Thesis

35% of the top 150 companies in the S&P 500 have a Chief Procurement Officer in their leadership team, and these companies outperformed the market by 134% between 2000 and 2020. Companies face myriad crises in the modern world; sanctions, pandemics, natural disasters, and war. Such crises often result in increased prices, lack of materials, and delayed deliveries. Leaders focusing on procurement and suppliers can realize lower costs, stronger resilience, higher quality innovations, and improved sustainability, giving them the upper hand over their competitors. The digitization of procurement led to the creation of a first wave of procurement giants like Ariba, created in 1996 and sold to SAP in 2012 for $4.3 billion or Coupa, created in 2006 and sold to Thoma Bravo in 2023 for $8 billion.

In the last decade, procurement has evolved. It has become more decentralized with employees actively picking the products or services they want to use and with the rise of remote work. It is also shifting from basic supply management and overseeing transactional activity to more holistic participation within the business. Legacy procurement platforms are struggling to adapt to this new paradigm. They were typically purpose-built for procurement teams and have a low adoption rate by employees and other stakeholders involved in procurement decisions. Chief Procurement Officers have three main priorities for 2023: mitigating the effects of inflation, adopting new procurement technologies, and delivering bottom-line savings. The global procurement software market is expected to grow from $6.7 billion in 2022 to $13.8 billion by 2029.

Zip provides a platform for the end-to-end procurement lifecycle, covering new purchase order management, accounts payable (AP) automation, and global B2B payments. Zip makes it easy for employees to request purchases and provides visual workflows for approvals across finance, legal, procurement, IT, and security teams. It hopes to help employees at organizations avoid jumping through hoops or navigating confusing processes when buying the software, services, or products they need to do their jobs.

Founding Story

Rujul Zaparde (CEO) and Lu Cheng (CTO) co-founded Zip in 2020. Prior to founding Zip, Cheng spent six years at Airbnb and had been the head of engineering of Airbnb’s Experiences business. In 2012, Zaparde started his first company called FlightCar, a car rental platform. It allowed users to drive others’ cars while they were away on a trip and their cars remained un-utilized. After four years and raising $40 million from well-known venture funds, FlightCar shut down its operations and sold the technology to Mercedes-Benz in 2016.

After this experience, Zaparde transitioned to product management at Airbnb, where he met Cheng. Zaparde and Cheng left Airbnb in 2019 and 2020, respectively, with the idea of starting a company but no idea of what issue to solve. After over 100 calls to experts in the course of two weeks of brainstorming, they decided to start a company in procurement. As Zaparde stated in a 2022 interview:

“Lu and I had both experienced firsthand the disjointed and complex process that is required for employees to purchase software. Employees often wonder not only how to begin the process, but how to secure all of the proper approvals—just to purchase technology and services needed to do their jobs. This left us wondering, ‘What is the best way to seamlessly secure approvals across finance, legal, IT, security and risk teams for a purchase request?’ At the time, there was no obvious place to begin this process, nor an easily accessible way to see a purchase request through to approval.”

Zaparde and Cheng participated in YC’s Summer 2020 cohort. Zip began with a product that managed the procurement process from initial purchase requests to vendor contract approval.

Product

Intake-to-Procure

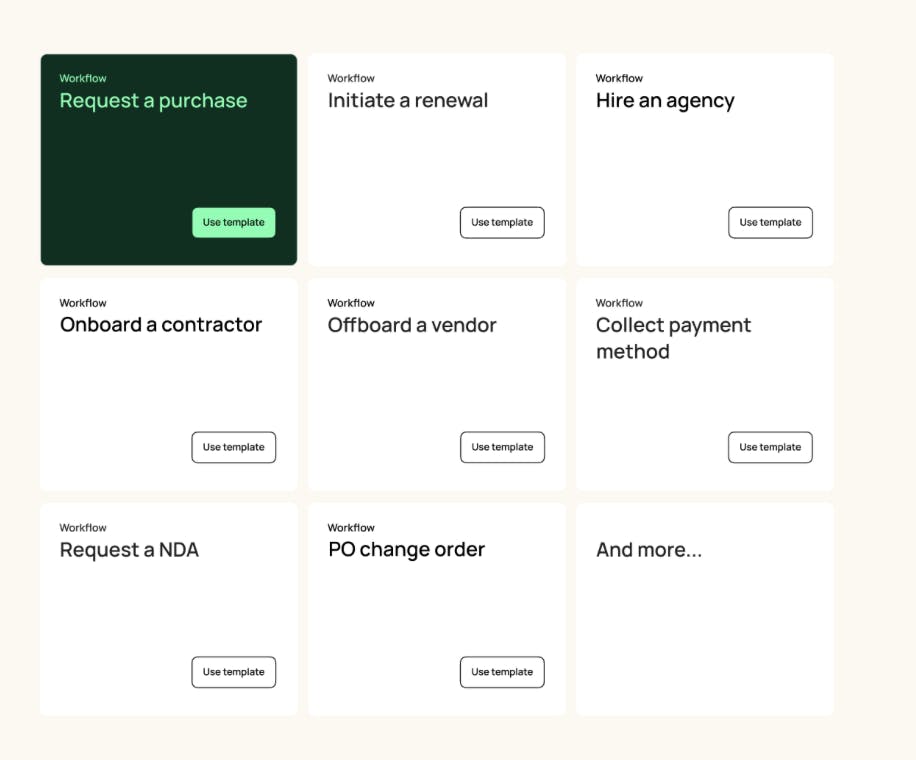

Intake: Employees can use a Typeform-like experience in which they answer different questions to start a purchase request. In the process, employees can double-check if they are making a request for a product or service already used by the organization and can add a new vendor to the Enterprise Resource Planning (ERP) or Procure-to-Pay (P2P) platform if needed. Zip also provides configurable pre-built templates.

