Thesis

With the fall of the Soviet Union in 1991, the United States lost its main competitor in space. This enabled the Department of Defense (DoD) to operate space-based assets without any foreign rivals until 2007, when the Chinese successfully tested a surface-launched anti-satellite missile (ASAT). Despite this emerging threat of a peer competitor in space, the majority of the DoD’s focus at the time remained centered on counterinsurgency operations in the Middle East. These insurgent forces operated without established air forces, let alone spacecraft or ASATs that could challenge American satellites.

Later, in the 2010s, as the fragility of space-based systems became more apparent, doctrine and policy began to shift. By 2019, NATO officially acknowledged space as a war-fighting domain. Just months later, the United States Space Force was established in December 2019. Space assets from the Air Force were transferred into the Space Force’s hands, enabling the funding of space programs for the sake of DoD development in the new domain rather than for the support of air and ground operations.

Military Reliance on Space

For modern military operations to function smoothly, a multitude of satellite constellations must operate without fail. Positioning, navigation, and timing (PNT), intelligence, surveillance, and reconnaissance (ISR), and communications all rely heavily on orbital vehicles.

Satellites for PNT enable services like GPS and worldwide synchronized timing with nanosecond-level precision. ISR satellites collect critical data that informs personnel movements in real time. Communications satellites like the Wideband Global SATCOM (WGS) satellites link American forces around the world with instant communication, regardless of mountainous terrain or a lack of ground-based infrastructure. Without the constellations of satellites that enable these systems, the DoD would not be able to function as it does.

Apart from the direct support of tactical ground and air operations, Space Force satellites play critical roles in many other DoD operational capabilities. Space Based Infrafred System (SBIRS) satellites play a crucial role in early missile launch detection and warning. Thanks to SBIRS, the DoD can detect and locate instances like nuclear missile launches anywhere on Earth within seconds.

While the capabilities of these satellites are impressive, they all have little to no maneuverability. In fact, they were designed to be set in one specific orbit and remain there for the duration of their lives. The predictability of their paths and inability to change course make Space Force satellites extremely vulnerable to attacks from both ASATs and other satellites. Due to this deeply-rooted reliance on space-based assets, the protection of satellites and complete control of the space domain are imperative to the DoD’s mission.

From Air to Space Superiority

In the early 1900s, when the plane was still a novel technology, few variations existed, and little to no military doctrine explored their usage. As the technology developed, different models of planes became increasingly specialized in different mission sets.

Aircraft designed for ground attack missions became larger and slower, carrying more fuel and munitions to deliver the greatest impact at the greatest distance. Other aircraft, designed for air-to-air engagements, became faster, smaller, and more agile. Pilots favored maneuverability to assist in achieving the most advantageous positioning in relation to enemy aircraft and their guns.

With these new specializations of aircraft came a new doctrine. During World War I, the early concepts of air superiority were realized. The idea was simple: to succeed in the air, an air force needed to first establish dominance with fighter aircraft and anti-aircraft guns so that only their own aircraft would be safe to fly in the skies. Without air superiority established, any attempt at delivering cargo or bombing objectives was futile at best. Enemy fighter planes could easily swoop in and down slow, large, lumbering cargo aircraft or bombers.

In the modern world, the ideas of air superiority have been translated into space-centric definitions, and the idea of space superiority has emerged. The United States Space Force defines space superiority as:

“A degree of control that allows forces to operate at a time and place of their choosing without prohibitive interference from space or counterspace threats, while also denying the same to an adversary.”

Simply put, it is the ability to be the sole operator of uncontested space-based assets. Just as the Air Force operates aircraft like the F-22 that were fielded for the sole purpose of establishing air superiority, the Space Force is moving towards adopting spacecraft designed for the space superiority mission.

True Anomaly and Space Superiority

While legacy space-based defense assets are primarily focused on the direct support of ground operations, True Anomaly develops spacecraft and supporting software for space superiority. True Anomaly’s satellites are designed to conduct space-to-space operations, targeting other satellites and defending the Space Force’s current constellations. As an alternative to expensive, non-maneuverable satellites produced in limited quantities, True Anomaly is designing low-cost, highly maneuverable satellites for inter-satellite operations, known as rendezvous and proximity operations (RPO).

Founding Story

True Anomaly was founded in August 2022 by Even Rogers (CEO), Daniel Brunski (former CTO), Kyle Zakrzewski (Chief Engineering Officer), and Tom Nichols (former COO, CPO, CMO) to build autonomous space systems for the mission of United States space superiority.

Born and raised in the aerospace powerhouse of Colorado Springs, CO, Rogers had always been drawn to space. As a child, he dreamed of becoming an astronaut, but, after graduating from Virginia Military Institute, Rogers chose to pursue higher education in the field of social sciences. After earning a master’s degree from the University of Chicago, his plans of continuing on to earn a Ph.D. were cut short upon realizing that he would be in his mid-thirties by the time he could work in industry. Following this realization, Rogers joined the Air Force in 2013 as an officer in the space operations field. Over the next decade, he served in a variety of roles throughout the Air Force, DARPA, and then the Space Force.

Like Rogers, each of True Anomaly’s three other cofounders has ten or more years of experience managing space-based defense assets for the United States. The four of them met while working for the Air Force’s 4th Space Operations Squadron. Through their experience managing Air Force and Space Force orbital assets, they recognized that the current defense industrial base wasn’t capable of supporting space superiority missions. In 2018, Rogers and Brunski unknowingly formed the thesis for True Anomaly. While working on a national security space program, they realized that space had become a contested domain, and actions must be taken to achieve and maintain space superiority. This led them to found True Anomaly.

However, not all four original co-founders remained with the company. Two years after the founding of True Anomaly, in August 2024, both Daniel Brunski and Tom Nichols left to cofound Citra Space Corporation, a company that performs space object characterization. In September 2025, Sarah Walter was hired as COO, fulfilling part of the void left by Nichols’s exit. Walter has accumulated 20 years of experience in the aerospace industry and served as VP of Engineering at York Space Systems before joining True Anomaly.

