Thesis

In Square’s 2021 Q3 Earnings Call (before changing its name to Block), Jack Dorsey announced the lowering of the age barrier to sign up for Cash App, claiming that this represented a milestone for “20 million American teens from age 13 to 17” to enter the cashless economy. While providing fintech products for teens is a fairly large untapped market, one key benefit for financial service providers in offering products to teens is it allows them to circumvent the high customer acquisition costs of bank accounts due to customer stickiness. In 2019, the average cost per click for finance and insurance was $3.44 in Google Ads. If 1% of clicks are converted to customers, the implied customer acquisition cost would be around $300, among the highest across industries. However, once a bank has acquired a customer, they tend to stay with the bank for an average of 17 years. Targeting younger demographics and having them stay with the bank is one of the most effective customer acquisition strategies.

Targeting teens for banking services isn’t just about customer acquisition. 83% of adults in the US believe that it's parents’ job to teach their children about investing and financial literacy. However, only 16% of parents talk to their kids about household finances once a month or more, with the rest not knowing where to start when it comes to financial education. On the other side, 73% of teens don’t feel confident enough about personal finance and want to learn more. The Google search term “kids debit card” rose 227% between 2020 and 2021.

This is where Greenlight comes in. The company provides an online banking app equipped with educational resources. Greenlight also offers debit cards via Mastercard to children with a variety of add-on parental features including budgeting, stock investing, parent-specified spending buckets, and more. Compared to traditional debit cards from banks, Greenlight attempts to make “money talk” more hands-on and interesting by giving kids a degree of freedom while offering parents more detailed control through constant monitoring, weekly reports, and automatic transfers.

Founding Story

Greenlight was founded in 2014 by Tim Sheehan (CEO) and Johnson Cook (President and COO). Sheehan and Cook both founded other companies before Greenlight. Sheehan founded a social media marketing platform called Reachable, and Cook founded Atlanta Tech Village, a tech startup hub. Sheehan then worked at Fiserv as an SVP for products and at Georgia’s Advanced Technology Development Center before founding Greenlight. Cook, on the other hand, worked at a variety of venture capital firms such as Atlanta Ventures and Boom Ventures.

Sheehan has said he was lucky that his father instilled in him good financial habits when he was a kid. He ended up going into finance and realized how important those childhood habits were. As the father of four children, Sheehan saw firsthand how few resources are available for parents to teach their kids about financial literacy, not to mention apps that help parents closely manage and monitor their kids’ financial situations. After surveying the parents around him, Sheehan realized that family finance is an area with lots of potential, which is how Greenlight was born. Originally based in Atlanta, the company had grown to 380 employees as of January 2023.