Source: Zip

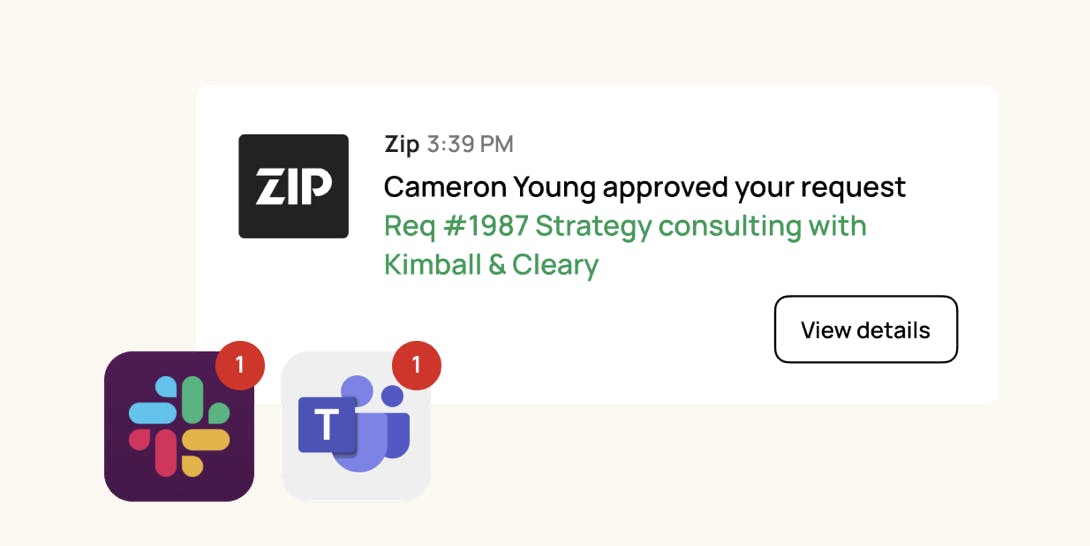

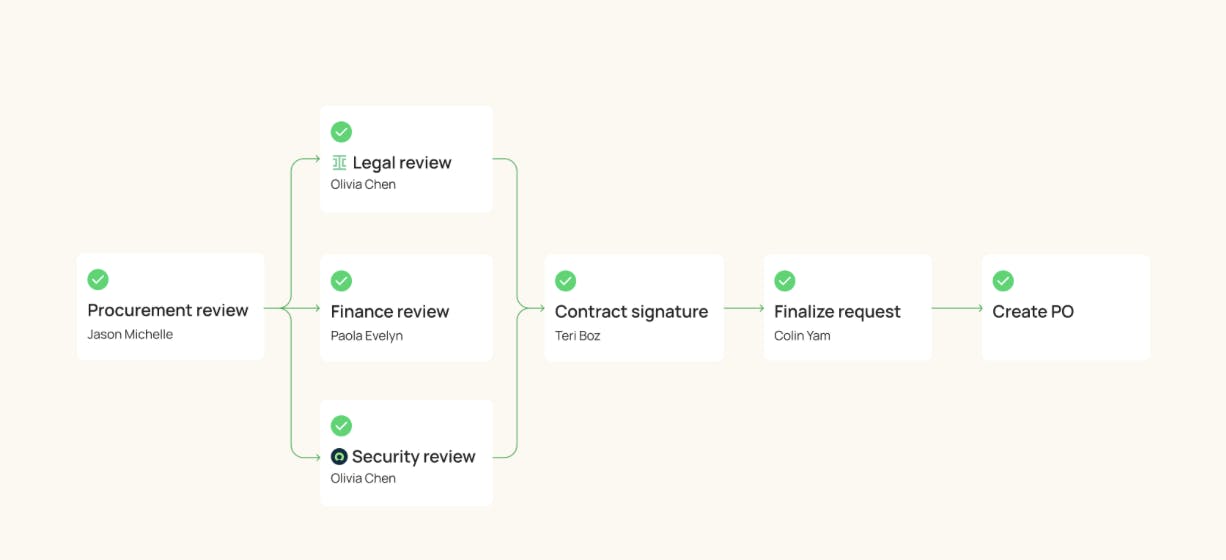

Approval Workflows: Zip offers workflows for purchase requests, contractor onboarding, and NDA signatures. Once employees submit their requests, Zip notifies them about any updates. Zip connects to all major ERPs and handles custom fields and updates with no-code integration admin.

