Thesis

In February 2001, Nike announced that its ambitious $400 million investment in a new ERP system had backfired, revealing a catastrophic $100 million loss that caused its stock to drop 19.8%. For nearly one year, a software glitch triggered a bullwhip effect across its core operations: deleting order data, mistranslating demand signals, and instructing factories to overproduce unpopular sneakers. During a tense earnings call, Phil Knight’s infamous remark captured his frustration: "This is what you get for $400 million, huh?"

Nike was not alone in its costly ERP implementation failure. A 2001 survey revealed that 51% of companies deemed their ERP projects unsuccessful, and by 2003, that pessimism had grown, with 65% of executives believing an ERP implementation was likely to harm their business. Fast forward over two decades, and the outlook remains equally bleak. In 2025, 50% of all ERP implementations are still expected to fail, often costing three to four times their initial budget.

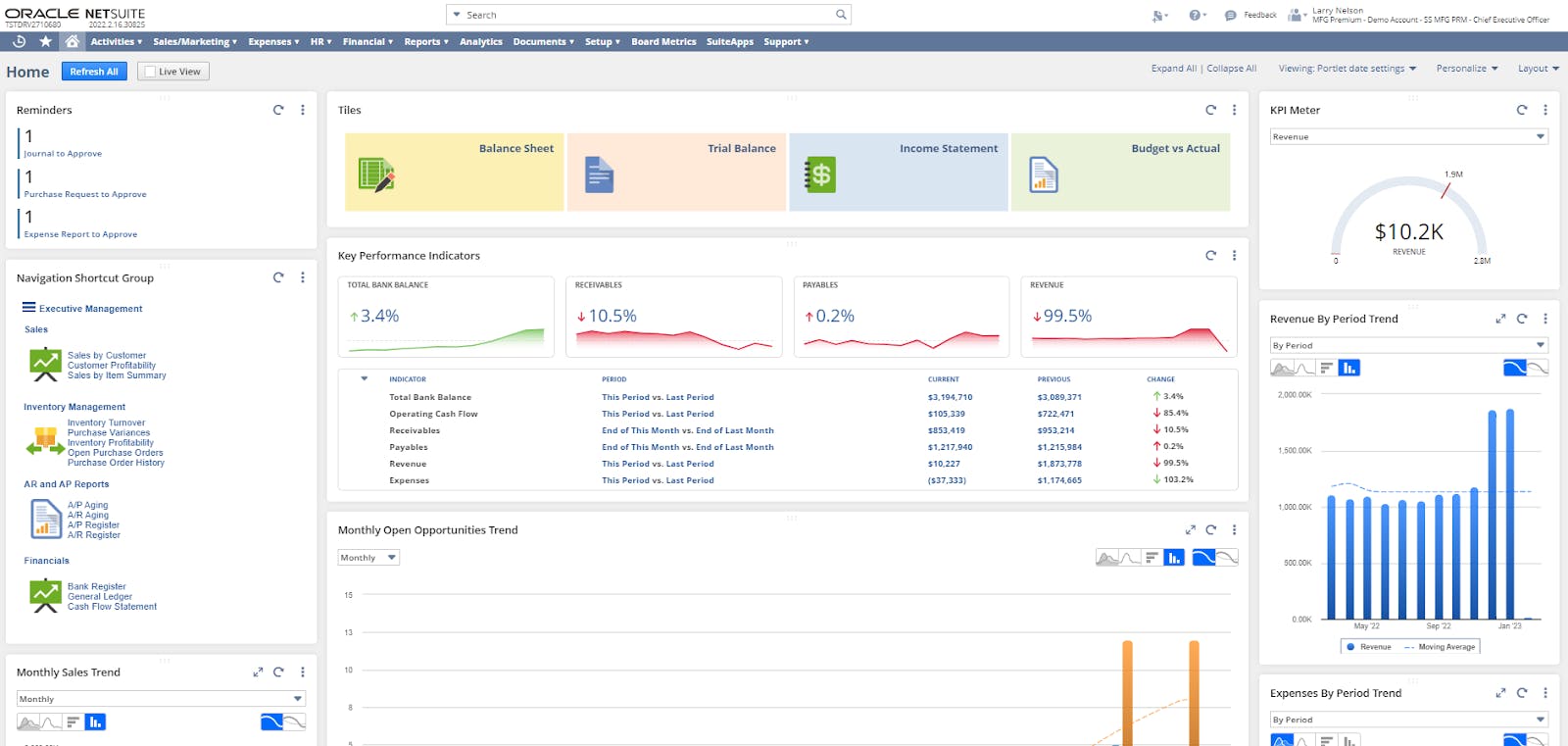

This continued dissatisfaction over ERP software and implementation stems from a structural flaw within the legacy ERP business model. Incumbent vendors like NetSuite and SAP built their empires on a vast network of third-party partners that serve as their sales channel. These partners sell ERP software and then profit from high-margin consulting fees, often necessary for implementation. For every dollar a customer spends on a license, these partners can earn up to three times that amount in consulting fees. This interdependent relationship prevents customer-centric innovation, as these partners are financially incentivized to sell the most complex and least functional software.

