Thesis

Fintech infrastructure has reached a tipping point in maturity. Companies like Marqeta, Stripe, Adyen, and Galileo have created the infrastructure to make issuing corporate cards almost effortless. At the same time, banks have gotten better at allowing startups to plug into their systems, bestowing a whole new wave of fintechs the ability to hold and move money. There were $120 trillion in global B2B payments encompassing non-payroll expenditures in 2022.

For mid-market businesses, the current process for managing spend is siloed and fragmented. Frequent expenses, travel-related costs, and employee-initiated spending are typically done via credit card or cash and managed by an expense management platform like SAP Concur or Expensify. Employees submit expense reports detailing their expenditures and software helps automate review, approval, and reimbursement.

Larger expenditures, specialized payments, and vendor preferences require the use of more involved payment methods like bank transfers, checks, or electronic funds transfers. Because of the complexity and strategic importance of these kinds of transactions, they involve multiple steps and stakeholders — and thus, require even more software.

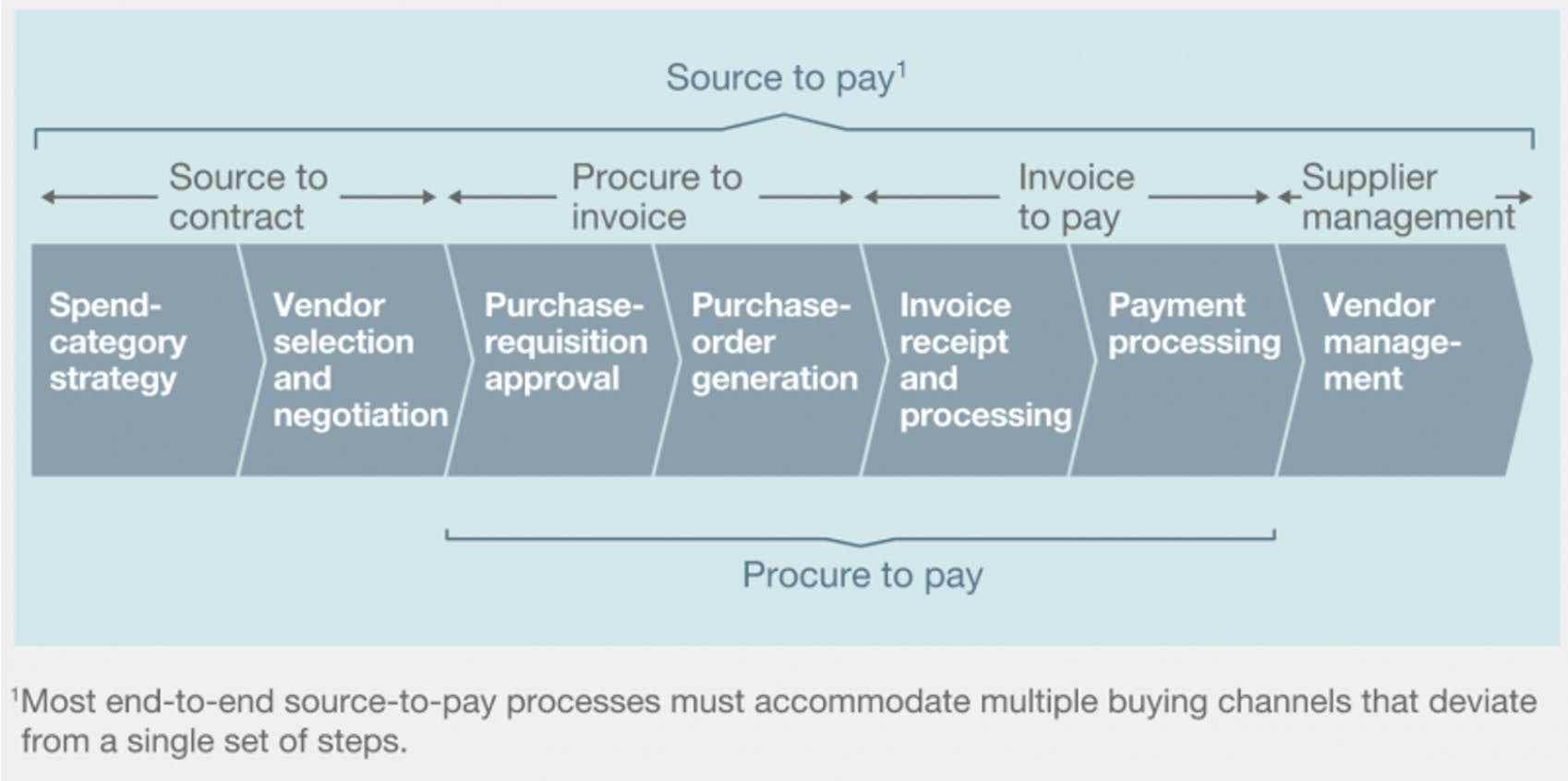

A typical procure-to-pay process looks like this:

Vendor selection and negotiation: The business identifies potential suppliers for desired goods or services, evaluates their capabilities, negotiates terms, and establishes formal contracts.

Purchase requisition: When an employee or department decides on a vendor, they create a purchase requisition. This document outlines the details of the desired purchase, including the item or service, quantity, cost, and purpose. It acts as an internal request for approval before an actual purchase order is generated.

Purchase order: Upon approval of the purchase requisition, a formal purchase order (PO) is generated. The PO specifies the terms and conditions of the purchase, including the agreed-upon price, quantity, delivery timeline, and any specific requirements. The PO serves as a contractual agreement between the company and the supplier

Invoicing and accounts payable: Suppliers send invoices to the company for the goods or services provided. Accounts payable (AP) teams verify the accuracy of these invoices, ensuring they match the corresponding purchase orders and receipts. After verification, the invoices are approved for payment.

Payment processing: Payments to suppliers are processed based on the approved invoices. Timely payment processing helps maintain positive vendor relationships and may also come with potential discounts or incentives.

Source: McKinsey

To automate some of this process, finance and accounting teams have historically been forced to stitch together SAP Ariba, Coupa, or Zip for the first three steps of the process in combination with Bill.com, Tipalti, or AvidXchange for the last two. On top of this, they might also have a separate provider for corporate cards like American Express and a request and approval workflow tool like Slack, Jira, or Procurify. The end results are monthly close processes that involve huge amounts of low-value, manual work and a lack of central visibility into how money is spent in the business.

Airbase is designed to replace all of the tools typically used by mid-market businesses to manage non-payroll spend with one platform. It offers spending control, book closure, and financial risk management and aims to improve these offerings by integrating accounts payable automation, expense management, and corporate cards. It is also designed to streamline procurement from requests to payment, even for complex tasks like multi-subsidiary management and purchase orders. Its intake and approval processes are designed to promote oversight and spending compliance among stakeholders. On the back end, Airbase automatically categorizes and records all spend in the company’s general ledger.

Founding Story

Airbase was founded by Thejo Kote (CEO) in 2017. Kote grew up in India and studied Electrical and Electronics Engineering in Bangalore. After graduating, he worked at the Indian IT firm Infosys as a software engineer after he wasn't offered an interview at Yahoo!, Google, and other big tech incumbents he had applied to. While there, Infosys CEO Nandan Nilekani helped him realize that he wanted to build something of his own.

Following this, Kote left Infosys to join Indian startup Netcore Solutions as an early employee. He spun out of the startup with a side project he was working on at the time, which was a text-message-based social application like Twitter. After realizing that the Indian tech ecosystem wasn’t mature enough yet to harbor the kinds of companies he hoped to build, he moved to the US for graduate school at UC Berkeley. He explained this choice with an analogy:

“If I was an artist during the Renaissance period, I would have found my way to Florence. I wanted to be where the action was, which was Silicon Valley. Also, I wanted to fill the skills gap. The way for me to address both was to come to grad school here [at the UC Berkeley School of Information] and that’s what I ended up doing.”

