Thesis

In the post-COVID-19 pandemic era, remote work continues to trend up compared to pre-pandemic levels, with remote work accounting for 28% of workdays in early 2023, versus only 6% before 2019. A July 2023 survey found that US executives expect hybrid and remote work to continue to increase for the next five years. The ongoing shift to remote work is a result of benefits to both employees and employers including reduced commute times, increased productivity, and better work-life balance. 57% of workers in 2023 say they’d leave their jobs if not allowed to work remotely. For employers, the reduced office costs associated with remote work, which can amount to $11K per employee, is a significant benefit.

Another benefit of remote work is that it allows businesses to access international labor markets, increasing the quality of job candidates. However, hiring internationally remains a complex process. An international workforce means managing different employment types, dealing with different tax implications in different countries, managing payroll and incentive distribution across a distributed workforce, and setting up costly legally compliant subsidiaries. To ensure compliance with a complicated array of international regulations, companies can either open a legal entity in every country they hire from or hire a mix of third-party professionals in different countries which can cost at least a 15% markup for each employee.

Remote is a global HR platform that provides global payroll and remote workforce management solutions for businesses with remote, global teams. It offers international payroll, solutions to help businesses remain compliant with local labor and tax laws, benefits management solutions for companies looking to hire full-time employees, and contractor management services. Remote owns local legal entities in countries that it covers and charges a flat fee with no minimum commitments to its customers. The company also offers relocation consultation and support, risk advisory, and talent acquisition strategy services. Remote itself is a fully distributed startup with no physical offices.

Founding Story

Remote was founded by Job van der Voort (CEO) and Marcelo Lebre (President) in 2019. Van der Voort was the VP of Product at Gitlab and Lebre was the VP of Engineering at Unbabel when they conceived the idea for Remote.

Van der Voort worked as a neuroscientist before leaving academia in 2012. He then founded a startup with Lebre which ran out of money within three months. He then joined GitLab as a service engineer, transitioning to product management, and eventually VP of Product between 2014-2019. It was during his time there that he encountered challenges dealing with the tedious process of hiring people from across 67 countries: GitLab itself was completely remote and fully distributed, which van der Voort considered an advantage.

Lebre, on the other hand, worked as a software developer and engineer in various companies before becoming the CTO at Faber Ventures in 2015 and then moving to Unbabel, an AI-powered translation platform in 2017. Lebre and van der Voort met in 2012 through friends and had been collaborating on side projects and business ideas throughout their careers. Lebre admitted that he found himself “limited by the aspects of office-bound culture”, and coming up against similar issues regarding global talent mobility.

In 2019, the two decided to found a company that would help address the challenges with international hiring. In a 2022 interview, van der Voort described why they felt motivated to work on this problem space as follows:

“Where you live should not determine the opportunities you are given in life. [With international hiring] jobseekers will be able to access well-paying jobs, companies with good benefits, and opportunities for professional development from wherever they choose to be based.”

There are tax and legal implications unique to every country, and employing global teams is challenging, even for bigger companies. The process of hiring usually takes several months to complete, which comes at a substantial cost to the company. Given these complexities, van der Voort hired the legal team at Remote early on and then worked to expand the rest of the team.

Van der Voort reached out to the owners of the domain Remote.com to acquire the name in 2019, saying that it was the “best possible domain” for the company’s goals. As of 2023, the company has over 1.2k employees and is Portugal’s fifth billion-dollar company.

Product

Remote is a cloud-based hiring tool that provides global payroll, HR, tax, and compliance solutions for distributed teams. It offers employer-of-record (EOR) services to clients, which allows them to hire, manage, and pay employees in different countries. Along with the EOR service to hire full-time employees, Remote also offers services to manage contractors and mitigate compliance risks.

For companies to be able to hire globally, they either need to have local legal entities set up in those locations, or partner with a Professional Employer Organization (PEO) or EOR. These employment partners can hire workers on a company’s behalf and handle payroll, benefits, and taxes for the employees. Partnering with a PEO means a company will still have to set up its own legal entity, but other HR functions including payroll, benefits, and in some cases talent will be managed by the PEO.

In case a company does not own a legal entity in the country where it is conducting a hire, it can use a company offering EOR services that employs workers on its behalf. Opening legal entities in countries can be a tedious process, especially for small to mid-sized companies, which is where EORs can be helpful. Remote operates on a “wholly-owned” EOR model, which means it owns the legal entities in the countries where it has a presence. This is in contrast to an “aggregator” model, in which an EOR partners with a local legal entity instead of setting up its own.