In response to this stagnation, 44% of end users are shifting away from legacy ERP solutions “that don’t provide measurable business results for months or even years.” This demand for value is driving customers toward modern architectures, with 60% of large enterprises planning to decouple from monolithic systems by 2027. Artificial intelligence is speeding this transition, as at least 15% of daily work decisions are expected to be made autonomously by AI by 2028. Concurrently, manual invoice processing dropped from 85% to 60% in 2023, fueling expectations for intelligent, autonomous systems.

DualEntry* competes with legacy vendors by modernizing its business model and approach to product. Instead of a monolithic suite, DualEntry focuses exclusively on the accounting core, creating an extensive, secure ledger designed to scale with a company from mid-market to IPO. This targeted strategy is supported by native integrations with over 200 platforms like Ramp*, Brex, and Deel that integrate with the ledger. This enables a fundamentally different value proposition: a zero-cost implementation process powered by an AI-native architecture that automates 90% of manual workflows. By delivering a fully configured ERP within one month, DualEntry aims to eliminate implementation risk and align its incentives directly with customer success.

Founding Story

Source: DualEntry

DualEntry was founded in 2024 by Santiago Nestares and Benedict Dohmen. In 2015, the two met as computer science students at Dartmouth, often being the last two people working until 4 AM in the library.

Bonding over their shared back pain from sitting for long periods, they took a research-driven approach to solving their problem, which led them to build a posture-support device. Soon, friends asked to borrow their prototypes for all-nighters, revealing an unexpected commercial demand. Embracing a “burn the ships” mentality, they pooled $2K in savings. Then, posing as a large Boston-based company needing samples for over one hundred board members, they convinced a Chinese supplier to produce an initial batch of 100 units. In 2015, they listed their product, Supportiback, on Amazon, and within the first day, sold a quarter of their inventory. This immediate validation was the spark that officially launched their first venture, Benitago Group, an ecommerce aggregator.

In just five years, Dohmen and Nestares bootstrapped Benitago to $25 million in annual revenue. After building a portfolio of over ten brands and 300 products, they raised $380 million to scale an M&A arm and product development studio aggressively. The influx of capital triggered significant growth. Soon, Benitago was a global operation spanning 14 countries, with 14 legal entities and 150 bank accounts. Given this scale, the company’s accounting stack became a liability. So, they decided to upgrade to an ERP.

Unfortunately, the implementation was a catastrophe. It took 18 months and hundreds of thousands of dollars to go live, only to end up with a clunky system where pages took 20 seconds to load and every minor adjustment required an expensive implementation partner. The breaking point came during a 3 AM "war room" session. With a dozen team members and M&A bankers desperately trying to manually enter two years of historical data, they paused to calculate how long the complete migration would take at their current pace. The answer was a staggering 982 days. Dohmen recalls turning to Nestares and asking, "What the hell did we pay for here?" It was in that moment of crisis that the idea for DualEntry was born. As Nestares later recalled, "I told Ben, if we ever start a new company, it will be the modern, AI-native ERP that we needed."

Shortly after, Benitago’s internal operational struggles worsened due to external market pressures. As the post-pandemic ecommerce boom cooled, the company’s M&A-driven growth model faltered. Weighed down by a clunky, expensive ERP, the team lacked the real-time financial visibility needed to navigate the downturn effectively. In November 2022, Bentiago laid off 14% of its staff, before leading the company through a successful restructuring in August 2023.

After the company was acquired in March 2024, Dohmen and Nestares reflected on the experience and recognized that what they wanted to build next was focused on making sure that the painful experience they had gone through wouldn’t happen to anyone else. As Nestares explained in an August 2025 interview with Contrary Research:

"No matter how much money we wanted to pay, there was no alternative to NetSuite. NetSuite was not good, and nobody cared to get you live. In fact, everyone cared to get you not live because that’s how they made the most money. To investors, NetSuite is this huge thing. But for customers, NetSuite primarily means just financial accounting. And that difference was one of the biggest opportunities that we saw. We don't have to build this whole thing. We need to build something very specific.”

As the team started to execute on this vision, they also brought in veteran support. In January 2025, Angus Norton, the former Chief Product Officer of Xero, joined as a strategic advisor. Norton brings deep domain expertise in scaling a global accounting platform, having led a 500-person product and engineering team through Xero's IPO.

Product

Unbundling the Legacy ERP

The legacy ERP market is in the midst of a massive replacement cycle. For decades, vendors like NetSuite built their empires, in part, by creating a defensive moat through their platform. By integrating all business functions into a single, monolithic suite, they became the sole system of record. This kept customers locked into their platform, leading to underinvestment in usability and performance. Because of their lack of innovation, they have faced increasing disruption from the growth of the API economy. With 50% of CIOs planning to upgrade their ERP systems within two years, many are opting for specialized alternatives.

