Thesis

In the United States, 4.5% of households were unbanked in 2021, meaning that no household member had a checking or savings account. In addition to this, a 2019 report by the Federal Reserve found that 16% of Americans were underbanked, meaning that despite having a bank account they must also rely on financial services like payday loans, pawnshop loans, and money orders.

Lack of accessibility is one reason for this; many traditional banks require a minimum account balance and charge high fees, making it difficult for low-income individuals to access essential financial services. Monthly service fees averaged $15.33 for checking accounts as of April 2024, while the average minimum account balance required to avoid this fee was $8.7K. Traditional banks also charged an average of $26.61 for overdrafts, and the average rate on a savings account was 0.58% as of April 2024.

The 2010s saw the rise of neobanks, also known as digital banks or challenger banks, in the United States. Neobanks offer various financial services from checking and savings accounts to loans and debit cards. Neobanks often have lower fees and minimum balance requirements than traditional banks, making them more accessible to more people, especially lower-income Americans who are unbanked or underbanked. Moreover, neobanks typically aim to make banking simple and convenient for customers with easy-to-use apps. In 2019, just over 1 in 20 US adults had digital-only bank accounts. By the end of 2021, 15.4 million adults had opened bank accounts digitally. Neobanks are continuing to gain traction, and the number of US account holders at neobanks was projected to grow 46.4% between 2022 and 2026.

Chime is a neobank that provides consumer banking services through its mobile app. It started as a mobile banking app that offered no-fee bank accounts, debit cards, and a way to get paychecks two days in advance. It has since added several other offerings to become a comprehensive banking product suite for its target audience of US workers earning up to $100K per year. It doesn’t charge overdraft fees or service fees and doesn’t have minimum balance requirements. Chime has been estimated to be the largest neobank in the US, and it had 7 million active users as of May 2024.

Founding Story

Chime was founded in 2012 by Chris Britt (CEO) and Ryan King (CTO).

Prior to founding Chime, Britt had previously served as Chief Product Officer at the financial technology company Green Dot and as a senior product leader at Visa. Before Chime, King was the VP of Engineering of Plaxo, an early social networking company that was later acquired by Comcast Interactive Media.

From the outset, the duo aimed to offer a more customer-centric alternative to traditional banks. Chime officially launched its product in April 2014 during an appearance on the Dr. Phil Show. In the beginning, Chime’s product roadmap was centered on rewards for their debit card. Over time, Chime evolved to focus on a suite of financial services. Chime forged a strategic partnership with The Bancorp Bank to support their services. These partnerships enabled Chime to offer FDIC-insured accounts without obtaining a banking license or establishing a brick-and-mortar presence.

Product

Online Banking

Checking Account

Source: Chime

Chime offers an online checking account that aims to lower friction and make banking more accessible. The Chime checking account has no hidden fees, overdraft fees, maintenance or monthly fees, or complex requirements. After a user signs up, Chime mails them Visa debit cards. The fee-free Visa debit card provides access to over 60K fee-free ATMs and real-time transaction alerts.

Free Debit Card

Chime provides a Visa Debit Card with no minimum balance requirements, no account maintenance fees, and no replacement fees. The debit card can be used to withdraw cash from 60K fee-free ATMs as of May 2024, including locations at Walgreens, 7-Eleven, CVS Pharmacy, and Circle K.

Chime’s debit card also allows for real-time transaction alerts, the ability to disable transactions via the Chime app if the card is lost, and a pay-with-your-phone feature via platforms such as Google Pay or Apple Pay. There is also a “Round Ups” feature which helps users save automatically by transferring the change from every purchase to their savings account.

Fee-Free Overdraft

Chime’s “fee-free overdraft” protection, called “SpotMe”, protects Chime users from overdrafts of up to $200 on credit or debit card purchases and cash withdrawals. This limit can be increased via “boosts”, i.e. referrals. Traditional typically charge fees ranging between $10 to $40 on overdrafts.