His first company, named NextDrop, came out of a social enterprise at Berkeley and was intended to help people in developing countries predict when during the day they’d have running tap water. In 2011, he left NextDrop to co-found Automatic, a connected car platform. Automatic was accepted into Y-Combinator’s summer 2011 batch and went on to sign contracts with prominent retailers like Apple, Best Buy, and Amazon over the next six years, raising $30 million along the way. This journey culminated in an acquisition by SiriusXM valued at $115 million in April 2017.

While managing the finance side of a business for the first time at Automatic, Kote was exposed to the broken state of corporate spend. He realized that every dollar he spent was going to a different system and as the company scaled, its request approval workflow became increasingly messy. There was no way for him to hold his employees accountable for their spend because he’d have to wait until the end of the month for the finance team to collate information from all of these different systems. In an interview with Contrary Research, Kote described this learning process:

“When someone who has built in one domain starts to see gaps in another industry, it can inform the opportunity. When I started my previous company, I didn’t know much about finance. I was forced to learn a lot of things when I was building a hardware company, all about how to manage inventory, and expenses, and everything.”

This led to his founding Airbase, which Kote bootstrapped with $300K of his own money in 2017. He took what he learned from building Automatic to hire a fully distributed team, and focused on targeting customers with 100 to 300 employees at first, as he told Contrary Research in an August 2023 interview:

“We started off focusing on 100-300, then it became 100-500, then it became 100-1K, and now we’re able to target even larger companies.”

Product

Guided Procurement

Source: Airbase

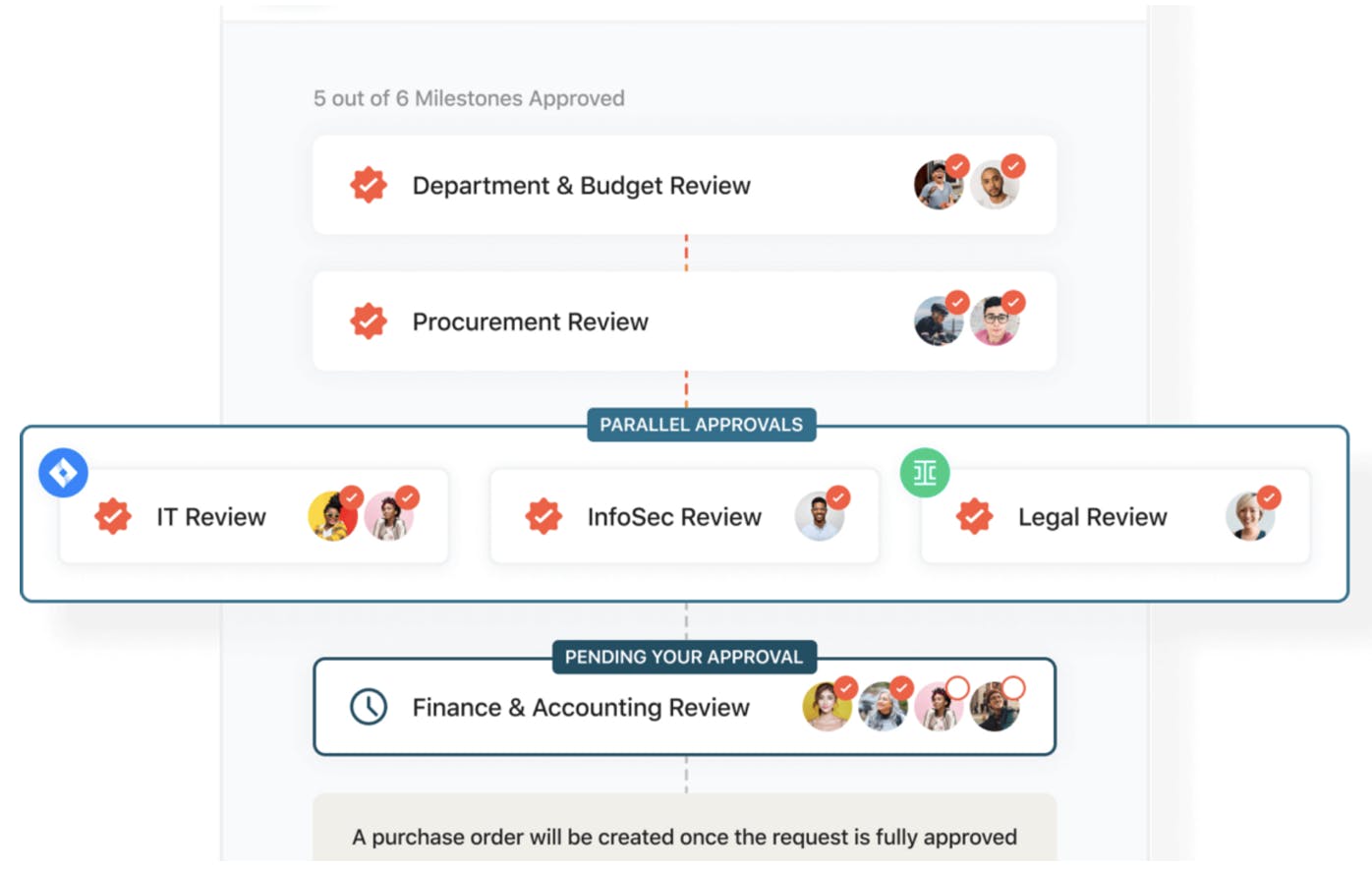

Airbase’s Guided Procurement module directs employees to gather necessary information from stakeholders like IT, procurement, and legal to ensure that approvals are in place before purchases. Airbase claims to be the first spend management platform to automate the intake process for purchasing.

Guided Procurement is designed to make collaboration easier for stakeholders involved in the procurement process. It routes necessary information to the company’s existing business systems (e.g. Jira, Ironclad, Slack, and most major HRIS and SSO providers) to make tracking purchase requests and approvals across teams more seamless. It also uses no-code workflows that adapt to spending policies, which is intended to allow procurement teams to take a more strategic approach rather than being bogged down by manual tasks.

AP Automation

Source: Airbase

Airbase’s AP Automation module allows AP teams to pay bills while syncing to customers’ general ledgers (GL) for accounting purposes. Specifically, it helps customers:

Onboard vendors: Airbase provides a self-service vendor portal that directs vendors to provide contact, banking, and tax information and gives them visibility into the payment status of every invoice.

Capture invoices electronically: Airbase’s optical character recognition (OCR) technology automatically scans and populates invoices from email or the vendor portal. Airbase gives teams context on an invoice with the automatic inclusion of email correspondence relating to that vendor or purchase.

Match invoices: Airbase automatically matches invoices with NetSuite purchase orders and item receipts to make sure customers get exactly what they pay for. This process also leaves a clear audit trail, aiding SOX compliance.

Get approvals for bill payments: Airbase automates customers’ approval workflows, engaging appropriate approvers based on factors like vendor, amount, and GL category. Review and approval can be done easily across devices.

Update the GL after a transaction: Airbase's intelligent automation categorizes expenses, and auto codes, tags, and records transactions in the GL. Banking activity reports with individual transactions simplify month-end bank reconciliations. Airbase integrates with NetSuite, Sage, QuickBooks, and Xero.

