Thesis

Medical knowledge is constantly increasing, with two new papers being added to PubMed every minute as of 2016 and over 1 million publications added annually. In October 2022, a survey of 600 physicians found that 70% “felt overwhelmed” trying to keep up with the amount of new information coming out about new trials, treatments, and procedures. Alongside the increasing volume of medical research, the United States is projected to face a physician shortfall of 86K by 2036. The combination of decreasing physicians and the overwhelming amount of information underscores the urgent need for accessible and accurate information sources to maintain the quality of patient care.

The time for medical research to double has significantly decreased over time. In 1950, the estimated time for research to double was 50 years; that figure had shrunk to 73 days by 2011. As a result, medical students graduating in 2020 will experience at least four doublings of knowledge during their time in school. This means that the information they learned in the first three years of medical school will constitute 6% of the medical knowledge in the decade between 2010 and 2020. The growth of medical information requires physicians to spend more time educating themselves on new research and relevant studies to provide effective and up-to-date patient care.

As of 2024, a large number of physicians were nearing retirement age, with 42% of physicians above 55 and 20% over 65 years of age. These physicians will reach retirement age within the next decade, which is projected to decrease the overall physician supply. Additionally, a growing number of physicians report experiencing burnout or a desire to leave their current positions. A 2023 survey conducted on US physicians reported that around 58% wished to change jobs, and 60% were likely to leave the clinical practice entirely. With the US population anticipated to grow by 8.4% by 2036, there is an expanding gap between healthcare needs and the number of available physicians.

To navigate and comprehend medical research, physicians currently need to manually search through numerous fragmented databases and piece together insights from various studies. The process is time-consuming and does not guarantee finding the most relevant piece of research for patient care. While electronic health records (EHR) have standardized medical information, they have also contributed to the increased amount of data physicians must navigate, along with medical research and studies.

OpenEvidence addresses information overload and physician shortages by providing a medical chat interface that draws answers from 35 million peer-reviewed medical publications, as of February 2025. Each OpenEvidence answer includes direct citations to the underlying research, allowing physicians to verify recommendations while accessing evidence-based answers for complex clinical questions. If medical research is inconclusive regarding a question, the platform will not provide a response, therefore reducing the chances of hallucinations.

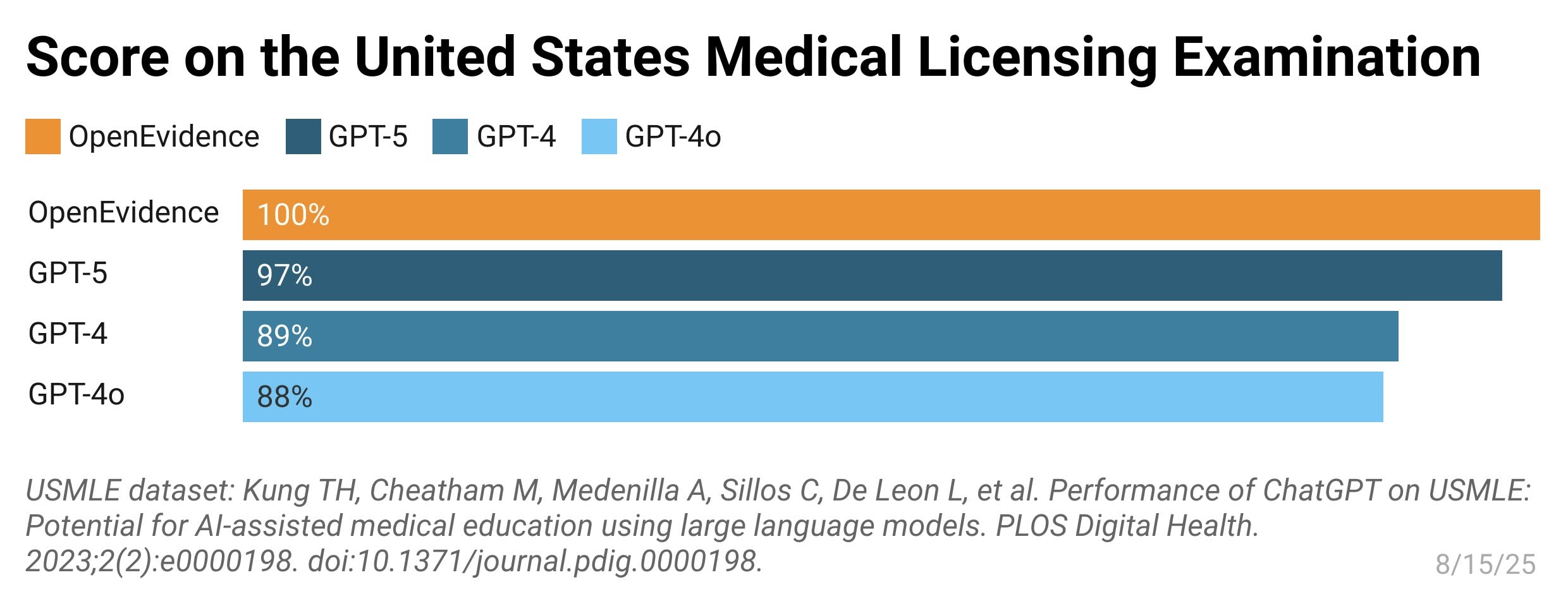

OpenEvidence is the first platform to achieve a perfect score on the United States Medical Licensing Examination. The company has partnered with leading journals for medical content, including a February 2025 partnership with New England Journal of Medicine (NEJM) and a June 2025 partnership with The Journal of the American Medical Association (JAMA). OpenEvidence is free for verified medical professionals and is HIPAA-compliant. As of July 2025, the platform was used across 10K hospitals and by 40% of physicians in the United States.