Savings Account

Source: Chime

Chime offers a savings account with a 2% APY as of May 2024. The Chime Savings Account has no monthly fees, no maximums on interest earned, and no minimum balance required. Chime also offers additional ways to boost savings. Its “Round-Ups” feature automatically rounds up debit card transactions to the nearest dollar and transfers the difference to the savings account. Chime also offers a “Save When I Get Paid” feature which sets aside a percentage of direct deposits.

Second Chance Banking

Users with problematic banking histories are tracked by consumer reporting agencies such as ChexSystems, who report to financial institutions. Chime offers checking and saving accounts to users irrespective of such reports.

Mobile Banking

Source: Chime

Chime’s mobile banking app allows users to check balances, pay bills, and transfer money to and from external bank accounts. It also offers a mobile check deposit feature, a “Pay Anyone” feature that can be used to send money instantly and without fees to friends and family, even non-Chime users. The app can also be used to freeze debit cards if they’re lost or stolen and receive transaction alerts. The Chime app also allows users to find nearby fee-free ATMs.

ATMs

As of May 2024, Chime offers users access to more than 60K fee-free ATMs, which it says exceeds the number of ATMs available for the top three national banks combined. The ATMs are accessible at locations including Target, Walgreens, 7-Eleven, CVS Pharmacy, and Circle K. Withdrawal limits are $500 per day. Deposits can also be made with a limit of $1K per day and $10K per month.

Credit Builder

Source: Chime

The Chime Credit Builder Secured Visa Credit Card is designed to help customers build or improve their credit scores. It offers a credit card with no annual fee, interest, or minimum security deposit. Chime does not require a credit check to apply for this card, making it accessible to those with limited or low credit history.

The credit card does not have a pre-set credit limit for holders. Instead, the money available to spend depends on how much the cardholders transfer into their Credit Builder secured account. The funds deposited into this account are the amount they can spend with the card. This structure is similar to a debit card and checking account, ensuring that users always know how much money they have left to spend with their credit card and avoid over-borrowing and outstanding balances.

Credit Builder offers a path to building a healthy credit history for those who don’t yet have one. It enables users to automatically pay their monthly balance with the money in their Credit Builder secured account, ensuring timely payments Chime reports payment activity to the major credit bureaus, contributing to improving the user’s credit score over time.

Manage Money

Get Paid Early

Chime checking account customers can get their paychecks up to two days early with direct deposit through Chime’s “Get Paid Early” feature.

Get Cash Back

In March 2024, Chime announced a cash-back feature for both its Debit Cards and its Credit Builder Visa credit card called Chime Deals. Users get varying rates of cash back on purchases of various kinds: up to 11% on grocery purchases, up to 24% on dining purchases, and up to $0.22 per gallon of gas purchased. Members must choose and activate a deal to receive the cash-back offer, it does not occur automatically.

Send and Receive Money

Chime’s “Pay Anyone” feature can be used to send money instantly and without fees to friends and family, even non-Chime users, with no instant cash out fee.

Chime Tax Refund

In addition to early paychecks, Chime users can receive federal tax refunds up to six days early if they have a direct deposit set up with Chime. As of May 2024, the company reports having processed over $19 billion in tax refund payments and that over 11 million tax deposits had been deposited to member accounts.

Market

Customer

Chime has attracted a mix of younger, low-balance customers and older, more affluent customers. Over 50% of Chime’s customers were over the age of 35 as of April 2021. Lack of friction and good customer experience is one of Chime’s core appeals to its customers, with the account opening process taking an average of 15 minutes as of April 2021. One source claimed that, as of May 2024, Chime’s customers were largely earning between $35K and $65K a year.

Chime’s NPS in 2020 was reported at 80, compared to an average of 54 NPS for other digital banks and 42 for traditional national banks. However, in 2021 Chime's NPS had fallen to 66, although it remained higher than other digital banks and national banks. Its low costs, lack of fees, and accessibility for those without established credit histories or high incomes also make it an appealing choice for lower-income customers.

