Thesis

The global business travel market is massive, having been valued at $787.8 billion in 2021. However, navigating corporate travel policies, booking and ticketing systems, and expense management can be tedious for business travelers. Inaccuracies and manual errors can easily occur when shifting between such systems. Often, expenses and receipts need to be saved and submitted as one bulk expense, either monthly or quarterly, which can lead to misreporting and reconciliation difficulties. Traditional corporate travel methods also frequently require multiple approvals and little to no customization. This causes many business travelers to check in to the same place, stay in the same hotel, and eat the same food when on a business trip, creating a rigid and standardized experience.

Employees and companies are both aware of these issues to varying degrees. 28% of travel managers report that traveler satisfaction is their corporate travel program's top pain point, while only 13% regard it as the greatest strength. 41% of corporate employees who travel for business claim their company's travel program puts cost savings before employee satisfaction, while 38% of business travelers say they are not satisfied with their employer’s travel software. Only 20% of travel managers say user experience is a strength of their employer’s corporate online booking.

Navan is an end-to-end travel management platform for corporations with booking, tracking, reporting, and expensing tools. Navan uses modern software coupled with 24/7 traveler support and incentives to solve common problems in business travel. Its goal is to provide a personalized and easy-to-use experience that makes corporate employees traveling for business feel like VIPs. It uses traveler feedback to offer the best flights and hotels according to their preferences and amenities. It also provides rewards to incentivize compliance with corporate policies in a manner that optimizes cost, convenience, and user satisfaction. With features such as automatic expense report generation, the input of frequent flyer and TSA information, and proactive support intervention in case of flight delays, Navan streamlines the business travel experience. Compared to legacy travel booking systems that can take an hour to book a single trip, Navan has an average booking time of just 6 minutes.

Founding Story

Source: CTECH

Navan (formerly known as TripActions) was founded in 2015 by Ariel Cohen (CEO) and Ilan Twig (CTO). The co-founders were both technology executives and worked at HP and Mercury Interactive before founding their first company together in 2012. This company, StreamOnce, was an internet software business that was later acquired by Jive Software.

Cohen first had the idea of tackling business travel during one of his business trips to Ukraine. Upon checking into his hotel, he realized that his travel agency had not booked his room properly. Despite attempts to contact the agency, he could not resolve the issue as no software was available then. Consequently, Cohen had to move between hotels in the frigid weather looking for open rooms until he eventually found a room. Such incidents were not uncommon for him when traveling for business at the time, regardless of the travel agency or software he used.

When Cohen and Twig later discussed their next startup idea, they decided to tackle the opportunity of making business travelers' lives easier by providing offerings such as mobile/web online booking tools, 24/7 customer support on the go, and travel gamification that incentivize business travelers to save their companies money.