Founding Story

OpenEvidence was founded in 2021 by Daniel Nadler (CEO) and Zachary Ziegler (CTO). Prior to founding OpenEvidence, Nadler earned his doctorate from Harvard and founded Kensho, while Ziegler was pursuing a Ph.D. in machine learning at Harvard.

Nadler began his doctoral studies in political economy at Harvard in 2018. During his time there, Nadler was a visiting scholar at the Federal Reserve, where he observed that regulators relied on spreadsheets to make crucial financial decisions. This observation led Nadler to start Kensho in 2013 with Peter Kruskall, a programmer at Google. Kensho employed artificial intelligence systems to parse and synthesize financial data for investment professionals. In 2018, S&P Global acquired Kensho for $550 million, validating the usage of specialized artificial intelligence in finance and for identifying patterns in vast quantities of information.

Nadler and Ziegler co-founded OpenEvidence in 2021 after recognizing direct parallels between the financial markets and healthcare, where professionals in both fields struggled to keep up with rapidly growing literature. Nadler noted, "Doctors needed the same type of intelligent information synthesis that proved successful in financial markets." Their decision to found OpenEvidence was also motivated by personal experiences with healthcare; Nadler’s grandfather died due to a medical error, and Ziegler's brother-in-law went through treatment for leukemia.

Ziegler brought significant AI expertise, which proved crucial to the platform’s technical differentiation. The founding team published research in April 2023 demonstrating that smaller, highly-specialized models trained on in-domain medical data could outperform much larger general models. The research won the best paper in machine learning at the leading 2023 conference in machine learning in healthcare.

From the beginning, Nadler made a key strategic decision that would differentiate OpenEvidence from typical healthcare startups. Instead of pursuing traditional enterprise sales through hospital IT departments, the founders opted to treat doctors as consumers. This direct-to-physician approach allowed OpenEvidence to bypass the lengthy procurement processes that delay healthcare technology adoption. Nadler’s prior experience with artificial intelligence from Kensho also gave OpenEvidence a head start by focusing on large, high-quality data sets.

OpenEvidence expanded its technical team in 2021 by recruiting AI researchers from leading academic institutions. Key additions included Evan Hernandez and Eric Lehman, PhD graduates from MIT, who serve as Chief Scientist and Head of Clinical NLP. The team focused on developing language models trained on medical literature rather than general-purpose AI systems. OpenEvidence launched from the Mayo Clinic Platform Accelerate program in 2023, gaining access to clinical expertise that improved the structuring and discovery of healthcare information.

As of September 2025, OpenEvidence employs a team of engineers and researchers with academic backgrounds. The company has also established a network of medical advisors from renowned medical institutions, including the Mayo Clinic, Harvard Medical School, and Johns Hopkins.

Product

Medical Search

OpenEvidence’s core product is a medical chat platform that uses artificial intelligence to provide physicians with peer-reviewed medical answers. Doctors can ask the platform patient care questions and receive cited responses sourced from medical literature and journals. The platform streamlines the search process, reducing the time physicians spend sifting through vast amounts of information by aggregating and synthesizing information through its interface. OpenEvidence incorporates content from medical journals through partnerships with NEJM and JAMA. The platform is free to use for verified US healthcare professionals who provide a National Provider Identifier for access and is available on mobile and web interfaces.

Source: OpenEvidence

The primary purpose of the platform is to provide clinical decision support during patient care. Doctors can verify treatment options, drug interactions, or diagnostic criteria, by asking questions such as, "What are the recommended therapies for a patient with stage 4 non-small cell lung cancer?” or “What is the first-line treatment for community-acquired pneumonia in adults?” The platform synthesizes information from medical studies and presents treatment guidelines with direct citations to the source material. Instead of searching through medical databases, doctors receive structured responses that include treatment recommendations tailored to patient-specific factors.

Answers include direct links to peer-reviewed publications, allowing physicians to verify underlying research. OpenEvidence provides a citation labeling system with each answer, which identifies sources by relevancy based on its proprietary evidence retrieval algorithm. The relevancy feature enables physicians to understand how recommendations are formulated and prioritize which sources to review first.

Physicians can also conduct in-depth research, request primary evidence from specific studies, seek curbside consultations, and construct diagnostic workups. They can inquire about appropriate dosing for specific patient populations, understand potential adverse effects of medications, and identify dangerous drug combinations. The system also provides treatment alternatives when standard therapies may not be suitable and helps identify appropriate laboratory tests to consider for specific clinical presentations.