Modern tools like Ramp (spend management), Zuora (billing), and Deel (HR) now provide better functionality, reducing the value of legacy ERP systems. In the mid-market, this shift has made ERP software more focused on accounting, but unbundling brings new problems. Since legacy platforms weren’t designed for the modern API economy, they don't integrate well with point solutions. This creates a costly and complicated dilemma for mid-market companies: either pay for expensive custom integrations or go back to the legacy vendor's less capable modules to avoid the high costs and effort of managing a fragmented system.

DualEntry’s strategy is to embrace this unbundling by focusing on the most vital component of the finance stack: the accounting core. The accounting core sits at the center of any ERP, serving as the primary system of record that all other financial processes read from and write to. The need for a single, consolidated general ledger is often the main reason a company adopts an ERP. By developing the leading accounting solution, which 89% of ERP buyers consider the most essential function, DualEntry positions itself to become the modern ERP platform.

Source: DualEntry

This focused strategy is enabled by a layer of native integrations that serve as the foundation of the entire product. To become the modern ERP platform, DualEntry has built and maintains API connections to the tools modern companies want to use. This includes more than 13K bank connections and over 200 native integrations with key platforms like Stripe, Coupa, and Soldo. By owning this integration layer, DualEntry addresses the fragmentation problem, removing the need for the costly, fragile third-party middleware that legacy systems rely on.

Core Platform

DualEntry’s core platform is built on an AI-native architecture with three interconnected layers that work together to deliver a more comprehensive accounting solution. It begins with the Unified Ledger, the foundational data layer that serves as the single source of truth. This ledger is governed by the Control Layer, a sophisticated rules engine that ensures automation is safe and auditable. Finally, accountants access this data and automation through dedicated accounting workflows, which represent a dedicated workspace for the month-end close. Accounting Intelligence is the key component that links these layers. It ingests and reconciles data for the Unified Ledger, acts as the agent governed by the Control Layer, and proactively flags issues in the accounting workflows.

Source: DualEntry

Accounting Intelligence is a capability that is accessible directly to the user through several features. An AI-powered Spotlight Search enables users to find any record instantly, while an Accounting Copilot functions as a conversational interface. With simple prompts, users can generate custom reports, schedule them to be sent to internal or external stakeholders, and export them to Excel with all formatting preserved.

The Unified Ledger

At the core of DualEntry’s platform is its Unified Ledger, the single source of truth for all financial data. Unlike legacy systems, where data is often siloed, the Unified Ledger is a unified database designed to handle over 40 billion records. The capabilities of this architecture become clear through the lifecycle of a transaction.

An invoice can be ingested into Accounts Payable using Intelligent Capture, an AI-powered OCR that automatically extracts and codes data. The bill is then recorded in the General Ledger. When the payment is made, the Cash Management function updates, and the transaction is automatically reconciled. Since these functions are integrated parts of the same platform, the entire process is seamless, with no syncing required. This unified structure allows for real-time reporting and makes the platform inherently audit-ready, which is especially important for multi-entity and multi-currency accounting, the primary driver for companies migrating from starter software. In legacy ERP systems, this process is often manual and prone to errors, forcing finance teams into multi-day spreadsheet exercises at the end of each month. DualEntry’s architecture automates this.

Source: DualEntry

AI features like Intercompany Netting and Auto Balancing automatically identify and settle balances between subsidiaries and post the required elimination entries, transforming a major bottleneck into an automated workflow.

The Control Layer

The Control Layer governs the data in the Unified Ledger, making automation secure and auditable by enabling finance teams to codify their internal policies directly into the platform. This is achieved through features like Approval Workflows, a flexible rules engine that enables teams to design multi-step approval policies for any transaction, including enforcing separation of duties to prevent fraud.

Source: DualEntry

This is complemented by granular User Permissions and GL Period Locking, offering administrators precise, role-based control over access and visibility. Combined with a comprehensive and immutable Audit Trail that records every line-level change, these features establish the security and compliance framework necessary for Audit Automation. This creates a foundation of trust that enables the system’s AI to operate autonomously.

Accounting Workflows

The apparatus around the product consists of accounting workflows that include the dedicated workspace where accountants handle one of their most critical and cumbersome tasks: the month-end close. In a legacy ERP, this process is stressful and manual, involving exporting data, manipulating it in spreadsheets, and chasing team members for updates. DualEntry’s accounting workflows transform this into a structured, collaborative, and proactive process. One core module within those workflows is the Close Management Checklist, a task management system visualized through a real-time dashboard that tracks progress and identifies bottlenecks. Since it is connected to the Unified Ledger, these workflows represent an intelligent, proactive system, not just a passive checklist. For example, when an accountant starts the Account Reconciliation for a specific bank account, the AI will proactively suggest matching rules based on historical patterns. Once the reconciliation is complete and the account is tied out in the ledger, the corresponding task in the close checklist is automatically marked as complete. This automation turns the month-end close from a reactive, manual effort into a more streamlined process.