Product

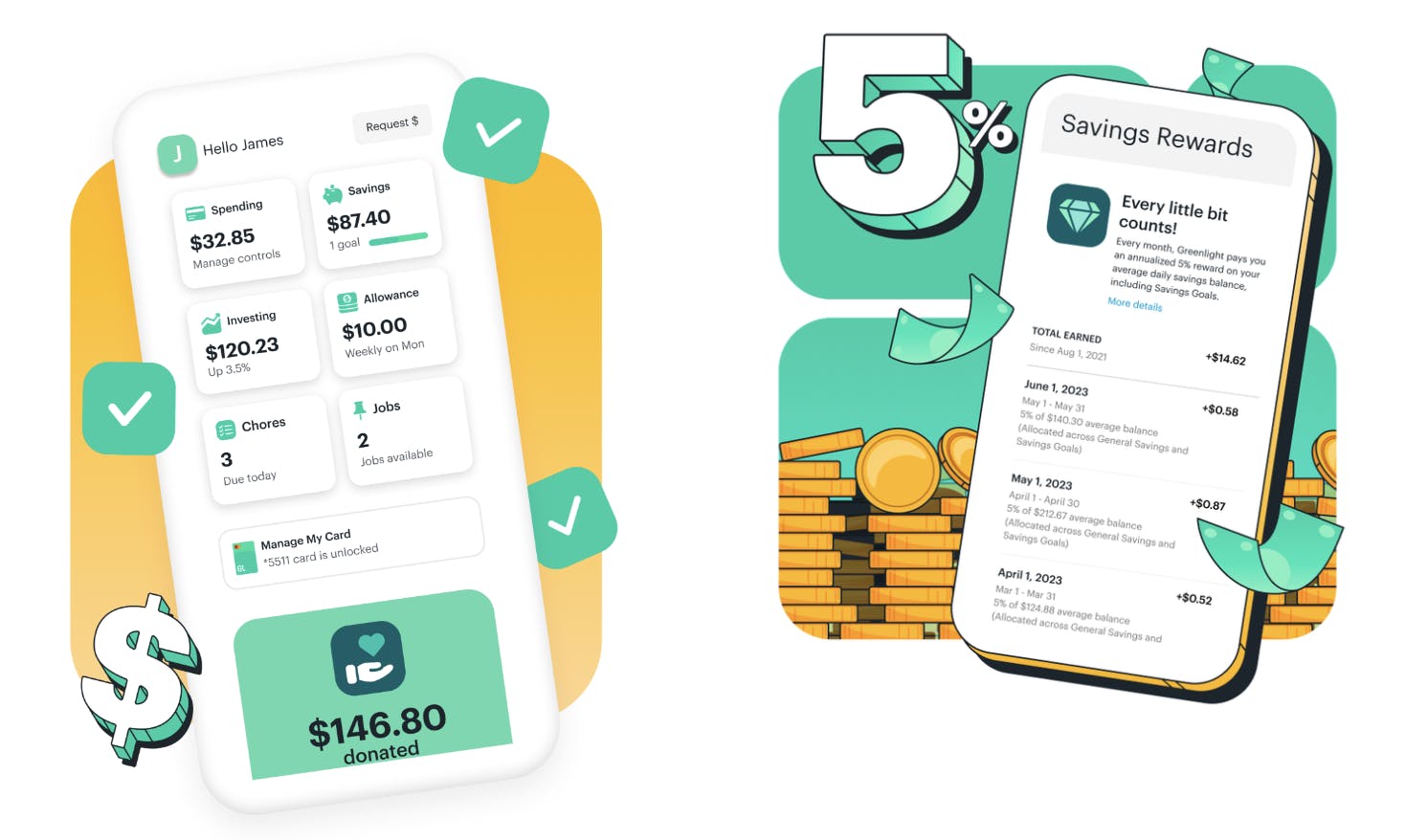

Debit Card & Savings

Greenlight provides debit cards for children and gives parents both control and oversight. One of the core services Greenlight offers is its mobile app. Not only can parents and children work together to set budgets and limits, but parents can also choose what kind of transaction or specific stores the card can be used at. There is also an option to set goals and tasks in order for children to be rewarded. Allowances are automatically transferred from parents’ accounts to kids’ accounts, and parents can lock the card at any time.

The debit card itself is insured by the Federal Deposit Insurance Corporation (FDIC) for a balance of up to $250K. Greenlight is registered with the SEC and is part of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC).

Source: Greenlight

In October 2022, Greenlight launched its family cash MasterCard with 3% cash back, which is high compared to the standard credit cards with rates around 1.5-2% cash back. Greenlight’s higher cash-back offering further incentivizes families to store money in the app.

