Thesis

“USDA-certified organic” defines organic food as food that doesn’t contain artificial preservatives, colors, or flavors, and which has grown on soil that has not been treated with prohibited substances for three years before harvest. Such production processes are more expensive than non-organic farming, and in turn, organic groceries generally have higher prices.

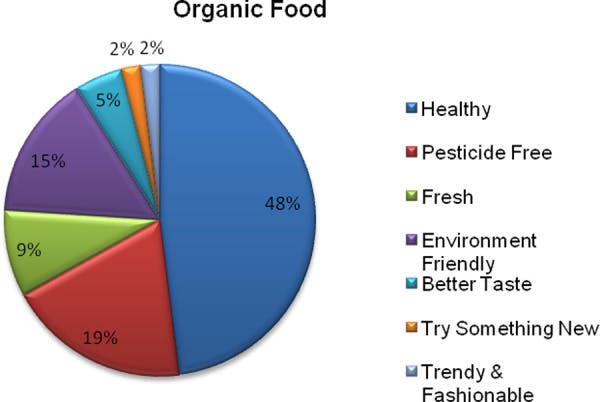

Despite the higher cost of organic goods, the US organic food market is growing in market share. In the year leading up to October 2024, the volume of organic produce sold in the US increased by 6.7%, faster than the 2.8% growth in conventional produce, despite costing 21% moreAs of 2021, health consciousness is the leading reason why consumers opt for organic food, which is perceived to be healthier than its non-organic counterparts. The second most common reason is that organic food is pesticide-free, which can also have perceived health benefits.

Source: National Institutes of Health

Online grocery platforms have also emerged in the past two decades. In 2024, online grocery marketplaces grew over three times faster than brick-and-mortar grocery stores. By January 2025, online grocery sales reached $10 billion (up 16.6% YoY), and over 77.8 million US households bought groceries online in November 2024, surpassing the record set during April 2020.

Thrive Market is a membership-based ecommerce platform offering organic groceries and sustainable household items. Thrive Market only sells items that meet its strict quality standards, such as being 100% non-GMO and not having any of its 1K banned ingredients, including artificial flavors or parabens. Thrive Market ships across the contiguous United States and partners directly with vendors to offer organic products at a discount, with a mission “to make healthy and sustainable living easy and affordable for everyone.”

Founding Story

Thrive Market was founded by Nick Green (CEO), Sasha Siddhartha (CTO), Gunnar Lovelace (former co-CEO), and Kate Mulling in 2014.

Green founded the standardized test prep company Ivy Insiders in 2003 while a student at Harvard University, from which he graduated in 2007 with a bachelor’s degree in Economics. In 2010, Green sold Ivy Insiders to online tutoring company Revolution Prep. While the sale price was undisclosed, at the time of sale, the company had $2–3 million in revenue and 6K customers. Green continued to serve as EVP Sales & Operations and Chief Product Officer at Revolution Prep until his departure in 2013.

Lovelace was likewise an entrepreneur before founding Thrive Market. His first company, Ego X Studios, founded in 1999, offered Flash motion graphics and Flash-to-database integrations and was sold to Visionarie in 2001. The second, Cognition, founded in 2004, offered a natural-language processing search engine and was sold to Nuance Communications in 2013. Immediately before Thrive Market, from 2005 to 2014, Lovelace was the cofounder and CEO of Love Heals Jewelry, a company that, as of 2018, supplied jewelry in over 200 retail locations and had more than 75 workers.

In 2012, Green became the Entrepreneur-in-Residence at startup accelerator Launchpad LA, where he participated in the investment committee and met other entrepreneurs. A mutual friend introduced Green and Lovelace in 2013. Their first meeting was a phone call during which Lovelace pitched Green to be an investor in “Shop Tribe,” which aimed to be “Groupon for healthy food” by leveraging the scale of a group of consumers to buy health foods at wholesale prices, thus reducing each consumer’s cost. Lovelace’s inspiration for Shop Tribe came from his upbringing on a “food co-op out of a hippie commune,” which demonstrated to him the impact of making healthy food more accessible and affordable. Green decided to partner with Lovelace because he was drawn to the same mission, something to which he credits his mother and her commitment to raising his family with healthy food despite his middle-class Midwestern upbringing.

Green and Lovelace discarded Shop Tribe’s initial business model of bulk buying events, since wholesale product fulfillment took two to four weeks, a wait they deemed too long for a grocery platform. Instead, the pair iterated on how to increase access and affordability of healthier and sustainable food, drawing particular inspiration from membership models of physical retailers like Costco.

Initially self-funded, in the year leading up to Thrive Market’s November 2014 launch, Green and Lovelace pitched to, and were rejected by, 50 VC firms. These firms were unconvinced that a distributed health food startup could compete with established retailers like Whole Foods, even before its 2017 acquisition by Amazon. In the meantime, Green and Lovelace had been building a network of influencers to promote Thrive Market, and asked them to invest as well. They ultimately raised an $8 million seed round in January 2014 from over 150 influencers, including prominent wellness figures Jillian Michaels and Deepak Chopra.