Product

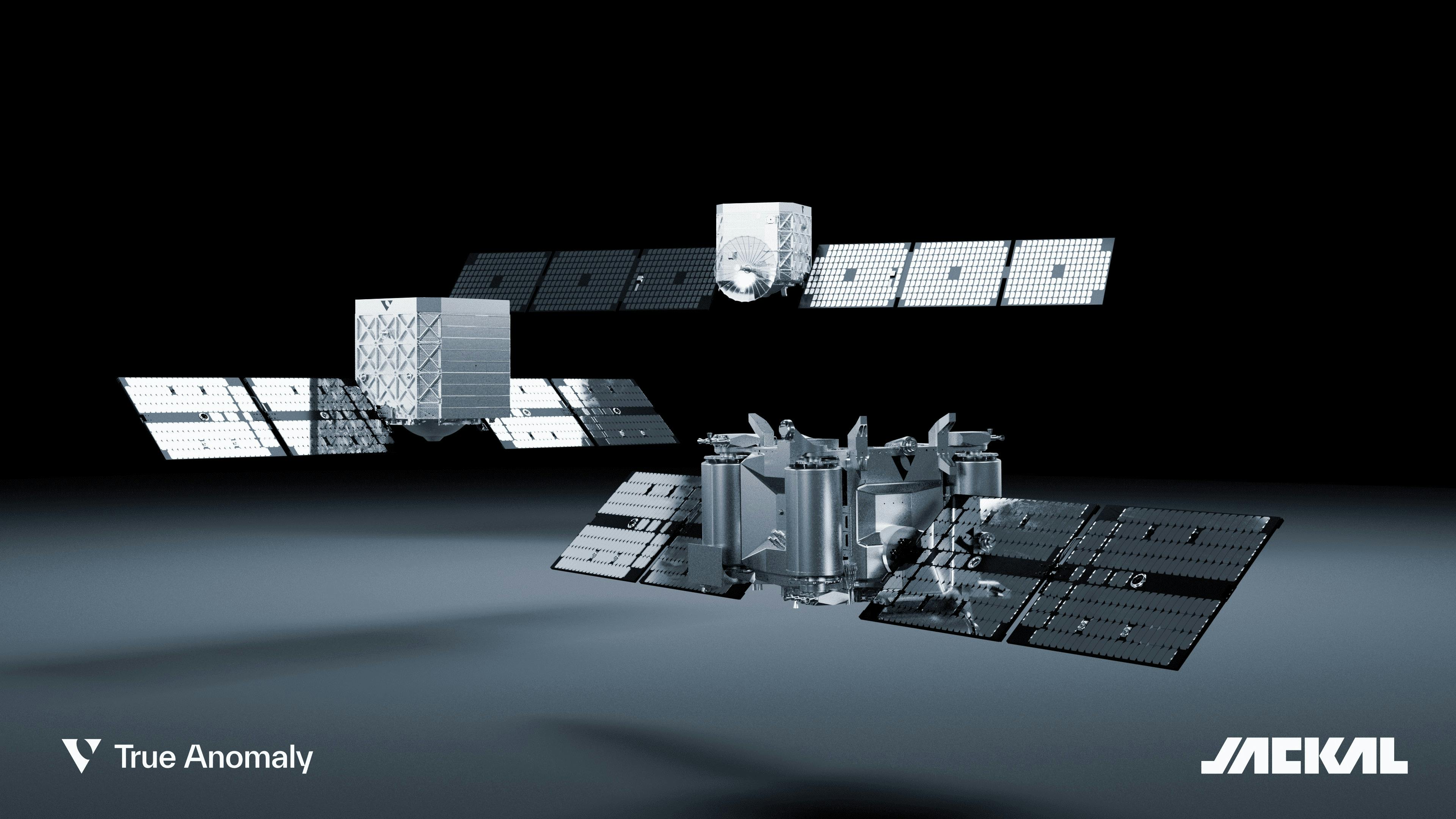

True Anomaly’s core product offering includes a line of highly maneuverable satellites, known as Jackal, which are enabled by its software platform, Mosaic. Jackal satellites are also referred to as “autonomous orbital vehicles” (AOVs). Together, these products are designed to support the mission of American space superiority by providing the DoD with the technology needed to protect and defend its space-based assets while denying the operation of adversarial space platforms.

Jackal

The Jackal is a highly maneuverable satellite, also described as an autonomous orbital vehicle (AOV), that acts as a mission-configurable payload truck for inter-satellite operations. With a main body comparable in size to a small refrigerator, Jackal is designed to be an economical option to accommodate a range of payloads that support the Space Force’s mission of achieving and maintaining space superiority.

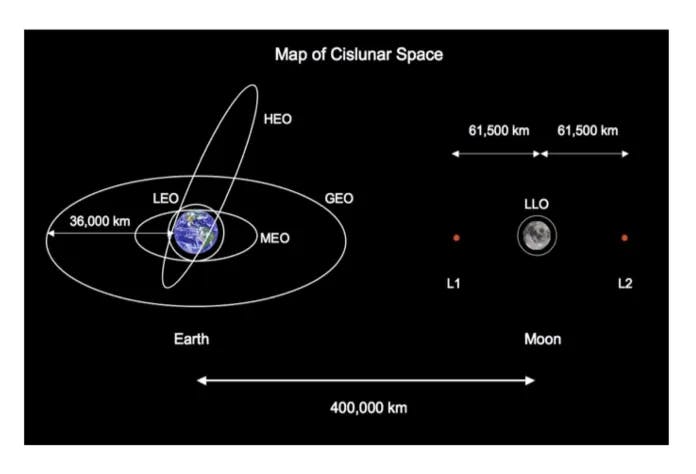

As of November 2025, there are three variations of the Jackal AOV designed for use in three different orbits: low Earth orbit (LEO), geosynchronous Earth orbit (GEO), and orbits in cislunar space.

