevention, and secure access for mobile and cloud applications. Both focus on securing remote and mobile workforces, with Lookout emphasizing endpoint security and Netskope providing broader cloud security solutions. This overlap positions them as competitors in securing enterprise data across devices and cloud environments.

Palo Alto Networks: Palo Alto Networks’ prisma access can be managed from a single, unified console, and integrates on-premises firewall management. Gartner clients report opaque licensing models and high pricing. Founded in 2005, Palo Alto Networks has a market cap of $124.4 billion as of December 2024. Lookout competes with Palo Alto Networks in mobile endpoint and cloud app security. While Palo Alto provides a wide range of cybersecurity services, Lookout specializes in securing mobile devices and protecting data in cloud applications, creating overlap in these areas.

Zscaler: Zscaler is managed through multiple consoles integrated via SSO. In 2024, Gartner reported the company to have strong revenue growth and global presence but faces challenges with complex pricing and occasional performance issues. ZScaler was founded in 2008 and raised $183.2 million from investors including Dell Technologies Capital, CapitalG, and Lightspeed, before going public in March 2018. As of December 2024, the company had a market cap of $28.2 billion.

Zscaler competes with Lookout by offering cloud-based security solutions that protect users, devices, and data through secure web gateways, zero-trust network access, and cloud access security broker (CASB) services. Both target enterprises securing mobile workforces and cloud applications, but Lookout emphasizes endpoint protection and data loss prevention, while Zscaler provides a broader zero-trust architecture for network and application security.

Skyhigh Security: Skyhigh Security is administered under a single, unified console, focusing on financial services, healthcare, and government sectors. It has strong data security capabilities but slower growth compared to competitors. Skyhigh Security was launched in March 2022 under Symphony Technology Group (STG), a spinoff from STG’s March 2021 $4.0 billion acquisition of McAfee’s Enterprise Business. Skyhigh Security generated revenues of $351 million in 2020 while still part of McAfee.

Skyhigh Security competes with Lookout by providing cloud-native security solutions, including secure web gateways, cloud access security brokers (CASB), and data loss prevention (DLP). Both focus on protecting sensitive data and securing mobile and cloud environments, but Lookout emphasizes endpoint security and mobile threat protection, while Skyhigh Security delivers a broader portfolio for securing multi-cloud environments and enforcing zero-trust principles.

Business Model

Lookout’s Cloud Security product employs a subscription-based business model that comes in three tiers of increasing functionality: essentials, advanced, and premium. The company does not disclose its pricing plans on its website as of December 2024, but its products are listed on the AWS Marketplace at $9K per year for up to 100 users, with charges based on the number of seats and devices. In 2024, Gartner noted that, unlike other cloud security vendors, Lookout charges on a per SaaS application basis for API connections and cloud sandboxing. Lookout’s EDR solution is also listed on the AWS marketplace as $7.2K a year for up to 100 users for its essentials subscription, and $8.4K a year for its advanced subscription.

Traction

Lookout protects over 2K enterprises and analyze more than 16.5K SaaS apps as of December 2024. Its customer base includes telecommunications companies like Vodafone, Verizon, AT&T, and Telefónica, as well as tech giants Google and VMware. In 2022, Lookout reported a 56% growth in annual recurring revenue (ARR). In 2024, GrowJo provided an unverified estimate of Lookout's revenue at $256.4 million.

In the mobile security sector, Lookout protects 219.5 million iOS, Android, and ChromeOS devices globally and ingests and analyzes 351.8 million mobile apps for risky behavior, malware, and other threats as of December 2024. Additionally, Lookout has identified 484.4 million sites as launching points for phishing credentials and hosting malware as of December 2024.

In March 2021, Lookout acquired CipherCloud, a leading cloud-native security company in the Secure Access Service Edge (SASE) market, for an undisclosed amount. Before the acquisition, CipherCloud had raised $80 million and was valued at $741 million in its November 2014 Series B round. This acquisition positioned Lookout to leverage CipherCloud’s SASE technologies and ultimately deliver a solution that protects an organization’s data from endpoint to cloud.

In April 2023, Lookout spun out its consumer arm to F-Secure in a deal reportedly worth $223 million. This transaction, which closed that June, transformed Lookout into a pure-play enterprise company. Both F-Secure and Lookout anticipate that this spin-out will generate over $13 million in annual revenue synergies by 2027. The divestiture allows Lookout to focus on expanding its enterprise products and customer base, capitalizing on the projected hypergrowth in the enterprise market.