In January 2014, Green and Lovelace brought on Mulling as a third cofounder. Mulling’s brand and content backgrounds were instrumental in rebranding Shop Tribe to “Thrive Market” ahead of its launch. Before Thrive Market, Mulling worked at numerous consumer publications, including Conde Nast, Who What Wear, and Refinery29. In 2011, she co-founded The Chalkboard Magazine, a digital publication that makes healthy lifestyle education accessible online, serving as editor-in-chief until the end of 2013. A year after Thrive Market’s founding, Mulling was no longer involved day-to-day as VP of Content and Brand.

After Thrive Market’s initial traction, they needed a technical co-founder to build the ecommerce platform in time for their official launch in November 2014, so the co-founders then brought on Siddhartha in 2014. Calling him “basically the most brilliant startup CTO in the LA tech community at the time,” Green recruited Siddhartha, who was initially only interested in investing in the company, as Thrive Market’s CTO. From 2011 to 2014, Siddhartha was the founder and CTO of a fashion ecommerce platform called Little Black Bag, which merged with another fashion ecommerce company called Pose in 2013. Before that, Siddhartha was co-founder and CTO of a parking database called Parking Maps and served as a development lead at Microsoft.

By 2018, Lovelace had transitioned from co-CEO to become Thrive Market’s Chief Strategy Officer, and Green became the sole CEO. As of 2019, Lovelace was no longer involved in the company day-to-day, but remains on the company’s board as of July 2025. In January 2023, Thrive Market hired Hetu Patel as CFO. Patel worked for nearly 12 years in finance roles at Amazon and briefly served as Imperfect Foods’ CFO before joining Thrive Market. In May 2025, Thrive Market hired Scott Lescher as its first COO. He previously worked at Amazon and Uniqlo in logistics and supply chain roles.

Product

Thrive Market is a membership-based ecommerce platform offering a curated assortment of natural and organic products across grocery, pantry staples, supplements, home goods, and personal care. For a flat annual fee, members gain access to Thrive’s online catalog of roughly 5K-6K products, all vetted to meet strict ingredient and sustainability standards. By cutting out intermediaries and selling direct-to-consumer, Thrive Market says its prices are up to 30% below traditional retail on comparable items.