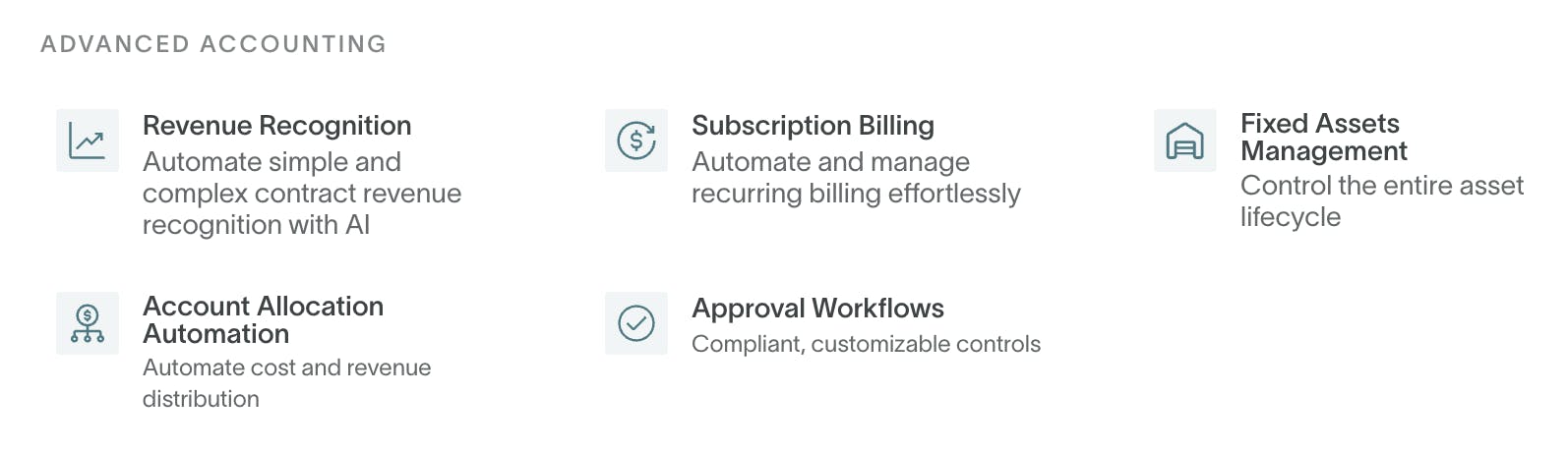

Advanced Modules

Source: DualEntry

On top of the core platform, DualEntry offers a suite of optional, advanced modules that customers can add as their business requirements change. These modules are specifically integrated extensions of the core platform that handle more complex, often industry-specific, accounting tasks. This approach allows DualEntry to support a variety of customers without the bloat of a monolithic system. For instance, a SaaS company might require sophisticated Revenue Recognition to comply with ASC 606, while also needing Subscription Management to automate billing; however, they might not need the Fixed Assets or Inventory Management modules. By offering these as optional add-ons, DualEntry enables its customers to create a customized accounting solution that precisely fits their specific needs.

Revenue Recognition: This module benefits businesses with complex contracts and is a key reason SaaS companies upgrade from basic software. Compliance with accounting standards like ASC 606 is often a manual, tedious process in legacy systems, relying on complex spreadsheets to track deferred revenue and manage multiple performance obligations. DualEntry’s module automates this entire process. Its AI-powered Contract Analysis can review a new contract, identify different performance obligations, such as a one-time setup fee, a recurring subscription, and professional services. It can then automatically generate the correct revenue recognition schedules for each. This ensures ongoing, audit-ready compliance and turns a common bottleneck into a more intelligent, automated workflow.

Subscription Billing: This module is valuable for businesses with recurring revenue models. In legacy ERP systems, managing the subscription lifecycle, from upgrades and downgrades to renewals and cancellations, is often a disjointed process that requires manual effort. DualEntry’s module unifies the entire quote-to-cash process. It accommodates a variety of pricing structures, from simple flat rates to complex usage-based models, and automates the entire billing and invoicing workflow. Additionally, it offers real-time, detailed insights into SaaS metrics like LTV, MRR, and churn, providing operators with a live view of their subscription business without needing a separate analytics tool.

Fixed Assets Management: This module is useful for companies with significant capital expenditures, such as manufacturing or construction firms. In legacy systems, tracking the entire lifecycle of a fixed asset, from acquisition and depreciation to retirement, is a time-intensive process prone to manual error. DualEntry’s module automates this workflow. Its Streamlined Asset Tracking feature automatically identifies and categorizes transactions that should be assigned to fixed assets. The platform then offers Automated Depreciation calculations, supporting everything from simple straight-line methods to complex custom rate curves. This ensures a company's balance sheet remains accurate and compliant with tax regulations.

