Thesis

Employee compensation is a crucial driver for any organization, as well as overall economic growth. The labor share of GDP is a statistic measuring employees’ total compensation as a percentage of GDP. That metric hovers around 50% for almost all developed countries. Despite how significant compensation is, it’s not a transparent or easy-to-manage process for anyone.

For managing their compensation, most companies use a combination of compensation consultants and data providers that offer stale, 6-month-old data points in the form of spreadsheets. As the number of employees a company is managing grows larger, the process becomes increasingly more complex. The less of a clear perspective companies have on the compensation market for specific roles, the less capable they are of attracting top talent. For highly competitive labor markets like engineering, data science, and other technical roles, this can be an even more significant problem.

Pave* is a compensation management software company that digitizes the way in which companies make compensation decisions. Pave’s platform is a real-time database for planning, communicating, and benchmarking employee compensation. Matt Schulman, the CEO and Founder of Pave, has described the problems the company is trying to solve like this:

“Compensation is, simply put, the most expensive thing in the world. Yet, compensation is the last major global marketplace without a real-time price. ‘Compensation fairness’ is a guessing game built on blind trust.”

Founding Story

Matt Schulman began his career as a software engineer at Microsoft and Facebook. In 2019, Schulman left his role at Facebook to found a company. He started exploring ideas in financial literacy first, but while none of his initial ideas gained traction there was one pain point that VPs of People and Finance continued to emphasize the difficulty of communicating stock options to employees. To test this idea, Schulman sent out 200 emails to these types of leaders, and 59 of them translated into meetings. That was Schulman’s initial validation that there was a problem to solve in this space.

Product

Pave’s compensation tools allow companies to manage every aspect of employee compensation:

Compensation Planning & Bands: Planning compensation and merit cycles.

Total Rewards & Visual Offer Letter: Employee and candidate compensation communication.

Benchmarking: Compensation benchmarking powered by real-time data.

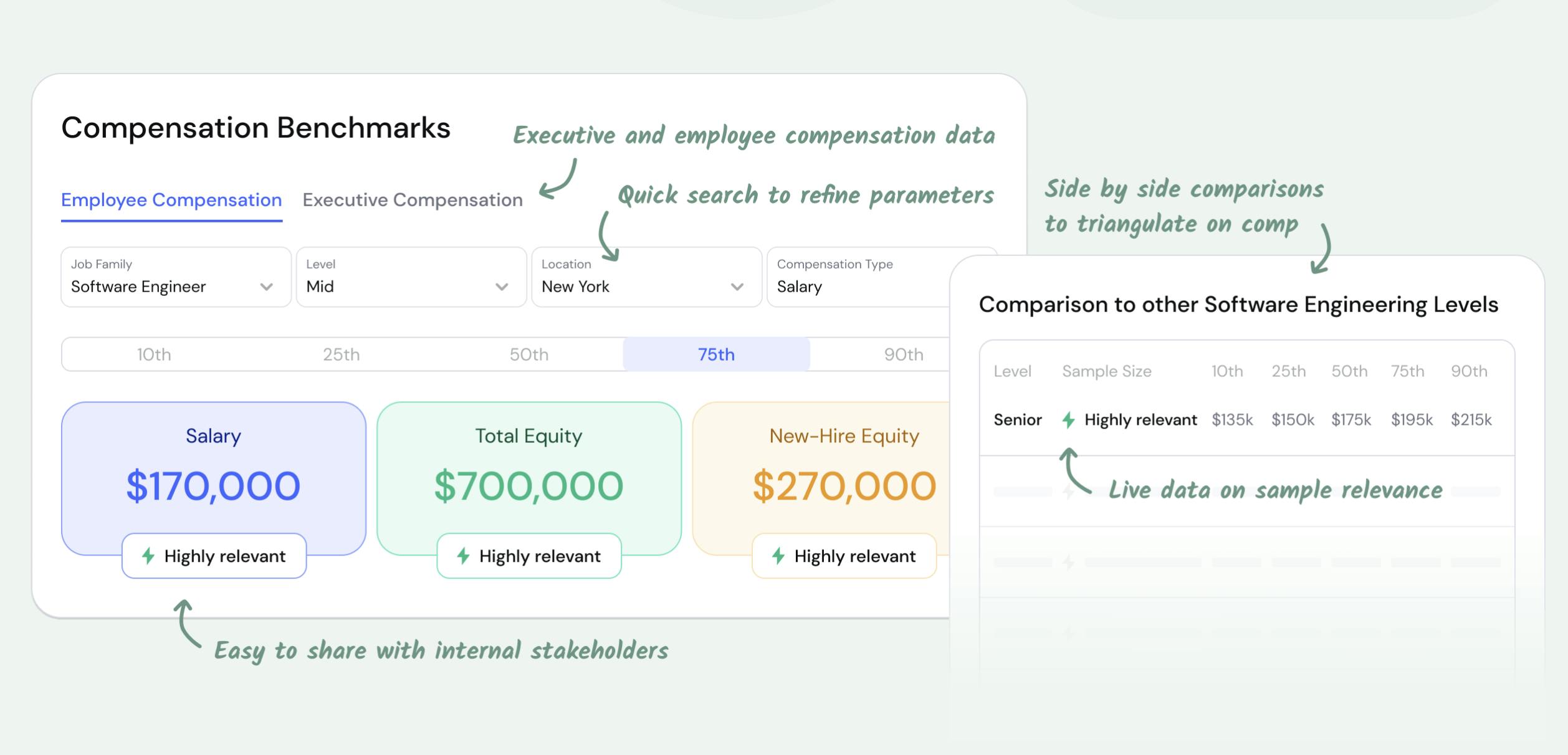

Benchmarking

Source: Pave

The lack of transparency in compensation often comes from limited visibility into the market for certain positions. Pave’s foundational data set is an aggregated, anonymized view of role-specific compensation. With its June 2022 acquisition of Option Impact, Pave has become one of the largest collections of compensation data, spanning 6K companies and 645K employee records as of September 2023.