Membership

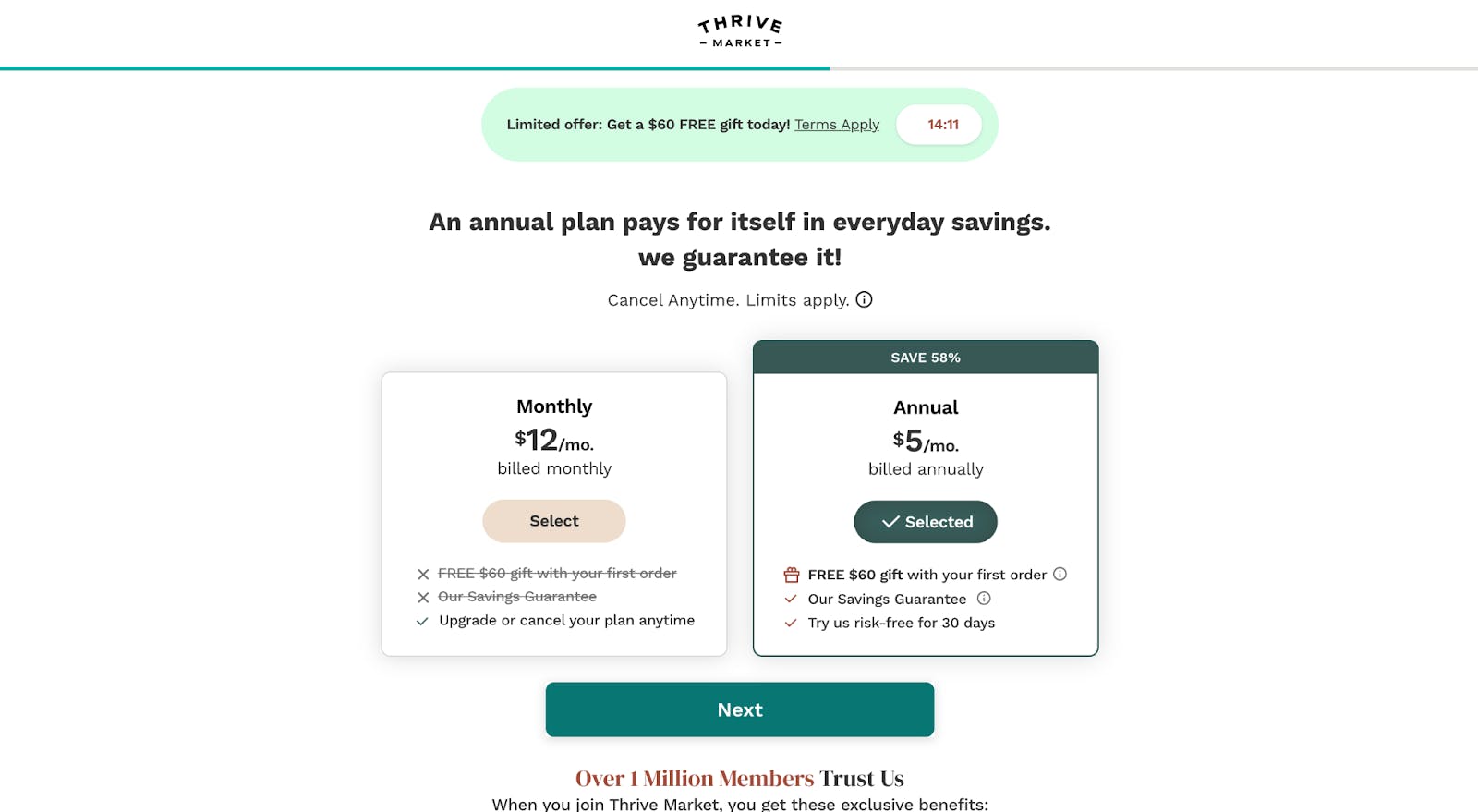

Source: Thrive Market

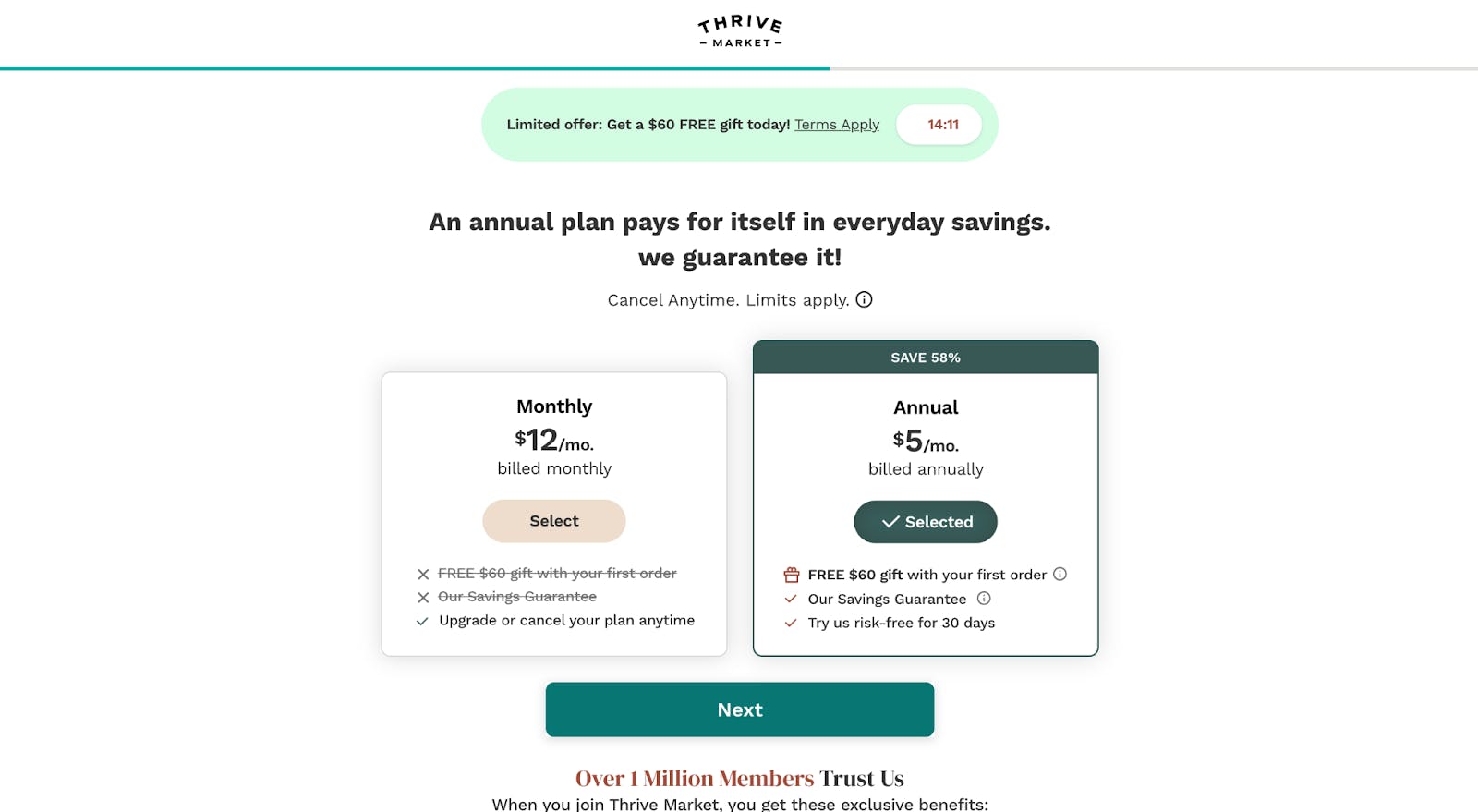

All Thrive Market customers are required to have a membership to order. As of July 2025, a yearly membership costs $59.95, and a monthly membership costs $12. Features of Thrive Market’s membership include:

Members‑only pricing: Thrive Market advertises “up to 30% off top brands.”

