Thesis

In the past 15 years, the total assets on major Canadian banks' balance sheets have grown from $1.7 trillion CAD in 2005 to $6.6 trillion CAD in the first quarter of 2021. The big five Canadian banks hold assets equal to 2.5 times Canada's GDP, a much bigger ratio than in the United States, where the five largest banks hold 40% of the nation's GDP. With a limited number of dominant banks controlling a large portion of the market, consumers often face reduced options and competitive pressures. The lack of competition can lead to higher fees for customers, limited product innovation, and less favorable interest rates for borrowers and savers. For example, more than 9 million consumers are either credit unserved or underserved in Canada.

A 2022 survey found that 90% of Canadians find banking more convenient because of new technologies, with 78% using digital channels such as websites and apps to conduct most of their banking. 89% of Canadians reported online banking in 2021, with 49% saying it's their most common method. Canadian millennials are increasingly dissatisfied with large and midsize banks. Even when overall satisfaction with Canadian banks rose in 2018, it decreased among those under 40 due to issues with non-automated services, such as in-branch and customer support. In contrast, automated channels such as online and mobile banking caused less frustration. This has paved the way for challenger banks, cutting a slice of the market share that the big banks have consistently dominated.

Neo Financial is a digital banking platform that wants to simplify spending, savings, borrowing, and investing for Canadians. Through partnerships with financial institutions, it provides financial offerings like cards, credit-building, bill pay, and mortgages.

Founding Story

Neo Financial was founded in 2019 by Andrew Chau (CEO), Jeff Adamson (CMO), and Kris Read (Head of Engineering) in Calgary, Alberta.

Prior to founding Neo Financial, Read was the CTO at Vogogo, where he built risks and payments solutions. Meanwhile, in 2012, Chau and Adamson had launched SkipTheDishes, a Canadian online food delivery company based in Winnipeg, Manitoba. Just Eat, a UK-based food delivery company, bought SkipTheDishes for $110 million CAD in 2016.

Neo Financial came about after the trio got together and started scribbling their ideas for a new company on a piece of paper in 2018. The founding team worked out of the Calgary Public Library to map Neo Financial’s early operations. After spending 18 months establishing its technical and banking infrastructure, Neo Financial released its financial services to customers in 2020. Neo Financial then rolled out its savings account, Mastercard, and merchant rewards program to a portion of its 30K waitlist. It initially targeted Western Canada with plans to expand to the rest of the country later that year.

As Chau said in 2020:

“What made us successful as SkipTheDishes was focusing on Canada, and really focusing on adding value back to the consumers, but also back to businesses too. So, with Neo Financial what we wanted to do was create a consumer experience that leveraged not only technology to help drive that, but also leveraged partners too.”