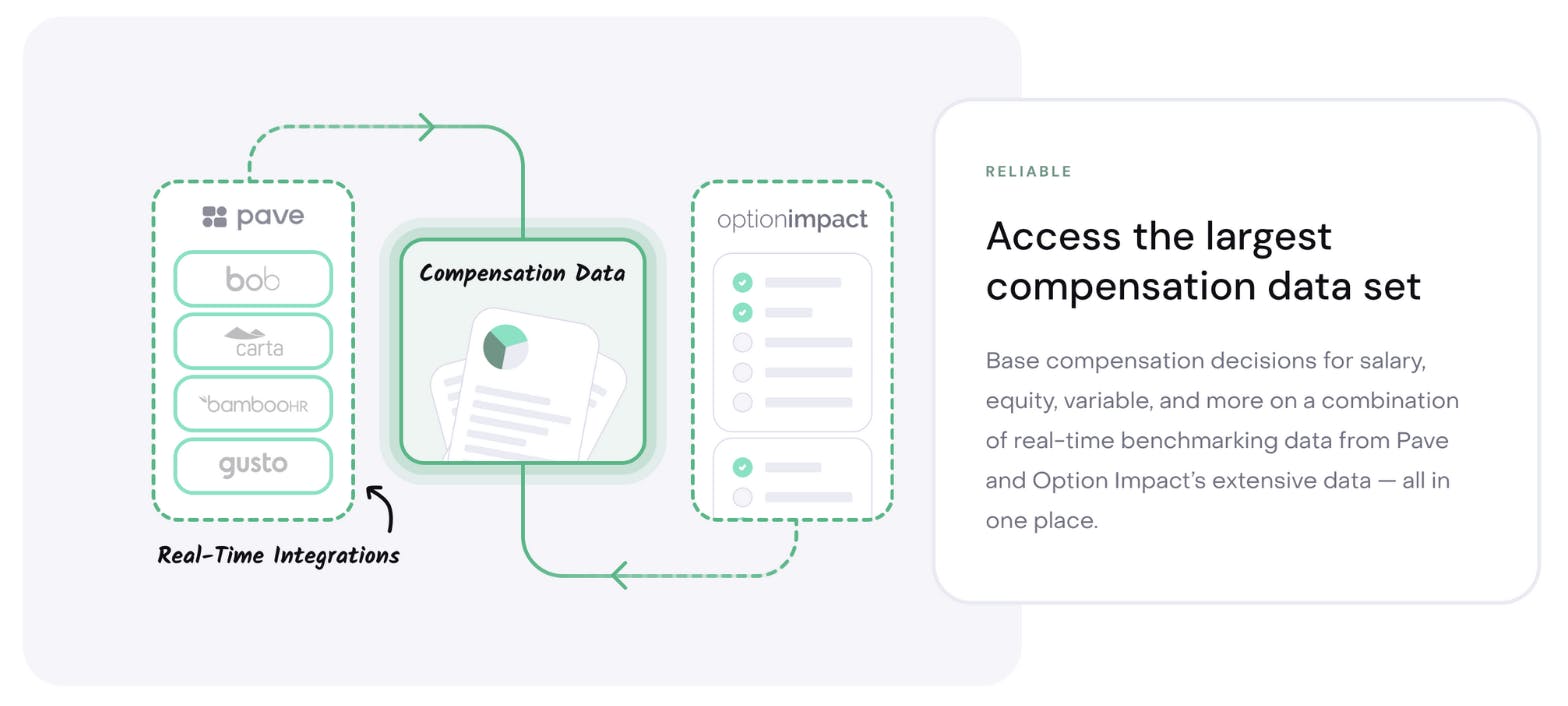

Source: Pave

In terms of Pave’s real-time integrations with companies for data, Pave uses a give-to-get data model. In order to access the benchmarking data, customers have to integrate their human resources information system (HRIS) and cap table management software and share anonymized versions of their own data. By obtaining compensation information from each customer, Pave continues to build its data pool via a network effect. The value of the data increases with each customer.