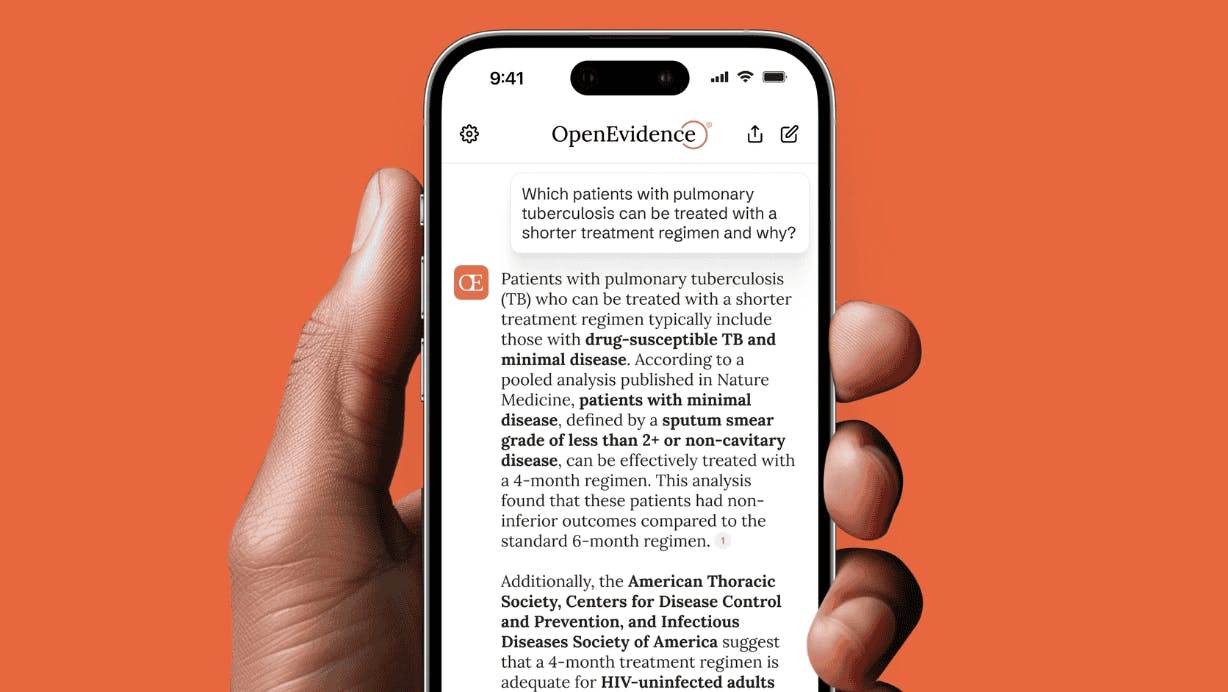

Source: Greycroft

In April 2025, the platform became HIPAA-compliant, enabling US physicians to safely input protected health information under a Business Associate Agreement. This allows doctors to include specific patient details when asking clinical questions while maintaining privacy and security standards.

OpenEvidence 2.0

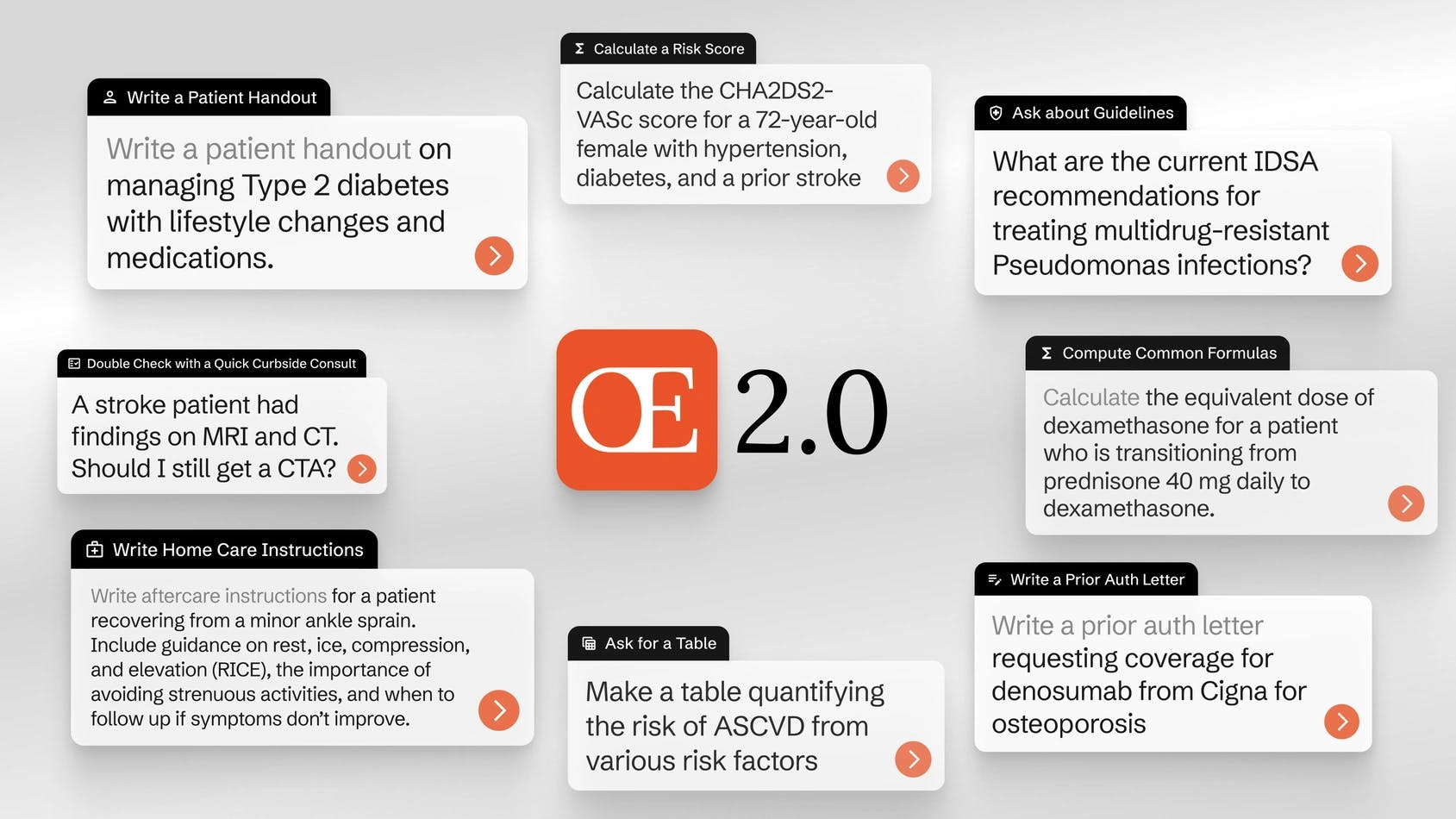

Launched in December 2024, OpenEvidence 2.0 adds support for administrative tasks, patient handouts, and over 50 widely used clinical calculators. These features, in addition to medical search, eliminate the need for physicians to open separate applications during patient consultations. Physicians can request risk score calculations for cardiovascular events, kidney function assessments, and other clinical prediction models directly on OpenEvidence.