Product

Travel

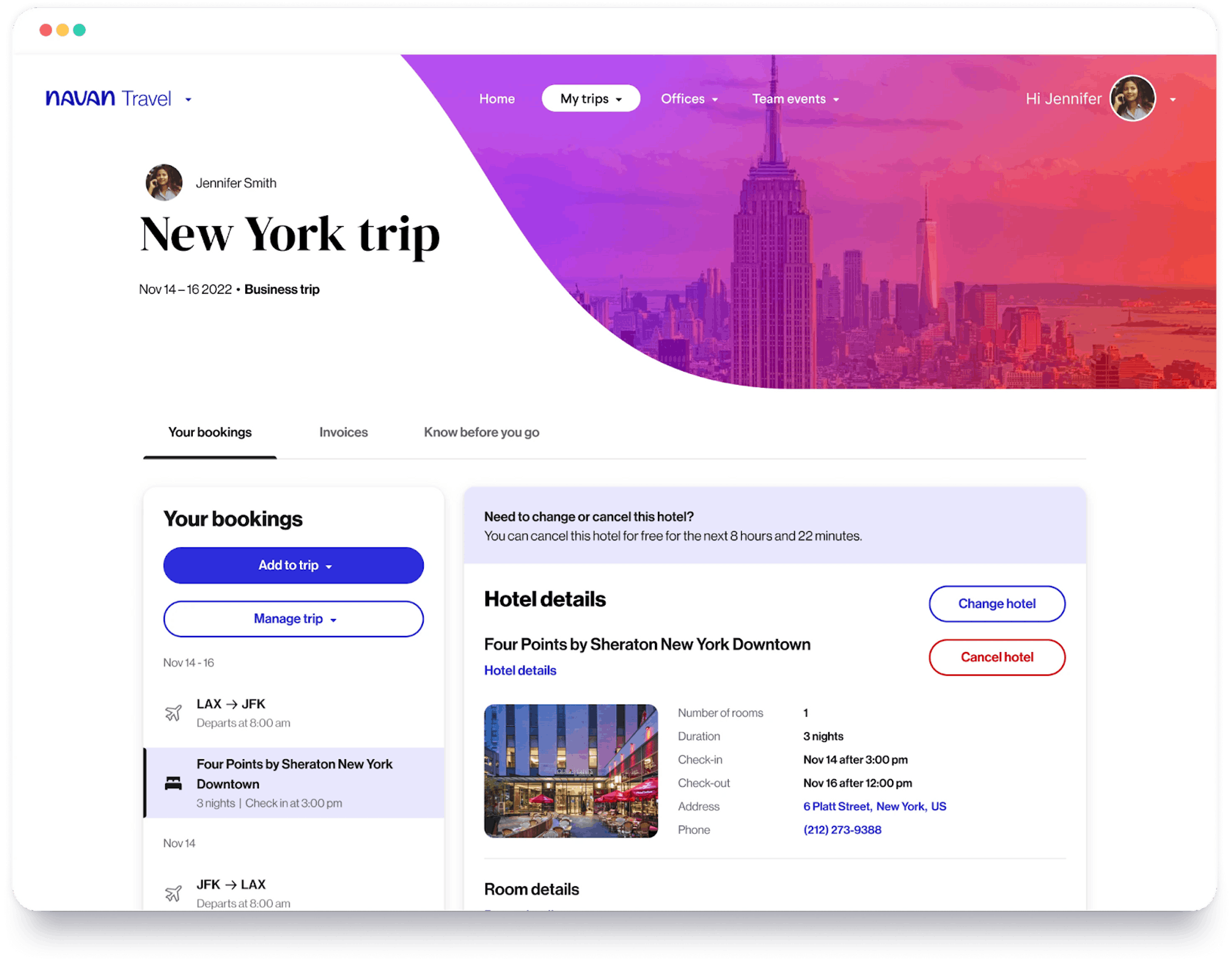

Navan’s travel product offers an online service that allows users to book and manage travel. Customers can select their preferred travel option from Navan’s inventory and book their trip within minutes. Navan returns personalized results tailored to users’ needs. The Navan Travel product caters to both individual travelers and groups, allowing customers to book and manage travel arrangements for guests and plan group travel and offsites for up to 50 employees. Customers also get access to 24/7 support from a global network of travel agents or self-serve with Ava, an AI agent designed to assist customers.

Navan rewards customers when they book cost-effective travel options through Navan Rewards. For every search that is done on Navan, the service calculates a "price to beat" for every search that takes into account real-time inventory availability, pricing, user preferences, and company policies. If a traveler books an option below the Price to Beat, that traveler earns a share of the savings — on average 30% of every dollar is saved. These savings are accrued as Navan Rewards, which can be redeemed for Amazon gift cards, upgrades on future business trips, or personal vacations booked through Navan's platform. Through Navan Rewards, Navan aims to save companies money by aligning employees’ incentives with the business.

Navan’s travel product is also designed for finance teams to optimize business travel while ensuring compliance and cost control. With Navan's spending policies, finance teams can use tools that dynamically adjust spending limits to enforce compliance at scale and in real time. Customized dashboards within the product provide real-time visibility of booking and spending, giving the finance team insights on travel spending and making informed decisions about budget allocation. Navan’s travel product also includes a suite of sustainability tools that allow finance teams to track and reduce carbon emissions.

Navan also offers travel services as part of its travel product, including Navan Pro, a premium high-touch travel service backed by agents from travel management company Reed & Mackay. In addition, the Travel product offers customers assistance in organizing and booking large group meetings and events. Lastly, the Travel product provides customers with a dedicated consulting team to help customers design their own travel program tailored to their needs.

Source: Navan

Expense Management

Navan’s expense management product is designed to help customers control spending, pay, and track their travel and other expenses.