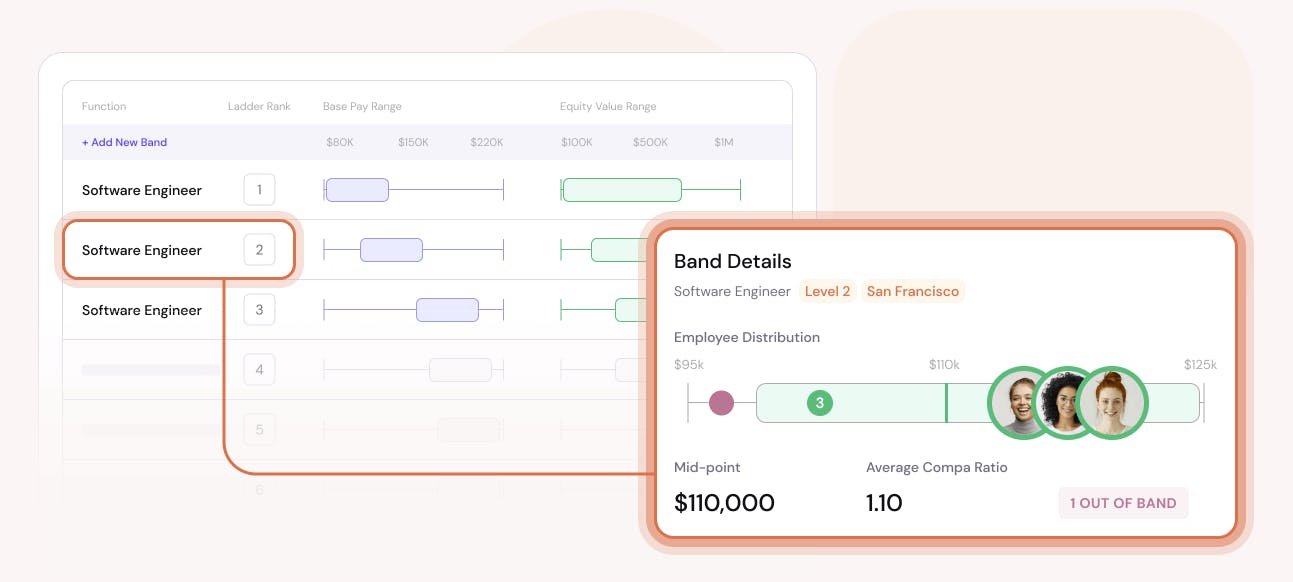

Compensation Bands

Source: Pave

Pave's Compensation Bands product is a platform designed to help companies establish and maintain their compensation relative to the market. It offers a centralized interface to replace existing spreadsheet methods, providing a foundation for more fair and transparent compensation decisions. Key features include:

Bands Manager: This functionality allows users to build and maintain a single, centralized view of the organization's compensation bands.

Band Builder: Utilizing real-time market data, users can construct compensation bands from scratch, with options for customization based on benchmark companies and desired band midpoints.

Access Controls: Pave provides a secure environment by allowing users to set granular permissions, ensuring compensation bands are shared with the appropriate stakeholders.

Employee Insights: This feature gives an overview of employees' placements within their compensation bands and highlights those who fall outside of their bands.