Source: Zip

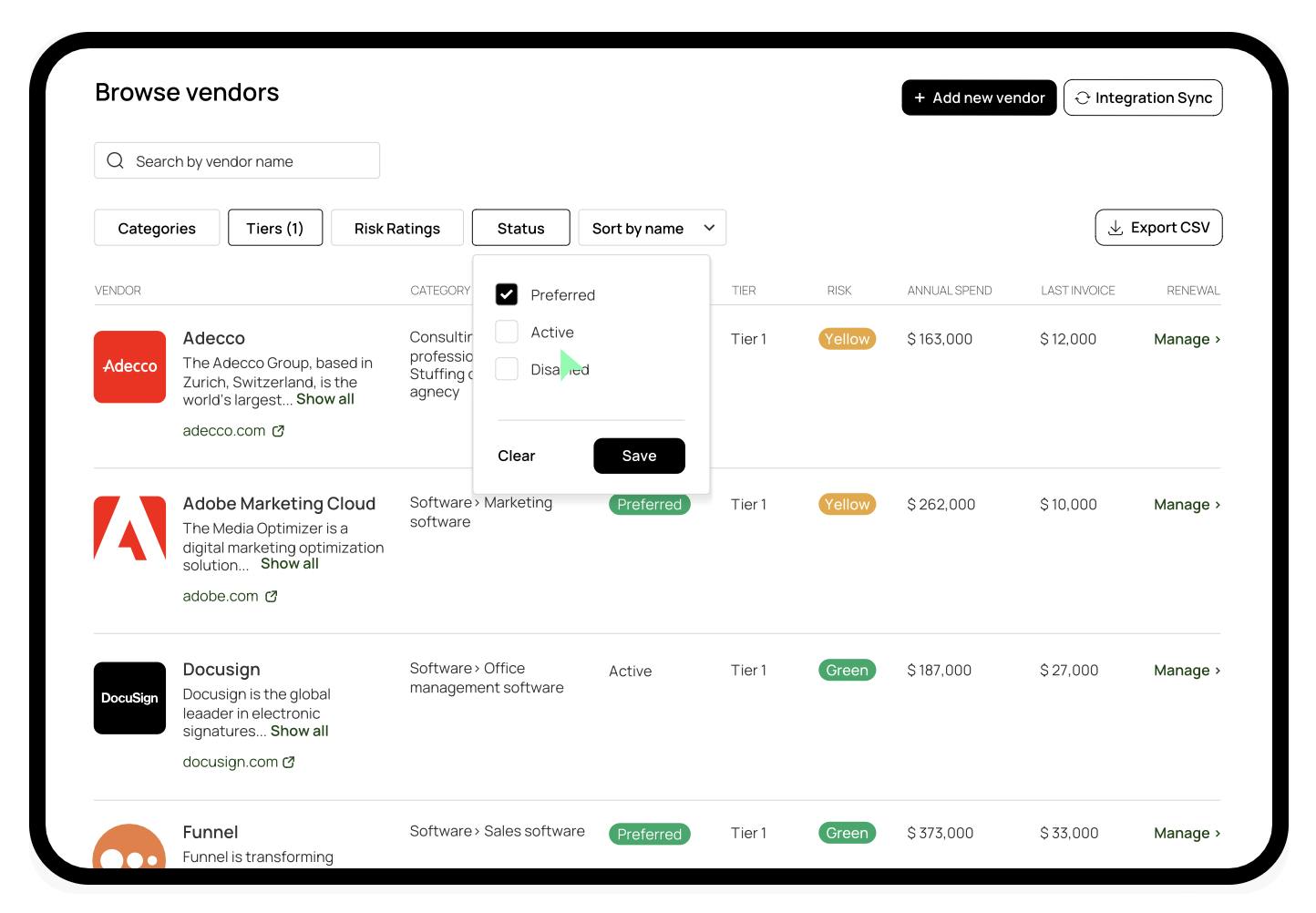

Vendor Management: Zip allows users to manage all vendor data in one system, including business information, documents, contracts, assessments, risk scores, payment methods, and vendor spending data. Users can also collect business information, contracts and documents, tax IDs, and payment details through the vendor portal.