EOR companies also offer integrations with other existing HRIS, finance, payroll, and SaaS management software. Remote, for example, offers integrations with Greenhouse, Zapier, Bamboo HR, HiBob, Personio, Easop, and Seit through the Remote API offering. Employees are paid in their home currency, and a competitive foreign exchange rate is used in case of currency conversion. Remote offers services including EOR services, contractor management, HRIS software, global payroll, remote relocation, and an API.

Employer of Record

Source: Remote

Remote operates as an EOR in countries around the world. It performs HR and legal functions, as well as providing intellectual property protections. Features of Remote’s EOR offering include:

Employing workers: Remote removes the need for customers to set up any legal entities since Remote is the on-paper employer for international hires.

Payroll and tax management: This allows hourly or salaried workers to be paid using Remote, which handles taxes and withholding agreements based on individual countries. This service is also offered as a standalone under Global Payroll for companies that don’t need EOR services but want to pay international employees.

Competitive local benefits: As an EOR, Remote lets companies offer health, vision, dental, retirement, and pension benefits, curated to the target country.

Operational management: Remote handles time-off requests, tracks working hours, and monitors attendance.

Remote IP Guard: Remote offers a service to safeguard clients’ intellectual property rights and allows tracing of IP transfer between employee and client company.

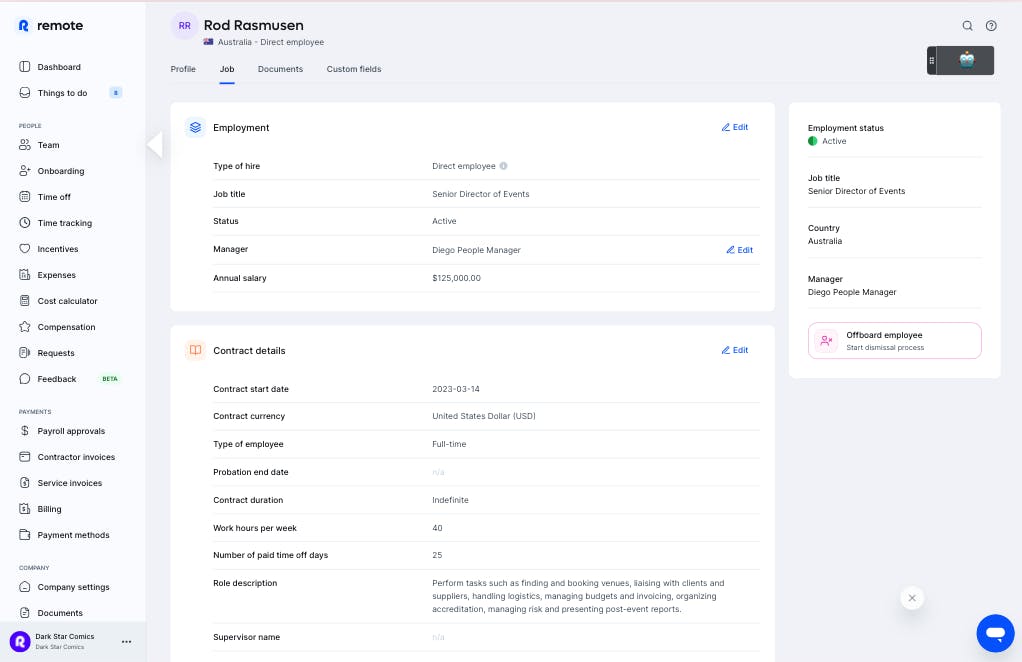

When clients use Remote as an EOR, they can manage all employment functions on its HRIS platform.