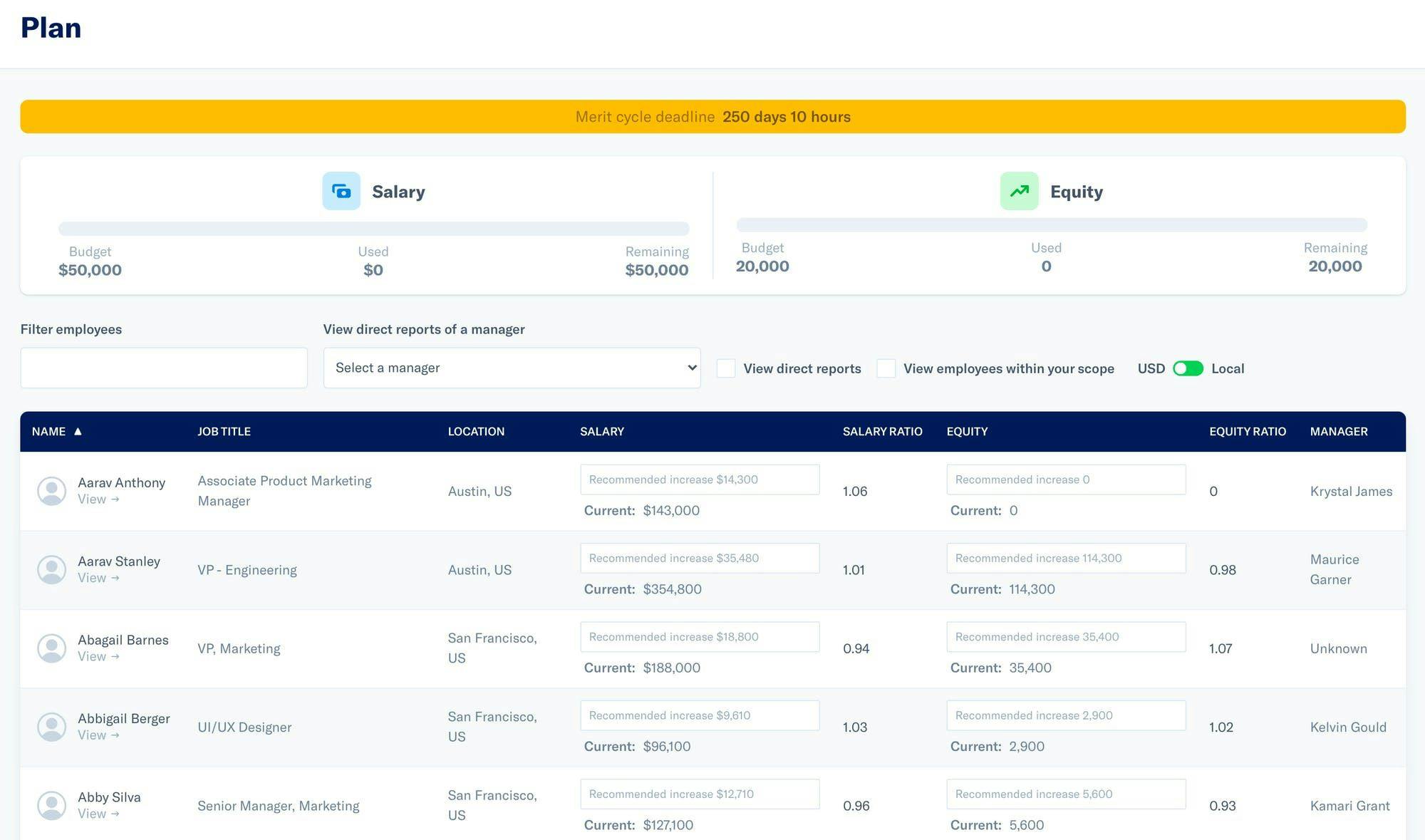

Compensation Planning

Source: Pave

Compensation planning and promotion cycles are painful, error-prone processes. Companies manage their planning processes in large complex spreadsheets with hundreds of tabs and personal data potentially being exposed. Employees, when interviewed about their stock options, often struggle to articulate their value, being unsure of what they are worth.

Pave’s compensation planning module leverages data integrations with the customer’s HRIS and cap table management software to create an overview of each employee's compensation structure. Managers can then engage with their own teams and map out budgeted compensation changes that can be reviewed in a rolled-up view by the HR managers and executives.

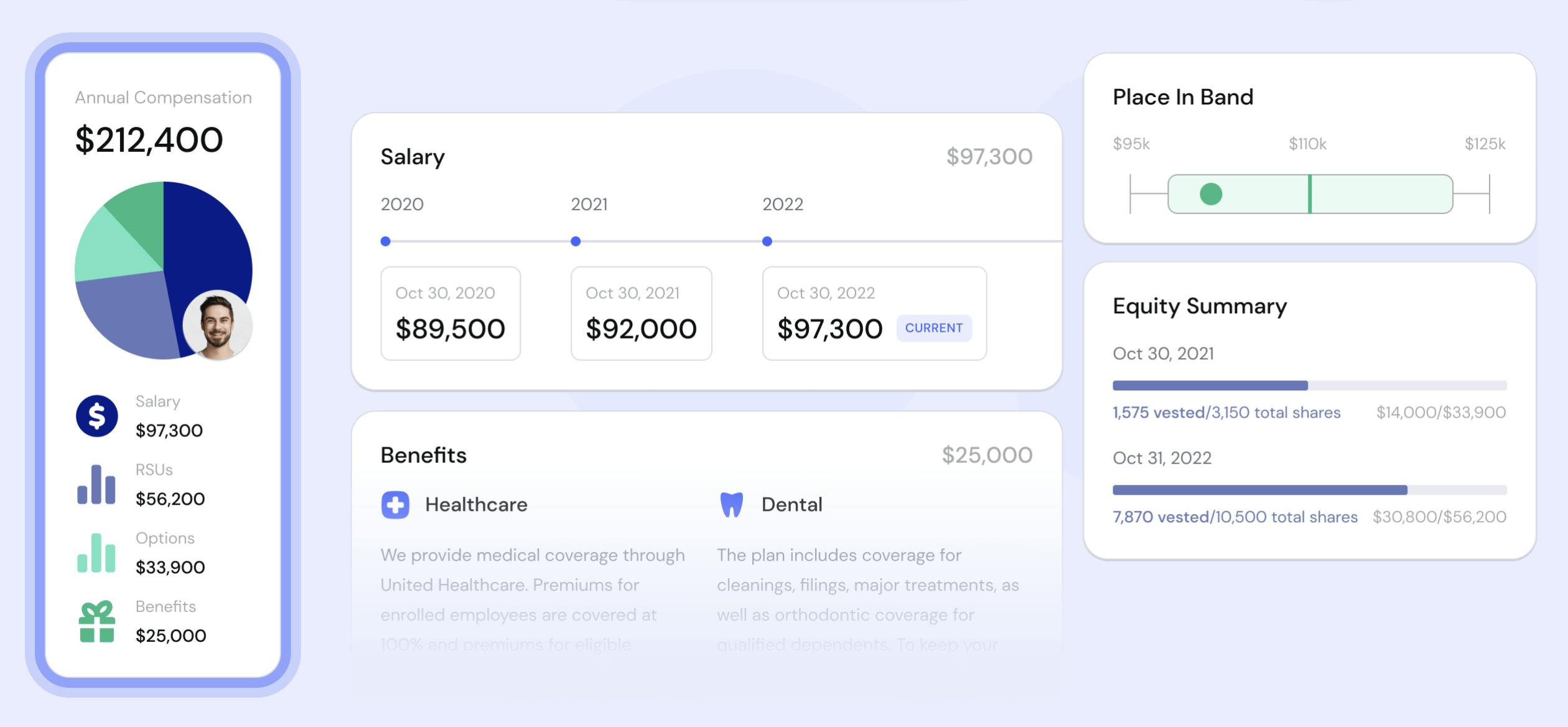

Total Rewards

Source: Pave

Communicating the value of stock options can be difficult, especially for an early-stage startup. Pave’s Total Rewards product makes it easier to visually illustrate the potential value of a certain equity grant depending on a range of possible outcomes for the employer. Employees can more easily understand the value of their options, which can improve employee retention. Pave allows customers to customize the look and feel of their Total Rewards module, and even manage employee communication.