Source: Zip

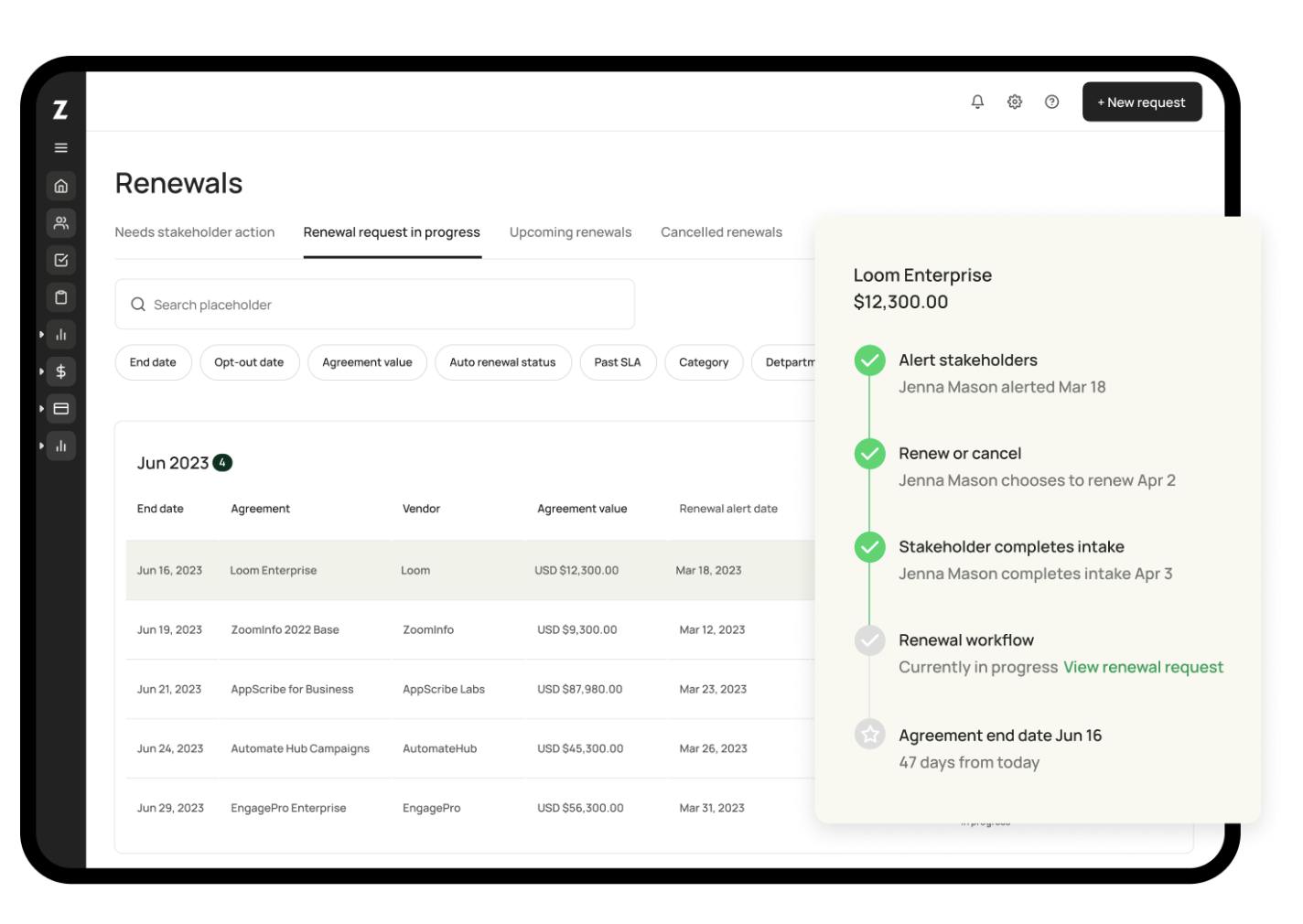

Renewal Management: Zip gives early warnings before any renewal so that users know when to start preparing for negotiation and who to loop in so everyone can contribute. It also allows for collecting performance and sentiment data needed to evaluate a renewal.