Product

Neo Money

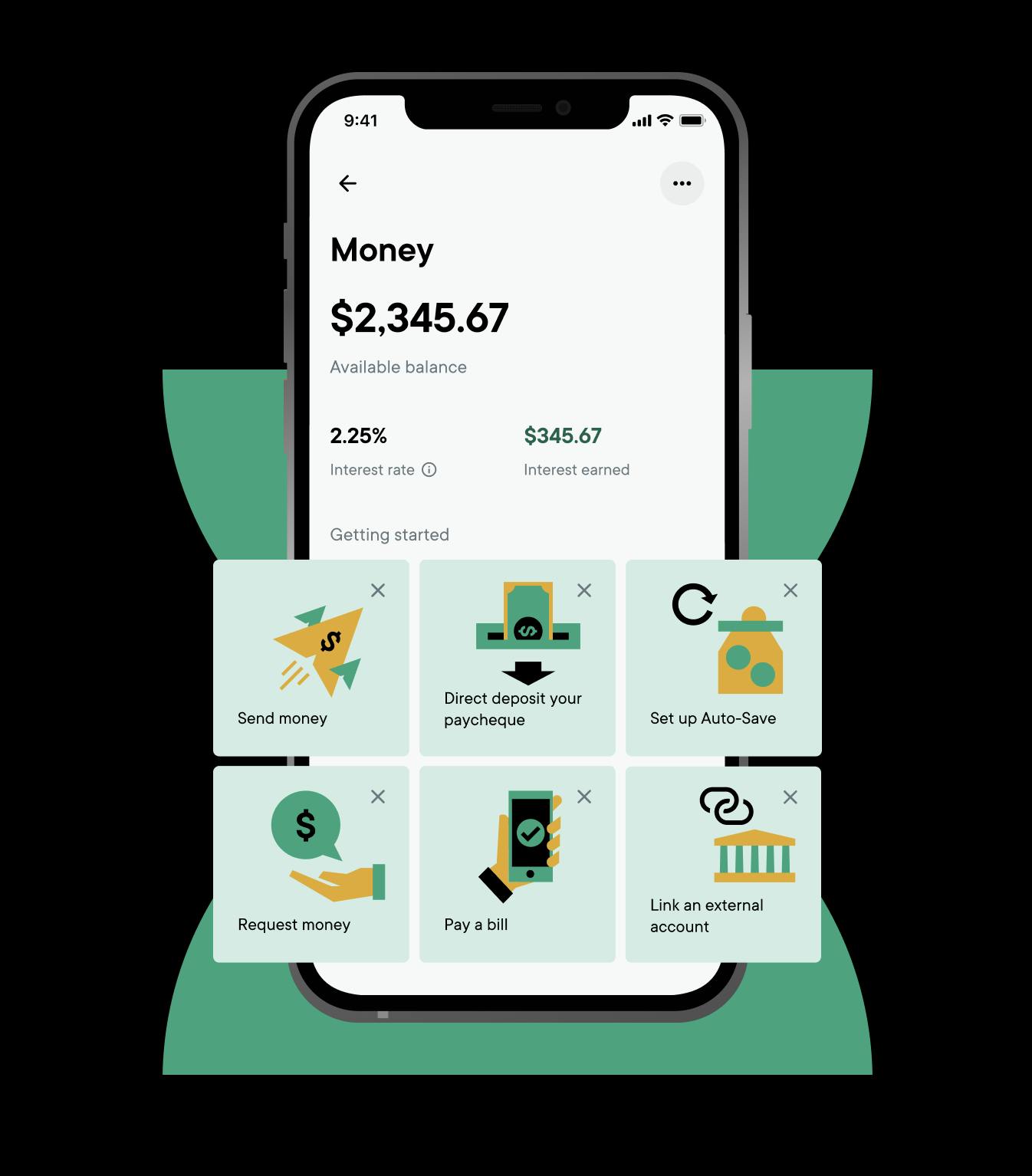

Neo Money offers a checking and savings account with a 2.25% interest rate on savings and cash back on spending. There are no monthly fees. Users can see a consolidated view of all transactions across Neo Financial products, review spending by category, and track transfers and bill payments. Account holders can enable the auto-save feature to set up automatic savings. Concentra Bank, a Canadian chartered bank and CDIC member, provides Neo Money accounts. This means customers’ savings are covered under CDIC for up to $100K CAD.

Source: Neo Financial

Neo Card

The Neo Card is a lifestyle-based credit card that links to Neo Savings accounts. Users can earn an average of 5% cash back at 10K+ partners nationwide. The earnings can be cashed out anytime to pay toward paying credit balances, purchasing exclusive merchandise (through Neo Store), savings (to Neo Money account), and investments. Users can add the virtual card to Apple Wallet or Google Pay and start spending as soon as they are approved.