Source: OpenEvidence

An example of OpenEvidence reducing administrative burden is automating paperwork that requires hours of manual work. The platform drafts prior authorization letters for insurance companies, automatically incorporating relevant medical evidence and citations to justify treatments. When a doctor needs approval for physical therapy after surgery, they can request, for example, "Write a prior authorization letter for physical therapy after rotator cuff surgery" and receive a complete document with supporting evidence from medical literature.

The platform also generates patient handouts explaining medical conditions, writes home care instructions with evidence-based recommendations, and creates educational materials that patients can understand. This addresses physician frustration and delays in patient care related to administrative tasks, as doctors spend an average of 7.9 hours per week on administrative tasks.

OpenEvidence also serves as an educational tool for medical professionals seeking to expand their knowledge or prepare for certifications. The platform helps physicians prepare for exams by providing practice questions and detailed explanations. Doctors can ask for facts about medical topics, request tables summarizing information, or explore pop-science questions that bridge clinical practice with broader scientific understanding. The system also generates exam questions that educators can use for teaching purposes.

In April 2025, OpenEvidence launched free continuing medical education credits for verified NPI users, allowing physicians to earn AMA PRA Category 1 Credits. The CME program works by having physicians review their past OpenEvidence questions, take short learning assessments, and receive official transcripts. The feature addresses the ongoing requirement for physicians to complete education while using the platform for clinical decision support.

OpenEvidence Visits

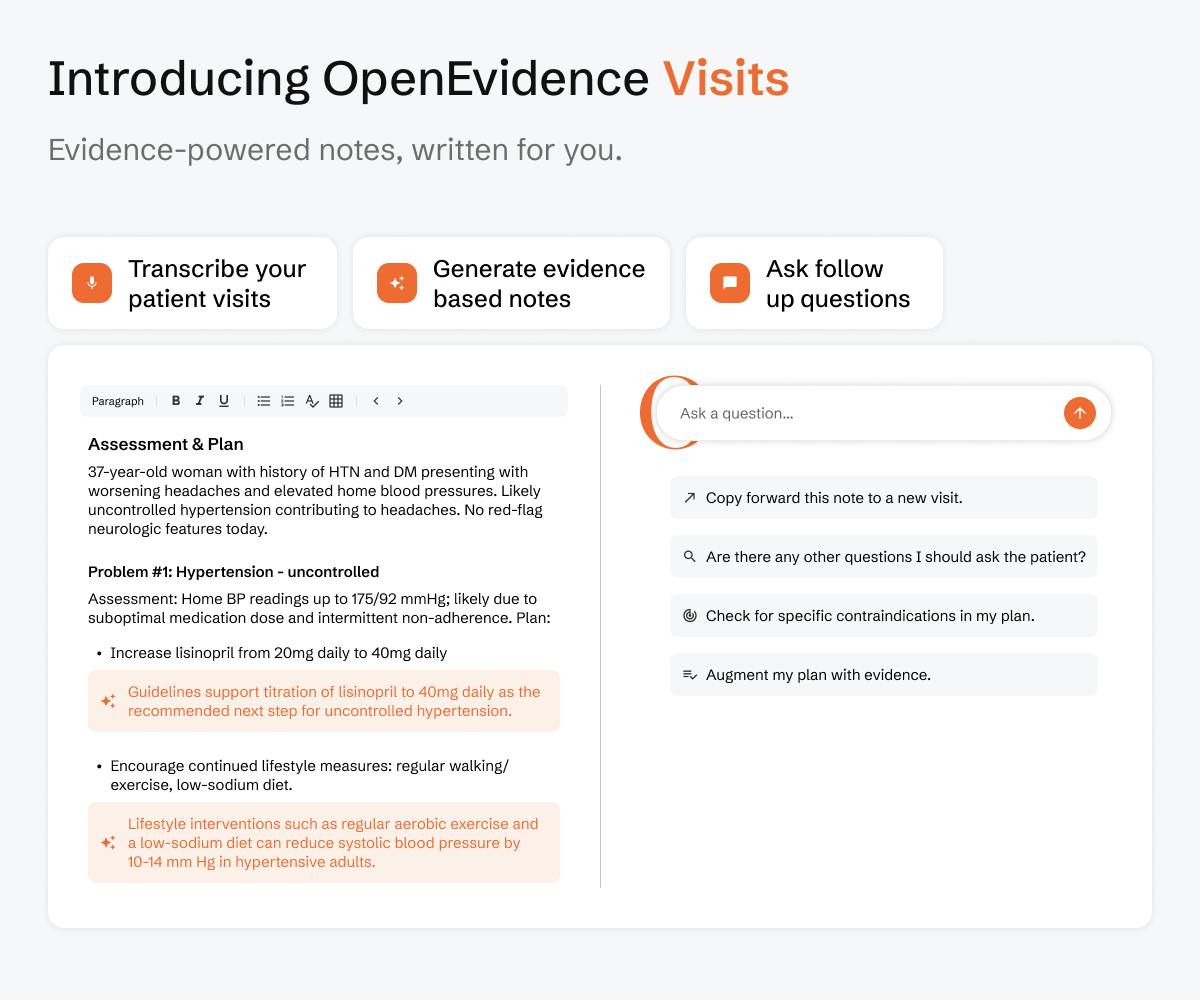

OpenEvidence Visits, announced in August 2025, is a feature to assist physicians in real-time patient encounters and acts as a digital Clinical Assistant. The feature integrates the platform’s medical intelligence into patient documentation, enriches assessments, streamlines notes, and connects decisions with patient context.