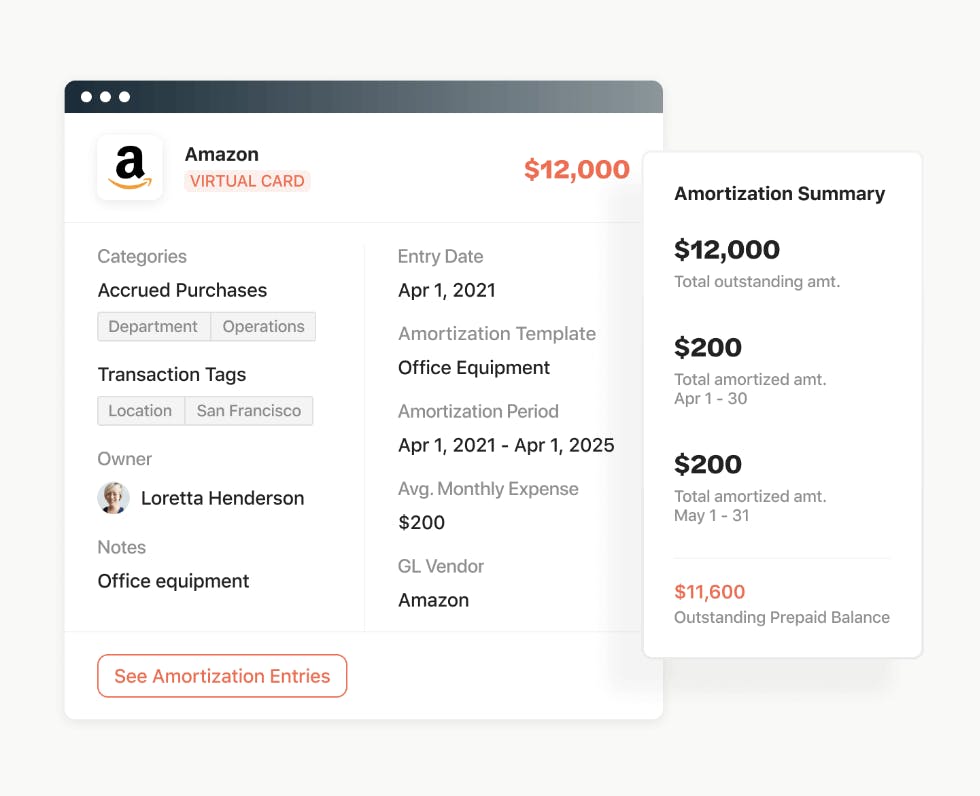

Amortize payments when necessary: The user inputs start and end dates and Airbase generates a complete amortization schedule with equal splits. It syncs booking details to the GL, eliminates spreadsheet usage, and supports a variety of amortization schedules and structures from NetSuite's library.

Expense Management

Source: Airbase

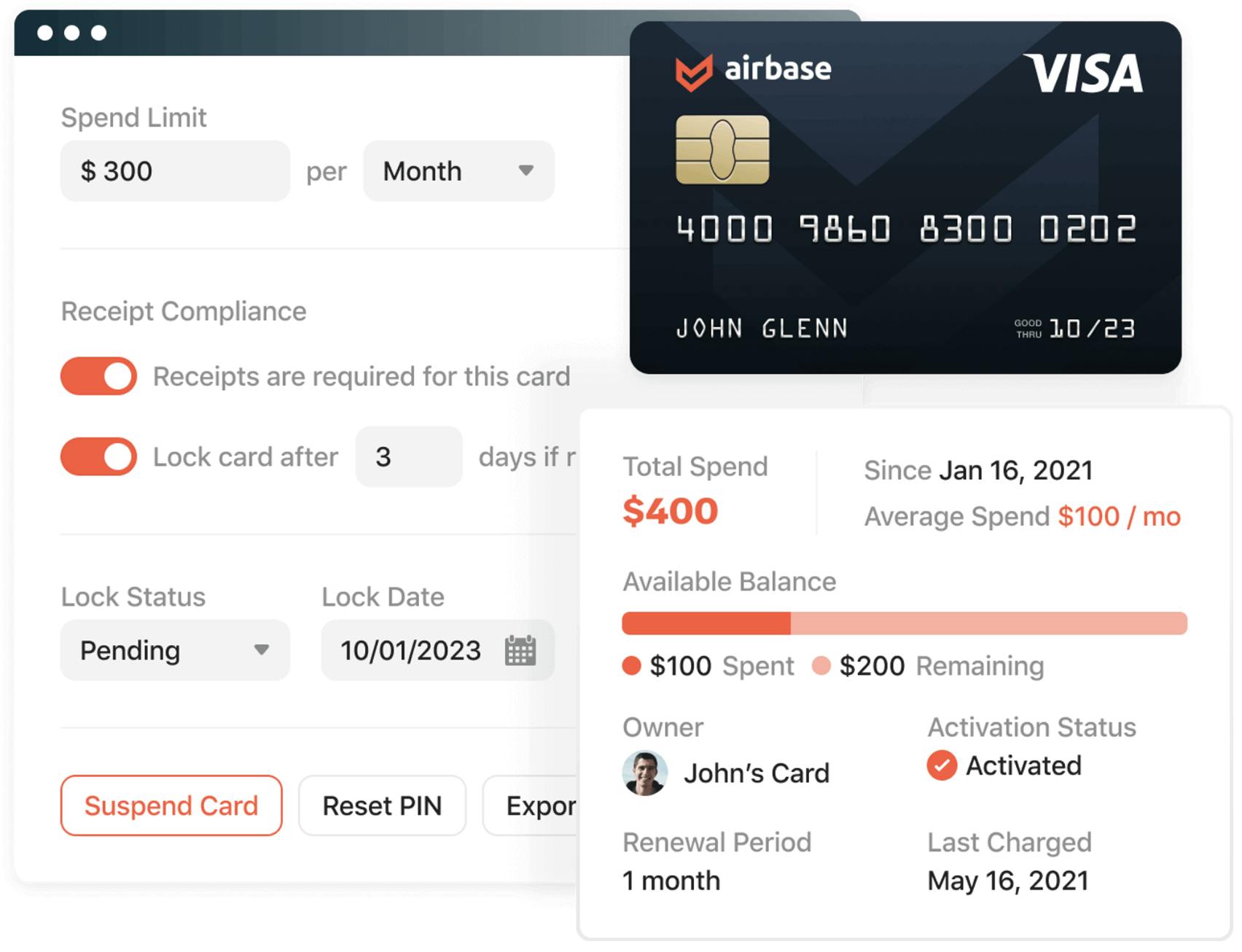

Spend Controls

Airbase allows budget owners to create custom approval workflows for virtual cards and purchase requests that enable them to preview and approve expenses before they occur. In practice, admins might use Airbase to place limits on physical cards to control for amount, or expiration date so that subscriptions are not automatically rolled over.

Approval requests are directed to approvers via email and Slack to allow for swift processing. The mobile app facilitates on-the-go approvals, while a Slack integration allows for clarifications before purchases. Spend control also happens directly through software-enabled corporate cards, where admins have granular control of how much money is spent and when.