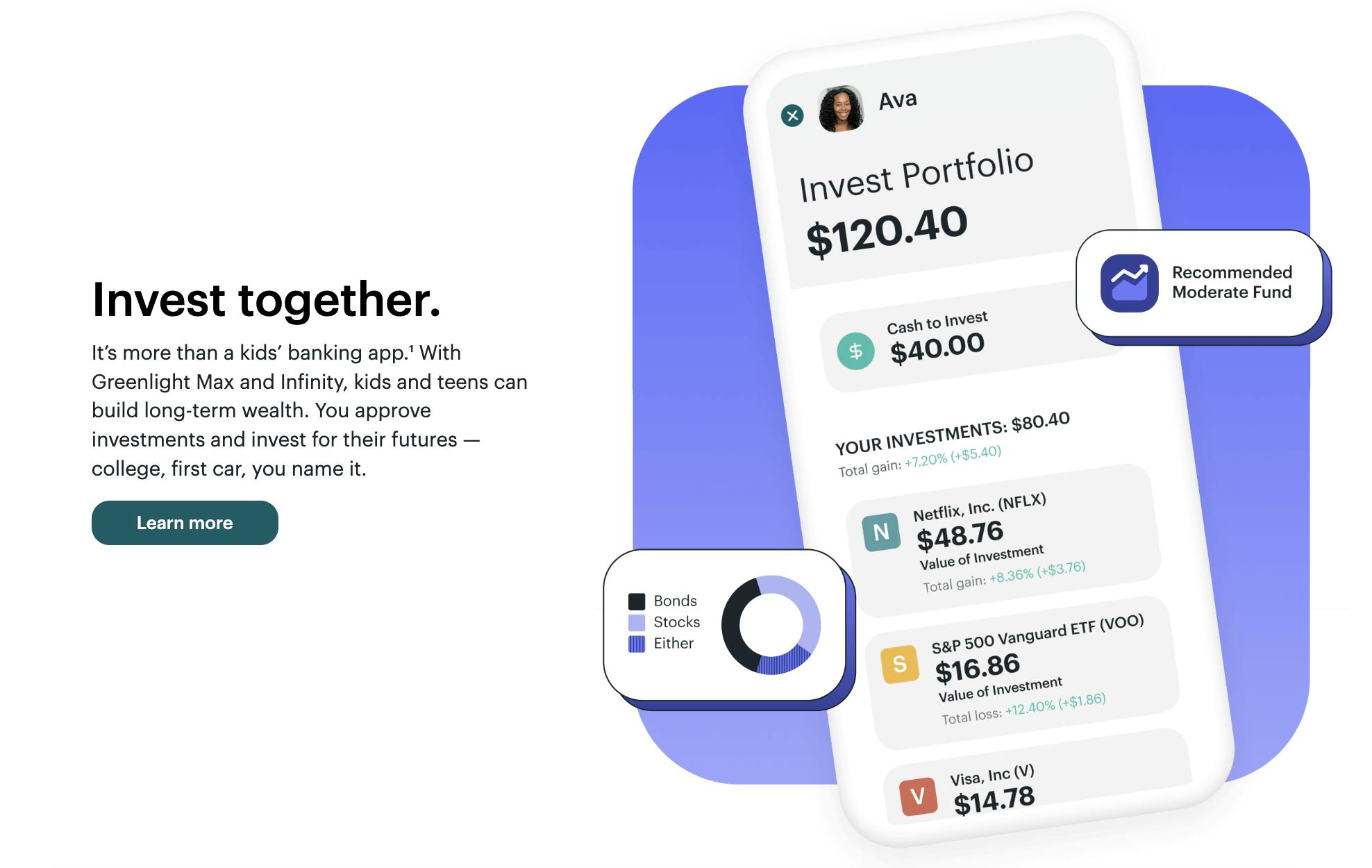

Investing

Greenlight’s Max and Infinity plans both have cash back and a brokerage account, in addition to an investing function where kids could start learning how to invest. The app asks users to fill out a survey on their investing time frame and risk tolerance to get ETF recommendations. There is also Morningstar content and other equity research resources for them to create their own portfolios. Users can set up multiple accounts for different goals. Greenlight doesn’t take any proceeds from the transaction and purely intends this as an educational tool.

Source: Greenlight

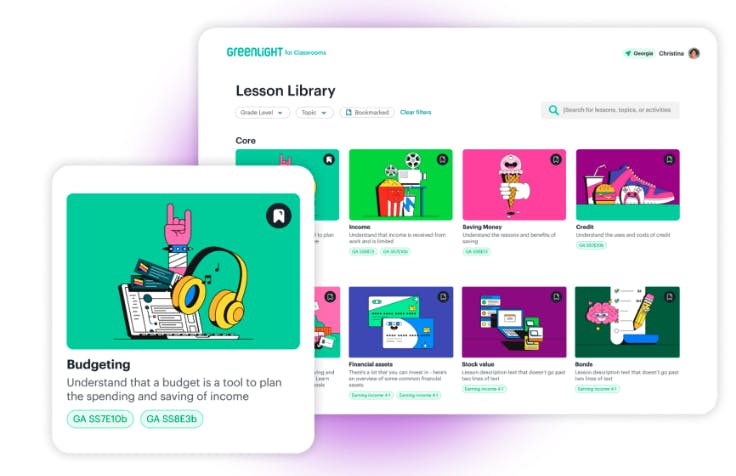

Classrooms

In 2010, only 30% of K-12 teachers taught personal finance material. Greenlight hopes to bring financial education to more students through its Greenlight Classrooms e-learning platform, designed for K-12 teachers and their students. The platform has 100 animated video lessons, quizzes, and teacher guides to make it easier for schools to implement a complete financial literacy curriculum. If a school already has a financial literacy course, teachers can share specific activities with their students alongside the existing curriculum. Greenlight Classrooms is free for schools and can act as a funnel for Greenlight to reach families early on.

Source: Greenlight

Banks

Similar to Greenlight’s Classrooms product, Greenlight offers bank integrations to acquire users from legacy banks and credit unions. When a bank partners with Greenlight, all bank customers get a free or discounted Greenlight subscription covered by the partner bank. In return, the Greenlight app partially displays the partner bank’s branding. As of November 2023, Greenlight has acquired over one million users for partner banks. Any customer deposits will be co-held or fully held by the partner bank as well, ensuring that banks do not lose AUM when partnering with Greenlight.

Source: Greenlight

Market

Customer

Greenlight is designed for children and teens from ages 5 to 17 who have a certain degree of spending power but are still supervised by their guardians. On the investing side, because the trades are made through brokerage accounts in the parent’s name, there is technically no age limit to who can participate in that part of Greenlight’s app.

Greenlight typically targets parents first through paid social. GoHenry, a UK-based teen debit card service, also focuses on a parent-first funnel with an estimated $20 CAC for invited child accounts. With an average 6-year retention and a nearly identical subscription model of roughly $5 per month per child, GoHenry’s Life Time Value (LTV) to CAC ratio is 3:1. Greenlight’s user economics are likely similar. Greenlight also acquires customers through Greenlight Classroom, connecting with students and K-12 teachers, and through their bank partnerships, which funnels families into Greenlight’s services.