Source: True Anomaly

LEO is characterized as any orbit between 160 and 2K kilometers above Earth’s surface. Satellites in GEO are much farther in space, with an altitude of 36K kilometers. This specific distance enables satellites in GEO to have an orbital period of exactly one Earth day, so the part of Earth they cover never changes. Cislunar space refers to any orbit past GEO that is still between Earth and its moon.

While all three variants share the same underlying design philosophy, many modifications to the power generation, communications, and radiation shielding systems are made to protect and enable the Jackal the farther it travels from Earth.

Source: NASA

Inter-satellite operations, known as rendezvous and proximity operations (RPO), involve altering a satellite’s orbit to maneuver within close distances or contact with other satellites. Orbital vehicles designed for RPO must have significant propulsion systems to successfully alter speed by hundreds of meters per second and precisely maneuver in close proximity to other satellites without colliding.

With 20 thrusters fueled from a single, large propellant tank, Jackal satellites offer a delta-V of 800 to 1K m/s, reflecting their role as RPO platforms. The delta-V measure of a satellite refers to the total velocity in meters per second that a satellite can gain or lose in any direction over its lifetime. This figure is fixed for an AOV like Jackal because of the finite supply of thruster propellant it is loaded with before launch. Delta-V is a critical metric used to compare RPO satellites because it effectively determines the number, speed, and extremity of RPOs a satellite can complete before it expends its total supply of propellant.

Jackal utilizes the Mosaic software suite in conjunction with Redwire cameras to enable its autonomous operations through advanced real-time tracking and sensor processing. This means RPOs that involve maneuvering around another satellite can be conducted with a higher degree of autonomy than what has traditionally been seen. As of December 2025, True Anomaly has launched two orbital missions involving three different Jackal AOVs. The RPO capabilities of the Jackal have not yet been demonstrated.

The maiden flight of the Jackal was conducted in March 2024. This operation is referred to as Mission X-1, the first in a testing series known as Mission X. For Mission X-1, two Jackal AOVs were carried to low Earth orbit by a SpaceX Falcon 9 rocket on the Transporter-10 Rideshare mission. The plan was for the two satellites to follow a sun-synchronous orbit for initial test and checkout procedures and the performance of a live RPO. However, True Anomaly’s mission control was unable to establish communications with the satellites, so the RPO demonstration was scrapped. The image below depicts Jackal with solar panels folded against the main body seconds after separation from the launching platform.

Source: True Anomaly

In December 2024, Mission X-2 launched. This time, a single Jackal was deployed from the SpaceX Bandwagon-2 Rideshare. The goal of X-2 was an envelope expansion for Jackal’s maneuverability, object characterization, and tracking functions, as well as the continuation of test and checkout procedures and Mosaic autonomous control. True Anomaly characterized Mission X-2 as a success, stating that the Jackal successfully deployed, transferred data with ground stations, and started the test and checkout procedures.

Jackal satellites are produced in True Anomaly’s GravityWorks production facilities. The main GravityWorks is located with the company headquarters in Centennial, CO, and a new, much larger GravityWorks in Long Beach, CA, was announced in early 2025. GravityWorks is designed for the scalable volume of production of Jackal and future products.

Mosaic

Designed to enable Jackal and all future True Anomaly AOVs, Mosaic is a full-stack software platform that ties all of True Anomaly’s products and services together to enhance its users’ space domain awareness. It offers satellite command and control features, virtual testing environments, and integrated AI to enhance AOV operations. Mosaic is written in the Elixir programming language for its low-latency, scalability, and fault tolerance. In April 2023, a partnership with Viasat and Microsoft Azure Space was announced to provide Mosaic with satellite management information through Viasat’s network of ground stations.