Source: Zip

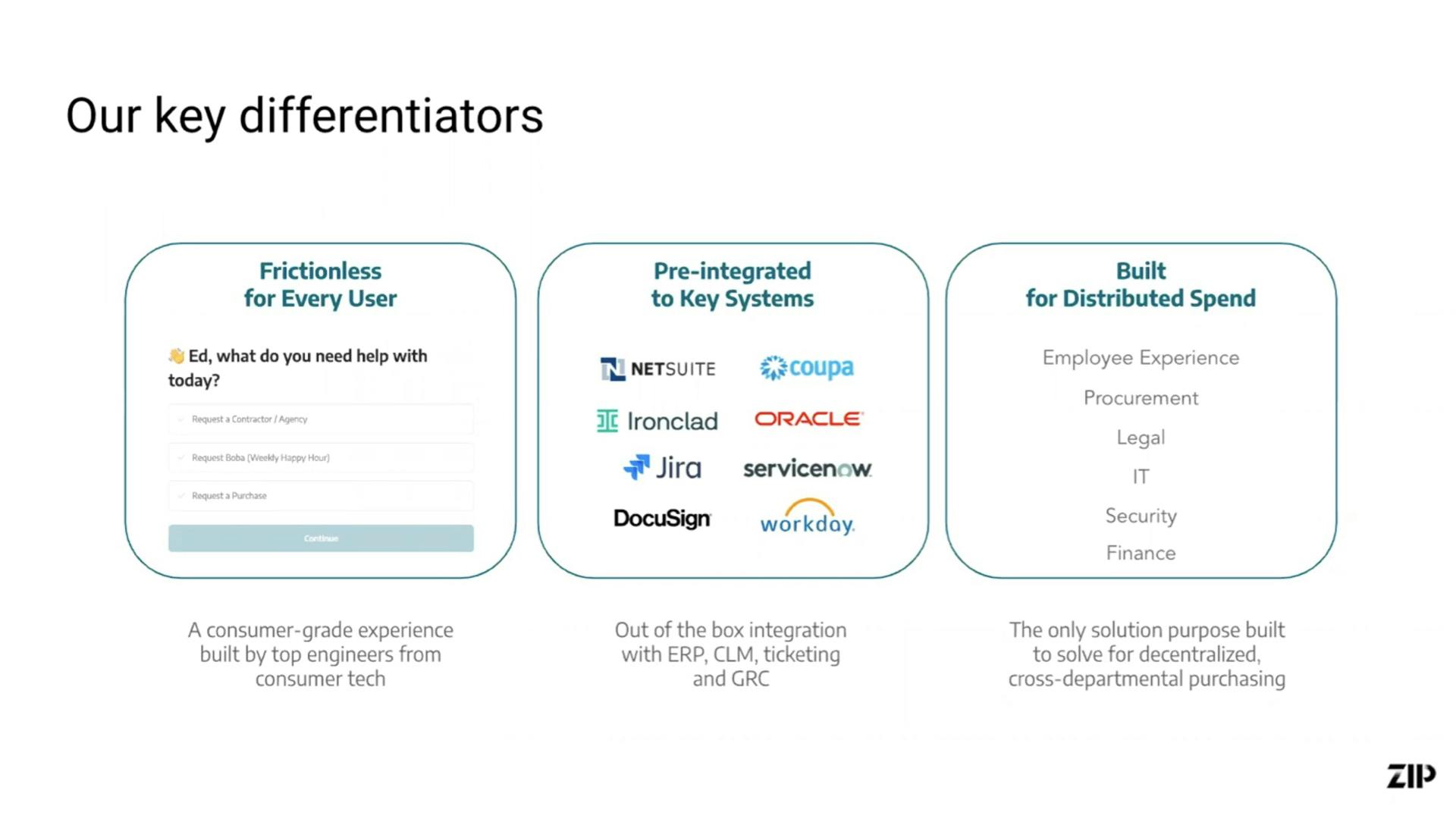

Integrations: Zip is integrated with ERP systems. This prevents duplicate data entry and creates financial visibility. Zip automatically logs the transaction and supplier information in customers’ ERP using data gathered during intake. Zip also connects with contract lifecycle management, governance, risk, and compliance, and IT service management tools, allowing approvers to work in their system of choice. With its UI and pre-built API calls, Zip enables non-technical team members to build and maintain integrations with any external system.

Source: Zip

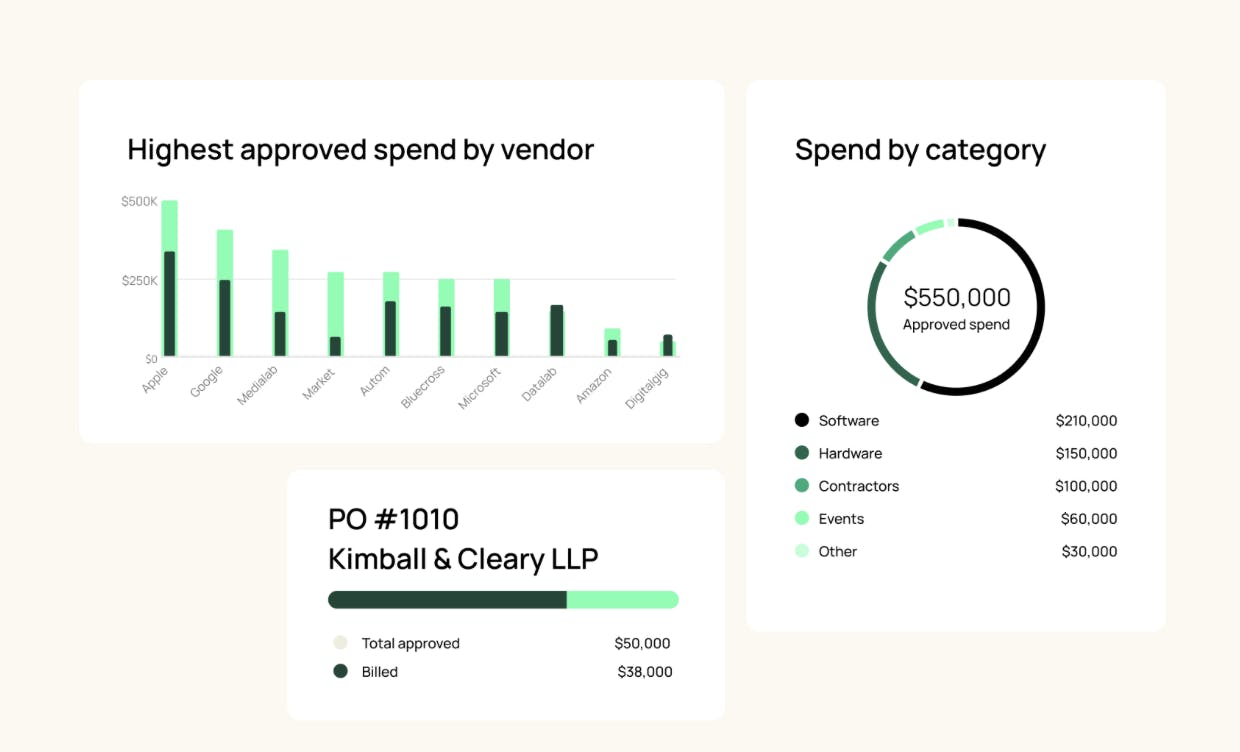

Spend Insights and Analytics: Zip allows users to track requests, purchase orders, and invoices to analyze spending volume and frequency. Users can create as many cuts as they want by department, category, vendor, or general ledger account, monitor service level agreements across all approvers, and optimize the purchase and accounts payable (AP) process.

Source: Zip

Intake-to-Pay

PO Management: A purchase order is automatically created and sent to the vendor at the end of the requisition process. Users can configure conditions to ensure the right data is captured at the beginning, down to line-item details. This allows the data to flow downstream from request to payment and brings business users along for visibility.