Market Size

As of 2021, there were roughly 64 million kids between the ages of 5 and 17 in the US. People under the age of 19 represent 16% of the global population, i.e. 1.3 billion people. In 2019, about two-thirds of kids in the US get an allowance averaging $30/week, and most of that money is spent. That number is only increasing—the hourly pay rate for children who have to work for their allowance has seen an increase of 38% from an average of $4.43 in 2016 to $6.11 in 2019.

In a cashless era, these allowances rely heavily on digital banking, and 49% of teens are opening a bank account in 2021. For those who aren’t investing, 91% say they plan on doing so in the near future. A typical bank account in the US remains in use for about 17 years with very high user stickiness. That is the potential market opportunity for fintech apps for children. The market has attracted an increase in venture capital from $8 million in 2016 to $344 million in 2020.

In February 2021, Eddie Behringer, the founder of PSL Ventures, said there was “a tremendous amount of inbound interest” in the fintech for kids industry because parents, and their children, are “the last unbanked segment in the US”. If you assume an average revenue of $5 per user per month, the US market size for fintech targeted at children is $3.8 billion annually.

Competition

The market is relatively fragmented between the size and specialty of different players, with Greenlight belonging to the newly emerged category of online banking for kids. Similar teen financial services, payment services, and legacy custodial (youth) banking services compete with Greenlight.

Fintech Startups Serving Teens

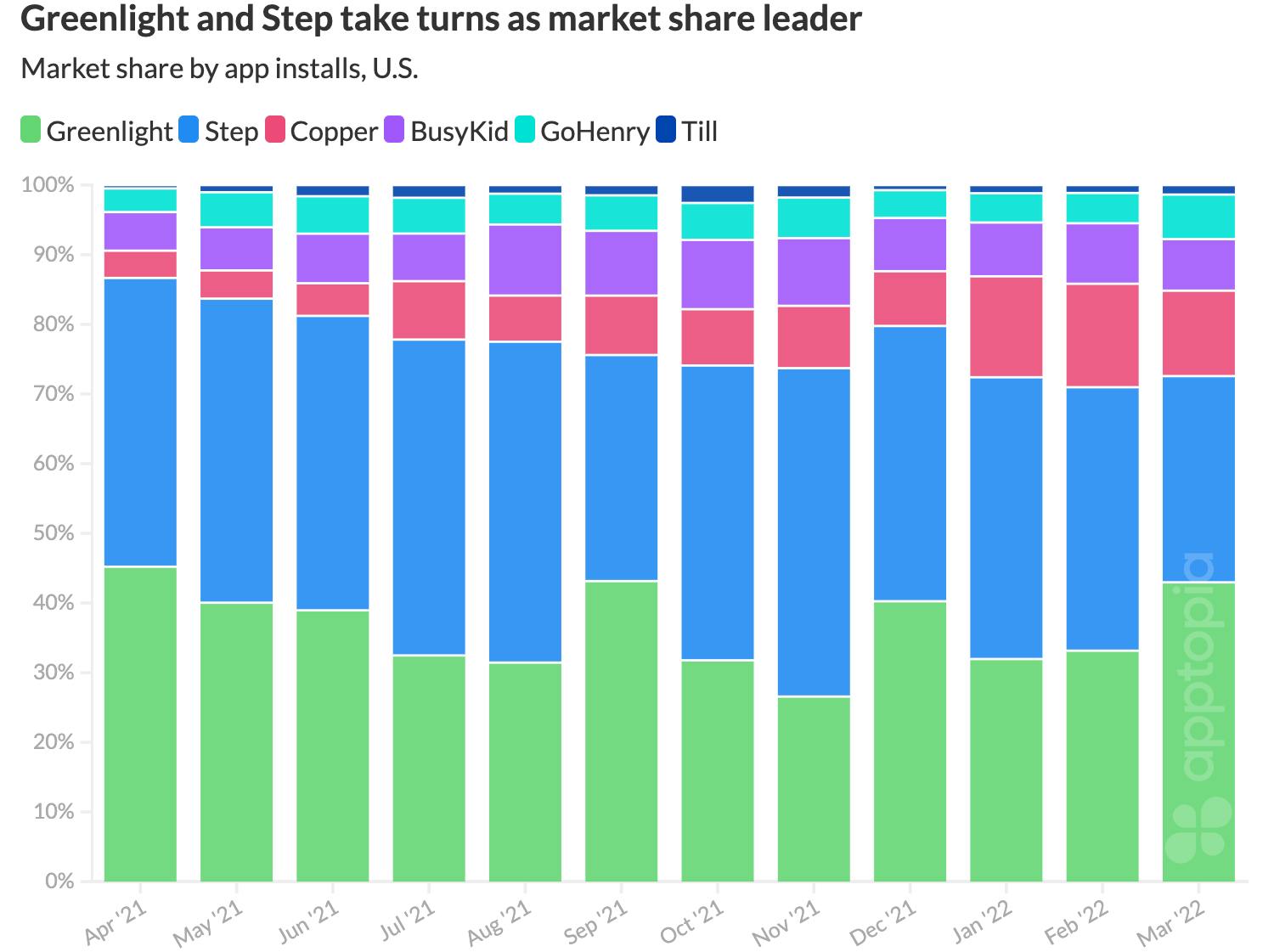

Source: Apptopia

Step: Founded in 2018, Step offers debit and partial credit cards for teens over the age of 13. Step took on $300 million in debt in October 2022, amounting to a total of $490 million in funding as of November 2023. Step leans into credit reporting, rewards, direct deposits for early paychecks, and a competitive 5% cash-back deal on savings.