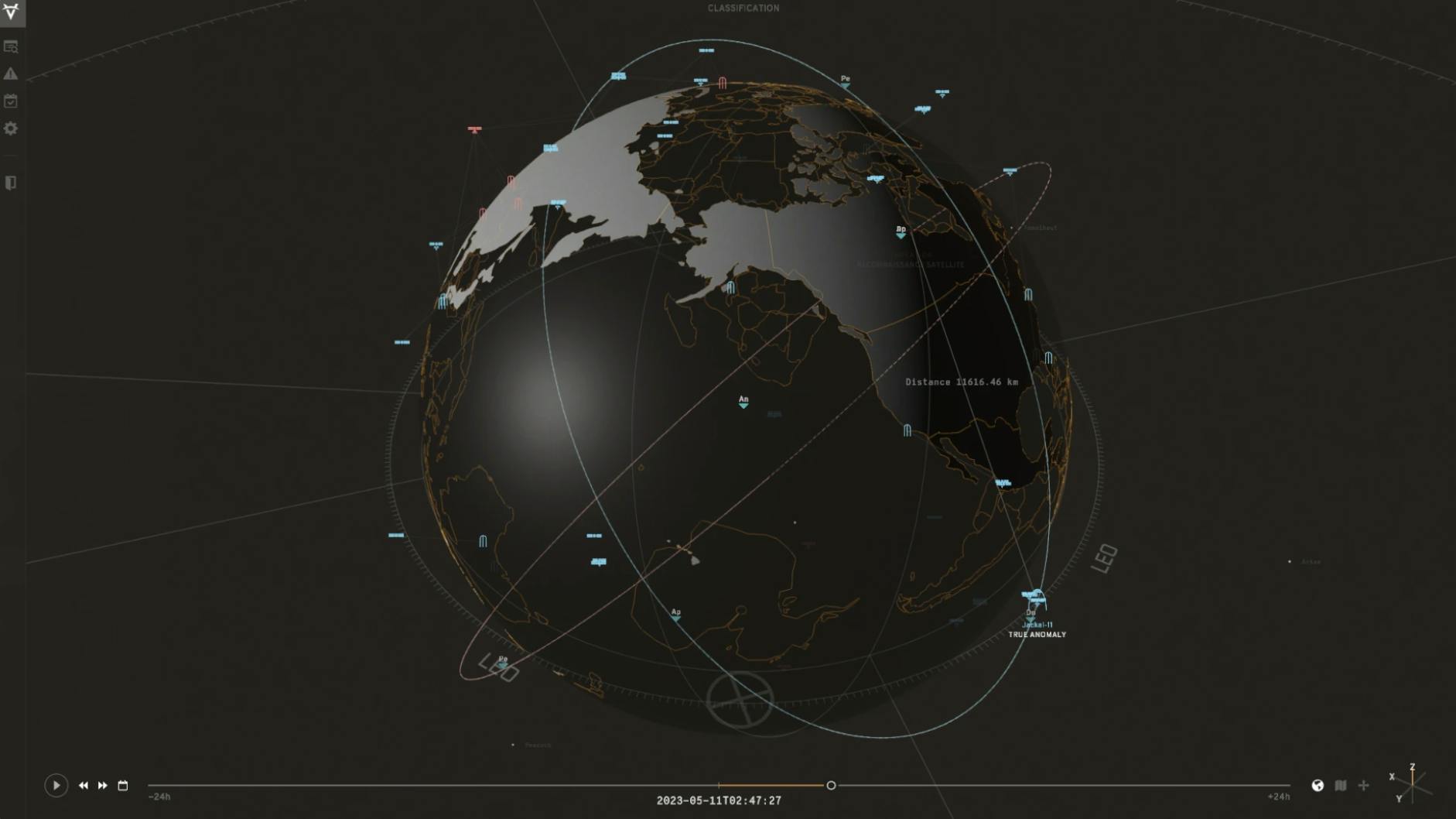

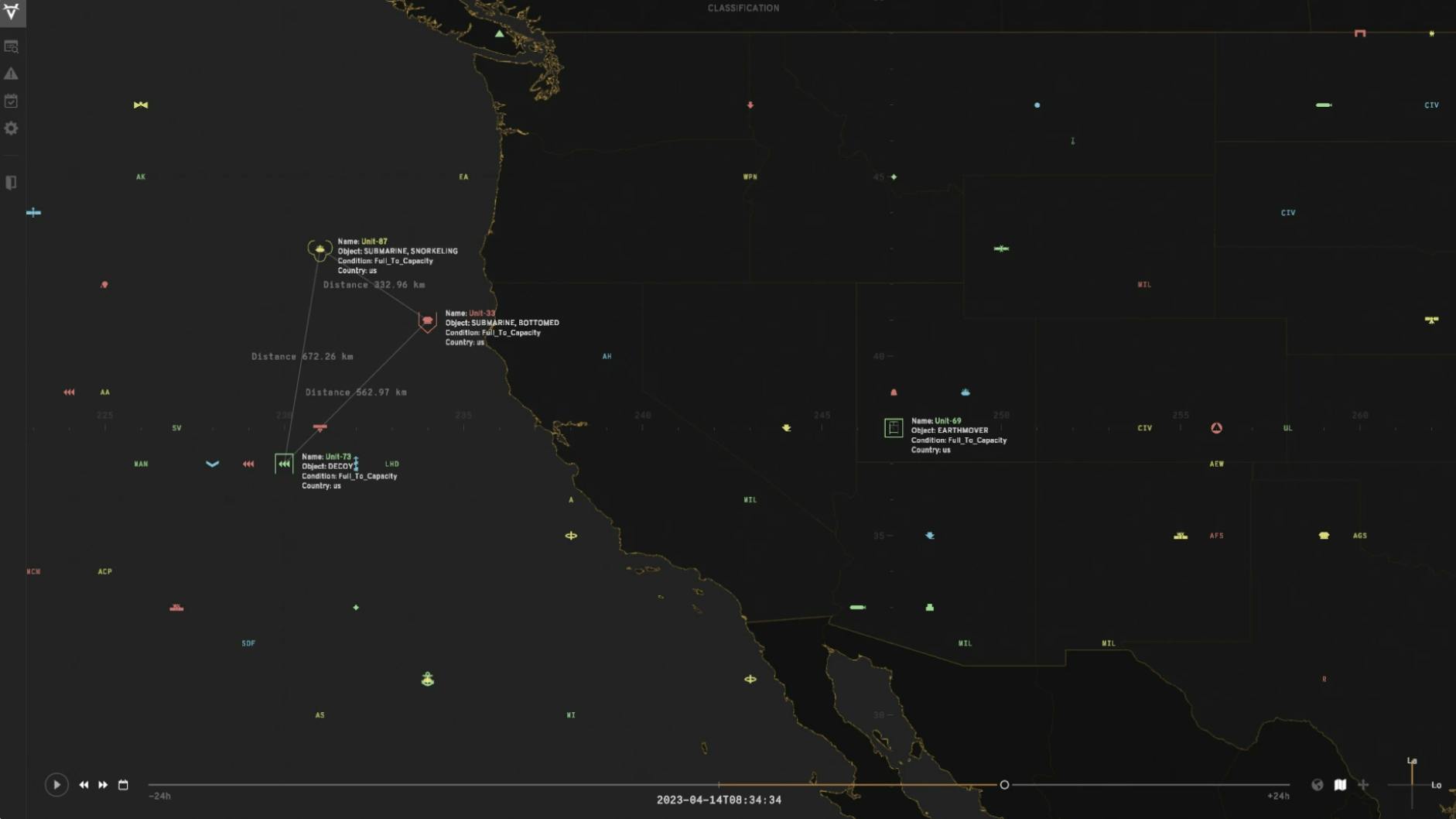

Space Operations Officers and Space Systems Operators, the Space Force personnel tasked with directly operating satellites, will likely be the primary end-users of Mosaic satellite command and control features like the battle management tool. This tool within Mosaic is used to enhance operators’ space domain awareness. Since Mosaic can take information from ground and space-based sensors, the battle management tool can provide viewers with a fuller context through intuitive visuals and data. It incorporates various AI tools for mission planning and tactical decision-making to free up more time for operators.