While some estimates have indicated Chime could have as many as 22.3 million users, Chime’s CEO, in an April 2024 interview, indicated that the company had 7 million active users. According to Similarweb, as of May 2024, 58.2% of Chime.com website visitors were between the ages of 18 and 44, with the rest of its customers (42.8%) ages 45 and older, implying that its customers were distributed relatively evenly across age groups. Chime website visitors were also 59.6% female, and the vast majority were located in the United States.

Market Size

Chime operates within the neobanking industry, a financial services sector comprising digital financial institutions that operate online without physical bank branches. In 2021, the neobanking market exceeded $45 billion in value. As digital banking services continue to gain traction, the market is expected to grow at an annual rate of over 45% between 2022 and 2028, and the industry is estimated to be $600 billion by 2028.

Competition

Current: Current was founded in 2015 and provides a mobile banking experience, including a checking account with a fee-free debit card, early direct deposit processing, and a high-yield savings account. Current differs from Chime in that it offers additional features such as a crypto trading feature, a specialized account for teenagers, and instant gas hold refunds.

Targeting a younger demographic with an average customer age of 27, Current has appealed to the Gen-Z demographic, many of whom have never used traditional banking services. The company had over 4 million registered users as of May 2022, marking it as one of the largest neobanks in the US. Current's Series D funding round was $220 million, valuing the company at $2.2 billion. It has raised $402.4 million in total funding as of May 2024.

Varo: Varo is another digital bank that was founded in 2015. In July 2020, it announced it had been granted its national bank charter from the Office of the Comptroller of the Currency (OCC) and secured regulatory approvals from the FDIC and Federal Reserve, representing the first national bank charter granted to a US consumer fintech company. Unlike Chime and Current, Varo offers its customers fee-free checking accounts, a secured credit card, and a small cash advance program. In February 2023, it was reported Varo was looking to raise $50 million at a $1.9 billion valuation, down from its $2.5 billion valuation in 2021. It has raised over $1 billion in total funding as of May 2024.

Dave: Dave, founded in 2016, is a fintech company that offers digital financial products designed to support those living paycheck to paycheck and disproportionately burdened by fees from traditional banks and credit unions. Its product includes a checking account, savings account, and a 0% interest cash advance. While Chime competes with Dave in its banking services, Dave primarily focuses on providing short-term liquidity solutions through its ExtraCash product, which helps users avoid overdraft fees and access quick cash advances.

In January 2022, Dave went public via a SPAC at a market cap of ~$3 billion. It had over 8.3 million members and $204.8 million in revenue for the 2022 fiscal year. In 2023, it reported $259.1 million in revenue and the addition of 683K new members, while reducing customer acquisition costs and achieving profitability with $0.2 million in net income. However, its market cap declined significantly following its IPO; it was $657.4 million as of May 2024.

SoFi: SoFi, founded in 2011, is a digital bank that offers a comprehensive suite of financial services in a single app that enables its members to borrow, save, spend, invest, manage, and protect their money. SoFi also owns Galileo, a payment and bank infrastructure company that powers numerous fintech companies. Chime competes with SoFi with its digital banking products, such as its checking account and debit cards, high-yield savings accounts, and credit cards.

In 2021, SoFi went public through a SPAC at a market cap of $18.4 billion but had a market cap of just $7.5 billion as of May 2024. Its adjusted net revenue in Q1 2024 was $581 million, and it had more than 7 million members as of January 2024.

Cash App: Cash App is a digital financial platform developed by Block (formerly known as Square). Launched in 2013, Cash App (originally Square Cash) started as a peer-to-peer payment app allowing individuals to send and receive money quickly. Over time it has expanded its offering to digital banking services, bitcoin trading, stock trading, buy now pay later, and tax filing. Chime competes with Cash App's digital banking services, such as checking accounts, savings accounts, and round-up automated savings. It said it had 44 million verified monthly users in March 2023, up from 24 million in December 2019.