With a 13+ age rating and focus on credit as well as investing, Step focuses on older children while Greenlight focuses on family use for younger children as young as 8. Unlike Greenlight, Step does not have a subscription model as of November 2023; it relies on network fees on debit card transactions and a 2% fee on investments. Step self-reports 4 million users on the app as of November 2023, which may refer to total downloads instead of completed accounts. In comparison, Greenlight had 6 million users as of March 2023.

Copper: Founded in 2019, Copper offers youth debit cards and investing. Copper matches Step’s 5% cash-back deals and also has in-app education and parent controls similar to Greenlight’s. Copper raised $29 million from Fiat Ventures in a Series A in April 2022, bringing its total funding as of $42 million as of November 2023. Copper self-reports 1 million users and operates on a $4.95 per month starting plan as well as a $7.95 per month plan for access to investing as well. Copper is less established than both Greenlight and Step and has near-identical features to both apps. Its relationships with schools and families may help Greenlight maintain its advantage against Step.

BusyKid: Founded in 2011, BusyKid is a debit card for kids that charges $4 per month and offers features like savings, payments, investing, charities, and more. BusyKid’s debit cards are issued by MVB Bank. The app claimed to have over 1 million users as of January 2020 and offers an app version that is free for families to use. The company has raised a total of $8.3 million in funding.

Acorn’s GoHenry: Although originally a UK counterpart that could participate in the US market, GoHenry is most similar to Greenlight in both funding, user base, and origins. However, GoHenry was acquired by Acorns in April 2023, marking its entrance into the US market through Acorn customers. Founded in 2012, two years before Greenlight, GoHenry also offers teen banking, investing, budgeting features, and parental controls as well as education experiences. In October of 2022, GoHenry raised $55 million in a Series B, bringing its total funding to $121 million as of November 2023. At the time of the acquisition in April 2023, GoHenry was roughly valued between $250 million and $500 million with Acorn’s valuation approaching $2 billion.

Till: Founded in 2018, Till Financial provides an app and debit card to teach kids about financial literacy. The product is completely free and doesn’t charge fees. Instead, Till works with brands to identify items for kids to save money for and then charges the brands a fee as part of the transaction. The company has raised a total of $6.2 million in funding.

Legacy Banks with Custodial Banking Services

The UTMA Act of 1993 allows minors under the age of majority, which is typically 18, to open financial accounts with the support of an adult sponsor. UTMA accounts are also known as youth custodial accounts and have typically been used to pass down inherited investments or wealth. Legacy bank accounts also offer custodial accounts for families, helping young people open savings, checking, and brokerage accounts since the law’s creation. The legacy banks below specifically offer digital custodial account services, granting teens the ability to actively manage their funds through a mobile app.

Charles Schwab One: Founded in 1971, Charles Schwab offers banking, investing, and financial advisory services. The launch of their Schwab One Custodial Account for youth banking is not disclosed, but its digital banking app was launched in 2010. As of November 2023, Schwab has a market capitalization of $102 billion.

Schwab One offers youth savings, checking, and investing accounts. The company has not disclosed how many families use Schwab One specifically, but the company serves over 34 million brokerage accounts as of October 2023. Schwab One reduces the likelihood of Schwab clients from using Greenlight, but Charles Schwab does not seem to be aggressively spending on teen ad campaigns, unlike Greenlight and other players in the teen-debit card space. Unlike Greenlight, Schwab does not have in-app education, budgeting, or financial planning tools designed for teens.

Wells Fargo Clear Access: Founded in 1852, Wells Fargo also offers a wide range of financial services, with mobile services launching in 2012, including youth custodial accounts for banking. As of November 2023, Wells Fargo has a market capitalization of $155 billion and supports a total of 70 million active brokerage accounts. Clear Access is also a UTMA custodial account designed for investors under the age of majority.

Unlike Greenlight, Clear Access accounts do not offer investing or in-app education, budgeting, or financial planning tools. Clear Access accounts also require a $25 minimum deposit to open the account, but they do not rely on a monthly subscription. Similar to Schwab accounts, Wells Fargo’s Clear Access is most appealing to family members who already use Wells Fargo. However, the limited features may still make Greenlight appealing to families who use Clear Access banking.