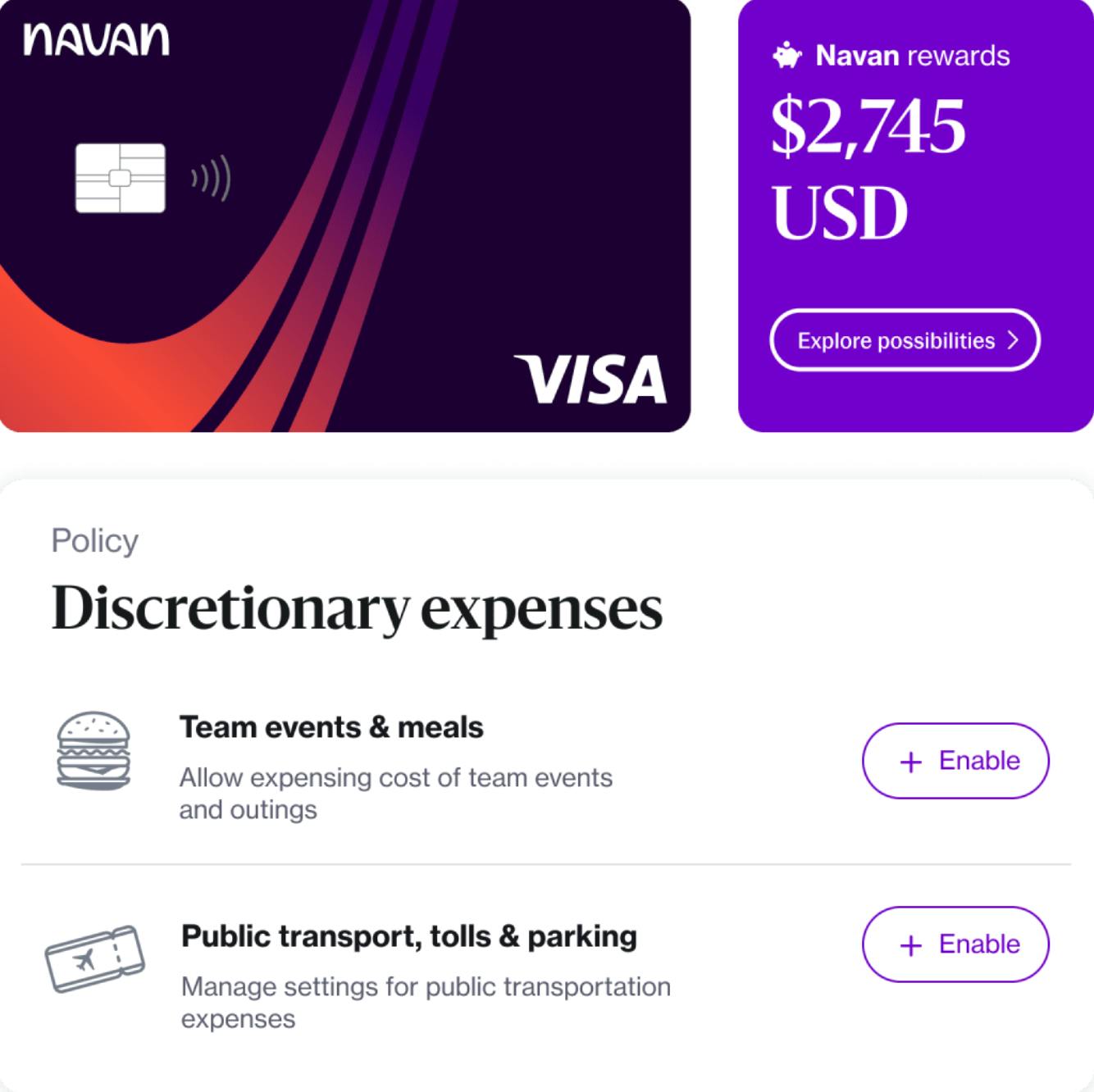

Part of Navan’s expense management solution is its corporate card product, which helps companies manage employee spending. With Navan's corporate cards, employees can make payments and earn a 1% rebate on eligible spending. Corporate cards also offer control over spending, allowing companies to build custom policies that proactively eliminate out-of-policy spending before it happens. Navan's corporate cards offer end-to-end automation, categorizing and reconciling transaction details, automating approvals, and eliminating the need for expense reports.