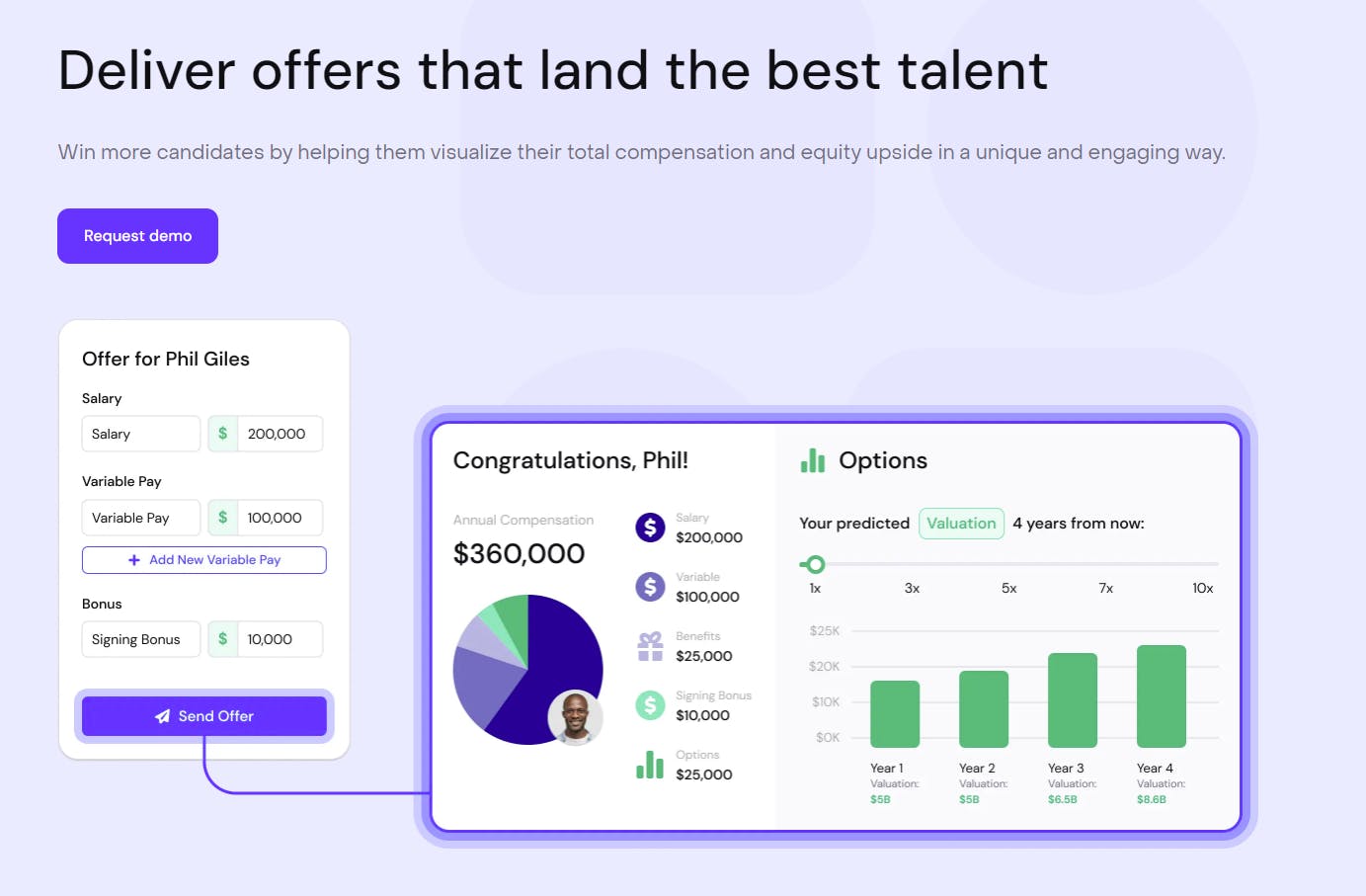

Visual Offer Letter

Source: Pave

Pave's Visual Offer Letter is a product designed to help companies win top talent by enabling candidates to clearly visualize their total offered compensation and potential equity growth. The product's key features include:

Total Compensation Showcase: Candidates can interactively view their salary, bonuses, benefits, and equity to understand their comprehensive compensation package.

Equity Modeling: Explains equity compensation components, allowing candidates to model the potential future value of their grant.

Real-Time Integrations: Visual Offer Letter can integrate with a company’s Applicant Tracking System (ATS) for more efficient recruiting operations.

Market

Customers

As of September 2023, Pave is primarily focused on private US-based tech companies, highlighting case studies like Cockroach Labs and Ro. The company has also secured high-profile public tech companies like Dropbox, HubSpot, and Credit Karma. The main reason for Pave’s focus on technology companies is the competitive and high-cost nature of securing technical talent.