Savings Guarantee: If customers don’t make back their annual fee in savings within a year, Thrive Market credits the difference in Thrive Cash at renewal.

Price Match Program: Thrive Market will match the lowest price provided by customers.

“Recurring” savings: Thrive Market offers 5–10% off eligible items when customers set up recurring deliveries.

Free shipping above thresholds: Thrive Market offers free shipping on Grocery orders above $49, Frozen orders above $120, and Wine orders above $79.

Thrive Market also maintains a program called Thrive Cash through which users can earn rewards and apply them to future orders. Members can earn Thrive Cash through successful new user referrals, writing reviews for eligible products, or purchasing items that offer Thrive Cash bonuses.

Thrive Market Catalog

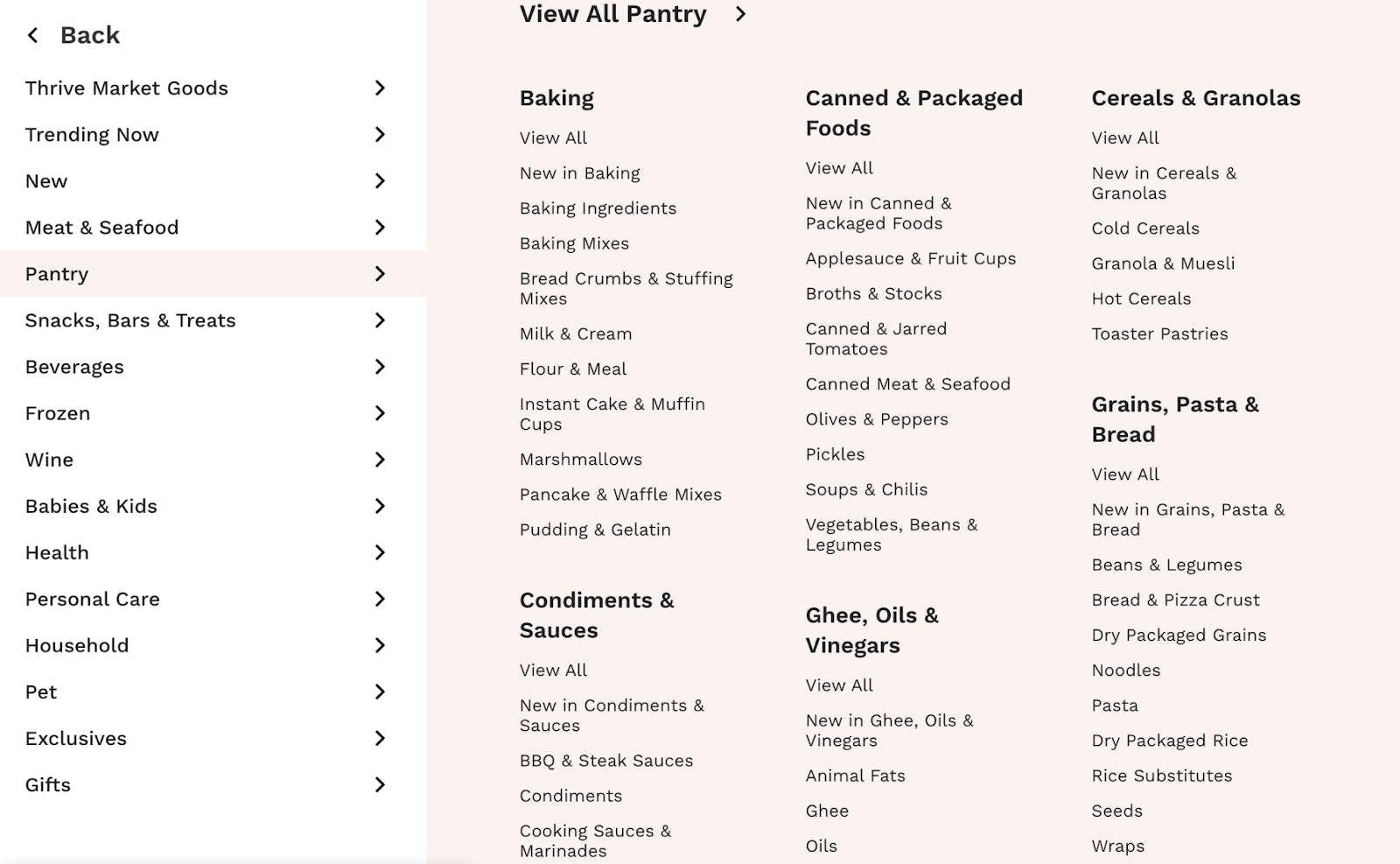

Source: Thrive Market

Thrive Market’s product offerings comprise non-perishable dry food, frozen food, meat and poultry, beverages, baby food and supplies, vitamins and supplements, beauty and personal care items, pet food and supplies, and household supplies. As of July 2025, Thrive Market was offering refrigerated perishables and produce to a small group of users.