Contractor Management

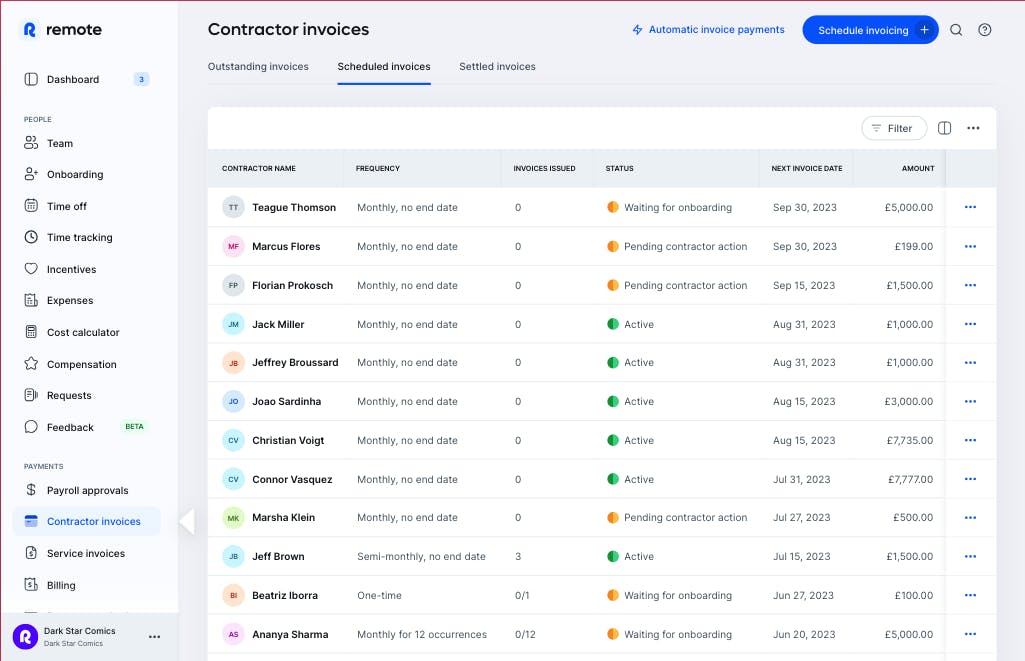

Source: Remote

Remote’s Contractor Management product lets clients hire and pay contractors across 180+ countries. Remote generates bilingual, legally compliant contracts for onboarding, generates contractor invoices, and provides payment insights like contractor rate, currency, and payout information. Remote also provides an Employee Misclassification Tool, which allows clients to check for the risk of incorrectly classifying employees as contractors.

The Contractor Management product also helps US employees with pre-filling 1099-NEC, a tax form to report non-employee compensation from independent contractor jobs. Clients can pay contractors using ACH or direct debit payments. When paying employees in different countries, a 1-2% currency exchange rate is applied, which is reflected at the contractor’s end.