Flux Analysis: This module enables finance teams to understand the "why" behind their numbers by automating variance and trend analysis. In legacy systems, a CFO might notice that expenses are up 15% month-over-month but would have to manually review spreadsheets to understand the reason. Accounting Intelligence automates this process. Its AI Variance Detection automatically scans transactional data to identify and propose explanations for significant fluctuations, flagging them for review. For example, it can instantly recognize that a spike in marketing spend was the primary driver of an increase in operating expenses, transforming a time-consuming investigation into a real-time, actionable insight.

Prepaid Amortization: This module automates the management of prepaid expenses. When a company prepays for a service, such as a software subscription, that expense must be expensed over the life of the contract. In legacy systems, this is a tedious process of creating and tracking amortization schedules in spreadsheets. DualEntry’s module automates this entire workflow. Its co-pilot identifies prepaid transactions, generates amortization schedules based on customizable rules, and posts the monthly journal entries. The co-pilot can also handle complex requests, such as a mid-contract software license upgrade, by posting the necessary journal entries.

Inventory Management: This module is critical for e-commerce and manufacturing businesses. In legacy systems, inventory data is often disconnected from the general ledger, resulting in manual reconciliations and potentially inaccurate financial records. In DualEntry, Inventory Management is connected to the Unified Ledger, enabling real-time stock tracking across multiple locations and the management of complex product variations. Accounting Intelligence automates the entire lifecycle, from forecasting demand and optimizing reorder points to generating automated purchase orders. This deep integration ensures that the inventory value on the balance sheet and the cost of goods sold on the income statement are always in sync, providing an accurate, real-time view of profitability that is difficult to achieve with a legacy ERP.

Market

Customer

DualEntry targets mid-market enterprises navigating the gap between basic accounting software and legacy ERPs. As these companies scale, they mature past tools like QuickBooks, which lack essential features such as multi-entity accounting and audit-ready financials. The status quo for this large and diversified customer base is a difficult choice: accept the limitations of their current financial stack or endure a costly and high-risk implementation of a legacy system, which has a 70% initial failure rate. This creates a highly motivated customer who is often seeking a third option.

DualEntry meets this demand with a zero-cost, “prove-it-first” implementation that disrupts the traditional model. Financially, it eliminates the $150K to $750K implementation expense for a mid-market ERP platform. Operationally, it replaces a cumbersome 9-month implementation process with a migration that delivers a configured system in under four weeks. This enables customers to test the platform without disrupting their current operations at no implementation cost. This method proved essential for one publicly traded customer as a critical M&A deal was at risk due to a failed ERP rollout and a six-month stall with Microsoft Dynamics. DualEntry delivered a fully reconciled ERP in just 48 hours, resolving the crisis and allowing the deal to move forward.

Market Size

DualEntry operates within the growing market for horizontal enterprise software. The global ERP market was valued at approximately $65 billion in 2024 and is projected to nearly double to $123.4 billion by 2030. This growth is fueled by productivity gains through automation, with expectations that 80% of ERP workflows will be automated by 2029.

Within this market, DualEntry focuses on the accounting software segment, the most critical function for ERP buyers. This segment is estimated at $21.6 billion in 2025, with forecasts that it will surpass $33.5 billion by 2030. The mid-market, defined as companies with annual revenues between $10 million and $1 billion, represents the primary catalyst for this growth. There are nearly 200K of these companies in the US alone, forming a large and constantly renewing customer base. This new wave of buyers has fundamentally different expectations for software; usability now ranks as a top priority for 80% of B2B users, fueling significant demand for modern, intuitive, and AI-native systems.

Competition

Competitive Landscape

DualEntry is competing to solve the QuickBooks/Xero to NetSuite gap, a well-defined market failure that leaves companies with $10 million to $100 million in revenue stuck between two poor options: the basic software they have outgrown and legacy systems that are complex, unintuitive, costly, and slow to implement. The latter stems from the business model used by established mid-market ERP vendors like NetSuite, Sage, and Acumatica. They rely on third-party partners who profit not only from selling ERP software but also from the high, long-term consulting fees needed for implementation. This arrangement creates a systemic incentive for the implementation partners to sell software that is difficult to use, as increased complexity boosts service revenue.

This market failure has opened the door for a new wave of challengers with two distinct strategies to bridge the gap. The first involves rebuilding the financial core, the general ledger, from the ground up. This category of modern, AI-native ERPs, including DualEntry, Rillet, and Campfire, believes that the best solution is a completely new, AI-native system of record. Owning the financial core is highly valuable because it grants the "right to win" in adjacent product categories. The second group, the Orchestrators, such as Translucent and Mayday, takes a less disruptive strategy. These platforms operate on top of existing starter accounting software like QuickBooks, aggregating data from multiple sources to create a single, unified view. While this method addresses the top-level consolidation issue for reporting, it doesn't fix the underlying operational issues that limits the more advanced automation and integrations that a single, AI-native ledger offers.