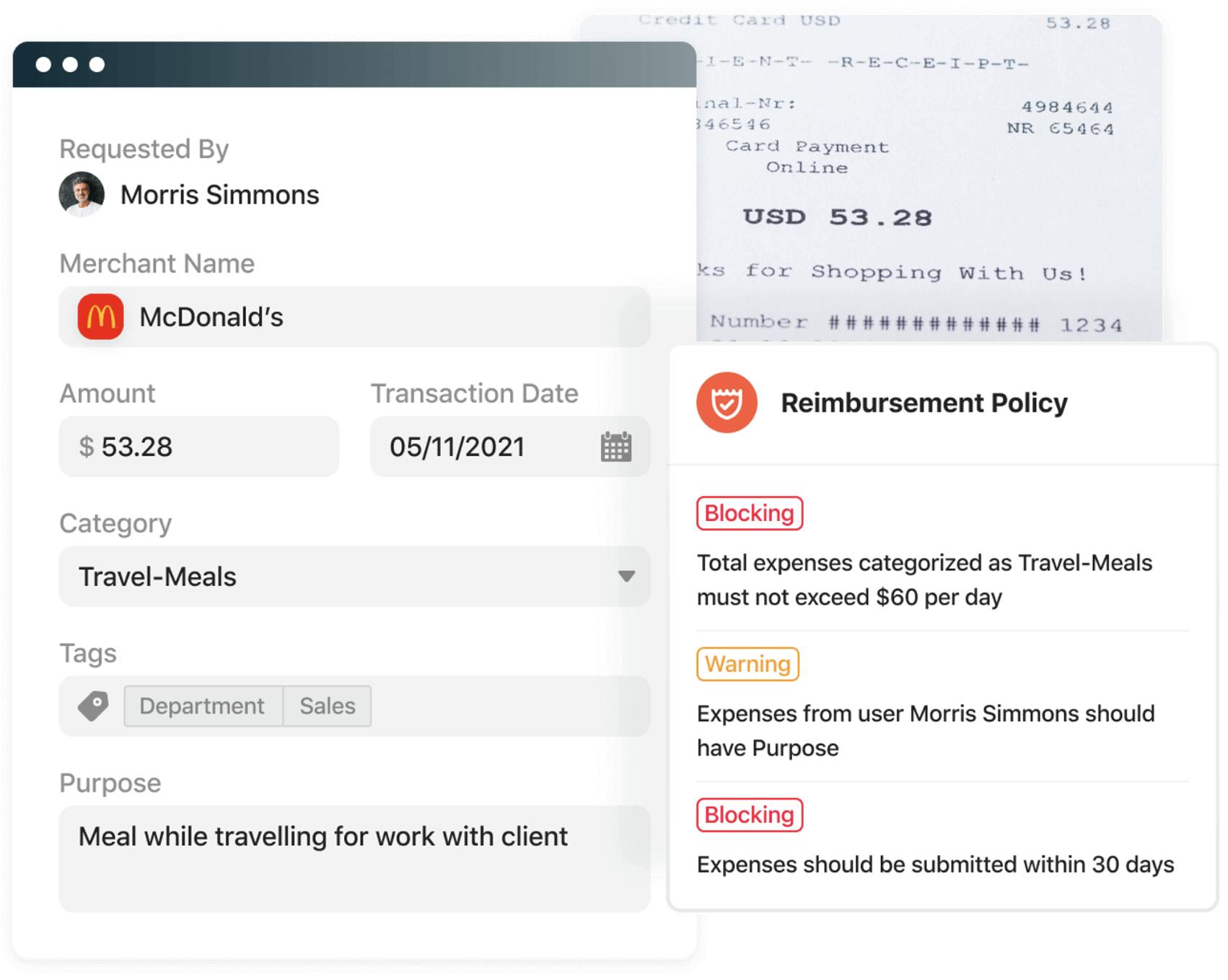

Reimbursements

When employees spend their own money, Airbase offers a streamlined reimbursement process. Users can submit their expenses using the mobile app, where a photo of the receipt triggers automatic scanning via OCR technology. Once approved, reimbursements are directly deposited into the employee's bank account.

This product is intended to ensure consistency in employee expense management by integrating reimbursement submissions into the same system used for all other purchase requests. This facilitates approval workflows, automatically routing requests to the appropriate approvers based on company policies. Users can customize submission requirements, submission timeframes, and budget limits, and flag or block expenses that don't adhere to the defined guidelines.

Airbase supports reimbursements across various currencies and locations. Customers can reimburse expenses from a US-based subsidiary to employee bank accounts both locally in the US and internationally across 45 countries and 15 currencies. Additionally, reimbursements can be processed for international-based subsidiaries in Canadian Dollars, British Pounds, Euros, Australian Dollars, and Singapore Dollars.

Travel

Airbase integrates with TravelPerk, a leading travel management provider, so that employees can book and expense travel on the same platform. Booking details are integrated with the Airbase Expense Management module for expense reporting and for syncing to the general ledger.

Corporate Cards

Source: Airbase

Airbase partners with Marqeta to enable its customers to issue vendor-specific virtual cards. Employees can also request virtual cards themselves through customizable approval workflows. The cards can be one-time for ad hoc purchases (e.g. meals, gifts, taxi fare, office supplies) or recurring for purchases made on a periodic basis (e.g. a monthly software subscription). After they are issued, transactions automatically sync to the general ledger to allow for real-time visibility into employee spend. Each virtual card can have unique spending thresholds, transaction count limits, and expiration dates. A "pending lock" feature alerts users about approaching card expirations.

Airbase also offers physical corporate cards for in-person spending. These can be customized with spending limits or disabled if employees are delinquent on receipt compliance. Its cards are compatible with Apple Pay and Google Pay digital wallets for contactless payments. Airbase’s cards give unlimited cash back, which employees have access to at the end of every month.

For customers who want to keep their existing corporate card programs, Airbase partners with American Express and Silicon Valley Bank to integrate their cards into the Airbase spend management platform. In July 2022, Airbase received a $150 million credit facility from Goldman Sachs to expand its corporate card program.

Market

Customer

Airbase primarily serves finance and accounting teams in the mid-market who are sized for ERPs like Intacct and NetSuite. The company believes the mid-market is highly underserved and that there is an opportunity for them to become the category leader in that segment. In an August 2023 interview with Contrary Research, CEO Thejo Kote described the problem Airbase’s customers face:

“What I noticed and what I set out to solve was that in the middle segment, there wasn't a NetSuite of spend management. Companies would start with these small business solutions. Initially, they would start off with a corporate card, Bill.com, Expensify. At some point as they continue to grow, the half a dozen different systems that they’re using to solve that non-payroll spending problem will turn out to be too painful, and then inevitably find themselves jumping to a Coupa, or some really heavy solution that wasn't a great fit for that middle segment.”

When a company implements Airbase in full, almost all of its employees interact with the software. Airbase is intended to automate low-value and manual work for CEOs, CFOs, VPs of finance, controllers, accounting managers, and budget owners. It also helps streamline approval workflows for procurement, legal, IT security teams and enables expense reporting for everyone at the company. Kote described the pain point Airbase solves as follows:

“If a controller is in the shower in the morning, are they thinking about how they can get 20 basis points more of cash back or extra dollars of credit on my corporate card? No, they're thinking about the fact that their entire team has a terrible experience. They're all unhappy about the expense reporting process and the pace at which they get information about what they're spending on. The controller then has to hire three more AP people given the rate at which their transactions are growing and how their system is set up. These are fundamental business problems that they are thinking about.”

In an interview with Contrary Research, Kote also said that he thinks about market segmentation in terms of employees because with workflow-driven products the complexity tends to come from employee count rather than revenue. When asked about whether or not he was worried about graduation risk, he said:

“I don’t want to try and stick with a customer forever if they truly become an enterprise company. Its okay if we lose them. I want to stay focused on our core segment of 200 to 2K employees.”

Kote also observed that the cost and effort required to implement a spend management solution is lower in the mid-market, since according to him customers get value out of software in just weeks compared to 8-12 months in the enterprise segment. Ongoing implementation costs also don’t exist in the mid-market.

However, Airbases’s ideal customer has not always been the same. It started off focusing on customers with 100-300 employees and are continuing to invest in moving further upmarket. As of February 2022, 80% of the company’s revenue came from companies with 100 to 5K customers, with most being US-based and in the technology sector.

Notable customers of Airbase include Coda, Lattice, OpenSea, Fivetran, Front, Jobber, and Modern Treasury, among others.

Market Size

There are three ways of looking at Airbase’s market size. One way would be to use the total amount of global B2B payments that flow through businesses each year, which is $120 trillion. Another way would be to break down market size by category, using public comps and market research as points of reference:

Corporate cards: American Express generates over $40 billion in annual revenue just addressing the card portion of business spend. With American Express at 42% market share, corporate card TAM likely represents ~$95 billion.

Bill pay: Bill.com processed over $240 billion of annualized transaction volume in 2022, earning $194.8 million from transaction and subscription fees.