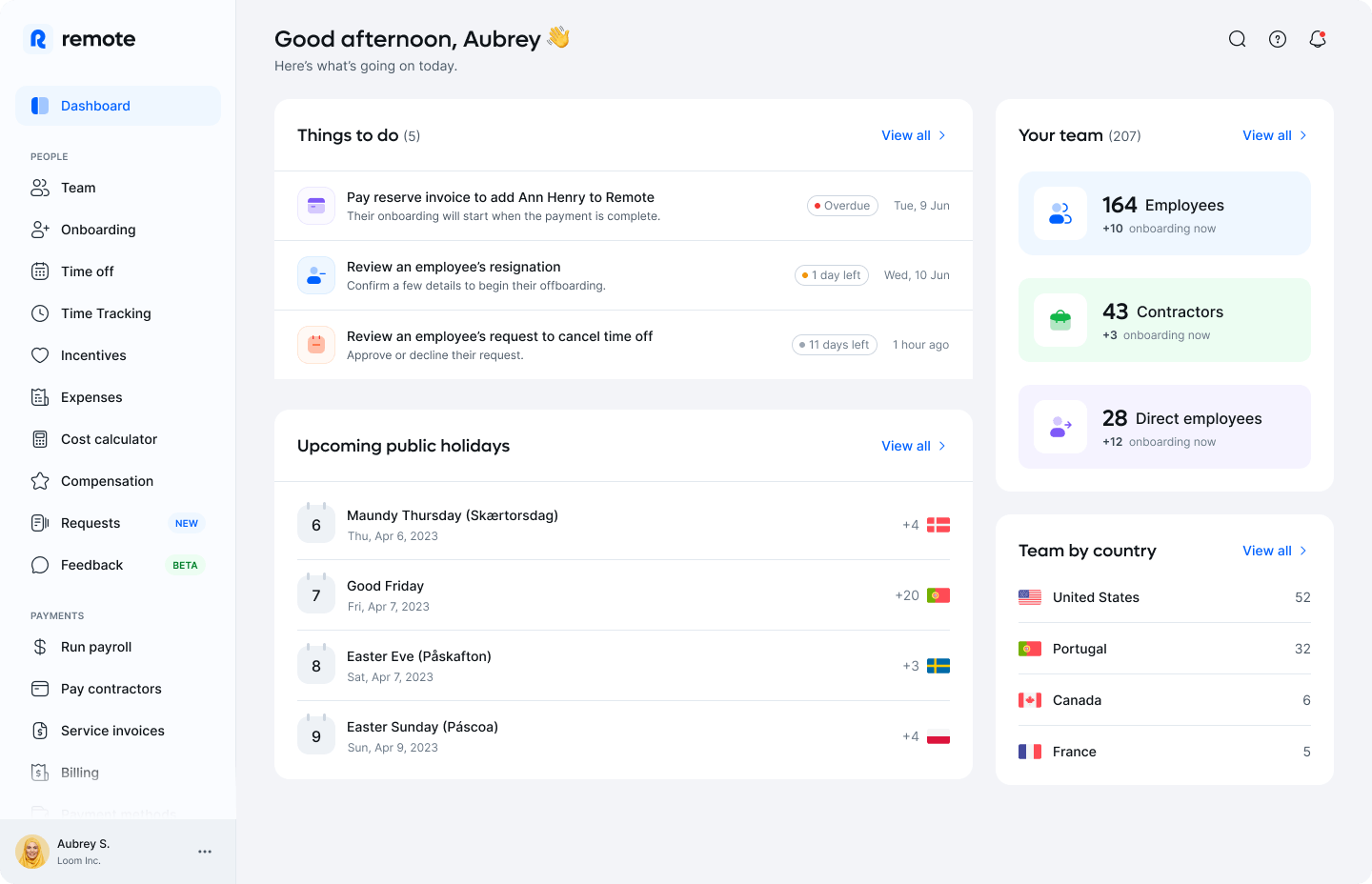

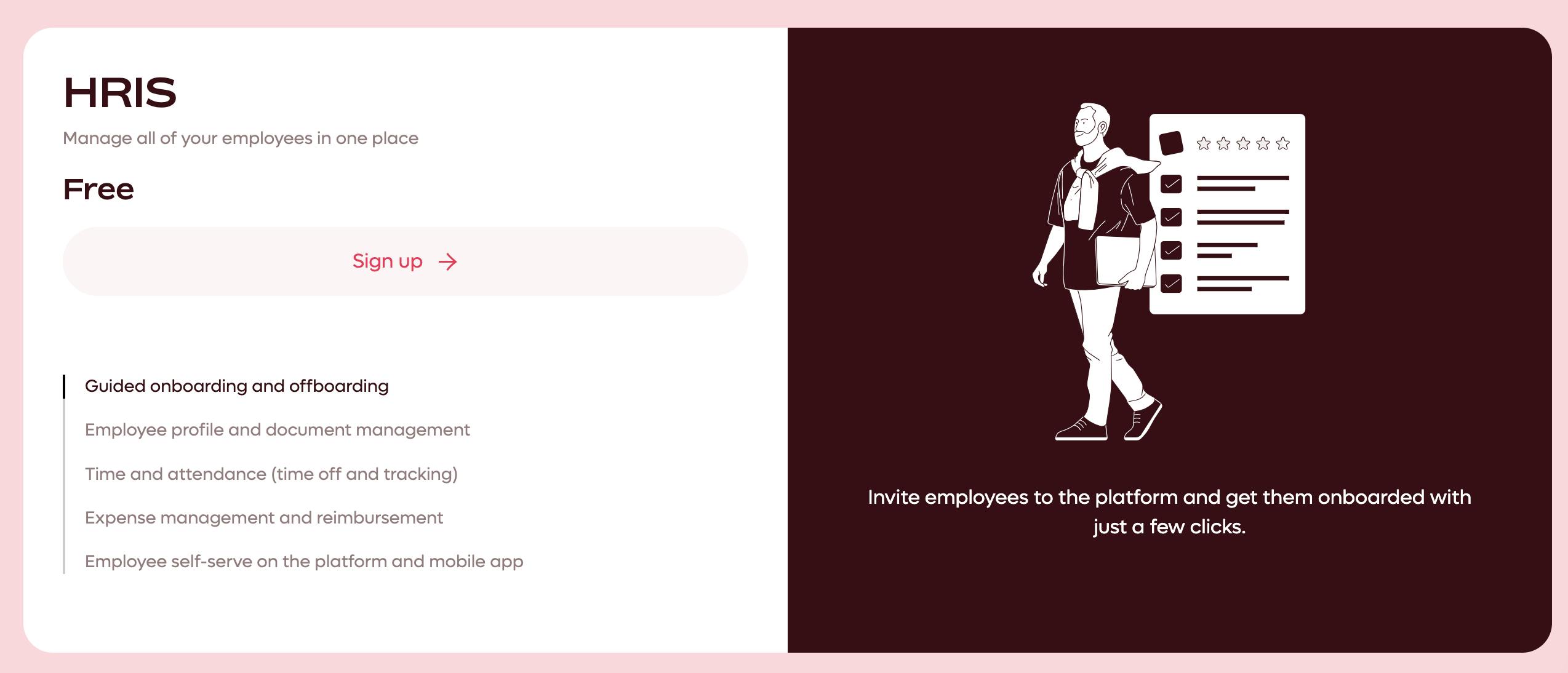

Human Resource Information Software (HRIS)

Source: Remote

Remote’s HRIS product allows companies to initiate employee onboarding, compile employee information like profile, pay, hours tracking, time off in one place, and track expense management. These services are free to use, but features like payroll processing for direct employees, onboarding contractors, and hiring international employees through the platform come at an additional cost.

