Actionable Summary

“Crypto” can be a catch-all term for a category that extends from cryptography to cryptocurrencies, blockchain technology, smart contracts, and more. In this report, the term is used to refer to the entire category.

While born as an optimistic movement, crypto has been inundated with noise and speculation. Meanwhile, many of the social, economic, and political systems controlling people’s lives have created frustration, leading trust in those institutions to drop. Crypto arose as a proposed solution to those systematic weaknesses. But volatility and speculation dampened the potential for any meaningful impact on those issues.

Crypto was built around creating ownership. The idea was that participants would be able to own and benefit from the value they helped create by tokenizing ideas or products to capture value, which would remove rent-seeking intermediaries.

However, some crypto users began to rely on centralized organizations like Coinbase, Binance, and FTX that presented a broader audience with a more approachable on-ramp into crypto. Many participants in the crypto community consider CEXs to be helpful in onboarding mainstream users to the crypto universe, but ultimately counter to the core tenets of crypto.

It was a tradeoff that was emblematic of crypto itself. Centralization allowed for control and an easy on-ramp for those new to crypto. Decentralization allowed for freedom and avoided the pitfalls of centralization, but required a more difficult on-ramp for new users.

The crypto bull markets in 2017 and 2021 drove the market cap of all cryptocurrencies from $18 billion in 2016 to $800 billion in early 2018, and finally to $2.7 trillion in 2021. But the surge in prices driven by retail also attracted institutional investors to invest billions in crypto, further driving the speculative nature of the space.

Institutional investor involvement in crypto led to perverse incentives. Larger, centralized allocators of capital are able to manipulate the value of different cryptocurrencies and generate liquidity by pumping up the price, and then selling. Typically institutional investors are selling to retail investors.

As the Federal Reserve started to raise interest rates, much of that institutional involvement in crypto dissipated, leaving a lot of projects with significantly reduced liquidity. This dynamic produced the second crypto winter in 2022. Over the course of 2022, the total market cap of all cryptocurrencies dropped to $829 billion, down 64% from $2.3 trillion at the beginning of the year. Bitcoin alone saw its value drop by over 60%.

FTX, a centralized crypto exchange, attempted to step in and play a role akin to the Federal Reserve within the crypto ecosystem for flailing crypto projects. First, FTX bailed out BlockFi with a $250 million credit line. Then, FTX’s hedge fund, Alameda Research, stepped in to provide $500 million to Voyager.

FTX and its CEO, Sam Bankman-Fried, were seen as regulatory darlings, doing the work for the alternative financial ecosystem that needed to be done. But in November, 2022, everything changed. FTX’s hedge fund, Alameda, had its balance sheet leaked by Coindesk, and the “Federal Reserve of Crypto” came crashing down. Soon after the FTX debacle, contagion started to take hold. BlockFi, Ikigai, Multicoin Capital were all impacted. The biggest impact was Genesis,

The rise and fall of the crypto industry across 2021 to 2022 put a number of crypto projects in the crosshairs of legal action and government regulation. In 2021, Coinbase CEO Brian Armstrong was picking fights with the SEC on Twitter. In early 2023, regulators issued a notice to Coinbase of possible legal action, not to mention the SEC’s investigation of stablecoin-issuer Paxos and lawsuit against crypto-exchange Kraken. This isn’t necessarily new; crypto has run afoul of regulators, and has been associated with crime since its earliest days.

Contrary to what some may think, crypto isn’t opposed to being regulated. While crypto was built around the idea of creating ownership for participants by removing rent-seeking intermediaries, most in the space want meaningful regulation to achieve a level of validation that would drive more mainstream adoption.

Crypto is still trying to figure out what it wants to be and where it wants to go. Regulation will likely guide a lot of that. But for now, the answer is to protect, own, and benefit – to create a world where access is equal, and everyone can have a chance to build. Whether or not crypto will deliver on that remains to be seen.

The Crypto Fever Dream

"The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust." - Satoshi Nakamoto

Crypto is divisive. That’s a pretty objective statement. There is a lot of vitriol at brands if they choose to launch crypto projects, there is the cryptobro persona, and in general, just a lot of anger at people in the space. Even the term “crypto” is used as a catch-all for everything from cryptocurrencies to smart contracts to blockchain technology, all of which attract the attention of people holding any number of opinions.

Crypto represents a complex balance of Things Bad and Things Good; digital landlords and over-financialization versus the potential of true life-changing wealth for all. Crypto offers so much, but has delivered on so little. There are going to be different interpretations even of that statement, with some people likely to respond “well actually it already has…” and others who would say “well actually it sure hasn’t…”

Crypto was invented to make systems better. But if you look at some current crypto projects, it looks less like something that is trying to fix things, and looks like something that is trying to complicate an existing system instead.

Crypto comes with its own colorful vernacular, representing a myriad of economic and digital interactions. There are ponzis, pump and dumps, shitcoins, grifts, rug pulls, and so much more. Many of these things happen frequently in crypto, and none are improvements on the existing financial system. Seeing through the noise of fraud and speculation can be difficult. But for many, crypto remains an opportunity to transform what wealth and ownership look like, what technology could do to make industries more efficient, and how money could be redefined.

Crypto is a microcosm of the world it emerged from.

For some, the culture of crypto takes many of the sins inherent in legacy systems and securitizes them. Critics see crypto as combining the badness of banks, the destructiveness of big tech, and the environmental degradation of big oil – all compounded by volatile financialization. It’s a recreation of the wealth gap, visualized through monkey jpegs. We have a very zero sum, individualistic society in the United States. Crypto embraces these aspects of technolibertarianism and puts it on the blockchain.

But the potential of crypto is much more than what people see it to be.

According to its first principles, crypto represents an option for ownership and access, and a way to understand the world around you. It’s an attempt to decentralize systems with the goal of creating greater equality. But it's also a recognition that the way the financial system currently operates is flawed. Unfortunately, many of these ideals and associated buzzwords have been used by less-than-honest speculators to inflate the price of projects with questionable relevance to crypto’s animating ideals, such as dog-themed digital coins.