Source: Zip

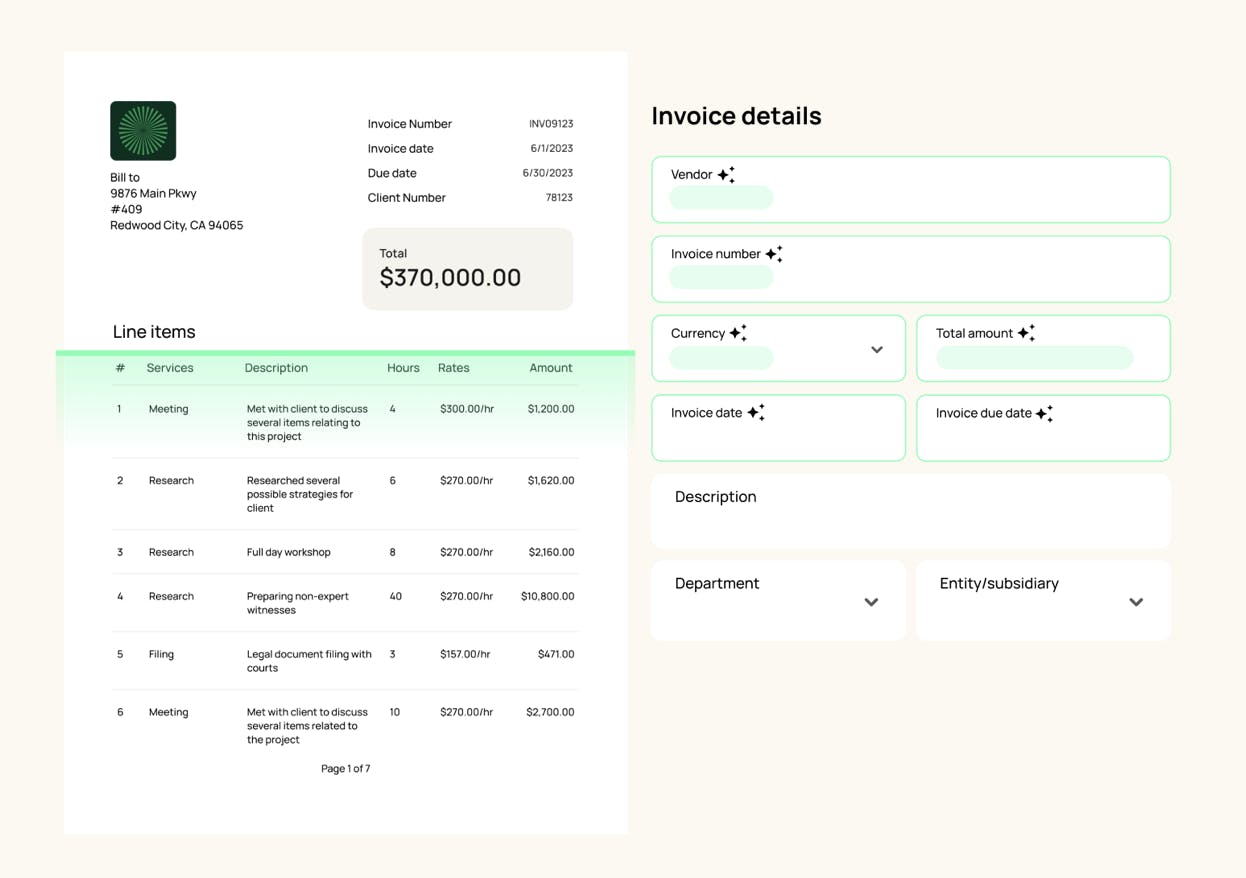

AP Automation: Zip enables any employee to submit a request while capturing all of the accounting and payment data the AP team needs. Zip extracts invoice data and removes manual data entry and coding for AP teams. This keeps approvals moving and reduces cycle times for all employees, including the AP team. Users can comment on invoices and tag stakeholders to ensure everyone has the context and necessary visibility.