Remote’s HRIS software also gives employees a self-serve platform, letting them update their personal details, generate documents, track hours, request time off, and submit expenses through an employee-facing portal.

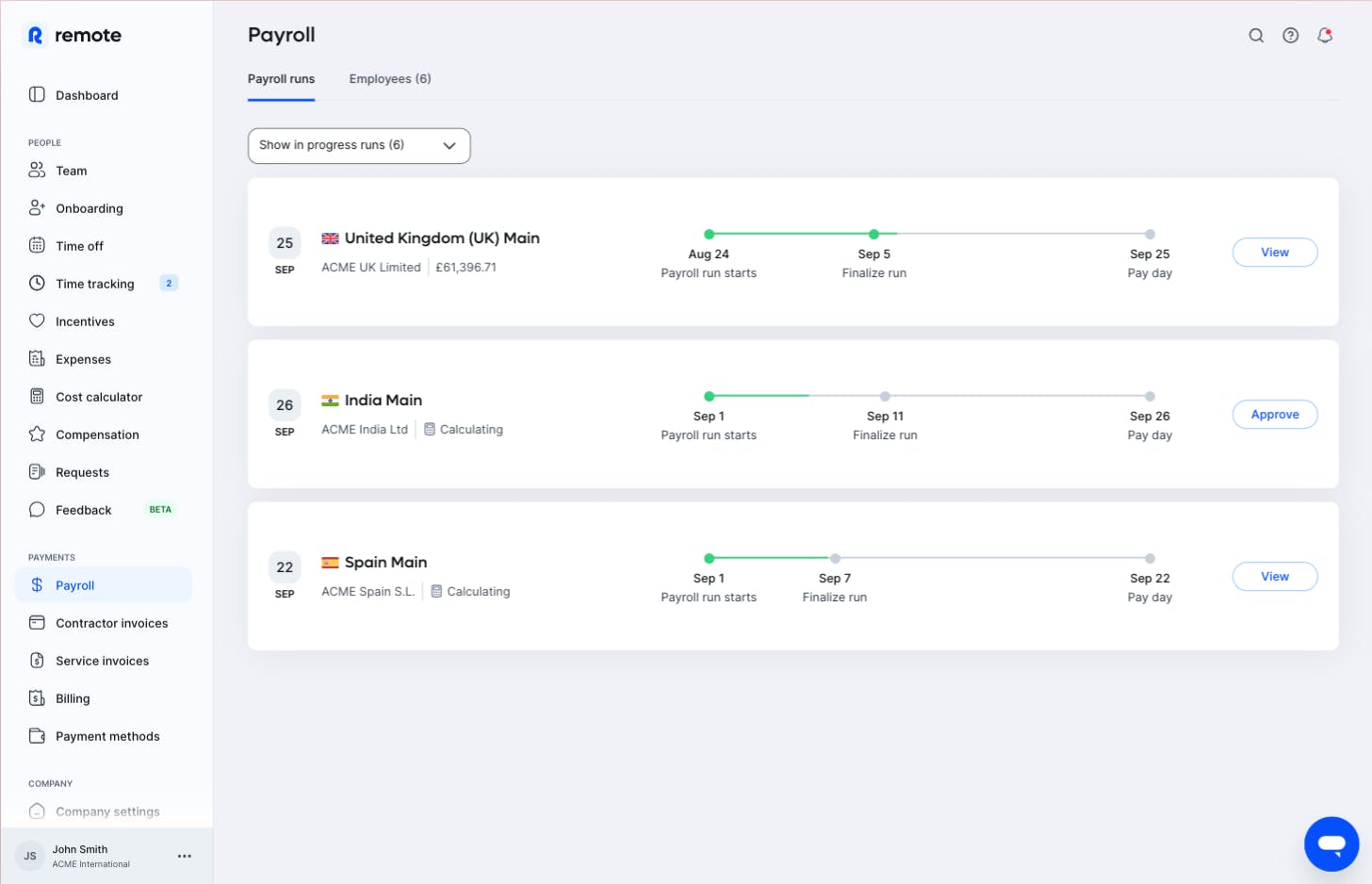

Source: Remote

Global Payroll

Source: Remote

Remote’s Global Payroll product lets companies manage payroll for employees around the world, including salary, benefits, expense management, stock and incentive offers, and tax withholding. Companies that already have a legal entity in the target country where their employees are based can use global payroll integrated into the HRIS software platform for an additional cost. Companies without a legal entity in the target country can first use Remote’s EOR product to hire employees. The Global Payroll offering is accessed through a tab on Remote’s HRIS platform and displays payroll breakdown by country and by employee.