Expense management: In its S-1 filing in October 2021, Expensify estimated its total addressable market to be about $16 billion in the US and $21.5 billion across the US, UK, Canada, in Australia as of 2020. Of this, it estimated that the majority of its addressable market ($12 billion), the majority, would come from SMBs.

Guided procurement: The global procurement software market size was valued at $6.2 billion in 2021 and is expected to grow to $13.8 billion by 2029.

Finally, to estimate the size of the mid-market segment, NetSuite is a mid-market company that targets the same customers as Airbase. It operates in a significantly more mature market and is doing $4.5 billion in revenue, according to a Contrary Research interview with Airbase CEO Thejo Kote.

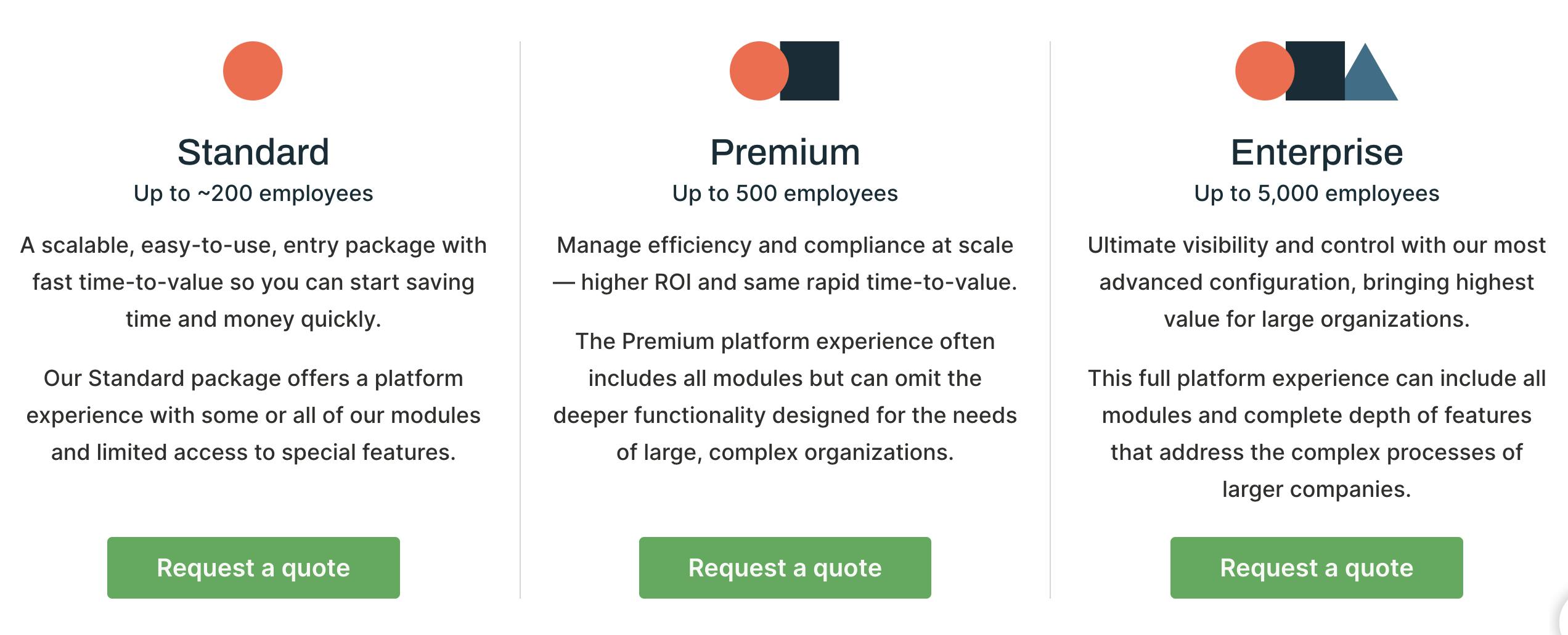

Competition

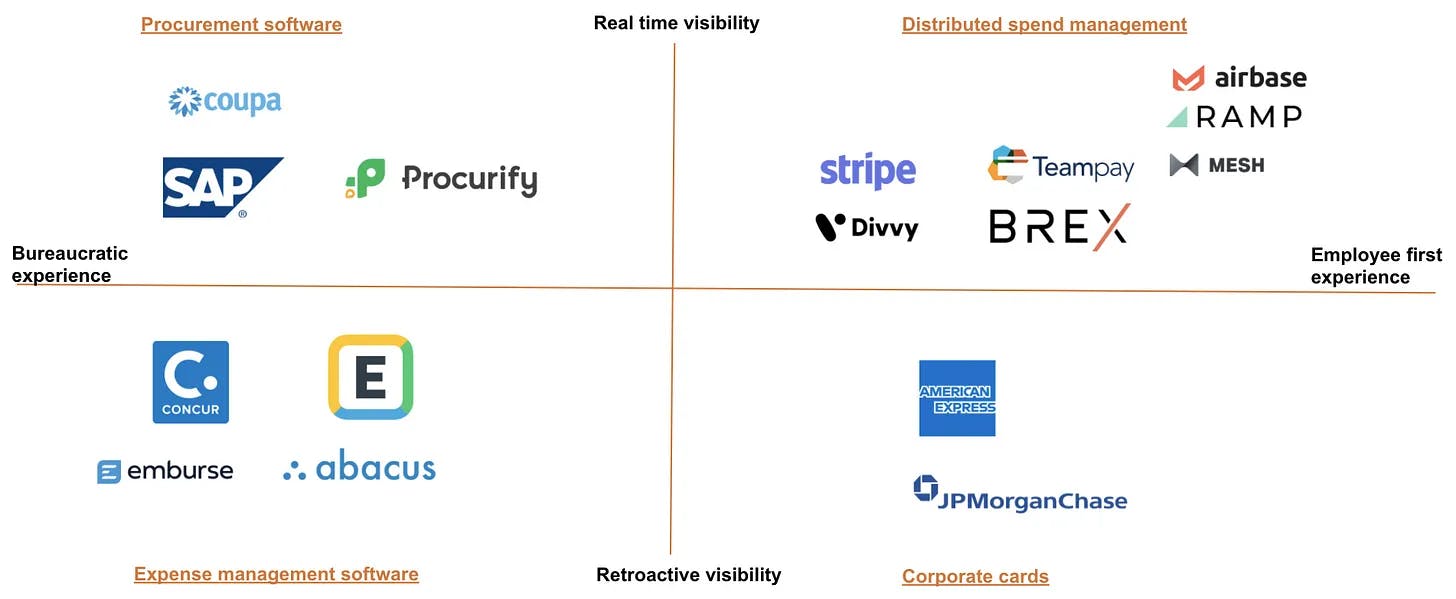

Source: Lisa Han as of January 2021

Spend management is a high-competition market with both deep-rooted incumbents and startups attacking the space from multiple angles, including expense management, corporate cards, travel management, and HRIS.

Nonetheless, Kote stated in an interview with Contrary Research that he does not believe that spend management is a winner-take-all market and that as long as companies clearly define their segments and strategies, multiple companies can succeed. He drew a parallel between spend management and workflow management; despite there being an abundance of competitors (e.g., Asana, Monday, Atlassian, Notion, Airtable, and ClickUp), the sheer size of the market has allowed it to produce several large public companies. Asana, Monday, and Atlassian had market caps of $4.6 billion, $8.2 billion, and $49.2 billion, respectively, as of August 2023.

Procure-to-pay

Airbase has positioned itself with procure-to-pay as its center of gravity. Airbase is one of the only modern solutions within this competitive set, with incumbents such as Ariba, AvidXchange, Tipalti, and Coupa being 20 years old or older. Airbase has an advantage over these players due to its product velocity and breadth of offering. One Airbase customer, for example, stated that his company switched from Tipalti to Airbase because Tipalti had no way to issue and set spend controls on specific cards, a feature the company deemed vital with the way companies transact nowadays.