Source: Neo Financial

Neo Invest

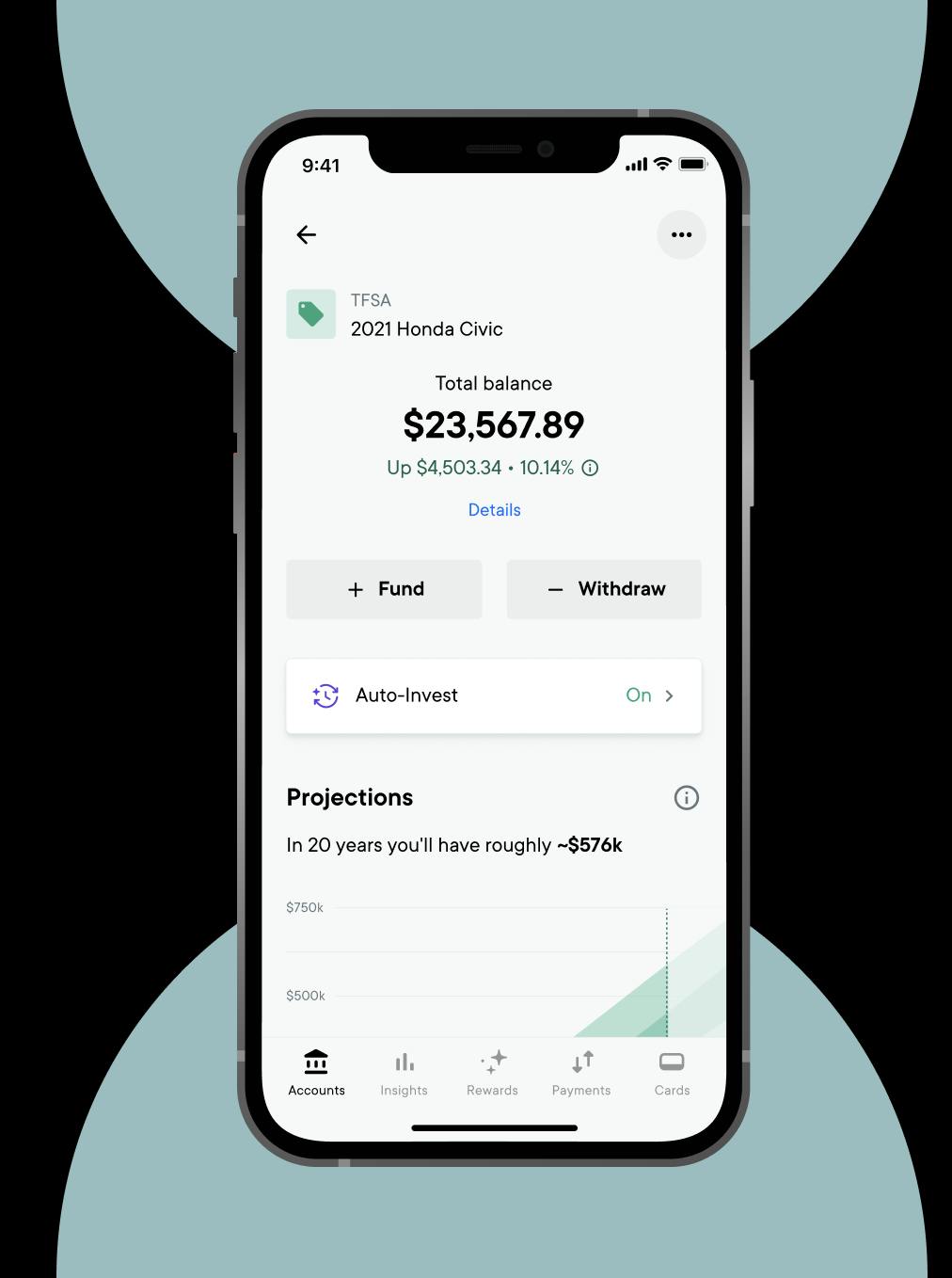

Neo Invest is a robo-advisor platform powered by OneVest that invests in ETFs based on each customer’s risk profile, timelines, and preferences. Users have the option to invest across a variety of asset classes, including fixed-income, stocks, and alternative assets. Users can invest on the Neo Financial platform through their Neo Money account, tax-free savings accounts, retirement savings plans, or other cash accounts. It has lower fees than traditional wealth management firms and banks, and users can start investing for as little as $1 CAD. Users can make regular contributions with auto-invest by linking their Neo Money account.