Remote Relocation

Companies can get relocation assistance for their employees in 19 countries through Remote’s relocation product. This offering covers pre-visa assessment, insurance, travel letter requests, pre-employment checks, progress tracking, immigration and tax guidance, and settling-in assistance. On a case-by-case basis, Remote also offers sponsorship for employees.

Consulting Services

Remote offers consulting sessions to provide information and help to clients on avoiding risk and global hiring. It offers advisory services informing companies about misclassification risks, the legal and tax implications that can result from misclassifying employees as contractors, and provides solutions for employee-to-contractor conversion. Remote’s consulting services also include sessions offered on talent acquisition strategy, equity incentive planning, tax analysis and impact of hiring in target countries, and switching EOR providers.

Remote API

Remote’s API offering allows companies to use the white-label version of its hiring solutions and integrate it with their own platform. Customers can also use Remote API to consolidate their global employee data across multiple systems into one place and have a single view of the entire team. The endpoints offered include country availability, customer onboarding, customer updates, employee onboarding, time off, employee updates, document management, payslips, billing, and expenses.

Market

Customer

Source: Remote

Remote’s customer base includes companies that want to hire contractors and full-time employees globally. It provides contractor management services in 160+ countries and global employment services by being an EOR in 80+ countries as of November 2023, according to a source at the company. Notable customers include Loom, GitLab, DoorDash*, Hello Fresh, Burger King, and Aston Martin. Remote also offers a discount on service fees for a year to Social Purpose Organizations, which are defined as companies registered as non-profits, charities, trusts, social enterprises, or benefit corporations with a mission to make positive social change.

Remote is marketed towards a range of companies, from startups (such as Loom, Loop Earplugs, and Primer) to enterprises (such as GitLab, Burger King, and Aston Martin), who want to hire globally, consolidate payroll, or offer remote relocation support.

Market Size

As of 2022, 70% of mid-sized companies globally had flexible work policies in place, though only 31% of employers offered the option to work fully remotely. Remote work is on the rise compared to pre-pandemic levels, with remote work accounting for 28% of workdays in early 2023, versus only 6% before 2019. A July 2023 survey found that US executives expect hybrid and remote work to continue to increase for the next five years.

EOR providers like Remote give their customers the ability to expand their business at lower costs by not setting up legal entities in multiple countries, while also allowing them to tap a wider international market for talent. The EOR market, which was valued at $4.4 billion in 2022 is expected to reach $6.6 billion by 2029, growing at a CAGR of 6.8%. The EOR market is likely to benefit from the continued growth of remote work.

Meanwhile, the broader global HR payroll software market which Remote also addresses was valued at $27.6 billion in 2022 and is forecasted to reach $61.9 billion by 2030, growing at a CAGR of 10.6%.

Competition

Direct Competitors

Deel: Deel is a global payroll and compliance provider which was founded in 2018. It raised $50 million in a venture round at a $12 billion valuation in May 2022, bringing its total funding to $679 million. The company reached $295 million in annual recurring revenue in December 2022, propelled largely by its EOR business. It has 15K+ customers, including Nike, Notion, Airtable, Mercury, and Shopify, and is available in 150 countries.

Like Remote, Deel owns entities in the countries where it offers hiring services, instead of an outsourced partnership model. The company is also expanding its offerings to compete with other adjacent players such as Gusto and Rippling by offering domestic payroll services, and Brex and Ramp by eventually expanding into spend management solutions. It acquired Capbase, a fintech startup for founders to manage their cap table in real time, for an undisclosed amount in January 2023.

Papaya Global: Papaya Global, founded in 2016, is a global payroll and payments solution provider. It raised a $250 million Series D in September 2021 at a valuation of $3.7 billion, bringing its total funding to $444 million. It has 1K+ customers in 140+ countries, including Wix, Datadog, Kong, and Rubrik.

Papaya Global follows the “aggregator EOR” model, differentiating itself from Remote and Deel. In this model, the EOR provider (i.e. Papaya Global) partners with an in-country partner (ICP) in every country served, instead of owning a legal entity in those places. It partnered with Mesh Payments, a provider of corporate payment and spend management in April 2022. Papaya Global also acquired Azimo, a money transfer business, in March 2022. The company, which has seen revenues growing 300% each year between 2019-2022, is expanding into more markets and focusing on the instant payroll payments part of the employee hiring lifecycle.

Oyster HR: Oyster HR, founded in 2020, is a global employment platform, offering hiring and compliance services in 180+ countries. It raised a $150 million Series C in April 2022, reaching a $1 billion valuation. The company saw a 20x increase in revenue in 2021, with women making up 50% of its leadership team. It has around 1K small- and medium-sized businesses as customers, including Quora, Lokalise, and Jobbatical.