Source: True Anomaly

Another unique function of the Mosaic software suite is the digital range testing environment. This digital range serves as a platform to virtually simulate complex inter-satellite operations. This function saves time and increases the efficacy of ground testing, which in turn improves on-orbital operational success rates. The digital range can also be used to validate orbital vehicles in satellite engagements, simulating both red force and blue force satellites.

The ascension tool of Mosaic is designed to be a training aid for Space Force Guardians who operate satellites. It increases operator readiness by preparing them in multiplayer command and control simulations. This reduces training time and is intended to allow trainees to seamlessly transition to real operations with a similar user interface.

Source: True Anomaly

In addition to battle management, simulation, and training features, Mosaic is also capable of directly controlling AOV movements and operations. With human-machine teaming, Mosaic can reduce operator workload by controlling many of the functions of deployed AOVs while still serving as a method to manually control active orbital assets. Mosaic is also run on True Anomaly’s first satellite, Jackal. This enables sensor data obtained by the Jackal to be efficiently integrated, processed for the satellite to autonomously react, and presented to human operators.

Market

Customer

True Anomaly’s primary customer is the DoD, and more specifically, the United States Department of the Air Force within the DoD. The Department of the Air Force includes both the Air Force and Space Force, and within the two branches are several organizations that are interested in True Anomaly. SpaceWERX, the innovation arm of the Space Force, is especially welcoming to new players through programs like Tactically Responsive Space (TacRS). TacRS was introduced by SpaceWERX in 2023 to promote rapid, on-orbit-response capabilities in the Space Force. True Anomaly has been awarded several contracts under the TacRS mission titled VICTUS HAZE.

The Space Force stated in a 2024 report on commercial space strategy that it is accepting commercial support in nearly all mission areas, including space domain awareness, access, mobility, and logistics. True Anomaly’s focus on developing highly maneuverable AOVs for the mission of space superiority is directly in line with these mission areas. While CEO Even Rogers has expressed interest in possible foreign military sales, it remains unclear when this might happen.

Market Size

As of November 2025, the United Nations Office for Outer Space Affairs acknowledges 15.7K satellites in Earth orbit. SpaceX is the largest operator of these satellites, with over 8.7K belonging to the Starlink satellite internet constellation. While the number of satellites operated by the DoD is classified, a 2023 report from the Union of Concerned Scientists estimated 413 United States military and government satellites. Considering that the total number of Earth’s satellites has more than doubled since the report, this estimate could substantially underestimate the current figure.

For the 2025 fiscal year, the United States Space Force’s total budget was listed as $29.4 billion. This budget included $18.7 billion for research, development, test, and evaluation, as well as $4.3 billion for procurement.

Competition

While True Anomaly has no competitors specifically focused on space superiority, several companies compete for the same contracts or develop related systems. The most direct competition to True Anomaly comes from Sierra Space and a partnership between defense startups Impulse Space and Anduril Industries. Additional competitors to True Anomaly include legacy defense contractors commonly referred to as Primes, other startups focused on developing technology to support satellite RPOs, and SpaceX.

Adjacent Competitors

Impulse Space: Founded in 2021 by Tom Mueller, a founding engineer at SpaceX, Impulse Space is working to develop in-space mobility. Impulse Space’s main products are Mira and Helios. Mira is a small spacecraft that acts as a “space tug” by transporting third-party cargo between orbits. With a stated size comparable to a dishwasher and a maximum delta-V of up to 900 m/s, Mira is in a similar class as True Anomaly’s Jackal. The Mira has flown since 2023 and can be contracted for rideshare missions.

Impulse Space’s larger offering, Helios, is designed for a similar space tug mission set, but it is significantly larger than Mira. With this increased size comes more room for propellant and an increased delta-V of up to 9 km/s. The maiden voyage of Helios is scheduled for 2026. Impulse Space has raised a total of $525 million in funding as of December 2025, with notable investors including Founders Fund, RTX Ventures, and Linse Capital. It had an implied valuation of $1.8 billion in June 2025 according to one third party source.

Anduril Industries: Founded in 2017, Anduril* is a defense startup developing autonomous systems for all domains and the software to support them. The company paved the way for modern defense startups, bringing massive change to DoD acquisition strategies. The company was valued at $30.5 billion as of June 2025 and has raised a total of $6.2 billion in funding as of December 2025, with investors including Founders Fund and Contrary. All of Anduril’s products are connected by a common operating system known as Lattice, enabling efficient data transfer between nodes so that all systems have increased situational awareness.

In November 2024, Anduril and Impulse announced a partnership to develop an Impulse Space Mira spacecraft operating Lattice OS with an Anduril mission payload. Although the Mira was originally designed for transporting cargo between Earth orbits, its Jackal-comparable size and maneuverability statistics indicate it could be utilized for a space superiority role.

Just as True Anomaly’s Mosaic is designed to link assets together to provide every autonomous system and human operator with a fuller picture of the battlefield, Lattice could do the same. However, Lattice offers further utility to the DoD through its seamless sensor, control, and data integrations between more mature products in all domains, such as the Ghost airborne ISR platform or Seabed Sentry underwater sensor node.

These integrations could enable the DoD to command and control missions to achieve and maintain superiority in multiple domains, all with the same software. Mosaic, by contrast, only focuses on the space domain. The only non-space assets Mosaic is designed to connect with are those focused on space, such as ground-based sensor arrays that provide data for space domain awareness.

Sierra Space: Sierra Space was founded in 2021 as a subsidiary of the Sierra Nevada Corporation, a leader in aircraft modifications for defense. Since its founding, Sierra Space has unveiled its Eclipse line of highly maneuverable satellites. Like Jackal, Eclipse is designed for RPOs to support national security missions, and it features a similar delta-V of 875 m/s. In addition to its affordable satellite offerings, Sierra Space also develops space planes, space stations, and hypersonic rocket engines. The company has raised a total of $1.7 billion in funding as of December 2025, with notable investors including Coatue and BlackRock. It closed its Series B round in 2023 at a $5.3 billion valuation.