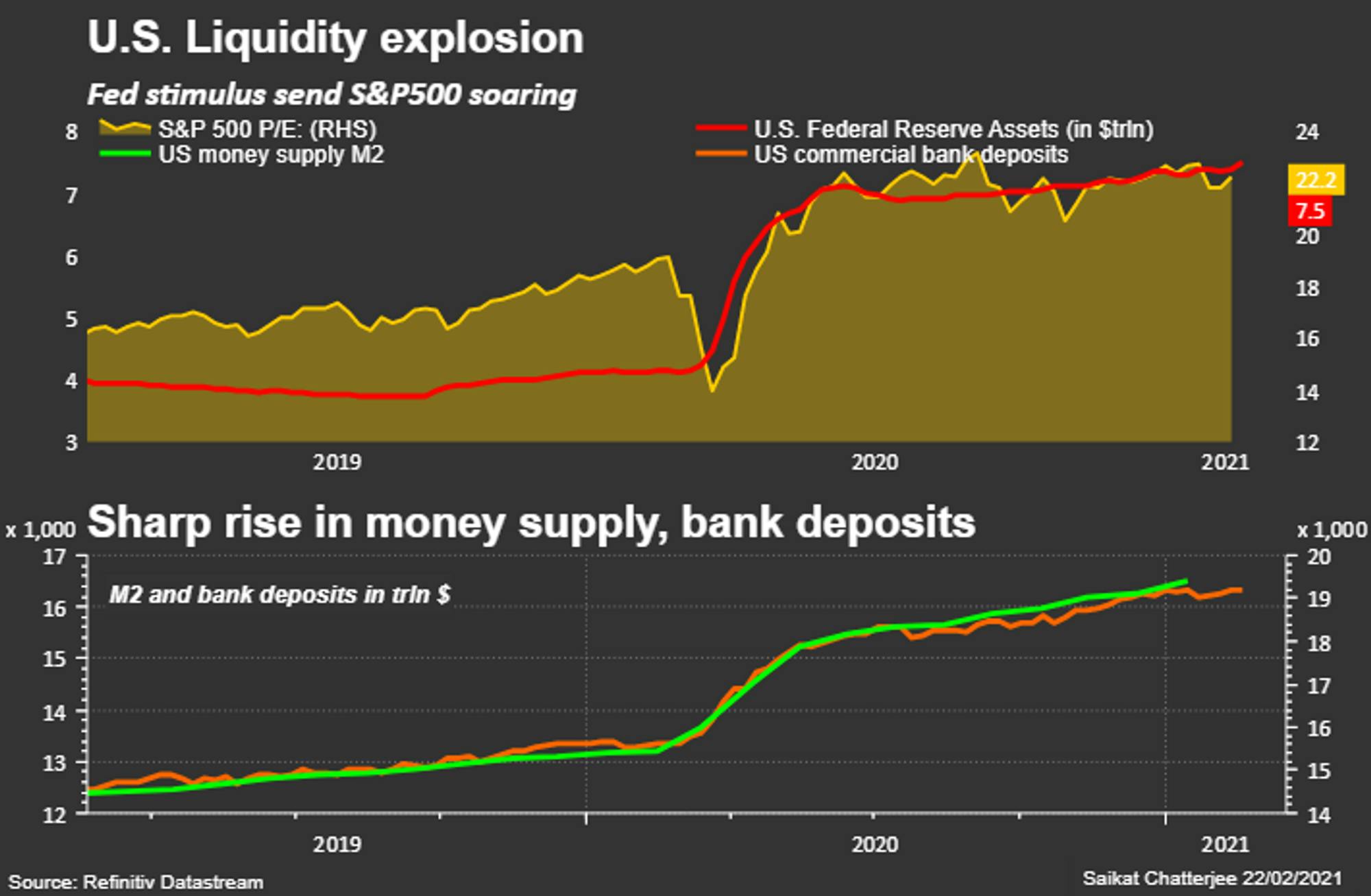

Because of the institutional flows that occur as crypto reached greater market acceptance, crypto tends to trade like a tech stock. When liquidity tightens, so do flows of cash to the crypto universe, just like the housing market, the stock market, and the bond market.

Source: Reuters

Unlike real estate or public stocks, however, crypto is meant to address many of the flaws in the system that we live in. It isn’t a perfect solution, but its goal is to create a path for true ownership and wealth beyond the concept of money.

The Systems We Have

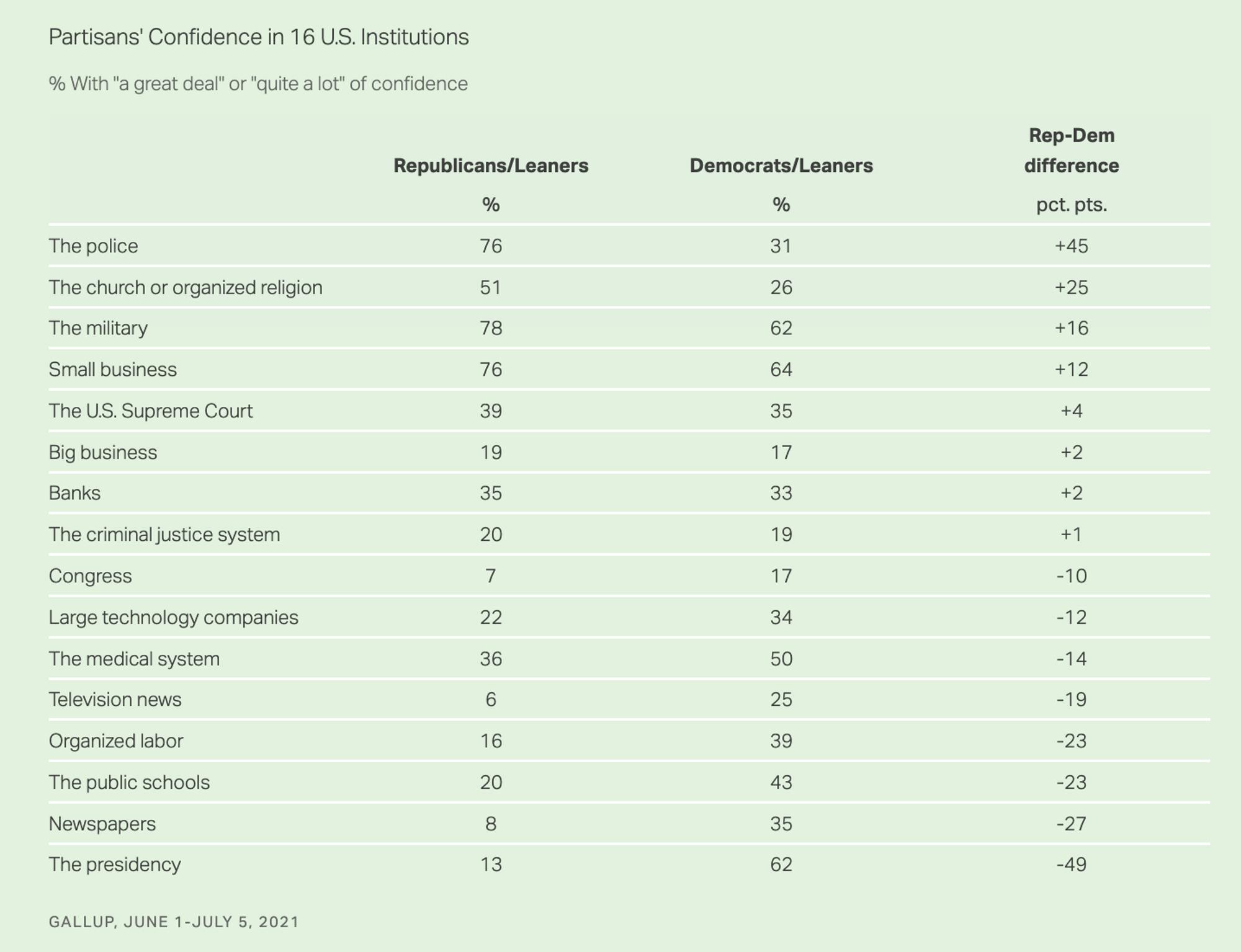

The general consensus among most people? Our systems suck. Among Americans, trust in major institutions like media outlets or political bodies is incredibly low, with just 7-20% of participants in both political parties indicating confidence in institutions like Congress or the criminal justice system.

Source: Gallup

Both inside and outside crypto, there is clear unhappiness with how the world is going. The fact that we are reverting back to coal production, the fact that we still have issues with worker’s rights, the ability to maintain effective healthcare in the U.S. remains an elusive goal at best. In the colorful words of many in the crypto community: “Is the world just a massive shitcoin?”

Money is a tool that facilitates relationships. But those relationships are confusing, and have only gotten more confusing since the latest crypto bull market starting in 2020. As documentarian Dan Olson said in his video Line Go Up:

“Our systems are breaking or broken, straining under neglect and sabotage, and our leaders seem at best complacent, willing to coast out the collapse. We need something better. But a system that turns everyone into petty digital landlords, that distills all interaction into transaction, that determines the value of something by how sellable it is and whether or not it can be gambled on as a fractional token sold via micro-auction, that’s not it.”

That’s a key problem. Much of the wealth creation that has taken place in crypto has been optimized for paper wealth, but not necessarily actual wealth. There is no delineation between paper wealth and true wealth.

Sal Delle Palme argued that the addition of verifiable digital ownership is creating a new economic system that is accessible to everyone, and democratizing access to investments. The evolution of web3 and its potential applications are being limited by traditional capital markets and fundraising regulation. Tim O’Reilly responded to that argument by asserting the need to focus on “real wealth” rather than paper wealth:

“[If] Web3 heralds the birth of a new economic system, let’s make it one that increases true wealth—not just paper wealth for those lucky enough to get in early but actual life-changing goods and services that make life better for everyone."