Oyster HR follows a hybrid model, operating fully-owned entities in some countries and partnering with ICPs in others. It has partnerships with benefits, HCM, and finance companies such as Brex, Greenhouse, and Airwallex, among others. These allow partners to obtain discounted solutions, API integrations with Oyster to build end-to-end solutions, and referral programs for their customers.

Adjacent Competitors

Gusto: Gusto is a human resource management company founded in 2011 that provides payroll and benefits solutions. It raised a $55 million Series E extension in May 2022 that brought the company’s valuation to $9.6 billion. The company has generated more than $500 million in revenue in the 2022-2023 fiscal year. Gusto has a customer base of more than 300K businesses. It entered a revenue-share arrangement with Remote in June 2023 to support full-time international workers.

Rippling: Founded in 2016, Rippling is an employee management software provider that encompasses payroll, benefits, and expense management features. It raised a $500 million Series E in March 2023 which valued the company at ~$11.3 billion. The company has reported over $100 million in ARR and has a customer base of more than 400K businesses as of March 2023. With a global payroll product launch in 2022, Rippling entered competition with Remote, Deel, and other companies offering PEO and EOR services.

Business Model

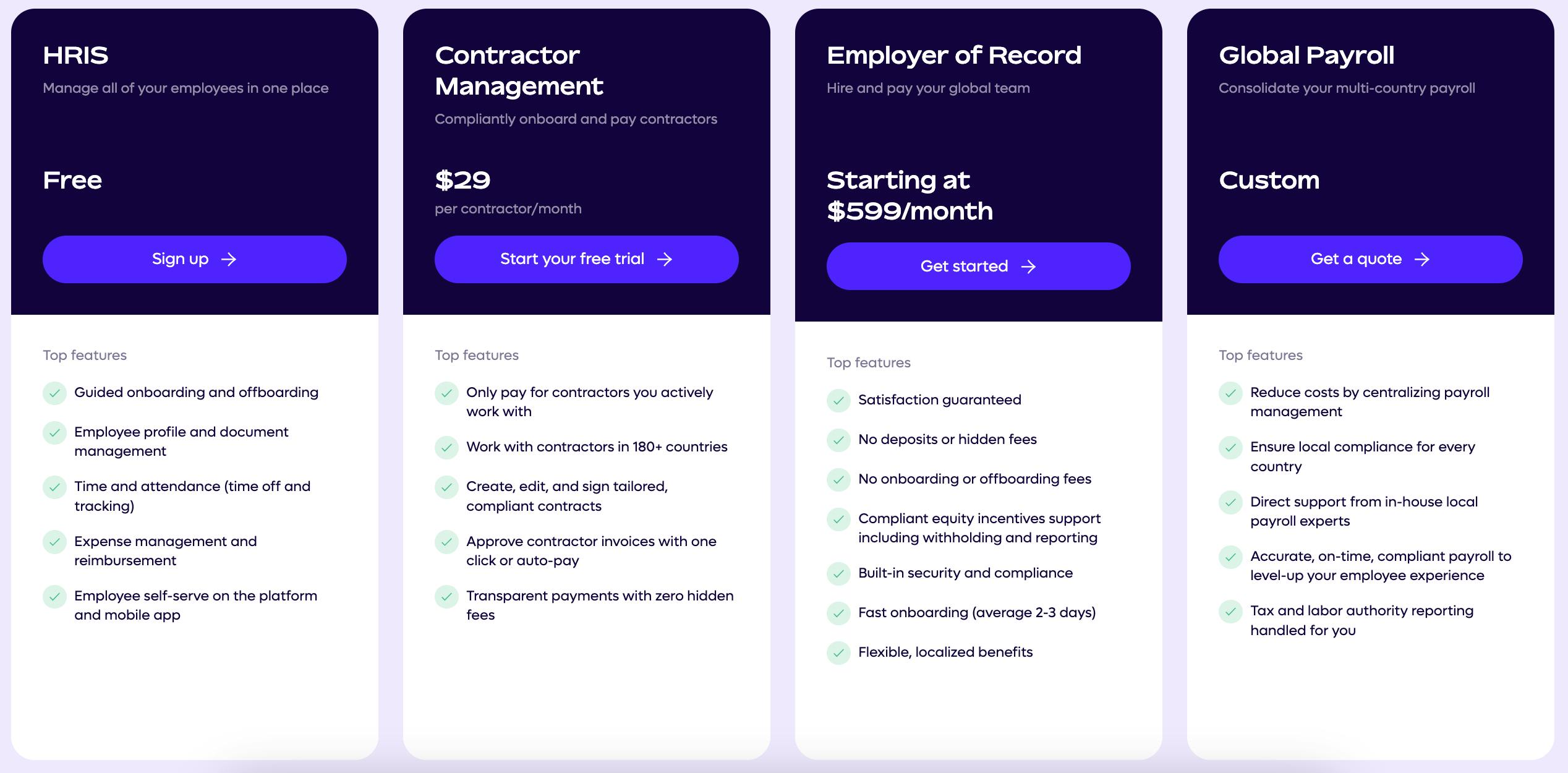

Remote offers free HRIS services and charges a subscription for its other solutions. It charges a flat rate of $29/month for individual independent contractor management. For hiring employees through the EOR model, Remote charges a flat fee of $599/month (if paid annually) or $699/month (if paid monthly) per employee. Custom pricing is available for Global Payroll services if the client wants to centralize payroll management.

Source: Remote.com

Remote has no “minimum” requirements for the number of employees, contract lengths, or number of contracts under its pricing plans.

Traction

In April 2022, at the time of its Series C fundraising round, Remote reported that the number of employees the company processed on its platform in the last twelve months had grown by 900%. It also said that its revenues had grown 13x over the same period, although it did not disclose specific numbers. Notable customers of Remote include Loom, GitLab, DoorDash*, Hello Fresh, Burger King, and Aston Martin.

The company has also seen traction with partnerships. After a beta release in 2021, Remote officially launched its API program in March 2022, allowing partners to white-label its employment solutions. In June 2023, Remote announced a partnership with Gusto.

Remote laid off 100 employees, or 10% of its workforce, in July 2022. It has not had significant layoffs since, as of October 2023. At the time, van der Voort emphasized that despite the layoffs, "Remote is doing well” and that the company was poised for future growth. As of January 2023, Remote had over 2K employees.

Valuation

Remote raised a $300 million Series C in April 2022 at a valuation of more than $3 billion. The round was led by Softbank Vision Fund 2, and investors from previous rounds including Accel, Sequoia, Index Ventures, Two Sigma Ventures, and General Catalyst participated in the round. This funding round came less than a year after Remote’s $150 million Series B in July 2021, which valued the company at over $1 billion. As of October 2023, Remote had not raised additional funding.