As competition for talent increases within an industry, compensation becomes even more important. Tech companies offer large equity compensation packages to compete for the best talent. Notable Pave customers include Shopify, Affirm, Discord, and OpenSea.

Source: Pave

Market Size

Every company with an employee base has to think about compensation plans in some way. 57% of organizations used spreadsheets for compensation strategies in 2020, but only 6% used pure-play compensation solutions. Typically, once a company has 100+ employees it’ll start thinking about solutions for managing compensation. In the US, approximately 18K+ tech companies have over 100 employees, and there are 160K companies globally that are of this size.

Competition

Pave’s offers a free benchmarking tool and a compensation communication and planning tool. As a result, Pave competes with several companies across each of their product modules.

Benchmarking Compensation: Traditionally, companies would access market data to benchmark their compensation bands from legacy providers like Radford or Option Impact (which Pave acquired in June 2022). These providers would offer a (typically 6-month-old) data set in a large spreadsheet that had data across roles. Radford gathers data through annual compensation surveys of late-stage and public companies. These surveys require manual processes for companies to compile and upload compensation spreadsheets. When companies receive such data, the fact that it is six months old makes it less valuable. Outdated data becomes even less useful as labor markets become more dynamic.

Compensation Management: Visual offer letters are becoming a more common way to attract top candidates. Companies like Assemble, Compaas, and Welcome (acquired by BambooHR) have their own visual offer letter tools. Merit cycle planning tools offered by Pave compete directly with ChartHop and Payscale. Pave attempts to differentiate by having its benchmarking data and compensation planning modules flow together more seamlessly.

Some primary competitors to Pave include:

Carta: Carta was founded in 2012. While most well-known as a cap table management platform, Carta has begun to expand into the broader compensation data market. In April 2021, Carta announced the launch of Total Comp, which focused on enabling private companies to compare salary and equity packages. The product also includes a benchmarking module to compare compensation to market rates. Carta Total Comp has integrated with companies like Rippling to allow Rippling users to “view real-time salary and equity compensation” in Rippling’s platform. It has raised a total of $1.2 billion in funding.

Levels.fyi: Founded in 2017, Levels.fyi has established itself as a source of information for candidates looking for transparency on tech industry salaries. While Levels.fyi is primarily known for its use by candidates to evaluate compensation bands across companies, the startup has started offering compensation benchmarking services and salary insight services to companies that directly compete with similar Pave offerings. Levels.fyi’s candidate-sourced data and popularity could pose a competitive threat to Pave. The company remains privately held and self-funded as of September 2023.

Payscale: Established in 2002, Payscale provides comprehensive salary data and software to businesses, serving as a direct competitor to Pave in the compensation planning space. Payscale's combination of software offerings and salary data allows customers to implement robust compensation strategies. Payscale remains an established market player due to its two-decade history and robust data collection. Payscale was acquired by Warburg Pincus in 2014 and merged with competitor Payfactors in 2021 under the ownership of private equity firm Francisco Partners.

Charthop: Launched in 2019, Charthop offers a dynamic platform for organizational planning, analytics, and people strategy. While originally not a direct competitor in the compensation planning domain, Charthop launched a compensation review product in July 2022 aimed at providing companies with salary data and benchmarking to allow them to make compensation decisions. The integration of compensation data into Charthop’s offerings gives managers and HR professionals valuable insights, potentially reducing the need for specialized tools like Pave. Charthop raised a $20 million Series C round led by Cox Enterprises in February 2023. It has raised a total of $74.1 million in funding.

Equifax: A multinational consumer credit reporting agency founded in 1899, Equifax's main line of business differs from Pave. However, its Workforce Solutions division, with The Work Number product, offers salary data for employment and income verification. Equifax’s breadth of data sources, made evident in its 2017 data breach, presents a substantial competitive presence in the salary data landscape. As of July 2023, Equifax is publicly traded and had a market cap of $26 billion.