Thus far, crypto hasn’t necessarily created true wealth. It’s created wealth for some, but much of the value has been created via speculation, which definitely hasn’t created wealth for all. Speculation in crypto often takes the form of ponzi schemes and scams. The combination of crypto-idealists and opportunistic speculators has led to a number of different perceptions of the crypto ecosystem. Understanding all of them can get overwhelming and confusing.

As trust in our systems erodes, there is an obvious need for some sort of refresh. People are frustrated with the feeling of being isolated and seeing opportunities shrink. Crypto painted itself as a solution to this. But the incessant ponzis and pump and dumps have tarnished most people’s perceptions of the space.

Beyond being a vehicle for speculation, what is crypto’s allure? Everyone wants elements of freedom, and everyone wants money. Both are inherently functions of one another. It’s rather difficult to have freedom without money, and the motive behind getting money is often to have freedom. Both are about being able to make choices that you want to make, spending time how you want to spend it, and engaging in things that you care about while you know that your present and future is secure.

Freedom = f(time allocation, choice, money)

Money = f(stability, freedom, choice)

Many people are frustrated with the status quo. There is a widespread desire to break out of the standard course of life. Working 40 hours a week at a 9-to-5 job with a 30-minute commute for the sake of securing basic healthcare and income, while struggling to save for retirement. All this was built on systems that were established during the Industrial Revolution, and the longer it persists, the more it loses its appeal.

The initial goal of crypto is a shift in the overall power distribution from institutions to individuals. But does it actually accomplish what it set out to do?

Crypto skeptics would say: not really. Instead, so far, we mostly got the speculative hyperfinancialization of digital commodities. Betting on whether the value of Mooncoin or Bored Ape Yacht Club will go up or down does very little for society. Instead, the speculative nature of crypto to this point has played on people’s desire for gambling and get-rich-quick schemes. Even the infrastructure for crypto causes concerns due to the pressure it puts on an already weak electrical grid.

But then there is the flipside of that narrative: one which still sees a path for crypto to fulfill its the original vision.

The Crypto Thesis

Crypto was built around the idea of creating ownership – that people should be able to own and benefit from the economic value they help create by tokenizing ideas or products to capture value, which would remove rent-seeking intermediaries. Crypto also represents elements of community. Some have seen the space as a pseudo-religion; a place for people to find and surround themselves with like-minded individuals who believe in technology and value decentralized ownership.

Most financial systems, including most crypto systems active since 2020, are built around zero-sum principles. Losing money is part of the “sport”. Some people end up as exit liquidity (often derided as “bag holders”). Some people make gobs of money. The slowest antelope gets eaten by the lion.

This predatory dynamic runs counter to what crypto hopes to achieve. In a world that is inherently unfair, unequal, destructive, and imbalanced, the decentralized ownership of value-creating assets were intended to make it more fair, more equal, less destructive, and more balanced.

The core thesis behind the creation of Bitcoin involved four key goals: (1) privacy, (2) money, (3) anonymity, and (4) resistance to censorship. That thesis was also built upon ~30 years of events leading up to Bitcoin:

1976: Public-key cryptography, which created a way to communicate securely and share a public key to encrypt communications, was invented by Whitfield Diffie and Martin Hellman .

1990s: eCash (then DigiCash) was created by David Chaum in an attempt to make online payments anonymous.

1997: Adam Back created HashCash, a proof-of-work system to reduce email spam and prevent denial of service attacks.

2004: Hal Finney builds on Hashcash and creates Reusable Proofs of Work

2008: Satoshi Nakamoto emailed a cryptography mailing list with the line “I’ve been working on a new electronic cash system that’s fully peer-to-peer, with no trusted third party,” linking to what has become known as the Bitcoin whitepaper.

Blockchain technology itself is the foundation for the entire conversation about crypto. A blockchain is a digital ledger that records transactions in a secure, decentralized manner, distributed across a network of computers so it’s resistant to tampering. Blockchain creates a transparent (everyone can see it) and immutable (no one can make modifications to it) record that removes the need for any centralized intermediary. The main thing to know is that blockchain keeps things secure and open while enabling ecosystems to be built on top of it.

The Bitcoin whitepaper was really the first foray of crypto into the mainstream. Historically, crypto had existed on the fringes, pursued by hobbyists. The introduction of Bitcoin in 2008, which was meant to remove third parties from financial transactions, was simultaneous with the fallout of the Global Financial Crisis, in which third parties wiped out $19 trillion in household wealth, along with 8.8 million jobs.

No one really knows who invented Bitcoin, but it’s credited to Satoshi Nakamoto, a pseudonym. Satoshi’s Bitcoin whitepaper outlined a scheme for a “peer-to- peer electronic cash system”. The goal was for Bitcoin to become a decentralized digital currency that would remove any need for financial intermediaries, like the banks who were bearing the brunt of public anger for the financial crisis.

While crypto would remain largely consigned to the fringes of public awareness until the first serious crypto bull market of 2017, the introduction of Bitcoin did attract a number of excited participants from the very beginning. In the aftermath of the global financial crisis, banks had just destroyed a lot of people’s lives, and this technology was presented as a more secure and transparent alternative to traditional banking. Because it was decentralized, people grew excited about the possibility of avoiding third-party intervention.

In 2010, Laszlo Hanyecz used 10K bitcoins to buy two pizzas. That was the first time that Bitcoin was used to purchase a real world item, which was huge. May 22nd is now known as Bitcoin Pizza Day, a celebration of one the first times that Bitcoin was utilized in a macro scope.

But the Bitcoin pizza was really just the beginning for crypto.

The Good Times

2017 was really when crypto became mainstream, with everyone asking “have you heard of Bitcoin?” The total market cap of all the cryptocurrencies skyrocketed to over $800 billion in early 2018, surging from $18 billion in 2016.

But it wasn’t just Bitcoin. With 1K+ different cryptocurrencies, anyone could find something that they were excited about. Some coins were explicitly created for fun or speculation, like Dogecoin which was based on the doge meme, while other crypto projects had legitimate applications. Before long, there were coins for everything from taking a stake in virtual real estate to trying to make bets on predicting the weather.

As crypto experienced its first bull market, projects like Cryptokitties started getting a lot of attention. Cryptokitties attracted $1 million in volume across 37K crypto kitties in 2017 alone. However, like all bubbles, the 2017 bull market eventually popped. In 2018, over $13 billion of crypto market cap was wiped out. While a number of participants left crypto for dead in the crypto winter of 2018, others doubled down. New crypto-focused investment firms, like Paradigm, launched with a clear vision:

“Despite being in the midst of a “winter,” crypto was poised to be one of the most important technical and economic shifts over the coming decades with the potential to fundamentally change money, the financial system (DeFi), and the internet more broadly (Web3).”

As crypto-loyalists continued to build the ecosystem, crypto re-emerged in its second bull market during 2021. The total market cap of all cryptocurrencies hit $2.7 trillion; up 3.4x from the previous peak of $800 billion in early 2018. As of November 2022, there were 21K+ different cryptocurrencies. However, some aspects of the crypto thesis had shifted.

In particular, crypto ownership had become more centralized. Organizations like Tesla, Square, and ARK had invested billions into Bitcoin. Big financial institutions were starting to pay attention. While the space had started to mature away from simple cryptographic hobbyists, immense institutional interest also drove more speculation.

Centralization & Decentralization

While many consumers express a lack of trust in large centralized institutions, actions often speak louder than words. Crypto users began to rely on centralized organizations like Coinbase, Binance, and FTX that presented a broader audience with a more frictionless on-ramp into crypto than the decentralized alternatives. These centralized organizations were important in driving mainstream adoption of crypto by providing a simple, easy-to-use interface to buy and sell cryptocurrencies. Coinbase, for example, states its mission this way:

“Our mission is to increase economic freedom in the world. Everyone deserves access to financial services that can help empower them to create a better life for themselves and their families. If the world economy ran on a common set of standards that could not be manipulated by any company or country, the world would be a more fair and free place, and human progress would accelerate.”