Defense Primes

The defense contractors Boeing, Lockheed Martin, Northrop Grumman, and RTX, commonly referred to as “Primes” for their role as prime contractors on defense programs, have historically dominated the defense space scene. Many of the DoD’s most important operational satellite constellations were developed by the Primes. However, none of the satellites produced by these companies were designed specifically for space superiority through inter-satellite operations, nor are any of these companies centered around the space superiority mission.

Boeing: Boeing’s primary satellite developments include the Wideband Global SATCOM constellation, as well as prototype Protected Tactical SATCOM payloads. Wideband Global SATCOM satellites have been in orbit since 2007, continuing to provide the DoD with secure worldwide communications.

Lockheed Martin: Lockheed Martin developed and produced the Space Based Infrared System (SBIRS) family of missile-warning satellites, the next-gen OPIR satellites, and advanced extremely high frequency secure communications satellites. SBIRS and the newer OPIR satellite are critical to the DoD, providing warnings within seconds of missiles launching anywhere on Earth.

Northrop Grumman: Northrop Grumman was responsible for the Defense Support Program constellation of infrared early-warning satellites and contributes payloads or integration work for SBIRS programs. Northrop is also developing on-orbit servicing vehicles for extending satellite life and maintaining assets in GEO orbits, and has been awarded a refueling tanker contract by the Space Force called GAS-T for demo missions.

RTX: RTX accounts for the production of many sensor and payload systems for missile warning and infrared detection functions, such as infrared sensor payloads for next-gen OPIR satellites. However, RTX has publicly stated it is shifting its role away from being a full space prime contractor itself.

RPO Satellite Companies

Several other startups develop satellites and associated systems to support RPOs.

Astroscale: Founded in 2013, Astroscale works to develop satellites for RPOs to identify, characterize, and remove space junk and defunct satellites from orbit. Originally headquartered in Singapore by founder and CEO Nobu Okada, Astroscale moved to Tokyo in 2019. Astroscale is listed on the Tokyo Stock Exchange and had a $580 million market capitalization in November 2025. Later in 2024, Astroscale’s ADRAS-J spacecraft successfully completed its first RPO, maneuvering within 15 meters of a discarded rocket upper stage in LEO and taking pictures.

ClearSpace: Similar to Astroscale, ClearSpace is a Switzerland-based startup that is designing orbital vehicles and related systems to support RPOs and orbital debris removal. As of November 2025, ClearSpace has raised a total of $37 million since its founding in 2018. The company’s flagship mission, ClearSpace-1, is scheduled to launch in 2029. This mission will entail an RPO with the satellite PROBA-1 to ultimately mate with it and remove it from orbit.

SpaceX

While not a space superiority company, SpaceX dominates the satellite market and is closely involved with the DoD. In November 2025, SpaceX operated roughly 8.7K Starlink satellites, accounting for over half of those orbiting Earth. SpaceX’s Starshield program serves the DoD by developing unique satellites for defense mission sets, and the program has seen massive wins for years. For instance, in 2021, Starshield entered a $1.8 billion contract with the DoD to provide spy satellites, and the company has seen many more large contracts since.

In addition to satellite design and operation, SpaceX’s ability to launch satellites is entirely unparalleled. This ability allows for a greater vertical integration that benefits SpaceX by improving both spacecraft and launch vehicle compatibility as well as launch schedules and costs.

Business Model

True Anomaly’s primary source of revenue is government contracts from organizations and units within the Department of the Air Force. While True Anomaly often serves as the main contractor in these awards, the company also works as a subcontractor on other projects, such as Gravitics’ $1.7 million Space Force contract. True Anomaly claims that Jackal is designed for rapid production at scalable price points. These rapid production rates are to be accomplished within the company’s GravityWorks production facilities. As of December 2025, True Anomaly operated two of these facilities.

Traction

True Anomaly’s mission has attracted the attention of many entities within the DoD, resulting in several multi-million dollar contracts. In August 2023, the company announced that it was awarded a $17.4 million contract from the Space Force to further develop its Mosaic software to enhance operators’ space domain awareness. In April 2024, the Space Force awarded True Anomaly with a $30 million contract to develop a Jackal for the VICTUS HAZE mission. Later that same month, True Anomaly was revealed as a subcontractor on a $1.7 million contract awarded to Gravitics.

In addition to contracts from the Department of Defense, True Anomaly has also partnered with several other companies. In April 2023, True Anomaly announced its Mosaic mission control systems would be powered by Viasat and Microsoft Azure Space technologies. Since partnering with Azure Space, True Anomaly hired Stephen Kitay, former Senior Director of Strategic Ventures and Azure Space at Microsoft, as Senior VP of Space Defense.

In November 2024, a multi-launch agreement was announced between launching provider startup Firefly Aerospace and True Anomaly. This agreement includes the three launches of the Firefly Alpha rocket to transport Jackals to orbit.

True Anomaly’s growth has also led to an expansion of production and operational facilities. In February 2025, a new 90K square foot GravityWorks production was announced in Long Beach, California. This facility is in addition to the current GravityWorks in Centennial, Colorado, as well as Mission Control in Colorado Springs, Colorado, and Government Affairs in Washington, D.C.

Valuation

In April 2025, True Anomaly announced a $260 million Series C led by Accel at an implied $916 million valuation. This funding round marked a total of $400 million raised by the company. The money raised in True Anomaly’s Series C was planned to be used for vertical integration, facility expansion, product development, and more. Previous funding rounds include a $17 million Series A at an implied $114 million valuation led by Eclipse Ventures in April 2023 and a $100 million Series B at an implied $360 million valuation led by Riot Ventures in December 2023.