Navan’s expense management product is intended to streamline the process of expense reimbursements by allowing employees to submit their expenses with just a photo of their receipts. Navan also offers rapid global reimbursements, ensuring employees are reimbursed within days across 45 countries and 25 currencies.

Navan's expense management product includes a real-time reporting feature that allows businesses to access a comprehensive view of all global spending across cards and reimbursements on a single dashboard. Additionally, Navan helps businesses stay VAT compliant by enabling them to capture, track, and report on VAT transactions, potentially allowing them to reclaim up to 25% of their expenses.

Source: Navan

Market

Customer

Navan’s travel and expense management solutions are designed for travelers, finance teams, travel managers, and HR teams and can serve both small businesses and enterprises.

Its travel product helps travelers book and manage travel, and travel managers to set up and manage travel programs. It also helps finance teams optimize business travel while ensuring cost efficiency and compliance. Navan’s expense management product helps travelers make payments and get reimbursed while helping finance teams manage employee spending.

With its history of starting as a technology company specializing in corporate travel management, Navan has traditionally focused on technology companies that have reached a certain scale, specifically those with 1K-5K employees and over $10-50 million in revenue. As of March 2023, Navan had over 9K customers, including Netflix, Adobe, Lyft, Shopify, Unilever, Rivian, Thomson Reuters, Heineken, Notion, Canva, Carta, Loom, Databricks, and Patreon.

Market Size

Navan taps into the global business travel market through its travel management solution, which users can use to book and manage travel. Before the COVID-19 pandemic, global expenditure on business trips had more than doubled from 2000, peaking at roughly $1.3 trillion U.S. dollars in 2019. While expenditure on business travel declined to $695.9 billion in 2020, the market is estimated to grow to $2 trillion by 2028.

In addition to the business travel market, Navan also entered the travel and expense management software market with its introduction of Liquid, an expense management solution that allows employees to make payments and get reimbursed while enabling finance teams to manage and monitor expenses. The global travel and expense management software market is projected to grow from $3.2 billion in 2023 to $7.9 billion by 2030, at a CAGR of 13.9%.

Competition

American Express Global Business Travel (Amex GBT): Amex GBT is a 100+-year-old multinational travel management company with over 19K clients. Amex GBT was divested from American Express in 2014 and later merged with special purpose acquisition company Apollo Strategic Growth Capital to go public in 2022. In contrast to Navan’s focus on mid-market technology companies, Amex GBT provides travel solutions to large corporations, specifically those that spend at least one million dollars a year on flights and those that spend over ten million dollars on business travel.

Egencia: Egencia was the Expedia Group’s answer to travel management before it was acquired by Amex GBT in 2021. Egencia is a corporate travel management company that provides various services and technology solutions to help businesses manage their travel needs. One advantage Egencia has is the benefit of leveraging the travel inventory from Amex GBT. Egencia differs from Navan in its pricing model. While it does not charge a per-trip booking fee like Navan, it charges for customer support separately, whereas Navan doesn’t.

TravelPerk: TravelPerk is a Spain-based travel management company that provides business travel solutions to companies. TravelPerk has raised $408.2 million in funding from investors, including General Catalyst, Spark Capital, and Greyhound Capital, and was last valued at $1.3 billion in its Series D round. While TravelPerk and Navan are similar in their focus on mid-market companies, and mid-market makes up ~60% of both companies’ customers, Navan trumps TravelPerk in scale. As of April 2023, Navan has around $8 billion in business travel spend under management, whereas TravelPerk has around $1 billion.

Brex: Brex is a spend management platform that issues corporate credit cards. It has features like virtual cards spend analytics, receipt capture, policy checks, and more that can help businesses control spending. Brex also offers a rewards program that enables companies to earn rewards on business spending from their credit card. In addition, Brex supports real-time expense tracking and integrates with all the major accounting platforms making it easier for employees and finance teams. Founded in 2017, Brex has since raised $1.5 billion. Whereas Navan focuses on mid-market technology companies, which usually have a stronger demand for travel programs, Brex started as a card issuer to Y-Combinator startups and maintained a strong startup focus, with more than 60% of its customers as small businesses, although it has attempted to move up-market as it has grown. In addition, Brex is focused on expense management and corporate card businesses and only built out its travel solution in March 2023.