Centralized exchanges (CEXs) like Coinbase are operated by centralized entities. They seek to provide a more seamless user experience. They also provide traditional finance tools like margin trading in addition to staking and other crypto-native tooling built in.

Margin trading allows users to borrow funds from an exchange to increase their trading position in order to make large trades. The trader puts up some money and the exchange puts up the rest. This can enable both outsized returns and outsized losses. Staking involves users holding funds in a digital wallet to earn rewards and secure the network, and essentially equates to passive income.

In addition to these offerings, CEXs also claimed to provide a higher level of security, as they were required to comply with more stringent regulation requirements than decentralized exchanges. Many participants in the crypto community consider CEXs to be helpful in onboarding mainstream users to the crypto universe, but some saw it as ultimately counter to the core tenets of crypto. As one critic put it, centralized exchanges “accelerated the growth of crypto” but “their centralization is antithetical to the idea of trustlessness or the ability to operate without a third party”, thus contradicting the original vision laid out in the Bitcoin whitepaper.

Decentralized exchanges (DEXs), like Uniswap and Curve, operate on networks like Ethereum, allowing users to trade without relying on any third-party intermediaries. Layer 1 protocols like the Ethereum blockchain run on a distributed network of computers, and decentralized exchanges built on top of them should theoretically be more resistant to hacks and other breaches than centralized exchanges. DEXs are also meant to be more transparent and put more control in the hands of the users. However, if you’re a first time crypto user, DEX platforms can be very confusing.d

So ultimately it came down to tradeoffs. Centralization allowed for control. An easy on-ramp for those new to crypto. Decentralization allowed for freedom. A more difficult on-ramp for new users, but one that was able to avoid the pitfalls of concentration. The model that wins out will depend on how the market values these tradeoffs, but the high-profile collapse of FTX has cast doubt on CEXs within the crypto ecosystem more broadly.

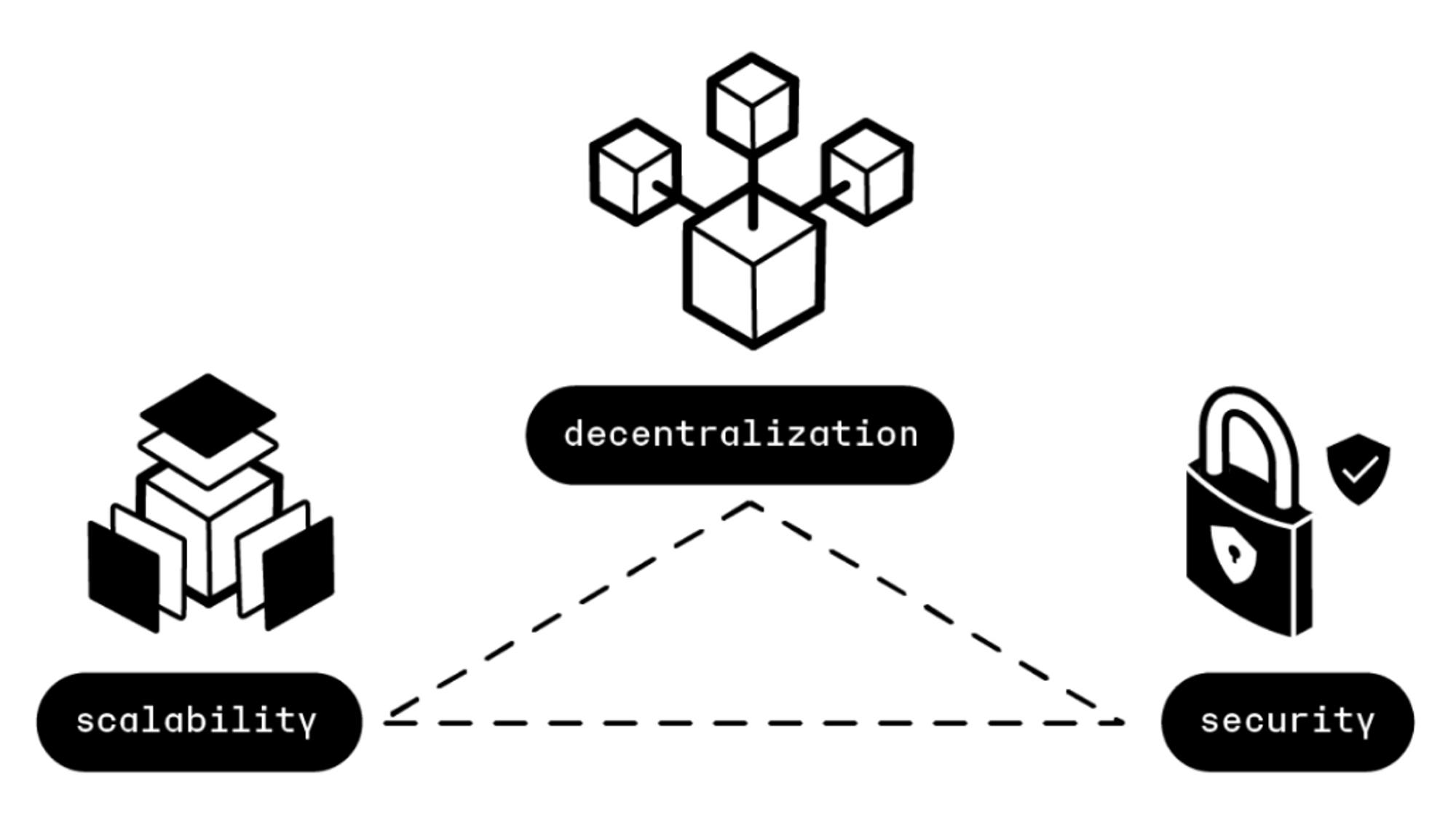

The Blockchain Trilemma

One of the most poignant frameworks for the tradeoffs in crypto is the Blockchain trilemma. This trilemma presents the inherent tradeoffs in crypto between scalability, decentralization, and security. Most economic systems operate on a spectrum across all three of these, not just cryptocurrencies like Bitcoin or Ethereum. If you optimize for scale, you give up aspects of decentralization and security. If you optimize for decentralization, you give up aspects of both security and scalability. And finally, you can optimize for security, but in doing so you give up some decentralization and some scalability.

Source: Ledger Academy

Ethereum is a blockchain-based decentralized platform created by Vitalik Buterin in 2015, with help from Gavin Wood, Charles Hoskinson, Anthony Di Lorio and Joseph Lubin. It is designed to be a platform for decentralized applications (dApps) which is different from Bitcoin, which was designed to be a digital currency. Ethereum does have a native cryptocurrency called Ether (abbreviated to ETH) which enables users to pay the gas fees for transactions and services on the Ethereum network. ETH can be traded like Bitcoin and other currencies, but has a utility beyond just HODLing. Ethereum is three main things - a chain, a token, and a virtual machine.

In late 2022, the Ethereum merge was completed. The Ethereum Merge was a big deal because it was the next iteration of Ethereum. It was meant to make it more efficient, easier to transact on, and a better steward of the environment. Ethereum went from proof-of-work to proof-of-stake. Proof of Work (PoW) and Proof of Stake (PoS) are both consensus mechanisms used to validate transactions on a blockchain and maintain the integrity of a network. However, proof-of-work consensus mechanisms use a significant amount of energy, and proof-of-stake doesn’t, which is why Ethereum 2.0 made the switch.