Key Opportunities

Relocation and Visa Services

For 49% of employees, the freedom to live and work anywhere is a high priority. Meanwhile, employers in Europe and elsewhere have observed cost savings as a result of shifting to distributed or remote work, making relocation services in those countries a key opportunity. Remote currently offers relocation support in 14 countries in Europe.

The global relocation management service market was valued at $31.6 billion in 2022, and Remote can continue to expand its relocation services to address more of this market. It can also increase the features within the existing service to provide an integrated product, such as relocation expense tracking and rental housing assistance.

Integrated Solutions

Remote offers products across different verticals like HRIS, payroll solutions, and EOR. 42% of companies still use disparate systems to manage their international hiring workflow, with country regulations and labor laws being among the top three challenges to international hiring. For small and medium-sized companies that cannot set up legal entities across the world, there is an underserved category that can benefit from integrated solutions, from talent sourcing to onboarding contractors and employees.

Key Risks

Competitive Landscape

EOR companies must struggle to differentiate from others; one way to do so concerns the kinds of integrations and the number of countries a company offers its services. Another way is to expand the number of services offered. Remote’s adjacent competitors, like Rippling, are expanding to PEO and EOR services, and direct competitors like Deel are making acquisitions to offer equity-related services to its startup clients. In a market where competitors are actively growing their services and addressable market, Remote must continue to expand its offering to retain its market position.

Direct EOR Costs

Payroll processing for global teams is complicated, requiring knowledge of taxation laws and local regulations regarding benefits, and legal compliance. Following the wholly-owned or direct EOR model, there are high costs involved with setting up a local presence for legal purposes. Unlike its competitor Papaya Global, Remote operates on a direct EOR model, which means longer set-up time in new countries for both contractor management and global employment provider service. While there are benefits to this for its customers, the costs in time and money may erode its competitive position.

Summary

The shift to remote work since the COVID-19 pandemic has emphasized the need for flexible workspaces. Remote is a global HR platform that provides global payroll and remote workforce management solutions for businesses with remote, global teams. Since its founding in 2019, it has seen notable traction and was valued at $3 billion within its first three years. However, its competitive landscape is crowded and it is dealing with competition from other high-growth startups like Rippling, Gusto, and Deel. With recent acquisitions occurring in the industry, Remote needs to capitalize on an increasingly remote workforce to retain its market position.

*Contrary is an investor in DoorDash through one or more affiliates.