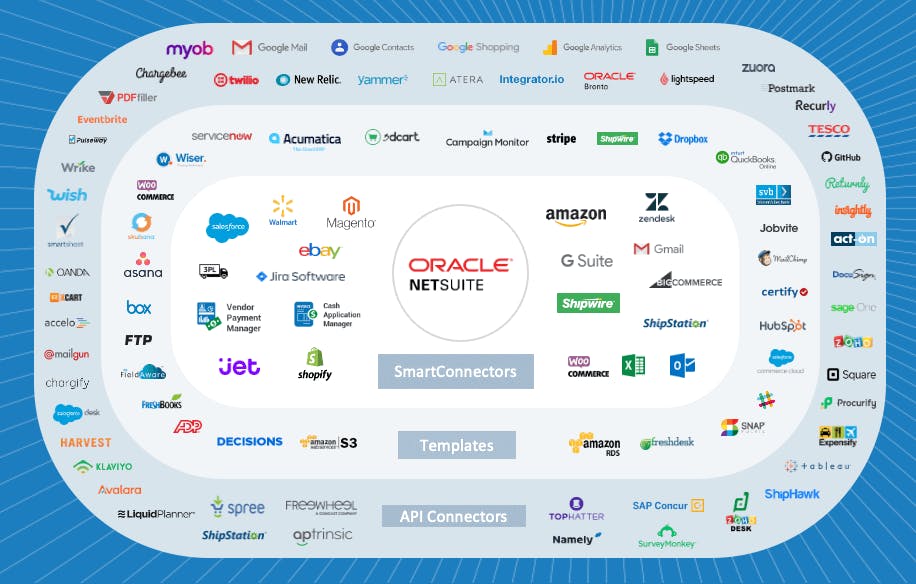

The legacy ERPs’ shortcomings have also fueled a vibrant ecosystem of adjacent point solutions that have built successful businesses by addressing their specific weaknesses.

Source: SuiteCentric

This includes tools for order management, such as Brightpearl. The market for order management tools alone is projected to reach over $5.7 billion by 2032, a testament to the scale of the incumbents' shortcomings. While these products are often best-in-class at their specific function, they are fundamentally limited because they must ultimately sync their data back to a clunky system of record. DualEntry’s strategy of owning the core gives it a long-term strategic advantage, as it can offer a more deeply integrated and seamless user experience for these adjacent workflows over time.

Legacy Mid-Market ERPs

Oracle NetSuite

Founded in 1998, NetSuite provides cloud-based software covering ERP, CRM, and ecommerce for 42K businesses. Oracle acquired NetSuite in July 2016 for $9.3 billion and now operates it within Oracle’s cloud applications division. As of August 2025, Oracle’s market cap stands at $709.7 billion.

NetSuite's pricing is based on a subscription model with tiered and volume-based pricing. A basic license starts at about $999 per month, with additional modules and implementation costs that can exceed $100K.

Source: SCS Cloud

While these implementation costs and timelines are often unpredictable, they are usually divided into multiple phases, including discovery and research, setup, customizations, and integrations. DualEntry contrasts this process with its zero-cost implementation and a promise to deliver a fully configured system in less than four weeks.

NetSuite's UI and usability, a result of its antiquated architecture from 1999, pose a major disadvantage as customers increasingly value intuitive navigation.

Source: SCS Cloud

Orchestrators

Translucent

Founded in 2022, Translucent was founded by Michael Wood, who previously built the accounting-tech platform Dext, which was acquired for several hundred million GBP in 2021. The company has raised a £5 million seed round, co-led by Chalfen Ventures and LocalGlobe, with angel investment from the co-founders of Xero. Translucent's core value proposition is to serve multi-entity businesses by providing a single financial system of record on top of existing accounting software like QuickBooks and Xero.

By unifying fragmented data from a client's existing software stack, it provides a consolidated view of financial information without the need for a full-scale ERP migration. However, this method has its limitations. Relying on a client's existing system means Translucent cannot address the core operational issues of that software. Any problems, such as manual data entry or reconciliation errors within QuickBooks or Xero, will remain. Translucent can only work with the data it receives; it cannot fundamentally alter how that data is created or processed. Conversely, DualEntry's AI-native approach represents a complete overhaul of the financial core, offering a single source of truth that facilitates more extensive, seamless automation and workflows.

Cube Software

Founded in 2018, Cube Software was started by Christina Ross, a former finance executive at Eyeview, Criteo, and Deloitte. As of August 2025, the company had raised over $45 million, including a $30 million Series B led by Battery Ventures, with participation from Mayfield, Bonfire Ventures, and Operator Collective. Cube positions itself as a financial planning and analysis (FP&A) platform that integrates directly with spreadsheets, enabling finance teams to leverage Excel and Google Sheets while pulling in real-time data from ERP, CRM, and HRIS systems.