PoW was the original consensus mechanism used by Bitcoin and many other cryptocurrencies (including Ethereum pre-merge). It involves solving complex math problems to validate transactions and chain together blocks of transactions on the blockchain. Miners compete to solve these problems, and get rewarded with the cryptocurrency when they successfully do so. This is a pretty energy-intensive process. It also requires an insane amount of hardware, so it isn’t accessible to everybody.

PoS is the intended solution to the problems of PoW. Validators are chosen based on the amount of cryptocurrency they hold (which comes with its own problems). The more that a given validator holds, the more transactions they can process, the more blocks they can create, and the more rewards that they generate. PoS is theoretically more accessible than PoW, but the worry with proof-of-stake is that it could give a lot of power to ETH whales (e.g. holders of significant amounts of ETH) who will then be able to stake their tokens, earn rewards, but also control a large part of the network.

Ethereum is a Layer 1 solution because it uses the Ethereum Virtual Machine (EVM) as the software environment - basically meaning it uses solidity to code. The EVM is the software environment that allows for the development and execution of smart contracts on the Ethereum blockchain.

Layer 1 essentially means that transactions settle to it – there isn’t another chain in the picture used for settlement. Layer 1 blockchains are built to be interoperable. Interoperability allows blockchains to talk to each other through the Inter-Blockchain communication protocol (IBC). The IBC allows for the exchange of information and assets between different blockchains, creating a more seamless ecosystem. It’s meant to be scalable and customizable. This allows for a bunch of alternative Layer 1 blockchains to co-exist within the broader crypto ecosystem. For example, Cosmos is an ecosystem of Layer 1 protocols that allows anyone to spin up their own sovereign chain and connect to each other via IBC.

On the other hand, Layer 2 solutions like Optimism and Arbitrum are built on top of Layer 1 protocols like Ethereum. Their purpose is allowing faster and cheaper transactions compared to Layer 1 solutions. Layers 2s are a scaling solution used to improve performance and increase transaction throughput. Layer 2 solutions work by processing transactions off-chain, and then posting a summary of those transactions to the Ethereum blockchain. Generally, transactions are first recorded on a separate ledger, which is maintained by the Layer 2 solution. This ledger is typically referred to as a "commit chain" or "rollup chain". Once a batch of transactions has been processed and recorded on the commit chain, a cryptographic proof of those transactions is generated. This proof is then posted to the Ethereum blockchain, where it serves as a summary of the batch of transactions that were processed off-chain. Layer 2 networks still have validators, which are nodes on a blockchain network that verify transactions and maintain network integrity. They don’t solve mathematical problems, but instead check transactions via code to make sure they conform to the network’s rules and standards. The goal of this is to enable Layer 1s like Ethereum to be bigger and better while reducing concerns about centralization.

That’s the core battleground between centralization and decentralization. Tradeoffs.

Show Me the Money

The tradeoffs in crypto made it possible for speculation to become a defining characteristic of the space. The more crypto exchanges improved the onboarding experience for users, the more people surged in looking for opportunities to ride the next wave of high-flying tokens. That’s where misaligned incentives come in. Institutional investors saw the opportunity to deploy significant capital into companies who saw the value of their tokens rise dramatically in a short period of time.

Venture funding for blockchain and crypto startups hit a record high in 2021, with over $33 billion raised across more than 1.1K companies. That’s a massive increase from years prior, with overall venture investment in the space at just $5.5 billion in 2020. Large venture firms like Andreessen Horowitz (a16z) and Paradigm raised dedicated crypto funds, managing $7.6 billion and $13.2 billion respectively by mid 2022. While a16z had been investing in crypto for several years, the firm scaled their crypto investing dramatically in 2021.

Institutional investors like BlackRock and Fidelity got involved too, with BlackRock launching various crypto-focused ETFs and Fidelity helping clients with the crypto investment process. Even staunch crypto skeptics like JPMorgan Chase CEO Jamie Dimon, who had previously referred to crypto as a “terrible store of value,” started deploying projects like JPMCoin. Anywhere there is money to be made at scale, it's difficult for any institutional capital allocator to ignore.

Venture Crypto

For many investors, a core focus is on following hype. The number of crypto users grew 190% from 2018 to 2020 alone. At the beginning of 2023, there were 420 million crypto users globally. That’s a level of consumer interest that investors can’t ignore. Crypto, however, introduced a unique characteristic for institutional investors that doesn’t exist in typical equity investments.

Similar to many individual crypto investors, institutional investors saw the nature of cryptocurrency valuations could be speculative. The right investment in the right token could mint 10x+ returns in a short period of time. Unlike equity investments, institutional investors didn’t have to be locked into their investment for long periods of time, whereas outside of crypto venture investors can be locked into their positions in private companies for up to 6-10 years. As Gergely Orosz wrote:

“The draw for VCs to invest in crypto companies issuing coins is how they don’t have to wait 5-10 years for an IPO with all the due diligence: they can sell their coins directly to retail. a16z marketed their investments, coined ‘web3’ and profited, while many investors lost.”

So just like the speculative individual investors, institutional investors were able to make speculative investments in various cryptocurrencies. The volume of that speculation inflated the value of cryptocurrencies, with the value of Solana, for example, increasing 90x from October 2020 to November 2021 after raising more than $300 million from institutional investors. Many of those same institutional crypto investors were able to sell some of the tokens of the companies they’ve invested in, often at a profit, while retail investors were “left holding the bag.”

While the original thesis of crypto was to democratize ownership for a broader group of people, the outsized role of large centralized institutional investors in this wave of crypto skewed that ownership towards these larger players, often at the expense of smaller individual investors. Institutional investors were incentivized to deliver returns for their own investors, not to maximize the ownership for broad swaths of individual investors. Those misaligned incentives muddied the waters for crypto’s original thesis.

Web3 was meant to inaugurate a new era of financial inclusion. In an interview with Contrary Research, one digital asset manager at a major bank described the vision of web3 as “the second half of the internet”:

“The first half of the internet was built around trading data back and forth, and capturing value while doing it, whether through ads or subscriptions. What is [crypto] but the second half of the internet, where you can trade value back and forth through economic ownership?”

In the web2 era, that transfer of data back and forth was largely monetized through advertising. In the early days of the internet, digital advertising was a $2 billion industry. By 2022, that number had ballooned over 100x to $220 billion in North America alone. In the web3 era, the transfer of value has largely been driven by speculatively trading cryptocurrencies. Institutional investors got involved to maximize the value transfer from individual owners of crypto to the institutions themselves. Because crypto became flush with institutional money, it became marred by institutional misdirection.

Crypto Winter

In early 2022, crypto entered another crypto winter. You can point to a number of causes, including interest rate hikes, which correlate to capital flowing out of riskier assets and into safer assets that can now generate higher yield, as well as macroeconomic softening, and anticipated inflation (even though it hasn’t really materialized). Over the course of 2022, the total market cap of all cryptocurrencies dropped to $829 billion, down 64% from $2.3 trillion at the beginning of the year. Bitcoin alone saw its value drop by over 60%.