Expense Management

SAP Concur is a legacy product used by over 75% of Fortune 100 and 500 companies. Expensify is another large player founded in 2008. Both products have been described by customers as “clunky” and “manual” compared to Airbase. Divvy is a younger expense management company that Bill.com acquired for $2.5 billion in May 2021. It monetizes from interchange and has higher churn compared to Airbase because its software is not the product’s main selling point.

Corporate Cards

American Express is by far the leader within the corporate card segment. It was founded in 1850 and owns 42% market share. On the other side of the corporate card angle are venture-backed startups Ramp and Brex, which were founded in 2019 and 2017 respectively, and pioneered the idea of the digital-first corporate card.

While they were able to subsidize their growth with swaths of venture capital in 2021, Ramp and Brex have started to diversify outside of a purely interchange-based revenue model, especially given the sales-led model required in B2B. They are now beginning to position themselves as software-driven products to capture more subscription revenue.

Ramp and Brex have historically differentiated themselves with their target customer, with Ramp focusing on profitable, lower-growth businesses and Brex focusing on funded startups. In an interview with Contrary Research, Kote said that Airbase rarely competes with Ramp or Brex for the same contract.

Travel Management

Travel management platforms like Navan provide solutions for booking, tracking, reporting, and expensing corporate travel. Because a large portion of corporate spend occurs when employees are traveling, Navan has a wedge into spend management. In October 2020, Navan added expense management and corporate cards to its product suite and in June 2023, Navan partnered with Mastercard and Visa to launch Navan Connect, a patented card-link technology that gives businesses a way to offer Navan’s expense management experience without having to change their corporate card provider.

HRIS

Rippling is a platform for HR, IT, and payroll processes that began foraying into spend management in September 2022. By unifying all employee data on a single platform, Rippling has the potential to build a solution that is even more comprehensive than Airbase’s. Notably, Brex CFO Adam Swiecicki left to join Rippling in the same role in December 2022.

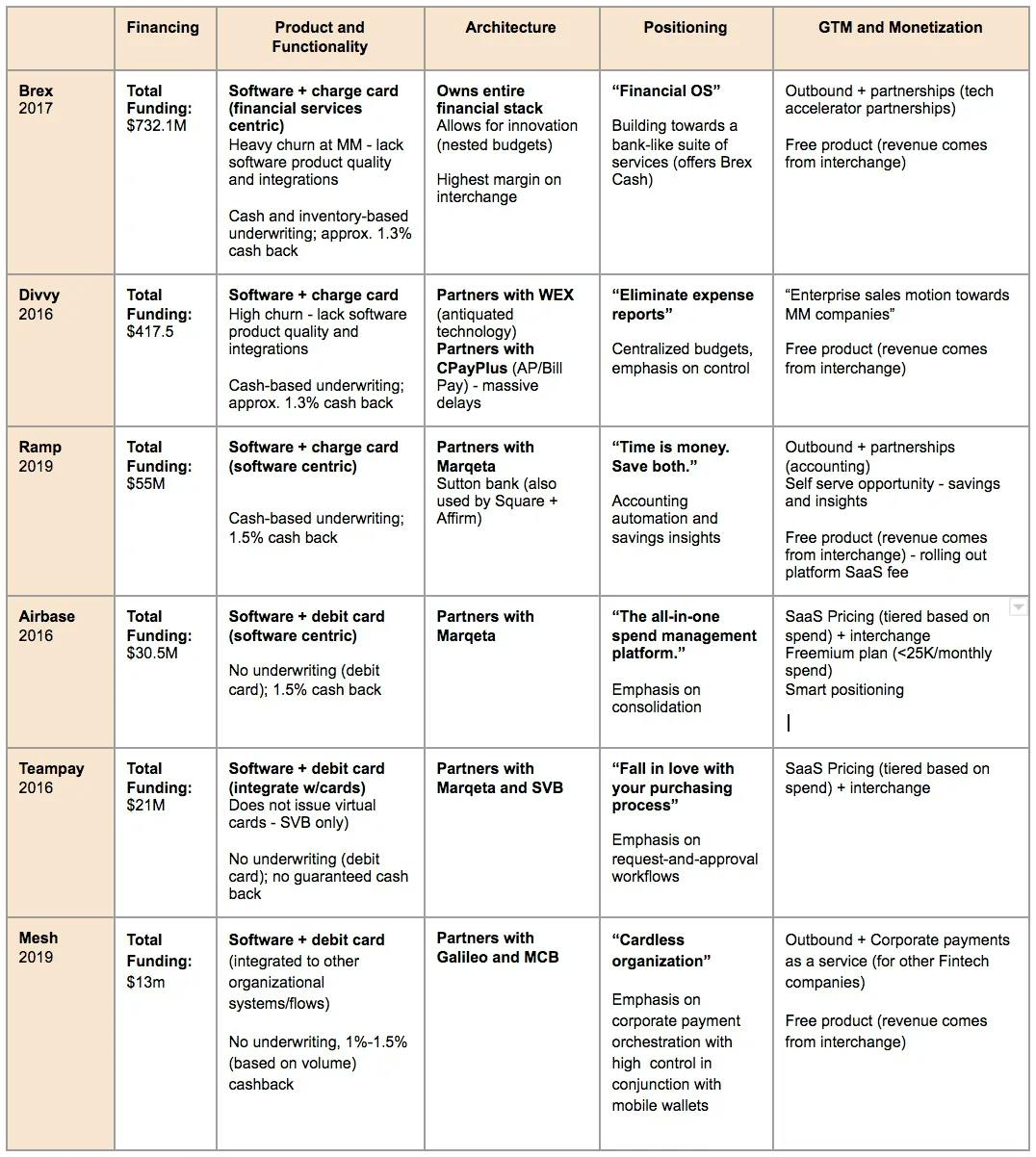

Source: Lisa Han as of January 2021

Business Model

Unlike other corporate card startups that give their product away for free and earn revenue via interchange fees, Airbase monetizes primarily through software subscriptions. According to Kote, software represents a “higher quality, more durable” source of revenue compared to interchange, which is tied directly to business expenditures that can be more sensitive to market downturns.

While the upfront cost of implementing Airbase might be costly compared to free solutions, the lack of transaction fees on the platform make Airbase an economic choice for middle-market customers with large transaction volumes. A portion of Airbase’s revenue also comes from transaction fees, and the company expects the ratio to financial services and subscription revenues to even out over time as it monetizes more of the payment channels on its platform.

Airbase offers three pricing tiers, serving up to 200, 500, and 5K employees, respectively. Pricing is not publicly available. Each tier can be customized to implement only the features that the customer needs from Airbase’s four modules — Guided Procurement, Accounts Payable Automation, Expense Management, and Corporate Cards.

Source: Airbase

According to a memo prepared by Airbase in advance of its Series B, gross margins for the financial year ending January 2021 were 90%. This is materially higher than interchange-focused companies like Brex, which end up with about 55% gross margins, according to one third-party estimate, after interchange is split to other stakeholders in the payment stack.

Traction

Airbase’s annual recurring revenue (ARR) increased by 300% in 2021, with payment volume growing 800% in the same time period. As of August 2021, a total of $2 billion of annual spend flowed through Airbase. In an August 2023 interview with Contrary Research, Kote shared that this number had risen to $6 billion. He also stated that while the company experienced 150-200% growth for multiple years, it chose to slow down in 2022 to preserve cash runway; according to Kote, most of the $100 million Airbase has raised is still in the bank.

The company has maintained a high customer retention rate through its growth, reporting that it did not churn a single customer due to dissatisfaction with the product and that the top reason for churn was customers getting acquired. G2 awarded the company the number one spot in multiple spend management categories of its 2022 Best of Software Awards and the third spot for the best overall accounting and finance software in 2022.