Capital One MONEY Teen Checking Account: Founded in 1994 as a spin-off from Wells Fargo, Capital One is a large consumer bank with 100 million users and a market cap of $40 billion as of November 2023. Capital One’s MONEY account is focused on users ages 8 and older. The product offers a free debit card, and the account is broken into two user experiences, one for kids and one for adults.

Peer-to-Peer Payment Apps

CashApp: Block launched Square Cash, which eventually became Cash App, in 2013 to help customers exchange money easily. Cash App received a total of $10 million from Block to launch and otherwise operates with an undisclosed budget from Block, which generated $18 billion in revenue in 2022. Cash App also offers partial debit cards and bank accounts through a partner bank.

In 2021, the company expanded its services to individuals under 18, including youth banking and investing. Similar to Step, CashApp targets users aged 13+, stressing independence and financial flexibility for older children on its landing page. Cash App’s popularity, with over 50 million users on the platform as of March 2023, makes Cash App extremely attractive for young people. However, Cash App’s youth services are still new so Greenlight can still maintain its reputation as a family financial platform for younger children.

Venmo: Founded in 2009, Venmo offers peer-to-peer payment services and partial banking as well. In 2020, Venmo announced a prototype for teen debit cards. Similar to Cash App, Venmo is primarily used by young adults, although some young people evade this restriction and use its services illegally under 18. If Venmo releases its teen debit card services, young people more interested in exchanging cash, rather than saving or investing, may find Venmo more appealing than Greenlight. Greenlight still has more education, budgeting, and financial planning tools than Venmo however, and pitches itself as family-oriented, unlike Venmo which is targeted towards individual use.