Source: CoinMarketCap; Price of Bitcoin

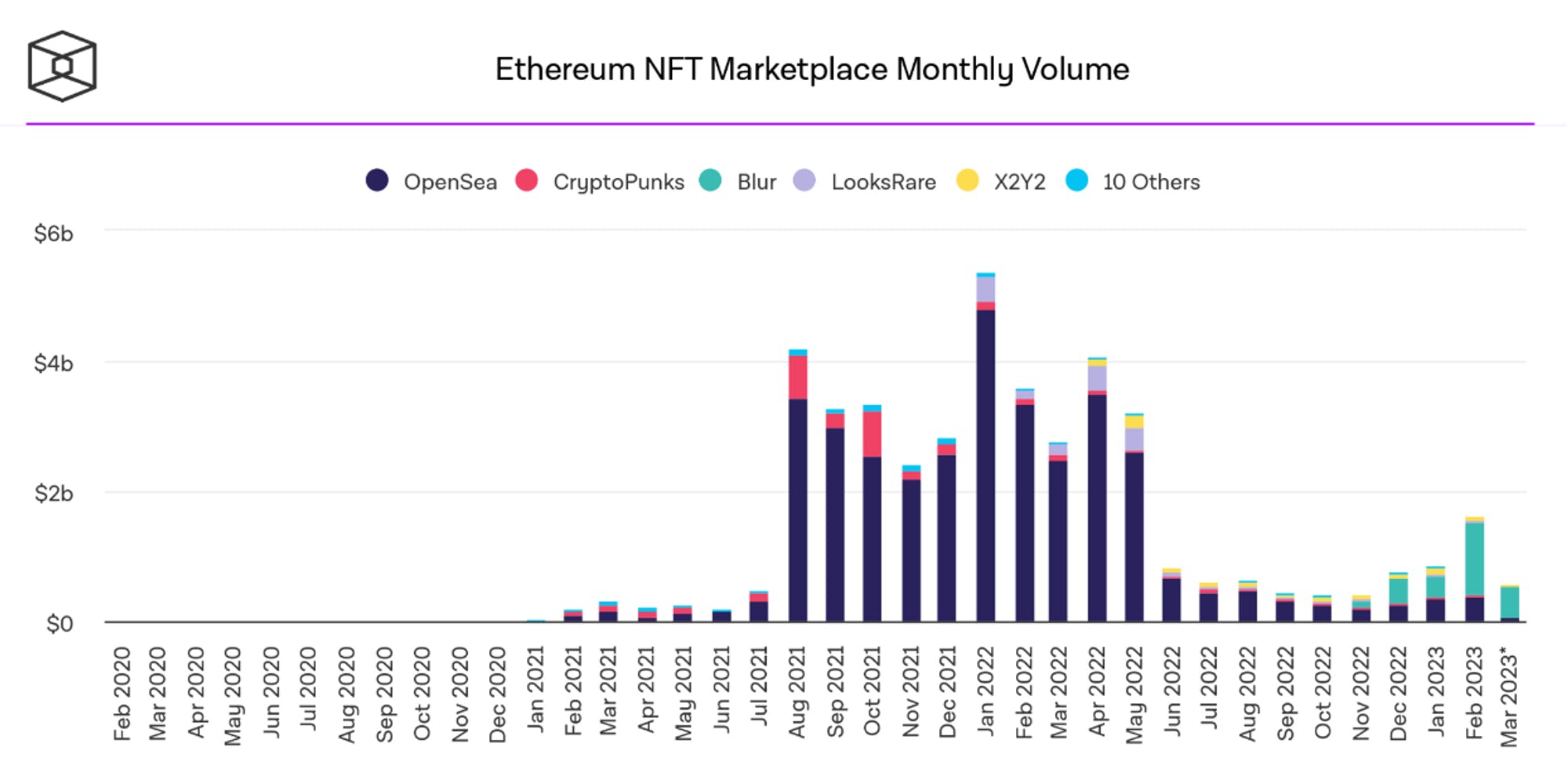

Outside of cryptocurrencies, another popular store of value are non-fungible tokens (NFTs), a token-backed indication for digital ownership of a specific non-fungible item, like digital art. Opensea, a popular NFT marketplace, which peaked at $57 billion of annualized volume at the end of 2021, saw volumes drop by 90%+ throughout 2022.

Source: The Block

Things were pretty bad. Then, Terra blew up.

Terra

Terra described itself as "public blockchain protocol deploying a suite of algorithmic decentralized stablecoins which underpin a thriving ecosystem that brings DeFi to the masses.” The main focus for Terra was to achieve Bitcoin’s goal of a peer-to-peer electronic cash system. The crypto ecosystem has a number of stablecoins, but TerraUSD (UST) was the most popular, with a market cap of $4.2 billion.

Stablecoins are digital assets whose value is pegged to a stable reserve asset, like the U.S. dollar. They are meant to maintain a stable value, meaning their price is not supposed to fluctuate a lot. Most stablecoins have some sort of backing. Tether, DAI, USDC, and others, are all collateralized, meaning that they are backed by a reserve of assets held in custody somewhere by somebody. Backed by either fiat money or crypto, there is some sort of floor.

But UST wasn’t backed – it had no reserve of assets supporting its value. Instead, it was created through a process called seigniorage, where users were able to mint new UST by exchanging other cryptocurrencies for it. The value of UST was maintained through an algorithmic mechanism that adjusted via market demand. There was also Luna, the cryptocurrency native to the Terra network. Luna was staked as collateral by validators on the Terra network and was adjusted relative to the peg - one was burned and one was minted. So if UST were to fall below the peg of the US dollar, the Luna collateral would be liquidated to help maintain the peg. UST was therefore collateralized in a sense, but there was really nothing there but vibes.

As CoinDesk wrote:

“UST gained the trust of the decentralized finance (DeFi) community as a truly decentralized stablecoin that does not need a central governing organization to ensure sufficient reserves to back the price.”

But turns out there was a central governing organization with reserves to back the price, because when your stablecoin goes into freefall, you’re going to protect it. In the Terra ecosystem, there were two important crypto assets and one important crypto central governing system:

UST was an algorithmic stablecoin which was meant to match the value of $1 USD.

Luna was helping UST maintain its peg and traded on the laws of supply and demand via the weird collateralization process described above.

There was also Anchor, a money market that was built on Terra, which created the incentive that powered the entire ecosystem by offering 19.5% APY for UST deposits on the platform. This is what got people to use Luna.

Finally, there was the Luna Foundation Guard, which was sort of like the Federal Reserve for crypto, meaning that they were willing and able to step in if anything went wrong

So how did it all work?

There were two separate cryptocurrencies in the ecosystem: TerraUSD (UST) and Luna (LUNA). Luna traded like any old crypto asset, on the laws of supply and demand. UST was the stablecoin whose value was determined based on the value of LUNA. But most importantly, 1 UST was always supposed to be convertible into ~$1 worth of Luna. The main thing to know here is that Luna and UST were supposed to be balanced.

This was the stabilization mechanism: UST stabilizes at $1 USD because you were supposed to be able to get $1 UST for $1 worth of Luna no matter what, even if UST is more than or less than $1. If UST is, say $0.98, the idea is that everyone would say “oh dang, I can arbitrage this and get $1 Luna, what a steal!” And vice versa - buy $1 worth of Luna if UST is like $1.02 and profit! This is probably the most important part. The system relies on arbitrage to maintain the peg (and the subsequent burning or minting of Luna). And of course arbitrage only works if people want to do that.

The utility of the UST stablecoin was the Anchor Protocol and that fat 19.5% yield, which was meant to incentivize liquidity where everyone was like “well sure, I’d love to earn 19.5% with inflation absolutely raging please sign me up.” That 19.5% was supported by the Luna Foundation Guard.

So basically, it was a system that relied on people paying enough attention to bring things back into balance. If you think that’s confusing, you’re right. That’s why it exploded. It was illogical.

Lots of things went wrong.

There was a really tense macro atmosphere where Bitcoin went through a massive selloff, as well as tech equities (which crypto trades like), and a tightening liquidity market as the Federal Reserve raised rates.

If you want more technical detail, there was also a migration from 3pool to 4pool on Curve Finance. Do Kwon, the founder of Terra, withdrew UST to prepare for this, resulting in a further liquidity dry up. The Luna Foundation Guard was selling UST to buy BTC to build up their reserves creating even more illiquidity and pressure. Then someone appeared to attack because it was an incredibly opportune time to do so. Someone dumped a bunch of UST on the market, and then Terraform Labs removed even more UST to try and balance everything out which resulted in even more instability.

People and funds began to get even more nervous so they sold their UST and created even more instability and then this massive death spiral began. The Luna Foundation Guard had to loan out $750 million in Bitcoin and $750 million in UST to defend the peg and were asking other institutions to help out. But they were selling Bitcoin creating even more pressure on Bitcoin which compounded the spiral.