Traditional Banks: Traditional banks include incumbent financial institutions like Wells Fargo, Chase, Citibank, and Bank of America. Traditional banks offer a broad range of financial products and services such as checking and savings accounts, credit cards, mortgages, loans, and investment services. These banks also have extensive branch networks; however, they often charge various fees for their services (e.g. overdraft fees averaging $35) which can be a point of contention for many customers. Chime attempts to differentiate itself from traditional banks by providing a user-friendly, digital-first banking experience focusing on fee-free service. This approach is meant to appeal to customers who prefer convenient banking solutions and low fees.

Business Model

Chime offers its banking services for free without charging members any monthly maintenance and other typical banking fees. Chime is not a bank, it partners with Bancorp Bank and Stride Bank to offer mobile banking products for consumers. Unlike traditional banks that generate significant revenue from interest income on loans and credit products, Chime primarily makes money through interchange fees.

When a user makes a transaction using the Chime Visa Debit Card, Visa charges an interchange fee to the merchant, paying a portion of this fee to Chime. Additionally, Chime makes money through ATM fees when members use ATMs outside the MoneyPass and VPA networks. One unverified estimate of Chime’s revenue in 2022 attributed ~80% to interchange fees and Chime’s remaining revenue to ATM fees.

Relative to traditional banks, challenger banks like Chime benefit from a provision to the Dodd-Frank Act known as the Durbin Amendment which limits interchange fees for banks with more than $10 billion in assets, allowing Chime, which partners with smaller banks to provide its services, to charge higher fees than its incumbent competitors.

Traction

At the end of 2015, Chime had 7K active users. Chime’s revenue was around $1 billion in 2021, compared to $600 million in 2020. By May 2024, Chime had grown to 7 million active users, $1.5 billion in annual revenue, and was processing $8 billion a month in transactions.

Chime has repeatedly considered going public. Chime had been targeting March 2022 to go public at between $35 billion and $45 billion in valuation. Later, it was reported Chime was delaying its IPO until the second half of 2022. It then laid off 12% of its workforce, or about 160 people, in November 2022. In March 2024, it was again reported that Chime was planning to IPO, this time in 2025.

Valuation

Since its founding in 2012, Chime has raised over $2.3 billion through nine funding rounds as of May 2024. It raised a Series G in August 2021 which valued the company at $25 billion which was led by investors such as Sequoia Capital Global Equities, Tiger Global, Softbank Vision Fund, Dragoneer Investment Group, and General Atlantic. Previous investors include Forerunner Ventures, Homebrew, Cathay Innovation, Aspect Ventures DST Global, Menlo Ventures, ICONIQ Capital, and more.

Chime has experienced significant growth in its valuation, from $1.3 billion in 2019 to $14 billion in 2020, reaching $25 billion in 2021, at which time it was the most valuable American fintech company that serves retail customers. Its valuation growth reflects a broader trend of growth in neobanking and fintech. Chime was gearing up to go public through an IPO in 2022 at a target valuation between $35 billion and $45 billion. However, Chime has pushed back its IPO timeline, and as of March 2024 said it was planning to go public in 2025.

While it’s unclear what market cap Chime could go public at, if the company were to maintain its last valuation of $25 billion, that would represent a 16.7x multiple on Chime’s 2024 revenue of $1.5 billion. However, in secondary markets, Chime’s estimated valuation was ~$7.3 billion as of May 2024, which would represent a 4.9x revenue multiple.