Cube’s goal is to combine the flexibility of spreadsheets with the scalability of enterprise software in order to allow finance teams to forecast, budget, and analyze performance without abandoning their familiar tools. This "spreadsheet-native" model has been its core differentiator. However, Cube’s reliance on external data sources and spreadsheet interfaces means it functions primarily as a layer of orchestration, rather than a re-architecture of the financial system itself. In contrast, DualEntry’s approach of building an AI-native financial core seeks to eliminate these dependencies altogether, creating a fully integrated environment where automation and data integrity are inherent to the system rather than added on top.

Mayday

Founded in 2021 by James Griffin, Mayday is an accounting software designed to simplify the arduous month-end process for multi-entity businesses. With over 11K users, Mayday has secured a $1.4 million pre-seed round from Flying Fox Ventures. The company's platform is built specifically for the Xero ecosystem, offering tools like Mayday Balancer to ensure inter-company loan accounts are in sync and Mayday Recharger to automate inter-company and interdepartmental charges.

Mayday aims to create a more resilient month-end process without needing a full ERP migration. However, like other orchestrators, Mayday's reliance on an external system such as Xero means it is constrained by the capabilities of that core product. DualEntry's strength is in its ability to address this issue within a single, AI-native system of record, providing a unified and automated solution that doesn't depend on the limitations of basic accounting software.

Business Model

DualEntry generates revenue through a tiered, recurring subscription model designed to offer a significantly lower total cost of ownership, even when its subscription fee is higher. DualEntry CEO, Santiago Nestares, shared in an August 2025 interview with Contrary Research that while DualEntry has priced its subscription more than 50% higher than legacy ERPs in competitive deals, it has won 100% of them. This success stems from a transparent pricing approach in a market notorious for hidden costs. For a mid-sized business, a typical legacy ERP subscription can range from $4.6K to $6.2K per month, but this figure masks the true expense: an implementation fee between $150K and $750K. By providing a fully configured system with zero implementation costs, DualEntry eliminates the single largest and most unpredictable expense, making its value proposition clear and compelling from the outset.

As of August 2025, DualEntry’s pricing is designed to scale with a company from mid-market to public offering:

DualEntry: The base plan serves as the landing pad for companies graduating from starter software. It provides the core accounting platform, including general ledger, AP/AR, and multi-currency, all of which are needed to professionalize the finance function and handle up to 1 million transactions per year.

DualEntry Plus: This tier is built for the next stage of complexity, as businesses expand internationally or add new legal entities. It handles up to 10 million transactions and adds critical modules for multi-entity management, advanced inventory, and revenue recognition.

DualEntry Ultra: The enterprise-grade plan is the IPO-ready stack. It offers unlimited transactions and adds advanced compliance (SOX, HIPAA), security, and data lake integrations required to operate as a public company.

This tiered model, combined with a zero-cost implementation, fundamentally changes the customer's purchasing decision. It transforms a high-risk, multi-year bet on a business-critical project into a straightforward evaluation of a working product.

In addition, DualEntry is frequently adding new modules including: Fixed Assets, Revenue Recognition, Amortizations, and Inventory, each of which is capable of operating across customer verticals. As the company expands its product footprint, it's able to offer additional modules. that can compound over time with each incremental capability.

Traction

Founded in 2024, DualEntry demonstrated notable growth within its first year. By July 2025, the team grew to 42 employees while onboarding 42 companies, including dozens of publicly traded corporations, to process over $100 billion in transactions. This early traction with enterprise-grade customers stems from a strong competitive win rate. As of August 2025, 90% of DualEntry’s deals have been against legacy incumbents, of which it has won 80%. In the emerging AI-native ERP market, DualEntry has won 100% of its deals against competitors like Rillet and Campfire.

This commercial success is underpinned by strong product-market fit. As of August 2025, DualEntry not only maintains a 4.9-star rating across 404 reviews on G2, a software review platform, but was also named a Highest Performer in the platform’s Financial Close Software category. This recognition is significant as the financial close is a leading pain point for accounting teams. Users consistently rank DualEntry higher than legacy systems on critical usability metrics such as “Ease of Use,” “Ease of Setup,” and “Quality of Support.”

Valuation

In May 2024, DualEntry raised a $6 million seed round from Contrary, as well as Tim Dilly, the former Chief Customer Officer of NetSuite, as an angel investor.

In September 2025, DualEntry announced that it had raised a $90 million Series A from Lightspeed Venture Partners, Khosla Ventures, and GV.

Key Opportunities

Replacing Embedded Legacy Systems

While DualEntry's initial customer profile is focused on the recurring wave of companies graduating from starter software, a larger, more strategic opportunity lies in replacing the deeply embedded legacy systems of established enterprises. This market has historically been difficult to penetrate due to powerful organizational inertia, as years of established workflows and employee training create natural resistance to replacing core business systems. Additionally, legacy ERPs are often designed to lock in customer data through proprietary formats and a web of complex customizations.

However, a significant market-wide shift is creating a powerful tailwind to overcome these barriers. With an estimated 60% of large enterprises planning to decouple from their monolithic ERPs by 2027, a massive replacement cycle is underway. To capture this demand, DualEntry can use its migration engine that uses AI to map and transfer historical data, enabling a seamless transition from legacy systems. This technology can neutralize the high switching costs that have historically protected legacy vendors, turning their defensive moat into a significant market opportunity.