It created a bank crisis. Luna and UST imploded.

Key thing to know here is that Luna and UST worked until they didn’t. And they could have kept working if people simply believed in them (and if their founder wasn’t a con artist).

A is collateral for B and B is collateral for C and C is collateral for A. So if A goes down, the whole house of cards collapses. Anchor got more inflows because the Federal Reserve was slamming brakes on the economy. One of the biggest reasons Luna’s demise was so impactful is because people were investing in something they expected to protect their assets by attaching their value to more stable reserve assets. But instead, the circular volatility caused extensive losses for everyone involved. The Luna crash alone ended up wiping out $60 billion of digital currency.

Frog Nation

Frog Nation was another example of what can happen when a crypto project fails. Frog Nation was “a collective of multichain DeFi projects like Abracadabra, Wonderland, and Popsicle Finance”. It was launched by Daniele Sesta and his team with the main goal of creating a place for stablecoin yields and fostering a community within DeFi.

Early on, Frog Nation had attracted significant interest. One of its major cryptocurrencies, Wonderland TIME, reached a high of nearly $10K. However, when news came out that Frog Nation’s CFO was a co-founder of a crypto exchange called QuadrigaCX that had collapsed back in 2019, leading to almost $200 million in losses, the value of Wonderland TIME dropped 40% in the first 24 hours before sinking to 5% of its previous high. The failure of the TIME token led to significant liquidation.

With so many different failure points in the crypto ecosystem, from Luna and Terra to Frog Nation, people started looking for someone to help support the ecosystem, and bolster failing projects.

The Federal Exchange of Crypto

FTX was a cryptocurrency derivatives exchange that was launched in 2019 by Sam Bankman-Fried, a former Wall Street quant. It had a variety of product offerings, like futures, options, leveraged tokens, spot trading, and more. FTX was known for being innovative and user-friendly, and acquired other cryptocurrency companies like Blockfolio.

In the depths of the oncoming crypto winter, FTX became the lender of last resort. While so many projects failed around it, FTX’s balance sheet seemed positioned to support a number of high-profile potential failures. First, FTX bailed out BlockFi. Blockfi was a cryptocurrency lending platform that essentially acted as a bank, allowing users to deposit their crypto which the company would then loan to other users. FTX bailed out BlockFi with a $250 million credit line. Then, FTX’s hedge fund, Alameda Research, stepped in to provide $500 million to Voyager. Voyager was another crypto platform that offered commission-free trading on a range of cryptocurrencies, and it imploded during May and June, requiring Alameda Research to step in. These projects were imploding because of a perfect storm of rising regulatory concerns, environmental concerns, and the fallout from UST and Luna.

But the pain was far from over. Three Arrows Capital (aka 3AC), a crypto venture capital firm that was heavily involved in a lot of projects trading on massive leverage, blew up next. Then, Celsius and Babel Finance also paused withdrawals. Celsius was yet another cryptocurrency lending platform that allowed people to earn interest on their crypto holdings and borrow against crypto collateral. Babel was a financial services provider offering borrowing, trading, and market-making services, mostly serving institutional investors.

FTX had been one of the firms that liquidated 3AC because of the UST blow up. Now, with what felt like a generational failure with Luna and Terra, FTX was involved with several other similar situations. 3AC, Celsius, and Babel had all been involved with UST and had outsized exposure to its collapse, which is what caused them to collapse too.

Stepping back from this series of events, it appears that the drastic institutional retreat from crypto which helped precipitate the series of collapses described above, was in part driven by the Federal Reserve’s rate hikes over the course of 2022. These rate hikes actually paved the way for SBF to flex his own “central bank” muscles across the crypto ecosystem. And that’s exactly what he did. The alleviation that FTX was attempting to provide is a big part of why the actual Federal Reserve exists for more typical financial markets.

At this stage, FTX was trying to play the role of crypto’s federal reserve. Any number of currencies and projects owed their continued existence to FTX’s balance sheet. Investors were heralding FTX and SBF himself as a visionary. Everything was going great for FTX.

Until it wasn’t.

The King Has No Clothes

FTX blew up.

In a nutshell, FTX made a number of big dumb bets that looked like they were working up until they failed miserably. SBF described the massive bets he was taking as “loans [with] no downside.” In both the tech ecosystem and in DC, SBF had been seen as a regulatory darling, doing the work for the alternative financial ecosystem that needed to be done.

But in November 2022, everything changed. Alameda’s balance sheet was leaked by Coindesk, and it raised a lot of eyebrows. Two numbers in particular drew everyone’s attention. Alameda had $4 billion of FTT on its balance sheet, and $2 billion of something called “FTT collateral.” FTT was a token issued by FTX for trading fees. So while people had previously considered FTX and Alameda as “just good friends,” there was now evidence in plain sight that FTX and Alameda’s finances were intricately, and dangerously, interconnected.

FTX and Alameda both tried to throw onlookers off the scent of their spiderweb of financial danger, but were called out by Changpeng Zhao (aka CZ), the CEO of Binance, a rival crypto exchange. FTX and Binance had extensive history. As early as 2019, FTX and Binance had been in conflict. At several points, SBF had seemingly weaponized global politics against Binance, which was already under investigation by the U.S. Government. Interestingly enough, Binance had previously helped to spin up FTX, and as a result had a sizable stake in FTX. Likely as a result of the conflict between SBF and CZ, Binance sold their FTX stake in 2021 for $2 billion of FTT.