Source: Neo Financial

Neo Mortgage

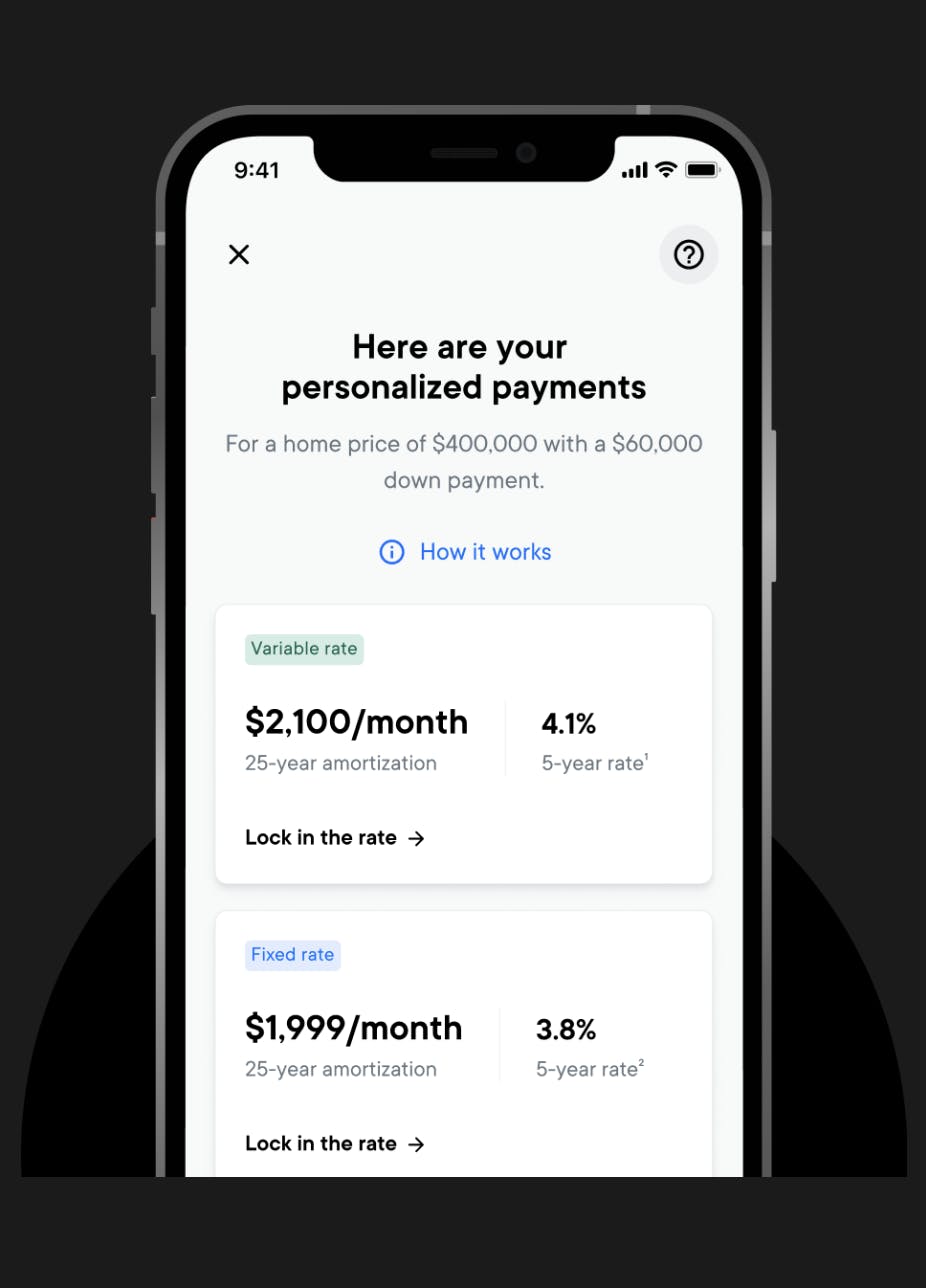

Neo Mortgage enables users to close a mortgage online. Users can upload documents digitally, connect with mortgage advisors online or over the phone, meet with lawyers online, sign all their legal documents online, and manage mortgages online. Neo Mortgage offers a 4.29% 5-year fixed rate as of May 2023. Neo Financial works with lending partners such as Canadian Western Bank, Home Trust, Strive, and CMLS Financial.

Source: Neo Financial

Neo for Business

Neo Financial offers a platform and APIs to enable other companies to launch financial products like cards, payments, accounts, lending, and investments to their end-users. It operates across finance, goods & services, and real estate sectors. From marketing to product development, it helps customers create and launch their programs to meet the financial needs of their users. It supports co-branded and white-labeled offerings.

Source: Neo Financial

Market

Customer

Neo Financial’s target customers can be divided into two main segments: (1) Consumers looking for a digital-first solution and an alternative to incumbents for managing, saving, spending, investing, and borrowing money and (2) companies looking for infrastructure capabilities to launch financial products with their platforms or product. For example, Consolidated Credit partnered with Neo Financial to offer Canadians a no-annual fee account.

Market Size

The global neobanking market was valued at $66.8 billion USD in 2022 and is expected to grow at CAGR of 54.8% from 2023 to 2030. 65% of Canadians used mobile banking in 2019, a substantial increase from 56% in 2018 and 44% in 2016. Amongst Canadians under 30, 59% have increased their use of mobile banking in the last few years. 33% of financial transactions are conducted with mobile devices, and this is predicted to rise to 37% in five years.

Competition

Wealthsimple: Founded in 2014, Wealthsimple is a digital financial services platform that helps people invest, save, and spend. Like Neo Financial, it has savings accounts, cards, investing, and bill pay offerings. Unlike Neo Financial, it does not help users close and manage a mortgage and offers P2P money transfer. The company had over 1.5 million users and $10 billion USD in assets under management as of May 2021.

Koho Financial: Founded in 2014, Koho Financial is another Canadian fintech company providing banking services in partnership with Peoples Trust. Like Neo Financial, it offers credit building, no-fee spending, and savings accounts with cashback with partner retailers. Unlike Neo Financial, Koho Financial offers instant pay, a free payroll benefit that gives employees on-demand access to their pay instead of having to wait for their paycheck every two weeks. Koho Financial allows employees to cash out up to 50% of their pay earned every workday on a daily basis. It has raised $278.9 million USD in funding.