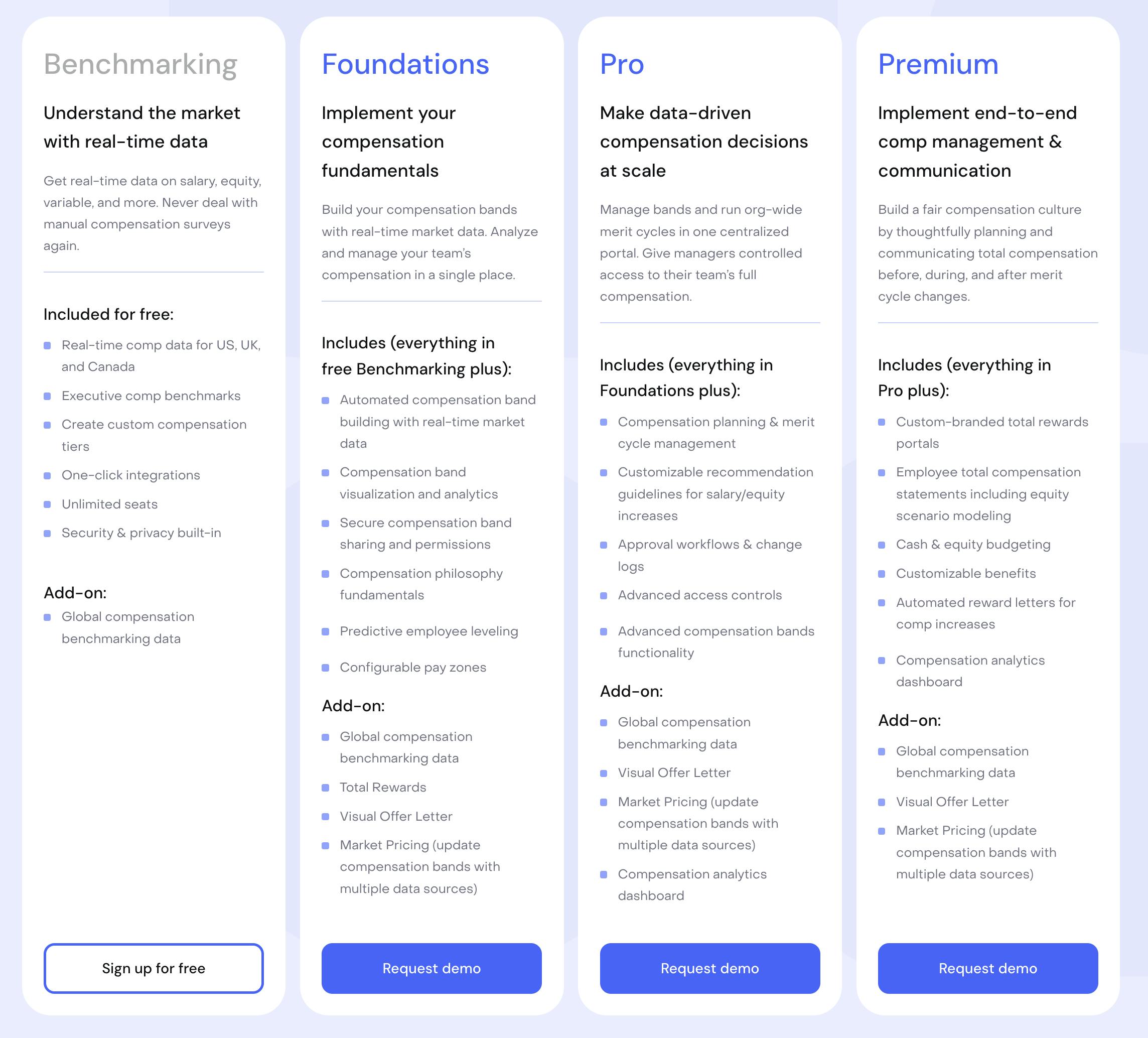

Business Model

Source: Pave

Pave’s business model is built on a foundation of compensation data that the company continuously collects. Initially, Pave worked with venture firms and groups like Y-Combinator to offer its benchmarking module in a give-to-get model. The benchmarking data would be free, assuming the user would connect and contribute their own data. Pave’s compensation planning and communication product suite uses a typical model where these modules are priced in based on which of the modules the customer wishes to use. While Pave does not disclose exact pricing on its website, there are several examples of customers who will annually pay somewhere between $30-50K.