Source: OpenEvidence

OpenEvidence Visits integrates medical evidence into documentation by allowing doctors to draft clinical notes while incorporating the latest medical guidelines and research. Physicians can dictate encounters and receive transcriptions, where OpenEvidence enriches the assessment with up-to-date clinical recommendations. Doctors can also customize documentation with structured templates that reflect their individual style.

In addition to note creation, OpenEvidence Visits introduces intelligence in the documentation workflow. Physicians can ask OpenEvidence to refine reasoning, edit notes, conduct literature searches, or surface treatment guidelines in real time. After an encounter, doctors can query OpenEvidence with the full patient and visit context included, ensuring responses are tailored to the specific clinical scenario.

The platform also supports patient documentation management, where clinicians can upload and organize records into a repository. After uploading, physicians can search across patient histories, past treatments, and diagnostic results to uncover patterns during care. This functionality turns patient documentation into a accessible database, which gives doctors immediate access to relevant information for making patient specific decisions.

By embedding evidence into the point of care and storing documentation, OpenEvidence Visits reduces time physicians spend on manual documentation and improves clinical reasoning for their patients based on cited medical information.

Market

Customer

OpenEvidence is designed for practicing physicians who need evidence-based information during patient care. As of June 2025, the platform was actively used across more than 10K hospitals and medical centers nationwide, with over 40% of US physicians using the platform. The platform has gained adoption among medical professionals seeking quicker access to peer-reviewed medical literature during clinical decision-making.

Traditionally, physicians seeking medical evidence have to manually search through databases, consult static reference materials, or sift through multiple sources to find current treatment guidelines. OpenEvidence streamlines this process by providing an AI-powered search through 35 million peer-reviewed medical publications, allowing doctors to ask questions in natural language and receive evidence-based responses with citations.

Customers use OpenEvidence to obtain evidence-backed answers for clinical questions arising during patient care. A primary care doctor might ask, "What's the latest recommended therapy for severe asthma that's not controlled by inhalers?" and receive a summary of new biologic treatments from recent trials. A cardiologist might query the platform during patient consultation to compare two medications' efficacy and side effects using head-to-head trial data. The tool replaces or supplements traditional methods of using search engines, textbooks, or static databases when providers are uncertain about current evidence.

The platform's customer base includes healthcare institutions such as Mayo Clinic, which became an early adopter through its Platform Accelerate program in 2023. OpenEvidence has also secured partnerships with major medical publishers, including NEJM and a multi-year content agreement with the JAMA Network signed in June 2025, providing access to content from JAMA and 11 specialty journals.

Market Size

OpenEvidence’s addressable market consists of practicing physicians who require evidence-based information for patient care. As of 2023, the United States had over 1 million active physicians, with 851K directly involved in patient care. The company operates within the Clinical Decision Support Systems market (CDSS), which was valued at $5.8 billion globally in 2024. The market is projected to reach $10.7 billion by 2030, and grow at a CAGR of 11% from 2025 to 2030.

This market growth is driven by increasing adoption of electronic health records, rising demand for personalized medicine, and the need for improved patient outcomes. In 2024, North America accounted for over 43.1% of the global CDSS market share, primarily due to advanced healthcare infrastructure and high EHR adoption rates.

OpenEvidence's model as a standalone, free platform represents a differentiated model within the CDSS market, which has historically been dominated by enterprise solutions integrated with hospital systems. As of June 2025, the company had been registering 50K new verified U.S. clinicians each month, indicating ongoing expansion within the market for US physicians.

Competition

Competitive Landscape

The market for clinical knowledge tools is fragmented, with established incumbents and new entrants. Traditionally, doctors have relied on manual methods like web searches, journal reading, or reference databases for answers. While these resources provide cited summaries, they often require manual reading and may be behind paywalls. Artificial Intelligence tools like ChatGPT are unsuitable for medical use due to inaccuracies and lack of source citation. The gap in resources has created opportunities for AI-powered startups focused on digital medical assistance.

The competitive field includes three major categories: evidence reference databases curated by experts with institutional credibility but manual update processes, AI clinical assistants using large language models on medical knowledge that offer conversational automation, and integrations from companies like Google, Microsoft, and EHR vendors exploring AI add-ons. The market is evolving as established players add AI capabilities and startups work on building user bases and collecting data.

OpenEvidence sets itself apart through its extensive content and specialized medical models. Unlike single-purpose tools, it aims to be a medical evidence engine plus assistant, answering questions with sources and handling tasks, such as drafting letters and performing calculations. Its no-hallucination policy of only answering when evidence exists addresses clinicians' trust requirements and differentiates it from generic AI bots. The platform's physician adoption and word-of-mouth growth could demonstrate elevated user trust compared to competitors. However incumbents maintain institutional relationships and integrations and startups continue to develop their offerings.

OpenEvidence's collection of specialized medical models also provides a technical advantage over competitors that rely on general-purpose AI systems. While ChatGPT is trained on broad internet data and prone to medical inaccuracies, OpenEvidence uses a series of smaller, specialized AI models trained exclusively on a corpus of over 35 million peer-reviewed publications.

Competitors

UpToDate: Founded in 1992, UpToDate is the established leader in digital clinical reference tools. It provides expert-written, peer-reviewed summaries across 25 specialties as of September 2025, updated continuously by a team of physicians. UpToDate served over 3 million health professionals worldwide in more than 190 countries as of September 2025. The company was acquired by Wolters Kluwer in 2008, a public company with a market cap of $31.3 billion as of September 2025. UpToDate operates on a subscription-based model with enterprise licenses and individual subscriptions costing hundreds of dollars annually.