Valuation

Lookout has raised a total of $432.2 million in funding as of December 2024. Its investors include a16z, Index Ventures, Accel, Greylock, Khosla Ventures, and Lowercase Capital. In 2022, Lookout raised $40 million of capital in a round led by a16z, plus a $150 million credit facility from BlackRock. As of December 2024, Lookout is valued at $295.6 million in secondary markets. This indicates that the valuation from 2020 has decreased by over $1.5 billion, as the company had previously raised capital at a $1.8 billion valuation in February 2020.

Key Opportunities

Data Moat

Lookout possession of the world's largest mobile security dataset creates a significant competitive advantage. It allows Lookout to discover, track, and protect against advanced cybercrime groups and APTs targeting mobile platforms more effectively than competitors. As Lookout's dataset grows, it will enhance the company's ability to detect and respond to threats, potentially creating a positive feedback loop where better protection leads to more users, which in turn improves threat detection capabilities. This data moat not only differentiates Lookout in the mobile security market but also positions the company to capitalize on the increasing importance of mobile security in enterprise environments.

Enterprise-led Growth

Lookout's decision to divest its consumer arm to F-Secure in 2023 marks a strategic pivot towards becoming a pure-play enterprise cybersecurity company. This move aligns Lookout with the growing enterprise security market, allowing the company to concentrate its resources and expertise on developing advanced solutions for business customers. By shedding its consumer division, Lookout can streamline its operations, potentially accelerating product development and go-to-market strategies in the enterprise sector. This focused approach could position Lookout to capture a larger share of the enterprise market, which is projected to experience significant growth in the coming years.

MSP Partnerships

While MSPs have been around since the early 2000s, the managed services market is expected to grow at a 12% CAGR to nearly $400 billion by 2028. In parallel to the market’s growth, MSPs are increasingly starting to focus on expanding their security offerings. While the company is behind its competitors in establishing partnerships in other areas, Lookout could build an outsized market share within the MSP market by prioritizing MSP partnerships. For example, in May 2024 Lookout partnered with Pax8, a leading cloud commerce marketplace, positioning the company to close the mobile security gap for MSP customers.

By offering its security solutions through MSPs, Lookout can expand its reach into the small and medium-sized business market, diversify its revenue streams, and establish itself as a go-to security provider in the managed services ecosystem.

Key Risks

Incomplete offering

Lookout's focus on mobile and cloud security, while strong in these niches, leaves gaps in its overall cybersecurity offering, particularly in providing a complete Secure Access Service Edge (SASE) solution. This limitation positions Lookout as a more specialized player in a market that increasingly favors comprehensive, end-to-end security solutions. As enterprises trend towards vendor consolidation to simplify their security stacks, Lookout may face challenges in competing against more holistic providers, potentially limiting its growth and market share in the broader enterprise cybersecurity landscape.

Geographic Limitations

Lookout's limited number of points of presence near major population centers, as noted by Gartner, poses a risk to the company's competitive position in the global cybersecurity market. This geographical limitation could result in higher latency and potentially inferior performance for customers in underserved regions compared to competitors with more extensive global infrastructure. Lookout's restricted geographical footprint may hinder its ability to attract and retain customers in certain markets, potentially constraining its growth and market share expansion efforts.

Competitive Market

Lookout faces competition from well-established and well-funded cybersecurity companies like Palo Alto Networks, Zscaler, and Netskope in the cloud security space, as well as specialized mobile security providers like Zimperium and Check Point Software. These competitors have been reported to offer more comprehensive product offerings for larger customer bases. As the cybersecurity market consolidates as of 2022, Lookout may struggle to differentiate its products and maintain its market position against its competitors. This competitive pressure could lead to pricing challenges, difficulty in customer acquisition and retention, and potential loss of market share, ultimately impacting Lookout's growth trajectory and profitability.

Summary

Lookout is a cybersecurity company specializing in mobile endpoint security and cloud security solutions for enterprises. The company evolved from a consumer-focused mobile security provider to a pure-play enterprise cybersecurity firm. Lookout's product suite includes Mobile Endpoint Security, Threat Intelligence, and a comprehensive Security Service Edge (SSE) platform. The company leverages the world's largest mobile security dataset to provide advanced threat detection and protection for over 2K enterprise customers, including major telecommunications and technology companies. Lookout's key opportunities lie in its extensive data moat, strategic focus on enterprise solutions, and partnerships with managed service providers, while it faces risks from an incomplete product offering, limited geographical presence, and competition in the evolving cybersecurity landscape.