Thrive Market deliberately limits its SKU count to simplify the shopping experience and ensure quality. As Siddhartha explained in February 2023, Thrive Market’s merchandising team pre-screens brands so members “don’t have to worry about which brand is better or study labels.” Thrive Market lets users filter products by over 90 dietary and lifestyle attributes (e.g., vegan, keto, gluten-free, non-GMO, Fair Trade) to find items aligned with their preferences or health needs.

All Thrive Market products meet its quality standards. These include:

“Trusted Ingredients”: Thrive Market products are 100% non-GMO and are prohobited from containing over 1K+ banned ingredients like artificial flavors, antibiotics, synthetic nitrates and nitrites, and parabens.

“Ethical Sourcing”: Thrive Market seeks out brands that follow ethical practices, including fair pay and treatment for workers, strict quality standards, and safe working conditions. It prioritizes trusted seals like Fair Trade Certified, Global Animal Partnership (G.A.P.), and Leaping Bunny.

“Planet Positive": Thrive Market prioritizes partnerships with brands and suppliers that also adhere to sustainable practices.

“On a Mission”: Thrive Market looks for “mission-driven partners working to improve supply chains and support people, animals, and our planet.”

“Tasted & Tested”: All products are tasted and tested before being sold to customers.

Source: Thrive Market

Thrive Market has also built up a private-label line of business. As of 2024, Thrive Market had over 650 owned‑brand products across food, home, cleaning, supplements, and beauty. As of May 2024, these products accounted for 25% of Thrive Market’s overall revenue.

Social Impact

Thrive Market’s platform also has a social impact component baked in. Through its “Thrive Gives” initiative, every paid membership sponsors a free membership for a family in need, including teachers, nurses, first responders, students, veterans, and EBT cardholders. In February 2024, Thrive Market said it became the first online-only grocer authorized to accept SNAP/EBT benefits for food purchases.

Any Thrive Market member can also gift their savings or any dollar amount at checkout to various social impact initiatives, including grocery discounts & stipends for Thrive Gives members, nonprofit partners, and food & product donations following natural disasters.

Market

Customer

Thrive Market’s target customer is the health-conscious but budget-minded shopper who wants organic, sustainable products without paying a premium. The company has focused on serving middle-class families, especially mothers, who want healthier products but can’t afford or don’t have access to Whole Foods. As of March 2024, over 40% of customers had household incomes less than 100K, and 50% of its customer base came from the Midwest and the South.

Market Size

Thrive Market operates within the US organic food market, which in 2024 was estimated to be around $65.6 billion and is expected to grow at a CAGR of 10.4% to $159 billion in 2033. This growth is fueled by growing consumer inclination toward buying organic food. At the end of 2023, 12% of Americans purchased organic “every chance [they got],” up from 10% in 2021. While organic food generally has higher production costs and therefore higher prices, the growth of organic food purchasing persists across socioeconomic strata. In 2023, 75% of American consumers who purchased organic food either regularly or occasionally made between $50K–$100K yearly, up five percentage points from 2021.

Thrive Market also competes in the US online grocery space, which in March 2024 was valued at $183.3 billion. ~78 million households purchased organic groceries in 2024, or 59% of the ~132 million households in the US that year. By 2033, the online grocery market is expected to grow to $715.5 billion, demonstrating a CAGR of 16.3%.

Competition

Thrive Market competes in two categories: organic grocery and grocery ecommerce, and as such, its key competitors fall into the categories of organic grocers and online grocery delivery companies.

Organic Grocers

Costco Wholesale: Founded in 1983, Costco is a membership-based wholesale retailer. Paying members can shop at its warehouse locations to purchase thousands of items, including bulk groceries, apparel, and home goods. In FY 2024, Costco generated over $249.6 billion in sales and, as of July 2025, it had a market cap of $412 billion. Like Thrive Market, Costco operates on a subscription business model, with over 128 million members globally in 2024. It also offers bulk items at a discount, including its own private label, accounting for 34% of sales in 2024, and is the leading US organic food retailer as of September 2024, with over $6 billion in sales. Thrive Market differentiates itself from Costco with its health-focused quality standards, online-only store, and more limited product selection.

Whole Foods Market: Founded in 1980 and acquired by Amazon for $13.7 billion in June 2017, Whole Foods is a specialty supermarket chain with an emphasis on natural and organic products. As of July 2025, it had over 500 locations in the US, Canada, and the UK. Customers can shop in person in Whole Foods stores and, through integration with Amazon Prime, place orders for pickup or same-day delivery, making Whole Foods an omnichannel retailer. Like Thrive Market, Whole Foods produces a private label brand, 365 by Whole Foods, which had over 2,600 products in 2023. Thrive Market differentiates itself from Whole Foods by being online-only and more geared towards savings.