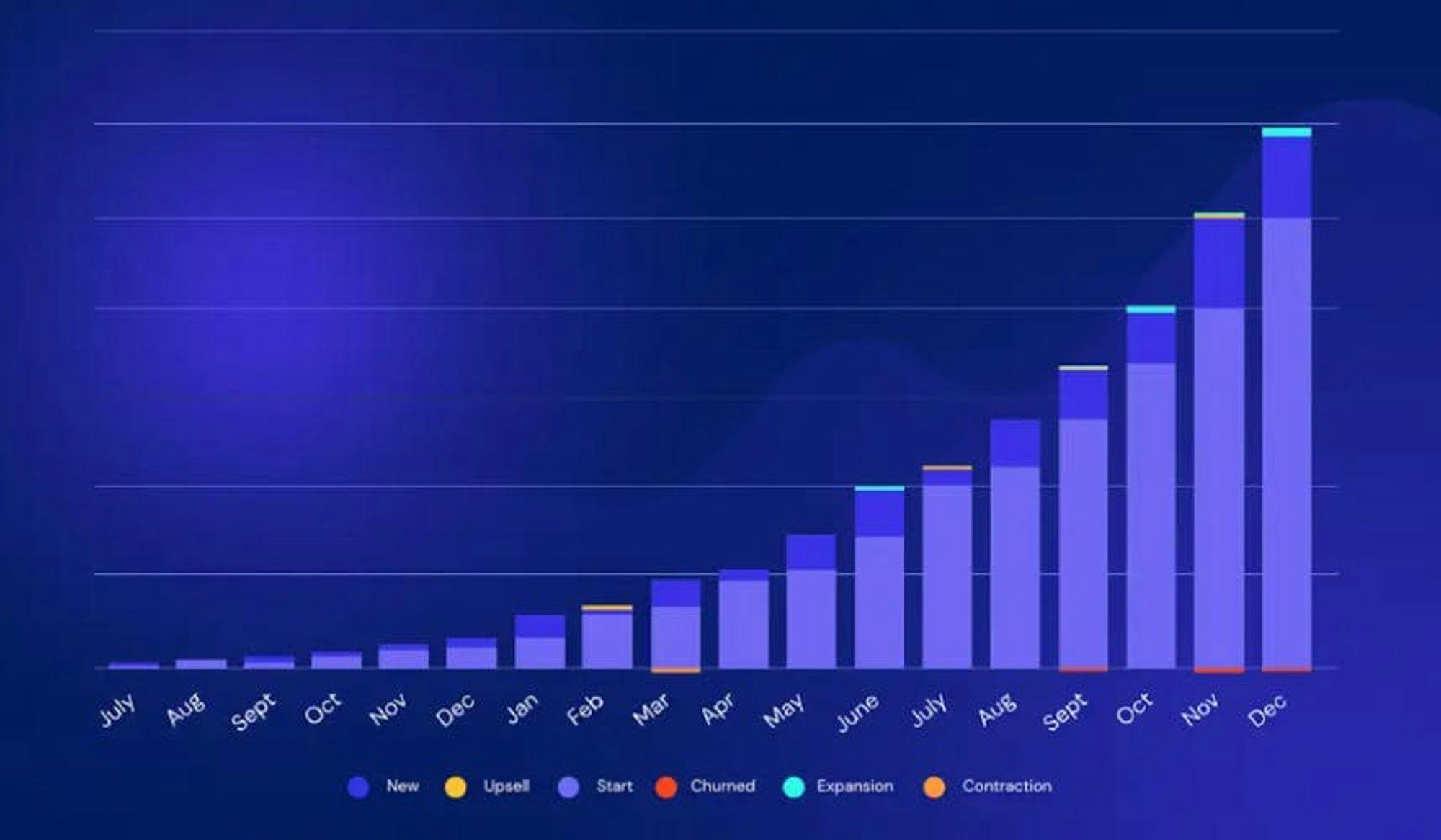

Traction

By June 2022, Pave had grown to 2.7K customers. With the acquisition of Option Impact, Pave expanded its user base to ~6K companies. However, not all of those companies are paying, as many of them are using the free benchmarking tool. The 6K companies participating in Pave’s benchmarking module account for over 27K executive compensation record and 645K employee records.

While Pave hasn’t disclosed its revenue, the chart below shows Pave’s ARR ramp over time. The company has continued to grow its business, though the majority of it has come from new customers. Upselling existing customers has been relatively nascent for Pave, likely the result of most customers using all available features as soon as they become paying customers.

Source: Business Insider

Valuation

In June 2022, Pave raised $100 million in Series C funding at a post-money valuation of $1.6 billion. Participants included lead investor Index Partners and participation from existing investors like Andreessen Horowitz and Y Combinator. As Pave CEO Matt Schulman describes it, Pave’s path to becoming a sizable business is dependent on bringing ubiquitous transparency to a massive labor market:

"It makes me excited that it's our addressable market [the 4 billion person labor market], this is a small step on our journey, we want to be a trillion-dollar business one day.”

Key Opportunities

VC Network

Pave has partnered with 300+ venture firms to offer its benchmarking data to the portfolio companies of these VC partners, including large networks like Y Combinator that provided one-third of Pave’s customers in 2021 before the acquisition of Option Impact. Pave’s advantage comes from having established relationships with these VCs in order to get their product in front of portfolio companies. This makes it harder for future entrants to replicate VCs as a distribution advantage.

First Mover Advantage

Existing compensation data providers have still been largely offline with manual spreadsheets of information. Only recently has the compensation process started coming online. In HR, that digitization started with applicant tracking and employee benefits management, but compensation management is becoming an increasingly digital process.

Pave’s real-time database compiles compensation information and anonymizes it. Every company using the database can benchmark its compensation decisions using anonymized data. Pave appears to be the first fully digital offering in the space, and as a result, has the advantage of being a first mover and establishing itself as a de facto standard.

Key Risks

Lack of Adoption in Low Competition Labor Market

The competitive nature of technical labor in the technology industry has been the main driver behind Pave’s initial growth. The complexity of including equity compensation as part of a candidate’s overall package is also an area of complexity that is fairly unique to tech. Senior engineer compensation packages often include more equity than base salary. Managing the equity process is complex, and Pave makes that easier.

However, in less competitive labor markets companies may offer less competitive equity compensation packages, and they’re not nearly as concerned with maintaining the most updated pulse on compensation for specific roles. As Pave expands outside of tech to industries like food services and hospitality, the need for up-to-date market compensation data is likely even less critical.

Willingness to Share Compensation Data

Tech companies can, on average, leverage 200+ applications across all their departments. Most of the time, these applications require connectivity with other applications, so these companies are no stranger to data integrations and can fairly easily connect an app like Pave to their HRIS and cap table management software. However, there are still a number of gaps to be filled in Pave’s compensation data, and the possible threat of employee data exposure, or even the disclosure of possible inequity, may slow the adoption of data sharing for Pave’s potential customers.

Summary

Pave’s proprietary benchmarking database and compensation communication tools are adding additional convenience and transparency to employee equity, particularly for technology companies. The labor market is always fluctuating, whether it’s because of events like the COVID-19 pandemic, the ensuing “great resignation”, layoffs during an economic downturn, or re-skilling and the reshuffling of labor needs. Pave is positioning itself as the easiest way to maintain a pulse on the compensation ranges for any role, which can be helpful not only in helping companies ensure they’re paying their employees enough but also in potentially avoiding paying employees too much. Layoffs in tech impacted 164K employees in 2022, and have already impacted 235K as of September 2023. Time will tell if Pave remains as relevant in a loose labor market as it was in a tight one.

*Contrary is an investor in Pave through one or more affiliates.