Ramp:* Ramp offers spend management and corporate card solutions to help companies spend less. Founded in 2019, Ramp has since raised $1.4 billion from investors such as Founders Fund, Redpoint, Altimeter, and Spark Capital, with its last round valuing it at $8.1 billion. Compared to Navan’s mid-market focus, Ramp focuses on small businesses, making up 60% of its customer base; specifically, slower-growing but profitable companies. Like Brex, Ramp has also focused mostly on expense management and corporate card businesses and didn’t launch its travel solution until March 2022.

SAP Concur: SAP Concur is an American SaaS company providing business travel and expense management services. SAP SE acquired Concur Technologies in September 2014 for $8.3 billion before rebranding it to SAP Concur. One advantage SAP Concur possesses is its integration with the SAP operating system. However, SAP Concur is also known to take six to eight weeks for customers (vs. Navan, which takes only days) to implement and requires training before using the platform.

Navan also competes with legacy travel management companies such as CWT, FCM Travel, and Travel CTM. Navan is an all-in-one travel management platform that combines an online booking experience and services traditionally provided by a travel management company. However, travel management companies usually have outdated tech infrastructure and means of communication, such as constant back and forth over email and phone calls.

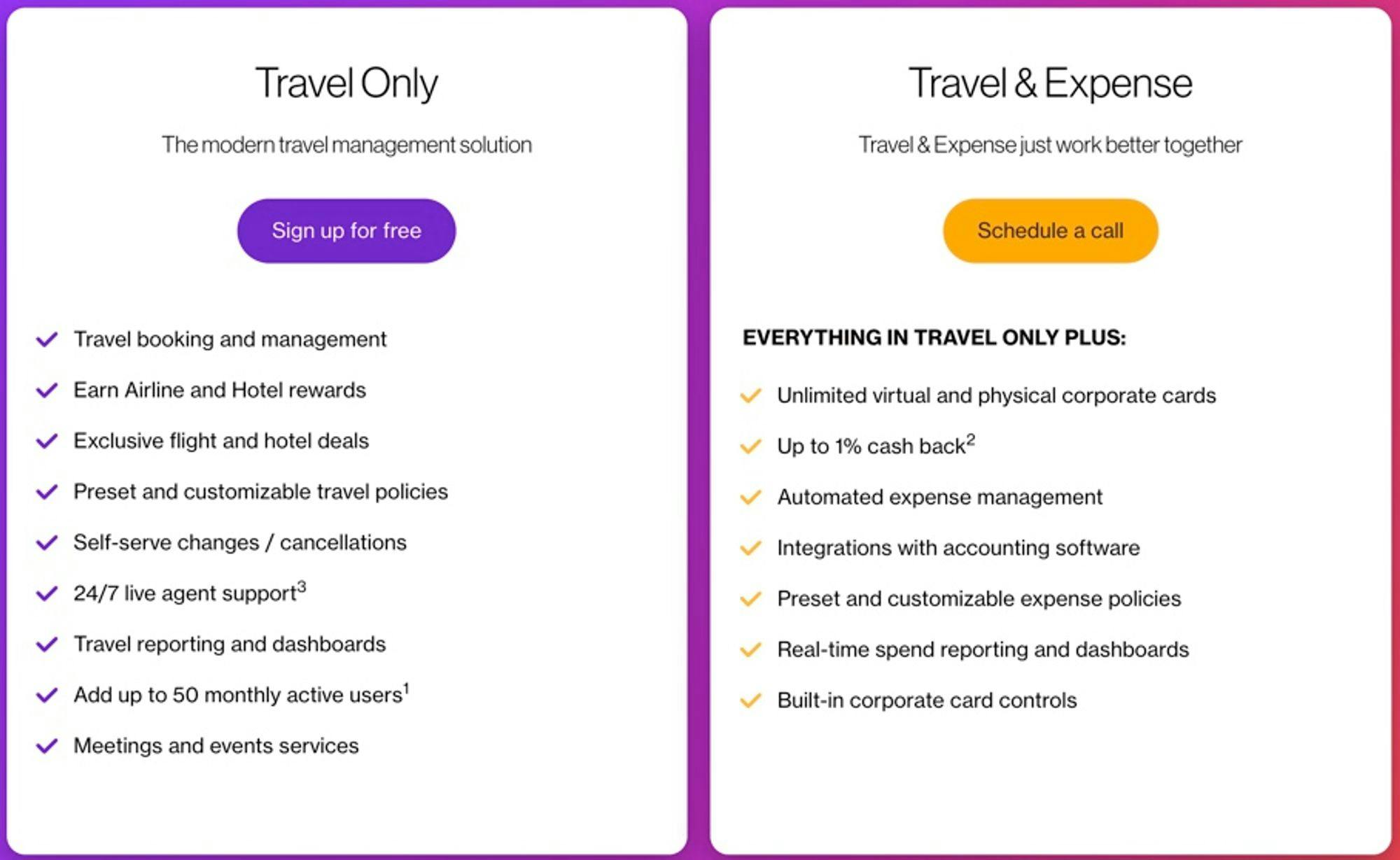

Business Model

Navan offers a free “Travel Only” package and a “Travel & Expense” package, for which the price is negotiated. The “Travel Only” package includes travel booking and management, exclusive flight and hotel deals, preset and customizable travel policies, self-serve changes/cancellations, 24/7 live agent support, travel reporting and dashboards, and meetings and events services. While the package is free, customers are charged a $25 trip fee each time they book a trip through Navan.

The “Travel & Expense” package includes everything in the “Travel Only” package, plus unlimited virtual and physical corporate cards, up to 1% cash back, automated expense management, integrations with accounting software, preset and customizable expense policies, real-time spend reporting and dashboards, and built-in corporate card controls. Customers have to pay a monthly subscription fee based on the number of users they have for the product. In addition to the subscription fees, Navan also derives revenue from interchange from its corporate cards.