Trader Joe’s: Founded in 1967, Trader Joe’s is a US-based grocery store chain particularly known for its affordable prices, with over 600 locations across 43 states. In 2024, Trader Joe’s generated $16.5 billion in annual revenue. Like Thrive Market, Trader Joe’s also has an extensive private label offering. In fact, it primarily stocks its private-label Trader Joe’s products in stores: as of 2018, private-label items account for 85% of inventory. Trader Joe’s leads brand awareness among organic food consumers, at 72% of surveyed consumers, outpacing even Whole Foods’ 365 by Whole Foods. Unlike Thrive Market, Trader Joe’s does not offer delivery and does not have the same restrictions on ingredients.

Online grocery delivery

Misfits Market: Founded in 2018, Misfits Market is an online grocery delivery platform. It partners directly with farmers to offer edible produce that is “misfit”, or produce with cosmetic flaws that are discarded by traditional grocers. Like Thrive Market, Misfits Market is an online grocer that ships directly to consumers across the contiguous United States, promotes sustainability, and aims to make high-quality food more affordable and accessible. Unlike Thrive Market, it was founded with fresh produce as its core offering and does not require a subscription.

As of July 2025, Misfits Market had raised a total of $526.5 million. Softbank’s Vision Fund 2 led a $225 million Series C extension in September 2021 at a $2 billion valuation. In 2022, Misfits Market acquired Imperfect Foods for an undisclosed amount. Founded in 2015, Imperfect Foods likewise partnered directly with growers to offer “imperfect” and surplus groceries at a discount. At the time of the acquisition, it was projected that the grocery platforms would reach profitability and a combined $1 billion in sales by 2024.

Instacart: Founded in 2012, Instacart is an online grocery delivery platform on which customers browse, order, and receive deliveries from retailers, including organic grocery leaders like Costco and Whole Foods. As of July 2025, it delivered to locations across the United States and Canada, and it led the US grocery delivery category in 2024, capturing 70% of Digital Grocery Baskets $75 and above. Instacart IPOed in September 2023 and, as of July 2025, had a market cap of $12.4 billion.

Unlike Thrive Market, Instacart does not warehouse and ship products offered on its platform. Instead, it maintains a network of delivery drivers, which it leverages to pack and deliver directly to consumers from existing physical retailers. Consumers can order on Instacart without a subscription, in which case they pay delivery and service fees. Instacart also offers a subscription, Instacart+, which provides unlimited delivery and reduced fees.

Grove Collaborative: Founded in 2012, Grove Collaborative is a subscription-based ecommerce platform where customers can find and place one-time or recurring orders of sustainably made household, beauty, and personal care items and have them delivered straight to their doors. Grove Collaborative, like Thrive Market, ships to the contiguous United States and produces its own private label brand called Grove Co., with over 300 private label products in 2024. Like Thrive Market, it also partners with third-party brands to list their products on its site. Select Grove Co. products are also sold at major retailers such as Target, CVS, Amazon, and at regional retail chains. In 2021, Grove Collaborative merged with Virgin Group Acquisition Corp II, backed by Richard Branson, and went public in July 2022 at a $1.5 billion valuation. As of July 2025, its market cap had fallen to $58 million. Unlike Thrive Market, Grove Collaborative’s business is mainly household, personal‑care, and wellness, and not food.

Business Model

Subscription

Thrive Market operates on a subscription business model. As of July 2025, members can opt for an annual membership at $60/year or a monthly membership at $12/month. Customers can only view products on Thrive Market after purchasing a paid membership. On top of that, Thrive Market makes a profit margin on products sold.

Source: Thrive Market

CEO Nick Green has stated that Thrive Market took inspiration from Costco’s membership model and also generates profit primarily from membership fees, thus allowing it to offer consumers wholesale prices on products. Indeed, Thrive Market procures directly from vendors and claims customers can save up to 30% off retail prices.

Private Label

As of 2024, Thrive Market had over 650 owned‑brand products across food, home, cleaning, supplements, and beauty. As of May 2024, these products accounted for 25% of Thrive Market’s overall revenue. According to Jeremiah McElwee, Thrive Market’s Chief Merchandising Officer until 2024, the company generates higher margins on its private label products by developing them with lower-cost ingredients that still meet the same, or even greater, organic and non-GMO certifications as third-party brands. In addition to buying trends, Thrive Market leverages search trends of items it doesn’t yet carry to inform its next private label bets, giving it an advantage over physical retailers, whose main insights come from point-of-sale (POS) data.