Mogo: Founded in 2003. Mogo offers high-interest loans, identity fraud protection mortgages, a Visa Prepaid Card, credit scores, and a crypto trading platform. The startup began trading on the Toronto Stock Exchange in 2015, where it raised $50 million CAD in its IPO. It listed its common shares on the Nasdaq in 2018.

Incumbents

The Big Five Banks is a term used in Canada to describe the five largest banks: Royal Bank, The Bank of Montreal, the Canadian Imperial Bank of Commerce, The National Bank of Canada, The Bank of Nova Scotia, and Toronto-Dominion Bank. These big banks control 90% of Canada's deposits, granting them access to low-cost money for lending and investments. This also greatly reduces competition in Canada’s banking ecocystem, resulting in little variety in fees or interest rates for Canadian customers.

Like Neo Financial, Canadian competitors are either challenger banks or fintech companies that offer banking services in partnership with Canadian financial institutions. All of them are trying to become a one-stop shop that serves all day-to-day financial needs of people. In 2021, European challenger bank Revolut pulled out of Canada more than a year after launching a beta version of its offering. Obtaining a banking license in Canada is notoriously challenging for new financial service providers due to the market oligopoly, which 5-6 major banks largely control.

Business Model

The key revenue drivers for Neo Financial can be broken down by product type. The Neo Card generates revenue from the interchange fees paid by the merchants, a portion of which is shared with the customer as a form of cashback. Neo Invest charges management fees. Lastly, Neo Mortgage generates revenue from its interest payments.

Traction

As of May 2022, Neo Financial had 1 million customers and had secured partnerships with Hudson’s Bay, The Home Depot, H&R Block, Boston Pizza, Goodfood, and 7K other local and national retailers. It also lists Mastercard, ATB Financial, and Concentra as its financial service partners.

Valuation

Neo Financial has raised $235.8 million USD in total funding as of April 2023. In May 2022 it raised a Series C of $145.2 million USD led by Valar Ventures. Tribe Capital, Altos Ventures, Blank Ventures, Gaingels, Maple VC and Knollwood Advisory participated in this round which valued the company at $784.8 million USD.

Key Opportunities

Pandemic Induced Demand

The COVID-19 pandemic accelerated the adoption of digital banking services in Canada as consumers increasingly seek safe and convenient banking solutions from home. Within the Canadian ecosystem, Neo Financial established itself as one of the key players to ride this wave. Going forward, with Canadian millennials increasingly dissatisfied with traditional Canadian banking options, Neo Financial is well positioned to continue to capitalize on the growth of digital banking.

Expansion

Neo Financial has opportunities to expand on multiple fronts. On the product side, it can go deeper in building a one-stop shop for consumers' financial needs. On the platform side, it can build an ecosystem of partners to enable companies across sectors to offer financial products customized to their end users. Neo Financial also has the opportunity to expand geographically.

Key Risks

Regulatory Landscape

As a fintech company operating in Canada, Neo Financial must comply with often cumbersome Canadian regulations to ensure the legitimacy of transactions and prevent financial misconduct. In addition, data privacy and security are paramount for Neo Financial. To operate within Canadian jurisdiction, the company must strictly adhere to the Personal Information Protection and Electronic Documents Act. This legislation governs the collection, use, and disclosure of personal information in Canada, ensuring the protection of individual privacy rights in the digital space. With the growing sophistication of cyber threats and their potential implications for the financial sector, regulators will likely introduce new cybersecurity requirements specifically designed for financial institutions.

Incumbent Dominance

In Canada, the big five banks’ oligarchical dominance persists, holding a 90% market share. While the challenger banks have been growing past few years, the incumbents continue to have strong brands and balance sheets. In light of the turmoil in the banking system in the United States following the 2023 collapse of banks like Silicon Valley Bank and the uncertain macroeconomic climate, consumers would likely trust established big banks even more with their deposits. The challenger bank startups must also navigate the increasingly tough venture capital funding landscape to raise funding to support their growth initiatives and become profitable.

Summary

Financial management among fintech platforms continues to outpace traditional banking offers due to ease and convenience. Neo Financial has positioned itself to take advantage of the population of millennials and Gen Z and their preference for digital banking services. However, a rising market also contributes to emerging players, where Neo Financial faces competition from other challengers with similar offerings. Furthermore, with incumbent banks recognizing the growth of challengers and expanding their digital banking offerings to optimize customer experience, the competition remains fierce, and regulatory risks going forward could prove to be a difficult obstacle.