Source: Zip

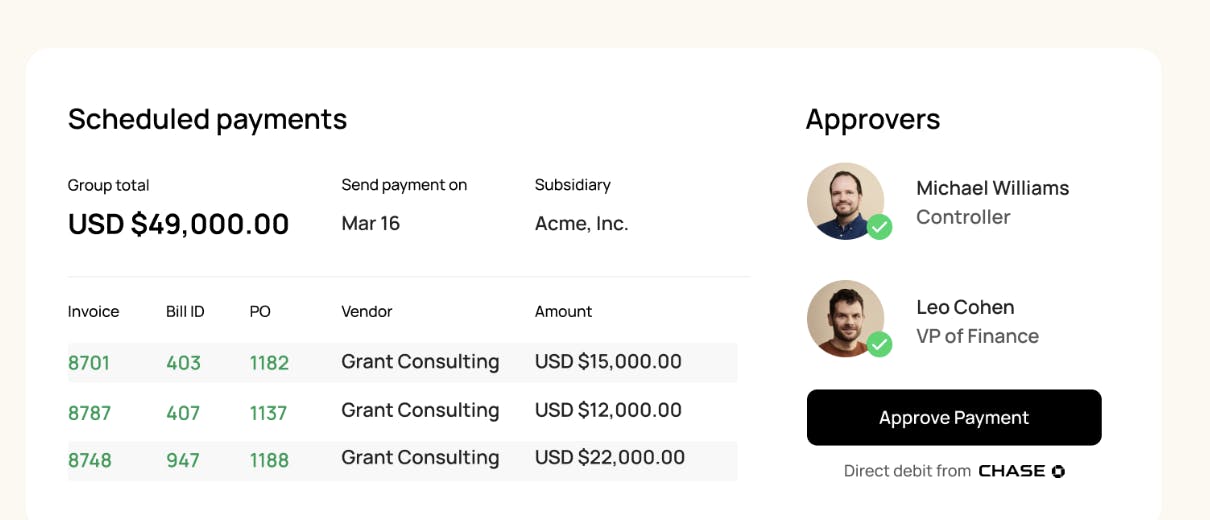

Global Payments: Once the vendor’s invoice is received, customers can pay the vendor directly within Zip using multiple payment methods. Zip reduces manual processing delays and allows companies to pay vendors in 140+ countries and 40+ currencies. It helps prepare payment runs for approval and automatically loops in payment batch approvers based on subsidiary and amount. It funds payment runs with a direct debit connection to the company’s bank. Zip also seeks to reduce fraud with payment method approval workflows and multi-factor authentication. It also posts the relevant funding and transaction records to ERP systems.

Source: Zip

Market

Customer

Zip goes after startups, mid-market, and enterprise customers. Its customers include Webflow, Notion, Snowflake, Coinbase, Zapier, Betterment, Airtable, Toast, and Canva. It is used by finance, IT, legal and procurement teams.

For companies starting to think about procurement to streamline their business spending, Zip helps design and implement procurement procedures without having to implement an extensive procure-to-pay platform which is expensive and long to set up. At this stage, companies typically don’t have or have just recruited a chief procurement officer, don’t have a P2P platform like Coupa or SAP Ariba, and have an ERP like Netsuite. For enterprises with procurement teams using a P2P platform or the procurement module of their ERP, Zip helps solve the employees’ adoption issue by providing a front door sitting on top of the enterprise’s procurement software.

Market Size

The global procurement software market was worth $6.7 billion in 2022 and was forecasted to reach $13.8 billion by 2027, growing at a 10.9% CAGR.

The growth of the procurement market is driven by several factors, including the shift towards cloud-based solutions, the rising adoption of procurement software by SMBs, and the increasing need for organizations to streamline their procurement process, especially in a down market.

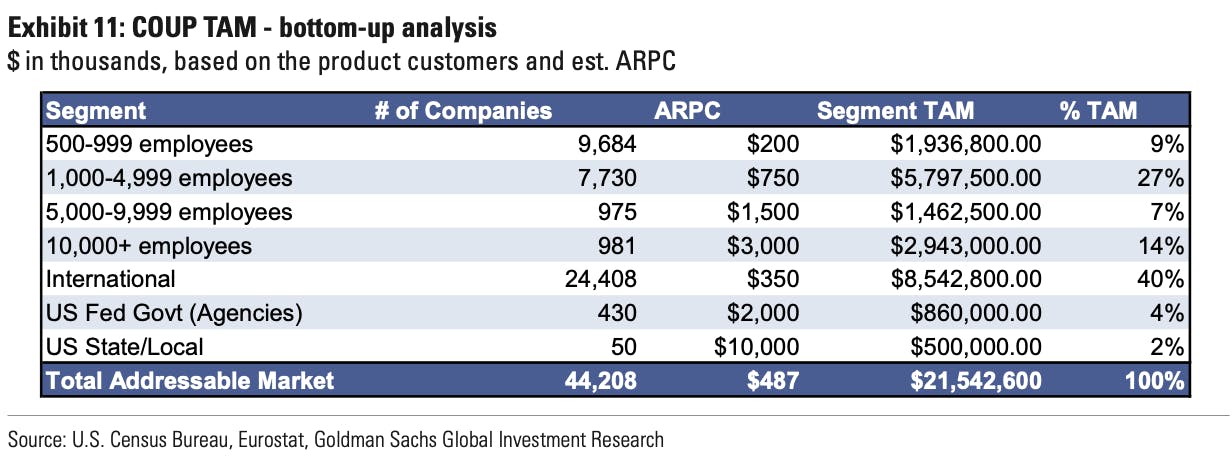

For comparison, Zip competitor Coupa can address 44K mid-market and enterprise companies, including 20K in the United States. An ACV of around $500K implies a $22 billion addressable market for Coupa. Zip is going after the same categories of companies as Coupa but does not have the same ACV potential and is focused only on procurement, while Coupa also does supply chain planning and travel and expense. Procurement is one-third of Coupa’s total addressable market, implying that Zip is going after a $6.3 billion market.

Source: Goldman Sachs

Competition

Zip used to compete with the requisition module from top procurement platforms and with in-house solutions to manage requisitions with its initial intake-to-procure offering. But, with the intake-to-pay offering launched in May 2023, Zip wants to become an end-to-end platform covering the entire procurement cycle. Since that time, it competes with category leaders in the procurement software market include players like SAP Ariba, Coupa, and Procurify. These solutions are comprehensive procurement platforms managing the end-to-end procurement workflow (request, procure, receive, and pay for goods and services).

Some organizations have built in-house systems to manage procurement requests either by coding a solution (e.g., Facebook built an in-house requisition tool according to one Zip customer) or by tweaking existing solutions which are not designed for procurement (e.g., Jira’s ticketing system). These in-house systems don’t work at scale. They don’t integrate with the tools used by all the teams involved in procurement decisions and don’t automate enough to generate time savings for stakeholders (e.g. avoiding double entries).