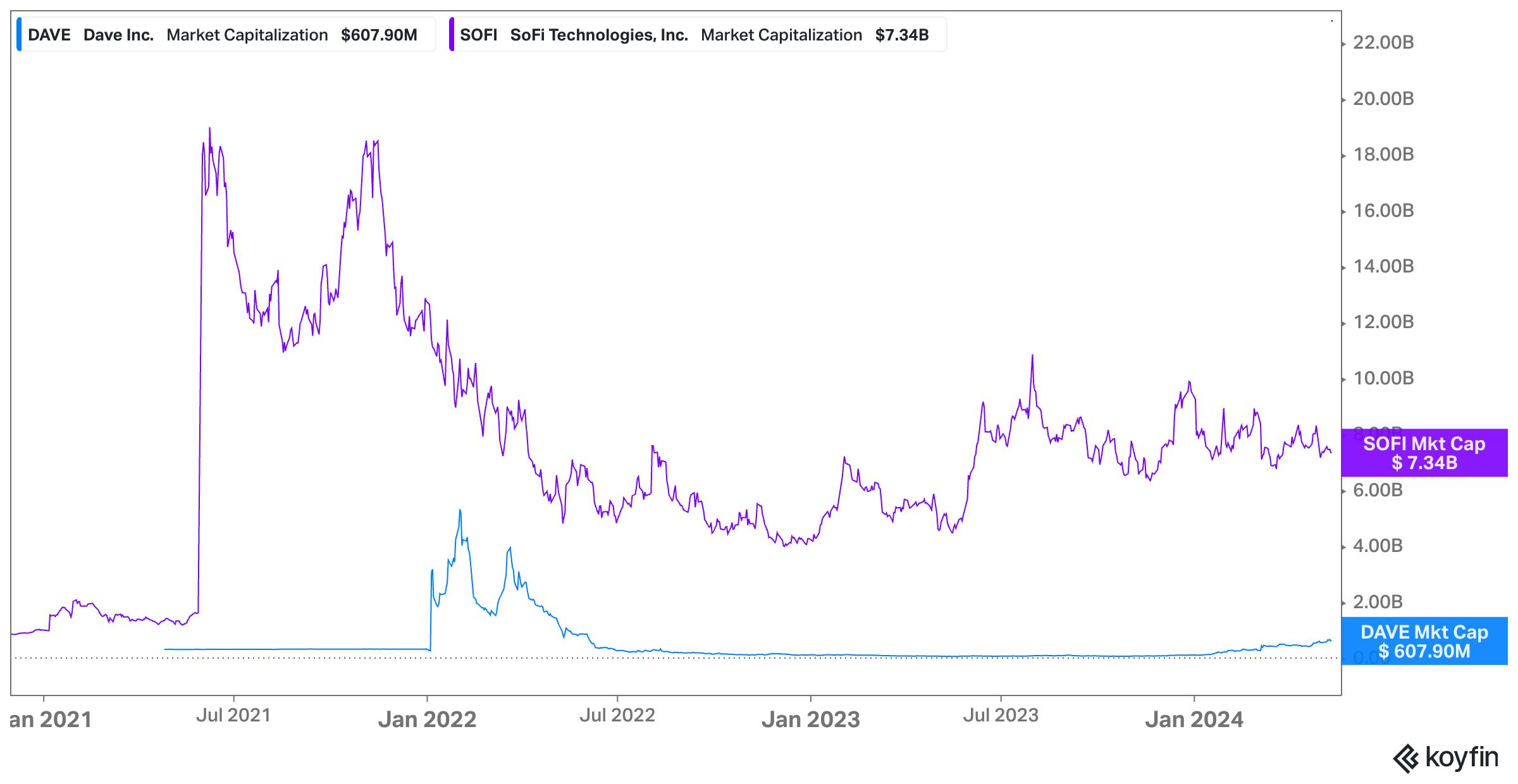

For comparison, public companies like Dave had $259.1 million in revenue in 2023 and a market cap of $607.9 million in May 2024, indicating a revenue multiple of 2.3x. Meanwhile, SoFi had a $7.3 billion market cap and $2.2 billion in revenue, implying a revenue multiple of 3.3x.