Shipping

Thrive Market operates nine fulfillment centers, and products are shipped from the fulfillment center closest to the customer. West Coast orders are shipped from Reno, NV, for non-perishable and pantry items, Ferndale, WA, for frozen items, and Napa Valley, CA, for wine. Midwest orders are shipped from Batesville, IN, for non-perishable and pantry items, Hastings, NE, for frozen items, and St. Louis, MO, for wine. East Coast orders are shipped from Batesville, IN, for non-perishable and pantry items, Richmond, VA, for frozen items, and Rensselaer, NY, for wine.

Irrespective of order location, Thrive Market claims that pantry products typically arrive two to four days after the order is placed, frozen products typically arrive two to three days after shipment, and wines typically arrive three to six days after the order is placed. To mitigate shipping costs, Thrive Market negotiates prices directly with delivery providers. To reduce packaging material costs, the company employs methods such as maximizing the products packed in a single box (averaging 12–14), packaging its private label items in lighter containers (e.g., housing liquids in tin containers instead of glass), and even reducing the number of colors on the boxes in which products ship.

As of July 2025, Thrive Market offers free shipping on Grocery orders above $49, Frozen orders above $120, and Wine orders above $79. Otherwise, Thrive Market charges $5.95 for Grocery orders, $19.95 for Frozen orders, and $13.95 for Wine orders.

As of January 2025, Thrive Market’s primary acquisition channel is referrals from existing members, which CEO Nick Green credits to customer loyalty toward the brand’s socially and environmentally conscious mission. Thrive Market also acquires new subscribers and retains existing members through targeted marketing campaigns that segment users by website, browsing behavior, product tendencies, and preferences. In 2023, according to its Chief Marketing Officer Amina Pasha, the majority of Thrive Market’s marketing dollars went to Meta, TikTok, and search.

Traction

As of March 2025, Thrive Market was doing over $700 million in annual sales, carried over 750 brands, and had over 1.6 million paying members.

In December 2024, Thrive Market began accepting SNAP EBT as a form of payment, opening up another revenue stream by offering healthier food options to low-income households who might otherwise not have access to organic groceries. In the first two months after its launch, Thrive Market generated over $1 million in revenue from SNAP EBT payments.

Even before raising for the first time, Thrive Market built up a network of influencers across social channels such as blogs, Instagram, and YouTube to promote its product and mission. Cofounders Nick Green and Gunnar Lovelace ultimately opened up and raised Thrive Market’s 2014 seed round from their network of over 150 influencers at the time. Presently, Thrive Market maintains an affiliate program through which partners can promote the platform and its products to earn commission. As of July 2025, it had over 500 affiliate partners, including prominent wellness figures Melissa Urban, founder of the Whole30 diet, and Mark Sisson, founder of the health-focused food brand Primal Kitchen.

Valuation

As of July 2025, Thrive Market has raised over $241 million. It raised a $111 million Series B in June 2016, led by Invus, at an undisclosed valuation. Other participating investors included Greycroft Partners, MaC Venture Capital, Kapor Capital, and individual public figures Demi Moore and John Legend. It was reported in July 2021 that Thrive Market was considering an IPO at a valuation of over $2 billion, but as of July 2025, the company remained private.

Key Opportunities

Faster Delivery

As of July 2025, Thrive Market says most orders arrive within four to six days of placing the order. This is longer than many competitors like Whole Foods or Instacart, so customers who might have otherwise purchased on Thrive Market may choose competitors due to the convenience of same or next-day delivery. By building out its delivery operations, Thrive Market could capture a customer segment that prioritizes convenience and speed. Thrive Market also has the unique advantage of already partnering directly with manufacturers and producing its own private label items. As of July 2025, Thrive Market only ships frozen product orders on Monday-Thursday to avoid weekend shipping delays. Expanding its delivery operations would allow it to move more perishable or frozen items, which do not hold up as well via shipping.

Expanding into delivery also presents an opportunity to explore environmentally-friendly and carbon-neutral delivery options, something both in alignment with Thrive Market’s mission of sustainability and popular with consumers. In 2024, 58% of US consumers indicated prioritizing sustainability in purchasing decisions. In fact, CEO Nick Green has stated that, in the future, he envisions Thrive Market carrying out its own direct-to-consumer delivery with sustainable electric vehicles.

Private Label Growth

In May 2024, over 25% of Thrive Market’s sales were from the company’s own private label brands. Once considered the cheap version of a branded good, buying trends indicate a positive shift in consumer sentiment on “store brand” items. In a 2021 press release, Target announced its tenth private label brand to reach $1 billion in sales, which it achieved in one year.

Private labels are advantageous for retailers because they afford differentiation, as private label items by definition can’t be found anywhere else, while controlling or even lowering production costs. Thrive Market, which maintains a curated product catalog and operates at the intersection of an already-fragmented packaged food space and a production-cost-heavy organic food space, can especially continue benefiting from the exclusivity and marginal gains of private labels.