Business Model

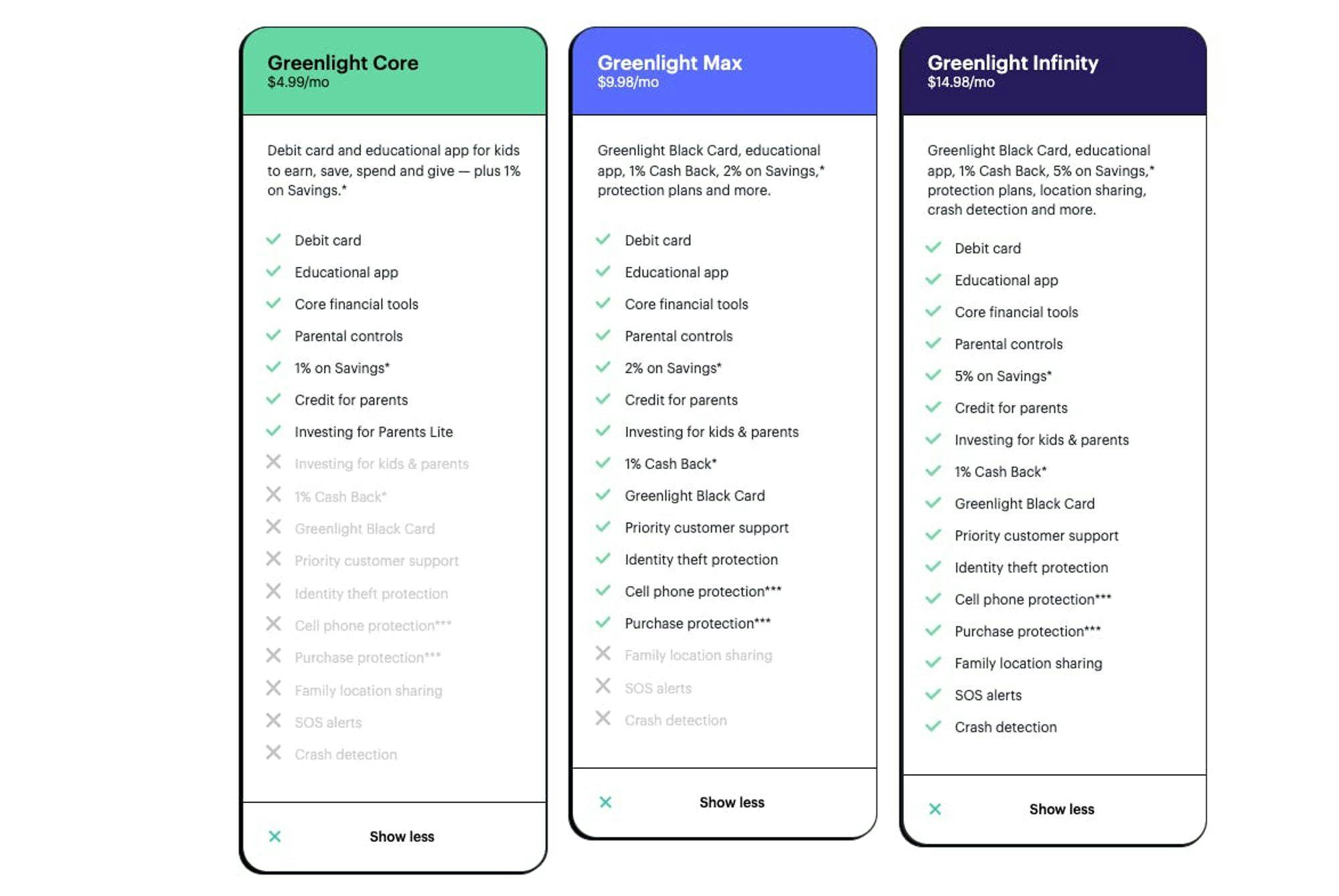

Source: Greenlight

Greenlight offers three plans: Greenlight Core for $4.99/month, Greenlight Max for $9.98/month, and Greenlight Infinity for $14.98/month. All three plans have the base benefit of debit cards for up to 5 kids, a complementary app that tracks spending/savings, and rewards. Greenlight Max offers investing, and cash back, as well as more protection, while Infinity has the newest location-sharing and SOS alert features.

Greenlight charges a fee of $25 for the issuance of debit cards. While a user subscription is unique for most accounts targeted at younger people, Greenlight also offers more robust features than a typical account. Greenlight charges a flat fee for Bank partnerships as well but does not disclose exact pricing.

In November 2021, Greenlight announced a partnership with Amazon+ to include access to Greenlight in a bundle with the Amazon Kids+ app. In terms of the customer acquisition cost, Charlie Javice, the founder of a financial services startup for students called Frank, disclosed that it is around $50 to $400 per customer in banking, with $200 as the average in retail banking.

Traction

As of June 2023, Greenlight serves over 6 million users and has a leading market penetration in the teen app category at 33% while its competitors are predominantly in the single-digit percent range. The trend of 300% growth YoY also signifies a positive outlook for the future. As of the end of 2021, Greenlight was claimed to have reached $100 million in revenue.