Horizontal ERPs vs Vertical ERPs in Mid-Market

A common belief is that the future of software is vertical, with solutions that provide deep, specialized functionality for niche industries. Proponents of this view argue that while horizontal ERPs offer a broad feature set, they often miss the nuanced workflow enhancements critical to a specific business, leading to significant operational headaches that vertical providers aim to solve.

While this argument holds true for small businesses, the dynamic shifts dramatically for the mid-market, where accounting is inherently horizontal. The scarcity of vertical ERP vendors in the middle market is a direct consequence of this, as the evolving complexity of larger businesses makes it difficult for a single, specialized solution to meet all their needs.

For example, a small business, like a single barbershop, operates with a relatively simple, "vertical" set of needs. However, a national chain of 40 barbershops will have far more diverse, "horizontal" requirements from developing its own ecommerce inventory to managing both W-2 payroll and independent contractor relationships. As a company scales, accounting itself evolves from a simple compliance task to a deeply analytical workflow, requiring sophisticated features like close checklists and robust AP software that small, vertical-focused solutions often lack. This fundamental mismatch between vertical solutions and horizontal needs in the mid-market is a significant opportunity for DualEntry.

The Right to Win the Financial Stack

DualEntry is positioned to leverage its position at the core of the finance stack to displace the fragmented ecosystem of adjacent point solutions. The general ledger is the foundational system of record for all other financial processes; it is the first reason companies adopt an ERP and the last system they will ever replace. Taking on the challenge of rebuilding the GL is a formidable task, which is why few new entrants attempt to compete at this level.

By owning this core, DualEntry gains the right to win adjacent product categories. A deeply integrated module for a function like close management or inventory will always provide a superior user experience to a separate, bolted-on solution that must sync data with a clunky legacy system. For example, a close management checklist built into the accounting core can automatically mark tasks as complete as they are finished in the ledger and seamlessly share user permissions. This creates a level of real-time automation and efficiency that a separate tool like FloQast, which is fundamentally a feature and not the platform, cannot replicate. This gives DualEntry a long-term strategic advantage to expand its product footprint and become the single, unified system of record for its customers.

Key Risks

Displacing Entrenched Incumbents

DualEntry’s primary risk lies in the immense challenge of displacing deeply entrenched legacy vendors like NetSuite, despite trends towards an industry transition. While DualEntry’s product and business model are designed to be superior, the incumbents are protected by powerful moats that are difficult to overcome. The first is the trust hurdle. For a CFO, choosing an ERP is a major decision. Choosing an established, 25-year-old vendor like NetSuite feels like a safe, predictable choice, even if the outcome is suboptimal. Opting for a startup for a company's core financial system, on the other hand, represents a larger risk. This creates a bias toward the incumbent, regardless of the product's merits.

This trust hurdle is reinforced by the incumbents' two core structural advantages: their partner ecosystem and their massive sales force. As previously discussed, the legacy vendors' go-to-market engine is built on a vast network of consultants and integrators. This ecosystem is not just a sales channel; it is a formidable defensive moat, creating a powerful network effect of trained professionals who are financially incentivized to recommend and support the incumbent's complex software. Compounding this is the sheer scale of their sales team. Legacy vendors like NetSuite can deploy a go-to-market force that is orders of magnitude larger than any startup's. In a direct comparison, DualEntry may have the superior product, but it will be consistently outmatched in sales and marketing resources.

QuickBooks or Xero Move Upstream

QuickBooks is developing its products to compete directly in the mid-market space. By introducing expanded roles and permissions, advanced charting and reporting, and a new platform for accountants, QuickBooks is bridging the gap between itself and NetSuite, which DualEntry aims to fill. These updates are designed to retain companies with 10 to 100 employees, preventing them from switching to more comprehensive platforms. QuickBooks' strategy to keep customers as they grow harms DualEntry by reducing the number of potential customers moving to ERP systems. The company’s investments in advanced analytics and a generative AI operating system also weaken DualEntry's AI-native value proposition. However, a key caveat is that QuickBooks offers fewer features and is unlikely to move as quickly as DualEntry. As part of Intuit, a publicly traded company, it faces the risk of cannibalizing its core business by making too rapid a shift. This organizational inertia could give DualEntry a critical speed advantage.

Summary

DualEntry is a modern, AI-native ERP platform built for mid-market companies that have outgrown basic accounting tools but remain poorly served by expensive, legacy solutions. Its robust and secure accounting ledger is built on an AI-native architecture that automates 90% of manual workflows and features over 13K bank connections and over 200 native integrations with essential platforms. By delivering a fully configured system with zero-cost implementation in under four weeks, DualEntry directly challenges the traditional legacy model of high-margin consulting fees and multi-year implementation cycles.

*Contrary is an investor in DualEntry and Ramp through one or more affiliates.