Consumer trends suggest continued upside for retailer-owned brands. In 2024, Costco’s private label items made up 33% of its sales, up from 28% in 2022. 60% of retailers indicated in 2023 that they predicted the most growth in private label products with “better for you” ingredients and catering to gluten-free diets. Thrive Market is already positioned as a key player in health-conscious products and presumably has years of data on customer buying habits, making it well-equipped to create private-label products that resonate with consumers.

A key risk with increasing private label offerings is category overextension, or releasing so many discordant products that they dilute or diminish consumers’ perception of brand value. However, Thrive Market maintains that its private label items are meant to fill in product gaps for which its users are already searching, and that the company does not intend to have a majority of its catalog comprise its own brand. It has also turned down offers from other retailers to carry its private label items, maintaining brand exclusivity.

Omnichannel

In 2024, 65% of omnichannel shoppers reported higher satisfaction than their brick and mortar-only counterparts, and the top three US grocers by revenue all employed an omnichannel strategy that allowed customers to buy in-store or place orders online: (1) Walmart, with $528 billion in revenue, (2) Costco, with $184 billion in revenue, and (3) Kroger, with $150 billion in revenue. All three top retailers also competed with Thrive Market in at least one other category in 2024: (1) Walmart produced six out of seven of the highest-penetrating household product private label brands, (2) Costco was the largest US organic food retailer at $6 billion in sales, 34% of which were from its private label brand, Kirkland Signature, and (3) Kroger sold its own organic private label brand, Simple Truth, which achieved $2 billion in annual sales by 2017.

The success of omnichannel for traditional retail grocery indicates the viability of maintaining multiple distribution channels. While Thrive Market CEO Nick Green has noted the risks associated with brick-and-mortar grocery stores, including real estate headwinds, increased CapEx, and the need for population density, consumer inclination toward omnichannel shopping might prompt Thrive Market to reconsider a foray into physical retail. Doing so would also allow Thrive Market to expand its categories into organic produce and perishable foods, which account for around half of a typical grocery order. As of April 2025, Thrive Market began shipping refrigerated items and fresh produce to a “small group of Thrive Market members.” Establishing physical retail locations could allow Thrive Market to bypass the expensive process of storing and shipping perishables from fulfillment centers and offer them to even more customers.

International Expansion

As of January 2025, Costco was the largest retailer of organic food in the US and operated 897 locations worldwide. The vast majority, 617 warehouses, were in the US and Puerto Rico. Canada and Mexico immediately followed, with 109 and 41 warehouses, respectively. As of 2023, North America held a 51% share of the organic packaged food market worldwide. Thrive Market could consider expanding operations across North America, at least to Canada and Mexico, to capture more of these consumers.

Behind North America in market share for the organic packaged food market were Europe, with 21%, and the Asia-Pacific (APAC) region, with 18%. While North America holds the majority of the global market share, Europe and APAC both present growth opportunities should Thrive Market expand internationally. Packaged goods, which make up the majority of Thrive Market’s product offerings, are a particularly suitable foray into international markets given their lower operational costs to store and ship compared to perishable ones.

Key Risks

Challenging Unit Economics in Online Grocery

Online grocery has challenging unit economics: order picking, packaging, and last-mile delivery add meaningful costs, so profitability tends to depend on high basket sizes, dense order volumes, and scale. Instacart, one of the largest competitors in this space, only reached consistent profitability in 2022, in part due to its higher-margin advertising businesses. Replicating this type of advertising may be difficult for a membership-based, curated retailer with high-quality standards like Thrive Market. Thrive Market also mitigates shipping costs with relatively high free-shipping minimums and higher thresholds in specific categories, which supports average order value. But this model discourages smaller, more frequent purchases and limits Thrive Market’s appeal relative to on-demand marketplaces like Instacart.

Market Saturation

Thrive Market’s biggest competitors in the organic food space continue to be traditional retailers. Many are increasing their investments in and market share of organic foods, which inherently challenges Thrive Market. For example, Costco, the largest retailer of organic food since 2015, also employs a membership business model and purchases stock in bulk to sell to customers at lower prices. Costco has increased its organic investments vertically, establishing partnerships with organic growers to scale farming operations and further decrease prices. 65% of frequent organic shoppers demonstrate cost sensitivity when making purchases, and competing low prices may entice Thrive Market’s customers to purchase elsewhere.

While traditional retailers are constrained to certain geographies and thus do not have the nationwide addressable market of ecommerce platforms like Thrive Market, they certainly pose a risk in markets with physical grocery presence. And with the continued growth of grocery delivery services like Instacart, traditional retailers can expand their geographic reach, posing an additional risk to Thrive Market’s market share.

Summary

Consumers are showing increasing interest in organic and sustainable grocery options. Thrive Market has built a business delivering the organic groceries American consumers want at a more affordable price point than traditional retailers. Thrive Market’s high-quality standards and emphasis on social impact have helped it grow to over 1.6 million paying members as of March 2025. However, the company faces growing competition from brick-and-mortar retailers, which are doubling down on organic grocery investments, and other online platforms that deliver organic and sustainable groceries and are increasing their market presence.