UpToDate's content is manually curated into narrative topic reviews, providing vetted and structured information, but with potential lag time before new research incorporation. Users must search for topics and read through articles, contrasting with OpenEvidence's natural Q&A interaction. To stay competitive, Wolters Kluwer launched "UpToDate AI" initiatives in 2023 to integrate generative AI capabilities.

DynaMed: DynaMed was founded in 1995 and serves as an evidence-based clinical reference database. The platform was acquired by EBSCO Information Services in 2005. DynaMed provides regularly updated summaries on medical topics, emphasizing evidence grading and providing direct answers. Its content is updated daily in a bulleted format as opposed to UpToDate’s narrative style.

The platform operates on a subscription-based model but is positioned as a more cost-effective alternative. DynaMed was named 2024 Best in KLAS for Clinical Decision Support. While DynaMed and UpToDate share a traditional model of curated content, DynaMed has integrated generative AI features through its DynaMedex platform, launched in 2022

Glass Health: Founded in 2021, Glass Health focuses on AI clinical decision support with diagnostic suggestions and clinical knowledge retrieval. The company has raised $7 million across three rounds as of September 2025: a $1.5 million pre-seed round led by Breyer Capital in Jan 2022, $500K by Y Combinator in April 2023, and a $5 million seed round led by Initialized Capital in September 2023.

Glass Health's product allows physicians to input patient case information and receive AI-generated differentials, workup plans, and evidence summaries for potential diagnoses. Unlike OpenEvidence's broad Q&A approach, Glass Health emphasizes diagnostic AI with a more case-centric focus, while OpenEvidence is question-centric.

Business Model

OpenEvidence’s platform is free-to-use for verified medical professionals and generates revenue through advertising. The platform clearly separates its clinical content and advertising, stating that "the OpenEvidence information system and the ad display system are fully unconnected systems" and that "advertisements shall not be considered an endorsement."

Given that pharmaceutical companies spent approximately $20 billion annually on marketing to healthcare professionals in the US as of 2019, capturing a portion of this market through digital channels could generate substantial revenue for the company. OpenEvidence’s advertising focus on contextual advertising and sponsored content while maintaining trust. For example, if a doctor submits a query about diabetes treatments, a sponsored summary from a pharmaceutical manufacturer may appear, or a banner for relevant clinical webinars could be displayed.

Additionally, OpenEvidence introduced continuing medical education (CME) credits as of April 2025. These credits open potential revenue through partnerships with accrediting bodies for paid certified CME modules, which physicians might pay directly or sponsors could underwrite costs in exchange for engagement.

The company's primary costs include research and development for AI model training, cloud infrastructure to support its platform, and content licensing agreements with medical publishers such as NEJM and the JAMA Network. The business operates with minimal physical assets, focusing primarily on software development and data processing capabilities.

Traction

OpenEvidence achieved technical validation when its AI system became the first to score 100% on the United States Medical Licensing Examination (USMLE) in August 2025. The perfect score represents a 10% improvement from the model’s initial test in 2023 and validates the accuracy of OpenEvidence’s platform for providing practitioners with medical information on demand.

Source: OpenEvidence

After raising its Series A round, OpenEvidence announced that funding would be used to form content partnerships to build its own repository of medical knowledge. The company partnered with the NEJM Group, publisher of the New England Journal of Medicine, and became a Mayo Clinic Platform Accelerate company. In June 2025, the company announced a multi-year content agreement with the Journal of the American Medical Association (JAMA) Network, gaining access to published content from the Network and its eleven specialty journals. In April 2025, OpenEvidence achieved HIPAA compliance, allowing covered entities in the United States to input protected health information in accordance with their Business Associate Agreement.

Since the company’s search engine launched in 2023, OpenEvidence gained adoption through word-of-mouth between doctors and practitioners. As of July 2025, over 65K new and verified US clinicians were registering for OpenEvidence each month, with the platform being used by 40% of physicians in the United States. OpenEvidence reported around 358K verified U.S. physician consultations in one month in July 2024. As of July 2025, OpenEvidence handled over 8.5 million clinical consultations by verified US physicians per month, representing over 2,000% in growth over a one year period.

Valuation

OpenEvidence raised $210 million in a Series B round in July 2025 at a $3.5 billion valuation. Google Ventures and Kleiner Perkins co-led the round, with participation from Sequoia, Coatue, Conviction, and Thrive. The round broughth the company’s total funding to $317 million where it remains as of September 2025.