Airbase’s partnership with large incumbents like American Express can be seen as one signal of the company’s potential leadership in the corporate spend management space. After a thorough due diligence process involving all of Airbase’s competitors, American Express Ventures stated that Airbase was a “no brainer” because it believed that the company provided the best customer experience. This is an outcome of Airbase’s software-first approach to the spend management problem, one that players like Brex and Ramp have taken from more of a financial services perspective.

In November 2021, the company had close to 200 employees spread across 11 countries. Airbase is remote-first, with 75-80% of its product development working out of India.

Valuation

By 2019, Airbase had gained enough traction to raise a pre-empted $7 million Series A from First Round Capital. Airbase closed a $60 million Series B led by Menlo Ventures in June 2021 at a $600 million post-money valuation. The round was raised in just 10 days and was Menlo’s largest check at the time from a non-growth fund at the time of investment. In an interview with Contrary Research, Kote described his philosophy of raising money as follows:

“You want to raise money from a position of strength. You never want to have your back to the wall. When we raised our Series B, we could’ve shot for a bigger valuation, we could’ve became a unicorn, but the fundamentals just didn’t make sense to me. If you’re building a company for 10, 15, 20 years, cycles will happen. You might have to raise money in a downmarket at some point and I’m always asking whether the multiple we sign up for will allow us to raise a healthy upround with some room.”

The deal came after Divvy, another corporate-spend-focused startup, was sold to Bill.com for $2.5 billion and other players in the space like Brex and Ramp raised at $12.3 billion and $8.1 billion valuations respectively. Ramp’s valuation implied an ~80x revenue multiple at the time of the last raise.

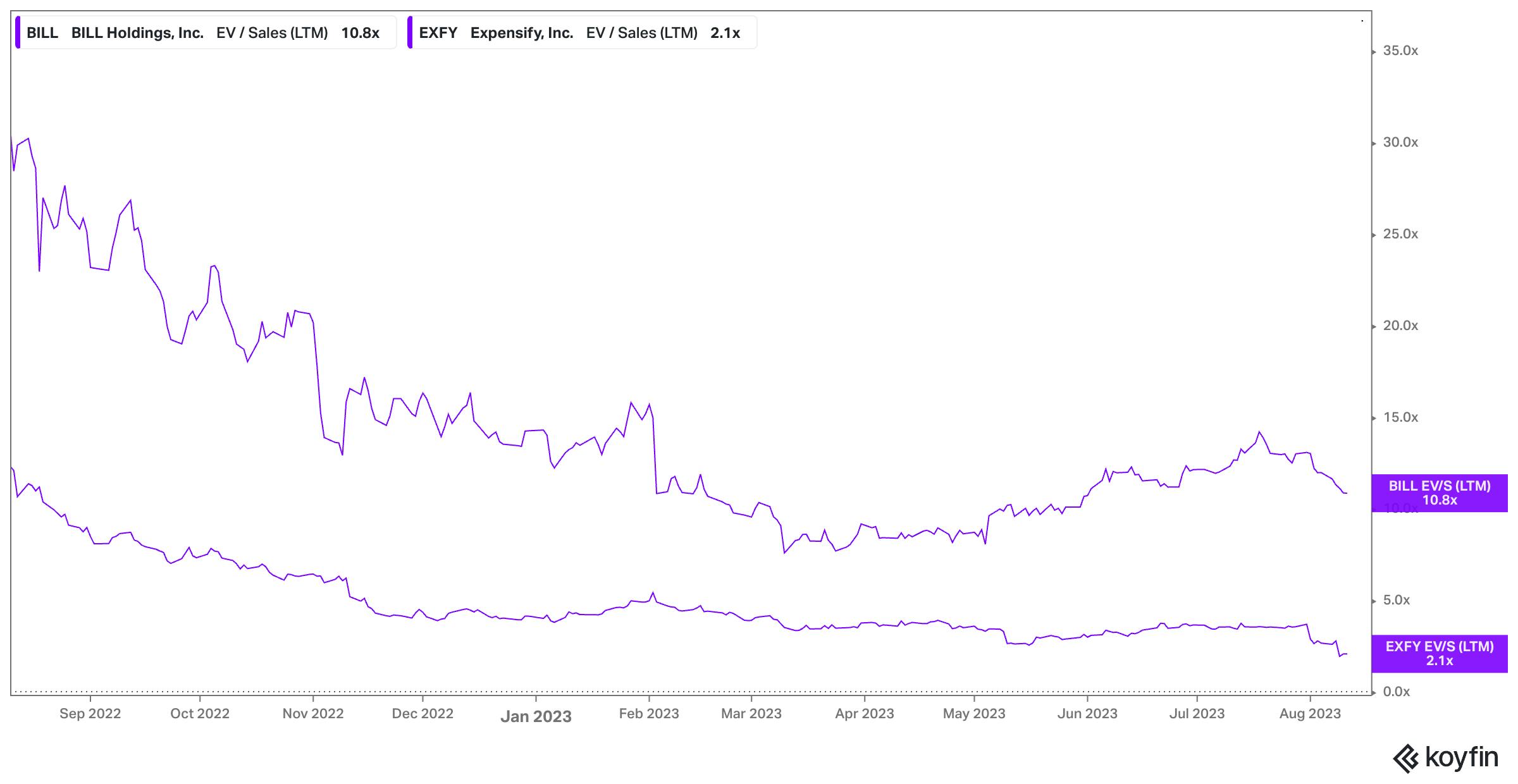

Since these investments, fintech multiples have compressed dramatically; the average revenue multiple for a public fintech fell from 20x in Q2 2021 to 4x in Q4 2022. Airbase’s direct competitors have felt the pain of this macro trend. In August 2023, Ramp announced that it was raising at a $5.5 billion valuation, down 32% from its early 2022 valuation. As of August 2023, Bill.com and Expensify have also traded down to 10.8x and 2.1x LTM revenue, respectively.

Source: Koyfin

Key Opportunities

Commoditization of Corporate Cards

While its closest competitors all started as corporate card companies, Airbase has always been a workflow-driven software product first and a fintech company second. Corporate card companies center their business models around generating interchange and their customer acquisition strategy around offering more attractive rewards and larger lines of credit.

Now that card-issuing fintechs have made it so that every company that wants to issue a corporate card can do so, this strategy has become a race to the bottom. To prove this point and attempt to drive the margin from interchange to zero, Airbase announced that it would offer 2.25% on every dollar spent on its pre-funded cards, the highest cashback rate in the market.

Companies like Ramp and Brex have acknowledged the reality that they cannot compete on price alone, taking steps to shift more of their revenue to subscriptions over time. In doing so, they may lose the key selling point of offering free software. While its competitors grapple with a new business model, Airbase will enjoy the first-mover advantage of having already solved the tricky problem of monetizing via SaaS.

The interest rate environment as of 2023 also offers an opportunity for Airbase to expand its lead. According to Michael Sindicich, general manager at expense management platform Navan, high interest rates make building an entire business around offering credit or loans very expensive.

More Bank Partnerships

Airbase’s strategy has been to focus on the software layer and partner with banks for card issuing. Incumbents are incentivized to partner with Airbase because it improves the card spend management experience for their customers while keeping at bay emerging players like Brex.

Airbase currently has partnerships with American Express and Silicon Valley Bank. With American Express claiming 42% market share of the corporate card market alone, Airbase is acquiring a large amount of distribution by partnering with the financial services giant. Despite this, Airbase has not announced any new partnerships since February 2022.

Moving Upmarket

In a memo prepared while fundraising for its Series B, Airbase stated its plans to move upmarket after exhausting the mid-market. While it may take several years for Airbase to reach this point, this could be a lucrative strategy considering that average contract value (ACV) is greater in the enterprise segment. In August 2022, the company brought in the former head of enterprise sales at Dropbox, Philip Lacor to lead this new go-to-market motion.