Source: Koyfin

Key Opportunities

Growth of Digital Banking

The accelerated shift towards digital banking, fueled by technological advancements and changing consumer preferences, is likely to continue to drive demand for mobile-first financial services and products like Chime. Customers, particularly in younger demographics, are increasingly dissatisfied with the fees, rigid structures, and lack of innovation associated with traditional banks. If Chime can continue to position itself as a low-fee option that provides a modern, easy-to-use customer experience, it can capitalize on this continuing secular tailwind.

Product Expansion

Chime's product expansion opportunities present important opportunities for the company as it enters its next growth phase. In May 2024, Chime announced “its first real foray into lending, the most profitable part of consumer banking” which could help it diversify its revenue streams beyond interchange revenue. With this new offering, Chime will allow customers to take out a $1K loan instantly for 3-6 months, with no credit check or late fees and with APRs between 6% and 36%. The company expects the offering to become available within 1-2 months of this announcement, as it is awaiting approval from regulators.

Chime CEO, Chris Britt, also highlighted the potential for Chime to explore the addition of an automated investment platform. This platform would feature low-cost financial products such as ETFs, making it a natural extension of Chime's existing products. By offering an investment offering, Chime can cater to the growing demand for accessible and user-friendly investment options, further enhancing its value proposition to customers.

Customer Expansion

As of May 2024, Chime’s customers were largely earning between $35K and $65K a year. Chime CEO Chris Britt wants to expand the company’s core customer base to include those earning between $65K-$100K per year, although many people in this income bracket already have checking accounts with traditional banks which may make it difficult to capture this customer segment. However, if Chime is able to do so, it would allow the company to address more than 75% of workers in the US, which would drastically increase its addressable market.

Key Risks

Heavy Competition

Chime operates in an increasingly competitive market and must contend with both well-established traditional banks, whose customers are often reluctant to switch to new banks because of high switching costs in terms of effort, and a growing number of fintech companies and neobanks. Chime must continuously innovate and adapt to stay ahead of its competitors to sustain and grow its market share.

Reliance on Interchange

Chime makes most of its revenue through interchange fees paid out from Visa. This poses a risk to Chime as its revenue model is extremely concentrated on a single partner, Visa, which makes it vulnerable to any issues or changes that might arise with Visa and hinders Chime’s ability to diversify its product offerings or explore alternative payment methods. The company’s recently announced lending product will diversify the company’s revenue, which will alleviate some of the pressure of this risk.

Dependence on Partner Banks

Chime’s business model relies on partnerships with regional banks like The Bancorp Bank. Disruption to these partnerships or financial, regulatory, or legal issues with their partner banks could severely impact Chime’s operations and service offerings. Since Chime acts as a digital middleman between its partner banks and customers, it has limited control over banking services, such as account management, transaction processing, and regulatory compliance. This lack of control may constrain Chime's ability to innovate, customize services, or respond to customer demands as effectively as a fully licensed bank.

Regulatory Pressure

Washington has been pursuing what has been described as a “regulatory crackdown on nonbanks”. This crackdown has affected Chime; in May 2024, the Consumer Financial Protection Bureau (CFPB) “took action” against Chime “for failing to give consumers timely refunds when their accounts were closed”, claiming that “thousands of consumers waited for weeks or even months for balance refunds”. The CFPB ordered Chime to pay $1.3 million in redress and ~$3.3 million in penalties, as well to provide refunds on closed accounts “within a reasonable period” going forward. Continued regulatory scrutiny could impose additional costs on Chime, or pose obstacles to its product expansion plans going forward.

Summary

Chime is a neobank that offers digital banking services through its partner banks. Its products include an online checking account, a high-yield savings account, and a Visa credit card that helps users without an existing credit history build credit. Chime aims to deliver a seamless, fee-free banking experience with early direct deposit access, overdraft protection, and tools to help users save, build their credit scores, and develop healthy financial habits.