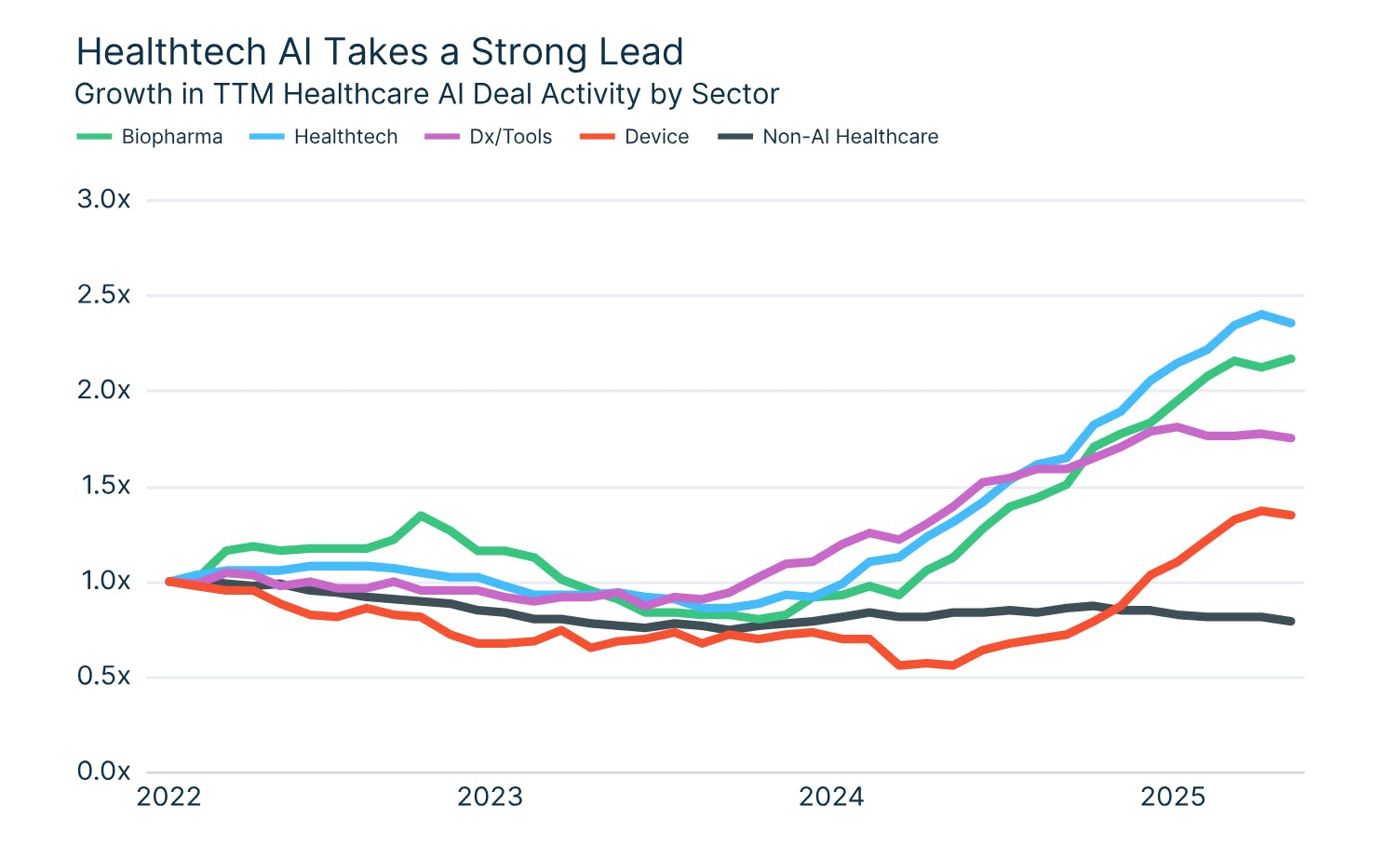

In 2024, venture capital funding for healthcare startups decreased year-over-year by 15%. The trend has continued into 2025 with $3 billion raised in total for healthcare startups in the first half of the year. However, deal activity in healthcare startups leveraging artificial intelligence has risen by 2X since 2022, as of mid-2025. Specifically, investments in biopharmaceutical startups leveraging artificial intelligence increased by 300% from 2023 to 2024. These companies accounted for nearly a third of all healthcare startup funding in the first half of 2025.

Source: Silicon Valley Bank

OpenEvidence was initially funded in a 2021 seed round by Daniel Nadler. The company raised a Series A in February 2025 at a $1 billion valuation. The rapid growth of OpenEvidence’s valuation by 3X within six months can be attributed to growth within healthcare artificial intelligence and significant adoption of its platform by doctors. As part of its Series B press release, OpenEvidence announced that more than 100 million Americans in 2025 will be treated by a doctor who uses the platform.

Key Opportunities

International Expansion

OpenEvidence primarily targets US physicians, but there is international demand for evidence-based medical support. With over 12 million physicians practicing globally, many international markets face considerable challenges in accessing medical information due to resource constraints and limited access to premium reference tools. Regions with fewer physicians per capita, such as sub-Saharan Africa or parts of Asia, could benefit from AI-assisted decision support, especially when one specialist might oversee hundreds of patients.

OpenEvidence's model of providing free access offers a competitive advantage over subscription-based services in emerging markets, where healthcare systems often face tight budgets. Traditional medical reference tools like UpToDate can cost $499 per year for physicians in the United States, leading to donation programs that provide complimentary subscriptions to clinicians in resource-limited settings.

The company can begin its international expansion by targeting English-speaking countries like those in the UK, Canada, and Australia, where medical practice patterns are similar to those in the US. In the long-term, OpenEvidence could incorporate regional clinical guidelines to serve non-English speaking markets. This international expansion could grow OpenEvidence's user base while advancing its mission to democratize medical knowledge globally.

Pharmaceutical Marketing

Pharmaceutical companies face challenges reaching physicians through traditional marketing methods, which creates an opportunity for OpenEvidence to capture a portion of the $30 billion spent annually on healthcare marketing. As of 2019, 68% of pharmaceutical marketing budgets target healthcare professionals rather than consumers, but traditional methods are becoming less effective. 51% of healthcare marketers in 2023 increased physician outreach budgets as they seek more targeted digital engagement channels.

OpenEvidence offers pharmaceutical companies access to physicians at the moment they're making clinical decisions. Unlike traditional sales representative visits or conference sponsorships, OpenEvidence delivers contextually relevant information to doctors when they are actively seeking evidence about specific treatments or conditions. With 8.5 million clinical consultations logged on the platform monthly as of July 2025, OpenEvidence has built an engaged audience that pharmaceutical companies find hard to reach through traditional channels.

The company can also reach physicians through clearly labeled sponsored content, evidence-based educational materials funded by the industry, or targeted alerts about new therapies that are relevant to queries. Success depends on maintaining physician trust by ensuring any sponsored content is evidence-based, clearly disclosed, and adds value rather than being purely promotional. If executed properly, this approach could generate revenue for OpenEvidence while still providing free access to medically backed answers for physicians.