In an interview with Contrary Research, CEO Thejo Kote alluded to opportunity, but stressed that the company is still focused on its ideal customer profile of companies with 100-2K employees:

“In the very early days, when the capabilities of the product were still not that mature, we started off focusing on 100 to 300, then it became 100 to 500, then it became 100-2K. And now we're able to target even larger companies, but that sweet spot still remains at 2000. Maybe if you talk to me next year, the sweet spot will have become 500 to 5K. And maybe eventually we'll go even up to 10K employee companies.”

Product breadth

Because of the central position it occupies in customer workflows, Airbase has the opportunity to expand its product offering to adjacent processes over time. In a memo prepared in advance of its Series B, it outlined a few areas that it might pursue in the future:

Budgeting: Airbase currently houses all real-time spending data, while budgeting occurs within a separate system such as Excel, Anaplan, or Adaptive Insights. Overlaying budget details in various spend workflows is a logical starting point to owning more of the budgeting process, which might be followed by adding functionality for users to collaborate on budget planning.

Contract lifecycle management: Today, users prepare contracts outside of the Airbase platform and attach a finalized version. Airbase can eventually help take teams all the way from creation to termination, including drafting, negotiation, execution, monitoring, and compliance.

SaaS management: This is an emerging category of tools (e.g. Zylo) that helps businesses oversee and optimize the usage of the software they purchase. Since the purchase lifecycle of these recurring expenses happens entirely in Airbase, it has an opportunity to build out features that help customers track these expenses and maximize the value of their software investments.

Procurement management: This represents another growing category where companies function as external procurement teams. Airbase can expand upon its Guided Procurement module to automate more of the vendor evaluation and selection stages of procurement as well.

Invoice factoring and similar offerings: Invoice factoring is the practice of buying a business’s outstanding invoices at a discounted rate to provide that business with immediate cash. When Airbase reaches sufficient scale, it can partner with lenders to act as a factor on behalf of its customers, charging to help its customers pay their invoices on time.

Kote stated in an interview with Contrary Research that Airbase is in no rush to expand the breadth of its product offering. Before it decides to release a new feature, the company asks itself if it has earned the right to do so yet. As such, the team is currently focused on building more depth into their products. For example, Kote talks to international customers every day about the complexity of spend management in different countries and how Airbase can alleviate their pain points.

Key Risks

Well-funded Competitors

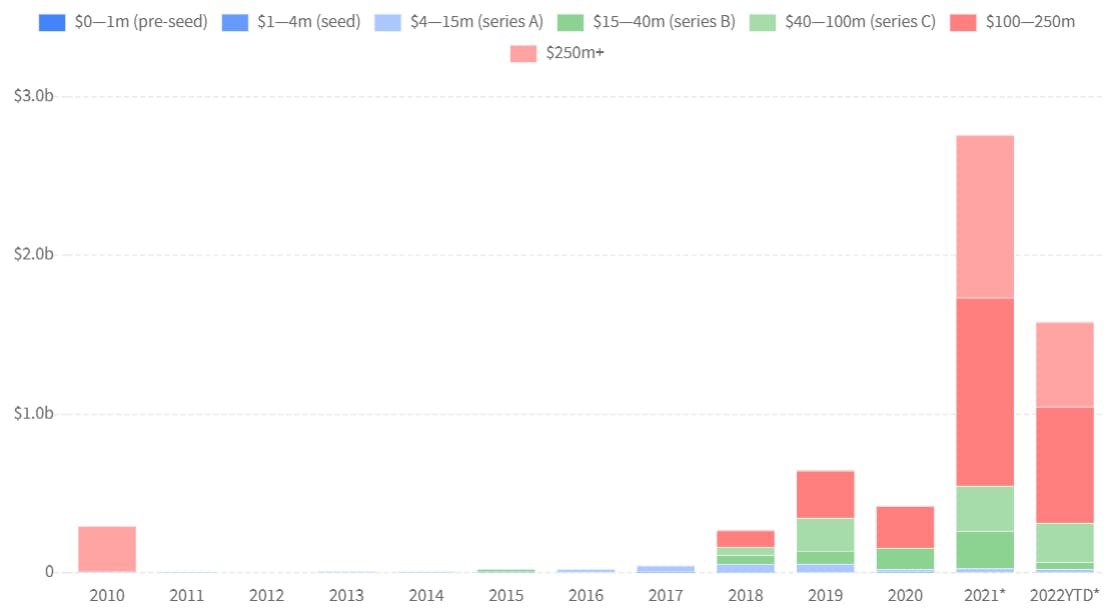

Ramp has secured a total of $970 million in equity financing, Brex has raised $1.2 billion, and Navan is at $2.2 billion. On the other hand, Airbase CEO Thejo Kote stated in an interview with Contrary Research that his company has only raised around $100 million as of August 2023. All of these companies are expanding their product lines and going after increasingly larger companies, eating into Airbase’s potential market share. For the past two years, billions of dollars have poured into spend management startups. Below is a graph of the funding that has gone into spend management startups, broken down by year and the size of the startups receiving funding:

Source: Dealroom as of May 2022

Nonetheless, Kote stated in the Contrary Research interview that Airbase rarely runs into Ramp or Brex in contract negotiations. Many companies don’t use any technology at all to manage spend, which may contribute to this. For example, 81% of firms in the US are still using paper checks to settle at least some of their bills. As Kote told Contrary Research:

“The bigger opportunity for everybody is companies that have no systems, its companies that are still in Excel, where the primary mode of payment is still paper checks. If you look at those statistics, you will realize that there is this massive opportunity where trillions of dollars of payments are moved through archaic processes and we want continue to digitize that for different segments of the market.”

Incumbent Stickiness in the Enterprise Segment

Because spend management is so mission critical, it is often an arduous process for enterprises to tear out existing systems and workflows that its employees are accustomed to. On the flip side, Airbase’s net retention rate has been high precisely for this reason. Commenting on the stickiness of incumbent solutions, the VP of Finance at one company said:

“Concur is so entrenched in our business that even I know that it makes sense to switch over to Airbase, I know that it would save us money. I know that it would be such an improvement reporting wise, so many things that can happen, having all your spend in one place, but just kind of gearing the team up to go through that type of undertaking, we end up saying, “Let’s close the month this month and then let's talk about it again next month.”

Airbase also needs to overcome the network effects garnered by dedicated bill pay solutions like Bill.com which handle accounts receivable in addition to accounts payable.

Graduation Risk

The company’s net revenue retention could suffer as its mid-market customers grow into enterprises. Airbase CEO Thejo Kote stated in an interview with Contrary Research that Airbase’s goal is to solve the spend management problem really well for businesses with 200 to 2K employees. In doing so, it is trading off some of the functionality and customization that enterprise customers demand. When Airbase’s customers grow large enough, the company may feel that it's worth it to switch over to a spend management tool like Coupa that’s specifically designed for enterprises.

Summary

Mature corporate-card-issuing technology and increasing interoperability in the fintech landscape have shifted innovation to the next layer of the stack — spend management. A well-funded wave of startups is taking advantage of these innovations. While many started solving adjacent problems like corporate cards and travel, they have coalesced on the goal of redefining the way businesses spend money.

Airbase was the first to take a software-first approach to the issue, consolidating expense management, procurement, accounts payable, and corporate cards all on one platform and selling subscriptions. With an intense focus on the needs of the mid-market segment, it has established itself as a category leader in spend management.

While Ramp and Brex are now following in Airbase’s footsteps, trading unsustainable interchange revenues for SaaS ones, competition remains Airbase’s largest threat. As Airbase further embeds itself in the spend-related workflows of mid-market companies at a global scale, and eventually climbs up-market, it has the potential to carve out a sizable piece of this crowded market.