Source: Navan

Traction

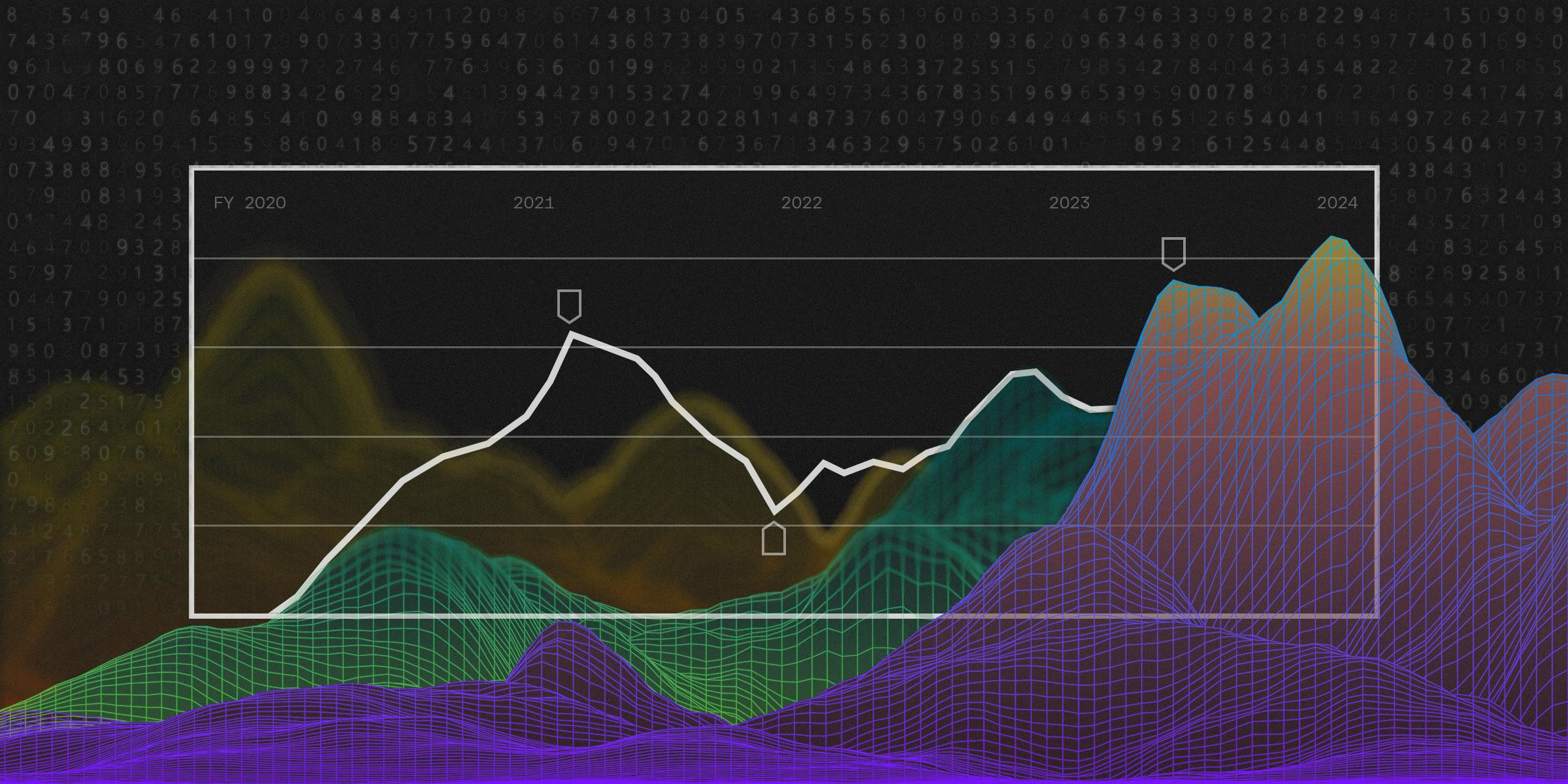

Before the COVID-19 pandemic, Navan was on the verge of surpassing $100 million in annual revenue. However, the business took a significant hit when the world went into lockdown, causing revenue to plummet to $0. Nevertheless, Navan has recovered, and in 2022, the company generated $300 million in annual revenue. Navan is projected to continue its growth trajectory and is expected to achieve an annual revenue of $1 billion by 2024.

One key inflection point for Navan was when it decided to pivot its business model during COVID and accelerated the launch of its expense management product, Liquid. After recording a 500% growth in transaction volume in 2021, Liquid grew another 7.5x in 2022. As of March 2023, Navan has over 9K customers, including Lyft, Shopify, Unilever, Adobe, Netflix, Rivian, Thomson Reuters, Heineken, Notion, Canva, Carta, Loom, Databricks, and Patreon.