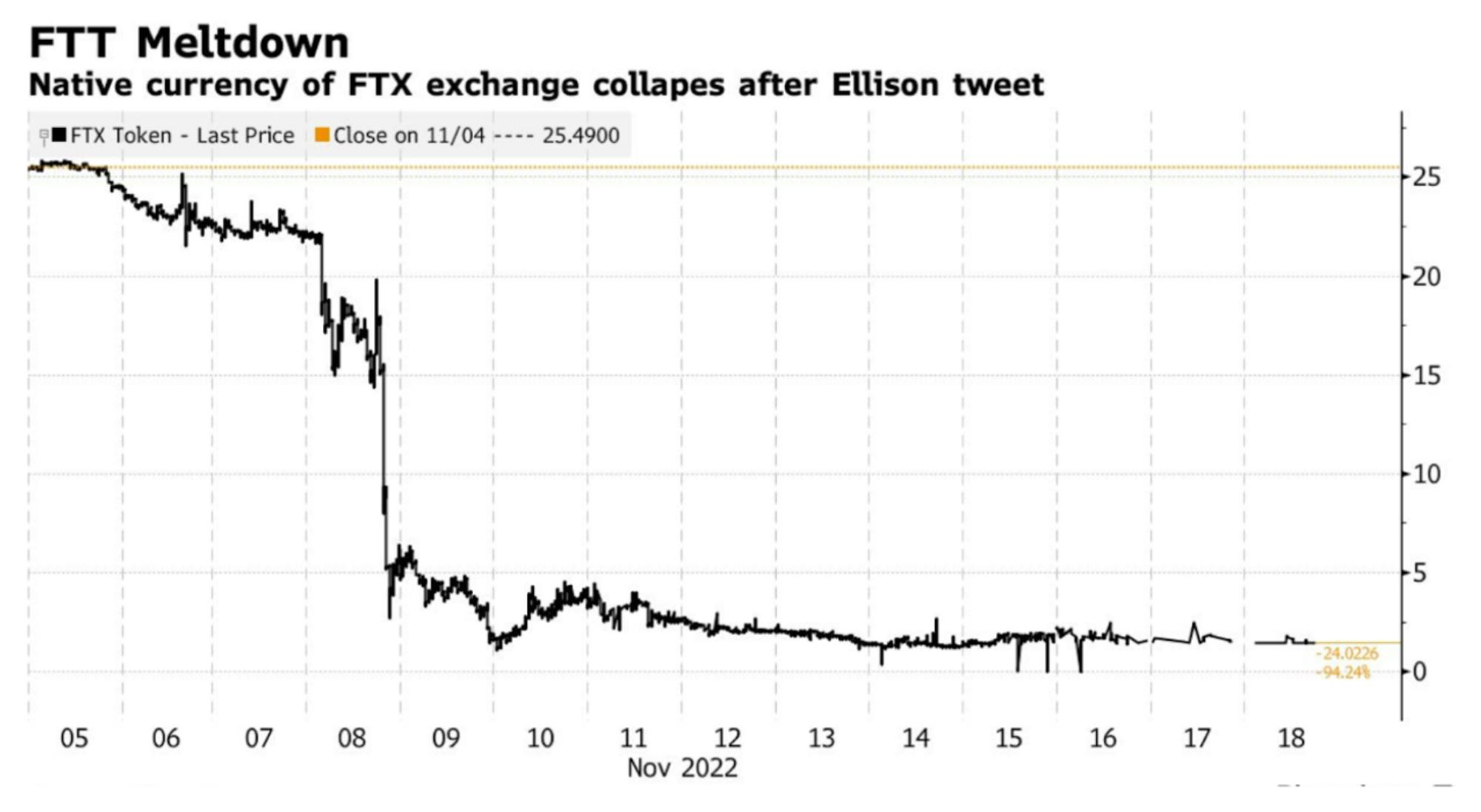

So when Alameda’s balance sheet became public, CZ said that he was going to sell his FTT holdings from the sale of Binance’s FTX stake because the situation was reminiscent of that which led to Luna’s failure. This signaled to the broader market that FTX was in danger of a similar blow up. Caroline Ellison, who was running Alameda, said that they could buy all the FTT from Binance for $22 a token. The market immediately turned on FTX.

Source: Bloomberg

Before FTX could respond, people took out $6 billion from both FTX and Alameda, leading FTX to pause withdrawals entirely, which only exacerbated the problem. Binance then stepped in and effectively said “I see we have a problem that we might have contributed to on our hands here”. Binance offered to save FTX, but quickly realized that the FTX and Alameda balance sheets were a special circle of hell and quickly said never mind. SBF was tweeting wildly during that time, trying to assure everyone that everything was fine and that a $9 billion hole in the balance sheet was totally normal and solvable.

The more people went to shine light on FTX and Alameda’s financial position, the more they learned. Alameda was bad at trading. The froth and upward volatility of crypto more broadly had convinced users that the underlying investments Alameda was making were sound. But, in reality, the firm was far too aggressive with their venture bets, carried large margin positions, pledged illiquid collateral to make more bets, and essentially just became very very well capitalized gamblers with FTX as their dealer.

When lenders demanded their money back, nobody had it. Alameda didn’t have enough liquidity on their balance sheet. FTX had lent $10 billion of client funds to Alameda. Alameda was also frontrunning tokens ahead of FTX listing them, which brought up a whirlwind of ethical and legal questions about the entire relationship.

The Bahamas, where FTX was based, then froze FTX’s assets and directed the assets to their government wallet. FTX had allowed for withdrawals from Bahamian users but that caused other problems. Finally, FTX Digital Markets filed for Chapter 15 bankruptcy and the Bahamian government started working with US bankruptcy firms to unpack the 134 firms associated with FTX.

John J. Ray III was brought in to salvage anything he could. Ray is the man who liquidated Enron, and somehow, FTX was in much worse shape than that. More than a million creditors. Over $50 billion in liabilities. In the vacuum left by FTX, Binance started to take on a similar role of “central bank.” CZ drew a number of comparisons to J.P. Morgan when he created an industry recovery initiative up until Binance too started to show cracks similar to those of FTX.

Before the FTX debacle had settled, contagion started to take hold. BlockFi, Ikigai, Multicoin Capital were all impacted. The biggest impact was on Genesis, a child company of Digital Currency Group, a big component of the institutional crypto system, which sought a $1 billion credit facility before pausing withdrawals. Genesis was the center of crypto markets providing custody funds, helping earn yield, and providing the yield product for the Centralized Finance platform.

The new FTX CEO (the guy who had previously liquidated Enron) couldn’t stop decrying the situation that SBF had created in statement after statement. In FTX’ first bankruptcy filing, John Ray wrote:

"Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information.”

Other people turned to the 69 investors who had poured $420 million into FTX in 2021 alone. After people started asking questions, it turned out that SBF had pocketed $300 million of that capital in secondary stock sales. Some investors made statements about the due diligence they had done. However, as others dug into the balance sheet and other documents that leaked, it was clear very few people had any involvement in FTX’s financial actions, and none of them were professionals.

Achieving Crypto’s Vision

The rise and fall of crypto mania across 2021 to 2022 put a number of crypto projects in the crosshairs of legal action and government regulation. In 2021, Coinbase CEO Brian Armstrong was picking fights with the SEC on Twitter. In early 2023, regulators began investigating stablecoin-issuer Paxos and sued crypto-exchange Kraken. This isn’t necessarily new; crypto has always been a regulator's nightmare, and often associated with crime.

One investigation found that, while crypto-related crime hit a record high of $14 billion, it represented only 0.15% of all crypto transactions. The SEC’s mindset is typically to regulate through litigation. Gary Gensler, the head of the SEC, is actually fairly knowledgeable about crypto. He has stated before that he is “technology neutral, but passionate about investor protection.” But the SEC still hasn’t done a great job of communicating their expectations.

Contrary to what some may think, crypto isn’t opposed to being regulated. While crypto was built around the idea of creating ownership for participants by removing rent-seeking intermediaries, most in the space want meaningful regulation to achieve a level of validation that would drive more mainstream adoption. The economic system crypto envisions can both circumvent financial interlopers, while also abiding by regulatory expectations, if only those expectations are clear.

Other aspects of the crypto vision present a promise of the convergence of the physical world and the internet. What has been promoted (and derided) as the metaverse is still reflected in how technology is changing. Any new technology becomes an extension of ourselves. Our phones are our second hand. Our laptops are literally our laps. We become the technology we use.

As much as we create the tools, the tools create us in turn. One of the biggest obstacles in crypto is this reflection of human nature in technology. Human beings aren’t rational, and a number of things about crypto highlight that. As Frank Rotman once said:

“The truth is that the human psyche is complex and not all decisions are made to produce an optimal outcome.”

A lot of crypto boils down to values, community, status, uniqueness, and memes. Those values are connected to economic transactions that express who we are as people; a high level of finance as culture. We, as people, crave community, with the desire to be a part of something bigger than ourselves. We also crave status, accessing things that other people can’t through utility and scarcity. We also want memes, myths that allow us to believe in the society that we’ve built up around ourselves.

There are a lot of people exploring the decentralized, tokenized world. Money is an abstraction of value. We want to own stuff. We want to build stuff. NFTs, cryptocurrencies, and blockchains have been used and abused, explored and deplored. But the reality is these technologies represent a human attempt at seeking a new system.

We still don’t own the Internet (to an extent). Intermediaries control the majority of people’s lives. People are seeking to redefine the frameworks and values that dictate their lives. And that attempt to redefine the world is taking into account community, ownership, and finance as an increasing part of our narrative.

The market is calibrating, and euphoria (and eventual winter) is a part of that. We are figuring out how to own the online via crypto, trying to adapt to this next plane of existence. As we continue to become more online, crypto could provide the tools we need to define ourselves. We are entering a space where we don’t really know what is next (the metaverse?). The stickiness of community is something we fundamentally crave as humans, and crypto is building on top of all existing community stacks.

Crypto is still trying to figure out what it wants to be and where it wants to go. Regulation will likely guide a lot of that. But for now, the answer is to protect, own, and benefit – to create a world where access is equal, and everyone can have a chance to build. Whether or not crypto will deliver on that remains to be seen. But the hope is there.

Special thanks to David Phelps for feedback