That said, three of ZIp’s principle direct competitors include SAP Ariba, Coupa, and Procurify.

Source: Zip

SAP Ariba: SAP Ariba is an SAP subsidiary. SAP acquired Ariba in 2012 for $4.3 billion. It’s a full Procure-to-Pay (P2P) platform. It’s a solution built particularly for enterprise customers and for customers who are already in the SAP ecosystem. Like Zip, SAP Ariba helps companies streamline purchasing, manage supplier relationships, automate invoice processing, and optimize spending. SAP Ariba also has a global network of suppliers, which are natively integrated into SAP. SAP Ariba has several drawbacks compared to Zip: it does not integrate into other ERPs than SAP, it can be a complex solution to use, it’s expensive, especially for mid-market companies, and it has long implementation cycles.

Coupa: Coupa is a US-based company that started in 2006. It's a business spend management platform to manage indirect spending with four main modules: travel & expense management, procurement management, AP management, and payments. It became public in 2016 before being acquired in December 2022 by Thoma Bravo for $8 billion. At the time, it had $811 million in revenue and 1.6K customers with a typical ACV of $100K. Compared to SAP, Coupa is easier to use and can be integrated into multiple ERPs. Like SAP, Coupa is also an expensive solution and takes a long time to be implemented. Zip is designed for high-growth companies. Coupa is more relevant to upper mid-market and enterprise businesses with the resources to implement a legacy procure-to-pay solution. While both Couple and Zip offer purchase order management, AP automation, and supplier onboarding, Zip claims to license its offering to encourage any employee in an organization to have access without training.

Procurify: Procurify is another procure-to-pay company founded in 2012. It has raised $32 million in total funding. Like Zip, it covers purchase order management, accounts payable automation, approvals, analytics, and integrations. However, it is a broader spend management platform offering virtual and physical cards to customers’ employees.

Business Model

Zip has a SaaS business model. It does not offer free trials or disclose any pricing information on its website. According to a customer interviewed on Tegus, Zip has an annual list price of $250K.

Traction

In December 2022, Zip disclosed that it had 175+ customers in 60 countries and helped customers save $673 million and onboard 40K new vendors. In May 2023, it said nearly $1 billion per month was approved in Zip, and $937 million in total was saved on the platform. It has hundreds of customers globally, including Snowflake, Coinbase, Northwestern Mutual, and Databricks.

Valuation

In May 2023, Zip announced its $100 million Series C funding round at a $1.5 billion post-money valuation, with investment from Y Combinator, CRV, and Tiger Global. In December 2022, Zip was valued at a $1.2 billion valuation after a $43 million Series B led by YC Continuity with the participation of Tiger and CRV.

Zip’s valuation can be compared with precedent transactions in the sectors, including Thoma Bravo’s acquisition of Coupa in December 2022 for $8 billion done at an 8.4x revenue multiple, and SAP’s acquisition of Ariba in May 2012 for $4.3 billion done at a 9.7x revenue multiple.

Key Opportunities

Procure to Pay Platform

With the intake-to-pay offering launched in May 2023, Zip wants to become an end-to-end platform covering the entire procurement cycle. Historically, most customers used Zip as a front door to manage procurement requests sitting on top of an ERP like Netsuite or a P2P solution like Coupa. ERPs and P2P solutions were built for finance teams and have had poor intake/requisition modules resulting in low-level employee adoption. By contrast, Zip is used across the organization for employees to make procurement requests and across different functions to process procurement requests (finance, IT, security, procurement, etc.). With its product evolution, it has a unique opportunity to go after incumbents with a P2P platform integrated with its intake-to-procure solution.

Marketplace of Suppliers

At scale, Zip’s customers will have many overlapping suppliers. This creates an opportunity for Zip to pull its customers to have the bargaining power to negotiate better rates for its customers from suppliers. For instance, an adjacent player called Vendr, which focused only on SaaS purchases, started as a buying platform before expanding into expense management and procurement.

Key Risks

Competition

Zip found an unsolved need to handle the requisition process in a more automated and user-friendly way for all the stakeholders involved in the procurement process. It had a first-mover advantage enabling the company to ride a market momentum. Nonetheless, in the medium term, Zip will have to compete on this product with alternatives launched by incumbents and new companies launching copycats. With procure-to-pay evolution, it seems Zip has recognized this and decided to cover the full procurement lifecycle. That being said, it will need to keep innovating on the product experience to stay ahead of the competition from new entrants and incumbents.

Customer Base Expansion

Zip serves customers mostly in the tech sector (e.g. Canva, Snowflake, Coinbase, Databricks, Toast). Zip likely needs to expand beyond the tech sector to continue to see traction. Product-wise, this implies building more integrations to support more diverse tech stacks and to have enterprise-grade features. Distribution-wise, it implies offering more support on integrations with a professional services team and with a network of IT integrators.

Summary

Zip is an intake to procure a solution that aims to streamline the requisition process. It enables employees to be autonomous in making and follow a purchase request throughout the different approval steps involving multiple stakeholders in the organization (procurement, IT, legal, and management). It frees time for procurement teams which used to manage purchase requests manually. Moreover, Zip is integrated into the tool stack of its customers facilitating general adoption. A key question moving forward is whether Zip will be able to evolve into a full Procure-to-Pay platform competing head-to-head with incumbent procurement platforms such as SAP Ariba or Coupa.