Valuation

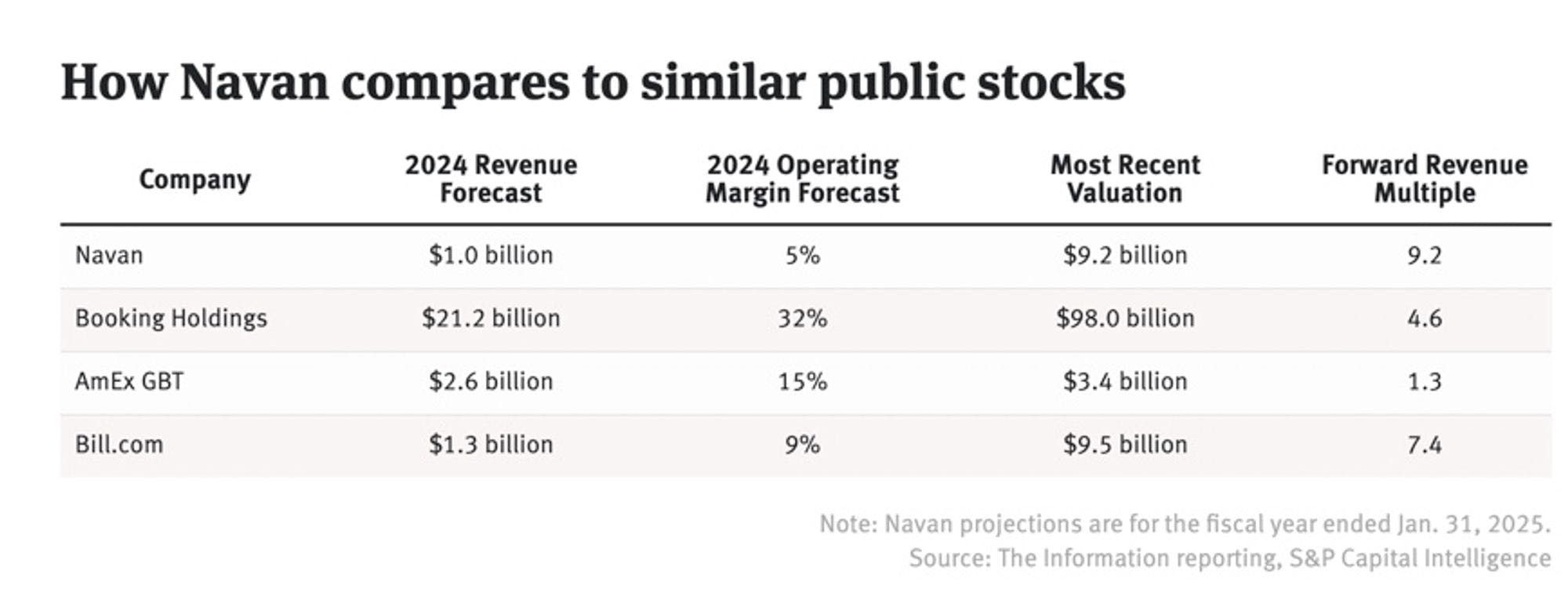

As of April 2023, Navan has raised $2.2 billion from investors including Andreessen Horowitz, Lightspeed Venture Partners, Greenoaks Capital Partners, Zeev Ventures, and Elad Gil. Navan last raised $300 million in a Series G round that valued the company at $9.2 billion in October 2022. Prior to that, Navan was valued at $1 billion in 2018, $4 billion in 2019, and $7.3 billion by December 2021. However, an analysis of a group of similar publicly traded firms—Booking Holdings, AmEx GBT, and Bill.com—shows that Navan is valued at a higher revenue multiple compared to its public comps despite having lower operating margins.

Source: The Information

Key Opportunities

Artificial Intelligence

Navan has entered into artificial intelligence by integrating OpenAI and ChatGPT across its product suite. In addition to improving personalized recommendations and increasing traveler engagement, Navan aims to lower costs with artificial intelligence by reducing the number of customer support agents required. In 2022, travel support expenses accounted for 14% of Navan’s revenue. With artificial intelligence, Navan can seek to replace work by customer service agents who have to rebook flights and hotel bookings.

International Expansion

International expansion is another growth opportunity for Navan. Since May 2021, Navan has been on an acquisition spree, acquiring four travel management companies and increasing its presence in regions such as Europe and India. According to a senior industry insider, Navan has been eying Europe as a growth opportunity because the continent historically has not been dominated by major players, and is easier for Navan to grow organically since it will be able to do so without having to unseat an incumbent.

Key Risks

Increased Competition

Navan has long positioned itself as one of the few all-in-one travel, corporate card, and expense management solutions. Until roughly 2022, travel management, expense management, and corporate cards had been distinct industries with separate major players. However, the success of Navan has encouraged competition to expand their offerings and develop their all-in-one solutions.