Key Opportunities

Utilizing AOVs as Orbital Payload Testing Trucks

Given Jackal’s payload-agnostic design and Mosaic’s open system architecture, True Anomaly could potentially sell space on board Jackals to other companies for the test and evaluation of different payloads and sensor packages. Just as SpaceX sells payload capacity on its rockets to other companies through programs like Rideshare, True Anomaly could sell space inside its AOVs for other companies to test orbital payloads. Similarly, a near competitor to True Anomaly, Impulse Space, has been conducting Rideshare missions with its Mira spacecraft since 2023. These missions allow customers the opportunity to buy space on board a Mira to transport satellites between orbits.

The US Golden Dome Program

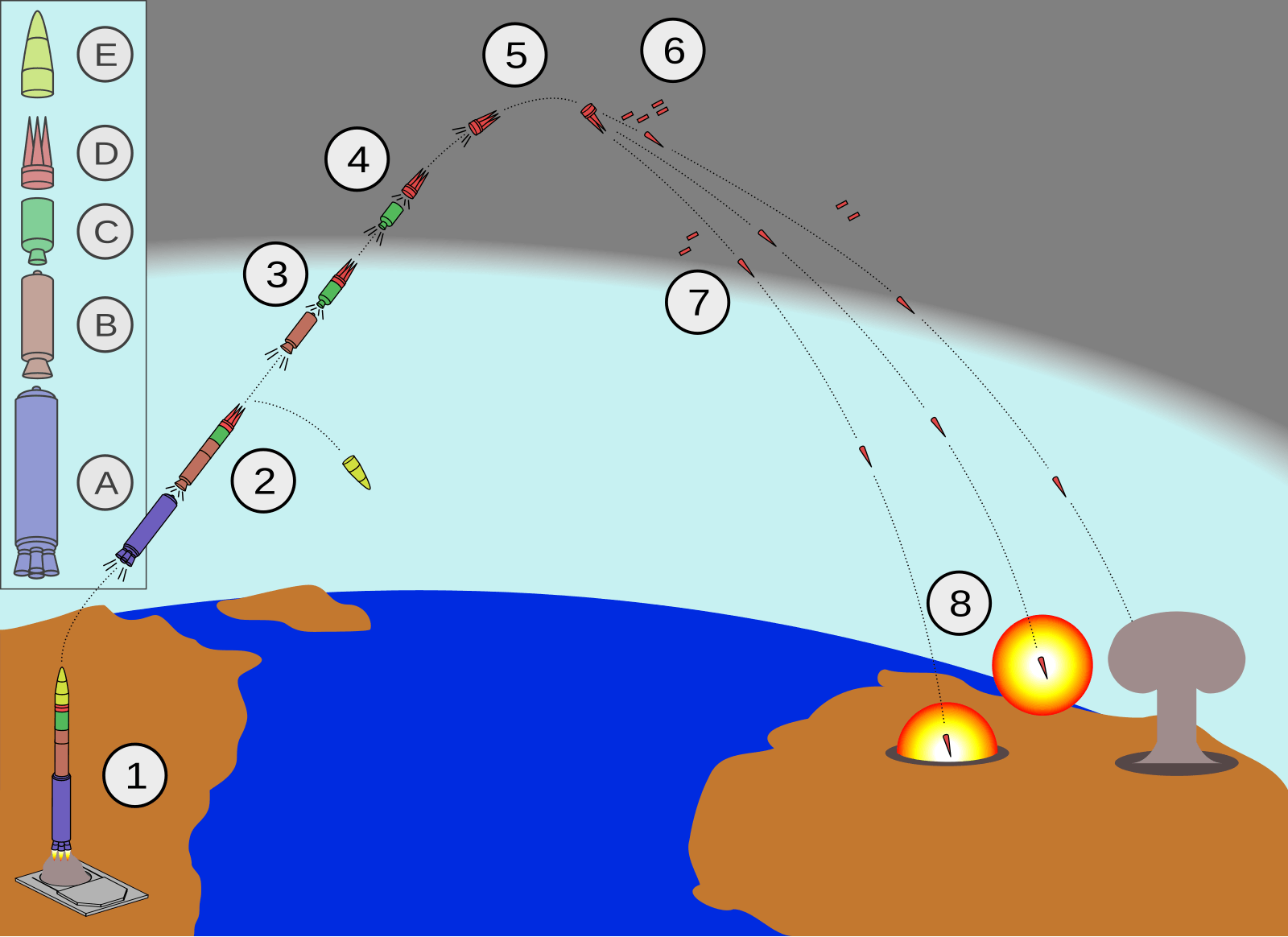

The Trump administration’s Golden Dome program was announced to cost a total of $175 billion over three years, following its 2025 announcement to design, develop, and implement a system of systems to detect and destroy ballistic, hypersonic, cruise, and other missile threats to the homeland. This program relies heavily on orbital assets for launch detection, warning, tracking, and potential space-based interceptors. While many ICBM interceptors are land or sea-based, space-based interceptors can be a more attractive option due to the characteristics of an ICBM’s flight path.

Source: Fastfission

An ICBM’s flight can be split into three main phases: boost phase, midcourse phase, and terminal phase. During the boost phase, the missile is at its slowest and easiest to track. The rocket engine propelling the ICBM produces an intense infrared signature that is easily distinguished. During the midcourse phase, most modern ICBMs split into multiple reentry vehicles. These reentry vehicles can independently navigate and target separate locations. To successfully intercept all reentry vehicles, a separate interceptor would be needed for each. Because the boost phase of an ICBM is only a few minutes long, space-based interceptors are the only feasible solution able to respond with the urgency needed to successfully intercept an ICBM in this phase.

Even without space-based interceptors, Golden Dome still relies heavily on satellites for the detection and identification of missile launches. Many organizations expect the total cost required to see the Golden Dome through to completion will be much higher than the initial $175 billion the White House has proposed to put towards the problem. Both the Congressional Budget Office and the American Enterprise Institute estimated total costs for the next 20 years of the program at $542 billion -$831 billion and $3.6 trillion, respectively.