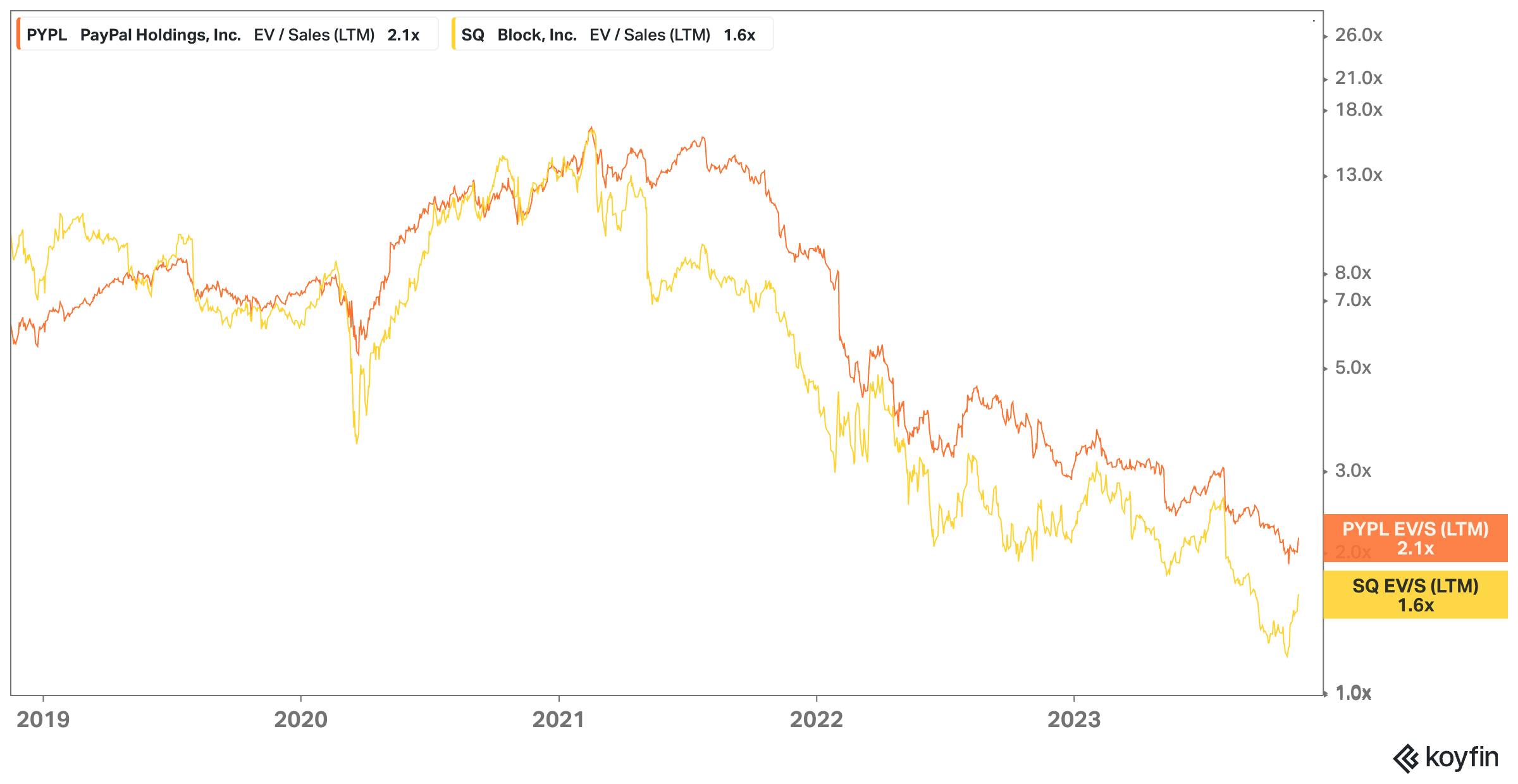

Valuation

Greenlight raised $260 million in a Series D round of funding from a16z in April 2021, bringing its total capital raised to $550 million. The round also brought Greenlight’s valuation to $2.3 billion. The company planned on using the money to fund product development, investigate strategies in partnerships and expansions, and hire 300+ employees in engineering over the following two years. Based on its 2021 revenue of ~$100 million revenue, its valuation implied a ~23x revenue multiple. Comparable consumer fintech stocks like Block ($SQ) and PayPal ($PYPL) have traded down as of November 2023, to ~1-2x LTM revenue.

Source: Koyfin

Key Opportunities

Fraud Detection and Security

In October 2022, Greenlight began offering an Infinity plan that includes the newest security features such as SOS alerts, location sharing, etc. Fintech startups in general have lots of opportunities and motivations to boost their security features, and this is especially the case as minors are involved. Even though Greenlight already allows parents to place restrictions on the type of stores their children can shop at, more anomaly detection and transaction location sharing will become increasingly important for parents worried about their children’s safety.

Partnerships

Greenlight’s partnership with Amazon Kids+ is one example of how kids’ services can be bundled together. Many kid-specific brands look for opportunities to combine multiple services, in order to entice parents to be more likely to pay for those bundles. Partnerships like these will boost Greenlight’s recognition, and customer acquisition capabilities.

Another source of partnerships could be traditional banks. Chase banking already offers allowance and chores features powered by Greenlight. Since there is limited product differentiation, partnering with larger banks allows Greenlight to acquire more customers, while simplifying the process of offering these features for larger companies like Chase.

Teen Influencers

One of Greenlight’s competitors, Step, has had success with marketing campaigns, like a TikTok video featuring Charli D’Amelio, Addison Rae, and other young influencers. Within six months of Step’s product launch, over 1.5 million teens signed up for an account. With the variety of online banking apps, Gen Z wants a brand that gives them enough flexibility and representation. Greenlight has mainly been focusing on the parent aspect of the app, but there are more opportunities to market directly to their younger users.

Key Risks

Crowded Competitive Landscape

There are a number of competitors in this space including companies like Jassby, Famzoo, Spriggy, Osper, GoHenry, and Step just to name a few. On Trustpilot, there have been multiple reviews citing how difficult it is to cancel a Greenlight subscription plan once purchased. Apparently, the only way to cancel is to call customer service and the process is tedious and difficult to navigate. In such a competitive landscape, Greenlight’s customer experience will be critical in order to differentiate.

Scaling Beyond Tech-Savvy Families

In 2022, Greenlight spent $7 million for a 30-second Superbowl Ad starring the Modern Family actor Ty Burrell. In 2023, 113 million people tuned into the Superbowl, potentially making Greenlight a household name. Although some families may have been searching for teen debit services, digital financial services are still relatively new and unfamiliar to many parents, with researchers even exploring UX tricks to make users more comfortable with submitting sensitive financial info online.

Greenlight achieved $100 million in revenue in 2021 but did not publicly report increased revenue as of 2022. As Greenlight becomes more well known, but with early adopters already signed on and potentially stagnant revenue growth, the company may have issues achieving the next $100 million, as their ads shift from demonstrating the value to convincing users they need teen banking. Depending on the growing interest in digital payments, the opposite may be true, however, and more parents may become more interested in digital banking for their teens.

Path to Profitability

Greenlight disclosed a desire to significantly expand its engineering team and as of November 2023, has multiple engineering roles listed. The company will need to ship valuable features rapidly without disproportionally increasing headcount. Failure to balance development speed with cost control could hinder Greenlight's ability to scale internally. Externally, Greenlight’s previous reliance on paid marketing for growth poses a risk. Finding sustainable and organic growth outlets is crucial to avoid over-dependence on paid acquisition methods. If not adequately addressed, Greenlight may struggle to become profitable or maintain its growth.

Summary

Online banking for kids is a large emerging part of digital transactions. As a major player in the field, Greenlight is building customer-centric products with detailed parental control features. Greenlight has seen meaningful traction, growing to 3 million users and over $100 million in revenue. The only concern is whether it would be able to differentiate itself and keep its competitive edge from the various similar products that are splitting the market.