Since 2022, Brex and Ramp* have both launched their travel management products. Furthermore, Amex GBT, the worldwide leader in travel management, has also been strengthening its expense management suite. Navan faces increased competition as its rivals overlap on their core offerings. While Navan's long-standing presence in the industry and established customer base may provide it with an advantage, it will need to continue innovating and adapting to meet the evolving needs of its customers in the face of increasing competition.

Multinational Enterprise Customers

The travel management and expense management market is dominated by leaders who have achieved significant growth by catering to large enterprise clients. Amex GBT is the market leader in travel management and boasts a 40% larger market share than its closest competitor. It specifically targets large enterprise clients who spend at least $1 million a year on flights or over $10 million dollars on business travel. Meanwhile, SAP Concur also has a 40% market share and focuses on serving enterprise clients, contributing to over 50% of its client base.

To establish a foothold in the enterprise market, Navan must invest in matching the strengths of industry leaders. While Navan's inventory outside of the US is not as robust, Amex GBT's presence in over 140 countries and its 40% market share in the global multinational travel segment make it challenging for Navan to compete for multinational customers who place a high value on international business travel.

Summary

Due to outdated booking software, compliance issues, and misaligned incentives, business travel remains complex and frustrating for employees, finance teams, and businesses. Navan aims to address these issues by encouraging employees to treat their company's travel budget with the same care as their travel budget and building an all-in-one travel, expense management, and corporate card solution powered by technology. Navan offers users incentives such as Amazon gift cards and flight upgrades to encourage cost savings and provides users with an improved travel experience with features such as mobile and web-based booking, 24/7 support, and automatic expense report generation.

*Contrary is an investor in Ramp through one or more affiliates.