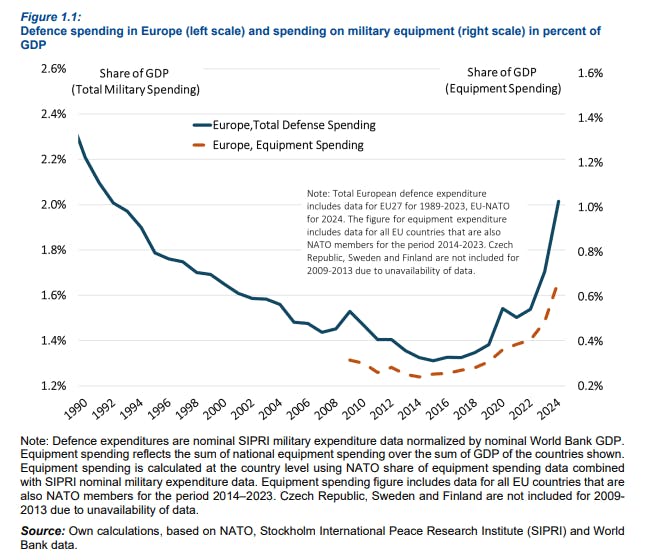

Rapidly Expanding European Defense Budgets

True Anomaly CEO Even Rogers has expressed interest in expanding the company to support the space superiority mission of other NATO countries. This potential expansion could result in sizable revenue for the company. Following the onset of the war in Ukraine and increased global instability, European defense budgets have seen massive increases. Total military spending as a percentage of GDP in Europe is now equivalent to the rates seen at the end of the Cold War.

In November 2025, European defense companies Airbus, Leonardo, and Thales announced the combination of their space programs to form a new company. Together, these companies aim to create a formidable player in the defense space industry, aligning with the European goal of independence from American space assets.

This push for European independence from American space-based defense assets offers further opportunity to True Anomaly. To become truly independent from the United States, European countries would need to field and protect satellite constellations to replace the functions of American satellites used for ISR, missile warning, and more. True Anomaly’s low-cost, modular approach could be a viable solution for Europe.

Key Risks

Dependency on Launch Providers

As of December 2025, only two launch providers, SpaceX and United Launch Alliance (ULA), were certified for the highest value DoD launches under the National Security Space Launch (NSSL) program. SpaceX’s Falcon 9 and Falcon Heavy rockets were both certified, whereas ULA, the merger between Boeing and Lockheed Martin, has only certified its Vulcan launch vehicle. A third launch provider, Blue Origin, is in the process of certifying its New Glenn rocket. In addition, five companies — SpaceX, ULA, Blue Origin, Rocket Lab, and Stoke Space — were certified to launch newer rockets on certain missions more tolerant of risk.

Separate from NSSL is the Orbital Services Program (OSP). This program is for rapid, small-lift, DoD launches with payloads under 2K kg. Firefly Aerospace’s Alpha rocket, the rocket slated to transport multiple Jackals to orbit for the Space Force’s VICTUS HAZE mission, operates under the OSP. Without third-party launch providers, True Anomaly has no way of sending AOVs into orbit for testing or operational use. This gives companies like SpaceX a massive edge over the competition because they can launch on a more expeditious timeline for a more favorable cost.

Shifting Global Power Balances

Since 2017, the defense startup landscape has seen massive growth. Russia’s invasion of Ukraine further catalyzed this growth as the fear of other large-scale conflicts erupting soared. However, this growth may not be sustainable. Many experts across the world speculate that the defense tech world has since entered into something of a bubble. If this is the case, a collapse of the bubble could have potentially negative effects on True Anomaly.

A reversal of heightened geopolitical tensions could also harm the defense tech market as a whole. Just as defense spending was dramatically reduced following the fall of the Soviet Union and the end of the Cold War in the 1990s, a similar cutback could occur following the end of a conflict or the collapse of a world power.

Export Bans

European Ministries of Defense could serve as major customers to True Anomaly. However, this market is blocked by extensive legislation regarding defense technology export limitations. Federal regulations like those in the International Traffic in Arms Regulations (ITAR) and Export Administration Regulations (EAR) could prevent True Anomaly products from being sold to Europe. These controls are designed to protect sensitive technologies with potential military applications and maintain American strategic advantages. Despite these constraints, True Anomaly can pursue Foreign Military Sales (FMS) channels to make its technology available to European partners through the United States’ government programs.

Competition from Legacy Manufacturers

The defense contracting world has been dominated for decades by a handful of major contractors commonly referred to as Primes. Although companies like Anduril have made great progress at breaking this mold, Primes still dominate high-profile DoD contract awards. Many developing space programs, such as the Protected Tactical SATCOM-Global program, see Primes competing for contract awards. For startups like True Anomaly, this creates a difficult competitive environment where legacy contractors benefit from decades-old relationships and past performance records. Even when startups offer cutting-edge technology, Primes often have the advantage of established supply chains and contracting experience. As a result, True Anomaly must work to establish programs of record and government relationships for credibility.

Summary

Space is a rapidly growing sector, and recent developments in satellite-denying technologies have led NATO to declare space as a war-fighting domain, officially confirming on-orbit military expansion. True Anomaly is the first company set on delivering an ecosystem of products to enable the United States’ military to protect space assets and maintain space superiority. Its Mosaic software suite offers tools for every aspect of orbital operations, and its development of highly maneuverable satellites like the Jackal provides the capabilities needed to intercept and interact with adversarial satellites.

While traditional defense satellites have been developed by the Primes, none of them are focused on space superiority and RPOs requiring high maneuverability. There are several startups focused on developing RPO satellites, but only a handful are related to military operations, and none are designed for the space superiority mission. Although True Anomaly faces many significant challenges, the DoD contracts and private partnerships the company has secured are promising signs of early traction.

*Contrary is an investor in Anduril through one or more affiliates.