Workflow and System Integrations

As of 2021, 78% of office-based physicians used certified Electronic Health Record (EHR) systems. However, these doctors must switch between multiple applications to access clinical decision support tools. By integrating with EHR platforms like Epic, Cerner, or Allscripts, OpenEvidence could increase usage by reducing friction and providing contextual recommendations directly within patient charts. This presents an opportunity to evolve from a standalone application to an embedded tool that physicians can utilize during patient care.

The increasing focus on interoperability in healthcare IT has made technical integration more feasible than in the past. SMART on FHIR is a healthcare standard that enables applications to access information in EHR systems, allowing developers to write a single application compatible with any EHR system that has adopted the standard. Major EHR vendors have established app marketplaces and APIs that third-party applications can leverage for integration.

When integrated, OpenEvidence could proactively surface relevant evidence or guidelines without requiring separate queries. For example, when a doctor documents a diagnosis or prescribes a medication, the platform could automatically provide relevant evidence or flag potential contraindications based on specific patient parameters.

Key Risks

Accuracy and Safety

OpenEvidence faces risks due to potential inaccuracies in its AI systems, which could harm patients and diminish physician trust. Despite achieving a 90% score on the USMLE, the company’s healthcare AI carries inherent risks, as medical errors are the third leading cause of death in the United States. At least 1 in 20 patients experience medical mistakes in the healthcare system, demonstrating the sector’s low tolerance for errors.

The World Health Organization has warned that the rapid adoption of untested systems could lead to mistakes by healthcare professionals, patient harm, and erode trust in AI. A high-profile incident involving incorrect guidance could significantly damage OpenEvidence’s reputation and reduce physician adoption. As OpenEvidence scales, its platform will handle more complex queries where evidence may be limited or conflicting. Even accurate information could be misapplied if physicians overly rely on the AI without considering patient-specific factors or fail to exercise appropriate clinical judgment.

The regulatory environment adds another layer of risk. Current regulatory uncertainty exists as standardized evaluations for AI systems are lacking, and ethical guidelines are underdeveloped. If OpenEvidence is perceived as directly influencing clinical decision-making rather than providing information, it could face FDA oversight as a medical device. This oversight would entail costly approval processes and ongoing compliance.

Competitive Pressure

OpenEvidence's early advantage is now facing competitive pressure as established players and competitors integrate AI capabilities and eye the healthcare AI market. UpToDate, which serves over 2 million clinicians worldwide, has already launched AI Labs in 2023 to bring generative AI to its platform. If UpToDate successfully integrates conversational AI with its trusted brand and existing institutional relationships, many physicians may prefer to use an enhanced version of a familiar tool rather than adopt a new platform.

Large technology companies also present a competitive threat. Google developed a medical LLM, Med-PaLM 2, which achieved 85% accuracy on a dataset of US Medical Licensing Examination style questions. Microsoft announced in April 2023 its partnership with Epic to integrate GPT capabilities into clinical workflows. Epic currently owns 32.9% of the US acute care hospital market, giving Microsoft access to thousands of hospitals. Google could integrate medical search directly into its main search engine, while Microsoft could embed similar functionality into Office 365 or Microsoft Teams, which are used by healthcare organizations.

OpenEvidence's size limits its ability to compete on distribution, integration depth, or price. Large incumbents can afford to offer AI features as part of existing enterprise contracts or bundle them with other services. These companies also have relationships with hospital IT departments and procurement teams. OpenEvidence must move quickly to establish a competitive advantage by focusing on information accuracy, exclusive content partnerships, or deep workflow integration before larger competitors can replicate its core value proposition.

Monetization and Physician Trust

OpenEvidence operates on an advertising-based business model, offering its AI chatbot free to verified physicians while generating revenue through advertising. The company has established policies stating advertisements "shall not be considered an endorsement" and that "advertisers cannot influence answers”. However, monetization in healthcare environments requires careful execution.

Although pharmaceutical companies spend billions marketing to physicians, they are hesitant to risk investing in any media that lacks a proven track record. OpenEvidence must demonstrate that advertising on its platform drives meaningful engagement and outcomes for pharmaceutical partners while maintaining physician trust. Striking a balance between advertiser demands for visibility with user expectations for unbiased information presents challenges for the company.

Diversifying revenue streams also presents regulatory and practical obstacles for OpenEvidence. HIPAA requires individual written authorization before using protected health information for marketing purposes. The company also needs to scale its sales and business development capabilities to pursue pharmaceutical partnerships while continuing to invest heavily in product development and AI infrastructure. If monetization efforts fail to generate sufficient revenue, OpenEvidence may be required to pivot to a subscription model or seek acquisition, which could undermine its mission to provide free access to physicians.

Summary

Healthcare physicians are grappling with an overwhelming amount of information. Established providers like UpToDate offer curated research summaries behind paywalls, while general AI tools lack medical accuracy and source verification. OpenEvidence aims to address these challenges by providing a chat interface that synthesizes answers from over 35 million peer-reviewed publications with full citations. The platform provides instant access to evidence-based medical information through a chat platform with a list of corresponding citations.

As of July 2025, the platform served over 358K verified US physicians and over 10K medical centers through a free access model. OpenEvidence is also HIPAA compliant and holds content partnerships with medical journals, such as the New England Journal of Medicine and Journal of the American Medical Association.

Although OpenEvidence faces competition from incumbents and large technology companies, its combination of extensive medical literature access with transparent sourcing creates a competitive advantage. OpenEvidence’s future success will depend on its ability to monetize its platform through advertising, defend against larger competitors, and maintain accuracy while accommodating increasingly complex queries.